UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-33409

T-MOBILE US, INC.

DELAWARE | 20-0836269 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

12920 SE 38th Street, Bellevue, Washington | 98006-1350 | |

(Address of principal executive offices) | (Zip Code) | |

(425) 378-4000 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.00001 par value per share | NYSE | |

5.50% Mandatory Convertible Preferred Stock, Series A, $0.00001 par value per share | NYSE | |

Securities registered pursuant to Section 12(g) of the Act: | ||

None. | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

As of June 30, 2014, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $9.1 billion based on the closing sale price as reported on the NYSE. As of February 17, 2015, there were 807,778,654 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference certain portions of the definitive Proxy Statement for the registrant’s Annual Meeting of Stockholders, which definitive Proxy Statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

T-Mobile US, Inc.

Form 10-K

For the Year Ended December 31, 2014

Table of Contents

2

Cautionary Statement Regarding Forward-Looking Statements

This Annual Report on Form 10-K (“Form 10-K”) includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, including information concerning our future results of operations, are forward-looking statements. These forward-looking statements are generally identified by the words “anticipate,” “believe,” “estimate,” “expect,” “intend” or similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties and may cause actual results to differ materially from the forward-looking statements. The following important factors, along with the Risk Factors included in Part I, Item 1A of this Form 10-K, could affect future results and cause those results to differ materially from those expressed in the forward-looking statements:

• | adverse conditions in the United States (“U.S.”) and international economies or disruptions to the credit and financial markets; |

• | competition in the wireless services market; |

• | the ability to complete and realize expected synergies and other benefits of acquisitions; |

• | the inability to implement our business strategies or ability to fund our wireless operations, including payment for additional spectrum, network upgrades, and technological advancements; |

• | the ability to renew our spectrum licenses on attractive terms or acquire new spectrum licenses; |

• | the ability to manage growth in wireless data services, including network quality and acquisition of adequate spectrum licenses at reasonable costs and terms; |

• | material changes in available technology; |

• | the timing, scope and financial impact of our deployment of advanced network and business technologies; |

• | the impact on our networks and business from major technology equipment failures; |

• | breaches of network or information technology security, natural disasters or terrorist attacks or existing or future litigation and any resulting financial impact not covered by insurance; |

• | any changes in the regulatory environments in which we operate, including any increase in restrictions on the ability to operate our networks; |

• | any disruption of our key suppliers’ provisioning of products or services; |

• | material adverse changes in labor matters, including labor negotiations or additional organizing activity, and any resulting financial and/or operational impact; |

• | changes in accounting assumptions that regulatory agencies, including the Securities and Exchange Commission (“SEC”), may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; and, |

• | changes in tax laws, regulations and existing standards and the resolution of disputes with any taxing jurisdictions. |

Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. In this Form 10-K, unless the context indicates otherwise, references to “T-Mobile,” “T-Mobile US,” “our Company,” “the Company,” “we,” “our,” and “us” refer to T-Mobile US, Inc., a Delaware corporation, and its wholly-owned subsidiaries.

PART I.

Item 1. Business

Business Overview

We are the Un-carrier™. Un-satisfied with the status quo. Un-afraid to innovate. T-Mobile is the fastest growing wireless company in the U.S., based on customer growth in 2014, currently providing wireless communications services, including voice, messaging and data, to over 55 million customers in the postpaid, prepaid, and wholesale markets. The Un-carrier proposition is an approach that seeks to listen to the customer, address their pain points, bring innovation to the industry, and improve the wireless experience for all. In practice, this means offering customers a great service on a nationwide 4G Long-Term Evolution (“LTE”) network, devices when and how they want them, and plans that are simple, affordable and without unnecessary restrictions. Going forward, we will continue to listen and respond to our customers, refine and improve the Un-carrier proposition, and deliver the best value experience in the industry.

3

History

T-Mobile USA, Inc. (“T-Mobile USA”) was formed in 1994 as VoiceStream Wireless PCS (“VoiceStream”), a subsidiary of Western Wireless Corporation (“Western Wireless”). VoiceStream was spun off from Western Wireless in 1999, acquired by Deutsche Telekom AG (“Deutsche Telekom”) in 2001 and renamed T-Mobile USA, Inc. in 2002.

T-Mobile US, Inc. was formed in 2013 through the business combination between T-Mobile USA and MetroPCS Communications, Inc. (“MetroPCS”). Under the terms of the business combination with MetroPCS, Deutsche Telekom received shares of common stock representing a majority ownership interest in the combined company in exchange for its transfer of all of T-Mobile USA’s common stock. The business combination aimed to provide us with expanded scale, spectrum, and financial resources to compete aggressively with other, larger U.S. wireless communication providers. The business combination was accounted for as a reverse acquisition with T-Mobile USA as the accounting acquirer. Accordingly, T-Mobile USA’s historical financial statements became the historical financial statements of the combined company. See Note 2 – Business Combination with MetroPCS of the Notes to the Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K for further information regarding the business combination.

Business Strategy

We generate revenue by offering affordable wireless communication services to our postpaid, prepaid and wholesale customers, as well as a wide selection of wireless devices and accessories. We provide service, devices and accessories across our flagship brands, T-Mobile and MetroPCS, through our owned and operated retail stores, third party distributors and our websites (www.T-Mobile.com and www.MetroPCS.com). The information on our websites is not part of this Form 10-K. Our most significant expenses are related to acquiring and retaining high-quality customers, compensating employees, and operating and expanding our network.

We continue to aggressively pursue our strategy, which includes the following elements:

Un-carrier Value Proposition

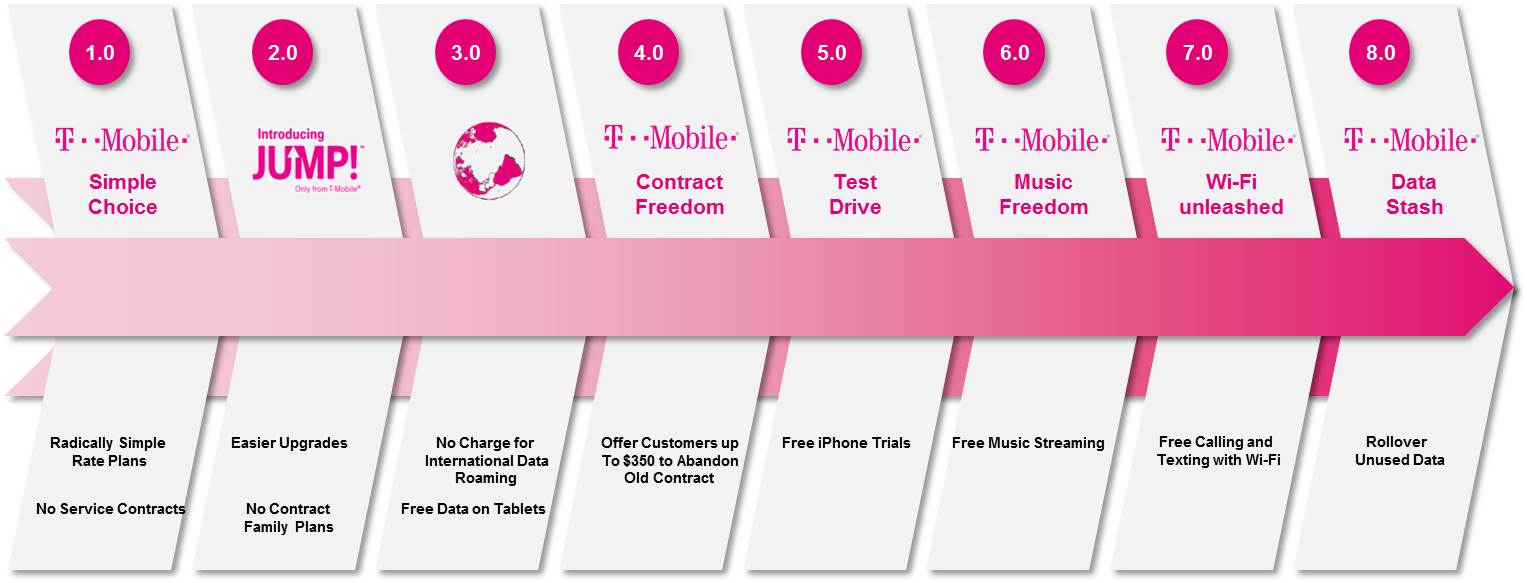

We introduced our Un-carrier proposition with the objective of eliminating customer pain points from the unnecessary complexity of the wireless communication industry. We believe Un-carrier phases 1.0 through 8.0 have been successful as evidenced by our strong customer growth since the launch of the Un-carrier proposition in 2013. We provided service to over 55 million customers as of December 31, 2014, compared to 47 million as of December 31, 2013.

Phases 1.0 through 8.0 of our Un-carrier proposition are described below:

• | Unlimited Data, No Annual Service Contract – In March 2013, we introduced Simple Choice™ plans, which eliminated annual service contracts and provided customers with affordable rate plans. Customers on Simple Choice plans can purchase the most popular smartphones and if qualified, pay for them with a low out-of-pocket payment and 24 affordable interest-free monthly installments. |

4

• | JUMP! – In July 2013, we announced Just Upgrade My Phone (“JUMP!™”) as phase 2.0, which allows participating customers to upgrade their eligible device when they want and not when they are told. In addition, participants benefit from handset insurance and extended warranty protection, protecting them from lost, stolen and damaged devices. |

• | International Roaming and Tablets Un-leashed – In October 2013, we unveiled phase 3.0, which provides our Simple Choice customers reduced United States to international calling rates, and messaging and data roaming while traveling abroad in over 100 countries at no extra cost with Simple Global™. In November 2013, we launched part 2 of phase 3.0, allowing every T-Mobile tablet user to use up to 200 MB of free LTE data every month for as long as they own their tablet and use it on our network, even if they are not yet a T-Mobile mobile internet customer. |

• | Contract Freedom – In January 2014, we announced phase 4.0, which eliminated one of the last remaining obstacles for customers wanting to switch from other carriers to T-Mobile by offering to reimburse customers’ early termination fees (“ETF”) when they switch from other carriers and trade in their eligible device. |

• | Test Drive – In June 2014, we released phase 5.0, which allows consumers to test our network using an Apple® iPhone® 5s with unlimited nationwide service for seven days at no charge. |

• | Music Freedom – In June 2014, we introduced phase 6.0, which allows Simple Choice customers to stream music from popular music services without it counting against their high-speed data allotment. Additionally, we launched Rhapsody® unRadio in partnership with Rhapsody for a limited time, which allows eligible Simple Choice customers with our newest unlimited 4G data service to stream music at no additional cost. We are also offering Rhapsody unRadio at a discounted price for our eligible customers. |

• | Wi-Fi Un-leashed – In September 2014, we launched phase 7.0, which delivers coverage to customers in more places. With Wi-Fi Un-leashed, we provide Wi-Fi calling and texting for Simple Choice customers on capable smartphones. In addition, we unveiled the T-Mobile Personal CellSpot™, a new device which provides customers with greater coverage in their home. Finally, through a new partnership with Gogo®, customers with compatible devices can send and receive unlimited text, picture messages and receive visual voicemails on any Gogo-equipped U.S.-based flight for free. |

• | Data Stash – In December 2014, we introduced phase 8.0, giving customers the ability to roll their unused high-speed data automatically each month into a personal Data Stash™ so they can use it when they need it for up to a year. Starting in January 2015, Data Stash became available at no extra charge to every T-Mobile customer with a postpaid Simple Choice plan who has purchased additional LTE data, 3GB or more for smartphones and 1 GB or more for tablets. In addition, beginning in January 2015, we will provide a one-time Free Data Stash to start with of 10 GB of LTE data to all qualifying customers, which will expire at the end of 2015. |

Network Modernization and Expansion

We have substantially completed the process of upgrading our network to LTE, which provides our customers with the fastest nationwide LTE services. Our LTE network covered 265 million people as of December 31, 2014, compared to more than 200 million people as of December 31, 2013. This surpassed our year-end goal of covering 250 million people with the fastest nationwide LTE network. We are targeting 300 million people with LTE by the end of 2015. In addition, we are currently in the process of building out our network to utilize our recently acquired 700 MHz A-Block spectrum licenses, which will boost network reach, improve in-building coverage and extend coverage to more areas.

5

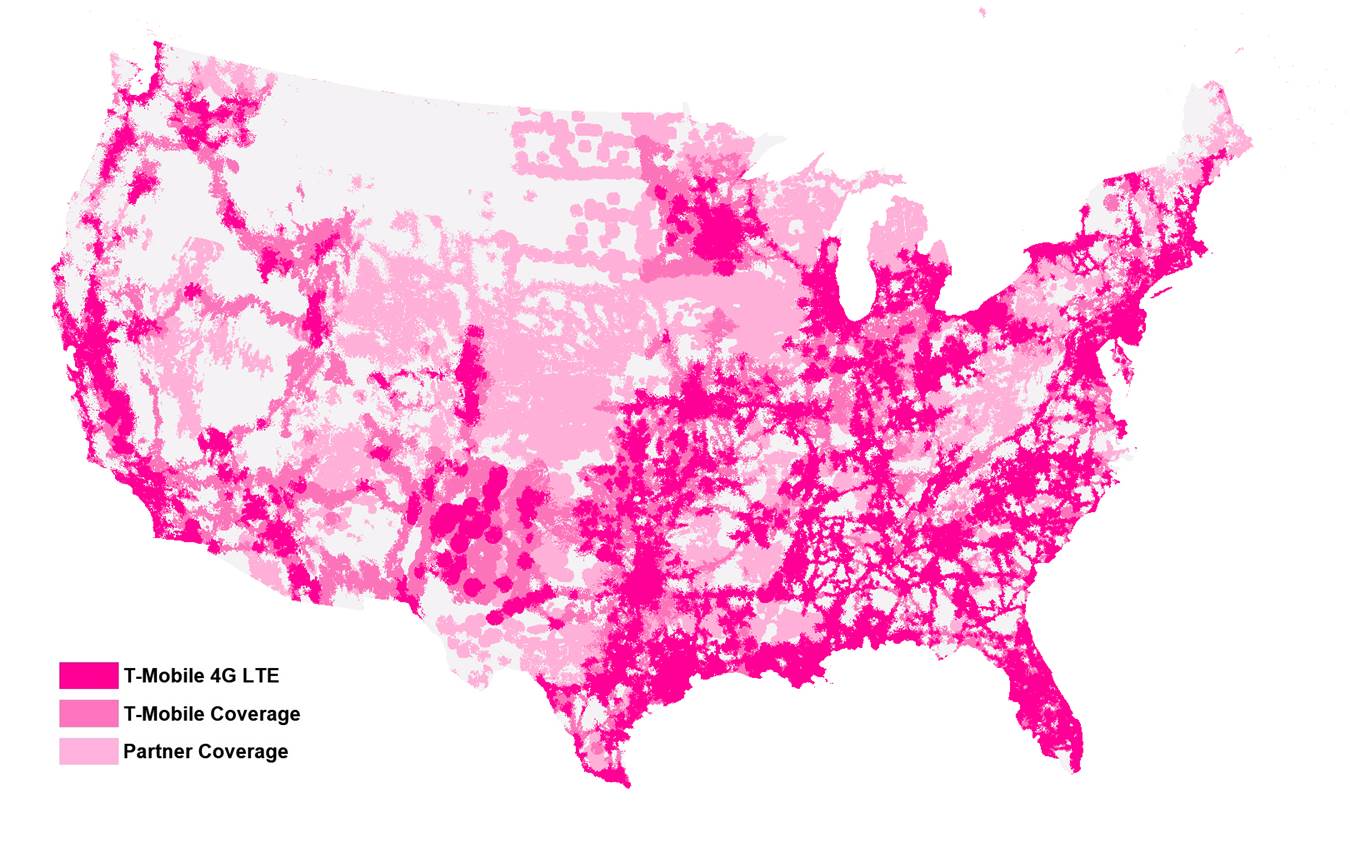

Below is a map showing our coverage, including LTE, in the U.S.:

In addition, we were the first U.S. carrier to introduce Voice over LTE (“VoLTE”) on a nationwide basis. Further, the migration of customers from the MetroPCS brand legacy Code Division Multiple Access (“CDMA”) network onto T-Mobile’s LTE and Evolved High Speed Packet Access Plus (“HSPA+”) network continues to be ahead of schedule, providing faster network performance for MetroPCS customers with compatible handsets.

In 2014, we completed transactions for the acquisition of 700 MHz A-Block, Advanced Wireless Service (“AWS”) and Personal Communications Service (“PCS”) spectrum licenses, primarily from Verizon Communications, Inc. (“Verizon”), for cash and the exchange of certain AWS and PCS spectrum licenses. In addition, in 2014, we entered into transactions, which are expected to close in 2015, with various other companies to acquire additional 700 MHz A-Block, AWS and PCS spectrum licenses, which covers more than 40 million people, for cash and the exchange of certain AWS and PCS spectrum licenses. The transactions are subject to regulatory approval and other customary closing conditions. Upon closing of these pending transactions, we will own 700 MHz A-Block spectrum covering 190 million people. In January 2015, the Federal Communications Commission (“FCC”) announced T-Mobile was the winning bidder of AWS spectrum licenses covering approximately 97 million people for an aggregate bid price of $1.8 billion. T-Mobile expects to receive the AWS spectrum licenses, subject to regulatory approval, in the second quarter of 2015.

Customer Experience

The success of our Un-carrier proposition and continued modernization of the network has further repositioned T-Mobile as a provider of dependable high-speed LTE service with a full range of desirable devices and provides our customers with an unrivaled customer experience. We have continued to focus on retaining customers through churn reduction initiatives to improve customer experience. Branded postpaid phone churn improved to 1.58% in 2014, compared to 1.69% in 2013 and 2.33% in 2012. These results reinforce our position as an organization with a strong focus and commitment to providing an outstanding customer experience whether customers call in, come in to our stores, or access our website.

Aligned Cost Structure

We continue to pursue a low-cost business operating model to drive cost savings, which can then be reinvested in the business. These cost-reduction programs are on-going as we continue to simplify our business and drive operational efficiencies and cost savings in areas, such as network optimization, customer roaming, customer service and improved customer collection rates.

6

We expect the business combination with MetroPCS to deliver at least $1.5 billion in annual run-rate synergies in operating and capital expenditures by 2016. A portion of these savings have been, and will continue to be, reinvested into growth of our business.

Customers

T-Mobile provides wireless communication services to three primary categories of customers: branded postpaid, branded prepaid and wholesale. Branded postpaid customers generally include customers that are qualified to pay after incurring wireless communication service. Branded prepaid customers generally include customers who pay in advance. Our branded prepaid customers include customers of the T-Mobile, MetroPCS and certain partner brands. Wholesale customers, which include Machine-to-Machine (“M2M”) and Mobile Virtual Network Operators (“MVNO”), operate on the T-Mobile network, but are managed by wholesale partners.

We generate the majority of our service revenues by providing wireless communication services to branded postpaid customers. In 2014, 64% of our service revenues were generated by providing wireless communication services to branded postpaid customers, compared to 31% from branded prepaid customers and 5% from wholesale customers, roaming and other services. Therefore, our ability to acquire and retain branded postpaid customers is important to our business in the generation of service revenues, equipment sales and other revenues. Our branded postpaid net customer additions were 4.9 million in 2014, compared to 2.0 million in 2013. Growth in our branded postpaid customer additions resulted primarily from strong customer response to our network modernization, Un-carrier proposition and promotions for services and devices.

Services and Products

T-Mobile provides wireless communication services through a variety of service plan options. We also offer a wide selection of wireless devices, including smartphones, tablets and other mobile communication devices, which are manufactured by various suppliers. Services, devices and accessories are offered directly to consumers through our owned and operated retail stores, as well as through our websites. In addition, we sell devices and accessories to dealers and other third party distributors for resale through independent third-party retail outlets and a variety of third-party websites.

Service plan options include our Value and Simple Choice (“Simple Choice”) plans, which allow customers to subscribe for wireless services separately from the purchase of a handset. We introduced our Simple Choice plans as part of phase 1.0 of our Un-carrier proposition in 2013, which eliminated annual service contracts and simplified the lineup of consumer rate plans to one affordable plan for unlimited voice and messaging services with the option to add data services. Depending on their credit profile, customers are qualified either for postpaid or prepaid service. As part of the ongoing movement towards simplifying the business, we continued to drive the penetration of Simple Choice plans within our base. The proportion of branded postpaid customers on Simple Choice plans was 89% as of December 31, 2014, up from 69% as of December 31, 2013.

Customers on our Simple Choice, benefit from reduced monthly service charges and can choose whether to use their own compatible handset on our network or purchase a handset from us or one of our dealers. Depending on their credit profile, qualifying customers who purchase a device from us have the option of financing all or a portion of the purchase price at the time of sale over an installment period using our Equipment Installment Plan (“EIP”). In addition, qualifying customers who finance their initial handset device with an EIP can enroll in JUMP! to later upgrade their device. Upon qualifying JUMP! program upgrades, the customers’ remaining EIP balance is settled provided they trade in their used handset at the time of upgrade in good working condition and purchase a new handset from us on a new EIP. Our Simple Choice plans result in increased equipment revenue for each handset sold compared to traditional bundled price plans that typically offer a significant handset discount but involve higher monthly service charges.

Network

Our nationwide network covers all major metropolitan areas and approximately 90% of people in the U.S., excluding roaming coverage. Over the last two years, we have continued to build out our network to be Data Strong™, meaning we have the most dense network in the nation, with more cell sites per customer than any other nationwide wireless communication provider, and we have concentrated our cell sites where our customers need data most.

We provide mobile communication services utilizing low-band spectrum licenses, consisting of 700 MHz A-Block, and mid-band spectrum licenses, such as AWS and PCS. We had an average of approximately 82 MHz of spectrum in the top 25 major metropolitan areas as of December 31, 2014. This is compared to an average of approximately 77 MHz of spectrum in the top 25 major metropolitan areas as of December 31, 2013. Over the last year, we have entered into various agreements for the acquisition of 700 MHz A-Block, AWS and PCS spectrum licenses. In addition, we will seek to opportunistically acquire

7

additional spectrum in private party transactions and government auctions to further enhance our portfolio of U.S. nationwide broadband spectrum.

We provide wireless communication services through a number of technologies, including LTE, HSPA+, Universal Mobile Telecommunications Systems (“UMTS”), General Packet Radio Service (“GPRS”), Enhanced Data rates for GSM Evolution (“EDGE”), Global System for Mobile Communications (“GSM”) and CDMA. We have substantially completed the process of upgrading our network to LTE using our mid-band spectrum licenses, which offers our customers faster data transfer speeds, greater connectivity and increased coverage. Not only does our network offer the fastest nationwide LTE network and the most consistent LTE speeds based on download speed, it currently has more capacity per customer than any other nationwide communications provider. In addition to expanding our LTE coverage, we are enhancing our network through an aggressive deployment of Wideband LTE of at least 15x15 MHz, which delivers faster LTE speeds. We have deployed Wideband LTE in 121 metropolitan areas as of December 31, 2014 and expect Wideband LTE to be available in 150 metropolitan areas by the end of 2015. We have also begun to launch low-band LTE using our recently acquired 700 MHz A-Block spectrum licenses. We offered five devices capable of using low-band LTE in 2014 and are working with our device partners to ensure all new LTE devices that launch in 2015 will be low-band capable. As part of the integration following the business combination, we are in the process of decommissioning the MetroPCS CDMA network and redundant cell sites, while also integrating select MetroPCS assets in certain metropolitan areas into the overall network. We have moved more than 70% of the MetroPCS spectrum licenses onto the T-Mobile network to provide faster LTE performance in many key markets. Upon completion of the migration of the MetroPCS customer base, we expect to have approximately 61,000 equivalent cell sites, including macro sites and certain distributed antenna system (“DAS”) network nodes from the MetroPCS network.

Distribution

We had approximately 62,000 total points of distribution, including approximately 10,000 T-Mobile and MetroPCS branded locations and 52,000 third-party and national retailer locations, as well as distribution through our websites, as of December 31, 2014. We had approximately 70,000 points of distribution as of December 31, 2013 and 61,000 as of December 31, 2012. Our distribution density in major metropolitan areas provides customers with the convenience of having retail and service locations close to where they live and work.

Competition

The wireless telecommunications industry is highly competitive. We are the fourth largest provider of postpaid service plans and the largest provider of prepaid service plans in the U.S. as measured by customers. Our competitors include other national carriers, such as AT&T Inc. (“AT&T”), Verizon and Sprint Corporation (“Sprint”), which offer predominantly contract-based service plans. AT&T and Verizon are significantly larger than us and may enjoy greater resources and scale advantages as compared to us. In addition, our competitors include numerous smaller regional carriers and MVNOs, such as TracFone Wireless, Inc., many of which offer no-contract, prepaid service plans. Competitors also include providers who offer similar communication services, such as voice and messaging, using alternative technologies or services. Competitive factors within the wireless telecommunications industry include pricing, market saturation, service and product offerings, customer experience, network investment and quality, development and deployment of technologies, availability of additional spectrum licenses, and regulatory changes. Some competitors have shown a willingness to use aggressive pricing as a source of differentiation. Taken together, the competitive factors we face will continue to put pressure on margins as companies compete to retain the current customer base and continue to add new customers.

Employees

As of December 31, 2014, we employed approximately 45,000 full-time and part-time employees, including network, retail, customer support and back office functions, of which approximately 30 employees were covered by a collective bargaining agreement, as of December 31, 2014.

Regulation

The FCC regulates many key aspects of our business, including licensing, construction, the operation and use of our network, modifications of our network, control and ownership of our business, the sale of certain business assets, domestic roaming arrangements and interconnection agreements, pursuant to its authority under the Communications Act of 1934, as amended (“Communications Act”). The FCC has a number of complex requirements and proceedings that affect our operations and that could increase our costs or diminish our revenues. For example, the FCC has rules regarding provision of 911 and E-911 services, porting telephone numbers, interconnection, roaming, internet openness, and the universal service and Lifeline programs. Many of these and other issues are being considered in ongoing proceedings, and we cannot predict whether or how

8

such actions will affect our business, financial condition, or results of operations. Our ability to provide services and generate revenues could be harmed by adverse regulatory action or changes to existing laws and regulations. In addition, regulation of companies that offer competing services can impact our business indirectly.

Wireless communications providers must be licensed by the FCC to provide communications services at specified spectrum frequencies within specified geographic areas and must comply with the rules and policies governing the use of the spectrum as adopted by the FCC. The FCC issues each license for a fixed period of time, typically 10 years in the case of cellular, PCS and point-to-point microwave licenses. AWS licenses have an initial term of 15 years, with successive 10-year terms thereafter. While the FCC has generally renewed licenses given to operating companies like us, the FCC has authority to both revoke a license for cause and to deny a license renewal if a renewal is not in the public interest. Furthermore, we could be subject to fines, forfeitures and other penalties for failure to comply with FCC regulations, even if any such non-compliance was unintentional. In extreme cases, penalties can include revocation of our licenses. The loss of any licenses, or any related fines or forfeitures, could adversely affect our business, results of operations and financial condition.

Additionally, Congress’ and the FCC’s allocation of additional spectrum for broadband commercial mobile radio service (“CMRS”), which includes cellular, PCS and specialized mobile radio, could significantly increase competition. We cannot assess the impact that any developments that may occur in the U.S. economy or any future spectrum allocations by the FCC may have on license values. FCC spectrum auctions and other market developments may adversely affect the market value of our licenses in the future. A significant decline in the value of our licenses could adversely affect our financial condition and results of operations. In addition, the FCC periodically reviews its policies on how to evaluate a carrier’s spectrum holdings in the context of transactions and auctions. A change in these policies could affect spectrum resources and competition among us and other carriers.

Congress and the FCC have imposed limitations on foreign ownership of CMRS licensees that exceed 20% direct ownership or 25% indirect ownership. The FCC has ruled that higher levels of indirect foreign ownership, even up to 100%, are presumptively consistent with the public interest albeit subject to review. Consistent with that established policy, the FCC has issued a declaratory ruling authorizing up to 100% ownership of our company by Deutsche Telekom. This declaratory ruling, and our licenses, are conditioned on Deutsche Telekom’s and the Company’s compliance with a network security agreement with the Department of Justice, the Federal Bureau of Investigation and the Department of Homeland Security. Failure to comply with the terms of this agreement could result in fines, injunctions and other penalties, including potential revocation of our spectrum licenses.

While the Communications Act generally preempts state and local governments from regulating the entry of, or the rates charged by, wireless communication providers, certain state and local governments regulate other terms and conditions of wireless service, including billing, termination of service arrangements and the imposition of early termination fees, advertising, network outages, the use of handsets while driving, zoning and land use. Further, the FCC and the Federal Aviation Administration regulate the siting, lighting and construction of transmitter towers and antennae. Tower siting and construction are also subject to state and local zoning, as well as federal statutes regarding environmental and historic preservation. The future costs to comply with all relevant regulations are to some extent unknown and regulations could result in higher operating expenses in the future.

Available Information

T-Mobile’s Form 10-K and all other reports and amendments filed with or furnished to the SEC, are publicly available free of charge on the Investor Relations section of our website at investor.t-mobile.com or at www.sec.gov as soon as reasonably practicable after these materials are filed with or furnished to the SEC. Our corporate governance guidelines, code of business conduct, code of ethics for senior financial officers and charters for the audit, compensation, nominating and corporate governance and executive committees of our board of directors are also posted on the Investor Relations section of T-Mobile’s website at investor.t-mobile.com. The information on our websites is not part of this or any other report T-Mobile files with, or furnishes to, the SEC.

Investors and others should note we announce material financial and operational information to our investors using our investor relations website, press releases, SEC filings and public conference calls and webcasts. T-Mobile intends to also use @TMobileIR (https://twitter.com/TMobileIR) and @JohnLegere (https://twitter.com/JohnLegere), which Mr. Legere also uses as a means for personal communications and observations, as a means of disclosing information about the Company, its services and other matters and for complying with its disclosure obligations under Regulation FD. The information we post through these social media channels may be deemed material. Accordingly, investors should monitor these social media channels in addition to following the Company’s press releases, SEC filings, public conference calls and webcasts. The social

9

media channels T-Mobile intends to use as a means of disclosing the information described above may be updated from time to time as listed on the Company’s investor relations website.

Item 1A. Risk Factors

In addition to the other information contained in this Form 10-K, the following risk factors should be considered carefully in evaluating T-Mobile. Our business, financial condition, liquidity, or results of operations could be materially adversely affected by any of these risks.

Risks Related to Our Business and the Wireless Industry

The scarcity and cost of additional wireless spectrum, and regulations relating to spectrum use, may adversely affect our business strategy and financial planning.

We will need to acquire additional spectrum in order to continue our customer growth, expand into new metropolitan areas, maintain our quality of service, meet increasing customer demands, and deploy new technologies. We will be at a competitive disadvantage and possibly experience erosion in the quality of service in certain markets if we fail to gain access to necessary spectrum before reaching capacity, especially below 1 GHz - low band spectrum.

The continued interest in, and aggregation of, spectrum by the largest national carriers may reduce our ability to acquire spectrum from other carriers or otherwise negatively impact our ability to gain access to spectrum through other means. As a result, we may need to acquire spectrum through government auctions and/or enter into spectrum sharing arrangements, which are subject to certain risks and uncertainties. For example, the FCC has encountered resistance to its plans to make additional spectrum available, which has created uncertainty about the timing and availability of spectrum through government auctions.

In addition, the FCC may impose conditions on the use of new wireless broadband mobile spectrum, including new restrictions or rules governing the use or access to current or future spectrum. This could increase pressure on capacity. Additional conditions that may be imposed by the FCC include heightened build-out requirements, limited renewal rights, clearing obligations, or open access or net neutrality requirements that may make it less attractive or less economical to acquire spectrum. The FCC has a pending notice of proposed rulemaking to examine whether the current spectrum screen used in acquisitions of spectrum should be changed or whether a spectrum cap should be imposed. In addition, rules may be established for future government spectrum auctions that may negatively impact our ability to obtain spectrum economically or in appropriate configurations or coverage areas.

If we cannot acquire needed spectrum from the government or otherwise, if new competitors acquire spectrum that will allow them to provide services competitive with our services, or if we cannot deploy services on a timely basis without burdensome conditions, at adequate cost, and while maintaining network quality levels, then our ability to attract and retain customers and our associated financial performance could be materially adversely affected.

Increasing competition for wireless customers could adversely affect our operating results.

We have multiple wireless competitors in each of our service areas, some of which have greater resources than us, and compete for customers based principally on service/device offerings, price, call quality, data use experience, coverage area, and customer service. In addition, we are facing growing competition from providers offering services using alternative wireless technologies and IP-based networks, as well as traditional wireline networks. We expect market saturation to continue to cause the wireless industry’s customer growth rate to be moderate in comparison with historical growth rates or possibly negative, leading to increased competition for customers. We also expect that our customers’ growing appetite for data services will place increased demands on our network capacity. This competition and our capacity issues will continue to put pressure on pricing and margins as companies compete for potential customers. Our ability to compete will depend on, among other things, continued absolute and relative improvement in network quality and customer services, effective marketing and selling of products and services, attractive pricing, and cost management, all of which will involve significant expenses.

Joint ventures, mergers, acquisitions and strategic alliances in the wireless industry have resulted in and are expected to result in larger competitors competing for a limited number of customers. The two largest national wireless communication providers currently serve a significant percentage of all wireless customers and hold significant spectrum and other resources. Our largest competitors may be able to enter into exclusive handset, device, or content arrangements, execute pervasive advertising and marketing campaigns, or otherwise improve their cost position relative to ours. In addition, the refusal of our large competitors to provide critical access to resources and inputs, such as roaming services on reasonable terms, may improve their position within the wireless broadband mobile services industry. These factors, together with the effects of the increasing

10

aggregate penetration of wireless services in all metropolitan areas and the ability of our larger competitors to use resources to build out their networks and to quickly deploy advanced technologies, have made it more difficult for smaller carriers like us to attract and retain customers, and may adversely affect our competitive position and ability to grow, which would have a material adverse effect on our business, financial condition, and operating results.

If our efforts to maintain the privacy and security of customer, employee, supplier or other proprietary or sensitive information are not successful at preventing a regulatory investigation, significant data breach or failure of compliance, we could incur substantial additional costs, become subject to litigation and enforcement actions, and suffer reputational damage.

Our business, like that of most retailers and wireless companies, involves the receipt, storage and transmission of customers’ personal information, consumer preferences and payment card information, as well as confidential information about our employees, our suppliers and our Company (“confidential information”). Cyber-attacks such as denial of service, other malicious attacks, unauthorized access or distribution of confidential information by third parties or employees, errors by third party suppliers or other breaches of security could disrupt our internal systems and applications, impair our ability to provide services to our customers or protect the privacy and confidentiality of our confidential information. Our information systems are vulnerable to continuously evolving data breach and information security risks. Unauthorized parties may attempt to gain access to our systems or information through fraud or other means of deceiving our employees or third party service providers. Hardware, software or applications we develop, have developed on our behalf, or we obtain from third parties may contain defects in design or manufacture or other problems that could compromise information security. The methods used to obtain unauthorized access, disable or degrade service, or sabotage systems are also constantly changing and evolving, and may be difficult to anticipate or detect for long periods of time.

Although we have implemented and regularly review and update processes and procedures to protect against unauthorized access to or use of sensitive data and to prevent data loss, the ever-evolving threats require us to continually evaluate and adapt our systems and processes. We cannot assure you that our systems and processes will be adequate to safeguard against all information security breaches or misuses of data. The actions we take may not be adequate to repel a significant attack or prevent a breach, unauthorized access by third parties or employees or errors by third party suppliers. If we are subject to a significant attack or breach, unauthorized access, errors of third party suppliers or other security breaches, we may incur significant costs, be subject to regulatory investigations and sanctions and private litigation, and may suffer damage to our business reputation that negatively impacts customer confidence, any or all of which could materially adversely affect our results of operations and financial condition.

Our reputation and financial condition could be materially adversely affected by system failures, business disruptions, and unauthorized use of or interference with our network and other systems.

To be successful, we must provide our customers with reliable, trustworthy service and protect the communications, location, and personal information shared or generated by our customers. We rely upon our systems and networks, and the systems and networks of other providers and suppliers, to provide and support our services and, in some cases, to protect our customers’ and our information. Failure of our or others’ systems, networks and infrastructure may prevent us from providing reliable service, or may allow for the unauthorized use of or interference with our networks and other systems. Examples of these risks include:

• | human error such as responding to deceptive communications or unintentionally executing malicious code; |

• | physical damage, power surges or outages, or equipment failure, including those as a result of severe weather, natural disasters, terrorist attacks, and acts of war; |

• | theft of customer/proprietary information: intrusion and theft of data offered for sale, competitive (dis)advantage, and/or corporate extortion; |

• | unauthorized access to our information technology, billing, customer care and provisioning systems and networks, and those of our suppliers and other providers; |

• | supplier failures or delays; and |

• | other systems failures or outages. |

Such events could cause us to lose customers, lose revenue, incur expenses, suffer reputational and goodwill damages, and subject us to litigation or governmental investigation. Remediation costs could include liability for information loss, repairing infrastructure and systems, and/or costs of incentives offered to customers. Our insurance may not cover, or be adequate to fully reimburse us for, costs and losses associated with such events.

11

We rely on third-parties to provide specialized products or services for the operation of our business, and a failure or inability by such parties to provide these products or services could adversely affect our business, results of operations, and financial condition.

We depend heavily on suppliers and other third parties in order for us to efficiently operate our business. Our business is complex, and it is not unusual for multiple vendors located in multiple locations to help us to develop, maintain, and troubleshoot products and services, such as network components, software development services, and billing and customer service support. Our suppliers often provide services outside of the U.S., which carries associated additional regulatory and legal obligations. We generally rely upon the suppliers to provide contractual assurances and accurate information regarding risks associated with their provision of products or services in accordance with our expectations and standards, and they may fail to do so.

Generally, there are multiple sources for the types of products and services we purchase or use. However, we currently rely on one key supplier for billing services, a limited number of suppliers for voice and data communications transport services, network infrastructure, equipment, handsets, and other devices, and payment processing services, among other products and services we rely on. Disruptions with respect to such suppliers, or failure of such suppliers to adequately perform, could have a material adverse on our financial performance.

In the past, our suppliers, contractors and third-party retailers have not always performed at the levels we expect or at the levels required by their contracts. Our business could be severely disrupted if key suppliers, contractors, service providers, or third-party retailers fail to comply with their contracts or become unable to continue the supply due to patent or other intellectual property infringement actions, or other disruptions. Our business could also be disrupted if we experience delays or service degradation during any transition to a new outsourcing provider or other supplier, or we were required to replace the supplied products or services with those from another source, especially if the replacement became necessary on short notice. Any such disruptions could have a material adverse effect on our business, results of operations and financial condition.

We are in the process of transferring our customer billing systems from our existing third-party vendor to a new third-party vendor. Any unanticipated difficulties, disruption or significant delays could have adverse operational, financial, and reputational effects on our business.

We are in the initial stages of implementing a new customer billing system, which involves moving to a new platform through utilization of a phased deployment approach. The first release phase is scheduled for 2015. Post implementation, we plan to operate both the existing and new billing systems in parallel to aid in the transition to the new system until all phases of the conversion are complete.

If the implementation causes major system disruptions or if we fail to implement the new billing system in a timely or effective manner, customer experience may be negatively impacted, which could cause material adverse effects on our operational and financial performance. In addition, the third-party billing services vendor may experience errors, cyber-attacks or other operational disruptions that could negatively impact us and over which we may have limited control. Interruptions and/or failure of this new billing services system could disrupt our operations and impact our ability to provide or bill for our services, retain customers or attract new customers. Any occurrence of the foregoing could cause material adverse effects on our operations and financial condition, material weaknesses in our internal control over financial reporting, and reputational damage.

If we are unable to attract and retain wireless subscribers our financial performance will be impaired.

We incur capital expenditures and operating expenses in order to improve and enhance our products, services, network quality and coverage, applications, and content to remain competitive and to keep up with our customer demand. If we fail to improve and enhance our products and services or expand the capacity of, or make upgrades to, our network to remain competitive, or if we fail to maintain access to desired handsets, content and features, or otherwise keep up with customer demand, our ability to attract and retain customers would be adversely affected.

In particular, our gross new subscriber activations may decrease and our subscriber churn may increase, leaving us unable to meet the assumptions of our business plan. Even if we effectively manage the factors described above that are within our control, there can be no assurance that our existing customers will not switch to another wireless communications provider or that we will be able to attract new customers. Our business, results of operations and financial condition, could be materially adversely affected if we are unable to grow our customer base at the levels we project, or achieve the aggregate levels of customer penetration that we currently believe are possible with our business model.

12

If we are unable to take advantage of technological developments on a timely basis, then we may experience a decline in demand for our services or face challenges in implementing or evolving our business strategy.

In order to grow and remain competitive, we will need to adapt to future changes in technology, enhance our existing offerings, and introduce new offerings to address our current and potential customers’ changing demands. For example, we are in the process of transforming and upgrading our network to deploy LTE Release 10 and use multimode integrated radios that can handle GSM, HSPA+ and LTE. As part of our network upgrade program, we expect to install new GSM, HSPA+, and LTE equipment on approximately 40,000 cell sites, and GSM and LTE on approximately 12,000 cell sites. This work is planned to be substantially completed in 2015. However, enhancing our network is subject to risk from equipment changes and migration of customers from existing spectrum bands. Scheduling and supplier delays, unexpected or increased costs, technological constraints, regulatory permitting issues, subscriber dissatisfaction, and other risks could cause delays in launching new network capabilities, which could result in significant costs or reduce the anticipated benefits of the upgrades. As it relates to our current upgrade plans, these risks will be reduced as work is completed. In general, the development of new services in the wireless telecommunications industry will require us to anticipate and respond to the continuously changing demands of our customers, which we may not be able to do accurately or timely. We could experience a material adverse effect on our business, operations, financial position, and operating results if our new services fail to retain or gain acceptance in the marketplace or if costs associated with these services are higher than anticipated.

The agreements governing our indebtedness include restrictive covenants that limit our operating flexibility.

The agreements governing our indebtedness impose significant operating and financial restrictions on us. These restrictions, subject in certain cases to customary baskets, exceptions and incurrence-based ratio tests, may limit our ability to engage in some transactions, including the following:

• | incurring additional indebtedness and issuing preferred stock; |

• | paying dividends, redeeming capital stock or making other restricted payments or investments; |

• | selling or buying assets, properties or licenses; |

• | developing assets, properties or licenses which we have or in the future may procure; |

• | creating liens on assets; |

• | participating in future FCC auctions of spectrum or private sales of spectrum; |

• | engaging in mergers, acquisitions, business combinations, or other transactions; |

• | entering into transactions with affiliates; and |

• | placing restrictions on the ability of subsidiaries to pay dividends or make other payments. |

These restrictions could limit our ability to react to changes in our operating environment or the economy. Any future indebtedness that we incur may contain similar or more restrictive covenants. Any failure to comply with the restrictions of our debt agreements may result in an event of default under these agreements, which in turn may result in defaults or acceleration of obligations under these agreements and other agreements, giving our lenders the right to terminate any commitments they had made to provide us with further funds and to require us to repay all amounts then outstanding. Any of these events would have a material adverse effect on our financial position and performance.

Our significant indebtedness could adversely affect our business, financial condition and operating results.

Our ability to make payments on our debt, to repay our existing indebtedness when due, and to fund operations and significant planned capital expenditures will depend on our ability to generate cash in the future, which is in turn subject to the operational risks described elsewhere in this section. Our debt service obligations could have material adverse effects on our operations and financial results, including by:

• | limiting our ability to borrow money, sell stock or similar equity linked securities to fund our operational, financing or strategic needs; |

• | limiting our flexibility in planning for, or reacting to, changes in our business or the communications industry or pursuing growth opportunities; |

• | reducing the amount of cash available for other operational or strategic needs; and |

• | placing us at a competitive disadvantage to competitors who are less leveraged than we are. |

In addition, the $5.6 billion in principal amount of the senior reset notes we issued to Deutsche Telekom in connection with the business combination between T-Mobile and MetroPCS bears interest at rates which will be reset at dates between April 2015 and April 2016. If the resets result in interest rate increases, debt service requirements will increase, which could adversely affect our cash flow. While we have and may enter into agreements limiting our exposure to higher interest rates in the future,

13

any such agreements may not offer complete protection from this risk, and any portion not subject to such agreements would have full exposure to higher interest rates. Any of these risks could have a material adverse effect on our business, financial condition, and operating results.

Economic and market conditions may adversely affect our business and financial performance, as well as our access to financing on favorable terms or at all.

Our business and financial performance are sensitive to changes in general economic conditions, including changes in interest rates, consumer credit conditions, consumer debt levels, consumer confidence, rates of inflation (or concerns about deflation), unemployment rates, energy costs and other macro-economic factors. Market and economic conditions have been unprecedented and challenging in recent years. Concerns about the systemic impact of a long-term downturn, underemployment and unemployment, energy costs, the availability and cost of credit and unstable housing and credit markets have contributed to market volatility and economic uncertainty.

Continued or renewed market turbulence and weak economic conditions may materially adversely affect our business and financial performance in a number of ways. Our services are available to a broad customer base, a significant segment of which may be more vulnerable to weak economic conditions. We may have greater difficulty in gaining new customers within this segment and existing customers may be more likely to terminate service due to an inability to pay. In addition, instability in the global financial markets has resulted in periodic volatility in the credit, equity, and fixed income markets. This volatility could limit our access to the credit markets, leading to higher borrowing costs or, in some cases, the inability to obtain financing on terms that are acceptable to us, or at all.

Weak economic conditions and credit conditions may also adversely impact our suppliers and dealers, some of which have filed for or may be considering bankruptcy, or may experience cash flow or liquidity problems or are unable to obtain or refinance credit such that they may no longer be able to operate. Any of these could adversely impact our ability to distribute, market, or sell our products and services. Difficult, or worsening, general economic conditions could have a material adverse effect on our business, financial condition and results of operations.

Our business and stock price may be adversely affected if our internal controls are not effective.

As a public company, we are required under Section 404 of the Sarbanes-Oxley Act of 2002 and the SEC rules and regulations promulgated thereunder to establish, maintain and annually evaluate the effectiveness of internal control over financial reporting, which is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. The information technology, or IT, systems on which we rely extensively to operate, transact and otherwise manage our business and to effectively and timely report our financial results, are an important part of our internal control over financial reporting. Each each year we are required to document and test our internal control over financial reporting, including these IT systems; our management is required to assess and issue a report concerning our internal control over financial reporting; and our independent registered public accounting firm is required to report on the effectiveness of our internal control over financial reporting.

We cannot assure you that we will not discover material weaknesses our IT controls or other aspects of our internal control over financial reporting in the future. The existence of one or more material weaknesses could result in errors in our financial statements, and substantial costs and resources may be required to rectify these or other internal control deficiencies. If we are unable to comply with the requirements of Section 404 in a timely manner or if we conclude that our internal control over financial reporting is not effective, investors may lose confidence in the accuracy and completeness of our financial reports and the trading price of our common stock could be negatively affected, and we could become subject to investigations by the stock exchange on which our securities are listed, the SEC, or other regulatory authorities, which could require additional financial and management resources.

Our financial performance will be impaired if we experience high fraud rates related to device financing, credit cards, dealers, or subscriptions.

Our operating costs could increase substantially as a result of fraud, including device financing, customer credit card, subscription or dealer fraud. If our fraud detection strategies and processes are not successful in detecting and controlling fraud, whether directly or by way of the systems, processes, and operations of third parties such as national retailers, dealers and others, the resulting loss of revenue or increased expenses could have a materially adverse impact on our financial condition and results of operations.

14

We rely on highly-skilled personnel throughout all levels of our business. Our business could be harmed if we are unable to retain or motivate key personnel, hire qualified personnel, or maintain our corporate culture.

We believe that our future success depends in substantial part on our ability to recruit, hire, motivate, develop, and retain talented and highly-skilled personnel. Achieving this objective may be difficult due to many factors, including fluctuations in economic and industry conditions, competitors’ hiring practices, employee tolerance for the significant amount of change within and demands on our company and our industry, and the effectiveness of our compensation programs. If we do not succeed in retaining and motivating our existing key employees and in attracting new key personnel, we may be unable to meet our business plan and, as a result, our revenue growth and profitability may be materially adversely affected.

Risk related to Legal and Regulatory Matters

We operate throughout the U.S., Puerto Rico, and the U.S. Virgin Islands, and as such are subject to regulatory and legislative action by applicable local, state and federal governmental entities, which may increase our costs of providing products or services, or require us to change our business operations, products, or services or subject us to material adverse impacts if we fail to comply with such regulations.

The FCC regulates the licensing, construction, modification, operation, ownership, sale, and interconnection of wireless communications systems, as do some state and local regulatory agencies. Additionally, the Federal Trade Commission (“FTC”) and other federal agencies, such as the Consumer Financial Protection Board (“CFPB”), have jurisdiction over consumer protection and elimination and prevention of anticompetitive business practices with respect to the provision of non-common carrier services. We cannot assure you that the FCC, FTC, CFPB or any other federal, state or local agencies having jurisdiction over our business will not adopt regulations or take other enforcement or other actions that would adversely affect our business, impose new costs, or require changes in current or planned operations. We are subject to regulatory oversight by the FCC, FTC, and/or other federal agencies, as well as judicial review and actions, on issues related to the wireless industry that include, but are not limited to: roaming, spectrum allocation and licensing, pole attachments, intercarrier compensation, Universal Service Fund (“USF”), net neutrality, special access, 911 services, consumer protection including cramming, bill shock, and handset unlocking, consumer privacy, and cybersecurity. We are also subject to regulations in connection with other aspects of our business, including handset financing activities.

In addition, states are increasingly focused on the quality of service and support that wireless communication providers provide to their customers and several states have proposed or enacted new and potentially burdensome regulations in this area. A number of state Public Utility Commissions and state legislatures have introduced proposals in recent years seeking to regulate carriers’ business practices. We also face potential investigations by, and inquiries from or actions by state Public Utility Commissions and state Attorneys General. We also cannot assure you that Congress will not amend the Communications Act, from which the FCC obtains its authority and which serves to limit state authority, or enact other legislation in a manner that could be adverse to our business. Enactment of additional state or federal regulations may increase our costs of providing services (including, through universal service programs, requiring us to subsidize wireline competitors) or require us to change our services. Failure to comply with applicable regulations could have a material adverse effect on our business, financial condition and results of operations.

Furthermore, we could be subject to fines, forfeitures, and other penalties (including, in extreme cases, revocation of our licenses) for failure to comply with FCC or other governmental regulations, even if any such non-compliance was unintentional. The loss of any licenses, or any related fines or forfeitures, could adversely affect our business, results of operations, and financial condition.

Unfavorable outcomes of legal proceedings may adversely affect our business and financial condition.

We are regularly involved in a number of legal proceedings before various state and federal courts, the FCC, the FTC, the CFPB, and state and local regulatory agencies. Such legal proceedings can be complex, costly, and highly disruptive to business operations by diverting the attention and energies of management and other key personnel. The assessment of the outcome of legal proceedings, including our potential liability, if any, is a highly subjective process that requires judgments about future events that are not within our control. The outcome of litigation or other legal proceedings, including amounts ultimately received or paid upon settlement, may differ materially from amounts accrued in the financial statements. In addition, litigation or similar proceedings could impose restraints on our current or future manner of doing business. Such potential outcomes including judgments, awards, settlements or orders could have a material adverse effect on our business, financial condition, operating results, or ability to do business.

15

We increasingly offer products that include highly regulated financial services. These products expose us to a wide variety of state and federal regulations.

The introduction of additional financial services offerings to our customers has expanded our regulatory compliance obligations. If we fail to remain compliant with any of these regulations, then we face the risk of:

• | Increased consumer complaints and potential examinations or enforcement actions by federal and state regulatory agencies, including but not limited to the CFPB, Federal Deposit Insurance Corporation and FTC; |

• | Violation of financial services and consumer protections regulations may result in regulatory fines, penalties, enforcement actions, civil litigation, and/or class action lawsuits. |

We may be unable to protect our intellectual property. Additionally, we use equipment, software, technology, and content in the operation of our business, which may subject us to third-party intellectual property claims and we may be adversely affected by litigation involving our suppliers

We rely on a combination of patent, service mark, trademark, and trade secret laws and contractual restrictions to establish and protect our proprietary rights, all of which offer only limited protection. The steps we have taken to protect our intellectual property may not prevent the misappropriation of our proprietary rights. Moreover, others may independently develop processes and technologies that are competitive to ours. We cannot be sure that any legal actions against such infringers will be successful, even when our rights have been infringed. We cannot assure you that our pending or future patent applications will be granted or enforceable, or that the rights granted under any patent that may be issued will provide us with any competitive advantages. In addition, we cannot assure you that any trademark or service mark registrations will be issued with respect to pending or future applications or will provide adequate protection of our brands. We do not have insurance coverage for intellectual property losses, and as such, a charge for an anticipated settlement, or an adverse ruling awarding damages, represents unplanned loss events. Any of these factors could have material adverse effects on our business, results of operations and financial condition.

We are a defendant in numerous intellectual property lawsuits, including patent infringement lawsuits, which exposes us to the risk of adverse financial impact either by way of significant settlement amounts or damage awards. As we adopt new technologies and new business systems, and provide customers with new products and/or services, we may face additional infringement claims. These claims could require us to cease certain activities or to cease selling relevant products and services. These claims can be time-consuming and costly to defend, and divert management resources. In addition to litigation directly involving our Company, our vendors and suppliers can be threatened with patent litigation and/or subjected to the threat of disruption or blockage of sale, use, or importation of products, posing the risk of supply chain interruption to particular products and associated services exposing us to material adverse operational and financial impacts.

Our business may be impacted by new or changing tax laws or regulations and actions by federal, state or local agencies, or how judicial authorities apply tax laws.

We calculate, collect, and remit various taxes and regulatory fees to numerous federal, state and local governmental authorities in connection with the products and services we provide. These fees include federal USF contributions and common carrier regulatory fees. Many state and local governments levy various taxes and fees on our sales of products and services to customers and on our purchases of telecommunications equipment and services from vendors and various telecommunications carriers. Further, we impose surcharges on customers to reimburse the company for taxes, regulatory assessments and other costs we incur to comply with governmental regulatory mandates. In many cases, the applicability and method of calculating these surcharges, taxes and fees may be uncertain, and our calculation, assessment or remittance of these amounts may be contested by either customers or governmental authorities. In the event that we have incorrectly described, disclosed, calculated, assessed or remitted amounts that were due to governmental authorities, we could be subject to additional taxes, fines, penalties, or other adverse actions, which could materially impact our operations or financial condition. In the event that federal, state and/or local municipalities were to significantly increase taxes and regulatory fees on our services or seek to impose new ones, it could have a material adverse effect on our margins and financial and operational results.

Our wireless licenses are subject to renewal and may be revoked in the event that we violate applicable laws.

Our existing wireless licenses are subject to renewal upon the expiration of the 10-year or 15-year period for which they are granted. Historically, the FCC has approved our license renewal applications. However, the Communications Act provides that licenses may be revoked for cause and license renewal applications denied if the FCC determines that a renewal would not serve the public interest. In addition, our licenses are subject to our compliance with the terms set forth in the agreement pertaining to national security among Deutsche Telekom, the Federal Bureau of Investigation, the Department of Justice, the

16

Department of Homeland Security and the Company. The failure of Deutsche Telekom or the Company to comply with the terms of this agreement could result in fines, injunctions, and other penalties, including potential revocation or non-renewal of our spectrum licenses. If we fail to timely file to renew any wireless license, or fail to meet any regulatory requirements for renewal, including construction and substantial service requirements, we could be denied a license renewal. Many of our wireless licenses are subject to interim or final construction requirements and there is no guarantee that the FCC will find our construction, or the construction of prior licensees, sufficient to meet the build-out or renewal requirements. The FCC has pending a rulemaking proceeding to reevaluate, among other things, its wireless license renewal showings and standards and may in this or other proceedings promulgate changes or additional substantial requirements or conditions to its renewal rules, including revising license build out requirements. Accordingly, we cannot assure you that the FCC will renew our wireless licenses upon their expiration. If any of our wireless licenses were to be revoked or not renewed upon expiration, we would not be permitted to provide services under that license, which could have a material adverse effect on our business, results of operations, and financial condition.

Our business could be adversely affected by findings of product liability for health/safety risks from wireless devices and transmission equipment, as well as by changes to regulations/radio frequency emission standards.

We do not manufacture devices or other equipment sold by us, and we depend on our suppliers to provide defect-free and safe equipment. Suppliers are required by applicable law to manufacture their devices to meet certain governmentally imposed safety criteria. However, even if the devices we sell meet the regulatory safety criteria, we could be held liable with the equipment manufacturers and suppliers for any harm caused by products we sell if such products are later found to have design or manufacturing defects. We generally seek to enter into indemnification agreements with the manufacturers who supply us with devices to protect us from losses associated with product liability, but we cannot guarantee that we will be fully protected against all losses associated with a product that is found to be defective.

Allegations have been made that the use of wireless handsets and wireless transmission equipment, such as cell towers, may be linked to various health concerns, including cancer and brain tumors. Lawsuits have been filed against manufacturers and carriers in the industry claiming damages for alleged health problems arising from the use of wireless handsets. In addition, the FCC recently indicated that it plans to gather additional data regarding wireless handset emissions to update its assessment of this issue. The media has also reported incidents of handset battery malfunction, including reports of batteries that have overheated. These allegations may lead to changes in regulatory standards. There have also been other allegations regarding wireless technology, including allegations that wireless handset emissions may interfere with various electronic medical devices (including hearing aids and pacemakers), airbags, and anti-lock brakes.

Additionally, there are safety risks associated with the use of wireless devices while operating vehicles or equipment. Concerns over any of these risks and the effect of any legislation, rules or regulations that have been and may be adopted in response to these risks could limit our ability to sell our wireless services.

Related to Ownership of our Common Stock

We are controlled by Deutsche Telekom, whose interests may differ from the interests of our other stockholders.

Deutsche Telekom beneficially owns and possesses majority voting power of the fully diluted shares of our common stock. Through its control of the voting power of our common stock and the rights granted to Deutsche Telekom in our certificate of incorporation and the Stockholder’s Agreement, Deutsche Telekom controls the election of a majority of our directors and all other matters requiring the approval of our stockholders. By virtue of Deutsche Telekom’s voting control, we are a “controlled company”, as defined in the New York Stock Exchange (“NYSE”), listing rules, and are not subject to NYSE requirements that would otherwise require us to have a majority of independent directors, a nominating committee composed solely of independent directors, or a compensation committee composed solely of independent directors.

In addition, our certificate of incorporation and the Stockholder’s Agreement restrict us from taking certain actions without Deutsche Telekom’s prior written consent as long as Deutsche Telekom beneficially owns 30% or more of the outstanding shares of our common stock, including the incurrence of debt (excluding certain permitted debt) if our consolidated ratio of debt to cash flow for the most recently ended four full fiscal quarters for which financial statements are available would exceed 5.25 to 1.0 on a pro forma basis, the acquisition of any business, debt or equity interests, operations or assets of any person for consideration in excess of $1 billion, the sale of any of our or our subsidiaries’ divisions, businesses, operations or equity interests for consideration in excess of $1 billion, any change in the size of our board of directors, the issuances of equity securities in excess of 10% of our outstanding shares or to repurchase debt held by Deutsche Telekom, the repurchase or redemption of equity securities or the declaration of extraordinary or in-kind dividends or distributions other than on a pro rata basis, or the termination or hiring of our chief executive officer. These restrictions could prevent us from taking actions that

17

our board of directors may otherwise determine are in the best interests of the Company and our stockholders or that may be in the best interests of our other stockholders.

Deutsche Telekom effectively has control over all matters submitted to our stockholders for approval, including the election or removal of directors, changes to our certificate of incorporation, a sale or merger of our company and other transactions requiring stockholder approval under Delaware law. Deutsche Telekom may have strategic, financial, or other interests different from our other stockholders, including as the holder of a substantial amount of our indebtedness, and may make decisions adverse to the interests of our other stakeholders.

Future sales or issuances of our common stock, including sales by Deutsche Telekom, could have a negative impact on our stock price.