UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

|

|

|

(Name of Registrant as Specified In Its Charter) |

|

n/a |

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

April 29, 2024

Dear Stockholders:

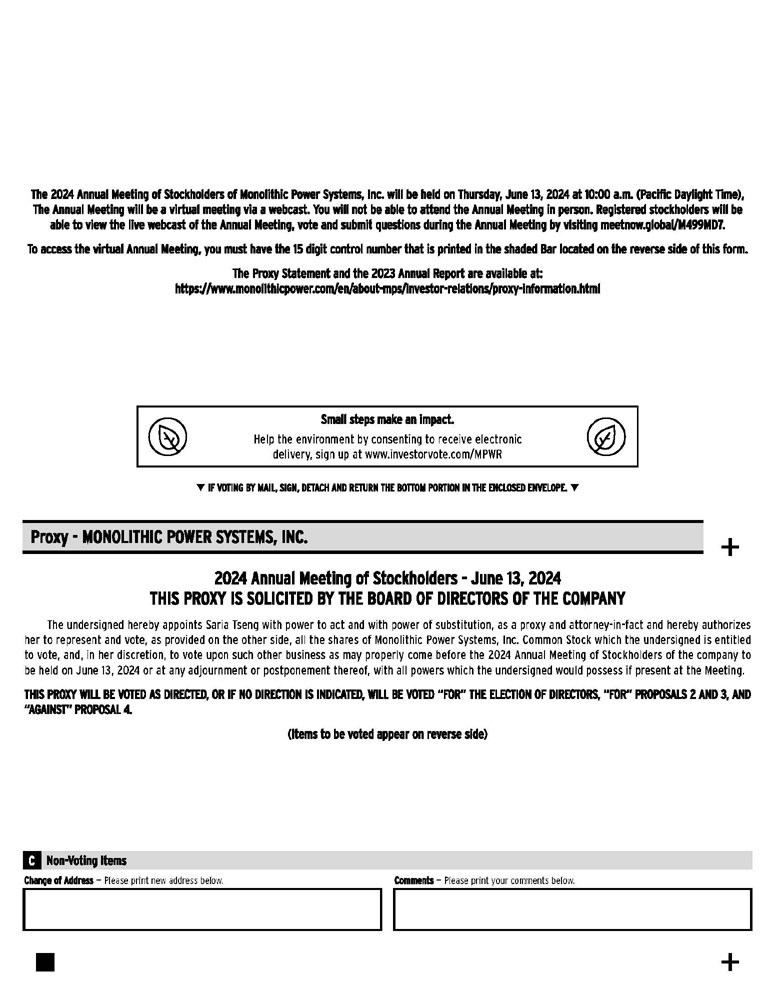

You are invited to attend the 2024 Annual Meeting of Stockholders of Monolithic Power Systems, Inc. to be held on Thursday, June 13, 2024, at 10:00 a.m., Pacific Daylight Time (the “Annual Meeting”). The Annual Meeting will be a virtual meeting. You will be able to attend the Annual Meeting online, vote and submit questions during the meeting by visiting http://meetnow.global/M499MD7. Please follow the instructions carefully on how to access and attend the virtual meeting in the “Annual Meeting Attendance” section of this Proxy Statement.

It is important that your shares be represented and voted whether or not you plan to attend the Annual Meeting. We continue using the Securities and Exchange Commission rule that permits companies to furnish proxy materials to stockholders over the Internet. If you are viewing the Proxy Statement on the Internet, you may grant your proxy electronically over the Internet by following the instructions on the Notice Regarding the Availability of Proxy Materials previously mailed to you and the instructions listed on the Internet site. If you have received a paper copy of the Proxy Statement and proxy card, you may grant a proxy to vote your shares by completing and mailing the proxy card enclosed with the Proxy Statement, or you may grant your proxy electronically over the Internet or by telephone by following the instructions on the proxy card. If your shares are held in “street name,” which means shares held of record by a broker, bank, trust or other nominee, you should review the Notice Regarding the Availability of Proxy Materials or Proxy Statement and voting instruction form used by that firm to determine whether and how you will be able to submit your proxy by telephone or over the Internet. Submitting a proxy over the Internet, by telephone or by mailing a proxy card will ensure your shares are represented at the Annual Meeting.

Your vote is important, regardless of the number of shares that you own.

On behalf of the Board of Directors, I thank you for your participation. We look forward to your attendance on June 13, 2024.

|

Sincerely, |

|

|

|

|

Michael Hsing |

|

|

Chairman of the Board, President and Chief Executive Officer |

MONOLITHIC POWER SYSTEMS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on June 13, 2024

To the Stockholders of Monolithic Power Systems, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Monolithic Power Systems, Inc., a Delaware corporation, will be held on Thursday, June 13, 2024, at 10:00 a.m., Pacific Daylight Time (the “Annual Meeting”). The Annual Meeting will be a virtual meeting. You will be able to attend the Annual Meeting online, vote and submit questions during the meeting by visiting http://meetnow.global/M499MD7. Please follow the instructions carefully on how to access and attend the virtual meeting in the “Annual Meeting Attendance” section of this Proxy Statement.

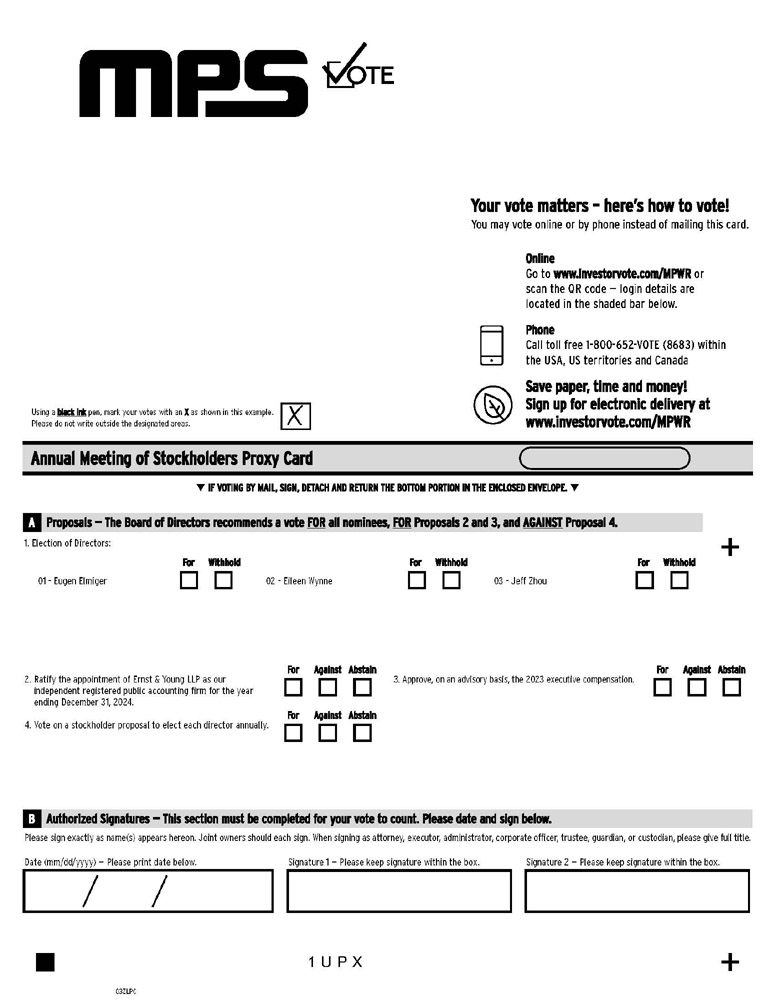

At the Annual Meeting, we will conduct the following items of business:

|

1. |

To elect three Class II directors to serve for three-year terms until our annual meeting of stockholders in 2027, or until their respective successors are duly elected and qualified. The nominees for election to the Board of Directors as Class II directors are Eugen Elmiger, Eileen Wynne and Jeff Zhou. |

|

|

2. |

To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024. |

|

|

3. |

To hold an advisory vote to approve the compensation of our named executive officers. |

|

|

4. 5. |

To vote on a stockholder proposal to elect each director annually, if properly presented at the Annual Meeting. To transact such other business as may properly come before the meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting. Only stockholders of record at the close of business on April 18, 2024 are entitled to notice of and to vote at the Annual Meeting.

Your vote is important. All stockholders are cordially invited to attend the Annual Meeting. However, to assure your representation at the meeting, we encourage you to submit your proxy as soon as possible using one of three convenient methods: (i) by accessing the Internet site described in the Notice Regarding the Availability of Proxy Materials (the “Notice”) or in the proxy card provided to you; (ii) by calling the toll-free number described in the Notice or in the proxy card; or (iii) by signing, dating and returning the proxy card. By submitting your proxy promptly, you will save us the expense of further proxy solicitation. Any stockholder of record attending the Annual Meeting may vote at the meeting even if he or she has already returned a proxy.

|

By Order of the Board of Directors, |

|

|

|

|

Saria Tseng |

|

|

Executive Vice President, Strategic Corporate Development, General Counsel and Corporate Secretary |

Kirkland, Washington

April 29, 2024

Important notice regarding the availability of proxy materials for the Annual Meeting: The Proxy Statement and the Annual Report on Form 10-K are available free of charge under the “Investor Relations” section of our website at http://www.monolithicpower.com.

MONOLITHIC POWER SYSTEMS, INC.

PROXY STATEMENT

FOR

2024 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION CONCERNING SOLICITATION AND VOTING

This Proxy Statement is being furnished to holders of common stock, par value $0.001 per share (the “Common Stock”), of Monolithic Power Systems, Inc., a Delaware corporation (the “Company,” “MPS,” “we,” “us,” or “our”), in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, June 13, 2024 at 10:00 a.m., Pacific Daylight Time, and at any adjournment or postponement thereof for the purpose of considering and acting upon the matters set forth herein.

The Annual Meeting will be a virtual meeting. You will not be able to attend the meeting in person. Please follow the instructions carefully on how to access and attend the virtual meeting in “Annual Meeting Attendance.”

Internet Availability of Proxy Materials

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending a Notice Regarding the Availability of Proxy Materials (the “Notice”) to our stockholders of record, and upon request, we will send a printed copy of the proxy materials and proxy card. Brokers and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. Stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to request a printed copy by mail or electronically may be found on the Notice and on the website referred to in the Notice, including an option to request paper copies on an ongoing basis. We intend to make this Proxy Statement available on the Internet at www.monolithicpower.com, and to mail the Notice or other proxy materials, as applicable, on or about May 2, 2024 to stockholders of record at the close of business on April 18, 2024 (the “Record Date”).

Record Date and Outstanding Shares

Only stockholders of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof. These stockholders are entitled to cast one vote for each share of Common Stock held as of the Record Date on all matters properly submitted for the vote of stockholders at the Annual Meeting. On the Record Date, 48,666,000 shares of Common Stock were issued and outstanding. No shares of Preferred Stock were issued and outstanding. For information regarding security ownership by management, directors, and beneficial owners of more than 5% of the Common Stock, see “Security Ownership of Certain Beneficial Owners and Management.”

Procedure for Submitting Stockholder Proposals and Director Nominations

Requirements for stockholder proposals to be considered for inclusion in our proxy materials. Proposals of stockholders which are to be presented by such stockholders at our 2025 annual meeting of stockholders must meet the stockholder proposal requirements contained in Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such proposals must be received by us no later than January 2, 2025 in order to be included in the proxy statement relating to that meeting. We received one stockholder proposal prior to the deadline for the Annual Meeting.

Requirements for director nominations to be considered for inclusion in our proxy materials. Pursuant to the proxy access provisions of our Amended and Restated Bylaws (the “Bylaws”), an eligible stockholder, or a group of up to 20 stockholders, who has held at least 3% of our Common Stock continuously for at least three years may nominate one director and have that nominee included in our proxy materials. To be timely for the 2025 annual meeting of stockholders, notice of proxy access director nominations must be received by us between January 2, 2025 and February 1, 2025. In addition, the notice must set forth the information required by our Bylaws with respect to each director nomination that a stockholder intends to present at the 2025 annual meeting of stockholders.

In addition to satisfying the requirements under our Bylaws, stockholders who intend to solicit proxies in support of director nominees, other than our nominees, must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act to comply with the universal proxy rules, which notice must be postmarked or transmitted electronically to us at our principal executive offices no later than April 14, 2025. However, if the date of the 2025 annual meeting of stockholders is changed by more than 30 calendar days from the anniversary date of the Annual Meeting, then notice must be provided by the later of 60 calendar days prior to the date of the 2025 annual meeting of stockholders or the 10th calendar day following the day on which public announcement of the date of the 2025 annual meeting of stockholders is first made by us.

Requirements for stockholder proposals to be brought before an annual meeting but not included in our proxy materials. If a stockholder wishes to present a proposal at our 2025 annual meeting of stockholders, and the proposal is not intended to be included in our proxy statement relating to that meeting, the stockholder must give advance notice to us prior to the deadline for such meeting. To be timely for the 2025 annual meeting of stockholders, notice of proposed business must be received by us between January 2, 2025 and February 1, 2025. However, in the event the date of the 2025 annual meeting of stockholders will be changed by more than 30 days from the date of the Annual Meeting, notice by the stockholder to be timely must be so received not later than the close of business on the later of: (1) 90 calendar days in advance of the 2025 annual meeting of stockholders and (2) 10 calendar days following the date on which public announcement of the date of the 2025 annual meeting of stockholders is first made. In addition, the notice must set forth the information required by our Bylaws with respect to each proposal that a stockholder intends to present at the 2025 annual meeting of stockholders.

All proposals described above must be submitted to our Corporate Secretary using the methods outlined in “Stockholder Communications.”

Attendance:

The Annual Meeting will be held solely by remote communication. You will not be able to attend the Annual Meeting in person. Stockholders as of the close of business on the Record Date who duly registered to attend the Annual Meeting will be able to listen to the webcast, vote their shares and submit questions during the virtual meeting. The Annual Meeting can be assessed at:

|

http://meetnow.global/M499MD7 |

You must have your 15-digit control number to join the event. We encourage you to access the Annual Meeting ten minutes prior to the start time for check-in and registration.

Registration Process:

Stockholders of record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. (“Computershare”), you are considered, with respect to those shares, the stockholder of record. As a stockholder of record, you are already registered for the virtual meeting and will be able to listen to the webcast, vote and submit questions during the meeting. Questions pertinent to meeting matters and that are submitted in accordance with our rules of conduct for the Annual Meeting will be answered during the meeting, subject to applicable time constraints.

Beneficial owners. If you hold your shares through a broker, bank, trust or other nominee, you must register in advance in order to vote and submit questions during the virtual meeting. To register in advance, you must obtain a legal proxy from the broker, bank, trust or other nominee that holds your shares giving you the right to vote the shares. You must submit proof of the legal proxy reflecting our holdings, along with your name and email address to Computershare. Requests for registration must be labeled as “Monolithic Power Systems Legal Proxy” and be received no later than 2:00 p.m., Pacific Time, on June 7, 2024. You will receive a confirmation of your registration by email after we receive your registration materials. Requests for registration can be made in the following methods:

|

By e-mail: |

legalproxy@computershare.com |

|

By mail: |

Computershare |

|

Monolithic Power Systems Legal Proxy |

|

|

P.O. Box 43001 |

|

|

Providence, RI 02940-3001 |

Alternatively, you may join the meeting as a guest and listen to the webcast without advance registration. As a guest, you will not be able to vote or submit questions during the meeting.

Voting prior to the Annual Meeting. If you are the record holder of your stock, you have three options for submitting your votes prior to the Annual Meeting:

|

● |

by following the instructions for Internet voting printed on the Notice or your proxy card; |

|

● |

by using the telephone number printed on your proxy card; or |

|

● |

by completing the enclosed proxy card, signing and dating it and mailing it in the enclosed postage-prepaid envelope. |

If you have Internet access, we encourage you to record your vote on the Internet. It is convenient, and it saves us significant postage and processing costs. In addition, when voting over the Internet or by telephone prior to the meeting date, your vote is recorded immediately, and there is no risk that postal delays will cause your vote to arrive late, and therefore not be counted. All shares entitled to vote and represented by properly executed proxy cards or properly granted proxies submitted electronically over the Internet or telephone received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions provided. If no instructions are indicated, the shares represented by that proxy will be voted as recommended by the Board. If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named as proxies and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. We do not currently anticipate that any matters other than the proposals described herein will be raised at the Annual Meeting. If your shares are held in a stock brokerage account or by a bank, trust or other nominee, you will receive a notice from your broker, bank, trust or other nominee that includes instructions on how to vote your shares. Your broker, bank, trust or other nominee will allow you to deliver your voting instructions over the Internet and may also permit you to submit your voting instructions by telephone.

YOUR VOTE IS IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting.

Voting by attending the Annual Meeting. The Annual Meeting will be a virtual meeting. Stockholders of record and beneficial owners as of the close of business on the Record Date who duly registered to attend the Annual Meeting will be able to listen to the webcast and vote their shares during the virtual meeting. Please follow the instructions carefully on how to access and attend the virtual meeting, and vote in “Annual Meeting Attendance.”

Any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote such stockholder casts at the Annual Meeting.

Changing vote; Revocability of proxy. Any proxy given by a stockholder of record pursuant to this solicitation may be revoked by the person giving it at any time before it is voted at the Annual Meeting. Proxies submitted by stockholders of record may be revoked by:

|

● |

filing a written notice of revocation bearing a later date than the previously submitted proxy which is received by our Corporate Secretary at or before the taking of the vote at the Annual Meeting; |

|

● |

duly executing a later dated proxy relating to the same shares and delivering it to our Corporate Secretary at or before the taking of the vote at the Annual Meeting; |

|

● |

submitting another proxy by telephone or via the Internet (your latest telephone or Internet voting instructions are followed); or |

|

● |

virtually attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a previously submitted proxy). |

Any written notice of revocation or subsequent proxy card must be received by our Corporate Secretary prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card must be submitted using the methods outlined in “Stockholder Communications.”

If you hold your shares through a broker, bank, trust or other nominee, you may change your vote by submitting new voting instructions to your broker, bank, trust or other nominee.

Neither Delaware law nor our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) provide for appraisal or other similar rights for dissenting stockholders in connection with any of the proposals to be voted upon at the Annual Meeting. Accordingly, our stockholders will have no right to dissent and obtain payment for their shares.

We will bear all expenses of this solicitation, including the cost of preparing and mailing this solicitation material. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Our directors, officers and employees may also solicit proxies in person or by telephone, letter, e-mail or other means of communication. Such directors, officers and employees will not be additionally compensated, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. We have engaged the services of a professional proxy solicitation firm to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. We expect our costs for such services would be approximately $25,000.

Quorum, Required Votes, Abstentions and Broker Non-Votes

Holders of a majority of the outstanding shares entitled to vote must be present at the Annual Meeting in order to have the required quorum for the transaction of business. Stockholders are counted as present at the Annual Meeting if they: (1) are duly registered to attend and vote their shares at the Annual Meeting, or (2) have properly submitted a proxy card by mail or voted by telephone or by using the Internet. If the shares present at the Annual Meeting do not constitute the required quorum, the Annual Meeting may be adjourned to a subsequent date for the purpose of obtaining a quorum.

The required votes to approve the proposals to be considered at this Annual Meeting are as follows:

|

● |

The affirmative vote of a plurality of the votes duly cast is required for the election of directors. As further described in Proposal One below, any nominee for director who receives a greater number of votes “Withheld” from his or her election than votes “For” his or her election will promptly tender his or her resignation to the Board following certification of the election results for the Board’s consideration. |

|

● |

The affirmative vote of a majority of the shares of stock entitled to vote thereon which are present in person by virtual attendance at the Annual Meeting or represented by proxy at the Annual Meeting is required to ratify the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm. While this vote is advisory and not binding on us or our Audit Committee, the Audit Committee intends to take into account the outcome of the vote when considering the appointment of EY. |

|

● |

The affirmative vote of a majority of the shares of stock entitled to vote thereon which are present in person by virtual attendance at the Annual Meeting or represented by proxy at the Annual Meeting is required to approve, on an advisory basis, the compensation of our named executive officers. While this vote is advisory and not binding on us or our Board, the Board and the Compensation Committee intend to take into account the outcome of the vote when considering future executive compensation arrangements. |

|

● |

The affirmative vote of a majority of the shares of stock entitled to vote thereon which are present in person by virtual attendance at the Annual Meeting or represented by proxy at the Annual Meeting is required to approve, on an advisory basis, the stockholder proposal to elect each director annually. While this vote is advisory and not binding on us or our Board, the Board intends to take into account the outcome of the vote when considering the structure of the Board. |

Under the General Corporation Law of the State of Delaware, both abstaining votes and broker non-votes are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting. An abstaining vote is not counted as a vote cast for the election of directors, but has the same effect as a vote cast against each of the other proposals requiring approval by a majority of the shares of stock entitled to vote thereon which are present in person by virtual attendance at the Annual Meeting or represented by proxy at the Annual Meeting. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. A broker non-vote will have no effect on the outcome of the proposals. For purposes of ratifying our independent registered public accounting firm, brokers have discretionary authority to vote.

A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting during ordinary business hours at: 5808 Lake Washington Boulevard NE, Kirkland, Washington 98033 for the ten days prior to the Annual Meeting, and will be open to the examination of any stockholder of the Company during the whole time of the Annual Meeting.

ELECTION OF DIRECTORS

Classified Board of Directors and Nominees

The Board currently consists of eight members. Under our Certificate of Incorporation and Bylaws, the Board has the authority to set the number of directors from time to time by resolution. In addition, our Certificate of Incorporation provides for a classified Board consisting of three classes of directors, each serving staggered three-year terms. As a result, a portion of the Board will be elected each year for three-year terms.

Three Class II directors are to be elected to the Board at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Board’s nominees, Eugen Elmiger, Eileen Wynne and Jeff Zhou. Mr. Elmiger, Ms. Wynne and Mr. Zhou are standing for re-election to the Board. Each person nominated for election has agreed to serve if elected, and the Board has no reason to believe that any nominee will be unavailable or will decline to serve. In the event, however, that any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who is designated by the current Board to fill the vacancy. The term of office of each person elected as a Class II director will continue for three years or until his or her successor has been duly elected and qualified. If elected, the term for Mr. Elmiger, Ms. Wynne and Mr. Zhou will expire at the 2027 annual meeting of stockholders.

Our directors are elected by a “plurality” vote. The nominees for each of the three Board seats to be voted on at the Annual Meeting receiving the greatest number of votes cast will be elected. Abstentions and shares held by brokers that are not voted in the election of directors will have no effect. In addition, we have adopted a corporate governance policy requiring each director nominee to submit a resignation letter if more “Withheld” than “For” votes are received. See “Director Voting Policy” for more details on this policy.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE ELECTION TO THE BOARD OF EACH OF THE PROPOSED NOMINEES.

Information Regarding Nominees and Other Directors

The following table summarizes certain information regarding the nominees and other directors:

|

Name |

Age |

Director Since |

Principal Role |

|||

|

Michael Hsing |

64 |

1997 |

Chairman of the Board, President and Chief Executive Officer |

|||

|

Herbert Chang (1)(2) |

62 |

1999 |

Lead Independent Director |

|||

|

Eugen Elmiger (1)(3) |

60 |

2012 |

Director / Nominee |

|||

|

Victor K. Lee (2) |

67 |

2006 |

Director |

|||

|

Carintia Martinez (3) |

58 |

2021 |

Director |

|||

|

James C. Moyer |

81 |

1998 |

Director |

|||

|

Eileen Wynne (2) |

58 |

2023 |

Director / Nominee |

|||

|

Jeff Zhou (1)(2) |

69 |

2010 |

Director / Nominee |

|

(1) |

Member of the Compensation Committee. |

|

(2) |

Member of the Audit Committee. |

|

(3) |

Member of the Nominating and Corporate Governance (“NCG”) Committee. |

Nominees for Class II Directors Whose Term Will Expire in 2024

Eugen Elmiger has served on our Board since October 2012. Mr. Elmiger currently serves as Chief Executive Officer of Maxon group, a leading advanced motion company, which position he has held since January 2011. Mr. Elmiger currently serves on the board of directors of Kardex, a global leader in automated storage solutions and material handling systems. Mr. Elmiger holds a B.S. in Electrical Engineering from the Lucerne (Horw) University of Applied Science and Art.

Eileen Wynne has served on our Board since February 2023. Ms. Wynne served as interim Chief Financial Officer of IDEX Biometrics ASA (“IDEX”), a provider of fingerprint identification technologies, from August 2022 to September 2023, and supported IDEX on a consulting basis since December 2020. From November 1999 to June 2019, Ms. Wynne held various managerial and senior roles at Analog Devices, Inc., a global semiconductor company, including Vice President and Chief Accounting Officer from May 2013 to June 2019, and interim Chief Financial Officer from March 2017 to September 2017. Ms. Wynne holds a B.A. in Financial Economics from St. Anselm College and an M.S. in Accounting from Bentley University.

Jeff Zhou has served on our Board since February 2010. Dr. Zhou is a retired business executive. Before his retirement, Dr. Zhou served as Executive Vice Chairman of MiaSolé, a developer of thin film solar technology, which position he held from 2018 to 2019. Dr. Zhou served as Chief Executive Officer of MiaSolé from 2013 to 2018. Dr. Zhou holds a Ph.D. degree in Electrical Engineering from the University of Florida.

Incumbent Class III Directors Whose Term Will Expire in 2025

Michael Hsing has served on our Board and as our President and Chief Executive Officer since founding MPS in August 1997. Prior to founding MPS, Mr. Hsing was a Senior Silicon Technology Developer at several analog integrated circuits (“IC”) companies, where he developed and patented key technologies, which set new standards in the power electronics industry. Mr. Hsing is an inventor on numerous patents related to the process development of bipolar mixed-signal semiconductor manufacturing. Mr. Hsing holds a B.S.E.E. from the University of Florida.

Herbert Chang has served on our Board since September 1999. Mr. Chang is currently the general partner of GrowStar Partners Group Limited. From March 2014 until December 2019, Mr. Chang was the general manager of Mutto Optronics Corporation, an OEM/ODM knife manufacturer listed on the Taiwan OTC. Mr. Chang is a venture capitalist and focuses on investing in companies in the semiconductor, telecommunications, networking, software and Internet industries. Mr. Chang serves on the board of directors of a number of private companies and a TWSE-listed company. Mr. Chang received a B.S. in geology from National Taiwan University and an M.B.A. from National Chiao Tung University in Taiwan.

Carintia Martinez has served on our Board since May 2021. Ms. Martinez currently serves as Chief Information Officer of IHS Towers, a provider of shared communications infrastructure, which position she has held since January 2024. From January 2018 to May 2023, Ms. Martinez served as Vice President, Chief Information Officer of Thales Alenia Space, a European aerospace manufacturer specializing in satellite systems. From February 2008 to December 2017, Ms. Martinez held various senior positions, including Vice President of Renault-Nissan Alliance Quality and Vice President of Information Systems for Marketing and Sales, at Renault Group, a French automobile manufacturer. Ms. Martinez holds a master’s degree in Architecture and City Planning from Pontificia Universidade Catolica do Parana in Brazil, a master’s degree in Project Management from Université de Technologie de Compiègne in France, and a master’s degree in Urban Planning from Université Paris XII - Val de Marne and Ecole Nationale des Ponts et Chaussées in France.

Incumbent Class I Directors Whose Terms Will Expire in 2026

Victor K. Lee has served on our Board since September 2006. Mr. Lee was a member of the board of directors at MoSys, Inc., a fabless semiconductor company, from June 2012 to June 2016. Mr. Lee served as Chief Financial Officer of Ambarella, Inc., a fabless semiconductor company, from August 2007 to March 2011. Mr. Lee holds a B.S. in Industrial Engineering and Operations Research and an M.B.A. from the University of California, Berkeley.

James C. Moyer has served on our Board since October 1998. Mr. Moyer is a retired business executive and served as our Chief Design Engineer from September 1997 until his retirement in January 2016. Mr. Moyer holds a B.A.E.E. from Rice University.

There is no family relationship among any of our executive officers, directors and nominees.

The following matrix presents the Board’s diversity statistics as of April 29, 2024:

|

Michael Hsing |

Herbert Chang |

Eugen Elmiger |

Victor K. Lee |

Carintia Martinez |

James C. Moyer |

Eileen Wynne |

Jeff Zhou |

|

|

Part I: Gender Identity |

||||||||

|

Male |

● |

● |

● |

● |

● |

● |

||

|

Female |

● |

● |

||||||

|

Non-Binary |

||||||||

|

Did Not Disclose Gender |

||||||||

|

Part II: Demographic Background |

||||||||

|

African American or Black |

||||||||

|

Alaskan Native or Native American |

||||||||

|

Asian |

● |

● |

● |

● |

||||

|

Hispanic or Latinx |

● |

|||||||

|

Native Hawaiian or Pacific Islander |

||||||||

|

White |

● |

● |

● |

|||||

|

Two or More Races or Ethnicities |

||||||||

|

LGBTQ+ |

||||||||

|

Did Not Disclose Demographic Background |

||||||||

At least annually, the NCG Committee reviews the independence of each non-employee director and makes recommendations to the Board, and the Board affirmatively determines whether each director qualifies as independent. Each director must keep the NCG Committee fully and promptly informed as to any development that may affect the director’s independence. The Board has determined that Herbert Chang, Eugen Elmiger, Victor K. Lee, Carintia Martinez, James C. Moyer, Eileen Wynne and Jeff Zhou are “independent” under the applicable listing standards of The NASDAQ Stock Market.

Director Skills and Qualifications

Our Board includes eight members who are well-qualified to serve on the Board and represent our stockholders’ best interests. Our Board consists of directors who have the following characteristics:

|

● |

Are seasoned executive leaders with strong corporate governance experience; |

|

● |

Possess a professional background that would enable the development of a deep understanding of our global business and operations; |

|

● |

Have strong interests in innovation and emerging technologies; |

|

● |

Have skills or experience in risk management and cybersecurity; |

|

● |

Have the ability to embrace our values, diversity and culture; |

|

● |

Bring diversity to the Board through their experiences in various industries, both domestically and internationally; |

|

● |

Are independent thinkers and work well together; |

|

● |

Have high ethical standards; |

|

● |

Possess sound business judgment and acumen; and |

|

● |

Are willing to commit their time and resources necessary for the Board to effectively fulfill its responsibilities. |

We believe that each of the directors possesses these attributes. In addition, the directors bring to the Board a breadth of experience, including extensive financial and accounting expertise, public company board experience, knowledge of the semiconductor business and related technologies, broad global business experience, extensive operational and strategic planning experience, and the ability to assess and manage business risks, including risks related to cybersecurity and information security, in complex, high-growth global companies. The Board and the NCG Committee believe the skills, qualities, attributes, experience and diversity of backgrounds of our directors provide us with a diverse range of perspectives to effectively address our evolving needs and represent the best interests of our stockholders. The tenure of some of our directors ensures that we benefit from their substantial knowledge of MPS, its business and long-term goals. Our Board is a mix of longer term directors and two directors who have joined our Board since 2021, resulting in a valuable combination of sustained knowledge of MPS and new viewpoints and perspectives.

The following table highlights the specific key qualifications, business skills, experience and attributes that each of the directors brings to the Board:

|

Michael Hsing |

Herbert Chang |

Eugen Elmiger |

Victor K. Lee |

Carintia Martinez |

James C. Moyer |

Eileen Wynne |

Jeff Zhou |

|

|

Executive leadership |

● |

● |

● |

● |

● |

● |

● |

● |

|

Corporate governance |

● |

● |

● |

● |

● |

● |

● |

● |

|

Global business and operations |

● |

● |

● |

● |

● |

● |

● |

● |

|

Innovation and technologies |

● |

● |

● |

● |

● |

● |

● |

● |

|

Risk management |

● |

● |

● |

● |

● |

● |

● |

● |

|

Cybersecurity |

● |

● |

● |

● |

● |

● |

||

|

Finance and accounting expertise |

● |

● |

● |

● |

● |

● |

||

|

Human capital management |

● |

● |

● |

● |

● |

● |

● |

● |

|

Diversity |

● |

● |

● |

● |

● |

● |

|

Michael Hsing |

Mr. Hsing, founder of MPS, is a visionary in power management technology as well as a strong leader, motivator and successful entrepreneur. Mr. Hsing provides the Board with valuable insight into management’s perspective with respect to our operations, and provides the Board with the most comprehensive view of our operational history. Under his leadership, we have experienced significant revenue growth and profitability. Since our initial public offering in 2004, stockholder value measured by market capitalization has increased significantly. Having worked in the semiconductor industry for over 40 years, Mr. Hsing’s vision, insight and experience enable him to understand and expand the markets we serve, control costs effectively, assess and manage business risks, including risks related to information technology, supply chain and cybersecurity, and enhance our technology advantages for our products, which have helped fuel our growth and created value for our stockholders. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Hsing should serve as a director of MPS. |

|

Herbert Chang |

Mr. Chang has been a member of the Board since 1999, which gives him significant knowledge of our business and history. We also continue to benefit from the broad experience gained by Mr. Chang through his numerous successful investments in both public and private high-technology companies. Mr. Chang has served on several boards of the companies in which he has invested, which has given him significant leadership skills, risk management, corporate governance and oversight experience. In addition, through these board and investor responsibilities, as well as his tenure on the Board, Mr. Chang has developed a deep knowledge of our industry, our operations, and the accompanying complex financial transactions and controls necessary for us to succeed. Mr. Chang’s financial expertise has also helped the Board analyze significant complex financial transactions that we have considered from time to time. Mr. Chang also has important international experience based on his educational background and work experience in the countries where we do business. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Chang should serve as a director of MPS. |

|

Eugen Elmiger |

Mr. Elmiger is a seasoned business executive with over 30 years of experience, including extensive international marketing, sales and product management expertise, executive board experience, knowledge of high-tech component business and technology, and operational and strategic planning experience, including the oversight of information technology and cybersecurity, in complex, high-growth global companies. This experience allows him to contribute his valuable executive leadership talent, risk management and understanding of international business to Board deliberations and oversight duties. His industrial, medical and automotive background is a valuable asset to the Board as we expand our business in these markets. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Elmiger should serve as a director of MPS. |

|

Victor K. Lee |

Mr. Lee is the audit committee financial expert on the Audit Committee of the Board. He has been the Chief Financial Officer at several public and private companies, and has worked in the semiconductor industry for over 40 years. Mr. Lee is familiar with not only the inner workings of the semiconductor industry, but also has intimate knowledge of the financial issues and business risks that semiconductor companies often face. His experience has allowed him to understand the broad issues, in particular those affecting the financial and accounting aspects of our business, that the Board must consider and to make sound recommendations to management and decisions by the Board. Mr. Lee also provides the Board with valuable insight into financial management, risk management, internal controls, disclosure issues and tax matters relevant to our business. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Lee should serve as a director of MPS. |

|

Carintia Martinez |

Ms. Martinez brings to the Board a diverse background with more than 30 years of information systems and technology experience, including serving as Chief Information Officer, in high-growth, multinational companies in the telecommunications, aerospace and automotive industries. The Board believes that Ms. Martinez’s valuable executive leadership talent, risk management experience, including the oversight of information technology and cybersecurity, diverse background, and understanding of complex international business issues allow her to bring new perspectives, ideas and outlooks to the Board. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Ms. Martinez should serve as a director of MPS. |

|

James C. Moyer |

Mr. Moyer is a technical expert in the design of analog semiconductors and is intimately familiar with us and our products. Mr. Moyer brings insight to the Board because of his cumulative experience gained as an engineer and technical leader in the semiconductor industry. This experience gives him a highly developed understanding of the needs and requirements of the analog market for our complex products and allows him as a director to guide our strategy and business approach. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Mr. Moyer should serve as a director of MPS. |

|

Eileen Wynne |

Ms. Wynne brings to the Board a diverse background with finance, operational and risk management experience in high-growth, multinational companies. Ms. Wynne has been the Chief Accounting Officer at a global semiconductor company and has worked in the semiconductor industry for over 20 years. Ms. Wynne is familiar with not only the inner workings of the semiconductor industry, but also has intimate knowledge of the financial and accounting issues and business risks that semiconductor companies often face. The Board believes that Ms. Wynne’s valuable executive leadership talent, financial oversight expertise, and understanding of complex international business and manufacturing issues in the semiconductor sector allow her to bring new perspectives, ideas and outlooks to the Board. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Ms. Wynne should serve as a director of MPS. |

|

Jeff Zhou |

Dr. Zhou is a senior business executive with over 40 years of industry experience at large, multinational corporations with global footprints. Dr. Zhou has an extensive background in the global manufacturing, electronics and renewable energy industry. This experience allows him to contribute his valuable executive leadership talent, risk management skills, including the oversight of information technology and cybersecurity, and understanding of international business to Board deliberations and oversight duties. Based on the Board’s identification of these qualifications, skills and experiences, the Board has concluded that Dr. Zhou should serve as a director of MPS. |

The Board currently consists of eight members, seven of which the Board has determined are independent.

Leadership Structure. Our current leadership structure and governing documents permit the roles of Chairman and Chief Executive Officer to be filled by the same or different individuals. Should the Board determine that it remains in the best interests of MPS and its stockholders that the Chief Executive Officer serve as Chairman, the independent members of the Board then elect a Lead Independent Director.

The Board has currently determined that it is in the best interests of MPS and its stockholders to have Michael Hsing, our President and Chief Executive Officer, serve as Chairman, coupled with an active Lead Independent Director. As such, Mr. Hsing holds the position of Chairman, President and Chief Executive Officer, and the Board has designated one of the independent directors, Mr. Chang, as the Lead Independent Director. Our Lead Independent Director is appointed by the Board on an annual basis. The Board believes our leadership structure, with its strong emphasis on Board independence, an active Lead Independent Director, and strong Board and committee involvement, provides sound and robust oversight of management, and provides a counterbalance to the management perspective provided by Mr. Hsing during Board deliberations.

The Board considers and discusses the Board leadership structure every year. As part of this evaluation process, the Board reviews its leadership structure and whether combining or separating the roles of Chairman and CEO is in the best interests of MPS and our stockholders. The Board also considers:

|

● |

The effectiveness of the policies, practices and people in place at MPS to help ensure strong, independent Board oversight; |

|

● |

MPS’s performance and the effect the leadership structure could have on its performance; |

|

● |

The Board’s performance and the effect the leadership structure could have on the Board’s performance; |

|

● |

The Chairman’s performance in the role; |

|

● |

The views of MPS’s stockholders; and |

|

● |

The practices at other companies and trends in governance. |

While we recognize that different board leadership structures may be appropriate for different companies, we believe that our current Board leadership structure is optimal for us. Our leadership structure demonstrates to our employees, suppliers, customers, stockholders and other stakeholders that we are governed by strong, balanced leadership, with a single person setting the tone and consistent message for the Board and management and having primary responsibility for managing our day-to-day operations, with appropriate oversight and direction from our Lead Independent Director and other independent directors. This message is increasingly important as we continue to seek to achieve success through new product releases and business growth. We also believe that our leadership structure sends the message that we value strong, independent oversight of our management operations and decisions in the form of our Lead Independent Director and other independent directors. Further, having a single leader for both MPS and the Board eliminates the potential for strategic misalignment or duplication of efforts, and provides clear leadership for us.

Benefits of Combined Leadership Structure. The Board believes that MPS and our stockholders have been best served by having Mr. Hsing in the role of Chairman and Chief Executive Officer for the following reasons:

|

● |

Mr. Hsing is most familiar with our business and the unique challenges we face. Mr. Hsing’s day-to-day insight into our challenges facilitates timely deliberation by the Board of important matters; |

|

● |

Mr. Hsing has and will continue to identify agenda items and lead effective discussions on the important matters affecting us. Mr. Hsing’s knowledge and extensive experience regarding our operations and the highly competitive semiconductor industry in which we compete position him to identify and prioritize matters for Board review and deliberation; |

|

● |

As Chairman and Chief Executive Officer, Mr. Hsing serves as an important bridge between the Board and management and provides critical leadership for carrying out our strategic initiatives and confronting our challenges. The Board believes that Mr. Hsing brings a unique, stockholder-focused insight to assist MPS to most effectively execute its strategy and business plans in the best interests of our stockholders; |

|

● |

The strength and effectiveness of the communications between Mr. Hsing, as our Chairman, and Mr. Chang, as our Lead Independent Director, as well as our other independent directors, result in comprehensive Board oversight of the issues, plans and prospects of MPS; and |

|

● |

This leadership structure provides the Board with more complete and timely information about MPS, a unified structure and consistent leadership direction internally and externally and provides a collaborative and collegial environment for Board decision making. |

Lead Independent Director Responsibilities. As the Lead Independent Director, Mr. Chang’s primary roles and responsibilities include:

|

● |

Reviewing meeting agendas; |

|

● |

Reviewing schedules and information sent to the Board; |

|

● |

Retaining independent advisors on behalf of the Board, or committees, as the Board may determine is necessary or appropriate; |

|

● |

Assuring that there is sufficient time for discussion of all meeting agenda items; |

|

● |

Consulting and communicating with independent directors and with the Chief Executive Officer/Chairman of the Board, as appropriate; |

|

● |

Performing such other functions as the independent directors may designate from time to time; |

|

● |

Presiding at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors; and |

|

● |

Calling and leading meetings of independent directors. |

Our independent directors meet in executive session during a portion of regularly scheduled Board or committee meetings, and otherwise as needed. Our Lead Independent Director presides over meetings of our independent directors and we believe that these meetings help to ensure an appropriate level of independent scrutiny of the functioning of MPS and the Board.

The Board held a total of four meetings during 2023, and all directors attended at least 75% of the meetings of the Board and the committees upon which such director served.

Audit Committee. The Board has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act, which currently consists of four members: Herbert Chang, Victor K. Lee, Eileen Wynne and Jeff Zhou. Mr. Lee is the chair of the Audit Committee. The primary responsibilities of the Audit Committee are to:

|

● |

Provide oversight of our accounting and financial reporting processes and the audit of our financial statements; |

|

● |

Appoint the independent registered public accounting firm to audit our financial statements; |

|

● |

Assist the Board in the oversight of the integrity of our financial statements, our compliance with legal and regulatory requirements, the independent registered public accounting firm’s qualifications, independence and performance, and our internal accounting and financial controls; and |

|

● |

Provide to the Board such information and materials as it may deem necessary to make the Board aware of financial matters requiring the attention of the Board. |

The Board has determined that Mr. Lee is an “audit committee financial expert,” as defined under the rules of the SEC, and all members of the Audit Committee are “independent” in accordance with the applicable SEC regulations and the applicable listing standards of NASDAQ and are financially literate. The Audit Committee held four meetings during 2023. The Audit Committee acts pursuant to a written charter adopted by the Board, which is available in the “Investor Relations” section of our website at http://www.monolithicpower.com.

Compensation Committee. The Board has designated a Compensation Committee consisting of three members: Herbert Chang, Eugen Elmiger and Jeff Zhou. Mr. Zhou is the chair of the Compensation Committee. In April 2024, the Board appointed Mr. Elmiger to be the chair of the Compensation Committee, effective June 13, 2024 after the Annual Meeting. The primary responsibilities of the Compensation Committee are to:

|

● |

Provide oversight of our compensation policies, plans and benefits programs; |

|

● |

Assist the Board in the oversight of the compensation of the executive officers, and evaluation and approval of the executive officer compensation plans, policies and programs; |

|

● |

Assist the Board in administering our equity compensation plans; and |

|

● |

Provide oversight of our practices and compliance efforts with respect to executive compensation policies and programs, as well as human capital management, under our environmental, social and governance (“ESG”) initiatives. |

All members of the Compensation Committee are “independent” in accordance with the applicable listing standards of NASDAQ. The Compensation Committee held four meetings during 2023. The Compensation Committee acts pursuant to a written charter adopted by the Board, which is available in the “Investor Relations” section of our website at http://www.monolithicpower.com.

NCG Committee. The Board has designated an NCG Committee consisting of two members: Eugen Elmiger and Carintia Martinez. Mr. Elmiger is the chair of the NCG Committee. In April 2024, the Board appointed Ms. Martinez to be the chair of the NCG Committee, effective June 13, 2024 after the Annual Meeting. The primary responsibilities of the NCG Committee are to:

|

● |

Review the composition and qualifications of the Board, recommend director nominees for the selection of the Board, and evaluate director compensation; |

|

● |

Review the composition of committees of the Board and recommend persons to be members of such committees; |

|

● |

Develop overall governance guidelines and oversee the overall performance of the Board, including the annual Board self-assessment; |

|

● |

Recommend to the Board whether to accept or reject a tendered director resignation, or take other action, in circumstances where a director receives a greater number of “withhold” votes than “for” votes in an uncontested election of directors as set forth in the director voting policy adopted by the Board; |

|

● |

Provide oversight of our practices, policies, strategies and disclosures respect to environmental sustainability issues, social initiatives and corporate governance; and |

|

● |

Provide oversight of our cybersecurity program, including policies, practices, internal controls and management of information security risks. |

All members of the NCG Committee are “independent” in accordance with the applicable listing standards of NASDAQ. The NCG Committee held four meetings in 2023. The NCG Committee acts pursuant to a written charter adopted by the Board, which is available in the “Investor Relations” section of our website at http://www.monolithicpower.com.

The information contained on our website is not intended to be part of this Proxy Statement and is not incorporated by reference into this Proxy Statement.

The Board is primarily responsible for the oversight of risks that could affect MPS. The Board believes that a fundamental part of risk management is understanding the risks that we face, monitoring these risks, and adopting appropriate controls and mitigation activities for such risks. We believe that the risk management areas that are critical to our long-term success primarily include product development, supply chain and quality, regulations and legal compliance, ESG, executive compensation programs, sales and promotions, and business development, as well as protection of our assets (financial, intellectual property and cybersecurity), all of which are managed by senior executive management reporting directly to our Chief Executive Officer. Our Board members have extensive experience in risk oversight arising from their current or prior experience as chief executive officers, chief financial officers, chief information officers, as well as other senior leadership positions or board members of other companies with responsibility for risk oversight obligations. As such, the Board believes that its members are qualified and experienced at identifying and addressing risk throughout our operations.

While the full Board has retained responsibility for general oversight of risk, the Board’s oversight is conducted principally through the committees of the Board. The Board satisfies its responsibility by requiring each committee chair to regularly report the committee’s considerations and actions, including risk oversight, as well as by requiring officers responsible for oversight of particular risks to submit regular reports. As these reports are submitted independent of review by Mr. Hsing, the Board believes that its leadership structure has no impact on the conduct of its risk oversight function other than to reinforce the involvement of the Board in ongoing management of MPS.

The following table outlines the specific risk oversight responsibilities of each committee:

|

Committee |

Primary Areas of Risk Oversight |

||

|

Audit |

● |

Oversee accounting policies and internal controls and evaluate enterprise risks associated with financial reporting, accounting, auditing and tax matters. |

|

| ● | Assess financial risks relating to our cash management and investment programs. | ||

|

Compensation |

● |

Assess risks related to our compensation programs and practices. |

|

| ● | Oversee risks related to human capital management. | ||

|

NCG |

● |

Assess risks and compliance related to corporate governance matters, including our policies and principles, our Board structure, membership and independence, and stockholder rights. |

|

| ● | Evaluate exposures and risks related to cybersecurity, data privacy and information technology security and controls. | ||

| ● | Assess risks arising from other ESG initiatives, including climate-related risks. |

Our senior management team, which conducts our day-to-day risk management, is responsible for assisting the Board and the committees with its risk oversight function. At its regularly scheduled meetings, the Board and the committees require officers responsible for oversight of particular risks to submit updates and reports on business matters including operational and ESG issues, financial results, cybersecurity and information security, and business outlook and strategy. These updates enable our Board and the committees to discuss enterprise risks with our senior management on a regular basis, including as a part of its annual strategic planning process and annual budget review.

In addition to requiring regular reporting from committees and officers, the Board also receives reports from third-party advisors in order to maintain oversight of risks that could affect us, including our independent auditors, outside counsel, compensation consultants and others. These advisors are consulted on a periodic basis, and as particular issues arise, in order to provide the Board and the committees with the benefit of independent expert advice and insights on specific risk-related matters.

We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing us and that the Board leadership structure supports this approach.

The Board has adopted guidelines for the identification, evaluation and nomination of candidates for director. If the NCG Committee wishes to identify new independent director candidates for Board membership, it is authorized to retain and approve fees of third-party search firms to help identify prospective director nominees. It is the practice of the Board that our Lead Independent Director interviews each Board candidate.

In addition to the minimum qualifications the NCG Committee has established for director nominees, the NCG Committee also considers whether a prospective nominee will foster a diversity of genders, races, backgrounds, skills, perspectives and experiences in the process of its evaluation of each prospective nominee. As part of our commitment to diversity and inclusion, the NCG Committee charter requires that women and minority candidates be included in the initial pool from which the NCG Committee selects prospective candidates.

The NCG Committee also focuses on skills, expertise or background that would complement the existing Board, recognizing that our businesses and operations are diverse and global in nature. While there are no specific minimum qualifications for director nominees, the ideal candidate should (a) exhibit independence, integrity, and qualifications that will increase overall Board effectiveness, and (b) meet other requirements as may be required by applicable rules, such as financial literacy or expertise for audit committee members.

The policy of the NCG Committee is to consider properly submitted stockholder nominations for candidates to serve on the Board. Stockholders who wish to nominate a candidate for election to the Board, including nominations using proxy access, must comply with the procedures set forth in our Bylaws. Refer to “Procedure for Submitting Stockholder Proposals and Director Nominations” for further details.

The NCG Committee uses the same process for evaluating all nominees, regardless of the original source of the nomination. After completing its review and evaluation of director candidates, the NCG Committee recommends to the Board the director nominees for selection.

The Board has approved a Stockholder Communication Policy to provide a process by which stockholders may communicate directly with the Board or one or more of its members. You may contact any of our directors by writing to them using the following methods:

|

By e-mail: |

corporate.secretary@monolithicpower.com |

|

By mail: |

Monolithic Power Systems, Inc. Attn: Corporate Secretary 5808 Lake Washington Blvd. NE Kirkland, WA 98033 |

Any stockholder communications to the Board will first go to the Corporate Secretary, who will log the date of receipt of the communication as well as the identity of the correspondent in our stockholder communications log. The Corporate Secretary will review, summarize and, if appropriate, draft a response to the communication in a timely manner. The Corporate Secretary will then forward copies of the stockholder communication to the Board member(s) (or specific Board member(s) if the communication is so addressed) for review, provided that such correspondence concerns the functions of the Board or its committees, or otherwise requires the attention of the Board or its members.

Attendance at Annual Meetings of Stockholders by the Board of Directors

We do not have a formal policy regarding attendance by members of the Board at our annual meetings of stockholders. In 2023, three Board members attended the Annual Meeting.

Code of Ethics and Business Conduct

We have adopted a Code of Ethics and Business Conduct, which is applicable to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer, controller or persons performing similar functions. The Code of Ethics and Business Conduct is available in the “Investor Relations” section of our website at http://www.monolithicpower.com. We will disclose on our website any amendment to the Code of Ethics and Business Conduct, as well as any waivers of the Code of Ethics and Business Conduct, that are required to be disclosed by the rules of the SEC or NASDAQ.

Policy on Hedging and Other Transactions

We have adopted a policy that prohibits our directors, officers (including our named executive officers), and other employees from engaging in hedging or monetization transactions with respect to our stock that they obtained through our plans or otherwise, without prior approval by our Chief Compliance Officer. We also prohibit our directors and officers (including our named executive officers) from engaging in any short sales of our stock. In addition, our directors and officers are prohibited at all times from holding our stock in a margin account and from pledging our stock as collateral.

The Board has adopted a director voting policy, which can be found in the “Investor Relations – Corporate Governance” section of our website at http://www.monolithicpower.com. The policy establishes that any director nominee who receives more “Withheld” votes than “For” votes in an uncontested election held in an annual meeting of stockholders shall promptly tender his or her resignation. The disinterested directors of the Board will then evaluate the relevant facts and circumstances and make a decision, within 90 days after the election, on whether to accept the tendered resignation. The Board will promptly publicly disclose its decision and, if applicable, the reasons for rejecting the tendered resignation.

Director Time Commitment Policy

In April 2024, the Board adopted a director time commitment policy, which can be found in the “Investor Relations – Corporate Governance” section of our website at http://www.monolithicpower.com. Directors are expected to devote the time and attention necessary to fully discharge their responsibilities as members of the Board and on each committee on which they serve. The policy also sets the following guidelines on public company board seats our directors can serve on:

| ● | No director may serve on more than five public company boards (including the Board); | |

| ● | No director who is an executive officer of a public company may serve on more than two public company boards (including the Board); and | |

|

● |

No director who is a chair of a public company board may serve on more than three public company boards (including the Board). |

The policy is subject to a waiver of such restrictions by a majority of non-affected members of the Board.

Analysis of 2023 Compensation Elements

For 2023, the Board engaged Radford, an independent compensation consultant, to review our non-employee director compensation. In its analysis, Radford gathered market data relating to the amount and type of compensation paid by our industry peer group for 2023 (see “Named Executive Officer Compensation — Peer Group and Use of Peer Data” for more information on the selection of the peer group). Based on its review of the results of this market review and recommendations by Radford, the Board approved the following compensation program for our non-employee directors for service in 2023:

|

Fee Description |

FY 2023 ($) |

FY 2022 ($) |

Change |

|||||||||

|

Annual Board retainer fee |

75,000 | 75,000 | 0 | % | ||||||||

|

Lead Independent Director fee |

40,000 | 40,000 | 0 | % | ||||||||

|

Compensation Committee chairperson fee |

20,000 | 20,000 | 0 | % | ||||||||

|

Compensation Committee membership fee (excluding chairperson) |

10,000 | 10,000 | 0 | % | ||||||||

|

NCG Committee chairperson fee |

15,000 | 15,000 | 0 | % | ||||||||

|

NCG Committee membership fee (excluding chairperson) |

7,500 | 7,500 | 0 | % | ||||||||

|

Audit Committee chairperson fee |

30,000 | 30,000 | 0 | % | ||||||||

|

Audit Committee membership fee (excluding chairperson) |

15,000 | 15,000 | 0 | % | ||||||||

|

Restricted stock unit (“RSU”) grant to new directors |

220,000 | 220,000 | 0 | % | ||||||||

|

Annual RSU grant to incumbent directors |

220,000 | 220,000 | 0 | % | ||||||||

The initial grant of RSUs to new directors vests as to 50% of the underlying shares of Common Stock on each of the first and second anniversaries of the date of grant. The annual grant of RSUs to incumbent directors vests as to 100% of the underlying shares of Common Stock on the first anniversary of the date of the grant. All awards will become fully vested in the event of a change in control.

All of our non-employee directors are subject to stock ownership guidelines that are described below in “Named Executive Officer Compensation — Compensation Discussion and Analysis — Stock Ownership Guidelines.”

The following table sets forth the total compensation for each non-employee director for services rendered in 2023. Mr. Hsing, who is our employee, does not receive additional compensation for his services as a director. Mr. Hsing’s compensation is reflected in “Named Executive Officer Compensation - 2023 Summary Compensation Table.”

|

Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

Total ($) |

|||||||||

|

Herbert Chang |

140,000 | 220,000 | 360,000 | |||||||||

|

Eugen Elmiger |

100,000 | 220,000 | 320,000 | |||||||||

|

Victor K. Lee |

105,000 | 220,000 | 325,000 | |||||||||

|

Carintia Martinez |

82,500 | 220,000 | 302,500 | |||||||||

|

James C. Moyer |

75,000 | 220,000 | 295,000 | |||||||||

|

Eileen Wynne |

75,000 | 220,000 | 295,000 | |||||||||

|

Jeff Zhou |

110,000 | 220,000 | 330,000 | |||||||||

|

(1) |

Reflects the aggregate grant date fair value of the RSUs granted to each director in 2023, computed in accordance with Financial Accounting Standards Board (“FASB”) ASC Topic 718. The grant date fair value was calculated using the closing price of our Common Stock on February 7, 2023, the date of grant for such awards. Assumptions used in the calculation of these amounts are included in Note 1 and Note 7 to the financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024 (the “2023 Annual Report”). |

The following table summarizes the number of shares of our Common Stock that are subject to unvested RSU awards held by each of the non-employee directors as of December 31, 2023. There were no outstanding stock option awards as of December 31, 2023.

|

Name |

Stock Awards (#) |

|||

|

Herbert Chang |

470 | |||

|

Eugen Elmiger |

470 | |||

|

Victor K. Lee |

470 | |||

|

Carintia Martinez |

470 | |||

|

James C. Moyer |

470 | |||

|

Eileen Wynne |

470 | |||

|

Jeff Zhou |

470 | |||

CORPORATE SOCIAL RESPONSIBILITY

Since MPS was founded in 1997, one of our core values has been to run a responsible and responsive business for the long term. We believe that positive ESG business practices strengthen our company and foster strong relationships with our stockholders, employees, business partners and communities where we operate. We are committed to making our workforce diverse, our business sustainable and our stakeholders engaged by maintaining strong ESG practices and policies.

ESG Oversight

We believe that effective oversight is essential to ensure our ESG practices and policies are aligned with our business strategy and serve the long-term interests of our stockholders and other stakeholders. Our Board is actively engaged on ESG matters and has the ultimate responsibility on the oversight, management and implementation of our ESG program. In its oversight role, our Board primarily focuses on:

|

● |

Assessing ESG risks and opportunities and the impact of our strategy on our business and operations. |

|

● |

Setting measurable and rigorous goals, monitoring progress and reviewing status reports. |

|

● |

Establishing management accountability for ESG performance. |

|

● |

Reviewing our reporting processes and controls. |

|

● |

Overseeing our engagement and communications strategy with our stockholders and other stakeholders. |

Our Board has assigned oversight responsibilities of our ESG compliance efforts to its committees, and receives reports and updates from each committee on a quarterly basis:

|

NCG Committee |

Provides oversight of overall strategy, performance and risk assessments related to our ESG program, including environmental and social initiatives, cybersecurity and corporate governance matters. |

|

Compensation Committee |

Establishes executive accountability through compensation policies and programs, and oversees human capital management. |

|

Audit Committee |

Oversees reporting, internal controls and disclosure requirements pursuant to regulatory standards. |

Our ESG Steering Committee is responsible for the day-to-day management of our ESG program and consists of a cross-functional group that includes two senior executives and leaders from Legal and Compliance, Information Technology, Facilities, Operations, Procurement, Quality Assurance, Product Line, Human Resources, Finance, Supply Chain Management, and Environmental, Health and Safety. Under the supervision of the Board committees, the ESG Steering Committee’s primary role is to: (a) manage the execution of our corporate strategy relating to ESG, (b) develop and implement initiatives and policies, (c) drive ESG performance, (d) oversee communications with employees, customers, suppliers, regulators and other stakeholders, and (e) monitor and assess regulatory developments and trends relating to ESG. On a quarterly basis, each Board committee receives updates from the ESG Steering Committee. These updates provide the Board committees with the opportunities to evaluate our ESG priorities, performance against our goals, and regulatory requirements.

ESG Initiative Highlights

For a complete description of our ESG priorities, initiatives and reduction goals, please refer to our Corporate Responsibility Report, which is available on our website at https://www.monolithicpower.com/en/about-mps/investor-relations/esg-report.html. The information contained in our Corporate Responsibility Report and on our website is not intended to be part of this Proxy Statement and is not incorporated by reference into this Proxy Statement.

Environmental Sustainability

Pursuant to our Environmental and Climate Change Policy, we seek to responsibly protect the environment and conserve natural resources by implementing sustainability programs and solutions, engaging partners across our value chain, and setting ambitious goals that we believe will help minimize the environmental impacts from our products and operations.

|

● |

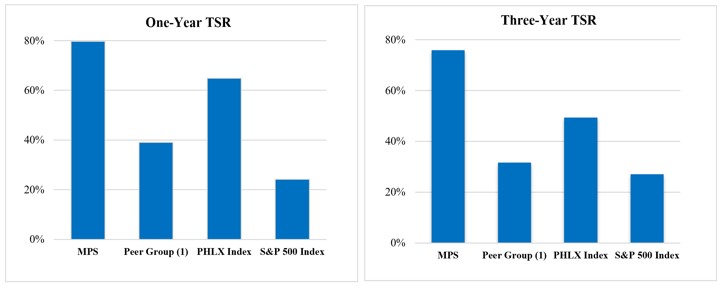

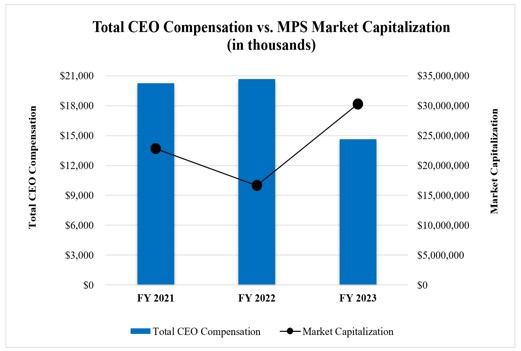

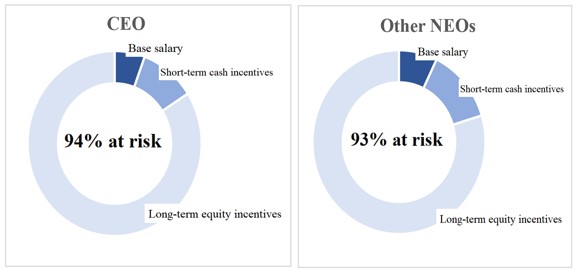

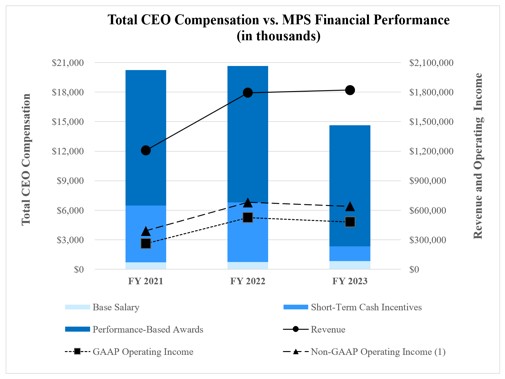

Carbon Footprint