2nd Quarter Earnings July 19, 2024 Exhibit 99.3

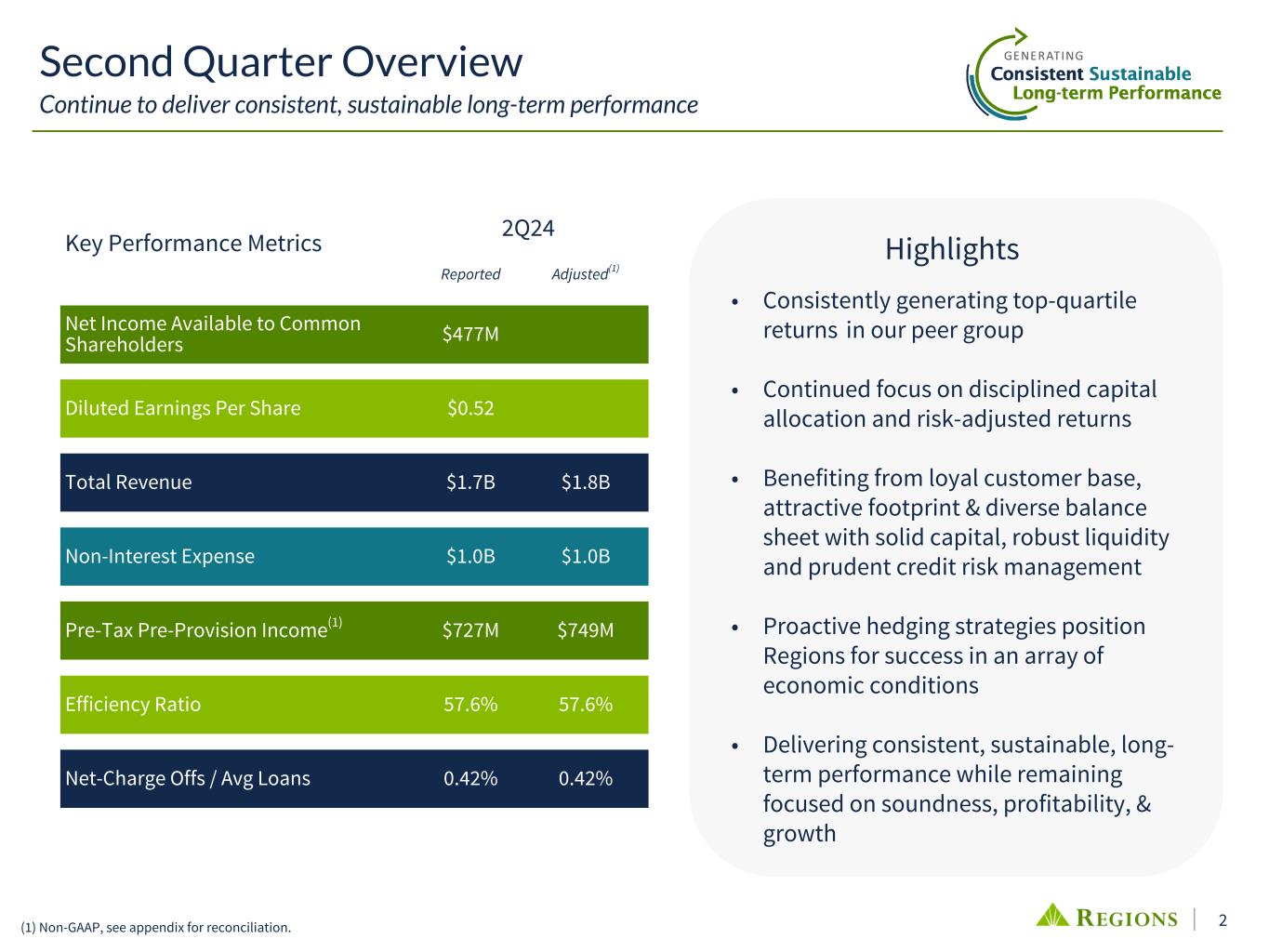

2 Second Quarter Overview Continue to deliver consistent, sustainable long-term performance (1) Non-GAAP, see appendix for reconciliation. Key Performance Metrics 2Q24 Reported Adjusted(1) Net Income Available to Common Shareholders $477M Diluted Earnings Per Share $0.52 Total Revenue $1.7B $1.8B Non-Interest Expense $1.0B $1.0B Pre-Tax Pre-Provision Income(1) $727M $749M Efficiency Ratio 57.6% 57.6% Net-Charge Offs / Avg Loans 0.42% 0.42% • Consistently generating top-quartile returns in our peer group • Continued focus on disciplined capital allocation and risk-adjusted returns • Benefiting from loyal customer base, attractive footprint & diverse balance sheet with solid capital, robust liquidity and prudent credit risk management • Proactive hedging strategies position Regions for success in an array of economic conditions • Delivering consistent, sustainable, long- term performance while remaining focused on soundness, profitability, & growth Highlights

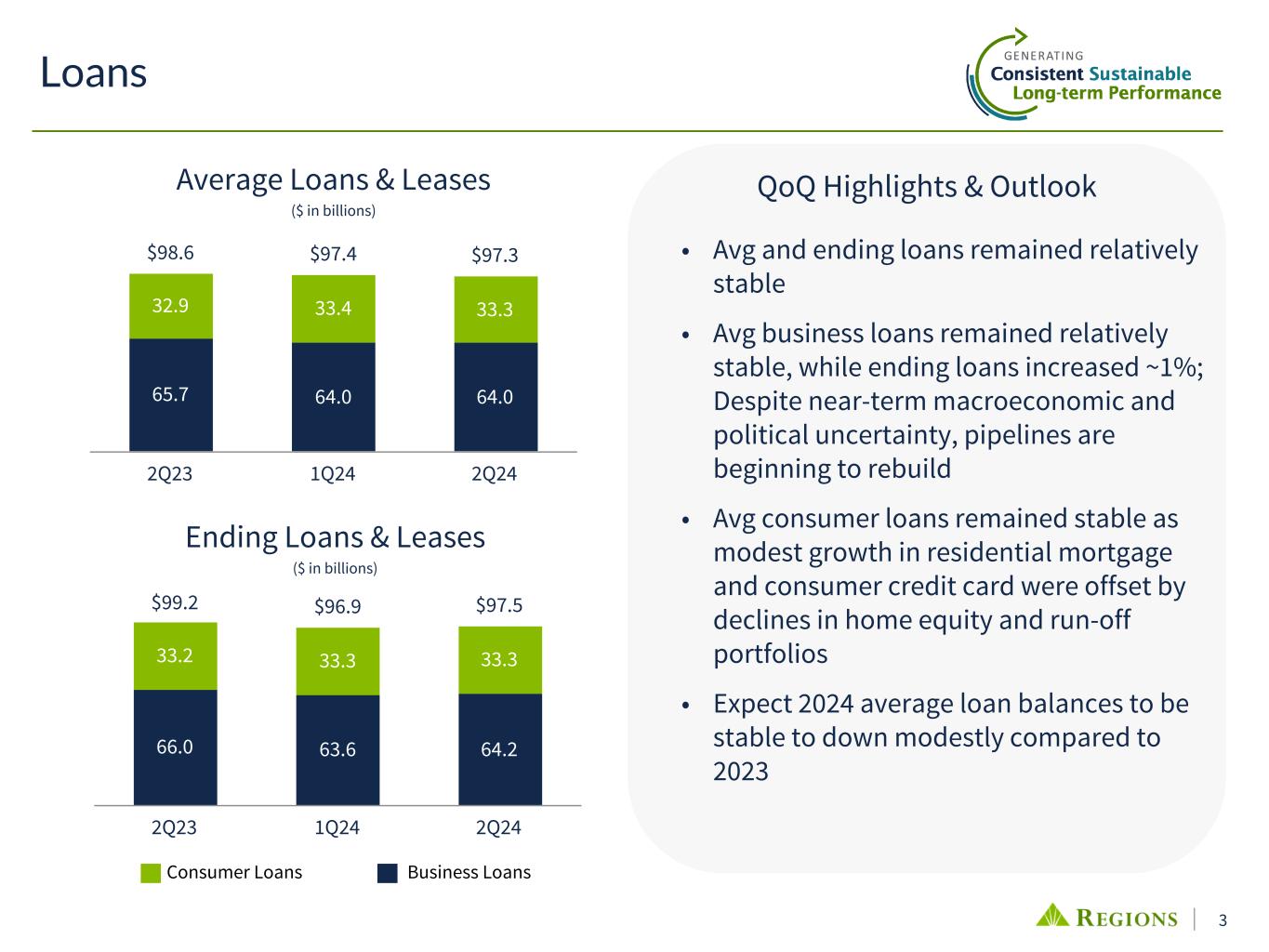

3 $99.2 $96.9 $97.5 66.0 63.6 64.2 33.2 33.3 33.3 2Q23 1Q24 2Q24 $98.6 $97.4 $97.3 65.7 64.0 64.0 32.9 33.4 33.3 2Q23 1Q24 2Q24 Average Loans & Leases ($ in billions) Business LoansConsumer Loans Ending Loans & Leases ($ in billions) Loans • Avg and ending loans remained relatively stable • Avg business loans remained relatively stable, while ending loans increased ~1%; Despite near-term macroeconomic and political uncertainty, pipelines are beginning to rebuild • Avg consumer loans remained stable as modest growth in residential mortgage and consumer credit card were offset by declines in home equity and run-off portfolios • Expect 2024 average loan balances to be stable to down modestly compared to 2023 QoQ Highlights & Outlook

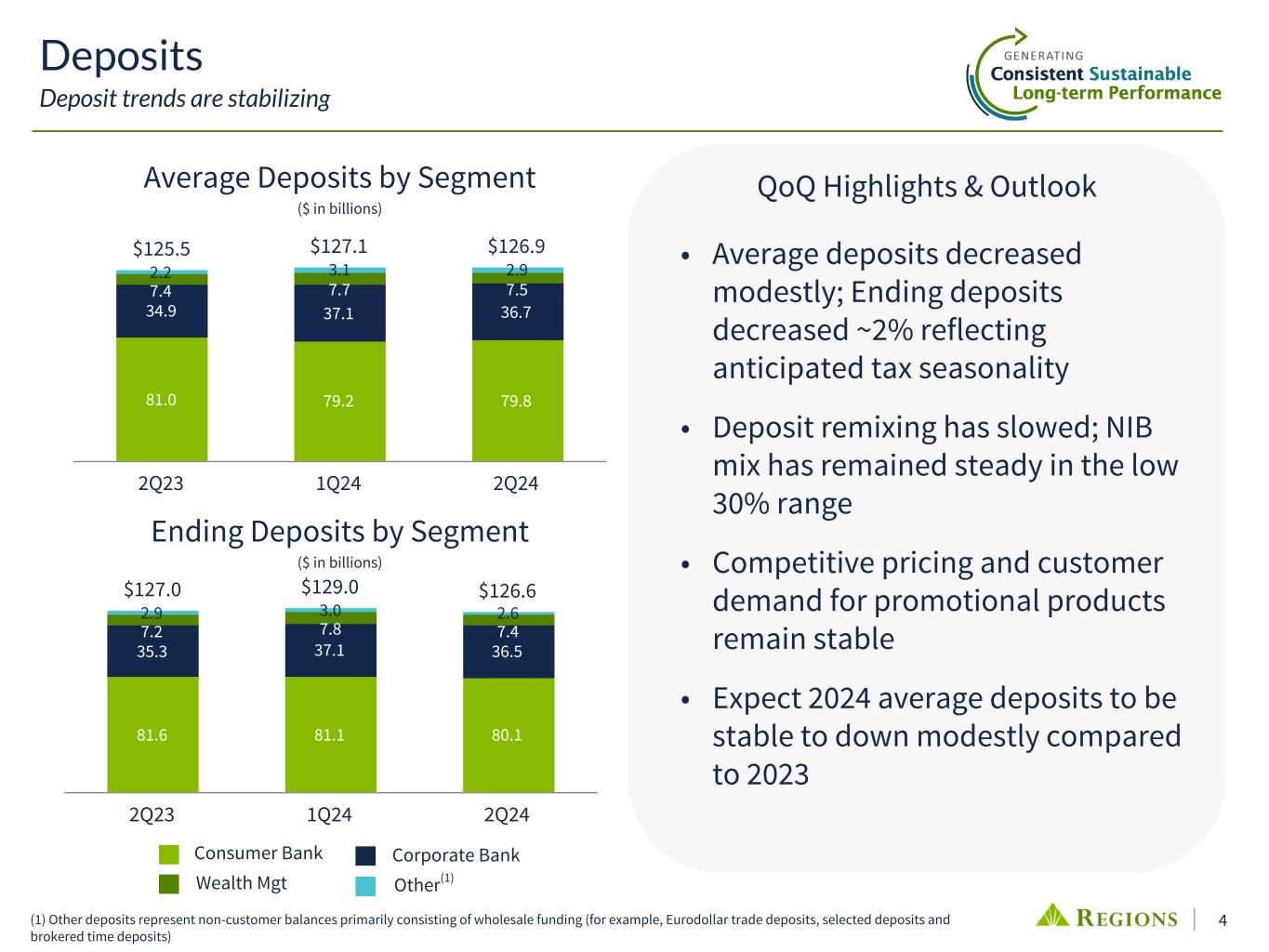

4 $127.0 $129.0 $126.6 81.6 81.1 80.1 35.3 37.1 36.5 7.2 7.8 7.4 2.9 3.0 2.6 2Q23 1Q24 2Q24 $125.5 $127.1 $126.9 81.0 79.2 79.8 34.9 37.1 36.7 7.4 7.7 7.5 2.2 3.1 2.9 2Q23 1Q24 2Q24 (1) Other deposits represent non-customer balances primarily consisting of wholesale funding (for example, Eurodollar trade deposits, selected deposits and brokered time deposits) • Average deposits decreased modestly; Ending deposits decreased ~2% reflecting anticipated tax seasonality • Deposit remixing has slowed; NIB mix has remained steady in the low 30% range • Competitive pricing and customer demand for promotional products remain stable • Expect 2024 average deposits to be stable to down modestly compared to 2023 Average Deposits by Segment ($ in billions) Deposits Deposit trends are stabilizing QoQ Highlights & Outlook Wealth Mgt Other(1) Consumer Bank Corporate Bank Ending Deposits by Segment ($ in billions)

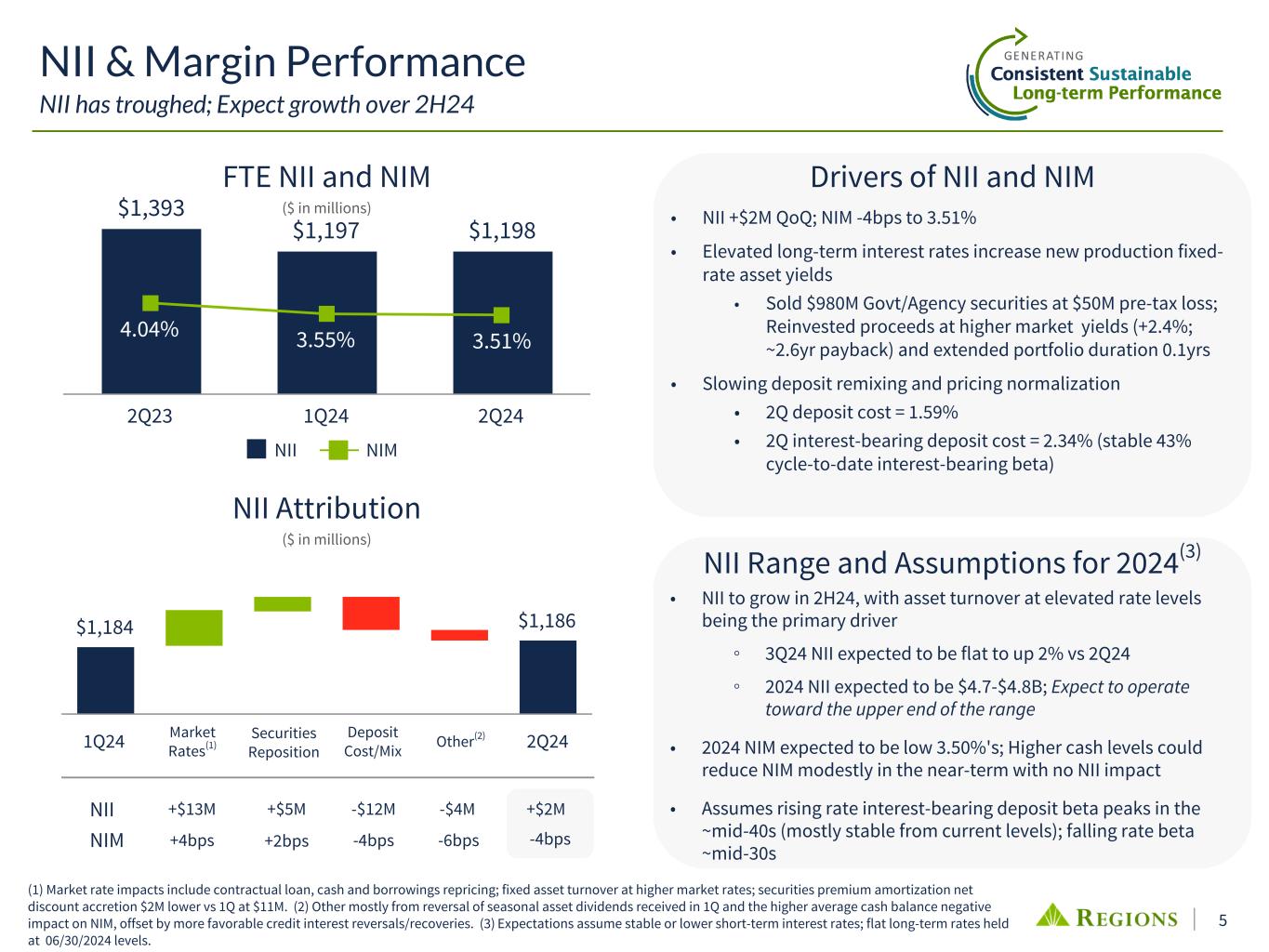

5 (1) Market rate impacts include contractual loan, cash and borrowings repricing; fixed asset turnover at higher market rates; securities premium amortization net discount accretion $2M lower vs 1Q at $11M. (2) Other mostly from reversal of seasonal asset dividends received in 1Q and the higher average cash balance negative impact on NIM, offset by more favorable credit interest reversals/recoveries. (3) Expectations assume stable or lower short-term interest rates; flat long-term rates held at 06/30/2024 levels. Market Rates(1) • NII +$2M QoQ; NIM -4bps to 3.51% • Elevated long-term interest rates increase new production fixed- rate asset yields • Sold $980M Govt/Agency securities at $50M pre-tax loss; Reinvested proceeds at higher market yields (+2.4%; ~2.6yr payback) and extended portfolio duration 0.1yrs • Slowing deposit remixing and pricing normalization • 2Q deposit cost = 1.59% • 2Q interest-bearing deposit cost = 2.34% (stable 43% cycle-to-date interest-bearing beta) $1,184 $1,186 2Q24 1Q24 +2bps -6bps+4bps +$5M -$4M+$13MNII NIM NII & Margin Performance NII has troughed; Expect growth over 2H24 Other(2) -$12M -4bps $1,393 $1,197 $1,198 4.04% 3.55% 3.51% 2Q23 1Q24 2Q24 NII Range and Assumptions for 2024(3) NII NIM Deposit Cost/Mix +$2M -4bps Securities Reposition FTE NII and NIM ($ in millions) NII Attribution ($ in millions) Drivers of NII and NIM • NII to grow in 2H24, with asset turnover at elevated rate levels being the primary driver ◦ 3Q24 NII expected to be flat to up 2% vs 2Q24 ◦ 2024 NII expected to be $4.7-$4.8B; Expect to operate toward the upper end of the range • 2024 NIM expected to be low 3.50%'s; Higher cash levels could reduce NIM modestly in the near-term with no NII impact • Assumes rising rate interest-bearing deposit beta peaks in the ~mid-40s (mostly stable from current levels); falling rate beta ~mid-30s

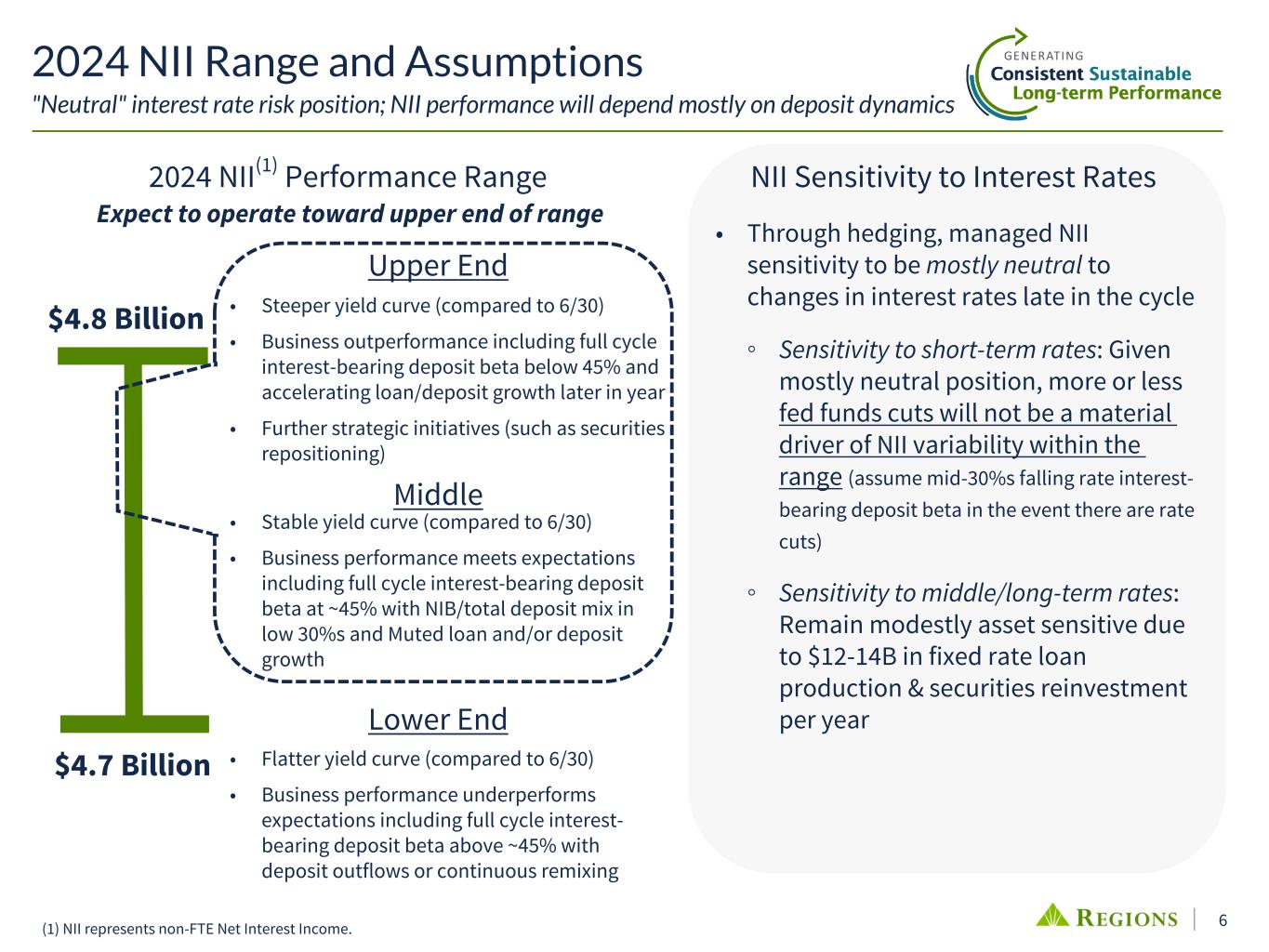

6 • Flatter yield curve (compared to 6/30) • Business performance underperforms expectations including full cycle interest- bearing deposit beta above ~45% with deposit outflows or continuous remixing 2024 NII Range and Assumptions "Neutral" interest rate risk position; NII performance will depend mostly on deposit dynamics (1) NII represents non-FTE Net Interest Income. 2024 NII(1) Performance Range NII Sensitivity to Interest Rates $4.8 Billion $4.7 Billion Upper End Lower End • Through hedging, managed NII sensitivity to be mostly neutral to changes in interest rates late in the cycle ◦ Sensitivity to short-term rates: Given mostly neutral position, more or less fed funds cuts will not be a material driver of NII variability within the range (assume mid-30%s falling rate interest- bearing deposit beta in the event there are rate cuts) ◦ Sensitivity to middle/long-term rates: Remain modestly asset sensitive due to $12-14B in fixed rate loan production & securities reinvestment per year Middle Expect to operate toward upper end of range • Steeper yield curve (compared to 6/30) • Business outperformance including full cycle interest-bearing deposit beta below 45% and accelerating loan/deposit growth later in year • Further strategic initiatives (such as securities repositioning) • Stable yield curve (compared to 6/30) • Business performance meets expectations including full cycle interest-bearing deposit beta at ~45% with NIB/total deposit mix in low 30%s and Muted loan and/or deposit growth

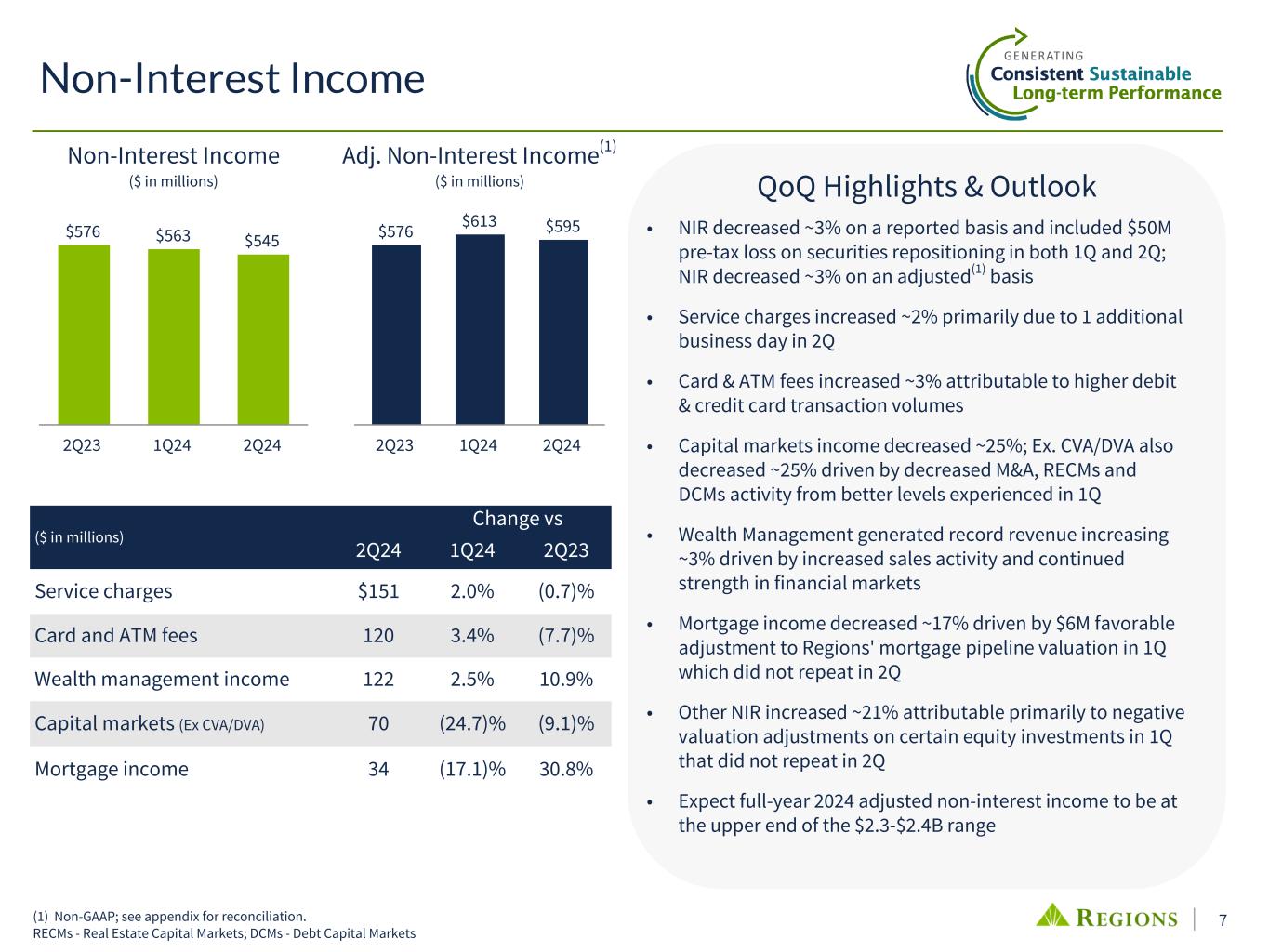

7 $576 $613 $595 2Q23 1Q24 2Q24 ($ in millions) Change vs 2Q24 1Q24 2Q23 Service charges $151 2.0% (0.7)% Card and ATM fees 120 3.4% (7.7)% Wealth management income 122 2.5% 10.9% Capital markets (Ex CVA/DVA) 70 (24.7)% (9.1)% Mortgage income 34 (17.1)% 30.8% Non-Interest Income (1) Non-GAAP; see appendix for reconciliation. RECMs - Real Estate Capital Markets; DCMs - Debt Capital Markets • NIR decreased ~3% on a reported basis and included $50M pre-tax loss on securities repositioning in both 1Q and 2Q; NIR decreased ~3% on an adjusted(1) basis • Service charges increased ~2% primarily due to 1 additional business day in 2Q • Card & ATM fees increased ~3% attributable to higher debit & credit card transaction volumes • Capital markets income decreased ~25%; Ex. CVA/DVA also decreased ~25% driven by decreased M&A, RECMs and DCMs activity from better levels experienced in 1Q • Wealth Management generated record revenue increasing ~3% driven by increased sales activity and continued strength in financial markets • Mortgage income decreased ~17% driven by $6M favorable adjustment to Regions' mortgage pipeline valuation in 1Q which did not repeat in 2Q • Other NIR increased ~21% attributable primarily to negative valuation adjustments on certain equity investments in 1Q that did not repeat in 2Q • Expect full-year 2024 adjusted non-interest income to be at the upper end of the $2.3-$2.4B range $576 $563 $545 2Q23 1Q24 2Q24 Non-Interest Income ($ in millions) Adj. Non-Interest Income(1) ($ in millions) QoQ Highlights & Outlook

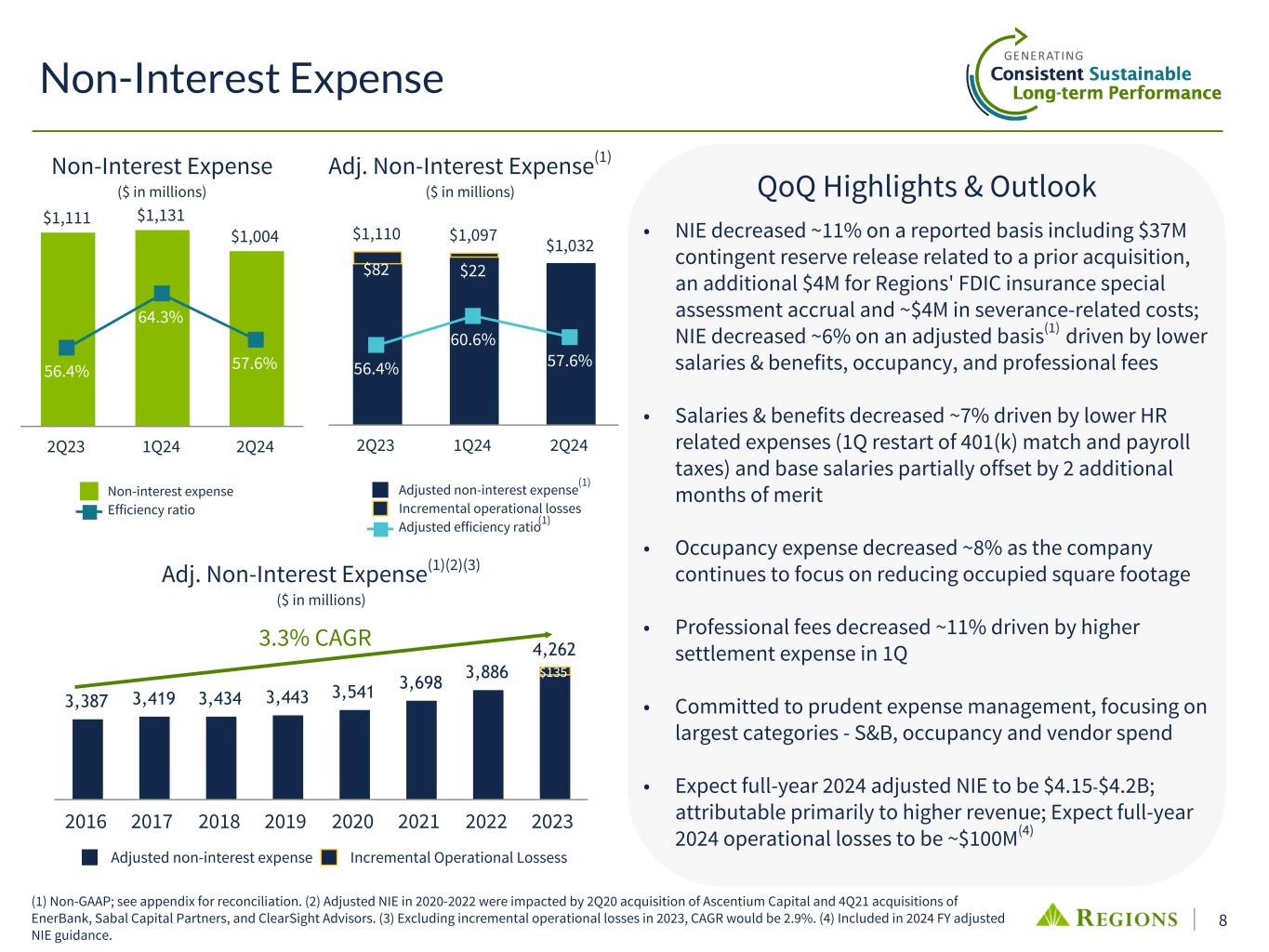

8 $1,111 $1,131 $1,004 56.4% 64.3% 57.6% Non-interest expense Efficiency ratio 2Q23 1Q24 2Q24 $1,110 $1,097 $1,032 $82 $22 $— 56.4% 60.6% 57.6% Adjusted non-interest expense Incremental operational losses Adjusted efficiency ratio 2Q23 1Q24 2Q24 • NIE decreased ~11% on a reported basis including $37M contingent reserve release related to a prior acquisition, an additional $4M for Regions' FDIC insurance special assessment accrual and ~$4M in severance-related costs; NIE decreased ~6% on an adjusted basis(1) driven by lower salaries & benefits, occupancy, and professional fees • Salaries & benefits decreased ~7% driven by lower HR related expenses (1Q restart of 401(k) match and payroll taxes) and base salaries partially offset by 2 additional months of merit • Occupancy expense decreased ~8% as the company continues to focus on reducing occupied square footage • Professional fees decreased ~11% driven by higher settlement expense in 1Q • Committed to prudent expense management, focusing on largest categories - S&B, occupancy and vendor spend • Expect full-year 2024 adjusted NIE to be $4.15-$4.2B; attributable primarily to higher revenue; Expect full-year 2024 operational losses to be ~$100M(4) 3,387 3,419 3,434 3,443 3,541 3,698 3,886 4,262 $135 Adjusted non-interest expense Incremental Operational Lossess 2016 2017 2018 2019 2020 2021 2022 2023 Non-Interest Expense 3.3% CAGR (1) (1) Non-GAAP; see appendix for reconciliation. (2) Adjusted NIE in 2020-2022 were impacted by 2Q20 acquisition of Ascentium Capital and 4Q21 acquisitions of EnerBank, Sabal Capital Partners, and ClearSight Advisors. (3) Excluding incremental operational losses in 2023, CAGR would be 2.9%. (4) Included in 2024 FY adjusted NIE guidance. (1) Non-Interest Expense ($ in millions) Adj. Non-Interest Expense(1) ($ in millions) Adj. Non-Interest Expense(1)(2)(3) ($ in millions) QoQ Highlights & Outlook

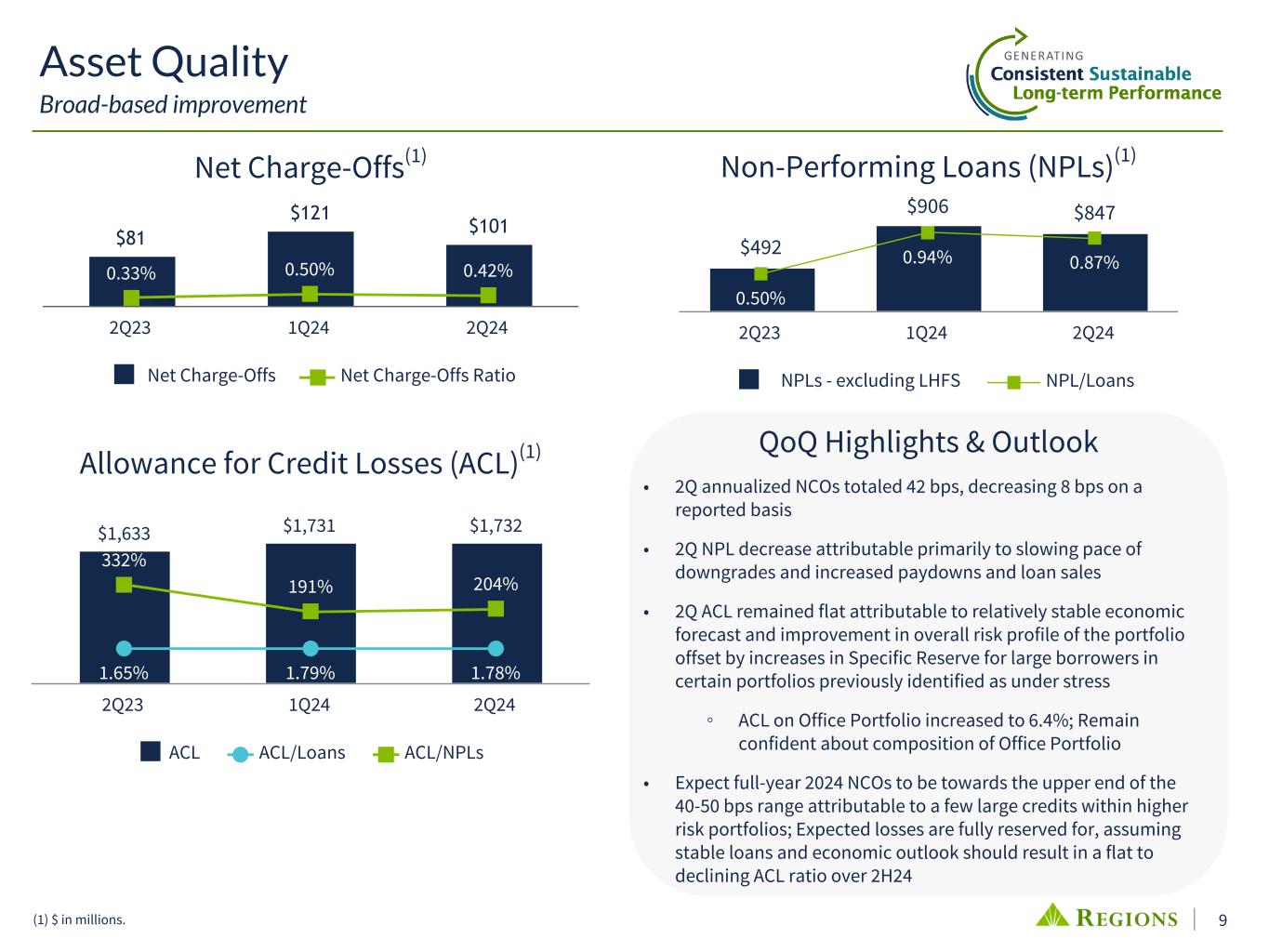

9 • 2Q annualized NCOs totaled 42 bps, decreasing 8 bps on a reported basis • 2Q NPL decrease attributable primarily to slowing pace of downgrades and increased paydowns and loan sales • 2Q ACL remained flat attributable to relatively stable economic forecast and improvement in overall risk profile of the portfolio offset by increases in Specific Reserve for large borrowers in certain portfolios previously identified as under stress ◦ ACL on Office Portfolio increased to 6.4%; Remain confident about composition of Office Portfolio • Expect full-year 2024 NCOs to be towards the upper end of the 40-50 bps range attributable to a few large credits within higher risk portfolios; Expected losses are fully reserved for, assuming stable loans and economic outlook should result in a flat to declining ACL ratio over 2H24 Asset Quality Broad-based improvement $1,633 $1,731 $1,732 1.65% 1.79% 1.78% 332% 191% 204% ACL ACL/Loans ACL/NPLs 2Q23 1Q24 2Q24 $81 $121 $101 0.33% 0.50% 0.42% Net Charge-Offs Net Charge-Offs Ratio 2Q23 1Q24 2Q24 $492 $906 $847 0.50% 0.94% 0.87% NPLs - excluding LHFS NPL/Loans 2Q23 1Q24 2Q24 (1) $ in millions. Net Charge-Offs(1) Allowance for Credit Losses (ACL)(1) Non-Performing Loans (NPLs)(1) QoQ Highlights & Outlook

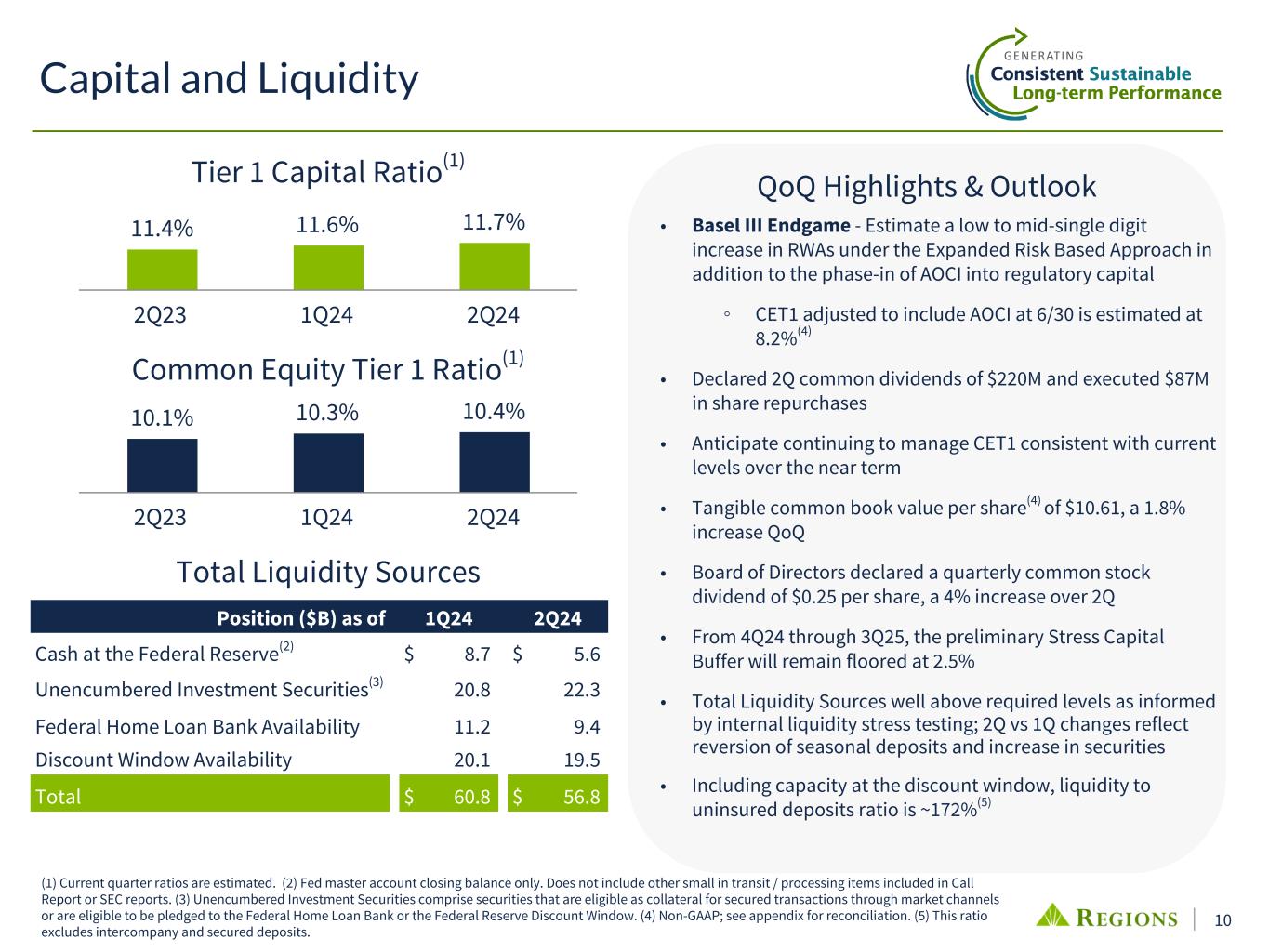

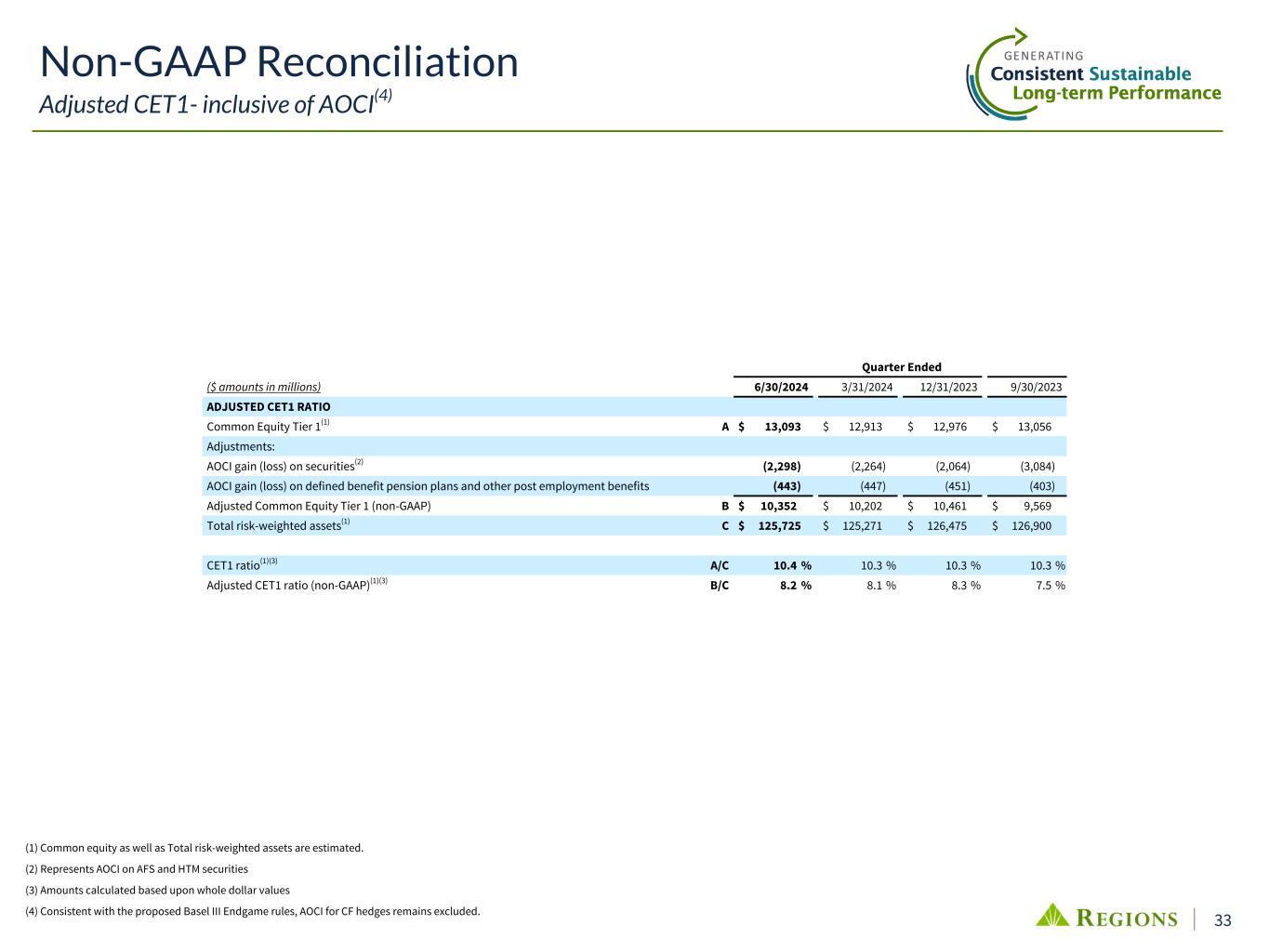

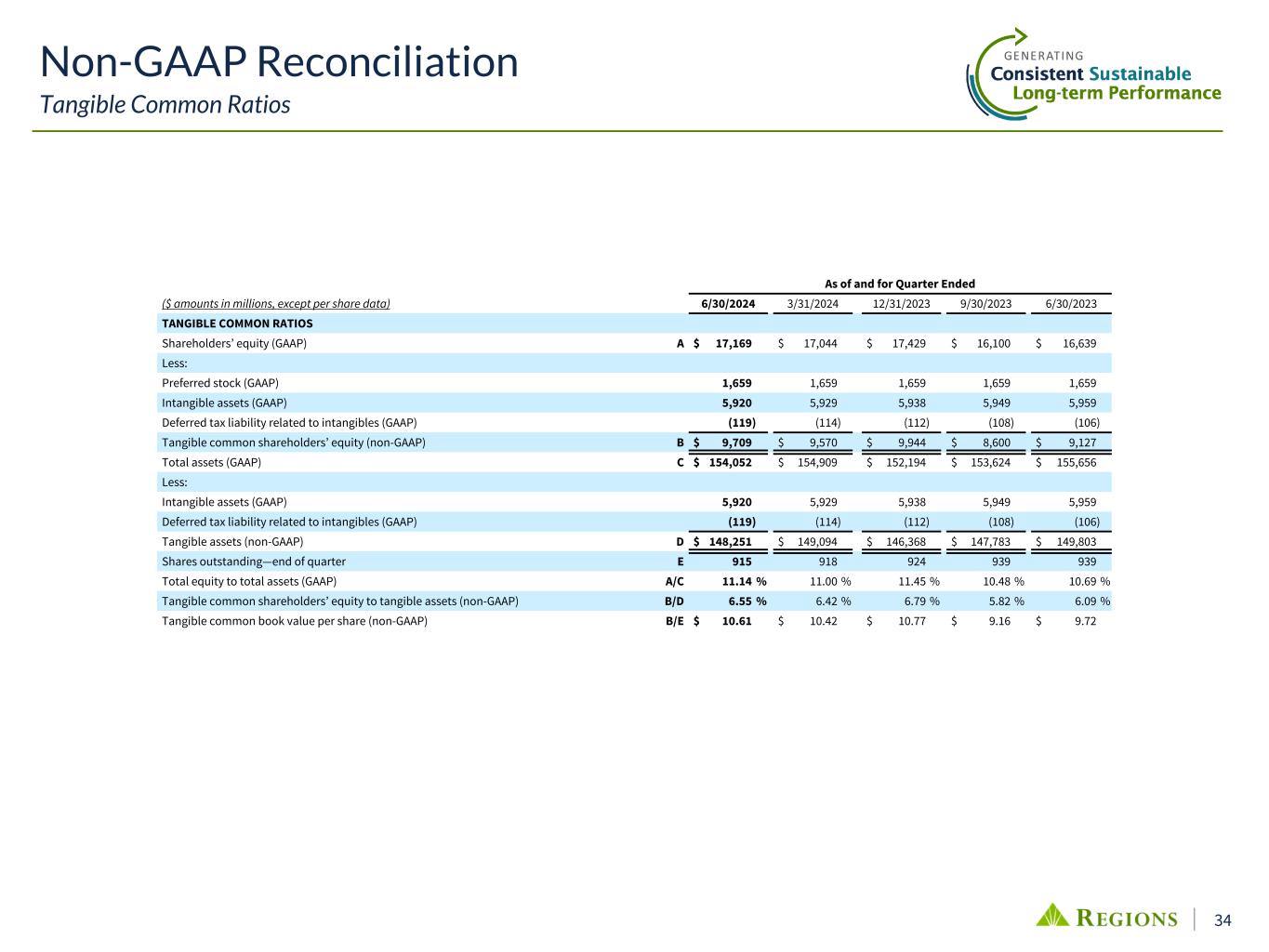

10 • Basel III Endgame - Estimate a low to mid-single digit increase in RWAs under the Expanded Risk Based Approach in addition to the phase-in of AOCI into regulatory capital ◦ CET1 adjusted to include AOCI at 6/30 is estimated at 8.2%(4) • Declared 2Q common dividends of $220M and executed $87M in share repurchases • Anticipate continuing to manage CET1 consistent with current levels over the near term • Tangible common book value per share(4) of $10.61, a 1.8% increase QoQ • Board of Directors declared a quarterly common stock dividend of $0.25 per share, a 4% increase over 2Q • From 4Q24 through 3Q25, the preliminary Stress Capital Buffer will remain floored at 2.5% • Total Liquidity Sources well above required levels as informed by internal liquidity stress testing; 2Q vs 1Q changes reflect reversion of seasonal deposits and increase in securities • Including capacity at the discount window, liquidity to uninsured deposits ratio is ~172%(5) 10.1% 10.3% 10.4% 2Q23 1Q24 2Q24 Capital and Liquidity 11.4% 11.6% 11.7% 2Q23 1Q24 2Q24 Tier 1 Capital Ratio(1) Common Equity Tier 1 Ratio(1) Position ($B) as of 1Q24 2Q24 Cash at the Federal Reserve(2) $ 8.7 $ 5.6 Unencumbered Investment Securities(3) 20.8 22.3 Federal Home Loan Bank Availability 11.2 9.4 Discount Window Availability 20.1 19.5 Total $ 60.8 $ 56.8 (1) Current quarter ratios are estimated. (2) Fed master account closing balance only. Does not include other small in transit / processing items included in Call Report or SEC reports. (3) Unencumbered Investment Securities comprise securities that are eligible as collateral for secured transactions through market channels or are eligible to be pledged to the Federal Home Loan Bank or the Federal Reserve Discount Window. (4) Non-GAAP; see appendix for reconciliation. (5) This ratio excludes intercompany and secured deposits. Total Liquidity Sources QoQ Highlights & Outlook

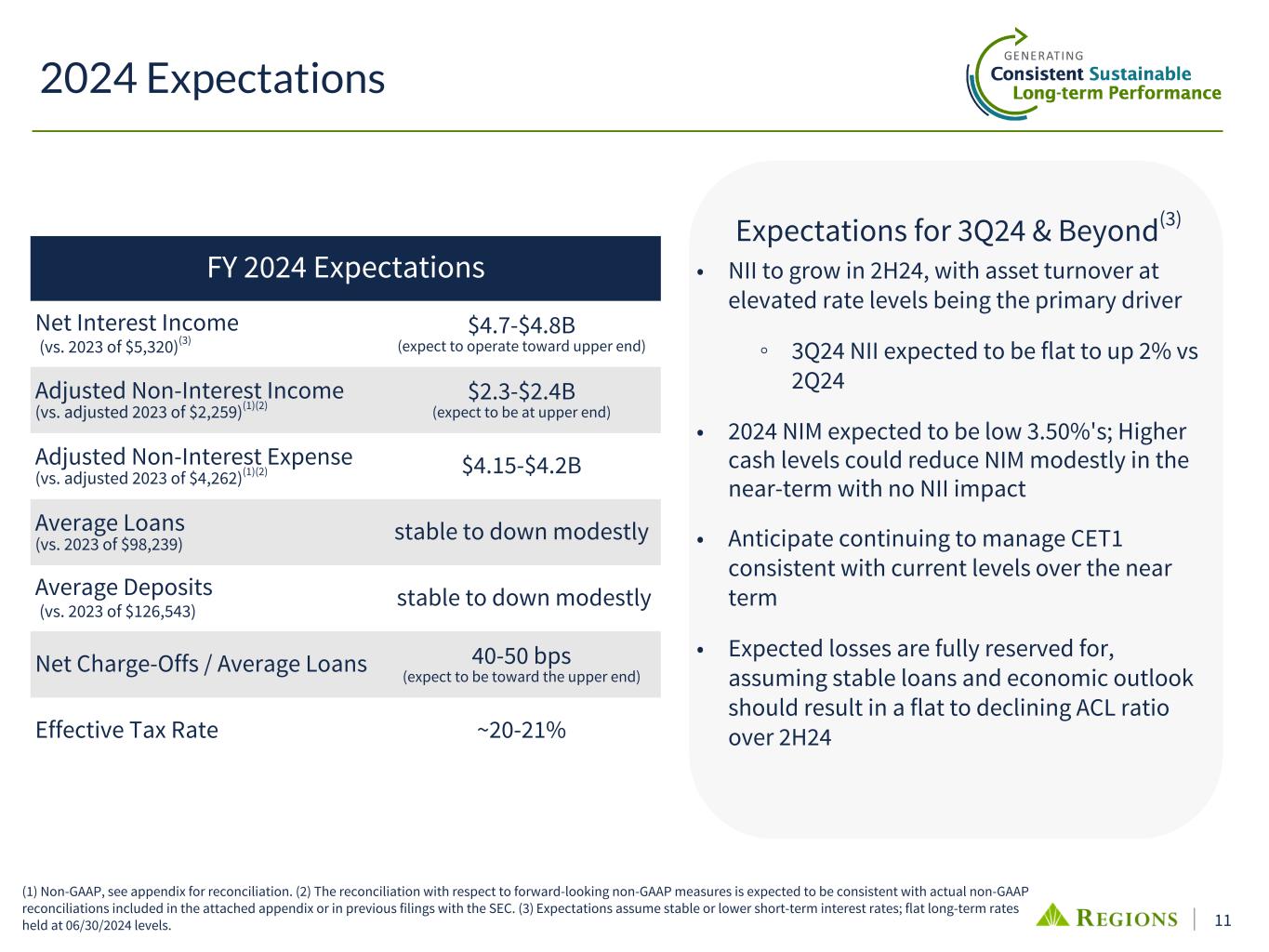

11 2024 Expectations (1) Non-GAAP, see appendix for reconciliation. (2) The reconciliation with respect to forward-looking non-GAAP measures is expected to be consistent with actual non-GAAP reconciliations included in the attached appendix or in previous filings with the SEC. (3) Expectations assume stable or lower short-term interest rates; flat long-term rates held at 06/30/2024 levels. FY 2024 Expectations Net Interest Income (vs. 2023 of $5,320)(3) $4.7-$4.8B (expect to operate toward upper end) Adjusted Non-Interest Income (vs. adjusted 2023 of $2,259)(1)(2) $2.3-$2.4B (expect to be at upper end) Adjusted Non-Interest Expense (vs. adjusted 2023 of $4,262)(1)(2) $4.15-$4.2B Average Loans (vs. 2023 of $98,239) stable to down modestly Average Deposits (vs. 2023 of $126,543) stable to down modestly Net Charge-Offs / Average Loans 40-50 bps (expect to be toward the upper end) Effective Tax Rate ~20-21% Expectations for 3Q24 & Beyond(3) • NII to grow in 2H24, with asset turnover at elevated rate levels being the primary driver ◦ 3Q24 NII expected to be flat to up 2% vs 2Q24 • 2024 NIM expected to be low 3.50%'s; Higher cash levels could reduce NIM modestly in the near-term with no NII impact • Anticipate continuing to manage CET1 consistent with current levels over the near term • Expected losses are fully reserved for, assuming stable loans and economic outlook should result in a flat to declining ACL ratio over 2H24

Appendix

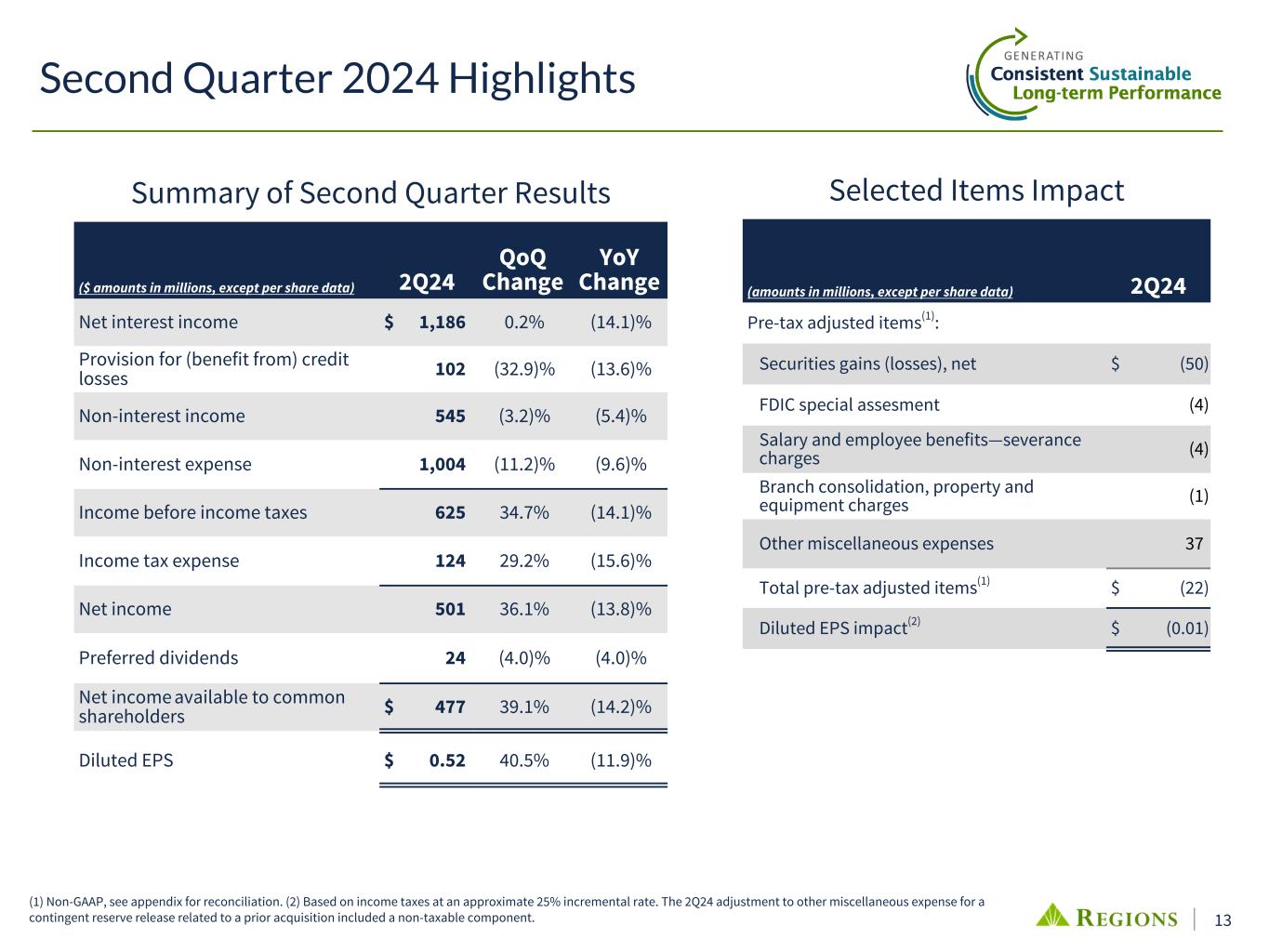

13 Selected Items Impact Second Quarter 2024 Highlights (1) Non-GAAP, see appendix for reconciliation. (2) Based on income taxes at an approximate 25% incremental rate. The 2Q24 adjustment to other miscellaneous expense for a contingent reserve release related to a prior acquisition included a non-taxable component. ($ amounts in millions, except per share data) 2Q24 QoQ Change YoY Change Net interest income $ 1,186 0.2% (14.1)% Provision for (benefit from) credit losses 102 (32.9)% (13.6)% Non-interest income 545 (3.2)% (5.4)% Non-interest expense 1,004 (11.2)% (9.6)% Income before income taxes 625 34.7% (14.1)% Income tax expense 124 29.2% (15.6)% Net income 501 36.1% (13.8)% Preferred dividends 24 (4.0)% (4.0)% Net income available to common shareholders $ 477 39.1% (14.2)% Diluted EPS $ 0.52 40.5% (11.9)% Summary of Second Quarter Results (amounts in millions, except per share data) 2Q24 Pre-tax adjusted items(1): Securities gains (losses), net $ (50) FDIC special assesment (4) Salary and employee benefits—severance charges (4) Branch consolidation, property and equipment charges (1) Other miscellaneous expenses 37 Total pre-tax adjusted items(1) $ (22) Diluted EPS impact(2) $ (0.01)

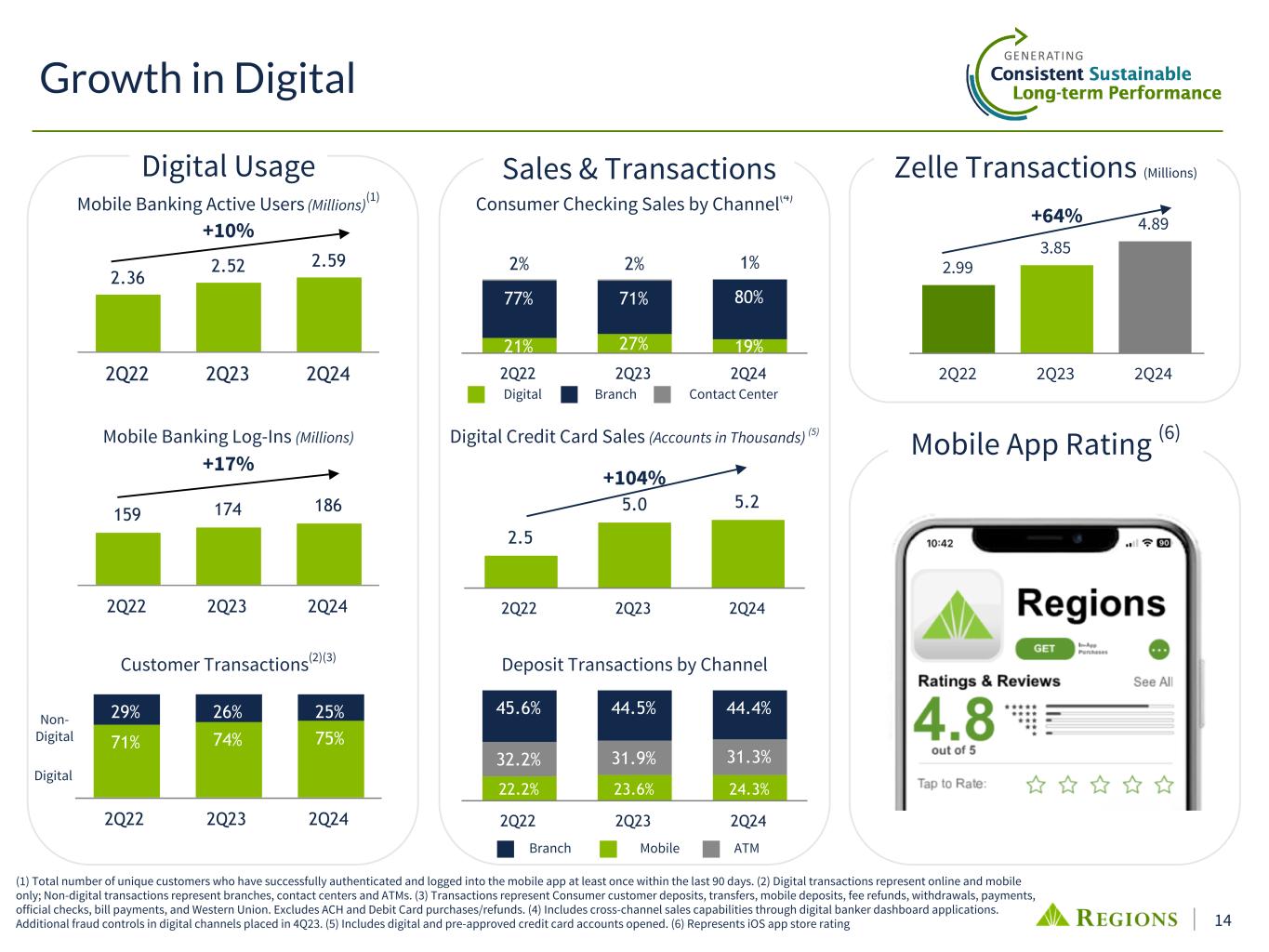

14 2.36 2.52 2.59 2Q22 2Q23 2Q24 2.99 3.85 4.89 2Q22 2Q23 2Q24 159 174 186 2Q22 2Q23 2Q24 22.2% 23.6% 24.3% 32.2% 31.9% 31.3% 45.6% 44.5% 44.4% 2Q22 2Q23 2Q24 2.5 5.0 5.2 2Q22 2Q23 2Q24 71% 74% 75% 29% 26% 25% 2Q22 2Q23 2Q24 Growth in Digital Mobile Banking Log-Ins (Millions) Customer Transactions(2)(3) Deposit Transactions by Channel Mobile Banking Active Users (Millions)(1) Digital Credit Card Sales (Accounts in Thousands) (5) Digital Non- Digital Mobile ATMBranch +64% +17% 21% 27% 19% 77% 71% 80% 2% 2% 1% 2Q22 2Q23 2Q24 Digital Branch Contact Center Consumer Checking Sales by Channel(4) Mobile App Rating (6) Zelle Transactions (Millions)Sales & TransactionsDigital Usage +10% (1) Total number of unique customers who have successfully authenticated and logged into the mobile app at least once within the last 90 days. (2) Digital transactions represent online and mobile only; Non-digital transactions represent branches, contact centers and ATMs. (3) Transactions represent Consumer customer deposits, transfers, mobile deposits, fee refunds, withdrawals, payments, official checks, bill payments, and Western Union. Excludes ACH and Debit Card purchases/refunds. (4) Includes cross-channel sales capabilities through digital banker dashboard applications. Additional fraud controls in digital channels placed in 4Q23. (5) Includes digital and pre-approved credit card accounts opened. (6) Represents iOS app store rating +104%

15 (1) Total Wealth Management Relationships as of May '24 to May '23. Investments in Our Businesses Investments in talent, technology and strategic acquisitions continue to pay off • Real Estate Capital Markets 2Q24 origination revenue up 15% vs 2Q23 • Clearsight & BlackArch acquisitions remain well-positioned for revenue synergies with strong pipelines • Ascentium Capital is providing cross-sell opportunities throughout our Commercial & Branch network • Launched new cash management client tools CashFlow IQ and CashFlow Advisor • Continued focus on Small Business resources in key strategic markets • Ongoing investment in modernizing Lending, Treasury Management, Embedded Finance, & Client-Facing Digital platforms Corporate • 1st in VISA Power Score for 41 consecutive quarters on Debit • Mobile app improvements: Zelle for Small Business and Card Services enhancements; 2Q24 mobile users increased 3% YoY • Implemented new digital SMS onboarding system for consumer checking customers • Hiring Mortgage Producers in key growth markets • Continue to grow primary consumer checking relationships & deepen customer relationships • Raising the bar on industry leading Customer Satisfaction • Enhanced personalization with Regions Greenprint to help customers build financial confidence Consumer • Total Wealth Management Relationship growth of 8.1%(1) • Non-Interest Revenue up 11% vs 2Q23; Record quarterly NIR • Creating buzz since the launch of the Philanthropic Solutions group with 434k impressions through Regions' direct channels, and more than 27 million in readership through news article • Protecting our clients through enhanced focus on fraud prevention, identifying trends, and client education through podcasts and email drip campaigns • Launched the Wealth Advisor Locator Tool on Regions.com; over 500k site visits in 2Q24 Wealth

16 Notional Fixed Rate Maturity AFS Securities(3) $1.3B 4.8% 0.9 years Debt(3) (4) $1.4B 0.6% 2.3 years Time Deposits(3) $0.3B 5.0% 0.4 years 1 2 3 4 Cash Flow Hedge Notional(1) (1) Floating rate leg of swaps vs overnight SOFR. (2) Collars use short interest rate caps to pay for long interest rate floors; weighted avg. floor of 1.86%, weighted avg. cap of 6.22%. (3) Fair value hedges on securities pay fixed; fair value hedges on debt and time deposits receive fixed. (4) Excludes forward-starting fair value swap on Q2 2024 debt issuance. (Quarterly Avg) 1 2 3 4 5 6 2.86% 2.92% 2.95% 3.03% 3.18% 3.59% 3.63% 2024 2025 2026 2027 2028 2029 2030 $19.9B $19.0B $16.9B $14.2B $8.6B $2.6B $2.0B - - - - +$0.5B +$1.0B +$1.0B $19.9B $19.0B $16.9B $14.2B $9.1B $3.6B $3.0B (Annual Avg) as of 6/30/2024 2Q24 3Q24 4Q24 1Q25 Swap Notional - 1Q24 $20.6B $19.6B $19.0B $19.6B 2Q24 Swap Changes - - - - Swap Notional - 2Q24 $20.6B $19.6B $19.0B $19.6B Swaps Swap Receive Rate(1) 2.83% 2.85% 2.85% $1.0B $2.0B $2.0B $2.0B $1.0B $0.0B $0.0BCollar Notional(2) $0.5B $1.5B $1.5B $2.0B Collars Hedging Strategy Update Creates mostly "neutral" interest rate risk position with well-protected margin in 3.50%s Fair Value Swaps(1) 2Q 2024 Activity Cash Flow Hedging - Hedges in place provide a well protected sensitivity profile in the near-term. Focused on opportunistically adding protection in outer years • Added $1B in forward-starting (July '28), 3-year receive- fixed swaps (3.83%)

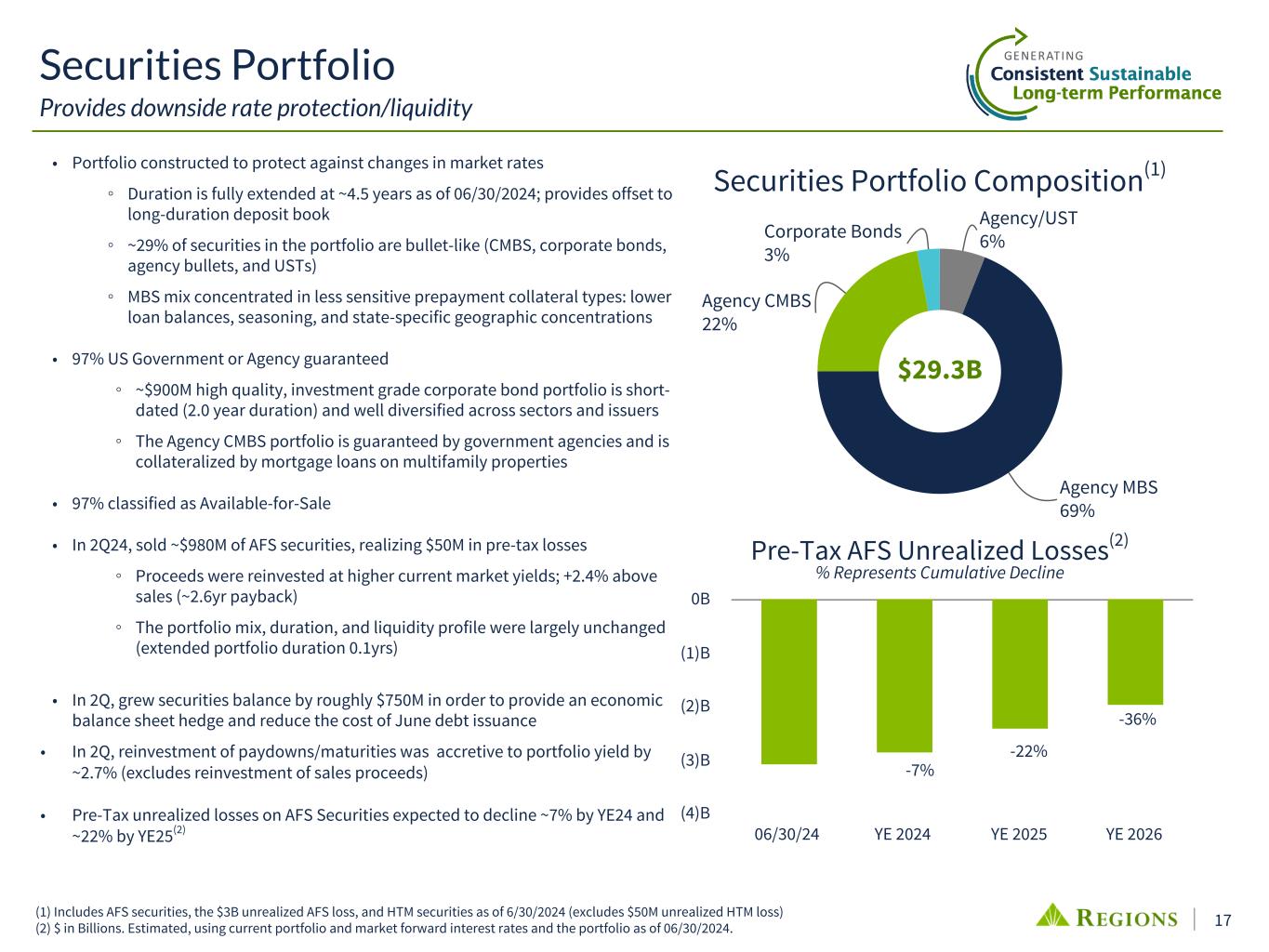

17 • Portfolio constructed to protect against changes in market rates ◦ Duration is fully extended at ~4.5 years as of 06/30/2024; provides offset to long-duration deposit book ◦ ~29% of securities in the portfolio are bullet-like (CMBS, corporate bonds, agency bullets, and USTs) ◦ MBS mix concentrated in less sensitive prepayment collateral types: lower loan balances, seasoning, and state-specific geographic concentrations • 97% US Government or Agency guaranteed ◦ ~$900M high quality, investment grade corporate bond portfolio is short- dated (2.0 year duration) and well diversified across sectors and issuers ◦ The Agency CMBS portfolio is guaranteed by government agencies and is collateralized by mortgage loans on multifamily properties • 97% classified as Available-for-Sale • In 2Q24, sold ~$980M of AFS securities, realizing $50M in pre-tax losses ◦ Proceeds were reinvested at higher current market yields; +2.4% above sales (~2.6yr payback) ◦ The portfolio mix, duration, and liquidity profile were largely unchanged (extended portfolio duration 0.1yrs) • In 2Q, grew securities balance by roughly $750M in order to provide an economic balance sheet hedge and reduce the cost of June debt issuance • In 2Q, reinvestment of paydowns/maturities was accretive to portfolio yield by ~2.7% (excludes reinvestment of sales proceeds) • Pre-Tax unrealized losses on AFS Securities expected to decline ~7% by YE24 and ~22% by YE25(2) (1) Includes AFS securities, the $3B unrealized AFS loss, and HTM securities as of 6/30/2024 (excludes $50M unrealized HTM loss) (2) $ in Billions. Estimated, using current portfolio and market forward interest rates and the portfolio as of 06/30/2024. Agency/UST 6% Agency MBS 69% Agency CMBS 22% Corporate Bonds 3% Securities Portfolio Provides downside rate protection/liquidity Securities Portfolio Composition(1) $29.3B Pre-Tax AFS Unrealized Losses(2) % Represents Cumulative Decline 06/30/24 YE 2024 YE 2025 YE 2026 (4)B (3)B (2)B (1)B 0B -7% -22% -36%

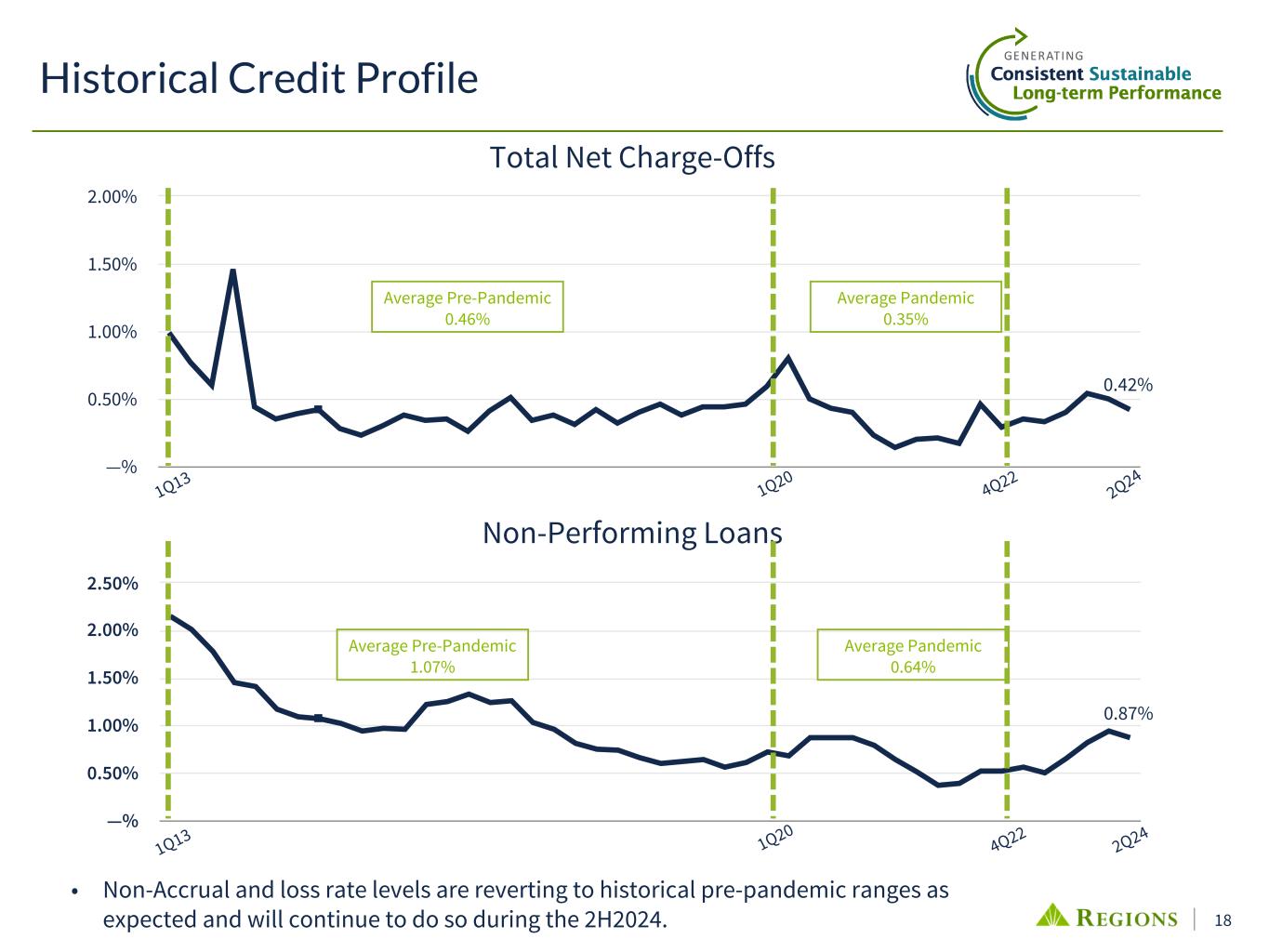

18 0.87% —% 0.50% 1.00% 1.50% 2.00% 2.50% 0.42% —% 0.50% 1.00% 1.50% 2.00% Historical Credit Profile Non-Performing Loans Total Net Charge-Offs 1Q20 2Q24 4Q221Q20 4Q22 2Q24 • Non-Accrual and loss rate levels are reverting to historical pre-pandemic ranges as expected and will continue to do so during the 2H2024. Average Pre-Pandemic 0.46% Average Pandemic 0.35% Average Pre-Pandemic 1.07% Average Pandemic 0.64% 1Q13 1Q13

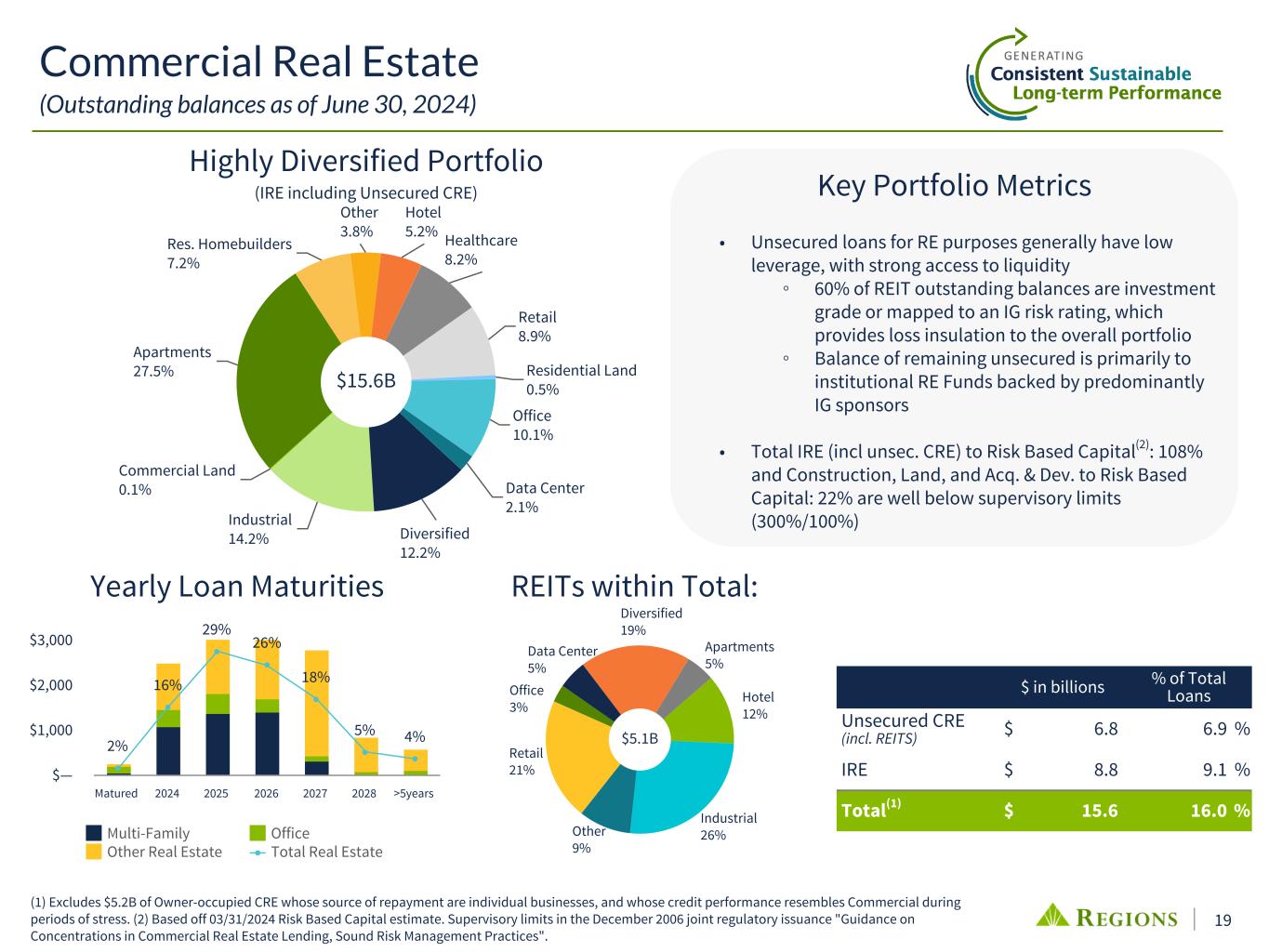

19 Commercial Real Estate (Outstanding balances as of June 30, 2024) Highly Diversified Portfolio (IRE including Unsecured CRE) (1) Excludes $5.2B of Owner-occupied CRE whose source of repayment are individual businesses, and whose credit performance resembles Commercial during periods of stress. (2) Based off 03/31/2024 Risk Based Capital estimate. Supervisory limits in the December 2006 joint regulatory issuance "Guidance on Concentrations in Commercial Real Estate Lending, Sound Risk Management Practices". Res. Homebuilders 7.2% Other 3.8% Hotel 5.2% Healthcare 8.2% Retail 8.9% Residential Land 0.5% Office 10.1% Data Center 2.1% Diversified 12.2% Industrial 14.2% Commercial Land 0.1% Apartments 27.5% $15.6B $ in billions % of Total Loans Unsecured CRE (incl. REITS) $ 6.8 6.9 % IRE $ 8.8 9.1 % Total(1) $ 15.6 16.0 % Yearly Loan Maturities 2% 16% 29% 26% 18% 5% 4% Multi-Family Office Other Real Estate Total Real Estate Matured 2024 2025 2026 2027 2028 >5years $— $1,000 $2,000 $3,000 Office 3% Data Center 5% Diversified 19% Apartments 5% Hotel 12% Industrial 26%Other 9% Retail 21% REITs within Total: $5.1B • Unsecured loans for RE purposes generally have low leverage, with strong access to liquidity ◦ 60% of REIT outstanding balances are investment grade or mapped to an IG risk rating, which provides loss insulation to the overall portfolio ◦ Balance of remaining unsecured is primarily to institutional RE Funds backed by predominantly IG sponsors • Total IRE (incl unsec. CRE) to Risk Based Capital(2): 108% and Construction, Land, and Acq. & Dev. to Risk Based Capital: 22% are well below supervisory limits (300%/100%) Key Portfolio Metrics

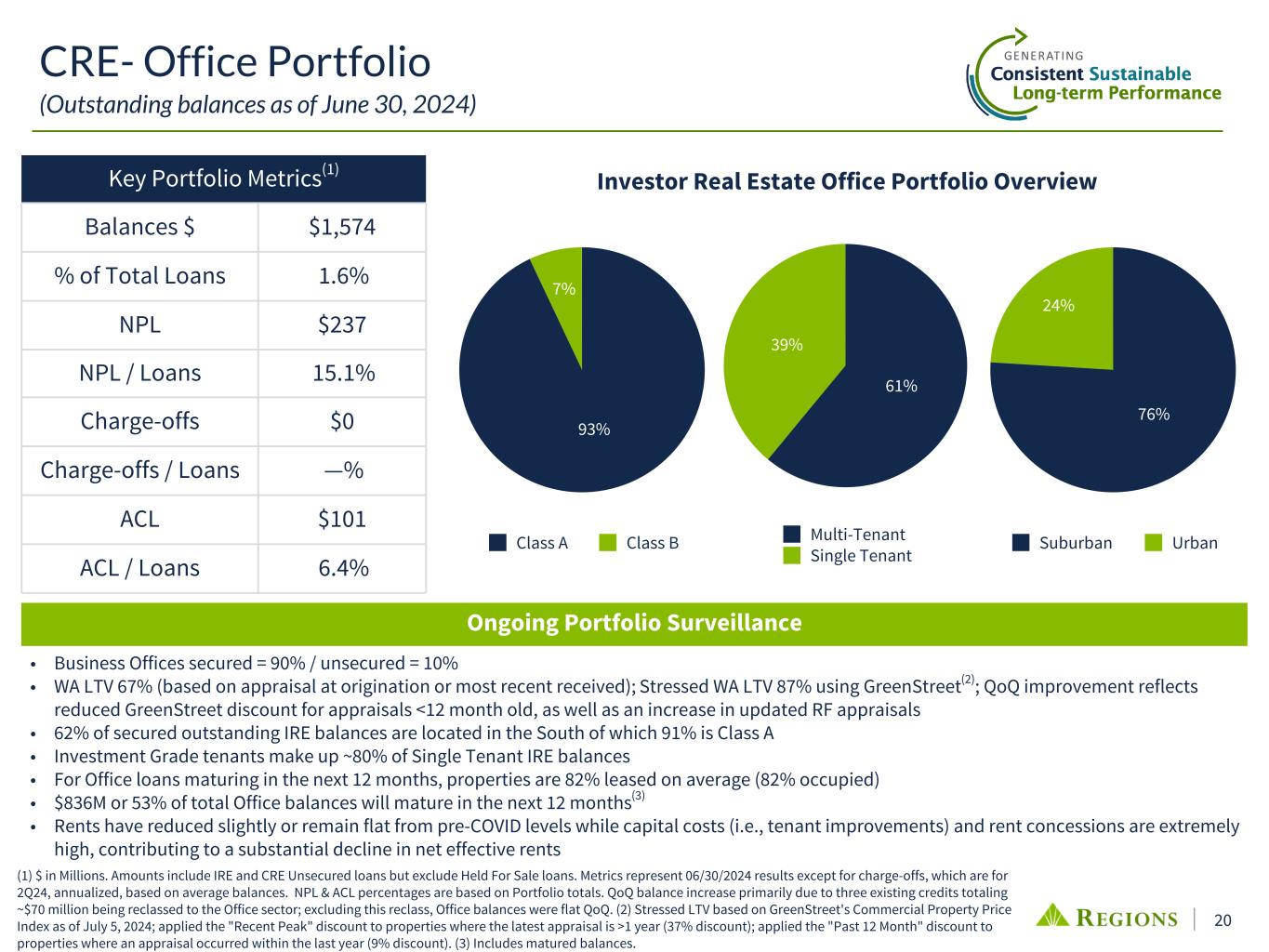

20 CRE- Office Portfolio (Outstanding balances as of June 30, 2024) (1) $ in Millions. Amounts include IRE and CRE Unsecured loans but exclude Held For Sale loans. Metrics represent 06/30/2024 results except for charge-offs, which are for 2Q24, annualized, based on average balances. NPL & ACL percentages are based on Portfolio totals. QoQ balance increase primarily due to three existing credits totaling ~$70 million being reclassed to the Office sector; excluding this reclass, Office balances were flat QoQ. (2) Stressed LTV based on GreenStreet's Commercial Property Price Index as of July 5, 2024; applied the "Recent Peak" discount to properties where the latest appraisal is >1 year (37% discount); applied the "Past 12 Month" discount to properties where an appraisal occurred within the last year (9% discount). (3) Includes matured balances. • Business Offices secured = 90% / unsecured = 10% • WA LTV 67% (based on appraisal at origination or most recent received); Stressed WA LTV 87% using GreenStreet(2); QoQ improvement reflects reduced GreenStreet discount for appraisals <12 month old, as well as an increase in updated RF appraisals • 62% of secured outstanding IRE balances are located in the South of which 91% is Class A • Investment Grade tenants make up ~80% of Single Tenant IRE balances • For Office loans maturing in the next 12 months, properties are 82% leased on average (82% occupied) • $836M or 53% of total Office balances will mature in the next 12 months(3) • Rents have reduced slightly or remain flat from pre-COVID levels while capital costs (i.e., tenant improvements) and rent concessions are extremely high, contributing to a substantial decline in net effective rents Key Portfolio Metrics(1) Balances $ $1,574 % of Total Loans 1.6% NPL $237 NPL / Loans 15.1% Charge-offs $0 Charge-offs / Loans —% ACL $101 ACL / Loans 6.4% Ongoing Portfolio Surveillance 61% 39% Multi-Tenant Single Tenant 93% 7% Class A Class B Investor Real Estate Office Portfolio Overview 76% 24% Suburban Urban

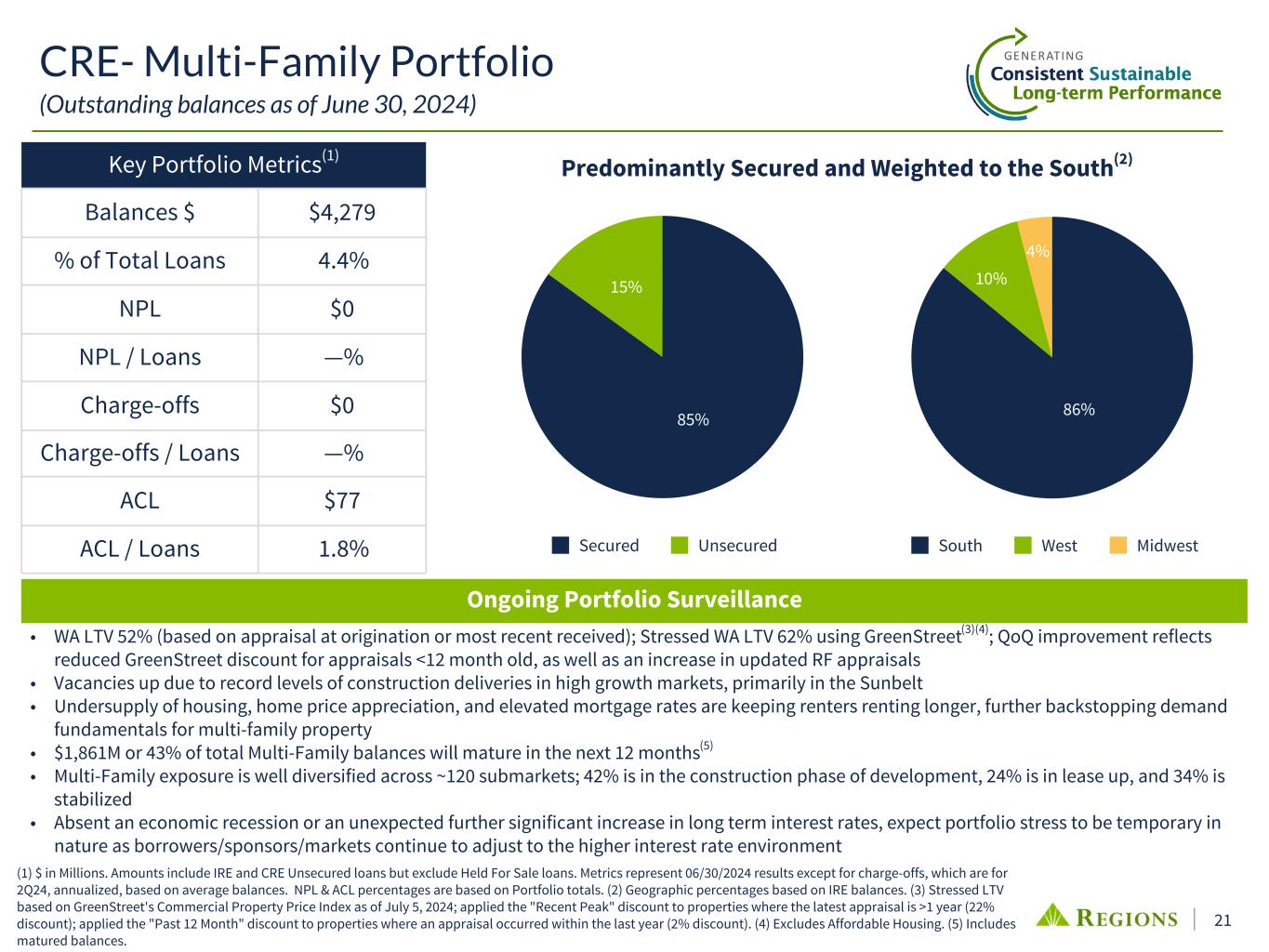

21 CRE- Multi-Family Portfolio (Outstanding balances as of June 30, 2024) Key Portfolio Metrics(1) Balances $ $4,279 % of Total Loans 4.4% NPL $0 NPL / Loans —% Charge-offs $0 Charge-offs / Loans —% ACL $77 ACL / Loans 1.8% • WA LTV 52% (based on appraisal at origination or most recent received); Stressed WA LTV 62% using GreenStreet(3)(4); QoQ improvement reflects reduced GreenStreet discount for appraisals <12 month old, as well as an increase in updated RF appraisals • Vacancies up due to record levels of construction deliveries in high growth markets, primarily in the Sunbelt • Undersupply of housing, home price appreciation, and elevated mortgage rates are keeping renters renting longer, further backstopping demand fundamentals for multi-family property • $1,861M or 43% of total Multi-Family balances will mature in the next 12 months(5) • Multi-Family exposure is well diversified across ~120 submarkets; 42% is in the construction phase of development, 24% is in lease up, and 34% is stabilized • Absent an economic recession or an unexpected further significant increase in long term interest rates, expect portfolio stress to be temporary in nature as borrowers/sponsors/markets continue to adjust to the higher interest rate environment Predominantly Secured and Weighted to the South(2) 86% 10% 4% South West Midwest 85% 15% Secured Unsecured Ongoing Portfolio Surveillance (1) $ in Millions. Amounts include IRE and CRE Unsecured loans but exclude Held For Sale loans. Metrics represent 06/30/2024 results except for charge-offs, which are for 2Q24, annualized, based on average balances. NPL & ACL percentages are based on Portfolio totals. (2) Geographic percentages based on IRE balances. (3) Stressed LTV based on GreenStreet's Commercial Property Price Index as of July 5, 2024; applied the "Recent Peak" discount to properties where the latest appraisal is >1 year (22% discount); applied the "Past 12 Month" discount to properties where an appraisal occurred within the last year (2% discount). (4) Excludes Affordable Housing. (5) Includes matured balances.

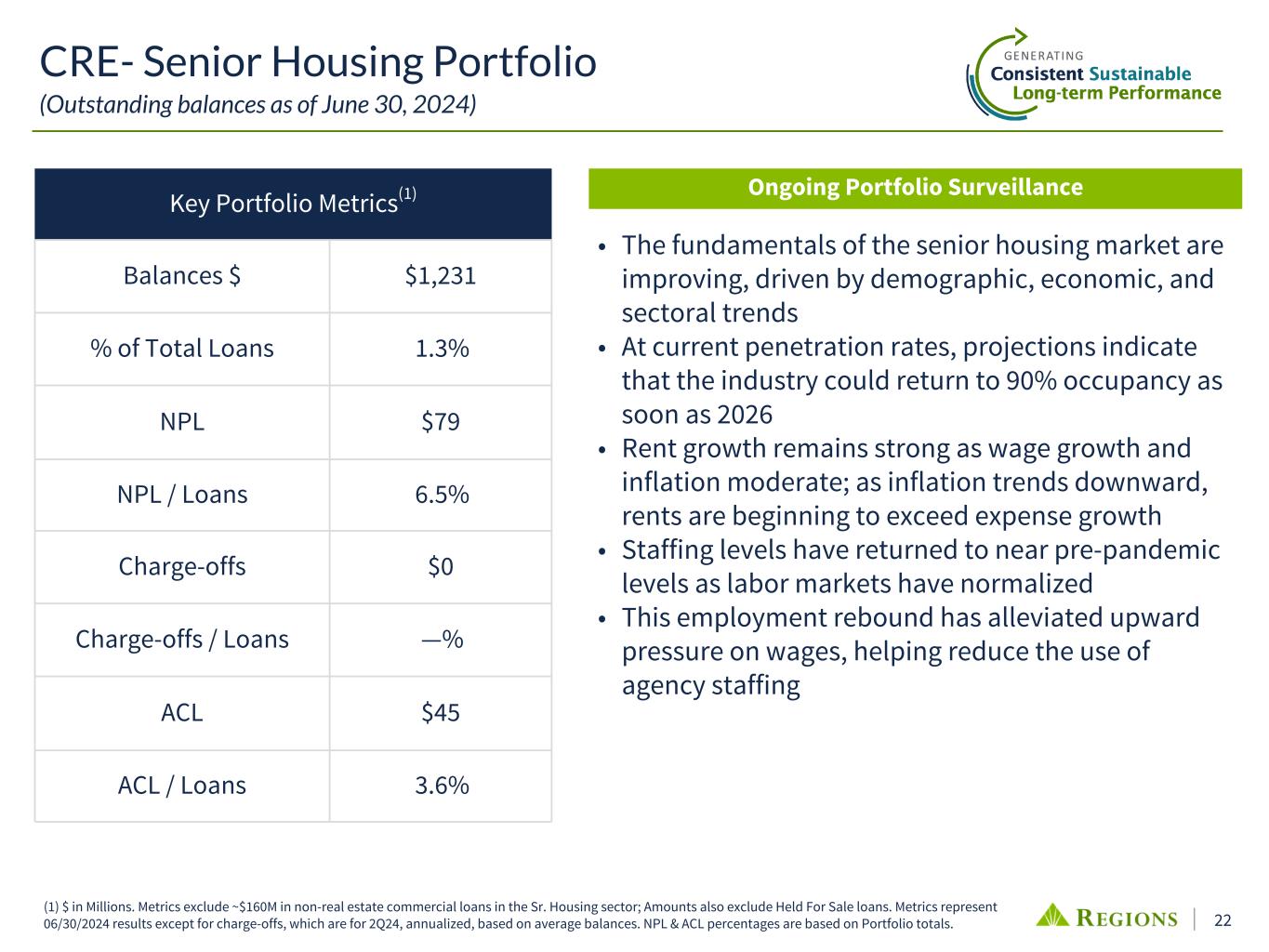

22 CRE- Senior Housing Portfolio (Outstanding balances as of June 30, 2024) (1) $ in Millions. Metrics exclude ~$160M in non-real estate commercial loans in the Sr. Housing sector; Amounts also exclude Held For Sale loans. Metrics represent 06/30/2024 results except for charge-offs, which are for 2Q24, annualized, based on average balances. NPL & ACL percentages are based on Portfolio totals. Key Portfolio Metrics(1) Balances $ $1,231 % of Total Loans 1.3% NPL $79 NPL / Loans 6.5% Charge-offs $0 Charge-offs / Loans —% ACL $45 ACL / Loans 3.6% • The fundamentals of the senior housing market are improving, driven by demographic, economic, and sectoral trends • At current penetration rates, projections indicate that the industry could return to 90% occupancy as soon as 2026 • Rent growth remains strong as wage growth and inflation moderate; as inflation trends downward, rents are beginning to exceed expense growth • Staffing levels have returned to near pre-pandemic levels as labor markets have normalized • This employment rebound has alleviated upward pressure on wages, helping reduce the use of agency staffing Ongoing Portfolio Surveillance

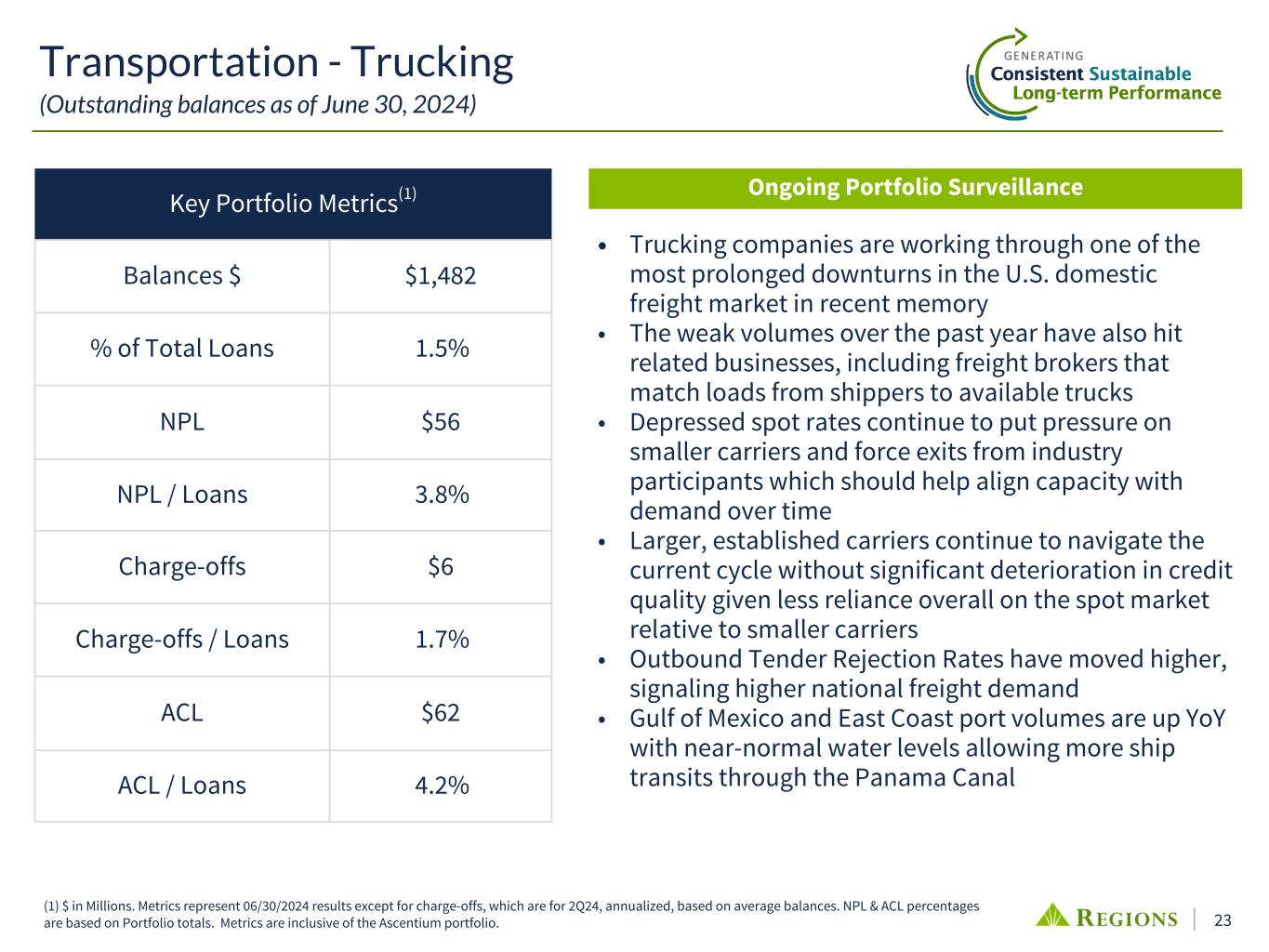

23 Transportation - Trucking (Outstanding balances as of June 30, 2024) (1) $ in Millions. Metrics represent 06/30/2024 results except for charge-offs, which are for 2Q24, annualized, based on average balances. NPL & ACL percentages are based on Portfolio totals. Metrics are inclusive of the Ascentium portfolio. Key Portfolio Metrics(1) Balances $ $1,482 % of Total Loans 1.5% NPL $56 NPL / Loans 3.8% Charge-offs $6 Charge-offs / Loans 1.7% ACL $62 ACL / Loans 4.2% • Trucking companies are working through one of the most prolonged downturns in the U.S. domestic freight market in recent memory • The weak volumes over the past year have also hit related businesses, including freight brokers that match loads from shippers to available trucks • Depressed spot rates continue to put pressure on smaller carriers and force exits from industry participants which should help align capacity with demand over time • Larger, established carriers continue to navigate the current cycle without significant deterioration in credit quality given less reliance overall on the spot market relative to smaller carriers • Outbound Tender Rejection Rates have moved higher, signaling higher national freight demand • Gulf of Mexico and East Coast port volumes are up YoY with near-normal water levels allowing more ship transits through the Panama Canal Ongoing Portfolio Surveillance

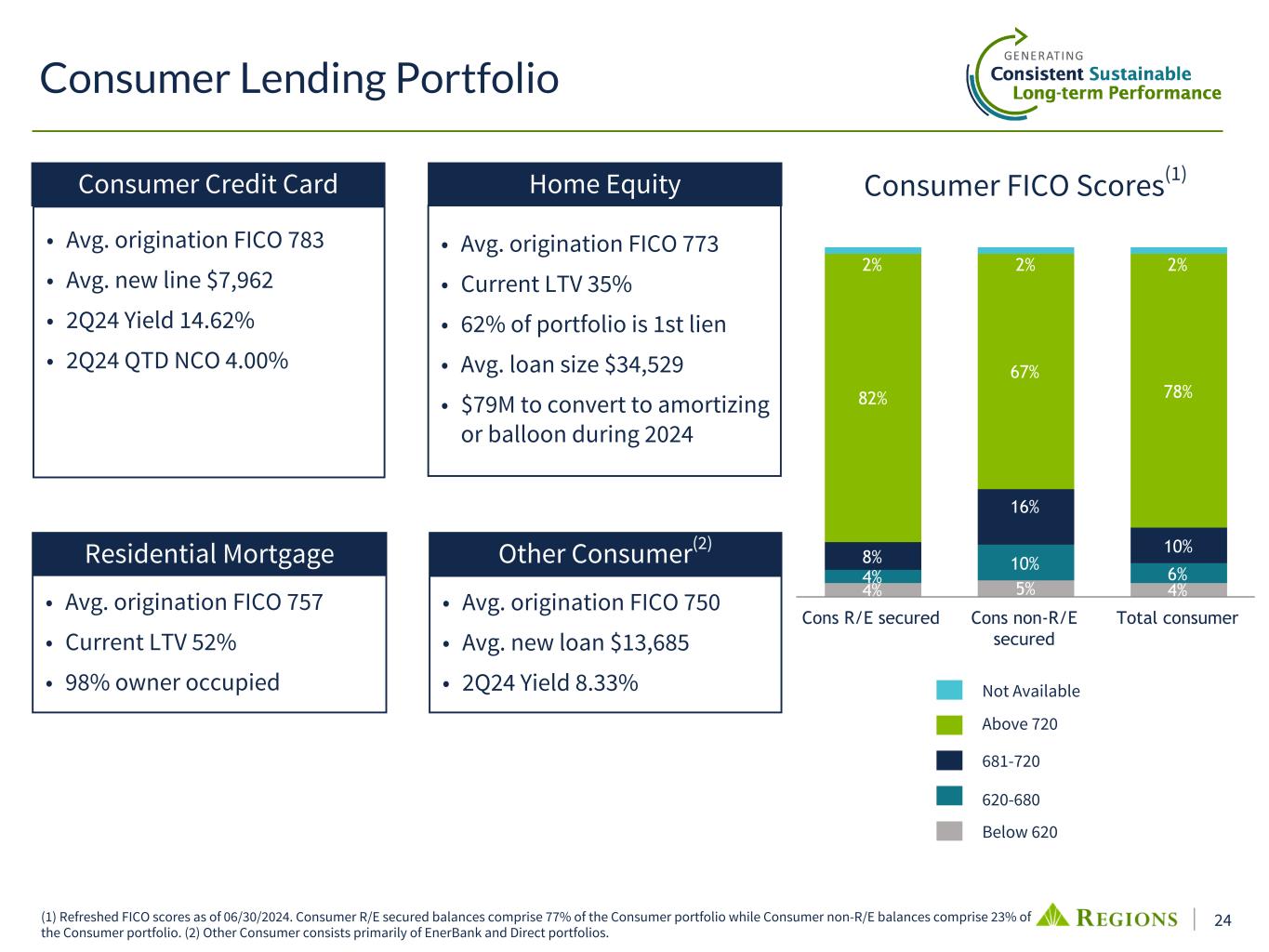

24 Consumer Lending Portfolio • Avg. origination FICO 757 • Current LTV 52% • 98% owner occupied • Avg. origination FICO 773 • Current LTV 35% • 62% of portfolio is 1st lien • Avg. loan size $34,529 • $79M to convert to amortizing or balloon during 2024 • Avg. origination FICO 750 • Avg. new loan $13,685 • 2Q24 Yield 8.33% • Avg. origination FICO 783 • Avg. new line $7,962 • 2Q24 Yield 14.62% • 2Q24 QTD NCO 4.00% 4% 5% 4% 4% 10% 6% 8% 16% 10% 82% 67% 78% 2% 2% 2% Cons R/E secured Cons non-R/E secured Total consumer Not Available Above 720 620-680 Below 620 681-720 Consumer FICO Scores(1) (1) Refreshed FICO scores as of 06/30/2024. Consumer R/E secured balances comprise 77% of the Consumer portfolio while Consumer non-R/E balances comprise 23% of the Consumer portfolio. (2) Other Consumer consists primarily of EnerBank and Direct portfolios. Residential Mortgage Consumer Credit Card Home Equity Other Consumer(2)

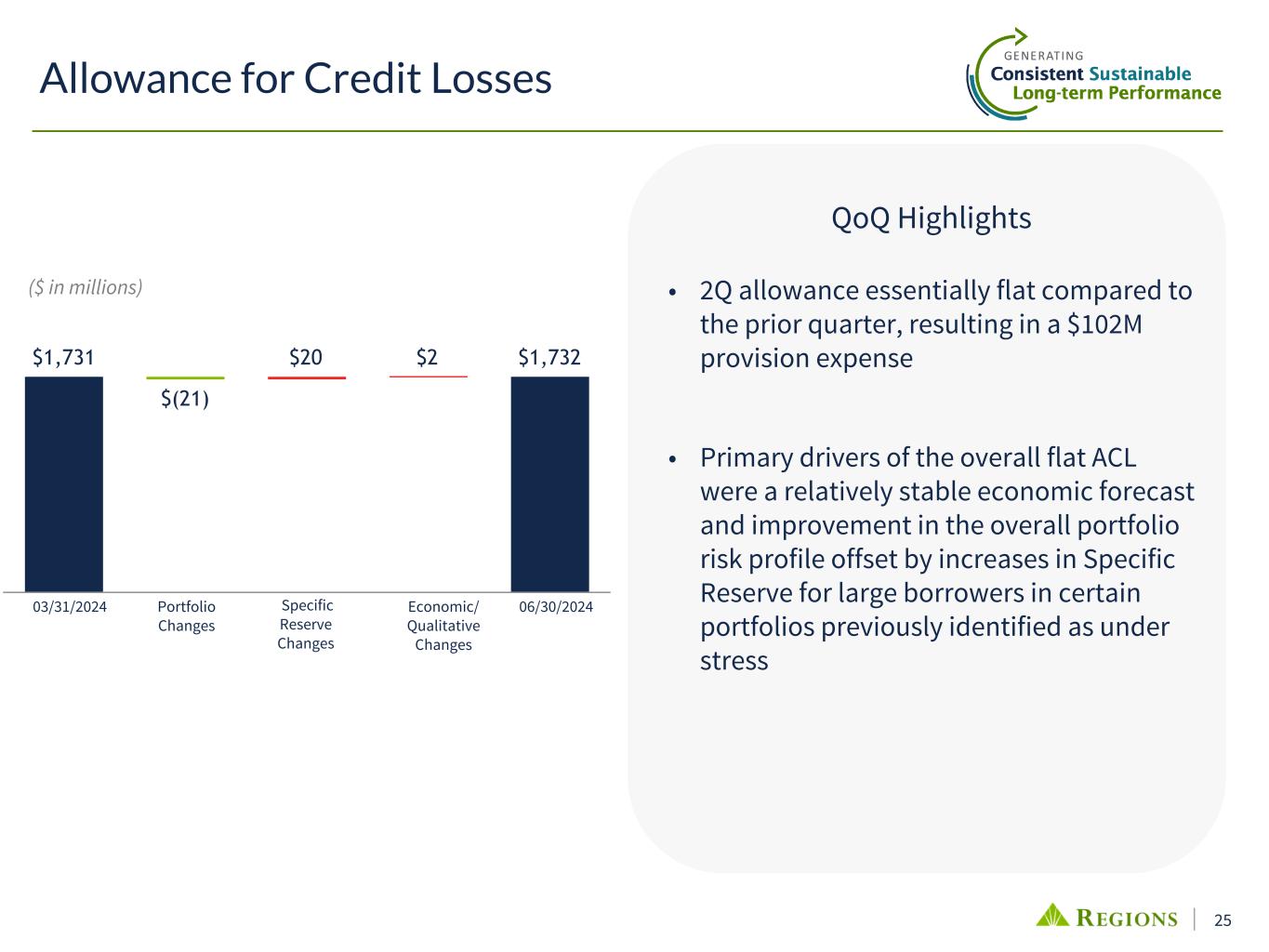

25 $1,731 $(21) $20 $2 $1,732 Allowance for Credit Losses 06/30/2024 • 2Q allowance essentially flat compared to the prior quarter, resulting in a $102M provision expense • Primary drivers of the overall flat ACL were a relatively stable economic forecast and improvement in the overall portfolio risk profile offset by increases in Specific Reserve for large borrowers in certain portfolios previously identified as under stress ($ in millions) 03/31/2024 Specific Reserve Changes Economic/ Qualitative Changes Portfolio Changes QoQ Highlights

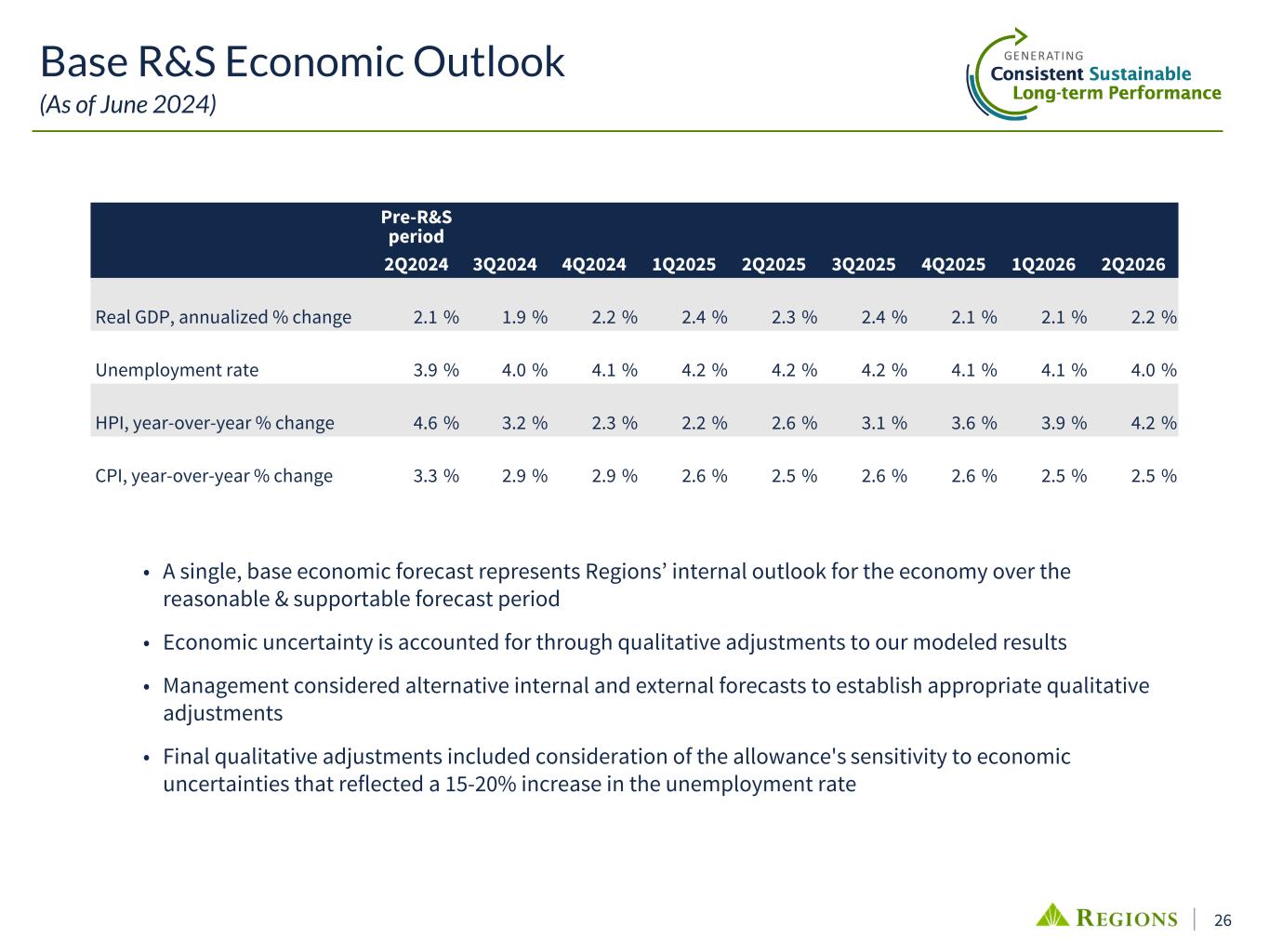

26 Pre-R&S period 2Q2024 3Q2024 4Q2024 1Q2025 2Q2025 3Q2025 4Q2025 1Q2026 2Q2026 Real GDP, annualized % change 2.1 % 1.9 % 2.2 % 2.4 % 2.3 % 2.4 % 2.1 % 2.1 % 2.2 % Unemployment rate 3.9 % 4.0 % 4.1 % 4.2 % 4.2 % 4.2 % 4.1 % 4.1 % 4.0 % HPI, year-over-year % change 4.6 % 3.2 % 2.3 % 2.2 % 2.6 % 3.1 % 3.6 % 3.9 % 4.2 % CPI, year-over-year % change 3.3 % 2.9 % 2.9 % 2.6 % 2.5 % 2.6 % 2.6 % 2.5 % 2.5 % Base R&S Economic Outlook (As of June 2024) • A single, base economic forecast represents Regions’ internal outlook for the economy over the reasonable & supportable forecast period • Economic uncertainty is accounted for through qualitative adjustments to our modeled results • Management considered alternative internal and external forecasts to establish appropriate qualitative adjustments • Final qualitative adjustments included consideration of the allowance's sensitivity to economic uncertainties that reflected a 15-20% increase in the unemployment rate

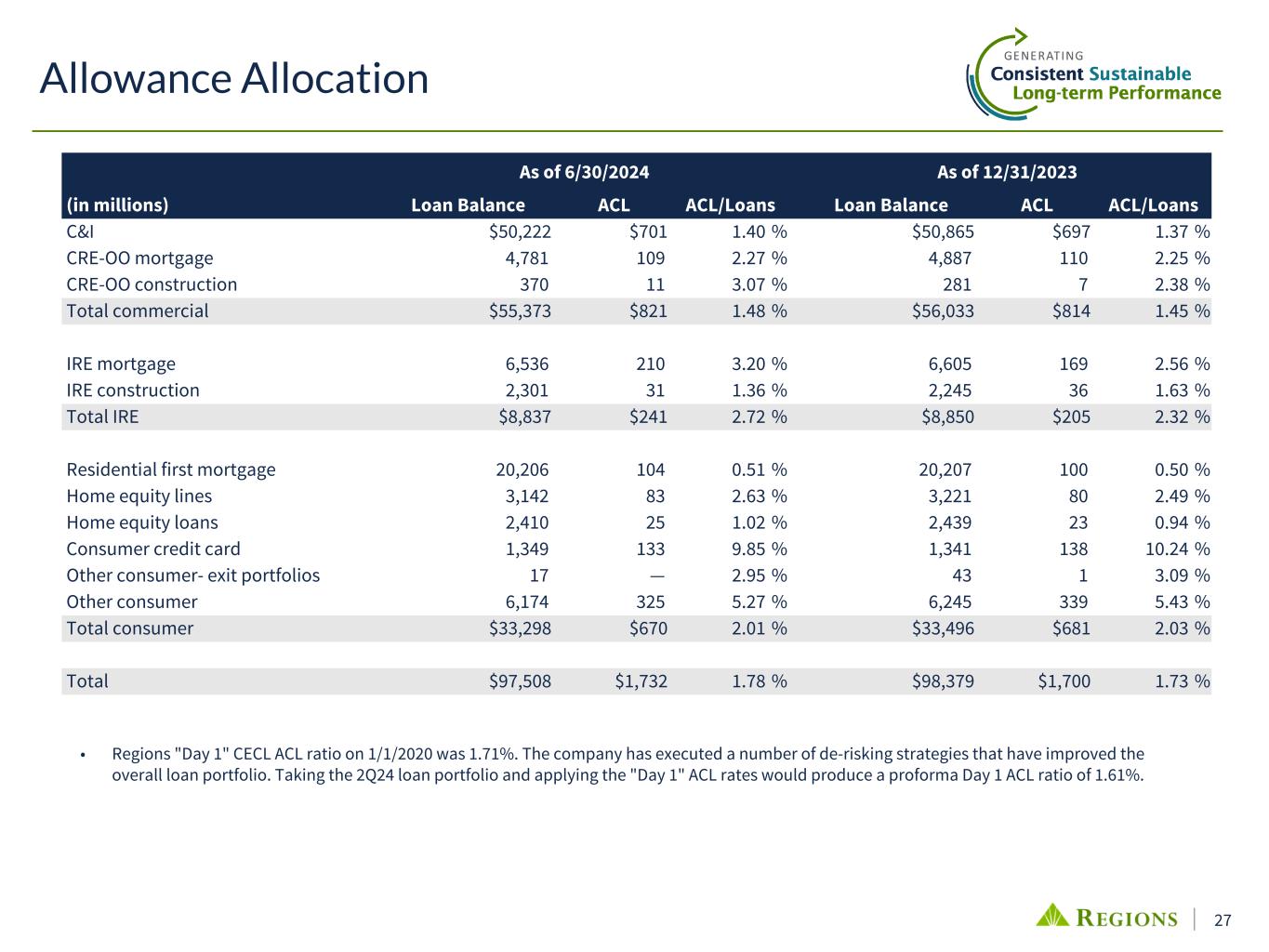

27 As of 6/30/2024 As of 12/31/2023 (in millions) Loan Balance ACL ACL/Loans Loan Balance ACL ACL/Loans C&I $50,222 $701 1.40 % $50,865 $697 1.37 % CRE-OO mortgage 4,781 109 2.27 % 4,887 110 2.25 % CRE-OO construction 370 11 3.07 % 281 7 2.38 % Total commercial $55,373 $821 1.48 % $56,033 $814 1.45 % IRE mortgage 6,536 210 3.20 % 6,605 169 2.56 % IRE construction 2,301 31 1.36 % 2,245 36 1.63 % Total IRE $8,837 $241 2.72 % $8,850 $205 2.32 % Residential first mortgage 20,206 104 0.51 % 20,207 100 0.50 % Home equity lines 3,142 83 2.63 % 3,221 80 2.49 % Home equity loans 2,410 25 1.02 % 2,439 23 0.94 % Consumer credit card 1,349 133 9.85 % 1,341 138 10.24 % Other consumer- exit portfolios 17 — 2.95 % 43 1 3.09 % Other consumer 6,174 325 5.27 % 6,245 339 5.43 % Total consumer $33,298 $670 2.01 % $33,496 $681 2.03 % Total $97,508 $1,732 1.78 % $98,379 $1,700 1.73 % Allowance Allocation • Regions "Day 1" CECL ACL ratio on 1/1/2020 was 1.71%. The company has executed a number of de-risking strategies that have improved the overall loan portfolio. Taking the 2Q24 loan portfolio and applying the "Day 1" ACL rates would produce a proforma Day 1 ACL ratio of 1.61%.

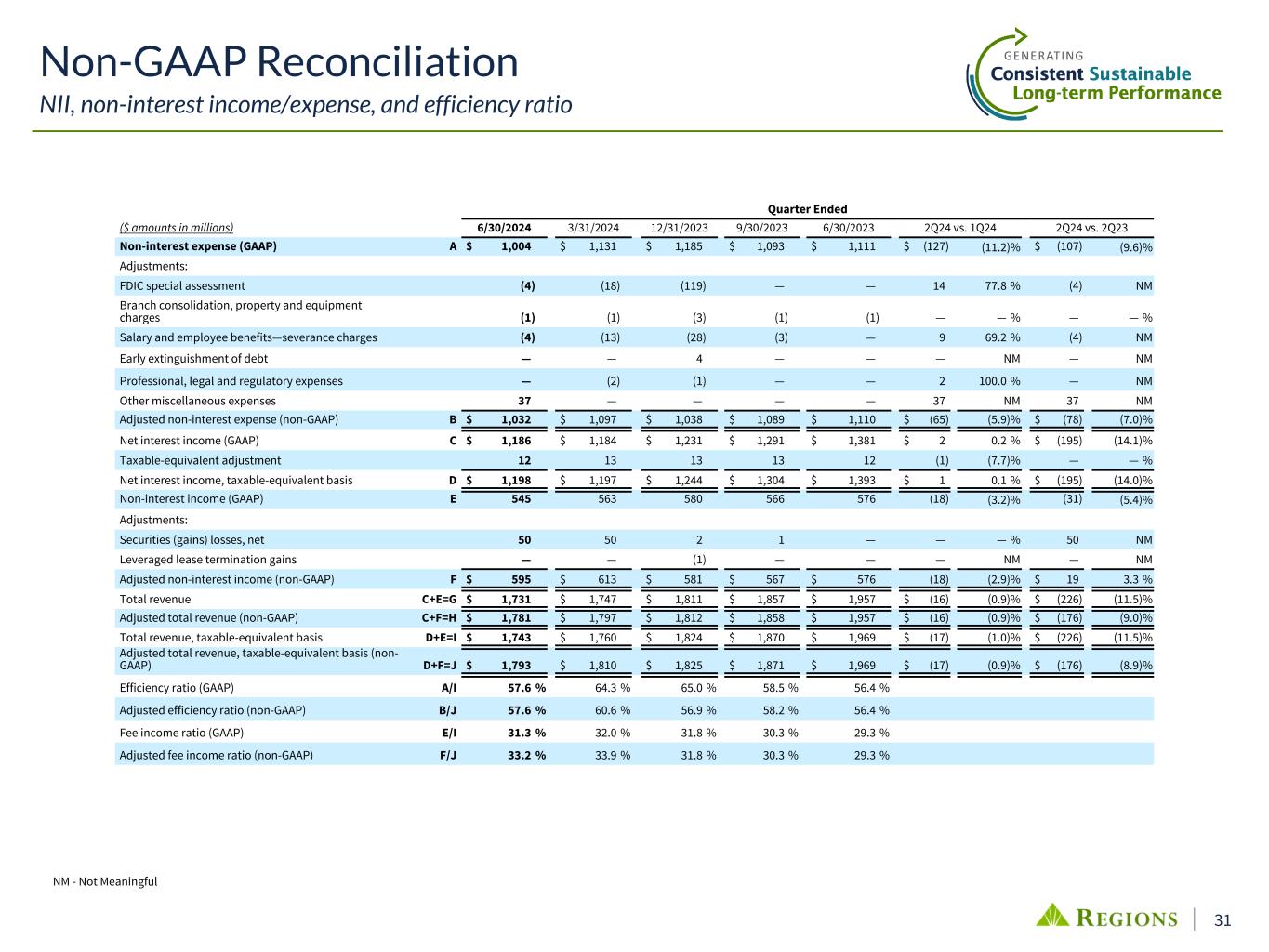

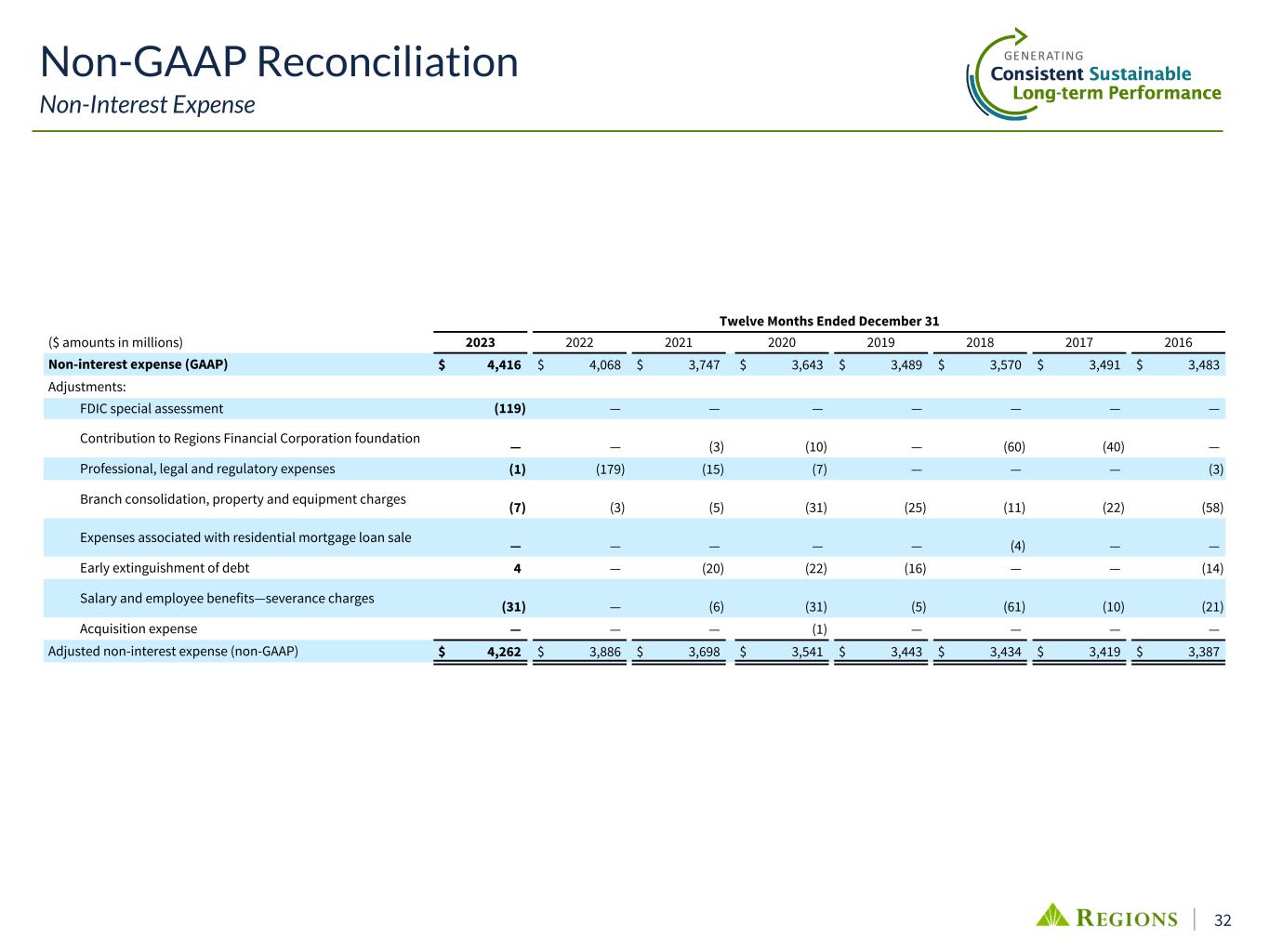

28 Management uses computations of earnings and certain other financial measures, which exclude certain adjustments that are included in the financial results presented in accordance with GAAP, to monitor performance and believes these measures provide meaningful information to investors. Non-interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest expense (non-GAAP), which is the numerator for the efficiency ratio. Non-interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non-interest income (non-GAAP), which is the numerator for the fee income ratio. Adjusted non-interest income (non-GAAP) and adjusted non-interest expense (non-GAAP) are used to determine adjusted pre-tax pre-provision income (non-GAAP). Net interest income (GAAP) on a taxable-equivalent basis and non-interest income are added together to arrive at total revenue on a taxable-equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable-equivalent basis (non-GAAP), which is the denominator for the fee income and efficiency ratios. Net loan charge-offs (GAAP) are presented excluding adjustments to arrive at adjusted net loan-charge offs (non-GAAP). Adjusted net loan charge-offs as a percentage of average loans (non-GAAP) are calculated as adjusted net loan charge-offs (non-GAAP) divided by average loans (GAAP) and annualized. Regions believes that the exclusion of these adjustments provides a meaningful base for period-to-period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non-GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non-GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. Tangible common shareholders’ equity, tangible common book value per share, and return on average tangible common shareholders' equity (ROATCE) ratios have become a focus of some investors and management believes they may assist investors in analyzing the capital position of the Company absent the effects of intangible assets and preferred stock. Analysts and banking regulators have assessed Regions’ capital adequacy using the tangible common shareholders’ equity measure. Because tangible common shareholders’ equity, tangible common book value per share, and ROATCE are not formally defined by GAAP or prescribed in any amount by federal banking regulations they are currently considered to be non-GAAP financial measures and other entities may calculate them differently than Regions’ disclosed calculations. Adjustments to shareholders' equity include intangible assets and related deferred taxes and preferred stock. Additionally, adjustments to ROATCE include accumulated other comprehensive income. The Company also presents accumulated other comprehensive excluding adjustments to arrive at adjusted accumulated other comprehensive income (non-GAAP). Since analysts and banking regulators may assess Regions’ capital adequacy using tangible common shareholders’ equity, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. CET1 is a capital adequacy measure established by federal banking regulators under the Basel III framework. Banking institutions that meet requirements under the regulations are required to maintain certain minimum capital requirements, including a minimum CET1 ratio. This measure is utilized by analysts and banking regulators to assess Regions’ capital adequacy. Under the framework, Regions elected to remove the effects of AOCI in the calculation of CET1. Adjustments to the calculation prescribed in federal banking regulations are considered to be non-GAAP financial measures. Adjustments to CET1 include certain portions of AOCI to arrive at CET1 inclusive of AOCI (non-GAAP), which is a potential impact under recent proposed rulemaking standards. Since analysts and banking regulators may assess Regions’ capital adequacy using proposed rulemaking standards, management believes that it is useful to provide investors the ability to assess Regions’ capital adequacy on this same basis. Non-GAAP financial measures have inherent limitations, are not required to be uniformly applied and are not audited. Although these non-GAAP financial measures are frequently used by stakeholders in the evaluation of a company, they have limitations as analytical tools, and should not be considered in isolation, or as a substitute for analyses of results as reported under GAAP. In particular, a measure of earnings that excludes selected items does not represent the amount that effectively accrues directly to shareholders. Management and the Board of Directors utilize non-GAAP measures as follows: • Preparation of Regions' operating budgets • Monthly financial performance reporting • Monthly close-out reporting of consolidated results (management only) • Presentation to investors of company performance • Metrics for incentive compensation Non-GAAP Information

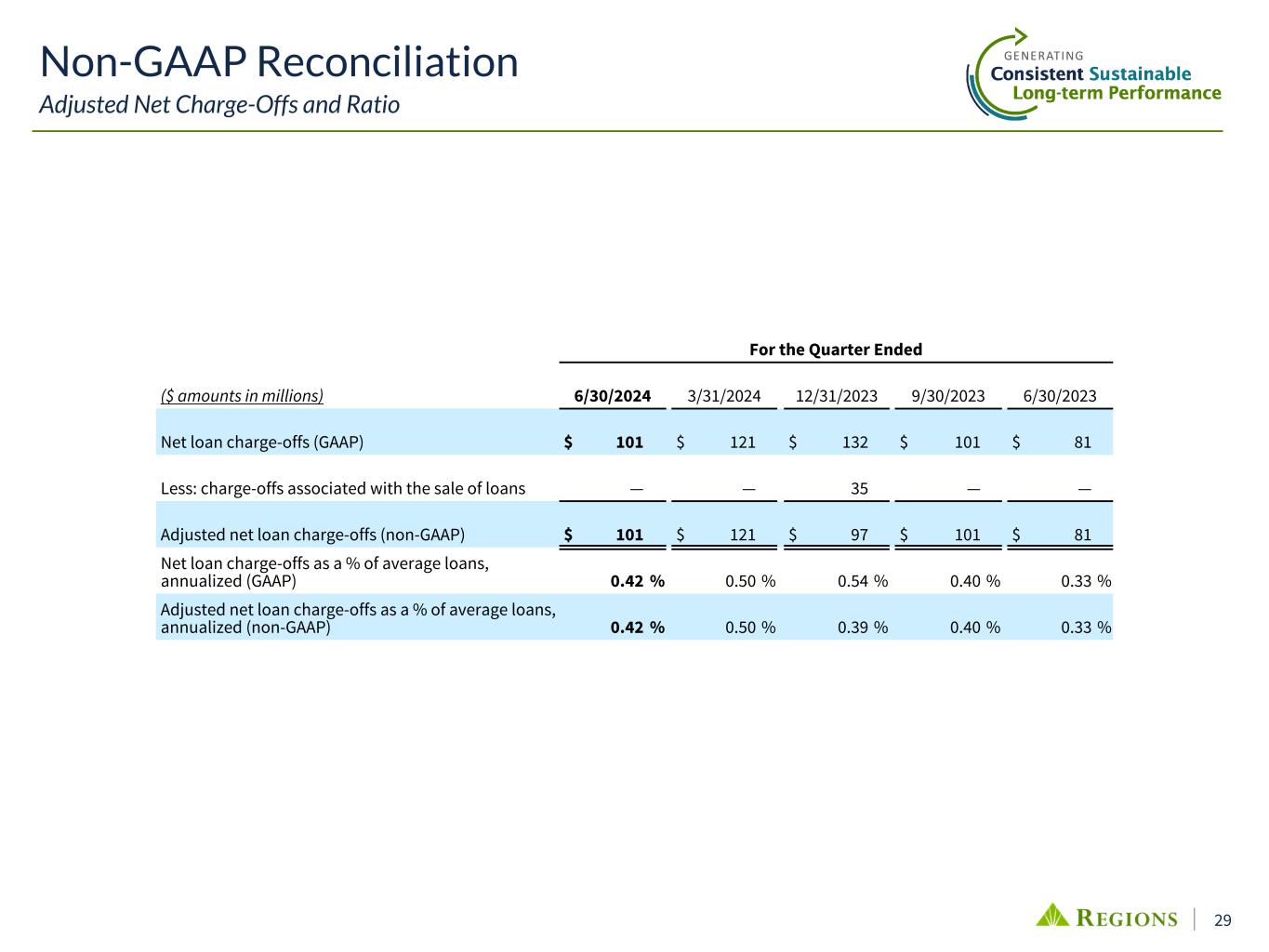

29 Non-GAAP Reconciliation Adjusted Net Charge-Offs and Ratio For the Quarter Ended ($ amounts in millions) 6/30/2024 3/31/2024 12/31/2023 9/30/2023 6/30/2023 Net loan charge-offs (GAAP) $ 101 $ 121 $ 132 $ 101 $ 81 Less: charge-offs associated with the sale of loans — — 35 — — Adjusted net loan charge-offs (non-GAAP) $ 101 $ 121 $ 97 $ 101 $ 81 Net loan charge-offs as a % of average loans, annualized (GAAP) 0.42 % 0.50 % 0.54 % 0.40 % 0.33 % Adjusted net loan charge-offs as a % of average loans, annualized (non-GAAP) 0.42 % 0.50 % 0.39 % 0.40 % 0.33 %

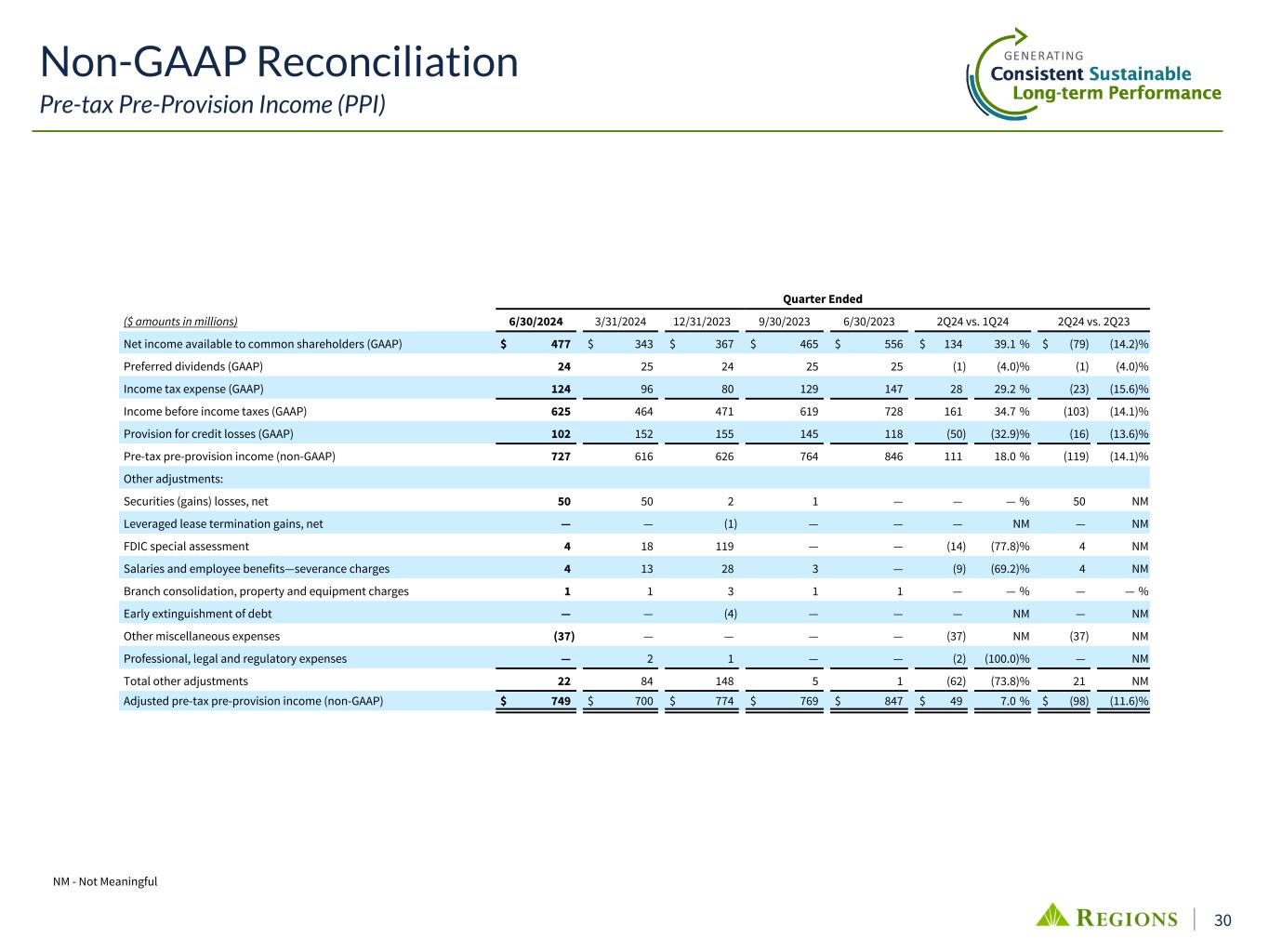

30 Non-GAAP Reconciliation Pre-tax Pre-Provision Income (PPI) Quarter Ended ($ amounts in millions) 6/30/2024 3/31/2024 12/31/2023 9/30/2023 6/30/2023 2Q24 vs. 1Q24 2Q24 vs. 2Q23 Net income available to common shareholders (GAAP) $ 477 $ 343 $ 367 $ 465 $ 556 $ 134 39.1 % $ (79) (14.2) % Preferred dividends (GAAP) 24 25 24 25 25 (1) (4.0) % (1) (4.0) % Income tax expense (GAAP) 124 96 80 129 147 28 29.2 % (23) (15.6) % Income before income taxes (GAAP) 625 464 471 619 728 161 34.7 % (103) (14.1) % Provision for credit losses (GAAP) 102 152 155 145 118 (50) (32.9) % (16) (13.6) % Pre-tax pre-provision income (non-GAAP) 727 616 626 764 846 111 18.0 % (119) (14.1) % Other adjustments: Securities (gains) losses, net 50 50 2 1 — — — % 50 NM Leveraged lease termination gains, net — — (1) — — — NM — NM FDIC special assessment 4 18 119 — — (14) (77.8) % 4 NM Salaries and employee benefits—severance charges 4 13 28 3 — (9) (69.2) % 4 NM Branch consolidation, property and equipment charges 1 1 3 1 1 — — % — — % Early extinguishment of debt — — (4) — — — NM — NM Other miscellaneous expenses (37) — — — — (37) NM (37) NM Professional, legal and regulatory expenses — 2 1 — — (2) (100.0) % — NM Total other adjustments 22 84 148 5 1 (62) (73.8) % 21 NM Adjusted pre-tax pre-provision income (non-GAAP) $ 749 $ 700 $ 774 $ 769 $ 847 $ 49 7.0 % $ (98) (11.6) % NM - Not Meaningful

31 Non-GAAP Reconciliation NII, non-interest income/expense, and efficiency ratio NM - Not Meaningful Quarter Ended ($ amounts in millions) 6/30/2024 3/31/2024 12/31/2023 9/30/2023 6/30/2023 2Q24 vs. 1Q24 2Q24 vs. 2Q23 Non-interest expense (GAAP) A $ 1,004 $ 1,131 $ 1,185 $ 1,093 $ 1,111 $ (127) (11.2) % $ (107) (9.6) % Adjustments: FDIC special assessment (4) (18) (119) — — 14 77.8 % (4) NM Branch consolidation, property and equipment charges (1) (1) (3) (1) (1) — — % — — % Salary and employee benefits—severance charges (4) (13) (28) (3) — 9 69.2 % (4) NM Early extinguishment of debt — — 4 — — — NM — NM Professional, legal and regulatory expenses — (2) (1) — — 2 100.0 % — NM Other miscellaneous expenses 37 — — — — 37 NM 37 NM Adjusted non-interest expense (non-GAAP) B $ 1,032 $ 1,097 $ 1,038 $ 1,089 $ 1,110 $ (65) (5.9) % $ (78) (7.0) % Net interest income (GAAP) C $ 1,186 $ 1,184 $ 1,231 $ 1,291 $ 1,381 $ 2 0.2 % $ (195) (14.1) % Taxable-equivalent adjustment 12 13 13 13 12 (1) (7.7) % — — % Net interest income, taxable-equivalent basis D $ 1,198 $ 1,197 $ 1,244 $ 1,304 $ 1,393 $ 1 0.1 % $ (195) (14.0) % Non-interest income (GAAP) E 545 563 580 566 576 (18) (3.2) % (31) (5.4) % Adjustments: Securities (gains) losses, net 50 50 2 1 — — — % 50 NM Leveraged lease termination gains — — (1) — — — NM — NM Adjusted non-interest income (non-GAAP) F $ 595 $ 613 $ 581 $ 567 $ 576 (18) (2.9) % $ 19 3.3 % Total revenue C+E=G $ 1,731 $ 1,747 $ 1,811 $ 1,857 $ 1,957 $ (16) (0.9) % $ (226) (11.5) % Adjusted total revenue (non-GAAP) C+F=H $ 1,781 $ 1,797 $ 1,812 $ 1,858 $ 1,957 $ (16) (0.9) % $ (176) (9.0) % Total revenue, taxable-equivalent basis D+E=I $ 1,743 $ 1,760 $ 1,824 $ 1,870 $ 1,969 $ (17) (1.0) % $ (226) (11.5) % Adjusted total revenue, taxable-equivalent basis (non- GAAP) D+F=J $ 1,793 $ 1,810 $ 1,825 $ 1,871 $ 1,969 $ (17) (0.9) % $ (176) (8.9) % Efficiency ratio (GAAP) A/I 57.6 % 64.3 % 65.0 % 58.5 % 56.4 % Adjusted efficiency ratio (non-GAAP) B/J 57.6 % 60.6 % 56.9 % 58.2 % 56.4 % Fee income ratio (GAAP) E/I 31.3 % 32.0 % 31.8 % 30.3 % 29.3 % Adjusted fee income ratio (non-GAAP) F/J 33.2 % 33.9 % 31.8 % 30.3 % 29.3 %

32 Non-GAAP Reconciliation Non-Interest Expense Twelve Months Ended December 31 ($ amounts in millions) 2023 2022 2021 2020 2019 2018 2017 2016 Non-interest expense (GAAP) $ 4,416 $ 4,068 $ 3,747 $ 3,643 $ 3,489 $ 3,570 $ 3,491 $ 3,483 Adjustments: FDIC special assessment (119) — — — — — — — Contribution to Regions Financial Corporation foundation — — (3) (10) — (60) (40) — Professional, legal and regulatory expenses (1) (179) (15) (7) — — — (3) Branch consolidation, property and equipment charges (7) (3) (5) (31) (25) (11) (22) (58) Expenses associated with residential mortgage loan sale — — — — — (4) — — Early extinguishment of debt 4 — (20) (22) (16) — — (14) Salary and employee benefits—severance charges (31) — (6) (31) (5) (61) (10) (21) Acquisition expense — — — (1) — — — — Adjusted non-interest expense (non-GAAP) $ 4,262 $ 3,886 $ 3,698 $ 3,541 $ 3,443 $ 3,434 $ 3,419 $ 3,387

33 Quarter Ended ($ amounts in millions) 6/30/2024 3/31/2024 12/31/2023 9/30/2023 ADJUSTED CET1 RATIO Common Equity Tier 1(1) A $ 13,093 $ 12,913 $ 12,976 $ 13,056 Adjustments: AOCI gain (loss) on securities(2) (2,298) (2,264) (2,064) (3,084) AOCI gain (loss) on defined benefit pension plans and other post employment benefits (443) (447) (451) (403) Adjusted Common Equity Tier 1 (non-GAAP) B $ 10,352 $ 10,202 $ 10,461 $ 9,569 Total risk-weighted assets(1) C $ 125,725 $ 125,271 $ 126,475 $ 126,900 CET1 ratio(1)(3) A/C 10.4 % 10.3 % 10.3 % 10.3 % Adjusted CET1 ratio (non-GAAP)(1)(3) B/C 8.2 % 8.1 % 8.3 % 7.5 % Non-GAAP Reconciliation Adjusted CET1- inclusive of AOCI(4) (1) Common equity as well as Total risk-weighted assets are estimated. (2) Represents AOCI on AFS and HTM securities (3) Amounts calculated based upon whole dollar values (4) Consistent with the proposed Basel III Endgame rules, AOCI for CF hedges remains excluded.

34 As of and for Quarter Ended ($ amounts in millions, except per share data) 6/30/2024 3/31/2024 12/31/2023 9/30/2023 6/30/2023 TANGIBLE COMMON RATIOS Shareholders’ equity (GAAP) A $ 17,169 $ 17,044 $ 17,429 $ 16,100 $ 16,639 Less: Preferred stock (GAAP) 1,659 1,659 1,659 1,659 1,659 Intangible assets (GAAP) 5,920 5,929 5,938 5,949 5,959 Deferred tax liability related to intangibles (GAAP) (119) (114) (112) (108) (106) Tangible common shareholders’ equity (non-GAAP) B $ 9,709 $ 9,570 $ 9,944 $ 8,600 $ 9,127 Total assets (GAAP) C $ 154,052 $ 154,909 $ 152,194 $ 153,624 $ 155,656 Less: Intangible assets (GAAP) 5,920 5,929 5,938 5,949 5,959 Deferred tax liability related to intangibles (GAAP) (119) (114) (112) (108) (106) Tangible assets (non-GAAP) D $ 148,251 $ 149,094 $ 146,368 $ 147,783 $ 149,803 Shares outstanding—end of quarter E 915 918 924 939 939 Total equity to total assets (GAAP) A/C 11.14 % 11.00 % 11.45 % 10.48 % 10.69 % Tangible common shareholders’ equity to tangible assets (non-GAAP) B/D 6.55 % 6.42 % 6.79 % 5.82 % 6.09 % Tangible common book value per share (non-GAAP) B/E $ 10.61 $ 10.42 $ 10.77 $ 9.16 $ 9.72 Non-GAAP Reconciliation Tangible Common Ratios

35 Forward-Looking Statements This presentation may include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. The words “future,” “anticipates,” “assumes,” “intends,” “plans,” “seeks,” “believes,” “predicts,” “potential,” “objectives,” “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” “would,” “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward-looking statements. Forward-looking statements are subject to the risk that the actual effects may differ, possibly materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond our control. Forward-looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward-looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve (in particular the Southeastern United States), including the effects of possible declines in property values, increases in interest rates and unemployment rates, inflation, financial market disruptions and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our businesses and our financial results and conditions. • Changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets (such as our portfolio of investment securities) and obligations, as well as the availability and cost of capital and liquidity. • Volatility and uncertainty about the direction of interest rates and the timing of any changes, which may lead to increased costs for businesses and consumers and potentially contribute to poor business and economic conditions generally. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge-offs, credit loss provisions or actual credit losses where our allowance for credit losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage-backed securities due to declining interest rates, and the related acceleration of premium amortization on those securities. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Loss of customer checking and savings account deposits as customers pursue other, higher-yield investments, or the need to price interest-bearing deposits higher due to competitive forces. Either of these activities could increase our funding costs. • Possible downgrades in our credit ratings or outlook could, among other negative impacts, increase the costs of funding from capital markets. • The loss of value of our investment portfolio could negatively impact market perceptions of us. • Our ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support our businesses. • The effects of social media on market perceptions of us and banks generally. • Market replacement of LIBOR and the related effect on our legacy LIBOR-based financial products and contracts, including, but not limited to, derivative products, debt obligations, deposits, investments, and loans. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Volatility in the financial services industry (including failures or rumors of failures of other depository institutions), along with actions taken by governmental agencies to address such turmoil, could affect the ability of depository institutions, including us, to attract and retain depositors and to borrow or raise capital. • Our ability to effectively compete with other traditional and non-traditional financial services companies, including fintechs, some of which possess greater financial resources than we do or are subject to different regulatory standards than we are. Forward-Looking Statements

36 • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes, including those related to the offering of digital banking and financial services, could result in losing business to competitors. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and nonfinancial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses and risks related to such acquisitions, including that the expected synergies, cost savings and other financial or other benefits may not be realized within expected timeframes, or might be less than projected; and difficulties in integrating acquired businesses. • The success of our marketing efforts in attracting and retaining customers. • Our ability to achieve our expense management initiatives. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair the ability of those borrowers to service any loans outstanding to them and/or reduce demand for loans in those industries. • The effects of geopolitical instability, including wars, conflicts, civil unrest, and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • Fraud, theft or other misconduct conducted by external parties, including our customers and business partners, or by our employees. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our businesses, such as credit risk and operational risk, including third-party vendors and other service providers, which inability could, among other things, result in a breach of operating or security systems as a result of a cyber-attack or similar act or failure to deliver our services effectively. • Our ability to identify and address operational risks associated with the introduction of or changes to products, services, or delivery platforms. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our businesses on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • Our ability to identify and address cyber-security risks such as data security breaches, malware, ransomware, “denial of service” attacks, “hacking” and identity theft, including account take-overs, a failure of which could disrupt our businesses and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, such as changes to debit card interchange fees, special FDIC assessments, any new long-term debt requirements, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self-regulatory agencies, including as a result of the changes in U.S. presidential administration, control of the U.S. Congress, and changes in personnel at the bank regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our capital actions, including dividend payments, common stock repurchases, or redemptions of preferred stock, must not cause us to fall below minimum capital ratio requirements, with applicable buffers taken into account, and must comply with other requirements and restrictions under law or imposed by our regulators, which may impact our ability to return capital to shareholders. Forward-Looking Statements (continued)

37 • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition and market perceptions of us could be negatively impacted. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Our ability to receive dividends from our subsidiaries, in particular Regions Bank, could affect our liquidity and ability to pay dividends to shareholders. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of anti-takeover laws and exclusive forum provision in our certificate of incorporation and bylaws. • The effect of new tax legislation and/or interpretation of existing tax law, which may impact our earnings, capital ratios and our ability to return capital to shareholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect our financial statements and how we report those results, and expectations and preliminary analyses relating to how such changes will affect our financial results could prove incorrect. • Any impairment of our goodwill or other intangibles, any repricing of assets or any adjustment of valuation allowances on our deferred tax assets due to changes in tax law, adverse changes in the economic environment declining operations of the reporting unit or other factors. • The effects of man-made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes and environmental damage (especially in the Southeastern United States), which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. The severity and frequency of future earthquakes, fires, hurricanes, tornadoes, droughts, floods and other weather-related events are difficult to predict and may be exacerbated by global climate change. • The impact of pandemics on our businesses, operations and financial results and conditions. The duration and severity of any pandemic as well as government actions or other restrictions in connection with such events could disrupt the global economy, adversely affect our capital and liquidity position, impair the ability of borrowers to repay outstanding loans and increase our allowance for credit losses, impair collateral values and result in lost revenue or additional expenses. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. • Other risks identified from time to time in reports that we file with the SEC. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward-Looking Statements” and “Risk Factors” in Regions’ Annual Report on Form 10-K for the year ended December 31, 2023 and in Regions’ subsequent filings with the SEC. You should not place undue reliance on any forward-looking statements, which speak only as of the date made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible to predict all of them. We assume no obligation and do not intend to update or revise any forward-looking statements that are made from time to time, either as a result of future developments, new information or otherwise, except as may be required by law. Regions’ Investor Relations contact is Dana Nolan at (205) 264-7040; Regions’ Media contact is Jeremy King at (205) 264-4551. Forward-Looking Statements (continued)