UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission File Number: 333-114564

CHINA CARBON GRAPHITE GROUP, INC.

(Exact name of registrant as specified in its charter)

Nevada |

98-0550699 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

20955 Pathfinder Road, Suite 200 Diamond Bar CA, USA |

91765 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: 909-843-6518

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

Name of each exchange on which registered: | |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter: $683,710.38 based on 22,790,346 non-affiliates shares of common stock at $0.03 per share as of June 28, 2019.

The number of shares of the registrant’s common stock outstanding as of May 14, 2020 was 27,742,346

Documents Incorporated by Reference: None

CHINA CARBON GRAPHITE GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2019

i

RELIANCE ON SECURITIES AND EXCHANGE COMMISSION ORDER

China Carbon Graphite Group, Inc. (the “Company”) is filing this Annual Report on Form 10-K (the “Annual Report”) for fiscal year ended December 31, 2019 pursuant to the Securities and Exchange Commission (the “SEC”) Order dated March 4, 2020 (Release No. 34-88318), as modified on March 25, 2020 (Release No. 34-88465) (the “Order”) to delay the filing of the Annual Report due to circumstances related to the coronavirus pandemic (“COVID-19”). On March 30, 2020, the Company filed a Current Report on Form 8-K stating that it is relying on the Order to delay the filing of the Report by up to 45 days due to circumstances related to the COVID-19 pandemic. The Company followed the restrictive measures implemented in China, by suspending operation and having employees work remotely during February and March 2020. The Company gradually resumed operation and production starting in April 2020. Such restrictive measures caused a delay in the entry time of the on-site audit by the Company’s independent public accountant and consequently a delay in the preparation, audit and completion of the Company’s financial statements for the Annual Report. As a result, the Company was unable to timely file the Annual Report without the extension provided for by the Order.

ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements regarding our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not deemed to represent an all-inclusive means of identifying forward-looking statements as denoted in this Annual Report on Form 10-K. Additionally, statements concerning future matters are forward-looking statements.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the headings “Risks Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the SEC. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K, except as required by law. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report on Form 10-K, which are designed to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

OTHER PERTINENT INFORMATION

Unless the context specifically states or implies otherwise, references in this Annual Report on Form 10-K to “we,” “us,” and words of like import refer to China Carbon Graphite Group, Inc., its wholly-owned subsidiaries, Talent International Investment Limited (“Talent”), XingheYongle Carbon Co., Ltd. (“Yongle”), Golden Ivy Limited (“BVI Co.”), Royal Elite International Limited (“Royal HK”), and Royal Elite New Energy Science and Technology (Shanghai) Co., Ltd. (“Royal Shanghai”).

Our business is conducted in the People’s Republic of China (“China” or the “PRC”). “RMB” refers to Renminbi, or the Yuan, the official currency of the PRC. Our consolidated financial statements are presented in U.S. dollars in accordance with U.S. GAAP. In this Annual Report, we refer to assets, obligations, commitments and liabilities in our financial statements in U.S. dollars. These dollar references are based on the exchange rate of RMB to U.S. dollars, determined as of a specific date. Changes in the exchange rate will affect the amount of our obligations and the value of our assets in terms of U.S. dollars, which may result in an increase or decrease in the amount of our obligations (expressed in U.S. dollars) and the value of our assets.

iii

Business Overview

China Carbon Graphite Group, Inc. (the “Company”), through its subsidiaries, is engaged in the research and development, rework and sales of graphene and graphene oxide and graphite bipolar plates in the People’s Republic of China (“China” or the “PRC”). The Company has developed its own graphene prototype and reworks the products by orders only. The Company outsource the production of large orders to third parties as it has not commercialized its product prototype. We also operate a business-to-business and business-to-consumers Internet portal (www.roycarbon.com) for graphite related products. Vendors can sell raw materials, industrial commodities and consumer (household) commodities to both business and consumers through the website by paying a fee for each transaction conducted through the website.

Our business scope includes manufacturing and selling primarily the following types of graphite products:

| ● | graphene; |

| ● | graphene oxide; |

| ● | carbon graphite felt; and |

| ● | graphite bipolar plates |

Our Growth Strategy

Some of our future business plans, including promoting our online portal and potential acquisition and merger, would likely require us to obtain additional funds from equity or debt markets, or to borrow additional funds from local banks. We currently have no commitments from any financing sources. There is no assurance that we will be able to raise any funds on terms favorable to us, or at all. In the event that we issue shares of equity or convertible securities, holdings of our existing stockholders would be diluted. In addition, there is no assurance that we will be able to successfully manage and integrate the production and sale of new products.

We will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include (1) obtaining capital from the sale of its equity securities, (2) sales of its products, and (3) short-term or long-term borrowings from banks, stockholders or other party(ies) when needed. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans. We plan to look for opportunities to merge with other companies in the graphite industry.

The ability of us to continue as a going concern is dependent upon our ability to successfully accomplish the plans described in the preceding paragraph and eventually to secure other sources of financing and attain profitable operations.

1

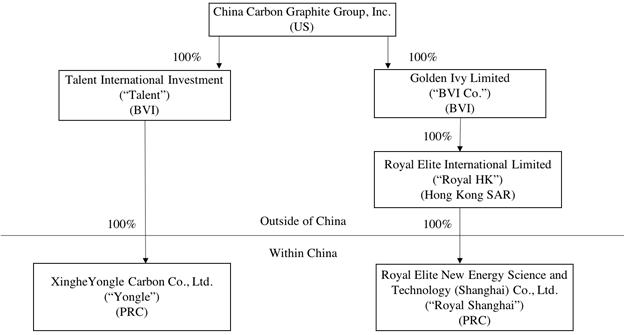

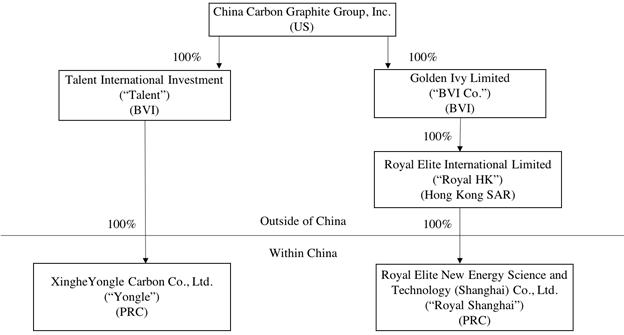

Organizational Structure

We were incorporated on February 13, 2003 in Nevada under the name Achievers Magazine Inc. In connection with the reverse merger transaction described below, our corporate name was changed to China Carbon Graphite Group, Inc. on January 30, 2008.

On December 17, 2007, we completed a share exchange pursuant to a share exchange agreement with Sincere Investment (PTC), Ltd. (“Sincere”), a British Virgin Islands corporation. Sincere was the sole stockholder of Talent International Investment Limited (“Talent”), a British Virgin Islands corporation., which is the sole stockholder of XingheYongle Carbon Co., Ltd. (“Yongle”), a wholly foreign-owned enterprise company organized under the laws of the PRC. Pursuant to the share exchange agreement, the Company issued 9,388,172 shares of common stock to Sincere in exchange for all of the outstanding on stock of Talent, and Talent became a wholly-owned subsidiary of the Company. Upon completion of the reverse merger, the Company’s business became the business of Talent, its subsidiaries and its affiliated variable interest entities.

Talent owns 100% of the stock of Yongle, which is a wholly foreign-owned enterprise organized under the laws of the PRC.

On December 23, 2013, we acquired Golden Ivy Limited, a British Virgin Island company (“BVI Co.”). Pursuant to the terms of the acquisition, we issued an aggregate of 5,000,000 shares of common stock, par value $0.001 per share, to the former shareholders of BVI Co. in exchange for 100% of the issued and outstanding equity of BVI Co. BVI Co. then became a wholly owned subsidiary of the Company.

The Business and the facilities related thereto are all located in the PRC. The Business is conducted by Royal Elite New Energy Science and Technology (Shanghai) Co., Ltd. (“Royal Shanghai”), a wholly foreign owned enterprise under laws of China. Royal Shanghai is wholly owned by Royal Elite International Limited, a Hong Kong company (“Royal HK”), which is wholly owned by BVI Co.

Royal Shanghai was set up in Shanghai on June 9, 2010. Royal HK was set up in Hong Kong on January 8, 2010.

The consolidated financial statements presented herein consolidate the financial statements of China Carbon Graphite, Inc. with the financial statements of its subsidiaries in the following structure chart.

2

Organizational Structure Chart

The following chart sets forth our organizational structure:

Our Products

Through our newly acquired subsidiary we now manufacture and sell the following products:

| ● | graphene; |

| ● | graphene oxide; |

| ● | carbon graphite felt; and |

| ● | graphite bipolar plates. |

Graphene Oxide has wide applications as a conductive agent, such as in lithium ion batteries, super capacitors, rubber and plastic additives, conductive ink, special coating, transparent conductive thin films and chips.

Graphite bipolar plates are primarily used in solar power storage.

In 2018, we discovered an Innovational Anti-Bacterial Graphene Silver Composite. We have applied for a patent on this new graphene/silver invention. This powerful composite has a bacterial killing rate of 99% in just 4 hours. The bacteria is used to test for product potency that includes: staphylococcus aureus, colibacillus and blastomyces albicans.

Our new material is forecasted to replace the current leading cure for dermatomycosis, a nano-silver based medicine. In addition, the new composite can be material for resin/polymer fiber industrial products such as: anti-bacterial PU insole, anti-bacterial PET fiber, etc. Due to its wide array of industrial and medical applications, this material will provide great chances for Roycarbon further expand towards new markets.

In 2018, we discovered an Innovational Anti-Bacterial Graphene Silver Composite. We have applied for a patent on this new graphene/silver invention. This powerful composite has a bacterial killing rate of 99% in just 4 hours. The bacteria is used to test for product potency that includes: staphylococcus aureus, colibacillus and blastomyces albicans.

Our new material is forecasted to replace the current leading cure for dermatomycosis, a nano-silver based medicine. In addition, the new composite can be material for resin/polymer fiber industrial products such as: anti-bacterial PU insole, anti-bacterial PET fiber, etc. Due to its wide array of industrial and medical applications, this material will provide great chances for Roycarbon further expand towards new markets.

3

Our Customers

Our customers include mainly domestic customers.

We generally do not enter into long-term contracts with our customers. Our customers generally purchase our products pursuant to purchase orders.

Sales to certain customers generated over 10% of the Company’s total net sales. Sales to one Company for the year ended December 31, 2019 were approximately 44% of the Company’s net sales. Sales to another Company for the year ended December 31, 2019 were approximately 33% of the Company’s net sales.

Our Sales and Marketing Efforts

We have not spent a significant amount of capital on advertising.

Competition and Competitive Advantages

We compete with a large number of domestic and international companies that manufacture graphene and grapheme related products. Because of the nature of the products that we sell, we believe that the reputation of the manufacturer and the quality of the product may be as important as price.

Government Regulations

Statutory Reserve

On December 31, 2013, the Company acquired new operations carried through BVI Co., and its subsidiaries Royal HK and Royal Shanghai. All of the cash generated by our operations has been held by our China entities. In order to transfer such cash to our parent entity, China Carbon Graphite Group, Inc., which is a Nevada Corporation, we would need to rely on dividends, loans or advances made by our PRC subsidiaries or VIE entity. Such transfers may be subject to certain regulations or risks. To date, our parent entity has paid its expenses by raising capital through private placement transactions. In the future, in the event that our parent entity is unable to raise needed funds from private investors, Royal Shanghai would have to transfer funds to our parent entity through our wholly-owned subsidiaries, Royal HK and BVI Co.

PRC regulations relating to statutory reserves and currency conversion would impact our ability to transfer cash within our corporate structure. The Company Law of the PRC applicable to Chinese companies provides that net after tax income should be allocated by the following rules:

| 1. | 10% of after tax income to be allocated to a statutory surplus reserve until the reserve amounts to 50% of the company’s registered capital. |

| 2. | If the accumulate balance of statutory surplus reserve is not enough to make up the Company’s cumulative prior years’ losses, the current year’s after tax income should be first used to make up the losses before the statutory surplus reverse is drawn. |

| 3. | Allocation can be made to the discretionary surplus reserve, if such a reserve is approved at the meeting of the equity owners. |

4

Therefore, the Company is required to maintain a statutory reserve in China that limits any equity distributions to its shareholders. The maximum amount of the shareholders has not been reached. The company has never distributed earnings to shareholders and has consistently stated in the Company’s filings it has no intentions to do so.

The RMB cannot be freely exchanged into Dollars. The State Administration of Foreign Exchange (“SAFE”) administers foreign exchange dealings and requires that they be conducted though designated financial institutions. Foreign Investment Enterprises, such as Royal Shanghai, may purchase foreign currency from designated financial institutions in connection with current account transactions, including profit repatriation.

These factors will limit the amount of funds that we can transfer from Royal Shanghai to our parent entity and may delay any such transfer. In addition, upon repatriation of earnings of Royal Shanghai to the United States, those earnings may become subject to United States federal and state income taxes. We have not accrued any U.S. federal or state tax liability on the undistributed earnings of our foreign subsidiary because those funds are intended to be indefinitely reinvested in our international operations. Accordingly, taxes imposed upon repatriation of those earnings to the U.S. would reduce the net worth of the Company.

Environmental Regulations

We believe that we are in compliance in all material respects with all applicable environmental protection laws and regulations.

Circular 106 Compliance and Approval

The State Administration of Foreign Exchange (“SAFE”) issued an official notice known as “Circular 106,” which requires the owners of any Chinese company to obtain SAFE’s approval before establishing any offshore holding company structure to facilitate foreign financing or subsequent acquisitions in China. We believe that our wholly-owned subsidiaries Talent and BVI. Co. were not required to obtain SAFE’s approval to establish its offshore companies Yongle and Royal HK as “special purpose vehicle” for capital raising activities on behalf of Royal Shanghai because of offshore structure.

Restrictions on Exports of Natural Resources

In 2010, the Chinese government decided to implement a number of new restrictions on natural resource industry sectors. As a result, domestic Chinese companies in certain natural resource industries face export restrictions. Such restrictions may limit our ability to export our products in the future, or may increase the expense of our exports, which may impact our business.

Employees

As of the date hereof, we have 9 full-time employees.

5

Not applicable because we are a smaller reporting company.

Item 1B. Unresolved Staff Comments.

Not required for smaller reporting companies.

There is no private ownership of land in China and all urban land ownership is held by the government, its agencies and collectives. Land use rights can be obtained from the government for a period of up to 50 years for industrial usage, 40 years for commercial usage and 70 years for residential usage, and are typically renewable. Land use rights can be transferred upon approval by the State Land Administration Bureau and payment of the required land transfer fee. The Company leases office to conduct business and does not own any land use right.

Our principal executive office is located at 20955 Pathfinder Road, Suite 200, Diamond Bar, CA 91765, and our telephone number is (909) 843-6518. The Company leases its corporate mailing address for a monthly fee of $365. The lease is month to month.

Royal Shanghai leases an office in Shanghai China. The lease term of the office space is from March 16, 2019 to March 15, 2021. The current monthly rent including monthly management fee is approximately $1,015 (RMB 7,063).

Royal Shanghai leases another laboratory in Shanghai China. The lease term of the office space is from December 1, 2019 to November 30, 2020. The current monthly rent including monthly management fee is approximately $2,500 (RMB 17,407).

As of December 31, 2019 and December 31, 2018, our property, plant and equipment consisted of the following:

| December 31, 2019 | December 31, 2018 | |||||||

| Machinery and equipment | $ | 41,708 | $ | 35,705 | ||||

| Office equipment | 10,963 | 11,100 | ||||||

| Motor vehicles | 40,127 | 40,630 | ||||||

| Total | 92,798 | 87,435 | ||||||

| Less: accumulated depreciation | (56,523 | ) | (48,962 | ) | ||||

| Plant and Equipment, net | $ | 36,275 | $ | 38,473 | ||||

For the years ended December 31, 2019 and 2018, depreciation expenses amounted to $8,231 and $15,111, respectively.

The Company purchased approximately $6,496 and $10,304 property and equipment during the years ended December 31, 2019 and 2018, respectively.

The Company reviews the carrying value of property and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition and other economic factors. Based on this assessment, no impairment expenses for property, plant, and equipment was recorded in operating expenses during the years ended December 31, 2019 and 2018.

There are no actions, suits, proceedings, inquiries or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our companies or our subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

Item 4. Mine Safety Disclosures.

Not Applicable.

6

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is quoted on the OTC Markets, or OTC, under the symbol “CHGI”. The bid prices set forth below reflect inter-dealer quotations, do not include retail markups, markdowns or commissions and do not necessarily reflect actual transactions.

The following table sets forth, for the periods indicated, the high and low bid prices of our common stock.

| High | Low | |||||||

| Fiscal Year Ended December 31, 2020 | ||||||||

| First Quarter | $ | 0.04 | $ | 0.02 | ||||

| Fiscal Year Ended December 31, 2019 | ||||||||

| First Quarter | $ | 0.05 | $ | 0.02 | ||||

| Second Quarter | $ | 0.04 | $ | 0.02 | ||||

| Third Quarter | $ | 0.03 | $ | 0.01 | ||||

| Fourth Quarter | $ | 0.03 | $ | 0.02 | ||||

| Fiscal Year Ended December 31, 2018 | ||||||||

| First Quarter | $ | 0.11 | $ | 0.05 | ||||

| Second Quarter | $ | 0.11 | $ | 0.04 | ||||

| Third Quarter | $ | 0.06 | $ | 0.02 | ||||

| Fourth Quarter | $ | 0.05 | $ | 0.02 | ||||

Number of Holders of Our Common Stock

As of May 14, 2020, there were 47 stockholders of record of our common stock. This number does not include shares held by brokerage clearing houses, depositories or others in unregistered form.

Transfer Agent

The transfer agent for the common stock is Empire Stock Transfer Inc. The transfer agent’s address is 2470 Saint Rose Parkway, Suite 304, Henderson, NV, and its telephone number is (702) 974-1444.

7

Dividend Policy

While we are required to pay dividends on the shares of our Series B Preferred Stock, we have never declared or paid cash dividends on our common stock and have no present plans to do so in the foreseeable future. In addition, any dividend payment that the Company makes is subject to foreign exchange rules governing repatriation. Current regulations in China permit our operating company to pay dividends to us only out of accumulated distributable profits, if any, determined in accordance with Chinese accounting standards and regulations. The inability of our operating company to pay dividends or make other payments to us may limit our ability to pay dividends to holders of our Series B Preferred Stock.

As of December 31, 2019, there were no shares of our Series A Preferred Stock or Series B Preferred Stock outstanding. Any future decisions regarding dividends will be made by our board of directors. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

Recent Sales of Unregistered Securities

On February 20,2019, the Company issued an aggregate of 200,000 shares of common stock to four directors as compensation for services provided in 2018. The issuance of these shares was recorded at grant date fair market value at $0.03 per share.

On February 20,2019, the Company issued 40,000 shares of common stock to the CFO. The issuance of these shares was recorded at grant date fair market value of $0.03.

Item 6. Selected Financial Data.

Not required.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion of the results of our operations and financial condition should be read in conjunction with our financial statements and the related notes, which appear elsewhere in this report. The following discussion includes forward-looking statements. For a discussion of important factors that could cause actual results to differ from our forward-looking statements, see the section entitled “Cautionary Note Regarding Forward Looking Statements” above.

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, undue reliance should not be placed on these forward-looking statements. Also, forward-looking statements represent our estimates and assumptions only as of the date of this report. This Annual Report should be read in its entirety and with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

Overview

We are engaged in the sale of graphene, graphene oxide, carbon graphite felt and graphite bipolar plates products in the PRC. We also operate a business-to-business and business-to-consumers Internet portal (www.roycarbon.com) for graphite related products. Vendors can sell raw materials, industrial commodities and consumer (household) commodities to both business and consumers through the website by paying a fee for each transaction conducted through the website.

As of and for the year ended December 31, 2019, the Company has incurred operating losses. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations. In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plans to obtain such resources for the Company include (1) obtaining capital from the sale of its equity securities, (2) sales of its products, and (3) short-term or long-term borrowings from banks, stockholders or other party(ies) when needed. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans. The Company plans to look for opportunities to merge with or acquire other graphite companies.

8

PRC regulations grant broad powers to the government to adjust the price of raw materials and manufactured products. Although the government has not imposed price controls on our raw materials or our products, it is possible that price controls may be implemented in the future, thereby affecting our results of operations and financial condition.

Recent Development

Started in December 2019, the outbreak of COVID-19 caused by a novel strain of the coronavirus has become widespread in China and in the rest of the world, including in each of the areas in which the Company, its suppliers and its customers operate. In order to avoid the risk of the virus spreading, the Chinese government enacted various restrictive measures, including suspending business operations and quarantines, starting from the end of January 2020. We followed the requirements of local health authorities to suspend operation and production and have employees work remotely in February and March 2020. During the first quarter of 2020, we experienced significant decrease in demand of our products because most of our customers’ operations were affected by COVID-19. Our abilities to fulfill orders also decreased during the first quarter of 2020 because of delays in deliveries from our suppliers, due to lack of raw material and delays in transportation as a result of the quarantine measures.

Since April 2020, the company has gradually resumed production and is now operating in its full capacity. Demands for our products have also increased compared to the first quarter of 2020. However, due to the negative impact of COVID-19 on domestic and global economy, the extent to which COVID-19 will affect our results of operations and future financial results in the long term remains uncertain.

Results of Operations - Fiscal Years Ended December 31, 2019 and 2018

The following table sets forth the results of our operations for the periods indicated in U.S. dollars:

| Years ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Sales | $ | 359,974 | $ | 1,478,115 | ||||

| Cost of Goods Sold | 171,869 | 1,367,084 | ||||||

| Gross Profit | 188,105 | 111,031 | ||||||

| Operating Expenses | ||||||||

| Selling expenses | 22,117 | 28,973 | ||||||

| General and administrative | 392,188 | 420,775 | ||||||

| Total operating expenses | 414,305 | 449,738 | ||||||

| Loss before other income (expense) and income taxes | (226,200 | ) | (338,717 | ) | ||||

| Other Income (Expense) | ||||||||

| Interest expense | (72,683 | ) | (7,397 | ) | ||||

| Other income (expense), net | - | 14 | ||||||

| Total other expense (income), net | (72,683 | ) | (7,383 | ) | ||||

| Loss before income taxes | (298,883 | ) | (346,100 | ) | ||||

| Income Tax Expense | - | - | ||||||

| Net loss | (298,883 | ) | (346,100 | ) | ||||

| Other Comprehensive Income | ||||||||

| Foreign currency translation gain (loss) | 5,007 | 17,467 | ||||||

| Total Comprehensive Loss | $ | (293,876 | ) | $ | (328,633 | ) | ||

| Share Data | ||||||||

| Basic and diluted loss per share | ||||||||

| Net loss per share – basic and diluted | $ | (0.01 | ) | $ | (0.01 | ) | ||

| Weighted average common shares outstanding, – basic and diluted | 27,469,469 | 27,231,968 | ||||||

Sales

During the year ended December 31, 2019, we had sales of $359,974, compared to sales of $1,478,115 for the year ended December 31, 2018, a decrease of $1,118,141, or approximately 75.6%. The sales decrease was mainly because of decreased in orders. We decided to work with a reduced number of import agencies in 2019 as compared to 2018 in order to focus on research and developing graphite felt for battery.

Cost of goods sold

Our cost of goods sold consists of the purchase cost. During the year ended December 31, 2019, our cost of goods sold was $171,869, compared to $1,367,084 for the cost of goods sold for the year ended December 31, 2018, a decrease of $1,195,215 or approximately 87.4%. The decrease in the cost of sales was in line with the decrease in sales volume.

Gross profit

Our gross profit increased from $111,031 for the year ended December 31, 2018 to $188,105 for the year ended December 31, 2019. The increase of the gross profit is mainly attributed to increased gross profit margin.

9

Gross profit Margin

Our gross profit margin increased from 7.5% for the year ended December 31, 2018 to 52.3% for the year ended December 31, 2019 because the Company cut down the lower gross margin of business for import agency during the year ended December 31, 2019 compared to the same period 2018.

Operating expenses

Operating expenses totalled $414,305 for the year ended December 31, 2019, compared to $449,748 for the year ended December 31, 2018, a decrease of $35,443, or approximately 7.9%. The decrease is mainly because of decreased professional expenses, decreased traveling expenses and decreased shipping expenses during the year ended December 31, 2019 compared to the same period 2018.

Selling, general and administrative expenses

Selling expenses decreased from $28,973 for the year ended December 31, 2018 to $22,117 for the year ended December 31, 2019, a decrease of $6,856, or 23.7%. The decrease is mainly attributed to decreased shipping expenses during the year ended December 31, 2019 compared to the same period 2018. The decrease is due to decreased sales.

Our general and administrative expenses consist of salaries, office expenses, utilities, business travel, amortization expenses, public company expenses (including legal expenses and accounting expenses) and stock compensation. General and administrative expenses were $392,188 for the year ended December 31, 2019, compared to $420,775 for the year ended December 31, 2018, a decrease of $28,587 or 6.8%. The decrease of general and administrative expenses is mainly because of decreased professional expenses and decreased travelling expenses during the years ended December 31, 2019 compared to the same period 2018. The decrease is due to decreased sales.

Loss from operations

Our operating loss was $226,200 for the year ended December 31, 2019, compared to operating loss of $338,717 for the year ended December 31, 2018, a decrease of approximately $112,517, or 33.2% due to decreased sales, offset by decreased operating expenses.

Other income and expenses

Our interest expense was $72,683 for the year ended December 31, 2019, compared to $7,397 for the year ended December 31, 2018.

Other income amounted to $0 and $14 for the years ended December 31, 2019 and 2018, respectively. Other income in 2018 is government subsidy.

Income tax

During the years ended December 31, 2019 and 2018, we did not incur any income tax due for these periods.

10

Net loss

As a result of the factors described above, our net loss for the year ended December 31, 2019 was $298,883 , compared to net loss of $346,100 for the year ended December 31, 2018, a decrease of $47,217 , or 13.6%.

Foreign currency translation

Our consolidated financial statements are expressed in U.S. dollars but the functional currency of our operating subsidiary is RMB. Results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period and equity is translated at historical exchange rates. Translation adjustments resulting from the process of translating the financial statements denominated in RMB into U.S. dollars are included in determining comprehensive income. Our foreign currency translation gain for the year ended December 31, 2019 was $5,007, compared to a translation gain of $17,467 for the year ended December 31, 2018, a decrease of $12,460.

Net loss available to common stockholders

Net loss available to our common stockholders was $298,883, or $(0.01) per share (basic and diluted), for the year ended December 31, 2019, compared to net loss of $346,100, or net loss of $(0.01) per share (basic and diluted), for the year ended December 31, 2018.

Liquidity and Capital Resources

All of our business operations are carried out by Royal Shanghai, and all of the cash generated by our operations has been held by that entity. In order to transfer such cash to our parent entity, China Carbon Graphite Group, Inc., which is a Nevada corporation, we would need to rely on dividends, loans or advances made by our PRC subsidiaries. Such transfers may be subject to certain regulations or risks. To date, our parent entity has paid its expenses by raising capital through private placement transactions. In the future, in the event that our parent entity is unable to raise needed funds from private investors, Royal Shanghai would have to transfer funds to our parent entity through our wholly-owned subsidiaries, Royal Hongkong and BVI. Co.

PRC regulations relating to statutory reserves and currency conversion would impact our ability to transfer cash within our corporate structure. The Company Law of the PRC applicable to Chinese companies provides that net after tax income should be allocated by the following rules:

| 1. | 10% of after tax income to be allocated to a statutory surplus reserve until the reserve amounts to 50% of the company’s registered capital. |

| 2. | If the accumulate balance of statutory surplus reserve is not enough to make up the Company’s cumulative prior years’ losses, the current year’s after tax income should be first used to make up the losses before the statutory surplus reverse is drawn. |

| 3. | Allocation can be made to the discretionary surplus reserve, if such a reserve is approved at the meeting of the equity owners. |

11

Therefore, the Company is required to maintain a statutory reserve in China that limits any equity distributions to its shareholders. The maximum amount of the shareholders has not been reached. The company has never distributed earnings to shareholders and has consistently stated in the Company’s filings it has no intentions to do so.

The RMB cannot be freely exchanged into the Dollars. The State Administration of Foreign Exchange (“SAFE”) administers foreign exchange dealings and requires that they be conducted though designated financial institutions. Foreign Investment Enterprises, such as Royal Shanghai, may purchase foreign currency from designated financial institutions in connection with current account transactions, including profit repatriation.

These factors will limit the amount of funds that we can transfer from Royal Shanghai to our parent entity and may delay any such transfer. In addition, upon repatriation of earnings of Royal Shanghai to the United States, those earnings may become subject to United States federal and state income taxes. We have not accrued any U.S. federal or state tax liability on the undistributed earnings of our foreign subsidiary because those funds are intended to be indefinitely reinvested in our international operations. Accordingly, taxes imposed upon repatriation of those earnings to the U.S. would reduce the net worth of the Company.

Our primary capital needs have been to fund our working capital requirements. Our primary sources of financing will be cash generated from loans from banks, equity investment from investors, and borrowings from unrelated parties.

The Company’s consolidated financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. As of and for the period ended December 31, 2019, the Company has incurred operating losses and working capital deficit from operating activities. The Company’s sales revenue is not sufficient to cover the company’s expenses for the year ended December 31, 2019.

The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations. At this point, there can be no assurance that the Company is able to obtain such funding.

Our long-term goal is to develop our Royal Shanghai business. During the interim, we expect that anticipated cash flows from future operations, loans and equity investment from unrelated or related parties, provided that:

| ● | we generate sufficient business so that we are able to generate substantial profits, which cannot be assured; |

| ● | we are able to generate savings by improving the efficiency of our operations. |

We may require additional equity, debt or bank funding to finance acquisitions or to allow us to develop our Royal Shanghai business, which is one of our primary growth strategies. We can provide no assurances that we will be able to enter into any additional financing agreements on terms favorable to us, if at all, especially considering the current global instability of the capital markets.

12

At December 31, 2019, cash and cash equivalents were $11,585, compared to $9,137 at December 31, 2018, an increase of $2,448. Our working capital deficit increased by $226,565 to a deficit of $2,540,699 at December 31, 2019 from a deficit of $2,314,134 at December 31, 2018.

Accounts receivable, net of allowance, were $3,781 and $5,587 for the fiscal year ended December 31, 2019 and 2018, respectively. The decrease was mainly due to the decrease in sales. Accounts receivable are recorded at the invoiced amount and do not bear interest. Our management reviews the adequacy of our allowance for doubtful accounts on an ongoing basis, using historical collection trends and the aging of receivables. Management also periodically evaluates individual customer’s financial condition, credit history, and the current economic conditions to make adjustments in the allowance when it is considered necessary.

As of December 31, 2019, inventories were $17,583, compared to $1,834 at December 31, 2018, an increase of $15,749, or 858.72%. As of December 31, 2019 and December 31, 2018, the Company has not made provision for inventory in regards to slow moving or obsolete items.

Advances to suppliers decreased from $7,517 at December 31, 2018 to $0 at December 31, 2019, a decrease of $7,517. The decrease of advances to suppliers is mainly because decreased sales.

Fiscal Year ended December 31, 2019 Compared to Fiscal Year ended December 31, 2018

The following table sets forth information about our net cash flow for the years indicated:

| Years ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Net cash provided by operating activities | 9,027 | 155,817 | ||||||

| Net cash used in investing activities | (6,496 | ) | (10,304 | ) | ||||

| Net cash used in financing activities | - | (144,139 | ) | |||||

Net cash flow provided by operating activities was $9,027 for the year ended December 31, 2019, compared to $155,817 provided by operating activities for the year ended December 31, 2018, a decrease of $146,790. The decrease in net cash flow in operating activities was mainly due to less increase in other payable for the year ended December 31, 2019 than 2018.

Net cash flow used in investing activities was $6,496 for the year ended December 31, 2019, compared to $10,304 for the year ended December 31, 2018, a decrease of $3,808. The decrease is mainly due to decreased purchase for equipment for the year ended December 31, 2019 than 2018.

Net cash flow used in financing activities was $0 for the year ended December 31, 2019, compared to $144,139 used in financing activities for the year ended December 31, 2018, a decrease of $144,139. The decrease is due to more payments made to related parties for the year ended December 31, 2019 than 2018.

13

Concentration of Business and Credit Risk

Most of the Company’s bank accounts are in banks located in the PRC and are not covered by any type of protection similar to that provided by the Federal Deposit Insurance Corporation (“FDIC”) on funds held in U.S. banks. The Company’s bank account in the United States is covered by FDIC insurance.

Because the Company’s operations are located in the PRC, this may give rise to significant foreign currency risks due to fluctuations in and the volatility of foreign exchange rates between U.S. dollars and RMB.

Financial instruments that potentially subject the Company to concentration of credit risk consist principally of cash, trade accounts receivables and inventories, the balances of which are stated on the balance sheet. The Company places its cash in banks located in China. Concentration of credit risk with respect to trade accounts receivables is limited due to the diversity of the Company’s customers who are located in different regions of China. The Company does not require collateral or other security to support financial instruments subject to credit risk.

Significant Accounting Estimates and Policies

The discussion and analysis of our financial condition and results of operations is based upon our financial statements that have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets and liabilities. On an ongoing basis, we evaluate our estimates including the allowance for doubtful accounts, the saleability and recoverability of our products, income taxes and contingencies. We base our estimates on historical experience and on other assumptions that we believe to be reasonable under the circumstances, the results of which form our basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

Revenue recognition

The Company derives revenues from distribution of graphite-based products. We recognize revenue in accordance with ASC 606, Revenue is recognized upon transfer of control of promised products to customers in an amount that reflects the consideration we expect to receive in exchange for those products. We enter into contracts that can include products, which are generally capable of being distinct and accounted for as separate performance obligations. Revenue is recognized net of allowances for returns and any taxes collected from customers, which are subsequently remitted to governmental authorities. Sales represent the invoiced value of goods, net of value added tax (“VAT”), if any, and are recognized upon delivery of goods and passage of title according to shipping terms.

The Company is subject to VAT, which is levied on a majority of the products, at a rate ranging from 13% to 17% on the invoiced value of sales. Output VAT is borne by customers in addition to the invoiced value of sales and input VAT is borne by the Company in addition to the invoiced value of purchases to the extent not refunded for export sales.

The Company recognizes revenue upon transfer of control of promised products to customers according to shipping terms. The Company does not provide chargeback or price protection rights to the customers. The customer only places purchase orders with the Company once it has confirmed the sale with a third party because this is a specialized business, which dictates that the Company will not sell the products until the purchase order is received. The Company allows its customers to return products only if its products are later determined by the Company to be defective. Based on the Company’s historical experience, product returns have been insignificant throughout all of its product lines. Therefore, the Company does not record an allowance for sales returns. If sales returns occur, they are taken against revenue when products are returned from customers. Sales are presented net of any discounts given to customers. Interest income is recognized when earned. The Company experienced no returns for the years ended December 31, 2019 and 2018.

14

In May 2014, the FASB issued Accounting Standards Update (“ASU”) 2014-09, Revenue from Contracts with Customers (Topic 606), amending revenue recognition guidance and requiring more detailed disclosures to enable users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. We adopted this ASU on January 1, 2018 for all revenue contracts with our customers using the modified retrospective approach.

There is no impact of applying this ASU.

Comprehensive Income

We have adopted ASC 220, Comprehensive Income, formerly known as SFAS No. 130, Reporting Comprehensive Income, which establishes standards for reporting and presentation of comprehensive income (loss) and its components in a full set of general purpose financial statements. We have chosen to report comprehensive income (loss) in the statements of operations and comprehensive income.

Income Taxes

We account for income taxes under the provisions of ASC 740, Income Tax, formerly known as SFAS No. 109, Accounting for Income Taxes, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Deferred tax assets and liabilities are recognized for the future tax consequence attributable to the difference between the tax bases of assets and liabilities and their reported amounts in the financial statements. Deferred tax assets and liabilities are measured using the enacted tax rate expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

Effective January 1, 2008, the new Chinese income tax law sets unified income tax rates for domestic and foreign companies at 25%, except for a 15% corporate income tax rate for qualified high technology and science enterprises. In accordance with this new income tax law, low preferential tax rates in accordance with both the tax laws and administrative regulations prior to the promulgation of this law gradually become subject to the new tax rate within five years after the implementation of this law.

Accounts Receivable and Allowance For Doubtful Accounts

The Company establishes an individualized credit and collection policy based on each individual customer’s credit history. The Company does not have a uniform policy that applies equally to all customers. The collection period usually ranges from three months to twelve months. The Company grants extended payment terms only when the Company believes that the payment will be collectible at the end of the term. The Company grants extended payment terms to customers if based on the following factors: (a) whether or not the Company views a real need, from the customer’s perspective, for the extension and (b) how critical the Company’s relationship with the customer and is the customer the Company’s long-term business. The Company grants extended payment terms only when the Company believes that the payment will be collectible at the end of the term. This meets the criteria of revenue recognition under U.S. GAAP, which requires that collection of the resulting receivable be reasonably assured.

As of December 31, 2019 and December 31, 2018, accounts receivable consisted of the following:

| December 31, 2019 | December 31, 2018 | |||||||

| Amount outstanding | $ | 3,781 | $ | 5,587 | ||||

| Less: Allowance for doubtful accounts | - | - | ||||||

| Net amount | $ | 3,781 | $ | 5,587 | ||||

15

Inventories

As of December 31, 2019 and December 31, 2018, inventories consisted of the following:

| December 31, 2019 | December 31, 2018 | |||||||

| Inventory in transit | $ | 17,583 | $ | 1,834 | ||||

| Reserve for slow moving and obsolete inventory | - | - | ||||||

| Inventory, net | $ | 17,583 | $ | 1,834 | ||||

For the years ended December 31, 2019 and 2018, the Company has not made provision for inventory in regards to slow moving or obsolete items. As of December 31, 2019 and December 31, 2018, the Company did not record any provision for inventory in regards to slow moving or obsolete items.

Property, Plant and Equipment

Property, plant and equipment are stated at cost. Major expenditures for betterments and renewals are capitalized while ordinary repairs and maintenance costs are expensed as incurred. Depreciation and amortization is provided using the straight-line method over the estimated useful life of the assets after taking into account the estimated residual value. The Company reviews the carrying value of property, plant, and equipment for impairment whenever events and circumstances indicate that the carrying value of an asset may not be recoverable from the estimated future cash flows expected to result from its use and eventual disposition. In cases where undiscounted expected future cash flows are less than the carrying value, an impairment loss is recognized equal to an amount by which the carrying value exceeds the fair value of assets. The factors considered by management in performing this assessment include current operating results, trends and prospects, the manner in which the property is used, and the effects of obsolescence, demand, competition, and other economic factors.

As of December 31, 2019 and December 31, 2018, property, plant and equipment consisted of the following:

| December 31, 2019 | December 31, 2018 | |||||||

| Machinery and equipment | $ | 41,708 | $ | 35,705 | ||||

| Office equipment | 10,963 | 11,100 | ||||||

| Motor vehicles | 40,127 | 40,630 | ||||||

| Total | 92,798 | 87,435 | ||||||

| Less: accumulated depreciation | (56,523 | ) | (48,962 | ) | ||||

| Plant and Equipment, net | $ | 36,275 | $ | 38,473 | ||||

For the years ended December 31, 2019 and 2018, depreciation expenses amounted to $8,231 and $15,111, respectively.

16

The Company purchased approximately $6,496 and $10,304 property and equipment during the years ended December 31, 2019 and 2018, respectively.

Research and Development

Research and development costs are expensed as incurred, and are included in general and administrative expenses. These costs primarily consist of the cost of material used and salaries paid for the development of our products and fees paid to third parties. Our research and development expense for the years ended December 31, 2019 and 2018 were not significant.

Value Added Tax

Pursuant to China’s VAT rules and regulations, as an ordinary VAT taxpayer we are subject to a tax rate of 17% (“output VAT”). The output VAT is payable after offsetting VAT paid by us on purchases (“input VAT”). Under the commercial practice of the PRC, the Company paid VAT and business tax based on tax invoices issued.

The tax invoices may be issued subsequent to the date on which revenue is recognized, and there may be a considerable delay between the date on which the revenue is recognized and the date on which the tax invoice is issued. In the event that the PRC tax authorities dispute the date on which revenue is recognized for tax purposes, the PRC tax office has the right to assess a penalty, which can range from zero to five times the amount of the taxes that are determined to be late or deficient. In the event that a tax penalty is assessed on late or deficient payments, the penalty will be expensed as a period expense if and when a determination has been made by the taxing authorities that a penalty is due.

Fair Value of Financial Instruments

On January 1, 2008, the Company began recording financial assets and liabilities subject to recurring fair value measurement at the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. On January 1, 2009, the Company began recording non-recurring financial as well as all non-financial assets and liabilities subject to fair value measurement under the same principles. These fair value principles prioritize valuation inputs across three broad levels. The three levels are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instruments. |

| ● | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

17

The carrying amounts of financial assets and liabilities, including cash and cash equivalents, accounts receivable, notes receivable, advances to suppliers, other receivables, short-term bank loans, notes payable, accounts payable, advances from customers and other payables, approximate their fair values because of the short maturity period for these instruments.

Stock-based Compensation

Stock-based compensation includes (i) common stock awards granted to employees and directors for services which are accounted for under FASB ASC 718, Compensation–Stock Compensation” and (ii) common stock awards granted to consultants which are accounted for under FASB ASC 505-50, Equity–Equity-Based Payments to Non-Employees.

All grants of common stock awards and stock options to employees and directors are recognized in the financial statements based on their grant date fair values. The Company has elected to recognize compensation expense using the straight-line method for all common stock awards and stock options granted with service conditions that have a graded vesting schedule, with a corresponding charge to additional paid-in capital.

Common stock awards are granted to directors for services provided. The vested portions of common stock awards granted but not yet issued are recorded in common stock to be issued.

Common stock awards issued to consultants represent common stock granted to non-employees in exchange for services at fair value. The measurement dates for such awards are set at the dates that the contracts are entered into as the awards are non-forfeitable and vest immediately. The measurement date fair value is then recognized over the service period as if the Company has paid cash for such service.

The Company estimates fair value of common stock awards based on the number of shares granted and the quoted price of the Company’s common stock on the date of grant.

Recent Accounting Pronouncements

The Company has reviewed all recently issued, but not yet effective, accounting pronouncements and does not believe the future adoption of any such pronouncements will have a material impact on its financial condition or the results of its operations.

In February 2016, the FASB issued ASU No. 2016-02, “Leases (Topic 842)”, to increase the transparency and comparability about leases among entities. The new guidance requires lessees to recognize a lease liability and a corresponding lease asset for virtually all lease contracts. It also requires additional disclosures about leasing arrangements. ASU 2016-02 is effective for interim and annual periods beginning after December 15, 2018, and requires a modified retrospective approach to adoption. The Company adopted the policy on January 1,2019 and the impact of the adoption of this guidance is listed in Note 15.

In October 2016, the FASB issued ASU 2016-16, “Income Taxes (Topic 740): Intra-Entity Transfer of Assets Other than Inventory”, which requires the recognition of the income tax consequences of an intra-entity transfer of an asset, other than inventory, when the transfer occurs. ASU 2016-06 will be effective for the Company in its first quarter of 2019. The Company does not expect that the adoption of this guidance will have a material impact on its consolidated financial statements.

Management does not believe that any recently issued, but not yet effective accounting pronouncements, when adopted, will have a material effect on the accompanying financial statements.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Not applicable to smaller reporting companies.

18

Item 8. Financial Statements and Supplementary Data

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors,

China Carbon Graphite Group Inc.

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated balance sheets of China Carbon Graphite Group, Inc. and Subsidiaries (the “Company”) as of December 31, 2019 and 2018, the related statement of operations, stockholders’ deficit, and cash flows for the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019 and 2018, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

Going Concern Matter

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has suffered recurring losses from operations that raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ TAAD LLP

We have served as the Company’s auditor since 2015

Diamond Bar, California

May 14, 2020

F-1

China Carbon Graphite Group, Inc. and subsidiaries

| December 31, 2019 | December 31, 2018 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 11,585 | $ | 9,137 | ||||

| Account Receivable | 3,781 | 5,587 | ||||||

| Inventories | 17,583 | 1,834 | ||||||

| Advance to suppliers | - | 7,517 | ||||||

| Prepaid expenses | 19,067 | - | ||||||

| Other receivables, net | 30,709 | 29,954 | ||||||

| Total current assets | 82,725 | 54,029 | ||||||

| Right-of-use asset - non current | 38,567 | 27,696 | ||||||

| Property And Equipment, Net | 36,275 | 38,473 | ||||||

| Total Assets | $ | 157,567 | $ | 120,198 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current Liabilities | ||||||||

| Accounts payable and accrued expenses | $ | 162,754 | $ | 91,189 | ||||

| Accrued payroll - related party | 679,410 | 626,662 | ||||||

| Advance from customers | 113,533 | 27,995 | ||||||

| Other payables | 1,576,148 | 1,539,606 | ||||||

| Lease liability - current | 36,564 | 27,696 | ||||||

| Dividends payable | 55,015 | 55,015 | ||||||

| Total current liabilities | 2,623,424 | 2,368,163 | ||||||

| Lease liability - non current | 2,003 | - | ||||||

| Total Liabilities | 2,625,427 | 2,368,163 | ||||||

| Stockholders’ Deficit | ||||||||

| Common stock, $0.001 par value; 100,000,000 shares authorized 27,502,346 and 27,262,346 shares issued and outstanding at December 31, 2019 and December 31, 2018, respectively | 27,502 | 27,262 | ||||||

| Additional paid-in capital | 48,827,492 | 48,753,751 | ||||||

| Accumulated other comprehensive income | 98,278 | 93,271 | ||||||

| Accumulated loss | (51,421,132 | ) | (51,122,249 | ) | ||||

| Total stockholders’ deficit | (2,467,860 | ) | (2,247,965 | ) | ||||

| Total Liabilities and Stockholders’ Deficit | $ | 157,567 | $ | 120,198 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

F-2

China Carbon Graphite Group, Inc and subsidiaries

Consolidated Statements of Operations and Comprehensive Loss

For the Years Ended December 31, 2019 and 2018

| Years Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Sales | $ | 359,974 | $ | 1,478,115 | ||||

| Cost of Goods Sold | 171,869 | 1,367,084 | ||||||

| Gross Profit | 188,105 | 111,031 | ||||||

| Operating Expenses | ||||||||

| Selling expenses | 22,117 | 28,973 | ||||||

| General and administrative | 392,188 | 420,775 | ||||||

| Total operating expenses | 414,305 | 449,748 | ||||||

| Loss before other income (expense) and income taxes | (226,200 | ) | (338,717 | ) | ||||

| Other Income (Expense) | ||||||||

| Interest expense | (72,683 | ) | (7,397 | ) | ||||

| Other income (expense), net | - | 14 | ||||||

| Total other expense (income), net | (72,683 | ) | (7,383 | ) | ||||

| Loss before income taxes | (298,883 | ) | (346,100 | ) | ||||

| Income Tax Expense | - | - | ||||||

| Net loss | (298,883 | ) | (346,100 | ) | ||||

| Other Comprehensive Income | ||||||||

| Foreign currency translation gain (loss) | 5,007 | 17,467 | ||||||

| Total Comprehensive Loss | $ | (293,876 | ) | $ | (328,633 | ) | ||

| Share Data | ||||||||

| Basic and diluted loss per share | ||||||||

| Net loss per share – basic and diluted | $ | (0.01 | ) | $ | (0.01 | ) | ||

| Weighted average common shares outstanding, basic and diluted | 27,469,469 | 27,231,968 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-3

China Carbon Graphite Group, Inc and subsidiaries

Consolidated Statements of Changes in Stockholders’ Deficit

| Additional | Other | Total | ||||||||||||||||||||||

| Common Stock | Paid-In | Retained | Comprehensive | Stockholders’ | ||||||||||||||||||||

| Number | Amount | Capital | Earnings | Income | Deficit | |||||||||||||||||||

| Balance at December 31, 2017 | 27,010,346 | $ | 27,010 | $ | 48,738,883 | $ | (50,776,149 | ) | $ | 75,804 | $ | (1,934,452 | ) | |||||||||||

| Issuance of common stock for directors and employees | 252,000 | 252 | 14,868 | - | - | 15,120 | ||||||||||||||||||

| Net loss | - | - | - | (346,100 | ) | - | (346,100 | ) | ||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 17,467 | 17,467 | ||||||||||||||||||

| Balance at December 31, 2018 | 27,262,346 | 27,262 | 48,753,751 | (51,122,249 | ) | 93,271 | (2,247,965 | ) | ||||||||||||||||

| Issuance of common stock for directors and employees | 240,000 | 240 | 6,960 | - | - | 7,200 | ||||||||||||||||||

| Imputed interest | - | - | 66,781 | - | - | 66,781 | ||||||||||||||||||

| Net loss | - | - | - | (298,883 | ) | - | (298,883 | ) | ||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 5,007 | 5,007 | ||||||||||||||||||

| Balance at December 31, 2019 | 27,502,346 | $ | 27,502 | $ | 48,827,492 | $ | (51,421,132 | ) | $ | 98,278 | $ | (2,467,860 | ) | |||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

F-4

China Carbon Graphite Group, Inc and subsidiaries

Consolidated Statements of Cash Flows

| Years Ended December 31, | ||||||||

| 2019 | 2018 | |||||||

| Cash Flows from Operating Activities | ||||||||

| Net Loss available to common shareholders | $ | (298,883 | ) | $ | (346,100 | ) | ||

| Adjustments to reconcile net cash provided by operating activities | ||||||||

| Depreciation | 8,231 | 15,111 | ||||||

| Inventory impairment | 1,430 | - | ||||||

| Stock compensation | 7,200 | 15,120 | ||||||

| Imputed interest | 67,300 | - | ||||||

| Changes in operating assets and liabilities | ||||||||

| Accounts receivable | 1,750 | (2,228 | ) | |||||

| Other receivables | (25,271 | ) | (13,731 | ) | ||||

| Advance to suppliers | 7,482 | 158,979 | ||||||

| Inventory | (17,324 | ) | 2,682 | |||||

| Prepaid expenses | (19,216 | ) | - | |||||

| Right-of-use asset | (11,302 | ) | - | |||||

| Accounts payable and accrued liabilities | 148,944 | 24,559 | ||||||

| Advance from customers | 86,552 | (166,068 | ) | |||||

| Taxes payable | (2,892 | ) | (1,405 | ) | ||||

| Other payables | 43,724 | 468,898 | ||||||

| Lease liability | 11,302 | - | ||||||

| Net cash provided by (used in) operating activities | 9,027 | 155,817 | ||||||

| Cash flows from investing activities | ||||||||

| Acquisition of plant and equipment | (6,496 | ) | (10,304 | ) | ||||

| Net cash used in investing activities | (6,496 | ) | (10,304 | ) | ||||

| Cash flows from financing activities | ||||||||

| Payments to loan from related parties | - | (144,139 | ) | |||||

| Net cash used in financing activities | - | (144,139 | ) | |||||

| Effect of exchange rate fluctuation on cash and cash equivalents | (83 | ) | (343 | ) | ||||

| Net increase (decrease) in cash | 2,448 | 1,031 | ||||||

| Cash and cash equivalents at beginning of period | 9,137 | 8,106 | ||||||

| Cash and cash equivalents at ending of period | $ | 11,585 | $ | 9,137 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Interest paid | $ | - | $ | (656 | ) | |||

| Income taxes paid | $ | - | $ | - | ||||

The accompanying notes are an integral part of these consolidated financial statements.

F-5

China Carbon Graphite Group, Inc. and subsidiaries

Notes to Consolidated Financial Statements

December 31, 2019 and 2018

(1) Organization and Business

China Carbon Graphite Group, Inc. (the “Company”), through its subsidiaries, is engaged in the research and development, rework and sales of graphene and graphene oxide and graphite bipolar plates in the People’s Republic of China (“China” or the “PRC”). The Company has developed its own graphene prototype and reworks the products by orders only. The Company outsource the production of large orders to third parties as it has not commercialized its product prototype. We also operate a business-to-business and business-to-consumers Internet portal (www.roycarbon.com) for graphite related products. Vendors can sell raw materials, industrial commodities and consumer (household) commodities to both business and consumers through the website by paying a fee for each transaction conducted through the website.

The Company was incorporated on February 13, 2003 in Nevada under the name Achievers Magazine Inc. In connection with the reverse merger transaction described below, the Company’s corporate name was changed to China Carbon Graphite Group, Inc. on January 30, 2008.

On December 17, 2007, the Company completed a share exchange pursuant to a share exchange agreement with Sincere Investment (PTC), Ltd. (“Sincere”), a British Virgin Islands corporation. Sincere was the sole stockholder of Talent International Investment Limited (“Talent”), a British Virgin Islands corporation., which is the sole stockholder of XingheYongle Carbon Co., Ltd. (“Yongle”), a wholly foreign-owned enterprise company organized under the laws of the PRC. Pursuant to the share exchange agreement, the Company issued 9,388,172 shares of common stock to Sincere in exchange for all of the outstanding on stock of Talent, and Talent became a wholly-owned subsidiary of the Company. Upon completion of the reverse merger, the Company’s business became the business of Talent, its subsidiaries and its affiliated variable interest entities.

Talent owns 100% of the stock of Yongle, which is a wholly foreign-owned enterprise organized under the laws of the PRC.

Acquisition in December 2013

On December 23, 2013, the Company acquired Golden Ivy Limited, a British Virgin Island company (“BVI Co.,”). Pursuant to the terms of the acquisition, we issued an aggregate of 5,000,000 shares of common stock, par value $0.001 per share, to the former shareholders of BVI Co. in exchange for 100% of the issued and outstanding equity of BVI Co. The shares were issued on January 16, 2014. BVI Co. then became a wholly owned subsidiary of the Company.