EExhibit 99.1 Investor Day 2019 Managing for the long‐term John Turner | President and Chief Executive Officer

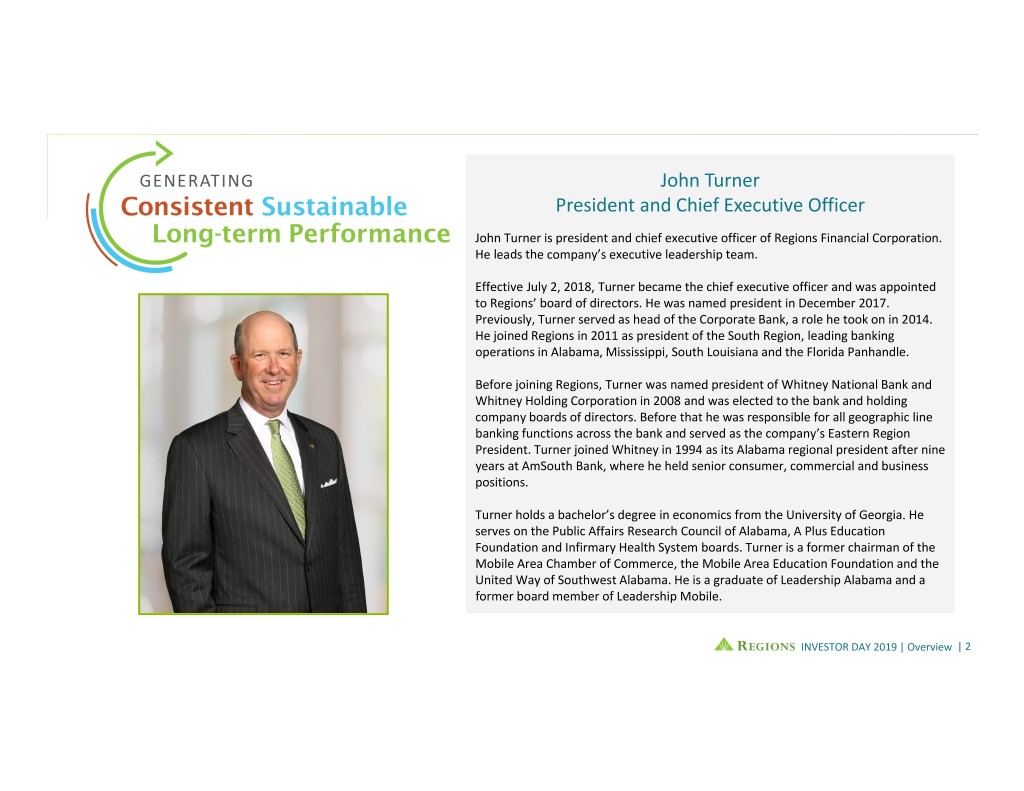

John Turner President and Chief Executive Officer John Turner is president and chief executive officer of Regions Financial Corporation. He leads the company’s executive leadership team. Effective July 2, 2018, Turner became the chief executive officer and was appointed to Regions’ board of directors. He was named president in December 2017. Previously, Turner served as head of the Corporate Bank, a role he took on in 2014. He joined Regions in 2011 as president of the South Region, leading banking operations in Alabama, Mississippi, South Louisiana and the Florida Panhandle. Before joining Regions, Turner was named president of Whitney National Bank and Whitney Holding Corporation in 2008 and was elected to the bank and holding company boards of directors. Before that he was responsible for all geographic line banking functions across the bank and served as the company’s Eastern Region President. Turner joined Whitney in 1994 as its Alabama regional president after nine years at AmSouth Bank, where he held senior consumer, commercial and business positions. Turner holds a bachelor’s degree in economics from the University of Georgia. He serves on the Public Affairs Research Council of Alabama, A Plus Education Foundation and Infirmary Health System boards. Turner is a former chairman of the Mobile Area Chamber of Commerce, the Mobile Area Education Foundation and the United Way of Southwest Alabama. He is a graduate of Leadership Alabama and a former board member of Leadership Mobile. INVESTOR DAY 2019 | Overview | 2

Achieved all of our long‐term targets established at Investor Day 2015 Adjusted ROATCE (1) Adjusted Efficiency Ratio (1) Adj. Earnings per Share Growth(1)(2) 16.5% <60% 24% 16% 59.3% 14% 19% Excluding 15% Tax Reform 12% 2018 Target 2018 Results 2018 Target 2018 Results 2018 Target 2018 Results Range(3) Range Range ACHIEVED ACHIEVED ACHIEVED (1) Non‐GAAP; see appendix for reconciliation (2) Three‐year target (3) Investor Day target was 12‐14% and was revised after tax reform INVESTOR DAY 2019 | Overview | 3

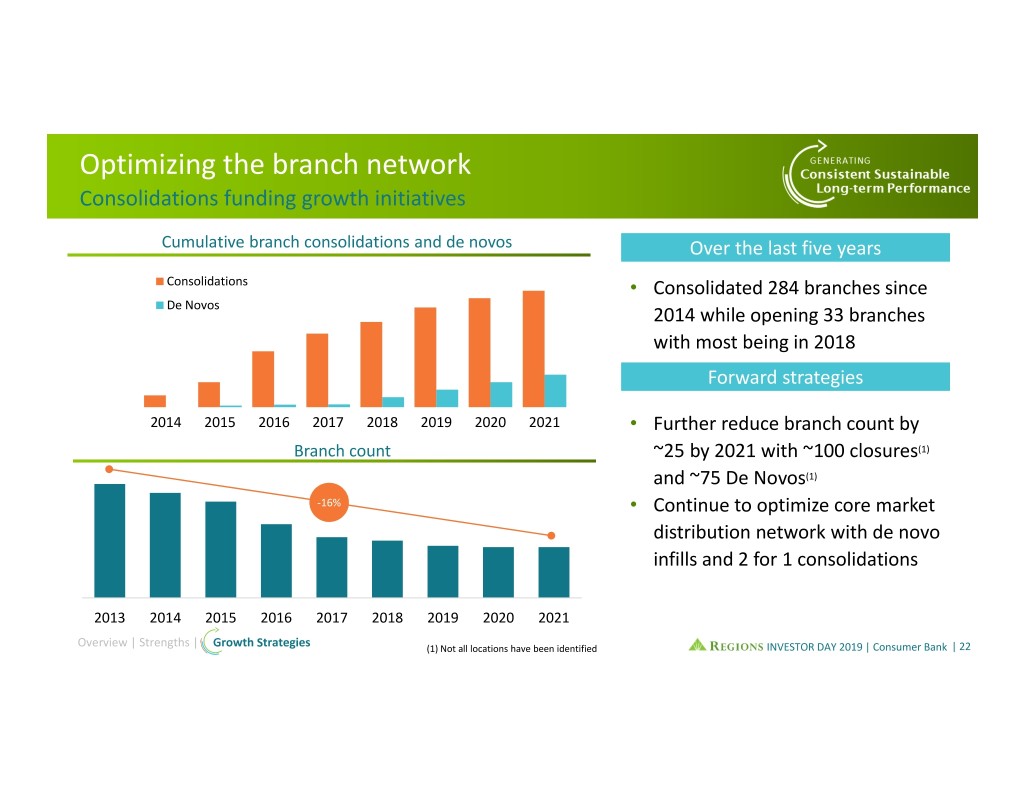

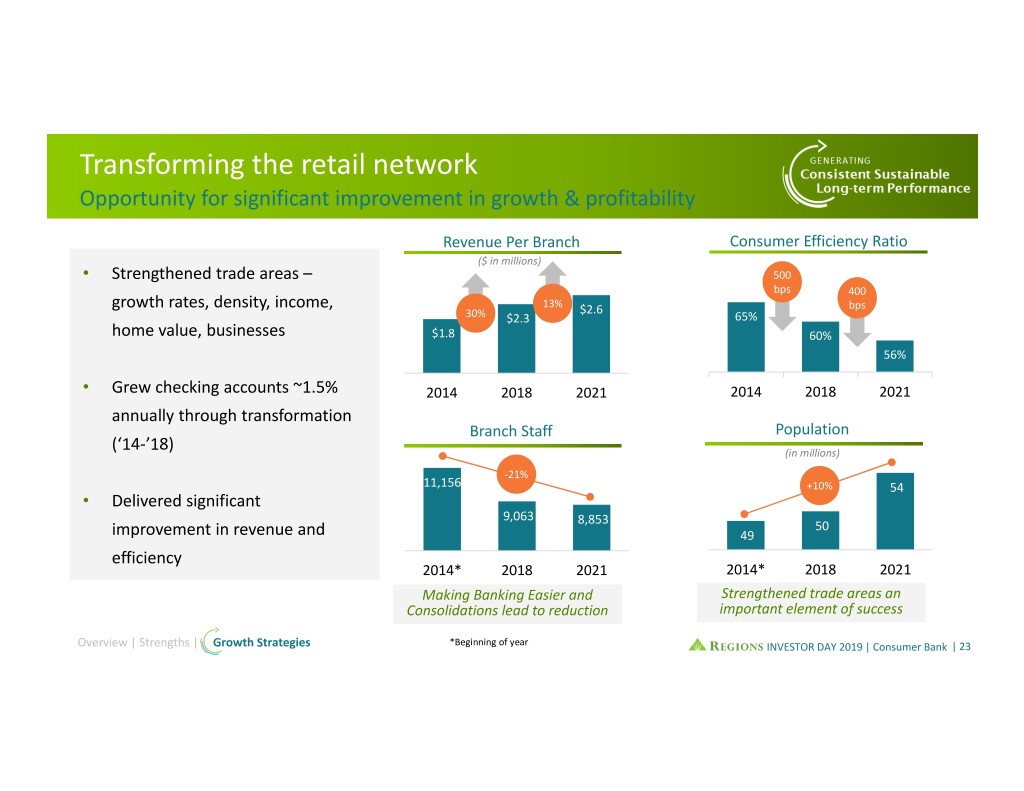

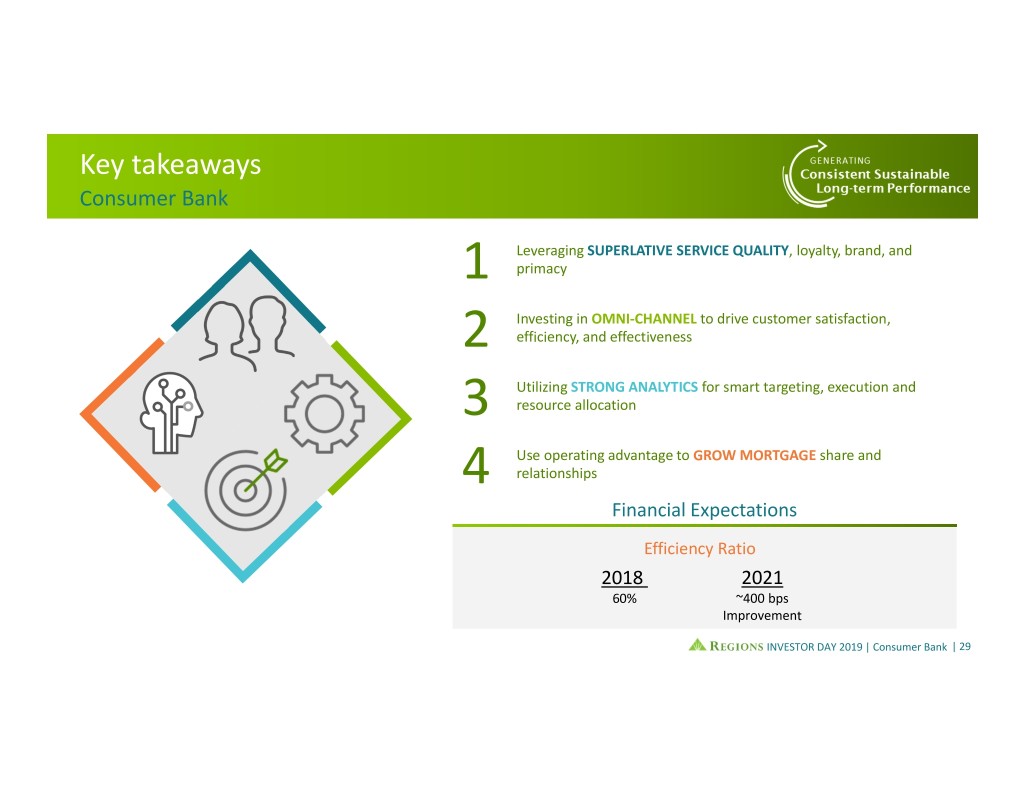

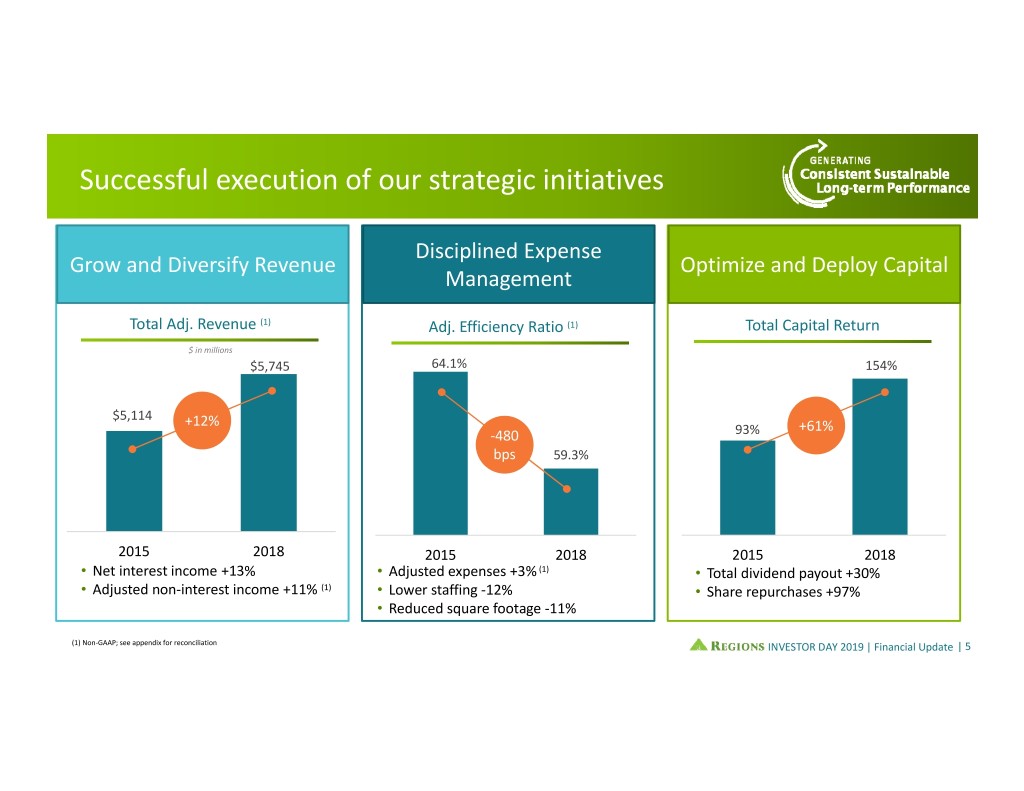

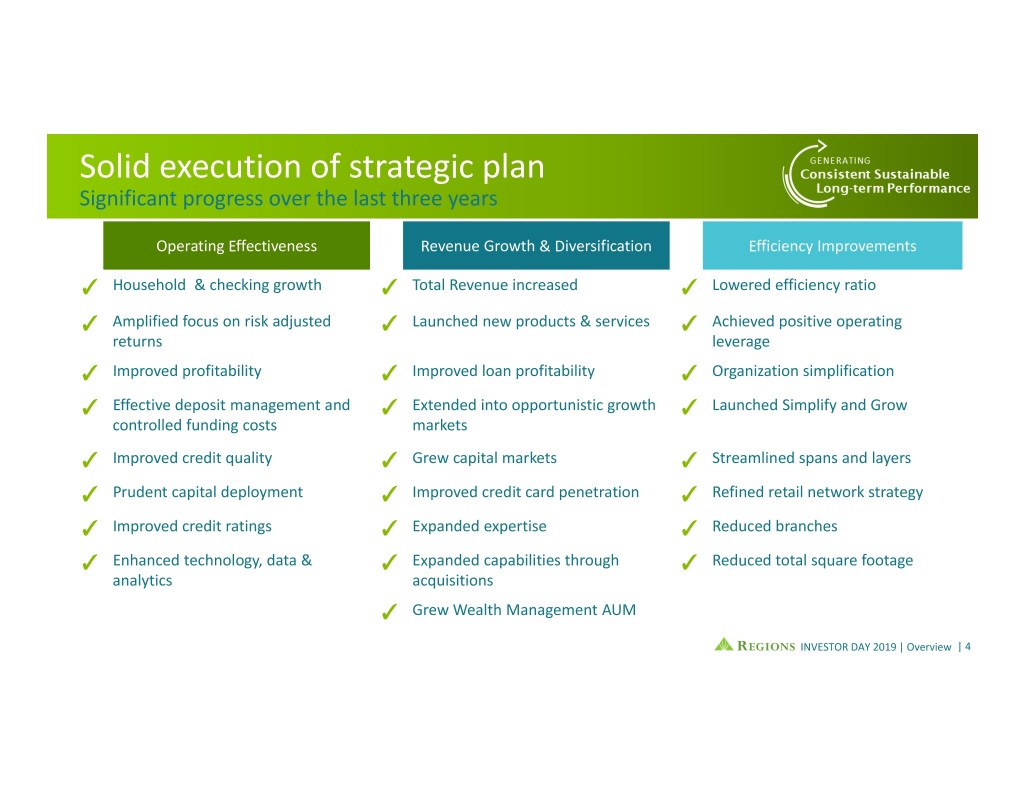

Solid execution of strategic plan Significant progress over the last three years Operating Effectiveness Revenue Growth & Diversification Efficiency Improvements ✓ Household & checking growth ✓ Total Revenue increased ✓ Lowered efficiency ratio ✓ Amplified focus on risk adjusted ✓ Launched new products & services ✓ Achieved positive operating returns leverage ✓ Improved profitability ✓ Improved loan profitability ✓ Organization simplification ✓ Effective deposit management and ✓ Extended into opportunistic growth ✓ Launched Simplify and Grow controlled funding costs markets ✓ Improved credit quality ✓ Grew capital markets ✓ Streamlined spans and layers ✓ Prudent capital deployment ✓ Improved credit card penetration ✓ Refined retail network strategy ✓ Improved credit ratings ✓ Expanded expertise ✓ Reduced branches ✓ Enhanced technology, data & ✓ Expanded capabilities through ✓ Reduced total square footage analytics acquisitions ✓ Grew Wealth Management AUM INVESTOR DAY 2019 | Overview | 4

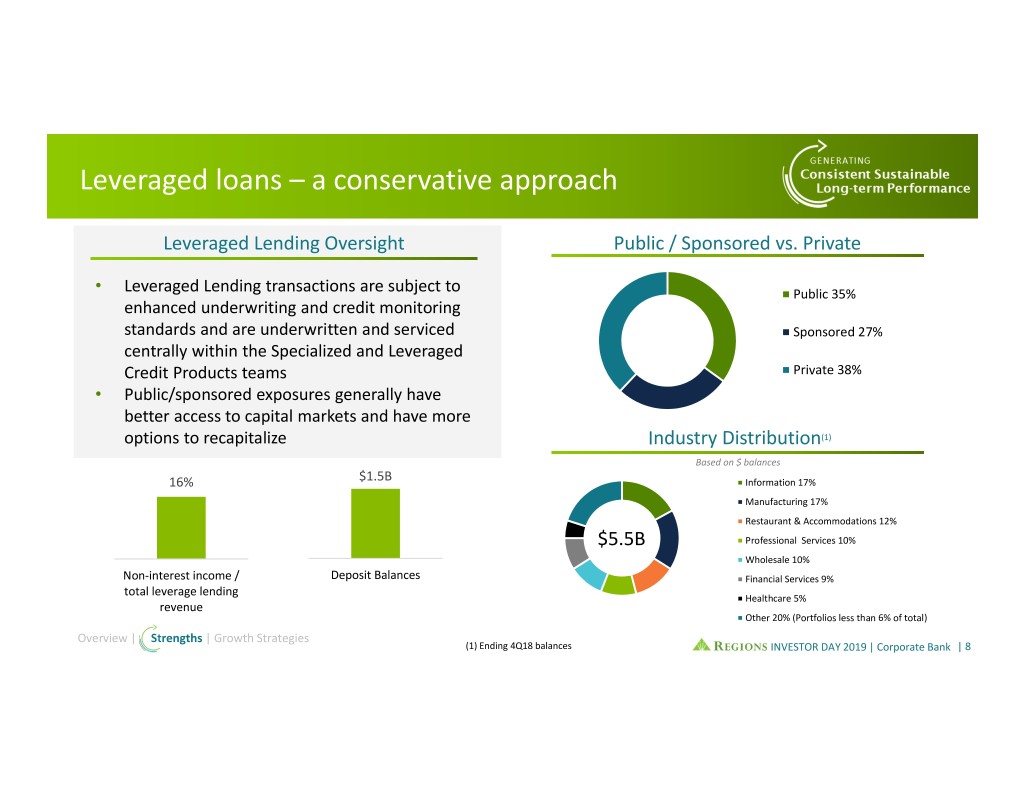

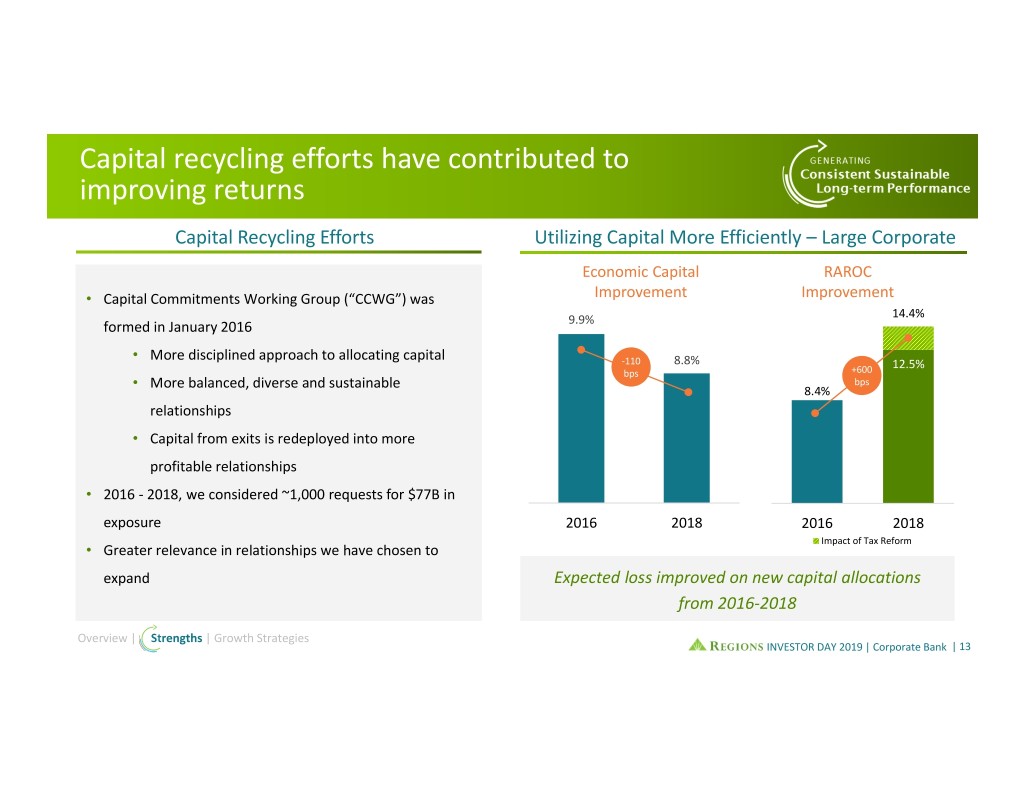

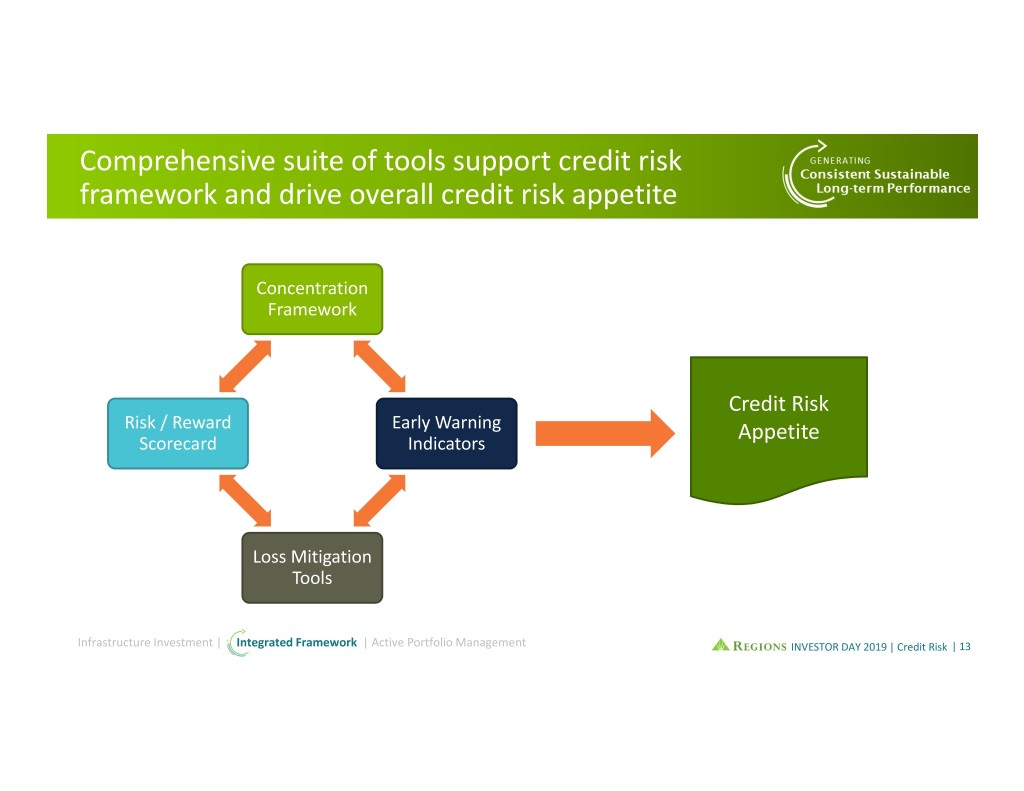

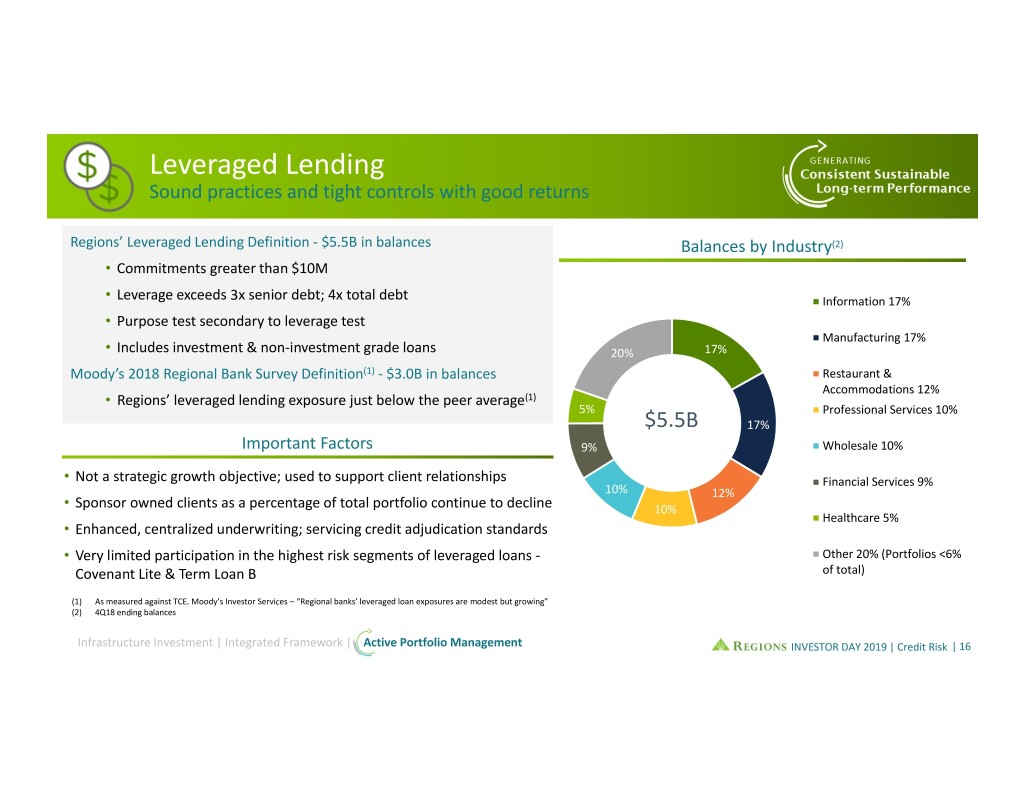

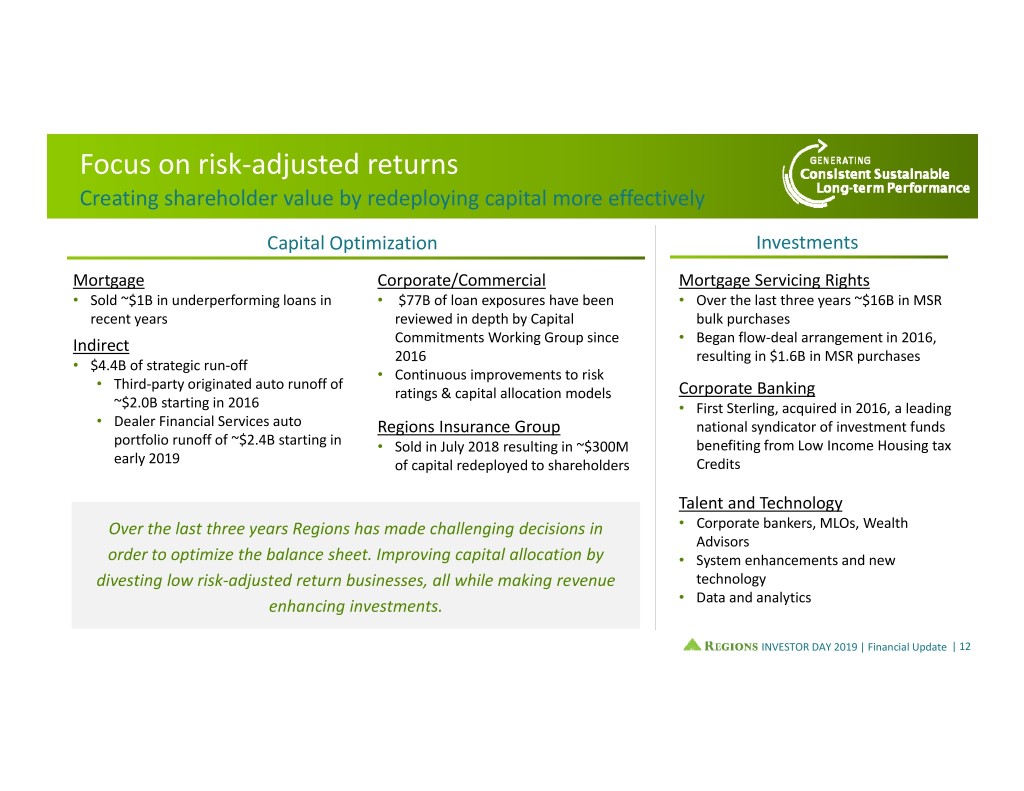

Appropriate capital allocation continues to be a priority Creating shareholder value through increased focus on risk adjusted returns We made challenging decisions in Rigorous processes in place to manage order to optimize our capital Business / Products / Relationships Disciplined focus on relationship profitability Return Hurdles: All businesses are managed to hurdle rates that incorporate through the cycle credit losses Exited lower returning businesses Consumer Bank Corporate Bank Consumer Loan Pricing Committee: Capital Commitments Working Meets monthly to evaluate pricing on all Group: Capital recycling efforts consumer products with an emphasis on Reviews relationship returns for risk adjusted return hurdles significant new & existing relationships Concentration Limit Framework: Further strengthened capital Scorecard based concentration limit allocation practices credit framework with emphasis on risk adjusted return on capital INVESTOR DAY 2019 | Overview | 5

Total shareholder return 3rd highest among peers since 2015 Investor Day 100% 77% 72% 63% 62% 52% 47% 47% 46% 46% 42% 32% 27% 26% 12% Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 Source: Bloomberg; time period 11/19/2015 to 2/19/2019; Peers include: BBT, CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, STI, USB, ZION INVESTOR DAY 2019 | Overview | 6

Why Regions? 1 FOOTPRINT advantage 2 Valuable DEPOSIT FRANCHISE 3 Focus on risk adjusted returns and PROFITABILITY ENHANCED risk management and governance 4 infrastructure Simplify and Grow underpins LONG‐TERM 5 PERFORMANCE INVESTOR DAY 2019 | Overview | 7

INVESTOR DAY 2019 | Overview | 8

Looking ahead…how we will deliver Lean Into Our Continuously Drive Innovation Make Strategic Strengths Improve Through Digital and Disciplined and Data Investments Strategy underpinned by relationship banking approach INVESTOR DAY 2019 | Overview | 9

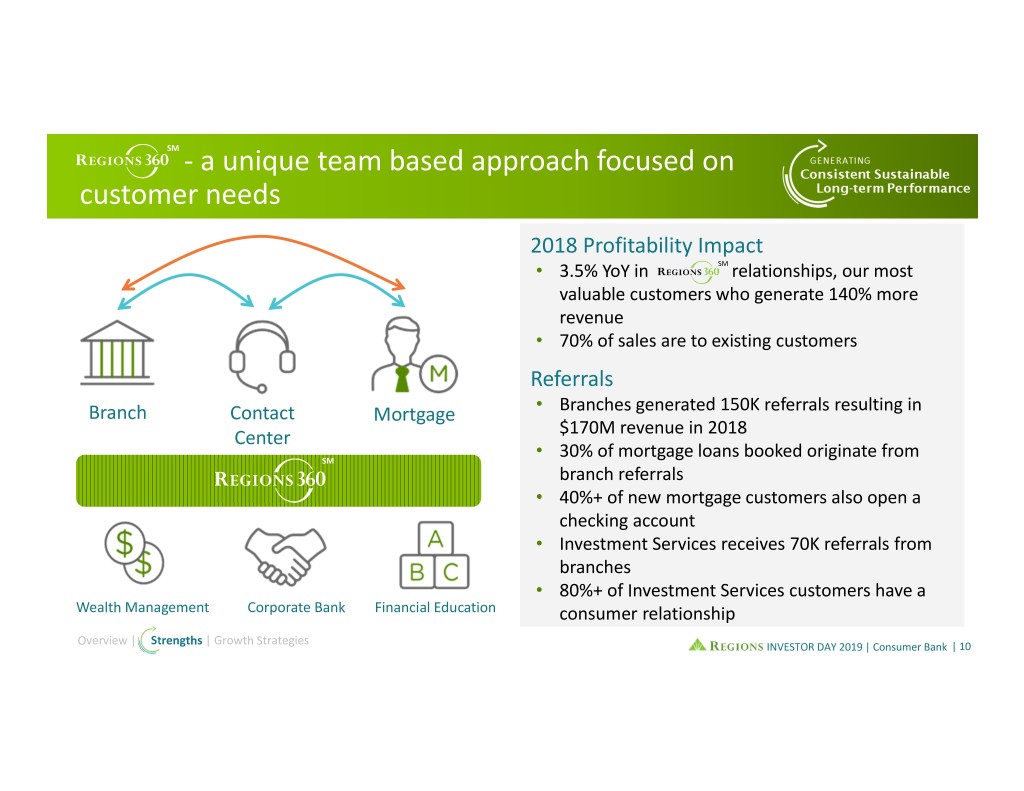

Strategy begins with our strengths Customer Team Culture Markets Enterprise Risk Focus Management Commitment to Attracting, retaining Shared value is at the Stable funding and Consistent and customer and developing foundation of our profitability from strong risk culture experience talent culture core franchise Integrated credit Top ranked Expanding Regions benefits when Opportunity to risk management satisfaction scores expertise our communities leverage presence Focus on risk Making banking prosper in growth markets easier High associate adjusted returns engagement Regions360 focuses on Geographic Investment in Clear and digital capabilities Continued focus on working together to diversity enhances accountable lines of diversity and meet customer needs risk profile defense inclusion Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 10

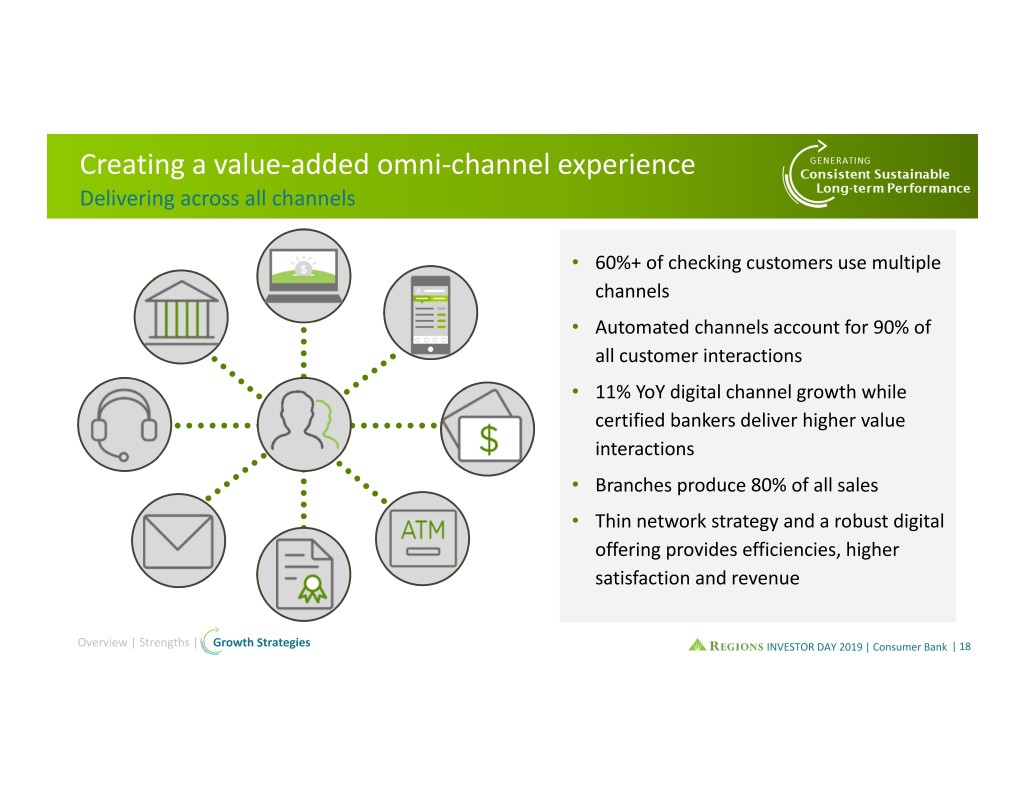

Longstanding commitment to our customers Customer Focus Outstanding customer service Customer expectations are changing • High customer loyalty and primacy • Value added omni‐channel experience • Brand favorability • Enhanced digital experiences • Third‐party recognition • Broad product sets and services • Customer, household and account growth • Proactive advice and guidance • Continued revenue growth • Expertise in commercial and wealth Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 11

Strong team and cultural foundation of honesty, integrity, and trust Team and Culture Shared Value Company Values Go‐To‐Market Our deliberate, prescriptive approach that puts the customers’ needs first Customers Shareholders Recruiting Top Talent Communities Associates Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 12

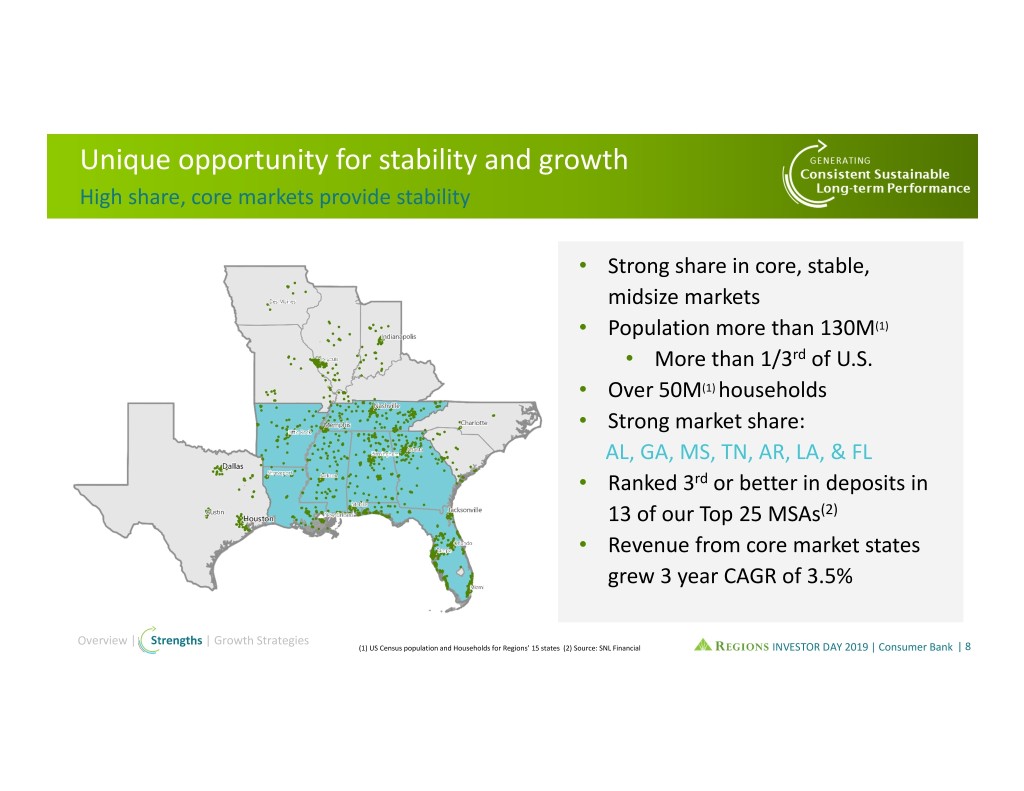

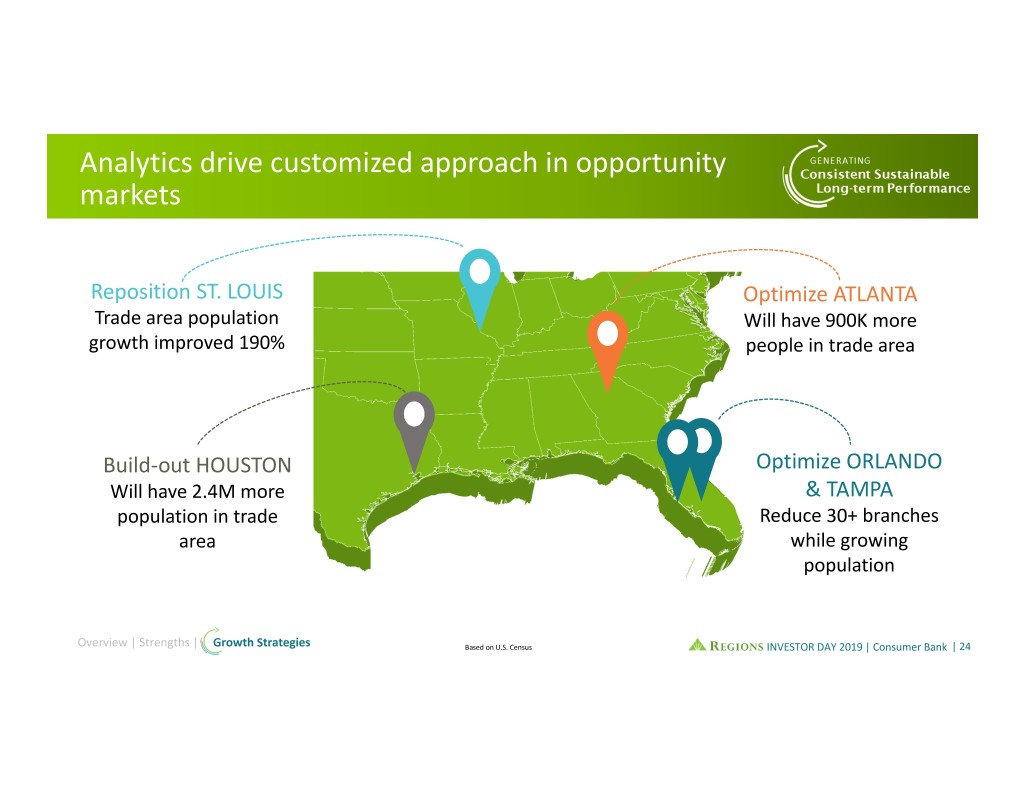

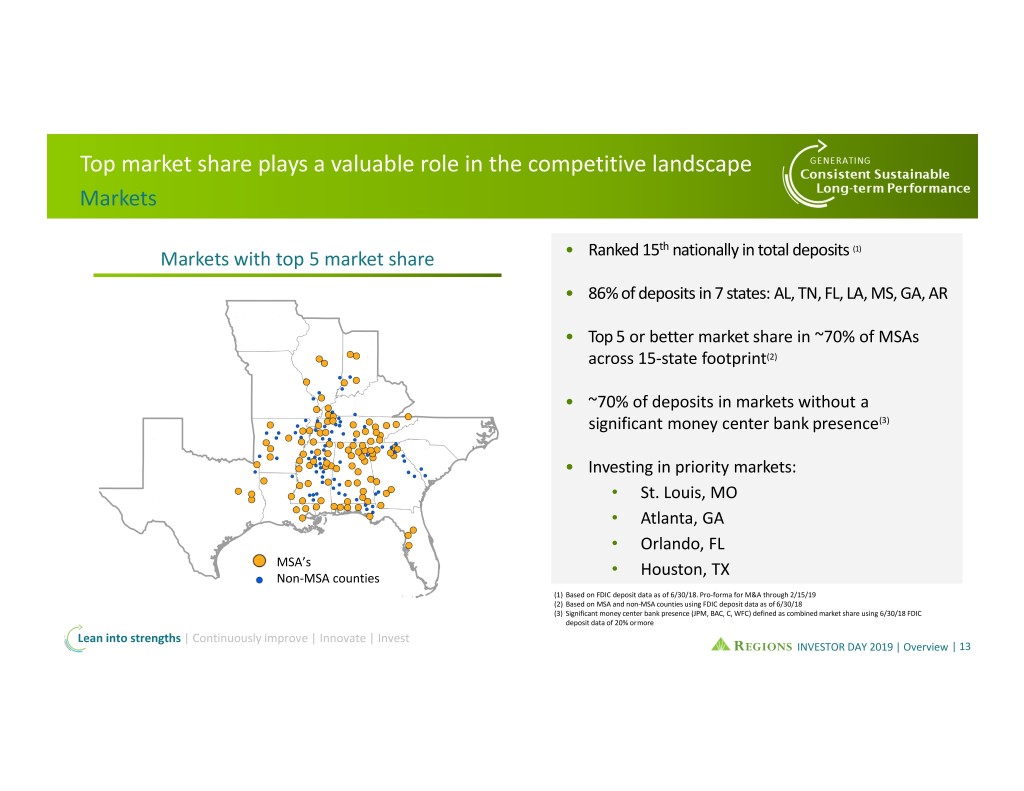

Top market share plays a valuable role in the competitive landscape Markets th (1) Markets with top 5 market share • Ranked 15 nationally in total deposits • 86% of deposits in 7 states: AL, TN, FL, LA, MS, GA, AR • Top 5 or better market share in ~70% of MSAs across 15‐state footprint(2) • ~70% of deposits in markets without a significant money center bank presence(3) • Investing in priority markets: • St. Louis, MO • Atlanta, GA • Orlando, FL MSA’s • Non‐MSA counties Houston, TX (1) Based on FDIC deposit data as of 6/30/18. Pro‐forma for M&A through 2/15/19 (2) Based on MSA and non‐MSA counties using FDIC deposit data as of 6/30/18 (3) Significant money center bank presence (JPM, BAC, C, WFC) defined as combined market share using 6/30/18 FDIC deposit data of 20% ormore Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 13

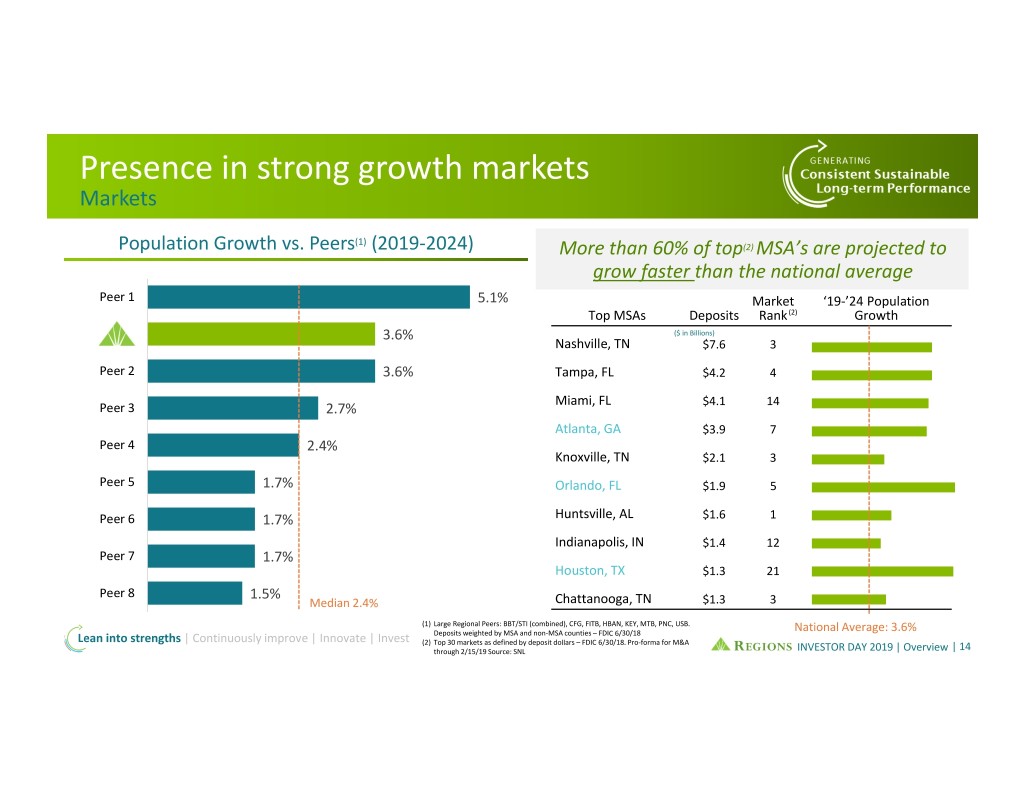

Presence in strong growth markets Markets (1) Population Growth vs. Peers (2019‐2024) More than 60% of top(2) MSA’s are projected to grow faster than the national average Peer 1 5.1% Market ‘19‐’24 Population Top MSAs Deposits Rank (2) Growth 3.6% ($ in Billions) Nashville, TN $7.6 3 Peer 2 3.6% Tampa, FL $4.2 4 Miami, FL $4.1 14 Peer 3 2.7% Atlanta, GA $3.9 7 Peer 4 2.4% Knoxville, TN $2.1 3 Peer 5 1.7% Orlando, FL $1.9 5 Peer 6 1.7% Huntsville, AL $1.6 1 Indianapolis, IN $1.4 12 Peer 7 1.7% Houston, TX $1.3 21 Peer 8 1.5% Median 2.4% Chattanooga, TN $1.3 3 (1) Large Regional Peers: BBT/STI (combined), CFG, FITB, HBAN, KEY, MTB, PNC, USB. Deposits weighted by MSA and non‐MSA counties –FDIC 6/30/18 National Average: 3.6% Lean into strengths | Continuously improve | Innovate | Invest (2) Top 30 markets as defined by deposit dollars –FDIC 6/30/18. Pro‐forma for M&A through 2/15/19 Source: SNL INVESTOR DAY 2019 | Overview | 14

Our footprint has significant economic advantages Markets Jobs Population Footprint Retirees 42% of all new jobs 51% of all U.S. 35% of the GDP 6 of the top 10 created in the US population growth in last generated in our states where since 2009 were in 10 years occurred within footprint retirees are our footprint our footprint moving Alabama Tennessee Louisiana Florida Georgia #1 state for #1 state for foreign #1 state for GDP ranks among the #1 state for doing manufacturing job investments workforce training world’s largest business economies Lean into strengths | Continuously improve | Innovate | Invest Note: See appendix for references INVESTOR DAY 2019 | Overview | 15

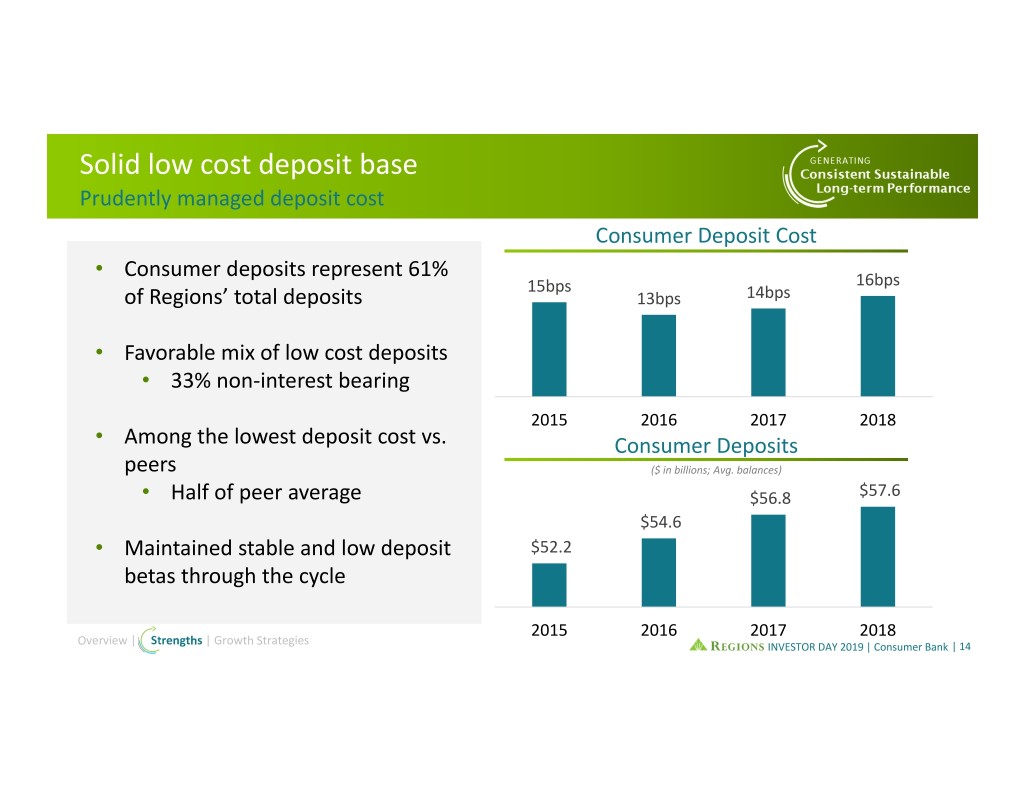

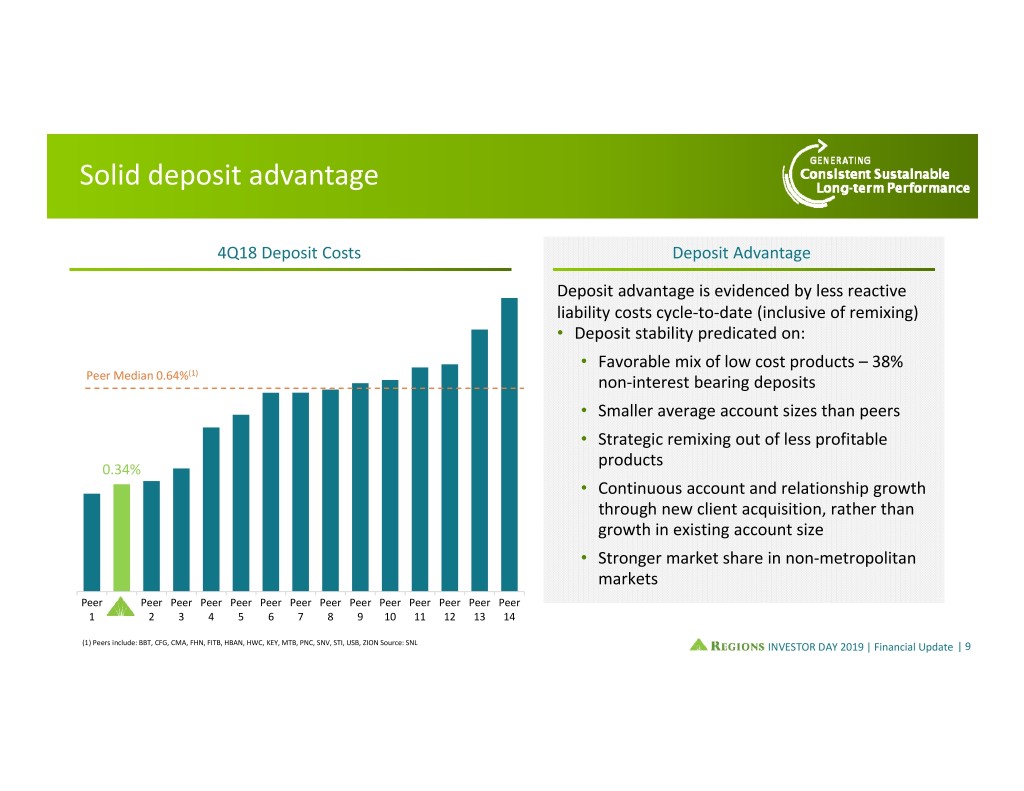

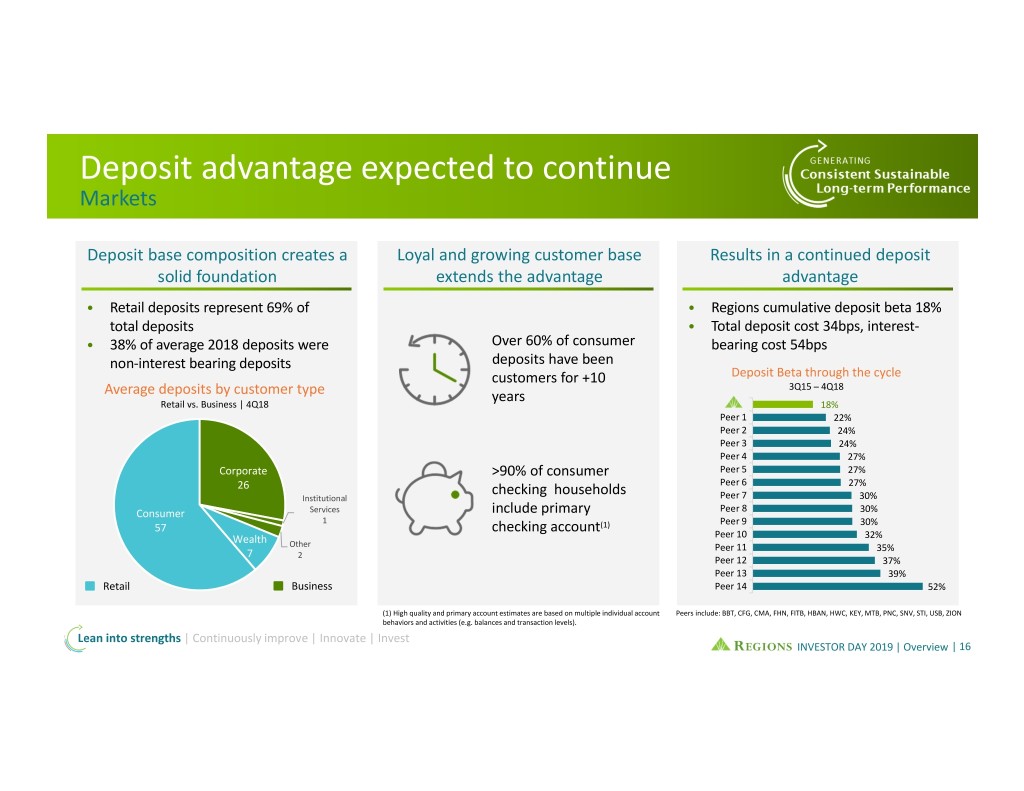

Deposit advantage expected to continue Markets Deposit base composition creates a Loyal and growing customer base Results in a continued deposit solid foundation extends the advantage advantage • Retail deposits represent 69% of • Regions cumulative deposit beta 18% total deposits • Total deposit cost 34bps, interest‐ • 38% of average 2018 deposits were Over 60% of consumer bearing cost 54bps non‐interest bearing deposits deposits have been customers for +10 Deposit Beta through the cycle 3Q15 –4Q18 Average deposits by customer type years Retail vs. Business | 4Q18 18% Peer 1 22% Peer 2 24% Peer 3 24% Peer 4 27% Corporate >90% of consumer Peer 5 27% 26 checking households Peer 6 27% Institutional Peer 7 30% Consumer Services include primary Peer 8 30% 1 Peer 9 30% 57 checking account(1) Wealth Peer 10 32% Other Peer 11 35% 7 2 Peer 12 37% Peer 13 39% Retail Business Peer 14 52% (1) High quality and primary account estimates are based on multiple individual account Peers include: BBT, CFG, CMA, FHN, FITB, HBAN, HWC, KEY, MTB, PNC, SNV, STI, USB, ZION behaviors and activities (e.g. balances and transaction levels). Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 16

Sound risk management practices Enterprise Risk Management Collaborative Risk Culture Sound Risk Appetite • Clear tone from the top • Knowing our risk capacity • Associate ownership • Alignment with strategy • Escalation expectations • Balanced financial strength • Effective challenge • Risk‐reward evaluation • Open communication • Company‐wide understanding • In‐depth training Responsible Risk Governance Sustainable Risk Processes • Interests aligned with all stakeholders • Identify –Measure – Mitigate – • Robust challenge process Monitor –Report • Extensive risk governance framework • Consistently managed and monitored process Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 17

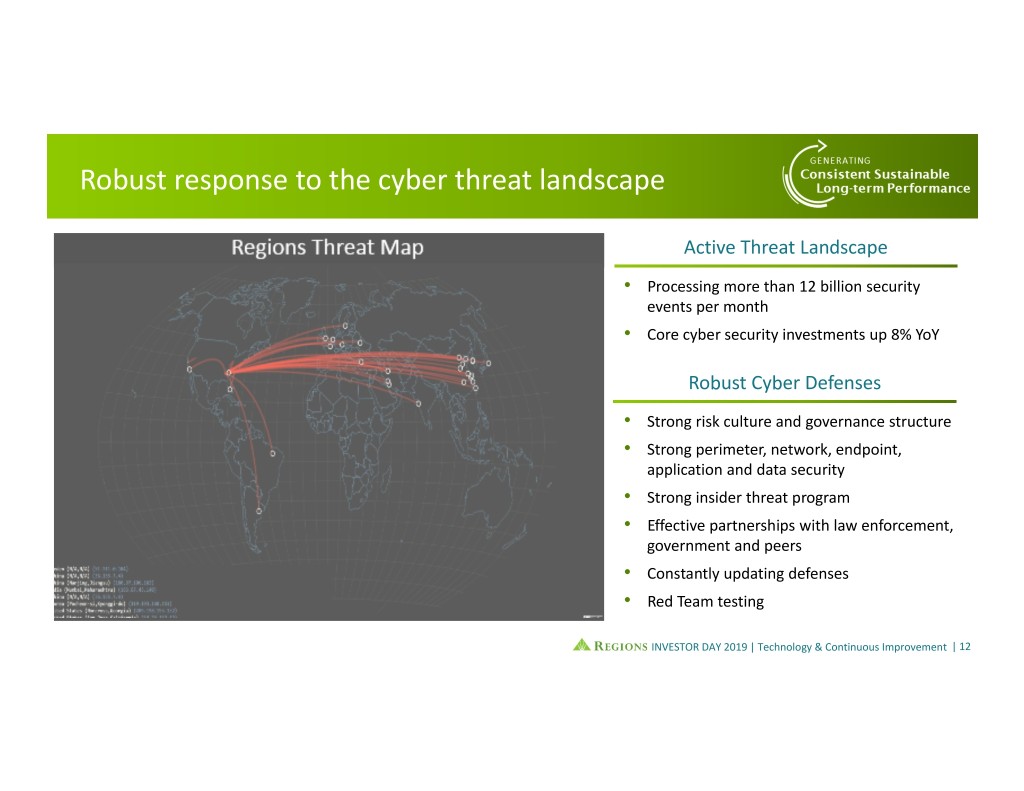

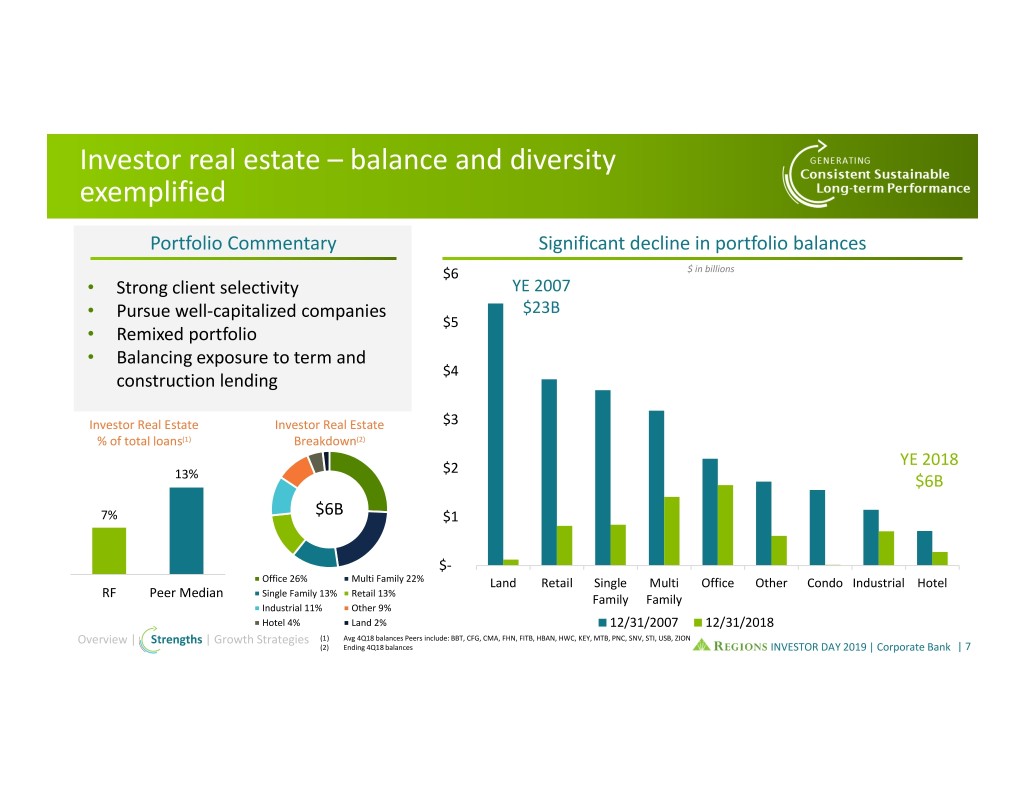

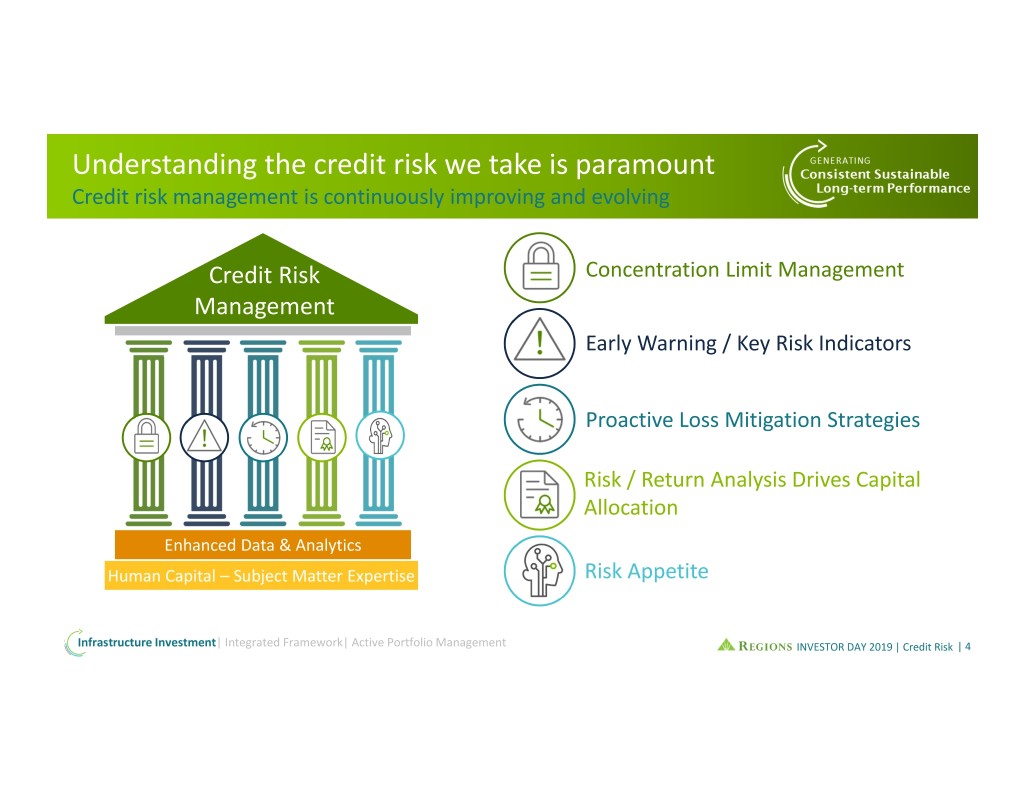

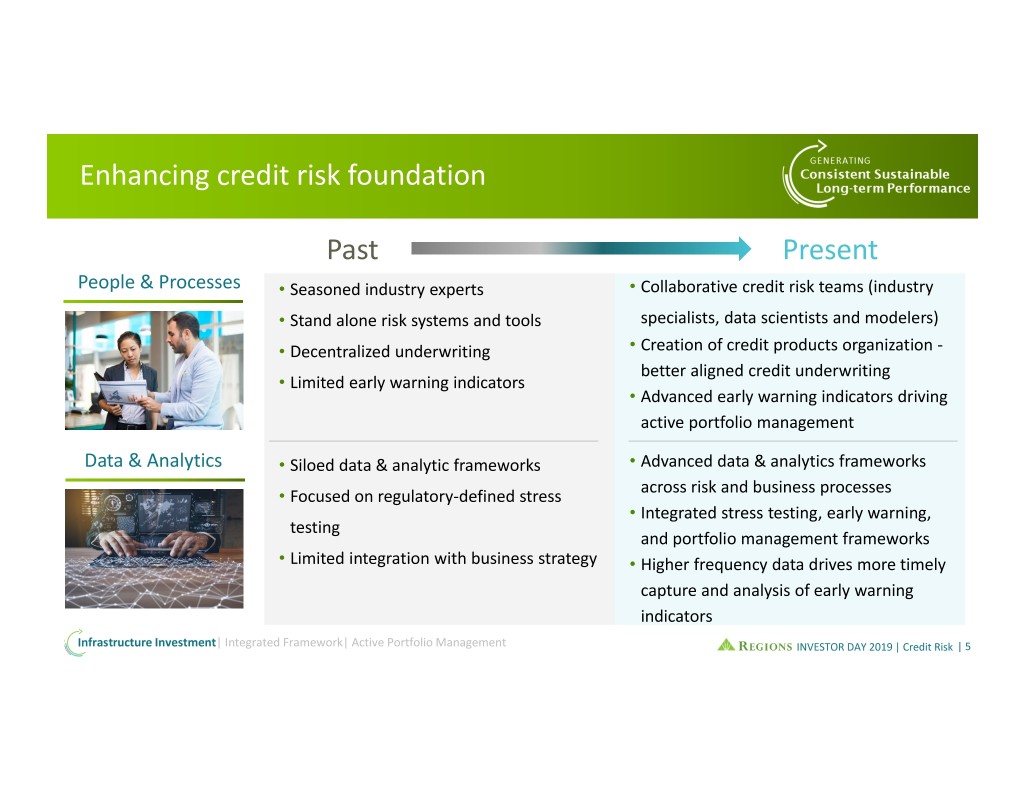

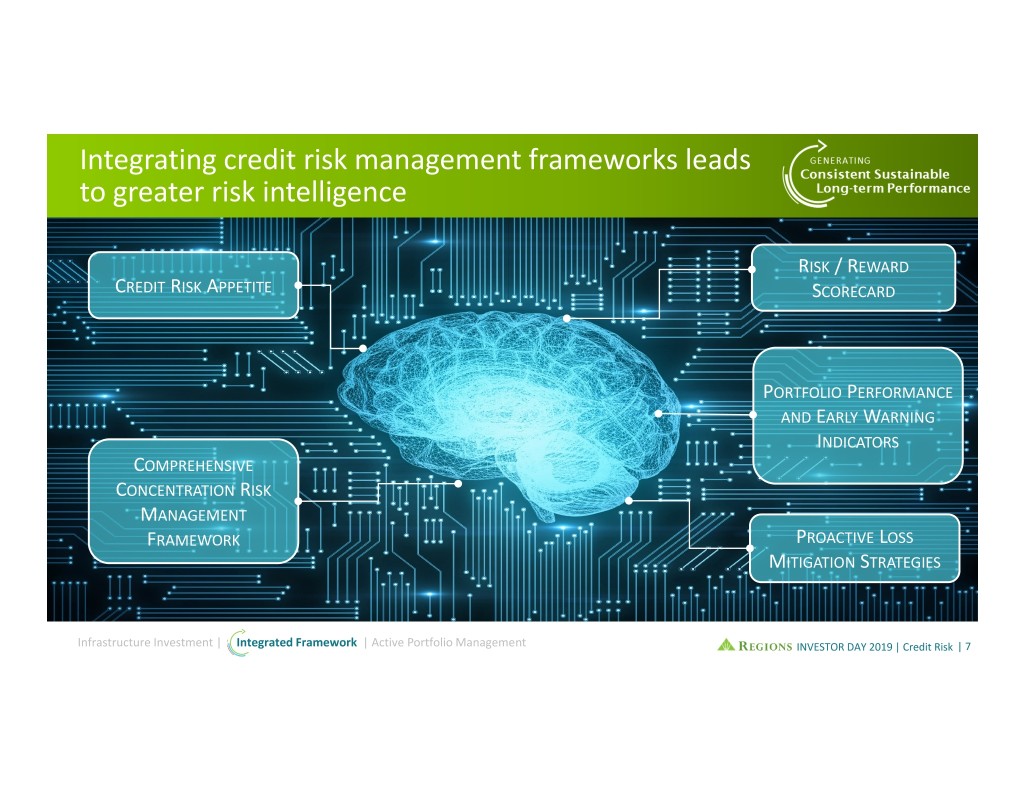

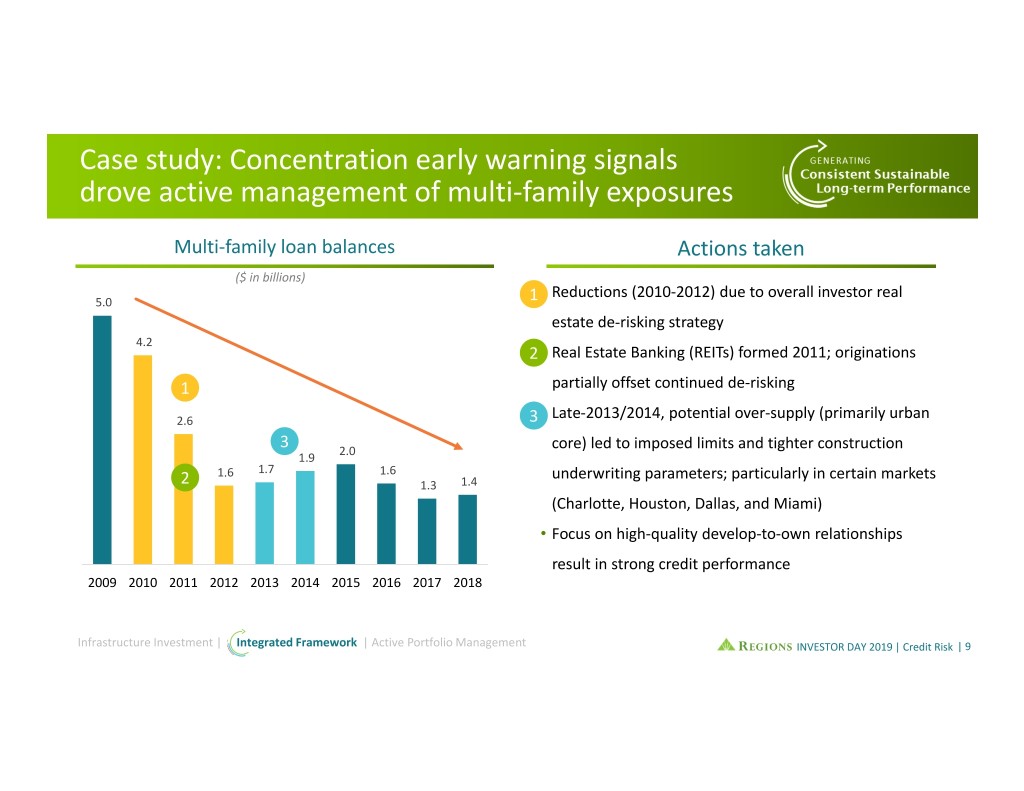

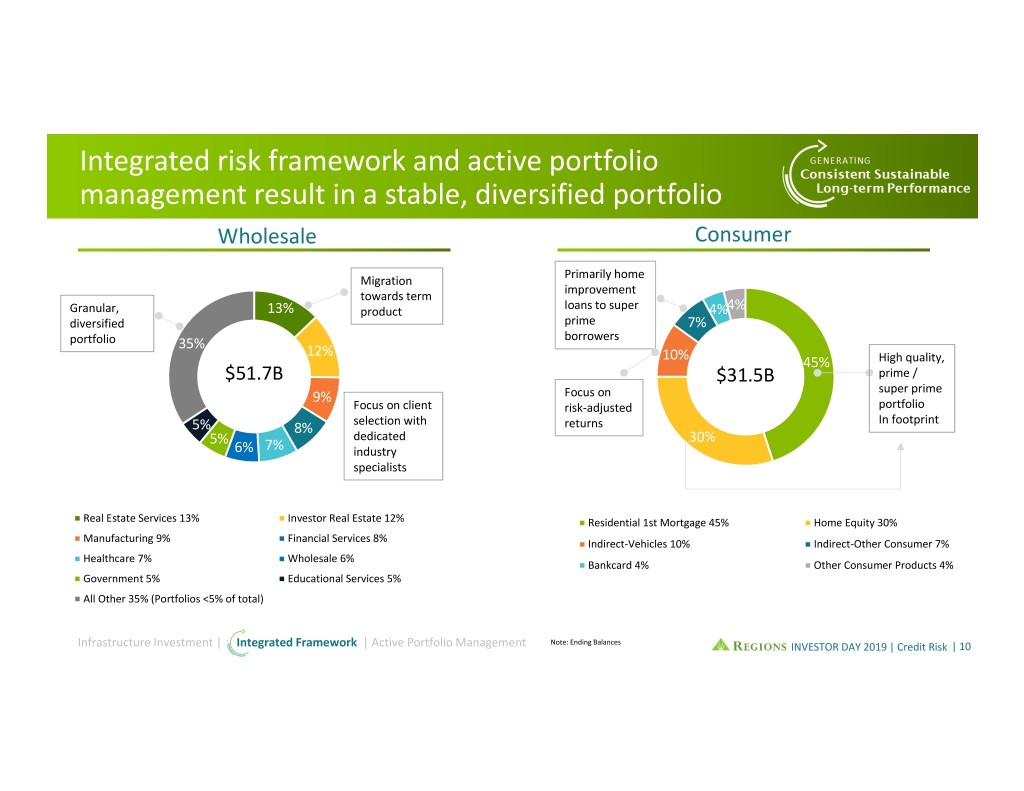

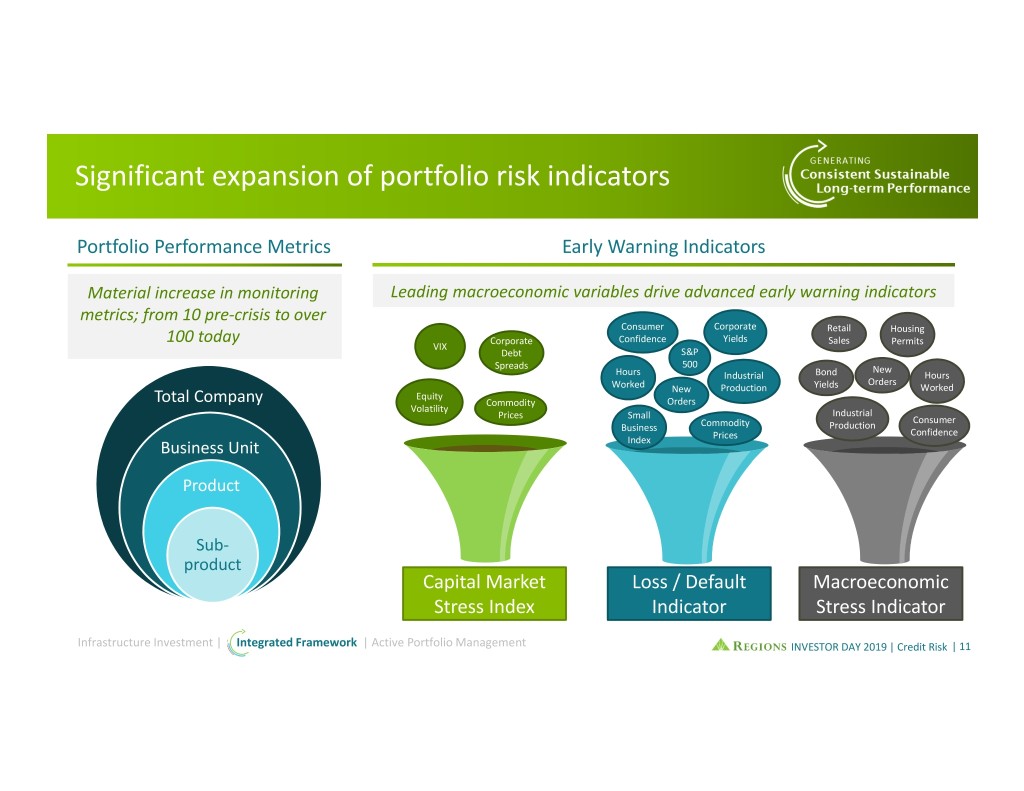

Solid approach to understanding the risks we take Enterprise Risk Management Positioned to perform in any environment Understanding Risk • Late‐stage credit cycle risk • Strategic risk • Interest rate risk • Customer and associate conduct risk • Information security risk • Business resilience risk • Change management risk • Geopolitical risk Credit Risk Mitigation • Strong credit risk culture • Balance and diversity • Client selection • Analytically informed decisions –early warning indicators • Managing through the cycle –concentration limits Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 18

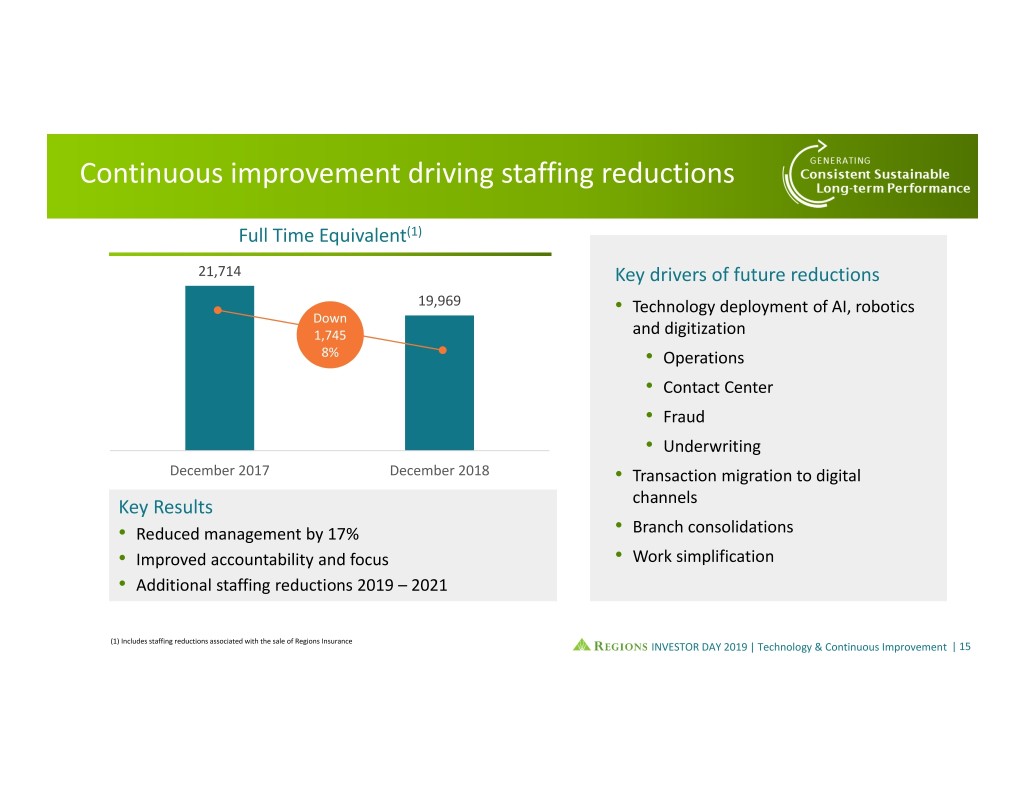

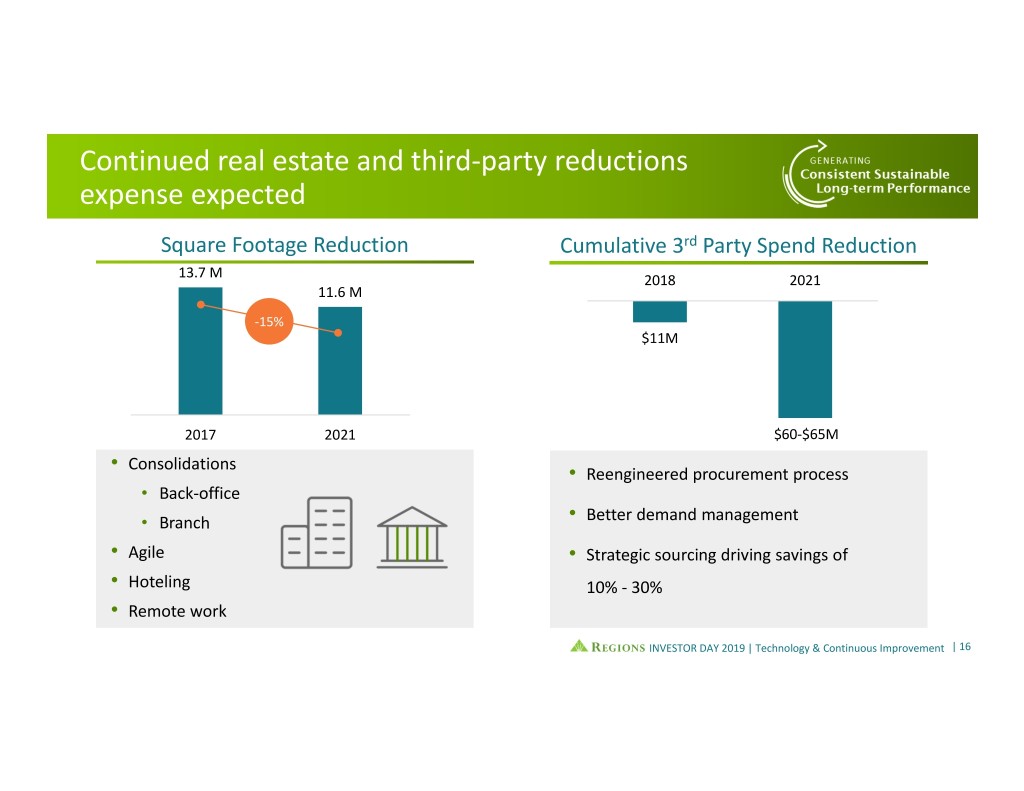

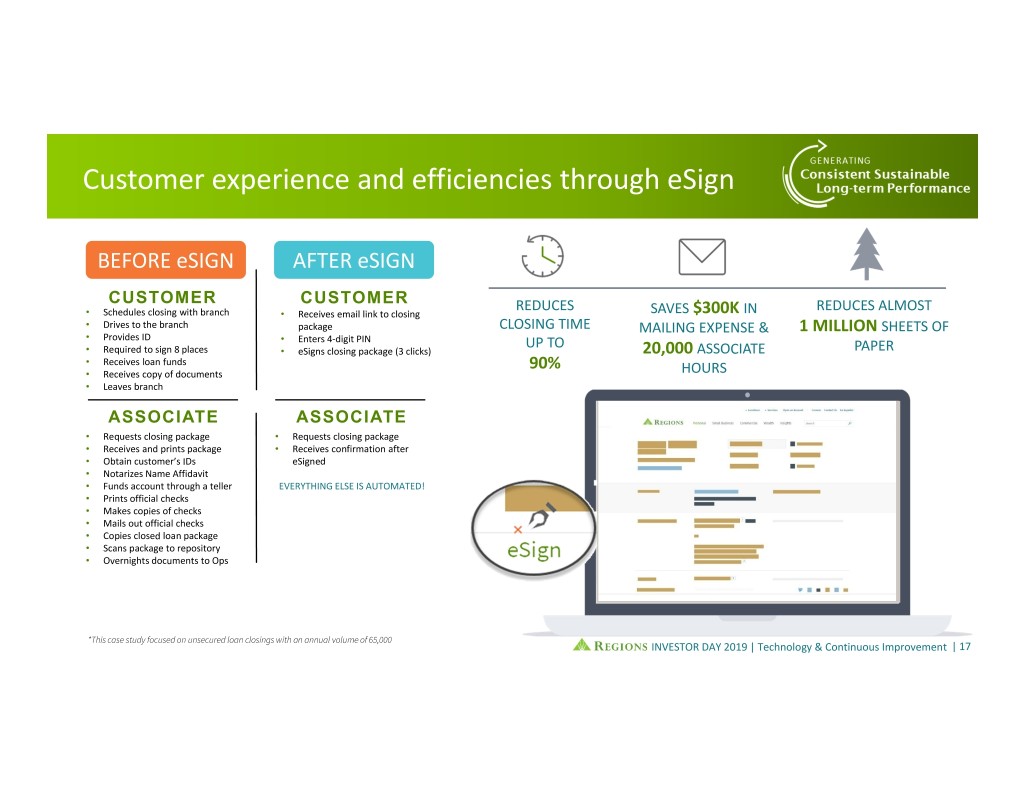

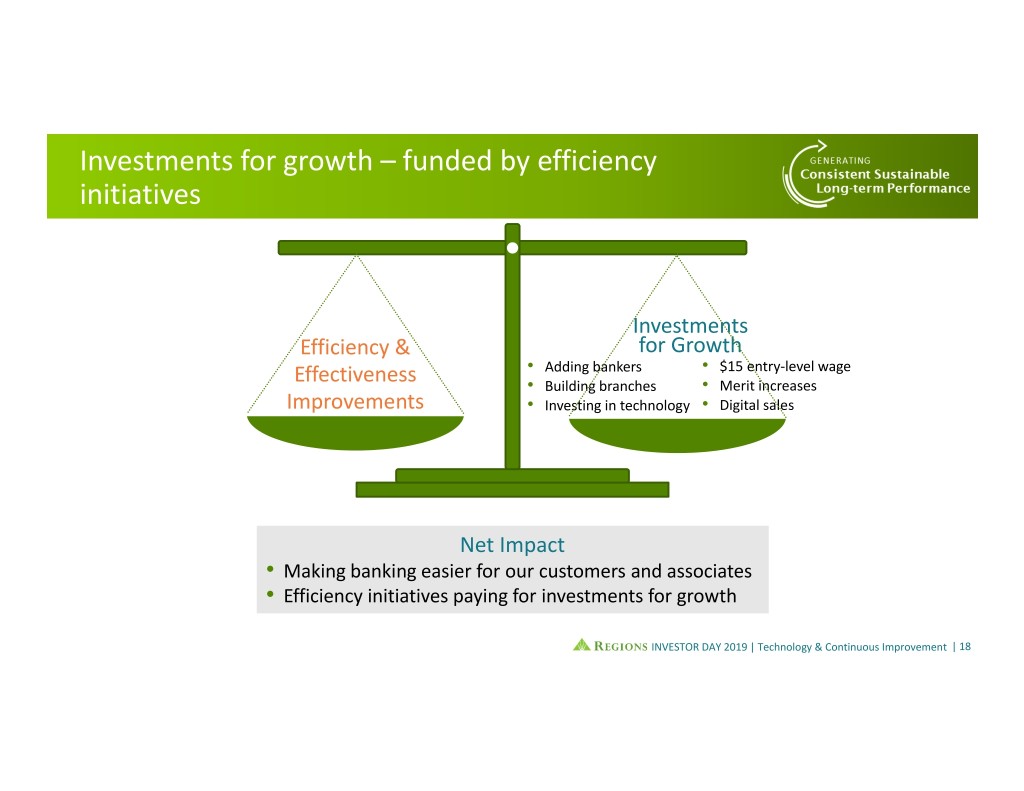

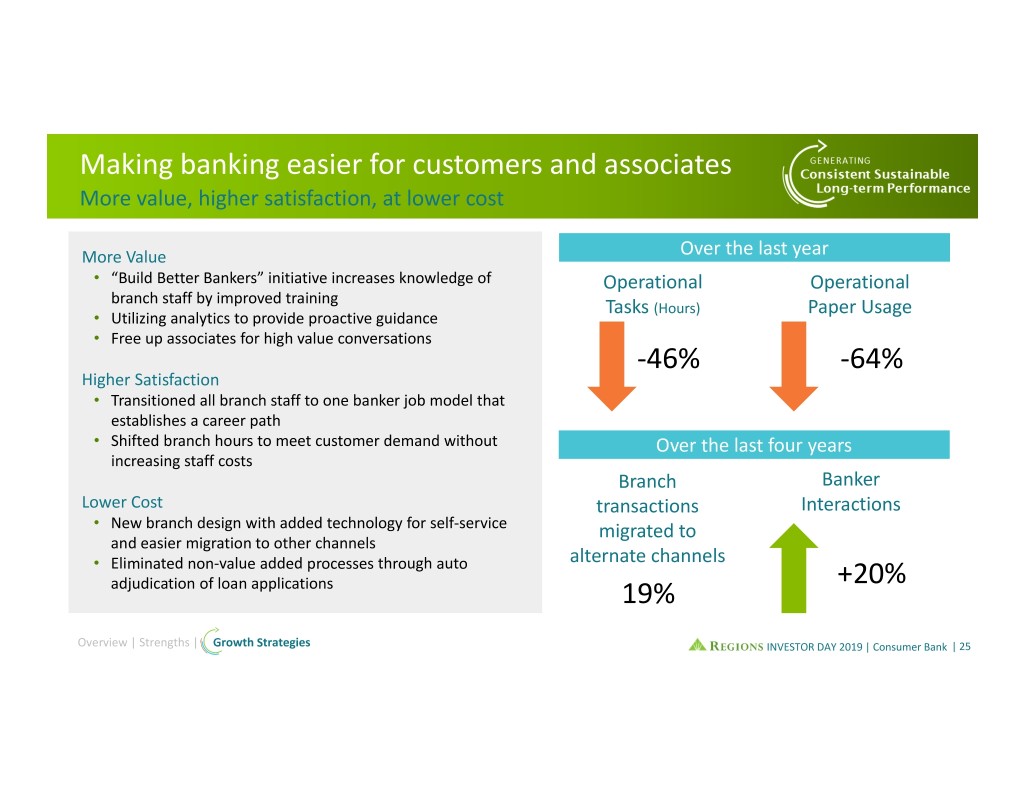

Delivering continuous improvement through our Simplify and Grow approach MAKING BANKING EASIER • Organization simplification MAKING • Full digitization BANKING REVENUE • Enhanced loan processes and account openings GROWTH • Streamline credit process; more digital; faster EASIER responses REVENUE GROWTH • Faster launch of new initiatives • Use advanced analytics to drive growth • Channel optimization EFFICIENCY IMPROVEMENTS • Robotics and artificial intelligence • Employ shared services model EFFICIENCY IMPROVEMENTS • Branch and other facility consolidations • Outsourcing Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 19

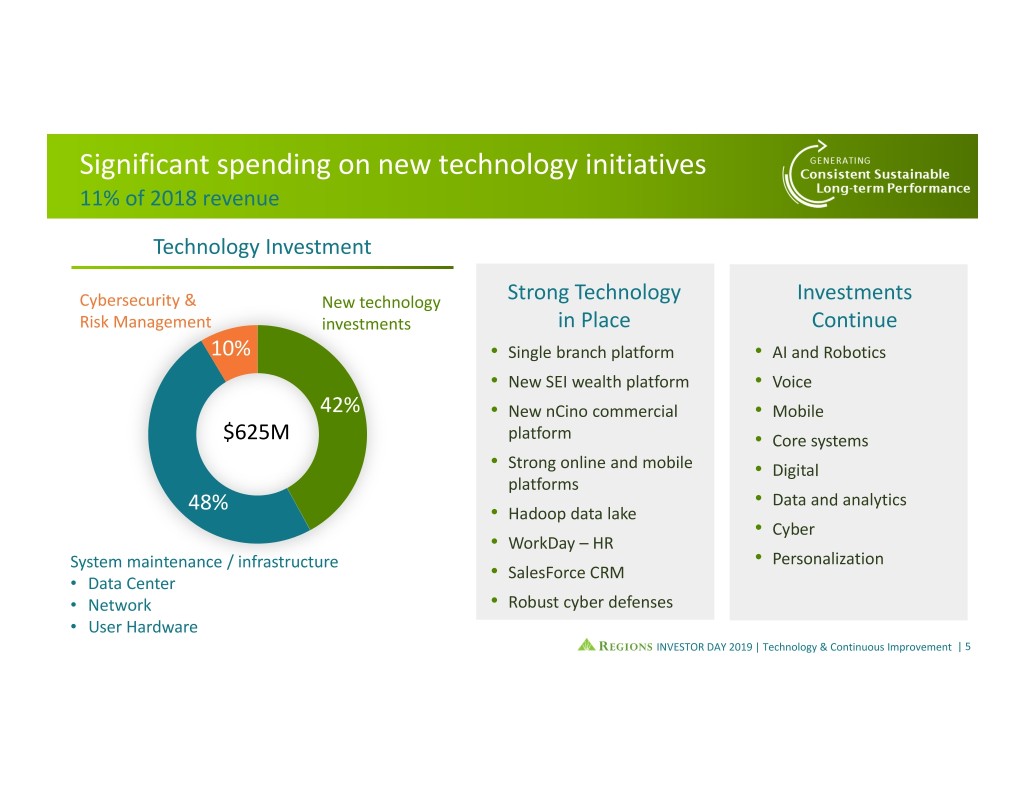

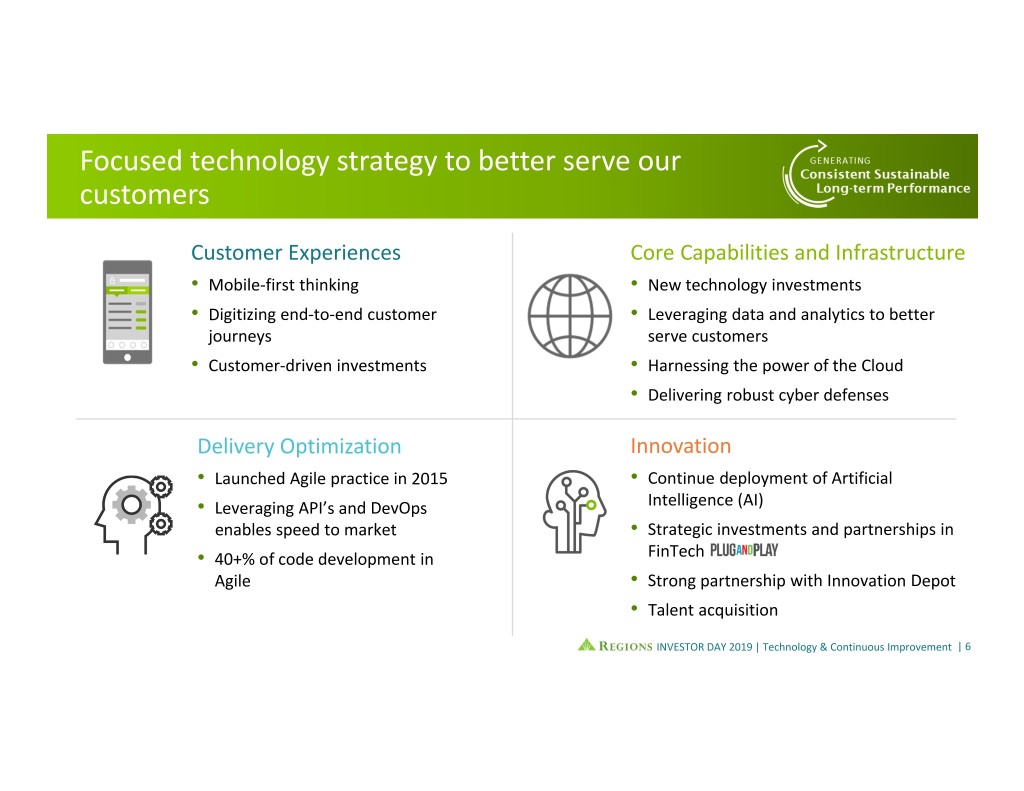

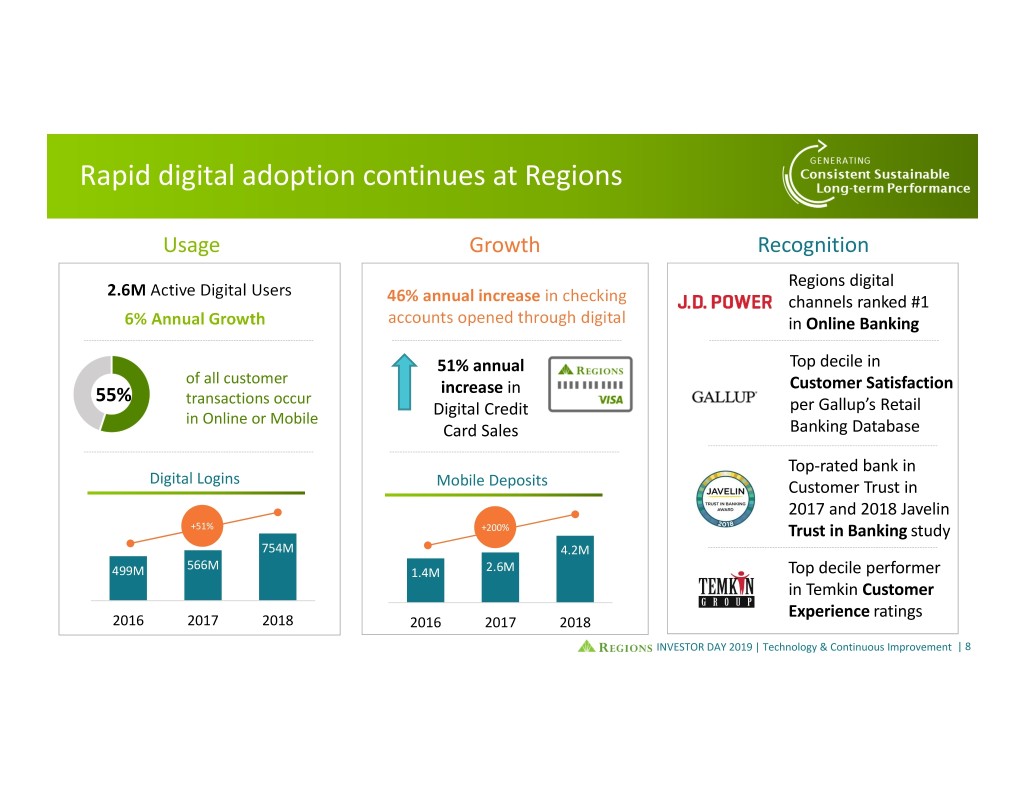

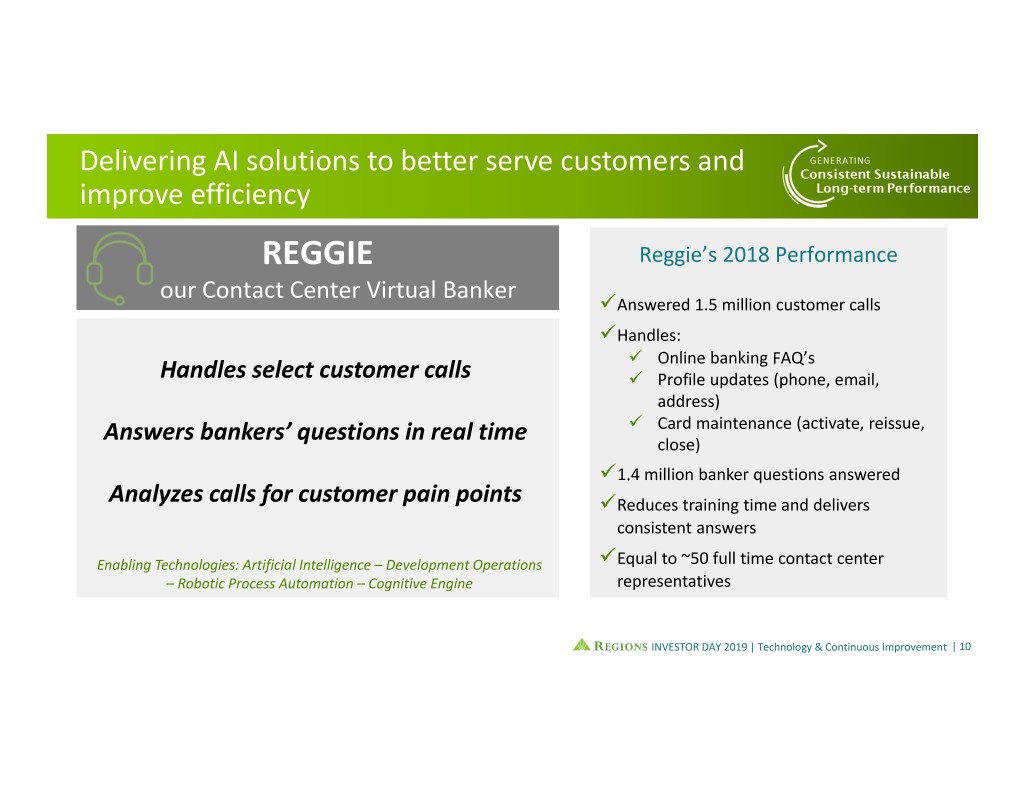

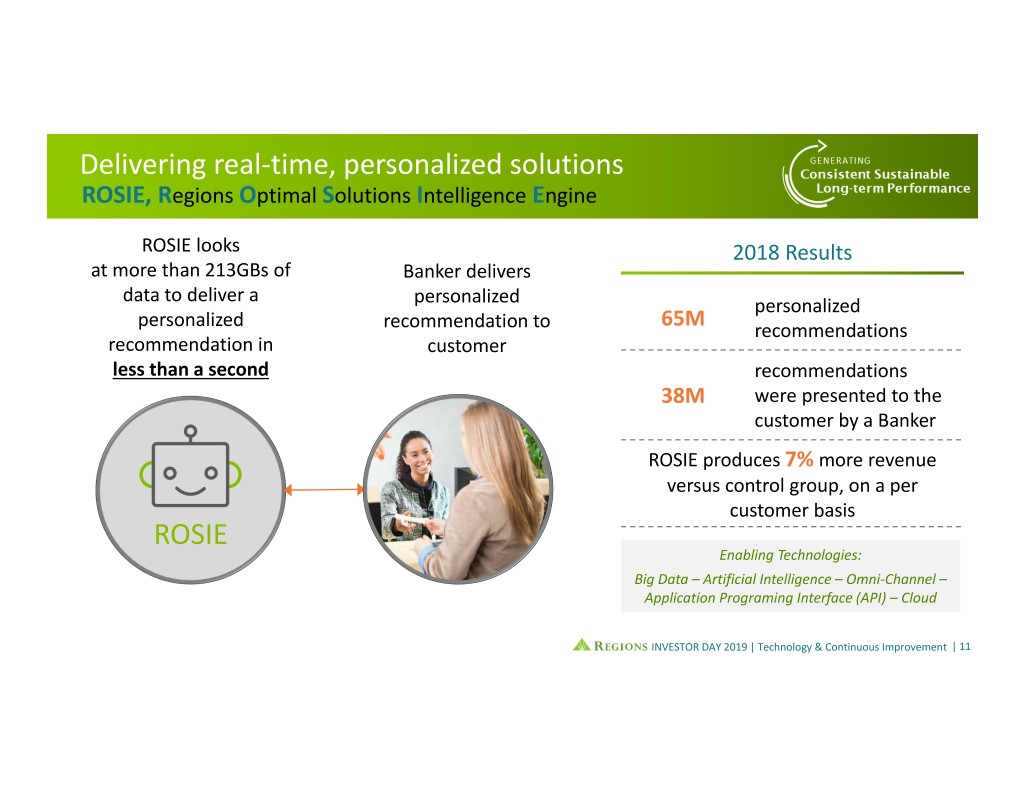

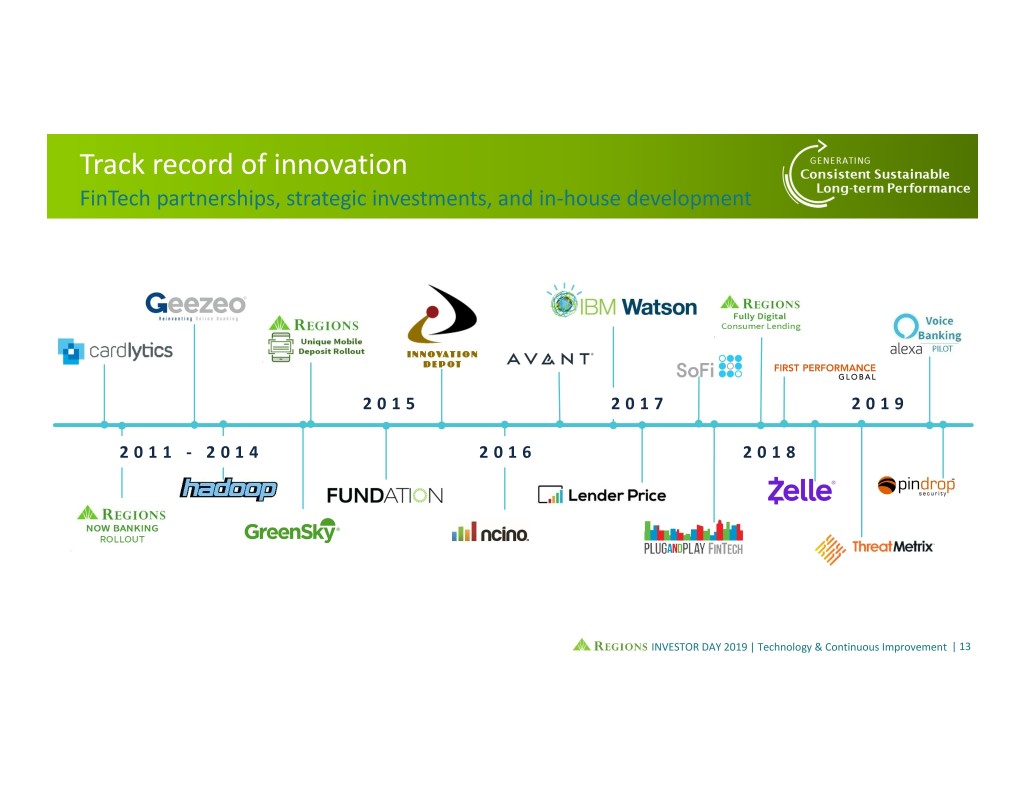

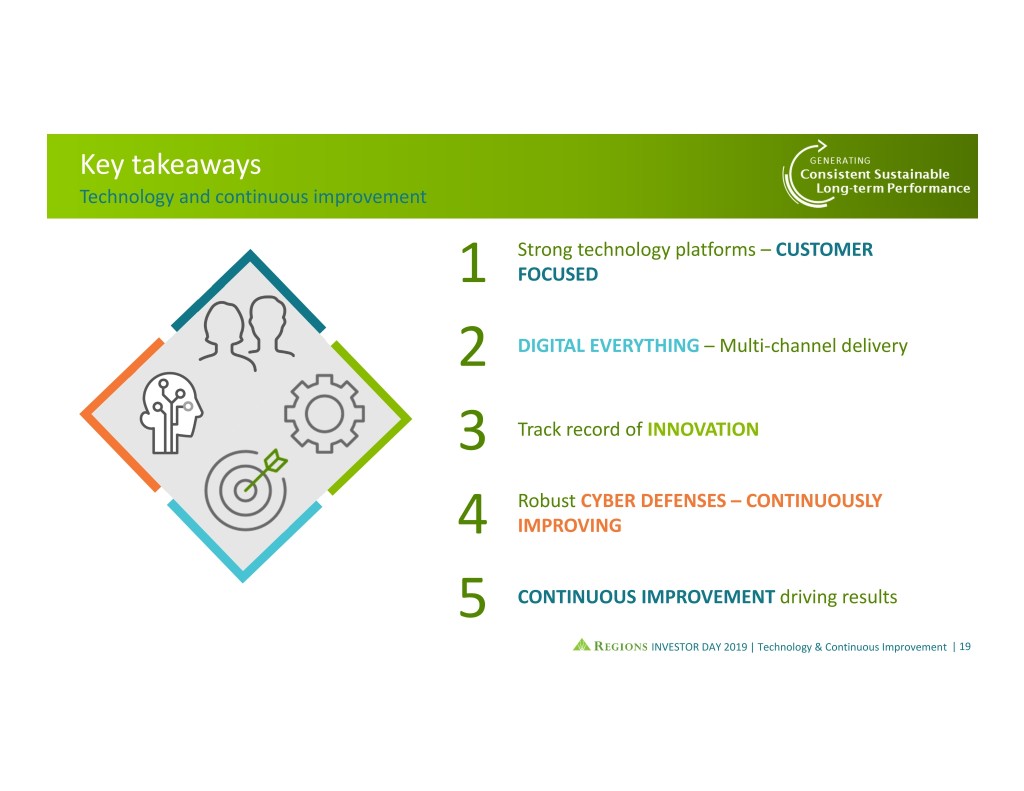

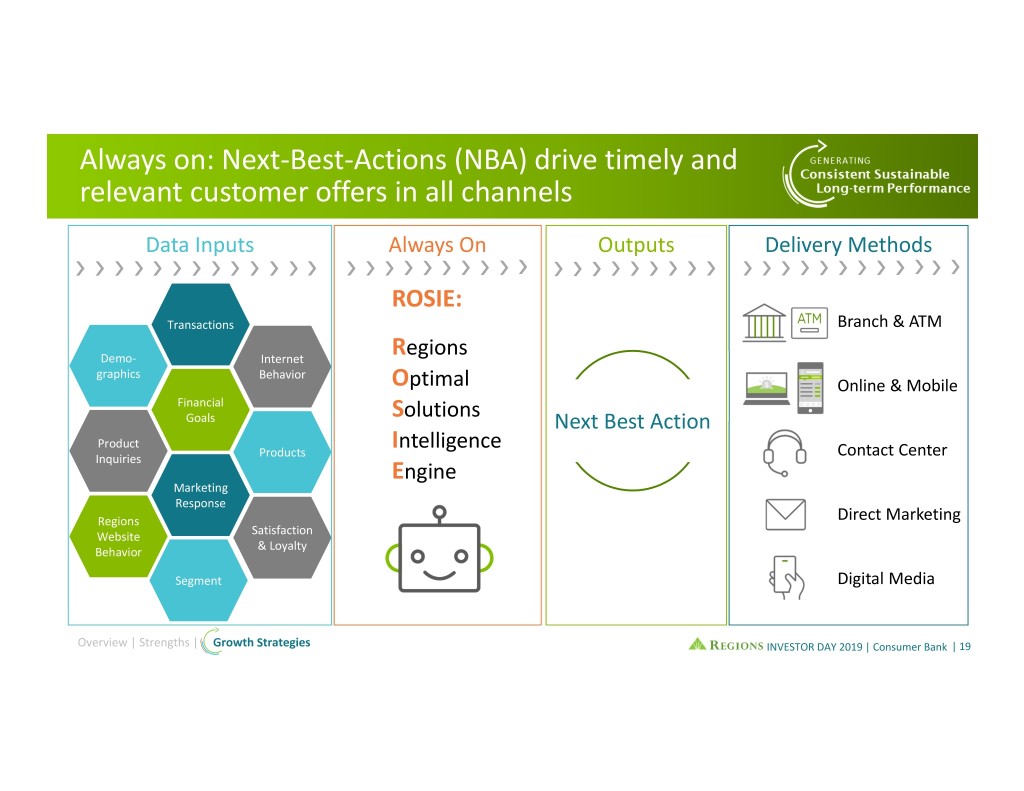

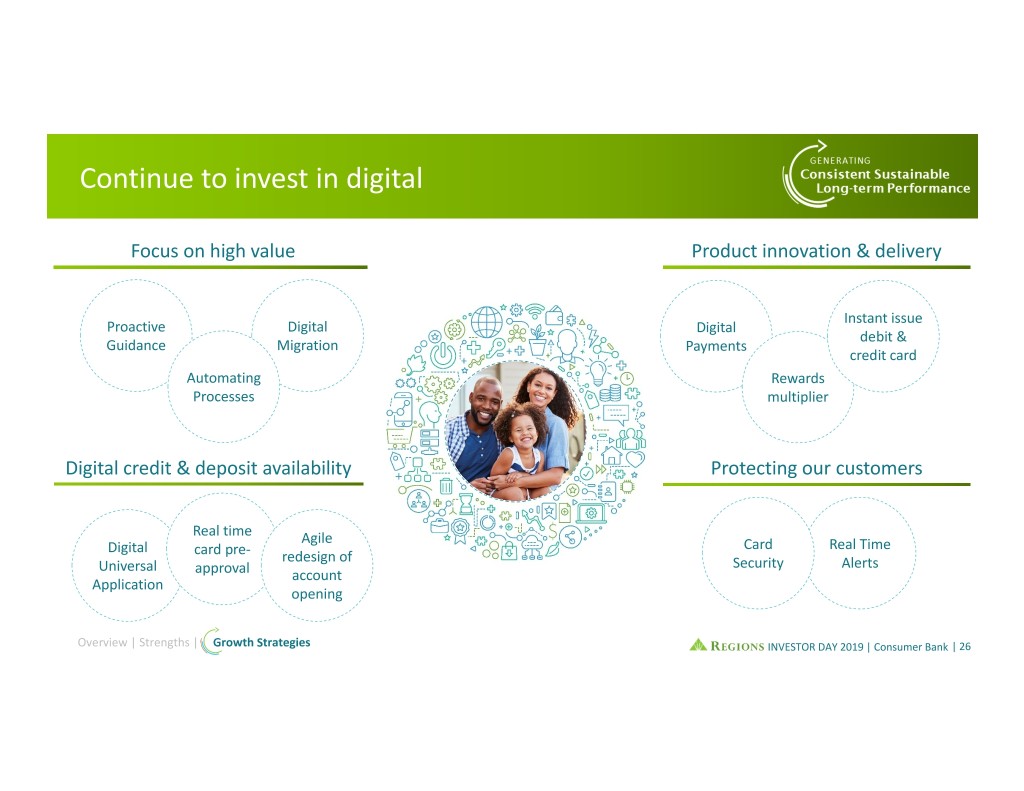

Focused technology strategy to better serve our customers Customer Experiences Innovation • Mobile first thinking • Continue deployment of AI • Continued digitization of customer • Strategic investments and partnerships experiences • Talent acquisition • Making banking easier • Develop processes that enable continuous agility Delivery Optimization Core Capabilities and • Enhancing speed to market Infrastructure • Utilize Agile methodology • Invest in core as well as new technology investments • Leveraging data and analytics • Harnessing the power of the Cloud • Deliver robust cyber defenses Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 20

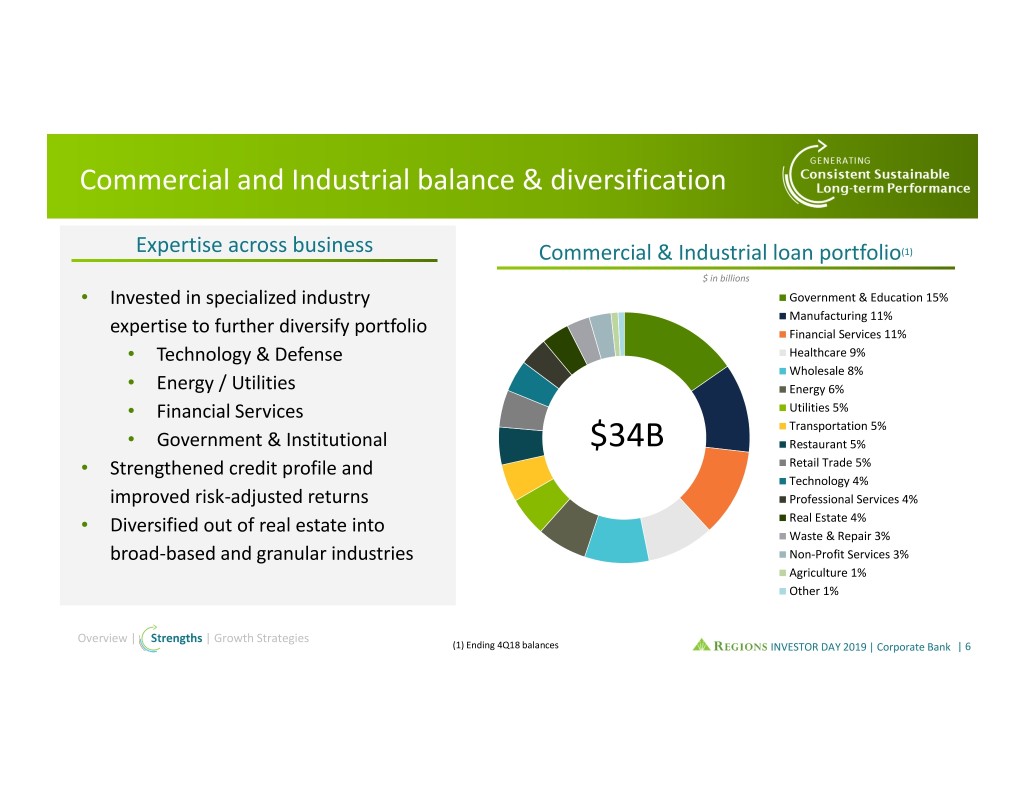

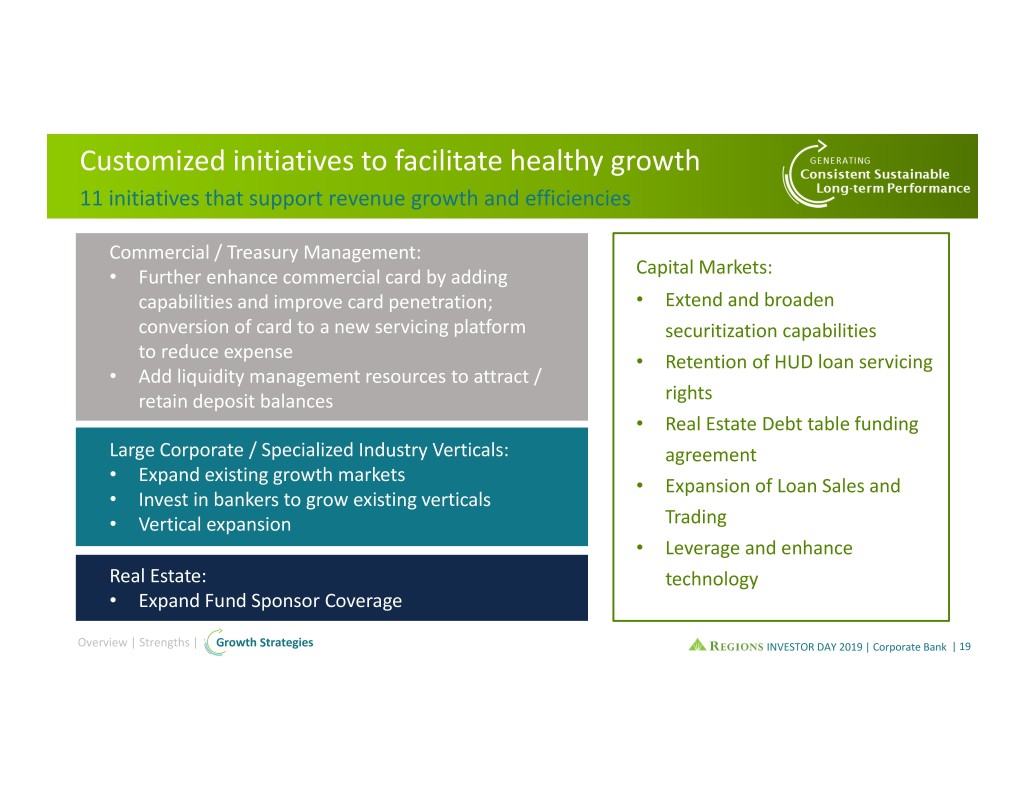

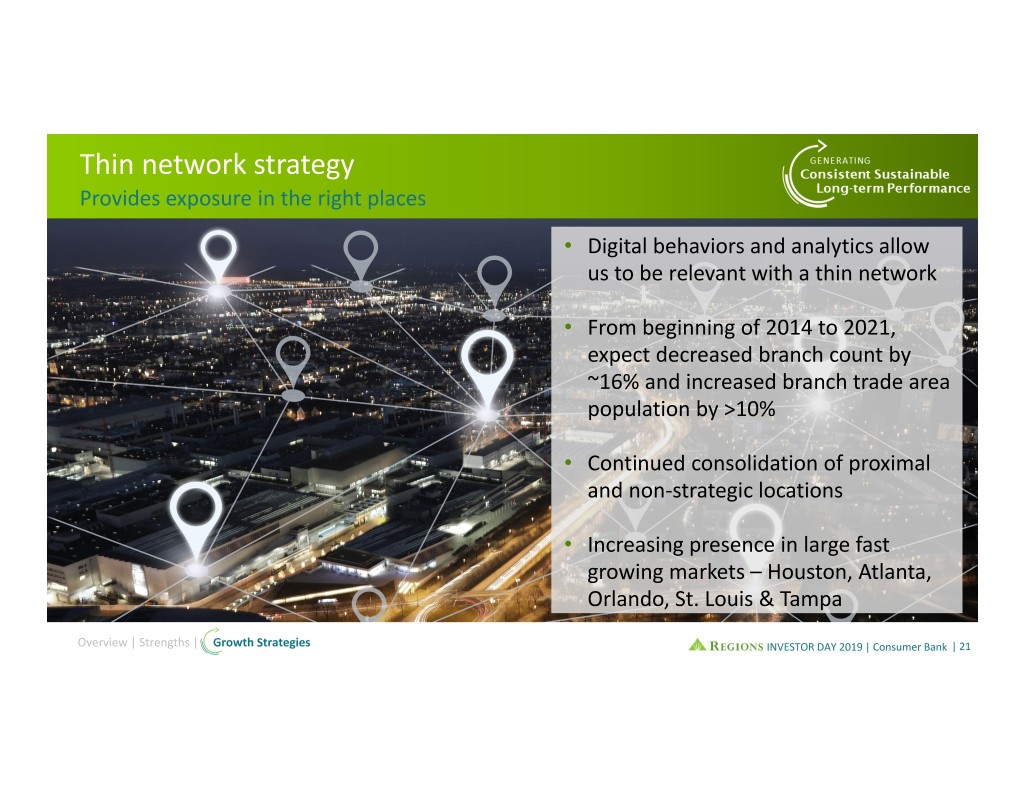

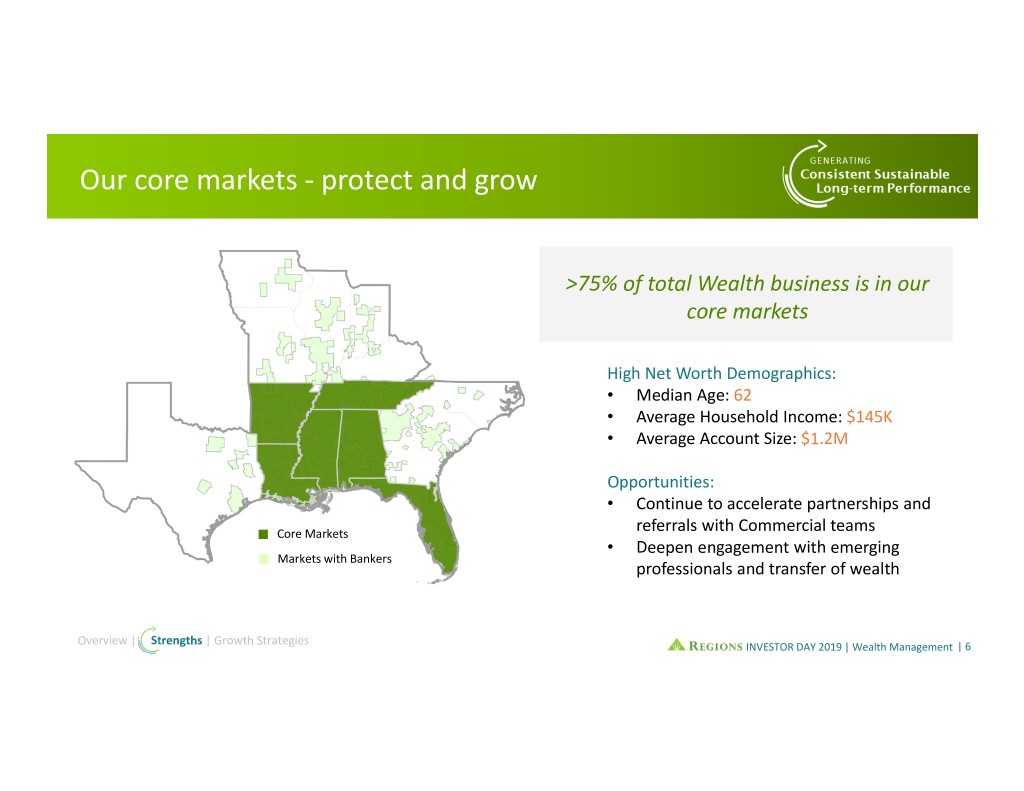

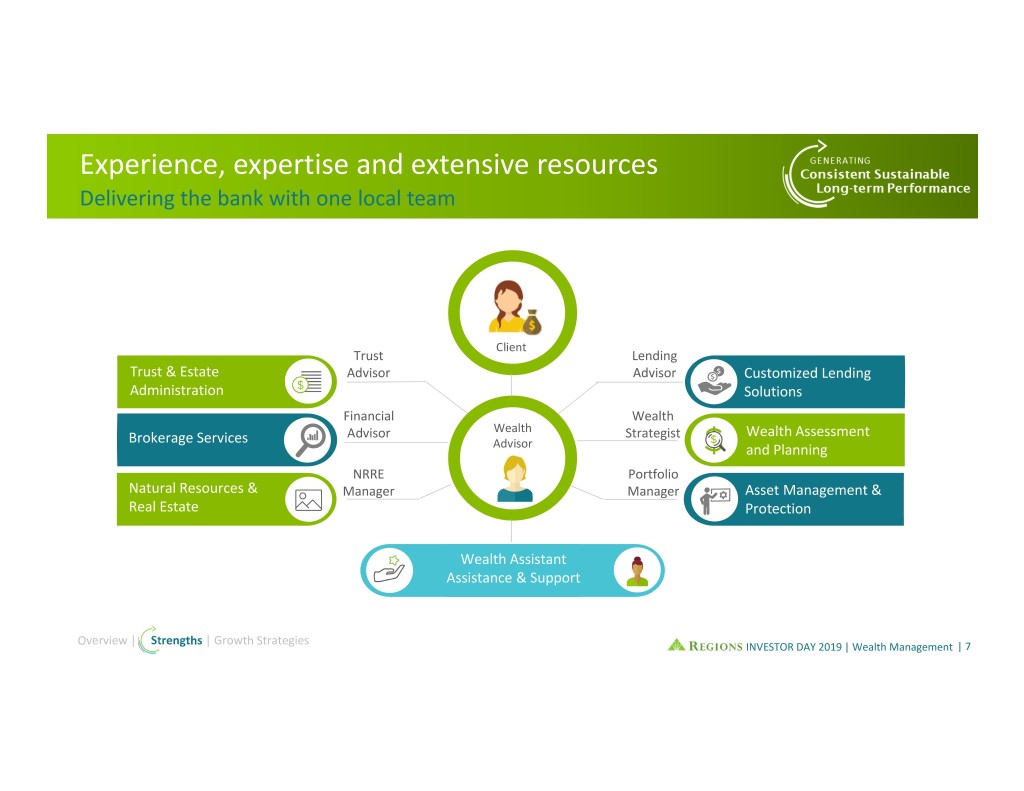

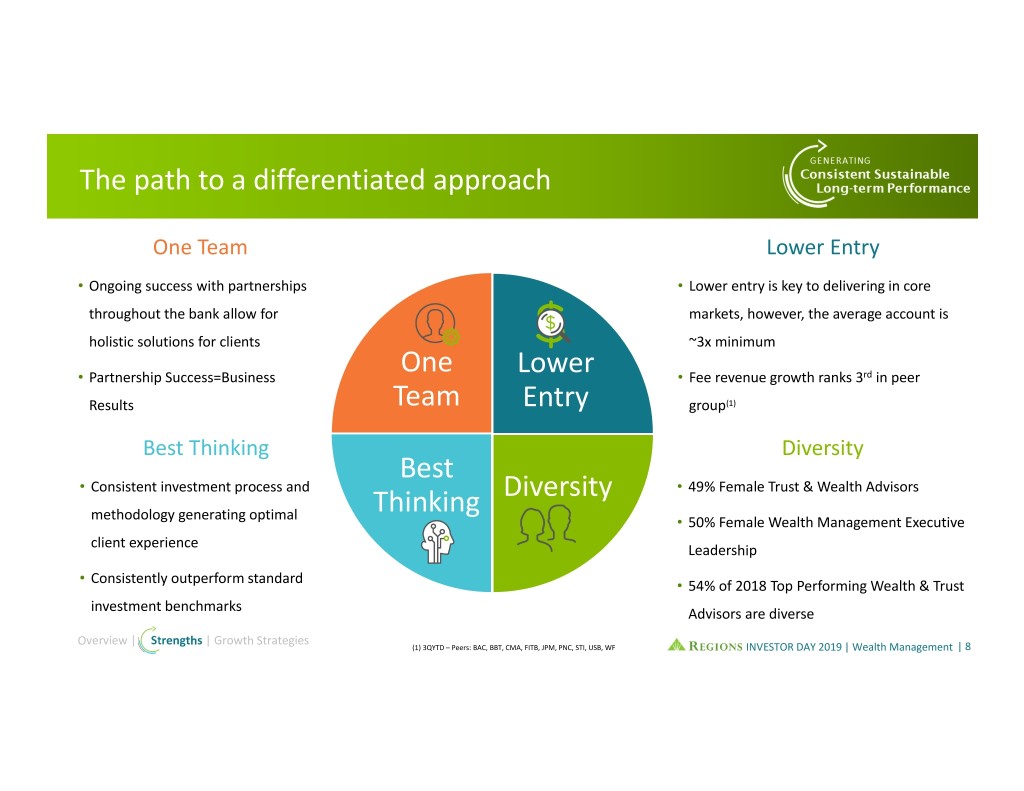

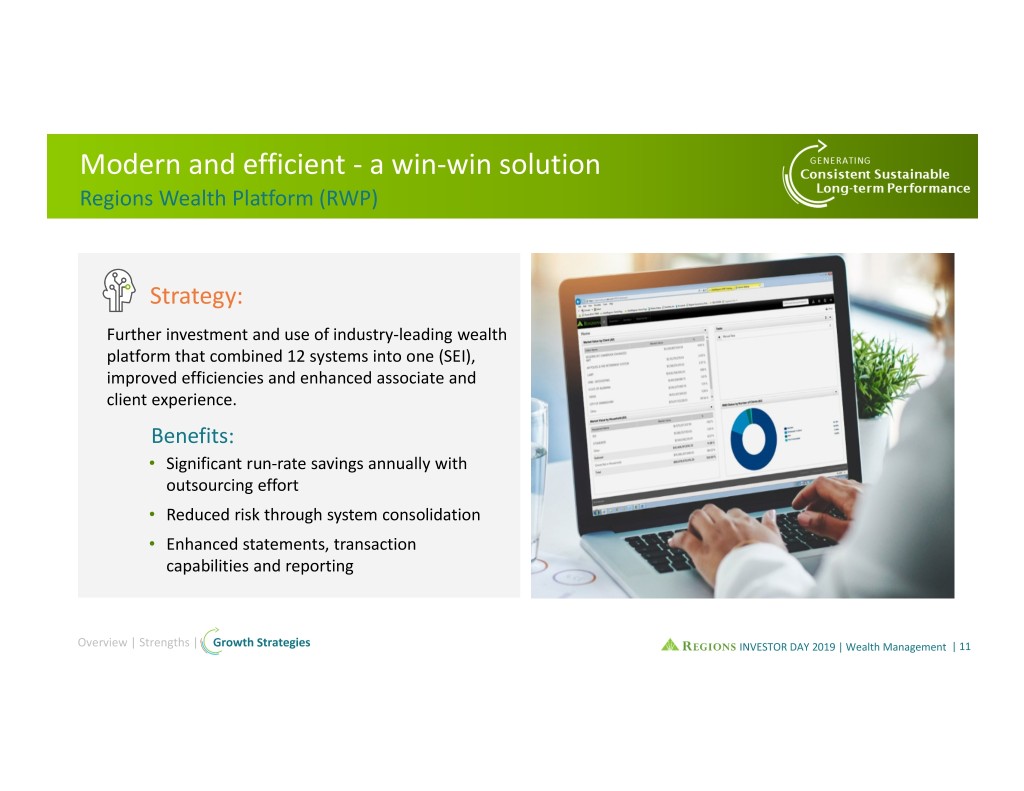

Strategic and disciplined investments Investing in organic growth, efficiency advancements and digitalization Consumer Bank Corporate Bank “Thin Network” Retail branch Expand industry expertise and market strategy opportunities Digital capabilities Product and customer platform enhancements Mortgage loan officers Digitalize portfolio analysis and risk Digitizing processes indicators Wealth Management Enterprise Technology Expand presence and expertise in Artificial intelligence and robotics key markets Data and analytics Digital capabilities Cloud technology Cyber defenses Expand product set Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 21

Strategic and disciplined investments Investing in our communities Economic and Community Development Engaging our Associates Financial Wellness Community Investment Education and Workforce Strengthening Customer Readiness Relationships Lean into strengths | Continuously improve | Innovate | Invest INVESTOR DAY 2019 | Overview | 22

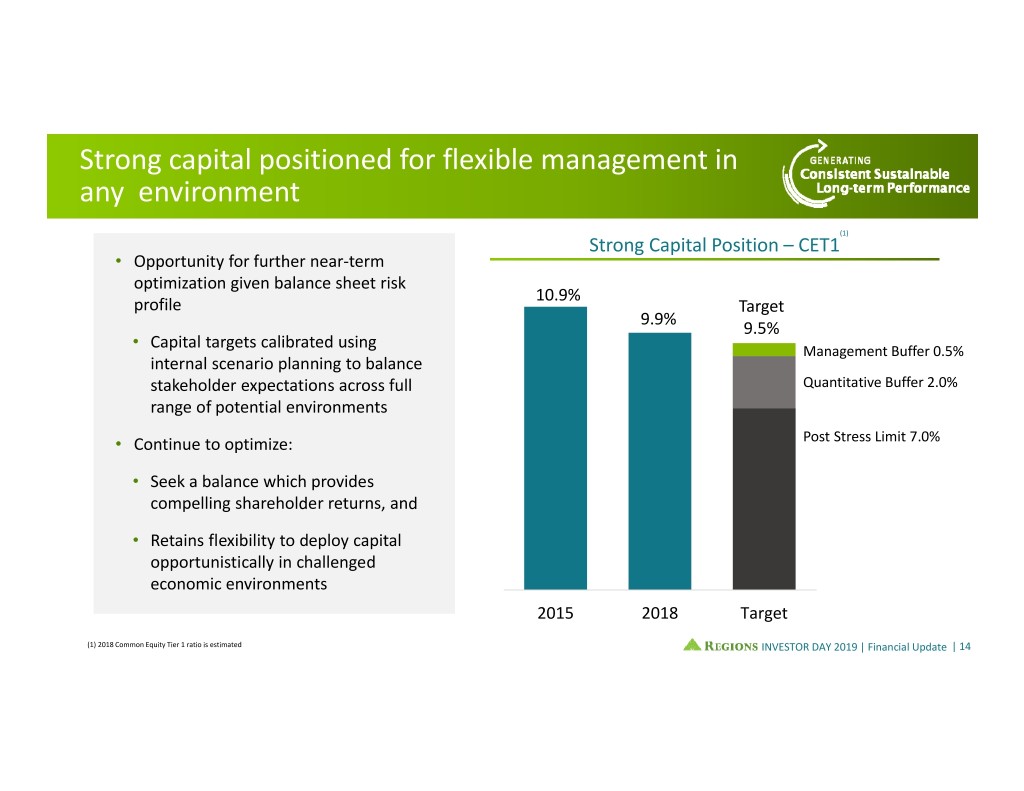

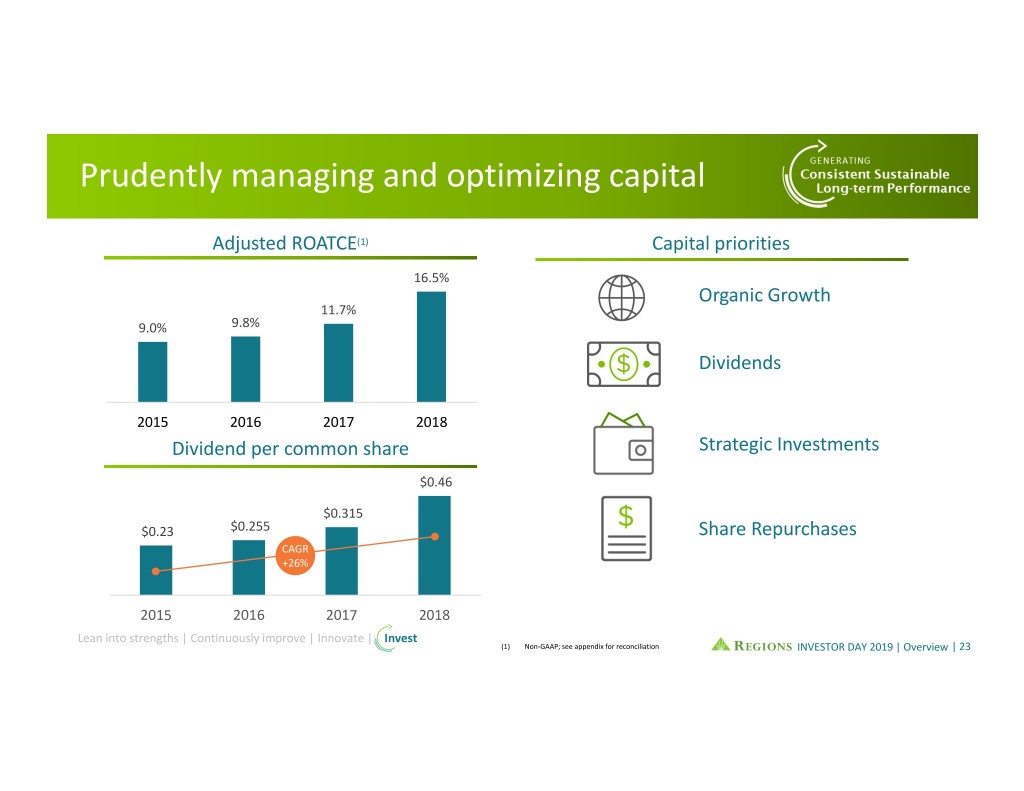

Prudently managing and optimizing capital Adjusted ROATCE(1) Capital priorities 16.5% Organic Growth 11.7% 9.0% 9.8% Dividends 2015 2016 2017 2018 Dividend per common share Strategic Investments $0.46 $0.315 $0.23 $0.255 Share Repurchases CAGR +26% 2015 2016 2017 2018 Lean into strengths | Continuously improve | Innovate | Invest (1) Non‐GAAP; see appendix for reconciliation INVESTOR DAY 2019 | Overview | 23

Why Regions? 1 FOOTPRINT advantage 2 Valuable DEPOSIT FRANCHISE 3 Focus on risk adjusted returns and PROFITABILITY ENHANCED risk management and governance 4 infrastructure 5 Simplify and Grow underpins LONG‐TERM PERFORMANCE INVESTOR DAY 2019 | Overview | 24

Appendix INVESTOR DAY 2019 | Overview | 25

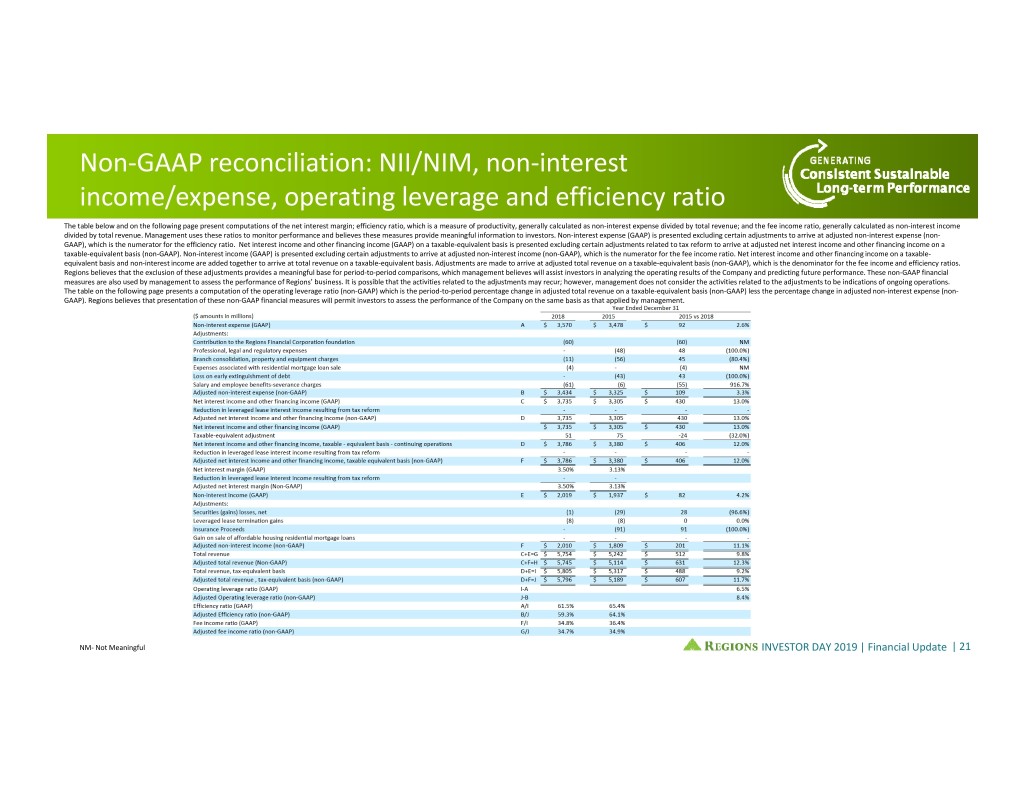

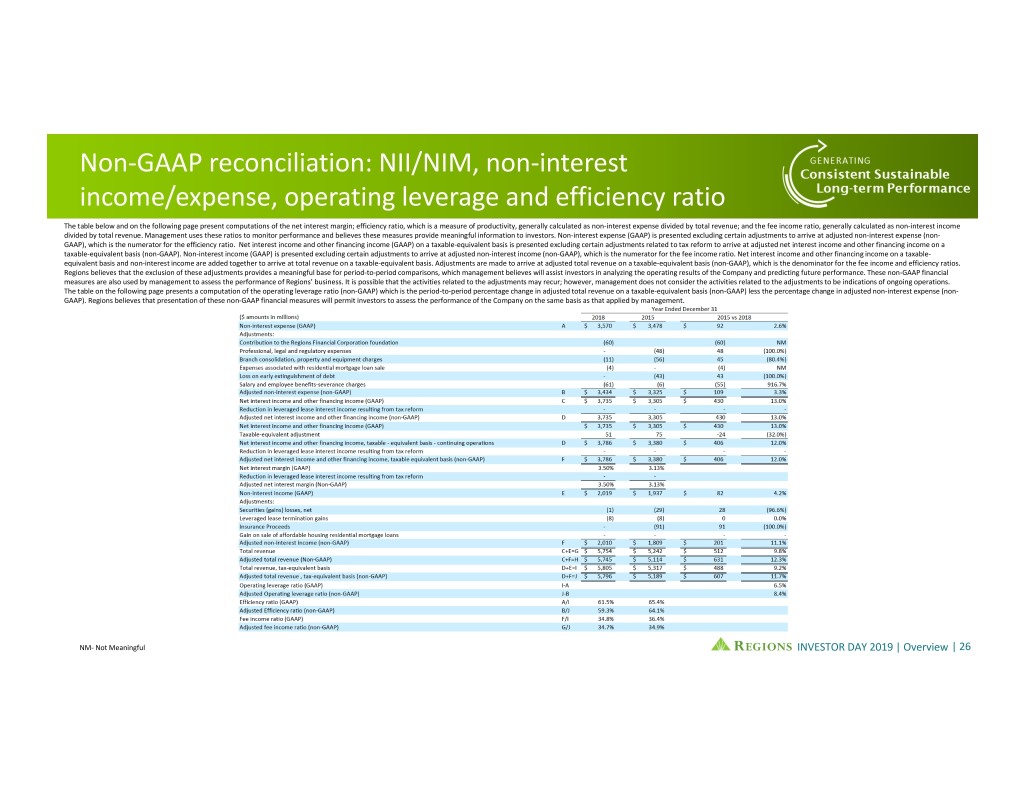

Non‐GAAP reconciliation: NII/NIM, non‐interest income/expense, operating leverage and efficiency ratio The table below and on the following page present computations of the net interest margin; efficiency ratio, which is a measure of productivity, generally calculated as non‐interest expense divided by total revenue; and the fee income ratio, generally calculated as non‐interest income divided by total revenue. Management uses these ratios to monitor performance and believes these measures provide meaningful information to investors. Non‐interest expense (GAAP) is presented excluding certain adjustments to arrive at adjusted non‐interest expense (non‐ GAAP), which is the numerator for the efficiency ratio. Net interest income and other financing income (GAAP) on a taxable‐equivalent basis is presented excluding certain adjustments related to tax reform to arrive at adjusted net interest income and other financing income on a taxable‐equivalent basis (non‐GAAP). Non‐interest income (GAAP) is presented excluding certain adjustments to arrive at adjusted non‐interest income (non‐GAAP), which is the numerator for the fee income ratio. Net interest income and other financing income on a taxable‐ equivalent basis and non‐interest income are added together to arrive at total revenue on a taxable‐equivalent basis. Adjustments are made to arrive at adjusted total revenue on a taxable‐equivalent basis (non‐GAAP), which is the denominator for the fee income and efficiency ratios. Regions believes that the exclusion of these adjustments provides a meaningful base for period‐to‐period comparisons, which management believes will assist investors in analyzing the operating results of the Company and predicting future performance. These non‐GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. The table on the following page presents a computation of the operating leverage ratio (non‐GAAP) which is the period‐to‐period percentage change in adjusted total revenue on a taxable‐equivalent basis (non‐GAAP) less the percentage change in adjusted non‐interest expense (non‐ GAAP). Regions believes that presentation of these non‐GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. NM‐ Not Meaningful INVESTOR DAY 2019 | Overview | 26

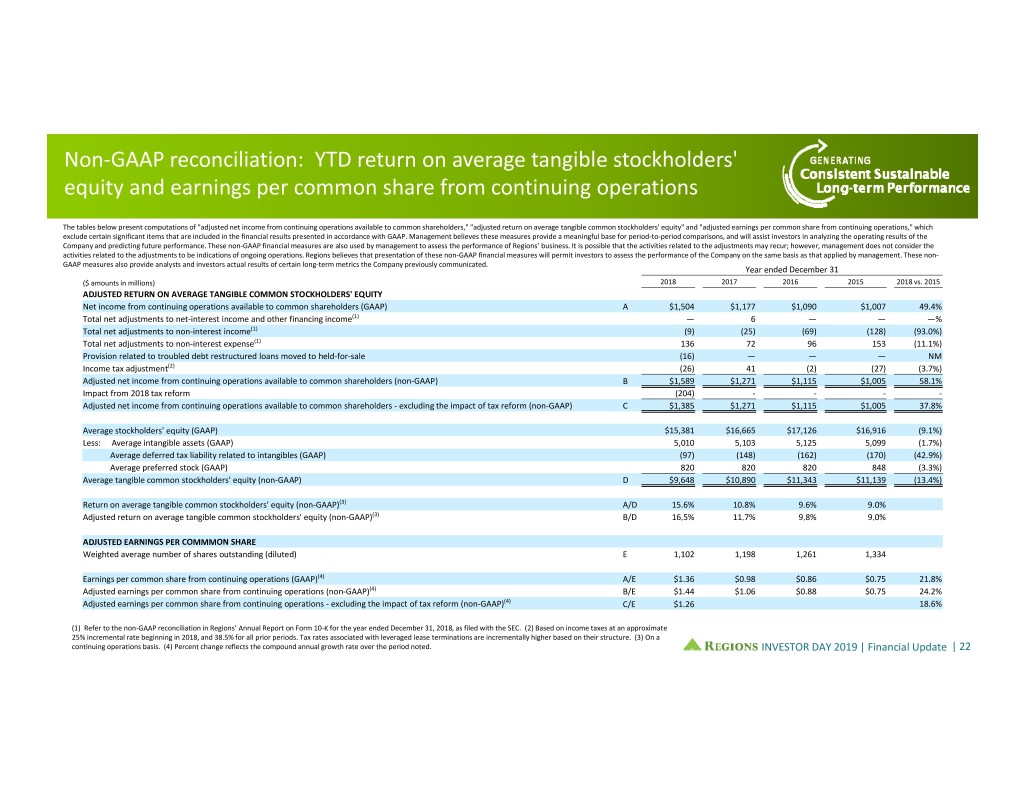

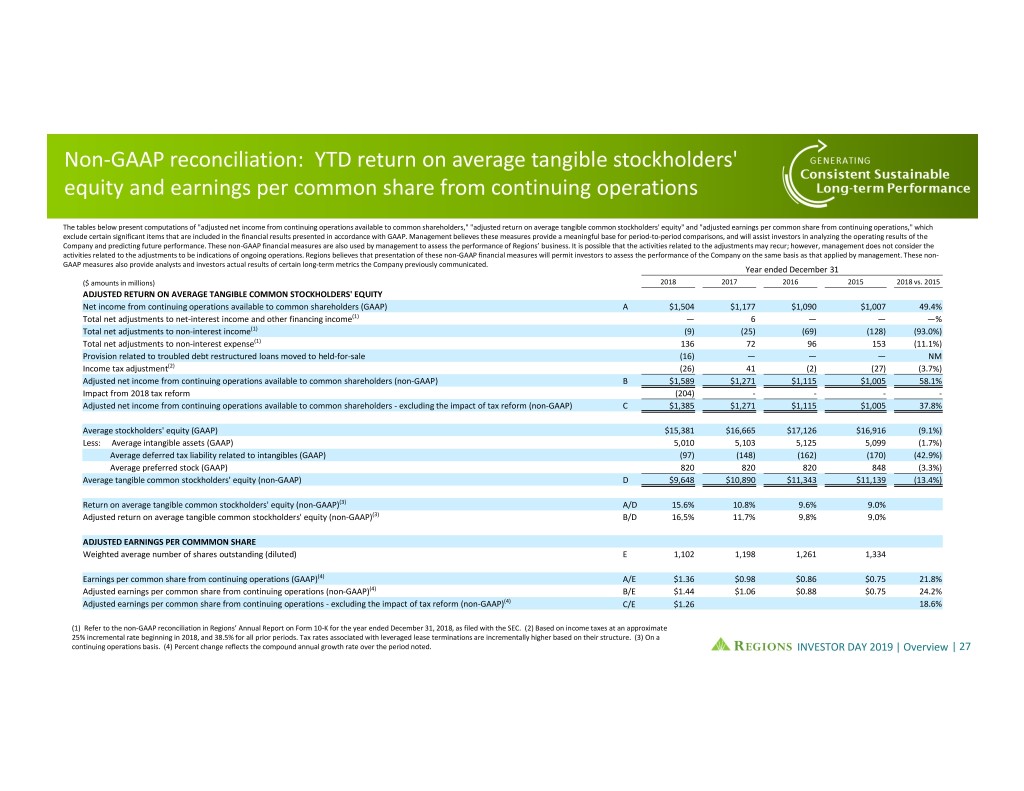

Non‐GAAP reconciliation: YTD return on average tangible stockholders' equity and earnings per common share from continuing operations The tables below present computations of "adjusted net income from continuing operations available to common shareholders," "adjusted return on average tangible common stockholders' equity" and "adjusted earnings per common share from continuing operations," which exclude certain significant items that are included in the financial results presented in accordance with GAAP. Management believes these measures provide a meaningful base for period‐to‐period comparisons, and will assist investors in analyzing the operating results of the Company and predicting future performance. These non‐GAAP financial measures are also used by management to assess the performance of Regions’ business. It is possible that the activities related to the adjustments may recur; however, management does not consider the activities related to the adjustments to be indications of ongoing operations. Regions believes that presentation of these non‐GAAP financial measures will permit investors to assess the performance of the Company on the same basis as that applied by management. These non‐ GAAP measures also provide analysts and investors actual results of certain long‐term metrics the Company previously communicated. Year ended December 31 ($ amounts in millions) 2018 2017 2016 2015 2018 vs. 2015 ADJUSTED RETURN ON AVERAGE TANGIBLE COMMON STOCKHOLDERS' EQUITY Net income from continuing operations available to common shareholders (GAAP) A $1,504 $1,177 $1,090 $1,007 49.4% Total net adjustments to net‐interest income and other financing income(1) —6— ——% Total net adjustments to non‐interest income(1) (9) (25) (69) (128) (93.0%) Total net adjustments to non‐interest expense(1) 136 72 96 153 (11.1%) Provision related to troubled debt restructured loans moved to held‐for‐sale (16) — — — NM Income tax adjustment(2) (26) 41 (2) (27) (3.7%) Adjusted net income from continuing operations available to common shareholders (non‐GAAP) B $1,589 $1,271 $1,115 $1,005 58.1% Impact from 2018 tax reform (204) ‐‐ ‐‐ Adjusted net income from continuing operations available to common shareholders ‐ excluding the impact of tax reform (non‐GAAP) C $1,385 $1,271 $1,115 $1,005 37.8% Average stockholders' equity (GAAP) $15,381 $16,665 $17,126 $16,916 (9.1%) Less: Average intangible assets (GAAP) 5,010 5,103 5,125 5,099 (1.7%) Average deferred tax liability related to intangibles (GAAP) (97) (148) (162) (170) (42.9%) Average preferred stock (GAAP) 820 820 820 848 (3.3%) Average tangible common stockholders' equity (non‐GAAP) D $9,648 $10,890 $11,343 $11,139 (13.4%) Return on average tangible common stockholders' equity (non‐GAAP)(3) A/D 15.6% 10.8% 9.6% 9.0% Adjusted return on average tangible common stockholders' equity (non‐GAAP)(3) B/D 16.5% 11.7% 9.8% 9.0% ADJUSTED EARNINGS PER COMMMON SHARE Weighted average number of shares outstanding (diluted) E 1,102 1,198 1,261 1,334 Earnings per common share from continuing operations (GAAP)(4) A/E $1.36 $0.98 $0.86 $0.75 21.8% Adjusted earnings per common share from continuing operations (non‐GAAP)(4) B/E $1.44 $1.06 $0.88 $0.75 24.2% Adjusted earnings per common share from continuing operations ‐ excluding the impact of tax reform (non‐GAAP)(4) C/E $1.26 18.6% (1) Refer to the non‐GAAP reconciliation in Regions’ Annual Report on Form 10‐K for the year ended December 31, 2018, as filed with the SEC. (2) Based on income taxes at an approximate 25% incremental rate beginning in 2018, and 38.5% for all prior periods. Tax rates associated with leveraged lease terminations are incrementally higher based on their structure. (3) On a continuing operations basis. (4) Percent change reflects the compound annual growth rate over the period noted. INVESTOR DAY 2019 | Overview | 27

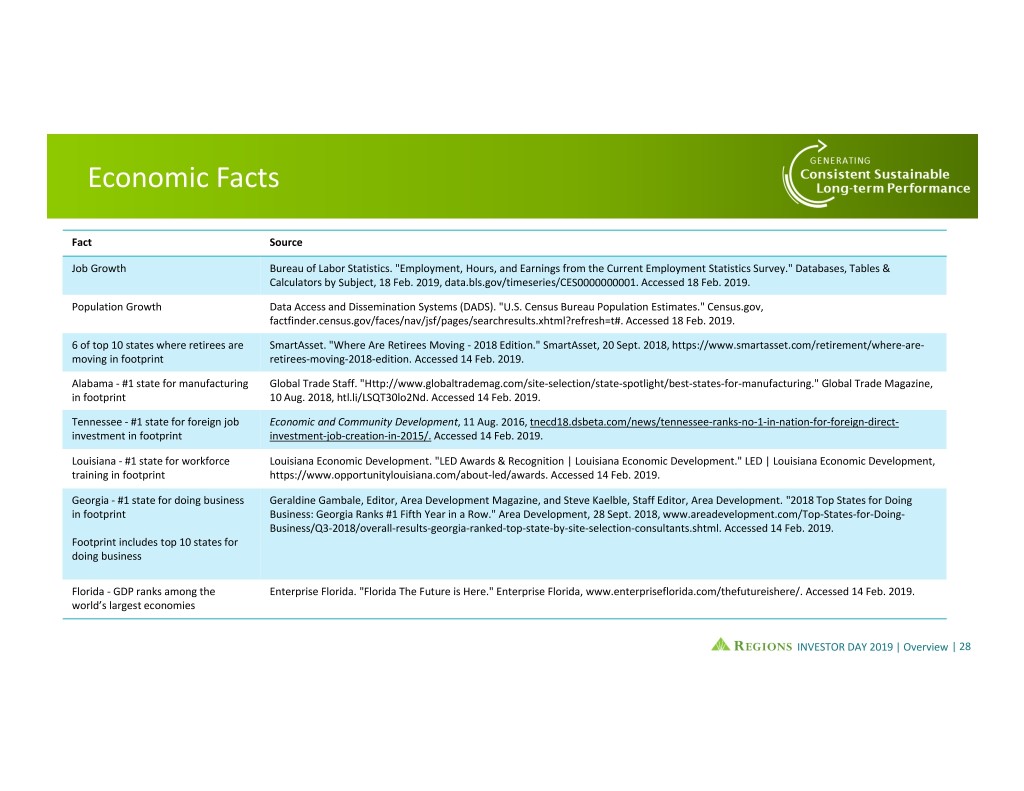

Economic Facts Fact Source Job Growth Bureau of Labor Statistics. "Employment, Hours, and Earnings from the Current Employment Statistics Survey." Databases, Tables & Calculators by Subject, 18 Feb. 2019, data.bls.gov/timeseries/CES0000000001. Accessed 18 Feb. 2019. Population Growth Data Access and Dissemination Systems (DADS). "U.S. Census Bureau Population Estimates." Census.gov, factfinder.census.gov/faces/nav/jsf/pages/searchresults.xhtml?refresh=t#. Accessed 18 Feb. 2019. 6 of top 10 states where retirees are SmartAsset. "Where Are Retirees Moving ‐ 2018 Edition." SmartAsset, 20 Sept. 2018, https://www.smartasset.com/retirement/where‐are‐ moving in footprint retirees‐moving‐2018‐edition. Accessed 14 Feb. 2019. Alabama ‐ #1 state for manufacturing Global Trade Staff. "Http://www.globaltrademag.com/site‐selection/state‐spotlight/best‐states‐for‐manufacturing." Global Trade Magazine, in footprint 10 Aug. 2018, htl.li/LSQT30lo2Nd. Accessed 14 Feb. 2019. Tennessee ‐ #1 state for foreign job Economic and Community Development, 11 Aug. 2016, tnecd18.dsbeta.com/news/tennessee‐ranks‐no‐1‐in‐nation‐for‐foreign‐direct‐ investment in footprint investment‐job‐creation‐in‐2015/. Accessed 14 Feb. 2019. Louisiana ‐ #1 state for workforce Louisiana Economic Development. "LED Awards & Recognition | Louisiana Economic Development." LED | Louisiana Economic Development, training in footprint https://www.opportunitylouisiana.com/about‐led/awards. Accessed 14 Feb. 2019. Georgia ‐ #1 state for doing business Geraldine Gambale, Editor, Area Development Magazine, and Steve Kaelble, Staff Editor, Area Development. "2018 Top States for Doing in footprint Business: Georgia Ranks #1 Fifth Year in a Row." Area Development, 28 Sept. 2018, www.areadevelopment.com/Top‐States‐for‐Doing‐ Business/Q3‐2018/overall‐results‐georgia‐ranked‐top‐state‐by‐site‐selection‐consultants.shtml. Accessed 14 Feb. 2019. Footprint includes top 10 states for doing business Florida ‐ GDP ranks among the Enterprise Florida. "Florida The Future is Here." Enterprise Florida, www.enterpriseflorida.com/thefutureishere/. Accessed 14 Feb. 2019. world’s largest economies INVESTOR DAY 2019 | Overview | 28

Forward looking statements disclosure This presentation may include forward‐looking statements as defined in the Private Securities Litigation Reform Act of 1995, which reflect Regions’ current views with respect to future events and financial performance. Forward‐looking statements are not based on historical information, but rather are related to future operations, strategies, financial results or other developments. Forward‐looking statements are based on management’s current expectations as well as certain assumptions and estimates made by, and information available to, management at the time the statements are made. Those statements are based on general assumptions and are subject to various risks, and because they also relate to the future they are likewise subject to inherent uncertainties and other factors that may cause actual results to differ materially from the views, beliefs and projections expressed in such statements. Therefore, we caution you against relying on any of these forward‐looking statements. These risks, uncertainties and other factors include, but are not limited to, those described below: • Current and future economic and market conditions in the United States generally or in the communities we serve, including the effects of possible declines in property values, increases in unemployment rates and potential reductions of economic growth, which may adversely affect our lending and other businesses and our financial results and conditions. • Possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, which could have a material adverse effect on our earnings. • Possible changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital and liquidity. • Any impairment of our goodwill or other intangibles, any repricing of assets, or any adjustment of valuation allowances on our deferred tax assets due to changes in law, adverse changes in the economic environment, declining operations of the reporting unit or other factors. • The effect of changes in tax laws, including the effect of Tax Reform and any future interpretations of or amendments to Tax Reform, which may impact our earnings, capital ratios and our ability to return capital to stockholders. • Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans and leases, including operating leases. • Changes in the speed of loan prepayments, loan origination and sale volumes, charge‐offs, loan loss provisions or actual loan losses where our allowance for loan losses may not be adequate to cover our eventual losses. • Possible acceleration of prepayments on mortgage‐backed securities due to low interest rates, and the related acceleration of premium amortization on those securities. • Loss of customer checking and savings account deposits as customers pursue other, higher‐yield investments, which could increase our funding costs. • Possible changes in consumer and business spending and saving habits and the related effect on our ability to increase assets and to attract deposits, which could adversely affect our net income. • Our ability to effectively compete with other traditional and non‐traditional financial services companies, some of whom possess greater financial resources than we do or are subject to different regulatory standards than we are. • Our inability to develop and gain acceptance from current and prospective customers for new products and services and the enhancement of existing products and services to meet customers’ needs and respond to emerging technological trends in a timely manner could have a negative impact on our revenue. • Our inability to keep pace with technological changes could result in losing business to competitors. • Changes in laws and regulations affecting our businesses, including legislation and regulations relating to bank products and services, as well as changes in the enforcement and interpretation of such laws and regulations by applicable governmental and self‐regulatory agencies, which could require us to change certain business practices, increase compliance risk, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • Our ability to obtain a regulatory non‐objection (as part of the CCAR process or otherwise) to take certain capital actions, including paying dividends and any plans to increase common stock dividends, repurchase common stock under current or future programs, or redeem preferred stock or other regulatory capital instruments, may impact our ability to return capital to stockholders and market perceptions of us. • Our ability to comply with stress testing and capital planning requirements (as part of the CCAR process or otherwise) may continue to require a significant investment of our managerial resources due to the importance and intensity of such tests and requirements. • Our ability to comply with applicable capital and liquidity requirements (including, among other things, the Basel III capital standards and the LCR rule), including our ability to generate capital internally or raise capital on favorable terms, and if we fail to meet requirements, our financial condition could be negatively impacted. • The effects of any developments, changes or actions relating to any litigation or regulatory proceedings brought against us or any of our subsidiaries. • The costs, including possibly incurring fines, penalties, or other negative effects (including reputational harm) of any adverse judicial, administrative, or arbitral rulings or proceedings, regulatory enforcement actions, or other legal actions to which we or any of our subsidiaries are a party, and which may adversely affect our results. • Our ability to manage fluctuations in the value of assets and liabilities and off‐balance sheet exposure so as to maintain sufficient capital and liquidity to support our business. • Our ability to execute on our strategic and operational plans, including our ability to fully realize the financial and non‐financial benefits relating to our strategic initiatives. • The risks and uncertainties related to our acquisition or divestiture of businesses. • The success of our marketing efforts in attracting and retaining customers. • Our ability to recruit and retain talented and experienced personnel to assist in the development, management and operation of our products and services may be affected by changes in laws and regulations in effect from time to time. • Fraud or misconduct by our customers, employees or business partners. • Any inaccurate or incomplete information provided to us by our customers or counterparties. • Inability of our framework to manage risks associated with our business such as credit risk and operational risk, including third‐party vendors and other service providers, which could, among other things, result in a breach of operating or security systems as a result of a cyber attack or similar act or failure to deliver our services effectively. • Dependence on key suppliers or vendors to obtain equipment and other supplies for our business on acceptable terms. • The inability of our internal controls and procedures to prevent, detect or mitigate any material errors or fraudulent acts. • The effects of geopolitical instability, including wars, conflicts and terrorist attacks and the potential impact, directly or indirectly, on our businesses. • The effects of man‐made and natural disasters, including fires, floods, droughts, tornadoes, hurricanes, and environmental damage, which may negatively affect our operations and/or our loan portfolios and increase our cost of conducting business. The severity and impact of future earthquakes, fires, hurricanes, tornadoes, droughts, floods and other weather‐related events are difficult to predict and may be exacerbated by global climate change. • Changes in commodity market prices and conditions could adversely affect the cash flows of our borrowers operating in industries that are impacted by changes in commodity prices (including businesses indirectly impacted by commodities prices such as businesses that transport commodities or manufacture equipment used in the production of commodities), which could impair their ability to service any loans outstanding to them and/or reduce demand for loans in those industries. INVESTOR DAY 2019 | Overview | 29

Forward looking statements disclosure (continued) • Our ability to identify and address cyber‐security risks such as data security breaches, malware, “denial of service” attacks, “hacking” and identity theft, a failure of which could disrupt our business and result in the disclosure of and/or misuse or misappropriation of confidential or proprietary information, disruption or damage to our systems, increased costs, losses, or adverse effects to our reputation. • Our ability to realize our adjusted efficiency ratio target as part of our expense management initiatives. • Possible cessation or market replacement of LIBOR and the related effect on our LIBOR‐based financial products and contracts, including, but not limited to, hedging products, debt obligations, investments, and loans. • Possible downgrades in our credit ratings or outlook could increase the costs of funding from capital markets. • The effects of a possible downgrade in the U.S. government’s sovereign credit rating or outlook, which could result in risks to us and general economic conditions that we are not able to predict. • The effects of problems encountered by other financial institutions that adversely affect us or the banking industry generally could require us to change certain business practices, reduce our revenue, impose additional costs on us, or otherwise negatively affect our businesses. • The effects of the failure of any component of our business infrastructure provided by a third party could disrupt our businesses, result in the disclosure of and/or misuse of confidential information or proprietary information, increase our costs, negatively affect our reputation, and cause losses. • Our ability to receive dividends from our subsidiaries could affect our liquidity and ability to pay dividends to stockholders. • Changes in accounting policies or procedures as may be required by the FASB or other regulatory agencies could materially affect our financial statements and how we report those results, and expectations and preliminary analyses relating to how such changes will affect our financial results could prove incorrect. • Other risks identified from time to time in reports that we file with the SEC. • Fluctuations in the price of our common stock and inability to complete stock repurchases in the time frame and/or on the terms anticipated. • The effects of any damage to our reputation resulting from developments related to any of the items identified above. The foregoing list of factors is not exhaustive. For discussion of these and other factors that may cause actual results to differ from expectations, look under the captions “Forward‐Looking Statements” and “Risk Factors” of Regions’ Annual Report on Form 10‐K for the year ended December 31, 2018 as filed with the SEC. The words "future," “anticipates,” "assumes," “intends,” “plans,” “seeks,” “believes,” "predicts," "potential," "objectives," “estimates,” “expects,” “targets,” “projects,” “outlook,” “forecast,” "would," “will,” “may,” “might,” “could,” “should,” “can,” and similar terms and expressions often signify forward‐looking statements. You should not place undue reliance on any forward‐looking statements, which speak only as of the date made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible to predict all of them. We assume no obligation and do not intend to update or revise any forward‐looking statements that are made from time to time, either as a result of future developments, new information or otherwise, except as may be required by law. Regions’ Investor Relations contact is Dana Nolan at (205) 264‐7040; Regions’ Media contact is Evelyn Mitchell at (205) 264‐4551. INVESTOR DAY 2019 | Overview | 30