UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No._________)

| Filed by the Registrant | x | |

| Filed by a Party other than the Registrant | ¨ | |

| Check the appropriate box: |

| x | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material under §240.14a-12 | |||

EMERALD OIL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |||

| x | No fee required. | ||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| ¨ | Fee paid previously with preliminary materials. | ||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: | ||

EMERALD OIL, INC.

1600 Broadway, Suite 1360

Denver, Colorado 80202

Ph: (303) 323-0008

April , 2013

Dear Shareholder:

We are pleased to invite you to attend the 2013 Annual Meeting of Shareholders of Emerald Oil, Inc., to be held on June 12, 2013 at The Ritz-Carlton Hotel, 2121 McKinney Avenue, Dallas, Texas 75201, commencing at 8 a.m., Central time.

The formal notice of the Annual Meeting and proxy statement follows this letter. Enclosed with this proxy statement you will also find your proxy card, a return envelope and a copy of our Annual Report on Form 10-K, for the year ended December 31, 2012.

I hope to see you at the Annual Meeting.

Emerald Oil, Inc.

James Russell (J.R.) Reger

Executive Chairman

EMERALD OIL, INC.

1600 Broadway, Suite 1360

Denver, Colorado 80202

Ph: (303) 323-0008

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON WEDNESDAY, JUNE 12, 2013

To Our Shareholders:

The 2013 Annual Meeting of the Shareholders (the “2013 Annual Meeting”) of Emerald Oil, Inc. will be held on June 12, 2013 at The Ritz-Carlton Hotel, 2121 McKinney Avenue, Dallas, Texas 75201, commencing at 8 a.m., Central time. The purposes of the 2013 Annual Meeting are to:

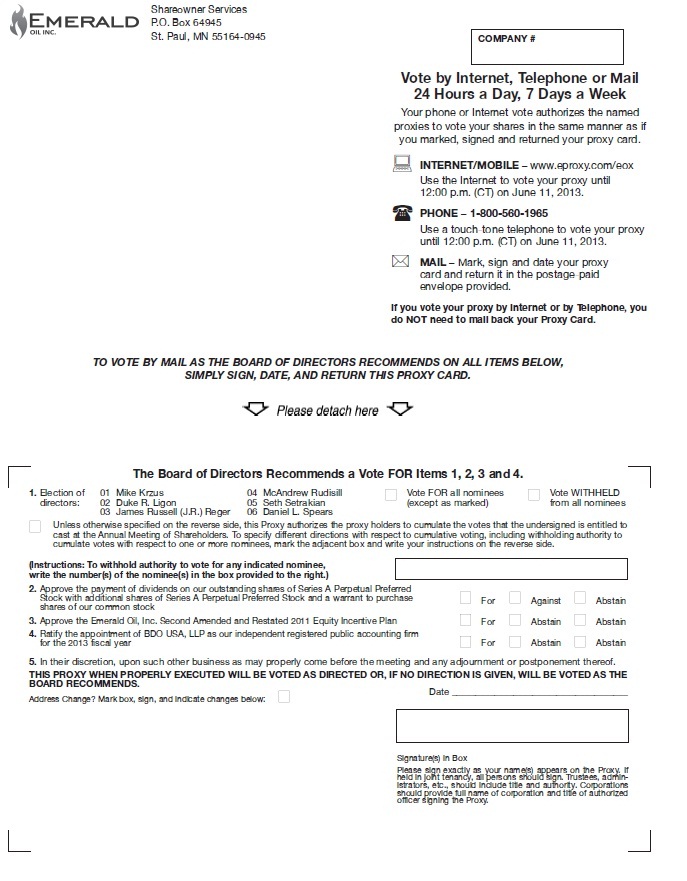

| (1) | Elect six (6) directors to our Board of Directors to serve until the next annual meeting of shareholders or until such time as their successors are elected and qualified; |

| (2) | Consider and vote upon a proposal to allow us, at our option, to pay dividends prior to April 1, 2015 on our outstanding shares of Series A Perpetual Preferred Stock by the issuance of (i) additional shares of Series A Perpetual Preferred Stock valued at the same value as the initial per share purchase price of the Series A Perpetual Preferred Stock and (ii) an additional warrant to purchase additional shares of our common stock; |

| (3) | Consider and vote upon a proposal to approve the Emerald Oil, Inc. Second Amended and Restated 2011 Equity Incentive Plan; |

| (4) | Consider and vote upon a proposal to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the 2013 fiscal year; and |

| (5) | To transact such other business as may properly come before the 2013 Annual Meeting or any adjournment or postponement thereof. |

Only shareholders of record at the close of business on April 22, 2013 are entitled to notice of the 2013 Annual Meeting and to vote at the meeting or any adjournment or postponement thereof.

Your vote is important. You are cordially invited to attend the meeting. Even if you do not plan to attend the 2013 Annual Meeting, we urge you to sign, date and return the proxy at once in the enclosed envelope, vote on the website or vote by telephone. The prompt return of proxies will save the Company the expense related to further requests for proxies.

By Order of the Board of Directors

Paul Wiesner

Secretary

Denver, Colorado

April , 2013

Important Notice Regarding the Availability of Proxy Materials for the 2013 Annual Meeting of Shareholders to be held on June 12, 2013: The proxy statement, form of proxy card and Annual Report on Form 10-K are available on the investor page of the Emerald Oil, Inc. website at www.emeraldoil.com.

| Tale of Contents | Page | |

| INTRODUCTION | 1 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 2 | |

| PROPOSALS TO BE VOTED UPON - PROPOSAL 1 - ELECTION OF DIRECTORS | 5 | |

| CORPORATE GOVERNANCE | 8 | |

| EXECUTIVE OFFICERS | 15 | |

| COMPENSATION DISCUSSION AND ANALYSIS | 16 | |

| EXECUTIVE COMPENSATION | 25 | |

| DIRECTOR COMPENSATION | 29 | |

| RELATED PARTY TRANSACTIONS | 30 | |

| PROPOSAL 2 - APPROVAL OF THE PAYMENT OF DIVIDENDS ON OUR OUTSTANDING SHARES OF SERIES A PERPETUAL PREFERRED STOCK WITH ADDITIONAL SHARES OF SERIES A PERPETUAL PREFERRED STOCK AND A WARRANT TO PURCHASE SHARES OF OUR COMMON STOCK | 32 | |

| PROPOSAL 3 - APPROVAL OF THE EMERALD OIL, INC. SECOND AMENDED AND RESTATED 2011 EQUITY INCENTIVE PLAN | 34 | |

| PROPOSAL 4 - RATIFICATION OF THE APPOINTMENT OF BDO USA, LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTANT FIRM | 42 | |

| OTHER BUSINESS | 43 | |

| ADDITIONAL INFORMATION | 43 | |

| ANNEX A - EMERALD OIL, INC. SECOND AMENDED AND RESTATED 2011 EQUITY INCENTIVE PLAN | A-1 |

| i |

EMERALD OIL, INC.

1600 Broadway, Suite 1360

Denver, Colorado 80202

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 12, 2013

PROXY STATEMENT

INTRODUCTION

Your proxy is solicited by the Board of Directors (the “Board”) of Emerald Oil, Inc., a Montana corporation, for the 2013 Annual Meeting of Shareholders to be held on June 12, 2013, at the location and for the purposes set forth in the Notice of Annual Meeting of Shareholders, and at any adjournment or postponement thereof. We expect that this proxy statement, the related proxy and Notice of Annual Meeting of Shareholders will first be mailed to shareholders on or about May 6, 2013.

The cost of soliciting proxies, including the preparation, assembly and mailing of the proxies and soliciting material, as well as the cost of forwarding such material to beneficial owners common stock, will be borne by us. Our directors, officers and regular employees may, without compensation other than their regular remuneration, solicit proxies personally or by telephone.

You may vote your shares by internet, by telephone or by mail by following the instructions on the enclosed proxy or you may vote your shares in person by attending the 2013 Annual Meeting. If your shares are held in “street name,” you must instruct the record holder of your shares in order to vote. Any shareholder giving a proxy may revoke it at any time prior to its use at the meeting by giving written notice of such revocation to the Secretary prior to the voting of such proxy, giving a duly executed proxy bearing a later date or by attending and voting at the meeting. Proxies not revoked will be voted in accordance with the choice specified by shareholders by means of the ballot provided on the proxy for that purpose. Proxies that are signed but lack any such specification will, subject to the following, be voted in favor of the proposals set forth in the Notice of Annual Meeting of Shareholders and in favor of the slate of directors proposed by the Board and listed herein.

You are entitled to one vote for each share of common stock and each share of Series B Voting Preferred Stock that you hold, except for the election of directors. If you vote for all nominees, one vote per share will be cast for each of the six nominees. You may withhold votes from any or all nominees. Except for the votes that shareholders of record withhold from any or all nominees, the persons named in the proxy card will vote such proxy “FOR” and, if necessary, will exercise their cumulative voting rights to elect the nominees as directors. If you wish to cumulate your votes in the election of directors, you are entitled to as many votes as equal the number of shares held by you at the close of business on April 22, 2013, the record date, multiplied by the number of directors to be elected. You may cast, under the cumulative voting option, all of your votes for a single nominee or apportion your votes among any two or more nominees. For example, a holder of 100 shares may cast 600 votes for a single nominee, apportion 100 votes for each of the six nominees or apportion 600 votes in any other manner by so noting in the space provided on the proxy card. The cumulative voting feature for the election of directors is also available by voting in person at the 2013 Annual Meeting; it is not available by telephone or on the internet. In the election of directors, the six director nominees who receive the highest number of votes will be elected as directors.

The Board has fixed April 22, 2013 as the record date for determining shareholders entitled to vote at the 2013 Annual Meeting. Persons who were not shareholders on such date will not be allowed to vote at the 2013 Annual Meeting. At the close of business on April 19, 2013, 25,899,658 shares of common stock and 5,114,633 shares of Series B Voting Preferred Stock were issued and outstanding. The holders of Series B Voting Preferred Stock are entitled to vote in the election of directors and on all other matters submitted to a vote of the holders of our common stock, with the holders of Series B Voting Preferred Stock and the holders of common stock voting together as a single class; provided, however, the holders of the Series B Voting Preferred Stock will not vote on Proposal 2—Approval of the Payment of Dividends on Our Outstanding Shares of Series A Perpetual Preferred Stock with Additional Shares of Series A Perpetual Preferred Stock and a Warrant to Purchase Shares of Our Common Stock. Each share of Series B Voting Preferred Stock entitled to vote at the meeting shall not be considered in determining whether a quorum is present at the 2013 Annual Meeting. Except for a shareholder’s right to cumulate its votes as described above for the election of directors and for the holders of the Series B Voting Preferred Stock who will not vote on Proposal 2, each share of common stock and each share of Series B Voting Preferred Stock is entitled to one vote on each matter to be voted upon at the meeting.

| 1 |

If you are a beneficial owner and you do not provide voting instructions to your broker, bank or other holder of record holding shares for you, your shares will not be voted with respect to any proposal for which the holder of record does not have discretionary authority to vote. Rules of the NYSE MKT determine whether proposals presented at shareholder meetings are “discretionary” or “non-discretionary.” If a proposal is determined to be discretionary, your broker, bank or other holder of record is permitted under NYSE MKT rules to vote on the proposal without receiving voting instructions from you. If a proposal is determined to be non-discretionary, your broker, bank or other holder of record is not permitted under NYSE MKT rules to vote on the proposal without receiving voting instructions from you. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a non-discretionary proposal because the holder of record has not received voting instructions from the beneficial owner.

Under the rules of the NYSE MKT, the proposal relating to the ratification of our independent registered public accounting firm is a discretionary proposal and all other proposals included in this proxy statement are non-discretionary proposals. If you are a beneficial owner and you do not provide voting instructions to your bank, broker or other holder of record holding shares for you, your shares may be voted with respect to the ratification of our independent registered public accounting firm, but will not be voted with respect to the other matters to be considered at the 2013 Annual Meeting without those instructions. Without your voting instructions on these matters, a broker non-vote will occur with respect to your shares. Shares subject to broker non-votes will not be counted as votes for or against and will not be included in calculating the number of votes necessary for approval of such matters to be presented at the 2013 Annual Meeting; however, such shares will be considered present at the 2013 Annual Meeting for purposes of determining the existence of a quorum. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of April 19, 2013 certain information regarding beneficial ownership of our common stock by:

| • | each person known to us to beneficially own 5% or more of our common stock; |

| • | each executive officer named in the Summary Compensation Table on page 25, who in this proxy statement are collectively referred to as the “named executive officers”; |

| • | each of our directors (including nominees); and |

| • | all of our executive officers (as that term is defined under the rules and regulations of the Securities and Exchange Commission) and directors as a group. |

We have determined beneficial ownership in accordance with Rule 13d-3 under the Securities Exchange Act of 1934. Beneficial ownership generally means having sole or shared voting or investment power with respect to securities. Unless otherwise indicated in the footnotes to the table, each shareholder named in the table has sole voting and dispositive power with respect to the shares of common stock set forth opposite the shareholder’s name. We have based our calculation of the percentage of beneficial ownership on 25,899,658 shares of common stock and 5,114,633 shares of Series B Voting Preferred Stock outstanding on April 19, 2013, plus common stock deemed outstanding pursuant to Rule 13d-3(d)(1) under the Exchange Act. Each share of Series B Voting Preferred Stock is part of a unit consisting of one share of Series B Voting Preferred Stock and a warrant representing the right to purchase one share of common stock. Unless otherwise noted, the address of each beneficial owner listed on the table is c/o Emerald Oil, Inc., 1600 Broadway, Suite 1360, Denver, Colorado 80202.

| 2 |

| Name and Address | Amount

and Nature of Beneficial Ownership of Common Stock |

Percent

of Common Stock(1) |

Amount

and Nature of Beneficial Ownership of Series B Voting Preferred Stock |

Percent

of Series B Voting Preferred Stock(1) |

Percent

of Voting Securities Beneficially Owned |

|||||||||||||||

| Certain Beneficial Owners: | ||||||||||||||||||||

| Edelman & Guill Energy L.P. (2) | 5,114,633 | 16.5 | % | 5,114,633 | 100 | % | 16.5 | % | ||||||||||||

| O-CAP Management, L.P. (3) | 2,043,583 | 7.9 | % | — | — | 6.6 | % | |||||||||||||

| Emerald Oil & Gas NL(4) | 1,662,174 | 6.4 | % | — | — | 5.4 | % | |||||||||||||

| FMR LLC(5) | 1,427,314 | 5.5 | % | — | — | 4.6 | % | |||||||||||||

| T. Rowe Price Associates, Inc.(6) | 1,375,000 | 5.3 | % | — | — | 4.4 | % | |||||||||||||

| Executive Officers and Directors: | ||||||||||||||||||||

| James Russell (J.R.) Reger(7) | 622,191 | 2.4 | % | — | — | 2.0 | % | |||||||||||||

| Michael Krzus(8)(9) | 1,768,124 | 6.8 | % | — | — | 5.7 | % | |||||||||||||

| McAndrew Rudisill(8)(10) | 1,768,124 | 6.8 | % | — | — | 5.7 | % | |||||||||||||

| Paul Wiesner(11) | 70,817 | * | — | — | * | |||||||||||||||

| Mitchell R. Thompson(12) | 86,182 | * | — | — | * | |||||||||||||||

| Lyle Berman(13)(14) | 349,638 | 1.3 | % | — | — | 1.1 | % | |||||||||||||

| Thomas J. Edelman(2) | 5,114,633 | 16.5 | % | 5,114,633 | 100 | % | 16.5 | % | ||||||||||||

| Duke R. Ligon(14) | 16,545 | * | — | — | * | |||||||||||||||

| Seth Setrakian(14) | 16,545 | * | — | — | * | |||||||||||||||

| Daniel L. Spears(14) | 16,545 | * | — | — | * | |||||||||||||||

| All current directors and executive officers as a group (11 persons)(14) | 8,256,462 | 26.3 | % | — | — | 26.3 | % | |||||||||||||

______________

* Less than one percent.

| (1) | Unless otherwise indicated, each shareholder has sole voting and investment power with respect to all shares of common stock indicated as being beneficially owned by such shareholder. Shares of common stock that are not outstanding, but which a designated shareholder has the right to acquire within 60 days, are included in the number of shares beneficially owned by such shareholder and are deemed to be outstanding for purposes of determining the percentage of outstanding shares beneficially owned by such shareholder, but not for purposes of determining the percentage of outstanding shares beneficially owned by any other designated shareholder. |

| (2) | Includes 4,943,729 units consisting of (i) a warrant to purchase 4,943,729 shares of common stock and (ii) 4,943,729 shares of Series B Voting Preferred Stock held by WDE Emerald Holdings LLC and 170,904 units consisting of (i) a warrant to purchase 170,904 shares of common stock and (ii) 170,904 shares of Series B Voting Preferred Stock held by White Deer Energy FI L.P., which are members of a “group” for purposes of Section 13(d) of the Exchange Act. Such group includes White Deer Energy L.P., White Deer Energy TE L.P., Edelman & Guill Energy L.P., Edelman & Guill Energy Ltd., Thomas J. Edelman and Ben A. Guill. White Deer Energy L.P. and White Deer Energy TE L.P. are the members of WDE Emerald Holdings LLC. By virtue of being members of WDE Emerald Holdings LLC, White Deer Energy L.P. and White Deer Energy TE L.P. may be deemed to possess voting and dispositive power with respect to 4,784,950 shares of common stock underlying the warrant and the 4,784,950 shares of Series B Voting Preferred Stock beneficially owned by WDE Emerald Holdings LLC. Edelman & Guill Energy L.P. is the general partner of White Deer Energy L.P., White Deer Energy TE L.P. and White Deer Energy FI L.P.; Edelman & Guill Energy Ltd. is the general partner of Edelman & Guill Energy L.P.; and Messrs. Edelman and Guill are the directors of Edelman & Guill Energy Ltd. Accordingly, each of Edelman & Guill Energy L.P., Edelman & Guill Energy Ltd., and Messrs. Edelman and Guill may be deemed to control the investment decisions of (i) White Deer Energy L.P. and White Deer Energy TE L.P. and, therefore, WDE Emerald Holdings LLC and (ii) White Deer Energy FI L.P. The members of the aforementioned “group” disclaim beneficial ownership of the shares of common stock underlying the warrants held by WDE Emerald Holdings LLC and White Deer Energy FI L.P. except to the extent of their respective pecuniary interests therein. The business address for each member of the aforementioned “group” is 700 Louisiana, Suite 4770, Houston, TX 77002. |

| 3 |

| (3) | The number of shares indicated is based on the Schedule 13G filed with the Securities Exchange Commission jointly by O-CAP Management, L.P., O-CAP GP, LLC, O-CAP Advisors, LLC, Michael E. Olshan and Jared S. Sturdivant on January 14, 2013. The 2,043,583 shares of common stock are held by CAP Offshore Master Fund, L.P. and O-CAP Partners, L.P., for each of which O-CAP Management, L.P. serves as the investment manager and O-CAP Advisors, LLC serves as the general partner. CAP GP, LLC serves as the general partner of O-CAP Management, L.P. Michael E. Olshan and Jared S. Sturdivant serve as managing members of both O-CAP Advisors, LLC and O-CAP GP, LLC. 2,043,583 shares are held by a managed account for which O-CAP Management, L.P. acts as sub-advisor and has sole investment discretion and voting authority with respect to such shares. The business address for O-CAP Management, L.P. is 623 Fifth Avenue, Suite 2601, New York, NY 10022. |

| (4) | The number of shares indicated is based on the Schedule 13D filed with the Securities Exchange Commission by Emerald Oil & Gas NL on April 10, 2013. The business address for Emerald Oil & Gas NL is Suite 2, 12 Parliament Place, West Perth, Western Australia, C3 6005. |

| (5) | The number of shares indicated is based on the Schedule 13G/A filed with the Securities Exchange Commission by FMR LLC on January 10, 2013. Included in the shares of common stock that are beneficially owned by FMR LLC are (a) 1,363,400 shares beneficially owned by Fidelity Management & Research Company, a wholly owned subsidiary of FMR LLC and an investment adviser registered under the Section 203 of the Investment Advisers Act of 1940 (“Investment Advisers Act”), and (b) 63,914 shares beneficially owned by Pyramis Global Advisors Trust Company, an indirect wholly owned subsidiary of FMR LLC and a bank as defined in Section 3(a)(6) of the Securities Exchange Act of 1934, as a result of its serving as investment manager of institutional accounts owning such shares. FMR LLC has sole voting power with respect to 63,914 shares and sole dispositive power with respect to 1,427,314 shares. The business address for FMR LLC is 82 Devonshire Street, Boston, MA 02109. |

| (6) | The number of shares indicated is based on the Schedule 13G filed with the Securities Exchange Commission by T. Rowe Price Associates, Inc. on February 13, 2013. T. Rowe Price Associates, Inc. has sole voting power with respect to 132,500 shares and sole dispositive power with respect to 1,375,000 shares. The business address for T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| (7) | Includes 170,373 shares of common stock held by South Fork Exploration, LLC, of which Mr. Reger owns 100% the issued membership units, warrants to purchase 186,077 shares of common stock that have vested but have not been exercised, and options to acquire 22,321 shares of common stock. Does not include 316,728 unvested restricted stock units and unvested options to purchase 66,965 shares of common stock. |

| (8) | Includes 1,662,174 shares held by Emerald Oil & Gas NL, which Messrs. Krzus and Rudisill comprise two of the five members of the board of directors of Emerald Oil & Gas NL. Messrs. Krzus and Rudisill disclaim beneficial ownership of the shares of common stock held by Emerald Oil & Gas NL, except to the extent of their respective pecuniary interests therein. |

| (9) | Includes options to acquire 22,321 shares of common stock. Does not include 316,728 unvested restricted stock units and unvested options to purchase 66,965 shares of common stock. |

| (10) | Includes options to acquire 22,321 shares of common stock. Does not include 316,728 unvested restricted stock units and unvested options to purchase 66,965 shares of common stock. |

| (11) | Includes options to acquire 11,161 shares of common stock. Does not include 223,246 unvested restricted stock units and unvested options to purchase 11,161 shares of common stock. |

| (12) | Includes warrants and options to acquire 55,073 shares of common stock. Does not include 123,220 unvested restricted stock units and unvested options to purchase 71,429 shares of common stock. |

| (13) | Includes 266,342 shares held by the Lyle Berman Irrevocable Trust and 28,931 shares held by the Berman Consulting Corp. |

| (14) | Does not include 60,164 unvested restricted stock units. |

| 4 |

PROPOSALS TO BE VOTED UPON

PROPOSAL 1

ELECTION OF DIRECTORS

Our Articles of Incorporation, as amended, specify that the number of directors shall consist of one or more members, the number thereof to be determined from time to time by resolution of our Board. Our Board is currently composed of eight directors, and our Board has adopted a resolution to reduce the number of members of our Board to seven directors to be effective upon the adjournment of the 2013 Annual Meeting. One of our current directors, Lyle Berman, has elected to retire from the Board following the adjournment of our 2013 Annual Meeting.

On July 26, 2012, we acquired Emerald Oil North America, Inc. (formerly Emerald Oil, Inc.) for approximately 1.66 million shares of our common stock and made a strategic decision to add operating capabilities and focus on growing operating acreage in the Williston Basin in North Dakota and Montana. We refer to this acquisition as the “Emerald Acquisition.” In connection with the closing of the Emerald Acquisition, Joseph Lahti, Myrna McLeroy, Loren J. O’Toole, Josh Sherman and Mitchell Thompson resigned from our Board of Directors, and Mike Krzus, Duke R. Ligon, McAndrew Rudisill, Seth Setrakian and Daniel L. Spears were appointed as directors. Also in connection with the closing of the Emerald Acquisition, our Board appointed Mike Krzus as Chief Executive Officer, McAndrew Rudisill as President, Paul Wiesner as Chief Financial Officer, and Karl Osterbuhr as Vice President of Exploration and Business Development, and our Board appointed James Russell (J.R.) Reger, formerly our Chief Executive Officer, as Executive Chairman, and Mitchell Thompson, formerly our Chief Financial Officer, as Chief Accounting Officer.

On February 19, 2013, we completed a private offering with affiliates of White Deer Energy L.P. (“White Deer Energy”), pursuant to which, in exchange for a cash investment of $50 million, we issued 500,000 shares of Series A Perpetual Preferred Stock, $0.001 par value per share, 5,114,633 shares of Series B Voting Preferred Stock, $0.001 par value per share, and warrants to purchase an initial aggregate 5,114,633 shares of our common stock, at an initial exercise price of $5.77 per share. In connection with the White Deer Energy private offering and pursuant to the obligations under the related Securities Purchase Agreement and the Preferences, Limitations and Relative Rights of Series A Perpetual Preferred Stock set forth in our Articles of Incorporation, the holders of the Series A Perpetual Preferred Stock selected Thomas J. Edelman to serve on our Board as the director designee of the holders of the Series A Perpetual Preferred Stock.

Our Governance/Nominating Committee has nominated six of our current directors for re-election at the 2013 Annual Meeting to hold office until the 2014 Annual Meeting of Shareholders or until the successor of each shall be elected and qualified in accordance with our bylaws. One of our current directors, Lyle Berman, has elected to retire from the Board following the adjournment of our 2013 Annual Meeting. The holders of our Series A Perpetual Preferred Stock have selected Thomas J. Edelman to serve as the Series A Perpetual Preferred Stock designee pursuant to their rights under our Articles of Incorporation. We have no reason to believe that any of the director nominees named below will be unable or unwilling to serve as director if elected. If for any reason any nominee withdraws or is unable to serve as a director (neither of which is expected at this time), the shares represented by all valid proxies will be voted for the election of a substitute nominee recommended by the Board or the Board may reduce the size of the Board.

The six nominees receiving the greatest number of affirmative votes cast will be elected as directors. Except as otherwise directed on the proxy cards, the proxies will vote all valid proxies for the six nominees identified below.

| 5 |

Nominees for Election as Directors at the 2013 Annual Meeting

The Board has recommended the following persons as nominees for election as directors at the 2013 Annual Meeting:

| Nominee Name | Age (as of 2013 Annual Meeting) |

Year First Became a Director | ||

| Mike Krzus | 55 | 2012 | ||

| Duke R. Ligon | 71 | 2012 | ||

| James Russell (J.R.) Reger | 38 | 2010 | ||

| McAndrew Rudisill | 34 | 2012 | ||

| Seth Setrakian | 41 | 2012 | ||

| Daniel L. Spears | 40 | 2012 |

Certain biographical information relating to each of the nominees for election to our Board is set forth below:

Mike Krzus has been a director and served as our Chief Executive Officer since July 2012. Mr. Krzus has over 30 years experience managing technical and business areas in upstream oil and natural gas, liquefied natural gas and geothermal. Prior to joining us, Mr. Krzus was the Chief Executive and Operating Officer of Emerald Oil & Gas NL, a petroleum exploration and production company based in Perth, Australia, since February 12, 2009 and was its Managing Director from August 13, 2009 before reverting to a non-executive director on being appointed our Chief Executive Officer in July 2012. Starting as a petroleum engineer with Home Oil in Calgary in 1983, Mr. Krzus then proceeded to Woodside Petroleum Ltd (Australia’s largest operating oil company) in 1986 where he held various management and executive positions involving oil and natural gas field development (including a four-year secondment to Shell International SIPM where he led natural gas and oil field development teams in the Netherlands), exploration and production business development, company business planning and evaluations, joint venture management and technical capability management. Before leaving Woodside Petroleum Ltd in 2007, Mr. Krzus was responsible for its sub-surface technical oil and natural gas development capability and technology and its capital gating approval process. Prior to joining Emerald Oil & Gas NL, Mr. Krzus managed a geothermal exploration company that was a subsidiary of Eden Energy. Mr. Krzus is a member of the Society of Petroleum Engineers (SPE) and Graduate member of the Australian Institute of Company Directors (AICD). Mr. Krzus holds a Diploma in Oil and Gas Technology from the British Columbia Institute of Technology and a BSc in Petroleum Engineering from Tulsa University. Mr. Krzus’ qualifications to sit on the Board include his role as our Chief Executive Officer, his experience in the energy industry, his petroleum engineering background and his years of experience in oil and natural gas development and production and technical and business management of upstream oil and natural gas companies.

Duke R. Ligon has been a director since July 2012. Mr. Ligon has served as Chairman of PostRock Energy Corporation (NASDAQ: PSTR), an independent oil and natural gas company, since October 2010 and as Chairman and Director of one of PostRock’s predecessor entities since 2006. Mr. Ligon has more than 40 years of legal expertise in corporate securities, litigation, governmental affairs and mergers and acquisitions. He is an attorney and served as senior vice president and general counsel of Devon Energy Corporation (NYSE: DVN), an independent natural gas and oil exploration and production company, from January 1997 until he retired in February 2007. From 2007 to 2010, Mr. Ligon served as a strategic legal advisor to Love’s Travel Stops & Country Stores, Inc., a privately held chain of fuelling stations and attached convenience stores, and currently is the manager and owner of Mekusukey Oil Company, LLC, a privately held oil and natural gas company. Prior to joining Devon, Mr. Ligon practiced law for 12 years and last served as a partner at the law firm of Mayer Brown LLP in New York City. In addition, Mr. Ligon was Senior Vice President and Managing Director for Investment Banking at Bankers Trust Co., a privately held commercial bank, in New York City for 10 years. Mr. Ligon also serves as a member of the board of directors of Panhandle Oil and Gas, Inc. (NYSE: PHX), an oil and natural gas company, as a member of the board of directors of Vantage Drilling Company (AMX: VTG), an offshore drilling contractor, Chairman of the Board of Blueknight Energy Partners, LP (NASDAQ: BKEP), a midstream energy business, Chairman of the Board of SteelPath MLP Funds, a privately held mutual fund providing access to the Master Limited Partnership asset class, member of the board of directors of SteelPath Energy Infrastructure Investment Company, an MLP focused investment manager, Chairman of the Board of Security State Bank, member of the board of directors of Heritage Trust Company, member of the board of directors of Orion California LP, a privately held oil and natural gas company. He was formerly on the board of directors of SteelPath MLP Funds Trust, TransMontaigne Partners L.P. (NYSE: TLP), TEPPCO Partners, L.P. (NYSE: TPP), and member of the Advisory Committee of LegalShield, a privately held prepaid legal services company (formerly Pre-Paid Legal Services, Inc. where he was a board member and Chairman of the Special Committee that negotiated the recent sale to MidOcean Partners). Mr. Ligon received an undergraduate degree in chemistry from Westminster College and a law degree from the University of Texas School of Law. Mr. Ligon’s qualifications to sit on the Board include his experience as senior vice president and general counsel of Devon Energy Corporation and his expertise in corporate securities, litigation, governmental affairs and mergers and acquisitions, as well as his service on a number of boards of directors of other publicly traded companies, primarily in the energy industry.

| 6 |

James Russell (J.R.) Reger has served as our Executive Chairman since July 2012, served on our Board since April 2010 and served as our Chief Executive Officer from April 2010 to July 2012. Mr. Reger was the Chief Executive Officer of Plains Energy Investments, Inc. from December 2009 to April 2010. Mr. Reger was born and raised in Billings, Montana and is the fourth generation in a family of oil and natural gas explorers and developers dating back more than 60 years. From May 2004 to July 2006, Mr. Reger developed Williston Basin leaseholds as a Principal of Reger Oil, LLC based in Billings, Montana. From August 2006 to December 31, 2009, Mr. Reger was the President of South Fork Exploration, LLC, a lease acquisition and development company with assets in North Dakota, Montana and Wyoming. Mr. Reger holds a B.A. in Finance from Baylor University in Waco, Texas. Mr. Reger’s qualifications to sit on the Board include his role as founder and executive officer of the Company since 2010, and his knowledge and understanding of the energy industry, especially in North Dakota and Montana.

McAndrew Rudisill has been a director and served as our President since July 2012. Mr. Rudisill has 12 years of investment management and investment banking experience in the natural resources sector. Prior to joining us, Mr. Rudisill was Executive Chairman of Emerald Oil, Inc., which we acquired in July 2012, from 2011 to 2012. Mr. Rudisill was the Managing Partner and founder of Pelagic Capital Advisors LP from 2007 to 2011. Prior to forming Pelagic Capital Advisors LP, Mr. Rudisill was a co-founder and Managing Partner of BrightStream Asset Management which focused on investments in natural resources from 2005 to 2007. Before co-founding BrightStream, Mr. Rudisill was an Analyst and Managing Director at North Sound Capital from 2003 to 2005 where he was responsible for investments in global natural resources. Mr. Rudisill currently serves as a Non-Executive Director of Ochre Group Holdings Limited (ASX: OGH), an Australia based mineral resources exploration company, serves as a non-executive director of Emerald Oil & Gas NL (ASX: EMR), a petroleum exploration and production company based in Perth Australia, and serves as a trustee of the Tiger Foundation, which is a philanthropic organization focused on serving New York City. Mr. Rudisill's investment career began at JPMorgan, where he worked as an investment banker. Mr. Rudisill holds a B.A. cum laude with high honors in Economics from Middlebury College in Middlebury, Vermont. Mr. Rudisill’s qualifications to sit on the Board include his role as our President and his public and private equity investment experience, investment banking experience and dealings with structuring numerous transactions in the energy industry.

Seth Setrakian has been a director since July 2012. Mr. Setrakian has 15 years of investment management experience. Mr. Setrakian currently is a Partner and Co-Head of Domestic Equities of First New York Securities, LLC, a privately held principal trading firm. Prior to First New York, Mr. Setrakian was a Partner of Helios Partners and Seneca Capital, both U.S.-based private investment firms. Mr. Setrakian’s career began at Arthur Andersen, where he was an associate in the Corporate Finance group. Mr. Setrakian graduated summa cum laude, with a B.S. in Accounting, from Pennsylvania State University. Mr. Setrakian’s qualifications to sit on the Board include his extensive capital markets expertise, his involvement with publicly traded energy companies and background in finance and strategic management.

Daniel L. Spears has been a director since July 2012. Mr. Spears has 16 years of investment management and investment banking experience in the natural resources sector. Mr. Spears is a partner and portfolio manager at Dallas, Texas based Swank Capital, LLC, an energy infrastructure investment management company, and its wholly owned investment manager, Cushing MLP Asset Management, LP. Mr. Spears was an investment banker in the Natural Resources Group at Bank of America Securities LLC for eight years. Mr. Spears also worked in the Global Energy and Power Investment Banking Group at Salomon Smith Barney. Mr. Spears serves on the board of directors of Lonestar Midstream, L.P., a private midstream master limited partnership, PostRock Energy Corporation (NASDAQ: PSTR), an independent oil and natural gas company, and Central Energy, LP, a private distribution-focused master limited partnership trading in the over-the-counter market. Mr. Spears received his B.S. in Economics from the Wharton School of the University of Pennsylvania. Mr. Spears’ qualifications to sit on the Board include his investment banking and money management expertise and his expertise related to public and private companies in the energy industry, as well as his service on a number of boards of directors of other publicly traded companies, primarily in the energy industry.

| 7 |

Director Designee of the Series A Perpetual Preferred Stock

The holders of our Series A Perpetual Preferred Stock are entitled to elect an individual designated by the holders of a majority of the Series A Perpetual Preferred Stock to serve as a member of our Board of Directors. The director selected by the Series A Perpetual Preferred Stock may be removed at any time with our without cause only by the holders of a majority of the Series A Perpetual Preferred Stock. Any vacancy in the directorship of the Series A Perpetual Preferred Stock designee may be filled only by the holders of a majority of the Series A Perpetual Preferred Stock. The holders of the Series A Perpetual Preferred Stock have selected Thomas J. Edelman to serve on our Board of Directors. The Governance/Nominating Committee reviewed the qualifications of Mr. Edelman and determined that he meets or exceeds the director qualifications standards adopted by the Governance/Nominating Committee, and in the Committee’s opinion, will make valuable contributions to the Board and the governance of the Company. Mr. Edelman’s biographical information is set forth below:

Thomas J. Edelman has been a director since February 2013. Mr. Edelman is currently Managing Partner of White Deer Energy L.P., an energy private equity fund. Mr. Edelman founded Patina Oil & Gas Corporation and served as its Chairman and Chief Executive Officer from its formation in 1996 through its merger with the Noble Energy, Inc. in 2005, when he joined its board of directors. Mr. Edelman co-founded Snyder Oil Corporation and was its President from 1981 through 1997. Mr. Edelman served as Chairman and Chief Executive Officer and later as Chairman of Range Resources Corporation (NYSE: RRC), an oil and natural gas company, from 1988 through 2003. From 1980 to 1981, he was with The First Boston Corporation and from 1975 through 1980 with Lehman Brothers Kuhn Loeb Incorporated. Mr. Edelman serves as a director of Noble Energy, Inc. (NYSE: NBL), an oil and natural gas company, PostRock Energy Corporation (NASDAQ: PSTR), an independent oil and natural gas company, President of Lenox Hill Neighborhood House, a Trustee and Chair of the Investment Committee of The Hotchkiss School and is a member of the board of directors of Georgetown University. Mr. Edelman brings a strong financial and executive management background to our Board. Mr. Edelman holds an M.B.A. in Finance from Harvard Business School and a B.A. in Political Economy from Princeton University. Mr. Edelman’s qualifications to sit on the Board include his extensive experience with investment banking and private equity funds, as well as the financial aspects of our business through leadership of large independent oil and natural gas companies, serving as President and CEO of several independent oil and natural gas companies and his knowledge and expertise of the oil and natural gas industry.

CORPORATE GOVERNANCE

Independence

Our Board has determined that all of our non-employee director nominees, Duke R. Ligon, Seth Setrakian and Daniel L. Spears, are independent directors, as defined by the listing standards of the NYSE MKT stock exchange. Our Board has also determined that Thomas J. Edelman, the designee of the Series A Perpetual Preferred Stock, is an independent director, as defined by the listing standards of the NYSE MKT stock exchange. Our employee directors are Mike Krzus (Chief Executive Officer), McAndrew Rudisill (President) and J.R. Reger (Executive Chairman).

| 8 |

Board Leadership Structure

In determining the appropriate leadership of our Board of Directors, the Board considers many factors, including our specific business needs, fulfilling the duties of the Board and the best interests of our shareholders. In connection with the Emerald Acquisition in July 2012, Mr. Reger, our former Chief Executive Officer, was named as Executive Chairman, and Mr. Krzus was appointed Chief Executive Officer and a member of the Board. In addition, Mr. Rudisill, our President, is a member of the Board. The Board believes this leadership structure is best for the Company at the current time because it provides us with the continued service of Mr. Reger, who has significant expertise in the oil and natural gas industry and acquiring acreage in North Dakota and Montana, our core focus area. It also provides the Board with the services of Messrs. Krzus and Rudisill, who both have significant management experience and expertise with respect to the oil and natural gas industry and the successful implementation of growth strategies, as well as oversight of management.

The Board also believes that the current leadership structure achieves independent oversight and management accountability through regular executive sessions of the non-management directors and through a Board composed of a majority of independent directors, and strong independent committee chairs. We do not have a designated lead independent director, instead we allow our independent directors as a group to choose who among them is best suited to serve as the chair of each executive session. The Board will, however, maintain its flexibility to modify this structure at any given point in time to provide appropriate leadership for us.

Board’s Role in Risk Oversight

Our Board retains primary responsibility for risk oversight. To assist the Board in carrying out its oversight responsibilities, members of our senior management report to the Board and its committees on areas of risk, and our Board committees consider specific areas of risk inherent in their respective areas of oversight and report to the full Board regarding their activities. For example, our Audit Committee periodically discusses with management our major financial risk exposures and the steps management has taken to monitor and control such exposures. Our Compensation Committee considers employee-related risks as it evaluates the performance of our executive officers and determines our executive compensation. Our Governance/Nominating Committee focuses on issues relating to Board composition and corporate governance matters. In addition, to ensure that our Board has a broad view of our overall risk management process, the Board periodically reviews our long-term strategic plans and the principal issues and risks that we may face, as well as the processes through which we manage risk.

Code of Ethics and Business Conduct

The Board has adopted a Code of Ethics and Business Conduct that applies to all employees, consultants, directors and officers, including our principal executive officer, principal financial officer, and principal accounting officer. Our Code of Ethics and Business Conduct addresses such topics as protection and proper use of our assets, compliance with applicable laws and regulations, accuracy and preservation of records, accounting and financial reporting, company opportunities, gifts and political contributions, relationships with government officials, conflicts of interest and insider trading. Our Code of Ethics and Business Conduct is available on our website at www.emeraldoil.com. Emerald intends to include on its website any amendment to, or waiver from, a provision of the Code of Ethics and Business Conduct that applies to the principal executive officer, principal financial officer, principal accounting officer and controller that relates to any element of the code of ethics definition enumerated in Item 406(b) of Regulation S-K. A copy of our Code of Ethics and Business Conduct will be provided to any person, without charge, upon request to the Secretary at 1600 Broadway, Suite 1360, Denver, Colorado 80202.

Shareholder Communications with the Board of Directors

Shareholders may communicate directly with the Board. All communications should be directed to our Secretary at the address below and should prominently indicate on the outside of the envelope that it is intended for the Board or for non-management directors, and our Secretary will forward the communications to all specified directors. If no director is specified, the communication will be forwarded to the entire Board. Shareholder communications to the Board should be sent to:

| 9 |

Emerald Oil, Inc. Board of Directors

Attention: Secretary

1600 Broadway, Suite 1360

Denver, Colorado 80202

Director Attendance at Annual Meetings

Directors’ attendance at annual meetings can provide shareholders with an opportunity to communicate with directors about issues affecting us. We do not have a policy regarding director attendance, but all directors are encouraged to attend the Annual Meeting of Shareholders. All of the current members of our Board who were members of our Board at the time of last year’s annual meeting attended the annual meeting in person.

Board and Committee Meetings

During fiscal 2012, the Board held nine formal meetings. The directors often communicate informally to discuss the affairs of the Company and, when appropriate, take formal action by written consent of a majority of all directors, in accordance with our Articles of Incorporation and bylaws and Montana law. The directors also participate in quarterly financial update calls with management.

Our Board has three standing committees, the Audit Committee, the Compensation Committee and the Governance/Nominating Committee. Members of such committees met formally and informally from time to time throughout fiscal 2012 on committee matters, with the Audit Committee holding four formal meetings, the Compensation Committee holding two formal meetings and the Governance/Nominating Committee holding one formal meeting.

Each director, including the directors who resigned following the Emerald Acquisition, attended, in person or by telephone, 100% of the meetings of the Board and at least 75% of the meetings for any committee of which he or she was a member.

Current Committee Membership

The following table sets forth the membership of each of our committees.

| Audit Committee | Governance/Nominating Committee |

Compensation Committee | ||

| Lyle Berman(1) | Duke R. Ligon | Duke R. Ligon | ||

| Duke R. Ligon* | Seth Setrakian | Seth Setrakian* | ||

| Daniel L. Spears | Daniel L. Spears* | Daniel L. Spears |

* Chairman of Committee

(1) Mr. Berman will retire upon the adjournment of the 2013 Annual Meeting, and Mr. Edelman will be appointed to serve on the Audit Committee.

Audit Committee

Among other matters, our Audit Committee:

| • | assists the Board in fulfilling its oversight responsibility to our shareholders and other constituents with respect to the integrity of financial statements; |

| • | reviews our annual financial statements and any reports or other financial information or estimates submitted to any governmental body or the public, including any certification, report, opinion or review rendered by our independent auditors; |

| 10 |

| • | appoints and has oversight over our independent auditors, determines the compensation of our independent auditors and reviews the independence and the experience and qualifications of our independent auditors’ lead partner, and pre-approves the engagement of our independent auditors for audit and permitted non-audit services; |

| • | meets with the independent auditors and reviews the scope and significant findings of audits and meets with management and internal financial personnel regarding these findings; |

| • | reviews the performance of our independent auditors; |

| • | periodically meet with key members of the internal audit consultants, without management or others present, to discuss the adequacy of the internal audit function and results of such internal audit reviews; |

| • | discusses with management, internal audit consultants and our independent auditors the adequacy and sufficiency of our disclosure and internal control procedures as a complete system, as well as the discovery of any individually material gaps and/or failures in our disclosure and internal control procedures; |

| • | meet periodically with those members of management responsible for our risk assessment and risk management to understand and evaluate our risk assessment and risk management effort; |

| • | in consultation with the independent auditors and the internal audit consultants, review the integrity of our financial reporting processes, both internal and external; |

| • | consider and approve, if appropriate, major changes to our auditing and accounting principles and practices as suggested by the independent auditors, management or the internal audit consultants; |

| • | establishes procedures for the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters; |

| • | review periodically the Code of Ethics and Business Conduct and management’s enforcement of the Code as it relates to our financial reporting process and internal control system; and |

| • | prepares the audit committee report required by the rules of the SEC to be included in our annual proxy statement. |

Our independent auditors and other key committee advisors have regular contact with our Audit Committee. Our Board has adopted a written charter describing the roles and responsibilities of the Audit Committee. The Audit Committee charter is available on the investor page of our website at www.emeraldoil.com.

Audit Committee Independence and Financial Expert

Our Board has determined that our Audit Committee is comprised entirely of independent directors, as defined by the listing standards of the NYSE MKT stock exchange and applicable SEC rules. In addition, our Board has determined that Mr. Spears is an “audit committee financial expert,” as defined under the applicable rules of the SEC. Each member of our Audit Committee possesses the financial qualifications required of Audit Committee members set forth in the rules and regulations of the NYSE MKT stock exchange and under the Securities Exchange Act of 1934, as amended.

Audit Committee Report

Management is responsible for our system of internal controls and the overall financial reporting process. Our independent auditors are responsible for performing an independent audit of our consolidated financial statements and internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board, and to issue reports thereon. The Audit Committee is responsible for overseeing management’s conduct of the financial reporting process and systems of internal accounting and financial controls.

| 11 |

In accordance with its written charter adopted by the Board, the Audit Committee assists the Board with fulfilling its oversight responsibility regarding the quality and integrity of our accounting, auditing and financial reporting practices. In discharging its oversight responsibilities regarding the audit process, the Audit Committee:

| (1) | reviewed and discussed the audited financial statements with management and the independent auditors; |

| (2) | discussed with the independent auditors the matters required to be discussed by the statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; and |

| (3) | received the written disclosures and the letter from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence. |

Based upon the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012, as filed with the Securities and Exchange Commission.

April 19, 2013

Duke R. Ligon, Chair

Lyle Berman

Daniel L. Spears

Governance/Nominating Committee

Our Governance/Nominating Committee makes recommendations to our Board regarding candidates for directorships and the composition of our Board and its committees. In addition, our Nominating/Corporate Governance Committee oversees our codes of conduct and makes recommendations to our Board concerning governance matters.

The Governance/Nominating Committee will review any director nominees proposed by shareholders. Shareholders may recommend a nominee to be considered by the Governance/Nominating Committee by submitting a written notice to the Company in accordance with our bylaws within the timeframes set forth below in the section titled “Shareholder Proposals.” A consent signed by the proposed nominee agreeing to be considered as a director should accompany the written notice. The notice should include the name and address of the nominee, the qualifications and experience of said nominee and any other information required by our bylaws.

The Governance/Nominating Committee acts pursuant to a written charter and is responsible for tasks relating to the adoption of corporate governance policies and procedures, the nomination of directors, and the oversight of the organization of Board committees. The Governance/Nominating Committee charter is available on the investor page of our website at www.emeraldoil.com.

| 12 |

When identifying and selecting candidates for recommendation to the Board, the Governance/Nominating Committee will consider the attributes of the candidates and the needs of the Board and will review all candidates in the same manner, regardless of the source of the recommendation. In evaluating director nominees, a candidate should have certain minimum qualifications, including being able to read and understand basic financial statements, being familiar with our business and industry, having high moral character and mature judgment, and being able to work collegially with others. In addition, factors such as the following are also considered when evaluating director nominees:

| • | appropriate size and diversity of the Board; |

| • | needs of the Board with respect to particular talent and experience; |

| • | knowledge, skills and experience of nominee; |

| • | familiarity with domestic and international business affairs; |

| • | legal and regulatory requirements; |

| • | appreciation of the relationship of our business to the changing needs of society; and |

| • | desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by a new member. |

The Governance/Nominating Committee does not have a formal diversity policy at this time; however, as summarized above, the Governance/Nominating Committee seeks to nominate candidates with a diverse range of knowledge, experience, skills, expertise, and other qualities that will contribute to the overall effectiveness of the Board.

Governance/Nominating Committee Independence

Our Board has determined that our Governance/Nominating Committee is comprised entirely of independent directors, as defined by the listing standards of the NYSE MKT stock exchange.

Compensation Committee

Our Compensation Committee reviews and recommends policy relating to compensation and benefits of our officers, employees and directors with input from our management and outside compensation consultants, if any. Our Compensation Committee reviews and approves corporate goals and objectives relevant to compensation of our executive officers, evaluates the performance of these officers in light of those goals and objectives and sets the compensation of these officers based on such evaluations. Our Compensation Committee provides input on compensation for our other officers and employees, but compensation levels for such officers and employees and the corporate goals and objectives relating to compensation are set by our Chief Executive Officer, President and Executive Chairman, subject to the Compensation Committee’s approval. Our Compensation Committee also administers the issuance of stock options, restricted stock awards, and other awards under our 2011 Equity Incentive Plan.

Compensation Committee Charter and Scope of Authority

Under the Compensation Committee’s written charter, the primary duties and responsibilities of the Compensation Committee include the following:

| • | develop and periodically review with management our philosophy of compensation, taking into consideration enhancement of shareholder value and the fair and equitable compensation of all employees; |

| • | determine the compensation for our executive officers and approve the compensation for all of our executive officers; |

| • | determine and approve equity grants made pursuant to our 2011 Equity Incentive Plan and any other equity incentive plan; |

| • | develop, recommend to the Board, review and administer executive officer compensation policy and plans, including incentive plans, benefits and perquisites; |

| 13 |

| • | develop, recommend, review and administer compensation plans for non-employee members of the Board; |

| • | annually consider the relationship between our strategic and operating plans and the various compensation plans for which the Committee is responsible; |

| • | periodically review and approve employment agreements, severance agreements, change of control agreements and material amendments to the foregoing which are applicable to any executive officer; and |

| • | review and discuss with management the Compensation Discussion and Analysis (“CD&A”) required by the SEC. Based on such review and discussion, the Committee determines whether to recommend to the full Board that the CD&A be included in the annual report or proxy statement. |

The Compensation Committee charter may be amended by approval of the Board. The Compensation Committee charter is available on the investor page of our website at www.emeraldoil.com.

Delegation of Authority

The Compensation Committee has delegated certain authority to our Chief Executive Officer to make limited equity award grants under our 2011 Equity Incentive Plan to non-executive employees.

Role of Management and Compensation Consultants

In making its compensation decisions and recommendations, the Compensation Committee takes into account the recommendations of our Chief Executive Officer, President and Executive Chairman. Other than giving their recommendations, our Chief Executive Officer, President and Executive Chairman do not participate in the Compensation Committee’s decisions regarding their own compensation. All of the Compensation Committee’s actions, decisions and recommendations are reported to our Board. In addition, the Compensation Committee may engage an independent compensation consultant to review compensation trends and compensation levels of companies that we deem to be in our peer group. Subsequent to the Emerald Acquisition, the Compensation Committee did not engage an independent compensation consultant for 2012, and the Compensation Committee relied on its own review of compensation trends and compensation levels of other companies that the Compensation Committee deemed to be in our peer group.

Compensation Committee Independence

Our Board has determined that our Compensation Committee is comprised entirely of independent directors, as defined by the listing standards of the NYSE MKT stock exchange.

Required Vote and Recommendation

Under Montana law, the election of each nominee requires the affirmative vote by a plurality of the votes cast by the shares entitled to vote on the election of directors at the 2013 Annual Meeting at which a quorum is present. At our 2013 Annual Meeting, six directors will be up for election. Each shareholder has the right to cast six votes in the election of directors for each share of stock held on the record date. If you wish to exercise, by proxy, your right to cumulative voting in the election of directors, you must provide a proxy showing how your votes are to be distributed among one or more candidates. Unless contrary instructions are given by a shareholder who signs and returns a proxy, all votes for the election of directors represented by such proxy will be divided equally among the six nominees. If cumulative voting is invoked by any shareholder, the vote represented by the proxies delivered pursuant to this solicitation, which do not contain contrary instructions, may be cumulated at the discretion of our Board in order to elect to the Board the maximum number of nominees named in this proxy statement. Abstentions and broker non-votes will not be counted as having been voted on the proposal.

| 14 |

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES TO THE BOARD SET FORTH IN THIS PROPOSAL #1.

EXECUTIVE OFFICERS

The following provides information about our current executive officers. Information with respect to Messrs. Krzus, Reger and Rudisill is set forth in “Election of Directors—Nominees for Election.”

| Name | Age | Positions | ||

| Mike Krzus | 55 | Chief Executive Officer and Director | ||

| James Russell (“J.R.”) Reger | 38 | Executive Chairman and Director | ||

| McAndrew Rudisill | 34 | President and Director | ||

| Paul Wiesner | 48 | Chief Financial Officer and Secretary | ||

| Mitchell R. Thompson | 32 | Chief Accounting Officer | ||

| David Veltri | 55 | Chief Operating Officer |

Paul Wiesner has been our Chief Financial Officer since the closing of the Emerald Acquisition in July 2012. Mr. Wiesner has over 25 years of experience with public and private oil and natural gas companies in senior financial and accounting positions. Prior to joining us, Mr. Wiesner was the Chief Financial Officer of Tracker Resource Development II, LLC from 2008 to 2011 a private oil exploration company focused in the North Dakota Bakken which sold for $1.05B. From 2005 to 2008, Mr. Wiesner was Chief Financial Officer, Secretary and Treasurer for Storm Cat Energy Corporation a publically traded coalbed methane gas exploration company focused in the Powder River Basin of Wyoming. In November 2008, while Mr. Wiesner served as an executive officer, entities affiliated with Storm Cat Energy filed for protection under Chapter 11 of the Federal bankruptcy laws in the U.S. Bankruptcy Court for the District of Colorado. From 2002 to 2005, Mr. Wiesner served as Chief Financial Officer of NRT Colorado, Inc. d/b/a Coldwell Banker Residential Colorado a residential real estate company with 22 offices and 2000 agents. Prior to 2002, Mr. Wiesner held financial positions with various private companies focused on oil and natural gas exploration, mid-stream natural gas gathering, mining and high technology products. Mr. Wiesner graduated with a Bachelor of Arts degree from Claremont McKenna College and holds an MBA from the MIT Sloan School of Management.

Mitchell R. Thompson has been our Chief Accounting Officer since the closing of the Emerald Acquisition in July 2012. Prior to then, Mr. Thompson served as our Chief Financial Officer from April 2010 to July 2012 and as a director from January 2011 to July 2012. Mr. Thompson was Chief Financial Officer of Plains Energy Investments, Inc. from December 1, 2009 until its merger with us in April 2010. From November 2008 to December 1, 2009, Mr. Thompson was with Anderson ZurMuehlen & Co., P.C. in Billings, Montana where he was an assurance manager. From September 2004 to November 2008, Mr. Thompson held various positions with Grant Thornton LLP in Minneapolis, where he last served as a senior associate. Mr. Thompson has been a licensed CPA since 2006 and holds a B.S. and Master’s in Accounting from Montana State University.

David Veltri has been our Chief Operating Officer since November 30, 2012. Mr. Veltri has over 31 years of oil and natural gas industry experience with a major oil company and several independent oil companies, where he has managed and provided engineering for all phases of upstream and mid-stream oil and natural gas operations, covering North Dakota, Wyoming, the Rocky Mountains, the Southern U.S., Mid-Continent, Louisiana, Texas and various international locations. Most recently, Mr. Veltri served as an independent petroleum engineering consultant from October 2011 through November 2012. From August 2008 through September 2011, Mr. Veltri served as Vice President/General Manager of Baytex Energy USA Ltd., where he managed business unit operations, capital drilling programs, lease maintenance and producing properties in the Williston Basin in North Dakota. From September 2006 to July 2008, Mr. Veltri was Production Manager at El Paso Exploration and Production Company, where he managed producing oil and natural gas properties located in northern New Mexico. Mr. Veltri received a Bachelor of Science in Mining and Engineering from West Virginia University.

| 15 |

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

Our compensation programs are generally, designed, structured and administered under the oversight of our Compensation Committee and subject to the approval of our Board of Directors. On July 26, 2012, we completed the acquisition of Emerald Oil, Inc., pursuant to which we purchased all of the outstanding capital stock of Emerald Oil, Inc. for 1,662,174 shares of our common stock and retained certain liabilities of Emerald Oil, Inc. We refer to the acquisition of Emerald Oil, Inc. as the “Emerald Acquisition”. In connection with the Emerald Acquisition, Joseph Lahti, Myrna McLeroy, Loren J. O’Toole II, Josh Sherman and Mitchell R. Thompson resigned as directors, and Duke R. Ligon, Seth Setrakian, Daniel L. Spears, Mike Krzus and McAndrew Rudisill, each of whom were previously employed by Emerald Oil, Inc. or previously served on the board of directors of Emerald Oil, Inc., were appointed to our Board of Directors. Following the Emerald Acquisition, our Compensation Committee consisted of Messrs. Setrakian (Chairman), Ligon and Spears.

Also in connection with the Emerald Acquisition, our Board of Directors appointed the Mike Krzus as Chief Executive Officer, McAndrew Rudisill as President, Paul Wiesner as Chief Financial Officer, and Karl Osterbuhr as Vice President of Exploration and Business Development, each of whom were former officers of Emerald Oil, Inc. In addition, our Board appointed J.R. Reger, our former Chief Executive Officer, and Mitchell R. Thompson, our former Chief Financial Officer, as our Executive Chairman and Chief Accounting Officer, respectively. Following the Emerald Acquisition, we changed our name from Voyager Oil & Gas, Inc. to Emerald Oil, Inc., and we shifted from our previous business model that focused on participating in non-operated wells developed by other operators to our current operated program over which we have control of the timing of well development and design of our wells. Going forward, we plan to participate in significantly fewer non-operated wells and grow reserves through our operated well development program.

As a result of the changes in the composition of our Board of Directors, Compensation Committee and senior management and our change in business model following the Emerald Acquisition, our compensation programs changed substantially, and the following discussion reflects those changes.

For the purposes of our discussion, our named executive officers for 2012 are as follows:

| Name | Title | |

| Mike Krzus | Chief Executive Officer (our principal executive officer) | |

| James Russell (J.R.) Reger | Executive Chairman | |

| McAndrew Rudisill | President | |

| Paul Wiesner | Chief Financial Officer (our principal financial officer) | |

| Mitchell R. Thompson | Chief Accounting Officer |

Compensation Objectives and Philosophy

Our future success and the ability to create long-term value for our shareholders depends on our ability to attract, retain and motivate the most qualified individuals in the oil and natural gas industry. We design our compensation programs to reward performance and to attract, retain and motivate employees at all levels. Our goal is to establish pay levels for our named executive officers that are competitive with comparable positions in our industry and in the regions in which we operate, while maintaining an atmosphere of teamwork, recognizing overall business results and individual achievement, and attaining our strategic objectives by tying the interest of our executive officers and employees with our shareholders through the use of equity-based compensation.

Our overall compensation philosophy is that rewards to executives should reflect and reinforce our company-wide focus on financial management and bottom-line performance. We believe this approach increases the likelihood that we will experience sustained profitability and generate greater shareholder value over time. In 2012, we compensated our named executive officers primarily in the form of a base salary and the grant of equity awards in the form of both restricted stock awards and stock options, which we believed aligned the interests of our executive management with our shareholders as a whole.

| 16 |

We intend for the amount of compensation paid to each executive officer to reflect the officer’s experience and individual performance, as well as our overall performance, all measured in the context of the oil and natural gas industry and locations in which we operate. Our objectives are to attract, retain and motivate executives of outstanding ability. In order to motivate each executive officer to achieve his potential, certain components of our total compensation package are dependent on corporate and individual performance and are therefore at risk. Generally, as an executive officer’s responsibility and ability to impact our financial performance increases, the individual’s performance-based compensation increases as a portion of his total compensation. Ultimately, executive officers with greater roles and responsibilities associated with achieving our performance targets should bear a greater proportion of the risk if those goals are not achieved and should receive a greater proportion of the reward if the goals are met or surpassed.

Our Board and the Compensation Committee is currently considering the compensation awarded to, earned by, or paid to its executive officers in the future. Specifically, it is considering the following:

| · | the objectives of our compensation programs; |

| · | various elements that our compensation program is designed to reward; |

| · | each element of compensation; |

| · | the reasons each element is considered important; |

| · | the methods for determining the amounts (and, where applicable, the formula) for each element to pay; and |

| · | how each compensation element fit into our overall compensation objectives and affect decisions regarding other elements. |

Compensation Committee

Our Compensation Committee oversees the design and administration of our executive compensation program according to the processes and procedures discussed in this proxy statement. To implement our compensation objectives and philosophy, our Board and Compensation Committee:

| · | consider individual performance, competence and leadership when setting base compensation, as well as Company-specific financial and business improvement goals to promote a cohesive, performance-focused culture among our executive team; |

| · | compare our compensation programs with the executive compensation policies, practices and levels at comparable companies in our industry selected for comparison by our Compensation Committee, based upon size, complexity and growth profile; and |

| · | structure compensation among the executive officers so that our named executive officers, with their greater responsibilities for achieving performance and strategic objectives, bear a greater proportion of the risk and rewards associated with achieving those goals. |

Setting Executive Compensation

The Compensation Committee selects the elements of executive compensation and determines the level of each element, the mix among the elements and total compensation based upon the objectives and philosophies set forth above, and by considering a number of factors, including:

| · | each executive officer’s position and the level of responsibility; |

| 17 |

| · | the skills and experiences required by an executive officer’s position; |

| · | the executive officer’s experience and qualifications; |

| · | the competitive environment for comparable executive officer talent having similar experience, skills and responsibilities; |

| · | our performance compared to specific objectives; |

| · | individual performance measures; |

| · | the executive officer’s current and historical compensation levels; |

| · | the executive officer’s length of service; |

| · | compensation equity and consistency across all executive positions; and |

| · | the stock ownership of each executive officer. |

As a means of assessing the competitive market for executive talent, we review competitive compensation data gathered in comparative third-party surveys that we believe to be relevant, considering our size and industry. For 2012, our Compensation Committee did not engage an independent compensation consultant, but may in the future.

Employment Agreements, Termination and Change of Control

As part of the Emerald Acquisition, entered into employment agreements with our named executive officers, J.R. Reger (Executive Chairman), Mike Krzus (Chief Executive Officer), McAndrew Rudisill (President), Paul Wiesner (Chief Financial Officer) and Mitchell R. Thompson (Chief Accounting Officer). We also entered into an employment agreement with Karl Osterbuhr (Vice President of Exploration and Business Development). Each agreement terminates on December 31, 2014 with automatic annual extensions unless we or the officer elects not to extend the agreement by providing at least 60 days prior written notice to the other party that the term will not be extended.