|

Go Green.

|

|

Go Paperless.

|

Sign up to receive your Baird Funds’ prospectuses and reports online.

|

Baird Ultra Short Bond Fund

|

3

|

|

Baird Short-Term Bond Fund

|

11

|

|

Baird Intermediate Bond Fund

|

19

|

|

Baird Intermediate Municipal Bond Fund

|

27

|

|

Baird Aggregate Bond Fund

|

38

|

|

Baird Core Plus Bond Fund

|

46

|

|

Additional Information on Fund Expenses

|

54

|

|

Statements of Assets and Liabilities

|

56

|

|

Statements of Operations

|

58

|

|

Statements of Changes in Net Assets

|

60

|

|

Financial Highlights

|

66

|

|

Notes to the Financial Statements

|

78

|

|

Additional Information

|

91

|

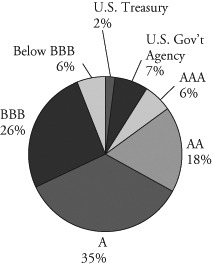

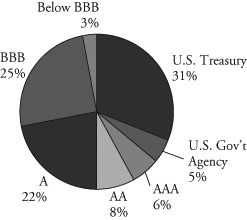

| Quality Distribution(1)(2) | ||||

|

Net Assets

|

$14,151,178

|

||

|

SEC 30-Day

|

||||

|

Yield(3)

|

||||

|

Institutional Class (Subsidized)

|

1.17%

|

|||

|

Institutional Class

|

||||

|

(Unsubsidized)

|

1.02%

|

|||

|

Investor Class (Subsidized)

|

0.92%

|

|||

|

Investor Class (Unsubsidized)

|

0.77%

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Duration

|

0.58 years

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Maturity

|

0.59 years

|

|||

|

Annualized Portfolio

|

||||

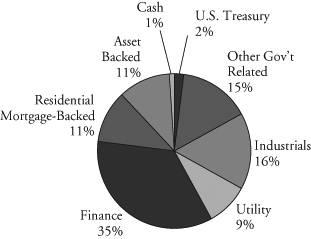

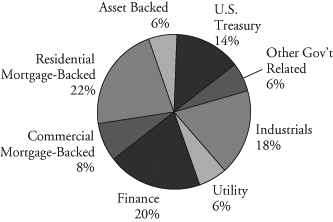

| Sector Weightings(1) |

Expense Ratio:(4)

|

|||

|

Gross

|

||||

|

Institutional Class

|

0.30%

|

||

|

Investor Class

|

0.55%(5)

|

|||

|

Net

|

||||

|

Institutional Class

|

0.15%

|

|||

|

Investor Class

|

0.40%(5)

|

|||

|

Portfolio

|

||||

|

Turnover

|

||||

|

Rate

|

31.8%(6)

|

|||

|

Number of

|

||||

|

Holdings

|

79

|

|||

|

(1)

|

Percentages shown are based on the Fund’s total investments.

|

|

(2)

|

The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest).

|

|

(3)

|

SEC yields are based on SEC guidelines and are calculated for the 30 days ended June 30, 2014.

|

|

(4)

|

Reflects expense ratios as stated in the Fund’s current prospectus. The Advisor has contractually agreed to waive management fees in an amount equal to an annual rate of 0.15% of average daily net assets for the Fund, at least through April 30, 2015. The agreement may only be terminated prior to the end of this term by or with the consent of the Board of Directors of Baird Funds, Inc.

|

|

(5)

|

Includes 0.25% 12b-1 fee.

|

|

(6)

|

Not annualized.

|

|

Six

|

Since

|

|

|

For the Periods Ended June 30, 2014

|

Months

|

Inception(1)

|

|

Institutional Class Shares

|

1.14%

|

1.14%

|

|

Investor Class Shares

|

1.03%

|

1.03%

|

|

Barclays U.S. Short-Term Government/Corporate Index(2)

|

0.12%

|

0.12%

|

|

(1)

|

For the period from December 31, 2013 (commencement of operations) through June 30, 2014.

|

|

(2)

|

The Barclays U.S. Short-Term Government/Corporate Index is an unmanaged, market value weighted index of investment grade, fixed debt including government and corporate securities with maturities less than one year. This index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible.

|

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

U.S. Treasury Securities

|

||||||||||||

|

United States Treasury Note/Bond

|

||||||||||||

|

0.500%, 06/30/2016

|

$ | 250,000 | $ | 250,215 | 1.8 | % | ||||||

|

Total U.S. Treasury Securities

|

||||||||||||

|

(Cost $249,991)

|

250,215 | 1.8 | % | |||||||||

|

Taxable Municipal Bonds

|

||||||||||||

|

Cook County School District No 144 Prairie Hills

|

||||||||||||

|

1.500%, 12/01/2016

|

250,000 | 249,410 | 1.8 | % | ||||||||

|

Louisiana Local Government Environmental

|

||||||||||||

|

Facilities & Community Development Auth.

|

||||||||||||

|

1.520%, 02/01/2018

|

249,463 | 251,249 | 1.8 | % | ||||||||

|

Madison County Community

|

||||||||||||

|

Unit School District No 12 Madison

|

||||||||||||

|

1.950%, 01/01/2017

|

200,000 | 199,710 | 1.4 | % | ||||||||

|

Other Taxable Municipal Bonds#

|

330,598 | 2.3 | % | |||||||||

|

Total Taxable Municipal Bonds

|

||||||||||||

|

(Cost $1,029,358)

|

1,030,967 | 7.3 | % | |||||||||

|

Other Government Related Securities

|

||||||||||||

|

CNPC General Capital Ltd

|

||||||||||||

|

1.125%, 05/14/2017 (Acquired 05/07/2014,

|

||||||||||||

|

Cost $250,000)* f

|

250,000 | 250,700 | 1.7 | % | ||||||||

|

EDF

|

||||||||||||

|

0.688%, 01/20/2017 (Acquired 01/13/2014,

|

||||||||||||

|

Cost $250,000) * f

|

250,000 | 251,014 | 1.8 | % | ||||||||

|

Petrobras Global Finance B.V.

|

||||||||||||

|

2.592%, 03/17/2017 f

|

250,000 | 252,975 | 1.8 | % | ||||||||

|

The Export-Import Bank of Korea

|

||||||||||||

|

0.977%, 01/14/2017 f

|

250,000 | 251,692 | 1.8 | % | ||||||||

|

Total Other Government Related Securities

|

||||||||||||

|

(Cost $1,000,000)

|

1,006,381 | 7.1 | % | |||||||||

Baird Ultra Short Bond Fund

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Corporate Bonds

|

||||||||||||

|

Industrials

|

||||||||||||

|

Amgen Inc.

|

||||||||||||

|

0.608%, 05/22/2017

|

$ | 250,000 | $ | 250,141 | 1.8 | % | ||||||

|

Anglo American Capital PLC

|

||||||||||||

|

1.176%, 04/15/2016 (Acquired 04/08/2014,

|

||||||||||||

|

Cost $200,000)* f

|

200,000 | 200,635 | 1.4 | % | ||||||||

|

Bunge Limited Finance Corp.

|

||||||||||||

|

5.100%, 07/15/2015

|

250,000 | 260,394 | 1.8 | % | ||||||||

|

Fiserv, Inc.:

|

||||||||||||

|

3.125%, 10/01/2015

|

75,000 | 77,155 | 0.5 | % | ||||||||

|

3.125%, 06/15/2016

|

175,000 | 181,795 | 1.3 | % | ||||||||

|

Glencore Canada Corporation

|

||||||||||||

|

5.375%, 06/01/2015 f

|

200,000 | 208,034 | 1.5 | % | ||||||||

|

Total Capital International

|

||||||||||||

|

0.580%, 06/19/2019 f

|

250,000 | 249,998 | 1.8 | % | ||||||||

|

Verizon Communications, Inc.

|

||||||||||||

|

1.981%, 09/14/2018

|

250,000 | 263,764 | 1.9 | % | ||||||||

|

Volkswagen Group of America Finance, LLC

|

||||||||||||

|

0.595%, 05/23/2017 (Acquired 05/15/2014,

|

||||||||||||

|

Cost $250,000)*

|

250,000 | 250,282 | 1.8 | % | ||||||||

|

Other Industrials#~

|

265,114 | 1.8 | % | |||||||||

|

Total Industrials (Cost $2,204,169)

|

2,207,312 | 15.6 | % | |||||||||

|

Utility

|

||||||||||||

|

Enbridge Inc.

|

||||||||||||

|

0.678%, 06/02/2017 f

|

250,000 | 250,503 | 1.8 | % | ||||||||

|

Midcontinent Express Pipeline LLC

|

||||||||||||

|

5.450%, 09/15/2014 (Acquired 01/09/2014,

|

||||||||||||

|

Cost $201,710)*

|

200,000 | 201,209 | 1.4 | % | ||||||||

|

Spectra Energy Capital LLC

|

||||||||||||

|

5.668%, 08/15/2014

|

250,000 | 251,665 | 1.8 | % | ||||||||

|

Trans-Allegheny Interstate Line Company

|

||||||||||||

|

4.000%, 01/15/2015 (Acquired 01/07/2014

|

||||||||||||

|

through 06/16/2014, Cost $354,877)*

|

350,000 | 355,747 | 2.5 | % | ||||||||

|

Other Utility#~

|

246,641 | 1.7 | % | |||||||||

|

Total Utility (Cost $1,304,809)

|

1,305,765 | 9.2 | % | |||||||||

|

Finance

|

||||||||||||

|

ABN AMRO Bank N.V.

|

||||||||||||

|

1.028%, 10/28/2016 (Acquired 01/03/2014,

|

||||||||||||

|

Cost $225,747)* f

|

225,000 | 226,953 | 1.6 | % | ||||||||

|

AmSouth Bank

|

||||||||||||

|

Series AI, 5.200%, 04/01/2015

|

150,000 | 154,739 | 1.1 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Banco Santander-Chile

|

||||||||||||

|

1.126%, 04/11/2017 (Acquired 04/08/2014,

|

||||||||||||

|

Cost $200,000)* f

|

$ | 200,000 | $ | 200,000 | 1.4 | % | ||||||

|

BPCE

|

||||||||||||

|

1.073%, 02/10/2017 f

|

250,000 | 252,123 | 1.8 | % | ||||||||

|

Commonwealth Bank of Australia

|

||||||||||||

|

0.830%, 10/08/2015 (Acquired 01/03/2014,

|

||||||||||||

|

Cost $199,800)* f

|

200,000 | 199,928 | 1.4 | % | ||||||||

|

Credit Agricole S.A.

|

||||||||||||

|

1.078%, 10/03/2016 (Acquired 01/03/2014,

|

||||||||||||

|

Cost $250,528)* f

|

250,000 | 251,392 | 1.8 | % | ||||||||

|

Deutsche Bank Aktiengesellschaft

|

||||||||||||

|

0.834%, 02/13/2017 f

|

150,000 | 150,698 | 1.1 | % | ||||||||

|

Dresdner Bank AG

|

||||||||||||

|

7.250%, 09/15/2015 f

|

150,000 | 159,180 | 1.1 | % | ||||||||

|

First Tennessee Bank, National Association

|

||||||||||||

|

5.050%, 01/15/2015

|

250,000 | 255,559 | 1.8 | % | ||||||||

|

General Electric Capital Corporation

|

||||||||||||

|

0.737%, 01/14/2019

|

250,000 | 252,349 | 1.8 | % | ||||||||

|

J.P. Morgan Chase & Co.

|

||||||||||||

|

Series 1, 0.858%, 01/28/2019

|

250,000 | 251,122 | 1.8 | % | ||||||||

|

Kookmin Bank

|

||||||||||||

|

1.103%, 01/27/2017 (Acquired 01/21/2014,

|

||||||||||||

|

Cost $250,000)* f

|

250,000 | 251,364 | 1.8 | % | ||||||||

|

Macquarie Bank Limited

|

||||||||||||

|

1.021%, 03/24/2017 (Acquired 03/18/2014,

|

||||||||||||

|

Cost $200,000)* f

|

200,000 | 200,643 | 1.4 | % | ||||||||

|

Marsh & McLennan Companies, Inc.

|

||||||||||||

|

5.375%, 07/15/2014

|

165,000 | 165,298 | 1.2 | % | ||||||||

|

Mizuho Bank, Ltd.

|

||||||||||||

|

0.659%, 04/16/2017 (Acquired 04/09/2014,

|

||||||||||||

|

Cost $200,000)* f

|

200,000 | 200,165 | 1.4 | % | ||||||||

|

Morgan Stanley

|

||||||||||||

|

1.079%, 01/24/2019

|

250,000 | 251,672 | 1.8 | % | ||||||||

|

National Australia Bank Limited

|

||||||||||||

|

0.730%, 10/08/2015 (Acquired 01/03/2014,

|

||||||||||||

|

Cost $199,860)* f

|

200,000 | 199,953 | 1.4 | % | ||||||||

|

Nomura Holdings, Inc.

|

||||||||||||

|

5.000%, 03/04/2015 f

|

250,000 | 257,007 | 1.8 | % | ||||||||

|

Rabobank Nederland

|

||||||||||||

|

0.481%, 03/07/2016 (Acquired 01/03/2014,

|

||||||||||||

|

Cost $249,625)* f

|

250,000 | 250,524 | 1.8 | % | ||||||||

|

SunTrust Bank

|

||||||||||||

|

0.533%, 04/01/2015

|

150,000 | 149,967 | 1.0 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

The Goldman Sachs Group, Inc.

|

||||||||||||

|

1.324%, 11/15/2018

|

$ | 250,000 | $ | 253,414 | 1.8 | % | ||||||

|

Willis North America, Inc.

|

||||||||||||

|

5.625%, 07/15/2015

|

237,000 | 248,334 | 1.7 | % | ||||||||

|

Other Finance#~

|

153,637 | 1.1 | % | |||||||||

|

Total Finance

|

||||||||||||

|

(Cost $4,921,424)

|

4,936,021 | 34.9 | % | |||||||||

|

Residential Mortgage-Backed Securities

|

||||||||||||

|

U.S. Government Agency Issues

|

||||||||||||

|

Fannie Mae Pool

|

||||||||||||

|

5.500%, 11/01/2017

|

296,448 | 314,847 | 2.2 | % | ||||||||

|

Federal Gold Loan Mortgage Corporation (FGLMC)

|

||||||||||||

|

5.000%, 12/01/2017

|

174,468 | 185,197 | 1.3 | % | ||||||||

|

Federal National Mortgage Association (FNMA):

|

||||||||||||

|

5.000%, 10/01/2017

|

179,665 | 190,592 | 1.4 | % | ||||||||

|

5.000%, 11/01/2017

|

145,169 | 153,989 | 1.1 | % | ||||||||

|

5.000%, 12/01/2017

|

125,502 | 133,125 | 0.9 | % | ||||||||

|

Total U.S. Government Agency Issues

|

||||||||||||

|

(Cost $650,932)

|

977,750 | 6.9 | % | |||||||||

|

Residential Mortgage-Backed Securities

|

||||||||||||

|

Non-U.S. Government Agency Issues

|

||||||||||||

|

Bank of America Alternative Loan Trust:

|

||||||||||||

|

5.000%-5.500%, 06/25/2018-02/25/2019

|

183,771 | 189,671 | 1.3 | % | ||||||||

|

Other Non-U.S. Government Agency Issues#

|

393,199 | 2.8 | % | |||||||||

|

Total Non-U.S. Government Agency Issues

|

||||||||||||

|

(Cost $577,606)

|

582,870 | 4.1 | % | |||||||||

|

Asset Backed Securities

|

||||||||||||

|

Accredited Mortgage Loan Trust

|

||||||||||||

|

Series 2005-3, Class A1, 0.390%, 09/25/2035

|

192,959 | 191,834 | 1.4 | % | ||||||||

|

Capital Auto Receivables Asset Trust

|

||||||||||||

|

Series 2014-1, Class A1B, 0.503%, 05/20/2016

|

200,000 | 200,140 | 1.4 | % | ||||||||

|

First Franklin Mortgage Loan Trust

|

||||||||||||

|

Series 2004-FF7, Class A1, 0.792%, 09/25/2034

|

225,333 | 224,807 | 1.6 | % | ||||||||

|

JP Morgan Mortgage Acquisition Trust

|

||||||||||||

|

Series 2007-CH3, Class A3, 0.302%, 03/25/2037

|

236,238 | 232,129 | 1.6 | % | ||||||||

|

Morgan Stanley Home Equity Loan Trust

|

||||||||||||

|

Series 2006-2, Class A3, 0.322%, 02/25/2036

|

164,381 | 162,390 | 1.1 | % | ||||||||

|

Specialty Underwriting & Residential Finance Trust

|

||||||||||||

|

Series 2006-BC1, Class A2C, 0.352%, 12/25/2036

|

196,709 | 194,312 | 1.4 | % | ||||||||

|

Other Asset Backed Securities#

|

356,269 | 2.5 | % | |||||||||

|

Total Asset Backed Securities

|

||||||||||||

|

(Cost $1,559,730)

|

1,561,881 | 11.0 | % | |||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Commercial Mortgage-Backed Securities

|

||||||||||||

|

Other Commercial Mortgage Backed Securities#

|

$ | 20,585 | 0.2 | % | ||||||||

|

Total Commercial Mortgage Backed Securities

|

||||||||||||

|

(Cost $333,484)

|

20,585 | 0.2 | % | |||||||||

|

Total Long-Term Investments

|

||||||||||||

|

(Cost $13,831,503)

|

13,879,747 | 98.1 | % | |||||||||

|

Short-Term Investments

|

||||||||||||

|

Shares

|

||||||||||||

|

Money Market Mutual Fund

|

||||||||||||

|

Dreyfus Institutional Cash Advantage Fund, 0.06%«

|

202,229 | 202,229 | 1.4 | % | ||||||||

|

Total Short-Term Investment

|

||||||||||||

|

(Cost $202,229)

|

202,229 | 1.4 | % | |||||||||

|

Total Investments

|

||||||||||||

|

(Cost $14,033,732)

|

14,081,976 | 99.5 | % | |||||||||

|

Other Assets in Excess of Liabilities

|

69,202 | 0.5 | % | |||||||||

|

TOTAL NET ASSETS

|

$ | 14,151,178 | 100.0 | % | ||||||||

|

*

|

Restricted Security Deemed Liquid

|

|

f

|

Foreign Security

|

|

«

|

7-Day Yield

|

|

#

|

Represents the aggregate value, by category, securities that are not among the 50 largest holdings and, in total for any issuer, represent 1% or less of net assets.

|

|

~

|

Groupings contain, in aggregate, restricted securities totaling $269,895 representing 1.91% of net assets.

|

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical unrestricted securities.

|

Baird Ultra Short Bond Fund

|

Level 2 –

|

Other significant observable inputs (including quoted prices for similar securities, quoted prices in inactive markets, dealer indications, interest rates, yield curves, prepayment speeds, credit risk, default rates, inputs corroborated by observable market data, etc.).

|

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions about the factors that market participants would use in valuing the security) based on the best information available.

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Fixed Income

|

||||||||||||||||

|

U.S. Treasury Securities

|

$ | — | $ | 250,215 | $ | — | $ | 250,215 | ||||||||

|

Taxable Municipal Bonds

|

— | 1,030,967 | — | 1,030,967 | ||||||||||||

|

Other Government Related Securities

|

— | 1,006,381 | — | 1,006,381 | ||||||||||||

|

Corporate Bonds

|

— | 8,449,098 | — | 8,449,098 | ||||||||||||

|

Residential Mortgage-Backed Securities –

|

||||||||||||||||

|

U.S. Government Agency Issues

|

— | 977,750 | — | 977,750 | ||||||||||||

|

Residential Mortgage-Backed Securities –

|

||||||||||||||||

|

Non-U.S. Government Agency Issues

|

— | 582,870 | — | 582,870 | ||||||||||||

|

Asset Backed Securities

|

— | 1,561,881 | — | 1,561,881 | ||||||||||||

|

Commercial Mortgage-Backed Securities

|

— | 20,585 | — | 20,585 | ||||||||||||

|

Total Fixed Income

|

— | 13,879,747 | — | 13,879,747 | ||||||||||||

|

Short-Term Investment

|

||||||||||||||||

|

Money Market Mutual Fund

|

202,229 | — | — | 202,229 | ||||||||||||

|

Total Short-Term Investment

|

202,229 | — | — | 202,229 | ||||||||||||

|

Total Investments

|

$ | 202,229 | $ | 13,879,747 | $ | — | $ | 14,081,976 | ||||||||

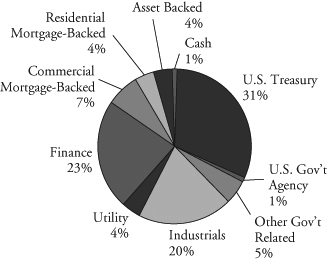

| Quality Distribution(1)(2) | ||||

|

Net Assets

|

$2,190,675,149

|

||

| SEC 30-Day | ||||

|

Yield(3)

|

||||

|

Institutional Class

|

1.29%

|

|||

|

Investor Class

|

1.04%

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Duration

|

1.95 years

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Maturity

|

1.97 years

|

|||

|

Annualized

|

||||

|

Expense

|

||||

|

Ratio

|

||||

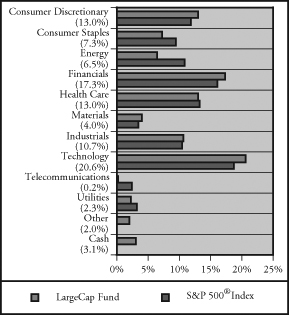

| Sector Weightings(1) |

Institutional Class

|

0.30%

|

||

|

Investor Class

|

0.55%(4)

|

|||

|

||||

|

Portfolio

|

||||

|

Turnover

|

||||

|

Rate

|

26.5%(5)

|

|||

|

Number of

|

||||

|

Holdings

|

489

|

|||

|

(1)

|

Percentages shown are based on the Fund’s total investments (less investments purchased with cash proceeds from securities lending).

|

|

(2)

|

The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest).

|

|

(3)

|

SEC yields are based on SEC guidelines and are calculated for the 30 days ended June 30, 2014.

|

|

(4)

|

Includes 0.25% 12b-1 fee.

|

|

(5)

|

Not annualized.

|

|

Average Annual

|

|||||

|

Since

|

Since

|

||||

|

Six

|

One

|

Five

|

Inception

|

Inception

|

|

|

For the Periods Ended June 30, 2014

|

Months

|

Year

|

Years

|

(8/31/04)

|

(9/19/12)

|

|

Institutional Class Shares

|

1.32%

|

2.49%

|

3.48%

|

3.25%

|

N/A

|

|

Investor Class Shares

|

1.20%

|

2.25%

|

N/A

|

N/A

|

1.68%

|

|

Barclays 1-3 Year U.S. Government/

|

|||||

|

Credit Bond Index(1)

|

0.56%

|

1.14%

|

1.73%

|

2.89%

|

0.80%

|

|

(1)

|

The Barclays 1-3 Year U.S. Government/Credit Bond Index is an unmanaged, market value weighted index of investment grade, fixed-rate debt issues, including government and corporate securities, with maturities between one and three years. This index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible.

|

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

U.S. Treasury Securities

|

||||||||||||

|

U.S. Treasury Bonds:

|

||||||||||||

|

0.500%, 06/30/2016

|

$ | 9,750,000 | $ | 9,758,375 | 0.4 | % | ||||||

|

2.375%, 07/31/2017@

|

17,850,000 | 18,633,722 | 0.9 | % | ||||||||

|

2.250%, 07/31/2018@

|

225,000,000 | 233,226,450 | 10.7 | % | ||||||||

|

Total U.S. Treasury Securities

|

||||||||||||

|

(Cost $260,877,726)

|

261,618,547 | 12.0 | % | |||||||||

|

Taxable Municipal Bonds

|

||||||||||||

|

New Jersey Economic Development Authority

|

||||||||||||

|

2.421%, 06/15/2018

|

10,000,000 | 10,083,100 | 0.5 | % | ||||||||

|

Rhode Island Housing & Mortgage Finance Corp/RI

|

||||||||||||

|

3.000%, 10/01/2034 (Callable 10/01/2022)

|

12,500,000 | 12,666,125 | 0.6 | % | ||||||||

|

Other Taxable Municipal Bonds#

|

41,754,784 | 1.9 | % | |||||||||

|

Total Taxable Municipal Bonds

|

||||||||||||

|

(Cost $64,139,765)

|

64,504,009 | 3.0 | % | |||||||||

|

Other Government Related Securities

|

||||||||||||

|

Electricite de France Societe anonyme

|

||||||||||||

|

0.688%, 01/20/2017 (Acquired 01/13/2014,

|

||||||||||||

|

Cost $9,750,000)* f

|

9,750,000 | 9,789,527 | 0.4 | % | ||||||||

|

Other Government Related Securities#~

|

64,810,415 | 3.0 | % | |||||||||

|

Total Other Government Related Securities

|

||||||||||||

|

(Cost $74,002,011)

|

74,599,942 | 3.4 | % | |||||||||

|

Corporate Bonds

|

||||||||||||

|

Industrials

|

||||||||||||

|

AbbVie Inc.

|

||||||||||||

|

1.750%, 11/06/2017

|

9,949,000 | 10,003,262 | 0.5 | % | ||||||||

|

Dollar General Corporation

|

||||||||||||

|

4.125%, 07/15/2017

|

17,221,000 | 18,433,789 | 0.8 | % | ||||||||

|

Ford Motor Credit Company LLC

|

||||||||||||

|

6.625%, 08/15/2017

|

9,000,000 | 10,360,026 | 0.5 | % | ||||||||

|

Murphy Oil Corporation

|

||||||||||||

|

2.500%, 12/01/2017

|

10,281,000 | 10,522,603 | 0.5 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Pioneer Natural Resources Company

|

||||||||||||

|

5.875%, 07/15/2016

|

$ | 10,000,000 | $ | 10,942,750 | 0.5 | % | ||||||

|

Plum Creek Timberlands, L.P.

|

||||||||||||

|

5.875%, 11/15/2015

|

9,700,000 | 10,298,267 | 0.5 | % | ||||||||

|

Seagate HDD Cayman

|

||||||||||||

|

6.875%, 05/01/2020 f

|

9,653,000 | 10,437,306 | 0.5 | % | ||||||||

|

Telecom Italia Capital

|

||||||||||||

|

5.250%, 10/01/2015 f

|

10,960,000 | 11,453,200 | 0.5 | % | ||||||||

|

The Valspar Corporation

|

||||||||||||

|

5.100%, 08/01/2015

|

10,450,000 | 10,843,066 | 0.5 | % | ||||||||

|

Warner Chilcott Co LLC /

|

||||||||||||

|

Warner Chilcott Finance LLC

|

||||||||||||

|

7.750%, 09/15/2018 f

|

10,585,000 | 11,127,905 | 0.5 | % | ||||||||

|

Other Industrials#~

|

482,651,573 | 22.0 | % | |||||||||

|

Total Industrials

|

||||||||||||

|

(Cost $591,024,080)

|

597,073,747 | 27.3 | % | |||||||||

|

Utility

|

||||||||||||

|

Boardwalk Pipelines, LP

|

||||||||||||

|

5.500%, 02/01/2017

|

13,384,000 | 14,579,138 | 0.6 | % | ||||||||

|

National Grid PLC

|

||||||||||||

|

6.300%, 08/01/2016 f

|

9,431,000 | 10,444,248 | 0.5 | % | ||||||||

|

Other Utility#~

|

142,308,098 | 6.5 | % | |||||||||

|

Total Utility

|

||||||||||||

|

(Cost $165,533,271)

|

167,331,484 | 7.6 | % | |||||||||

|

Finance

|

||||||||||||

|

ABN AMRO Bank N.V.

|

||||||||||||

|

1.028%, 10/28/2016 (Acquired 10/23/2013

|

||||||||||||

|

through 05/19/2014, Cost $11,060,905)* f

|

11,050,000 | 11,145,914 | 0.5 | % | ||||||||

|

BPCE

|

||||||||||||

|

1.073%, 02/10/2017 f

|

9,650,000 | 9,731,957 | 0.4 | % | ||||||||

|

Credit Agricole S.A.

|

||||||||||||

|

1.082%, 10/03/2016 (Acquired 09/26/2013,

|

||||||||||||

|

Cost $10,000,000)* f

|

10,000,000 | 10,055,670 | 0.4 | % | ||||||||

|

Dresdner Bank AG

|

||||||||||||

|

7.250%, 09/15/2015 f

|

10,522,000 | 11,165,915 | 0.5 | % | ||||||||

|

General Electric Capital Corporation:

|

||||||||||||

|

0.877%, 07/12/2016

|

10,000,000 | 10,090,770 | 0.5 | % | ||||||||

|

5.625%, 09/15/2017

|

9,080,000 | 10,278,796 | 0.5 | % | ||||||||

|

0.737%-5.625%, 05/09/2016-01/14/2019

|

6,325,000 | 6,587,500 | 0.3 | % | ||||||||

|

LeasePlan Corporation N.V.

|

||||||||||||

|

2.500%, 05/16/2018 (Acquired 05/07/2013

|

||||||||||||

|

through 02/20/2014, Cost $11,668,719)* f

|

11,785,000 | 11,882,533 | 0.5 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Macquarie Bank Limited

|

||||||||||||

|

2.000%, 08/15/2016 (Acquired 08/07/2013

|

||||||||||||

|

through 09/27/2013, Cost $10,020,038)* f

|

$ | 10,000,000 | $ | 10,181,620 | 0.5 | % | ||||||

|

Manulife Financial Corporation

|

||||||||||||

|

3.400%, 09/17/2015 f

|

9,761,000 | 10,086,568 | 0.5 | % | ||||||||

|

Nomura Holdings, Inc.

|

||||||||||||

|

2.000%, 09/13/2016 f

|

10,105,000 | 10,269,914 | 0.5 | % | ||||||||

|

Other Finance#~

|

483,943,773 | 22.1 | % | |||||||||

|

Total Finance

|

||||||||||||

|

(Cost $588,504,498)

|

595,420,930 | 27.2 | % | |||||||||

|

Residential Mortgage-Backed Securities

|

||||||||||||

|

U.S. Government Agency Issues

|

||||||||||||

|

Other U.S. Government Agency Issues#

|

886,828 | 0.0 | % | |||||||||

|

Total U.S. Government Agency Issues

|

||||||||||||

|

(Cost $838,269)

|

886,828 | 0.0 | % | |||||||||

|

Residential Mortgage-Backed Securities

|

||||||||||||

|

Non-U.S. Government Agency Issues

|

||||||||||||

|

MASTR Alternative Loan Trust:

|

||||||||||||

|

Series 2003-5, Class 7A1, 5.000%, 07/25/2018

|

10,147,529 | 10,537,702 | 0.5 | % | ||||||||

|

4.750%-5.500%, 11/25/2018-07/25/2033

|

13,673,629 | 14,338,435 | 0.6 | % | ||||||||

|

Structured Asset Securities Corp.

|

||||||||||||

|

Mortgage Pass-Through Certificates

|

||||||||||||

|

Series 2004-22, Class A2, 5.175%, 01/25/2035

|

13,066,038 | 13,566,049 | 0.6 | % | ||||||||

|

Washington Mutual Mortgage Pass Through Certificates

|

||||||||||||

|

Series 2004-AR3, Class A1, 2.377%, 06/25/2034

|

12,100,270 | 12,328,252 | 0.6 | % | ||||||||

|

Other Non-U.S. Government Agency Issues#

|

24,516,448 | 1.1 | % | |||||||||

|

Total Non-U.S. Government Agency Issues

|

||||||||||||

|

(Cost $75,137,989)

|

75,286,886 | 3.4 | % | |||||||||

|

Asset Backed Securities

|

||||||||||||

|

Accredited Mortgage Loan Trust

|

||||||||||||

|

Series 2006-2, Class A3, 0.302%, 09/25/2036

|

10,342,164 | 10,025,714 | 0.5 | % | ||||||||

|

Argent Securities Inc Asset-Backed

|

||||||||||||

|

Pass-Through Certificates

|

||||||||||||

|

Series 2005-W3, Class A2D, 0.492%, 11/25/2035

|

12,870,162 | 12,156,023 | 0.5 | % | ||||||||

|

First Franklin Mortgage Loan Trust

|

||||||||||||

|

Series 2004-FF7, Class A1, 0.792%, 09/25/2034

|

9,897,122 | 9,874,022 | 0.4 | % | ||||||||

|

Ford Credit Auto Owner Trust

|

||||||||||||

|

Series A, 2.260%, 11/15/2025 (Acquired 05/06/2014,

|

||||||||||||

|

Cost $9,997,505)*

|

10,000,000 | 10,089,660 | 0.5 | % | ||||||||

|

GSAA Trust

|

||||||||||||

|

Series 2005-8, Class A4, 0.422%, 06/25/2035

|

13,067,907 | 12,329,349 | 0.6 | % | ||||||||

|

J.P. Morgan Mortgage Acquisition Trust

|

||||||||||||

|

Series 2006-CH1, Class A1, 0.280%, 07/25/2036

|

11,210,786 | 10,773,150 | 0.5 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Nationstar Home Equity Loan Trust

|

||||||||||||

|

Series 2006-B, Class AV3, 0.320%, 09/25/2036

|

$ | 10,413,559 | $ | 10,377,955 | 0.5 | % | ||||||

|

RASC Series Trust

|

||||||||||||

|

Series 2005-AHL2, Class A3, 0.502%, 10/25/2035

|

12,150,000 | 11,680,621 | 0.5 | % | ||||||||

|

Securitized Asset Backed Receivables LLC Trust

|

||||||||||||

|

Series 2005-OP2, Class A1, 0.477%, 10/25/2035

|

||||||||||||

|

(Acquired 03/13/2014, Cost $16,134,734)*

|

16,333,802 | 16,102,434 | 0.7 | % | ||||||||

|

Springleaf Funding Trust

|

||||||||||||

|

Series 2013-AA, Class A, 2.580%, 09/15/2021

|

||||||||||||

|

(Acquired 01/09/2014 through 06/05/2014,

|

||||||||||||

|

Cost $13,253,852)*

|

13,200,000 | 13,296,730 | 0.6 | % | ||||||||

|

Other Asset Backed Securities#~

|

68,108,587 | 3.1 | % | |||||||||

|

Total Asset Backed Securities

|

||||||||||||

|

(Cost $184,986,212)

|

184,814,245 | 8.4 | % | |||||||||

|

Commercial Mortgage-Backed Securities

|

||||||||||||

|

Bear Stearns Commercial Mortgage Securities Trust

|

||||||||||||

|

Series 2005-PWR9, Class A4A, 4.871%, 09/11/2042

|

15,739,236 | 16,297,900 | 0.7 | % | ||||||||

|

CD Commercial Mortgage Trust

|

||||||||||||

|

Series 2005-CD1, Class A4, 5.401%, 07/15/2044

|

19,390,988 | 20,162,517 | 0.9 | % | ||||||||

|

COMM Mortgage Trust

|

||||||||||||

|

Series 2005-C6, Class A5A, 5.116%, 06/10/2044

|

15,968,173 | 16,510,340 | 0.7 | % | ||||||||

|

Credit Suisse First Boston Mortgage Securities Corp.

|

||||||||||||

|

Series 2005-C5, Class A4, 5.100%, 08/15/2038

|

19,822,454 | 20,400,933 | 0.9 | % | ||||||||

|

FHLMC Multifamily Structured

|

||||||||||||

|

Pass Through Certificates

|

||||||||||||

|

Series K-701, Class A2, 3.882%, 11/25/2017

|

10,015,000 | 10,805,223 | 0.5 | % | ||||||||

|

J.P. Morgan Chase Commercial

|

||||||||||||

|

Mortgage Securities Trust

|

||||||||||||

|

Series 2005-CB12, Class A4, 4.895%, 09/12/2037

|

19,435,000 | 20,003,376 | 0.9 | % | ||||||||

|

Morgan Stanley Capital I Trust

|

||||||||||||

|

Series 2005-HQ7, Class A4, 5.376%, 11/14/2042

|

13,524,689 | 14,025,806 | 0.6 | % | ||||||||

|

Wachovia Bank Commercial Mortgage Trust

|

||||||||||||

|

Series 2005-C22, Class A4, 5.455%, 12/15/2044

|

9,912,000 | 10,394,437 | 0.5 | % | ||||||||

|

Other Commercial Mortgage Backed Securities#

|

11,202,239 | 0.5 | % | |||||||||

|

Total Commercial Mortgage Backed Securities

|

||||||||||||

|

(Cost $143,460,416)

|

139,802,771 | 6.4 | % | |||||||||

|

Total Long-Term Investments

|

||||||||||||

|

(Cost $2,148,504,237)

|

2,161,339,389 | 98.7 | % | |||||||||

|

% of

|

||||||||||||

|

Shares

|

Value

|

Net Assets

|

||||||||||

|

Money Market Mutual Fund

|

||||||||||||

|

Short-Term Investments Trust –

|

||||||||||||

|

Liquid Assets Portfolio, 0.06%«

|

20,999,321 | $ | 20,999,321 | 1.0 | % | |||||||

|

Total Short-Term Investment

|

||||||||||||

|

(Cost $20,999,321)

|

20,999,321 | 1.0 | % | |||||||||

|

Investments Purchased with Cash

|

||||||||||||

|

Proceeds from Securities Lending

|

||||||||||||

|

Investment Companies

|

||||||||||||

|

Mount Vernon Securities Lending

|

||||||||||||

|

Trust Prime Portfolio, 0.20%«

|

132,338,001 | 132,338,001 | 6.0 | % | ||||||||

|

Total Investment Companies

|

||||||||||||

|

(Cost $132,338,001)

|

132,338,001 | 6.0 | % | |||||||||

|

Total Investments Purchased With

|

||||||||||||

|

Cash Proceeds From Securities Lending

|

||||||||||||

|

(Cost $132,338,001)

|

132,338,001 | 6.0 | % | |||||||||

|

Total Investments

|

||||||||||||

|

(Cost $2,301,841,559)

|

2,314,676,711 | 105.7 | % | |||||||||

|

Liabilities in Excess of Other Assets

|

(124,001,562 | ) | (5.7 | )% | ||||||||

|

TOTAL NET ASSETS

|

$ | 2,190,675,149 | 100.0 | % | ||||||||

|

*

|

Restricted Security Deemed Liquid

|

|

@

|

This security or portion of this security is out on loan at June 30, 2014.

|

|

f

|

Foreign Security

|

|

«

|

7-Day Yield

|

|

#

|

Represents the aggregate value, by category, securities that are not among the 50 largest holdings and, in total for any issuer, represent 1% or less of net assets.

|

|

~

|

Groupings contain, in aggregate, restricted securities totaling $286,678,126 representing 13.09% of net assets.

|

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical unrestricted securities.

|

|

Level 2 –

|

Other significant observable inputs (including quoted prices for similar securities, quoted prices in inactive markets, dealer indications, interest rates, yield curves, prepayment speeds, credit risk, default rates, inputs corroborated by observable market data, etc.).

|

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions about the factors that market participants would use in valuing the security) based on the best information available.

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Fixed Income

|

||||||||||||||||

|

U.S. Treasury Securities

|

$ | — | $ | 261,618,547 | $ | — | $ | 261,618,547 | ||||||||

|

Taxable Municipal Bonds

|

— | 64,504,009 | — | 64,504,009 | ||||||||||||

|

Other Government Related Securities

|

— | 74,599,942 | — | 74,599,942 | ||||||||||||

|

Corporate Bonds

|

— | 1,359,826,161 | — | 1,359,826,161 | ||||||||||||

|

Residential Mortgage-Backed Securities –

|

||||||||||||||||

|

U.S. Government Agency Issues

|

— | 886,828 | — | 886,828 | ||||||||||||

|

Residential Mortgage-Backed Securities –

|

||||||||||||||||

|

Non-U.S. Government Agency Issues

|

— | 75,286,886 | — | 75,286,886 | ||||||||||||

|

Asset Backed Securities

|

— | 184,814,245 | — | 184,814,245 | ||||||||||||

|

Commercial Mortgage-Backed Securities

|

— | 139,802,771 | — | 139,802,771 | ||||||||||||

|

Total Fixed Income

|

— | 2,161,339,389 | — | 2,161,339,389 | ||||||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Mutual Fund

|

20,999,321 | — | — | 20,999,321 | ||||||||||||

|

Total Short-Term Investments

|

20,999,321 | — | — | 20,999,321 | ||||||||||||

|

Investments Purchased with Cash

|

||||||||||||||||

|

Proceeds from Securities Lending

|

||||||||||||||||

|

Investment Companies

|

132,338,001 | — | — | 132,338,001 | ||||||||||||

|

Total Investments Purchased with

|

||||||||||||||||

|

Cash Proceeds from Securities Lending

|

132,338,001 | — | — | 132,338,001 | ||||||||||||

|

Total Investments

|

$ | 153,337,322 | $ | 2,161,339,389 | $ | — | $ | 2,314,676,711 | ||||||||

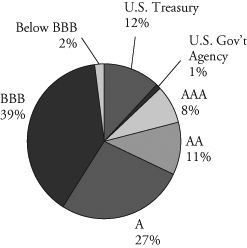

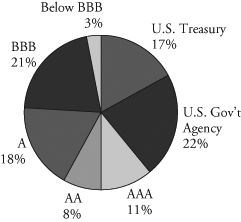

| Quality Distribution(1)(2) | ||||

|

Net Assets

|

$1,265,895,885

|

||

|

SEC 30-Day

|

||||

|

Yield(3)

|

||||

|

Institutional Class

|

1.92%

|

|||

|

Investor Class

|

1.67%

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Duration

|

3.89 years

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Maturity

|

4.39 years

|

|||

|

Annualized

|

||||

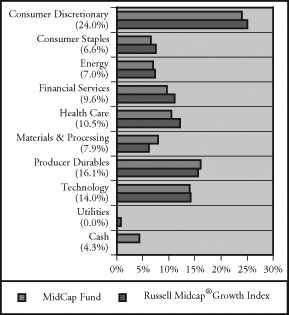

| Sector Weightings(1) |

Expense

|

|||

|

Ratio

|

||||

|

Institutional Class

|

0.30%

|

||

|

Investor Class

|

0.55%(4)

|

|||

|

Portfolio

|

||||

|

Turnover

|

||||

|

Rate

|

14.0%(5)

|

|||

|

Number of

|

||||

|

Holdings

|

403

|

|||

|

(1)

|

Percentages shown are based on the Fund’s total investments (less investments purchased with cash proceeds from securities lending).

|

|

(2)

|

The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest).

|

|

(3)

|

SEC yields are based on SEC guidelines and are calculated for the 30 days ended June 30, 2014.

|

|

(4)

|

Includes 0.25% 12b-1 fee.

|

|

(5)

|

Not annualized.

|

|

Average Annual

|

|||||

|

Six

|

One

|

Five

|

Ten

|

Since

|

|

|

For the Periods Ended June 30, 2014

|

Months

|

Year

|

Years

|

Years

|

Inception(1)

|

|

Institutional Class Shares

|

2.76%

|

3.95%

|

5.77%

|

4.96%

|

5.60%

|

|

Investor Class Shares

|

2.71%

|

3.72%

|

5.53%

|

4.69%

|

5.33%

|

|

Barclays Intermediate U.S. Government/

|

|||||

|

Credit Bond Index(2)

|

2.25%

|

2.86%

|

4.09%

|

4.33%

|

5.08%

|

|

(1)

|

For the period from September 29, 2000 (commencement of operations) through June 30, 2014.

|

|

(2)

|

The Barclays Intermediate U.S. Government/Credit Bond Index is an unmanaged, market value weighted index of investment grade, fixed-rate debt issues, including government and corporate securities, with maturities between one and ten years. This index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible.

|

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

U.S. Treasury Securities

|

||||||||||||

|

U.S. Treasury Bonds:

|

||||||||||||

|

9.125%, 05/15/2018@

|

$ | 12,950,000 | $ | 16,842,084 | 1.3 | % | ||||||

|

1.250%, 04/30/2019@

|

275,625,000 | 271,490,625 | 21.5 | % | ||||||||

|

2.625%, 08/15/2020

|

12,000,000 | 12,491,256 | 1.0 | % | ||||||||

|

7.875%, 02/15/2021@

|

67,000,000 | 91,601,596 | 7.2 | % | ||||||||

|

Total U.S. Treasury Securities

|

||||||||||||

|

(Cost $389,665,644)

|

392,425,561 | 31.0 | % | |||||||||

|

U.S. Government Agency Issues

|

||||||||||||

|

Federal Home Loan Mortgage Corporation (FHLMC)

|

||||||||||||

|

1.375%, 05/01/2020@

|

10,000,000 | 9,727,060 | 0.8 | % | ||||||||

|

Other U.S. Government Agency Issue#

|

299,410 | 0.0 | % | |||||||||

|

Total U.S. Government Agency Issue

|

||||||||||||

|

(Cost $9,736,766)

|

10,026,470 | 0.8 | % | |||||||||

|

Taxable Municipal Bonds

|

||||||||||||

|

New Jersey Economic Development Authority

|

||||||||||||

|

1.802%, 06/15/2017

|

5,000,000 | 5,037,050 | 0.4 | % | ||||||||

|

Other Taxable Municipal Bonds#

|

26,464,064 | 2.1 | % | |||||||||

|

Total Taxable Municipal Bonds

|

||||||||||||

|

(Cost $30,376,589)

|

31,501,114 | 2.5 | % | |||||||||

|

Other Government Related Securities

|

||||||||||||

|

CNOOC Nexen Finance (2014) ULC

|

||||||||||||

|

4.250%, 04/30/2024 f

|

5,150,000 | 5,280,470 | 0.4 | % | ||||||||

|

Petrobras International Finance Company

|

||||||||||||

|

3.875%, 01/27/2016 f

|

4,175,000 | 4,304,634 | 0.4 | % | ||||||||

|

Other Government Related Securities#~

|

19,105,358 | 1.5 | % | |||||||||

|

Total Other Government Related Securities

|

||||||||||||

|

(Cost $27,032,647)

|

28,690,462 | 2.3 | % | |||||||||

|

Corporate Bonds

|

||||||||||||

|

Industrials

|

||||||||||||

|

Computer Sciences Corporation

|

||||||||||||

|

2.500%, 09/15/2015

|

4,500,000 | 4,580,460 | 0.4 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

CVS Caremark Corporation

|

||||||||||||

|

4.000%, 12/05/2023

|

$ | 4,425,000 | $ | 4,630,612 | 0.4 | % | ||||||

|

Fidelity National Information Services, Inc.

|

||||||||||||

|

7.875%, 07/15/2020

|

4,800,000 | 5,083,488 | 0.4 | % | ||||||||

|

Glencore Funding LLC

|

||||||||||||

|

2.500%, 01/15/2019 (Acquired 05/22/2013

|

||||||||||||

|

through 10/29/2013, Cost $4,301,850)*

|

4,400,000 | 4,388,802 | 0.3 | % | ||||||||

|

Hutchison Whampoa International (09) Limited

|

||||||||||||

|

7.625%, 04/09/2019 (Acquired 10/16/2009

|

||||||||||||

|

through 04/16/2014, Cost $6,215,960)* f

|

5,400,000 | 6,593,843 | 0.5 | % | ||||||||

|

Hyundai Capital Services, Inc.

|

||||||||||||

|

6.000%, 05/05/2015 (Acquired 03/27/2013

|

||||||||||||

|

through 05/30/2013, Cost $5,760,366)* f

|

5,549,000 | 5,785,177 | 0.4 | % | ||||||||

|

Murphy Oil Corporation

|

||||||||||||

|

3.700%, 12/01/2022

|

5,000,000 | 4,976,270 | 0.4 | % | ||||||||

|

Telecom Italia Capital

|

||||||||||||

|

5.250%, 10/01/2015 f

|

4,425,000 | 4,624,125 | 0.4 | % | ||||||||

|

Waste Management, Inc.

|

||||||||||||

|

7.375%, 03/11/2019

|

5,000,000 | 6,109,795 | 0.5 | % | ||||||||

|

Other Industrials#~

|

206,151,960 | 16.3 | % | |||||||||

|

Total Industrials

|

||||||||||||

|

(Cost $244,486,739)

|

252,924,532 | 20.0 | % | |||||||||

|

Utility

|

||||||||||||

|

National Grid PLC

|

||||||||||||

|

6.300%, 08/01/2016 f

|

3,925,000 | 4,346,694 | 0.3 | % | ||||||||

|

Other Utility#~

|

52,851,873 | 4.2 | % | |||||||||

|

Total Utility

|

||||||||||||

|

(Cost $54,734,588)

|

57,198,567 | 4.5 | % | |||||||||

|

Finance

|

||||||||||||

|

ABN AMRO Bank N.V.

|

||||||||||||

|

4.250%, 02/02/2017 (Acquired 11/22/2013,

|

||||||||||||

|

Cost $4,797,617)* f

|

4,500,000 | 4,828,365 | 0.4 | % | ||||||||

|

BPCE

|

||||||||||||

|

4.000%, 04/15/2024 f

|

7,000,000 | 7,145,950 | 0.6 | % | ||||||||

|

Comerica Bank

|

||||||||||||

|

5.200%, 08/22/2017

|

4,095,000 | 4,542,547 | 0.4 | % | ||||||||

|

Commonwealth Bank of Australia

|

||||||||||||

|

5.000%, 10/15/2019 (Acquired 03/02/2012,

|

||||||||||||

|

Cost $4,243,961)* f

|

4,000,000 | 4,519,720 | 0.3 | % | ||||||||

|

Deutsche Bank Aktiengesellschaft

|

||||||||||||

|

3.250%, 01/11/2016 f

|

4,250,000 | 4,409,851 | 0.3 | % | ||||||||

|

First Tennessee Bank National Association

|

||||||||||||

|

5.650%, 04/01/2016

|

4,263,000 | 4,532,392 | 0.4 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Macquarie Bank Limited

|

||||||||||||

|

2.000%, 08/15/2016 (Acquired 08/07/2013,

|

||||||||||||

|

Cost $4,998,250)* f

|

$ | 5,000,000 | $ | 5,090,810 | 0.4 | % | ||||||

|

The Goldman Sachs Group, Inc.

|

||||||||||||

|

6.150%, 04/01/2018

|

3,900,000 | 4,472,598 | 0.3 | % | ||||||||

|

The Huntington National Bank

|

||||||||||||

|

1.300%, 11/20/2016

|

4,850,000 | 4,871,098 | 0.4 | % | ||||||||

|

WEA Finance LLC / WT Finance Aust Pty Ltd

|

||||||||||||

|

6.750%, 09/02/2019 (Acquired 11/21/2013,

|

||||||||||||

|

Cost $4,741,244)*

|

4,000,000 | 4,985,368 | 0.4 | % | ||||||||

|

Other Finance#~

|

232,944,742 | 18.4 | % | |||||||||

|

Total Finance

|

||||||||||||

|

(Cost $270,965,359)

|

282,343,441 | 22.3 | % | |||||||||

|

Residential Mortgage-Backed Securities

|

||||||||||||

|

U.S. Government Agency Issues

|

||||||||||||

|

Other U.S. Government Agency Issues#

|

1,155,990 | 0.1 | % | |||||||||

|

Total U.S. Government Agency Issues

|

||||||||||||

|

(Cost $1,087,833)

|

1,155,990 | 0.1 | % | |||||||||

|

Residential Mortgage-Backed Securities

|

||||||||||||

|

Non-U.S. Government Agency Issues

|

||||||||||||

|

Banc of America Funding Trust

|

||||||||||||

|

Series 2004-2, Class 1CB1, 5.750%, 09/20/2034

|

5,339,457 | 5,759,758 | 0.5 | % | ||||||||

|

Structured Asset Securities Corp. Mortgage

|

||||||||||||

|

Pass-Through Certificates

|

||||||||||||

|

Series 2004-22, Class A2, 5.175%, 01/25/2035

|

8,710,692 | 9,044,033 | 0.7 | % | ||||||||

|

Washington Mutual Mortgage

|

||||||||||||

|

Pass Through Certificates:

|

||||||||||||

|

Series 2004-AR3, Class A1, 2.377%, 06/25/2034

|

7,098,825 | 7,232,574 | 0.6 | % | ||||||||

|

Series 2004-CB2, Class 3A, 6.000%, 08/25/2034

|

5,338,086 | 5,713,941 | 0.4 | % | ||||||||

|

5.000%-6.000%, 06/25/2019-12/25/2019

|

2,551,104 | 2,655,547 | 0.2 | % | ||||||||

|

Other Non-U.S. Government Agency Issues#~

|

14,447,710 | 1.1 | % | |||||||||

|

Total Non-U.S. Government Agency Issues

|

||||||||||||

|

(Cost $44,715,956)

|

44,853,563 | 3.5 | % | |||||||||

|

Asset Backed Securities

|

||||||||||||

|

First Franklin Mortgage Loan Trust

|

||||||||||||

|

Series 2004-FF7, Class A1, 0.792%, 09/25/2034

|

6,160,958 | 6,146,579 | 0.5 | % | ||||||||

|

J.P. Morgan Mortgage Acquisition Trust

|

||||||||||||

|

Series 2006-CH1, Class A1, 0.280%, 07/25/2036

|

5,381,177 | 5,171,112 | 0.4 | % | ||||||||

|

Securitized Asset Backed Receivables LLC Trust

|

||||||||||||

|

Series 2005-OP2, Class A1, 0.477%, 10/25/2035

|

||||||||||||

|

(Acquired 03/13/2014, Cost $8,936,160)*

|

9,046,413 | 8,918,271 | 0.7 | % | ||||||||

|

Soundview Home Loan Trust

|

||||||||||||

|

Series 2003-2, Class A2, 1.452%, 11/25/2033

|

4,321,857 | 4,282,662 | 0.4 | % | ||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Specialty Underwriting & Residential Finance Trust

|

||||||||||||

|

Series 2006-BC1, Class A2D, 0.452%, 12/25/2036

|

$ | 5,607,100 | $ | 5,318,312 | 0.4 | % | ||||||

|

Springleaf Funding Trust

|

||||||||||||

|

Series 2013-AA, Class A, 2.580%, 09/15/2021

|

||||||||||||

|

(Acquired 02/14/2014, Cost $5,024,363)*

|

5,000,000 | 5,036,640 | 0.4 | % | ||||||||

|

Other Asset Backed Securities#~

|

15,572,525 | 1.2 | % | |||||||||

|

Total Asset Backed Securities

|

||||||||||||

|

(Cost $50,415,037)

|

50,446,101 | 4.0 | % | |||||||||

|

Commercial Mortgage-Backed Securities

|

||||||||||||

|

Bear Stearns Commercial Mortgage Securities Trust

|

||||||||||||

|

Series 2005-PWR9, Class A4A, 4.871%, 09/11/2042

|

5,773,604 | 5,978,538 | 0.5 | % | ||||||||

|

CD Commercial Mortgage Trust

|

||||||||||||

|

Series 2005-CD1, Class A4, 5.401%, 07/15/2044

|

6,731,363 | 6,999,191 | 0.6 | % | ||||||||

|

Credit Suisse First Boston Mortgage Securities Corp.

|

||||||||||||

|

Series 2005-C5, Class A4, 5.100%, 08/15/2038

|

5,885,454 | 6,057,209 | 0.5 | % | ||||||||

|

DBUBS Mortgage Trust

|

||||||||||||

|

Series 2011-LC3A, Class A2, 3.642%, 08/10/2044

|

5,150,000 | 5,407,969 | 0.4 | % | ||||||||

|

FHLMC Multifamily Structured

|

||||||||||||

|

Pass Through Certificates:

|

||||||||||||

|

Series K-708, Class A2, 2.130%, 01/25/2019

|

8,300,000 | 8,427,148 | 0.7 | % | ||||||||

|

Series K-003, Class A4, 5.053%, 01/25/2019

|

9,000,000 | 10,211,193 | 0.8 | % | ||||||||

|

Series K-004, Class A2, 4.186%, 08/25/2019

|

5,875,000 | 6,489,319 | 0.5 | % | ||||||||

|

Series K-005, Class A2, 4.317%, 11/25/2019

|

4,975,000 | 5,533,658 | 0.4 | % | ||||||||

|

Series K-F02, Class A3, 0.782%, 07/25/2020

|

9,051,773 | 9,063,405 | 0.7 | % | ||||||||

|

1.655%-4.251%, 11/25/2016-01/25/2020

|

7,783,000 | 8,125,227 | 0.6 | % | ||||||||

|

J.P. Morgan Chase Commercial Mortgage Securities Trust

|

||||||||||||

|

Series 2005-CB12, Class A4, 4.895%, 09/12/2037

|

5,000,000 | 5,146,225 | 0.4 | % | ||||||||

|

Wachovia Bank Commercial Mortgage Trust

|

||||||||||||

|

Series 2005-C22, Class A4, 5.455%, 12/15/2044

|

5,000,000 | 5,243,360 | 0.4 | % | ||||||||

|

Other Commercial Mortgage Backed Securities#

|

6,615,186 | 0.5 | % | |||||||||

|

Total Commercial Mortgage Backed Securities

|

||||||||||||

|

(Cost $88,876,615)

|

89,297,628 | 7.0 | % | |||||||||

|

Total Long-Term Investments

|

||||||||||||

|

(Cost $1,212,093,773)

|

1,240,863,429 | 98.0 | % | |||||||||

|

Short-Term Investments

|

||||||||||||

|

Shares

|

||||||||||||

|

Money Market Mutual Funds

|

||||||||||||

|

Short-Term Investments Trust –

|

||||||||||||

|

Liquid Assets Portfolio, 0.06%«

|

24,000,000 | 24,000,000 | 1.9 | % | ||||||||

|

Other Short-Term Invesments#

|

3,872,934 | 3,872,934 | 0.3 | % | ||||||||

|

Total Short-Term Investments

|

||||||||||||

|

(Cost $27,872,934)

|

27,872,934 | 2.2 | % | |||||||||

|

% of

|

||||||||||||

|

Shares

|

Value

|

Net Assets

|

||||||||||

|

Investment Companies

|

||||||||||||

|

Mount Vernon Securities Lending

|

||||||||||||

|

Trust Prime Portfolio, 0.20%«

|

$ | 231,817,863 | $ | 231,817,863 | 18.3 | % | ||||||

|

Total Investment Companies

|

||||||||||||

|

(Cost $231,817,863)

|

231,817,863 | 18.3 | % | |||||||||

|

Total Investments Purchased With

|

||||||||||||

|

Cash Proceeds From Securities Lending

|

||||||||||||

|

(Cost $231,817,863)

|

231,817,863 | 18.3 | % | |||||||||

|

Total Investments

|

||||||||||||

|

(Cost $1,471,784,570)

|

1,500,554,226 | 118.5 | % | |||||||||

|

Liabilities in Excess of Other Assets

|

(234,658,341 | ) | (18.5 | )% | ||||||||

|

TOTAL NET ASSETS

|

$ | 1,265,895,885 | 100.0 | % | ||||||||

|

*

|

Restricted Security Deemed Liquid

|

|

@

|

This security or portion of this security is out on loan at June 30, 2014.

|

|

f

|

Foreign Security

|

|

«

|

7-Day Yield

|

|

#

|

Represents the aggregate value, by category, securities that are not among the 50 largest holdings and, in total for any issuer, represent 1% or less of net assets.

|

|

~

|

Groupings contain, in aggregate, restricted securities totaling $135,411,174 representing 10.70% of net assets.

|

|

Level 1 –

|

Unadjusted quoted prices in active markets for identical unrestricted securities.

|

|

Level 2 –

|

Other significant observable inputs (including quoted prices for similar securities, quoted prices in inactive markets, dealer indications, interest rates, yield curves, prepayment speeds, credit risk, default rates, inputs corroborated by observable market data, etc.).

|

|

Level 3 –

|

Significant unobservable inputs (including the Fund’s own assumptions about the factors that market participants would use in valuing the security) based on the best information available.

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Fixed Income

|

||||||||||||||||

|

U.S. Treasury Securities

|

$ | — | $ | 392,425,561 | $ | — | $ | 392,425,561 | ||||||||

|

U.S. Government Agency Issues

|

— | 10,026,470 | — | 10,026,470 | ||||||||||||

|

Taxable Municipal Bonds

|

— | 31,501,114 | — | 31,501,114 | ||||||||||||

|

Other Government Related Securities

|

— | 28,690,462 | — | 28,690,462 | ||||||||||||

|

Corporate Bonds

|

— | 592,444,643 | 21,897 | 592,466,540 | ||||||||||||

|

Residential Mortgage-Backed Securities –

|

||||||||||||||||

|

U.S. Government Agency Issues

|

— | 1,155,990 | — | 1,155,990 | ||||||||||||

|

Residential Mortgage-Backed Securities –

|

||||||||||||||||

|

Non-U.S. Government Agency Issues

|

— | 44,853,563 | — | 44,853,563 | ||||||||||||

|

Asset Backed Securities

|

— | 50,445,709 | 392 | 50,446,101 | ||||||||||||

|

Commercial Mortgage-Backed Securities

|

— | 89,297,628 | — | 89,297,628 | ||||||||||||

|

Total Fixed Income

|

— | 1,240,841,140 | 22,289 | 1,240,863,429 | ||||||||||||

|

Short-Term Investments

|

||||||||||||||||

|

Money Market Mutual Funds

|

27,872,934 | — | — | 27,872,934 | ||||||||||||

|

Total Short-Term Investments

|

27,872,934 | — | — | 27,872,934 | ||||||||||||

|

Investments Purchased with Cash

|

||||||||||||||||

|

Proceeds from Securities Lending

|

||||||||||||||||

|

Investment Companies

|

231,817,863 | — | — | 231,817,863 | ||||||||||||

|

Total Investments Purchased with

|

||||||||||||||||

|

Cash Proceeds from Securities Lending

|

231,817,863 | — | — | 231,817,863 | ||||||||||||

|

Total Investments

|

$ | 259,690,797 | $ | 1,240,841,140 | $ | 22,289 | $ | 1,500,554,226 | ||||||||

|

Description

|

Investments in Securities

|

|||

|

Balance as of December 31, 2013

|

$ | 392 | ||

|

Accrued discounts/premiums

|

— | |||

|

Realized gain (loss)

|

— | |||

|

Change in unrealized appreciation (depreciation)

|

— | |||

|

Purchases

|

— | |||

|

Sales

|

— | |||

|

Transfers in and/or out of Level 3*

|

21,897 | |||

|

Balance as of June 30, 2014

|

$ | 22,289 | ||

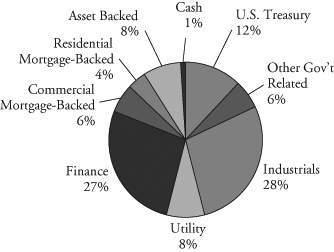

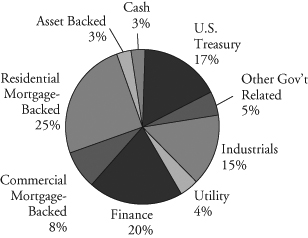

| Quality Distribution(1)(2) | ||||

|

Net Assets

|

$1,081,098,526

|

||

|

SEC 30-Day

|

||||

|

Yield(4)

|

||||

|

Institutional Class

|

1.57%

|

|||

|

Investor Class

|

1.32%

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Duration

|

4.62 years

|

|||

|

Average

|

||||

|

Effective

|

||||

|

Maturity

|

5.51 years

|

|||

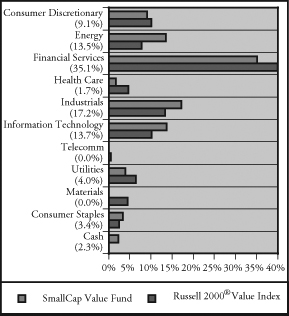

| Sector Weightings(1) |

Annualized

|

|||

|

Expense

|

||||

|

Ratio

|

|||

|

Institutional Class

|

0.30%

|

|||

|

Investor Class

|

0.55%(5)

|

|||

|

Portfolio

|

||||

|

Turnover

|

||||

|

Rate

|

3.2%(6)

|

|||

|

Number of

|

||||

|

Holdings

|

277

|

|||

|

(1)

|

Percentages shown are based on the Fund’s total investments.

|

|

(2)

|

The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest).

|

|

(3)

|

Includes pre-refunded and escrowed-to-maturity (ETM) bonds.

|

|

(4)

|

SEC yields are based on SEC guidelines and are calculated for the 30 days ended June 30, 2014.

|

|

(5)

|

Includes 0.25% 12b-1 fee.

|

|

(6)

|

Not annualized.

|

|

Average Annual

|

|||||

|

Six

|

One

|

Five

|

Ten

|

Since

|

|

|

For the Periods Ended June 30, 2014

|

Months

|

Year

|

Years

|

Years

|

Inception(1)

|

|

Institutional Class Shares

|

3.27%

|

4.31%

|

3.90%

|

4.28%

|

4.65%

|

|

Investor Class Shares

|

3.08%

|

4.04%

|

3.64%

|

4.00%

|

4.37%

|

|

Barclays 7-Year General Obligation

|

|||||

|

Bond Index(2)

|

4.13%

|

5.23%

|

5.13%

|

4.87%

|

4.96%

|

|

(1)

|

For the period from March 30, 2001 (commencement of operations) through June 30, 2014.

|

|

(2)

|

The Barclays 7-Year General Obligation Bond Index is an unmanaged, market value weighted index comprised of investment grade state and local general obligation bonds that have been issued as part of an offering of at least $50 million, have a minimum amount outstanding of at least $5 million, have been issued within the last five years and have a maturity of six to eight years. This index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible.

|

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Municipal Bonds

|

||||||||||||

|

Alabama

|

||||||||||||

|

Other Alabama#

|

$ | 3,959,700 | 0.4 | % | ||||||||

|

Total Alabama

|

||||||||||||

|

(Cost $3,752,013)

|

3,959,700 | 0.4 | % | |||||||||

|

Alaska

|

||||||||||||

|

Other Alaska#

|

1,042,820 | 0.1 | % | |||||||||

|

Total Alaska

|

||||||||||||

|

(Cost $1,008,561)

|

1,042,820 | 0.1 | % | |||||||||

|

Arizona

|

||||||||||||

|

Other Arizona#

|

4,647,546 | 0.4 | % | |||||||||

|

Total Arizona

|

||||||||||||

|

(Cost $4,481,851)

|

4,647,546 | 0.4 | % | |||||||||

|

Arkansas

|

||||||||||||

|

Other Arkansas#

|

1,151,980 | 0.1 | % | |||||||||

|

Total Arkansas

|

||||||||||||

|

(Cost $1,154,819)

|

1,151,980 | 0.1 | % | |||||||||

|

California

|

||||||||||||

|

Bakersfield California Certificates Participation

|

||||||||||||

|

0.000%, 04/15/2021 (ETM)^

|

$ | 12,380,000 | 10,816,654 | 1.0 | % | |||||||

|

San Joaquin Hills California Transportation

|

||||||||||||

|

Corridor Agency Toll Road Revenue:

|

||||||||||||

|

0.000%, 01/01/2020 (ETM)^

|

6,865,000 | 6,327,265 | 0.6 | % | ||||||||

|

0.000%, 01/01/2023 (ETM)^

|

14,000,000 | 11,460,680 | 1.0 | % | ||||||||

|

San Marcos California Public

|

||||||||||||

|

Facilities Authority Revenue

|

||||||||||||

|

0.000%, 09/01/2019 (ETM)^

|

17,295,000 | 16,093,516 | 1.5 | % | ||||||||

|

Other California#

|

10,821,991 | 1.0 | % | |||||||||

|

Total California

|

||||||||||||

|

(Cost $50,624,944)

|

55,520,106 | 5.1 | % | |||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Colorado

|

||||||||||||

|

Colorado Springs Colorado Utilities Revenue Bonds

|

||||||||||||

|

5.875%, 11/15/2017 (ETM)

|

$ | 6,105,000 | $ | 6,699,017 | 0.6 | % | ||||||

|

Dawson Ridge Metropolitan District No. 1 Colorado:

|

||||||||||||

|

0.000%, 10/01/2022 (ETM)^

|

21,595,000 | 17,884,331 | 1.7 | % | ||||||||

|

0.000%, 10/01/2022 (ETM)^

|

17,540,000 | 14,585,387 | 1.3 | % | ||||||||

|

Regional Transportation District

|

||||||||||||

|

Colorado Sales Tax Revenue

|

||||||||||||

|

5.000%, 11/01/2036 (Pre-refunded to 11/01/2016)

|

6,785,000 | 7,520,765 | 0.7 | % | ||||||||

|

Other Colorado#

|

2,847,596 | 0.3 | % | |||||||||

|

Total Colorado

|

||||||||||||

|

(Cost $47,143,069)

|

49,537,096 | 4.6 | % | |||||||||

|

Connecticut

|

||||||||||||

|

Other Connecticut#

|

5,220,939 | 0.5 | % | |||||||||

|

Total Connecticut

|

||||||||||||

|

(Cost $5,071,924)

|

5,220,939 | 0.5 | % | |||||||||

|

Florida

|

||||||||||||

|

Broward County Florida School Board

|

||||||||||||

|

5.250%, 07/01/2022 (Callable 07/01/2021)

|

8,390,000 | 9,968,746 | 0.9 | % | ||||||||

|

5.250%, 07/01/2023 (Callable 07/01/2021)

|

4,915,000 | 5,746,471 | 0.5 | % | ||||||||

|

County of St. Lucie Florida

|

||||||||||||

|

6.000%, 10/01/2020 (ETM)

|

6,420,000 | 7,819,945 | 0.7 | % | ||||||||

|

Florida State Board of Education

|

||||||||||||

|

5.000%, 06/01/2022 (Callable 06/01/2019)

|

13,800,000 | 16,078,380 | 1.5 | % | ||||||||

|

Miami-Dade County Florida

|

||||||||||||

|

4.500%, 10/01/2020

|

7,100,000 | 8,163,864 | 0.8 | % | ||||||||

|

Other Florida#

|

56,464,050 | 5.2 | % | |||||||||

|

Total Florida

|

||||||||||||

|

(Cost $96,674,254)

|

104,241,456 | 9.6 | % | |||||||||

|

Georgia

|

||||||||||||

|

Atlanta Georgia Water & Wastewater Revenue

|

||||||||||||

|

5.500%, 11/01/2017 (Insured by AGM)

|

8,445,000 | 9,739,703 | 0.9 | % | ||||||||

|

Forsyth County Georgia Hospital Authority

|

||||||||||||

|

Revenue Anticipation Certificates

|

||||||||||||

|

6.375%, 10/01/2028 (Callable 08/01/2014)(ETM)

|

8,050,000 | 10,152,821 | 0.9 | % | ||||||||

|

Gwinnett County Georgia School District

|

||||||||||||

|

5.000%, 02/01/2026 (Pre-refunded to 02/01/2018)

|

7,400,000 | 8,488,318 | 0.8 | % | ||||||||

|

State of Georgia

|

||||||||||||

|

5.000%, 07/01/2020 (Callable 07/01/2017)

|

12,570,000 | 14,192,913 | 1.3 | % | ||||||||

|

Other Georgia#

|

10,575,116 | 1.0 | % | |||||||||

|

Total Georgia

|

||||||||||||

|

(Cost $51,600,205)

|

53,148,871 | 4.9 | % | |||||||||

|

Principal

|

% of

|

|||||||||||

|

Amount

|

Value

|

Net Assets

|

||||||||||

|

Illinois

|

||||||||||||

|

Illinois Finance Authority:

|

||||||||||||

|

0.000%, 07/15/2023 (ETM)^

|

$ | 16,860,000 | $ | 13,494,744 | 1.2 | % | ||||||

|

0.000%, 07/15/2025 (ETM)^

|

9,560,000 | 7,165,698 | 0.7 | % | ||||||||

|

Kane McHenry Cook & De Kalb Counties

|

||||||||||||

|