UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2016 | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to | |

Commission File Number: 001-36065 | |

ACCELERON PHARMA INC.

(Exact name of Registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 27-0072226 (I.R.S. Employer Identification No.) | |

128 Sidney Street Cambridge, Massachusetts (Address of principal executive offices) | 02139 (Zip Code) | |

(617) 649-9200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act

Title of Class: | Name of Each Exchange on Which Registered | |

Common Stock, $0.001 par value | NASDAQ Global Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to the filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes o No ý

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) computed by reference to the price at which the common stock was last sold (based on the closing share price as quoted on the NASDAQ Global Market) as of the last business day of the registrant’s most recently completed second fiscal quarter was approximately $986 million.

As of January 31, 2017, the registrant had 38,394,708 shares of Common Stock, $0.001 par value per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The following documents (or parts thereof) are incorporated by reference into the following parts of this Form 10-K: Certain information required in Part III of this Annual Report on Form 10-K is incorporated from the Registrant’s Proxy Statement for the Annual Meeting of Stockholders to be held on June 1, 2017.

ACCELERON PHARMA INC.

FORM 10-K

INDEX

Page | ||

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the information incorporated herein by reference includes statements that are, or may be deemed, "forward-looking statements." In some cases, these forward-looking statements can be identified by the use of forward-looking terminology. The terms "anticipate", "believe", "contemplate", "continue", "could", "estimate", "expect", "forecast", "goal", "intend", "may", "plan", "potential", "predict", "project", "should", "strategy", "target", "will", "would", "vision", or, in each case, the negative or other variations thereon or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this Annual Report on Form 10-K include, among other things, statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things:

• | our ongoing and planned preclinical studies and clinical trials; |

• | clinical trial data and the timing of results of our ongoing clinical trials; |

• | our plans to develop and commercialize dalantercept and ACE-083, and our and Celgene's plans to develop and commercialize luspatercept and sotatercept; |

• | the potential benefits of strategic partnership agreements and our ability to enter into selective strategic partnership arrangements; |

• | the timing of, and our and Celgene's ability to, obtain and maintain regulatory approvals for our therapeutic candidates; |

• | the rate and degree of market acceptance and clinical utility of any approved therapeutic candidate, particularly in specific patient populations; |

• | our ability to quickly and efficiently identify and develop therapeutic candidates; |

• | our commercialization, marketing and manufacturing capabilities and strategy; |

• | our intellectual property position; and |

• | our estimates regarding our results of operations, financial condition, liquidity, capital requirements, prospects, growth and strategies. |

By their nature, forward-looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and industry change and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and events in the industry in which we operate may differ materially from the forward-looking statements contained herein.

Any forward-looking statements that we make in this Annual Report on Form 10-K speak only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect the occurrence of unanticipated events.

You should also read carefully the factors described in the "Risk Factors" section of this Annual Report on Form 10-K to better understand the risks and uncertainties inherent in our business and underlying any forward-looking statements. You are advised, however, to consult any further disclosures we make on related subjects in our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, press releases, and our website.

Trademarks

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this report are the property of their respective owners. The trademarks that we own include Acceleron Pharma® and IntelliTrap™. Solely for convenience, some of the trademarks, service marks and trade names referred to in this report are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

1

PART I

Item 1. Business

We are a clinical stage biopharmaceutical company focused on the discovery, development and commercialization of innovative therapeutics to treat serious and rare diseases. Our research focuses on key natural regulators of cellular growth and repair, particularly the Transforming Growth Factor-Beta, or TGF-beta, protein superfamily. By combining our discovery and development expertise, including our proprietary knowledge of the TGF-beta superfamily, and our internal protein engineering and manufacturing capabilities, we have built a highly productive discovery and development platform that has generated innovative therapeutic candidates with novel mechanisms of action. These differentiated therapeutic candidates have the potential to significantly improve clinical outcomes for patients across many fields of medicine.

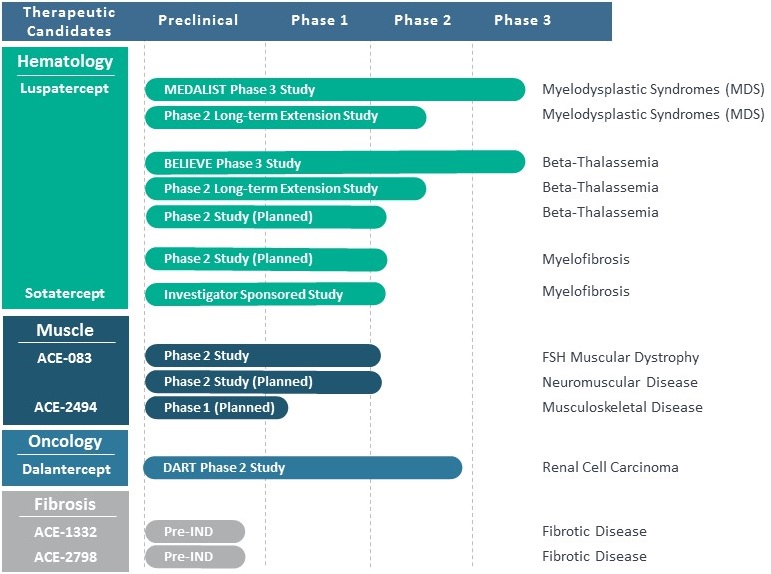

We have four internally discovered therapeutic candidates that are currently in clinical trials: luspatercept, sotatercept, dalantercept and ACE-083.

Luspatercept, our lead program, and sotatercept, are partnered with Celgene Corporation, or Celgene. Luspatercept is designed to promote red blood cell production through a novel mechanism, and we are developing luspatercept with Celgene to treat anemia and associated complications in myelodysplastic syndromes (MDS), beta-thalassemia, and myelofibrosis. Celgene is currently conducting two Phase 3 clinical trials with luspatercept: one for the treatment of patients with lower risk MDS, the "MEDALIST" trial, and another for the treatment of patients with beta-thalassemia, the "BELIEVE" trial. Clinical studies with sotatercept in chronic kidney disease have been deprioritized and we are evaluating other opportunities for the development of sotatercept. Celgene is responsible for paying 100% of the development costs for all clinical trials for luspatercept and sotatercept. We may receive up to an additional $545.0 million of potential development, regulatory and commercial milestone payments and, if these therapeutic candidates are commercialized, we will receive a royalty on net sales in the low-to-mid 20% range. We will co-promote luspatercept and sotatercept, if approved, in North America for which our commercialization costs will be entirely funded by Celgene.

We wholly own dalantercept and ACE-083, and we are independently developing these therapeutic candidates. We are currently evaluating dalantercept in combination with axitinib, a tyrosine kinase inhibitor of the VEGF pathway, in a Phase 2 clinical trial for the treatment of patients with renal cell carcinoma. ACE-083 is designed for the treatment of focal muscle disorders, and we are currently conducting a Phase 2 clinical trial with ACE-083 in patients with facioscapulohumeral dystrophy, or FSHD. In 2017, we expect to initiate a Phase 2 clinical trial with ACE-083 in a second neuromuscular disease indication. We previously reported data from the Phase 1 clinical trial of ACE-083 showing marked increases in the volume of muscles treated with ACE-083 measured using MRI.

In addition to our clinical programs, we are conducting research to identify new therapeutic candidates to bring forward into clinical trials. To this end, we implemented a new platform technology, IntelliTrap™, that is expanding our discovery efforts. We have nominated an IntelliTrap™ molecule, ACE-2494, as a candidate for clinical development.

As of December 31, 2016 our operations have been funded primarily by $105.1 million in equity investments from venture investors, $337.3 million from public investors, $96.2 million in equity investments from our collaboration partners and $261.1 million in upfront payments, milestones, and net research and development payments from our collaboration partners. We estimate that we have spent approximately $68.6 million, $58.4 million, and $50.9 million on research and development for the years ended December 31, 2016, 2015, and 2014, respectively.

Our Goals and Objectives in the Year 2017

By building on the milestones achieved in 2016, we intend to advance and expand our pipeline in 2017 and achieve the following goals and objectives:

• | Luspatercept in Rare Blood Disorders |

Goals for luspatercept in myelodysplastic syndromes (MDS):

◦ | Complete patient enrollment in the MEDALIST Phase 3 clinical trial in the second half of 2017. |

◦ | Evaluate and design a clinical and regulatory strategy for luspatercept in first-line lower risk MDS patients. |

Goals for luspatercept in beta-thalassemia:

◦ | Complete patient enrollment in the BELIEVE Phase 3 clinical trial in the second half of 2017. |

◦ | Initiate a Phase 2 trial in patients with non-transfusion dependent beta-thalassemia by the end of 2017. |

Goals for luspatercept in myelofibrosis:

◦ | Initiate a Phase 2 trial in patients with myelofibrosis by the end of 2017. |

2

• | ACE-083 in Neuromuscular Disease |

◦ | Present initial topline results from the open label, dose-escalation stage of the Phase 2 study in FSHD in late 2017. |

◦ | Initiate a Phase 2 clinical trial in a second neuromuscular disease in 2017. |

• | Pipeline Expansion |

◦ | Initiate a Phase 1 healthy volunteer study with ACE-2494 in 2017. |

◦ | Host an investor and analyst research day to discuss ongoing preclinical research and potential future disease areas in 2017. |

• | Dalantercept in Advanced Renal Cell Carcinoma |

◦ | Present topline progression-free survival (PFS) results from Phase 2 DART study in advanced renal cell carcinoma patients in the second half of 2017. |

The Acceleron Discovery Platform: Novel Approaches to Potent Biology

Since our founding, we have focused on developing therapeutic candidates that regulate cellular growth and repair. We have targeted a group of approximately 30 secreted proteins, or ligands, that are collectively referred to as the TGF-beta superfamily. These ligands bind to subsets of 12 different receptors on the surface of cells, triggering intra-cellular changes in gene expression that guide cell growth and differentiation. The TGF-beta superfamily ligands and their receptors represent a diverse and underexplored set of drug targets with the potential to yield potent therapeutics for the growth and repair of diseased cells and tissues.

Applying our proprietary discovery and development platform, including our knowledge of the biology of the TGF-beta superfamily and its receptors, we have generated our novel IntelliTrap™ platform technology and a robust pipeline of innovative clinical and preclinical therapeutic candidates targeting key mechanisms underlying cancer and rare diseases. Additionally, we are conducting a multi-target antibody discovery collaboration with Adimab LLC, or Adimab, a leading antibody discovery company, under which Adimab is generating human antibodies against undisclosed targets that we select. We expect that this collaboration will expand our biologics platform and provide us with enhanced access to antibody therapeutic candidates.

We use our integrated platform of research, development and manufacturing technologies to rapidly and cost-effectively create, test and advance our therapeutic candidates. Our robust clinical and preclinical pipeline is focused on areas of high-unmet medical need, particularly in the areas of cancer and rare diseases.

3

Our Product Pipeline

Luspatercept

Luspatercept is designed to promote red blood cell production through a novel mechanism. We are developing luspatercept, through our collaborations with Celgene, as a treatment for anemia and associated complications in diseases in which erythropoiesis-stimulating agents are either not approved or are not well-suited to treat the underlying anemia, such as beta-thalassemia and MDS.

Myelodysplastic Syndromes (MDS)

With respect to MDS, both our and Celgene's objective is to develop luspatercept as a treatment to increase hemoglobin levels and decrease red blood cell transfusion burden, with patients ultimately becoming transfusion independent.

MDS is a group of heterogeneous hematologic diseases characterized by abnormal proliferation and differentiation of blood precursor cells, including red blood cell precursors, in the bone marrow. This leads to peripheral reductions in red blood cells, often accompanied by decreases in white blood cells and platelets, as well as a risk of disease progression to acute myeloid leukemia. Although MDS patients may have varying forms of the disease, anemia is present in the vast majority of MDS patients at the time of diagnosis. MDS is primarily a disease of the elderly, with 88% of cases diagnosed in individuals 60 years of age or older. Cancer surveillance databases estimate the annual incidence of MDS in the United States at 10,000 to 15,000 cases and the overall U.S./EU prevalence at approximately 125,000 patients.

Hematopoietic stem cell transplantation represents the only treatment modality with curative potential, although the relatively high morbidity and mortality of this approach limits its use. Approximately 75% of the MDS patients in the U.S. and EU are classified as lower risk and 25% are classified as higher risk. High risk patients are typically treated with inhibitors of DNA methyltransferase such as Vidaza® or Dacogen®, or generic versions that are now available in some countries. Many categorized as lower-risk typically receive erythropoiesis stimulating agents as first-line therapy, though erythropoiesis stimulating agents are not approved by the FDA or the EMA for the treatment of anemia in MDS patients. Our internal market

4

research estimates that erythropoiesis stimulating agents generate $500 to $700 million in annual U.S. sales from their use in this disease. Therapeutic options following failure on erythropoiesis stimulating agents are limited, and most patients end up receiving red blood cell transfusions to manage their anemia. Across the disease, approximately 15% of patients have a specific chromosomal mutation and are treated with Revlimid®.

The anemia in MDS is primarily due to ineffective erythropoiesis, and a significant number of MDS patients have serum erythropoietin levels substantially above the normal range, indicating that the anemia in these MDS patients is not a consequence of erythropoietin deficiency. The ineffective erythropoiesis of MDS may be caused by excess signaling by members of the TGF-beta superfamily, which inhibits red blood cell maturation. For this reason we believe that blocking this excess signaling by luspatercept may reverse this inhibition. Approximately 50% of MDS patients are unresponsive to the administration of recombinant erythropoietin and instead require red blood cell transfusions, which can increase the risk of infection and iron-overload related toxicities. Treatment-resistant anemia resulting from ineffective erythropoiesis is a major cause of morbidity in MDS patients.

Given the effects of members of the TGF-beta superfamily ligands on late-stage erythropoiesis, we have investigated our candidate therapeutics in mouse models of MDS, with a focus on luspatercept. In our 2014 publication in the journal Nature Medicine, we and our collaborators showed that the ligand GDF11 is expressed at an elevated level in a mouse model of MDS, leading to elevated levels of an activated transcription factor, P-SMAD2/3, and ineffective erythropoiesis. Treatment with a mouse version of luspatercept, referred to as RAP-536, reduced P-SMAD2/3 levels and caused statistically significant increases in red blood cell count, hemoglobin levels and hematocrit compared to controls. Additionally, RAP-536 reduced the ineffective erythropoiesis as evidenced by the improvement in the ratio of red blood cell precursors to other cells in the bone marrow.

Celgene is currently conducting a Phase 3 clinical trial with luspatercept in patients with very low, low and intermediate risk MDS per the Revised International Prognostic Scoring System, the "MEDALIST" trial. The MEDALIST trial targets patients with very low, low or intermediate risk MDS with ring sideroblasts who require red blood cell, or RBC, transfusions. The trial is double-blinded, placebo-controlled and will enroll an estimated 210 patients randomized 2:1, luspatercept versus placebo. In order to enroll in the trial, patients must meet the following eligibility criteria: refractory / intolerant to prior erythropoiesis stimulating agents (ESA) or ESA ineligible, ring sideroblast positive, or RS+, received transfusions of at least 2 units of RBCs every 8 weeks confirmed for a minimum of 16 weeks with no consecutive 8-week period free from transfusion, and have not received prior lenalidomide, hypomethylating agents or immunosuppressive therapy. Patients are excluded from the study if they have del(5q) or secondary MDS. The primary endpoint for efficacy analysis will be the proportion of patients who become RBC-transfusion independent for a period of at least 8 weeks during the first 24 weeks of treatment. Certain secondary endpoints are assessed at 48 weeks, and we expect to assess all endpoints after completion of the 48-week timepoint.

In addition to the Phase 3 clinical trial, we are currently conducting two Phase 2 clinical trials of luspatercept in patients with MDS. The first clinical trial, a 3-month base study, is designed as a two-part trial, with an ascending dose part to evaluate the safety and efficacy in patients with low or intermediate risk MDS per the International Prognostic Scoring System, and an expansion part in which additional patients are enrolled at a selected dose level. We have completed enrollment in all of the dose escalation cohorts and we have completed enrollment of patients in the initial expansion cohort of the trial for a total of 58 patients.

We have expanded the trial to include two additional cohorts of patients to further evaluate the effects of luspatercept in selected MDS patient populations. Enrollment in expansion cohort 1 is completed and includes patients with serum erythropoietin, or EPO, levels > 500 U/L, or, if ≤ 500 U/L, patients that are non-responsive, refractory, or intolerant to ESAs, or ESAs are contraindicated or unavailable. Enrollment in expansion cohort 2 is ongoing and includes patients with either (i) RS+ (≥ 15% ring sideroblasts in bone marrow), low transfusion burden (< 4U RBC/8 weeks), no prior ESA treatment, and EPO levels ≤ 200 U/L or (ii) RS- (< 15% ring sideroblasts in bone marrow), low transfusion burden (< 6U RBC/8 weeks), any prior ESA treatment and any EPO level. Patients are treated every 3 weeks by subcutaneous injection for up to 5 doses (titration allowed from 1.0 to 1.75 mg/kg). All patients enrolled in the base study are eligible to enroll in a second Phase 2 trial (long-term extension study) that permits dosing with luspatercept for up to an additional five years. These trials are being conducted at sites in Germany.

We believe that preliminary results from the Phase 2 MDS study, including the two additional cohorts, are encouraging. We presented these results, using a data cut-off date of September 9, 2016, at the 58th American Society of Hematology (ASH) Annual Meeting and Exposition in December 2016. As of the cut-off date, a total of 73 patients were treated in the base study, of which 42 patients were treated in the extension study. Of the 73 patients, 32 had a low RBC transfusion burden, or LTB (< 4 units RBC/8 weeks), and 41 had a high transfusion burden, or HTB (≥ 4 units RBC/8 weeks). 53% of patients had been treated previously with ESA and 14% of patients had been treated previously with lenalidomide. The median hemoglobin for LTB patients was 8.6 g/dL (range 6.4-10.1 g/dL) and the median RBC transfusion burden for HTB patients was 6U RBC/8 weeks (range 4-18 units). A total of 71% of patients were RS+.

5

Patient response was evaluated using the International Working Group (IWG) Hematologic Improvement Erythroid (HI-E) response criterion. To achieve IWG HI-E criterion, an LTB patient must have a hemoglobin increase of ≥ 1.5 g/dL for ≥ 8 weeks, and an HTB patient must have a reduction of ≥ 4 units RBC over 8 weeks. The preliminary IWG HI-E response rates for patients treated with luspatercept dose levels of ≥ 0.75 mg/kg in the base study and the extension study respectively were 62% and 83% for RS+ patients with EPO levels < 200 U/L, 40% and 100% for RS- patients with EPO levels < 200 U/L, 46% and 88% for RS+ patients with EPO levels 200-500 U/L, and 0% and 0% for RS- patients with EPO levels 200-500 U/L.

Patients were also evaluated on the basis of whether they achieved RBC transfusion independence, or RBC-TI, for ≥ 8 weeks. The RBC-TI rates for patients treated with luspatercept dose levels of ≥ 0.75 mg/kg in the base study and extension study respectively were 68% and 71% for RS+ patients with EPO levels < 200 U/L, 25% and 50% for RS- patients with EPO levels < 200 U/L, 33% and 60% for RS+ patients with EPO levels 200-500 U/L, and 100% and 100% for RS- patients with EPO levels 200-500 U/L. To date, in the base and extension studies (totaling 73 patients), we have received reports of related grade 3/serious adverse events consisting of myalgia, worsening of general condition and blast cell count increase. Adverse events which may be related to luspatercept observed in ≥ 2 patients in these studies were diarrhea, fatigue, headache, hypertension, arthralgia, bone pain, injection site erythema, myalgia, and peripheral edema.

Beta-thalassemia

With respect to beta-thalassemia, both our and Celgene's objective is to develop luspatercept as a treatment to increase hemoglobin levels, decrease transfusion burden, decrease iron overload, improve symptoms associated with anemia, and alleviate other disease complications, such as leg ulcers.

The thalassemias comprise a heterogeneous group of disorders arising from defects in the genes that encode the proteins that comprise hemoglobin. Hemoglobin is a four-subunit protein complex formed of two alpha-subunits and two beta-subunits, each with an iron-containing heme group that binds to and carries oxygen molecules within red blood cells. There are two main classifications of thalassemia, alpha-thalassemia and beta-thalassemia, depending on whether the genetic defect lies in the gene encoding the alpha-subunit or the beta-subunit, respectively. Beta-thalassemia is particularly prevalent throughout the Mediterranean region, Middle East, and Southeast Asia, and, due to migration and immigration, is increasingly a global disease. The Thalassaemia International Federation estimates that there are approximately 300,000 patients worldwide with beta-thalassemia, approximately 20,000 of which are in the United States and Europe, who are dependent on frequent blood transfusions. We estimate that there are at least as many beta-thalassemia patients in the same regions who are not transfusion dependent and not included in these estimates. Many of these patients have hemoglobin levels that are approximately half that of normal individuals and experience significant complications of the disease. Beta-thalassemia is treated primarily by red blood cell transfusions that, over time, cause a toxic accumulation of iron in the body. A central challenge for managing patients with beta-thalassemia is to restore the red blood cell levels while avoiding iron overload. Iron chelation therapy alone costs between $40,000 and $60,000 per year in countries such as the United States and Italy and yet does not treat the underlying anemia. The course of the disease depends largely on whether patients are maintained on an adequate transfusion and iron chelation regimen. Poor compliance with transfusion and/or iron chelation is associated with a poor prognosis and shortened survival. However, even with the standard of care, patients are at risk of infection from transfusions as well as toxicities related to iron chelation therapy.

No drug is approved to treat the anemia of beta-thalassemia. Hematopoietic stem cell transplantation is viewed as the only curative approach for beta-thalassemia, although this option is limited by the availability of appropriate donors and by risks, including death, associated with the bone marrow transplant procedure. Consequently this treatment is used only in the most severely affected patients.

Given the effects of members of the TGF-beta superfamily ligands on late-stage erythropoiesis, we have investigated our candidate therapeutics in mouse models of this disease. We evaluated the effects of RAP-536 in a series of studies using a mouse model of beta-thalassemia. These mice carry deletion mutations in the beta-globin genes, resulting in a deficiency of beta-globin protein and hematologic abnormalities very similar to those seen in human beta-thalassemia patients, including severe anemia and ineffective erythropoiesis. These mice also exhibit severe complications common in patients with thalassemia, such as an enlarged spleen, bone loss and iron overload. As reported in our 2014 publication in the journal Blood, RAP-536 treatment improved numerous hematologic parameters in these mice, including a decrease in hemoglobin aggregates, significant increases in red blood cell count, hemoglobin levels, and hematocrit, decreased serum erythropoietin, normalized red blood cell size, and reduced red blood cell breakdown, as measured by serum bilirubin. Importantly, RAP-536 decreased the elevated levels of the activated transcription factor, P-SMAD2/3, restored iron homeostasis and improved the maturation of later-stage red blood cell precursor populations.

Celgene is currently conducting a Phase 3 clinical trial with luspatercept in regularly transfused patients with beta-thalassemia, the "BELIEVE" trial. The BELIEVE trial targets adult beta-thalassemia patients who are regularly transfused. The trial is double-blinded and placebo-controlled and will enroll an estimated 300 patients randomized 2:1, luspatercept versus

6

placebo. In order to enroll in the trial, patients must receive 6-20 units RBC transfused over the prior 24 weeks and have no transfusion-free period ≥ 35 days. Patients will be monitored for a 12-week prospective pre-treatment period to calculate baseline transfusion burden. The primary endpoint for efficacy analysis will be the proportion of patients with at least a 33% reduction in transfusion burden during weeks 13 to 24 of the trial compared to the 12 weeks preceding treatment. Certain secondary endpoints are assessed at 48 weeks, and we expect to assess all endpoints after completion of the 48-week timepoint.

In addition to the Phase 3 clinical trial, we are currently conducting two Phase 2 clinical trials of luspatercept in patients with beta-thalassemia. The first clinical trial, a 3-month base study, is designed as a two-part trial, with an ascending dose part to evaluate the safety and efficacy of luspatercept in patients with beta-thalassemia, and an expansion part in which additional patients are enrolled at a selected dose level. We have currently completed enrollment and treatment of all of the dose escalation cohorts as well as the expansion cohort of the trial. Patients enrolled in the initial 3-month trial are eligible to enroll in a second Phase 2 trial (extension study) that permits dosing with luspatercept for up to an additional five years. This trial is currently being conducted at sites in Italy and Greece.

We believe the preliminary results from the Phase 2 clinical trials are encouraging. We presented these results, using a data cut-off date of September 2, 2016, at the 58th ASH Annual Meeting and Exposition in December 2016. As of the cut-off date, a total of 64 patients were treated in the dose escalation and expansion cohorts of this study, and of those patients, a total of 51 were enrolled in the extension study. In both studies, luspatercept was administered subcutaneously, once every 3 weeks. Of these 64 patients, 31 were transfusion dependent and 33 were non-transfusion dependent. For the transfusion dependent patients in the base study and extensions study respectively, 71% and 83% patients had a ≥ 33% reduction in transfusion burden, and 55% and 71% patients had a ≥ 50% reduction in transfusion burden, over any 12-week period compared to baseline.

For the non-transfusion dependent patients treated with luspatercept dose levels ≥ 0.6 mg/kg in the base study and extension study, 62% and 78%, respectively, achieved ≥ 1.0 g/dL increases, and 33% and 52%, respectively, achieved ≥ 1.5 g/dL increases, in mean hemoglobin over any 12-week period compared to baseline.

A trend of reduction in liver iron concentration, or LIC, was observed in the majority of non-transfusion dependent patients with or without iron chelation therapy, and in the majority of transfusion dependent patients receiving iron chelation therapy. Improvement in patient-reported quality of life in non-transfusion dependent patients correlated with increase in hemoglobin. Rapid healing and partial healing of leg ulcers, a serious complication of beta-thalassemia, was observed in some patients. To date, we have received no reports of related serious adverse events and we have received reports of related grade 3 adverse events consisting of bone pain, asthenia, and headache. Adverse events which may be related to luspatercept observed in ≥ 10% of patients were bone pain, myalgia, headache, arthralgia, musculoskeletal pain, and injection site pain

Myelofibrosis

Myelofibrosis is an acquired disease of the bone marrow that results in replacement of the bone marrow with fibrotic tissue leading to bone marrow failure and inability to make new blood cells, including red blood cells, which leads to anemia. Epidemiological databases suggest that there are 30,000-40,000 myelofibrosis patients in the United States and Europe. Approximately 30% of myelofibrosis patients present primarily with anemia when diagnosed and nearly all patients will develop anemia with progression of the disease. There is no approved drug therapy to treat anemia in myelofibrosis. Our and Celgene's objective is to develop luspatercept as a treatment for the anemia in myelofibrosis patients, and we plan to initiate a Phase 2 clinical trial in patients with myelofibrosis with luspatercept by the end of 2017.

Sotatercept

Clinical studies with sotatercept in chronic kidney disease have been deprioritized. We are evaluating other opportunities for the development of sotatercept.

Sotatercept is being studied through investigator-initiated clinical trials in multiple myeloma, Diamond-Blackfan anemia and myelofibrosis. Multiple myeloma is a cancer of the bone marrow that leads to the uncontrolled growth of certain white blood cells, causing bone marrow failure, bone pain, bone fractures and kidney problems. Nearly all multiple myeloma patients suffer from anemia. Investigators at the Massachusetts General Hospital are conducting a trial to explore the possibility that the combination of anti-myeloma therapies Revlimid® and dexamethasone together with sotatercept may reduce the growth of cancer cells along with improving anemia as well as bone lesions that often occur in patients with multiple myeloma. Diamond-Blackfan anemia is a rare and severe anemia that is present at birth in affected individuals. Investigators at North Shore Long Island Jewish Health System are conducting a trial to determine the safety and efficacy of sotatercept in adult patients with Diamond-Blackfan anemia who are red blood cell transfusion-dependent. Myelofibrosis is an acquired disease of the bone marrow that results in replacement of the bone marrow with fibrotic tissue leading to bone marrow failure and inability to make new blood cells, including red blood cells, which leads to anemia. Investigators at the MD Anderson Cancer Center are conducting a trial to determine the safety and efficacy of sotatercept in patients with myeloproliferative neoplasm-associated

7

myelofibrosis and anemia. Based on data from this investigator sponsored trial presented at the 58th ASH Annual Meeting and Exposition in December 2016, and taking into account mechanistic similarities between sotatercept and luspatercept, we and Celgene plan to initiate a Phase 2 clinical trial in patients with myelofibrosis with luspatercept by the end of 2017.

Dalantercept

Our third clinical stage therapeutic candidate, dalantercept, is designed to treat cancers by inhibiting blood vessel formation by inhibiting signaling through the ALK1 receptor. This mechanism is distinct from, and potentially synergistic with, the dominant class of cancer drugs that inhibit blood vessel formation, the vascular endothelial growth factor, or VEGF, pathway inhibitors. We are developing dalantercept primarily for use in combination with VEGF pathway inhibitors to produce better outcomes for cancer patients.

We believe that a combination of ALK1 and VEGF pathway inhibitors could have application in a number of different oncology indications where VEGF pathway inhibitors are currently used and are currently studying the combination in renal cell carcinoma. The currently approved VEGF pathway inhibitors to treat renal cell carcinoma include Avastin® (bevacizumab), Cabometyx® (cabozantinib), Inlyta® (axitinib), Lenvima® (lenvatinib), Nexavar® (sorafenib), Sutent® (sunitinib), and Votrient® (pazopanib). The National Cancer Institute estimates there were 62,700 new cases of kidney and renal pelvis cancer in the United States in 2016 with 14,240 deaths. In 2016, U.S. sales of drugs for renal cell carcinoma were $1.4 billion, of which $1.0 billion were anti-angiogenesis drugs that target the VEGF pathway, principally Sutent® (sunitinib), Inlyta® (axitinib), Votrient® (pazaopanib) and Avastin® (bevacizumab). Worldwide sales in 2016 of drugs for renal cell carcinoma were $3.1 billion, of which $2.6 billion were drugs that target the VEGF pathway.

We are evaluating dalantercept in combination with axitinib, a tyrosine kinase inhibitor of the VEGF pathway, for the treatment of renal cell carcinoma in the DART trial, a two part Phase 2 clinical trial. In Part 1 of the DART trial, dalantercept plus axitinib produced clinical outcomes that exceed historical results with axitinib alone. We have reported a median progression-free survival (PFS) for dalantercept plus axitinib of 8.3 months. There was no control arm in Part 1 of the DART trial, however published data from a prior phase 3 trial of axitinib alone (the AXIS trial) in a similar patient subgroup show a median PFS of 4.8 months. We are currently conducting Part 2 of the DART trial, which is a double-blind, placebo-controlled trial, in which an estimated 130 patients are randomized to dalantercept plus axitinib or placebo plus axitinib. We expect to report on progression free survival from Part 2 of the DART trial in the second half of 2017. In the open-label Part 1 and blinded Part 2 of the DART trial, we have received reports of serious adverse events as related to dalantercept, dalantercept or placebo (blinded Part 2), or both dalantercept and axitinib, including fluid overload, dyspnea, epistaxis, renal injury, acute renal failure, hyponatremia and pulmonary embolism. At last assessment, non-serious adverse events associated with axitinib did not generally occur with higher than expected frequency or severity.

Dalantercept has been tested as a single-agent therapy in four completed clinical trials: a Phase 1 clinical trial and Phase 2 clinical trials in head and neck cancer, ovarian cancer and endometrial cancer. In these studies of dalantercept as monotherapy, there was not sufficient activity to warrant further development of dalantercept as monotherapy in these tumor types. We believe the greatest potential for dalantercept will be in combination with VEGF pathway inhibitors or in combination with cytotoxic chemotherapy.

ACE-083

Our fourth clinical stage therapeutic candidate, ACE-083, is designed to promote muscle growth and function in specific, targeted muscles. We completed a Phase 1 clinical trial with ACE-083 in healthy volunteers. ACE-083 was well tolerated in the Phase 1 clinical trial and no serious adverse events were reported. Data from cohorts 1 through 5 in the Phase 1 trial showed that, at the highest dose level tested, ACE-083 generated a mean increase in muscle volume of approximately 14.5% in the injected rectus femoris muscle of the quadriceps. Data from cohorts 6 and 7 demonstrated that, at the highest dose level tested, ACE-083 generated a mean increase in muscle volume of approximately 8.9% in the injected tibialis anterior muscle of the lower leg. We have completed the Phase 1 clinical trial and we have initiated a Phase 2 clinical trial with ACE-083 in patients with facioscapulohumeral dystrophy, or FSHD. We expect to initiate a Phase 2 clinical trial with ACE-083 in a second neuromuscular disease in 2017.

FSHD is a severe, disabling, and painful skeletal muscle disease that presents with muscle-by-muscle progression. Muscle weakness can be heterogeneous, but is highly focal and primarily asymmetric. Typical onset occurs between the ages 20 and 40. Most FSHD patients live a normal lifespan, but many will suffer from disability, pain, and depression. Current treatment is largely limited to orthotic or surgical intervention to provide or maintain functionality. FSHD is one of the most prevalent forms of muscular dystrophy affecting roughly 19,000 patients in the United States.

Preclinical Programs

8

In addition to our clinical development activities, we are expanding our research capabilities in order to increase the rate at which our highly productive research group can identify and advance new, internally discovered, therapeutic candidates for clinical development. Our discovery efforts are primarily focused on identifying new protein therapeutic candidates from our IntelliTrap™ platform and identifying novel antibodies. We have selected our first IntelliTrap™ therapeutic candidate, ACE-2494, for advancement to clinical trials by the end of 2017. We are also evaluating ACE-1332, a selective TGF-beta antagonist, for treatment of disorders with a fibrotic component, and additional molecules from our IntelliTrap™ platform for undisclosed therapeutic areas.

Our Strategic Partnerships

Collaborations with corporate partners have provided us with significant funding and access to our partners' scientific, development, regulatory and commercial capabilities. We have received more than $357.3 million from our collaborations with Celgene and our prior collaborations with Alkermes plc (Alkermes) and Shire AG (Shire).

Celgene

On February 20, 2008 we entered into an agreement, which we refer to as the Sotatercept Agreement, with Celgene Corporation, under which we granted to Celgene worldwide rights to sotatercept. On August 2, 2011 we entered into a second agreement with Celgene for luspatercept, which we refer to as the Luspatercept Agreement under which we granted to Celgene worldwide rights to luspatercept and also amended certain terms of the Sotatercept Agreement. These agreements provide Celgene exclusive licenses for these therapeutic candidates in all indications, as well as exclusive rights to obtain a license to certain future compounds.

Sotatercept Agreement. Under the terms of the Sotatercept Agreement, we and Celgene are collaborating on the development and commercialization of sotatercept. We also granted Celgene an option to license discovery stage compounds against three specified targets. Celgene paid $45.0 million and bought $5.0 million of equity upon execution of the Sotatercept Agreement and, as of December 31, 2016, we have received $43.7 million in research and development funding and milestone payments for the sotatercept program.

We retained responsibility for research, development through the end of Phase 2a clinical trials, as well as manufacturing the clinical supplies for these trials. These activities are substantially complete. Celgene is responsible for all clinical trials and manufacturing for sotatercept. We are eligible to receive future development, regulatory and commercial milestones of up to $360.0 million for the sotatercept program and up to an additional $348.0 million for each of the three discovery stage programs. None of the three discovery stage programs has advanced to the stage to achieve payment of a milestone, nor do we expect any such milestone payments in the near future.

Luspatercept Agreement. Under the terms of the Luspatercept Agreement, we and Celgene are collaborating in the development and commercialization of luspatercept. We also granted Celgene an option to license products for which Acceleron files an investigational new drug application for the treatment of anemia. Celgene paid $25.0 million to us upon execution of the Luspatercept Agreement in August 2011 and, as of December 31, 2016, we have received $87.2 million in research and development funding and milestone payments for the luspatercept program.

Under this agreement, we retained responsibility for research, development through the end of Phase 1 and the two ongoing Phase 2 clinical trials in MDS and beta-thalassemia, as well as manufacturing the clinical supplies for these studies. Celgene will conduct subsequent Phase 2 and Phase 3 clinical trials. Acceleron will manufacture luspatercept for all Phase 1 and Phase 2 clinical trials, and Celgene will have responsibility for the manufacture of luspatercept for Phase 3 clinical trials and commercial supplies. We are eligible to receive future development, regulatory and commercial milestones of up to $185.0 million for the luspatercept program.

In November 2013, the Company has agreed to conduct additional development activities including clinical and non-clinical services, which are reimbursed under the same terms and rates of the existing Agreements. Please refer to Note 10 to the financial statements in this Annual Report on Form 10-K for the revenue recognition accounting, including changes in estimates, pursuant to the revenue recognition accounting literature.

Both Agreements. Under each agreement, the conduct of the collaboration is managed by a Joint Development Committee and Joint Commercialization Committee. Other than with respect to certain matters related to our conduct of Phase 2 trials, in the event of a deadlock of a committee, the resolution of the relevant issue is determined by Celgene. Prior to January 1, 2013, Celgene paid the majority of development costs under the Sotatercept and Luspatercept Agreements. As of January 1, 2013, Celgene became responsible for paying 100% of worldwide development costs for both programs. Celgene will be responsible for all commercialization costs worldwide. We are obligated to co-promote sotatercept, luspatercept and future products, in each case if approved, under both agreements in North America, and Celgene will pay all costs related thereto. We will receive tiered royalties in the low-to-mid 20% range on net sales of sotatercept and luspatercept. The royalty

9

schedules for sotatercept and luspatercept are the same. Celgene is obligated to use commercially reasonable efforts to develop and commercialize sotatercept and luspatercept. Celgene may determine that it is commercially reasonable to develop and commercialize only luspatercept or sotatercept and discontinue the development or commercialization of the other therapeutic candidate, or Celgene may determine that it is not commercially reasonable to continue development of one or both of sotatercept and luspatercept. In the event of any such decision, we may be unable to progress the discontinued candidate or candidates ourselves. The agreements are terminable by either party upon a breach that is uncured and continuing or by Celgene for convenience on a country by country or product by product basis, or in its entirety. Celgene may also terminate the agreement, in its entirety or on a product by product basis, for failure of a product to meet a development or clinical trial endpoint. Termination for cause by us or termination by Celgene for convenience or failure to meet an endpoint will have the effect of terminating the applicable license, while termination for cause by Celgene will have the effect of reducing remaining royalties by a certain percentage.

Competition

The development and commercialization of new drugs is highly competitive. We and our collaborators will face competition with respect to all therapeutic candidates we may develop or commercialize in the future from pharmaceutical and biotechnology companies worldwide. Many of the entities developing and marketing potentially competing products have significantly greater financial resources and expertise than we do in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing. Our commercial opportunity will be reduced or eliminated if our competitors develop and commercialize products that are more effective, have fewer side effects, are more convenient or are less expensive than any products that we may develop.

If our clinical stage therapeutic candidates are approved, they will compete with currently marketed drugs and therapies used for treatment of the following indications, and potentially with drug candidates currently in development for the same indications:

MDS

If luspatercept is approved for the treatment of patients with MDS, it would compete with the following:

• | Recombinant erythropoietin and other erythropoiesis stimulating agents. Although these agents are not approved to treat anemia in MDS, current practice guidelines include the use of erythropoiesis stimulating agents and granulocyte colony stimulating factor agents (G-CSF) to treat patients with MDS. Additionally, Amgen is currently studying erythropoiesis stimulating agent, Aranesp® and Janssen Pharmaceuticals is studying erythropoiesis stimulating agent Eprex® in Phase 3 clinical trials in Europe for treatment of anemia in patients with lower risk MDS. |

• | Red blood cell transfusion and iron chelation therapy, including Exjade® and JadenuTM, which is used to treat anemia and iron overload in patients with MDS. |

• | Immunomodulators, including Celgene's approved product, Revlimid® (lenalidomide), for the treatment of anemia of certain MDS patients. |

• | Eli Lilly and Company is studying TGF-beta receptor I kinase inhibitor, LY2157299 in a Phase 2 study in lower risk MDS patients with anemia. |

• | Other therapies in development, including: an oral form of the hypomethylating agent azacitidine, known as CC-486, being developed by Celgene to treat patients with transfusion dependent anemia and thrombocytopenia due to lower risk MDS, which is currently in Phase 3 clinical trials in the United States and Europe; an anti-cancer therapy being developed by Onconova to treat patients with MDS; a telemorase inhibitor, imetelstat, being studied by Geron and Janssen in a Phase 2/3 study in lower risk MDS patients; and a CD95 ligand inhibitor, APG101, being studied by Apogenix in a Phase 1 study in transfusion dependent, lower risk MDS patients. |

Beta-thalassemia

If luspatercept is approved for the treatment of patients with beta-thalassemia, it would compete with:

• | Red blood cell transfusions and iron chelation therapy, such as Novartis's oral iron chelating agents, Exjade® and Jadenu™. |

• | Fetal hemoglobin stimulating agents, such as hydroxyurea, which are primarily used to treat patients with anemia from sickle cell disease, are sometimes used to treat patients with beta-thalassemia. |

10

• | Hematopoietic stem cell transplant treatment is given to a small percentage of patients with beta-thalassemia, since it requires a sufficiently well-matched source of donor cells. Certain academic centers around the world are seeking to develop improvements to this approach. |

• | Other therapies in development, including gene therapy and genome editing are being developed by several different groups, including bluebird bio, Inc., Memorial Sloan Kettering Cancer Center, GlaxoSmithKline plc, and Sangamo BioSciences Inc. in collaboration with Biogen Idec. |

Oncology Therapies

We are developing dalantercept to be used in combination with a VEGF pathway inhibitor for the treatment of cancer. If dalantercept is approved, it would compete with the following.

• | Nivolumab, an anti-PD1 monoclonal antibody developed by Bristol-Myers Squibb, cabozantinib, an inhibitor of VEGF and MET receptors developed by Exelixis, and lenvatinib, a multireceptor tyrosine kinase inhibitor, developed by Eisai, in combination with everolimus, were approved in 2015, 2016 and 2016, respectively, to treat patients with renal cell carcinoma. Additionally, nivolumab is being studied in combination with other treatments for renal cell carcinoma. Merck is also studying pembrolizumab, an anti-PD1 antibody, is also being studied as monotherapy and in combination therapy in renal cell carcinoma. |

• | Tracon is developing TRC105, an antibody to endoglin, which is a protein in the TGF-beta superfamily that is overexpressed on endothelial cells and plays a role in angiogenesis. TRC105 is currently being studied in Phase 1 and Phase 2 clinical trials for the treatment of multiple solid tumor types, including soft tissue sarcoma, renal cell carcinoma, glioblastoma, hepatocellular carcinoma and colorectal cancer, in combination with approved VEGF inhibitors. |

• | Other non-VEGF angiogenesis inhibitors in development, which also have the potential to be combined with VEGF pathway inhibitors or used independently of VEGF pathway inhibitors to inhibit angiogenesis. Amgen, Regeneron, MedImmune, and OncoMed Pharmaceuticals are each developing non-VEGF angiogenesis inhibitors. |

In addition to the therapies mentioned above, there are many generic chemotherapy agents and other regimens commonly used to treat various types of cancer, including renal cell carcinoma.

Therapies for Treating Muscle Loss

We are currently studying ACE-083 in a Phase 2 clinical trial for the treatment of patients with facioscapulohumeral muscular dystrophy (FSHD) and also plan to develop ACE-083 for the treatment of additional neuromuscular disorders and other diseases characterized by a loss of muscle function. One potential competitor of ACE-083 in FSHD is Resolaris® (ATYR1940), which is an investigational protein in Phase 1b/2 studies to treat adult patients with FSHD being developed by aTyr Pharma.

We are also aware of approaches to treat other muscle loss diseases that are in clinical trials. Novartis is developing bimagrumab (BYM338), a monoclonal antibody targeting the activin receptor type IIB (ActRIIB), in various Phase 2 clinical trials to treat pathological muscle loss and weakness. Regeneron is developing a myostatin monoclonal antibody, REGN1033 (SAR391786), which has completed a Phase 2 clinical trial for treatment of sarcopenia. Pfizer is conducting a Phase 2 clinical study for PF-06252616, a myostatin antibody, in patients with Duchenne muscular dystrophy (DMD). Nationwide Children's Hospital, in collaboration with The Myositis Association, Parent Project Muscular Dystrophy and Milo Biotechnology, are conducting a Phase 1 clinical trial of a gene therapy delivery of follistatin (FS344) to muscle in patients with Becker muscular dystrophy (BMD) and sporadic inclusion body myositis (sIBM).

The key competitive factors affecting the success of any approved product will be its efficacy, safety profile, price, method of administration and level of promotional activity.

Commercialization

We retain co-promotion rights with our collaboration partner, Celgene, for both sotatercept and luspatercept in North America, and under the terms of our agreements with Celgene, our commercialization costs will be entirely funded by Celgene. We also currently retain worldwide commercialization rights for our oncology therapeutic candidate, dalantercept, ACE-083, and our systemic muscle therapeutic candidate, ACE-2494. We intend to build hematology and neuromuscular disorder focused, specialty sales forces in North America and, possibly, other markets to effectively support the commercialization of these and future products. We believe that a specialty sales force will be sufficient to target key prescribing physicians in these areas. We currently do not have any sales or marketing capabilities or experience. We will establish the required capabilities

11

within an appropriate time frame ahead of any product approval and commercialization to support a product launch. If we are not able to establish sales and marketing capabilities or are not successful in commercializing our future products, either on our own or through collaborations with Celgene, any future product revenue will be materially adversely affected.

Intellectual Property

Our commercial success depends in part on our ability to obtain and maintain proprietary protection for our therapeutic candidates, novel biological discoveries, screening and drug development technology, to operate without infringing on the proprietary rights of others and to prevent others from infringing our proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing U.S. and foreign patent applications related to our proprietary technology, inventions and improvements that are important to the development and implementation of our business. We also rely on trade secrets, know-how, continuing technological innovation and potential in-licensing opportunities to develop and maintain our proprietary position. Additionally, we expect to benefit from a variety of statutory frameworks in the United States, Europe and other countries that relate to the regulation of biosimilar molecules and orphan drug status. These statutory frameworks provide periods of non-patent-based exclusivity for qualifying molecules. See "Government Regulations".

Our patenting strategy is focused on our therapeutic candidates. We seek composition-of-matter and method-of-treatment patents for each such protein in key therapeutic areas. We also seek patent protection with respect to companion diagnostic methods and compositions and treatments for targeted patient populations. We have sought patent protection alone or jointly with our collaborators, as dictated by our collaboration agreements.

Our patent estate, on a worldwide basis, includes approximately 230 issued patents (approximately 530 issued patents when separately counting each European and Eurasian national validation) and approximately 440 pending patent applications, with pending and issued claims relating to all of our current clinical stage therapeutic candidates, sotatercept, luspatercept, dalantercept and ACE-083. These figures include in-licensed patents and patent applications to which we hold exclusive commercial rights.

Individual patents extend for varying periods of time depending on the date of filing of the patent application or the date of patent issuance and the legal term of patents in the countries in which they are obtained. Generally, patents issued from applications filed in the United States are effective for twenty years from the earliest non-provisional filing date. In addition, in certain instances, a patent term can be extended to recapture a portion of the term effectively lost as a result of the FDA regulatory review period, however, the restoration period cannot be longer than five years and the total patent term including the restoration period must not exceed 14 years following FDA approval. The duration of foreign patents varies in accordance with provisions of applicable local law, but typically is also twenty years from the earliest international filing date. Our issued patents and pending applications with respect to our clinical stage therapeutic candidates will expire on dates ranging from 2026 to 2035, exclusive of possible patent term extensions, However, the actual protection afforded by a patent varies on a product by product basis, from country to country and depends upon many factors, including the type of patent, the scope of its coverage, the availability of extensions of patent term, the availability of legal remedies in a particular country and the validity and enforceability of the patent.

National and international patent laws concerning therapeutic candidates remain highly unsettled. No consistent policy regarding the patent-eligibility or the breadth of claims allowed in such patents has emerged to date in the United States, Europe or other countries. Changes in either the patent laws or in interpretations of patent laws in the United States and other countries can diminish our ability to protect our inventions and enforce our intellectual property rights. Accordingly, we cannot predict the breadth or enforceability of claims that may be granted in our patents or in third-party patents. The biotechnology and pharmaceutical industries are characterized by extensive litigation regarding patents and other intellectual property rights. Our ability to maintain and solidify our proprietary position for our drugs and technology will depend on our success in obtaining effective claims and enforcing those claims once granted. We do not know whether any of the patent applications that we may file or license from third parties will result in the issuance of any patents. The issued patents that we own or may receive in the future, may be challenged, invalidated or circumvented, and the rights granted under any issued patents may not provide us with sufficient protection or competitive advantages against competitors with similar technology. Furthermore, our competitors may be able to independently develop and commercialize similar drugs or duplicate our technology, business model or strategy without infringing our patents. Because of the extensive time required for clinical development and regulatory review of a drug we may develop, it is possible that, before any of our drugs can be commercialized, any related patent may expire or remain in force for only a short period following commercialization, thereby reducing any advantage of any such patent. The patent positions for our most advanced programs are summarized below:

Luspatercept Patent Coverage

We hold two issued patents covering the luspatercept composition of matter in the United States, one issued patent in Europe (registered in most countries of the European Patent Convention) and additional patents issued or pending in many

12

other major jurisdictions worldwide, including Europe, Australia, Canada, Japan, China, South Korea, Brazil, Mexico, Russia and India. The expected expiration dates for these composition of matter patents are 2028 and 2029, exclusive of possible patent term extensions.

We hold two issued patents covering the treatment of anemia by administration of luspatercept in the United States and similar patents issued or pending in other major jurisdictions worldwide, including Europe, Australia, Canada, Japan, China, South Korea, Brazil, Mexico, Russia and India. The expected expiration date for these method of treatment patents is 2029, exclusive of possible patent term extensions.

We also hold patent applications directed to a variety of other uses for luspatercept, including the treatment of complications of thalassemia, such as iron overload and ulcers, and treatment of patient sub-groups with MDS. The expected expiration date for these method of treatment patents ranges from 2029 to 2035 exclusive of possible patent term extensions.

Sotatercept Patent Coverage

We hold two issued patents covering the sotatercept composition of matter in the United States, one issued patent in Europe (registered in most countries of the European Patent Convention) and additional patents issued or pending in many other major jurisdictions worldwide, including Australia, Canada, Japan, China, South Korea, Brazil, Mexico, Russia, Israel and India. The expected expiration date for these composition of matter patents is 2026, exclusive of possible patent term extensions.

We hold three issued patents covering the treatment of anemia by administration of sotatercept in the United States and similar patents issued or pending in many other major jurisdictions worldwide, including Europe, Australia, Canada, Japan, China, South Korea, Brazil, Mexico, Russia, Israel and India. The expected expiration date for these method of treatment patents is 2027, exclusive of possible patent term extensions.

We also hold patents and patent applications directed to a variety of other uses for sotatercept, including the treatment of multiple myeloma and the treatment of bone loss in patients with chronic kidney disease.

Dalantercept Patent Coverage

We hold one issued patent covering the dalantercept composition of matter in the United States, which is expected to expire in 2029, exclusive of possible patent term extensions, and we hold additional pending patent applications. We hold additional issued patents and pending patent applications covering composition of matter in many other major jurisdictions worldwide, including Europe, Australia, Canada, Japan, China, South Korea, Brazil, Mexico, Russia and India. The expected expiration dates for these patent filings, if issued, are either 2027 or 2029, exclusive of possible patent term extensions.

We hold one issued patent covering the treatment of tumor angiogenesis by administration of dalantercept in the United States and similar patents issued or pending in other major jurisdictions worldwide, including Europe, Japan, China, South Korea, Brazil, Mexico, Russia and India. The expected expiration date for these method of treatment patents is 2027, exclusive of possible patent term extensions.

We also hold patent applications directed to a variety of other uses for dalantercept, including the treatment of renal cell carcinoma with a combination of dalantercept and a VEGF-targeted tyrosine kinase inhibitor. This patent application is jointly invented and owned with the Beth Israel Deaconess Medical Center, or BIDMC, and we have secured an exclusive license to the BIDMC rights. The expected expiration date for these patent applications, should they issue as patents, is 2033 plus any extensions of term available under national law.

ACE-083 Patent Coverage

We hold two pending patent applications covering the ACE-083 composition of matter in the United States, which, if issued are expected to expire in 2029 and 2035, respectively, exclusive of possible patent term extensions. We hold additional pending patent applications covering the ACE-083 composition of matter in many other major jurisdictions worldwide, including Europe, Australia, Canada, Japan, China, South Korea, Brazil, Mexico, Russia and India. The expected expiration date for these patent applications, should they issue as patents, is 2035, exclusive of possible patent term extensions.

We also hold patent applications directed to a variety of uses for ACE-083, including the treatment of muscular dystrophies, such as facioscapulohumeral muscular dystrophy. The expected expiration date for these method of treatment patent applications, should they issue as patents, is 2035, exclusive of possible patent term extensions.

ACE-2494 Patent Coverage

13

We hold two pending patent applications covering the ACE-2494 composition of matter in the United States, which, if issued, are expected to expire in 2036 and 2037, respectively, exclusive of possible patent term extensions. These patent applications are also eligible for filing in major jurisdictions worldwide.

We also hold two pending patent applications in the United States directed to a variety of uses for ACE-2494, including the treatment of systemic muscle disorders which, if issued, are expected to expire in 2036 and 2037, respectively, exclusive of possible patent term extensions. These patent applications are also eligible for filing in major jurisdictions worldwide.

Trade Secrets

In addition to patents, we rely upon unpatented trade secrets and know-how and continuing technological innovation to develop and maintain our competitive position. We seek to protect our proprietary information, in part, using confidentiality agreements with our commercial partners, collaborators, employees and consultants and invention assignment agreements with our employees. These agreements are designed to protect our proprietary information and, in the case of the invention assignment agreements, to grant us ownership of technologies that are developed through a relationship with a third party. These agreements may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. To the extent that our commercial partners, collaborators, employees and consultants use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

In-Licenses

Effective June 21, 2012, we entered into a license agreement with the Beth Israel Deaconess Medical Center, or BIDMC, to obtain worldwide, exclusive rights under patent filings jointly invented by us and BIDMC. The patent rights relate to the treatment of renal cell cancer by combination therapy with dalantercept and VEGF-receptor tyrosine kinase inhibitors (TKIs). The intellectual property includes one pending U.S. patent filing and one pending PCT (international) patent filing. If issued, the patents are predicted to expire in 2033. Under the agreement, BIDMC retained rights, on behalf of itself and other non-profit academic institutions, to practice under the licensed rights for non-profit purposes. The license rights granted to us are further subject to any rights the United States Government may have in such licensed rights due to its sponsorship of research that led to the creation of the licensed rights. We agreed to pay BIDMC specified development and sales milestone payments aggregating up to $1.0 million. In addition, we are required to pay BIDMC royalties in the low single-digits on worldwide net product sales of drug labeled for treatment regimens that are claimed in the licensed patents. The agreement terminates upon the expiration of the last valid claim of the licensed patent rights. We may terminate the agreement at any time by giving BIDMC advance written notice. The agreement may also be terminated by BIDMC in the event of a material breach by us or in the event we become subject to specified bankruptcy or similar circumstances. In any termination event, we retain our joint ownership of the patent rights and a worldwide non-exclusive license with right to sublicense.

On August 6, 2010, we entered into an amended and restated license agreement with the Ludwig Institute for Cancer Research, or LICR, to obtain worldwide, exclusive rights under patent filings solely owned by LICR and patent rights jointly invented by us and LICR. The LICR-owned patent rights relate to the first cloning of the type I activin receptors, ALK1, ALK2, ALK3, ALK4, ALK5 and ALK6, and include claims to nucleic acids, proteins and antibodies with respect to each of the foregoing. These patent rights expire between the years 2013 and 2018. The license excludes the rights with regard to anti-ALK2 antibodies. The joint patent rights relate to the treatment of pancreatic tumors with dalantercept and, if issued, such patent rights are expected to expire in 2029. Under the agreement, LICR retained rights, on behalf of itself and other non-profit academic institutions, to practice under the licensed rights for non-profit purposes. We agreed to pay LICR specified development and sales milestone payments aggregating up to $1.6 million for dalantercept. In addition, we are required to pay LICR royalties in the low single-digits on worldwide net product sales of products claimed in the licensed patents, with royalty obligations continuing at a 50% reduced rate for eight years after patent expiration. If we sublicense the LICR patent rights, we will owe LICR a percentage of sublicensing revenue, excluding payments based on the level of sales, profits or other levels of commercialization. The agreement terminates upon the expiration of royalty obligations. We may terminate the agreement at any time by giving LICR advance written notice. The agreement may also be terminated by LICR in the event of a material breach by us or in the event we become subject to specified bankruptcy or similar circumstances. In any termination we retain our joint ownership right in the jointly owned patent filings.

In August 2010, we entered into two amended and restated license agreements with the Salk Institute for Biological Studies, or Salk, providing rights under U.S. patent filings solely owned by Salk. The agreements for the licensed patent rights relate to the first cloning of the type II activin receptors, human ActRIIA and frog ActRIIB, respectively, and include claims to vertebrate homolog nucleic acids and proteins with respect to each of the foregoing. These patent rights expire between the years 2016 and 2017. One of these agreements relates to ActRIIA and sotatercept; the other agreement relates to ActRIIB, luspatercept and the discontinued program ACE-031, which we refer to as the ActRIIB Agreement. The licenses granted are exclusive as to the therapeutic products that are covered by the patents and non-exclusive as to diagnostic products and other

14

products that are developed using the Salk patent rights. If we sublicense the Salk patent rights, we will owe Salk a percentage of sublicensing revenue, excluding payments based on sales. Under the agreements, Salk retained rights, on behalf of itself and other non-profit academic institutions, to practice under the licensed rights for non-profit purposes. We agreed to pay Salk specified development milestone payments totaling up to $2.0 million for sotatercept and $0.7 million for luspatercept. In addition, we are required to pay Salk royalties in the low single-digits on worldwide net product sales by us or our sublicensees of products claimed in the licensed patents, or derived from use of the licensed patent rights, with royalty obligations continuing at a reduced rate for a period of time after patent expiration. The agreements terminate upon the expiration of royalty obligations. We may terminate either agreement at any time by giving Salk advance written notice. Either agreement may also be terminated by Salk in the event of a material breach by us or in the event we become subject to bankruptcy or similar circumstances.

In October 2012, Salk filed a lawsuit against us alleging that we breached the ActRIIB Agreement. In July 2014, we settled the Salk lawsuit and entered into an amendment to the ActRIIB Agreement with Salk. Pursuant to the settlement, we made a one-time total payment of $5 million, inclusive of interest, to Salk and we agreed to pay Salk 6% of future development milestone payments received under the agreement with Celgene relating to luspatercept. Finally, we and Salk have further agreed that the royalty percentage on net sales of luspatercept will remain at 1% as provided in the ActRIIB Agreement with Salk, and that such royalty will be payable until June 2022.

Government Regulation

The preclinical studies and clinical testing, manufacture, labeling, storage, record keeping, advertising, promotion, export, marketing and sales, among other things, of our therapeutic candidates and future products, are subject to extensive regulation by governmental authorities in the United States and other countries. In the United States, pharmaceutical products are regulated by the FDA under the Federal Food, Drug, and Cosmetic Act and other laws, including, in the case of biologics, the Public Health Service Act. We expect sotatercept, luspatercept, dalantercept, ACE-083 and ACE-2494 to be regulated by the FDA as biologics and to be reviewed by the Center for Drug Evaluation and Research (CDER) as proteins intended for therapeutic use. Therapeutic candidates require the submission of a Biologics License Application, or BLA, and approval by the FDA prior to being marketed in the U.S. Manufacturers of therapeutic candidates may also be subject to state regulation. Failure to comply with FDA requirements, both before and after product approval, may subject us or our partners, contract manufacturers, and suppliers to administrative or judicial sanctions, including FDA refusal to approve applications, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, fines and/or criminal prosecution.

The steps required before a biologic may be approved for marketing of an indication in the United States generally include:

• | completion of preclinical laboratory tests, animal studies and formulation studies conducted according to Good Laboratory Practices, or GLPs, and other applicable regulations; |

• | submission to the FDA of an Investigational New Drug application or IND, which must become effective before human clinical trials may commence; |

• | completion of adequate and well-controlled human clinical trials in accordance with Good Clinical Practices, or GCPs, to establish that the biological product is "safe, pure and potent", which is analogous to the safety and efficacy approval standard for a chemical drug product for its intended use; |

• | submission to the FDA of a BLA; |

• | satisfactory completion of an FDA pre-approval inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with applicable current Good Manufacturing Practice requirements, or cGMPs; and |

• | FDA review of the BLA and issuance of a biologics license which is the approval necessary to market a therapeutic candidate. |