Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

AMERICAN CAMPUS COMMUNITIES, INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date filed:

| |||

Table of Contents

SUBJECT TO COMPLETION

PRELIMINARY PROXY MATERIALS DATED APRIL 6, 2022

Table of Contents

12700 Hill Country Blvd., Suite T-200

Austin, Texas 78738

[ ], 2022

Dear American Campus Communities shareholders, residents, team members and other stakeholders:

As a pioneer in the student housing industry, our team at American Campus Communities has long understood the importance of helping students find what may be their first home away from home by providing environmentally responsible places to live that are conducive to safe and healthy living, personal growth, and academic and professional achievement. Since our inception in 1993, delivering on this vision has propelled us to become the largest developer, owner and manager of high-quality student housing communities in the United States with a current enterprise value approaching $12 billion and operating over 200 properties, consisting of over 140,000 beds located in 71 collegiate markets. Our dedication has also yielded exceptional shareholder value creation, with ACC providing a 39% total shareholder return for 2021 and 597% from our IPO in 2004 through December 31, 2021, as compared to the 407% return provided by the RMS REIT index and the 530% returned by the S&P 500 index.

While delivering sustainable shareholder value, we are also appealing to students’ increasing desire to make responsible housing choices.

| • | We are retrofitting our existing communities to promote sustainability and improve efficiency and are building more Leadership In Energy and Environmental Design (LEED) projects than any other student housing provider—these both save us money and fill growing demand for environmentally sustainable buildings, |

| • | Nearly 95% of our communities are located within a half-mile of campus, increasing their appeal to residents while promoting academic achievement, health and wellness and reducing emissions and noise, |

| • | We make quality housing affordable to students of all backgrounds without sacrificing location or quality, making us highly competitive, and |

| • | We partner with experts to support student mental health and well-being which builds community and connection among our residents, our staff and the universities we serve. |

We also believe that focus on corporate governance is vital to ACC and shareholders. In recent years, we have advanced several important initiatives including board refreshment that has enhanced director diversity, shareholder perspective, experience in higher education, and provided additional relevant real estate, capital allocation and institutional investment expertise. Today, our Board is comprised of ten highly-qualified and experienced leaders, led by an independent Chair, committed to ensuring that each director contributes the robust oversight and balanced skill set of diverse perspectives, capabilities and relevant expertise to enhance the creation of sustainable long-term value for all of our stakeholders.

Our Board and management team have engaged extensively with our shareholders and taken meaningful actions to deliver significant earnings per share growth and continued value creation. While the student housing sector was challenged by the pandemic, ACC has emerged as a stronger company and our efforts are yielding tangible results, including our shares setting new all-time highs several times in December 2021. We are excited about our runway for strong earnings and net asset value growth, which we expect will further drive substantial shareholder returns.

Table of Contents

Your vote is especially important this year, and we urge you to cast your vote as soon as possible. A fund managed by Land & Buildings Investment Management, LLC has notified the company of its intention to nominate an employee of Land & Buildings for election to the Board at the 2022 Annual Meeting of Shareholders in opposition to the highly qualified nominees recommended by the Board. Enclosed with your proxy materials is a WHITE proxy card or WHITE voting instruction form, which is being solicited on behalf of our Board.

We strongly urge you to read the accompanying Notice of Annual Meeting and Proxy Statement carefully and vote FOR the Board’s nominees and in accordance with the Board’s recommendation on the other proposals by using the enclosed WHITE proxy card. If you have any questions, please contact MacKenzie Partners, Inc., our proxy solicitor assisting us in connection with the 2022 Annual Meeting. Shareholders in the U.S. and Canada may call toll-free at 1-800-322-2885 or you may call collect at 212-929-5500.

We ask for your voting support for the items described in the pages that follow and thank you for your investment and trust in us.

On behalf of the Board of Directors,

| Sincerely, |

| Cydney Donnell |

| Independent Chair of the Board |

Table of Contents

12700 Hill Country Blvd., Suite T-200

Austin, Texas 78738

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held [ ], 2022

The accompanying WHITE proxy card, to be mailed to shareholders together with this Notice of Annual Meeting of Shareholders and this Proxy Statement on or about [ ], 2022, is solicited by the Board of Directors of American Campus Communities, Inc. (the “Company”) in connection with the Annual Meeting of Shareholders (the “Annual Meeting”).

To the Holders of Common Stock of AMERICAN CAMPUS COMMUNITIES, INC.:

The 2022 Annual Meeting of Shareholders of American Campus Communities, Inc., a Maryland corporation, will be held at our corporate office located at 12700 Hill Country Blvd., Suite T-200, Austin, Texas, on [ ] [ ], 2022 at 8:00 a.m. (Central Time) to consider and take action upon the following:

| (i) | To elect ten directors to a one-year term of office expiring at the 2023 Annual Meeting of Shareholders or until their successors are duly elected and qualified; |

| (ii) | To ratify Ernst & Young LLP as our independent auditors for 2022; |

| (iii) | To hold an advisory vote on executive compensation; and |

| (iv) | To consider and act upon any other matters that may properly be brought before the Annual Meeting and at any adjournments or postponements thereof. |

The enclosed WHITE proxy card is solicited by the Board of Directors, which recommends that our shareholders vote FOR the election of the nominees named therein and FOR approval, on an advisory basis, of the compensation of our named executive officers. The Audit Committee, which has the sole authority to retain our independent auditors, recommends that you vote FOR the ratification of Ernst & Young LLP as our independent auditors for 2022. Please refer to the attached Proxy Statement for further information with respect to the business to be transacted at the Annual Meeting.

The Board of Directors has fixed the close of business on [ ], 2022, as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof. Only shareholders of record of our common stock at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting and at any adjournments or postponements thereof.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting in person. Whether or not you plan to attend the Annual Meeting in person, please mark, execute, date and return the enclosed WHITE proxy card in the postage-prepaid envelope provided. Voting by written proxy will ensure your shares are represented at the Annual Meeting. Should you attend the Annual Meeting in person you may, if you wish, withdraw your proxy and vote your shares in person. Please review the instructions on the WHITE proxy card or the information forwarded by your bank, broker or other holder of record regarding each of these voting options.

Please note that Land & Buildings Capital Growth Fund, LP, a fund managed by Land & Buildings Investment Management, LLC (“Land & Buildings”), has notified us that it intends to nominate one of Land & Buildings’ employees

Table of Contents

for election to our Board of Directors at the Annual Meeting. You may receive solicitation materials from Land & Buildings, including a proxy statement and [COLOR] proxy card. We are not responsible for the accuracy of any information provided by or relating to Land & Buildings or its nominee contained in solicitation materials filed or disseminated by or on behalf of Land & Buildings or any other statements Land & Buildings may make.

Our Board of Directors does not endorse the Land & Buildings nominee and unanimously recommends that you vote “FOR” the election of all nominees proposed by the Board of Directors on the WHITE proxy card (including via the telephone or Internet methods of voting specified). Our Board of Directors strongly urges you not to return or vote any [COLOR] proxy card sent to you by Land & Buildings. Please note that voting to “withhold” with respect to the Land & Buildings nominee on a [COLOR] proxy card sent to you by Land & Buildings is not the same as voting “for” the Board of Directors’ nominees, because a vote to “withhold” with respect to the Land & Buildings nominee on its [COLOR] proxy card will revoke any WHITE proxy you may have previously submitted.

To support the Board of Director’ nominees, you should vote FOR the Board of Directors’ nominees on the WHITE proxy card and disregard, and not return, any [COLOR] proxy card sent to you by Land & Buildings. If you have previously submitted a [COLOR] proxy card sent to you by Land & Buildings, you can revoke that proxy and vote for our Board of Directors’ nominees by using the enclosed WHITE proxy card (including via the telephone or Internet methods of voting specified thereon) which will automatically revoke your prior proxy. Any later-dated [COLOR] proxy card that you send to Land & Buildings will also revoke your proxy, including WHITE proxies that you have voted FOR our Board of Directors’ nominees, and we strongly urge you not to sign or return any [COLOR] proxy cards sent to you by Land & Buildings. Only the latest dated validly executed proxy that you submit will be counted.

Given the contested nature of the election, under the rules of the NYSE, if your shares of common stock are held through a broker, bank or other nominee in “street name” as of the close of business on the record date and you receive proxy materials from Land & Buildings, your broker, bank, or other nominee will only be able to vote your shares with respect to any proposals at the Annual Meeting if you have instructed them how to vote. Your broker, bank, or other nominee has enclosed a WHITE voting instruction form for you to use to direct them regarding how to vote your shares. Please instruct your broker, bank, or other nominee how to vote your shares using the WHITE voting instruction form you received from them. Please return your completed WHITE proxy card or WHITE voting instruction form to your broker, bank, or other nominee and contact the person responsible for your account so that your vote can be counted. In most instances, you will be able to do this over the Internet or by telephone, or by mail as indicated on your WHITE voting instruction form and utilizing the post-paid return envelope provided.

Table of Contents

If you have questions about the matters described in this proxy statement, how to submit your proxy or if you need additional copies of this proxy statement, the enclosed WHITE proxy card, you should contact our proxy solicitor, MacKenzie Partners, Inc., assisting us in connection with the Annual Meeting. Shareholders in the U.S. and Canada may call toll-free at 1-800-322-2885 or you may call collect at 212-929-5500.

| By Order of the Board of Directors, |

| DANIEL B. PERRY Executive Vice President, Chief Financial Officer, Treasurer and Secretary |

Austin, Texas

[ ], 2022

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Shareholders Meeting to Be Held on [ ], 2022

This Proxy Statement, Annual Report to Shareholders and Annual Report on Form 10-K for the fiscal year ended December 31, 2021 are available in the Investor Relations section of our website at www.AmericanCampus.com under “SEC Filings.”

|

Table of Contents

| 1 | ||||

| 10 | ||||

| 13 | ||||

| 13 | ||||

| 19 | ||||

| Board Leadership Structure; Separate Independent Chair of the Board |

19 | |||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| Shareholder Outreach, Stakeholder Engagement and Communication |

27 | |||

| 28 | ||||

| 28 | ||||

| Repricing and Cash Buyouts of Underwater Options and Stock Appreciation Right Prohibitions |

29 | |||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 56 | ||||

| 58 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 59 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 69 | ||||

| 69 | ||||

| Proposal 2 - Ratification of the Selection of the Independent Auditors |

70 | |||

| 70 | ||||

| 70 | ||||

| 72 | ||||

| 73 | ||||

| 75 | ||||

| 75 | ||||

| 75 | ||||

| A-1 |

i

Table of Contents

American Campus Communities, Inc.

12700 Hill Country Blvd., Suite T-200

Austin, Texas 78738

PROXY STATEMENT

The accompanying WHITE proxy card, together with the Notice of Annual Meeting of Shareholders and this Proxy Statement, are first being mailed to shareholders on [ ], 2022, and is solicited by the Board of Directors of American Campus Communities, Inc. (the “Company”) in connection with the Annual Meeting of Shareholders (the “Annual Meeting”) to be held on [ ], 2022.

The following summary highlights important information you will find in this Proxy Statement regarding matters to be considered at the Annual Meeting. As it is only a summary, please read the other information contained in this Proxy Statement before you vote.

Board Composition and Refreshment

The Nominating and Corporate Governance Committee of the Board of Directors regularly reviews the overall composition of the Board and its committees to assess whether they reflect the appropriate mix of skills, experience, backgrounds and qualifications that are relevant to our current and future business and strategy. Each member of our Board has the necessary qualifications, expertise, and attributes in real estate, business, leadership, and financial literacy to be an effective member of the Board. Our director nominees’ biographies describe each director’s background and relevant experience in more detail.

Thoughtful consideration is continuously given to the composition of our Board in order to maintain an appropriate mix of experience, qualifications and attributes, introduce fresh perspectives, and broaden and diversify the views and experience represented on the Board. As a result of our focus on refreshment, we added three new independent directors to our Board in early 2021. Currently, five of our independent directors have a tenure of less than five years, two have a tenure of five to ten years, and two have a tenure greater than ten years.

Governance Highlights

The Board of Directors and the Company are committed to strong corporate governance to promote the long-term interests of shareholders, strengthen management accountability, and help to maintain public trust in the Company. During 2021, the Company made the following enhancements to its governance profile:

| • | Refreshing and enhancing board diversity by identifying and appointing three new highly-qualified independent directors, resulting in a 40% diverse Board with an average independent director tenure of less than 7 years. These three new directors, Herman Bulls, Alison Hill and Craig Leupold provide a breadth of expertise, such as extensive real estate experience, including capital allocation and institutional fund management, public company expertise, executive leadership, financial literacy and extensive experience with strategic transactions; |

| • | Appointing Cydney Donnell as new Independent Board Chair. Ms. Donnell provides extensive investment experience and shareholder perspectives from her prior role as former Principal and Managing Director of European Investors / E.I.I. Realty Securities; |

| • | Forming a Capital Allocation Committee, an advisory committee designated to evaluate the Company’s capital allocation strategy and priorities to further improve investment strategies, net asset value creation and the quality of earnings growth. The committee consists of four independent directors, chaired by Craig Leupold, former CEO of Green Street Advisors – a leading independent research and advisory firm for the real estate industry known for its analysis regarding corporate governance and capital allocation. During 2021, the committee met eight times, as well as multiple additional working sessions with and without management, to evaluate historic investment results and make appropriate recommendations to the Company’s short and long-term capital allocation strategy; and |

1

Table of Contents

| • | Making significant advancements in the Company’s ESG program as outlined under Corporate Responsibility / ESG, below. |

The “Governance of the Company” section describes the governance framework, which includes the following highlights:

| • Separate Chief Executive Officer and Independent Chair of the Board |

• Robust board refreshment and director selection process, which resulted in three new independent directors joining the Board during 2021 | |

| • Annual election of directors by majority vote, with a plurality carve-out in the case of contested elections |

• Gender diversified board with 30% of director nominees being women, including of our independent Chair | |

| • Prohibition on a classified board structure |

• Limits on board service | |

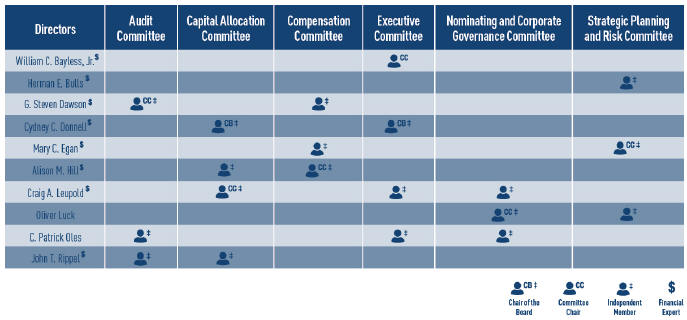

| • 9 of our 10 current Board members are independent and independent directors comprise 100% of the Audit, Compensation, Nominating and Corporate Governance, Capital Allocation and Strategic Planning and Risk Committees |

• Director and senior officer stock ownership guidelines, which include a prohibition on the sale by senior officers of vested restricted stock awards until the applicable ownership guideline has been met, and a requirement that the Chief Executive Officer own common stock having a market value of at least six times his annual base salary | |

| • Regular director performance assessment and annual board and committee evaluations |

• Prohibition on repricing options and stock appreciation rights, and prohibition on cash buyouts of underwater options and stock appreciation rights | |

| • Board oversight of environmental, social and governance practices, including human capital management matters |

• Anti-hedging and anti-pledging policies | |

| • Risk oversight by full Board and committees and independent Audit Committee and Strategic Planning and Risk Committee |

• Clawbacks to recoup compensation | |

| • Ongoing succession planning for directors, the Chief Executive Officer and other executive officers |

• No directors or executive officers a party to any material related party transactions | |

| • Regular executive sessions of independent directors |

• Bylaw provision which permits shareholders to amend Bylaws | |

2021 Executive Compensation

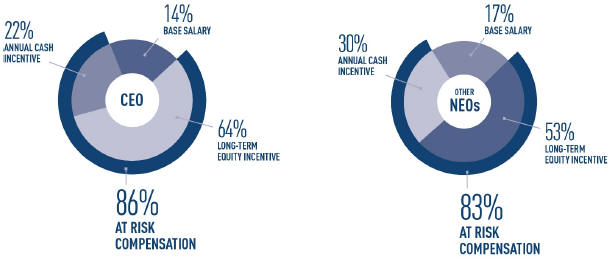

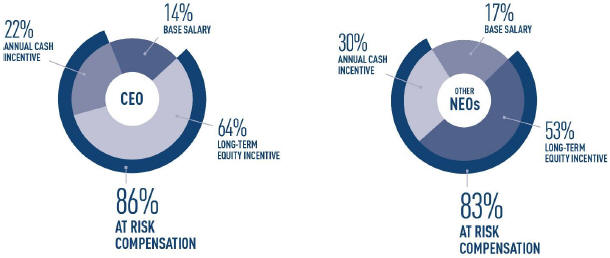

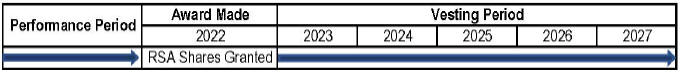

The Company’s executive compensation programs are designed to attract, retain and motivate talented executives, to reward executives for the achievement of pre-established Company and tailored individual goals consistent with the Company’s strategic plan and to link compensation to Company performance. Executives are primarily compensated through base salary, annual cash incentive compensation and long-term equity incentive compensation. The Company’s executive compensation philosophy emphasizes performance-based incentive compensation over fixed cash compensation so that the vast majority of total direct compensation is variable and not guaranteed, as displayed below in the visual diagram of 2021 target compensation for the Chief Executive Officer, or CEO, and other named executive officers or NEOs. In addition, a significant percentage of incentive compensation is in the form of equity awards granted to reward performance. These performance-based equity awards include one and three-year pre-determined performance metrics, are fully earned at the time of grant and vest ratably over a five-year period, thereby enhancing executive retention and closely aligning executive and shareholder interests as the value of the award increases or decreases with the value of the Company’s share price. We believe this structure appropriately focuses the executive officers on the creation of long-term value and encourages prudent evaluation of risks.

2

Table of Contents

We also believe that regular engagement with shareholders is essential to the ongoing development of our executive compensation programs and practices. As detailed under “Shareholder Outreach, Stakeholder Engagement and Communication”, we regularly communicate with our shareholders who have consistently supported our executive compensation program. Over the last five years, shareholder support for our advisory vote on executive compensation has averaged 95%. While we have consistently had strong shareholder support for our executive compensation program, the Compensation Committee does use an independent compensation consultant to review the structure of our compensation program, provide compensation benchmarks and to assess the effectiveness of our program in aligning executive and shareholder interests.

Pay-At-Risk: 2021 Direct Compensation Target

2021 Executive Compensation Decisions

The 2021 compensation decisions made by the Compensation Committee reflect strong continued alignment between pay and performance with respect to the pre-established measures and goals under the annual cash and long-term equity incentive plans and the performance and contributions of the Named Executive Officers to the Company’s financial and operating performance. In determining the incentive compensation paid to the Named Executive Officers for 2021, the Compensation Committee rigorously evaluated Company and individual performance relative to the pre-established measures and goals, but also took into consideration management’s considerable efforts and leadership in continuing to successfully navigate the Company through the lingering disruption of COVID-19 in an effort to re-stabilize our operations in 2021.

It is worth acknowledging that the Company’s 2021 outlook, and therefore the financial metrics used to assess management’s performance for 2021, were below the actual results produced for 2020. This was due to the ongoing impact of the pandemic on the 2020-2021 academic year occupancy at the Company’s properties, which affected a significant portion of 2021, and the gradual return to normal operations that was expected to occur over two academic year cycles. We are pleased to report that our team’s efforts led to significant outperformance relative to original expectations.

2021 Performance Amidst a Global Pandemic

Operationally, the Company began 2021 facing significant uncertainty and disruption caused by the COVID-19 pandemic. Guided by our eight principle objectives outlined early in the pandemic, which are detailed under “COVID-19 Response”, we continued to provide essential housing services to students all across the country and provided thought leadership and action to help universities return to a sense of normalcy.

3

Table of Contents

We continued to employ numerous decisive actions which began in the earliest days of the pandemic and served to protect our team members, our residents and our shareholders:

| • | Though significantly reduced from 2020 levels, we continued to prudently utilize our COVID-19 Resident Hardship Program to provide direct financial relief to our residents suffering financial hardship and rent relief to students through our university partnerships. |

| • | At the property level, we continued our collaboration with RB, the makers of Lysol and a global leader in hygiene products, to set the standard for cleanliness and disinfection at our student housing communities and promoted our “Be safe. Be smart. Do your part.TM” program. This includes a comprehensive review of cleaning products and procedures by a third-party hygiene and disinfectant specialist that integrates enhanced cleaning standards, resident responsibility education and touchless preventative measures in the Company’s college communities across the country. |

| • | We extended work-from-home and emergency leave measures. |

| • | We made numerous advances in our ESG programs as outlined in our Corporate Responsibility section. |

Throughout the year, our ability to be resilient and adapt quickly to external changes was critical to the re-stabilization of our operations despite the challenges presented by the global pandemic. We employed the enhanced capabilities of our newly developed operational systems to optimize mid-term academic year leasing to students making the decision to physically return to campus throughout the 2020-2021 academic year, resulting in our signing more spring and summer term leases than in any prior period in our history. For the 2021-2022 academic year, as of September 30, 2021, the Company leased 95.8% of its same store owned property beds, as compared to only 90.3% as of the same date prior year. In addition to our nimble operational approach, strategic improvements in recent years significantly improved the property portfolio quality in terms of proximity to campus, positioning the Company for outperformance relative to the broader industry. As compared to the top 175 markets, as measured and reported by a third-party provider of student housing statistics, the Company’s achievement of same store occupancy of 95.8% and 3.8% average rental rate growth per occupied bed for 2022 same store properties compared to occupancy of 94.1% and rental rate growth of 2.5%, or approximately 3.0 percentage points of revenue outperformance.

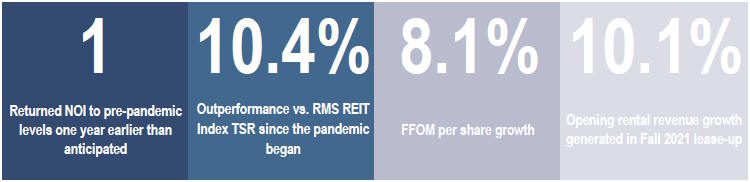

In 2021, amidst ongoing challenges presented by the global pandemic, we exceeded maximum targets for most of our executive compensation metrics and accomplished significant financial and strategic objectives and milestones, including:

| • | Despite industry-wide preleasing for the 2021-2022 academic year that was tracking significantly behind its traditional pace due to lingering COVID-19 uncertainty, achieved 95.8% opening fall occupancy and 3.8% average rental rate growth over the prior year for the 2022 same store portfolio as of September 30, 2021, exceeding the high end of our guidance; |

| • | Growing same store rental rate for the 17th consecutive year, measured as of September 30, 2021 versus 2020; |

| • | Outperforming our student housing peer set in the 2020-2021 academic year lease-up as detailed under 2021 Long-Term Equity Incentive Awards; |

| • | Returning same store net operating income (NOI) to pre-pandemic levels in the fourth quarter, one year earlier than anticipated, demonstrating the Company’s resiliency during the pandemic; |

| • | Growing same store NOI for 16 of 17 years as a public company (every year since 2004, except for 2020 which was significantly disrupted by the COVID-19 global pandemic); |

| • | Generating FFOM per share growth of 8.1%, as compared to the Company’s initial expectation of (2.5)% to 4.5%; |

| • | Delivering three new phases of Flamingo Crossings Village, the Disney College Program (DCP) residential development, into service on-schedule and within its $210.8 million budget despite the national labor shortage and widespread supply chain constraints; |

| • | Opening Flamingo Crossings Village to college program participants and moving in over 4,500 residents by Fall 2021, shortly after the Disney College Program recommenced in May 2021, following the program’s COVID-19 related pause; |

| • | Commencing five new on-campus third-party development projects since January 1, 2021, representing total fees to be recognized exceeding $24 million; |

4

Table of Contents

| • | Expanding the Company’s successful public-private partnership business with university clients with four new awards for on-campus third-party development projects; and |

| • | Forming a joint venture to own our eight-property Arizona State University student housing portfolio for aggregate proceeds of $551.3 million as part of our strategic capital program to utilize joint venture and private equity capital to enhance sustainable long-term shareholder value. |

This discussion of the Company, its business and individual measures are used in assessing performance. These measures are discussed in the limited context of the executive compensation program. You should not interpret them as statements of the Company’s expectations or as any form of guidance. We caution you not to apply the statements or disclosures made in this Proxy Statement in any other context.

2021 Compensation Practices at a Glance

| ✓ DO align pay and performance by linking a substantial portion of compensation to the achievement of pre-established performance measures that drive shareholder value |

C DO NOT base incentive awards on a single performance measure, thereby discouraging unnecessary or excessive risk-taking | |

| ✓ DO provide executive officers with the opportunity to earn market-competitive compensation through a mix of cash and equity compensation, with strong emphasis on performance-based incentive awards |

C DO NOT provide guaranteed minimum payouts or uncapped award opportunities | |

| ✓ DO have a robust peer selection process and benchmark executive compensation to target the median of the comparative group of peer companies |

C DO NOT reprice or permit cash buyouts of underwater stock options | |

| ✓ DO require executive officers and directors to own and retain shares of common stock that have significant value to further align interests with shareholders |

C DO NOT provide executive officers with excessive perquisites or other personal benefits | |

| ✓ DO enhance alignment with long-term shareholder value and executive officer retention with 5-year vesting schedules for equity incentive awards earned for prior-year performance |

C DO NOT provide executive officers with pension or retirement benefits other than pursuant to a 401(k) plan and a deferred compensation plan | |

| ✓ DO enable the Board to “claw back” incentive compensation in the event of an accounting restatement due to material non-compliance with financial reporting requirements as a result of misconduct by executive officers |

C DO NOT permit executive officers or directors to engage in derivative or other hedging transactions in the Company’s securities | |

| ✓ DO prohibit new tax gross-up arrangements under anti-tax gross-up policy |

C DO NOT provide accelerated vesting upon a change of control under the 2018 Incentive Award Plan | |

| ✓ DO maintain a Compensation Committee comprised solely of independent directors |

C DO NOT provide single-trigger change of control benefits | |

| ✓ DO engage an independent compensation consultant to advise the Compensation Committee on executive compensation matters and establishing an appropriate peer group |

C DO NOT permit executive officers and directors to hold the Company’s securities in margin accounts or to otherwise pledge the securities to secure loans | |

Corporate Responsibility / ESG

Corporate responsibility is fundamental to the Company’s mission to consistently provide every resident and team member with an environment conducive to healthy living, personal growth, academic achievement and professional success. This mission drives our ESG (environmental, social and governance) vision of creating healthy, sustainable environments with a sense of community and connection by giving back, investing in our employees and driving long-term value for all stakeholders.

5

Table of Contents

Our core products and services directly further some of the most important of all ESG values. For example:

| • | We have developed 37 Leadership in Energy and Environmental Design (LEED) certified student housing projects – these promote sustainability and operating efficiency, thereby reducing recurring operating and capital expenses, and fill a growing demand for LEED-certified buildings: |

| • | We promote walkability by prioritizing proximity to campus in our development and acquisition criteria, thus reducing emissions and noise – nearly 95% of our owned communities are located within a half mile from campus, so students can easily walk or bike to campus; |

| • | We continuously evaluate opportunities to perform efficiency upgrades that both reduce energy and water consumption and provide financial returns; |

| • | We strive to make high-quality student housing affordable for students from all backgrounds without sacrificing location, quality or service; |

| • | We promote an “open-door” culture where every employee should feel comfortable approaching their peers and leadership with questions or feedback; |

| • | We support our residents’ mental health via our long-term partnership with the Hi, How Are You Project and staff training on peer-to-peer support at 200+ communities across the country; and |

| • | We foster environments with a sense of community and connection by regularly surveying our employees and residents and creating programs and practices that promote achievement and wellbeing. |

We support these important value-adding ESG practices by, among other things:

| • | Regularly reviewing ESG initiatives and results with our Board of Directors |

| • | Employing significant internal resources including appointing a new Executive Vice President and Chief Purpose and Inclusion Officer, Senior Vice President of Corporate Responsibility, and Director of ESG, and forming both a multi-functional ESG Committee and a Diversity and Inclusion Task Force to support and enhance our programs and goals and to ensure we execute on our ESG strategy |

| • | Selecting the Sustainability Accounting Standards Board’s (SASB) standards as our ESG guidance framework, which we plan to report against in our upcoming 2021 Corporate Sustainability Report |

| • | Planning for entity-level ESG goalsetting and climate risk analysis in 2022, as we endeavor to report in line with the Task Force on Climate-Related Financial Disclosures (TCFD) framework in the future |

| • | Maintaining communication with ESG-focused stakeholders |

| • | Publishing our annual Corporate Sustainability Report at ESG.americancampus.com |

| • | Engaging stakeholders and executing an ESG materiality analysis, and benchmarking our ESG progress against our peers |

| • | Amending our $1.0 billion unsecured revolving credit facility to incorporate sustainability goals to promote the awareness and achievement of ESG performance targets each year (with a performance target in each pillar of E, S, and G) |

| • | Engaging third-party experts to help us develop ambitious usage reduction targets, perform a climate and transition risk scenario analysis, and monitor and report on our progress |

| • | Engaging experts to perform property audits and analyzing energy, water, and waste data to identify opportunities to implement energy and water saving retrofits |

| • | Performing environmental due diligence on all acquisitions and development properties based on LEED specifications |

| • | Annually report our greenhouse gas (GHG) emissions and company demographic and diversity metrics |

| • | Contracting to source 10.3m kWh of electricity from renewable energy |

| • | Implementing business development outreach programs to broaden our network of minority and women-owned businesses for development projects |

| • | Contributing to a scholarship fund at Prairie View A&M University, a Historically Black College and University (HBCU) and committing to a $5.0 million donation to Arizona State University to support student scholarships and sustainability initiatives on the campus |

6

Table of Contents

| • | Publishing a summary of our Human Rights policies |

| • | Engaging local businesses by developing a neighborhood small business nurturing program to attract and support disadvantaged and underrepresented business owners in our owned portfolio |

Our company values are centered around people. We care deeply about our residents and serving students well requires engaged, passionate, and diverse team members, so we’ve created an award-winning culture that fosters growth and rewards achievement. We achieve these efforts by, among other things:

| • | Engaging with our employees through regular communication and by soliciting valuable feedback on our efforts to create a healthy and meaningful work culture, including: |

| • | Annually surveying our employees regarding their satisfaction and views on the workplace environment |

| • | Publishing a monthly newsletter that welcomes new team members, highlights employee advancement, celebrates life events, and promotes company milestones and achievements |

| • | Founding a Culture Committee which promotes company-wide initiatives and togetherness |

| • | Providing a quarterly update to all property and corporate employees, highlighting employee accomplishments, operational best practices, upcoming events and other Culture Committee initiatives |

| • | Conducting “Bill’s Quarterly Call”, a CEO update event where every employee in the company can ask questions to leadership regarding the company’s direction and the state of the industry |

| • | Maintaining a digital suggestion box on the company intranet site for employees to offer ideas and feedback on all aspects of the company |

| • | Becoming a signatory of the CEO Action for Diversity & Inclusion pledge |

| • | Forming a diversity and inclusion (D & I) task force to oversee the execution of our goals over the long-term |

| • | Engaging a third-party consultant to review our employment program according to diversity and inclusion criteria, including vision, goals and company demographic breakdown |

| • | Conducting “Unconscious Bias/Business Training” for employees and collaborating with our consultant to develop D&I training curriculum for employees and supervisors including: |

| • | Introduction to Diversity, Equity, & Inclusion |

| • | The Benefits of Diversity, Equity, & Inclusion |

| • | Empathy, Sensitivity, & Inclusion |

| • | Overcoming Unconscious Bias in the Workplace |

| • | Applying gender-inclusive roommate matching programs at ACC properties |

| • | Demonstrating our commitment to protecting our team members and residents during the pandemic by rapidly adopting protective objectives and guidelines, as detailed under COVID-19 Response |

| • | Promoting training and professional development to provide the training necessary to further employee effectiveness and assist in career advancement and retention |

| • | Supporting a culture of developing future leaders from our existing workforce, enabling us to promote from within for many leadership positions |

| • | Emphasizing safety by creating an environment where every supervisor is expected to devote the time and effort necessary to ensure the safety of employees at all times, including proper work methods, reporting potential hazards and abating known hazards |

| • | Developing a comprehensive “Product Health and Safety Plan” that includes safety-related work practices that apply to our student housing communities and include: |

| • | Safety rules and safe job procedures |

| • | Safety meetings and training sessions |

| • | Keeping work areas clean and free from slipping or tripping hazards |

| • | Immediately reporting all malfunctions to a supervisor |

| • | Using care when lifting and carrying objects |

| • | Observing restricted areas and all warning signs |

| • | Knowing emergency procedures |

7

Table of Contents

| • | Reporting unsafe conditions to supervisors |

| • | Promptly reporting every accident and injury |

| • | Following the care prescribed by the attending physician when treated for an injury or illness |

| • | Participating in accident investigations, serving on safety committees or other loss control activities |

| • | Requiring service contract agreements, mandating that all contractors and subcontractors that perform work in facilities or on property controlled by ACC abide by all safety rules and follow safety procedures |

| • | Maintaining contractor safety training records that are accessible for review by property staff |

Our ESG leadership has been recognized. We have been:

| • | An honoree of Texan by Nature 20 (TxN20), an official ranking of the top 20 companies in Texas for our leadership and commitment to conservation and sustainability |

| • | A recipient of the Great Place to Work™ certification - with 97% of the employees surveyed saying ACC is a great place to work |

We are committed to diversity and inclusion and became a signatory of the CEO Action for Diversity & Inclusion pledge, as noted above. Our Company and our student communities are defined and strengthened by the principle that every individual and their experience adds value and enhances our position as an industry leader and university partner. Through diversity and inclusion, we create and maintain a workplace environment that supports the development and advancement of all team members from all backgrounds. As of December 31, 2021:

| • | 44% of our independent directors, including the Board Chair, self-identify as women or people of color. |

| • | Our total workforce self-identifies as 50% female, 48% male, and 2% unspecified and 45% White, 21% Black, 24% Hispanic/Latino, 5% Asian and 5% Other. “Other” includes American Indian, Alaska Native, Native Hawaiian, Pacific Islander, Not Specified or two or more races. |

| • | Our management team (team members with the title of general manager or higher job classifications) self-identifies as 56% female and 44% male and 67% White, 12% Black, 13% Hispanic/Latino, 4% Asian and 4% Other. |

| • | Our executive management team was represented by individuals who self-identify as female (33%) and minority (22%), both having increased by over 10 percentage points during the year. |

Additional information regarding the Company’s ESG initiatives may be found online at ESG.AmericanCampus.com (although none of the information on the Company’s website is incorporated into this Proxy Statement by reference).

COVID-19 Response

While the Company’s crisis management structure and approach prepare us to effectively address emergency incidents, the COVID-19 pandemic presented itself as a unique challenge.

During 2021, management met on a regular basis to discuss the ongoing impacts of COVID-19 on the Company, including on the Company’s financial position and results of operations, as well as matters including health safeguards, resident programs, community operations, communications to tenants and infrastructure.

In response to the pandemic, in March 2020, the Company implemented eight principle objectives as guidelines to follow during the pandemic:

| • | Strive to maintain a healthy and academically oriented environment for the Company’s residents by adopting and implementing all CDC guidelines with regard to cleaning, sanitization, and social distancing as the Company continues to deliver essential services, and ensure that the Company’s state of the art broadband service continues to be reliable to facilitate the delivery of online education as universities move to that medium to deliver classroom lectures; |

8

Table of Contents

| • | Be compassionate and provide financial assistance and support to residents and their families who suffer a diminishment of income as a result of the COVID-19 crisis; |

| • | Strive to ensure that all American Campus Communities team members have a safe, healthy and productive work environment as they continue to deliver services to the Company’s residents and university partners and as they continue to construct and deliver the Company’s development projects; |

| • | Work with the Company’s university partners to understand their individual unique challenges with regard to COVID-19 and assist them in implementing their plans and accomplishing their objectives. Anyone can be a good partner when things are going well – our goal is to demonstrate that we are a good partner in times of crisis such as this; |

| • | Attempt to limit all negative financial and operational impacts to the period directly associated with this crisis and work to prevent negative financial impacts from carrying forward into the Company’s stabilized business model or from negatively impacting long-term valuations for the Company’s portfolio and sector; |

| • | Adapt the Company’s marketing and leasing strategies to successfully complete the fall lease-up and work collaboratively with all the universities the Company serves in an attempt to return to a state of normalcy, stability and “business as usual” for the 2021-2022 academic year; |

| • | Ensure the necessary balance sheet liquidity to withstand the duration of the crisis; and |

| • | Reflect on the challenges faced during this black swan event and take note of the lessons learned, in an effort to be better prepared for a future pandemic or other unanticipated event to improve the Company’s future products, services and operational policies, as well as to advance and refine the Company’s investment and capital allocation strategies, transaction structures and underwriting standards. |

Early in the pandemic, the Company made a pledge that every resident would have a home, regardless of their ability to pay, and formed a COVID-19 Resident Hardship Program which provided direct financial relief to our residents suffering financial hardship and relief to students through our university partnerships. In addition to this financial assistance, the Company also waived all late fees and online payment fees and suspended financial related evictions during the spring and summer terms of 2020, and in certain cases continued to do so during 2021.

We supported our employees and residents at the property level by collaborating with RB, the makers of Lysol® and a global leader in hygiene products, to set a new standard and formalized approach to cleanliness and disinfection at our student housing communities. We also launched a “Be safe. Be smart. Do your part.TM” program, which includes a comprehensive review of cleaning products and procedures by a third-party hygiene and disinfectant specialist that integrates enhanced cleaning standards, resident responsibility education and touchless preventative measures in the Company’s college communities across the country. We also assisted our team members by adopting pervasive work-from-home and emergency leave measures for our employees.

9

Table of Contents

BACKGROUND OF THE SOLICITATION

The following discussion provides background information regarding our interactions with Land & Buildings Investment Management, LLC and its affiliates and representatives (collectively, “Land & Buildings”) during 2020, 2021 and 2022.

In November 2020, Jonathan Litt, the Founder and Chief Investment Officer of Land & Buildings, contacted Edward Lowenthal, the then Chair of the Board, and Cydney Donnell, a member of the Board and the current Chair of the Board, to discuss certain valuation, operational and governance matters. On November 24, 2020, Mr. Lowenthal, Ms. Donnell and Mary Egan, the Chair of the Strategic Planning and Risk Committee, met by videoconference with Mr. Litt and Corey Lorinsky, an employee of Land and Buildings, to discuss various matters related to the Company, including those relating to valuation. On December 2, 2020, Ms. Egan, John Rippel, a member of the Board, William Bayless, our Chief Executive Officer, and Daniel Perry, our Chief Financial Officer, met by video conference with Messrs. Litt and Lorinsky to discuss, among other things, the Company’s valuation, operations and strategic objectives.

On December 8, 2020, Land & Buildings submitted a notice to the Company regarding its intent to nominate three people for election to the Board at the 2021 annual meeting.

From December 2020 through January 2021, the Nominating and Corporate Governance Committee, as part of its ongoing board refreshment efforts, conducted a search process for additional independent directors. During this time, the Nominating and Corporate Governance Committee considered 14 candidates and conducted interviews with nine of these candidates, including the three Land & Buildings nominees. After the consideration of the professional experience, skills, personal attributes, including those relating to diversity, the Nominating and Corporate Governance Committee concluded that Herman Bulls, Alison Hill and Craig Leupold, three of the candidates identified by the Company, each had significantly stronger qualifications to serve on the Company’s board than did any of the nominees identified by Land & Buildings.

During this same period, representatives of the Company and the Board held discussions with Mr. Litt regarding his views on board composition matters.

On January 27, 2021, the Company entered into a Cooperation Agreement with Land & Buildings. In connection with entering into the Cooperation Agreement, the Company paid $450,000 to Land & Buildings as a reimbursement of its costs, and the Board appointed Messrs. Bulls and Leupold and Ms. Hill to the Board, which nominees were identified by the Company in consultation with Land & Buildings, and established a Capital Allocation Committee of four members: Mr. Leupold, who is the Chair, Ms. Hill, Ms. Donnell and Mr. Rippel. Also on January 27, 2021, the Company announced that Mr. Lowenthal, having met the Company’s mandatory retirement age, would retire as Chair of the Board, effective as of the conclusion of the 2021 Annual Meeting, at which time Ms. Donnell will become the Chair of the Board, and Carla Piñeyro Sublett resigned from the Board effective immediately in connection with an upcoming change in her principal occupation.

During 2021, the Company’s management and Board and its committees focused its time and efforts on the re-stabilization of operations despite the challenges presented by the global pandemic, resulting in the Company accomplishing significant financial and strategic objectives and milestones described in “Summary-2021 Performance Amidst a Global Pandemic.” Also during 2021, the Board received quarterly “Progress Report” videos from Land & Buildings.

In late October, 2021, Mr. Litt scheduled a call with Ms. Donnell and Mr. Leupold to discuss the Company’s year-to-date performance. On November 1, 2021, Mr. Litt sent a letter to Ms. Donnell and Mr. Leupold regarding valuation, operational and governance matters, and informing the Company that Land & Buildings intended to nominate Mr. Litt for election to the Board at the 2022 Annual Meeting.

By letter dated November 5, 2021, Ms. Donnell informed Mr. Litt that she had shared the November 5 letter with the Board, and noted that a meeting had been scheduled with Land & Buildings to discuss its perspective regarding the Company’s net asset value (NAV) and that Oliver Luck, Chair of the Nominating & Corporate Governance Committee, would be contacting Mr. Litt to schedule a meeting regarding Mr. Litt joining the Board.

10

Table of Contents

On November 8, 2021, a meeting was held by videoconference with Messrs. Litt, Lorinsky, Ms. Donnell and Messrs. Leupold, Rippel and Perry regarding valuation matters and assumptions underlying Land & Buildings’ analysis of the Company’s NAV.

On November 9, 2021, Mr. Litt sent a letter to the Company stating that he believed the principal difference in the NAV calculations of the Company and Land & Buildings was the starting point of the analysis, without further amplification.

On November 18, 2021, Mr. Litt met with the Nominating and Corporate Governance Committee and Ms. Donnell by video conference to discuss him joining the Board. During this discussion, Mr. Litt agreed to provide the Committee with two items of additional information:

| 1. | Case studies demonstrating that substantial sales of up to half a company’s assets, as he had suggested for the Company, as an effective means of enhancing public market valuation and eliminating any discount to Net Asset Value. |

| 2. | Which shareholders of the Company were supportive of Land & Buildings’ proposed asset-sale strategic plan and Mr. Litt’s participation on the Company’s Board. As the Company representatives communicated to Mr. Litt, the Company had not heard support for this asset-sale strategy from shareholders, despite extensive shareholder engagement, and therefore asked Mr. Litt to provide a channel for the Board to speak directly to those shareholders who supported this strategy, and he indicated he would “clear it with them and get back to us.” |

On November 19, 2021, Mr. Luck sent an e-mail to Mr. Litt thanking him for his time and reminding Mr. Litt to provide these items.

On November 23, 2021, Mr. Litt responded to Mr. Luck’s email requesting that his nomination to the Board be resolved by the end of the following week. This communication did not address the provision of the additional items of information.

On December 13, 2021, Land & Buildings issued a press release announcing that it had sent an open letter to the Company’s shareholders and would be hosting a conference call on December 16, 2021 to discuss the contents of its letter.

On December 16, 2021, the Company issued a press release announcing that it had issued an open letter to its shareholders that (1) disclosed that the Company’s Board and members of management have each recently met with representatives of Land & Buildings, (2) detailed the Company’s performance and Board refreshment and (3) reiterated the commitment of the Board and management team to enhancing value for all shareholders of the Company. Copies of the press release and letters to and from Land and Buildings to certain members of the Board are attached as exhibits to the Current Report on Form 8-K filed by the Company with the SEC on December 16, 2021.

Also on December 16, 2021, Land & Buildings hosted a webcast and issued a website presentation regarding the Company. During the webcast, Mr. Litt stated that he did not believe that any independent member of the Board had any public REIT management experience, when in fact Messrs. Rippel and Dawson and Ms. Hill all have served as senior executives of publicly-traded REITs, and that the Company needed a revenue management system, while various of the Company’s public filings have detailed disclosure regarding our historical leasing and revenue management systems as well as our newly-implemented enterprise resource planning system.

On December 17, 2021, Land & Buildings sent a letter to the Company nominating Mr. Lorinsky as a nominee for election to the Board at the Annual Meeting.

On January 5, 2022, Ms. Donnell and Mr. Luck sent a letter to Mr. Litt expressing disappointment that Land & Buildings had launched a public campaign while discussions were ongoing regarding the evaluation of his candidacy, and surprise that given his stated intent to join the Board, he had nominated Mr. Lorinsky as Land & Buildings’ candidate. In this letter, Mr. Litt was informed that after careful consideration of Mr. Lorinsky’s experience and qualifications, as well as the numerous prior engagements and interactions members of the Board have had with Mr. Lorinsky over the past year, the Board had determined that it does not believe Mr. Lorinsky will be an additive member of the Board and did not intend to move forward with his candidacy, and requesting that Land & Buildings withdraw its director nomination and continue to engage privately and constructively with the Company’s Board and management team.

11

Table of Contents

On January 18, 2022, the Company received another letter from Land & Buildings in which Mr. Litt demanded that he or his colleague be added to the Board, saying, “Both myself (sic) and Corey Lorinsky, my partner of over ten years, are uniquely qualified to be on the Board of ACC and we remain open to resolving the nomination.”

On January 19, 2022, Ms. Donnell responded to Mr. Litt by email on behalf of the Board confirming receipt of the January 18 letter and confirming that as previously communicated, the Board has concluded that Mr. Lorinsky, the candidate Land & Buildings nominated to stand for election, lacks the requisite qualifications to serve on the Board.

On February 15, 2022, the Company received a letter from Land & Buildings in which Land & Buildings stated it is “indicating its willingness to offer to acquire” the Company for $57.00 per share.

On February 16, 2022, the Company issued a press release (1) disclosing that the Company had received a nomination from Land & Buildings of Mr. Lorinsky, (2) providing an update on the Company’s extensive engagement with Land & Buildings, including the receipt of the February 15 letter with what was characterized in such press release as a “faux bid” tactic in light of Land & Buildings’ lack of capital capacity and demonstrated transaction experience to execute an acquisition of the Company, and (3) reiterating the commitment of the Board and management team to enhancing value for all shareholders of the Company. Copies of the press release and letters to and from Land and Buildings to certain members of the Board are attached as exhibits to the Current Report on Form 8-K filed by the Company with the SEC on February 16, 2022.

On February 28, 2022, Ms. Donnell and Mr. Leupold received a letter from Land & Buildings in which Land & Buildings, among other things, requested the execution of a non-disclosure agreement (NDA) prior to disclosing the identity of its financial advisor, which form did not include generally customary provisions, such as a standstill and restrictions on broadly “shopping” the Company’s sensitive, confidential information. By letter dated March 1, 2022, Ms. Donnell requested information regarding Land & Buildings’ sources and uses of funding, stated that the execution of an NDA is not a prerequisite for the provision of this information, and informed Land & Buildings that the Board did not believe the proposed price appropriately valued the Company. Copies of these letters are attached as exhibits to the Current Report on Form 8-K filed by the Company with the SEC on March 4, 2022.

On March 14, 2022, representatives of BofA Securities, the Company’s financial advisor, and Dentons US LLP, the Company’s legal advisor, contacted counsel to Land & Buildings, as a courtesy, to inform them that the Company intended to shortly file this preliminary proxy statement with the SEC and to inquire as to whether Land & Buildings intended to proceed with its nomination of Mr. Lorinsky to the Company’s Board. Land & Buildings’ counsel informed the Company’s representatives that they would respond after discussing. To date, there has been no response.

On April 1, 2022, Mr. Litt contacted Mr. Leupold to request a call. Discussions between Messrs. Leupold and Litt occurred over the following several days.

On April 6, 2022, the Company filed this preliminary proxy statement with the SEC.

12

Table of Contents

Board Composition and Refreshment

The Nominating and Corporate Governance Committee performs an assessment of the skills and the experience needed to properly oversee the Company’s interests. Generally, the Nominating and Corporate Governance Committee reviews both the Company’s short and long-term strategies to determine what current and future skills and experience are required of the Board in exercising its oversight function. The Nominating and Corporate Governance Committee then compares those skills to the skills of the current directors and potential director candidates. The Nominating and Corporate Governance Committee conducts targeted efforts to identify and recruit individuals who have the qualifications identified through this process.

Thoughtful consideration is continuously given to the composition of our Board in order to maintain an appropriate mix of experience, qualifications and attributes, introduce fresh perspectives, and broaden and diversify the views and experience represented on the Board. As a result of our focus on refreshment, we added three new directors to our Board in early 2021. The average tenure of our independent Board nominees is currently approximately 7 years.

The table below summarizes the key qualifications, skills, and attributes most relevant to the decision to nominate candidates to serve on the Board. A mark indicates a specific area of focus or expertise on which the Board particularly relies. The absence of a mark does not mean the director does not possess that qualification or skill. Our director nominees’ biographies describe each director’s background and relevant experience in more detail.

| Qualifications, Expertise and Attributes |

Bill Bayless |

Herman Bulls |

Steve Dawson |

Cydney Donnell |

Mary Egan |

Alison Hill |

Craig Leupold |

Oliver Luck |

Pat Oles |

John Rippel | ||||||||||

| Board Diversity | ||||||||||||||||||||

| Representation of gender and/or ethnic diversity | ● | ● | ● | ● | ||||||||||||||||

| Real Estate | ||||||||||||||||||||

| Significant background working in real estate, resulting in knowledge of public and private capital, how to anticipate trends, generate returns or create capital allocation models | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||

| University Relations | ||||||||||||||||||||

| Experience cultivating and sustaining business relationships with universities | ● | ● | ● | ● | ● | |||||||||||||||

| Leadership | ||||||||||||||||||||

| Has overseen the execution of important strategic, operational and policy issues while serving in an executive or senior leadership role | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Strategic Transactions | ||||||||||||||||||||

| A history of leading growth through acquisitions, business combinations, strategic partnerships or other transactions | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Financial Literacy | ||||||||||||||||||||

| Knowledge of financial markets, financing operations, complex financial management and accounting and financial reporting processes | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Capital Allocation | ||||||||||||||||||||

| Experience in the distribution and investment of an enterprise’s financial resources to maximize returns to stakeholders | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| Public Company Executive | ||||||||||||||||||||

| Has served as a senior officer of a public company | ● | ● | ● | ● | ● | |||||||||||||||

| Enterprise Human Capital Management | ||||||||||||||||||||

| Enterprise-wide experience in recruiting, managing, developing and optimizing an entity’s human resources(1) | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||

| (1) | Qualifications, attributes and expertise includes direct experience with diversity, equity and inclusion. |

13

Table of Contents

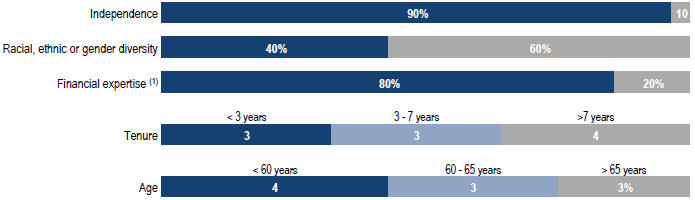

Additionally, as set forth below, our director nominees exhibit a balanced mix of independence, diversity, financial expertise, tenure and age.

| (1) | As such term is defined in item 407(d)(5)(ii) of Regulation S-K |

|

William C. Bayless, Jr. Age: 57

CEO & Director since 2004

Committees: Executive |

Experience • Chief Executive Officer (since 2003); President (2003 – 2017); Co-founder of the Company and participated in the founding of the student housing business of its predecessor entities • Executive Vice President and Chief Operating Officer of the predecessor entities (1995 – 2003), where he directed all aspects of the predecessor entities’ business segments including business development, development and construction management, acquisitions and management services; Vice President of Development (1993 – 1995) • Director of Operations, Student Housing Division; Century Development (1991 – 1993) • Director of Marketing, Student Housing Division; Cardinal Industries (1988 – 1991) • Began his career with Allen & O’Hara where he held the positions of Resident Assistant, Resident Manager and Area Marketing Coordinator (1984 – 1988)

Qualifications • Ability to lead the organization • Detailed knowledge, unique perspective and insights regarding the student housing industry and the strategic and operational opportunities and challenges, economic and industry trends, and competitive and financial positioning of the Company and its business

Education • B.S., Business Administration, West Virginia University

Non-Public Boards • Advisory Board, Amherst Holdings, LLC (since June 2018) • Board, Rise School of Austin, which provides high quality early childhood education for gifted, traditional and developmentally delayed children in an inclusive setting, using individualized learning techniques • Board, Hi How Are You Project, a platform for the exchange of ideas and education on mental well-being • Instrumental in the formation of American Campus Charities Foundation, which supports charitable activities focused on disadvantaged youth and education in the Company’s hometown of Austin, TX, as well as in the local markets served by the Company’s communities. The Foundation has raised in excess of $7.5 million for the causes consistent with its focus. |

14

Table of Contents

|

Herman E. Bulls Age: 66

Director since 2021

Committees: Strategic Planning and Risk |

Experience • Vice Chairman, Americas; International Director and the founder of the Public Institutions Business Unit, JLL; joined 1989 and worked in the areas of development, investment management, asset management, facilities operations and business development/retention. • Co-founder, President and CEO, Bulls Capital Partners, a Fannie Mae multi-family financing company (former) • Founder, Bulls Advisory Group, LLC, a management and real estate advisory firm (former) • Selected by the Secretary of Veteran Affairs under President Obama to serve as a member of the MyVA Advisory Committee, whose mission was to advise the Secretary on the modernization of VA’s culture, processes, and capabilities in order to put the needs, expectations, and interests of Veterans and beneficiaries first. • Completed almost 12 years of active-duty service with the United States Army; last active-duty assignments were working in the Office of the Assistant Secretary of the Army for Financial Management at the Pentagon and as an Assistant Professor of Economics and Finance at West Point; completed the Army’s Airborne, Ranger and Command and General Staff College courses and served overseas in the Republic of Korea; retired as a Colonel in the U.S. Army Reserves in 2008.

Qualifications • Experience in real estate investment and development; real estate operation; real estate capital allocation; strategic planning; corporate governance; higher education; business development and leadership; diversity and inclusion

Education • B.S., Engineering, United States Military Academy at West Point • M.B.A., Finance, Harvard Business School

Other Public Boards • Director, Host Hotels (NYSE: HST) • Director, Comfort Systems, USA (NYSE: FIX) • Chairman, Fluence Energy (NASDAQ: FLNC)

Prior Public Boards • Director, Computer Sciences Corporation (CSC) (2015 – 2017)

Non-Public Boards • Director, Collegis Education • Vice Chairman, USAA • Member, Real Estate Advisory Committee for New York State Teachers’ Retirement System • Member, American Red Cross National Board of Governors • Vice Chairman, West Point Association of Graduates • Chairman, Fannie Mae National Housing Advisory Council (former) |

|

G. Steven Dawson Age: 64

Director since 2004

Committees: Audit, Compensation |

Experience • Private investor focused on real estate, financial services and other commercial interests in the US and Canada • Chief Financial Officer, Camden Property Trust (NYSE:CPT), a large multifamily REIT based in Houston with apartment operations, construction and development activities throughout the United States, and its predecessors (1990 – 2003)

Qualifications • Experience in financial reporting, accounting and controls; REIT management; real estate operations, investment and development

Education • B.B.A., Accounting, Texas A&M University

Other Public Boards • Cohen & Co. (NYSE American: COHN), a financial services firm specializing in fixed income and structured credit securities trading, securitizations, management, advisory operations and sponsor, advisor, and underwriter of special purpose acquisition companies (SPACs) in the U.S. and Europe • Medical Properties Trust (NYSE: MPW), a hospital/healthcare REIT with hospital properties in the U.S., Australia, Europe and South America • Nova Net Lease REIT (CSE: NNL-U.CN), a Canadian listed REIT with assets located in the U.S.

Non-Public Boards • Real Estate Roundtable, Mays Graduate School of Business at Texas A&M University |

15

Table of Contents

|

Cydney C. Donnell Age: 62

Chair of the Board

Director since 2004 Committees: Executive, Capital Allocation |

Experience • Director of Real Estate Programs, Executive Professor and Associate Department Head of the Finance Department, Mays Business School of Texas A&M University (since February 2011); has taught various subject matters, including real estate finance, investments and corporate governance (since August 2004) • Former Principal and Managing Director, European Investors/E.I.I. Realty Securities, Inc.; served in various capacities at EII and was Chair of the Investment Committee (2002 – 2003); Head of the Real Estate Securities Group and Portfolio Manager (1992 – 2002); Vice-President and Analyst (1986 – 1992); served on the Board of European Investors Holding Company (1992 – 2005) • Real Estate Lending Officer, RepublicBanc Corporation in Dallas (1983 – 1986)

Qualifications • Experience in financial investment and services; REITs; corporate governance; university operations; strategic planning

Education • B.B.A., Texas A&M University • M.B.A., Southern Methodist University

Other Public Boards • Pebblebrook Hotel Trust (NYSE:PEB), a hotel REIT

Non-Public Boards • Board of Trustees, Trinity University in San Antonio, Texas • Board of Directors, Madison Harbor Balanced Strategies Inc., a closed-end investment fund registered under the Investment Company Act of 1940 and a REIT from 2005 to 2017 (former) • Employees Retirement System of Texas Board of Trustees, appointed by Governor Rick Perry (2017 – May 2019) • Board and Institutional Advisory Committee of the National Association of Real Estate Investment Trusts, or Nareit (former) |

|

Mary C. Egan Age: 54

Director since 2018

Committees: Compensation, Strategic Planning and Risk |

Experience • Independent consultant providing customer-centric research and strategy services to companies across the consumer sector (food, restaurants, home, fashion, travel and tourism, and healthcare) • Founder and CEO, Gatheredtable, a food tech B2C SaaS startup (2013 – 2018) • Head of Global Strategy, Starbucks (2010 – 2012) • Partner and Managing Director, The Boston Consulting Group (1996 – 2010)

Qualifications • Experience in strategic planning; technology; business development; leadership; development and execution of strategic enterprise, operational and policy plans

Education • B.A., Barnard College, Columbia University • M.B.A., Columbia University Graduate School of Business

Other Public Boards • Noodles & Company (NASDAQ: NDLS), a fast-casual restaurant concept |

16

Table of Contents

|

Alison M. Hill Age: 56

Director since 2021

Committees: Capital Allocation, Compensation |

Experience • Independent advisor • Managing Director, Strategic Capital, Prologis (NYSE: PLD), where she was responsible for the formation, structuring and operations of Prologis’ co-investment ventures globally; member of the Prologis’ Americas and Europe Investment Committees; after merger with AMB (NYSE: AMB), was integral in growing and streamlining Prologis’ strategic capital business (2009 – 2021) • Served in a variety of positions within the private capital business, helping to expand the private capital business outside the U.S., AMB Property Corporation (1999 – merger with Prologis in 2011) • Practiced real estate law at the global law firm of Morrison & Foerster • Practiced law with Lionel Sawyer & Collins within the real estate and commercial transactions groups

Qualifications • Experience in real estate investment and development; real estate private capital, funds and joint ventures; real estate operation; real estate capital allocation; REITs; law; business development and leadership

Education • B.A., International Relations, Hamilton College • J.D., cum laude, Case Western Reserve University School of Law

Non-Public Boards • The SWIG Company, a San Francisco based privately owned real estate investor and operator • GirlVentures, a San Francisco-Bay area based non-profit that inspires girls to lead through outdoor adventure, inner discovery and collective action • Board of Trustees, Hamilton College |

|

Craig A. Leupold Age: 59

Director since 2021

Committees: Capital Allocation, Executive, Nominating and Corporate Governance |

Experience • Chief Executive Officer, GSI Capital Advisors, an investment manager focused on investment opportunities in publicly traded real estate securities, primarily REITs • President and Chief Executive Officer, Green Street Advisors, Inc., a commercial real estate, news, data, analytics and advisory services firm (2008 – 2020); joined in 1993 • Real estate consultant, Kenneth Leventhal and Company • Commercial real estate lender, Union Bank of California

Qualifications • Experience in real estate investment and development; REIT management; real estate operations, real estate capital allocation; business development and leadership

Education • B.A., University of California, San Diego • M.B.A., Finance and Real Estate, Columbia University Graduate School of Business |

17

Table of Contents

|

Oliver Luck Age: 62

Director since 2012

Committees: Nominating and Corporate Governance, Strategic Planning and Risk |