UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Securities Exchange Act of 1934 (Amendment No. )

þ | Filed by the Registrant |

o | Filed by a Party Other than the Registrant |

Check the appropriate box: | |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

þ | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to § 240.14a-12 |

PLY GEM HOLDINGS, INC. | |

(Name of Registrant as Specified In Its Charter) | |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

þ | No fee required. | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | ||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

(1) | Amount Previously Paid: | ||

(2) | Form, Schedule or Registration Statement No.: | ||

(3) | Filing Party: | ||

(4) | Date Filed: | ||

|

April 3, 2014

Dear Stockholders:

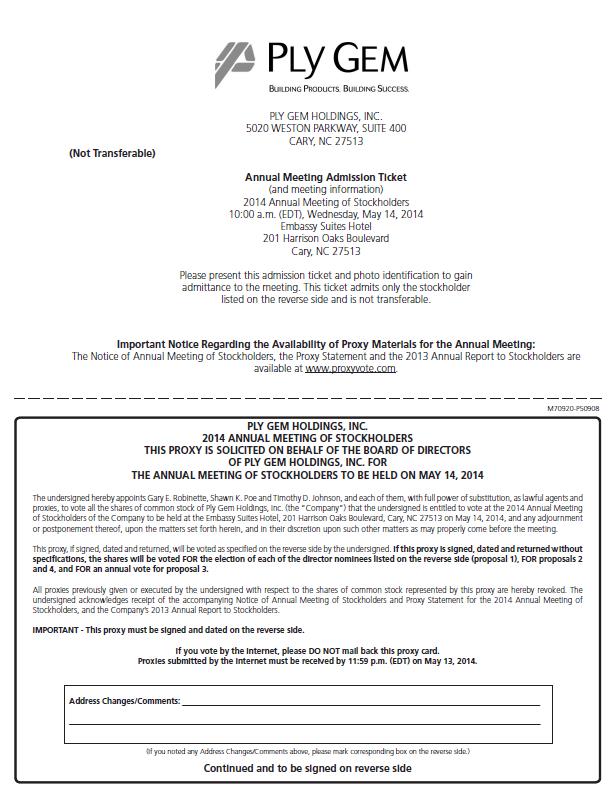

You are invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Ply Gem Holdings, Inc. at the Embassy Suites Hotel located at 201 Harrison Oaks Boulevard, Cary, North Carolina 27513 on Wednesday, May 14, 2014, at 10:00 a.m. Eastern Time. The accompanying formal notice of the Annual Meeting and proxy statement set forth the details regarding admission to the Annual Meeting and the business to be conducted.

At the Annual Meeting, we will ask you to elect the three director nominees listed in the proxy statement, consider a non-binding advisory vote to approve the compensation of our named executive officers, consider a non-binding advisory vote to recommend the frequency of the advisory vote on the compensation of our named executive officers and ratify the appointment of our independent registered public accounting firm for 2014. We will also discuss any other business matters properly brought before the meeting. The attached proxy statement explains our voting procedures, describes the business we will conduct and provides information about Ply Gem Holdings, Inc. that you should consider when you vote your shares.

The formal notice of the Annual Meeting, the proxy statement and the proxy card follow. It is important that your shares be represented and voted, regardless of the size of your holdings. Accordingly, whether or not you plan to attend the Annual Meeting, I encourage you to complete, sign, date and return the enclosed proxy card promptly so that your shares will be represented at the Annual Meeting or to access the proxy materials and vote via the Internet in accordance with the “notice and access” letter you will receive. The proxy is revocable at any time before it is voted and will not affect your right to vote in person if you attend the Annual Meeting.

I hope to see you at the meeting. Thank you for your ongoing support of Ply Gem Holdings, Inc.

Very truly yours,

Gary E. Robinette

President, Chief Executive Officer and Vice Chairman of the Board of Directors

TABLE OF CONTENTS

Proxy Voting Methods | |

Notice of Annual Meeting of Stockholders | |

General Information | |

Proposal 1: Election of Directors | |

Composition of our Board | |

CI Director Nominees | |

Nominees for the Board of Directors | |

Directors Continuing in Office | |

Executive Officers | |

Corporate Governance | |

Code of Ethics and Corporate Governance Guidelines | |

Compliance and Ethics Hotline | |

Director Independence | |

Certain Relationships and Related Party Transactions | |

Board Meetings and Annual Meeting Attendance by Board Members | |

Board Leadership Structure | |

Risk Oversight | |

Risk and Compensation Policies | |

Committees of the Board | |

Executive Sessions of Non-Management Directors | |

Communications with the Board of Directors | |

Controlled Company | |

Executive Compensation Disclosure | |

Compensation Discussion and Analysis | |

Summary Compensation Table | |

Grants of Plan-Based Awards for 2013 | |

Outstanding Equity Awards at Fiscal Year-End for 2013 | |

Director Compensation for 2013 | |

Compensation Committee Report | |

Proposal 2: Advisory Vote on Executive Compensation | |

Report of the Audit Committee | |

Proposal 3: Advisory Vote on the Frequency of an Advisory Vote on Executive Compensation | |

Proposal 4: Ratification of the Selection of Independent Registered Public Accounting Firm | |

Security Ownership and Other Matters | |

Security Ownership of Certain Beneficial Owners and Management | |

Securities Authorized for Issuance under Equity Compensation Plans | |

Section 16(a) Beneficial Ownership Reporting Compliance | |

Stockholder Proposals for the 2015 Annual Meeting | |

Annual Report | |

Delivery of Proxy Statement, Annual Report or Notice of Internet Availability of Materials | |

Other Business | |

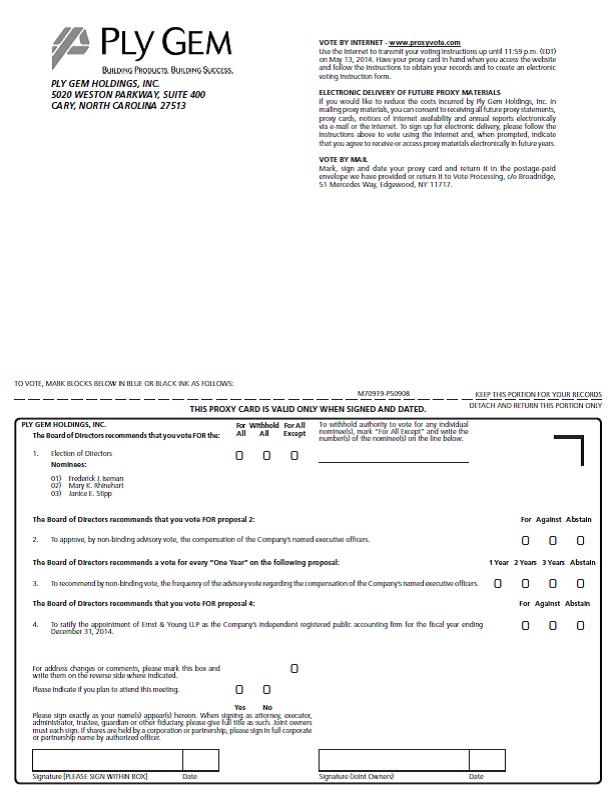

PROXY VOTING METHODS

If, at the close of business on March 24, 2014, you were a stockholder of record or held shares through a broker or bank, you may vote your shares by proxy on the Internet or by mail, or you may also vote in person at the Annual Meeting. For shares held through a broker or nominee, you may vote by submitting voting instructions to your broker or nominee. To reduce our administrative and postage costs, we ask that you vote on the Internet, which is available 24 hours a day. You may revoke your proxies or change your vote at the times and as described in the Section “General Information” in this proxy statement.

If you are a stockholder of record or hold shares through a broker or bank and are voting by proxy, your vote must be received by 11:59 p.m. (Eastern Time) on May 13, 2014 to be counted.

To vote by proxy:

BY INTERNET

• | Go to the website www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week. |

• | You will need the 12-digit number included on your Notice of Internet Availability of Proxy Materials or on your proxy card. |

BY MAIL

• | If you have not already received a proxy card, you may request a proxy card from us by following the instructions on your Notice of Internet Availability of Proxy Materials. |

• | When you receive the proxy card, mark your selections on the proxy card. |

• | Date and sign your name exactly as it appears on your proxy card. |

• | Mail the proxy card in the postage-paid envelope that will be provided to you. |

YOUR VOTE IS IMPORTANT. THANK YOU FOR VOTING.

ii

5020 Weston Parkway, Suite 400

Cary, North Carolina 27513

Cary, North Carolina 27513

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

WEDNESDAY, MAY 14, 2014, 10:00 A.M. (EASTERN TIME)

The Annual Meeting of Stockholders (the “Annual Meeting”) of Ply Gem Holdings, Inc. will be held at the Embassy Suites Hotel located at 201 Harrison Oaks Boulevard, Cary, North Carolina 27513 on Wednesday, May 14, 2014, at 10:00 a.m. Eastern Time or at any subsequent time that may be necessary by any adjournment or postponement of the Annual Meeting. The purposes of the meeting are to:

(1) | elect three nominees to serve as Class I directors of the Company, as nominated by the Board of Directors, for three-year terms, with each director to hold office until the 2017 annual meeting or until such director’s successor is duly elected and qualified or until his earlier death, resignation, disqualification or removal; |

(2) | approve, by non-binding advisory vote, the compensation of our named executive officers; |

(3) | recommend, by non-binding advisory vote, the frequency of the advisory vote regarding the compensation of our named executive officers; |

(4) | ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

(5) | transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on March 24, 2014 as the record date for determining the stockholders of the Company entitled to notice of and to vote at the Annual Meeting or any adjournment thereof. Representation of at least a majority of the voting power represented by all outstanding shares is required to constitute a quorum at the Annual Meeting. Accordingly, it is important that your shares be represented at the Annual Meeting.

We will be using the Securities and Exchange Commission’s Notice and Access model (“Notice and Access”), which allows us to deliver proxy materials via the Internet, as the primary means of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient method to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about April 3, 2014, we will mail to stockholders holding shares in “street name” a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and our Annual Report for the fiscal year ended December 31, 2013 (“2013 Annual Report”) online and how to vote via the Internet. The Notice also contains instructions on how to receive a paper copy of the proxy materials and our 2013 Annual Report.

April 3, 2014:

By Order of the Board of Directors,

Shawn K. Poe

Vice President, Chief Financial Officer, Treasurer and Secretary

Cary, North Carolina

YOUR VOTE IS IMPORTANT |

We urge you to vote using Internet voting, if available to you, or if you received these proxy materials by mail, by completing, signing, dating and returning the enclosed proxy card promptly. Please note that if your shares are held by a bank, broker or other recordholder and you wish to vote them at the meeting, you must obtain a legal proxy from that recordholder. |

Important Notice Regarding the Availability of

Proxy Materials for the Annual Meeting of Stockholders

To Be Held on May 14, 2014.

The Notice of Annual Meeting, proxy statement and the 2013 Annual Report

are available at www.plygem.com.

GENERAL INFORMATION

1. When and where is the Annual Meeting?

Our Annual Meeting of Stockholders (the “Annual Meeting”) will be held at the Embassy Suites Hotel located at 201 Harrison Oaks Boulevard, Cary, North Carolina 27513 on Wednesday, May 14, 2014, at 10:00 a.m. Eastern Time, or at any subsequent time that may be necessary by any adjournment or postponement of the Annual Meeting.

2. What is “Notice and Access” and why did Ply Gem elect to use it?

We are making the proxy solicitation materials available to stockholders who hold shares in “street name” electronically via the Internet under the Notice and Access rules and regulations of the Securities and Exchange Commission (the “SEC”). On or about April 3, 2014, we mailed to such stockholders a Notice of Internet Availability of Proxy Materials (“Notice”) in lieu of mailing a full set of proxy materials. Accordingly, our proxy materials are first being made available to our stockholders on or about April 3, 2014. The Notice includes information on how to access and review the proxy materials and how to vote via the Internet. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We believe this method of delivery will decrease costs, expedite distribution of proxy materials to you and reduce our environmental impact. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our Annual Meeting. Stockholders who received the Notice but would like to receive a printed copy of the proxy materials in the mail should follow the instructions in the Notice for requesting such materials.

3. Why am I receiving these proxy materials?

We are furnishing you these proxy materials in connection with the solicitation of proxies on behalf of our Board of Directors (the “Board”) for use at the Annual Meeting. This proxy statement includes information that we are required to provide under SEC rules and is designed to assist you in voting your shares.

Proxies in proper form received by us at or before the time of the Annual Meeting will be voted as specified. Stockholders may specify their choices by marking the appropriate boxes on your proxy card. If a proxy card is dated, signed and returned without specifying choices, the proxies will be voted in accordance with the recommendations of the Board set forth in this proxy statement, and, in their discretion, upon such other business as may properly come before the Annual Meeting. Business transacted at the Annual Meeting will be confined to the purposes stated in the Notice of Annual Meeting. Shares of our common stock, par value $0.01 per share (“Common Stock”), cannot be voted at the Annual Meeting unless the holder is present in person or represented by proxy.

4. How can I get electronic access to the proxy materials?

The Notice will provide you with instructions regarding how to (1) view on the Internet our proxy materials for the Annual Meeting; and (2) instruct us to send proxy materials to you by email. The proxy materials are also available on our website at www.plygem.com under the “Investor relations” tab. Choosing to receive proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our annual meetings on the environment.

5. What is included in the proxy materials?

The proxy materials include:

• | our Notice of Annual Meeting of Stockholders (“Notice”); |

• | this proxy statement; and |

• | our 2013 Annual Report. |

If you receive a paper copy of these materials by mail, the proxy materials also include a proxy card.

4

6. What does it mean if I receive more than one Notice or proxy card on or about the same time?

It generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card or, if you vote by Internet, vote once for each Notice or proxy card you receive.

7. Who pays the cost of soliciting proxies for the Annual Meeting?

Proxies will be solicited on behalf of the Board by mail, telephone, email or other electronic means or in person, and we will pay the solicitation costs. We will supply our proxy materials, including our 2013 Annual Report, to brokers, dealers, banks and voting trustees, or their nominees for the purpose of soliciting proxies from beneficial owners, and we will reimburse such recordholders for their reasonable expenses.

8. Who is entitled to vote at the Annual Meeting?

In accordance with our Amended and Restated By-laws (the “By-laws”), the Board has fixed the close of business on March 24, 2014 as the record date (the “Record Date”) for determining the stockholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. At the close of business on the Record Date, the outstanding number of our voting securities was 67,810,280 shares. Each stockholder is entitled to one vote for each share of Common Stock he or she held as of the Record Date. Shares cannot be voted at the Annual Meeting unless the holder is present in person or represented by proxy.

9. Are the CI Partnerships entitled to nominate any directors for election to the Board?

Under the Company’s Second Amended and Restated Stockholders Agreement, dated as of May 22, 2013 (the “Stockholders Agreement”), Caxton-Iseman (Ply Gem), L.P. and Caxton-Iseman (Ply Gem) II, L.P., affiliates of CI Capital Partners LLC (collectively, the “CI Partnerships”), are entitled to nominate the number of directors to the Board (the “CI Director Nominees”) (rounded up to the nearest whole number) equal to the percentage of the Common Stock beneficially owned by the stockholders party to the Stockholders Agreement, including certain members of management (collectively with the CI Partnerships, the “Pre-IPO Stockholders”) (assuming the exercise of conversion of all outstanding options, whether vested or unvested). Because the Pre-IPO Stockholders beneficially own approximately 69.3% of the Common Stock, the CI Partnerships are currently entitled to nominate six of our eight directors for election to the Board.

10. What matters will be voted on at the Annual Meeting?

The following matters will be voted on at the Annual Meeting:

• | Proposal 1: To elect three directors nominees named in this proxy statement to serve as Class I directors for three-year terms expiring in 2017; |

• | Proposal 2: To approve, by non-binding advisory vote, the compensation of our named executive officers; |

• | Proposal 3: To recommend, by non-binding vote, the frequency of the advisory vote regarding the compensation of our named executive officers; |

• | Proposal 4: To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

• | Such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

5

11. What is the vote required for each proposal and what are my voting choices?

Proposal | Vote Required | Broker Discretionary Voting Allowed? |

Proposal 1 – Election of three directors | Plurality of the votes cast | No |

Proposal 2 – Advisory vote on executive compensation | Majority of the shares entitled to vote and present or represented by proxy | No |

Proposal 3 – Advisory vote on frequency of advisory vote on execution compensation | Plurality of the votes cast | No |

Proposal 4 – Ratification of auditors for fiscal year 2014 | Majority of the shares entitled to vote and present or represented by proxy | Yes |

With respect to Proposal 1, the election of directors, you may vote FOR, AGAINST or ABSTAIN. A “plurality of the votes cast” means that the three director nominees that receive the most number of votes cast “FOR” will be elected. If you ABSTAIN from voting on Proposal 1, the abstention will have an effect on the outcome of the vote (only because the outcome is determined by the number of affirmative votes for each director).

With respect to Proposals 2 and 4 (or on any other matter to be voted on at the Annual Meeting), you may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on either Proposal 2 or 4, the abstention will have the same effect as an AGAINST vote.

With respect to Proposal 3, you may vote FOR Every Year, FOR Every Two Years, FOR Every Three Years or ABSTAIN. If you ABSTAIN from voting on Proposal 3, the abstention will have an effect on the outcome of the vote (only because the outcome is determined by the number of affirmative votes for each option).

12. Could other matters be decided at the Annual Meeting?

At the date this proxy statement went to press, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this proxy statement. If other matters are properly presented at the Annual Meeting for consideration and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

13. How does the Board recommend that I vote?

The Board recommends that you vote:

• | FOR the election of the three directors nominees and named in this proxy statement; |

• | FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers; |

• | FOR annual votes, on a non-binding advisory basis, of the compensation of our named executive officers; and |

• | FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014. |

6

14. How do I vote my shares?

How to vote your shares depends on whether you hold your shares as a “stockholder of record” or as a “beneficial owner,” which terms we explain in Question 15 below. If you are a stockholder of record, you can vote in the following ways:

• | By Internet: by following the Internet voting instructions included in the proxy package sent you (or by going to www.proxyvote.com and following the instructions) at any time up until 11:59 p.m., Eastern Time, on May 13, 2014. |

• | By Mail: if you have received a printed copy of the proxy materials from us by mail, you may vote by mail by marking, dating, and signing your proxy card in accordance with the instructions on it and returning it by mail in the pre-addressed reply envelope provided with the proxy materials. The proxy card must be received prior to 11:59 p.m., Eastern Time, on May 13, 2014. |

• | In Person: First, you must satisfy the requirements for admission to the Annual Meeting (see below). Then, if you are a stockholder of record and prefer to vote your shares at the Annual Meeting, you must bring proof of identification along with your Notice, proxy card or proof of ownership. |

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet or mail so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are a beneficial owner, you should follow the instructions in the Notice or your broker should give you instructions for voting your shares. In these cases, you may vote by Internet or mail, as applicable. You may vote your shares beneficially held through your broker in person if you attend the Annual Meeting and you obtain a valid proxy from your broker giving you the legal right to vote the shares at the Annual Meeting.

15. What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Stockholder of Record. You are a stockholder of record if at the close of business on the Record Date your shares were registered directly in your name with American Stock Transfer and Trust Company, our transfer agent.

Beneficial Owner. You are a beneficial owner if at the close of business on the Record Date your shares were held by a brokerage firm or other nominee and not in your name. Being a beneficial owner means that, like most of our stockholders, your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares by following the voting instructions your broker or other nominee provides. If you do not provide your broker or nominee with instructions on how to vote your shares, your broker or nominee will be able to vote your shares as described below.

16. What do I need to be admitted to the Annual Meeting?

You will need a form of personal identification (such as a driver’s license or passport) along with either your Notice, proxy card or proof of stock ownership to enter the Annual Meeting. If your shares are held beneficially in the name of a bank, broker or other holder of record and you wish to be admitted to the Annual Meeting, you must present proof of your ownership of Ply Gem Holdings, Inc. stock, such as a bank or brokerage account statement.

17. Are there other things I should know if I intend to attend the Annual Meeting?

Please note that no cell phones, PDAs, computers, pagers, cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

7

18. What will happen if I do not vote my shares?

Stockholders of Record. If you are the stockholder of record and you do not vote by proxy card, via the Internet or in person at the Annual Meeting, your shares will not be voted at the Annual Meeting.

Beneficial Owners. If you are the beneficial owner and you do not direct your broker or nominee how to vote your shares, your broker or nominee may vote your shares only on those proposals for which it has discretion to vote. Under the rules of the New York Stock Exchange (“NYSE”), your broker or nominee does not have discretion to vote your shares on non-routine matters such as Proposals 1, 2 and 3. We believe that Proposal 4 — ratification of our auditor — is a routine matter on which brokers and nominees can vote on behalf of their clients if clients do not furnish voting instructions.

19. What is the effect of a broker non-vote?

Brokers or other nominees who hold shares for a beneficial owner have the discretion to vote on routine proposals when they have not received voting instructions from the beneficial owner at least ten days prior to the Annual Meeting. A broker non-vote occurs when a broker or other nominee does not receive voting instructions from the beneficial owner and does not have the discretion to direct the voting of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting, but will not be counted for purposes of determining the number of votes present in person or represented by proxy and entitled to vote with respect to certain proposals. Accordingly, a broker non-vote will not impact our ability to obtain a quorum or the outcome of voting on Proposals 1, 2 and 3. Because brokers are entitled on vote on Proposal 4, we do not anticipate any broker non-votes with regard to this proposal.

20. May I revoke my proxy or change my vote?

Yes, you may revoke a proxy you have given at any time before it is voted at the Annual Meeting by (1) giving our Secretary a letter revoking the proxy, which the Secretary must receive prior to the Annual Meeting, or (2) attending the Annual Meeting and voting in person. Attendance at the Annual Meeting does not standing alone constitute your revocation of a proxy. You may change your vote at any time prior to the voting of your shares at the Annual Meeting by (a) casting a new vote over the Internet by the time and date set forth in Question 14 above; or (b) sending a new proxy card with a later date that is received prior to the Annual Meeting.

21. Where do I send a stockholder proposal for consideration at the Company’s 2015 Annual Meeting of Stockholders?

If you wish to propose a matter for consideration at our 2015 Annual Meeting of Stockholders, the proposal should be mailed by certified mail return receipt requested, to our Secretary, at the Company’s principal executive office, 5020 Weston Parkway, Suite 400, Cary, North Carolina 27513. To be eligible under the SEC stockholder proposal rule (Rule 14a-8(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) for inclusion in our 2015 Annual Meeting Proxy Statement and form of proxy expected to be made available in March 2015, a proposal must be received by our Secretary at our principal executive office on or before November 28, 2014 at 5:00 p.m. Eastern Time. Failure to deliver a proposal in accordance with this procedure may result in it not being deemed timely received. For additional requirements, see “Stockholder Proposals for the 2015 Annual Meeting” below in this proxy statement.

22. How can I find the results of the Annual Meeting?

We will announce preliminary results at the Annual Meeting. We will publish final results in a current report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If the official results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available.

8

PROPOSAL 1: ELECTION OF DIRECTORS

The Board is elected by the stockholders to oversee their interest in the overall success of our business and financial strength. The Board serves as our ultimate decision-making body to the extent set forth in our amended and restated certificate of incorporation (the “Certificate of Incorporation”) and By-laws. It also selects and oversees members of our senior management, who, in turn, oversee our day-to-day business and affairs.

Composition of our Board

The Board currently consists of eight directors divided into three classes as described below. Commencing with the directors elected at Annual Meeting, each director will serve a three-year term with one class being elected at each year’s annual meeting of stockholders. Messrs. Ferris, Iseman and Roach currently serve as Class I directors (with a term expiring at the Annual Meeting). Messrs. Barber, Hall and Lefkowitz will serve initially as Class II directors (with a term expiring in 2015). Messrs. Haley and Robinette will serve initially as Class III directors (with a term expiring in 2016). Each of our directors holds office until a successor is elected or qualified or until his earlier death, resignation, disqualification or removal. Vacancies and newly created directorships on the Board may be filled by the remaining directors.

CI Director Nominees

Under the Stockholders Agreement, the CI Partnerships (or if such partnerships are dissolved, their general partner) are entitled to nominate such number of directors to the Board (rounded up to the nearest whole number) equal to the percentage of the Common Stock beneficially owned by the Pre-IPO Stockholders (assuming the exercise or conversion of all outstanding options (whether vested or unvested) and convertible or exchangeable securities held by the Pre-IPO Stockholders). Because the Pre-IPO Stockholders beneficially own approximately 69.3% of the Common Stock, the CI Partnerships are currently entitled to nominate six of our eight directors for election to the Board. Mr. Iseman, who is presently serving as a Class I director and is named in this proxy statement for re-election to the Board at the Annual Meeting, is a CI Director Nominee. The other directors on the Board initially nominated by the CI Partnerships are currently Messrs. Lefkowitz, Hall and Haley.

Nominees for the Board of Directors

Three directors to serve as Class I directors of the Company are to be elected at the Annual Meeting to hold office until the 2017 annual meeting or until their successors are duly elected and qualified, or until the director’s death, resignation, disqualification or removal. It is recommended that the three nominees named below be elected as Class I directors of the Company. One of the nominees, Frederick J. Iseman, is presently serving as a Class I director of the Company, and has served as a director since the Ply Gem acquisition. The other two current Class I directors have not been nominated for re-election but will continue to serve as directors of the Company until their successors are elected at the Annual Meeting. The second and third nominees below, Mary K. Rhinehart and Janice E. Stipp, were nominated for election by the members of the Board upon the recommendation of the Nominating and Governance Committee to replace our two currently serving Class I directors who have not been nominated for re-election. The proxy will be voted in accordance with the directions stated on the card, or, if no directions are stated, for election of each of the three Class I director nominees listed below. The director nominees for election named below are willing to be duly elected and to serve. If any such nominee is not a candidate for election at the Annual Meeting, an event that the Board does not anticipate, the proxies will be voted for a substitute nominee. We set forth information with respect to the business experience, qualifications and affiliations of our director nominees below:

Frederick J. Iseman

Since the Ply Gem acquisition, Frederick Iseman has served as our Chairman of the board of directors. Mr. Iseman is currently Chairman and CEO of CI Capital Partners, a private equity firm which was founded by Mr. Iseman in 1993. Prior to establishing CI Capital Partners, Mr. Iseman founded Hambro-Iseman Capital Partners, a merchant banking firm. From 1988 to 1990, Mr. Iseman was a member of the Hambro International Venture Fund. Mr. Iseman is a former Chairman of the Board of Anteon International Corporation and a former director of Buffets Holdings, Inc. Mr. Iseman graduated from Yale University with a BA in English Literature. Mr. Iseman is 61 years of age.

Mr. Iseman’s experience in the private equity field provides us with valuable insight regarding acquisitions, debt financings, equity financings and public market sentiment. In addition, Mr. Iseman’s experience with growing portfolio companies similar to the Company provides benchmarking and other industry tools pertinent to us. Mr. Iseman’s background and experiences qualify him to serve as Chairman of the Board.

9

Mary K. Rhinehart

Mary K. Rhinehart has been nominated to our board of directors. Ms. Rhinehart is President and Chief Executive Officer of Johns Manville, a manufacturer and marketer of building and specialty products and a Berkshire Hathaway company. She was named to this position in November 2012. She joined Johns Manville in 1979, and has held numerous leadership roles in most of Johns Manville’s businesses, including chief financial officer, corporate treasurer, corporate controller, vice president of human resources and vice president and general manager of a business unit. Ms. Rhinehart currently serves as a director of CoBiz Financial Inc., a financial services company, where she serves as chair of the audit committee. Ms. Rhinehart received a BS degree in Business cum laude from the University of Colorado at Boulder, and a MBA from the University of Denver. Ms. Rhinehart is 55 years of age.

Ms. Rhinehart has extensive experience as a financial expert, having served as the chief financial officer of Johns Manville for a number of years. The Company believes Ms. Rhinehart’s qualifications to serve as a director include her various positions in the building and specialty products industry, her education and experience in multiple business disciplines - including her strong financial background and global mergers and acquisitions experience and her extensive board experience.

Janice E. Stipp

Janice E. Stipp has been nominated to our board of directors. Ms. Stipp is Executive Vice President, Chief Financial Officer and Treasurer of Tecumseh Products, a global manufacturer of compressors and condensing units for the commercial refrigeration market. She was named to this position in October 2011. Prior to that, she was Chief Financial Officer at Revestone Industries, Acument Global Technologies, and GDX Automotive. From 1984 to 1999, she worked for General Motors in a variety of financial roles, including corporate controller. Ms. Stipp currently serves as a director of Arkansas Best Corp., a freight transportation services and solutions provider, where she serves as a member of the audit committee. She graduated from Michigan State University in 1981 with a BA in Accounting, and received a MBA from Wayne State University in 1987. She received her CPA certification in 1983. Ms. Stipp is 54 years of age.

Ms. Stipp has over 32 years of financial and accounting experience, having served as the Chief Financial Officer of both public and private firms. The Company believes Ms. Stipp’s qualifications to serve as a director include her strong background in financial controls, auditing, accounting, acquisitions and treasury, her years of senior-level executive management, and her extensive experience working with boards of directors at several companies.

Directors Continuing in Office

Class II Directors

The following is information with respect to the business experience, qualifications and affiliations of our Class II directors below (with a term expiring in 2015):

Jeffrey T. Barber

In January 2010, the board of directors approved the addition of Mr. Barber as a member of the board. Mr. Barber is a certified public accountant who worked for PricewaterhouseCoopers LLP from 1977 to 2008 and served as managing partner of PricewaterhouseCoopers’ Raleigh, North Carolina office for 14 years. Mr. Barber is currently a Managing Director with Fennebresque & Co., a Charlotte, North Carolina based investment banking firm. In addition, Mr. Barber currently serves on the board of Trustees of Blue Cross and Blue Shield of North Carolina and the board of directors of SciQuest, Inc., a procurement software company, where he serves as chair of the audit committee. Mr. Barber has a BS degree in accounting from the University of Kentucky. Mr. Barber is 61 years of age.

Mr. Barber’s audit experience with PricewaterhouseCoopers LLP for 31 years in which he worked on initial public offerings, Sarbanes-Oxley 404 attestations, business acquisitions and debt financings provides the board with the financial background and experience to ensure the Company’s consolidated financial statements comply with financial reporting guidelines. These experiences qualify Mr. Barber as a financial expert allowing him to contribute financial reporting considerations when evaluating certain strategic decisions.

Timothy T. Hall

In December 2006, the board of directors approved the addition of Mr. Hall as a member of the board. Mr. Hall is a Managing Director at CI Capital Partners and has been employed by CI Capital Partners since 2001. Prior to joining CI Capital Partners, Mr. Hall was a Vice President at FrontLine Capital and an Assistant Vice President at GE Equity. Mr. Hall has an MBA from Columbia Business School and a BS degree from Lehigh University. Mr. Hall is 44 years of age.

10

Mr. Hall’s experience with private equity markets provides the board integral knowledge with respect to acquisitions, debt financings and equity financings.

Steven M. Lefkowitz

Since the Ply Gem acquisition, Steven M. Lefkowitz has served as a director. Mr. Lefkowitz is President and Chief Operating Officer of CI Capital Partners, which he co-founded in 1993. From 1988 to 1993, Mr. Lefkowitz was employed by Mancuso & Company, a private investment firm, and served in several positions including as Vice President and as a Partner of Mancuso Equity Partners. Mr. Lefkowitz is a former director of Anteon International Corporation and Buffets Holdings, Inc. Mr. Lefkowitz graduated from Northwestern University and Kellogg Graduate School of Management. Mr. Lefkowitz is 49 years of age.

Mr. Lefkowitz’s experience with private equity markets provides the board integral knowledge with respect to acquisitions, debt financings and equity financings.

Class III Directors

The following is information with respect to the business experience, qualifications and affiliations of our Class III directors below (with a term expiring in 2016):

Michael Haley

Mr. Haley has served as a director since January 2005. Mr. Haley joined MW Manufacturers Inc. in June 2001 as President and served in this capacity until being named Chairman in January 2005. Mr. Haley retired as Chairman of MW in June 2005. Prior to joining MW, Mr. Haley was the President of American of Martinsville (a subsidiary of La-Z-Boy Inc.) from 1994 until May 2001 and was President of Loewenstein Furniture Group from 1988 to 1994. From April 2006 to present, Mr. Haley has served as an advisor to Fenway Partners, a private equity firm. From 2008 to present, Mr. Haley has been a managing director of Fenway Resources, an affiliate of Fenway Partners. Mr. Haley was the executive chairman of Coach America from 2007 to 2010. In addition, Mr. Haley currently serves as a director of American National Bankshares, Inc., Stanley Furniture Company, Inc. and LifePoint Hospitals, Inc. Mr. Haley graduated from Roanoke College in 1973 with a Bachelor’s Degree in Business Administration. Mr. Haley is 63 years of age.

Mr. Haley’s industry experience and background with the Company provides the board with relevant industry knowledge and expertise when evaluating certain strategic decisions.

Gary E. Robinette

Gary E. Robinette was appointed our President and Chief Executive Officer in October 2006 at which time he was also elected to our board of directors. Mr. Robinette was elected Vice Chairman of the board of directors in May 2013. Prior to joining Ply Gem, Mr. Robinette served as Executive Vice President and COO at Stock Building Supply, formerly a Wolseley company, since September 1998, and was also a member of the Wolseley North American Management board of directors. Mr. Robinette held the position of President of Erb Lumber Inc., a Wolseley company, from 1993 to 1998 and served as Chief Financial Officer and Vice President of Carolina Holdings which was the predecessor company of Stock Building Supply. Mr. Robinette received a BS in accounting from Tiffin University and a MBA from Xavier University, where he is a member of the Board of Trustees. He is also a member of the Policy Advisory Board of Harvard University’s Joint Center for Housing Studies and serves on the board of directors for three companies sponsored by private equity firms. Mr. Robinette is 65 years of age.

Mr. Robinette’s 36 years of experience with building products and distribution companies provides the board with relevant industry knowledge and expertise pertinent to the current economic environment. Throughout Mr. Robinette’s tenure with various building product companies, he has experienced the housing industry’s thriving growth, as well as a number of recessionary declines in the market. These experiences provide the board with valuable insight regarding strategic decisions and the future direction and vision of the Company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE THREE DIRECTOR NOMINEES NAMED ABOVE. |

11

EXECUTIVE OFFICERS

The current executive officers for the Company are set forth below:

Name | Age | Position |

Gary E. Robinette | 65 | President, Chief Executive Officer, Vice Chairman of the Board and Director |

Shawn K. Poe | 52 | Vice President, Chief Financial Officer, Treasurer and Secretary |

John Wayne | 52 | Executive Vice President, Chief Operating Officer |

John Buckley | 49 | President, Siding Group |

Art Steinhafel | 45 | President, U.S. Windows and Doors |

David N. Schmoll | 54 | Senior Vice President, Human Resources |

Timothy D. Johnson | 38 | General Counsel |

Set forth below is certain additional information concerning the Company’s executive officers, including their respective positions with the Company and prior business experience (other than Mr. Robinette, for whom such information is provided above under the caption “Proposal 1: Election of Directors”).

Shawn K. Poe

Since the Ply Gem acquisition, Mr. Poe has served as our Vice President, Chief Financial Officer, Treasurer and Secretary. Mr. Poe was appointed Vice President of Finance of our siding and accessories subsidiaries in March 2000. Prior to joining the Company, Mr. Poe held the position of Corporate Controller and various other accounting positions at Nordyne, Inc., which he joined in 1990. In addition, Mr. Poe held various accounting positions with Federal Mogul Corporation from 1984 to 1990. Mr. Poe graduated from Southeast Missouri State University in 1984 with a BS in Accounting. Mr. Poe graduated from Fontbonne College in 1994 with an MBA.

John Wayne

Mr. Wayne was appointed Executive Vice President and Chief Operating Officer of the Company on June 1, 2012 after having served as President of our Siding, Fencing and Stone group subsidiaries since January of 2002. Mr. Wayne joined the Company in 1998, and prior to his appointment to President of our Siding, Fencing and Stone group had been Vice President of Sales and Marketing for our Variform and Napco siding and accessories subsidiaries. Prior to joining us, Mr. Wayne worked for Armstrong World Industries, Inc. from 1985 to 1998, holding a variety of sales management positions, including Vice President of Sales. Mr. Wayne served as the Chairman of the Vinyl Siding Institute, the Chairman of the VSI Code and Regulatory Committee, and Chairman of the VSI board of directors through December 2007 when his term ended. Mr. Wayne graduated from the University of Wisconsin in 1984 with a BBA in Finance and Marketing.

John Buckley

Mr. Buckley was appointed President of our Siding Group effective June 1, 2012. Mr. Buckley joined the Company in 1999, and prior to his appointment to President of our Siding Group had been Senior Vice President of Sales for our siding and accessories subsidiaries. Prior to joining us, Mr. Buckley worked for CertainTeed from 1991 to 1999, holding a variety of sales management positions. Mr. Buckley received a BA in communications from the University of Michigan in 1986, and a MSA from Madonna University in 1991.

Art Steinhafel

Mr. Steinhafel was appointed President of U.S. Windows and Doors Group in August 2013. Mr. Steinhafel joined the Company in 2010, and prior to his appointment to President of the Company’s U.S. Window and Door group had been Senior Vice President of Sales for our U.S. Window and Door group. Prior to joining the Company, Mr. Steinhafel worked for Atrium Windows from 2008 to 2010 as President of the Central Region and for Peachtree Window Companies in various capacities from 1999 to 2007. Mr. Steinhafel received a BS in Industrial Technology from the University of Wisconsin-Stout in 1992.

12

David N. Schmoll

Mr. Schmoll was appointed Senior Vice President of Human Resources in July 2007. Prior to joining Ply Gem, he served as Vice President of Stock Building Supply (formerly a Wolseley plc company) since 1995. Prior to that position, he served as Director of Human Resources since 1989 at Carolina Holdings, the predecessor company of Stock Building Supply, with responsibility for all human resource and development functions. Previously, Mr. Schmoll served in both human resource and collective bargaining positions at Reynolds & Reynolds. Mr. Schmoll graduated from the University of North Texas in 1981 and has attended executive development programs at both Duke University and the International Institute of Management Development.

Timothy D. Johnson

Mr. Johnson joined the Company in June 2008 as Senior Vice President and General Counsel. Prior to joining the Company, he served as Vice President and Regional Counsel at Arysta LifeScience North America from 2006 to 2008. Previously, Mr. Johnson was an attorney with the law firms of Hunton & Williams from 2003 to 2006 and Wilson Sonsini Goodrich & Rosati from 2001 to 2003. Mr. Johnson received a BA in biology from Taylor University in 1997, and a JD from Duke University School of Law in 2001.

13

CORPORATE GOVERNANCE

Code of Ethics and Corporate Governance Guidelines

We have adopted a code of ethics that applies to our Chief Executive Officer, Chief Financial Officer and all other employees (“Code of Ethics”). We have also adopted corporate governance guidelines (“Guidelines”). The Code of Ethics and Guidelines are posted on our website at www.plygem.com. Any waiver or amendment to the Code of Ethics will be timely disclosed on our website. We also make these materials available in print to any stockholder upon request. The Board regularly reviews corporate governance developments and modifies the Code of Ethics and Guidelines as warranted.

Compliance and Ethics Hotline

We maintain a compliance and ethics hotline through which employees can report evidence of illegal or unethical behavior, or violations of the Code of Ethics. The compliance and ethics hotline is serviced by an independent company, is available seven days a week, 24 hours a day and can be accessed by individuals through a toll-free number. Employees can report concerns anonymously. We maintain a formal no retaliation policy that prohibits retaliation against, or discipline of, an employee who raises an ethical concern in good faith. This system documents the reporting person’s statement and transmits the information to the corporate oversight board. This board has the authority to conduct an investigation, research applicable policies, regulations, and statutes, and determine the appropriate action to resolve the reported item.

Director Independence

The Board has adopted categorical standards for director independence. Under these standards, a director will not be considered independent if:

(1) | the director does not qualify as independent under Rule 303A.02(b) of the NYSE Listed Company Manual, |

(2) | the director or an immediate family member is a partner of, or of counsel to, a law firm that performs substantial legal services for us on a regular basis, or |

(3) | the director or an immediate family member is a partner, officer or employee of an investment bank or consulting firm that performs substantial services for us on a regular basis. |

The Board does not consider the following relationships to be material relationships that would impair a director’s independence:

(1) | the director or an immediate family member is an executive officer of another company that does business with us and the annual sales to, or purchases from, us are less than 1% of the annual revenues of the company for which he or she serves as an executive officer, |

(2) | the director or an immediate family member is an executive officer of another company which is indebted to us, or to which we are indebted, and the total amount of either company’s indebtedness to the other is less than 1% of the total consolidated assets of the company for which he or she serves as an executive officer and such indebtedness is not past due, or |

(3) | the director or an immediate family member serves as an officer, director or trustee of a charitable organization, and our discretionary charitable contributions to the organization are less than 1% of its total annual charitable receipts (the Company’s automatic matching of employee charitable contributions will not be included in the amount of the Company’s contributions for this purpose). |

The Board has determined that director nominees Mses. Rhinehart and Stipp, and directors Messrs. Barber, Ferris, Haley and Roach, meet our categorical standards for director independence and the applicable rules and regulations of the NYSE and federal securities laws regarding director independence.

14

Certain Relationships and Related Party Transactions

Reorganization Transactions

In connection with our initial public offering (the “IPO”), we merged with our former parent corporation, Ply Gem Prime Holdings, Inc. (“Ply Gem Prime”), and engaged in a series of transactions that converted the outstanding subordinated debt, common stock and preferred stock of Ply Gem Prime into common equity and resulted in a single class of our common stock outstanding (the “Reorganization Transactions”). In addition, prior to this merger, a wholly-owned subsidiary of Ply Gem Prime merged with and into Ply Gem Prime, with Ply Gem Prime being the surviving entity. As part of the IPO, the stockholders of Ply Gem Prime received interests in an entity controlled by an affiliate of the CI Partnerships (the “Tax Receivable Entity”) in proportion to their ownership interests in Ply Gem Prime.

Previously, Ply Gem Prime owned 100% of our capital stock. Prior to the IPO, Ply Gem Prime had three classes of preferred stock, three classes of common stock and approximately $68.4 million aggregate principal amount of its 10% Senior Subordinated Notes due 2015 (the “Prime Notes”) outstanding. The Prime Notes were held by the CI Partnerships and all of the preferred stock and common stock of Ply Gem Prime was held by the CI Partnerships and certain current and former directors and members of our management team or their related parties. Prior to the closing of the IPO, the CI Partnerships exchanged the Prime Notes held by them for a new class of senior preferred stock of Ply Gem Prime (the “New Preferred Stock”) with a liquidation preference equal to the principal amount of and accrued interest on the Prime Notes.

Prior to the closing of the IPO, Ply Gem Prime merged with and into Ply Gem Holdings, with Ply Gem Holdings being the surviving entity. In the reorganization merger, we issued a total of 48,962,494 shares of Common Stock, representing approximately 72.9% of our outstanding Common Stock after giving effect to the IPO and exercise by the underwriters of their over-allotment option in full. In the reorganization merger, all of the preferred stock (including New Preferred Stock) of Ply Gem Prime (including the subordinated debt of Ply Gem Prime that had been converted into preferred stock as part of the Reorganization Transactions) was converted into a number of shares of Common Stock based on the initial public offering price of the Common Stock and the liquidation value of and the maximum dividend amount in respect of the preferred stock. The holders of common stock of Ply Gem Prime received an aggregate number of shares of Common Stock equal to the difference between 48,962,494 and the number of shares of our Common Stock issued to the holders of preferred stock of Ply Gem Prime.

In the reorganization merger, holders of preferred stock of Ply Gem Prime (including the New Preferred Stock) received an aggregate of 21,286,225 shares of our Common Stock and holders of common stock of Ply Gem Prime received an aggregate of 27,676,269 shares of our Common Stock. In addition, in connection with the Reorganization Transactions, options to purchase shares of common stock of Ply Gem Prime were converted into options to purchase shares of our Common Stock with adjustments to the number of shares and per share exercise prices to reflect the reorganization merger.

The table below sets forth the consideration received by our directors, executive officers and our principal stockholders at the time of the Reorganization Transactions in connection with the Reorganization Transactions:

Name | Common stock issued in Reorganization Transactions |

Caxton-Iseman (Ply Gem), L.P. | 9,985,631 |

Caxton-Iseman (Ply Gem) II, L.P. | 35,709,612 |

Frederick J. Iseman | — |

Gary E. Robinette | — |

Shawn K. Poe | 277,448 |

John Wayne | 293,395 |

John Buckley | 82,182 |

Lynn Morstad | 372,827 |

Timothy D. Johnson | — |

David N. Schmoll | 32,472 |

Robert A. Ferris | — |

Steven M. Lefkowitz | — |

John D. Roach | 46,350 |

Michael Haley | 81,234 |

Timothy T. Hall | — |

Jeffrey T. Barber | 3,886 |

Stockholders Agreement

On May 22, 2013, the Company entered into a second amended and restated stockholders’ agreement (the “Stockholders Agreement”), by and among the Company, Ply Gem Prime and the Pre-IPO Stockholders, which included the CI Partnerships and certain of the Company’s members of management at the time of the IPO, including Messrs. Robinette, Poe, Wayne, Buckley, Schmoll, Johnson and Morstad. As described below, the Stockholders Agreement contains provisions related to stockholder voting, the composition of the Board and the committees of the Board, the Company’s corporate governance, restrictions on the transfer of shares of the Company’s capital stock and certain other provisions.

Voting Agreements

Under the Stockholders Agreement, each of the Pre-IPO Stockholders has agreed to vote all shares of the Company’s voting stock held by it as directed by the CI Partnerships (or if such partnerships are dissolved, their general partner) in any voting matter before the Company’s stockholders including, without limitation, elections of directors, amendments to the Company’s certificate of incorporation, approvals of mergers and other transactions or stockholder proposals, whether in an annual stockholder meeting, special stockholder meeting or an action by written consent.

Board and Committees

Under the Stockholders Agreement, the CI Partnerships (or if such partnerships are dissolved, their general partner) are entitled to nominate such number of directors to the Board (rounded up to the nearest whole number) equal to the percentage of the Common Stock beneficially owned by the Pre-IPO Stockholders (assuming the exercise or conversion of all outstanding options (whether vested or unvested) and convertible or exchangeable securities held by the Pre-IPO Stockholders).

The Board initially consisted of eight directors and the CI Partnerships initially had the right to nominate six directors on the Board. The CI Partnerships’ initial nominees were Messrs. Iseman, Lefkowitz, Hall, Ferris, Roach and Haley. As of the date of this proxy statement, the CI Partnerships have the right to nominate a total of six directors to the Board, and have nominated three directors for election at the Annual Meeting.

The Stockholders Agreement also provides that the CI Partnerships (or if such partnerships are dissolved, their general partner) will be entitled to nominate such number of directors to the standing committees of the Board (other than the Audit Committee) (rounded up to the nearest whole number) equal to the percentage of Common Stock beneficially owned by the Pre-IPO Stockholders (assuming the exercise or conversion of all outstanding options (whether vested or unvested) and convertible or exchangeable securities held by the Pre-IPO Stockholders).

16

The Company’s Compensation Committee consists of four directors and the CI Partnerships have the right to designate three members of the Compensation Committee. The Compensation Committee members designated by the CI Partnerships are Messrs. Lefkowitz, Hall and Ferris.

The Company’s Nominating and Governance Committee consists of four directors and the CI Partnerships have the right to designate three members of the Nominating and Governance Committee. The Nominating and Governance Committee members designated by the CI Partnerships are Messrs. Iseman, Lefkowitz and Hall.

In the event that a vacancy is created on the Board or any committee thereof for any reason, the CI Partnerships (or if such partnerships are dissolved, their general partner) will have the right to designate a director or committee member to fill such vacancy to the extent the CI Partnerships (or if such partnerships are dissolved, their general partner) had the right to designate or nominate the director or committee member who created the vacancy. The right of the CI Partnerships to nominate any board member or committee member will be subject to compliance with applicable federal and state securities laws and the rules of NYSE (or any securities exchange on which any of the Company’s equity securities may then be listed or admitted for trading) and, with respect to the Compensation Committee, subject to compliance with Section 162(m) of the Internal Revenue Code of 1986, as amended, to the extent that the Board elects to satisfy Section 162(m)’s outside directors requirements.

General Restrictions on Transfer

Subject to certain limited exceptions, no Pre-IPO Stockholder may transfer its shares of Common Stock (or stock options or other securities exercisable or convertible or exchangeable for shares of Common Stock), unless the transferee agrees to become a party to the Stockholders Agreement.

Restrictions on Transfer

Under the Stockholders Agreement, each member of the Company’s senior management, including Messrs. Robinette, Poe, Wayne, Buckley, Schmoll and Johnson (collectively, the “Management Stockholders”), and, under separate transfer restriction agreements, dated as of May 22, 2013, certain other employees and stockholders, including Messrs. Barber, Ferris, Haley and Roach (collectively with the Management Stockholders, the “Restricted Stockholders”), agreed to restrict their ability to transfer (i) Common Stock issued to him or it in the reorganization merger (the “Initial Common Stock”) and (ii) options to purchase Common Stock whether issued prior to or in connection with the Offering (whether vested or unvested) (the “Initial Option Securities”). Subject to certain exceptions, such as transfers to permitted transferees, each Restricted Stockholder may only transfer his or its Initial Common Stock and Initial Option Securities as follows:

• | Prior to May 29, 2014 (and only following 180 days after May 29, 2013 in the case of Restricted Stockholders that are not Management Stockholders), up to 20% of the Initial Common Stock and 20% of the Initial Option Securities; |

• | On and after May 29, 2014 and through May 29, 2015, up to an additional 40% of the Initial Common Stock and 40% of the Initial Option Securities; and |

• | After May 29, 2015, up to 100% of the Initial Common Stock and up to 100% of the Initial Option Securities. |

Notwithstanding the foregoing limitations, if the CI Partnerships (or if such partnerships are dissolved, their general partner) sell any of the Common Stock held by them in an underwritten public offering, then each Restricted Stockholder may sell its Initial Common Stock and Initial Option Securities in such public offering on a pro rata basis with the CI Partnerships (or if such partnerships are dissolved, their general partner). The restrictions on transfer will terminate upon a change of control of the Company. In addition, the restrictions on transfer will terminate with respect to any Management Stockholder and certain other employees that are party to transfer restriction agreements whose employment is terminated by the Company, who resigns for good reason or who retires. These restrictions on transfer may be amended or waived by the Board in its sole discretion.

The Stockholders Agreement contains customary confidentiality agreements from the Pre-IPO Stockholders and covenants from the Management Stockholders not to compete with the Company or solicit employees from the Company for a period of one year following termination of employment with the Company (whether such termination was voluntary or involuntary or with or without cause or good reason).

17

Other Provisions

The Stockholders Agreement requires the Company to deliver to the CI Partnerships (or if such partnerships are dissolved, their general partner) a copy of the Company’s unaudited monthly management report (including the Company’s unaudited consolidated balance sheet and income statement) as soon as it is available after the end of each monthly accounting period, a copy of the Company’s annual strategic plan and budget as soon as practicable following approval by the Board and such other information and data with respect to the Company as the CI Partnerships may reasonably request, subject to customary confidentiality provisions. In addition, the Company is required to give the CI Partnerships, their manager and their general partner and outside accountants, auditors, legal counsel and other authorized representatives or agents of such persons reasonable access to the Company’s books and records and all documents and information related to the Company’s properties, assets and business as they may reasonably request, including access to the Company’s properties and employees.

Under the Stockholders Agreement, the Company has agreed that until the CI Partnerships and certain related parties cease to beneficially own, in the aggregate, at least 15% of the Company’s outstanding Common Stock (assuming the exercise or conversion of all outstanding options (whether vested or unvested) and convertible or exchangeable securities held by the CI Partnerships and certain related parties) the Company will elect not to be governed by section 203 of the Delaware General Corporation Law. (However, the Certificate of Incorporation contains provisions that have the same effect as section 203 of the Delaware General Corporation Law, except that the CI Partnerships and their respective affiliates and successors and certain of their transferees as a result of private sales will not be subject to such restrictions.) The Company has also agreed that the doctrine of “corporate opportunity” will not apply with respect to the Company, to any of the CI Partnerships or certain related parties or any directors of the Company who are employees of the CI Partnerships or their affiliates.

Under the Stockholders Agreement, the Company has agreed to indemnify the CI Partnerships from any losses arising directly or indirectly out of the CI Partnerships actual, alleged or deemed control or ability to influence control of the Company or the actual or alleged act or omission of any director nominated by the CI Partnerships, including any act or omission in connection with the Offering.

Under the Stockholders Agreement, the Company has agreed to reimburse the CI Partnerships (or if such partnerships are dissolved, their general partner) for all reasonable out-of-pocket fees and expenses incurred in connection with the transactions contemplated by the Stockholders Agreement and the ongoing monitoring of their investments in the Company.

Termination

The Stockholders Agreement will terminate upon the earliest to occur of (i) an agreement among the Company, the CI Partnerships (or if such partnerships are dissolved, their general partner) and the other Pre-IPO Stockholders holding a majority of the voting stock held by the Pre-IPO Stockholders (other than the CI Partnerships and certain related parties) to terminate the Stockholders Agreement or (ii) as to any Pre-IPO Stockholder (with respect to any provisions other than the confidentiality, non-compete and non-solicitation provisions applicable to the Management Stockholders), if such Pre-IPO Stockholder no longer owns any shares of Common Stock (or stock options or other securities exercisable or convertible or exchangeable for shares of Common Stock) other than by reason of a transfer in violation of the Stockholders Agreement.

In addition, the voting agreement and the provisions relating to the right to nominate or designate directors and committee members will terminate at such time as the Pre-IPO Stockholders cease to beneficially own at least 15% of the Common Stock outstanding immediately prior to the consummation of the IPO (after giving effect to the Reorganization Merger) (assuming the exercise or conversion of all outstanding options (whether vested or unvested) and convertible or exchangeable securities held by the Pre-IPO Stockholders).

18

Registration Rights Agreement

On May 22, 2013, the Company entered into a registration rights agreement (the “Registration Rights Agreement”) with the Pre-IPO Stockholders. Subject to several exceptions, including the Company’s right to defer a demand registration under certain circumstances, the CI Partnerships (or if such partnerships are dissolved, their general partner) may require that the Company register for public resale under the Securities Act all shares of Common Stock that they request be registered at any time following the closing of the Offering so long as the securities being registered in each registration statement are reasonably expected to produce aggregate proceeds of at least $20.0 million. The Company will not be obligated to effectuate more than five demand registrations under the Registration Rights Agreement. If the Company becomes eligible to register the sale of its securities on Form S-3 under the Securities Act, the CI Partnerships (or if such partnerships are dissolved, their general partner) have the right to require the Company to register the sale of the Common Stock held by them on Form S-3, subject to offering size and other restrictions. The other Pre-IPO Stockholders are entitled to piggyback registration rights with respect to any registration request made by the CI Partnerships (or if such partnerships are dissolved, their general partner). If the registration requested by the CI Partnerships (or if such partnerships are dissolved, their general partner) is in the form of a firm underwritten offering, and if the managing underwriter of the offering determines that the number of securities to be offered would have a material adverse effect on the distribution or sales price of the shares of Common Stock in the offering, the number of shares included in the offering will be determined as follows:

• | first, shares offered by the Pre-IPO Stockholders who request to include their shares in the registration (pro rata, based on the number of registrable securities owned by such Pre-IPO Stockholders); |

• | second, shares offered by any other stockholders (pro rata, based on the number of registrable securities owned by such stockholder) except to the extent any such holders have agreed under existing agreements to grant priority with regard to participation in such offering to any other holders of the Company’s securities; and |

• | third, shares offered by us for our own account. |

In addition, the Pre-IPO Stockholders have been granted piggyback rights on any registration for the Company’s account or the account of another stockholder. If the managing underwriter in an underwritten offering determines that the number of securities offered in a piggyback registration would have a material adverse effect on the distribution or sales price of the shares of Common Stock in the offering, the number of shares included in the offering will be determined as follows:

• | first, shares offered by the Company for its own account if the Company has initiated such registration or by any stockholders exercising demand rights with respect to such registration (pro rata, based on the number of registrable securities owned by the requesting stockholders); |

• | second, shares offered by any of the Company’s other stockholders (including the Pre-IPO Stockholders) (pro rata, based on the number of registrable securities owned by such stockholder); and |

• | third, shares offered by the Company for its own account if any stockholder initiated such registration by exercising demand rights. |

In connection with the registrations described above, the Company will indemnify any selling stockholders and will bear all fees, costs and expenses (except underwriting discounts and selling commissions).

General Advisory Agreement

Upon completion of the Ply Gem acquisition, Ply Gem Industries entered into an advisory agreement with an affiliate of CI Capital Partners LLC (the “CI Party”), which we refer to as the “General Advisory Agreement.”

Under the General Advisory Agreement, the CI Party provided us with acquisition and financial advisory services as the Board shall have reasonably requested. In consideration of these services, Ply Gem Industries, Inc. (“Ply Gem Industries”) agreed to pay the CI Party (1) an annual fee equal to 2% of our EBITDA, as defined in such agreement, (2) a transaction fee, payable upon the completion by us of any acquisition, of 2% of the sale price, (3) a transaction fee, payable upon the completion by us of any divestitures, of 1% of the sale price, and (4) a transaction fee, payable upon the completion of the sale of our company, of 1% of the sale price.

Under the General Advisory Agreement, the Company paid management fees of approximately $0.8 million during the year ended December 31, 2013. On May 19, 2013, in connection with the IPO, the Company terminated the General Advisory Agreement and paid a termination fee of approximately $18.9 million to the CI Party.

19

Tax Sharing Agreement

Prior to January 11, 2010, Ply Gem Prime was the common parent of an affiliated group of corporations that included Ply Gem Investment Holdings, Ply Gem Holdings, Ply Gem Industries and their subsidiaries. Ply Gem Prime elected to file consolidated federal income tax returns on behalf of the group. Accordingly, on February 24, 2006, Ply Gem Prime, Ply Gem Investment Holdings, Ply Gem Industries and Ply Gem Holdings entered into an Amended and Restated Tax Sharing Agreement, under which Ply Gem Investment Holdings, Ply Gem Industries and Ply Gem Holdings agreed to make payments to Ply Gem Prime. These payments will not be in excess of the tax liabilities of Ply Gem Investment Holdings, Ply Gem Industries, Ply Gem Holdings and their respective subsidiaries, if these tax liabilities had been computed on a stand-alone basis. On January 11, 2010, Ply Gem Investment Holdings was merged with and into Ply Gem Prime, with Ply Gem Prime being the surviving corporation. As a result, on March 17, 2011, we entered into a Second Amended and Restated Tax Sharing Agreement, effective as of January 11, 2010, so that the tax sharing agreement is among Ply Gem Prime, Ply Gem Holdings and Ply Gem Industries. In connection with the Reorganization Transactions, Ply Gem Prime merged with and into Ply Gem Holdings with Ply Gem Holdings being the surviving corporation. As a result, the Company entered into a Third Amended and Restated Tax Sharing Agreement on May 23, 2013 in connection with the Reorganization Transactions so that the tax sharing agreement is between Ply Gem Holdings and Ply Gem Industries.

Tax Receivable Agreement

In order to induce the stockholders of Ply Gem Prime to consent to the IPO and the related transactions, we entered into a tax receivable agreement with the Tax Receivable Entity (an entity controlled by an affiliate of the CI Partnerships). We entered into the tax receivable agreement because certain favorable tax attributes related to the period prior to this offering will be available to us. Specifically, we have substantial deferred tax assets related to NOLs for United States federal and state income tax purposes, which are available to offset future taxable income. The CI Partnerships and our stockholders from before the IPO believed that the value of these tax attributes should be considered in determining the value of our shares that were sold in the IPO. Since it was difficult to determine the present value of these attributes with certainty, the tax receivable agreement generally provides for the payment by us to the Tax Receivable Entity of 85% of the amount of cash savings, if any, in U.S. federal, state and local income tax that we actually realize in periods after the IPO as a result of (i) NOL carryovers from periods (or portions thereof) ending before January 1, 2013, (ii) deductible expenses attributable to the transactions related to this offering and (iii) deductions related to imputed interest deemed to be paid by us as a result of or attributable to payments under this tax receivable agreement. We will retain the benefit of the remaining 15% of these tax savings.

The amount and timing of any payments under the tax receivable agreement will vary depending upon a number of factors, including the amount and timing of the taxable income we generate in the future and the tax rate then applicable, our use of NOL carryovers and the portion of our payments under the tax receivable agreement constituting imputed interest.

The payments we will be required to make under the tax receivable agreement could be substantial. We expect that, as a result of the amount of the NOL carryovers from prior periods (or portions thereof), assuming no material changes in the relevant tax law and that we earn sufficient taxable income to realize in full the potential tax benefit described above, future payments under the tax receivable agreement, in respect of the federal and state NOL carryovers, will not exceed approximately $100.0 million in the aggregate and would be paid within the next five years, assuming that utilization of such tax attributes is not subject to limitation under Section 382 of the Code as the result of an “ownership change” (within the meaning of Section 382 of the Code) of Ply Gem Holdings. It is possible that future transactions or events could increase or decrease the actual tax benefits realized from these tax attributes and the corresponding tax receivable agreement payments. We are currently unable to estimate the amount of payments under the tax receivable agreement in respect of deductible expenses attributable to the transactions related to this offering or deductions related to imputed interest deemed paid by us as a result of or attributable to payments under this tax receivable agreement. However, in no event will the total payments made under the tax receivable agreement exceed $100.0 million.

In addition, although we are not aware of any issue that would cause the IRS to challenge the benefits arising under the tax receivable agreement, the Tax Receivable Entity will not reimburse us for any payments previously made if such benefits are subsequently disallowed, however, any excess payments made to the Tax Receivable Entity will be netted against payments otherwise to be made, if any, after our determination of such excess. As a result, in such circumstances, we could make payments under the tax receivable agreement that are greater than our actual cash tax savings and may not be able to recoup those payments, which could adversely affect our liquidity.