UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21539

First Trust Senior Floating Rate

Income Fund II

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant’s telephone number,

including area code: 630-765-8000

Date of fiscal year end: May 31

Date of reporting period: May 31,

2020

Form N-CSR is to be used by management

investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report

that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking

roles.

A registrant is required to disclose

the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to

respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management

and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden

estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington,

DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

First Trust

Senior Floating

Rate Income Fund II (FCT)

Annual Report

For the

Year Ended

May 31,

2020

First Trust Senior Floating Rate

Income Fund II (FCT)

Annual Report

May 31, 2020

| 1

|

| 2

|

| 4

|

| 6

|

| 15

|

| 16

|

| 17

|

| 18

|

| 19

|

| 20

|

| 26

|

| 27

|

| 32

|

| 34

|

Caution Regarding

Forward-Looking Statements

This report contains

certain forward-looking statements within the meaning of the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. (“First Trust” or the “Advisor”) and its representatives, taking into account the information currently available to them.

Forward-looking statements include all statements that do not relate solely to current or historical fact. For example, forward-looking statements include the use of words such as “anticipate,”

“estimate,” “intend,” “expect,” “believe,” “plan,” “may,” “should,” “would” or other words that convey uncertainty of

future events or outcomes.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of First Trust Senior Floating Rate Income Fund II (the “Fund”) to

be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. When evaluating the information included in this report, you are cautioned not to

place undue reliance on these forward-looking statements, which reflect the judgment of the Advisor and its representatives only as of the date hereof. We undertake no obligation to publicly revise or update these

forward-looking statements to reflect events and circumstances that arise after the date hereof.

Performance and Risk

Disclosure

There is no assurance

that the Fund will achieve its investment objectives. The Fund is subject to market risk, which is the possibility that the market values of securities owned by the Fund will decline and that the value of the

Fund’s shares may therefore be less than what you paid for them. Accordingly, you can lose money by investing in the Fund. See “Risk Considerations” in the Additional Information section of this

report for a discussion of certain other risks of investing in the Fund.

Performance data quoted

represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. For the most recent month-end performance figures, please visit www.ftportfolios.com or speak with your financial advisor. Investment returns, net asset value and common share price will fluctuate and Fund shares, when sold,

may be worth more or less than their original cost.

The Advisor may also

periodically provide additional information on Fund performance on the Fund’s web page at www.ftportfolios.com.

How to Read This

Report

This report contains

information that may help you evaluate your investment in the Fund. It includes details about the Fund and presents data and analysis that provide insight into the Fund’s performance and investment approach.

By reading the portfolio

commentary by the portfolio management team of the Fund, you may obtain an understanding of how the market environment affected the Fund’s performance. The statistical information that follows may help you

understand the Fund’s performance compared to that of a relevant market benchmark.

It is important to keep

in mind that the opinions expressed by personnel of the Advisor are just that: informed opinions. They should not be considered to be promises or advice. The opinions, like the statistics, cover the period through the

date on the cover of this report. The material risks of investing in the Fund are spelled out in the prospectus, the statement of additional information, this report and other Fund regulatory filings.

First Trust Senior Floating Rate

Income Fund II (FCT)

Annual Letter from the Chairman and

CEO

May 31, 2020

Dear Shareholders,

First Trust is pleased

to provide you with the annual report for the First Trust Senior Floating Rate Income Fund II (the “Fund”), which contains detailed information about the Fund for the twelve months ended May 31, 2020.

Much has transpired

since I last shared my thoughts with you. One event that has resonated with me more than any other in recent memory was the announcement by Federal Reserve (the “Fed”) Chairman Jerome Powell on June 10,

2020, that the Fed was not even “thinking about thinking about raising rates.” The Fed signaled its intention to leave short-term interest rates near zero until at least 2023. That level of conviction and

commitment from the Fed is rare, and that gesture should be viewed as a positive for both the U.S. economy and securities markets, in my opinion. CEOs and executives can now fund any potential growth strategies they

may have on the drawing board knowing that their cost of capital should remain near historically low levels for an extended period.

The Fed’s

commitment to injecting massive amounts of stimulus into the economy is in response to the anticipated economic fallout from the coronavirus (“COVID-19”) pandemic. As of June 17, 2020, the estimate for

real U.S. gross domestic product growth for the second quarter of 2020 was -45.5% (annualized), according to the Federal Reserve Bank of Atlanta. The U.S. economy contracted by an annualized 5.0% in the first quarter

of 2020, according to the Bureau of Economic Analysis. The National Bureau of Economic Research, the organization that determines the beginning and end of business cycles in the U.S., reported on June 8, 2020, that

U.S. economic activity peaked in February of this year. That marked the end of a 128-month economic expansion, the longest in this nation’s history. For all intents and purposes, the U.S. economy is now in a

recession. The $64,000 question is as follows: “How long will it last?” While some pundits are predicting a V-shaped recovery, others are touting a U- or L-shaped recovery. Only time will tell. Brian

Wesbury, Chief Economist at First Trust Advisors L.P., believes the economy is already sprouting green shoots, though he acknowledges it will take a few years to fully recover from the downturn.

So far in 2020, we have

experienced a quick bear market in stocks followed by something that resembles a soft V-shaped recovery in stock prices, as measured by the S&P 500® Index (the “Index”). A bear market is defined as a 20% or more decline in price from the most recent peak.

From February 19, 2020 (peak) through March 23, 2020, the Index declined in price by 33.92%, according to Bloomberg. From March 23, 2020 through May 29, 2020, the Index posted a price gain of 36.06%, leaving it just

10.10% below its peak on February 19. While we find this upswing in the Index to be encouraging, there is a clear disconnect between the performance of the stock market and the turmoil in the economy. As strange as it

may be − let us hope it continues.

The climate for

income-oriented investors has been a bit of a mixed bag. The Fed has communicated that it intends to essentially backstop the bond market by buying bonds, including municipals, corporates and select corporate bond

exchange-traded funds, in the secondary market. To date, the Fed’s commitment, which can be interpreted as an aggressive effort to mitigate risk, has been well-received by investors, in my opinion.

Income-oriented investors that favor dividend-paying stocks have a different climate to navigate. The Financial Times reported that global dividend payouts, as measured by the Janus Henderson Global Dividend Index, could decline by as much as $490 billion in 2020 due to companies

cutting or suspending their dividend distributions, according to Wealth Professional (Canada). Year-to-date through May 31, 2020, a total of 19 companies in the S&P 500® Index had cut their dividend payouts and another 40 companies had suspended them, according to S&P Dow Jones

Indices. There were no dividends suspended in 2019. Some companies may be pulling back on dividend distributions as a means of preserving liquidity over the near-term.

The bottom line is that

it is too soon to know if the worst from the COVID-19 pandemic is behind us, in my opinion. U.S. businesses are in the process of reopening. Be prepared for a bumpy ride over the coming months and stay the course.

Thank you for giving

First Trust the opportunity to play a role in your financial future. We value our relationship with you and will report on the Fund again in six months.

Sincerely,

James A. Bowen

Chairman of the Board of Trustees

Chief Executive Officer of First Trust

Advisors L.P.

First Trust Senior Floating Rate Income

Fund II (FCT)

“AT A GLANCE”

As of May 31, 2020

(Unaudited)

| Fund Statistics

|

|

| Symbol on New York Stock Exchange

| FCT

|

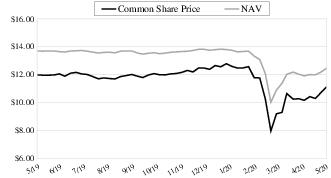

| Common Share Price

| $11.12

|

| Common Share Net Asset Value (“NAV”)

| $12.46

|

| Premium (Discount) to NAV

| (10.75)%

|

| Net Assets Applicable to Common Shares

| $332,266,587

|

| Current Monthly Distribution per Common Share(1)

| $0.1050

|

| Current Annualized Distribution per Common Share

| $1.2600

|

| Current Distribution Rate on Common Share Price(2)

| 11.33%

|

| Current Distribution Rate on NAV(2)

| 10.11%

|

Common Share Price & NAV (weekly closing price)

| Performance

|

|

|

|

|

|

| |

Average Annual Total Returns |

|

| 1 Year Ended

5/31/20

| 5 Years Ended

5/31/20

| 10 Years Ended

5/31/20

| Inception (5/25/04)

to 5/31/20

|

| Fund Performance(3)

|

|

|

|

|

| NAV

| -1.38%

| 3.29%

| 5.35%

| 3.95%

|

| Market Value

| 0.65%

| 2.30%

| 5.19%

| 2.92%

|

| Index Performance

|

|

|

|

|

| S&P/LSTA Leveraged Loan Index

| -2.86%

| 2.57%

| 4.00%

| 4.25%

|

| (1)

| Most recent distribution paid or declared through 5/31/2020. Subject to change in the future.

|

| (2)

| Distribution rates are calculated by annualizing the most recent distribution paid or declared through the report date and then dividing by Common Share Price or NAV, as applicable, as of 5/31/2020.

Subject to change in the future.

|

| (3)

| Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per

share for NAV returns and changes in Common Share Price for market value returns. From inception to October 12, 2010, Four Corners Capital Management, LLC served as the Fund’s sub-advisor. Effective October 12,

2010, the Leveraged Finance Team of First Trust Advisors L.P. assumed the day-to-day responsibility for management of the Fund’s portfolio. Total returns do not reflect sales load and are not annualized for

periods of less than one year. Past performance is not indicative of future results.

|

First Trust Senior Floating Rate Income

Fund II (FCT)

“AT A GLANCE”

(Continued)

As of May 31, 2020

(Unaudited)

| Credit Quality (S&P Ratings)(4)

| % of Senior

Loans and Other

Debt Securities(5)

|

| BBB-

| 7.9%

|

| BB+

| 2.9

|

| BB

| 9.1

|

| BB-

| 11.7

|

| B+

| 25.5

|

| B

| 26.8

|

| B-

| 10.7

|

| CCC+

| 2.7

|

| CCC

| 1.9

|

| D

| 0.8

|

| Total

| 100.0%

|

| Top 10 Issuers

| % of Senior

Loans and other

Securities(5)

|

| Multiplan, Inc. (MPH)

| 3.7%

|

| Bausch Health Companies, Inc. (Valeant)

| 3.4

|

| HUB International Limited

| 3.1

|

| Amwins Group, Inc.

| 2.5

|

| iHeartCommunications, Inc.

| 2.4

|

| Micro Focus International (MA Financeco, LLC)

| 2.4

|

| Refinitiv US Holdings, Inc.

| 2.3

|

| Alliant Holdings I, LLC

| 2.3

|

| AlixPartners, LLP

| 2.1

|

| Stars Group Holdings B.V. (Amaya)

| 2.1

|

| Total

| 26.3%

|

| Industry Classification

| % of Senior

Loans and Other

Securities(5)

|

| Health Care Providers & Services

| 15.6%

|

| Software

| 15.2

|

| Insurance

| 9.9

|

| Pharmaceuticals

| 9.6

|

| Hotels, Restaurants & Leisure

| 9.5

|

| Media

| 9.0

|

| Diversified Financial Services

| 4.5

|

| Diversified Telecommunication Services

| 4.5

|

| Containers & Packaging

| 3.1

|

| Entertainment

| 2.4

|

| Health Care Technology

| 2.1

|

| Diversified Consumer Services

| 2.0

|

| Auto Components

| 2.0

|

| Food Products

| 1.9

|

| Food & Staples Retailing

| 1.4

|

| Building Products

| 1.3

|

| Capital Markets

| 1.2

|

| Professional Services

| 1.0

|

| Commercial Services & Supplies

| 0.7

|

| Wireless Telecommunication Services

| 0.7

|

| Electric Utilities

| 0.5

|

| Independent Power & Renewable Electricity Producers

| 0.4

|

| Communications Equipment

| 0.3

|

| Household Durables

| 0.3

|

| Life Sciences Tools & Services

| 0.3

|

| Oil, Gas & Consumable Fuels

| 0.2

|

| Chemicals

| 0.2

|

| Machinery

| 0.2

|

| Construction & Engineering

| 0.0*

|

| Total

| 100.0%

|

| *

| Amount is less than 0.1%.

|

| (4) | The ratings are by Standard & Poor’s except where

otherwise indicated. A credit rating is an assessment provided by a nationally recognized statistical rating organization

(NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are

only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). Investment

grade is defined as those issuers that have a long-term credit rating of BBB- or higher. The credit ratings shown relate

to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit

ratings are subject to change. |

| (5) | Percentages

are based on long-term positions. Money market funds are excluded. |

Portfolio Commentary

First Trust Senior

Floating Rate Income Fund II (FCT)

Annual Report

May 31, 2020

(Unaudited)

Advisor

The First Trust Advisors

L.P. (“First Trust”) Leveraged Finance Team is comprised of 15 experienced investment professionals specializing in below investment grade securities. The team is comprised of portfolio management,

research, trading and operations personnel. As of May 31, 2020, the First Trust Leveraged Finance Team managed or supervised approximately $4.12 billion in senior secured bank loans and high-yield bonds. These assets

are managed across various strategies, including two closed-end funds, an open-end fund, three exchange-traded funds, and a series of unit investment trusts on behalf of retail and institutional clients.

Portfolio Management

Team

William Housey, CFA -

Managing Director of Fixed Income, Senior Portfolio Manager

Jeffrey Scott, CFA - Senior

Vice President, Deputy Chief Credit Officer and Portfolio Manager

Orlando Purpura, CFA, CMT -

Senior Vice President, Chief Credit Officer and Portfolio Manager

Commentary

First Trust Senior Floating

Rate Income Fund II

The primary investment

objective of First Trust Senior Floating Rate Income Fund II (“FCT” or the “Fund”) is to seek a high level of current income. As a secondary objective, the Fund attempts to preserve capital.

The Fund pursues its investment objectives by investing primarily in a portfolio of senior secured floating-rate corporate loans (“Senior Loans”). Under normal market conditions, at least 80% of the

Fund’s Managed Assets are generally invested in lower grade debt instruments. “Managed Assets” means the total asset value of the Fund minus the sum of its liabilities, other than the principal

amount of borrowings. There can be no assurance that the Fund will achieve its investment objectives. Investing in Senior Loans involves credit risk, and, during periods of generally declining credit quality, it may

be particularly difficult for the Fund to achieve its secondary investment objective. The Fund may not be appropriate for all investors.

Market Recap

The twelve-month period

ended May 31, 2020 saw the market reach all-time highs in February 2020, only to be followed by a historic sell-off due to government-imposed shutdowns mandated in an attempt to slow the spread of the coronavirus

(“COVID-19”) pandemic. This was followed by a sharp rebound driven by the unprecedented monetary and fiscal stimulus measures taken by central banks and lawmakers in order to combat the economic impact of

the shutdowns to the economy. Senior loans experienced eight months of positive returns and four months of negative returns during the period. This included the second largest monthly negative return on record in

March 2020 of -12.37%, which compared to the -13.22% return in October 2008. However, April and May 2020 saw returns of 4.50% and 3.80%, good for the 5th and 7th strongest monthly returns on record, respectively, for

the asset class. The last twelve month (“LTM”) total return for the S&P/LSTA Leveraged Loan Index (the “Index”) was -2.86%. Over the twelve-month period ended May 31, 2020, the S&P

500® Index returned 12.84%, high-yield bonds returned 0.29%, the US Aggregate Index returned 9.42%, and investment grade

bonds returned 9.59%.1

During the same period,

retail demand for the senior loan asset class remained weak with approximately $41.0 billion of outflows over the LTM period.2 The outflows began in the fourth quarter of 2018 due to a general concern for the sustainability of growth in the economy

which was fueled by the ongoing trade dispute with China and the potential implications of the Fed tightening cycle which began in December 2015 and resulted in a 225 basis point (“bps”) increase in the

target Federal Funds rate to 2.50%. Since then the Federal funds target rate was cut to 0.25% to combat the current economic conditions due to the COVID-19 pandemic. The outflows in the senior loan asset class have

persisted for 20 consecutive months since the fourth quarter of 2018. While the Federal Reserve (the “Fed”) has stated that it does not plan any additional future rate cuts, which would result in negative

rates, they also do not expect to raise rates in the near term as they expect the economy will take time to fully recover. We believe that the expectation of low rates persisting and economic uncertainty surrounding

the reopening of the economy has led fixed income investors to continue to withdraw money out of senior loans due to the floating rate nature of the asset class.

Senior Loan Market

The Index returned -2.86%

for the twelve-month period ended May 31, 2020. Lower quality CCC rated issues underperformed returning -16.77% over the LTM period, which compares to the -1.52% return for BB rated issues and the -2.14% return for

single B rated issues. The average bid price of loans in the market entered the same period at $96.99, fell to $82.85 at the end of March 2020

| 1

| Bloomberg: High-Yield Bonds are represented by the ICE BofA US High Yield Constrained Index, Investment Grade Bonds are represented by the ICE BofA US Corporate Index, and the US Aggregate Index is

represented by the Bloomberg Barclays US Aggregate Bond Index.

|

| 2

| JP Morgan Leverage Loan Market Monitor.

|

Portfolio Commentary (Continued)

First Trust Senior

Floating Rate Income Fund II (FCT)

Annual Report

May 31, 2020

(Unaudited)

and ended the period at

$89.08 as of May 31, 2020. The discounted spread to a 3-year life for the senior loan market began the period at L+446, rose to L+1076 at the end of March 2020 and ended the period at L+734, for a widening of 288 bps

over the fiscal year.

The default rate within

the Index crossed the long-term average for senior loans. The LTM default rate within the senior loan index ended the period at 3.14%, which compares to the long-term average default rate of 2.88% dating back to March

1999. Looking forward, we anticipate the default rate will meaningfully increase and remain elevated compared to the long-term average and that energy will likely be the hardest hit sector given current energy

prices.

Performance Analysis

The Fund outperformed the

Index on a net asset value (“NAV”) basis and on a market value basis for the LTM period. The Fund generated a NAV return3 of -1.38% and a market price return3 of 0.65% while the Index generated a total return of -2.86%. The Fund’s discount to NAV improved 180 bps from one year

ago. At the start of the twelve-month period ended May 31, 2020, the Fund’s market price was at a -12.55% discount to NAV and tightened to a -10.75% discount to NAV by the end of the period.

Contributing to the

Fund’s performance relative to the Index over the same period was the Fund’s asset selection and overweight to the electronics/electrical (technology) and healthcare industries, which outperformed the

broader Index. Additionally, the Fund’s performance benefitted from its de minimis exposure to the oil & gas industry which underperformed the broader market and comprised 3.03% of the Index. Partially

offsetting these tailwinds was the Fund’s use of leverage as the cost of borrowing outpaced loan returns. Leverage entered the same period at 30.83% of managed assets and ended the period at 26.37%.

From an income

perspective, the monthly distribution rate began the twelve-month period ended May 31, 2020 at $0.0625 per share and ended the period at $0.1050 per share. At the $0.1050 per share monthly distribution rate, the

annualized distribution rate at the end of May 2020 was 10.11% at NAV and 11.33% at market price.

Market and Fund Outlook

We believe that the

impact from the global shutdown will weigh on global economic growth for some time, with certain sectors recovering more slowly than others. We believe sectors such as leisure, travel, retail and hospitality will lag

the overall recovery as additional restrictions remain in place on the way back to a normal operating environment. We also believe that, while certain sectors have been hit hard by COVID-19, other sectors, such as

technology, healthcare, and pharmaceuticals remain well positioned to weather the pandemic. While the current economic backdrop remains uncertain, at current spreads and prices we see the potential opportunity to

achieve above average returns in the senior loan asset class over the next 12 months, in our opinion. As we evaluate existing and new investment opportunities in this environment, our decisions will continue to be

rooted in our rigorous bottom-up credit analysis process and our focus will remain on identifying the opportunities that we believe offer the best risk and reward balance.

| 3

| Total return is based on the combination of reinvested dividend, capital gain and return of capital distributions, if any, at prices obtained by the Dividend Reinvestment Plan and changes in NAV per

Common Share for NAV returns and changes in Common Share price for market value returns. Total returns do not reflect sales load and are not annualized for periods of less than one year. Past performance is not

indicative of future results.

|

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

May 31, 2020

Principal

Value

|

| Description

|

| Rate (a)

|

| Stated

Maturity (b)

|

| Value

|

| SENIOR FLOATING-RATE LOAN INTERESTS (c) – 137.5%

|

|

|

| Alternative Carriers – 0.2%

|

|

|

|

|

|

|

| $806,996

|

| Level 3 Financing, Inc., Tranche B 2027 Term Loan, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 03/01/27

|

| $781,633

|

|

|

| Application Software – 11.8%

|

|

|

|

|

|

|

| 1,000,000

|

| AppLovin Corp., Amendment No. 3 New Term Loan, 1 Mo. LIBOR + 4.00%, 0.00% Floor

|

| 4.26%

|

| 08/15/25

|

| 977,500

|

| 1,934,467

|

| CCC Information Services, Inc. (Cypress), Term Loan B, 1 Mo. LIBOR + 3.00%, 1.00% Floor

|

| 4.00%

|

| 04/26/24

|

| 1,860,725

|

| 308,927

|

| Hyland Software, Inc., 2nd Lien TL, 1 Mo. LIBOR + 7.00%, 0.75% Floor

|

| 7.75%

|

| 07/10/25

|

| 293,737

|

| 8,305,549

|

| Hyland Software, Inc., Term Loans, 1 Mo. LIBOR + 3.25%, 0.75% Floor

|

| 4.00%

|

| 07/01/24

|

| 8,064,189

|

| 3,952,398

|

| Internet Brands, Inc. (MH Sub I, LLC), Initial Term Loan, 6 Mo. LIBOR + 3.75%, 0.00% Floor

|

| 4.82%

|

| 09/13/24

|

| 3,818,372

|

| 1,232,492

|

| Micro Focus International (MA Financeco, LLC), Miami Escrow TL B3, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 06/21/24

|

| 1,162,647

|

| 8,323,164

|

| Micro Focus International (MA Financeco, LLC), Seattle Spinco TLB, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 06/21/24

|

| 7,851,490

|

| 415,723

|

| Micro Focus International (MA Financeco, LLC), Term Loan B2, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.42%

|

| 11/19/21

|

| 413,645

|

| 1,462,868

|

| Micro Focus International (MA Financeco, LLC), Term Loan B4, 3 Mo. LIBOR + 4.25%, 1.00% Floor

|

| 5.25%

|

| 06/15/25

|

| 1,437,268

|

| 1,215,673

|

| Mitchell International, Inc., 1st Lien Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 11/30/24

|

| 1,142,125

|

| 1,946,160

|

| NCR Corp., Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.68%

|

| 08/28/26

|

| 1,868,314

|

| 748,629

|

| Qlik Technologies (Project Alpha Intermediate Holding, Inc.), 2019 Incremental Term Loan, 6 Mo. LIBOR + 4.25%, 0.00% Floor

|

| 6.13%

|

| 04/26/24

|

| 716,812

|

| 2,219,476

|

| Qlik Technologies (Project Alpha Intermediate Holding, Inc.), Term Loan B, 6 Mo. LIBOR + 3.50%, 1.00% Floor

|

| 5.38%

|

| 04/26/24

|

| 2,102,954

|

| 1,089

|

| RP Crown Parent, LLC (JDA Software Group), Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

|

| 3.75%

|

| 10/12/23

|

| 1,061

|

| 4,575,975

|

| SolarWinds Holdings, Inc., Initial Term Loans, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 02/05/24

|

| 4,471,689

|

| 220,629

|

| TIBCO Software, Inc., Term Loan B-3, 1 Mo. LIBOR + 3.75%, 0.00% Floor

|

| 3.93%

|

| 07/03/26

|

| 211,943

|

| 3,037,797

|

| Veeam Software Holdings Limited (VS Buyer, LLC), Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 02/28/27

|

| 2,954,258

|

|

|

|

|

| 39,348,729

|

|

|

| Auto Parts & Equipment – 2.8%

|

|

|

|

|

|

|

| 2,274,638

|

| American Axle & Manufacturing Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.75% Floor

|

| 3.00%

|

| 04/06/24

|

| 2,168,481

|

| 6,478,868

|

| Gates Global, LLC, Initial B-2 Dollar Term Loans, 1 Mo. LIBOR + 2.75%, 1.00% Floor

|

| 3.75%

|

| 03/31/24

|

| 6,195,417

|

| 7,436

|

| Lumileds (Bright Bidco B.V.), Term Loan B, 3 Mo. LIBOR + 3.50%, 1.00% Floor

|

| 4.95%

|

| 06/30/24

|

| 2,333

|

| 2,889,113

|

| Lumileds (Bright Bidco B.V.), Term Loan B, 6 Mo. LIBOR + 3.50%, 1.00% Floor

|

| 4.57%

|

| 06/30/24

|

| 906,460

|

|

|

|

|

| 9,272,691

|

|

|

| Broadcasting – 8.4%

|

|

|

|

|

|

|

| 1,239,768

|

| Cumulus Media Holdings, Inc., Term Loan B, 6 Mo. LIBOR + 3.75%, 1.00% Floor

|

| 4.82%

|

| 03/31/26

|

| 1,056,902

|

| 2,564,128

|

| E.W. Scripps Company, Term Loan B-2, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 05/01/26

|

| 2,425,230

|

Page 6

See Notes to Financial Statements

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

Principal

Value

|

| Description

|

| Rate (a)

|

| Stated

Maturity (b)

|

| Value

|

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued)

|

|

|

| Broadcasting (Continued)

|

|

|

|

|

|

|

| $270,234

|

| Entercom Media Corp. (CBS Radio), Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 11/17/24

|

| $243,818

|

| 4,664,222

|

| Gray Television, Inc., Term C Loan, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.83%

|

| 01/02/26

|

| 4,540,947

|

| 11,811,126

|

| iHeartCommunications, Inc., Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 04/29/26

|

| 11,013,875

|

| 470,736

|

| Nexstar Broadcasting, Inc., Mission Term Loan B-3, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.62%

|

| 01/17/24

|

| 452,396

|

| 1,829,815

|

| Nexstar Broadcasting, Inc., Nexstar Term Loan B-3, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.42%

|

| 01/17/24

|

| 1,758,525

|

| 6,682,609

|

| Nexstar Broadcasting, Inc., Term Loan B-4, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 3.12%

|

| 09/19/26

|

| 6,427,868

|

|

|

|

|

| 27,919,561

|

|

|

| Building Products – 1.8%

|

|

|

|

|

|

|

| 6,334,601

|

| Quikrete Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 01/31/27

|

| 6,009,192

|

|

|

| Cable & Satellite – 3.9%

|

|

|

|

|

|

|

| 2,600,573

|

| Cablevision (aka CSC Holdings, LLC), March 2017 Term Loan B-1, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.43%

|

| 07/17/25

|

| 2,498,501

|

| 2,992,424

|

| Cablevision (aka CSC Holdings, LLC), October 2018 Incremental Term Loan B-3, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.43%

|

| 01/15/26

|

| 2,877,395

|

| 3,156,867

|

| Cablevision (aka CSC Holdings, LLC), Sept. 2019 Term Loan B-5, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.68%

|

| 04/15/27

|

| 3,040,473

|

| 4,625,322

|

| Virgin Media Investment Holdings Limited, Term Loan N, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.68%

|

| 01/31/28

|

| 4,478,838

|

|

|

|

|

| 12,895,207

|

|

|

| Casinos & Gaming – 10.0%

|

|

|

|

|

|

|

| 7,874,365

|

| Caesars Resort Collection, LLC, Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 12/22/24

|

| 7,098,740

|

| 7,459,362

|

| CityCenter Holdings, LLC, Term Loan B, 1 Mo. LIBOR + 2.25%, 0.75% Floor

|

| 3.00%

|

| 04/18/24

|

| 6,978,531

|

| 1,970,665

|

| Golden Nugget, Inc., Term Loan B, 2 Mo. LIBOR + 2.50%, 0.75% Floor

|

| 3.25%

|

| 10/04/23

|

| 1,688,308

|

| 1,682,147

|

| Golden Nugget, Inc., Term Loan B, 3 Mo. LIBOR + 2.50%, 0.75% Floor

|

| 3.70%

|

| 10/04/23

|

| 1,441,129

|

| 588,715

|

| Scientific Games International, Inc., Term Loan B5, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 08/14/24

|

| 525,722

|

| 15,360

|

| Scientific Games International, Inc., Term Loan B5, 2 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 3.45%

|

| 08/14/24

|

| 13,717

|

| 2,406,520

|

| Scientific Games International, Inc., Term Loan B5, 6 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 3.61%

|

| 08/14/24

|

| 2,149,023

|

| 9,654,290

|

| Stars Group Holdings B.V. (Amaya), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.00% Floor

|

| 4.95%

|

| 07/10/25

|

| 9,518,551

|

| 3,339,369

|

| Station Casinos, Inc. (Red Rocks), Term Loan B, 1 Mo. LIBOR + 2.25%, 0.25% Floor

|

| 2.50%

|

| 01/31/27

|

| 3,130,658

|

| 735,840

|

| Twin River Worldwide Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 05/10/26

|

| 645,927

|

|

|

|

|

| 33,190,306

|

|

|

| Coal & Consumable Fuels – 0.3%

|

|

|

|

|

|

|

| 1,015,515

|

| Arch Coal, Inc., Term Loan, 1 Mo. LIBOR + 2.75%, 1.00% Floor

|

| 3.75%

|

| 03/07/24

|

| 847,955

|

See Notes to Financial Statements

Page 7

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

Principal

Value

|

| Description

|

| Rate (a)

|

| Stated

Maturity (b)

|

| Value

|

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued)

|

|

|

| Coal & Consumable Fuels (Continued)

|

|

|

|

|

|

|

| $303,660

|

| Peabody Energy, Corp., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 03/31/25

|

| $163,217

|

|

|

|

|

| 1,011,172

|

|

|

| Communications Equipment – 0.5%

|

|

|

|

|

|

|

| 1,633,142

|

| Commscope, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 04/06/26

|

| 1,565,775

|

|

|

| Construction & Engineering – 0.0%

|

|

|

|

|

|

|

| 174,141

|

| Pike Corp., 2019 New Term Loans, 1 Mo. LIBOR + 3.25%, 1.00% Floor

|

| 4.25%

|

| 07/24/26

|

| 170,404

|

|

|

| Environmental & Facilities Services – 0.8%

|

|

|

|

|

|

|

| 2,944,472

|

| Packers Holdings, LLC, Term Loan B, 1 Mo. LIBOR + 3.25%, 1.00% Floor

|

| 4.25%

|

| 12/04/24

|

| 2,795,776

|

|

|

| Food Distributors – 0.4%

|

|

|

|

|

|

|

| 1,461,017

|

| US Foods, Inc., Incremental B-2019 Term Loan, 6 Mo. LIBOR + 2.00%, 0.00% Floor

|

| 3.07%

|

| 08/31/26

|

| 1,375,796

|

|

|

| Health Care Facilities – 1.2%

|

|

|

|

|

|

|

| 1,151,542

|

| Acadia Healthcare Company, Inc., Term Loan B4, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 02/16/23

|

| 1,120,692

|

| 1,558,119

|

| Gentiva Health Services, Inc. (Kindred at Home), Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.44%

|

| 07/02/25

|

| 1,511,375

|

| 1,415,180

|

| Select Medical Corp., Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 03/06/25

|

| 1,362,111

|

|

|

|

|

| 3,994,178

|

|

|

| Health Care Services – 13.8%

|

|

|

|

|

|

|

| 467,931

|

| Air Medical Group Holdings, Inc. (Global Medical Response), 2018 New Term Loan, 6 Mo. LIBOR + 4.25%, 1.00% Floor

|

| 5.25%

|

| 03/14/25

|

| 446,373

|

| 5,026,272

|

| Air Medical Group Holdings, Inc. (Global Medical Response), 2018 Term Loan, 6 Mo. LIBOR + 3.25%, 1.00% Floor

|

| 4.25%

|

| 04/28/22

|

| 4,869,201

|

| 2,807,502

|

| Air Methods Corp. (a/k/a ASP AMC Intermediate Holdings, Inc.), Term Loan B, 3 Mo. LIBOR + 3.50%, 1.00% Floor

|

| 4.95%

|

| 04/21/24

|

| 2,217,646

|

| 6,039,717

|

| athenahealth, Inc (VVC Holding Corp.), Term Loan B, 3 Mo. LIBOR + 4.50%, 0.00% Floor

|

| 5.28%

|

| 02/15/26

|

| 5,813,227

|

| 23,545

|

| CHG Healthcare Services, Inc., Term Loan, 3 Mo. LIBOR + 3.00%, 1.00% Floor

|

| 4.45%

|

| 06/07/23

|

| 22,972

|

| 9,137,381

|

| CHG Healthcare Services, Inc., Term Loan, 6 Mo. LIBOR + 3.00%, 1.00% Floor

|

| 4.07%

|

| 06/07/23

|

| 8,914,703

|

| 3,607,363

|

| DaVita, Inc., Term Loan B, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 08/12/26

|

| 3,518,081

|

| 3,603,104

|

| DuPage Medical Group (Midwest Physician Admin. Services, LLC), Repricing Term Loan, 1 Mo. LIBOR + 2.75%, 0.75% Floor

|

| 3.50%

|

| 08/15/24

|

| 3,311,253

|

| 5,551,646

|

| Envision Healthcare Corporation, Initial Term Loan, 1 Mo. LIBOR + 3.75%, 0.00% Floor

|

| 3.92%

|

| 10/10/25

|

| 3,611,068

|

| 4,577,800

|

| Surgery Centers Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 1.00% Floor

|

| 4.25%

|

| 08/31/24

|

| 4,178,661

|

| 3,070,677

|

| Team Health, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 1.00% Floor

|

| 3.75%

|

| 02/06/24

|

| 2,227,346

|

| 2,127,340

|

| U.S. Renal Care, Inc., Term Loan B, 1 Mo. LIBOR + 5.00%, 0.00% Floor

|

| 5.19%

|

| 06/28/26

|

| 2,023,249

|

| 4,770,981

|

| Verscend Technologies, Inc., Term Loan B, 1 Mo. LIBOR + 4.50%, 0.00% Floor

|

| 4.67%

|

| 08/27/25

|

| 4,607,003

|

| 186,188

|

| Vizient, Inc., Term Loan B-6, 1 Mo. LIBOR + 2.00%, 0.00% Floor

|

| 2.17%

|

| 05/06/26

|

| 178,973

|

|

|

|

|

| 45,939,756

|

Page 8

See Notes to Financial Statements

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

Principal

Value

|

| Description

|

| Rate (a)

|

| Stated

Maturity (b)

|

| Value

|

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued)

|

|

|

| Health Care Technology – 2.9%

|

|

|

|

|

|

|

| $7,192,642

|

| Change Healthcare Holdings, LLC, Closing Date Term Loan, 3 Mo. LIBOR + 2.50%, 1.00% Floor

|

| 3.50%

|

| 03/01/24

|

| $6,988,874

|

| 2,724,599

|

| Press Ganey (Azalea TopCo, Inc.), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.00% Floor

|

| 4.26%

|

| 07/25/26

|

| 2,611,528

|

|

|

|

|

| 9,600,402

|

|

|

| Household Appliances – 0.4%

|

|

|

|

|

|

|

| 1,447,138

|

| Traeger Grills (TGP Holdings III LLC), 2018 Refinancing Term Loans, 3 Mo. LIBOR + 4.25%, 1.00% Floor

|

| 5.25%

|

| 09/25/24

|

| 1,287,953

|

|

|

| Human Resource & Employment Services – 1.2%

|

|

|

|

|

|

|

| 4,194,867

|

| Alight, Inc. (fka Tempo Acq.), Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 05/01/24

|

| 4,020,067

|

|

|

| Hypermarkets & Super Centers – 1.6%

|

|

|

|

|

|

|

| 5,327,212

|

| BJ’s Wholesale Club, Inc., Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.44%

|

| 02/03/24

|

| 5,220,668

|

|

|

| Independent Power Producers & Energy Traders – 0.6%

|

|

|

|

|

|

|

| 1,894,664

|

| Calpine Corporation, Term Loan B5, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.43%

|

| 01/15/24

|

| 1,854,403

|

|

|

| Industrial Machinery – 0.3%

|

|

|

|

|

|

|

| 842,237

|

| Douglas Dynamics, LLC, Term Loan B, 1 Mo. LIBOR + 3.00%, 1.00% Floor

|

| 4.00%

|

| 12/31/21

|

| 838,025

|

|

|

| Insurance Brokers – 13.7%

|

|

|

|

|

|

|

| 4,626,485

|

| Alliant Holdings I, LLC, 2019 New Term Loan, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 05/10/25

|

| 4,420,606

|

| 6,620,652

|

| Alliant Holdings I, LLC, Initial Term Loan, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 05/09/25

|

| 6,306,900

|

| 11,590,142

|

| Amwins Group, Inc., Term Loan B (First Lien), 1 Mo. LIBOR + 2.75%, 1.00% Floor

|

| 3.75%

|

| 01/25/24

|

| 11,377,695

|

| 4,292,994

|

| AssuredPartners, Inc., Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

|

| 3.67%

|

| 02/15/27

|

| 4,082,809

|

| 2,858,085

|

| BroadStreet Partners, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 01/31/27

|

| 2,738,988

|

| 37,871

|

| HUB International Limited, Term Loan B, 2 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.87%

|

| 04/25/25

|

| 36,408

|

| 14,845,294

|

| HUB International Limited, Term Loan B, 3 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 4.02%

|

| 04/25/25

|

| 14,271,969

|

| 2,238,321

|

| USI, Inc. (fka Compass Investors, Inc.), Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 05/15/24

|

| 2,147,109

|

|

|

|

|

| 45,382,484

|

|

|

| Integrated Telecommunication Services – 5.9%

|

|

|

|

|

|

|

| 8,667,312

|

| CenturyLink, Inc. (Qwest), Term Loan B, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.42%

|

| 03/15/27

|

| 8,305,712

|

| 3,468,217

|

| Numericable (Altice France SA or SFR), Term Loan B-11, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 07/31/25

|

| 3,266,644

|

| 379,734

|

| Numericable (Altice France SA or SFR), Term Loan B13, 1 Mo. LIBOR + 4.00%, 0.00% Floor

|

| 4.18%

|

| 08/14/26

|

| 364,188

|

| 8,057,558

|

| Zayo Group Holdings, Inc., Initial Dollar Term Loan, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 02/28/27

|

| 7,740,332

|

|

|

|

|

| 19,676,876

|

See Notes to Financial Statements

Page 9

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

Principal

Value

|

| Description

|

| Rate (a)

|

| Stated

Maturity (b)

|

| Value

|

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued)

|

|

|

| Interactive Home Entertainment – 0.5%

|

|

|

|

|

|

|

| $1,531,421

|

| Playtika Holding Corp., Term Loan B, 6 Mo. LIBOR + 6.00%, 1.00% Floor

|

| 7.07%

|

| 12/10/24

|

| $1,529,782

|

|

|

| Investment Banking & Brokerage – 1.7%

|

|

|

|

|

|

|

| 5,698,275

|

| Citadel Securities L.P., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 02/27/26

|

| 5,572,457

|

|

|

| Leisure Facilities – 1.0%

|

|

|

|

|

|

|

| 3,837,437

|

| ClubCorp Holdings, Inc., Term Loan B, 3 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 4.20%

|

| 09/18/24

|

| 3,344,557

|

|

|

| Life Sciences Tools & Services – 0.4%

|

|

|

|

|

|

|

| 1,256,297

|

| Grifols Worldwide Operations Limited, Term Loan B, 1 Mo. LIBOR + 2.00%, 0.00% Floor

|

| 2.09%

|

| 11/15/27

|

| 1,224,890

|

|

|

| Managed Health Care – 6.5%

|

|

|

|

|

|

|

| 17,965,920

|

| Multiplan, Inc. (MPH), Term Loan B, 3 Mo. LIBOR + 2.75%, 1.00% Floor

|

| 4.20%

|

| 06/07/23

|

| 17,221,053

|

| 4,659,173

|

| Versant Health (Wink Holdco, Inc.), Initial Term Loan, 3 Mo. LIBOR + 3.00%, 1.00% Floor

|

| 4.45%

|

| 12/02/24

|

| 4,447,180

|

|

|

|

|

| 21,668,233

|

|

|

| Metal & Glass Containers – 1.3%

|

|

|

|

|

|

|

| 4,491,865

|

| Berry Global, Inc., Term Loan Y, 1 Mo. LIBOR + 2.00%, 0.00% Floor

|

| 2.22%

|

| 07/01/26

|

| 4,379,568

|

|

|

| Movies & Entertainment – 2.9%

|

|

|

|

|

|

|

| 2,702,205

|

| AMC Entertainment, Inc., Term Loan B, 6 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 4.08%

|

| 04/22/26

|

| 2,057,054

|

| 7,494,478

|

| Cineworld Group PLC (Crown), Term Loan B, 6 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 3.32%

|

| 02/05/25

|

| 5,514,662

|

| 529,237

|

| Live Nation Entertainment, Inc., Term Loan B, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.94%

|

| 10/17/26

|

| 495,101

|

| 1,686,455

|

| PUG, LLC (Stubhub), Term Loan B, 1 Mo. LIBOR + 3.50%, 0.00% Floor

|

| 3.67%

|

| 01/31/27

|

| 1,471,432

|

|

|

|

|

| 9,538,249

|

|

|

| Other Diversified Financial Services – 6.2%

|

|

|

|

|

|

|

| 10,178,269

|

| AlixPartners, LLP, Term Loan B, 1 Mo. LIBOR + 2.50%, 0.00% Floor

|

| 2.67%

|

| 04/04/24

|

| 9,874,244

|

| 10,918,573

|

| Refinitiv US Holdings, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 10/01/25

|

| 10,747,042

|

|

|

|

|

| 20,621,286

|

|

|

| Packaged Foods & Meats – 2.7%

|

|

|

|

|

|

|

| 410,683

|

| BellRing Brands, LLC, Term Loan B, 1 Mo. LIBOR + 5.00%, 1.00% Floor

|

| 6.00%

|

| 10/21/24

|

| 408,630

|

| 1,057,502

|

| Froneri International Limited, Facility B2 Loan, 1 Mo. LIBOR + 2.25%, 0.00% Floor

|

| 2.42%

|

| 01/31/27

|

| 1,007,271

|

| 1,994,006

|

| Hostess Brands, LLC (HB Holdings), Term Loan B, 1 Mo. LIBOR + 2.25%, 0.75% Floor

|

| 3.00%

|

| 08/03/25

|

| 1,932,311

|

| 18,556

|

| Hostess Brands, LLC (HB Holdings), Term Loan B, 2 Mo. LIBOR + 2.25%, 0.75% Floor

|

| 3.00%

|

| 08/03/25

|

| 17,982

|

| 5,372,830

|

| Hostess Brands, LLC (HB Holdings), Term Loan B, 3 Mo. LIBOR + 2.25%, 0.75% Floor

|

| 3.01%

|

| 08/03/25

|

| 5,206,595

|

Page 10

See Notes to Financial Statements

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

Principal

Value

|

| Description

|

| Rate (a)

|

| Stated

Maturity (b)

|

| Value

|

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued)

|

|

|

| Packaged Foods & Meats (Continued)

|

|

|

|

|

|

|

| $355,742

|

| Simply Good Foods (Atkins Nutritionals, Inc.), Term Loan B, 1 Mo. LIBOR + 3.75%, 1.00% Floor

|

| 4.75%

|

| 07/07/24

|

| $349,516

|

|

|

|

|

| 8,922,305

|

|

|

| Paper Packaging – 2.9%

|

|

|

|

|

|

|

| 1,902,471

|

| Reynolds Consumer Products, LLC, Initial Term Loans, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 01/31/27

|

| 1,865,621

|

| 8,067,389

|

| Reynolds Group Holdings, Inc., U.S. Term Loan, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 02/05/23

|

| 7,806,893

|

|

|

|

|

| 9,672,514

|

|

|

| Pharmaceuticals – 13.2%

|

|

|

|

|

|

|

| 4,080,076

|

| Akorn, Inc., Loan, 1 Mo. LIBOR + 14.50%, 1.00% Floor (d)

|

| 15.50%

|

| 04/16/21

|

| 3,484,100

|

| 15,965,747

|

| Bausch Health Companies, Inc. (Valeant), Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 06/01/25

|

| 15,629,349

|

| 9,624,002

|

| Endo, LLC, Term Loan B, 1 Mo. LIBOR + 4.25%, 0.75% Floor

|

| 5.00%

|

| 04/29/24

|

| 8,981,022

|

| 4,824,535

|

| GoodRX, Inc., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 3.15%

|

| 10/15/25

|

| 4,677,387

|

| 461,707

|

| IQVIA, Inc. (Quintiles), Term Loan B3, 3 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 3.20%

|

| 06/11/25

|

| 447,855

|

| 4,736,930

|

| Mallinckrodt International Finance S.A., 2017 Term Loan B, 3 Mo. LIBOR + 2.75%, 0.75% Floor

|

| 4.20%

|

| 09/24/24

|

| 3,227,033

|

| 1,077,444

|

| Mallinckrodt International Finance S.A., 2018 Incremental Term Loan, 3 Mo. LIBOR + 3.00%, 0.75% Floor

|

| 3.75%

|

| 02/24/25

|

| 730,141

|

| 3,771,811

|

| Parexel International Corp., Term Loan B, 1 Mo. LIBOR + 2.75%, 0.00% Floor

|

| 2.92%

|

| 09/27/24

|

| 3,558,968

|

| 3,222,836

|

| Pharmaceutical Product Development, Inc. (PPDI/Jaguar), Initial Term Loan, 1 Mo. LIBOR + 2.50%, 1.00% Floor

|

| 3.50%

|

| 08/18/22

|

| 3,206,335

|

|

|

|

|

| 43,942,190

|

|

|

| Research & Consulting Services – 0.2%

|

|

|

|

|

|

|

| 450,500

|

| Clarivate Analytics PLC (Camelot), Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 10/31/26

|

| 439,801

|

| 187,566

|

| Nielsen Finance, LLC (VNU, Inc.), Term Loan B5, 1 Mo. LIBOR + 3.75%, 1.00% Floor

|

| 4.75%

|

| 06/30/25

|

| 186,550

|

|

|

|

|

| 626,351

|

|

|

| Restaurants – 2.1%

|

|

|

|

|

|

|

| 3,759,047

|

| 1011778 B.C. Unlimited Liability Company (Restaurant Brands) (aka Burger King/Tim Horton’s), Term Loan B-4, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 11/14/26

|

| 3,603,987

|

| 3,980,000

|

| Portillo’s Holdings, LLC, Term Loan B-3, 3 Mo. LIBOR + 5.50%, 1.00% Floor

|

| 6.95%

|

| 08/30/24

|

| 3,446,003

|

|

|

|

|

| 7,049,990

|

|

|

| Security & Alarm Services – 0.2%

|

|

|

|

|

|

|

| 549,406

|

| Garda World Security Corp., Term Loan B, 1 Mo. LIBOR + 4.75%, 0.00% Floor

|

| 4.93%

|

| 10/30/26

|

| 533,611

|

|

|

| Specialized Consumer Services – 2.8%

|

|

|

|

|

|

|

| 366,121

|

| Aramark Services, Inc., Term Loan B-4, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 12/31/26

|

| 347,702

|

| 724,000

|

| Asurion, LLC, Second Lien Replacement B-2 Term Loan, 1 Mo. LIBOR + 6.50%, 0.00% Floor

|

| 6.67%

|

| 08/04/25

|

| 719,931

|

| 6,343,563

|

| Asurion, LLC, Term Loan B6, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 11/03/23

|

| 6,173,111

|

See Notes to Financial Statements

Page 11

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

Principal

Value

|

| Description

|

| Rate (a)

|

| Stated

Maturity (b)

|

| Value

|

| SENIOR FLOATING-RATE LOAN INTERESTS (c) (Continued)

|

|

|

| Specialized Consumer Services (Continued)

|

|

|

|

|

|

|

| $2,184,782

|

| Asurion, LLC, Term Loan B7, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 11/03/24

|

| $2,120,331

|

|

|

|

|

| 9,361,075

|

|

|

| Specialty Chemicals – 0.3%

|

|

|

|

|

|

|

| 1,032,455

|

| H.B. Fuller Company, Term Loan B, 1 Mo. LIBOR + 2.00%, 0.00% Floor

|

| 2.17%

|

| 10/20/24

|

| 1,005,353

|

|

|

| Systems Software – 9.2%

|

|

|

|

|

|

|

| 5,160,517

|

| Applied Systems, Inc., 1st Lien Term Loan, 3 Mo. LIBOR + 3.25%, 1.00% Floor

|

| 4.70%

|

| 09/19/24

|

| 5,000,334

|

| 1,511,160

|

| Applied Systems, Inc., 2nd Lien Term Loan, 3 Mo. LIBOR + 7.00%, 1.00% Floor

|

| 8.45%

|

| 09/19/25

|

| 1,479,048

|

| 9,324,400

|

| McAfee, LLC, Term Loan B, 1 Mo. LIBOR + 3.75%, 0.00% Floor

|

| 3.92%

|

| 09/30/24

|

| 9,161,223

|

| 1,350,426

|

| Misys Financial Software Ltd. (Almonde, Inc.) (Finastra), Term Loan B, 6 Mo. LIBOR + 3.50%, 1.00% Floor

|

| 4.50%

|

| 06/13/24

|

| 1,224,391

|

| 8,565

|

| Riverbed Technology, Inc., Term Loan B, 2 Mo. LIBOR + 3.25%, 1.00% Floor

|

| 4.25%

|

| 04/24/22

|

| 7,392

|

| 3,246,084

|

| Riverbed Technology, Inc., Term Loan B, 3 Mo. LIBOR + 3.25%, 1.00% Floor

|

| 4.25%

|

| 04/24/22

|

| 2,801,501

|

| 3,156,407

|

| Sophos Group PLC (Surf), Term Loan B, 3 Mo. LIBOR + 3.50%, 0.00% Floor

|

| 4.81%

|

| 03/05/27

|

| 3,018,314

|

| 1,583,715

|

| SS&C European Holdings, S.a.r.l, Term Loan B-3, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 04/16/25

|

| 1,531,262

|

| 1,082,432

|

| SS&C European Holdings, S.a.r.l, Term Loan B-4, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 04/16/25

|

| 1,046,581

|

| 2,164,470

|

| SS&C European Holdings, S.a.r.l, Term Loan B-5, 1 Mo. LIBOR + 1.75%, 0.00% Floor

|

| 1.92%

|

| 04/16/25

|

| 2,093,866

|

| 1,315,791

|

| SUSE (Marcel Lux IV SARL), Facility B1 USD, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 03/15/26

|

| 1,250,001

|

| 2,029,246

|

| Vertafore, Inc., Term Loan B, 1 Mo. LIBOR + 3.25%, 0.00% Floor

|

| 3.42%

|

| 07/02/25

|

| 1,920,174

|

|

|

|

|

| 30,534,087

|

|

|

| Wireless Telecommunication Services – 0.9%

|

|

|

|

|

|

|

| 3,102,950

|

| T-Mobile USA, Inc., Term Loan B, 1 Mo. LIBOR + 3.00%, 0.00% Floor

|

| 3.17%

|

| 04/01/27

|

| 3,102,236

|

|

|

| Total Senior Floating-Rate Loan Interests

|

| 456,779,788

|

|

|

| (Cost $481,178,622)

|

|

|

|

|

|

|

Principal

Value

|

| Description

|

| Stated

Coupon

|

| Stated

Maturity

|

| Value

|

| CORPORATE BONDS AND NOTES (c) – 0.1%

|

|

|

| Broadcasting – 0.1%

|

|

|

|

|

|

|

| 519,000

|

| Diamond Sports Group, LLC / Diamond Sports Finance Co. (e)

|

| 5.38%

|

| 08/15/26

|

| 413,819

|

|

|

| (Cost $398,513)

|

|

|

|

|

|

|

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (c) – 0.7%

|

|

|

| Broadcasting – 0.0%

|

|

|

| 25,815

|

| Cumulus Media, Class A (f)

|

| 133,464

|

|

|

| Electric Utilities – 0.7%

|

|

|

| 106,607

|

| Vistra Energy Corp.

|

| 2,179,047

|

Page 12

See Notes to Financial Statements

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (c) (Continued)

|

|

|

| Oil & Gas Exploration & Production – 0.0%

|

|

|

| 119,734

|

| Ascent Resources - Marcellus, LLC Class A Common Shares (f) (g)

|

| $104,767

|

| 3,699

|

| Fieldwood Energy Equity (f) (g)

|

| 370

|

|

|

|

|

| 105,137

|

|

|

| Total Common Stocks

|

| 2,417,648

|

|

|

| (Cost $3,357,339)

|

|

|

| RIGHTS (c) – 0.0%

|

|

|

| Electric Utilities – 0.0%

|

|

|

| 106,607

|

| Vistra Energy Corp. (f)

|

| 114,603

|

|

|

| Life Sciences Tools & Services – 0.0%

|

|

|

| 1

|

| New Millennium Holdco, Inc., Corporate Claim Trust (f) (h) (i) (j)

|

| 0

|

| 1

|

| New Millennium Holdco, Inc., Lender Claim Trust (f) (h) (i) (j)

|

| 0

|

|

|

|

|

| 0

|

|

|

| Total Rights

|

| 114,603

|

|

|

| (Cost $174,207)

|

|

|

| WARRANTS (c) – 0.0%

|

|

|

| Oil & Gas Exploration & Production – 0.0%

|

|

|

| 31,000

|

| Ascent Resources - Marcellus, LLC First Lien Warrants (f)

|

| 930

|

|

|

| (Cost $3,100)

|

|

|

| MONEY MARKET FUNDS (c) – 1.6%

|

| 5,200,355

|

| Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class - 0.05% (k)

|

| 5,200,355

|

|

|

| (Cost $5,200,355)

|

|

|

|

|

| Total Investments – 139.9%

|

| 464,927,143

|

|

|

| (Cost $490,312,136) (l)

|

|

|

|

|

| Outstanding Loans – (35.8)%

|

| (119,000,000)

|

|

|

| Net Other Assets and Liabilities – (4.1)%

|

| (13,660,556)

|

|

|

| Net Assets – 100.0%

|

| $332,266,587

|

|

| (a)

| Senior Floating-Rate Loan Interests (“Senior Loans”) in which the Fund invests pay interest at rates which are periodically predetermined by reference to a base lending

rate plus a premium. These base lending rates are generally (i) the lending rate offered by one or more major European banks, such as the LIBOR, (ii) the prime rate offered by one or more United States banks or (iii)

the certificate of deposit rate. Certain Senior Loans are subject to a LIBOR floor that establishes a minimum LIBOR rate. When a range of rates is disclosed, the Fund holds more than one contract within the same

tranche with identical LIBOR period, spread and floor, but different LIBOR reset dates.

|

| (b)

| Senior Loans generally are subject to mandatory and/or optional prepayment. As a result, the actual remaining maturity of Senior Loans may be substantially less than the stated

maturities shown.

|

| (c)

| All of these securities are available to serve as collateral for the outstanding loans.

|

| (d)

| This issuer has filed for protection in bankruptcy court.

|

| (e)

| This security, sold within the terms of a private placement memorandum, is exempt from registration upon resale under Rule 144A under the Securities Act of 1933, as amended (the

“1933 Act”), and may be resold in transactions exempt from registration, normally to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has

been determined to be liquid by First Trust Advisors L.P. (the “Advisor”). Although market instability can result in periods of increased overall market illiquidity, liquidity for each security is

determined based on security specific factors and assumptions, which require subjective judgment. At May 31, 2020, securities noted as such amounted to $413,819 or 0.1% of net assets.

|

| (f)

| Non-income producing security.

|

| (g)

| Security received in a transaction exempt from registration under the 1933 Act. The security may be resold pursuant to an exemption from registration under the

1933 Act, typically to qualified institutional buyers. Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be liquid by the Advisor. Although market instability

can result in periods of increased overall market illiquidity, liquidity for the security is determined based on security-specific factors and assumptions, which require subjective judgment. At May 31, 2020,

securities noted as such amounted to $105,137 or 0.0% of net assets.

|

See Notes to Financial Statements

Page 13

First Trust Senior Floating Rate Income

Fund II (FCT)

Portfolio of Investments

(Continued)

May 31, 2020

| (h)

| This security is fair valued by the Advisor’s Pricing Committee in accordance with procedures adopted by the Fund’s Board of Trustees, and in accordance with the provisions of the Investment

Company Act of 1940, as amended. At May 31, 2020, securities noted as such are valued at $0 or 0.0% of net assets.

|

| (i)

| Pursuant to procedures adopted by the Fund’s Board of Trustees, this security has been determined to be illiquid by the Advisor.

|

| (j)

| This security’s value was determined using significant unobservable inputs (see Note 2A – Portfolio Valuation in the Notes to Financial Statements).

|

| (k)

| Rate shown reflects yield as of May 31, 2020.

|

| (l)

| Aggregate cost for federal income tax purposes was $490,432,917. As of May 31, 2020, the aggregate gross unrealized appreciation for all investments in which there

was an excess of value over tax cost was $1,388,271 and the aggregate gross unrealized depreciation for all investments in which there was an excess of tax cost over value was $26,894,045. The net unrealized

depreciation was $25,505,774.

|

| LIBOR

| London Interbank Offered Rate

|

Valuation Inputs

A summary of the inputs

used to value the Fund’s investments as of May 31, 2020 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial Statements):

|

| Total

Value at

5/31/2020

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Senior Floating-Rate Loan Interests*

| $ 456,779,788

| $ —

| $ 456,779,788

| $ —

|

Corporate Bonds and Notes*

| 413,819

| —

| 413,819

| —

|

| Common Stocks:

|

|

|

|

|

Oil & Gas Exploration & Production

| 105,137

| —

| 105,137

| —

|

Other industry categories*

| 2,312,511

| 2,312,511

| —

| —

|

| Rights:

|

|

|

|

|

Electric Utilities

| 114,603

| —

| 114,603

| —

|

Life Sciences Tools & Services

| —**

| —

| —

| —**

|

Warrants*

| 930

| —

| 930

| —

|

Money Market Funds

| 5,200,355

| 5,200,355

| —

| —

|

Total Investments

| $ 464,927,143

| $ 7,512,866

| $ 457,414,277

| $—**

|

| *

| See Portfolio of Investments for industry breakout.

|

| **

| Investment is valued at $0.

|

As of May 31, 2020, the

Fund transferred common stocks and warrants valued at $105,697 from Level 3 to Level 2 of the fair value hierarchy. The common stocks and warrants that transferred from Level 3 to Level 2 did so as a result of the

availability of observable inputs.

Level 3 Rights that are

fair valued by the Advisor’s Pricing Committee are footnoted in the Portfolio of Investments. All Level 3 values are based on unobservable inputs.

Page 14

See Notes to Financial Statements

First Trust Senior Floating Rate Income

Fund II (FCT)

Statement of Assets and

Liabilities

May 31, 2020

| ASSETS:

|

|

Investments, at value

(Cost $490,312,136)

| $ 464,927,143

|

Cash

| 46,445

|

| Receivables:

|

|

Investment securities sold

| 4,377,897

|

Interest

| 1,163,105

|

Prepaid expenses

| 17,407

|

Total Assets

| 470,531,997

|

| LIABILITIES:

|

|

Outstanding loans

| 119,000,000

|

| Payables:

|

|

Investment securities purchased

| 18,664,849

|

Investment advisory fees

| 279,852

|

Interest and fees on loans

| 99,789

|

Administrative fees

| 92,253

|

Audit and tax fees

| 59,021

|

Custodian fees

| 23,355

|

Shareholder reporting fees

| 21,167

|

Legal fees

| 11,217

|

Transfer agent fees

| 6,706

|

Trustees’ fees and expenses

| 2,744

|

Financial reporting fees

| 771

|

Other liabilities

| 3,686

|

Total Liabilities

| 138,265,410

|

NET ASSETS

| $332,266,587

|

| NET ASSETS consist of:

|

|

Paid-in capital

| $ 391,605,342

|

Par value

| 266,670

|

Accumulated distributable earnings (loss)

| (59,605,425)

|

NET ASSETS

| $332,266,587

|

NET ASSET VALUE, per Common Share (par value $0.01 per Common Share)

| $12.46

|

Number of Common Shares outstanding (unlimited number of Common Shares has been authorized)

| 26,666,989

|

See Notes to Financial Statements

Page 15

First Trust Senior Floating Rate Income

Fund II (FCT)

Statement of Operations

For the Year Ended May 31,

2020

| INVESTMENT INCOME:

|

|

Interest

| $ 25,518,728

|

Dividends

| 54,370

|

Other

| 272,106

|

Total investment income

| 25,845,204

|

| EXPENSES:

|

|

Interest and fees on loans

| 3,852,722

|

Investment advisory fees

| 3,717,590

|

Administrative fees

| 352,648

|

Custodian fees

| 70,519

|

Shareholder reporting fees

| 67,271

|

Audit and tax fees

| 61,237

|

Legal fees

| 52,481

|

Listing expense

| 29,843

|

Transfer agent fees

| 25,873

|

Trustees’ fees and expenses

| 16,716

|

Financial reporting fees

| 9,250

|

Other

| 24,054

|

Total expenses

| 8,280,204

|

NET INVESTMENT INCOME (LOSS)

| 17,565,000

|

| NET REALIZED AND UNREALIZED GAIN (LOSS):

|

|

Net realized gain (loss) on investments

| (9,549,702)

|

Net change in unrealized appreciation (depreciation) on investments

| (16,261,384)

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

| (25,811,086)

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS

| $(8,246,086)

|

Page 16

See Notes to Financial Statements

First Trust Senior Floating Rate Income

Fund II (FCT)

Statements of Changes in

Net Assets

|

| Year

Ended

5/31/2020

|

| Year

Ended

5/31/2019

|

| OPERATIONS:

|

|

|

|

Net investment income (loss)

| $ 17,565,000

|

| $ 19,688,863

|

Net realized gain (loss)

| (9,549,702)

|

| (5,925,300)

|

Net change in unrealized appreciation (depreciation)

| (16,261,384)

|

| (3,619,109)

|