UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21533

Western Asset Inflation Management Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, N.Y. 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888)777-0102

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| Annual Report | December 31, 2013 |

WESTERN ASSET

INFLATION MANAGEMENT FUND INC. (IMF)

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objectives

The Fund’s primary investment objective is total return. Current income is a secondary investment objective.

Dear Shareholder,

We are pleased to provide the annual report of Western Asset Inflation Management Fund Inc. for the twelve-month reporting period ended December 31, 2013. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

Special shareholder notice

On January 21, 2014, the Board of Directors of Western Asset Inflation Management Fund Inc. announced a proposal to liquidate and dissolve the Fund. Subject to stockholder approval of a plan of liquidation and dissolution (the “Plan”) adopted by the Board, the Fund plans to cease to invest in assets in accordance with its investment objectives and will, as soon as reasonable and practicable, complete the sale of any remaining portfolio securities it holds and will dissolve.

The Board, on recommendation of Legg Mason Partners Fund Advisor, LLC and Western Asset Management Company, the Fund’s investment adviser and subadviser, respectively, believes that the liquidation and dissolution of the Fund is in the best interests of the Fund and its stockholders due to, among other things, the Fund’s small asset size and relatively high expense ratio.

The Board plans to submit a proposal to stockholders to approve the Plan at the annual meeting of stockholders to be held on April 25, 2014 (the “Annual Meeting”). If the proposal is approved by stockholders, the Fund will commence the orderly liquidation of its assets in accordance with the Plan. Following the liquidation of the Fund’s assets, the Fund will pay one or more liquidating distributions to stockholders of record in accordance with the Plan. There can be no assurance that the necessary percentage of the stockholders of the Fund will vote to approve the liquidation and dissolution of the Fund in accordance with the Plan.

The Fund plans to file a proxy statement with the SEC in connection with the solicitation of proxies for the Annual Meeting.

| II | Western Asset Inflation Management Fund Inc. |

Promptly after filing its definitive proxy statement for the Annual Meeting with the SEC, the Fund will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the Annual Meeting. Stockholders are urged to carefully read the proxy materials when they become available because they will contain important information, including a more detailed description of the Plan. When filed with the SEC, the proxy statement and other documents filed by the Fund in connection with the Annual Meeting will be available free of charge at the SEC’s website, http://www.sec.gov and the Fund’s website at www.lmcef.com. Stockholders can also obtain copies of these documents, when available, free of charge, by calling the Fund at 1-888-777-0102 or by writing the Fund at 620 Eighth Avenue, 49th Floor, New York, New York 10018.

Western Asset Inflation Management Fund Inc., its directors and executive officers and the Fund’s investment adviser, members of its management and employees may be deemed to be participants in the Fund’s solicitation of proxies from its stockholders in connection with the proposed liquidation and dissolution. Information concerning the interests of the participants in the solicitation will be set forth in Western Asset Inflation Management Fund Inc.’s proxy statement and shareholder reports on Form N-CSR, to be filed with the SEC.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| Ÿ | Fund prices and performance, |

| Ÿ | Market insights and commentaries from our portfolio managers, and |

| Ÿ | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Kenneth D. Fuller

Chairman, President and Chief Executive Officer

January 31, 2014

| Western Asset Inflation Management Fund Inc. | III |

Economic review

The U.S. economy continued to grow over the twelve months ended December 31, 2013 (the “reporting period”). Looking back, U.S. gross domestic product (“GDP”)i growth, as reported by the U.S. Department of Commerce, was 1.1% during the first quarter of 2013. The economic expansion then accelerated, as GDP growth was 2.5% during the second quarter. This was partially due to increases in exports and non-residential fixed investments, along with a smaller decline in federal government spending versus the previous quarter. The economy gained further momentum during the third quarter, with GDP growth of 4.1%, its best reading since the fourth quarter of 2011. Stronger growth was driven, in part, by an increase in private inventory investment, a deceleration in imports and accelerating state and local government spending. The U.S. Department of Commerce’s initial reading for fourth quarter 2013 GDP growth, released after the reporting period ended, was 3.2%. Slower growth was due to several factors, including a deceleration in private inventory investment, declining federal government spending and less residential fixed investments.

The U.S. job market improved during the reporting period, although unemployment remained elevated from a historical perspective. When the period began, unemployment, as reported by the U.S. Department of Labor, was 7.9%. Unemployment fell to 7.7% in February 2013 and generally edged lower over the remainder of the period, falling to 6.7% in December. This represented the lowest level since October 2008. However, falling unemployment during the period was partially due to a decline in the workforce participation rate, which was 62.8% in December, its lowest level since 1978. In addition, the number of longer-term unemployed continues to be high, as roughly 37.7% of the 10.4 million Americans looking for work in December 2013 had been out of work for more than six months.

While sales of existing-homes declined at times throughout the reporting period given rising mortgage rates, they moved higher at the end of the year. According to the National Association of Realtors (“NAR”), existing-home sales rose 1.0% on a seasonally adjusted basis in December 2013 versus the previous month, although they were 0.6% lower than in December 2012. However, existing homes sales in 2013 were 9.1% higher than the previous year and 2013’s sales were the strongest since 2006. In addition, the NAR reported that the median existing-home price for all housing types was $198,100 in December 2013, up 9.9% from December 2012. The inventory of homes available for sale in December 2013 was 11% lower than the previous month at a 4.6 month supply at the current sales pace but 1.6% higher than in December 2012.

The manufacturing sector expanded during the majority of the reporting period, although it experienced a temporary soft patch. Based on the Institute for Supply Management’s Purchasing Managers’ Index (“PMI”)ii, manufacturing expanded during the first four months of the reporting period. It then contracted in May 2013, with a PMI of 49.0 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). This represented the PMI’s lowest reading since June 2009. However, the contraction was a short-term setback, as the PMI rose over the next seven months and peaked at 57.3 in November,

| IV | Western Asset Inflation Management Fund Inc. |

the best reading since April 2011. The PMI then moderated somewhat in December 2013, edging back to a still strong 57.0.

Growth outside the U.S. generally improved in developed countries. In its January 2014 World Economic Outlook Update, released after the reporting period ended, the International Monetary Fund (“IMF”) stated that “Global activity strengthened during the second half of 2013… activity is expected to improve further in 2014–15, largely on account of recovery in the advanced economies.” From a regional perspective, the IMF anticipates 2014 growth will be 1.0% in the Eurozone, versus -0.4% in 2013. After moderating somewhat in 2013, the IMF projects that overall growth in emerging market countries will improve in 2014, with growth of 5.1% versus 4.7% in 2013. For example, GDP growth in India is projected to move from 4.4% in 2013 to 5.4% in 2014. However, the IMF now projects that growth in China will dip from 7.7% in 2013 to 7.5% in 2014.

The Federal Reserve Board (“Fed”)iii took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. As has been the case since December 2008, the Fed kept the federal funds rateiv at a historically low range between zero and 0.25%. At its meeting in December 2012, the Fed announced that it would continue purchasing $40 billion per month of agency mortgage-backed securities (“MBS”), as well as initially purchasing $45 billion per month of longer-term Treasuries. At its meeting that ended on June 19, 2013, the Fed did not make any material changes to its official policy statement. However, in a press conference following the meeting, Fed Chairman Bernanke said “…the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year.” In a surprise to many investors, at its meeting that ended on September 18, 2013, the Fed did not taper its asset purchase program and said that it “…decided to await more evidence that progress will be sustained before adjusting the pace of its purchases.” At its meeting that concluded on December 18, 2013, the Fed announced that it would begin reducing its monthly asset purchases, saying “Beginning in January 2014, the Committee will add to its holdings of agency mortgage-backed securities at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month.” At the Fed’s meeting that concluded on January 29, 2014, after the reporting period ended, it announced that in February 2014 it would further taper its asset purchases, to a total of $65 billion a month ($30 billion per month of agency mortgage-backed securities and $35 billion per month of longer-term Treasury securities).

Given the economic challenges in the Eurozone, the European Central Bank (“ECB”)v took a number of actions to stimulate growth. In May 2013, the ECB cut rates from 0.75% to 0.50%. The ECB then lowered the rates to a new record low of 0.25% in November 2013. In other developed countries, the Bank of England kept rates on hold at 0.50% during the reporting period, as did Japan at a range of zero to 0.10%, its lowest level since 2006. In January 2013, the Bank of Japan announced that it would raise its target for annual inflation from 1% to 2%, and the Japanese government

| Western Asset Inflation Management Fund Inc. | V |

Investment commentary (cont’d)

introduced a ¥10.3 trillion ($116 billion) stimulus package to support its economy. Elsewhere, the People’s Bank of China kept rates on hold at 6.0%.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Kenneth D. Fuller

Chairman, President and Chief Executive Officer

January 31, 2014

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. Forecasts and predictions are inherently limited and should not be relied upon as an indicator of actual or future performance.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| VI | Western Asset Inflation Management Fund Inc. |

Q. What is the Fund’s investment strategy?

A. The Fund’s primary investment objective is total return. Current income is a secondary investment objective. The Fund invests the majority of its assets in inflation-protected securities issued by U.S. and non-U.S. governments, their agencies or instrumentalities, and corporate securities that are structured to provide protection against inflation. We also have the flexibility to invest in certain other fixed-income securities that we believe will provide protection against inflation. Inflation-protected securities will include U.S. Treasury Inflation Protected Securities (“TIPS”)i, as well as other bonds issued by U.S. and non-U.S. government agencies or instrumentalities or corporations and derivatives related to these securities.

At Western Asset Management Company (“Western Asset”), the Fund’s subadviser, we utilize a fixed-income team approach, with decisions derived from interaction among various investment management sector specialists. The sector teams are comprised of Western Asset’s senior portfolio management personnel, research analysts and an in-house economist. Under this team approach, management of client fixed-income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization. The individuals responsible for development of investment strategy, day-to-day portfolio management, oversight and coordination of the Fund are Stephen A. Walsh, Paul E. Wynn, Dennis J. McNamara, Keith J. Gardner and Michael C. Buchanan. It is anticipated that Mr. Walsh will step down as a member of the Fund’s portfolio management team effective on or about March 31, 2014 and that S. Kenneth Leech will join the Fund’s portfolio management team at that time. Mr. Leech has been employed by Western Asset as an investment professional for more than 20 years.

Q. What were the overall market conditions during the Funds’ reporting period?

A. The spread sectors (non-Treasuries) experienced several periods of heightened risk aversion but largely outperformed equal-durationii Treasuries over the twelve months ended December 31, 2013. However, most spread sectors posted negative absolute returns during the reporting period. Risk aversion was prevalent at times given mixed economic data, geopolitical issues, signs of shifting monetary policy by the Federal Reserve Board (“Fed”)iii and the U.S government’s sixteen-day partial shutdown which ended on October 16, 2013.

Both short- and long-term Treasury yields moved higher during the twelve months ended December 31, 2013. Two-year Treasury yields rose from 0.25% at the beginning of the period to 0.38% at the end of the period. Their peak of 0.52% occurred on September 5, 2013 and they were as low as 0.20% in late April and early May 2013. Ten-year Treasury yields were 1.78% at the beginning of the period and reached a low of 1.66% in early May 2013. Their peak of 3.04% occurred on December 31, 2013, as fixed-income investors reacted negatively to the Fed’s announcement that it would start tapering its asset purchase program. This was the highest level for the ten-year Treasury since July 2011. All told, the Barclays U.S. Aggregate Indexiv returned

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 1 |

Fund overview (cont’d)

-2.02% for the twelve months ended December 31, 2013, its first calendar year decline since 1999.

Inflation was generally well contained during the reporting period. For the twelve months ended December 31, 2013, the seasonally unadjusted rate of inflation, as measured by the Consumer Price Index for All Urban Consumers (“CPI-U”)v, was 1.5%. The CPI-U less food and energy was 1.7% over the same time frame. Given benign inflation and sharply rising interest rates, U.S. TIPS generated very weak results. During the twelve months ended December 31, 2013, the Barclays U.S. TIPS Indexvi returned -8.61%.

Q. How did we respond to these changing market conditions?

A. A number of adjustments were made to the Fund during the reporting period. During the first half of the period we moderately increased our allocation to U.S. TIPS and moved out of our small high-yield corporate bond position. We also used the sharp sell-off in TIPS to increase the interest rate exposure in the Fund, having been very defensive at the outset of the year. Elsewhere, over the period we generally increased our short Canadian dollar position, as well as increased a short euro position in the latter half of the period. Finally, we began the period with a short yen position which we took off in the spring, but reestablished in the summer.

The Fund employed interest rate futures and options during the reporting period to manage its yield curvevii positioning and duration. The use of these instruments contributed to performance. Currency forwards were used to hedge the Fund’s currency risk and manage its currency exposures. They were additive for performance during the reporting period. During the third quarter 2013 the Fund began re-levering, and this continued during the fourth quarter. At the end of the period, approximately 16% of the Fund’s gross assets were levered. With real yields back to levels similar to those seen in 2010, and inflation expectations towards the low end of the range, we now see the prospect of adding significant income (or indeed total return) through leverage, and as yields rise further, we will continue adding leverage to the Fund provided uncertainty regarding rising interest rates remains contained.

Performance review

For the twelve months ended December 31, 2013, Western Asset Inflation Management Fund Inc. returned -8.71% based on its net asset value (“NAV”)viii and -6.76% based on its New York Stock Exchange (“NYSE”) market price per share. The Fund’s unmanaged benchmark, the Barclays U.S. TIPS Index, returned -8.61% for the same period. The Lipper Corporate Debt BBB-Rated Closed-End Funds Category Averageix returned -1.78% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the twelve-month period, the Fund made distributions to shareholders totaling $0.60 per share, which included a return of capital of $0.06 per share*. The

| * | Distributions paid by the Fund may be comprised of income, capital gains and/or return of capital. For the character of distributions paid during the fiscal year ended December 31, 2013, please refer to page 18 of this report. |

| 2 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

performance table shows the Fund’s twelve-month total return based on its NAV and market price as of December 31, 2013. Past performance is no guarantee of future results.

| Performance Snapshot as of December 31, 2013 | ||||

| Price per share | 12-month total return** |

|||

| $17.82 (NAV) | -8.71 | %† | ||

| $16.93 (Market Price) | -6.76 | %‡ | ||

All figures represent past performance and are not a guarantee of future results.

** Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including return of capital, at NAV.

‡ Total return assumes the reinvestment of all distributions, including return of capital, in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Q. What were the leading contributors to performance?

A. Contributors to the Fund’s relative performance for the period came from a variety of sources. Our interest rate stance, which reflected our view that real interest rates were likely to rise through the year, contributed to results, especially towards the end of the year.

Our decision to overweight longer maturity bonds, especially U.S. TIPS, also added value throughout the year. In addition, our preference for nominal securities in the first half of the year helped performance. We took this position as we felt that inflation expectations, or breakevens, would decline.

Our credit exposures were positive contributors. Finally our preference for the U.S. dollar versus both the Canadian dollar and Japanese yen enhanced the Fund’s performance, as the latter two currencies depreciated versus the greenback.

Q. What were the leading detractors from performance?

A. The largest detractor from the Fund’s relative performance for the period was a small short position to the euro in the latter half of the period. This modestly detracted from results as the euro appreciated versus the U.S. dollar as the period progressed. Elsewhere, our emerging market exposure, most notably our position in Brazil, modestly detracted from performance

Looking for additional information?

The Fund is traded under the symbol “IMF” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XIMFX” on most financial websites. Barron’s and the Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.lmcef.com.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 3 |

Fund overview (cont’d)

Thank you for your investment in Western Asset Inflation Management Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Western Asset Management Company

January 24, 2014

RISKS: If interest rates rise, but the rate of inflation does not, the Fund’s performance will be adversely affected. The Fund is subject to the risks associated with inflation-protected securities (“IPS”). Risks associated with IPS investments include liquidity risk, interest rate risk, prepayment risk, extension risk and deflation risk. Income distributions of the Fund are likely to fluctuate more than those of a conventional bond fund. Changes in inflation will cause the Fund’s income to fluctuate, sometimes substantially. Periods of deflation may adversely affect the Fund’s NAV. As interest rates rise, bond prices fall, reducing the value of the Fund’s fixed-income holdings. The Fund is non-diversified, which means that it is permitted to invest a higher percentage of its assets in any one issuer than a diversified fund. This may magnify the Fund’s losses from events affecting a particular issuer. Foreign securities are subject to certain risks of overseas investing, including currency fluctuations and changes in political and economic conditions. These risks are greater in emerging markets. High-yield bonds involve greater credit and liquidity risks than investment grade bonds. The Fund may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. Leverage may result in greater volatility of NAV and the market price of common shares and increases a shareholder’s risk of loss. There is no assurance that the Fund’s leveraging strategy will be successful.

Portfolio holdings and breakdowns are as of December 31, 2013 and are subject to change and may not be representative of the portfolio managers’ current or future investments. Please refer to pages 9 through 14 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. Portfolio holdings are subject to change at any time and may not be representative of the portfolio managers’ current or future investments. The Fund’s top five sector holdings (as a percentage of net assets) as of December 31, 2013 were: U.S. Treasury Inflation Protected Securities (92.8%), Corporate Bonds & Notes (15.7%), Sovereign Bonds (6.5%), Non-U.S. Treasury Inflation Protected Securities (1.3%) and Collateralized Mortgage Obligations (0.9%).The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| 4 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

| i | U.S. Treasury Inflation Protected Securities (“TIPS”) are inflation-indexed securities issued by the U.S. Treasury in five-year, ten-year and twenty-year maturities. The principal is adjusted to the Consumer Price Index, the commonly used measure of inflation. The coupon rate is constant, but generates a different amount of interest when multiplied by the inflation-adjusted principal. |

| ii | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| iv | The Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| v | The Consumer Price Index for All Urban Consumers (“CPI-U”) is a measure of the average change in prices over time of goods and services purchased by households, which covers approximately 87% of the total population and includes, in addition to wage earners and clerical worker households, groups such as professional, managerial and technical workers, the self-employed, short-term workers, the unemployed and retirees and others not in the labor force. |

| vi | The Barclays U.S. TIPS Index represents an unmanaged market index made up of U.S. Treasury Inflation-Linked Index securities. |

| vii | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

| viii | Net asset value (“NAV”) is calculated by subtracting total liabilities and outstanding preferred stock (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total investments) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

| ix | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the twelve-month period ended December 31, 2013, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 14 funds in the Fund’s Lipper category. |

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 5 |

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of December 31, 2013 and December 31, 2012 and does not include derivatives, such as futures contracts, written options and forward foreign currency contracts. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| ‡ | Represents less than 0.1%. |

| 6 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

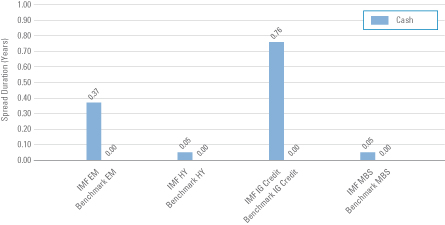

Economic exposure — December 31, 2013

| Total Spread Duration | ||

| IMF | — 1.23 years | |

| Benchmark | — 0.00 years | |

Spread duration measures the sensitivity to changes in spreads. The spread over Treasuries is the annual risk-premium demanded by investors to hold non-Treasury securities. Spread duration is quantified as the % change in price resulting from a 100 basis points change in spreads. For a security with positive spread duration, an increase in spreads would result in a price decline and a decline in spreads would result in a price increase. This chart highlights the market sector exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| EM | — Emerging Markets | |

| HY | — High Yield | |

| IG Credit | — Investment Grade Credit | |

| IMF | — Western Asset Inflation Management Fund Inc. | |

| MBS | — Mortgage-Backed Securities | |

| Benchmark | — Barclays U.S. TIPS Index |

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 7 |

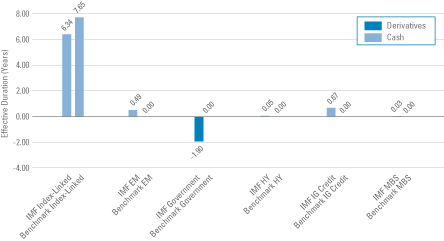

Effective duration (unaudited)

Interest rate exposure — December 31, 2013

| Total Effective Duration | ||

| IMF | — 5.68 years | |

| Benchmark | — 7.65 years | |

Effective duration measures the sensitivity to changes in relevant interest rates. Effective duration is quantified as the % change in price resulting from a 100 basis points change in interest rates. For a security with positive effective duration, an increase in interest rates would result in a price decline and a decline in interest rates would result in a price increase. This chart highlights the interest rate exposure of the Fund’s sectors relative to the selected benchmark sectors as of the end of the reporting period.

| EM | — Emerging Markets | |

| HY | — High Yield | |

| IG Credit | — Investment Grade Credit | |

| IMF | — Western Asset Inflation Management Fund Inc. | |

| MBS | — Mortgage-Backed Securities | |

| Benchmark | — Barclays U.S. TIPS Index |

| 8 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

December 31, 2013

Western Asset Inflation Management Fund Inc.

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| U.S. Treasury Inflation Protected Securities — 92.8% | ||||||||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

2.375 | % | 1/15/25 | 2,335,704 | $ | 2,688,432 | ||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

2.000 | % | 1/15/26 | 7,719,742 | 8,558,060 | |||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

1.750 | % | 1/15/28 | 5,596,748 | 6,002,730 | |||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

2.500 | % | 1/15/29 | 1,229,293 | 1,446,533 | |||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

3.875 | % | 4/15/29 | 1,719,132 | 2,359,709 | |||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

2.125 | % | 2/15/40 | 2,820,418 | 3,174,293 | |||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

2.125 | % | 2/15/41 | 1,653,153 | 1,861,088 | |||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

0.750 | % | 2/15/42 | 4,503,657 | 3,630,195 | |||||||||||

| U.S. Treasury Bonds, Inflation Indexed |

0.625 | % | 2/15/43 | 2,285,775 | 1,762,191 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

2.000 | % | 1/15/16 | 13,509,549 | 14,407,191 | (a) | ||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 4/15/16 | 1,523,736 | 1,565,639 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

2.500 | % | 7/15/16 | 2,555,953 | 2,806,258 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

2.375 | % | 1/15/17 | 5,130,782 | 5,649,873 | (a) | ||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 4/15/17 | 5,203,350 | 5,351,323 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

1.625 | % | 1/15/18 | 4,348,071 | 4,728,527 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 4/15/18 | 2,990,814 | 3,051,799 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

1.375 | % | 7/15/18 | 3,368,534 | 3,654,072 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

2.125 | % | 1/15/19 | 979,083 | 1,094,125 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

1.875 | % | 7/15/19 | 1,093,890 | 1,216,525 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

1.250 | % | 7/15/20 | 2,377,576 | 2,546,048 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

1.125 | % | 1/15/21 | 11,456,636 | 12,052,289 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.625 | % | 7/15/21 | 5,554,568 | 5,643,747 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 1/15/22 | 10,680,683 | 10,275,981 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 7/15/22 | 2,681,369 | 2,570,972 | |||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 1/15/23 | 6,435,620 | 6,083,669 | (a) | ||||||||||

| U.S. Treasury Notes, Inflation Indexed |

0.375 | % | 7/15/23 | 2,709,828 | 2,615,512 | |||||||||||

| Total U.S. Treasury Inflation Protected Securities (Cost — $116,044,200) |

|

116,796,781 | ||||||||||||||

| Asset-Backed Securities — 0.2% | ||||||||||||||||

| Asset-Backed Funding Certificates, 2004-FF1 M2 |

2.340 | % | 1/25/34 | 115,975 | 3,781 | (b) | ||||||||||

| Finance America Net Interest Margin Trust, 2004-1 A |

5.250 | % | 6/27/34 | 73,417 | 1 | (c)(d)(e) | ||||||||||

| GSAMP Trust, 2004-OPT M3 |

1.890 | % | 11/25/34 | 96,825 | 74,443 | (b) | ||||||||||

| Renaissance Home Equity Loan Trust, 2003-4 M3 |

2.065 | % | 3/25/34 | 234,685 | 165,034 | (b) | ||||||||||

| Sail Net Interest Margin Notes, 2004-2A A |

5.500 | % | 3/27/34 | 71,380 | 1 | (c)(d)(e) | ||||||||||

| Total Asset-Backed Securities (Cost — $597,150) |

243,260 | |||||||||||||||

| Collateralized Mortgage Obligations — 0.9% | ||||||||||||||||

| Federal National Mortgage Association (FNMA), STRIPS, IO, 339 30 |

5.500 | % | 7/1/18 | 863,900 | 68,377 | (b) | ||||||||||

See Notes to Financial Statements.

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 9 |

Schedule of investments (cont’d)

December 31, 2013

Western Asset Inflation Management Fund Inc.

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Collateralized Mortgage Obligations — continued | ||||||||||||||||

| Government National Mortgage Association (GNMA), 2011-121 IO, IO |

1.048 | % | 6/16/43 | 4,495,806 | $ | 204,557 | (b) | |||||||||

| Government National Mortgage Association (GNMA), 2011-142 IO, IO |

0.952 | % | 9/16/46 | 4,188,896 | 224,680 | (b) | ||||||||||

| Government National Mortgage Association (GNMA), 2011-152 IO, IO |

1.347 | % | 8/16/51 | 3,292,600 | 194,581 | (b) | ||||||||||

| Government National Mortgage Association (GNMA), 2012-112 IO, IO |

0.870 | % | 2/16/53 | 3,150,518 | 215,825 | (b) | ||||||||||

| Government National Mortgage Association (GNMA), 2012-125 IO, IO |

0.856 | % | 2/16/53 | 1,432,866 | 103,518 | (b) | ||||||||||

| Structured Asset Securities Corp., 1998-02 M1 |

1.265 | % | 2/25/28 | 8,264 | 8,351 | (b) | ||||||||||

| Structured Asset Securities Corp., 1998-03 M1 |

1.165 | % | 3/25/28 | 96,486 | 93,802 | (b) | ||||||||||

| Total Collateralized Mortgage Obligations (Cost — $1,056,226) |

|

1,113,691 | ||||||||||||||

| Corporate Bonds & Notes — 15.7% | ||||||||||||||||

| Consumer Discretionary — 0.5% | ||||||||||||||||

| Automobiles — 0.5% |

||||||||||||||||

| Ford Motor Credit Co., LLC, Senior Notes |

5.875 | % | 8/2/21 | 510,000 | 579,090 | |||||||||||

| Consumer Staples — 1.0% | ||||||||||||||||

| Food Products — 0.2% |

||||||||||||||||

| WM Wrigley Jr. Co., Senior Notes |

2.900 | % | 10/21/19 | 320,000 | 317,775 | (c) | ||||||||||

| Tobacco — 0.8% |

||||||||||||||||

| Altria Group Inc., Senior Notes |

2.850 | % | 8/9/22 | 400,000 | 368,979 | |||||||||||

| Altria Group Inc., Senior Notes |

9.950 | % | 11/10/38 | 150,000 | 229,485 | |||||||||||

| Reynolds American Inc., Senior Notes |

3.250 | % | 11/1/22 | 270,000 | 249,332 | |||||||||||

| Reynolds American Inc., Senior Notes |

4.750 | % | 11/1/42 | 150,000 | 133,818 | |||||||||||

| Total Tobacco |

981,614 | |||||||||||||||

| Total Consumer Staples |

1,299,389 | |||||||||||||||

| Energy — 1.5% | ||||||||||||||||

| Oil, Gas & Consumable Fuels — 1.5% |

||||||||||||||||

| Dolphin Energy Ltd., Senior Secured Bonds |

5.888 | % | 6/15/19 | 159,504 | 174,497 | (c) | ||||||||||

| Ecopetrol SA, Senior Notes |

5.875 | % | 9/18/23 | 300,000 | 317,250 | |||||||||||

| Lukoil International Finance BV, Senior Notes |

4.563 | % | 4/24/23 | 200,000 | 188,200 | (c) | ||||||||||

| Pacific Rubiales Energy Corp., Senior Notes |

5.125 | % | 3/28/23 | 150,000 | 138,375 | (c) | ||||||||||

| Pemex Project Funding Master Trust, Senior Bonds |

6.625 | % | 6/15/35 | 29,000 | 30,668 | |||||||||||

| Petrobras International Finance Co., Senior Notes |

5.750 | % | 1/20/20 | 180,000 | 186,109 | |||||||||||

| Petrobras International Finance Co., Senior Notes |

5.375 | % | 1/27/21 | 140,000 | 139,634 | |||||||||||

| Petroleos de Venezuela SA, Senior Notes |

8.500 | % | 11/2/17 | 250,000 | 208,750 | (c) | ||||||||||

| PT Pertamina Persero, Senior Notes |

4.875 | % | 5/3/22 | 200,000 | 184,000 | (c) | ||||||||||

| Reliance Holdings USA Inc., Senior Notes |

5.400 | % | 2/14/22 | 250,000 | 253,248 | (c) | ||||||||||

| Total Energy |

1,820,731 | |||||||||||||||

See Notes to Financial Statements.

| 10 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

Western Asset Inflation Management Fund Inc.

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Financials — 6.9% | ||||||||||||||||

| Capital Markets — 0.3% |

||||||||||||||||

| Goldman Sachs Group Inc., Senior Notes |

3.625 | % | 1/22/23 | 350,000 | $ | 339,570 | ||||||||||

| Commercial Banks — 2.7% |

||||||||||||||||

| Barclays Bank PLC, Subordinated Notes |

7.625 | % | 11/21/22 | 700,000 | 747,250 | |||||||||||

| Credit Agricole SA, Subordinated Bonds |

8.125 | % | 9/19/33 | 200,000 | 221,250 | (b)(c) | ||||||||||

| Wachovia Capital Trust III, Junior Subordinated Bonds |

5.570 | % | 2/10/14 | 2,260,000 | 2,079,200 | (b)(f) | ||||||||||

| Wells Fargo & Co., Subordinated Notes |

5.375 | % | 11/2/43 | 400,000 | 411,138 | |||||||||||

| Total Commercial Banks |

3,458,838 | |||||||||||||||

| Consumer Finance — 0.8% |

||||||||||||||||

| American Express Co., Subordinated Debentures |

6.800 | % | 9/1/66 | 400,000 | 427,700 | (b) | ||||||||||

| HSBC Finance Corp., Senior Notes |

6.676 | % | 1/15/21 | 500,000 | 575,339 | |||||||||||

| Total Consumer Finance |

1,003,039 | |||||||||||||||

| Diversified Financial Services — 3.1% |

||||||||||||||||

| Bank of America Corp., Junior Subordinated Notes |

5.200 | % | 6/1/23 | 500,000 | 442,500 | (b)(f) | ||||||||||

| Bank of America Corp., Senior Notes |

4.100 | % | 7/24/23 | 950,000 | 955,905 | |||||||||||

| Citigroup Inc., Junior Subordinated Bonds |

5.350 | % | 5/15/23 | 500,000 | 440,880 | (b)(f) | ||||||||||

| Citigroup Inc., Subordinated Notes |

5.500 | % | 9/13/25 | 700,000 | 738,865 | |||||||||||

| Citigroup Inc., Subordinated Notes |

6.675 | % | 9/13/43 | 200,000 | 230,928 | |||||||||||

| General Electric Capital Corp., Senior Notes |

6.875 | % | 1/10/39 | 300,000 | 386,974 | |||||||||||

| JPMorgan Chase & Co., Junior Subordinated Bonds |

5.150 | % | 5/1/23 | 500,000 | 451,250 | (b)(f) | ||||||||||

| JPMorgan Chase & Co., Subordinated Notes |

5.625 | % | 8/16/43 | 200,000 | 212,136 | |||||||||||

| Total Diversified Financial Services |

3,859,438 | |||||||||||||||

| Total Financials |

8,660,885 | |||||||||||||||

| Health Care — 0.3% | ||||||||||||||||

| Pharmaceuticals — 0.3% |

||||||||||||||||

| Mallinckrodt International Finance SA, Senior Notes |

4.750 | % | 4/15/23 | 150,000 | 138,694 | (c) | ||||||||||

| Teva Pharmaceutical Finance Co. BV, Senior Notes |

2.950 | % | 12/18/22 | 320,000 | 290,278 | |||||||||||

| Total Health Care |

428,972 | |||||||||||||||

| Industrials — 0.1% | ||||||||||||||||

| Construction & Engineering — 0.1% |

||||||||||||||||

| Odebrecht Finance Ltd., Senior Notes |

4.375 | % | 4/25/25 | 200,000 | 175,000 | (c) | ||||||||||

| Materials — 2.0% | ||||||||||||||||

| Chemicals — 0.2% |

||||||||||||||||

| LyondellBasell Industries NV, Senior Notes |

6.000 | % | 11/15/21 | 220,000 | 253,429 | |||||||||||

| Construction Materials — 0.3% |

||||||||||||||||

| Cemex Finance LLC, Senior Secured Notes |

9.375 | % | 10/12/22 | 300,000 | 339,750 | (c) | ||||||||||

See Notes to Financial Statements.

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 11 |

Schedule of investments (cont’d)

December 31, 2013

Western Asset Inflation Management Fund Inc.

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Metals & Mining — 1.4% |

||||||||||||||||

| AngloGold Ashanti Holdings PLC, Senior Notes |

8.500 | % | 7/30/20 | 150,000 | $ | 155,640 | ||||||||||

| Evraz Group SA, Senior Notes |

6.750 | % | 4/27/18 | 200,000 | 199,600 | (c) | ||||||||||

| Freeport-McMoRan Copper & Gold Inc., Senior Notes |

3.550 | % | 3/1/22 | 550,000 | 523,632 | |||||||||||

| Samarco Mineracao SA, Senior Notes |

4.125 | % | 11/1/22 | 200,000 | 180,500 | (c) | ||||||||||

| Southern Copper Corp., Senior Notes |

5.250 | % | 11/8/42 | 150,000 | 122,397 | |||||||||||

| Vale Overseas Ltd., Notes |

6.875 | % | 11/21/36 | 180,000 | 186,795 | |||||||||||

| Vale Overseas Ltd., Senior Notes |

4.375 | % | 1/11/22 | 168,000 | 164,068 | |||||||||||

| Vedanta Resources PLC, Senior Notes |

7.125 | % | 5/31/23 | 300,000 | 275,625 | (c) | ||||||||||

| Total Metals & Mining |

1,808,257 | |||||||||||||||

| Paper & Forest Products — 0.1% |

||||||||||||||||

| Fibria Overseas Finance Ltd., Senior Notes |

6.750 | % | 3/3/21 | 150,000 | 165,000 | (c) | ||||||||||

| Total Materials |

2,566,436 | |||||||||||||||

| Telecommunication Services — 3.1% | ||||||||||||||||

| Diversified Telecommunication Services — 2.6% |

||||||||||||||||

| Verizon Communications Inc., Senior Notes |

5.150 | % | 9/15/23 | 3,000,000 | 3,227,262 | |||||||||||

| Wireless Telecommunication Services — 0.5% |

||||||||||||||||

| America Movil SAB de CV, Senior Notes |

5.000 | % | 3/30/20 | 100,000 | 108,806 | |||||||||||

| SoftBank Corp., Senior Notes |

4.500 | % | 4/15/20 | 200,000 | 196,000 | (c) | ||||||||||

| VimpelCom Holdings BV, Senior Notes |

7.504 | % | 3/1/22 | 300,000 | 314,136 | (c) | ||||||||||

| Total Wireless Telecommunication Services |

618,942 | |||||||||||||||

| Total Telecommunication Services |

3,846,204 | |||||||||||||||

| Utilities — 0.3% | ||||||||||||||||

| Electric Utilities — 0.3% |

||||||||||||||||

| Centrais Eletricas Brasileiras SA, Senior Notes |

5.750 | % | 10/27/21 | 200,000 | 195,250 | (c) | ||||||||||

| FirstEnergy Corp., Notes |

7.375 | % | 11/15/31 | 150,000 | 163,404 | |||||||||||

| Total Utilities |

358,654 | |||||||||||||||

| Total Corporate Bonds & Notes (Cost — $19,629,017) |

|

19,735,361 | ||||||||||||||

| Mortgage-Backed Securities — 0.5% | ||||||||||||||||

| FHLMC — 0.4% |

||||||||||||||||

| Federal Home Loan Mortgage Corp. (FHLMC), Gold |

7.000 | % | 6/1/17 | 10,144 | 10,569 | |||||||||||

| Federal Home Loan Mortgage Corp. (FHLMC), Gold |

8.500 | % | 9/1/24 | 517,722 | 580,217 | |||||||||||

| Total FHLMC |

590,786 | |||||||||||||||

| FNMA — 0.1% |

||||||||||||||||

| Federal National Mortgage Association (FNMA) |

5.500 | % | 1/1/14 | 61 | 65 | |||||||||||

| Federal National Mortgage Association (FNMA) |

7.000 | % | 10/1/18-6/1/32 | 99,804 | 113,895 | |||||||||||

| Total FNMA |

113,960 | |||||||||||||||

| Total Mortgage-Backed Securities (Cost — $689,035) |

|

704,746 | ||||||||||||||

See Notes to Financial Statements.

| 12 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

Western Asset Inflation Management Fund Inc.

| Security | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Non-U.S. Treasury Inflation Protected Securities — 1.3% | ||||||||||||||||

| Canada — 1.3% |

||||||||||||||||

| Government of Canada, Bonds (Cost — $1,880,325) |

4.250 | % | 12/1/26 | 1,260,549 | CAD | $ | 1,660,210 | |||||||||

| Sovereign Bonds — 6.5% | ||||||||||||||||

| Argentina — 0.1% |

||||||||||||||||

| Republic of Argentina, Senior Bonds |

7.000 | % | 10/3/15 | 100,000 | 98,250 | |||||||||||

| Brazil — 3.0% |

||||||||||||||||

| Federative Republic of Brazil, Notes |

10.000 | % | 1/1/21 | 3,000,000 | BRL | 1,108,469 | ||||||||||

| Federative Republic of Brazil, Senior Notes |

4.875 | % | 1/22/21 | 350,000 | 371,000 | |||||||||||

| Federative Republic of Brazil, Notes |

6.000 | % | 8/15/22 | 5,595,538 | BRL | 2,354,772 | ||||||||||

| Total Brazil |

3,834,241 | |||||||||||||||

| Indonesia — 0.1% |

||||||||||||||||

| Republic of Indonesia, Notes |

3.750 | % | 4/25/22 | 200,000 | 181,750 | (c) | ||||||||||

| Mexico — 1.2% |

||||||||||||||||

| United Mexican States, Bonds |

6.500 | % | 6/9/22 | 15,470,000 | MXN | 1,200,745 | ||||||||||

| United Mexican States, Medium-Term Notes |

6.050 | % | 1/11/40 | 44,000 | 48,070 | |||||||||||

| United Mexican States, Senior Notes |

4.750 | % | 3/8/44 | 236,000 | 213,875 | |||||||||||

| Total Mexico |

1,462,690 | |||||||||||||||

| Peru — 0.1% |

||||||||||||||||

| Republic of Peru, Senior Bonds |

8.750 | % | 11/21/33 | 100,000 | 142,750 | |||||||||||

| Philippines — 0.2% |

||||||||||||||||

| Republic of the Philippines, Senior Bonds |

5.500 | % | 3/30/26 | 200,000 | 221,500 | |||||||||||

| Russia — 0.3% |

||||||||||||||||

| Russian Foreign Bond — Eurobond, Senior Bonds |

7.500 | % | 3/31/30 | 357,500 | 417,274 | (c) | ||||||||||

| South Africa — 1.0% |

||||||||||||||||

| Republic of South Africa, Senior Notes |

5.875 | % | 9/16/25 | 1,220,000 | 1,272,460 | |||||||||||

| Turkey — 0.3% |

||||||||||||||||

| Republic of Turkey, Notes |

4.875 | % | 4/16/43 | 450,000 | 346,725 | |||||||||||

| Venezuela — 0.2% |

||||||||||||||||

| Bolivarian Republic of Venezuela, Senior Notes |

7.750 | % | 10/13/19 | 300,000 | 225,000 | (c) | ||||||||||

| Total Sovereign Bonds (Cost — $8,751,818) |

|

8,202,640 | ||||||||||||||

| U.S. Government & Agency Obligations — 0.1% | ||||||||||||||||

| U.S. Government Obligations — 0.1% |

||||||||||||||||

| U.S. Treasury Notes (Cost — $80,160) |

2.500 | % | 8/15/23 | 80,000 | 76,834 | |||||||||||

See Notes to Financial Statements.

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 13 |

Schedule of investments (cont’d)

December 31, 2013

Western Asset Inflation Management Fund Inc.

| Security | Expiration Date |

Contracts | Value | |||||||||||

| Purchased Options — 0.0% | ||||||||||||||

| U.S. Treasury 10-Year Notes Futures, Put @ $122.50 (Cost — $25,343) |

1/24/14 | 67 | $ | 25,125 | ||||||||||

| Total Investments — 118.0% (Cost — $148,753,274#) |

|

148,558,648 | ||||||||||||

| Liabilities in Excess of Other Assets — (18.0)% |

|

(22,697,718 | ) | |||||||||||

| Total Net Assets — 100.0% |

|

$ | 125,860,930 | |||||||||||

| † | Face amount denominated in U.S. dollars, unless otherwise noted. |

| (a) | All or a portion of this security is held by the counterparty as collateral for open reverse repurchase agreements. |

| (b) | Variable rate security. Interest rate disclosed is as of the most recent information available. |

| (c) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from registration, normally to qualified institutional buyers. This security has been deemed liquid pursuant to guidelines approved by the Board of Directors, unless otherwise noted. |

| (d) | The coupon payment on these securities is currently in default as of December 31, 2013. |

| (e) | Illiquid security (unaudited). |

| (f) | Security has no maturity date. The date shown represents the next call date. |

| # | Aggregate cost for federal income tax purposes is $150,568,998. |

| Abbreviations used in this schedule: | ||

| BRL | — Brazilian Real | |

| CAD | — Canadian Dollar | |

| IO | — Interest Only | |

| MXN | — Mexican Peso | |

| STRIPS | — Separate Trading of Registered Interest and Principal Securities | |

| Schedule of Written Options | ||||||||||||||||

| Security | Expiration Date |

Strike Price |

Contracts | Value | ||||||||||||

| U.S. Treasury 10-Year Notes Futures, Put (Premiums received — $8,157) | 1/24/14 | $ | 120.50 | 67 | $ | 3,141 | ||||||||||

See Notes to Financial Statements.

| 14 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

Statement of assets and liabilities

December 31, 2013

| Assets: | ||||

| Investments, at value (Cost — $148,753,274) |

$ | 148,558,648 | ||

| Foreign currency, at value (Cost — $127,050) |

127,889 | |||

| Interest receivable |

1,073,850 | |||

| Deposits with brokers for open futures contracts |

594,025 | |||

| Unrealized appreciation on forward foreign currency contracts |

343,336 | |||

| Receivable from broker — variation margin on open futures contracts |

89,503 | |||

| Prepaid expenses |

9,306 | |||

| Total Assets |

150,796,557 | |||

| Liabilities: | ||||

| Payable for open reverse repurchase agreements (Note 3) |

24,559,306 | |||

| Unrealized depreciation on forward foreign currency contracts |

143,994 | |||

| Investment management fee payable |

76,803 | |||

| Due to custodian |

58,088 | |||

| Interest payable (Note 3) |

7,504 | |||

| Written options, at value (premiums received — $8,157) |

3,141 | |||

| Accrued expenses |

86,791 | |||

| Total Liabilities |

24,935,627 | |||

| Total Net Assets | $ | 125,860,930 | ||

| Net Assets: | ||||

| Par value ($0.001 par value; 7,062,862 shares issued and outstanding; 100,000,000 shares authorized) |

$ | 7,063 | ||

| Paid-in capital in excess of par value |

135,845,919 | |||

| Overdistributed net investment income |

(283,944) | |||

| Accumulated net realized loss on investments, futures contracts, written options and foreign |

(10,067,958) | |||

| Net unrealized appreciation on investments, futures contracts, written options and foreign currencies |

359,850 | |||

| Total Net Assets | $ | 125,860,930 | ||

| Shares Outstanding | 7,062,862 | |||

| Net Asset Value | $17.82 | |||

See Notes to Financial Statements.

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 15 |

For the Year Ended December 31, 2013

| Investment Income: | ||||

| Interest |

$ | 2,219,103 | ||

| Expenses: | ||||

| Investment management fee (Note 2) |

831,585 | |||

| Audit and tax |

69,090 | |||

| Transfer agent fees |

44,693 | |||

| Shareholder reports |

32,171 | |||

| Directors’ fees |

21,266 | |||

| Stock exchange listing fees |

19,504 | |||

| Fund accounting fees |

13,412 | |||

| Legal fees |

9,515 | |||

| Interest expense (Note 3) |

9,365 | |||

| Custody fees |

3,962 | |||

| Insurance |

3,933 | |||

| Miscellaneous expenses |

13,021 | |||

| Total Expenses |

1,071,517 | |||

| Net Investment Income | 1,147,586 | |||

| Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Written Options and Foreign Currency Transactions (Notes 1, 3 and 4): |

||||

| Net Realized Gain (Loss) From: |

||||

| Investment transactions |

609,189 | |||

| Futures contracts |

(48,500) | |||

| Written options |

274,569 | |||

| Foreign currency transactions |

600,465 | |||

| Net Realized Gain |

1,435,723 | |||

| Change in Net Unrealized Appreciation (Depreciation) From: |

||||

| Investments |

(15,139,683) | |||

| Futures contracts |

334,546 | |||

| Written options |

3,795 | |||

| Foreign currencies |

(6,608) | |||

| Change in Net Unrealized Appreciation (Depreciation) |

(14,807,950) | |||

| Net Loss on Investments, Futures Contracts, Written Options and Foreign Currency Transactions |

(13,372,227) | |||

| Decrease in Net Assets from Operations | $ | (12,224,641) | ||

See Notes to Financial Statements.

| 16 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

Statements of changes in net assets

| For the Years Ended December 31, | 2013 | 2012 | ||||||

| Operations: | ||||||||

| Net investment income |

$ | 1,147,586 | $ | 2,469,991 | ||||

| Net realized gain |

1,435,723 | 3,969,622 | ||||||

| Change in net unrealized appreciation (depreciation) |

(14,807,950) | 2,792,002 | ||||||

| Increase (Decrease) in Net Assets from Operations |

(12,224,641) | 9,231,615 | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Net investment income |

(3,840,127) | (3,884,574) | ||||||

| Return of capital |

(397,590) | — | ||||||

| Decrease in Net Assets from Distributions to Shareholders |

(4,237,717) | (3,884,574) | ||||||

| Increase (Decrease) in Net Assets |

(16,462,358) | 5,347,041 | ||||||

| Net Assets: | ||||||||

| Beginning of year |

142,323,288 | 136,976,247 | ||||||

| End of year* |

$ | 125,860,930 | $ | 142,323,288 | ||||

| * Includes overdistributed net investment income of: |

$(283,944) | $(354,204) | ||||||

See Notes to Financial Statements.

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 17 |

| For a share of capital stock outstanding throughout each year ended December 31, unless otherwise noted: | ||||||||||||||||||||||||

| 20131 | 20121 | 20111 | 20101 | 20091,2 | 20091,3 | |||||||||||||||||||

| Net asset value, beginning of year | $20.15 | $19.39 | $18.04 | $17.69 | $17.68 | $15.29 | ||||||||||||||||||

| Income (loss) from operations: | ||||||||||||||||||||||||

| Net investment income |

0.16 | 0.35 | 0.67 | 0.39 | 0.06 | 0.16 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

(1.89) | 0.96 | 1.50 | 0.56 | 0.05 | 2.99 | ||||||||||||||||||

| Total income (loss) from operations |

(1.73) | 1.31 | 2.17 | 0.95 | 0.11 | 3.15 | ||||||||||||||||||

| Less distributions from: | ||||||||||||||||||||||||

| Net investment income |

(0.54) | (0.55) | (0.82) | (0.58) | (0.10) | (0.76) | ||||||||||||||||||

| Return of capital |

(0.06) | — | — | (0.02) | — | — | ||||||||||||||||||

| Total distributions |

(0.60) | (0.55) | (0.82) | (0.60) | (0.10) | (0.76) | ||||||||||||||||||

| Net asset value, end of year | $17.82 | $20.15 | $19.39 | $18.04 | $17.69 | $17.68 | ||||||||||||||||||

| Market price, end of year | $16.93 | $18.80 | $17.49 | $17.65 | $16.15 | $15.99 | ||||||||||||||||||

| Total return, based on NAV4,5 |

(8.71) | % | 6.82 | % | 12.21 | % | 5.42 | % | 0.62 | % | 21.09 | % | ||||||||||||

| Total return, based on Market Price6 |

(6.76) | % | 10.76 | % | 3.83 | % | 13.26 | % | 1.62 | % | 24.67 | % | ||||||||||||

| Net assets, end of year (000s) | $125,861 | $142,323 | $136,976 | $127,385 | $124,891 | $124,813 | ||||||||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||||||

| Gross expenses |

0.80 | % | 0.80 | % | 0.87 | % | 0.87 | % | 1.04 | %7 | 1.09 | % | ||||||||||||

| Net expenses8 |

0.80 | 0.80 | 0.87 | 0.87 | 1.04 | 7 | 1.09 | |||||||||||||||||

| Net investment income |

0.86 | 1.76 | 3.53 | 2.15 | 2.03 | 7 | 0.97 | |||||||||||||||||

| Portfolio turnover rate | 35 | % | 46 | % | 52 | % | 48 | % | 2 | % | 45 | %9 | ||||||||||||

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the period ended November 1, 2009 through December 31, 2009. |

| 3 | For the year ended October 31. |

| 4 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 5 | The total return calculation assumes that distributions are reinvested at NAV. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 6 | The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | Annualized. |

| 8 | The impact of compensating balance arrangements, if any, was less than 0.01%. |

| 9 | Excluding mortgage dollar roll transactions. If mortgage dollar roll transactions had been included, the portfolio turnover rate would have been 55% for the year ended October 31, 2009. |

See Notes to Financial Statements.

| 18 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

1. Organization and significant accounting policies

Western Asset Inflation Management Fund Inc. (the “Fund”) was incorporated in Maryland on March 16, 2004 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors authorized 100 million shares of $0.001 par value common stock. The Fund’s primary investment objective is total return. Current income is the Fund’s secondary investment objective.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Short-term fixed income securities that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. Futures contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. When the Fund holds securities or other assets that are denominated in a foreign currency, the Fund will normally use the currency exchange rates as of 4:00 p.m. (Eastern Time). If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

The Board of Directors is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North American Fund Valuation

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 19 |

Notes to financial statements (cont’d)

Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Directors, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Directors. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Directors, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Directors

quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| Ÿ | Level 1 — quoted prices in active markets for identical investments |

| Ÿ | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Ÿ | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

| 20 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets and liabilities carried at fair value:

| ASSETS | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant (Level 3) |

Total | ||||||||||||

| Long-term investments†: | ||||||||||||||||

| U.S. Treasury inflation protected securities |

— | $ | 116,796,781 | — | $ | 116,796,781 | ||||||||||

| Asset-backed securities |

— | 243,260 | — | 243,260 | ||||||||||||

| Collateralized mortgage obligations |

— | 1,113,691 | — | 1,113,691 | ||||||||||||

| Corporate bonds & notes |

— | 19,735,361 | — | 19,735,361 | ||||||||||||

| Mortgage-backed securities |

— | 704,746 | — | 704,746 | ||||||||||||

| Non-U.S. Treasury inflation protected securities |

— | 1,660,210 | — | 1,660,210 | ||||||||||||

| Sovereign bonds |

— | 8,202,640 | — | 8,202,640 | ||||||||||||

| U.S. government & agency obligations |

— | 76,834 | — | 76,834 | ||||||||||||

| Purchased options |

$ | 25,125 | — | — | 25,125 | |||||||||||

| Total investments | $ | 25,125 | $ | 148,533,523 | — | $ | 148,558,648 | |||||||||

| Other financial instruments: | ||||||||||||||||

| Futures contracts |

$ | 480,702 | — | — | $ | 480,702 | ||||||||||

| Forward foreign currency contracts |

— | $ | 343,336 | — | 343,336 | |||||||||||

| Total other financial instruments | $ | 480,702 | $ | 343,336 | — | $ | 824,038 | |||||||||

| Total | $ | 505,827 | $ | 148,876,859 | — | $ | 149,382,686 | |||||||||

| LIABILITIES | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant (Level 3) |

Total | ||||||||||||

| Other financial instruments: | ||||||||||||||||

| Written options |

$ | 3,141 | — | — | $ | 3,141 | ||||||||||

| Futures contracts |

126,061 | — | — | 126,061 | ||||||||||||

| Forward foreign currency contracts |

— | $ | 143,994 | — | 143,994 | |||||||||||

| Total | $ | 129,202 | $ | 143,994 | — | $ | 273,196 | |||||||||

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Repurchase agreements. The Fund may enter into repurchase agreements with institutions that its investment adviser has determined are creditworthy. Each repurchase agreement is recorded at cost. Under the terms of a typical repurchase agreement, the Fund acquires a debt security subject to an obligation of the seller to repurchase, and of the Fund to resell, the security at an agreed-upon price and time, thereby determining the yield during the Fund’s holding period. When entering into repurchase agreements, it is the Fund’s

| Western Asset Inflation Management Fund Inc. 2013 Annual Report | 21 |

Notes to financial statements (cont’d)

policy that its custodian or a third party custodian, acting on the Fund’s behalf, take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction maturity exceeds one business day, the value of the collateral is marked-to-market and measured against the value of the agreement in an effort to ensure the adequacy of the collateral. If the counterparty defaults, the Fund generally has the right to use the collateral to satisfy the terms of the repurchase transaction. However, if the market value of the collateral declines during the period in which the Fund seeks to assert its rights or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or

limited.

(c) Reverse repurchase agreements. The Fund may enter into reverse repurchase agreements. Under the terms of a typical reverse repurchase agreement, a fund sells a security subject to an obligation to repurchase the security from the buyer at an agreed-upon time and price. In the event the buyer of securities under a reverse repurchase agreement files for bankruptcy or becomes insolvent, the Fund’s use of the proceeds of the agreement may be restricted pending a determination by the counterparty, or its trustee or receiver, whether to enforce the Fund’s obligation to repurchase the securities. In entering into reverse repurchase agreements, the Fund will maintain cash, U.S. government securities or other liquid debt obligations at least equal in value to its obligations with respect to reverse repurchase agreements or will take other actions permitted by law to cover its obligations.

(d) Futures contracts. The Fund uses futures contracts generally to gain exposure to, or hedge against, changes in interest rates or gain exposure to, or hedge against, changes in certain asset classes. A futures contract represents a commitment for the future purchase or sale of an asset at a specified price on a specified date.

Upon entering into a futures contract, the Fund is required to deposit cash or cash equivalents with a broker in an amount equal to a certain percentage of the contract amount. This is known as the ‘‘initial margin’’ and subsequent payments (‘‘variation margin’’) are made or received by the Fund each day, depending on the daily fluctuation in the value of the contract. For certain futures, including foreign denominated futures variation margin is not settled daily, but is recorded as a net variation margin payable or receivable. Futures contracts are valued daily at the settlement price established by the board of trade or exchange on which they are traded. The daily changes in contract value are recorded as unrealized gains or losses in the Statement of Operations and the Fund recognizes a realized gain or loss when the contract is closed.

Futures contracts involve, to varying degrees, risk of loss in excess of the amounts reflected in the financial statements. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

(e) Written options. When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability, the value of which is marked-to-market daily

| 22 | Western Asset Inflation Management Fund Inc. 2013 Annual Report |

to reflect the current market value of the option written. If the option expires, the premium received is recorded as a realized gain. When a written call option is exercised, the difference between the premium received plus the option exercise price and the Fund’s basis in the underlying security (in the case of a covered written call option), or the cost to purchase the underlying security (in the case of an uncovered written call option), including brokerage commission, is recognized as a realized gain or loss. When a written put option is exercised, the amount of the premium received is subtracted from the cost of the security purchased by the Fund from the exercise of the written put option to form the Fund’s basis in the underlying security purchased. The writer or buyer of an option traded on an exchange can liquidate the position before the exercise of the option by entering into a closing transaction. The cost of a closing transaction is deducted from the original premium received resulting in a realized gain or loss to the Fund.

The risk in writing a covered call option is that the Fund may forego the opportunity of profit if the market price of the underlying security increases and the option is exercised. The risk in writing a put option is that the Fund may incur a loss if the market price of the underlying security decreases and the option is exercised. The risk in writing an uncovered call option is that the Fund is exposed to the risk of loss if the market price of the underlying security increases. In addition, there is the risk that the Fund may not be able to enter into a closing transaction because of an illiquid secondary market.

(f) Forward foreign currency contracts. The Fund enters into a forward foreign currency contract to hedge against foreign currency exchange rate risk on its non-U.S. dollar denominated securities or to facilitate settlement of a foreign currency denominated portfolio transaction. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set price with delivery and settlement at a future date. The contract is marked-to-market daily and the change in value is recorded by the Fund as an unrealized gain or loss. When a forward foreign currency contract is closed, through either delivery or offset by entering into another forward foreign currency contract, the Fund recognizes a realized gain or loss equal to the difference between the value of the contract at the time it was opened and the value of the contract at the time it is closed.

Forward foreign currency contracts involve elements of market risk in excess of the amounts reflected on the Statement of Assets and Liabilities. The Fund bears the risk of an unfavorable change in the foreign exchange rate underlying the forward foreign currency contract. Risks may also arise upon entering into these contracts from the potential inability of the counterparties to meet the terms of their contracts.