10Q Q3 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________________________________________________________________________

FORM 10-Q

_____________________________________________________________________________________

(Mark one)

|

| | |

þ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the quarterly period ended September 30, 2013. |

OR |

¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from to . |

Commission file number 001-32147

______________________________________________________________________________________

GREENHILL & CO., INC.

(Exact Name of Registrant as Specified in its Charter)

______________________________________________________________________________________

|

| |

Delaware | 51-0500737 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| |

300 Park Avenue New York, New York | 10022 (ZIP Code) |

(Address of Principal Executive Offices) | |

Registrant's telephone number, including area code: (212) 389-1500

______________________________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer þ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| | (Do not check if a smaller reporting company) | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of October 30, 2013, there were 27,767,702 shares of the registrant's common stock outstanding.

TABLE OF CONTENTS

|

| | |

| | Page |

| | |

1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

2. | | |

| | |

3. | | |

| | |

4. | | |

| | |

| | |

1. | | |

| | |

1A. | | |

| | |

2. | | |

| | |

3. | | |

| | |

4. | | |

| | |

5. | | |

| | |

6. | | |

| | |

| | |

| | |

Exhibits | | |

AVAILABLE INFORMATION

Greenhill & Co., Inc. files current, annual and quarterly reports, proxy statements and other information required by the Securities Exchange Act of 1934, as amended (the “Exchange Act”), with the United States Securities and Exchange Commission (the “SEC”). You may read and copy any document the company files at the SEC's public reference room located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The company's SEC filings are also available to the public from the SEC's internet site at http://www.sec.gov. Copies of these reports, proxy statements and other information can also be inspected at the offices of the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005, U.S.A.

Our public internet site is http://www.greenhill.com. We make available free of charge through our internet site, via a link to the SEC's internet site at http://www.sec.gov, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and Forms 3, 4 and 5 filed on behalf of directors and executive officers and any amendments to those reports filed or furnished pursuant to the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our website in the “Corporate Governance” section, and available in print upon request of any stockholder to our Investor Relations Department, are charters for our Audit Committee, Compensation Committee and Nominating & Corporate Governance Committee, our Corporate Governance Guidelines, Related Party Transaction Policy and Code of Business Conduct & Ethics governing our directors, officers and employees. You may need to have Adobe Acrobat Reader software installed on your computer to view these documents, which are in PDF format.

Part I. Financial Information

Item 1. Financial Statements

Greenhill & Co., Inc. and Subsidiaries

Condensed Consolidated Statements of Financial Condition

(in thousands except share and per share data)

|

| | | | | | | |

| As of |

| September 30, | | December 31, |

| 2013 | | 2012 |

| (unaudited) | | |

Assets | | | |

Cash and cash equivalents ($5.2 million and $7.1 million restricted from use at September 30, 2013 and December 31, 2012, respectively) | $ | 30,344 |

| | $ | 50,324 |

|

Advisory fees receivable, net of allowance for doubtful accounts of $0.0 million at September 30, 2013 and December 31, 2012 | 64,645 |

| | 54,444 |

|

Other receivables | 4,341 |

| | 1,554 |

|

Property and equipment, net of accumulated depreciation of $56.2 million and $54.8 million at September 30, 2013 and December 31, 2012, respectively | 11,893 |

| | 14,404 |

|

Other investments | 11,012 |

| | 34,215 |

|

Investments in merchant banking funds | 11,285 |

| | 16,772 |

|

Goodwill | 149,112 |

| | 164,890 |

|

Deferred tax asset, net | 47,062 |

| | 47,512 |

|

Other assets | 2,982 |

| | 2,855 |

|

Total assets | $ | 332,676 |

| | $ | 386,970 |

|

Liabilities and Equity | | | |

Compensation payable | $ | 4,600 |

| | $ | 21,419 |

|

Accounts payable and accrued expenses | 9,450 |

| | 7,872 |

|

Bank loan payable | 36,350 |

| | 29,125 |

|

Current income taxes payable | 11,921 |

| | 15,797 |

|

Deferred tax liability | 2,368 |

| | 9,245 |

|

Total liabilities | 64,689 |

| | 83,458 |

|

Common stock, par value $0.01 per share; 100,000,000 shares authorized, 37,840,092 and 36,513,507 shares issued as of September 30, 2013 and December 31, 2012, respectively; 27,747,240 and 27,488,828 shares outstanding as of September 30, 2013 and December 31, 2012, respectively | 378 |

| | 365 |

|

Contingent convertible preferred stock, par value $0.01 per share; 10,000,000 shares authorized and 1,099,877 shares issued as of September 30, 2013 and December 31, 2012 and 439,951 and 1,099,877 shares outstanding as of September 30, 2013 and December 31, 2012, respectively | 14,446 |

| | 46,950 |

|

Restricted stock units | 106,565 |

| | 107,253 |

|

Additional paid-in capital | 532,503 |

| | 458,642 |

|

Exchangeable shares of subsidiary; 257,156 shares issued as of September 30, 2013 and December 31, 2012, respectively; 32,804 shares outstanding as of September 30, 2013 and December 31, 2012, respectively | 1,958 |

| | 1,958 |

|

Retained earnings | 150,231 |

| | 159,918 |

|

Accumulated other comprehensive income (loss) | (4,789 | ) | | 6,624 |

|

Treasury stock, at cost, par value $0.01 per share; 10,092,852 and 9,024,679 shares as of September 30, 2013 and December 31, 2012 respectively | (534,347 | ) | | (479,551 | ) |

Stockholders’ equity | 266,945 |

| | 302,159 |

|

Noncontrolling interests | 1,042 |

| | 1,353 |

|

Total equity | 267,987 |

| | 303,512 |

|

Total liabilities and equity | $ | 332,676 |

| | $ | 386,970 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

Greenhill & Co., Inc. and Subsidiaries

Condensed Consolidated Statements of Income (unaudited)

(in thousands except share and per share data)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended, September 30, | | For the Nine Months Ended, September 30, |

| 2013 | | 2012 | | 2013 | | 2012 |

Revenues | | | | | | | |

Advisory revenues | $ | 46,983 |

| | $ | 72,757 |

| | $ | 211,496 |

| | $ | 191,160 |

|

Investment revenues | (2,440 | ) | | (10,010 | ) | | (672 | ) | | 1,594 |

|

Total revenues | 44,543 |

| | 62,747 |

| | 210,824 |

| | 192,754 |

|

Expenses | | | | | | | |

Employee compensation and benefits | 27,073 |

| | 33,290 |

| | 115,202 |

| | 102,932 |

|

Occupancy and equipment rental | 4,672 |

| | 4,627 |

| | 13,322 |

| | 13,370 |

|

Depreciation and amortization | 861 |

| | 1,775 |

| | 3,612 |

| | 5,463 |

|

Information services | 2,042 |

| | 2,103 |

| | 6,020 |

| | 6,192 |

|

Professional fees | 1,297 |

| | 1,304 |

| | 4,050 |

| | 4,038 |

|

Travel related expenses | 2,879 |

| | 2,270 |

| | 9,360 |

| | 8,359 |

|

Interest expense | 241 |

| | 242 |

| | 769 |

| | 750 |

|

Other operating expenses | 2,529 |

| | 3,158 |

| | 8,453 |

| | 9,337 |

|

Total expenses | 41,594 |

| | 48,769 |

| | 160,788 |

| | 150,441 |

|

Income before taxes | 2,949 |

| | 13,978 |

| | 50,036 |

| | 42,313 |

|

Provision for taxes | 1,152 |

| | 5,389 |

| | 19,134 |

| | 15,348 |

|

Consolidated net income | 1,797 |

| | 8,589 |

| | 30,902 |

| | 26,965 |

|

Less: Net income allocated to noncontrolling interests | — |

| | — |

| | — |

| | — |

|

Net income allocated to common stockholders | $ | 1,797 |

| | $ | 8,589 |

| | $ | 30,902 |

| | $ | 26,965 |

|

Average shares outstanding: | | | | | | | |

Basic | 29,792,997 |

| | 30,252,342 |

| | 30,094,986 |

| | 30,611,270 |

|

Diluted | 29,805,553 |

| | 30,260,808 |

| | 30,122,352 |

| | 30,618,837 |

|

Earnings per share: | | | | | | | |

Basic | $ | 0.06 |

| | $ | 0.28 |

| | $ | 1.03 |

| | $ | 0.88 |

|

Diluted | $ | 0.06 |

| | $ | 0.28 |

| | $ | 1.03 |

| | $ | 0.88 |

|

Dividends declared and paid per share | $ | 0.45 |

| | $ | 0.45 |

| | $ | 1.35 |

| | $ | 1.35 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

Greenhill & Co., Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income (unaudited)

(in thousands)

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| 2013 | | 2012 | | 2013 | | 2012 |

Consolidated net income | $ | 1,797 |

| | $ | 8,589 |

| | $ | 30,902 |

| | $ | 26,965 |

|

Currency translation adjustment, net of tax | 3,190 |

| | 3,276 |

| | (11,413 | ) | | 3,742 |

|

Comprehensive income | 4,987 |

| | 11,865 |

| | 19,489 |

| | 30,707 |

|

Less: Net income allocated to noncontrolling interests | — |

| | — |

| | — |

| | — |

|

Comprehensive income allocated to common stockholders | $ | 4,987 |

| | $ | 11,865 |

| | $ | 19,489 |

| | $ | 30,707 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

Greenhill & Co., Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Equity

(in thousands, except for per share data)

|

| | | | | | | |

| Nine Months Ended September 30, | | Year Ended December 31, |

| 2013 | | 2012 |

| (unaudited) | | |

Common stock, par value $0.01 per share | | | |

Common stock, beginning of the period | $ | 365 |

| | $ | 358 |

|

Common stock issued | 13 |

| | 7 |

|

Common stock, end of the period | 378 |

| | 365 |

|

Contingent convertible preferred stock, par value $0.01 per share | | | |

Contingent convertible preferred stock, beginning of the period | 46,950 |

| | 46,950 |

|

Contingent convertible preferred stock converted | (32,504 | ) | | — |

|

Contingent convertible preferred stock, end of the period | 14,446 |

| | 46,950 |

|

Restricted stock units | | | |

Restricted stock units, beginning of the period | 107,253 |

| | 99,916 |

|

Restricted stock units recognized | 42,916 |

| | 54,178 |

|

Restricted stock units delivered | (43,604 | ) | | (46,841 | ) |

Restricted stock units, end of the period | 106,565 |

| | 107,253 |

|

Additional paid-in capital | | | |

Additional paid-in capital, beginning of the period | 458,642 |

| | 412,283 |

|

Common stock issued | 75,716 |

| | 51,306 |

|

Tax (expense) from the delivery of restricted stock units | (1,855 | ) | | (4,947 | ) |

Additional paid-in capital, end of the period | 532,503 |

| | 458,642 |

|

Exchangeable shares of subsidiary | | | |

Exchangeable shares of subsidiary, beginning of the period | 1,958 |

| | 6,578 |

|

Exchangeable shares of subsidiary delivered | — |

| | (4,620 | ) |

Exchangeable shares of subsidiary, end of the period | 1,958 |

| | 1,958 |

|

Retained earnings | | | |

Retained earnings, beginning of the period | 159,918 |

| | 173,374 |

|

Dividends | (42,175 | ) | | (57,129 | ) |

Tax benefit from payment of restricted stock unit dividends | 1,586 |

| | 1,581 |

|

Net income allocated to common stockholders | 30,902 |

| | 42,092 |

|

Retained earnings, end of the period | 150,231 |

| | 159,918 |

|

Accumulated other comprehensive income (loss) | | | |

Accumulated other comprehensive income, beginning of the period | 6,624 |

| | 3,128 |

|

Currency translation adjustment, net of tax | (11,413 | ) | | 3,496 |

|

Accumulated other comprehensive income (loss), end of the period | (4,789 | ) | | 6,624 |

|

Treasury stock, at cost, par value $0.01 per share | | | |

Treasury stock, beginning of the period | (479,551 | ) | | (396,386 | ) |

Repurchased | (54,796 | ) | | (83,165 | ) |

Treasury stock, end of the period | (534,347 | ) | | (479,551 | ) |

Total stockholders’ equity | 266,945 |

| | 302,159 |

|

Noncontrolling interests | | | |

Noncontrolling interests, beginning of the period | 1,353 |

| | 1,353 |

|

Net income allocated to noncontrolling interests | — |

| | — |

|

Distributions to noncontrolling interests | (311 | ) | | — |

|

Noncontrolling interests, end of the period | 1,042 |

| | 1,353 |

|

Total equity | $ | 267,987 |

| | $ | 303,512 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

Greenhill & Co., Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (unaudited)

(in thousands)

|

| | | | | | | |

| For the Nine Months Ended September 30, |

| 2013 | | 2012 |

Operating activities: | | | |

Consolidated net income | $ | 30,902 |

| | $ | 26,965 |

|

Adjustments to reconcile consolidated net income to net cash provided by operating activities: | | | |

Non-cash items included in consolidated net income: | | | |

Depreciation and amortization | 3,612 |

| | 5,463 |

|

Net investment gains | 1,612 |

| | (100 | ) |

Restricted stock units recognized and common stock issued | 42,916 |

| | 42,008 |

|

Deferred taxes | (2,809 | ) | | (13,683 | ) |

Deferred gain on sale of certain merchant banking assets | (147 | ) | | (194 | ) |

Changes in operating assets and liabilities: | | | |

Advisory fees receivable | (10,201 | ) | | (5,549 | ) |

Other receivables and assets | (3,578 | ) | | (1,174 | ) |

Compensation payable | (16,807 | ) | | (27,098 | ) |

Accounts payable and accrued expenses | 3,326 |

| | 7,607 |

|

Current income taxes payable | (3,876 | ) | | 1,989 |

|

Net cash provided by operating activities | 44,950 |

| | 36,234 |

|

Investing activities: | | | |

Purchases of investments | (500 | ) | | (6,536 | ) |

Proceeds from sales of investments | 26,582 |

| | 24,914 |

|

Distributions from investments | 1,004 |

| | 3,040 |

|

Purchases of property and equipment | (637 | ) | | (2,106 | ) |

Net cash provided by investing activities | 26,449 |

| | 19,312 |

|

Financing activities: | | | |

Proceeds from revolving bank loan | 89,900 |

| | 62,595 |

|

Repayment of revolving bank loan | (82,675 | ) | | (55,270 | ) |

Distributions to noncontrolling interests | (311 | ) | | — |

|

Dividends paid | (42,175 | ) | | (42,221 | ) |

Purchase of treasury stock | (54,796 | ) | | (40,497 | ) |

Net tax (cost) from the delivery of restricted stock units and payment of dividend equivalents | (269 | ) | | (4,430 | ) |

Net cash used in financing activities | (90,326 | ) | | (79,823 | ) |

Effect of exchange rate changes on cash and cash equivalents | (1,053 | ) | | 334 |

|

Net decrease in cash and cash equivalents | (19,980 | ) | | (23,943 | ) |

Cash and cash equivalents, beginning of period | 50,324 |

| | 62,050 |

|

Cash and cash equivalents, end of period | $ | 30,344 |

| | $ | 38,107 |

|

Supplemental disclosure of cash flow information: | | | |

Cash paid for interest | $ | 761 |

| | $ | 763 |

|

Cash paid for taxes, net of refunds | $ | 27,040 |

| | $ | 24,742 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

Greenhill & Co., Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (unaudited)

Note 1 — Organization

Greenhill & Co., Inc., a Delaware corporation, together with its subsidiaries (collectively, the “Company”), is a leading independent investment bank focused on providing financial advice on significant mergers, acquisitions, restructurings, financings and capital raisings to corporations, partnerships, institutions and governments. The Company acts for clients located throughout the world from its offices located in the United States, United Kingdom, Germany, Canada, Japan, Australia, Sweden and Brazil.

The Company's activities as an investment banking firm constitute one business segment, with two principal sources of revenue:

| |

• | Advisory, which includes engagements relating to mergers and acquisitions, financing advisory and restructuring, and private equity and real estate capital advisory services; and |

| |

• | Investments, which includes the Company's principal investments in certain merchant banking funds, Iridium Communications Inc. (“Iridium”), other investments and interest income. |

The Company's wholly-owned subsidiaries that provide advisory services include Greenhill & Co., LLC (“G&Co”), Greenhill & Co. International LLP (“GCI”), Greenhill & Co. Europe LLP (“GCE”), Greenhill & Co. Canada Ltd. (“GCC”), Greenhill & Co. Japan Ltd. (“GCJ”), Greenhill & Co. Australia Pty Limited (“Greenhill Australia”), and Greenhill & Co. Sweden AB ("GCS").

G&Co is engaged in investment banking activities principally in the U.S. G&Co is registered as a broker-dealer with the Securities and Exchange Commission (“SEC”) and the Financial Industry Regulatory Authority (“FINRA”), and is licensed in all 50 states and the District of Columbia. G&Co is also registered as a municipal advisor with the SEC and the Municipal Securities Rulemaking Board.

GCI is engaged in investment banking activities in the U.K. and GCE is engaged in investment banking activities in Europe. GCI and GCE are subject to regulation by the U.K. Financial Conduct Authority (“FCA”). GCJ and GCC are engaged in investment banking activities in Japan and Canada, respectively. GCJ is registered with the Kanto Local Finance Bureau in Japan and is subject to regulation by the Financial Services Agency in Japan. Greenhill Australia engages in investment banking activities in Australia and New Zealand and is licensed and subject to regulation by the Australian Securities and Investment Commission (“ASIC”). GCS is engaged in investment banking activities in Sweden and the general Nordic region and is subject to regulation by the Swedish Financial Supervisory Authority.

Note 2 — Summary of Significant Accounting Policies

Basis of Financial Information

These condensed consolidated financial statements are prepared in conformity with accounting principles generally accepted in the United States (U.S. GAAP), which require management to make estimates and assumptions regarding future events that affect the amounts reported in our financial statements and these footnotes, including investment valuations, compensation accruals and other matters. Management believes that the estimates used in preparing its condensed consolidated financial statements are reasonable and prudent. Actual results could differ materially from those estimates. Certain reclassifications have been made to prior year information to conform to current year presentation.

The condensed consolidated financial statements of the Company include all consolidated accounts of Greenhill & Co., Inc. and all other entities in which the Company has a controlling interest after eliminations of all significant inter-company accounts and transactions. In accordance with the accounting pronouncements related to consolidation of variable interest entities, the Company consolidates the general partners of certain merchant banking funds in which it has a majority of the economic interest and control. The general partners account for their investments in these merchant banking funds under the equity method of accounting. As such, the general partners record their proportionate shares of income (loss) from the underlying merchant banking funds. As these merchant banking funds follow investment company accounting, and generally record all their assets and liabilities at fair value, the general partners’ investment in these merchant banking funds represents an estimation of fair value. The Company does not consolidate the merchant banking funds since the Company, through its general partner and limited partner interests, does not have a majority of the economic interest in such funds and the limited partners have certain rights to remove the general partner by a simple majority vote of unaffiliated third-party investors.

These condensed consolidated financial statements are unaudited and should be read in conjunction with the audited consolidated financial statements and notes thereto for the year ended December 31, 2012 included in the Company's Annual Report on Form 10-K filed with the SEC. The condensed consolidated financial information as of December 31, 2012 has been derived from audited consolidated financial statements not included herein. The results of operations for interim periods are not necessarily indicative of results for the entire year.

Revenue Recognition

Advisory Revenues

The Company's accounting policy is to recognize revenue when (i) there is persuasive evidence of an arrangement with a client, (ii) the agreed-upon services have been completed and delivered to the client or the transaction or events noted in the engagement letter are determined to be substantially complete, (iii) fees are fixed and determinable, and (iv) collection is reasonably assured.

The Company recognizes advisory fee revenues for mergers and acquisitions or financing advisory and restructuring engagements when the services related to the underlying transactions are completed in accordance with the terms of the engagement letter and all other requirements for revenue recognition are satisfied.

The Company recognizes private equity and real estate capital advisory fees at the time of the client's acceptance of capital or capital commitments to a fund in accordance with the terms of the engagement letter. Generally, fee revenue is determined based upon a fixed percentage of capital committed to the fund. For multiple closings, revenue is recognized at each interim closing based on the amount of capital committed at each closing at the fixed fee percentage. At the final closing, revenue is recognized at the fixed percentage for the amount of capital committed since the last interim closing.

While the majority of the Company's fee revenue is earned at the conclusion of a transaction or closing of a fund, on-going retainer fees, substantially all of which relate to non-success based strategic advisory and financing advisory and restructuring assignments, are also earned and recognized as advisory fee revenue over the period in which the related service is rendered.

The Company’s clients reimburse certain expenses incurred by the Company in the conduct of advisory engagements. Expenses are reported net of such client reimbursements. Client reimbursements totaled $1.3 million and $1.6 million for the three months ended September 30, 2013 and 2012, respectively and $4.8 million and $5.4 million for the nine months ended September 30, 2013 and 2012, respectively.

Investment Revenues

Investment revenues consist of (i) gains (or losses) on the Company's investments in certain merchant banking funds, Iridium and other investments, (ii) profit overrides from certain merchant banking funds, if any, and (iii) interest income.

The Company recognizes revenue on its investments in merchant banking funds based on its allocable share of realized and unrealized gains (or losses) reported by such funds. The Company recognizes revenue on its other investments, including Iridium, which considers the Company's influence or control of the investee, based on gains and losses on investment positions held, which arise from sales or changes in the fair value of investments. The amount of gains or losses are not predictable and can cause periodic fluctuations in net income and therefore subject the Company to market and credit risk.

If certain financial returns are achieved over the life of a merchant banking fund, the Company may recognize merchant banking profit overrides at the time that certain financial returns are achieved. Profit overrides are generally calculated as a percentage of the profits over a specified threshold earned by each fund on investments managed on behalf of unaffiliated investors except the Company. The Company may be required to repay a portion of the overrides it realized in the event a minimum performance level is not achieved by the fund as a whole (we refer to these potential repayments as “clawbacks”). As of September 30, 2013, the Company believes it is more likely than not that the amount of profit overrides recognized as revenue in prior periods, which relates solely to its interest in GCP I, will be realized and accordingly, the Company has not reserved for any clawback obligations under applicable fund agreements.

Cash and Cash Equivalents

The Company’s cash and cash equivalents consist of (i) cash held on deposit with financial institutions, (ii) cash equivalents and (iii) restricted cash.

At September 30, 2013 and December 31, 2012, the Company had $30.3 million and $50.3 million of cash and cash equivalents. The Company considers all highly liquid investments with a maturity date of three months or less, when purchased, to be cash equivalents. Cash equivalents primarily consist of money market funds and overnight deposits. At September 30, 2013 and December 31, 2012, the carrying value of the Company’s cash equivalents amounted to $6.8 million and $4.5 million, respectively, which approximated fair value, and are included in total cash and cash equivalents.

Also included in the total cash and cash equivalents balance at September 30, 2013 and December 31, 2012 was restricted cash of $5.2 million and $7.1 million, respectively (including $0.9 million and $2.6 million restricted for the payout of Greenhill Australia's deferred compensation plan, respectively).

The Company maintains its cash and cash equivalents with financial institutions with high credit ratings. Management believes that the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held.

Advisory Fees Receivables

Receivables are stated net of an allowance for doubtful accounts. The estimate for the allowance for doubtful accounts is derived by the Company by utilizing past client transaction history and an assessment of the client’s creditworthiness. The Company did not record a charge for bad debt expense for either of the three or nine month periods ended September 30, 2013 or 2012.

Included in the advisory fees receivable balance at September 30, 2013 and December 31, 2012 were $24.9 million and $28.1 million, respectively, of long term receivables related to private equity and real estate capital advisory engagements, which are generally paid in installments over a period of three years. Included as a component of investment revenues on the condensed consolidated statements of income is interest income related to capital advisory engagements of $0.3 million and $0.5 million for the three month periods ended September 30, 2013 and 2012, respectively, and $0.6 million and $0.9 million for the nine month periods ended September 30, 2013 and 2012, respectively.

Credit risk related to advisory fees receivable is disbursed across a large number of clients located in various geographic areas. The Company controls credit risk through credit approvals and monitoring procedures but does not require collateral to support accounts receivable.

Investments

The Company's investment in Iridium is valued using its quoted market price. The Company's investments in merchant banking funds are recorded under the equity method of accounting based upon the Company's proportionate share of the estimated fair value of the underlying merchant banking fund's net assets. The value of merchant banking fund investments in privately held companies is determined by the general partner of the fund after giving consideration to the cost of the security, the pricing of other sales of securities by the portfolio company, the price of securities of other companies comparable to the portfolio company, purchase multiples paid in other comparable third-party transactions, the original purchase price multiple, market conditions, liquidity, operating results and other qualitative and quantitative factors. Discounts may be applied to the funds' privately held investments to reflect the lack of liquidity and other transfer restrictions. Because of the inherent uncertainty of valuations as well as the discounts applied, the estimated fair values of investments in privately held companies may differ significantly from the values that would have been used had a ready market for the securities existed. The value of merchant banking fund investments in publicly traded securities is determined using quoted market prices discounted for any legal or contractual restrictions on sale. The values at which the Company's investments are carried on its condensed consolidated statements of financial condition are adjusted to estimated fair value at the end of each quarter and the volatility in general economic conditions, stock markets and commodity prices may result in significant changes in the estimated fair value of the investments from period to period.

Goodwill

Goodwill is the cost of acquired companies in excess of the fair value of identifiable net assets at acquisition date. The Company tests its goodwill for impairment at least annually. An impairment loss is triggered if the estimated fair value of an operating unit is less than estimated net book value. Such loss is calculated as the difference between the estimated fair value of goodwill and its carrying value.

Goodwill is translated at the rate of exchange prevailing at the end of the periods presented in accordance with the accounting guidance for foreign currency translation. Any translation gain or loss is included in the foreign currency translation adjustment, which is included as a component of other comprehensive income in the condensed consolidated statements of changes in equity. At September 30, 2013, goodwill decreased by $15.8 million from the beginning of the year as a result of the foreign currency translation adjustment.

Restricted Stock Units

The Company accounts for its share-based compensation payments under which the fair value of restricted stock units granted to employees with future service requirements is recorded as compensation expense and the units are generally amortized over a three to five year service period following the date of grant. Compensation expense is determined based upon the fair market value of the Company’s common stock at the date of grant. As the Company expenses the awards, the restricted stock units recognized are recorded within equity. The restricted stock units are reclassified into common stock and additional paid-in capital upon vesting. The Company records as treasury stock the repurchase of stock delivered to its employees in settlement of tax liabilities incurred upon the vesting of restricted stock units. The Company records dividend equivalent payments on outstanding restricted stock units as a dividend payment and a charge to equity.

Earnings per Share

The Company calculates basic earnings per share (“EPS”) by dividing net income allocated to common stockholders by the weighted average number of shares outstanding for the period. The denominator for basic EPS includes the weighted average number of shares deemed issuable due to the vesting of restricted stock units for accounting purposes and the contingently issuable convertible preferred shares deemed to meet the performance contingency.

Diluted EPS includes the determinants of basic EPS plus the dilutive effect of the common stock deliverable pursuant to restricted stock units for which future service is required as a condition to the delivery of the underlying common stock. Under the treasury method, the number of shares issuable upon the vesting of restricted stock units included in the calculation of diluted EPS is the excess, if any, of the number of shares expected to be issued, less the number of shares that could be purchased by the Company with the proceeds to be received upon settlement at the average market closing price during the reporting period.

Provision for Taxes

The Company accounts for taxes in accordance with the accounting guidance for income taxes which requires the recognition of tax benefits or expenses on the temporary differences between the financial reporting and tax bases of its assets and liabilities.

The Company follows the guidance for income taxes in recognizing, measuring, presenting and disclosing in its financial statements uncertain tax positions taken or expected to be taken on its income tax returns. Income tax expense is based on pre-tax accounting income, including adjustments made for the recognition or derecognition related to uncertain tax positions. The recognition or derecognition of income tax expense related to uncertain tax positions is determined under the guidance.

Deferred tax assets and liabilities are recognized for the future tax attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in earnings in the period of change. Management applies the “more-likely-than-not criteria” when determining tax benefits.

Foreign Currency Translation

Assets and liabilities denominated in foreign currencies have been translated at rates of exchange prevailing at the end of the periods presented in accordance with the accounting guidance for foreign currency translation. Income and expenses transacted in foreign currency have been translated at average monthly exchange rates during the period. Translation gains and losses are included in the foreign currency translation adjustment, which is included as a component of other comprehensive income in the condensed consolidated statements of changes in equity. Foreign currency transaction gains and losses are included in the condensed consolidated statements of income.

Financial Instruments and Fair Value

The Company accounts for financial instruments measured at fair value in accordance with accounting guidance for fair value measurements and disclosures which establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under the pronouncement are described below:

Basis of Fair Value Measurement

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly; and

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. In determining the appropriate levels, the Company performs an analysis of the assets and liabilities that are subject to these disclosures. At each reporting period, all assets and liabilities for which the fair value measurement is based on significant unobservable inputs or instruments which trade infrequently and therefore have little or no price transparency are classified as Level 3. Transfers between levels are recognized as of the end of the period in which they occur.

Fair Value of Other Financial Instruments

The Company believes that the carrying values of all other financial instruments presented in the condensed consolidated statements of financial condition approximate their fair value generally due to their short-term nature and generally negligible credit risk. These fair value measurements would be categorized as Level 2 within the fair value hierarchy.

Noncontrolling Interests

The portion of the consolidated interests in the general partners of certain of the merchant banking funds not held by the Company is presented as noncontrolling interest, included as a component of equity in the condensed consolidated statements of financial condition. Additionally, the condensed consolidated statements of income separately present income allocated to both noncontrolling interests and common stockholders.

Property and Equipment

Property and equipment is stated at cost less accumulated depreciation and amortization. Depreciation is computed using the straight-line method over the life of the assets. Amortization of leasehold improvements is computed using the straight-line method over the lesser of the life of the asset or the remaining term of the lease. Estimated useful lives of the Company’s fixed assets are generally as follows:

Aircraft – 7 years

Equipment – 5 years

Furniture and fixtures – 7 years

Leasehold improvements – the lesser of 10 years or the remaining lease term

Note 3 — Investments

Merchant Banking Funds

The Company has invested in certain previously sponsored merchant banking funds: Greenhill Capital Partners (“GCP I”) and Greenhill Capital Partners II (“GCP II”), which are families of merchant banking funds. In July 2013, the Company sold the remaining limited partnership interest in Greenhill Capital Partners III for approximately $2.0 million, which represented the book value of the investment at June 30, 2013. In connection with that sale, the purchasers assumed the remaining undrawn commitments to the fund.

The Company recognized a gain at the time of the exit from the merchant banking business, which is amortizing over a five year period ending in 2014.

As of September 30, 2013, the Company continues to retain control only of the general partner of GCP I and GCP II and consolidates the results of each such general partner. As the general partner, the Company is entitled to receive from those funds a portion of the override of the profits realized from investments. The Company recognizes profit overrides related to certain merchant banking funds at the time certain performance hurdles are achieved. The Company did not recognize any profit overrides for the three or nine month periods ended September 30, 2013 and 2012.

The carrying value of the Company’s investments in merchant banking funds are as follows (in thousands): |

| | | | | | | |

| As of September 30, | | As of December 31, |

| 2013 | | 2012 |

| (unaudited) | | |

Investment in GCP I | $ | 1,732 |

| | $ | 2,247 |

|

Investment in GCP II | 7,627 |

| | 11,173 |

|

Investment in GCP III | — |

| | 1,367 |

|

Investment in other merchant banking funds | 1,926 |

| | 1,985 |

|

Total investments in merchant banking funds | $ | 11,285 |

| | $ | 16,772 |

|

The investment in GCP I represents an interest in a previously sponsored merchant banking fund and includes $0.1 million and $0.3 million at September 30, 2013 and December 31, 2012, respectively, related to the noncontrolling interests in the managing general partner of GCP I. The investment in GCP II principally represents the capital interest in a portfolio company and also includes $0.9 million and $1.1 million at September 30, 2013 and December 31, 2012, respectively, related to the noncontrolling interests in the general partner of GCP II.

Approximately $0.3 million of the Company’s compensation payable related to profit overrides for unrealized gains of GCP I at September 30, 2013 and December 31, 2012. This amount may increase or decrease depending on the change in the fair value of GCP I, and is payable, subject to clawback, at the time cash proceeds are realized.

Investments in other merchant banking funds includes the Company's investment in Barrow Street III, a real estate investment fund, which we committed $5.0 million to in 2005. At September 30, 2013, $0.1 million of the Company's commitment remains unfunded and may be drawn any time prior to the expiration of the fund in June 2015.

Other Investments

The Company has other investments including investments in Iridium and certain deferred compensation plan investments related to Greenhill Australia. The Company’s other investments are as follows (in thousands):

|

| | | | | | | |

| As of September 30, | | As of December 31, |

| 2013 | | 2012 |

| (unaudited) | | |

Iridium common stock | $ | 10,978 |

| | $ | 34,165 |

|

Deferred compensation plan investments | 34 |

| | 50 |

|

Total other investments | $ | 11,012 |

| | $ | 34,215 |

|

Iridium

At September 30, 2013, the Company owned 1,595,629 shares of Iridium common stock (NASDAQ:IRDM) with a quoted market price of $6.88 per share and had fully diluted share ownership in Iridium of approximately 2%. At December 31, 2012, the Company owned 5,084,016 shares of Iridium common stock with a quoted market price of $6.72 per share and had a fully diluted ownership of approximately 7%.

The carrying value of the investment in Iridium common stock is valued at the end of each period and its closing quoted market price. The Company’s investment in Iridium is accounted for as a trading security as the Company does not maintain or exercise significant influence over Iridium.

Deferred compensation plan investments

In connection with the acquisition of Caliburn Partnership Pty Limited ("Caliburn"), the Company assumed amounts due under Caliburn's deferred compensation plan. Under this plan, a portion of certain employees' compensation was deferred and invested in cash, or at the election of each respective employee, in certain mutual fund investments. These investments are being distributed to certain employees of Greenhill Australia over a period ending in 2016. The invested assets relating to this plan have been recorded on the condensed consolidated statements of financial condition as components of both cash and cash equivalents and other investments. The deferred compensation liability relating to the plan has been recorded on the condensed consolidated statements of financial condition as a component of compensation payable. Subsequent to the acquisition, the Company discontinued future participation in the plan.

Investment revenues

The Company’s investment revenues, by source, are as follows:

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| 2013 | | 2012 | | 2013 | | 2012 |

| (in thousands, unaudited) |

Net realized and unrealized gains (losses) on investment in Iridium | $ | (3,223 | ) | | $ | (10,826 | ) | | $ | 1,347 |

| | $ | (1,153 | ) |

Net realized and unrealized gains (losses) on investments in merchant banking funds | 394 |

| | 161 |

| | (2,959 | ) | | 1,253 |

|

Deferred gain on sale of certain merchant banking assets | 49 |

| | 65 |

| | 147 |

| | 195 |

|

Interest income | 340 |

| | 590 |

| | 793 |

| | 1,299 |

|

Total investment revenues | $ | (2,440 | ) | | $ | (10,010 | ) | | $ | (672 | ) | | $ | 1,594 |

|

Fair Value Hierarchy

The following tables set forth by level, assets and liabilities measured at fair value on a recurring basis. Assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. There were no transfers between Level 1 and Level 2 investments in the fair value measurement hierarchy during the three and nine month periods ended September 30, 2013 and 2012.

Assets Measured at Fair Value on a Recurring Basis as of September 30, 2013

|

| | | | | | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Balance as of September 30, 2013 |

| (in thousands) |

Assets | | | | | | | |

Iridium common stock | $ | 10,978 |

| | $ | — |

| | $ | — |

| | $ | 10,978 |

|

Deferred compensation plan investments | — |

| | 34 |

| | — |

| | 34 |

|

Total investments | $ | 10,978 |

| | $ | 34 |

| | $ | — |

| | $ | 11,012 |

|

Assets Measured at Fair Value on a Recurring Basis as of December 31, 2012

|

| | | | | | | | | | | | | | | |

| Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | Significant Unobservable Inputs (Level 3) | | Balance as of December 31, 2012 |

| (in thousands) |

Assets | | | | | | | |

Iridium common stock | $ | 34,165 |

| | $ | — |

| | $ | — |

| | $ | 34,165 |

|

Deferred compensation plan investments | — |

| | 50 |

| | — |

| | 50 |

|

Total investments | $ | 34,165 |

| | $ | 50 |

| | $ | — |

| | $ | 34,215 |

|

Level 3 Gains and Losses

There were no Level 3 investments during the three and nine month periods ended September 30, 2013 and 2012.

Note 4 — Related Parties

At September 30, 2013 and December 31, 2012, the Company had no amounts receivable or payable to related parties.

In conjunction with the sale of certain assets of the merchant banking business, the Company agreed to sublease office space to GCP Capital beginning in April 2011. This sublease is expected to terminate in December 2013. The Company also subleases airplane and office space to a firm owned by the Chairman of the Company. The Company recognized rent reimbursements of $0.4 million and $1.2 million for each of the three and nine month periods ended September 30, 2013 and 2012, respectively, which are included as a reduction of occupancy and equipment rental on the condensed consolidated statements of income.

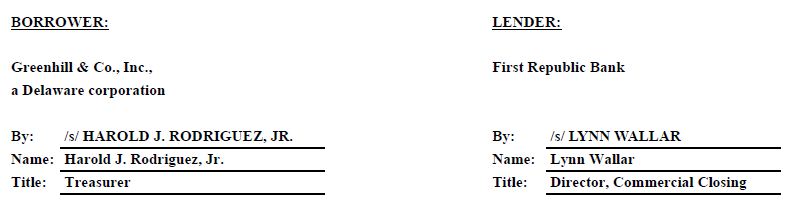

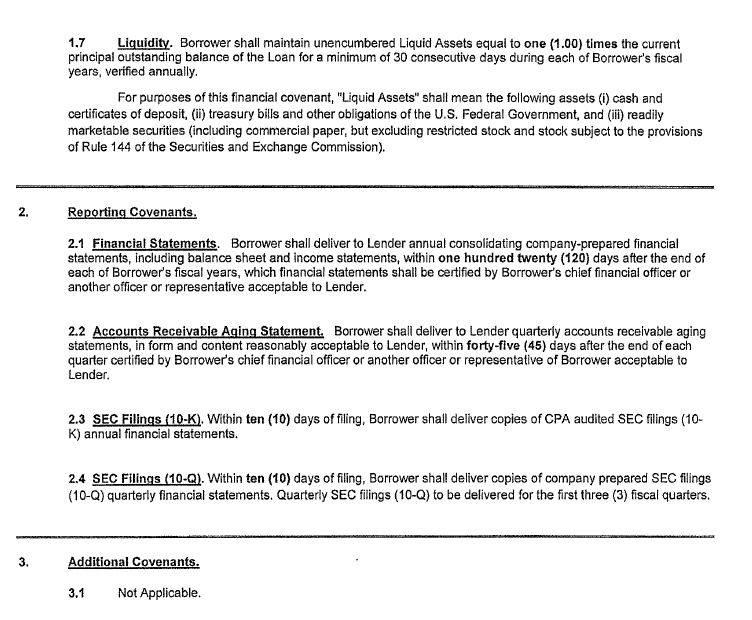

Note 5 — Revolving Bank Loan Facility

At September 30, 2013, the Company had a $45.0 million revolving loan facility from a U.S. banking institution to provide for working capital needs and for other general corporate purposes. Effective May 1, 2013, the loan facility was renewed, with a maturity date of April 30, 2014. The revolving loan facility is secured by any cash distributed in respect of the Company’s investment in the U.S. based merchant banking funds and cash distributions from G&Co. In addition, the revolving loan facility has a prohibition on the incurrence of additional indebtedness without the prior approval of the lender and the Company is required to comply with certain financial and liquidity covenants. The weighted average daily borrowings outstanding under the revolving loan facility were approximately $30.9 million and $27.3 million for the nine months ended September 30, 2013 and 2012, respectively. The weighted average interest rate was 3.25% and 3.55% for the nine months ended September 30, 2013 and 2012, respectively. At September 30, 2013, the Company was compliant with all loan covenants.

Note 6 — Equity

On September 18, 2013, a dividend of $0.45 per share was paid to stockholders of record on September 4, 2013. Dividends include dividend equivalents of $4.7 million and $4.2 million, which were paid on outstanding restricted stock units during the nine months ended September 30, 2013 and September 30, 2012, respectively.

During the nine months ended September 30, 2013, 662,569 restricted stock units vested and were issued as common stock of which the Company is deemed to have repurchased 214,303 shares at an average price of $57.22 per share in conjunction with the payment of tax liabilities in respect of stock delivered to its employees in settlement of restricted stock units. In addition, during the nine months ended September 30, 2013, the Company repurchased in open market transactions 853,870 shares of its common stock at an average price of $49.81 per share.

During the nine months ended September 30, 2012, 632,794 restricted stock units vested and were issued as common stock of which the Company is deemed to have repurchased 176,781 shares at an average price of $45.21 per share in conjunction with the payment of tax liabilities in respect of stock delivered to its employees in settlement of restricted stock units. In addition, during the nine months ended September 30, 2012, the Company repurchased in open market transactions 859,006 shares of its common stock at an average price of $37.84 per share.

In connection with the acquisition of Caliburn, 1,099,877 shares of contingent convertible preferred stock ("Performance Stock") were issued. The Performance Stock, which does not pay dividends, was issued in tranches of 659,926 shares and 439,951 shares and converts to shares of the Company's common stock promptly after the third and fifth anniversary of the closing of the acquisition, respectively, if certain separate revenue targets are achieved. The revenue target for the first tranche was achieved and on April 1, 2013, the third anniversary of the closing, 659,926 shares of Performance Stock, which had a fair value of $32.5 million at the acquisition date, were converted to common stock. If the revenue target for the second tranche is achieved the Performance Stock will be converted to common stock on April 1, 2015. If the revenue target for the second tranche is not achieved, the Performance Stock in that tranche will be canceled.

Note 7 — Earnings Per Share

The computations of basic and diluted EPS are set forth below:

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| 2013 | | 2012 | | 2013 | | 2012 |

| (in thousands, except per share amounts, unaudited) |

Numerator for basic and diluted EPS — net income allocated to common stockholders | $ | 1,797 |

| | $ | 8,589 |

| | $ | 30,902 |

| | $ | 26,965 |

|

Denominator for basic EPS — weighted average number of shares | 29,793 |

| | 30,252 |

| | 30,095 |

| | 30,611 |

|

Add — dilutive effect of: | | | | | | | |

Weighted average number of incremental shares issuable from restricted stock units | 13 |

| | 8 |

| | 27 |

| | 8 |

|

Denominator for diluted EPS — weighted average number of shares and dilutive potential shares | 29,806 |

| | 30,260 |

| | 30,122 |

| | 30,619 |

|

Earnings per share: | | | | | | | |

Basic | $ | 0.06 |

| | $ | 0.28 |

| | $ | 1.03 |

| | $ | 0.88 |

|

Diluted | $ | 0.06 |

| | $ | 0.28 |

| | $ | 1.03 |

| | $ | 0.88 |

|

The weighted number of shares and dilutive potential shares for the three and nine month periods ended September 30, 2013 include the conversion of the first tranche of 659,926 shares of Performance Stock to common stock. The weighted number of shares for the three and nine month periods ended September 30, 2012 do not include the dilutive effect of the first tranche of Performance Stock since the revenue target was not achieved at that time. The weighted number of shares and dilutive potential shares for the three and nine month periods ended September 30, 2013 and 2012 do not include the Performance Stock related to the second tranche, which will be included in the Company's share count at the time the revenue target is met. If the revenue target for the second tranche is not achieved, the contingent convertible preferred shares in that tranche will be canceled.

Note 8 — Income Taxes

The Company's effective tax rate will vary depending on the source of the income. Investment and certain foreign sourced income are taxed at a lower effective rate than U.S. trade or business income.

The Company believes it is more likely than not that the deferred tax asset, which relates principally to compensation expense deducted for book purposes but not yet deducted for tax purposes, will be realized as offsets to: (i) the realization of its deferred tax liabilities and (ii) future taxable income.

Any gain or loss resulting from the translation of deferred taxes for foreign affiliates is included in the foreign currency translation adjustment incorporated as a component of other comprehensive income, net of tax, in the condensed consolidated statements of changes in equity and the condensed consolidated statements of comprehensive income.

The Company's income tax returns are routinely examined by the U.S. federal, U.S. state, and international tax authorities. The Company regularly assesses its tax positions with respect to applicable income tax issues for open tax years in each respective jurisdiction in which the Company operates. As of September 30, 2013, the Company does not believe the resolution of any current ongoing income tax examinations will have a material adverse impact on the financial position of the Company.

Note 9 — Regulatory Requirements

Certain subsidiaries of the Company are subject to various regulatory requirements in the United States, United Kingdom, Australia and certain other jurisdictions, which specify, among other requirements, minimum net capital requirements for registered broker-dealers.

G&Co is subject to the SEC’s Uniform Net Capital requirements under Rule 15c3-1 (the “Rule”), which specifies, among other requirements, minimum net capital requirements for registered broker-dealers. The Rule requires G&Co to maintain a minimum net capital of the greater of $5,000 or 1/15 of aggregate indebtedness, as defined in the Rule. As of September 30, 2013, G&Co’s net capital was $1.4 million, which exceeded its requirement by $1.1 million. G&Co’s aggregate indebtedness to net capital ratio was 2.72 to 1 at September 30, 2013. Certain distributions and other capital withdrawals of G&Co are subject to certain notifications and restrictive provisions of the Rule.

GCI and GCE are subject to capital requirements of the FCA. Greenhill Australia is subject to capital requirements of the ASIC. We are also subject to certain capital regulatory requirements in other jurisdictions. As of September 30, 2013, GCI, GCE, Greenhill Australia, and our other regulated operations were in compliance with local capital adequacy requirements.

Note 10 - Business Information

The Company's activities as an investment banking firm constitute one business segment, with two principal sources of revenue:

| |

• | Advisory, which includes engagements relating to mergers and acquisitions, financing advisory and restructuring, and private equity and real estate capital advisory services; and |

| |

• | Investment, which includes the Company's principal investments in merchant banking funds, Iridium and other investments and interest. |

The following provides a breakdown of our revenues by source for the three and nine month periods ended September 30, 2013 and 2012, respectively:

|

| | | | | | | | | | | |

| For the Three Months Ended |

| September 30, 2013 | | September 30, 2012 |

| Amount | % of Total | | Amount | % of Total |

| (in millions, unaudited) |

Advisory revenues | $47.0 | | 105 | % | | $72.7 | | 116 | % |

Investment revenues | (2.4 | ) | | (5 | )% | | (10.0 | ) | | (16 | )% |

Total revenues | $44.6 | | 100 | % | | $62.7 | | 100 | % |

|

| | | | | | | | | | | |

| For the Nine Months Ended |

| September 30, 2013 | | September 30, 2012 |

| Amount | % of Total | | Amount | % of Total |

| (in millions, unaudited) |

Advisory revenues | $211.5 | | 100 | % | | $191.2 | | 99 | % |

Investment revenues | (0.7 | ) | | — | % | | 1.6 |

| | 1 | % |

Total revenues | $210.8 | | 100 | % | | $192.8 | | 100 | % |

In reporting to management, the Company distinguishes the sources of its revenues between advisory and investment revenues. However, management does not evaluate other financial data or operating results such as operating expenses, profit and loss or assets by its advisory and investment activities.

Note 11 — Subsequent Events

The Company evaluates subsequent events through the date on which the financial statements are issued.

On October 16, 2013, the Board of Directors of the Company declared a quarterly dividend of $0.45 per share. The dividend will be payable on December 18, 2013 to the common stockholders of record on December 4, 2013.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

In this Management's Discussion and Analysis of Financial Condition and Results of Operations, “we”, “our”, “Firm” and “us” refer to Greenhill & Co., Inc.

This Management's Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and subsequent Forms 8-K.

Cautionary Statement Concerning Forward-Looking Statements

The following discussion should be read in conjunction with our condensed consolidated financial statements and the related notes that appear elsewhere in this report. We have made statements in this discussion that are forward-looking statements. In some cases, you can identify these statements by forward-looking words such as “may”, “might”, “will”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “intend”, “predict”, “potential” or “continue”, the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, based on our growth strategies and anticipated trends in our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the numerous risks outlined under “Risk Factors” in our 2012 Annual Report on Form 10-K.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to and we do not undertake any obligation to update or review any of these forward-looking statements after the date of this filing to conform our prior statements to actual results or revised expectations whether as a result of new information, future developments or otherwise.

Overview

Greenhill is a leading independent investment bank focused on providing financial advice related to significant mergers, acquisitions, restructurings, financings and capital raisings to corporations, partnerships, institutions and governments. We represent clients throughout the world and have offices located in the United States, United Kingdom, Germany, Canada, Japan, Australia, Sweden and Brazil.

Our revenues are principally derived from advisory services on mergers and acquisitions, or M&A, financings and restructurings and are primarily driven by total deal volume and size of individual transactions. Additionally, our private capital and real estate capital advisory group provides fund placement and other capital raising advisory services, where revenues are driven primarily by the amount of capital raised.

Greenhill was established in 1996 by Robert F. Greenhill, the former President of Morgan Stanley and former Chairman and Chief Executive Officer of Smith Barney. Since our founding, Greenhill has grown steadily, recruiting a number of managing directors from major investment banks (as well as senior professionals from other institutions), with a range of geographic, industry and transaction specialties as well as different sets of corporate management and other relationships. As part of this expansion, we opened a London office in 1998, opened a Frankfurt office in 2000 and began offering financial restructuring advice in 2001. On May 11, 2004, we completed an initial public offering of our common stock. We opened our second U.S. office in 2005 and we currently have five offices in the U.S. We opened a Canadian office in 2006. In 2008, we opened an office in Tokyo. In 2008, we also entered the capital advisory business, which provides capital raisings advice and related services to private equity and real estate funds. In 2010, we acquired the Australian advisory firm, Caliburn, which has two Australian offices. In 2012, we opened our Stockholm office. In October 2013, we opened an office in São Paulo, Brazil.

Beginning in 2011, we initiated the monetization of our investments in both our previously sponsored merchant banking funds and Iridium. In 2011, we sold substantially all of our interests in GCP II and GSAVP for $49.4 million, which represented the book value of the investments. In 2012, we repurchased interests in two portfolio companies of GCP II for $15.5 million upon exercise of put rights. Also in 2012, we sold our entire interest in GCP Europe for $27.2 million, which represented approximately 90% of its book value. In July 2013, we sold our investment in GCP III for $2.0 million, which represented the book value of our investment. In conjunction with that sale we eliminated our last remaining commitment to merchant banking fund investments.

Beginning in October 2011, we initiated a plan to sell our entire interest in Iridium (NASDAQ: IRDM) systematically over a period expected to be two or more years. As of September 30, 2013, we have sold approximately 84% of our holdings in Iridium, which generated proceeds of $60.8 million. The net proceeds of the merchant banking fund and Iridium sales have been used principally to repurchase our common stock and reduce the outstanding amount of our revolving loan facility.

Business Environment

Economic and global financial market conditions can materially affect our financial performance. See “Risk Factors” in our 2012 Annual Report on Form 10-K filed with Securities and Exchange Commission. Revenues and net income in any period may not be indicative of full year results or the results of any other period and may vary significantly from year to year and quarter to quarter.

Advisory revenues were $47.0 million in the third quarter of 2013 compared to $72.7 million in the third quarter of 2012, which represents a decrease of 35%. Although the third quarter of 2013 was a slow quarter for transaction activity for the Firm, and the market generally, on a year to date basis for the nine months ended September 30, 2013, our advisory revenues were $211.5 million compared to $191.2 million for the comparable period in 2012, which represents an increase of 11%. During the nine month period ended September 30, 2013, in comparison to the same period in 2012 the worldwide number of completed M&A transactions decreased 13%, the number of completed $1 billion or greater transactions decreased 15% and worldwide completed transaction volume (the sum of all deal sizes) decreased by 1% from 1,485 billion to 1,465 billion(1). Despite the challenging market, we continue to expect our advisory revenues for 2013 to be up slightly, or at least close to last year's level.

We believe our business performance is best measured over longer periods of time, and in that regard it is noteworthy that our advisory revenues for the twelve month period ending September 30, 2013 (a measure we refer to as trailing twelve months advisory revenues) was approximately $312 million. In terms of geographic diversity, during the first nine months of 2013, North America, and specifically the U.S. M&A business, continued to be the strongest performing region for us, consistent with the global market statistics by region. Our European business showed significant improvement in the first nine months of 2013 compared to the same period in 2012 in what continued to be a difficult economic and transaction environment in that market. Our Australian revenue declined year-over-year, in what was a more challenging environment than in previous years. For the full year, we expect results for North America will be similar to last year, with improvement in Europe off-setting a decline in Australia.

We generally experience significant variations in revenues and profits from quarter to quarter. These variations can generally be attributed to the fact that our revenues are usually earned in large amounts throughout the year upon the successful completion of a transaction or restructuring or closing of a fund, the timing of which is uncertain and is not subject to our control. Moreover, the value of our principal investments may vary significantly from period to period and depends on a number of factors beyond our control, including most notably credit and public equity markets and general economic conditions. As a result, our quarterly results vary and our results in one period may not be indicative of our results in any future period.

________________________

| |

(1) | Global M&A completed volume and number of transactions for the nine months ended September 30, 2013 as compared to the nine months ended September 30, 2012. Source: Thompson Financial as of October 30, 2013. The number of transactions excludes transactions less than $100,000. |

Results of Operations

Summary

Our total revenues of $44.5 million for the third quarter of 2013 compared to total revenues of $62.7 million for the third quarter of 2012, which represented a decrease of $18.2 million, or 29%. Advisory revenues for the third quarter of 2013 were $47.0 million compared to $72.7 million for the third quarter of 2012. We recorded an investment loss of $2.4 million for the third quarter of 2013 compared to an investment loss of $10.0 million in the third quarter of the prior year. The decrease in our third quarter revenues as compared to the same period in 2012 resulted from a decrease in advisory revenues of $25.7 million offset by a decline in investment losses of $7.6 million.

For the nine months ended September 30, 2013, total revenues were $210.8 million compared to $192.8 million over the same year to date period in 2012, which represented an increase of $18.0 million, or 9%. Advisory revenues for the nine months ended September 30, 2013 were $211.5 million compared to $191.2 million over the same year to date period in 2012. Investment revenues for the nine months ended September 30, 2013 were negative $0.7 million compared to a gain of $1.6 million for the same period in the prior year. The increase in our year to date revenues as compared to the same period in 2012 resulted from an increase in advisory revenues of $20.3 million, offset in part by a net decrease in investment revenues of $2.3 million.

Our third quarter 2013 net income allocated to common stockholders of $1.8 million and diluted earnings per share of $0.06 compare to net income allocable to common stockholders of $8.6 million and diluted earnings per share of $0.28 in the third quarter of 2012. On a year to date basis, net income allocable to common stockholders of $30.9 million and diluted earnings per share of $1.03 for the nine months ended September 30, 2013 compare to net income allocated to common stockholders of $27.0 million and diluted earnings per share of $0.88 for the same nine month period in 2012.

Our quarterly revenues and net income can fluctuate materially depending on the number and size of completed transactions on which we advised, the size of investment gains (or losses), and other factors. Accordingly, the revenues and net income in any particular period may not be indicative of future results.

Revenues by Source

The following provides a breakdown of total revenues by source for the three and nine month periods ended September 30, 2013 and 2012, respectively:

|

| | | | | | | | | | | | | |

| For the Three Months Ended |

| September 30, 2013 | | September 30, 2012 |

| Amount | | % of Total | | Amount | | % of Total |

| (in millions, unaudited) |

Advisory revenues | $ | 47.0 |

| | 105 | % | | $ | 72.7 |

| | 116 | % |

Investment revenues | (2.4 | ) | | (5 | )% | | (10.0 | ) | | (16 | )% |

Total revenues | $ | 44.6 |

| | 100 | % | | $ | 62.7 |

| | 100 | % |

|

| | | | | | | | | | | | | | |

| For the Nine Months Ended |

| September 30, 2013 | | September 30, 2012 | |

| Amount | | % of Total | | Amount | | % of Total | |

| (in millions, unaudited) |

Advisory revenues | $ | 211.5 |

| | 100 | % | | $ | 191.2 |

| | 99 | % | |

Investment revenues | (0.7 | ) | | — | % | | 1.6 |

| | 1 | % | |

Total revenues | $ | 210.8 |

| | 100 | % | | $ | 192.8 |

| | 100 | % | |

Advisory Revenues

Advisory revenues primarily consist of financial advisory and transaction related fees earned in connection with advising clients in mergers, acquisitions, financings, restructurings, capital raisings or similar transactions. We earned $47.0 million in advisory revenues in the third quarter of 2013 compared to $72.7 million in the third quarter of 2012, a decrease of 35%. The decrease in advisory revenues in the third quarter of 2013 as compared to the same period in 2012 resulted primarily from a decrease in transaction advisory fees due to fewer announced and completed assignments.

For the nine months ended September 30, 2013, advisory revenues were $211.5 million compared to $191.2 million for the comparable period in 2012, an increase of 11%. This increase resulted principally from an increase in the size of completed assignments and associated fees, offset in part by a decrease in announcement and opinion fees and retainer fees. At the same time, for the first nine months of 2013 compared to the same period in the prior year, worldwide completed M&A volume decreased by 1%, the number of completed transactions decreased by 13% and the number of $1 billion or greater completed transactions decreased by 15%.1

During each of the nine months ended September 30, 2013 and 2012, we earned $1 million or more from 48 clients. For the year to date period ended September 30, 2013, as compared to the same period in 2012, we generated a greater portion of our advisory revenues from M&A transaction activity compared to other sources of revenue with restructuring and financing advisory lower in the first nine months of 2013 compared to the same period in 2012 and fund placement activity comparable period to period.

Completed assignments in the third quarter of 2013 included:

| |

• | the representation of American Roads, LLC in connection with its pre-arranged Chapter 11 proceedings; |

| |

• | the balance sheet restructuring of CPP Group plc; |

| |

• | the sale of Dentsu Inc.'s retail data analytics subsidiary Aztec, to IRI; |

| |

• | the merger of Det Norske Veritas of Norway with Germanischer Lloyd of Germany; |

| |

• | the sale of Elders Limited's Futuris Automotive to Clearlake Capital; |

| |

• | the representation of Schenck Process Holding GmbH on the refinancing of its existing senior and mezzanine syndicated facilities; and |

| |

• | the sale by Suncorp Group Ltd of a portfolio of corporate and property loans to Goldman Sachs Group Inc. |

During the third quarter of 2013, our capital advisory group served as global placement agent on behalf of private equity and real estate funds for one final closing and five interim closings of limited partnership interests in such funds.

Investment Revenues

Investment revenues primarily consist of our investment gains and losses from our investments in Iridium and previously sponsored merchant banking funds.

| |

(1) | Global M&A completed volume and number of transactions for the nine months ended September 30, 2013 as compared to the nine months ended September 30, 2012. Source: Thompson Financial as of October 30, 2013. The number of transactions excludes transactions less than $100,000. |

The following table sets forth additional information relating to our investment revenues for the three and nine months ended September 30, 2013 and 2012:

|

| | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| 2013 | | 2012 | | 2013 | | 2012 |

| (in millions, unaudited) |

Net realized and unrealized gains (losses) on investment in Iridium | $ | (3.2 | ) | | $ | (10.8 | ) | | $ | 1.3 |

| | $ | (1.2 | ) |

Net realized and unrealized gains (losses) on investments in merchant banking funds | 0.4 |

| | 0.1 |

| | (3.0 | ) | | 1.3 |

|

Deferred gain on sale of certain merchant banking assets | 0.1 |

| | 0.1 | | 0.2 |

| | 0.2 |

Interest income | 0.3 | | 0.6 | | 0.8 | | 1.3 |

Total investment revenues | $ | (2.4 | ) | | $ | (10.0 | ) | | $ | (0.7 | ) | | $ | 1.6 |

|

For the third quarter of 2013, we recorded an investment loss of $2.4 million compared to an investment loss of $10.0 million in the third quarter of 2012. The decrease in the investment loss of $7.6 million principally resulted from a smaller decline in the quoted market value of Iridium during the third quarter of 2013 as compared to 2012.

For the nine months ended September 30, 2013, we recorded an investment loss of $0.7 million compared to an investment gain of $1.6 million in the nine months ended September 30, 2012. The decrease in investment revenues of $2.3 million principally resulted from a year to date loss in our investments in merchant banking funds in 2013 as compared to a gain in 2012, offset in part, by a year to date gain in our investment in Iridium in 2013 as compared to a loss in 2012.