UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

ý Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 2013.

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period From ______________________ to _________________________

Commission file number 001-32265 (American Campus Communities, Inc.)

Commission file number 333-181102-01 (American Campus Communities Operating Partnership, L.P.)

AMERICAN CAMPUS COMMUNITIES, INC.

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P.

(Exact name of registrant as specified in its charter)

Maryland (American Campus Communities, Inc.) Maryland (American Campus Communities Operating Partnership, L.P.) | 76-0753089 (American Campus Communities, Inc.) 56-2473181 (American Campus Communities Operating Partnership, L.P.) | |

(State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |

12700 Hill Country Blvd., Suite T-200 Austin, TX (Address of Principal Executive Offices) | 78738 (Zip Code) | |

(512) 732-1000

Registrant’s telephone number, including area code

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

American Campus Communities, Inc. | Yes x No o |

American Campus Communities Operating Partnership, L.P. | Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

American Campus Communities, Inc. | Yes x No o |

American Campus Communities Operating Partnership, L.P. | Yes x No o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

American Campus Communities, Inc.

Large accelerated filer x | Accelerated Filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

American Campus Communities Operating Partnership, L.P.

Large accelerated filer o | Accelerated Filer o |

Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act)

American Campus Communities, Inc. | Yes o No x |

American Campus Communities Operating Partnership, L.P | Yes o No x |

There were 104,782,817 shares of the American Campus Communities, Inc.’s common stock with a par value of $0.01 per share outstanding as of the close of business on October 31, 2013.

EXPLANATORY NOTE

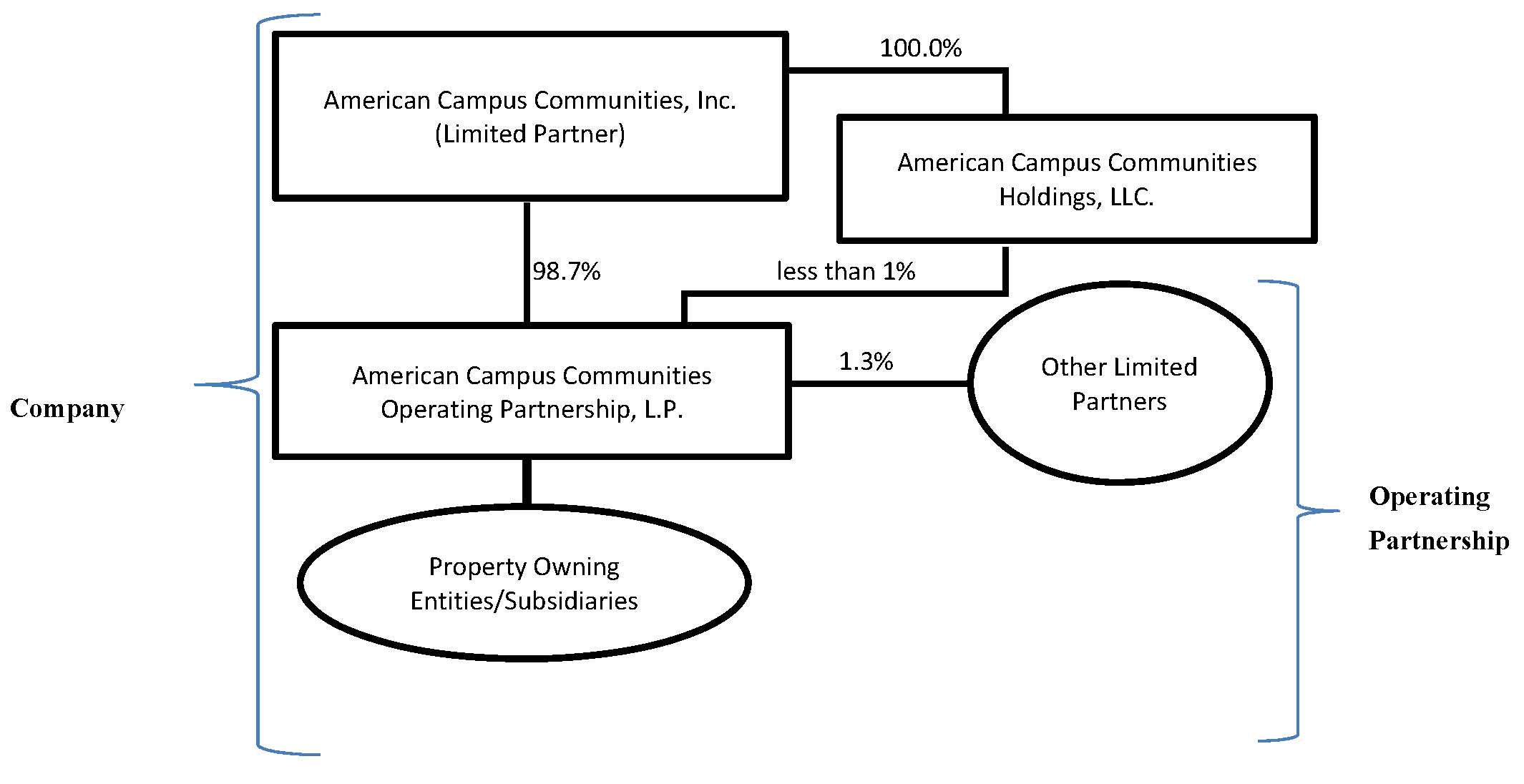

This report combines the reports on Form 10-Q for the quarterly period ended September 30, 2013 of American Campus Communities, Inc. and American Campus Communities Operating Partnership, L.P. Unless stated otherwise or the context otherwise requires, references to “ACC” mean American Campus Communities, Inc., a Maryland real estate investment trust (“REIT”), and references to “ACCOP” mean American Campus Communities Operating Partnership, L.P., a Maryland limited partnership. References to the “Company,” “we,” “us” or “our” mean collectively ACC, ACCOP and those entities/subsidiaries owned or controlled by ACC and/or ACCOP. References to the “Operating Partnership” mean collectively ACCOP and those entities/subsidiaries owned or controlled by ACCOP. The following chart illustrates the Company’s and the Operating Partnership’s corporate structure:

The general partner of ACCOP is American Campus Communities Holdings, LLC (“ACC Holdings”), an entity that is wholly-owned by ACC. As of September 30, 2013, ACC Holdings held an ownership interest in ACCOP of less than 1%. The limited partners of ACCOP are ACC and other limited partners consisting of current and former members of management and nonaffiliated third parties. As of September 30, 2013, ACC owned an approximate 98.7% limited partnership interest in ACCOP. As the sole member of the general partner of ACCOP, ACC has exclusive control of ACCOP’s day-to-day management. Management operates the Company and the Operating Partnership as one business. The management of ACC consists of the same members as the management of ACCOP. The Company is structured as an umbrella partnership REIT (“UPREIT”) and ACC contributes all net proceeds from its various equity offerings to the Operating Partnership. In return for those contributions, ACC receives a number of units of the Operating Partnership (“OP Units,” see definition below) equal to the number of common shares it has issued in the equity offering. Contributions of properties to the Company can be structured as tax-deferred transactions through the issuance of OP Units in the Operating Partnership. Based on the terms of ACCOP’s partnership agreement, OP Units can be exchanged for ACC’s common shares on a one-for-one basis. The Company maintains a one-for-one relationship between the OP Units of the Operating Partnership issued to ACC and ACC Holdings and the common shares issued to the public. The Company believes that combining the reports on Form 10-Q of ACC and ACCOP into this single report provides the following benefits:

(1) | enhances investors’ understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

(2) | eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and |

(3) | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

ACC consolidates ACCOP for financial reporting purposes, and ACC essentially has no assets or liabilities other than its investment in ACCOP. Therefore, the assets and liabilities of the Company and the Operating Partnership are the same on their respective financial statements. However, the Company believes it is important to understand the few differences between the Company and

the Operating Partnership in the context of how the entities operate as a consolidated company. All of the Company’s property ownership, development and related business operations are conducted through the Operating Partnership. ACC also issues public equity from time to time and guarantees certain debt of ACCOP, as disclosed in this report. ACC does not have any indebtedness, as all debt is incurred by the Operating Partnership. The Operating Partnership holds substantially all of the assets of the Company, including the Company’s ownership interests in its joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for the net proceeds from ACC’s equity offerings, which are contributed to the capital of ACCOP in exchange for OP Units on a one-for-one common share per OP Unit basis, the Operating Partnership generates all remaining capital required by the Company’s business. These sources include, but are not limited to, the Operating Partnership’s working capital, net cash provided by operating activities, borrowings under its credit facility, and proceeds received from the disposition of certain properties. Noncontrolling interests, stockholders’ equity, and partners’ capital are the main areas of difference between the consolidated financial statements of the Company and those of the Operating Partnership. The noncontrolling interests in the Operating Partnership’s financial statements consist of the interests of unaffiliated partners in various consolidated joint ventures. The noncontrolling interests in the Company’s financial statements include the same noncontrolling interests at the Operating Partnership level and OP Unit holders of the Operating Partnership. The differences between stockholders’ equity and partners’ capital result from differences in the equity issued at the Company and Operating Partnership levels.

To help investors understand the significant differences between the Company and the Operating Partnership, this report provides separate consolidated financial statements for the Company and the Operating Partnership. A single set of consolidated notes to such financial statements is presented that includes separate discussions for the Company and the Operating Partnership when applicable (for example, noncontrolling interests, stockholders’ equity or partners’ capital, earnings per share or unit, etc.). A combined Management’s Discussion and Analysis of Financial Condition and Results of Operations section is also included that presents discrete information related to each entity, as applicable. This report also includes separate Part I, Item 4 Controls and Procedures sections and separate Exhibits 31 and 32 certifications for each of the Company and the Operating Partnership in order to establish that the requisite certifications have been made and that the Company and the Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

In order to highlight the differences between the Company and the Operating Partnership, the separate sections in this report for the Company and the Operating Partnership specifically refer to the Company and the Operating Partnership. In the sections that combine disclosure of the Company and the Operating Partnership, this report refers to actions or holdings as being actions or holdings of the Company. Although the Operating Partnership is generally the entity that directly or indirectly enters into contracts and joint ventures and holds assets and debt, reference to the Company is appropriate because the Company operates its business through the Operating Partnership. The separate discussions of the Company and the Operating Partnership in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

FORM 10-Q

FOR THE QUARTER ENDED SEPTEMBER 30, 2013

TABLE OF CONTENTS

PAGE NO. | ||

PART I. | ||

Item 1. | Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries: | |

Consolidated Balance Sheets as of September 30, 2013 (unaudited) and December 31, 2012 | ||

Consolidated Statements of Comprehensive Income for the three and nine months ended September 30, 2013 and 2012 (all unaudited) | ||

Consolidated Statement of Changes in Equity for the nine months ended September 30, 2013 (unaudited) | ||

Consolidated Statements of Cash Flows for the nine months ended September 30, 2013 and 2012 (all unaudited) | ||

Consolidated Financial Statements of American Campus Communities Operating Partnership, L.P. and Subsidiaries: | ||

Consolidated Balance Sheets as of September 30, 2013 (unaudited) and December 31, 2012 | ||

Consolidated Statements of Comprehensive Income for the three and nine months ended September 30, 2013 and 2012 (all unaudited) | ||

Consolidated Statement of Changes in Capital for the nine months ended September 30, 2013 (unaudited) | ||

Consolidated Statements of Cash Flows for the nine months ended September 30, 2013 and 2012 (all unaudited) | ||

Notes to Consolidated Financial Statements of American Campus Communities, Inc. and Subsidiaries and American Campus Communities Operating Partnership, L.P. and Subsidiaries (unaudited) | ||

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 3. | Quantitative and Qualitative Disclosure about Market Risk | |

Item 4. | Controls and Procedures | |

PART II. | ||

Item 1. | Legal Proceedings | |

Item 1A. | Risk Factors | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

Item 3. | Defaults Upon Senior Securities | |

Item 4. | Mine Safety Disclosures | |

Item 5. | Other Information | |

Item 6. | Exhibits | |

SIGNATURES | ||

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

September 30, 2013 | December 31, 2012 | |||||||

(Unaudited) | ||||||||

Assets | ||||||||

Investments in real estate: | ||||||||

Wholly-owned properties, net | $ | 5,003,173 | $ | 4,871,376 | ||||

Wholly-owned properties held for sale | 23,707 | — | ||||||

On-campus participating properties, net | 62,162 | 57,346 | ||||||

Investments in real estate, net | 5,089,042 | 4,928,722 | ||||||

Cash and cash equivalents | 25,267 | 21,454 | ||||||

Restricted cash | 37,480 | 36,790 | ||||||

Student contracts receivable, net | 17,207 | 14,122 | ||||||

Other assets | 151,090 | 117,874 | ||||||

Total assets | $ | 5,320,086 | $ | 5,118,962 | ||||

Liabilities and equity | ||||||||

Liabilities: | ||||||||

Secured mortgage, construction and bond debt | $ | 1,414,943 | $ | 1,509,105 | ||||

Secured agency facility | 95,355 | 104,000 | ||||||

Unsecured notes | 398,692 | — | ||||||

Unsecured term loan | 350,000 | 350,000 | ||||||

Unsecured revolving credit facility | 175,300 | 258,000 | ||||||

Accounts payable and accrued expenses | 63,895 | 56,046 | ||||||

Other liabilities | 135,788 | 107,223 | ||||||

Total liabilities | 2,633,973 | 2,384,374 | ||||||

Commitments and contingencies (Note 14) | ||||||||

Redeemable noncontrolling interests | 49,790 | 57,534 | ||||||

Equity: | ||||||||

American Campus Communities, Inc. stockholders’ equity: | ||||||||

Common stock, $.01 par value, 800,000,000 shares authorized, 104,782,817 and 104,665,212 shares issued and outstanding at September 30, 2013 and December 31, 2012, respectively | 1,043 | 1,043 | ||||||

Additional paid in capital | 3,014,239 | 3,001,520 | ||||||

Accumulated earnings and dividends | (382,231 | ) | (347,521 | ) | ||||

Accumulated other comprehensive loss | (2,210 | ) | (6,661 | ) | ||||

Total American Campus Communities, Inc. stockholders’ equity | 2,630,841 | 2,648,381 | ||||||

Noncontrolling interests - partially owned properties | 5,482 | 28,673 | ||||||

Total equity | 2,636,323 | 2,677,054 | ||||||

Total liabilities and equity | $ | 5,320,086 | $ | 5,118,962 | ||||

See accompanying notes to consolidated financial statements.

1

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except share and per share data)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2013 | 2012 | 2013 | 2012 | |||||||||||||

Revenues | ||||||||||||||||

Wholly-owned properties | $ | 150,668 | $ | 104,062 | $ | 449,779 | $ | 286,932 | ||||||||

On-campus participating properties | 5,066 | 5,087 | 17,871 | 17,766 | ||||||||||||

Third-party development services | 622 | 1,467 | 1,656 | 7,427 | ||||||||||||

Third-party management services | 1,792 | 1,687 | 5,425 | 5,083 | ||||||||||||

Resident services | 883 | 454 | 1,912 | 982 | ||||||||||||

Total revenues | 159,031 | 112,757 | 476,643 | 318,190 | ||||||||||||

Operating expenses | ||||||||||||||||

Wholly-owned properties | 87,189 | 57,941 | 222,768 | 141,772 | ||||||||||||

On-campus participating properties | 3,021 | 3,010 | 8,454 | 8,306 | ||||||||||||

Third-party development and management services | 3,058 | 2,602 | 7,786 | 8,013 | ||||||||||||

General and administrative | 3,934 | 7,582 | 12,366 | 15,760 | ||||||||||||

Depreciation and amortization | 45,248 | 27,165 | 138,373 | 73,355 | ||||||||||||

Ground/facility leases | 1,386 | 1,093 | 3,749 | 2,861 | ||||||||||||

Total operating expenses | 143,836 | 99,393 | 393,496 | 250,067 | ||||||||||||

Operating income | 15,195 | 13,364 | 83,147 | 68,123 | ||||||||||||

Nonoperating income and (expenses) | ||||||||||||||||

Interest income | 792 | 428 | 2,165 | 1,355 | ||||||||||||

Interest expense | (19,819 | ) | (13,530 | ) | (57,063 | ) | (38,742 | ) | ||||||||

Amortization of deferred financing costs | (1,413 | ) | (1,060 | ) | (4,143 | ) | (3,012 | ) | ||||||||

Income from unconsolidated joint ventures | — | — | — | 444 | ||||||||||||

Other nonoperating income (expense) | 134 | 136 | (2,666 | ) | 14 | |||||||||||

Total nonoperating expenses | (20,306 | ) | (14,026 | ) | (61,707 | ) | (39,941 | ) | ||||||||

(Loss) income before income taxes and discontinued operations | (5,111 | ) | (662 | ) | 21,440 | 28,182 | ||||||||||

Income tax provision | (255 | ) | (181 | ) | (765 | ) | (493 | ) | ||||||||

(Loss) income from continuing operations | (5,366 | ) | (843 | ) | 20,675 | 27,689 | ||||||||||

Income attributable to discontinued operations | 367 | 1,865 | 5,373 | 7,062 | ||||||||||||

Gain from disposition of real estate | 52,831 | — | 52,831 | 83 | ||||||||||||

Total discontinued operations | 53,198 | 1,865 | 58,204 | 7,145 | ||||||||||||

Net income | 47,832 | 1,022 | 78,879 | 34,834 | ||||||||||||

Net income attributable to noncontrolling interests | ||||||||||||||||

Redeemable noncontrolling interests | (573 | ) | (66 | ) | (986 | ) | (541 | ) | ||||||||

Partially owned properties | (83 | ) | (329 | ) | (1,078 | ) | (1,312 | ) | ||||||||

Net income attributable to noncontrolling interests | (656 | ) | (395 | ) | (2,064 | ) | (1,853 | ) | ||||||||

Net income attributable to common shareholders | $ | 47,176 | $ | 627 | $ | 76,815 | $ | 32,981 | ||||||||

Other comprehensive (loss) income | ||||||||||||||||

Change in fair value of interest rate swaps | (1,163 | ) | (2,386 | ) | 4,451 | (4,191 | ) | |||||||||

Comprehensive income (loss) | $ | 46,013 | $ | (1,759 | ) | $ | 81,266 | $ | 28,790 | |||||||

(Loss) income per share attributable to common shareholders - basic | ||||||||||||||||

(Loss) income from continuing operations per share | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.32 | ||||||

Net income per share | $ | 0.45 | $ | — | $ | 0.73 | $ | 0.41 | ||||||||

(Loss) income per share attributable to common shareholders - diluted | ||||||||||||||||

(Loss) income from continuing operations per share | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.31 | ||||||

Net income per share | $ | 0.45 | $ | — | $ | 0.72 | $ | 0.40 | ||||||||

Weighted-average common shares outstanding | ||||||||||||||||

Basic | 104,781,431 | 89,169,868 | 104,752,982 | 79,404,323 | ||||||||||||

Diluted | 104,781,431 | 89,169,868 | 105,381,053 | 80,009,463 | ||||||||||||

See accompanying notes to consolidated financial statements.

2

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(unaudited, in thousands, except share data)

Common Shares | Par Value of Common Shares | Additional Paid in Capital | Accumulated Earnings and Dividends | Accumulated Other Comprehensive Loss | Noncontrolling Interests – partially owned properties | Total | |||||||||||||||||||||

Equity, December 31, 2012 | 104,665,212 | $ | 1,043 | $ | 3,001,520 | $ | (347,521 | ) | $ | (6,661 | ) | $ | 28,673 | $ | 2,677,054 | ||||||||||||

Adjustments to reflect redeemable noncontrolling interests at fair value | — | — | 10,823 | — | — | — | 10,823 | ||||||||||||||||||||

Amortization of restricted stock awards | — | — | 4,806 | — | — | — | 4,806 | ||||||||||||||||||||

Vesting of restricted stock awards and restricted stock units | 116,105 | — | (2,928 | ) | — | — | — | (2,928 | ) | ||||||||||||||||||

Distributions to common and restricted stockholders | — | — | — | (111,525 | ) | — | — | (111,525 | ) | ||||||||||||||||||

Distributions to noncontrolling joint venture partners | — | — | — | — | — | (861 | ) | (861 | ) | ||||||||||||||||||

Contributions by noncontrolling partners | — | — | — | — | — | 1,500 | 1,500 | ||||||||||||||||||||

Increase in ownership of consolidated subsidiary | — | — | — | — | — | (24,908 | ) | (24,908 | ) | ||||||||||||||||||

Conversion of preferred units to common stock | 1,500 | — | 18 | — | — | — | 18 | ||||||||||||||||||||

Change in fair value of interest rate swaps | — | — | — | — | 4,451 | — | 4,451 | ||||||||||||||||||||

Net income | — | — | — | 76,815 | — | 1,078 | 77,893 | ||||||||||||||||||||

Equity, September 30, 2013 | 104,782,817 | $ | 1,043 | $ | 3,014,239 | $ | (382,231 | ) | $ | (2,210 | ) | $ | 5,482 | $ | 2,636,323 | ||||||||||||

See accompanying notes to consolidated financial statements.

3

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

Nine Months Ended September 30, | ||||||||

2013 | 2012 | |||||||

Operating activities | ||||||||

Net income | $ | 78,879 | $ | 34,834 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Gain from disposition of real estate | (52,831 | ) | (83 | ) | ||||

Loss on remeasurement of equity method investment | — | 122 | ||||||

Depreciation and amortization | 140,059 | 77,407 | ||||||

Amortization of deferred financing costs and debt premiums/discounts | (6,397 | ) | 1,904 | |||||

Share-based compensation | 5,008 | 3,948 | ||||||

Income from unconsolidated joint ventures | — | (444 | ) | |||||

Income tax provision | 765 | 493 | ||||||

Changes in operating assets and liabilities: | ||||||||

Restricted cash | 1,468 | (2,772 | ) | |||||

Student contracts receivable, net | (3,333 | ) | (4,088 | ) | ||||

Other assets | (16,315 | ) | 1,224 | |||||

Accounts payable and accrued expenses | 3,577 | 8,930 | ||||||

Other liabilities | 25,919 | 11,877 | ||||||

Net cash provided by operating activities | 176,799 | 133,352 | ||||||

Investing activities | ||||||||

Proceeds from disposition of real estate | 155,234 | 28,167 | ||||||

Cash paid for property acquisitions | (92,508 | ) | (634,581 | ) | ||||

Cash paid for land acquisitions | (9,920 | ) | (25,103 | ) | ||||

Capital expenditures for wholly-owned properties | (52,587 | ) | (20,739 | ) | ||||

Investments in wholly-owned properties under development | (219,036 | ) | (265,070 | ) | ||||

Capital expenditures for on-campus participating properties | (1,323 | ) | (1,710 | ) | ||||

Investment in on-campus participating properties under development | (7,045 | ) | — | |||||

Investment in loans receivable | (52,038 | ) | — | |||||

Investment in mezzanine loans | (8,750 | ) | (2,000 | ) | ||||

Repayment of mezzanine loan | — | 4,000 | ||||||

Increase in escrow deposits | (2,500 | ) | (19,170 | ) | ||||

Change in restricted cash related to capital reserves | (1,156 | ) | (366 | ) | ||||

Proceeds from insurance settlement | 636 | — | ||||||

Purchase of corporate furniture, fixtures and equipment | (1,997 | ) | (1,396 | ) | ||||

Net cash used in investing activities | (292,990 | ) | (937,968 | ) | ||||

Financing activities | ||||||||

Proceeds from unsecured notes | 398,636 | — | ||||||

Proceeds from sale of common stock | — | 838,313 | ||||||

Offering costs | — | (33,223 | ) | |||||

Pay-off of mortgage loans and construction loans | (61,891 | ) | (62,182 | ) | ||||

Proceeds from unsecured term loan | — | 150,000 | ||||||

Proceeds from credit facilities | 364,855 | 371,000 | ||||||

Pay downs of credit facilities | (456,200 | ) | (438,000 | ) | ||||

Proceeds from construction loans | 3,917 | 72,583 | ||||||

Principal payments on debt | (11,353 | ) | (8,064 | ) | ||||

Redemption of common units for cash | — | (132 | ) | |||||

Debt issuance and assumption costs | (4,239 | ) | (5,655 | ) | ||||

Distributions to common and restricted stockholders | (111,525 | ) | (82,083 | ) | ||||

Distributions to noncontrolling partners | (2,196 | ) | (2,329 | ) | ||||

Net cash provided by financing activities | 120,004 | 800,228 | ||||||

Net change in cash and cash equivalents | 3,813 | (4,388 | ) | |||||

Cash and cash equivalents at beginning of period | 21,454 | 22,399 | ||||||

Cash and cash equivalents at end of period | $ | 25,267 | $ | 18,011 | ||||

Supplemental disclosure of non-cash investing and financing activities | ||||||||

Loans assumed in connection with property acquisitions | $ | — | $ | (250,073 | ) | |||

Issuance of common units in connection with property acquisitions | $ | (3,451 | ) | $ | (15,000 | ) | ||

Change in fair value of derivative instruments, net | $ | 4,451 | $ | (4,191 | ) | |||

Supplemental disclosure of cash flow information | ||||||||

Interest paid | $ | 70,226 | $ | 48,390 | ||||

See accompanying notes to consolidated financial statements.

4

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except unit data)

September 30, 2013 | December 31, 2012 | |||||||

(Unaudited) | ||||||||

Assets | ||||||||

Investments in real estate: | ||||||||

Wholly-owned properties, net | $ | 5,003,173 | $ | 4,871,376 | ||||

Wholly-owned properties held for sale | 23,707 | — | ||||||

On-campus participating properties, net | 62,162 | 57,346 | ||||||

Investments in real estate, net | 5,089,042 | 4,928,722 | ||||||

Cash and cash equivalents | 25,267 | 21,454 | ||||||

Restricted cash | 37,480 | 36,790 | ||||||

Student contracts receivable, net | 17,207 | 14,122 | ||||||

Other assets | 151,090 | 117,874 | ||||||

Total assets | $ | 5,320,086 | $ | 5,118,962 | ||||

Liabilities and capital | ||||||||

Liabilities: | ||||||||

Secured mortgage, construction and bond debt | $ | 1,414,943 | $ | 1,509,105 | ||||

Secured agency facility | 95,355 | 104,000 | ||||||

Unsecured notes | 398,692 | — | ||||||

Unsecured term loan | 350,000 | 350,000 | ||||||

Unsecured revolving credit facility | 175,300 | 258,000 | ||||||

Accounts payable and accrued expenses | 63,895 | 56,046 | ||||||

Other liabilities | 135,788 | 107,223 | ||||||

Total liabilities | 2,633,973 | 2,384,374 | ||||||

Commitments and contingencies (Note 14) | ||||||||

Redeemable limited partners | 49,790 | 57,534 | ||||||

Capital: | ||||||||

Partners’ capital: | ||||||||

General partner – 12,222 OP units outstanding at both September 30, 2013 and December 31, 2012 | 112 | 116 | ||||||

Limited partner – 104,770,595 and 104,652,990 OP units outstanding at September 30, 2013 and December 31, 2012, respectively | 2,632,939 | 2,654,926 | ||||||

Accumulated other comprehensive loss | (2,210 | ) | (6,661 | ) | ||||

Total partners’ capital | 2,630,841 | 2,648,381 | ||||||

Noncontrolling interests - partially owned properties | 5,482 | 28,673 | ||||||

Total capital | 2,636,323 | 2,677,054 | ||||||

Total liabilities and capital | $ | 5,320,086 | $ | 5,118,962 | ||||

See accompanying notes to consolidated financial statements.

5

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(unaudited, in thousands, except unit and per unit data)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2013 | 2012 | 2013 | 2012 | |||||||||||||

Revenues | ||||||||||||||||

Wholly-owned properties | $ | 150,668 | $ | 104,062 | $ | 449,779 | $ | 286,932 | ||||||||

On-campus participating properties | 5,066 | 5,087 | 17,871 | 17,766 | ||||||||||||

Third-party development services | 622 | 1,467 | 1,656 | 7,427 | ||||||||||||

Third-party management services | 1,792 | 1,687 | 5,425 | 5,083 | ||||||||||||

Resident services | 883 | 454 | 1,912 | 982 | ||||||||||||

Total revenues | 159,031 | 112,757 | 476,643 | 318,190 | ||||||||||||

Operating expenses | ||||||||||||||||

Wholly-owned properties | 87,189 | 57,941 | 222,768 | 141,772 | ||||||||||||

On-campus participating properties | 3,021 | 3,010 | 8,454 | 8,306 | ||||||||||||

Third-party development and management services | 3,058 | 2,602 | 7,786 | 8,013 | ||||||||||||

General and administrative | 3,934 | 7,582 | 12,366 | 15,760 | ||||||||||||

Depreciation and amortization | 45,248 | 27,165 | 138,373 | 73,355 | ||||||||||||

Ground/facility leases | 1,386 | 1,093 | 3,749 | 2,861 | ||||||||||||

Total operating expenses | 143,836 | 99,393 | 393,496 | 250,067 | ||||||||||||

Operating income | 15,195 | 13,364 | 83,147 | 68,123 | ||||||||||||

Nonoperating income and (expenses) | ||||||||||||||||

Interest income | 792 | 428 | 2,165 | 1,355 | ||||||||||||

Interest expense | (19,819 | ) | (13,530 | ) | (57,063 | ) | (38,742 | ) | ||||||||

Amortization of deferred financing costs | (1,413 | ) | (1,060 | ) | (4,143 | ) | (3,012 | ) | ||||||||

Income from unconsolidated joint ventures | — | — | — | 444 | ||||||||||||

Other nonoperating income (expense) | 134 | 136 | (2,666 | ) | 14 | |||||||||||

Total nonoperating expenses | (20,306 | ) | (14,026 | ) | (61,707 | ) | (39,941 | ) | ||||||||

(Loss) income before income taxes and discontinued operations | (5,111 | ) | (662 | ) | 21,440 | 28,182 | ||||||||||

Income tax provision | (255 | ) | (181 | ) | (765 | ) | (493 | ) | ||||||||

(Loss) income from continuing operations | (5,366 | ) | (843 | ) | 20,675 | 27,689 | ||||||||||

Income attributable to discontinued operations | 367 | 1,865 | 5,373 | 7,062 | ||||||||||||

Gain from disposition of real estate | 52,831 | — | 52,831 | 83 | ||||||||||||

Total discontinued operations | 53,198 | 1,865 | 58,204 | 7,145 | ||||||||||||

Net income | 47,832 | 1,022 | 78,879 | 34,834 | ||||||||||||

Net income attributable to noncontrolling interests – partially owned properties | (83 | ) | (329 | ) | (1,078 | ) | (1,312 | ) | ||||||||

Net income attributable to American Campus Communities Operating Partnership, L.P. | 47,749 | 693 | 77,801 | 33,522 | ||||||||||||

Series A preferred unit distributions | (46 | ) | (46 | ) | (137 | ) | (137 | ) | ||||||||

Net income available to common unitholders | $ | 47,703 | $ | 647 | $ | 77,664 | $ | 33,385 | ||||||||

Other comprehensive (loss) income | ||||||||||||||||

Change in fair value of interest rate swaps | (1,163 | ) | (2,386 | ) | 4,451 | (4,191 | ) | |||||||||

Comprehensive income (loss) | $ | 46,540 | $ | (1,739 | ) | $ | 82,115 | $ | 29,194 | |||||||

(Loss) income per unit attributable to common unitholders – basic | ||||||||||||||||

(Loss) income from continuing operations per unit | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.32 | ||||||

Net income per unit | $ | 0.45 | $ | — | $ | 0.73 | $ | 0.41 | ||||||||

(Loss) income per unit attributable to common unitholders – diluted | ||||||||||||||||

(Loss) income from continuing operations per unit | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.31 | ||||||

Net income per unit | $ | 0.45 | $ | — | $ | 0.72 | $ | 0.40 | ||||||||

Weighted-average common units outstanding | ||||||||||||||||

Basic | 105,919,787 | 90,069,204 | 105,887,837 | 80,291,801 | ||||||||||||

Diluted | 105,919,787 | 90,069,204 | 106,515,908 | 80,896,941 | ||||||||||||

See accompanying notes to consolidated financial statements.

6

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN CAPITAL

(unaudited, in thousands, except unit data)

Accumulated | Noncontrolling | |||||||||||||||||||||||||

Other | Interests - | |||||||||||||||||||||||||

General Partner | Limited Partner | Comprehensive | Partially Owned | |||||||||||||||||||||||

Units | Amount | Units | Amount | Loss | Properties | Total | ||||||||||||||||||||

Capital as of December 31, 2012 | 12,222 | $ | 116 | 104,652,990 | $ | 2,654,926 | $ | (6,661 | ) | $ | 28,673 | $ | 2,677,054 | |||||||||||||

Adjustments to reflect redeemable limited partners’ interest at fair value | — | — | — | 10,823 | — | — | 10,823 | |||||||||||||||||||

Amortization of restricted stock awards | — | — | — | 4,806 | — | — | 4,806 | |||||||||||||||||||

Vesting of restricted stock awards and restricted stock units | — | — | 116,105 | (2,928 | ) | — | — | (2,928 | ) | |||||||||||||||||

Distributions | — | (13 | ) | — | (111,512 | ) | — | — | (111,525 | ) | ||||||||||||||||

Distributions to noncontrolling joint venture partners | — | — | — | — | — | (861 | ) | (861 | ) | |||||||||||||||||

Contributions by noncontrolling partners | — | — | — | — | — | 1,500 | 1,500 | |||||||||||||||||||

Increase in ownership of consolidated subsidiary | — | — | — | — | — | (24,908 | ) | (24,908 | ) | |||||||||||||||||

Conversion of preferred units to common stock | — | — | 1,500 | 18 | — | — | 18 | |||||||||||||||||||

Change in fair value of interest rate swaps | — | — | — | — | 4,451 | — | 4,451 | |||||||||||||||||||

Net income | — | 9 | — | 76,806 | — | 1,078 | 77,893 | |||||||||||||||||||

Capital as of September 30, 2013 | 12,222 | $ | 112 | 104,770,595 | $ | 2,632,939 | $ | (2,210 | ) | $ | 5,482 | $ | 2,636,323 | |||||||||||||

See accompanying notes to consolidated financial statements.

7

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in thousands)

Nine Months Ended September 30, | ||||||||

2013 | 2012 | |||||||

Operating activities | ||||||||

Net income | $ | 78,879 | $ | 34,834 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Gain from disposition of real estate | (52,831 | ) | (83 | ) | ||||

Loss on remeasurement of equity method investment | — | 122 | ||||||

Depreciation and amortization | 140,059 | 77,407 | ||||||

Amortization of deferred financing costs and debt premiums/discounts | (6,397 | ) | 1,904 | |||||

Share-based compensation | 5,008 | 3,948 | ||||||

Income from unconsolidated joint ventures | — | (444 | ) | |||||

Income tax provision | 765 | 493 | ||||||

Changes in operating assets and liabilities: | ||||||||

Restricted cash | 1,468 | (2,772 | ) | |||||

Student contracts receivable, net | (3,333 | ) | (4,088 | ) | ||||

Other assets | (16,315 | ) | 1,224 | |||||

Accounts payable and accrued expenses | 3,577 | 8,930 | ||||||

Other liabilities | 25,919 | 11,877 | ||||||

Net cash provided by operating activities | 176,799 | 133,352 | ||||||

Investing activities | ||||||||

Proceeds from disposition of real estate | 155,234 | 28,167 | ||||||

Cash paid for property acquisitions | (92,508 | ) | (634,581 | ) | ||||

Cash paid for land acquisitions | (9,920 | ) | (25,103 | ) | ||||

Capital expenditures for wholly-owned properties | (52,587 | ) | (20,739 | ) | ||||

Investments in wholly-owned properties under development | (219,036 | ) | (265,070 | ) | ||||

Capital expenditures for on-campus participating properties | (1,323 | ) | (1,710 | ) | ||||

Investment in loans receivable | (52,038 | ) | — | |||||

Investment in mezzanine loans | (8,750 | ) | (2,000 | ) | ||||

Investment in on-campus participating properties under development | (7,045 | ) | — | |||||

Repayment of mezzanine loan | — | 4,000 | ||||||

Increase in escrow deposits | (2,500 | ) | (19,170 | ) | ||||

Change in restricted cash related to capital reserves | (1,156 | ) | (366 | ) | ||||

Proceeds from insurance settlement | 636 | — | ||||||

Purchase of corporate furniture, fixtures and equipment | (1,997 | ) | (1,396 | ) | ||||

Net cash used in investing activities | (292,990 | ) | (937,968 | ) | ||||

Financing activities | ||||||||

Proceeds from unsecured notes | 398,636 | — | ||||||

Proceeds from issuance of common units in exchange for contributions, net | — | 805,090 | ||||||

Pay-off of mortgage loans and constructions loans | (61,891 | ) | (62,182 | ) | ||||

Proceeds from unsecured term loan | — | 150,000 | ||||||

Proceeds from credit facilities | 364,855 | 371,000 | ||||||

Paydowns of credit facilities | (456,200 | ) | (438,000 | ) | ||||

Proceeds from construction loans | 3,917 | 72,583 | ||||||

Principal payments on debt | (11,353 | ) | (8,064 | ) | ||||

Redemption of common units for cash | — | (132 | ) | |||||

Debt issuance and assumption costs | (4,239 | ) | (5,655 | ) | ||||

Distributions paid on unvested restricted stock awards | (710 | ) | (652 | ) | ||||

Distributions paid on common units | (112,013 | ) | (82,301 | ) | ||||

Distributions paid on preferred units | (137 | ) | (137 | ) | ||||

Distributions paid to noncontrolling partners - partially owned properties | (861 | ) | (1,322 | ) | ||||

Net cash provided by financing activities | 120,004 | 800,228 | ||||||

Net change in cash and cash equivalents | 3,813 | (4,388 | ) | |||||

Cash and cash equivalents at beginning of period | 21,454 | 22,399 | ||||||

Cash and cash equivalents at end of period | $ | 25,267 | $ | 18,011 | ||||

Supplemental disclosure of non-cash investing and financing activities | ||||||||

Loans assumed in connection with property acquisitions | $ | — | $ | (250,073 | ) | |||

Issuance of common units in connection with property acquistiions | $ | (3,451 | ) | $ | (15,000 | ) | ||

Change in fair value of derivative instruments, net | $ | 4,451 | $ | (4,191 | ) | |||

Supplemental disclosure of cash flow information | ||||||||

Interest paid | $ | 70,226 | $ | 48,390 | ||||

See accompanying notes to consolidated financial statements.

8

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. Organization and Description of Business

American Campus Communities, Inc. (“ACC”) is a real estate investment trust (“REIT”) that commenced operations effective with the completion of an initial public offering (“IPO”) on August 17, 2004. Through ACC’s controlling interest in American Campus Communities Operating Partnership, L.P. (“ACCOP”), ACC is one of the largest owners, managers and developers of high quality student housing properties in the United States in terms of beds owned and under management. ACC is a fully integrated, self-managed and self-administered equity REIT with expertise in the acquisition, design, financing, development, construction management, leasing and management of student housing properties. ACC’s common stock is publicly traded on the New York Stock Exchange (“NYSE”) under the ticker symbol “ACC.”

The general partner of ACCOP is American Campus Communities Holdings, LLC (“ACC Holdings”), an entity that is wholly-owned by ACC. As of September 30, 2013, ACC Holdings held an ownership interest in ACCOP of less than 1%. The limited partners of ACCOP are ACC and other limited partners consisting of current and former members of management and nonaffiliated third parties. As of September 30, 2013, ACC owned an approximate 98.7% limited partnership interest in ACCOP. As the sole member of the general partner of ACCOP, ACC has exclusive control of ACCOP’s day-to-day management. Management operates ACC and ACCOP as one business. The management of ACC consists of the same members as the management of ACCOP. ACC consolidates ACCOP for financial reporting purposes, and ACC does not have significant assets other than its investment in ACCOP. Therefore, the assets and liabilities of ACC and ACCOP are the same on their respective financial statements. References to the “Company,” “we,” “us” or “our” mean collectively ACC, ACCOP and those entities/subsidiaries owned or controlled by ACC and/or ACCOP. References to the “Operating Partnership” mean collectively ACCOP and those entities/subsidiaries owned or controlled by ACCOP. Unless otherwise indicated, the accompanying Notes to the Consolidated Financial Statements apply to both the Company and the Operating Partnership.

As of September 30, 2013, our property portfolio contained 165 properties with approximately 100,600 beds in approximately 32,700 apartment units. Our property portfolio consisted of 142 owned off-campus student housing properties that are in close proximity to colleges and universities, 18 American Campus Equity (“ACE®”) properties operated under ground/facility leases with eight university systems and five on-campus participating properties operated under ground/facility leases with the related university systems. Of the 165 properties, eight were under development as of September 30, 2013, and when completed will consist of a total of approximately 5,500 beds in approximately 1,700 units. Our communities contain modern housing units and are supported by a resident assistant system and other student-oriented programming, with many offering resort-style amenities.

Through one of ACC’s taxable REIT subsidiaries (“TRSs”), we also provide construction management and development services, primarily for student housing properties owned by colleges and universities, charitable foundations, and others. As of September 30, 2013, also through one of ACC’s TRSs, we provided third-party management and leasing services for 35 properties that represented approximately 25,900 beds in approximately 10,500 units. Third-party management and leasing services are typically provided pursuant to management contracts that have initial terms that range from one to five years. As of September 30, 2013, our total owned and third-party managed portfolio included 200 properties with approximately 126,500 beds in approximately 43,200 units.

2. Summary of Significant Accounting Policies

Basis of Presentation

The accompanying consolidated financial statements, presented in U.S. dollars, are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). GAAP requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities as of the date of the financial statements, and revenue and expenses during the reporting periods. Our actual results could differ from those estimates and assumptions. All material intercompany transactions among consolidated entities have been eliminated. All dollar amounts in the tables herein, except share, per share, unit and per unit amounts, are stated in thousands unless otherwise indicated. Certain prior period amounts have been reclassified to conform to the current period presentation.

Interim Financial Statements

The accompanying interim financial statements are unaudited, but have been prepared in accordance with GAAP for interim financial information and in conjunction with the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all disclosures required by GAAP for complete financial statements. In the opinion of management, all adjustments (consisting solely of normal recurring matters) necessary for a fair presentation of the financial statements of the

9

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Company for these interim periods have been included. Because of the seasonal nature of the Company’s operations, the results of operations and cash flows for any interim period are not necessarily indicative of results for other interim periods or for the full year. These financial statements should be read in conjunction with the financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Investments in Real Estate

Investments in real estate are recorded at historical cost. Major improvements that extend the life of an asset are capitalized and depreciated over the remaining useful life of the asset. The cost of ordinary repairs and maintenance are charged to expense when incurred. Depreciation and amortization are recorded on a straight-line basis over the estimated useful lives of the assets as follows:

Buildings and improvements | 7-40 years | |

Leasehold interest - on-campus participating properties | 25-34 years (shorter of useful life or respective lease term) | |

Furniture, fixtures and equipment | 3-7 years | |

Project costs directly associated with the development and construction of an owned real estate project, which include interest, property taxes, and amortization of deferred finance costs, are capitalized as construction in progress. Upon completion of the project, costs are transferred into the applicable asset category and depreciation commences. Interest totaling approximately $2.8 million and $2.4 million was capitalized during the three months ended September 30, 2013 and 2012, respectively, and $8.6 million and $8.3 million was capitalized during the nine months ended September 30, 2013 and 2012, respectively. Amortization of deferred financing costs totaling approximately $0.1 and was capitalized as construction in progress during both the three months ended September 30, 2013 and 2012, and $0.2 million and was capitalized as construction in progress during both the nine months ended September 30, 2013 and 2012.

Management assesses whether there has been an impairment in the value of the Company’s investments in real estate whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Impairment is recognized when estimated expected future undiscounted cash flows are less than the carrying value of the property. The estimation of expected future net cash flows is inherently uncertain and relies on assumptions regarding current and future economics and market conditions. If such conditions change, then an adjustment to the carrying value of the Company’s long-lived assets could occur in the future period in which the conditions change. To the extent that a property is impaired, the excess of the carrying amount of the property over its estimated fair value is charged to earnings. The Company believes that there were no impairments of the carrying values of its investments in real estate as of September 30, 2013.

The Company allocates the purchase price of acquired properties to net tangible and identified intangible assets based on relative fair values. Fair value estimates are based on information obtained from a number of sources, including independent appraisals that may be obtained in connection with the acquisition or financing of the respective property, our own analysis of recently acquired and existing comparable properties in our portfolio, and other market data. Information obtained about each property as a result of due diligence, marketing and leasing activities is also considered. The value allocated to land is generally based on the actual purchase price adjusted to fair value (as necessary) if acquired separately, or market research / comparables if acquired as part of an existing operating property. The value allocated to building is based on the fair value determined on an “as-if vacant” basis, which is estimated using an income, or discounted cash flow, approach that relies upon internally determined assumptions that we believe are consistent with current market conditions for similar properties. The value allocated to furniture, fixtures, and equipment is based on an estimate of the fair value of the appliances and fixtures inside the units.

Long-Lived Assets–Held for Sale

Long-lived assets to be disposed of are classified as Held for Sale in the period in which all of the following criteria are met:

10

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

a. | Management, having the authority to approve the action, commits to a plan to sell the asset. |

b. | The asset is available for immediate sale in its present condition subject only to terms that are usual and customary for sales of such assets. |

c. | An active program to locate a buyer and other actions required to complete the plan to sell the asset have been initiated. |

d. | The sale of the asset is probable, and transfer of the asset is expected to qualify for recognition as a completed sale, within one year. |

e. | The asset is being actively marketed for sale at a price that is reasonable in relation to its current fair value. |

f. | Actions required to complete the plan indicate that it is unlikely that significant changes to the plan will be made or that the plan will be withdrawn. |

Concurrent with this classification, the asset is recorded at the lower of cost or fair value less estimated selling costs, and depreciation ceases.

Loans Receivable

Loans held for investment are intended to be held to maturity and, accordingly, are carried at cost, net of unamortized loan purchase discounts, and net of an allowance for loan losses when such loan is deemed to be impaired. Loan purchase discounts are amortized over the term of the loan. The Company considers a loan impaired when, based upon current information and events, it is probable that it will be unable to collect all amounts due for both principal and interest according to the contractual terms of the loan agreement. Significant judgments are required in determining whether impairment has occurred. The Company performs an impairment analysis by comparing either the present value of expected future cash flows discounted at the loan’s effective interest rate, the loan’s observable current market price or the fair value of the underlying collateral to the net carrying value of the loan, which may result in an allowance and corresponding loan loss charge. Loans receivable are included in other assets on the accompanying consolidated balance sheets.

Intangible Assets

A portion of the purchase price of acquired properties is allocated to the value of in-place leases for both student and commercial tenants, which is based on the difference between (i) the property valued with existing in-place leases adjusted to market rental rates and (ii) the property valued “as-if” vacant. As lease terms for student leases are typically one year or less, rates on in-place leases generally approximate market rental rates. Factors considered in the valuation of in-place leases include an estimate of the carrying costs during the expected lease-up period considering current market conditions, nature of the tenancy, and costs to execute similar leases. Carrying costs include estimates of lost rentals at market rates during the expected lease-up period, as well as marketing and other operating expenses. The value of in-place leases is amortized over the remaining initial term of the respective leases. The purchase price of property acquisitions is not expected to be allocated to student tenant relationships, considering the terms of the leases and the expected levels of renewals.

Amortization expense related to in-place leases was approximately $2.1 million and $1.4 million for the three months ended September 30, 2013 and 2012, respectively, and $13.0 million and $3.5 million for the nine months ended September 30, 2013 and 2012, respectively. Accumulated amortization at September 30, 2013 and December 31, 2012 was approximately $24.8 million and $12.4 million, respectively. Intangible assets, net of amortization, are included in other assets on the accompanying consolidated balance sheets and the amortization of intangible assets is included in depreciation and amortization expense in the accompanying consolidated statements of comprehensive income.

Mortgage Debt - Premiums and Discounts

Mortgage debt premiums and discounts represent fair value adjustments to account for the difference between the stated rates and market rates of mortgage debt assumed in connection with the Company’s property acquisitions. The mortgage debt premiums and discounts are amortized to interest expense over the term of the related mortgage loans using the effective-interest method. The amortization of mortgage debt premiums and discounts resulted in a net decrease to interest expense of approximately $3.4 million and $0.6 million for the three months ended September 30, 2013 and 2012, respectively, and $10.6 million and $1.2 million for

11

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

the nine months ended September 30, 2013 and 2012, respectively. Mortgage debt premiums and discounts are included in secured mortgage, construction and bond debt on the accompanying consolidated balance sheets and amortization of mortgage debt premiums and discounts is included in interest expense on the accompanying consolidated statements of comprehensive income.

Unsecured Notes - Original Issue Discount

In April 2013, the Company issued $400 million of senior unsecured notes at 99.659 percent of par value (see Note 8) and recorded an original issue discount of approximately $1.4 million. The original issue discount is amortized to interest expense over the term of the unsecured notes using the effective-interest method. The unamortized original issue discount was approximately $1.3 million as of September 30, 2013 and is included in unsecured notes on the accompanying consolidated balance sheets and amortization of the original issue discount of $28,000 and $56,000 for the three and nine months ended September 30, 2013, respectively, is included in interest expense on the accompanying consolidated statements of comprehensive income.

Pre-development Expenditures

Pre-development expenditures such as architectural fees, permits and deposits associated with the pursuit of third-party and owned development projects are expensed as incurred, until such time that management believes it is probable that the contract will be executed and/or construction will commence. Because the Company frequently incurs these pre-development expenditures before a financing commitment and/or required permits and authorizations have been obtained, the Company bears the risk of loss of these pre-development expenditures if financing cannot ultimately be arranged on acceptable terms or the Company is unable to successfully obtain the required permits and authorizations. As such, management evaluates the status of third-party and owned projects that have not yet commenced construction on a periodic basis and expenses any deferred costs related to projects whose current status indicates the commencement of construction is unlikely and/or the costs may not provide future value to the Company in the form of revenues. Such write-offs are included in third-party development and management services expenses (in the case of third-party development projects) or general and administrative expenses (in the case of owned development projects) on the accompanying consolidated statements of comprehensive income. As of September 30, 2013, the Company has deferred approximately $2.4 million in pre-development costs related to third-party and owned development projects that have not yet commenced construction. Such costs are included in other assets on the accompanying consolidated balance sheets.

Earnings per Share – Company

Basic earnings per share is computed using net income attributable to common shareholders and the weighted average number of shares of the Company’s common stock outstanding during the period. Diluted earnings per share reflect common shares issuable from the assumed conversion of OP Units and common share awards granted. Only those items having a dilutive impact on basic earnings per share are included in diluted earnings per share.

The following potentially dilutive securities were outstanding for the three and nine months ended September 30, 2013 and 2012, but were not included in the computation of diluted earnings per share because the effects of their inclusion would be anti-dilutive.

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2013 | 2012 | 2013 | 2012 | |||||||||

Common OP Units (Note 10) | 1,138,356 | 899,336 | 1,134,855 | 887,478 | ||||||||

Preferred OP Units (Note 10) | 114,014 | 114,128 | 114,090 | 114,128 | ||||||||

Restricted Stock Awards (Note 11) | 606,024 | 581,627 | — | — | ||||||||

Total potentially dilutive securities | 1,858,394 | 1,595,091 | 1,248,945 | 1,001,606 | ||||||||

12

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

The following is a summary of the elements used in calculating basic and diluted earnings per share:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2013 | 2012 | 2013 | 2012 | |||||||||||||

Numerator – basic and diluted earnings per share: | ||||||||||||||||

(Loss) income from continuing operations | $ | (5,366 | ) | $ | (843 | ) | $ | 20,675 | $ | 27,689 | ||||||

Income from continuing operations attributable to noncontrolling interests | (30 | ) | (374 | ) | (1,380 | ) | (1,762 | ) | ||||||||

(Loss) income from continuing operations attributable to common shareholders | (5,396 | ) | (1,217 | ) | 19,295 | 25,927 | ||||||||||

Amount allocated to participating securities | (218 | ) | (196 | ) | (710 | ) | (652 | ) | ||||||||

(Loss) income from continuing operations attributable to common shareholders, net of amount allocated to participating securities | (5,614 | ) | (1,413 | ) | 18,585 | 25,275 | ||||||||||

Income from discontinued operations | 53,198 | 1,865 | 58,204 | 7,145 | ||||||||||||

Income from discontinued operations attributable to noncontrolling interests | (626 | ) | (21 | ) | (684 | ) | (91 | ) | ||||||||

Income from discontinued operations attributable to common shareholders | 52,572 | 1,844 | 57,520 | 7,054 | ||||||||||||

Net income attributable to common shareholders | $ | 46,958 | $ | 431 | $ | 76,105 | $ | 32,329 | ||||||||

Denominator: | ||||||||||||||||

Basic weighted average common shares outstanding | 104,781,431 | 89,169,868 | 104,752,982 | 79,404,323 | ||||||||||||

Restricted Stock Awards (Note 11) | — | — | 628,071 | 605,140 | ||||||||||||

Diluted weighted average common shares outstanding | 104,781,431 | 89,169,868 | 105,381,053 | 80,009,463 | ||||||||||||

Earnings per share – basic: | ||||||||||||||||

(Loss) income from continuing operations attributable to common shareholders, net of amount allocated to participating securities | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.32 | ||||||

Income from discontinued operations attributable to common shareholders | $ | 0.50 | $ | 0.02 | $ | 0.55 | $ | 0.09 | ||||||||

Net income attributable to common shareholders | $ | 0.45 | $ | — | $ | 0.73 | $ | 0.41 | ||||||||

Earnings per share – diluted: | ||||||||||||||||

(Loss) income from continuing operations attributable to common shareholders, net of amount allocated to participating securities | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.31 | ||||||

Income from discontinued operations attributable to common shareholders | $ | 0.50 | $ | 0.02 | $ | 0.54 | $ | 0.09 | ||||||||

Net income attributable to common shareholders | $ | 0.45 | $ | — | $ | 0.72 | $ | 0.40 | ||||||||

Earnings per Unit – Operating Partnership

Basic earnings per OP Unit is computed using net income attributable to common unitholders and the weighted average number of common units outstanding during the period. Diluted earnings per OP Unit reflects the potential dilution that could occur if securities or other contracts to issue OP Units were exercised or converted into OP Units or resulted in the issuance of OP Units and then shared in the earnings of the Operating Partnership.

The following potentially dilutive securities were outstanding for the three months ended September 30, 2013 and 2012, but were not included in the computation of diluted earnings per unit because the effects of their inclusion would be anti-dilutive.

13

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

2013 | 2012 | 2013 | 2012 | |||||||||

Restricted Stock Awards (Note 11) | 606,024 | 581,627 | — | — | ||||||||

Total potentially dilutive securities | 606,024 | 581,627 | — | — | ||||||||

The following is a summary of the elements used in calculating basic and diluted earnings per unit:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2013 | 2012 | 2013 | 2012 | |||||||||||||

Numerator – basic and diluted earnings per unit: | ||||||||||||||||

(Loss) income from continuing operations | $ | (5,366 | ) | $ | (843 | ) | $ | 20,675 | $ | 27,689 | ||||||

Income from continuing operations attributable to noncontrolling interests – partially owned properties | (83 | ) | (329 | ) | (1,078 | ) | (1,312 | ) | ||||||||

Loss (income) from continuing operations attributable to Series A preferred units | 11 | (44 | ) | (76 | ) | (127 | ) | |||||||||

Amount allocated to participating securities | (218 | ) | (196 | ) | (710 | ) | (652 | ) | ||||||||

(Loss) income from continuing operations attributable to common unitholders, net of amount allocated to participating securities | (5,656 | ) | (1,412 | ) | 18,811 | 25,598 | ||||||||||

Income from discontinued operations | 53,198 | 1,865 | 58,204 | 7,145 | ||||||||||||

Income from discontinued operations attributable to Series A preferred units | (57 | ) | (2 | ) | (61 | ) | (10 | ) | ||||||||

Income from discontinued operations attributable to common unitholders | 53,141 | 1,863 | 58,143 | 7,135 | ||||||||||||

Net income attributable to common unitholders | $ | 47,485 | $ | 451 | $ | 76,954 | $ | 32,733 | ||||||||

Denominator: | ||||||||||||||||

Basic weighted average common units outstanding | 105,919,787 | 90,069,204 | 105,887,837 | 80,291,801 | ||||||||||||

Restricted Stock Awards (Note 11) | — | — | 628,071 | 605,140 | ||||||||||||

Diluted weighted average common units outstanding | 105,919,787 | 90,069,204 | 106,515,908 | 80,896,941 | ||||||||||||

Earnings per unit - basic: | ||||||||||||||||

(Loss) income from continuing operations attributable to common unitholders, net of amount allocated to participating securities | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.32 | ||||||

Income from discontinued operations attributable to common unitholders | $ | 0.50 | $ | 0.02 | $ | 0.55 | $ | 0.09 | ||||||||

Net income attributable to common unitholders | $ | 0.45 | $ | — | $ | 0.73 | $ | 0.41 | ||||||||

Earnings per unit - diluted: | ||||||||||||||||

(Loss) income from continuing operations attributable to common unitholders, net of amount allocated to participating securities | $ | (0.05 | ) | $ | (0.02 | ) | $ | 0.18 | $ | 0.31 | ||||||

Income from discontinued operations attributable to common unitholders | $ | 0.50 | $ | 0.02 | $ | 0.54 | $ | 0.09 | ||||||||

Net income attributable to common unitholders | $ | 0.45 | $ | — | $ | 0.72 | $ | 0.40 | ||||||||

3. Property Acquisitions

The Company previously provided mezzanine financing of $2.0 million to a private developer and was obligated to purchase a 152-unit, 608-bed property (Townhomes at Newtown Crossing) once construction was completed and certain closing conditions

14

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

were met. The property opened for operations in August 2013, and the Company acquired Townhomes at Newtown Crossing on September 26, 2013 for a purchase price of $38.8 million, at which time the Company's mezzanine investment along with accrued but unpaid interest was credited to the Company. As part of the transaction, the Company issued 97,143 common OP units to the seller, valued at $35.53 per unit and the Company did not assume any property-level debt. Townhomes at Newtown Crossing is located in Lexington, Kentucky near the University of Kentucky campus.

On August 20, 2013, the Company acquired The Plaza Apartments, a 289-unit, 359-bed wholly-owned property located near the campus of Florida State University, for a purchase price of $10.4 million. The Company will operate the property until the current leases are vacated, which will be no later than July 31, 2014. Once the property is vacated, it will be demolished and developed into a 496-bed community scheduled to open for occupancy in August 2015. The Company did not assume any property-level debt as part of this transaction.

On July 31, 2013, the Company acquired a 366-bed additional phase at an existing property, The Lodges of East Lansing, for a purchase price of $32.3 million. Concurrent with the purchase of the Kayne Anderson Portfolio on November 30, 2012, the Company entered into a purchase and sale agreement whereby the Company was obligated to purchase this additional phase as long as the developer met certain construction completion deadlines and other completion deadlines. This additional phase opened for operations in August 2013 and serves students attending Michigan State University. The Company deposited $8.3 million towards the purchase price of this additional phase on November 30, 2012 and the remaining $24.0 million was paid at closing. The Company did not assume any property-level debt as part of this transaction.

On July 25, 2013, the Company acquired 7th Street Station, an 82-unit, 309-bed wholly-owned property located near the campus of Oregon State University, for a purchase price of $26.5 million, which excludes approximately $0.5 million of anticipated transaction costs, initial integration expenses and capital expenditures necessary to bring this property up to the Company’s operating standards. The Company did not assume any property-level debt as part of this transaction.

The acquired property’s results of operations have been included in the accompanying consolidated statements of comprehensive income since their respective acquisition closing dates, with the exception of properties subject to pre-sale/mezzanine investment agreements. As a result of applying accounting guidance related to variable interest entities ("VIEs"), we include properties subject to pre-sale/mezzanine investment agreements in our consolidated financial statements during the construction period. As a result, Townhomes at Newtown Crossing’s results of operations have been included in the accompanying consolidated statements of comprehensive income from the date of project completion in August 2013 through the acquisition date in September 2013. The following pro forma information for the three and nine months ended September 30, 2013 and 2012, presents consolidated financial information for the Company as if the property acquisitions discussed above had occurred at the beginning of the earliest period presented. The unaudited pro forma information is provided for informational purposes only and is not indicative of results that would have occurred or which may occur in the future:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2013 | 2012 | 2013 | 2012 | ||||||||||||

Total revenues | $ | 159,859 | $ | 113,484 | $ | 479,332 | $ | 319,972 | |||||||

Net income attributable to common Shareholders | $ | 47,574 | $ | 589 | $ | 77,582 | $ | 32,871 | |||||||

Net income per share attributable to common shareholders, as adjusted - basic | $ | 0.45 | $ | — | $ | 0.73 | $ | 0.41 | |||||||

Net income per share attributable to common shareholders, as adjusted - diluted | $ | 0.45 | $ | — | $ | 0.73 | $ | 0.40 | |||||||

4. Property Dispositions and Discontinued Operations

The following two owned off-campus properties were classified as Held for Sale on the accompanying consolidated balance sheet as of September 30, 2013:

Property | Location | Primary University Served | Units | Beds | ||||

University Mills | Cedar Falls, IA | University of Northern Iowa | 121 | 481 | ||||

Campus Ridge (1) | Johnson City, TN | University of Tennessee | 132 | 528 | ||||

15

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(1) | Property was sold in October 2013 (see Note 16). |

Concurrent with this classification, these properties were recorded at the lower of cost or fair value less estimated selling costs. The net income attributable to these properties is included in discontinued operations on the accompanying consolidated statements of comprehensive income for all periods presented.

In July 2013, the following four owned off-campus properties were sold for a combined sales price of $157.4 million resulting in proceeds of approximately $155.2 million. The resulting gain on disposition of approximately $52.8 million is included in discontinued operations on the accompanying consolidated statements of comprehensive income for the three and nine months ended September 30, 2013.

Property | Location | Primary University Served | Units | Beds | ||||

The Village at Blacksburg | Blacksburg, VA | Virginia Tech University | 288 | 1,056 | ||||

State College Park | State College, PA | Penn State University | 196 | 752 | ||||

University Pines | Statesboro, GA | Georgia Southern University | 144 | 552 | ||||

Northgate Lakes (1) | Orlando, FL | The University of Central Florida | 194 | 710 | ||||

(1) | This property was included in the 9-property Collateral Pool which secures our agency facility (see Note 8). As a result, concurrent with the sale of this property, $15.5 million of the secured agency facility's outstanding balance was paid down. |

In 2012, the Company sold three owned off-campus properties, located in Wilmington, North Carolina (Brookstone Village and Campus Walk) and Greenville, North Carolina (Pirates Cove) containing 1,584 beds for a combined sales price of approximately $54.1 million. The net income attributable to these properties is included in discontinued operations on the accompanying consolidated statements of comprehensive income for the three and nine months ended September 30, 2012.

The properties discussed above are included in the wholly-owned properties segment (see Note 15). Below is a summary of the results of operations for the properties discussed above:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2013 | 2012 | 2013 | 2012 | |||||||||||||

Total revenues | $ | 1,762 | $ | 7,039 | $ | 13,418 | $ | 21,734 | ||||||||

Total operating expenses | (1,140 | ) | (3,360 | ) | (5,785 | ) | (9,261 | ) | ||||||||

Depreciation and amortization | (131 | ) | (1,361 | ) | (1,686 | ) | (4,052 | ) | ||||||||

Operating income | 491 | 2,318 | 5,947 | 8,421 | ||||||||||||

Total nonoperating expenses | (124 | ) | (453 | ) | (574 | ) | (1,359 | ) | ||||||||

Net income | $ | 367 | $ | 1,865 | $ | 5,373 | $ | 7,062 | ||||||||

5. Investments in Wholly-Owned Properties

Wholly-owned properties consisted of the following:

September 30, 2013 | December 31, 2012 | |||||||

Land (1) (2) | $ | 563,467 | $ | 550,274 | ||||

Buildings and improvements | 4,596,433 | 4,351,239 | ||||||

Furniture, fixtures and equipment (2) | 258,707 | 227,409 | ||||||

Construction in progress (2) | 70,483 | 138,923 | ||||||

5,489,090 | 5,267,845 | |||||||

Less accumulated depreciation | (485,917 | ) | (396,469 | ) | ||||

Wholly-owned properties, net (3) | $ | 5,003,173 | $ | 4,871,376 | ||||

(1) | The land balance above includes undeveloped land parcels with book values of approximately $34.6 million and $30.7 million as of September 30, 2013 and December 31, 2012, respectively. Also includes land totaling approximately $31.1 |

16

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

million and $41.6 million as of September 30, 2013 and December 31, 2012, respectively, related to properties under development.

(2) | Land, furniture, fixtures and equipment and construction in progress as of September 30, 2013 include $3.4 million, $0.4 million and $2.3 million, respectively, related to the University Walk property located in Knoxville, Tennessee, that will serve students attending the University of Tennessee. In July 2013, the Company entered into a purchase and contribution agreement with a private developer whereby the Company is obligated to purchase the property as long as the developer meets certain construction completion deadlines and other closing conditions. The development of the property is anticipated to be completed in August 2014. The entity that owns University Walk is deemed to be a variable interest entity (“VIE”), and the Company is determined to be the primary beneficiary of the VIE. As such, the assets and liabilities of the entity owning the property are included in the Company’s and the Operating Partnership’s consolidated financial statements. |

(3) | The balances above exclude the net book value of two properties, University Mills and Campus Ridge which are classified as wholly-owned properties Held for Sale in the accompanying consolidated balance sheet as of September 30, 2013. |

6. On-Campus Participating Properties

On-campus participating properties are as follows:

Historical Cost | ||||||||||||

Lessor/University | Lease Commencement | Required Debt Repayment (1) | September 30, 2013 | December 31, 2012 | ||||||||

Texas A&M University System / Prairie View A&M University (2) | 2/1/1996 | 9/1/2023 | $ | 42,211 | $ | 41,485 | ||||||

Texas A&M University System / Texas A&M International | 2/1/1996 | 9/1/2023 | 6,701 | 6,651 | ||||||||

Texas A&M University System / Prairie View A&M University (3) | 10/1/1999 | 8/31/2025 | 26,172 | 25,766 | ||||||||

8/31/2028 | ||||||||||||

University of Houston System / University of Houston (4) | 9/27/2000 | 8/31/2035 | 36,077 | 35,936 | ||||||||

West Virginia University Project / West Virginia University (5) | 7/16/2013 | 7/16/2045 | 7,045 | — | ||||||||

118,206 | 109,838 | |||||||||||

Less accumulated amortization | (56,044 | ) | (52,492 | ) | ||||||||

On-campus participating properties, net | $ | 62,162 | $ | 57,346 | ||||||||

(1) | Represents the effective lease termination date. The Leases terminate upon the earlier to occur of the final repayment of the related debt or the end of the contractual lease term. |

(2) | Consists of three phases placed in service between 1996 and 1998. |

(3) | Consists of two phases placed in service in 2000 and 2003. |

(4) | Consists of two phases placed in service in 2001 and 2005. |

(5) | In July 2013, the Company entered into long-term ground and facility leases with the University to finance, construct and manage this on-campus participating property. Under the terms of the leases, title to the constructed facility will be held by the University/lessor and the University will receive 50% of defined net cash flows on an annual basis through the term of the leases. Due to our involvement in the construction of the facility, any fees paid to the Company/lessee for development and construction management services during the construction period are deferred and amortized to revenue over the lease term. This facility is scheduled to be placed in service in August 2014. |

17

AMERICAN CAMPUS COMMUNITIES, INC. AND SUBSIDIARIES

AMERICAN CAMPUS COMMUNITIES OPERATING PARTNERSHIP, L.P. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

7. Investments in Unconsolidated Joint Ventures