| MEDIA RELEASE |  |

American Campus Communities, Inc. Reports Fourth Quarter

and Year End 2011 Financial Results

AUSTIN, Texas--(BUSINESS WIRE)—February 14, 2012--American Campus Communities, Inc. (NYSE:ACC) today announced the following financial results for the quarter and year ended December 31, 2011.

Highlights

|

§

|

Increased quarterly FFOM 18.6 percent to $36.7 million or $0.50 per fully diluted share compared to $30.9 million or $0.45 per fully diluted share in the fourth quarter prior year. Increased 2011 full year FFOM 36.5 percent to $128.1 million or $1.81 per fully diluted share compared to $93.9 million or $1.58 per fully diluted share for the full year 2010.

|

|

§

|

Increased same store wholly-owned net operating income ("NOI") by 4.2 percent over the fourth quarter 2010 and 5.1 percent over the year ended December 31, 2010.

|

|

§

|

Increased same store wholly-owned occupancy to 98.4 percent as of December 31, 2011 compared to 98.3 percent for same date prior year.

|

|

§

|

Acquired two off-campus properties totaling $93.0 million with 1,710 beds and serving students attending The University of Texas at Austin and Florida State University in Tallahassee.

|

|

§

|

Acquired a 79.5 percent interest in the existing entity that owns The Varsity, based upon a total value of $121.5 million, containing 901 beds and serving students attending the University of Maryland in College Park.

|

|

§

|

Commenced redevelopment on Manzanita Hall, a $50.3 million American Campus Equity (ACE®) project, containing 816 beds at Arizona State University.

|

|

§

|

In 2011, completed construction and opened four new owned properties totaling $109.6 million with approximately 2,480 beds and average occupancy of 98.7 percent.

|

|

§

|

During the year, acquired four properties containing approximately 3,400 beds with an average distance to campus of 0.4 miles, and a retail center for future development totaling $261.6 million.

|

|

§

|

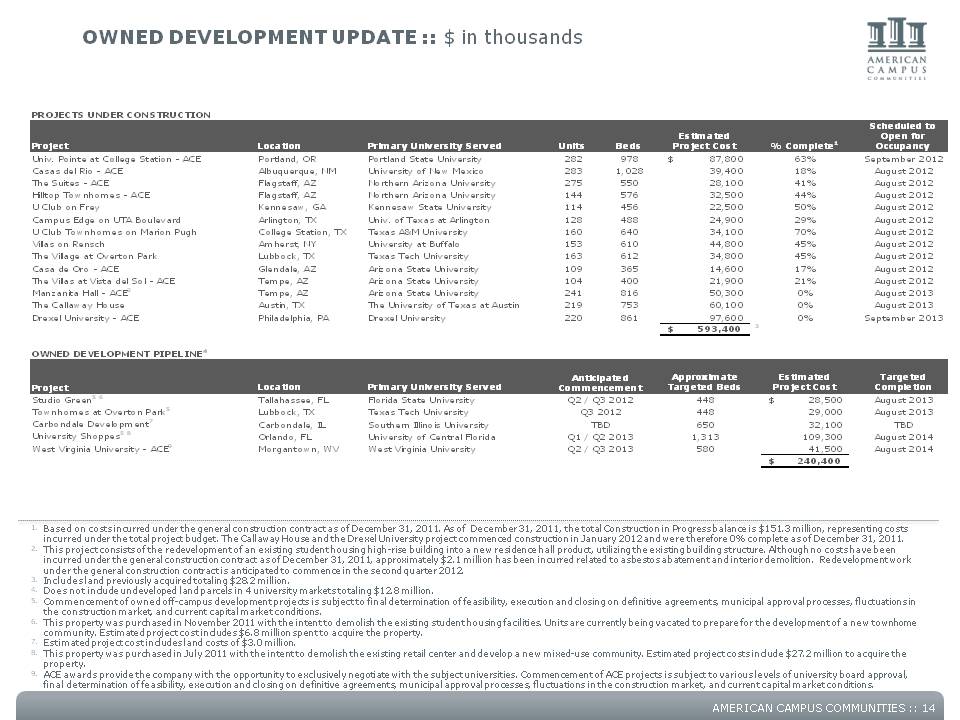

In 2011, commenced or continued construction on 11 owned-development projects totaling approximately $385.4 million and containing 6,703 beds to be delivered in 2012 with average distance to campus of 0.1 miles.

|

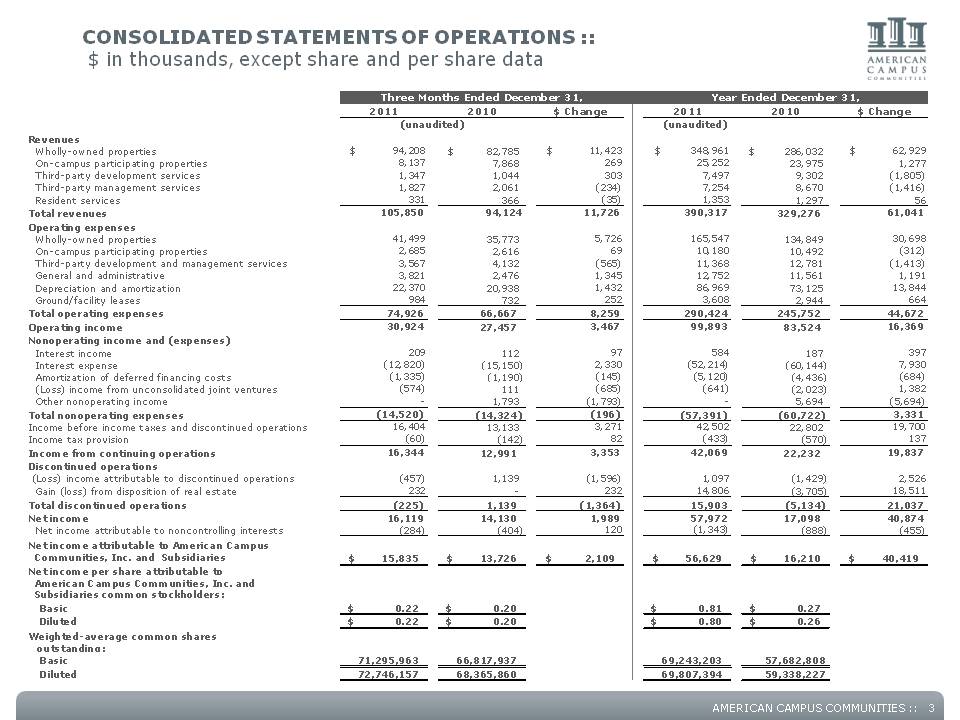

Fourth Quarter Operating Results

Revenue for the 2011 fourth quarter totaled $105.9 million, up 12.5 percent from $94.1 million in the fourth quarter 2010. Operating income for the quarter increased $3.5 million or 12.6 percent over the prior year fourth quarter, primarily due to growth resulting from property acquisitions and recently completed development properties, as well as increased occupancy and rental rates for the 2011-2012 academic year. Net income for the 2011 fourth quarter totaled $15.8 million, or $0.22 per fully diluted share, compared with net income of $13.7 million, or $0.20 per fully diluted share, for the same quarter in 2010. The increase in net income as compared to the prior year quarter is primarily due to the increases in operating income discussed above, as well as a decrease in interest expense resulting from loans paid off in 2010 and 2011 and increased capitalized interest due to an increase in construction activity on our owned development projects. This increase in net income was offset by a gain on insurance settlement recognized in the fourth quarter 2010, and an impairment charge totaling $0.6 million taken in the fourth quarter 2011 related to a property that is anticipated to be sold in the first half of 2012 and is classified in discontinued operations. FFO for the 2011 fourth quarter totaled $39.4 million, or $0.54 per fully diluted share, as compared to $35.4 million, or $0.52 per fully diluted share for the same quarter in 2010. FFOM for the 2011 fourth quarter was $36.7 million, or $0.50 per fully diluted share as compared to $30.9 million, or $0.45 per fully diluted share for the same quarter in 2010. A reconciliation of FFO and FFOM to net income is shown in Table 3.

1

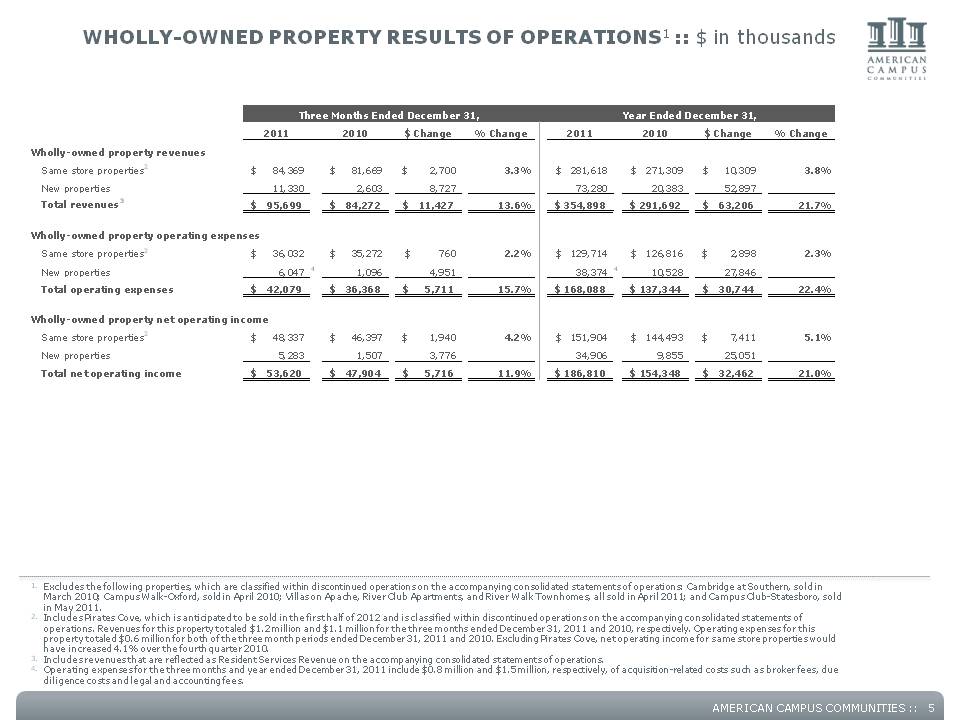

NOI for same store wholly-owned properties was $48.3 million in the quarter, up 4.2 percent from $46.4 million in the 2010 fourth quarter. Same store wholly-owned property revenues increased by 3.3 percent over the 2010 fourth quarter due to an increase in occupancy and average rental rates for the 2011-2012 academic year. Same store wholly-owned property operating expenses increased by 2.2 percent over the prior year quarter. NOI for the total wholly-owned portfolio increased 11.9 percent to $53.6 million for the quarter from $47.9 million in the comparable period of 2010.

“Our fourth quarter operational performance, financial results and investment activity exceeded our expectations, capping off a year of solid value creation with FFOM per share increasing 15 percent,” said Bill Bayless, American Campus CEO. “In Fall 2011 we added more than $370 million in assets via our development and acquisition efforts and cemented a development and presale pipeline of an additional $682 million for Fall 2012-2013 deliveries. This brings our expected growth for the two year period of Fall 2011 to 2013 to more than $1.0 billion and approximately 16,460 beds with 23 of these 25 properties being core class A assets pedestrian to their respective universities.”

Portfolio Update

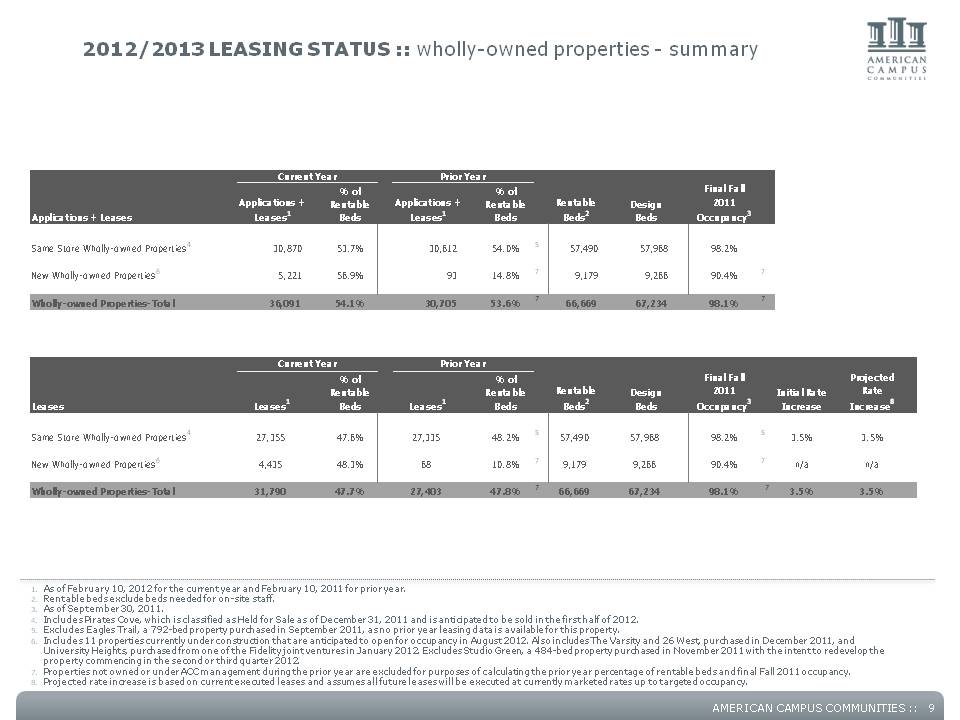

As of February 10, 2012, the company’s same store wholly-owned portfolio was 53.7 percent applied for and 47.6 percent leased compared to 54.0 percent applied for and 48.2 percent leased for the same date prior year, with a 3.5 percent current rental rate increase projected over the in-place rent.

Acquisitions

On November 4, Studio Green, located across the street from Florida State University in Tallahassee, was acquired for $6.8 million as a development opportunity. The company plans to invest an additional $21.7 million to demolish the existing structure and develop a new 448-bed townhome community with an 8,400-square-foot community center and resort-style pool. Construction is scheduled to commence in Summer 2012 with targeted completion in August 2013.

On December 7, the company acquired Jefferson 26, renamed 26 West, for $86.2 million. The 1,026-bed off-campus community is located one block from The University of Texas at Austin in the West Campus submarket. Including $2.8 million in amenity enhancements and capital improvements, the property is expected to produce a 6.2 percent nominal yield and 5.9 percent economic yield during the first year.

On December 28, American Campus acquired a 79.5 percent interest in the existing entity that owns The Varsity, based upon a total value of $121.5 million, and has full operational control of the property. The 901-bed community, located immediately adjacent to the University of Maryland campus, opened in August 2011 with 91 percent occupancy and includes 23,000-square feet of fully leased student-oriented retail. Based on the total value of the asset and including retail operations, the property is expected to produce a 6.2 percent nominal yield and 6.0 percent economic yield during the first year.

Subsequent to year-end, the company acquired the remaining 90 percent ownership interest in University Heights, a former joint venture asset, for a purchase price of $14.5 million. The 636-bed off-campus community serves students attending the University of Tennessee in Knoxville.

2

Developments

Owned

During the quarter, the company commenced demolition and abatement for the redevelopment of Manzanita Hall, an 816-bed iconic high-rise at Arizona State University. Full construction on the $50.3 million ACE project is scheduled to commence in the second quarter of 2012 with completion anticipated in August 2013.

In January, the company commenced construction on The Callaway House Austin, a 753-bed off-campus community serving students attending The University of Texas. The $60.1 million modern full service residence hall is located on a 1.2-acre site one block from the core of campus within the West Campus area.

Subsequent to year end, the company commenced construction on the owned American Campus Equity (ACE) project at Drexel University. The $97.6 million urban high-rise community will contain 861 beds and is adjacent to the student center, dining and performing arts building. The mixed-use community will include 25,000-square-feet of retail space and feature a 14,800-square-foot community center. The project is scheduled to open for occupancy in Fall 2013.

In February, the company executed a predevelopment agreement with West Virginia University for a $41.5 million on-campus ACE project containing 580 beds with targeted August 2014 completion.

Also subsequent to year end, the company purchased an 8.0-acre site located approximately 0.25 miles from Texas Tech University in Lubbock and obtained zoning approvals to develop the Townhomes at Overton Park. The $29.0 million townhome community will include 448 beds and a 7,750-square-foot community center. Construction is scheduled to commence in July 2012 with completion in Fall 2013.

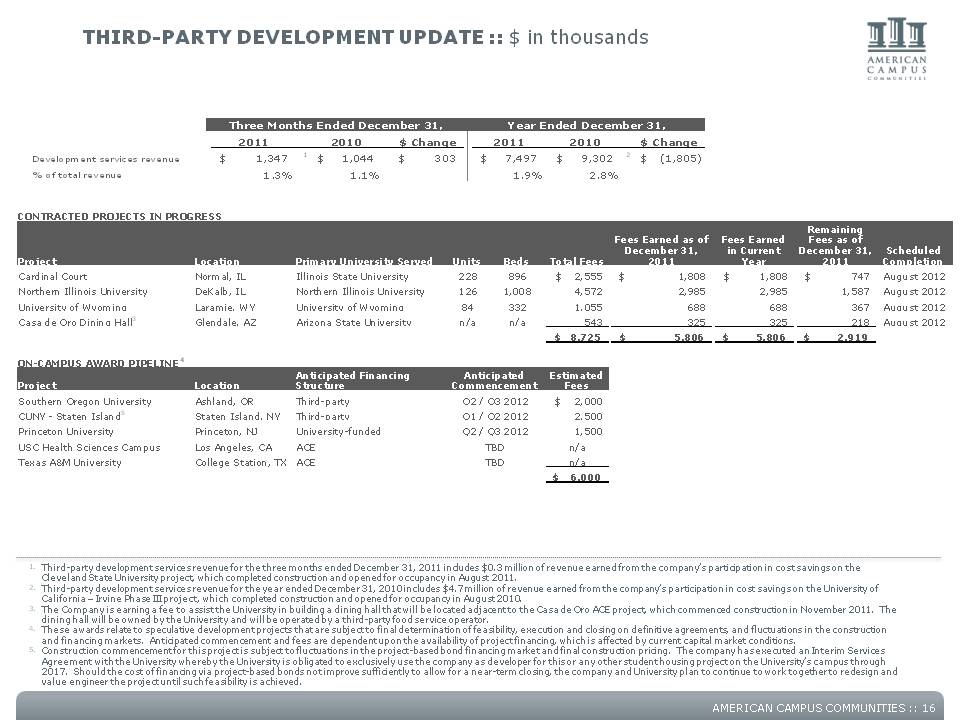

Third-party

During the quarter, the company commenced construction on the third-party Casa de Oro dining hall on the Arizona State University - West campus with scheduled completion in August 2012.

Capital Markets

Subsequent to quarter end, the company amended and expanded its combined revolver and term loan unsecured credit facility. The amendment included expanding the term loan facility by $150 million, increasing the maturity date of the facilities each by one year from the date of the amendment, and lowering the interest rate spreads to reflect current market terms. The revolving credit facility will now mature in January 2016 with an option to extend the maturity date by one year to January 2017. The term loan facility will mature in January 2017. The amended facility has an accordion feature that allows American Campus to expand either loan by up to an additional $100 million combined. Borrowing rates under the amended facility will float at a margin over LIBOR based on a grid tied to the company’s credit rating. Based on American Campus’ current Baa3/BBB- rating, the all-in LIBOR margin at closing was 175 basis points on the revolving credit facility and 165 basis points on the term loan facility.

On February 2, 2012, the company entered into multiple interest rate swap agreements totaling $350 million effective February 2, 2012 through January 2, 2017. The counter-parties are major financial institutions and the swaps will be used to hedge the company’s exposure to fluctuations in interest payments on its LIBOR-based unsecured term loan. Under the terms of the interest rate swap agreements, the company will pay an average fixed rate of 0.8792 percent plus a spread based upon the company’s credit rating and receives a floating rate of LIBOR.

At-The-Market (ATM) Share Offering Program

During the quarter, the company sold 1,903,024 shares of common stock under the ATM program at a weighted average price of $39.54 per share for net proceeds of approximately $74.1 million. For the full year, the company sold 5,716,760 shares of common stock at a weighted average price of $36.56 per share for net proceeds of approximately $205.8 million. Subsequent to quarter end, ACC sold an additional 1,802,306 shares of common stock at a weighted average price of $41.61 per share for net proceeds of approximately $73.9 million. The proceeds raised under the program are being used to match fund the company's development activity.

3

2012 Outlook

The company believes that the financial results for the fiscal year ending December 31, 2012 may be affected by, among other factors:

|

§

|

national and regional economic trends and events;

|

|

§

|

the timing of dispositions;

|

|

§

|

interest rate risk;

|

|

§

|

the timing of starts and completion of owned development projects;

|

|

§

|

the ability of the company to be awarded and the timing of the commencement of construction of third-party development projects;

|

|

§

|

university enrollment, funding and policy trends;

|

|

§

|

the ability of the company to earn third-party development and management revenues;

|

|

§

|

the amount of income recognized by the taxable REIT subsidiaries and any corresponding income tax expense;

|

|

§

|

the ability of the company to integrate acquired properties; and

|

|

§

|

the success of releasing the company’s owned properties for the 2012-2013 academic year.

|

Based upon these factors, management anticipates that fiscal year 2012 FFO will be in the range of $1.99 to $2.10 per fully diluted share and FFOM will be in the range of $1.94 to $2.05 per fully diluted share. All guidance is based on the current expectations and judgment of the company’s management team.

A reconciliation of the range provided for projected net income to projected FFO and FFOM for the fiscal year ending December 31, 2012, and assumptions utilized, is included in Table 4.

Supplemental Information and Earnings Conference Call

Supplemental financial and operating information, as well as this release, are available in the investor relations section of the American Campus Communities website, www.americancampus.com. In addition, the company will host a conference call to discuss fourth quarter and year end results and the 2012 outlook on Wednesday, February 15, 2012 at 11 a.m. EST (10:00 a.m. CST). To participate by telephone, call 866-843-0890 at least five minutes prior to the call.

To listen to the live broadcast, go to www.americancampus.com at least 15 minutes prior to the call so that required audio software can be downloaded. Informational slides in the form of the supplemental analyst package can be accessed via the website. A replay of the conference call will be available beginning one hour after the end of the call until February 23, 2012 by dialing 877-344-7529 or 412-317-0088 conference number 10008510. The replay also will be available for one year at www.americancampus.com. The call will also be available as a podcast on www.REITcafe.com and on the company’s website shortly after the call.

About American Campus Communities

American Campus Communities, Inc. is the largest owner and manager of high-quality student housing communities in the United States. The company is a fully integrated, self-managed and self-administered equity real estate investment trust (REIT) with expertise in the design, finance, development, construction management, and operational management of student housing properties. American Campus Communities owns 120 student housing properties containing approximately 74,900 beds. Including its owned and third-party managed properties, ACC’s total managed portfolio consists of 149 properties with approximately 98,400 beds. Visit www.americancampus.com or www.studenthousing.com

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates and projections about the industry and markets in which American Campus operates management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict.

4

Table 1

American Campus Communities, Inc. and Subsidiaries

Consolidated Balance Sheets

(dollars in thousands)

|

December 31, 2011

|

December 31, 2010

|

|||||||

|

Assets

|

(unaudited)

|

|||||||

|

Investments in real estate:

|

||||||||

|

Wholly-owned properties, net

|

$ | 2,761,757 | $ | 2,433,844 | ||||

|

Wholly-owned property held for sale

|

27,300 | - | ||||||

|

On-campus participating properties, net

|

59,850 | 62,486 | ||||||

|

Investments in real estate, net

|

2,848,907 | 2,496,330 | ||||||

|

Cash and cash equivalents

|

22,399 | 113,507 | ||||||

|

Restricted cash

|

22,956 | 26,764 | ||||||

|

Student contracts receivable, net

|

5,324 | 5,736 | ||||||

|

Other assets

|

108,996 | 51,147 | ||||||

|

Total assets

|

$ | 3,008,582 | $ | 2,693,484 | ||||

|

Liabilities and equity

|

||||||||

|

Liabilities:

|

||||||||

|

Secured mortgage, construction and bond debt

|

$ | 858,530 | $ | 1,144,103 | ||||

|

Unsecured term loan

|

200,000 | - | ||||||

|

Senior secured term loan

|

- | 100,000 | ||||||

|

Unsecured revolving credit facility

|

273,000 | - | ||||||

|

Secured agency facility

|

116,000 | 101,000 | ||||||

|

Accounts payable and accrued expenses

|

36,884 | 34,771 | ||||||

|

Other liabilities

|

77,840 | 61,011 | ||||||

|

Total liabilities

|

1,562,254 | 1,440,885 | ||||||

|

Redeemable noncontrolling interests

|

42,529 | 34,704 | ||||||

|

Equity:

|

||||||||

|

American Campus Communities, Inc. and Subsidiaries

stockholders’ equity:

|

||||||||

|

Common stock

|

725 | 667 | ||||||

|

Additional paid in capital

|

1,664,416 | 1,468,179 | ||||||

|

Accumulated earnings and dividends

|

(286,565 | ) | (249,381 | ) | ||||

|

Accumulated other comprehensive loss

|

(3,360 | ) | (5,503 | ) | ||||

|

Total American Campus Communities, Inc. and Subsidiaries

stockholders’ equity

|

1,375,216 | 1,213,962 | ||||||

|

Noncontrolling interests

|

28,583 | 3,933 | ||||||

|

Total equity

|

1,403,799 | 1,217,895 | ||||||

|

Total liabilities and equity

|

$ | 3,008,582 | $ | 2,693,484 | ||||

5

Table 2

American Campus Communities, Inc. and Subsidiaries

Consolidated Statements of Operations

(dollars in thousands, except share and per share data)

|

Three Months Ended December 31,

|

Year Ended December 31,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Revenues:

|

(unaudited)

|

(unaudited)

|

||||||||||||||

|

Wholly-owned properties

|

$ | 94,208 | $ | 82,785 | $ | 348,961 | $ | 286,032 | ||||||||

|

On-campus participating properties

|

8,137 | 7,868 | 25,252 | 23,975 | ||||||||||||

|

Third-party development services

|

1,347 | 1,044 | 7,497 | 9,302 | ||||||||||||

|

Third-party management services

|

1,827 | 2,061 | 7,254 | 8,670 | ||||||||||||

|

Resident services

|

331 | 366 | 1,353 | 1,297 | ||||||||||||

|

Total revenues

|

105,850 | 94,124 | 390,317 | 329,276 | ||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

Wholly-owned properties

|

41,499 | 35,773 | 165,547 | 134,849 | ||||||||||||

|

On-campus participating properties

|

2,685 | 2,616 | 10,180 | 10,492 | ||||||||||||

|

Third-party development and management services

|

3,567 | 4,132 | 11,368 | 12,781 | ||||||||||||

|

General and administrative

|

3,821 | 2,476 | 12,752 | 11,561 | ||||||||||||

|

Depreciation and amortization

|

22,370 | 20,938 | 86,969 | 73,125 | ||||||||||||

|

Ground/facility leases

|

984 | 732 | 3,608 | 2,944 | ||||||||||||

|

Total operating expenses

|

74,926 | 66,667 | 290,424 | 245,752 | ||||||||||||

|

Operating income

|

30,924 | 27,457 | 99,893 | 83,524 | ||||||||||||

|

Nonoperating income and (expenses):

|

||||||||||||||||

|

Interest income

|

209 | 112 | 584 | 187 | ||||||||||||

|

Interest expense

|

(12,820 | ) | (15,150 | ) | (52,214 | ) | (60,144 | ) | ||||||||

|

Amortization of deferred financing costs

|

(1,335 | ) | (1,190 | ) | (5,120 | ) | (4,436 | ) | ||||||||

|

(Loss) income from unconsolidated joint ventures

|

(574 | ) | 111 | (641 | ) | (2,023 | ) | |||||||||

|

Other nonoperating income

|

- | 1,793 | - | 5,694 | ||||||||||||

|

Total nonoperating expenses

|

(14,520 | ) | (14,324 | ) | (57,391 | ) | (60,722 | ) | ||||||||

|

Income before income taxes and discontinued operations

|

16,404 | 13,133 | 42,502 | 22,802 | ||||||||||||

|

Income tax provision

|

(60 | ) | (142 | ) | (433 | ) | (570 | ) | ||||||||

|

Income from continuing operations

|

16,344 | 12,991 | 42,069 | 22,232 | ||||||||||||

|

Discontinued operations:

|

||||||||||||||||

|

(Loss) income attributable to discontinued operations

|

(457 | ) | 1,139 | 1,097 | (1,429 | ) | ||||||||||

|

Gain (loss) from disposition of real estate

|

232 | - | 14,806 | (3,705 | ) | |||||||||||

|

Total discontinued operations

|

(225 | ) | 1,139 | 15,903 | (5,134 | ) | ||||||||||

|

Net income

|

16,119 | 14,130 | 57,972 | 17,098 | ||||||||||||

|

Net income attributable to noncontrolling interests

|

(284 | ) | (404 | ) | (1,343 | ) | (888 | ) | ||||||||

|

Net income attributable to American Campus

Communities, Inc. and Subsidiaries

|

$ | 15,835 | $ | 13,726 | $ | 56,629 | $ | 16,210 | ||||||||

|

Net income per share attributable to American

Campus Communities Inc. and Subsidiaries

common stockholders:

|

||||||||||||||||

|

Basic

|

$ | 0.22 | $ | 0.20 | $ | 0.81 | $ | 0.27 | ||||||||

|

Diluted

|

$ | 0.22 | $ | 0.20 | $ | 0.80 | $ | 0.26 | ||||||||

|

Weighted average common shares outstanding:

|

||||||||||||||||

|

Basic

|

71,295,963 | 66,817,937 | 69,243,203 | 57,682,808 | ||||||||||||

|

Diluted

|

72,746,157 | 68,365,860 | 69,807,394 | 59,338,227 | ||||||||||||

6

Table 3

American Campus Communities, Inc. and Subsidiaries

Calculation of FFO and FFOM

(dollars in thousands, except share and per share data)

|

Three Months Ended December 31,

|

Year Ended December 31,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Net income attributable to American Campus

Communities, Inc. and Subsidiaries

|

$ | 15,835 | $ | 13,726 | $ | 56,629 | $ | 16,210 | ||||||||

|

Noncontrolling interests

|

284 | 404 | 1,343 | 888 | ||||||||||||

|

(Gain) loss from disposition of real estate

|

(232 | ) | - | (14,806 | ) | 3,705 | ||||||||||

|

Loss (income) from unconsolidated joint ventures

|

574 | (111 | ) | 641 | 2,023 | |||||||||||

|

FFO from unconsolidated joint ventures1

|

(557 | ) | 23 | (576 | ) | (1,195 | ) | |||||||||

|

Real estate related depreciation and amortization

|

22,382 | 21,325 | 87,951 | 75,667 | ||||||||||||

|

Elimination of provision for asset impairment –

wholly owned properties2 3

|

559 | - | 559 | 4,036 | ||||||||||||

|

Elimination of provision for asset impairment –

unconsolidated joint ventures2 4

|

546 | - | 546 | 1,414 | ||||||||||||

|

Funds from operations (“FFO”)

|

39,391 | 35,367 | 132,287 | 102,748 | ||||||||||||

|

Elimination of operations of on-campus participating

properties and unconsolidated joint venture:

|

||||||||||||||||

|

Net income from on-campus participating properties

|

(2,498 | ) | (2,367 | ) | (3,074 | ) | (1,809 | ) | ||||||||

|

Amortization of investment in on-campus participating

properties

|

(1,138 | ) | (1,092 | ) | (4,468 | ) | (4,345 | ) | ||||||||

|

FFO from Hampton Roads unconsolidated joint venture5

|

- | - | - | 160 | ||||||||||||

| 35,755 | 31,908 | 124,745 | 96,754 | |||||||||||||

|

Modifications to reflect operational performance of on

campus participating properties:

|

||||||||||||||||

|

Our share of net cash flow6

|

564 | 449 | 2,190 | 1,710 | ||||||||||||

|

Management fees

|

374 | 363 | 1,144 | 1,086 | ||||||||||||

|

Impact of on-campus participating properties

|

938 | 812 | 3,334 | 2,796 | ||||||||||||

|

Gain on remeasurement of equity method investments7

|

- | (197 | ) | - | (4,098 | ) | ||||||||||

|

Gain on insurance settlement8

|

- | (1,596 | ) | - | (1,596 | ) | ||||||||||

|

Funds from operations-modified ("FFOM”)

|

$ | 36,693 | $ | 30,927 | $ | 128,079 | $ | 93,856 | ||||||||

|

FFO per share – diluted

|

$ | 0.54 | $ | 0.52 | $ | 1.87 | $ | 1.73 | ||||||||

|

FFOM per share – diluted

|

$ | 0.50 | $ | 0.45 | $ | 1.81 | $ | 1.58 | ||||||||

|

Weighted average common shares outstanding –

diluted

|

72,860,285 | 68,480,823 | 70,834,789 | 59,453,190 | ||||||||||||

| 1. | Represents our share of the FFO from three joint ventures in which we are or were a minority partner. Includes the Hampton Roads Military Housing joint venture in which we have a minimal economic interest as well as our 10% noncontrolling interest in two joint ventures (the “Fidelity Joint Ventures”) formed or assumed as part of the company’s acquisition of GMH. In September and November 2010, we purchased Fidelity’s 90% interest in 14 joint venture properties. Subsequent to the acquisition, the 14 properties are now wholly-owned and are consolidated by the company. One property was not acquired and will continue to be owned by one of the Fidelity Joint Ventures. |

| 2. |

In October 2011, the National Association of Real Estate Investment Trusts (“NAREIT”) issued guidance directing member companies to exclude impairment write-downs of depreciable real estate from the calculation of FFO. Previously, the company had included such charges in the calculation of FFO, but had excluded these charges when calculating FFOM. In order to conform to the current NAREIT guidance, the company has revised its calculation of FFO for all periods presented to exclude such impairment charges. This change in presentation has no effect on FFOM for any of the periods presented, as the company previously excluded such charges from FFOM.

|

| 3. |

For the three months and year ended December 31, 2011, represents an impairment charge recorded for Pirates Cove, a property that is classified as Held for Sale as of December 31, 2011 and is included in discontinued operations for all periods presented. For the year ended December 31, 2010, represents an impairment charge recorded for Campus Walk – Oxford, a property that was sold in April 2010.

|

| 4. |

Represents our share of impairment charges recorded during the periods presented for properties owned through our unconsolidated Fidelity Joint Ventures.

|

| 5. |

Our share of the FFO from the Hampton Roads Military Housing unconsolidated joint venture is excluded from the calculation of FFOM, as management believes this amount does not accurately reflect the company’s participation in the economics of the transaction.

|

| 6. |

50% of the properties’ net cash available for distribution after payment of operating expenses, debt service (including repayment of principal) and capital expenditures. Represents actual cash received for the year-to-date periods and amounts accrued for the interim periods.

|

| 7. |

Represents non-cash gains recorded to remeasure the company’s equity method investments in the Fidelity Joint Ventures to fair value as a result of the company purchasing Fidelity’s remaining 90% interest in 14 joint venture properties in September and November 2010.

|

| 8. |

Represents a gain on insurance settlement related to significant property damage resulting from a fire that occurred at one of our wholly-owned properties in April 2010.

|

7

Table 4

American Campus Communities, Inc. and Subsidiaries

2012 Outlook1

(unaudited, dollars in thousands, except per share data)

|

Low

|

High

|

|||||||

|

Net income

|

$ | 50,800 | $ | 58,500 | ||||

|

Noncontrolling interests

|

1,200 | 1,400 | ||||||

|

Depreciation and amortization

|

100,400 | 102,100 | ||||||

|

Funds from operations (“FFO”)

|

152,400 | 162,000 | ||||||

|

Elimination of operations from on-campus participating properties

|

(7,000 | ) | (7,200 | ) | ||||

|

Modifications to reflect operational performance of on-campus

participating properties

|

2,800 | 3,200 | ||||||

|

Funds from operations – modified (“FFOM”)

|

$ | 148,200 | $ | 158,000 | ||||

|

Weighted average common shares outstanding – diluted

|

76,500,000 | 77,250,000 | ||||||

|

Net income per share – diluted

|

$ | 0.66 | $ | 0.76 | ||||

|

FFO per share – diluted

|

$ | 1.99 | $ | 2.10 | ||||

|

FFOM per share – diluted

|

$ | 1.94 | $ | 2.05 | ||||

1 Assumes: (1) the company will achieve property level net operating income net of dispositions of $219.9 million to $228.8 million; (2) property dispositions of $68 million to $110 million; (3) property acquisitions and/or exercise of our purchase options under our mezzanine structures of $98 million to $119 million; (4) the company will generate third-party development and management services revenues from $13.5 million to $14.8 million; and (5) the issuance of an unsecured bond offering during the second or third quarter of 2012.

8