Exhibit 10.5

Execution Version

THIRD AMENDED AND RESTATED MASTER LEASE AND ACCESS AGREEMENT

Effective as of October 1, 2016

TABLE OF CONTENTS

| ARTICLE 1 DEFINITIONS AND INTERPRETATIONS |

1 | |||||

| 1.1 |

Definitions |

1 | ||||

| 1.2 |

Interpretation |

1 | ||||

| 1.3 |

Independent Obligations |

1 | ||||

| 1.4 |

Prior Leases |

2 | ||||

| ARTICLE 2 DEMISE OF APPLICABLE PREMISES AND TERM |

2 | |||||

| 2.1 |

Demise of Applicable Premises and Applicable Term |

2 | ||||

| 2.2 |

Access |

2 | ||||

| 2.3 |

Rent |

3 | ||||

| 2.4 |

Place of Payment |

3 | ||||

| 2.5 |

Net Lease |

3 | ||||

| ARTICLE 3 CONDUCT OF BUSINESS |

3 | |||||

| 3.1 |

Use of Applicable Premises |

3 | ||||

| 3.2 |

Waste |

3 | ||||

| 3.3 |

Governmental Regulations |

4 | ||||

| 3.4 |

Permits |

4 | ||||

| 3.5 |

Utilities |

6 | ||||

| 3.6 |

Tank Inspection and Repairs |

6 | ||||

| 3.7 |

Tank Inspection and Maintenance Plan |

6 | ||||

| 3.8 |

Notice of Planned Shutdown |

6 | ||||

| 3.9 |

Tulsa West Crude Tank Assets |

6 | ||||

| ARTICLE 4 ALTERATIONS, ADDITIONS AND IMPROVEMENTS |

7 | |||||

| 4.1 |

Additional Improvements |

7 | ||||

| 4.2 |

Quality; Compliance with Applicable Laws |

8 | ||||

| 4.3 |

Ownership |

8 | ||||

| 4.4 |

No Liens |

8 | ||||

| ARTICLE 5 MAINTENANCE OF APPLICABLE PREMISES |

8 | |||||

| 5.1 |

Maintenance by Relevant Asset Owner |

8 | ||||

| 5.2 |

Operation |

8 | ||||

| 5.3 |

Surrender of Applicable Premises |

8 | ||||

| 5.4 |

Release of Hazardous Substances |

9 | ||||

| ARTICLE 6 TAXES, ASSESSMENTS |

9 | |||||

| 6.1 |

Relevant Asset Owner’s Obligation to Pay |

9 | ||||

| 6.2 |

Manner of Payment |

9 | ||||

| ARTICLE 7 EMINENT DOMAIN; CASUALTY; INSURANCE |

10 | |||||

| 7.1 |

Total Condemnation of Applicable Premises |

10 | ||||

| 7.2 |

Partial Condemnation |

10 | ||||

| 7.3 |

Damages and Right to Additional Property |

10 | ||||

| 7.4 |

Insurance |

11 | ||||

i

| ARTICLE 8 ASSIGNMENT AND SUBLETTING |

11 | |||||

| 8.1 |

Assignment and Subletting |

11 | ||||

| 8.2 |

Release of Assigning Party |

11 | ||||

| ARTICLE 9 DEFAULTS; REMEDIES; TERMINATION |

12 | |||||

| 9.1 |

Default |

12 | ||||

| 9.2 |

Related Refinery Owner’s Remedies |

12 | ||||

| 9.3 |

Relevant Asset Owner’s Remedies |

13 | ||||

| ARTICLE 10 LIABILITY AND INDEMNIFICATION |

13 | |||||

| 10.1 |

Limitation of Liability; Indemnity |

13 | ||||

| 10.2 |

Survival |

13 | ||||

| ARTICLE 11 OPTION |

14 | |||||

| 11.1 |

Applicability of Option |

14 | ||||

| 11.2 |

Grant of Option |

14 | ||||

| 11.3 |

Determination of Fair Market Value |

14 | ||||

| 11.4 |

Cooperation |

14 | ||||

| 11.5 |

Survival |

14 | ||||

| ARTICLE 12 GENERAL PROVISIONS |

14 | |||||

| 12.1 |

Estoppel Certificates |

14 | ||||

| 12.2 |

Notices |

15 | ||||

| 12.3 |

Severability |

15 | ||||

| 12.4 |

Time of Essence |

15 | ||||

| 12.5 |

Captions |

15 | ||||

| 12.6 |

Entire Agreement |

15 | ||||

| 12.7 |

Waivers |

15 | ||||

| 12.8 |

Incorporation by Reference |

15 | ||||

| 12.9 |

Binding Effect |

15 | ||||

| 12.10 |

Amendment |

15 | ||||

| 12.11 |

No Partnership |

16 | ||||

| 12.12 |

No Third Party Beneficiaries |

16 | ||||

| 12.13 |

Governing Law |

16 | ||||

| 12.14 |

Cooperation |

16 | ||||

| 12.15 |

Further Assurances |

16 | ||||

| 12.16 |

Waiver of the Related Refinery Owner’s Lien |

16 | ||||

| 12.17 |

Recording |

16 | ||||

| 12.18 |

Warranty of Peaceful Possession |

17 | ||||

| 12.19 |

Survival |

17 | ||||

| 12.20 |

AS IS, WHERE IS |

17 | ||||

| 12.21 |

Relocation of Pipelines; Amendment |

17 | ||||

| 12.22 |

Counterparts |

17 | ||||

| 12.23 |

Joinder by Affiliates of Parties |

17 | ||||

EXHIBITS

| Exhibit A – Parties |

| Exhibit B – Master Lease and Access Agreement Amendments |

| Exhibit C - Definitions |

| Exhibit D – Interpretation |

ii

Applicable Assets:

| Exhibit E – Applicable Term and Applicable Assets |

| Exhibit E-1 – Applicable Assets: El Dorado Refinery Complex (for El Dorado Logistics) |

| Exhibit E-2 – Applicable Assets: Cheyenne Refinery Complex |

| Exhibit E-3 – Applicable Assets: Tulsa Refinery Complex |

| Exhibit E-4 – Applicable Assets: Woods Cross Refinery Complex |

| Exhibit E-5 – Applicable Assets: Woods Cross Pipeline Pad |

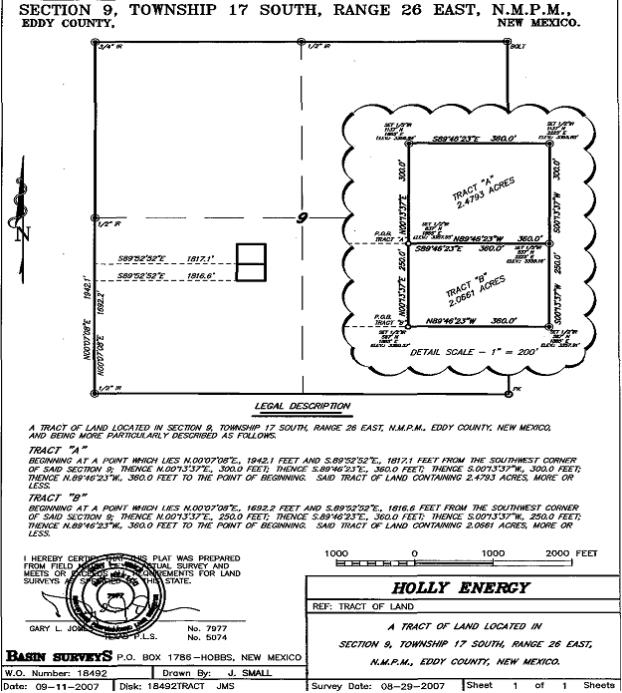

| Exhibit E-6 – Applicable Assets: Navajo Refinery Complex |

| Exhibit E-7 – Applicable Assets: Artesia Pump and Receiving Stations |

| Exhibit E-8 – Applicable Assets: El Dorado Refinery Complex (for El Dorado Operating) |

| Exhibit E-9 – Applicable Assets: Woods Cross Refinery Complex (for Woods Cross Operating) |

| Legal Descriptions: |

| Exhibit F – Description of Applicable Premises |

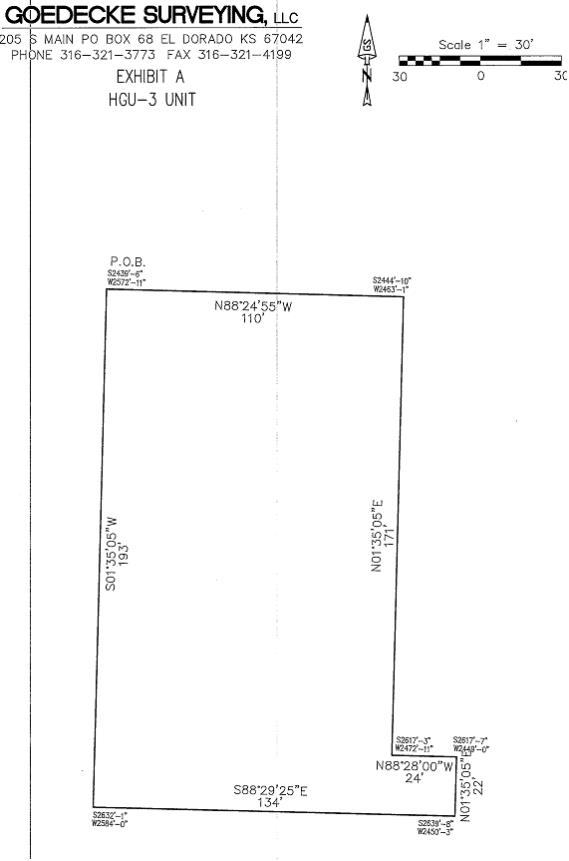

| Exhibit F-1 – Legal Description for El Dorado Refinery Complex |

| Exhibit F-2 – Legal Description for Cheyenne Refinery Complex |

| Exhibit F-3 – Legal Description for Tulsa Refinery Complex |

| Exhibit F-4 - Legal Description for Woods Cross Refinery Complex |

| Exhibit F-5 – Legal Description for Woods Cross Pipeline Pad |

| Exhibit F-6 – Legal Description for Navajo Refinery Complex |

| Exhibit F-7 – Legal Description for Artesia Pump and Receiving Stations |

| Exhibit F-8 – Legal Description for Woods Cross Crude Unit 2, FCC Unit 2 and Polymerization Unit |

iii

THIRD AMENDED AND RESTATED MASTER LEASE AND ACCESS AGREEMENT

This Third Amended and Restated Master Lease and Access Agreement (this “Lease”) is entered into on October 3, 2016 and effective as of 12:01 a.m. Central Time (the “Effective Time”) on October 1, 2016 (the “Effective Date”) by and between the Parties set forth on Exhibit A.

RECITALS:

A. Pursuant to certain transactions, each Relevant Asset Owner acquired its Applicable Assets located at the Refinery Complex from the Related Refinery Owner.

B. In connection with each such acquisition, each Related Refinery Owner and Relevant Asset Owner (except El Dorado Operating) entered into a Prior Lease pursuant to which the Related Refinery Owner leased to the Relevant Asset Owner real property at the Related Refinery Owner’s Refinery Complex on which all or a part of the Applicable Assets are located.

C. The Parties concurrently entered into an amended Master Site Services Agreement pursuant to which each Related Refinery Owner has agreed to provide certain services to the Relevant Asset Owner in connection with the Applicable Assets located at each Refinery Complex.

D. Each Related Refinery Owner and each Relevant Asset Owner (except El Dorado Operating) entered into the Original Master Lease and Access Agreement which amended and restated in its entirety their respective Prior Leases, if any, from and after January 1, 2015, all in accordance with the terms and conditions set forth in the Original Master Lease and Access Agreement.

E. The Original Master Lease and Access Agreement has been further amended and restated as set forth on Exhibit B, resulting in the Second Amended and Restated Master Lease and Access Agreement identified on Exhibit B.

F. The Parties now desire to amend and restate the Second Amended and Restated Master Lease and Access Agreement in its entirety in accordance with the terms and conditions set forth herein.

NOW, THEREFORE, for and in consideration of the Applicable Premises and the covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby amend and restate the Second Amended and Restated Master Lease and Access Agreement in its entirety as follows:

ARTICLE 1

DEFINITIONS AND INTERPRETATIONS

1.1 Definitions. Capitalized terms used throughout this Lease and not otherwise defined herein has the meanings set forth on Exhibit C.

1.2 Interpretation. Matters relating to the interpretation of this Agreement are set forth on Exhibit D.

1.3 Independent Obligations. The Parties hereby acknowledge and agree that (a) the obligations of each Relevant Asset Owner and each Related Refinery Owner are independent of any obligation of any other Relevant Asset Owner and Related Refinery Owner, respectively, (b) the Parties shall look solely to their counterparty (as identified on Exhibit A) for fulfillment of their respective obligations under this Agreement; and (c) no Relevant Asset Owner or Related Refinery Owner shall be obligated to fulfill any of the obligations of any other Relevant Asset Owner or Related Refinery Owner, respectively, and shall have no liability for such obligations.

1

1.4 Prior Leases. The Original Master Lease and Access Agreement, and each subsequent amendment identified on Exhibit B, amended and restated each Prior Lease in its entirety from and after January 1, 2015 through the Effective Time. It is the Parties’ intent that the terms and provisions of this Lease shall be effective and govern from and after the Effective Time. Any matter first arising prior to January 1, 2015 shall be governed by the respective Prior Lease related thereto, if any.

ARTICLE 2

DEMISE OF APPLICABLE PREMISES AND TERM

2.1 Demise of Applicable Premises and Applicable Term.

2.1.1 Demise of Applicable Premises. In consideration of the rents, covenants, and agreements set forth herein and subject to the terms and conditions hereof, each Related Refinery Owner hereby leases to the Relevant Asset Owner and each Relevant Asset Owner hereby leases from the Related Refinery Owner, the Applicable Premises for the Applicable Term; provided, however, the Relevant Asset Owner may terminate this Lease (with respect to itself only) at the end of the Applicable Term or by delivering written notice to the Related Refinery Owner, on or before 180 days prior to the end of the Applicable Term, that the Relevant Asset Owner has elected to terminate this Lease (with respect to itself only).

2.1.2 Early Termination by the Relevant Asset Owner. At the Relevant Asset Owner’s option, such Relevant Asset Owner may terminate this Lease (with respect to itself only), by providing written notice to the Related Refinery Owner on or before 180 days prior to the desired termination date if the Relevant Asset Owner ceases to operate the Applicable Assets at the Applicable Premises or ceases its business operations. In the event of such termination pursuant to this Section 2.1.2, such Related Refinery Owner shall retain the remaining Rent for the then current 12-month rental period as set forth in Section 2.3 as its sole and exclusive remedy for such early termination and shall refund to the Relevant Asset Owner any Rent relating to any period after such 12-month period.

2.2 Access.

2.2.1 Access. Each Related Refinery Owner hereby grants to the Relevant Asset Owner and its Affiliates, agents, employees and contractors (collectively, the “Relevant Asset Owner Parties”) free of charge, non-exclusive right of access to and use of those portions of such Related Refinery Owner’s Refinery Complex that are reasonably necessary for access to and/or the operation of the Applicable Assets by the Relevant Asset Owner as a stand-alone enterprise (the “Shared Access Facilities”), all so long as such access and use by any of the Relevant Asset Owner Parties does not unreasonably interfere in any material respect with the Related Refinery Owner’s operations at the Refinery Complex and complies with the Related Refinery Owner’s rules, norms and procedures governing safety and security at the Refinery Complex. The provisions of this Section 2.2.1 relate only to access and use of the Shared Access Facilities, and the Master Site Services Agreement shall cover all services that are to be provided by the Related Refinery Owner under the terms of the Master Site Services Agreement.

2.2.2 Retained Rights. Each Related Refinery Owner hereby retains for itself and its Affiliates, agents, employees and contractors (collectively, the “Related Refinery Owner’s Parties”), the right of access to the Applicable Premises and the Applicable Assets located at the Refinery Complex of such Related Refinery Owner:

(a) to determine whether the conditions and covenants contained in this Lease are being kept and performed,

2

(b) to comply with Environmental Laws, and

(c) to inspect, maintain, repair, improve and operate the Service Assets and the Shared Access Facilities and any assets of such Related Refinery Owner located on such Applicable Premises or to install or construct any structures or equipment necessary for the maintenance, operation or improvement of any such assets or the installation, construction or maintenance of any Connection Facilities,

in each case, so long as such access by the Related Refinery Owner’s Parties does not unreasonably interfere in any material respect with the Relevant Asset Owner’s operations on the Applicable Premises and complies with such Relevant Asset Owner’s rules, norms and procedures governing safety and security at the Applicable Premises.

2.3 Rent. As rental for the Applicable Premises during the Applicable Term, each Relevant Asset Owner agrees to pay to the applicable Related Refinery Owner for each 12-month period of the Applicable Term One Hundred and 00/100 Dollars ($100.00) (the “Rent”) on or before the 1st day of each 12-month period, the first such payment being due within 30 days of the Commencement Date of the Applicable Term.

2.4 Place of Payment. All Rent and other fees due and payable to the Related Refinery Owner hereunder shall be payable at the Related Refinery Owner’s address set forth the Omnibus Agreement.

2.5 Net Lease. Except as otherwise expressly provided herein and in the Ancillary Agreements, this is a net lease and the Related Refinery Owner shall not at any time be required to pay any costs associated with the maintenance, repair, alteration or improvement of the Applicable Premises or to provide any services or do any act or thing with respect to the Applicable Premises or any part thereof or any appurtenances thereto. The Rent reserved herein shall be paid without any claim on the part of the Relevant Asset Owner for diminution, setoff or abatement and nothing shall suspend, abate or reduce any Rent to be paid hereunder, except as expressly provided herein.

ARTICLE 3

CONDUCT OF BUSINESS

3.1 Use of Applicable Premises. Each Relevant Asset Owner shall have the right to use the Applicable Premises:

(a) for the purpose of owning, operating, maintaining, repairing, replacing, improving, and expanding the Applicable Assets and the Additional Improvements as permitted herein, and

(b) for any other lawful purpose associated with the operation and ownership of the Applicable Assets and the Additional Improvements.

3.2 Waste. Subject to the obligations of the Related Refinery Owner under the Ancillary Agreements, the Relevant Asset Owner shall not commit, or suffer to be committed, any waste to the Applicable Premises, ordinary wear and tear or casualty excepted.

3

3.3 Governmental Regulations.

3.3.1 Compliance with Governmental Requirements. Subject to the obligations of the Related Refinery Owner to the Relevant Asset Owner under this Lease and the Ancillary Agreements including the indemnity provisions contained in the Omnibus Agreement, the Relevant Asset Owner shall, at the Relevant Asset Owner’s sole cost and expense, at all times:

(a) comply with all applicable requirements (including requirements under Environmental Laws) of all Governmental Authorities now in force, or which may hereafter be in force, pertaining to the Applicable Premises, and

(b) faithfully observe all Applicable Laws now in force or which may hereafter be in force pertaining to the Applicable Premises or the use, maintenance or operation thereof.

3.3.2 Notices. Each Relevant Asset Owner shall give prompt written notice to the Related Refinery Owner of such Relevant Asset Owner’s receipt from time to time of any notice of non-compliance, order or other directive from any court or other Governmental Authority under Applicable Laws, including Environmental Laws, relating to the Applicable Premises.

3.3.3 Right to Remedy. If a Related Refinery Owner reasonably believes at any time that a Relevant Asset Owner is not complying with all Applicable Laws (including requirements under Environmental Laws) with respect to the Applicable Assets and Additional Improvements, it will provide reasonable notice to the Relevant Asset Owner of such condition. If such Relevant Asset Owner fails to take appropriate action to cause such assets to comply with Applicable Laws or take other actions required under Applicable Laws within 30 days of the Related Refinery Owner’s reasonable notice, the Related Refinery Owner may, without further notice to such Relevant Asset Owner, take such actions for such Relevant Asset Owner’s account. Within 30 days following the date the Related Refinery Owner delivers to such Relevant Asset Owner evidence of payment for those actions by the Related Refinery Owner reasonably necessary to cause the Applicable Assets and Additional Improvements to achieve compliance with Applicable Laws because of such Relevant Asset Owner’s failure to do so, the Relevant Asset Owner shall reimburse the Related Refinery Owner all amounts paid by the Related Refinery Owner on such Relevant Asset Owner’s behalf.

3.4 Permits.

3.4.1 Environmental Permits. Notwithstanding the Relevant Asset Owner’s obligation to maintain and operate the Applicable Assets and Additional Improvements and comply with Applicable Laws, the Related Refinery Owner and the Relevant Asset Owner acknowledge that the Related Refinery Owner may, as required by any applicable Governmental Authorities, maintain Environmental Permits under the federal Clean Air Act or similar state statutes in its name. Consequently and also for the ease of administration, the Related Refinery Owner may maintain in its name such air quality Environmental Permits and other authorizations applicable to all, or part of, the Applicable Assets and Additional Improvements and may be responsible for making any reports or other notifications to Governmental Authorities pursuant to such Permits or Applicable Laws; provided that upon the Related Refinery Owner’s written request the Relevant Asset Owner shall apply for, use commercially reasonable efforts to obtain and, if obtained, maintain any such Environmental Permits in its name, at such Relevant Asset Owner’s sole cost and expense. Except as provided in the preceding sentence, nothing in this Lease shall reduce the Relevant Asset Owner’s obligations under Applicable Laws with respect to the Applicable Assets and Additional Improvements.

4

3.4.2 Violation of Environmental Permits. If the Related Refinery Owner or one of such Related Refinery Owner’s Affiliates receives a notice of violation or enforcement action from a Governmental Agency, including the U.S. Environmental Protection Agency or a similar state agency alleging non-compliance with such Environmental Permits, and such non-compliance relates to the Applicable Assets, then the Relevant Asset Owner (and not the Related Refinery Owner or its Affiliates), will be responsible for promptly responding to any such notice of violation or enforcement action. The Related Refinery Owner shall have the right, but not the duty, to be fully informed and to participate in the prosecution and/or settlement of any notice of violation or enforcement action relating to such Applicable Assets.

3.4.3 Cheyenne RCRA Order. HollyFrontier Cheyenne will retain responsibility for complying with the terms of the Cheyenne RCRA Order, including all obligations that apply or relate to the Applicable Assets located at the Cheyenne Refinery Complex. Cheyenne Logistics will and will cause its Affiliates to cooperate with and support HollyFrontier Cheyenne and its Affiliates in satisfying any applicable compliance and reporting obligations under the Cheyenne RCRA Order or Environmental Permits as they relate to the Cheyenne Assets and does hereby authorize HollyFrontier Cheyenne to submit all reports, certifications and other compliance related submissions on its behalf in satisfaction of such compliance and reporting obligations. Cheyenne Logistics confirms that it has received a copy of the Cheyenne RCRA Order. If, as a result of future circumstances or construction, it becomes necessary for HollyFrontier Cheyenne or Cheyenne Logistics (or their Affiliates) to obtain additional Environmental Permit(s) that relate to assets that will be located at the Cheyenne Refinery Complex but owned by Cheyenne Logistics or its Affiliates, such Environmental Permit(s) shall be held by or in the name of HollyFrontier Cheyenne or its Affiliates and shall be subject to the provisions of this Section 3.4.3 to the same extent as if the assets to which such Environmental Permit(s) relate were originally included in the Applicable Assets at the Cheyenne Refinery Complex.

3.4.4 El Dorado RCRA Order. HollyFrontier El Dorado will retain responsibility for complying with the terms of the El Dorado RCRA Order, including all obligations that apply or relate to the El Dorado Assets. El Dorado Logistics will and will cause its Affiliates to cooperate with and support HollyFrontier El Dorado and its Affiliates in satisfying any applicable compliance and reporting obligations under the El Dorado RCRA Order or Environmental Permits as they relate to the Applicable Assets located at the El Dorado Refinery Complex and does hereby authorize HollyFrontier El Dorado to submit all reports, certifications and other compliance related submissions on its behalf in satisfaction of such compliance and reporting obligations. El Dorado Logistics confirms that it has received a copy of the El Dorado RCRA Order. If, as a result of future circumstances or construction, it becomes necessary for HollyFrontier El Dorado or El Dorado Logistics (or their Affiliates) to obtain additional Environmental Permit(s) that relate to assets that will be located at the El Dorado Refinery Complex but owned by El Dorado Logistics or its Affiliates, such Environmental Permit(s) shall be held by or in the name of HollyFrontier El Dorado or its Affiliates and shall be subject to the provisions of this Section 3.4.4 to the same extent as if the assets to which such Environmental Permit(s) relate were originally included in the Applicable Assets at the El Dorado Refinery Complex.

3.4.5 Indemnification. The Parties acknowledge that any costs, penalties, fines or losses associated with responses to any notices of violation from the Environmental Protection Agency or a state agency under any such Environmental Permits (including the Cheyenne RCRA Order or the El Dorado RCRA Order) may be the subject of indemnification under the Omnibus Agreement, and nothing in this Section 3.4.5 shall be deemed to change, amend or expand the Parties’ obligations under such Omnibus Agreement provisions (other than with regard to the obligation to respond to such notice of violation or enforcement).

5

3.5 Utilities. The Related Refinery Owner may, at its election, provide any utilities (electricity, natural gas, water, steam, etc.) necessary for the Relevant Asset Owner’s operation of the Applicable Assets in accordance with the provisions of the Master Site Services Agreement. Any other necessary utilities shall be provided by and at the sole expense of the Relevant Asset Owner

3.6 Tank Inspection and Repairs. Each Related Refinery Owner will reimburse the Relevant Asset Owner for the cost of performing the first API 653 inspection on each of the tanks included in the Applicable Assets (other than the tanks included in the Malaga Pipeline System) and any repairs or tests or consequential remediation that may be required to be made to such tanks as a result of any discovery made during such inspection; provided, however, that if a tank is two (2) years old or less or has been inspected and repaired during the last twelve months prior to the applicable Commencement Date, then the Relevant Asset Owner will bear the cost of any API 653 inspection and any required repair, testing or consequential remediation of such tank. In addition, the Relevant Asset Owner will be responsible for the costs of painting any tanks included in the Applicable Assets that require it.

3.7 Tank Inspection and Maintenance Plan. At least annually, the Relevant Asset Owner shall prepare and submit to the Related Refinery Owner a tank inspection and maintenance plan (which shall include an inspection plan, a cleaning plan, a waste disposal plan, details regarding scheduling and a budget) for the tankage included in the Applicable Assets. If the Related Refinery Owner consents to the submitted plan (which consent shall not be unreasonably withheld, conditioned or delayed), then the Relevant Asset Owner shall conduct tank maintenance in conformity with such approved tank maintenance plan (other than any deviations or changes from such plan to which the Related Refinery Owner consents (which consent shall not be unreasonably withheld, conditioned or delayed)). Each Relevant Asset Owner will use its commercially reasonable efforts to schedule the activities under such maintenance plan to minimize disruptions to the operations of the Related Refinery Owner at the Refinery Complex.

3.8 Notice of Planned Shutdown. Each Related Refinery Owner shall deliver to the Relevant Asset Owner at least six months advance written notice of any planned shut down or reconfiguration (excluding planned maintenance turnarounds) of the Refinery Complex or any portion of the Refinery Complex of which the Related Refinery Owner has advance notice that would reduce the output of the Refinery Complex. Each Related Refinery Owner will use its commercially reasonable efforts to mitigate any reduction in revenues or throughput obligations under the Master Throughput Agreement or Master Tolling Agreements, as applicable, that would result from such a shut down or reconfiguration.

3.9 Tulsa West Crude Tank Assets.

(a) HollyFrontier Tulsa hereby represents and warrants to HEP Tulsa that as of March 31, 2016, to HollyFrontier Tulsa’s knowledge, the Tulsa West Crude Tank Assets are in good operating condition and repair (normal wear and tear excepted), are free from material defects (patent and latent), are suitable for the purposes for which they are currently used, and are not in need of material maintenance or repair except for ordinary routine maintenance and repair. For the purposes of this Section 3.9(a), the phrase “to HollyFrontier Tulsa’s knowledge” means actual knowledge after reasonable inquiry of James M. Stump.

(b) HEP Tulsa acknowledges and agrees that HEP Tulsa’s sole and exclusive remedy with respect to any breach of the representation and warranty set forth in Section 3.9(a) shall be the indemnity provided for in Section 3.2(a)(vi)(F) of the Omnibus Agreement.

(c) EXCEPT FOR THE REPRESENTATION AND WARRANTY SET FORTH IN SECTION 3.9(a), HOLLYFRONTIER TULSA AND HEP TULSA ACKNOWLEDGE AND AGREE

6

THAT NEITHER OF THEM HAS MADE, DOES MAKE, AND THEY SPECIFICALLY NEGATE AND DISCLAIM, ANY REPRESENTATION, WARRANTY, PROMISE, COVENANT, AGREEMENT OR GUARANTY OF ANY KIND OR CHARACTER WHATSOEVER, WHETHER EXPRESS, IMPLIED OR STATUTORY, ORAL OR WRITTEN, PAST OR PRESENT, REGARDING (I) THE VALUE, NATURE, QUALITY OR CONDITION OF THE TULSA WEST CRUDE TANK ASSETS, INCLUDING, WITHOUT LIMITATION, THE ENVIRONMENTAL CONDITION OF THE TULSA WEST CRUDE TANK ASSETS GENERALLY, INCLUDING THE PRESENCE OF LACK OF HAZARDOUS SUBSTANCES OR OTHER MATTERS IN THE TULSA WEST CRUDE TANK ASSETS AND THE LAND ON WHICH THE TULSA WEST CRUDE TANK ASSETS ARE SITUATED, (II) THE INCOME TO BE DERIVED FROM THE TULSA WEST CRUDE TANK ASSETS, (III) THE SUITABILITY OF THE TULSA WEST CRUDE TANK ASSETS FOR ANY AND ALL ACTIVITIES AND USES THAT MAY BE CONDUCTED THEREON, (IV) THE COMPLIANCE OF OR BY THE ASSETS OR THEIR OPERATION WITH ANY APPLICABLE LAWS (INCLUDING WITHOUT LIMITATION ANY ZONING, ENVIRONMENTAL PROTECTION, POLLUTION OR LAND USE LAWS, RULES, REGULATIONS, ORDERS OR REQUIREMENTS), OR (V) THE MERCHANTABILITY, MARKETABILITY, PROFITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OF THE TULSA WEST CRUDE TANK ASSETS. EXCEPT TO THE EXTENT PROVIDED IN THIS AGREEMENT OR THE OMNIBUS AGREEMENT, NEITHER HOLLYFRONTIER TULSA NOR HEP TULSA IS LIABLE OR BOUND IN ANY MANNER BY ANY VERBAL OR WRITTEN STATEMENTS, REPRESENTATIONS OR INFORMATION PERTAINING TO THE TULSA WEST CRUDE TANK ASSETS FURNISHED BY ANY AGENT, EMPLOYEE, SERVANT OR THIRD PARTY. THE PROVISIONS OF THIS SECTION 3.9 HAVE BEEN NEGOTIATED BY THE PARTIES AFTER DUE CONSIDERATION AND ARE INTENDED TO BE A COMPLETE EXCLUSION AND NEGATION OF ANY REPRESENTATIONS OR WARRANTIES, WHETHER EXPRESS, IMPLIED OR STATUTORY, WITH RESPECT TO THE TULSA WEST CRUDE TANK ASSETS THAT MAY ARISE PURSUANT TO ANY LAW NOW OR HEREAFTER IN EFFECT, OR OTHERWISE, EXCEPT AS SET FORTH IN THIS AGREEMENT OR THE OMNIBUS AGREEMENT.

ARTICLE 4

ALTERATIONS, ADDITIONS AND IMPROVEMENTS

4.1 Additional Improvements. Subject to the provisions of this Article 4, each Relevant Asset Owner may make any alterations, additions, improvements or other changes to the Applicable Premises, and the Applicable Assets, and may request that the Related Refinery Owner make any alterations, additions, improvements or other changes to the Shared Access Facilities, as may be necessary or useful in connection with the operation of the Applicable Assets (collectively, the “Additional Improvements”). If such Additional Improvements require alterations, additions or improvements to the Applicable Premises or any of the Shared Access Facilities, the Relevant Asset Owner shall notify the Related Refinery Owner in writing in advance and the parties shall:

(a) negotiate in good faith any increase to the fees paid by the Relevant Asset Owner under the Master Site Services Agreement;

(b) provide for reimbursement of any material increase in cost (if any) to the Related Refinery Owner under the Master Site Services Agreement that results from any modifications to the Applicable Premises or the Shared Access Facilities necessary to accommodate the Additional Improvements; or

(c) proceed in such manner as otherwise mutually agreed by the Parties.

7

4.2 Quality; Compliance with Applicable Laws. Any alteration, addition, improvement or other change to the Applicable Assets or Additional Improvements (and, if agreed by the Relevant Asset Owner and the Related Refinery Owner, to the Applicable Premises and Shared Access Facilities) by the Relevant Asset Owner shall be made in a good and workmanlike manner and in accordance with all Applicable Laws.

4.3 Ownership. The Applicable Assets and all Additional Improvements shall remain the property of the Relevant Asset Owner and shall be removed by the Relevant Asset Owner within one year after termination of this Lease as to the Applicable Premises (provided that such can be removed by the Relevant Asset Owner without unreasonable damage or harm to the Applicable Premises or Refinery Complex) or, at the Relevant Asset Owner’s option exercisable by notice to the Related Refinery Owner, surrendered to the Related Refinery Owner upon the termination of this Lease.

4.4 No Liens. No Relevant Asset Owner shall have the right or power to create or permit any lien of any kind or character on the Applicable Premises or Refinery Complex by reason of repair or construction or other work. Unless otherwise agreed in writing by the Relevant Asset Owner and the Related Refinery Owner, in the event any such lien is filed against the Applicable Premises or Refinery Complex, the Relevant Asset Owner shall cause such lien to be discharged or bonded within 30 days of the date of filing thereof.

ARTICLE 5

MAINTENANCE OF APPLICABLE PREMISES

5.1 Maintenance by the Relevant Asset Owner. Except as otherwise expressly provided in this Article 5 and in Article 7 or elsewhere in this Lease and subject to the obligations of the Related Refinery Owner and the Relevant Asset Owner under the Ancillary Agreements, including any indemnity provisions contained in the Omnibus Agreement, the Relevant Asset Owner shall at its sole cost, risk and expense at all times keep the Applicable Premises and the Applicable Assets and Additional Improvements in good order and repair and in compliance with all Applicable Laws and make all necessary repairs thereto, structural and nonstructural, ordinary and extraordinary, and unforeseen and foreseen. For the avoidance of doubt, the Related Refinery Owner shall maintain, at its sole cost, risk and expense, any dikes, including those dikes surrounding tanks owned by the Relevant Asset Owner and whether or not the entire dike is located on the Applicable Premises, and any roads located on the Applicable Premises. As used in this Article 5, the term “repairs” shall include all necessary replacements, renewal, alterations and additions. All repairs made by the Relevant Asset Owner shall be made in accordance with normal and customary practices in the industry, in a good and workmanlike manner, and in accordance with all Applicable Laws. The Relevant Asset Owner shall be responsible at its sole cost and expense for the proper handling, removal and disposal of all materials, debris, waste and Hazardous Substances generated or resulting from such repair and maintenance activities, all in accordance with Applicable Laws.

5.2 Operation. Subject to the obligations of the Related Refinery Owner and the Relevant Asset Owner in this Lease and under the Ancillary Agreements, including any indemnity provisions contained in the Omnibus Agreement, the Relevant Asset Owner covenants and agrees to operate the Applicable Assets and Additional Improvements in accordance with normal and customary practices in the industry and all Applicable Laws now in force, or which may hereafter be in force.

5.3 Surrender of Applicable Premises. The Relevant Asset Owner shall at the expiration of the Applicable Term or at any earlier termination of this Lease as to the Applicable Assets, surrender the Applicable Premises to the Related Refinery Owner in as good condition as it received the same, ordinary wear and tear and limitations permitted by Article 7 excepted and in accordance with the provisions of Article 4.

8

5.4 Release of Hazardous Substances. The Relevant Asset Owner shall give prompt notice to the Related Refinery Owner of any release of any Hazardous Substances on or at the Applicable Premises or Shared Access Facilities that occur during the Applicable Term. The Relevant Asset Owner shall immediately take all steps necessary to contain or remediate (or both) any such release and provide any governmental notifications required by Applicable Law. If the Related Refinery Owner believes at any time that the Relevant Asset Owner is failing to contain or remediate in compliance with all Applicable Laws (including Environmental Laws) any release arising from the Relevant Asset Owner’s operation of the Applicable Assets or Additional Improvements or the Relevant Asset Owner’s failure to comply with its obligations pursuant to this Lease, the Related Refinery Owner will provide reasonable notice to the Relevant Asset Owner of such failure. If the Relevant Asset Owner fails to take appropriate action to contain or remediate such a release or take other actions required under Applicable Laws or this Lease within 30 days of the Related Refinery Owner’s reasonable notice, the Related Refinery Owner may, without further notice to the Relevant Asset Owner, take such actions for the Relevant Asset Owner’s account. Within 30 days following the date the Related Refinery Owner delivers to the Relevant Asset Owner evidence of payment for those actions by the Related Refinery Owner reasonably necessary to contain or remediate a release or otherwise achieve compliance with Applicable Laws or this Lease because of the Relevant Asset Owner’s failure to do so, the Relevant Asset Owner shall reimburse the Related Refinery Owner all amounts paid by the Related Refinery Owner on the Relevant Asset Owner’s behalf.

ARTICLE 6

TAXES, ASSESSMENTS

6.1 Relevant Asset Owner’s Obligation to Pay. The Relevant Asset Owner shall pay during the Applicable Term all Taxes assessed against the Applicable Premises, or improvements situated thereon, including the Applicable Assets and all Additional Improvements (including those Additional Improvements situated on the Shared Access Facilities but excluding any Shared Access Facilities and any Service Assets) (for purposes of this Article 6, collectively, the “Taxable Assets”) during the Applicable Term that are payable to any Governmental Authority assessed against or with respect to the Applicable Premises or the use or operation thereof during the Applicable Term. In the event that the Relevant Asset Owner fails to pay its share of such Taxes in accordance with the provisions of this Article 6 prior to the time the same become delinquent, the Related Refinery Owner may pay the same and the Relevant Asset Owner shall reimburse the Related Refinery Owner all amounts paid by the Related Refinery Owner on the Relevant Asset Owner’s behalf within 30 days following the date the Related Refinery Owner delivers to the Relevant Asset Owner evidence of such payment.

6.2 Manner of Payment. Upon notice by the Relevant Asset Owner to the Related Refinery Owner, the Related Refinery Owner and the Relevant Asset Owner shall use commercially reasonable efforts to cause the Taxable Assets to be separately assessed for purposes of Taxes as soon as reasonably practicable following the Commencement Date (to the extent allowed by Applicable Law). During the Applicable Term but subject to the provisions of this Section 6.2, the Relevant Asset Owner shall pay all Taxes assessed directly against the Taxable Assets directly to the applicable taxing authority prior to delinquency and shall promptly thereafter provide the Related Refinery Owner with evidence of such payment. Until such time as the Related Refinery Owner and the Relevant Asset Owner can cause the Taxable Assets to be separately assessed as provided above, the Relevant Asset Owner shall reimburse the Related Refinery Owner, upon request, for any such Taxes paid by the Related Refinery Owner to the applicable taxing authorities (such reimbursement to be based upon the mutual agreement of the Related Refinery Owner and the Relevant Asset Owner as to the portion of such Taxes attributable to the Taxable

9

Assets), subject to the terms of this Section 6.2. The certificate issued or given by the appropriate officials authorized or designated by law to issue or give the same or to receive payment of such Taxes shall be prima facie evidence of the existence, payment, nonpayment and amount of such Taxes. The Relevant Asset Owner may contest the validity or amount of any such Taxes or the valuation of the Taxable Assets (to the extent any of them may be separately issued), at the Relevant Asset Owner’s sole cost and expense, by appropriate proceedings, diligently conducted in good faith in accordance with Applicable Law. If the Relevant Asset Owner contests such items then the Related Refinery Owner shall cooperate with the Relevant Asset Owner in any such contesting of the validity or amount of any such Taxes or the valuation of the Taxable Assets. Taxes for the first and last years of the Applicable Term shall be prorated between the Related Refinery Owner and the Relevant Asset Owner based on the portions of such years that are coincident with the applicable tax years and for which each of them is responsible.

ARTICLE 7

EMINENT DOMAIN; CASUALTY; INSURANCE

7.1 Total Condemnation of Applicable Premises. If the whole of the Applicable Premises is acquired or condemned by eminent domain for any public or quasi-public use or purpose, then this Lease shall terminate with respect to such Applicable Premises as of the date title vests in any public agency. All rentals and other charges owing hereunder shall be prorated as of such date.

7.2 Partial Condemnation. If only a portion of the Applicable Premises is acquired or condemned by eminent domain for any public or quasi-public use or purpose, and if in the Relevant Asset Owner’s reasonable opinion such partial taking or condemnation renders the Applicable Premises unsuitable for the business of the Relevant Asset Owner, then this Lease shall terminate with respect to such Applicable Premises at the Relevant Asset Owner’s election as of the date title vests in any public agency, provided the Relevant Asset Owner delivers to the Related Refinery Owner written notice of such election to terminate within 60 days following the date title vests in such public agency. In the event of such termination, all rentals and other charges owing hereunder with respect to such Applicable Premises shall be prorated as of such effective date of termination.

7.3 Condemnation Award and Damages. The Related Refinery Owner shall be entitled to any award and all damages payable as a result of any condemnation or taking of the fee title of the Applicable Premises. The Relevant Asset Owner shall have the right to claim and recover from the condemning authority, but not from the Related Refinery Owner, such compensation as may be separately awarded or recoverable by the Relevant Asset Owner in the Relevant Asset Owner’s own right on account of any and all damage to the Applicable Assets, the Additional Improvements and/or the Relevant Asset Owner’s business by reason of the condemnation, including loss of value of any unexpired portion of the Applicable Term, and for or on account of any cost or loss to which the Relevant Asset Owner might be put in removing the Relevant Asset Owner’s personal property, fixtures, leasehold improvements and equipment, including the Applicable Assets and the Additional Improvements, from the Applicable Premises use good faith efforts to resolve such infeasibility.

7.4 Restoration of Applicable Premises. If the Applicable Assets and/or Additional Improvements are partially damaged by any casualty insured against under any insurance policy maintained by the Related Refinery Owner (a “Casualty Event”) or damaged by reason of a condemnation proceeding, the net amount that may be awarded or tendered to the Related Refinery Owner in such condemnation proceedings or realized from any applicable insurance policy in the event of a Casualty Event (less all legal and other expenses incurred by the Related Refinery Owner in connection therewith) shall (as long as the Relevant Asset Owner is not then in default hereunder) be used to pay for any repair, replacement or restoration by the Relevant Asset Owner of the Applicable Assets, the Additional

10

Improvements and/or the remainder of the Applicable Premises hereof to the extent the Relevant Asset Owner desires any of the same to be repaired, replaced or restored and such repair, replacement or restoration is commercially practicable, as determined by the Related Refinery Owner in the exercise of its reasonable discretion. If it is so determined that such repair, replacement or restoration is not commercially practicable, the Relevant Asset Owner and the Related Refinery Owner shall use good faith efforts to resolve such infeasibility.

7.5 Rent Abatement. During any periods of time during which the Applicable Assets and/or Additional Improvements are destroyed, damaged by a Casualty Event or are being restored or reconstructed under the terms of Section 7.4, Rent hereunder shall be abated in the proportion that the Relevant Asset Owner’s use thereof is impacted, on the condition that the Relevant Asset Owner uses commercially reasonable efforts to mitigate the disruption to its business caused by such event.

7.6 Insurance. Except as otherwise agreed by the Related Refinery Owner and the Relevant Asset Owner, the Relevant Asset Owner shall, during the Applicable Term, maintain or cause to be maintained property and casualty insurance (including pollution insurance coverage) on the Applicable Premises and the Applicable Assets and Additional Improvements in accordance with customary industry practices and with a licensed, reputable carrier.

ARTICLE 8

ASSIGNMENT AND SUBLETTING

8.1 Assignment and Subletting. Neither this Lease nor any of the rights or obligations hereunder shall be assigned by a the Related Refinery Owner without the prior written consent of the Relevant Asset Owner, or by a Related Asset Owner without the prior written consent of the Related Refinery Owner, in each case, such consent is not to be unreasonably withheld or delayed; provided, however, that:

(a) The Related Refinery Owner or the Relevant Asset Owner may make such an assignment (including a partial pro rata assignment) to its Affiliate without the other’s consent,

(b) The Related Refinery Owner may make a collateral assignment of its rights and obligations hereunder, and

(c) The Relevant Asset Owner may make a collateral assignment of its rights hereunder and/or grant a security interest in all or a portion of the Applicable Assets and/or Additional Improvements to a bona fide third party lender or debt holder, or trustee or representative for any of them, without the Related Refinery Owner’s consent, if such third party lender, debt holder or trustee shall have executed and delivered to the Related Refinery Owner a non-disturbance agreement in such form as is reasonably satisfactory to the Related Refinery Owner and such third party lender, debt holder or trustee and the Related Refinery Owner executes an acknowledgement of such collateral assignment in such form as may from time to time be reasonably requested.

Any attempt to make an assignment otherwise than as permitted by the foregoing shall be null and void. The assigning Party agrees to require its respective successors, if any, to expressly assume, in a form of agreement reasonably acceptable to the other Party, its obligations under this Lease.

8.2 Release of Assigning Party. Any assignment of this Lease by a Party in accordance with this Article 8 shall operate to terminate the liability of the assigning Party for all obligations under this Lease accruing after the date of any such assignment.

11

ARTICLE 9

DEFAULTS; REMEDIES; TERMINATION

9.1 Default. The occurrence of any one or more of the following events shall constitute a material default and breach of this Lease by the Party for whom such event occurred:

(a) The failure by the Relevant Asset Owner to make when due any payment of Rent or any other payment required to be made by the Relevant Asset Owner hereunder, if such failure continues for a period of 90 days following written notice from the Related Refinery Owner;

(b) The failure by a Party to observe or perform any of the other covenants, conditions or provisions of this Lease to be observed or performed by such Party, if such failure continues for a period of 90 days (in the case of the Relevant Asset Owner) or 30 days (in the case of the Related Refinery Owner) following written notice from the non-defaulting the Relevant Asset Owner or the Related Refinery Owner; provided, however, if a reasonable time to cure such default would exceed 90 days (in the case of the Relevant Asset Owner) or 30 days (in the case of the Related Refinery Owner), such Party shall not be in default so long as it begins to cure such default within 90 days (in the case of the Relevant Asset Owner) or 30 days (in the case of the Related Refinery Owner) of receiving written notice from the non-defaulting Relevant Asset Owner or the Related Refinery Owner and thereafter completes the curing of such default within reasonable period of time (under the circumstances) following the receipt of such written notice; or

(c) The occurrence of any Bankruptcy Event.

9.2 Related Refinery Owner’s Remedies.

9.2.1 Termination Remedies. In the event of any such material default under or material breach of the terms of this Lease by the Relevant Asset Owner, the Related Refinery Owner may, at the Related Refinery Owner’s option, at any time thereafter that such default or breach remains uncured, without further notice or demand:

(a) terminate this Lease with respect to the Relevant Asset Owner and the Relevant Asset Owner’s right to possession of the Applicable Premises, and

(b) thereafter repossess the Applicable Premises by any lawful means in which event the Relevant Asset Owner shall immediately surrender possession of the Applicable Premises to the Related Refinery Owner.

9.2.2 Right to Perform. If, by the terms of this Lease, the Relevant Asset Owner is required to do or perform any act or to pay any sum to a Third Party, and fails or refuses to do so, the Related Refinery Owner, after 30 days written notice to the Relevant Asset Owner, without waiving any other right or remedy hereunder for such default, may do or perform such act, at the Relevant Asset Owner’s expense, or pay such sum for and on behalf of the Relevant Asset Owner, and the amounts so expended by the Related Refinery Owner shall be repayable on demand, and bear interest from the date expended by the Related Refinery Owner until paid at the Post-Maturity Rate. Past due Rent and any other past due payments required hereunder shall bear interest from maturity until paid at the Post-Maturity Rate.

12

9.2.3 Cumulative Remedies. The Related Refinery Owner may, at the Related Refinery Owner’s option, deduct any such amounts so expended by the Related Refinery Owner from any amounts owed hereunder or under any Ancillary Agreement. Any such action on the part of the Related Refinery Owner shall be in addition to any other remedy that may be available to the Related Refinery Owner for arrears of Rent or breach of contract, or otherwise, including the right of setoff.

9.3 Relevant Asset Owner’s Remedies.

9.3.1 Remedies. In the event of any such default under or breach of the terms of this Lease by the Related Refinery Owner, the Relevant Asset Owner may, at the Relevant Asset Owner’s option, at any time thereafter that such default or breach remains uncured, after ten days prior written notice to the Related Refinery Owner:

(a) perform any act that the Related Refinery Owner is required to do, or

(b) perform any act for or to pay any sum to a Third Party, at the Related Refinery Owner’s expense (to the extent the terms of this Lease require such performance at the Related Refinery Owner’s expense) or pay such sum for and on behalf of the Related Refinery Owner, and the amounts so expended by the Relevant Asset Owner shall be repayable on demand, and bear interest from the date expended by the Relevant Asset Owner until paid at the Post-Maturity Rate.

9.3.2 Cumulative Remedies. The Relevant Asset Owner may, at the Relevant Asset Owner’s option, deduct any such amounts so expended by the Relevant Asset Owner from the Rent and any other amounts owed hereunder or under any Ancillary Agreement. Any such action on the part of the Related Refinery Owner shall be in addition to any other remedy that may be available to the Related Refinery Owner for arrears of Rent or breach of contract, or otherwise, including the right of setoff.

ARTICLE 10

LIABILITY AND INDEMNIFICATION

10.1 Limitation of Liability; Indemnity. The Parties acknowledge and agree that the provisions relating to force majeure, indemnity and the limitation of liability are set forth in the Omnibus Agreement. Notwithstanding anything in this Lease or the Omnibus Agreement to the contrary and solely for the purpose of determining which of the Related Refinery Owners or the Relevant Asset Owners shall be liable in a particular circumstance, neither a the Related Refinery Owner nor the Relevant Asset Owner shall be liable to another Party for any default, loss, damage, injury, judgment, claim, cost, expense or other liability suffered or incurred (collectively, “Damages”) by such Party except to the extent set forth in the Omnibus Agreement and to the extent that the Related Refinery Owner or the Relevant Asset Owner causes such Damages or owns or operates the assets or other property in question responsible for causing such Damages. In no event shall any Related Refinery Owner have any liability to another Related Refinery Owner, or shall any Relevant Asset Owner have any liability to another Relevant Asset Owner, for Damages, regardless of how caused or under any theory of recovery.

10.2 Survival. The provisions of this Article 10 shall survive the termination of this Agreement.

13

ARTICLE 11

OPTION

11.1 Applicability of Option. The provisions of this Article 11 shall apply to all Applicable Assets except those that are located at the Refinery Complexes of HollyFrontier Navajo or HollyFrontier Woods Cross (other than the Applicable Assets owned by Woods Cross Operating).

11.2 Grant of Option. Following the termination or expiration of the Master Throughput Agreement or Master Tolling Agreements, as applicable, as it relates to a Refinery Complex, including any renewal, extension, or replacement agreement thereof pursuant thereto, the affected Related Refinery Owner shall have an option, and the affected Relevant Asset Owner hereby grants such option, to purchase the Applicable Assets and the Additional Improvements at such Refinery Complex at a cost equal to the fair market value thereof, as reasonably determined by the Related Refinery Owner and the Relevant Asset Owner.

11.3 Determination of Fair Market Value. In the event that the Related Refinery Owner and the Relevant Asset Owner cannot agree as to the fair market value of such Applicable Assets and the Additional Improvements, the Related Refinery Owner and the Relevant Asset Owner shall each select a qualified appraiser. The two appraisers shall give their opinion of the fair market value of such Applicable Assets and Additional Improvements within 20 days after their retention. In the event the opinions of the two appraisers differ and, after good faith efforts over the succeeding 20-day period, they cannot mutually agree, the appraisers shall immediately and jointly appoint a third qualified appraiser. The third appraiser shall immediately (within five days) choose the determination of either appraiser and such choice of this third appraiser shall be final and binding on the Related Refinery Owner or the Relevant Asset Owner. Each of the Related Refinery Owner and the Relevant Asset Owner shall pay its own costs for its appraiser. Following the determination of the fair market value of the Applicable Assets and the Additional Improvements by the appraisers, the Related Refinery Owner and the Relevant Asset Owner shall equally share the costs of any third appraiser.

11.4 Cooperation. Upon the Related Refinery Owner’s exercise of the option granted pursuant to this Article 11, the Related Refinery Owner and the Relevant Asset Owner shall cooperate to convey the Applicable Assets and the Additional Improvements from the Relevant Asset Owner to the Related Refinery Owner. If the Related Refinery Owner chooses to exercise its option granted pursuant to this Article 11, the sale of the Applicable Assets and the Additional Improvements shall be subject to the receipt of any consents or waivers required pursuant to the Relevant Asset Owner’s credit facility or indentures then in effect.

11.5 Survival. The terms and conditions of this Article 11 shall survive the termination or expiration of this Lease or the Master Throughput Agreement or the Master Tolling Agreements, as applicable, with respect to the Related Refinery Owner and the Relevant Asset Owner.

ARTICLE 12

GENERAL PROVISIONS

12.1 Estoppel Certificates. The Related Refinery Owner and the Relevant Asset Owner shall, at any time and from time to time upon not less than 20 days prior written request from the other, execute, acknowledge and deliver to the other a statement in writing (a) certifying that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification and certifying that this Lease, as so modified, is in full force and effect) and the date to which Rent and other charges are paid, and (b) acknowledging that there are not, to the executing party’s knowledge, any uncured defaults on the part of the other Party hereunder (or specifying such defaults, if any are claimed). Any such statement

14

may be conclusively relied upon by any prospective purchaser of the Applicable Premises or the leasehold evidenced by this Lease or any lender with respect to the Applicable Premises or the leasehold evidenced by this Lease. Nothing in this Section 12.1 shall be construed to waive the conditions elsewhere contained in this Lease applicable to assignment or subletting of the Applicable Premises by the Relevant Asset Owner.

12.2 Notices. Any notice or other communication given under this Lease shall be in writing and shall be delivered in accordance with the requirements for notices set forth in the Omnibus Agreement.

12.3 Severability. If any term or other provision of this Lease is invalid, illegal or incapable of being enforced by any Applicable Law or public policy, all other terms and provisions of this Lease shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner materially adverse to any Party hereto. Upon such determination that any term or other provision is invalid, illegal, or incapable of being enforced, the Parties hereto shall negotiate in good faith to modify this Lease so as to effect the original intent of the Parties as closely as possible in an acceptable manner in order that the transactions contemplated hereby are consummated as originally contemplated to the greatest extent possible.

12.4 Time of Essence. Time is of the essence in the performance of all obligations falling due hereunder.

12.5 Captions. The headings to Articles and Sections of this Lease are inserted for convenience of reference only and will not affect the meaning or interpretation of this Lease.

12.6 Entire Agreement This Lease constitutes the entire agreement of the Parties hereto with respect to the subject matter hereof as applicable to such Party and supersedes all prior agreements and undertakings, both written and oral, between the Related Refinery Owner and the Relevant Asset Owner with respect to the subject matter hereof.

12.7 Waivers. To be effective, any waiver of any right under this Lease must be in writing and signed by a duly authorized officer or representative of the Party bound thereby. No waiver or waivers of any breach or default or any breaches or defaults by any Party of any term, condition or liability of or performance by any other Party of any duty or obligation hereunder shall be deemed or construed to be a waiver or waivers of any subsequent breaches or defaults of any kind, character or description under any circumstance. The acceptance of Rent hereunder by the Related Refinery Owner shall not be a waiver of any preceding breach by the Relevant Asset Owner of any provision hereof, other than the failure of the Relevant Asset Owner to pay the particular Rent so accepted, regardless of the Related Refinery Owner’s knowledge of such preceding breach at the time of acceptance of such Rent.

12.8 Incorporation by Reference. Any reference herein to any Appendix or Exhibit to this Lease will incorporate such Appendix or Exhibit herein as if it were set out in full in the text of this Lease.

12.9 Binding Effect. This Lease will be binding upon, and will inure to the benefit of, the Parties and their respective successors, permitted assigns and legal representatives. Nothing in this Section 12.9 shall be construed to waive the conditions elsewhere contained in this Lease applicable to assignment or subletting of the Applicable Premises by the Relevant Asset Owner.

12.10 Amendment. This Lease may not be amended or modified except by an instrument in writing signed by, or on behalf of, each of the Parties hereto. If and to the extent the Relevant Asset Owner may have occupied any portion of the Applicable Premises prior to the date of a Prior Lease

15

without the benefit of any written lease, license or other instrument, the Relevant Asset Owner and the Related Refinery Owner release and waive any claims that such Party may have against the other Party with respect to such prior occupancy.

12.11 No Partnership. The relationship between the Related Refinery Owner and the Relevant Asset Owner at all times shall remain solely that of the landlord and tenant and shall not be deemed a partnership or joint venture.

12.12 No Third Party Beneficiaries. Subject to the provisions Article 10 and Section 12.9. Any Person not a Party to this Lease shall have no rights under this Lease as a third party beneficiary or otherwise.

12.13 Governing Law. THIS LEASE AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY AND INTERPRETED IN ACCORDANCE WITH THE LAWS OF THE STATE WHERE THE APPLICABLE PREMISES ARE LOCATED WITHOUT GIVING EFFECT TO PRINCIPLES THEREOF RELATING TO CONFLICTS OF LAW RULES THAT WOULD DIRECT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION.

12.14 Cooperation. The Parties acknowledge that they are entering into a long-term arrangement in which the cooperation of the Related Refinery Owner and the Relevant Asset Owner will be required. If, during the Applicable Term of this Lease, changes in the operations, facilities or methods of either the Related Refinery Owner or the Relevant Asset Owner will materially benefit one of them without detriment to the other, the Related Refinery Owner or the Relevant Asset Owner commit to each other to make reasonable efforts to cooperate and assist each other.

12.15 Further Assurances. The Parties shall execute such additional documents and shall cause such additional actions to be taken as may be required or, in the judgment of any Party, be necessary or desirable, to carry out the purposes of this Lease and to more fully assure the Parties’ rights and interests provided for hereunder. The Parties each agree to reasonably cooperate with the other Parties on all matters relating to the required Permits and regulatory compliance by any Party in respect of the Applicable Premises so as to ensure continued full operation of the Relevant Assets by the Relevant Asset Owner pursuant to the terms of this Lease.

12.16 Waiver of the Related Refinery Owner’s Lien. To the extent permitted by Applicable Law, the Related Refinery Owner hereby expressly waives any and all liens (constitutional, statutory, contractual or otherwise) upon the Relevant Asset Owner’s personal property now or hereafter installed or placed in or on the Applicable Premises, which otherwise might exist to secure payment of the sums herein provided to be paid by the Relevant Asset Owner to the Related Refinery Owner.

12.17 Recording. Upon the request of the Related Refinery Owner or the Relevant Asset Owner, the Related Refinery Owner and the Relevant Asset Owner shall execute, acknowledge, deliver and record a “short form” memorandum of this Lease in a form mutually acceptable to the Related Refinery Owner and the Relevant Asset Owner. Promptly upon request by the Related Refinery Owner at any time following the expiration or earlier termination of this Lease with respect to such Related Refinery Owner and the Relevant Asset Owner, however such termination may be brought about, the Relevant Asset Owner shall execute and deliver to the Related Refinery Owner an instrument, in recordable form, evidencing the termination of this Lease with respect to the Related Refinery Owner and the Relevant Asset Owner and the release by the Relevant Asset Owner of all of the Relevant Asset Owner’s right, title and interest in and to the Applicable Premises existing under and by virtue of this Lease (the “Relevant Asset Owner Release”) and the Relevant Asset Owner grants the Related Refinery

16

Owner an irrevocable power of attorney coupled with an interest for the purpose of executing the Relevant Asset Owner Release in the name of the Relevant Asset Owner. This Section 12.17 shall survive the termination of this Lease.

12.18 Warranty of Peaceful Possession. The Related Refinery Owner covenants and warrants that the Relevant Asset Owner, upon paying the Rent reserved hereunder and observing and performing all of the covenants, conditions and provisions on the Relevant Asset Owner’s part to be observed and performed hereunder, may peaceably and quietly have, hold, occupy, use and enjoy, and, subject to the terms of this Lease, shall have the full, exclusive, and unrestricted use and enjoyment of, all the Applicable Premises during the Applicable Term for the purposes permitted herein, and the Related Refinery Owner agrees to warrant and forever defend title to the Applicable Premises against the claims of any and all persons whomsoever lawfully claiming the same or any part thereof.

12.19 Survival. All obligations of the Related Refinery Owner and the Relevant Asset Owner that shall have accrued under this Lease prior to the expiration or earlier termination hereof shall survive such expiration or termination to the extent the same remain unsatisfied as of the expiration or earlier termination of this Lease. The Related Refinery Owner and the Relevant Asset Owner further expressly agree that all provisions of this Lease which contemplate performance after the expiration or earlier termination hereof shall survive such expiration or earlier termination of this Lease.

12.20 AS IS, WHERE IS. SUBJECT TO ALL OF THE OBLIGATIONS OF RELATED REFINERY OWNER UNDER THIS LEASE INCLUDING THOSE SET FORTH IN ARTICLE 5, ARTICLE 10 AND SECTION 12.18, RELEVANT ASSET OWNER HEREBY ACCEPTS THE APPLICABLE PREMISES “AS IS”, “WHERE IS”, AND “WITH ALL FAULTS”, AND RELATED REFINERY OWNER MAKES NO REPRESENTATIONS OR WARRANTIES, EXPRESS, IMPLIED OR STATUTORY, UNDER THIS LEASE AS TO THE PHYSICAL CONDITION OF THE APPLICABLE PREMISES, INCLUDING THE APPLICABLE PREMISES’ MERCHANTABILITY, HABITABILITY, CONDITION, FITNESS, OR SUITABILITY FOR ANY PARTICULAR USE OR PURPOSE.

12.21 Relocation of Pipelines; Amendment. If the Related Refinery Owner elects to move certain pipelines within the Refinery Complex, and such relocation of the pipelines requires relocation of any of the Applicable Assets, then this Lease shall continue in full force and effect; provided, however, the Parties shall execute an amendment hereto reflecting the new location(s) of the Applicable Assets.

12.22 Counterparts. This Lease may be executed in one or more counterparts, and by the Parties hereto in separate counterparts, each of which when executed shall be deemed to be an original but all of which taken together shall constitute one and the same agreement.

12.23 Joinder by Affiliates of Parties. From time to time, an Affiliate of the Relevant Asset Owner who own assets at a refinery (whether now or in the future owned by the Related Refinery Owner or its Affiliate), may desire to become a party to this Lease, upon such terms and conditions that such Relevant Asset Owner (or its Affiliate) and the applicable Related Refinery Owner may agree. The joinder of such Relevant Asset Owner’s Affiliate and/or the Related Refinery Owner’s Affiliate to this Agreement shall be effective upon the execution of a joinder agreement (a “Joinder”), in form and substance acceptable to such parties. The Joinder shall specify such Affiliate’s “Applicable Assets,” the “Applicable Term” and the applicable “Rent,” and shall include any provisions unique to such Affiliate’s assets. In executing the Joinder, such parties thereby acknowledge, represent and warrant that they have read and are familiar with the terms and conditions of this Lease and upon execution of the Joinder, and that this Lease is the binding and enforceable obligation of them, modified only as expressly set forth in such Joinder. The Joinder shall be for the sole purpose of joining such Affiliate(s) to this Lease and,

17

except as expressly set forth in the Joinder only with respect to such Affiliate(s), shall not alter, modify or affect any of the terms or conditions of this Lease as they relate to such Affiliate(s), the Relevant Asset Owners or the Related Refinery Owners, all of which remain in full force and effect.

[Remainder of Page Intentionally Left Blank]

18

The parties hereto have executed this Third Amended and Restated Master Lease and Access Agreement to be effective as of the Effective Date.

| Related Refinery Owners: | ||||||||

| HOLLYFRONTIER EL DORADO REFINING LLC | ||||||||

| HOLLYFRONTIER CHEYENNE REFINING LLC | ||||||||

| HOLLYFRONTIER TULSA REFINING LLC | ||||||||

| HOLLYFRONTIER WOODS CROSS REFINING LLC | ||||||||

| HOLLYFRONTIER NAVAJO REFINING LLC | ||||||||

| By: | /s/ George J. Damiris | |||||||

| Name: | George J. Damiris | |||||||

| Title: | Chief Executive Officer and President | |||||||

| Relevant Asset Owners: | ||||||||

| EL DORADO LOGISTICS LLC | ||||||||

| EL DORADO OPERATING LLC | ||||||||

| CHEYENNE LOGISTICS LLC | ||||||||

| HEP TULSA LLC | ||||||||

| WOODS CROSS OPERATING LLC | ||||||||

| By: | /s/ Michael C. Jennings | |||||||

| Name: | Michael C. Jennings | |||||||

| Title: | Chief Executive Officer | |||||||

| HEP WOODS CROSS, L.L.C. | ||||||||

| HEP PIPELINE, L.L.C. | ||||||||

| By: | Holly Energy Partners – Operating, L.P., its sole member | |||||||

| By: | /s/ Michael C. Jennings | |||||||

| Name: | Michael C. Jennings | |||||||

| Title: | Chief Executive Officer | |||||||

[Signature Page to Third Amended and Restated Master Lease and Access Agreement]

Exhibit A

to

Third Amended and Restated Master Lease and Access Agreement

Parties

| 1. | HollyFrontier El Dorado and El Dorado Logistics with respect to the Applicable Premises at the El Dorado Refinery Complex |

| 2. | HollyFrontier Cheyenne and Cheyenne Logistics with respect to the Applicable Premises at the Cheyenne Refinery Complex |

| 3. | HollyFrontier Tulsa and HEP Tulsa with respect to the Applicable Premises at the Tulsa Refinery Complex |

| 4. | HollyFrontier Woods Cross and HEP Woods Cross with respect to the Applicable Premises at the Woods Cross Refinery Complex |

| 5. | HollyFrontier Navajo and HEP Pipeline with respect to the Applicable Premises at the Navajo Refinery Complex |

| 6. | HollyFrontier El Dorado and El Dorado Operating with respect to the Applicable Premises at the El Dorado Refinery Complex |

| 7. | HollyFrontier Woods Cross and Woods Cross Operating with respect to the Applicable Premises at the Woods Cross Refinery Complex |

Exhibit A-1

Exhibit B

to

Third Amended and Restated Master Lease and Access Agreement

Master Lease and Access Agreement Amendments

| Agreement | Effective Date | Reason for Amendment | ||

| Original Master Lease and Access Agreement | January 1, 2015 | n/a | ||

| Amended and Restated Master Lease and Access Agreement | November 1, 2015 | LLC Interest Purchase Agreement for certain El Dorado Refinery Assets | ||

| Second Amended and Restated Master Lease and Access Agreement | March 31, 2016 | Purchase of certain Tulsa Refinery Assets by HEP Tulsa from a third party and construction of new tanks at the Tulsa Refinery Complex by HEP Tulsa |

Exhibit B-1

Exhibit C

to

Third Amended and Restated Master Lease and Access Agreement

Definitions

“Additional Improvements” is defined in Section 4.1.

“Affiliates” means, with to respect to a specified person, any other person controlling, controlled by or under common control with that first person. As used in this definition, the term “control” includes (i) with respect to any person having voting securities or the equivalent and elected directors, managers or persons performing similar functions, the ownership of or power to vote, directly or indirectly, voting securities or the equivalent representing 50% or more of the power to vote in the election of directors, managers or persons performing similar functions, (ii) ownership of 50% or more of the equity or equivalent interest in any person and (iii) the ability to direct the business and affairs of any person by acting as a general partner, manager or otherwise. Notwithstanding the foregoing, for purposes of this Agreement, the Related Refinery Owners, on the one hand, and the Relevant Asset Owners, on the other hand, shall not be considered Affiliates of each other.

“Ancillary Agreements” means, collectively, any other agreement executed by the Related Refinery Owner and the Relevant Asset Owner in connection with the Relevant Asset Owner’s ownership of the Applicable Assets or the Relevant Asset Owner’s acquisition of the Applicable Assets, as the case may be, each as amended, supplemented or otherwise modified from time to time, and specifically includes the Omnibus Agreement.

“Applicable Assets” means the assets located at a Refinery Complex owned by the Relevant Asset Owner, identified on Exhibit E and any Additional Improvements.

“Applicable Law” means any applicable statute, law, regulation, ordinance, rule, judgment, rule of law, order, decree, permit, approval, concession, grant, franchise, license, agreement, requirement, or other governmental restriction or any similar form of decision of, or any provision or condition of any permit, license or other operating authorization issued under any of the foregoing by, or any determination of, any Governmental Authority having or asserting jurisdiction over the matter or matters in question, whether now or hereafter in effect and in each case as amended (including all of the terms and provisions of the common law of such Governmental Authority), as interpreted and enforced at the time in question.

“Applicable Premises” means those certain tracts or parcels of land on which the Applicable Assets are situated at a Refinery Complex, such land as to each of the Applicable Assets more particularly described or identified on Exhibit F together with all right, title and interest, if any, of the Related Refinery Owner in and to all accretion attaching to the land and any rights to submerged lands or interests in riparian rights or riparian grants owned by the Related Asset Owner and adjoining the land shown on said Exhibit F, but excluding (i) the Applicable Assets, and (ii) the Additional Improvements.

“Applicable Term” means the Applicable Term set forth on Exhibit E for the Applicable Assets as such Applicable Term may be extended from time to time pursuant to Exhibit E.

“Bankruptcy Event” means, in relation to any Party,

| (a) | the making of a general assignment for the benefit of creditors by such Party; |

Exhibit C-1

| (b) | the entering into of any arrangement or composition with creditors as a result of insolvency (other than for the purposes of a solvent reconstruction or amalgamation); |

| (c) | the institution by such Party of proceedings: |

(i) seeking to adjudicate such Party as bankrupt or insolvent or seeking protection or relief from creditors,

(ii) seeking liquidation, winding up, or rearrangement, reorganization or adjustment of such Party or its debts (other than for purposes of a solvent reconstruction or amalgamation), or

(iii) seeking the entry of an order for the appointment of a receiver, trustee or other similar official for such Party or for all or a substantial part of such Party’s assets; or

(d) the institution of any proceeding of the type described in the third bullet above against such Party, which proceeding shall not have been dismissed within ninety (90) days following its institution.

“Business Day” means any day other than Saturday, Sunday or other day upon which commercial banks in Dallas, Texas are authorized by law to close.

“Casualty Event” is defined in Section 7.4.

“Cheyenne Logistics” means Cheyenne Logistics LLC, a Delaware limited liability company.

“Cheyenne RCRA Order” means that certain administrative order dated September 24, 1990, as transferred to the Wyoming Department of Environmental Quality on March 22, 1995, to which the Cheyenne Refinery Complex is subject.

“Commencement Date” is defined in Exhibit E.

“Connection Facilities” is defined in the Master Site Services Agreement.

“El Dorado Logistics” means El Dorado Logistics LLC, a Delaware limited liability company.

“El Dorado Operating” means El Dorado Operating LLC, a Delaware limited liability company.

“El Dorado RCRA Order” means that certain administrative order to which the El Dorado Refinery Complex is or soon will be subject issued by the U.S. Environmental Protection Agency under Section 3008(h) of the Resource Conservation and Recovery Act.