blkb-20240630false2024Q2000128005812/31http://www.blackbaud.com/20240630#AccruedExpensesAndOtherCurrentLiabilitieshttp://www.blackbaud.com/20240630#AccruedExpensesAndOtherCurrentLiabilitieshttp://fasb.org/us-gaap/2024#LongTermDebtCurrent http://fasb.org/us-gaap/2024#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2024#LongTermDebtCurrent http://fasb.org/us-gaap/2024#LongTermDebtNoncurrenthttp://fasb.org/us-gaap/2024#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2024#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://www.blackbaud.com/20240630#AccruedExpensesAndOtherCurrentLiabilitieshttp://www.blackbaud.com/20240630#AccruedExpensesAndOtherCurrentLiabilitieshttp://fasb.org/us-gaap/2024#InterestExpense http://fasb.org/us-gaap/2024#RevenueFromContractWithCustomerExcludingAssessedTaxhttp://fasb.org/us-gaap/2024#InterestExpense http://fasb.org/us-gaap/2024#RevenueFromContractWithCustomerExcludingAssessedTaxP6M3DP6M3Dxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:CADiso4217:GBPblkb:cases00012800582024-01-012024-06-3000012800582024-07-2900012800582024-06-3000012800582023-12-310001280058blkb:RecurringMember2024-04-012024-06-300001280058blkb:RecurringMember2023-04-012023-06-300001280058blkb:RecurringMember2024-01-012024-06-300001280058blkb:RecurringMember2023-01-012023-06-300001280058us-gaap:TechnologyServiceMember2024-04-012024-06-300001280058us-gaap:TechnologyServiceMember2023-04-012023-06-300001280058us-gaap:TechnologyServiceMember2024-01-012024-06-300001280058us-gaap:TechnologyServiceMember2023-01-012023-06-3000012800582024-04-012024-06-3000012800582023-04-012023-06-3000012800582023-01-012023-06-3000012800582022-12-3100012800582023-06-300001280058us-gaap:CommonStockMember2023-12-310001280058us-gaap:TreasuryStockCommonMember2023-12-310001280058us-gaap:AdditionalPaidInCapitalMember2023-12-310001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001280058us-gaap:RetainedEarningsMember2023-12-310001280058us-gaap:RetainedEarningsMember2024-01-012024-03-3100012800582024-01-012024-03-310001280058us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001280058us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001280058us-gaap:CommonStockMember2024-01-012024-03-310001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001280058us-gaap:CommonStockMember2024-03-310001280058us-gaap:TreasuryStockCommonMember2024-03-310001280058us-gaap:AdditionalPaidInCapitalMember2024-03-310001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001280058us-gaap:RetainedEarningsMember2024-03-3100012800582024-03-310001280058us-gaap:RetainedEarningsMember2024-04-012024-06-300001280058us-gaap:CommonStockMember2024-04-012024-06-300001280058us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300001280058us-gaap:TreasuryStockCommonMember2024-04-012024-06-300001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001280058us-gaap:CommonStockMember2024-06-300001280058us-gaap:TreasuryStockCommonMember2024-06-300001280058us-gaap:AdditionalPaidInCapitalMember2024-06-300001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300001280058us-gaap:RetainedEarningsMember2024-06-300001280058us-gaap:CommonStockMember2022-12-310001280058us-gaap:TreasuryStockCommonMember2022-12-310001280058us-gaap:AdditionalPaidInCapitalMember2022-12-310001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001280058us-gaap:RetainedEarningsMember2022-12-310001280058us-gaap:RetainedEarningsMember2023-01-012023-03-3100012800582023-01-012023-03-310001280058us-gaap:CommonStockMember2023-01-012023-03-310001280058us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001280058us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001280058us-gaap:CommonStockMember2023-03-310001280058us-gaap:TreasuryStockCommonMember2023-03-310001280058us-gaap:AdditionalPaidInCapitalMember2023-03-310001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001280058us-gaap:RetainedEarningsMember2023-03-3100012800582023-03-310001280058us-gaap:RetainedEarningsMember2023-04-012023-06-300001280058us-gaap:CommonStockMember2023-04-012023-06-300001280058us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300001280058us-gaap:TreasuryStockCommonMember2023-04-012023-06-300001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001280058us-gaap:CommonStockMember2023-06-300001280058us-gaap:TreasuryStockCommonMember2023-06-300001280058us-gaap:AdditionalPaidInCapitalMember2023-06-300001280058us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001280058us-gaap:RetainedEarningsMember2023-06-300001280058blkb:EVERFILimitedMember2023-01-012023-12-3100012800582024-03-022024-03-020001280058us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001280058us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001280058us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300001280058us-gaap:FairValueMeasurementsRecurringMember2024-06-300001280058us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001280058us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001280058us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001280058us-gaap:FairValueMeasurementsRecurringMember2023-12-310001280058us-gaap:RevolvingCreditFacilityMember2024-06-300001280058us-gaap:RevolvingCreditFacilityMember2023-12-310001280058us-gaap:SecuredDebtMember2024-06-300001280058us-gaap:SecuredDebtMember2023-12-310001280058us-gaap:MortgagesMember2024-06-300001280058us-gaap:MortgagesMember2023-12-310001280058us-gaap:LoansPayableMember2024-06-300001280058us-gaap:LoansPayableMember2023-12-310001280058us-gaap:ShortTermDebtMember2024-06-300001280058us-gaap:ShortTermDebtMember2023-12-310001280058us-gaap:LongTermDebtMember2024-06-300001280058us-gaap:LongTermDebtMember2023-12-3100012800582022-01-3100012800582024-04-300001280058us-gaap:RevolvingCreditFacilityMember2024-04-300001280058us-gaap:SecuredDebtMember2024-04-300001280058us-gaap:SecuredDebtMember2024-04-302024-04-300001280058us-gaap:RevolvingCreditFacilityMember2024-04-302024-04-300001280058us-gaap:RevolvingCreditFacilityMember2020-10-302020-10-3000012800582024-04-302024-04-300001280058us-gaap:StandbyLettersOfCreditMember2024-04-300001280058blkb:SwinglineloansMember2024-04-300001280058us-gaap:ForeignLineOfCreditMember2024-04-300001280058us-gaap:FederalFundsEffectiveSwapRateMember2024-04-302024-04-300001280058us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-04-302024-04-300001280058us-gaap:BaseRateMembersrt:MinimumMember2024-04-302024-04-300001280058us-gaap:BaseRateMembersrt:MaximumMember2024-04-302024-04-300001280058srt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-04-302024-04-300001280058srt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2024-04-302024-04-300001280058srt:MinimumMember2024-04-302024-04-300001280058srt:MaximumMember2024-04-302024-04-300001280058srt:MinimumMemberblkb:DesignatedCurrencyRateMember2024-04-302024-04-300001280058blkb:DesignatedCurrencyRateMembersrt:MaximumMember2024-04-302024-04-300001280058srt:MaximumMember2024-04-300001280058blkb:GlobalHQMember2020-08-310001280058us-gaap:LoansPayableMember2022-12-310001280058us-gaap:LoansPayableMember2023-01-310001280058us-gaap:LoansPayableMember2024-04-300001280058us-gaap:InterestRateSwapMember2024-06-300001280058us-gaap:InterestRateSwapMember2023-12-310001280058us-gaap:ForeignExchangeForwardMember2024-06-300001280058us-gaap:ForeignExchangeForwardMember2023-12-310001280058us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001280058us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001280058us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001280058us-gaap:DesignatedAsHedgingInstrumentMember2024-06-300001280058us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001280058us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-01-012024-06-300001280058us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2024-04-012024-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMember2024-01-012024-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMember2024-04-012024-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2024-01-012024-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2024-04-012024-06-300001280058us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-01-012023-06-300001280058us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMember2023-04-012023-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMember2023-01-012023-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:CashFlowHedgingMember2023-04-012023-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2023-01-012023-06-300001280058us-gaap:ForeignExchangeForwardMemberus-gaap:NetInvestmentHedgingMember2023-04-012023-06-300001280058blkb:ThirdpartyTechnologyMember2024-06-300001280058srt:MinimumMember2024-06-300001280058srt:MaximumMember2024-06-3000012800582024-06-132024-06-130001280058blkb:December2021StockRepurchaseProgramMember2024-01-170001280058blkb:January2024StockRepurchaseProgramMember2024-01-170001280058blkb:Q12024ASRMember2024-03-012024-03-310001280058blkb:Q12024ASRMember2024-03-310001280058blkb:January2024StockRepurchaseProgramMember2024-04-012024-06-300001280058blkb:January2024StockRepurchaseProgramMember2024-01-012024-06-300001280058us-gaap:SubsequentEventMemberblkb:July2024StockRepurchaseProgramMember2024-07-160001280058us-gaap:CashFlowHedgingMember2024-03-310001280058us-gaap:CashFlowHedgingMember2023-03-310001280058us-gaap:CashFlowHedgingMember2023-12-310001280058us-gaap:CashFlowHedgingMember2022-12-310001280058us-gaap:CashFlowHedgingMember2024-04-012024-06-300001280058us-gaap:CashFlowHedgingMember2023-04-012023-06-300001280058us-gaap:CashFlowHedgingMember2024-01-012024-06-300001280058us-gaap:CashFlowHedgingMember2023-01-012023-06-300001280058us-gaap:CashFlowHedgingMember2024-06-300001280058us-gaap:CashFlowHedgingMember2023-06-300001280058us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310001280058us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310001280058us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001280058us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001280058us-gaap:AccumulatedTranslationAdjustmentMember2024-04-012024-06-300001280058us-gaap:AccumulatedTranslationAdjustmentMember2023-04-012023-06-300001280058us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-06-300001280058us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-06-300001280058us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300001280058us-gaap:AccumulatedTranslationAdjustmentMember2023-06-3000012800582024-07-012024-06-300001280058country:US2024-04-012024-06-300001280058country:US2023-04-012023-06-300001280058country:US2024-01-012024-06-300001280058country:US2023-01-012023-06-300001280058country:GB2024-04-012024-06-300001280058country:GB2023-04-012023-06-300001280058country:GB2024-01-012024-06-300001280058country:GB2023-01-012023-06-300001280058blkb:OthercountriesMember2024-04-012024-06-300001280058blkb:OthercountriesMember2023-04-012023-06-300001280058blkb:OthercountriesMember2024-01-012024-06-300001280058blkb:OthercountriesMember2023-01-012023-06-300001280058blkb:SocialSectorMember2024-04-012024-06-300001280058blkb:SocialSectorMember2023-04-012023-06-300001280058blkb:SocialSectorMember2024-01-012024-06-300001280058blkb:SocialSectorMember2023-01-012023-06-300001280058blkb:CorporateSectorMember2024-04-012024-06-300001280058blkb:CorporateSectorMember2023-04-012023-06-300001280058blkb:CorporateSectorMember2024-01-012024-06-300001280058blkb:CorporateSectorMember2023-01-012023-06-300001280058blkb:ContractualRecurringMember2024-04-012024-06-300001280058blkb:ContractualRecurringMember2023-04-012023-06-300001280058blkb:ContractualRecurringMember2024-01-012024-06-300001280058blkb:ContractualRecurringMember2023-01-012023-06-300001280058blkb:TransactionalRecurringMember2024-04-012024-06-300001280058blkb:TransactionalRecurringMember2023-04-012023-06-300001280058blkb:TransactionalRecurringMember2024-01-012024-06-300001280058blkb:TransactionalRecurringMember2023-01-012023-06-300001280058blkb:MichaelP.GianoniMember2024-04-012024-06-300001280058blkb:MichaelP.GianoniMember2024-06-300001280058blkb:KevinR.McDearisMember2024-04-012024-06-300001280058blkb:KevinR.McDearisMember2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the quarterly period ended June 30, 2024 |

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to . |

Commission file number: 000-50600

Blackbaud, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| |

| Delaware | 11-2617163 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

65 Fairchild Street

Charleston, South Carolina 29492

(Address of principal executive offices, including zip code)

(843) 216-6200

(Registrant’s telephone number, including area code)

| | | | | | | | |

| | |

| Securities Registered Pursuant to Section 12(b) of the Act: |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Common Stock, $0.001 Par Value | BLKB | Nasdaq Global Select Market |

| | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

The number of shares of the registrant’s Common Stock outstanding as of July 29, 2024 was 51,626,340.

TABLE OF CONTENTS

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 1 |

| | | | | | | | |

| | CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

This Quarterly Report on Form 10-Q, including the documents incorporated herein by reference, contains forward-looking statements that anticipate results based on our estimates, assumptions and plans that are subject to uncertainty. These "forward-looking statements" are made subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements consist of, among other things, trend analyses, statements regarding future events, future financial performance, our anticipated growth, the effect of general economic and market conditions, our business strategy and our plan to build and grow our business, our operating results, our ability to successfully integrate acquired businesses and technologies, the effect of foreign currency exchange rate and interest rate fluctuations on our financial results, the impact of expensing stock-based compensation, the sufficiency of our capital resources, our ability to meet our ongoing debt and obligations as they become due, cybersecurity and data protection risks and related liabilities, and current or potential legal proceedings involving us, all of which are based on current expectations, estimates, and forecasts, and the beliefs and assumptions of our management. Words such as “believes,” “seeks,” “expects,” “may,” “might,” “should,” “intends,” “could,” “would,” “likely,” “will,” “targets,” “plans,” “anticipates,” “aims,” “projects,” “estimates” or any variations of such words and similar expressions are also intended to identify such forward-looking statements. These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict. Accordingly, they should not be viewed as assurances of future performance, and actual results may differ materially and adversely from those expressed in any forward-looking statements.

Important factors that could cause actual results to differ materially from our expectations expressed in forward-looking statements include, but are not limited to, those summarized under “Part II, Item 1A. Risk factors” and elsewhere in this report, in our Annual Report on Form 10-K for the year ended December 31, 2023 and in our other filings made with the United States Securities & Exchange Commission ("SEC"). Forward-looking statements represent our management's beliefs and assumptions only as of the date of this Quarterly Report on Form 10-Q. We undertake no obligation to update or revise any forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statement, whether as a result of new information, future events or otherwise.

| | | | | | | | |

2 | | Second Quarter 2024 Form 10-Q |

| | | | | | | | |

| | PART I. FINANCIAL INFORMATION |

ITEM 1. FINANCIAL STATEMENTS

| | | | | | | | |

Blackbaud, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) |

| (dollars in thousands, except per share amounts) | June 30,

2024 | December 31,

2023 |

| Assets | | |

| Current assets: | | |

| Cash and cash equivalents | $ | 30,438 | | $ | 31,251 | |

| Restricted cash | 800,670 | | 697,006 | |

Accounts receivable, net of allowance of $6,006 and $6,907 at June 30, 2024 and December 31, 2023, respectively | 152,832 | | 101,862 | |

| Customer funds receivable | 2,943 | | 353 | |

| Prepaid expenses and other current assets | 92,290 | | 99,285 | |

| Total current assets | 1,079,173 | | 929,757 | |

| Property and equipment, net | 98,066 | | 98,689 | |

| Operating lease right-of-use assets | 28,489 | | 36,927 | |

| Software and content development costs, net | 165,465 | | 160,194 | |

| Goodwill | 1,053,249 | | 1,053,738 | |

| Intangible assets, net | 549,521 | | 581,937 | |

| Other assets | 68,785 | | 51,037 | |

| Total assets | $ | 3,042,748 | | $ | 2,912,279 | |

| Liabilities and stockholders’ equity | | |

| Current liabilities: | | |

| Trade accounts payable | $ | 44,038 | | $ | 25,184 | |

| Accrued expenses and other current liabilities | 51,682 | | 64,322 | |

| Due to customers | 802,372 | | 695,842 | |

| Debt, current portion | 23,786 | | 19,259 | |

| Deferred revenue, current portion | 427,098 | | 392,530 | |

| Total current liabilities | 1,348,976 | | 1,197,137 | |

| Debt, net of current portion | 998,071 | | 760,405 | |

| Deferred tax liability | 75,397 | | 93,292 | |

| Deferred revenue, net of current portion | 2,315 | | 2,397 | |

| Operating lease liabilities, net of current portion | 36,290 | | 40,085 | |

| Other liabilities | 4,362 | | 10,258 | |

| Total liabilities | 2,465,411 | | 2,103,574 | |

| Commitments and contingencies (see Note 9) | | |

| Stockholders’ equity: | | |

Preferred stock; 20,000,000 shares authorized, none outstanding | — | | — | |

Common stock, $0.001 par value; 180,000,000 shares authorized, 70,883,488 and 69,188,304 shares issued at June 30, 2024 and December 31, 2023, respectively; 51,623,951 and 53,625,440 shares outstanding at June 30, 2024 and December 31, 2023, respectively | 71 | | 69 | |

| Additional paid-in capital | 1,208,624 | | 1,203,012 | |

Treasury stock, at cost; 19,259,537 and 15,562,864 shares at June 30, 2024 and December 31, 2023, respectively | (857,452) | | (591,557) | |

| Accumulated other comprehensive income (loss) | 175 | | (1,688) | |

| Retained earnings | 225,919 | | 198,869 | |

| Total stockholders’ equity | 577,337 | | 808,705 | |

| Total liabilities and stockholders’ equity | $ | 3,042,748 | | $ | 2,912,279 | |

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 3 |

| | | | | | | | | | | | | | | | | |

Blackbaud, Inc. Condensed Consolidated Statements of Comprehensive Income (Loss) (Unaudited) |

| Three months ended

June 30, | | Six months ended

June 30, |

| (dollars in thousands, except per share amounts) | 2024 | 2023 | | 2024 | 2023 |

| Revenue | | | | | |

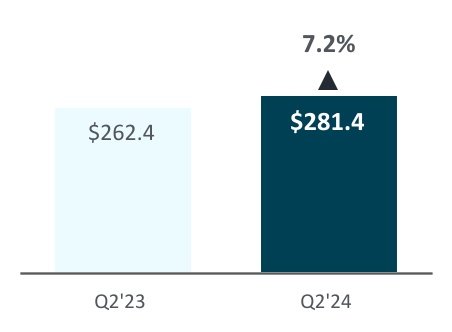

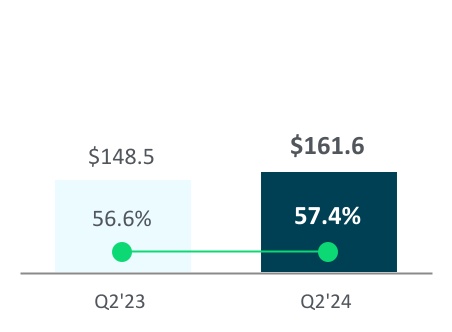

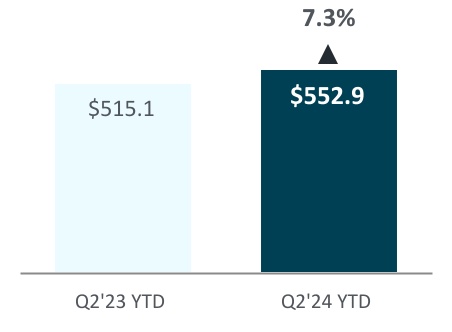

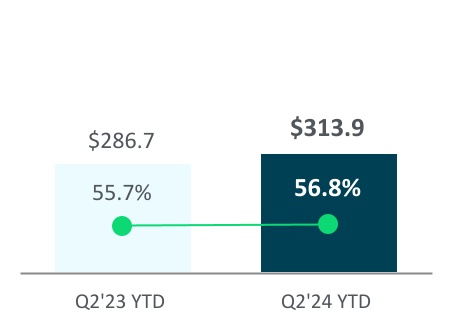

| Recurring | $ | 281,376 | | $ | 262,390 | | | $ | 552,894 | | $ | 515,138 | |

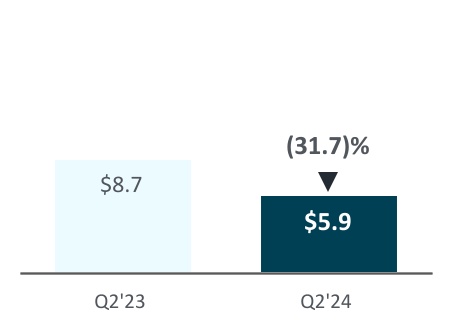

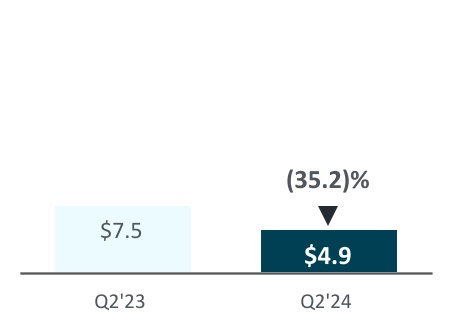

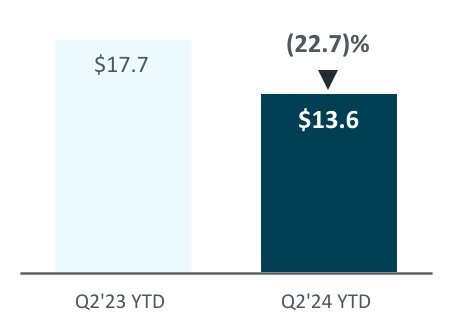

| One-time services and other | 5,910 | | 8,652 | | | 13,642 | | 17,657 | |

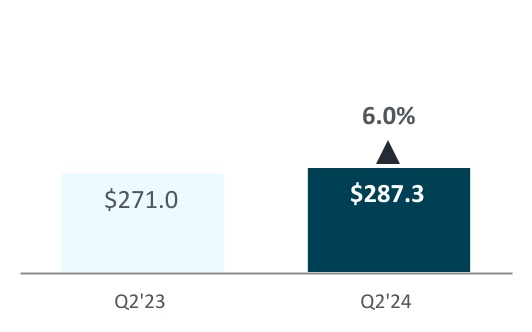

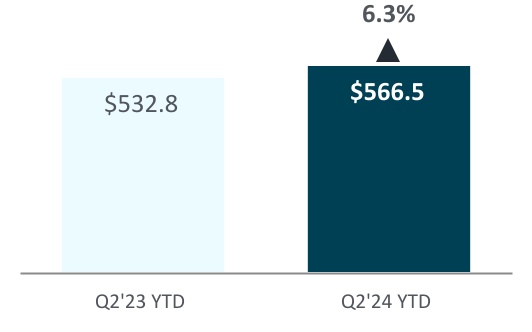

| Total revenue | 287,286 | | 271,042 | | | 566,536 | | 532,795 | |

| Cost of revenue | | | | | |

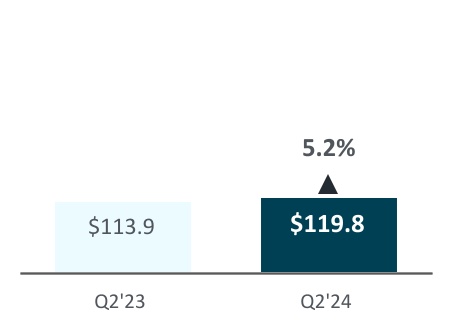

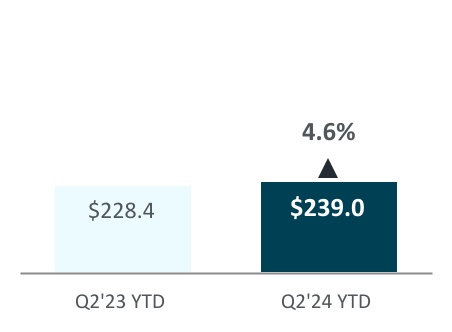

| Cost of recurring | 119,810 | | 113,926 | | | 238,998 | | 228,426 | |

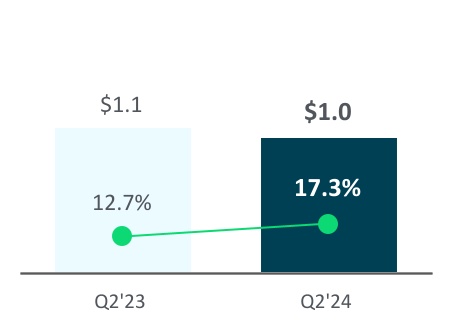

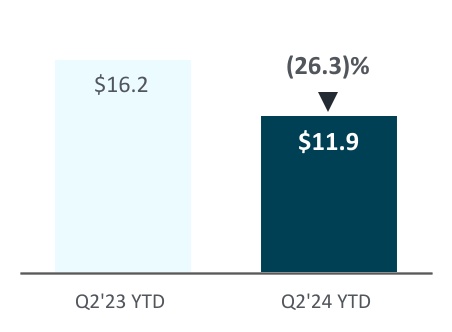

| Cost of one-time services and other | 4,890 | | 7,549 | | | 11,908 | | 16,161 | |

| Total cost of revenue | 124,700 | | 121,475 | | | 250,906 | | 244,587 | |

| Gross profit | 162,586 | | 149,567 | | | 315,630 | | 288,208 | |

| Operating expenses | | | | | |

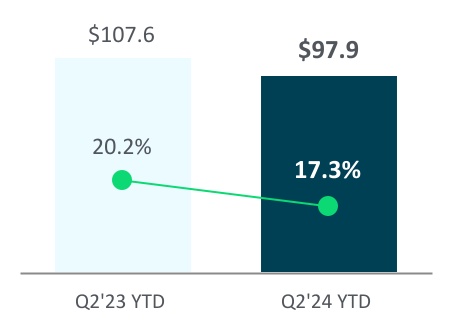

| Sales, marketing and customer success | 47,081 | | 53,191 | | | 97,946 | | 107,576 | |

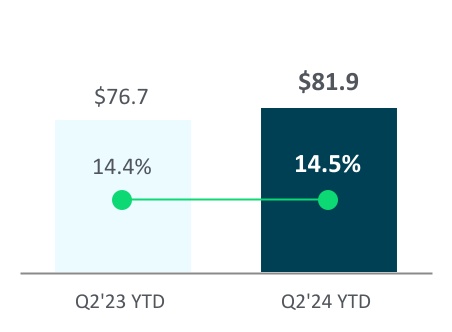

| Research and development | 39,068 | | 36,146 | | | 81,870 | | 76,737 | |

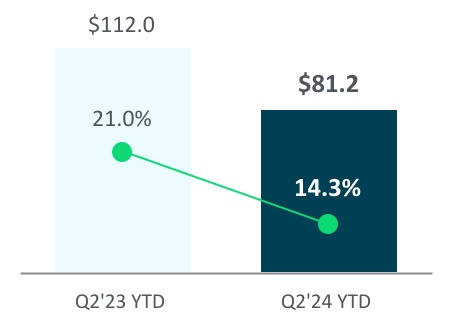

| General and administrative | 33,443 | | 59,148 | | | 81,197 | | 111,986 | |

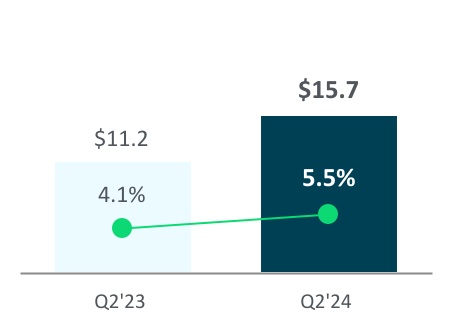

| Amortization | 902 | | 788 | | | 1,806 | | 1,562 | |

| | | | | |

| Total operating expenses | 120,494 | | 149,273 | | | 262,819 | | 297,861 | |

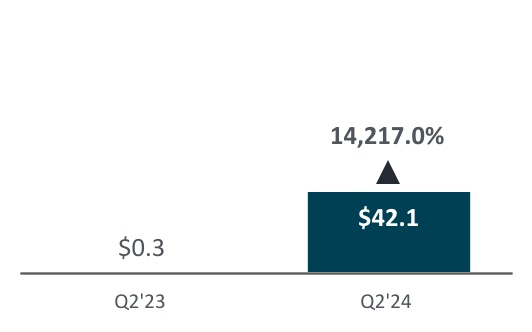

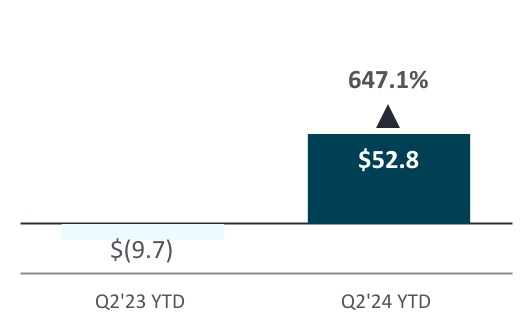

| Income (loss) from operations | 42,092 | | 294 | | | 52,811 | | (9,653) | |

| Interest expense | (15,715) | | (11,167) | | | (25,991) | | (21,829) | |

| Other income, net | 3,310 | | 2,778 | | | 6,657 | | 4,785 | |

| Income (loss) before provision (benefit) for income taxes | 29,687 | | (8,095) | | | 33,477 | | (26,697) | |

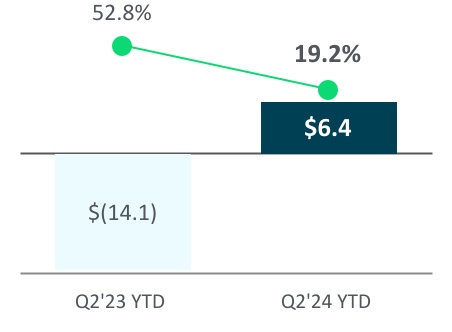

| Income tax provision (benefit) | 7,883 | | (10,200) | | | 6,427 | | (14,101) | |

| Net income (loss) | $ | 21,804 | | $ | 2,105 | | | $ | 27,050 | | $ | (12,596) | |

| Earnings (loss) per share | | | | | |

| Basic | $ | 0.43 | | $ | 0.04 | | | $ | 0.53 | | $ | (0.24) | |

| Diluted | $ | 0.42 | | $ | 0.04 | | | $ | 0.52 | | $ | (0.24) | |

| Common shares and equivalents outstanding | | | | | |

| Basic weighted average shares | 50,747,337 | | 52,642,411 | | | 51,399,853 | | 52,389,112 | |

| Diluted weighted average shares | 51,677,418 | | 53,643,124 | | | 52,371,927 | | 52,389,112 | |

| Other comprehensive (loss) income | | | | | |

| Foreign currency translation adjustment | $ | 339 | | $ | 3,055 | | | $ | (846) | | $ | 5,213 | |

| Unrealized (loss) gain on derivative instruments, net of tax | (1,386) | | 5,383 | | | 2,709 | | (5,309) | |

| Total other comprehensive (loss) income | (1,047) | | 8,438 | | | 1,863 | | (96) | |

| Comprehensive income (loss) | $ | 20,757 | | $ | 10,543 | | | $ | 28,913 | | $ | (12,692) | |

| | | | | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

4 | | Second Quarter 2024 Form 10-Q |

| | | | | | | | |

Blackbaud, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

| | Six months ended

June 30, |

| (dollars in thousands) | 2024 | 2023 |

| Cash flows from operating activities | | |

| Net income (loss) | $ | 27,050 | | $ | (12,596) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | |

| Depreciation and amortization | 60,553 | | 53,622 | |

| Provision for credit losses and sales returns | 519 | | 3,798 | |

| Stock-based compensation expense | 57,856 | | 63,289 | |

| Deferred taxes | (18,810) | | (33,101) | |

| Amortization of deferred financing costs and discount | 984 | | 963 | |

| Loss on disposition of business | 1,561 | | — | |

| | |

| Other non-cash adjustments | 2,462 | | (1,569) | |

| Changes in operating assets and liabilities, net of acquisition and disposal of businesses: | | |

| Accounts receivable | (53,062) | | (69,624) | |

| Prepaid expenses and other assets | (2,473) | | 9,470 | |

| Trade accounts payable | 19,146 | | (3,431) | |

| Accrued expenses and other liabilities | (13,579) | | 11,948 | |

| Deferred revenue | 36,228 | | 52,233 | |

| Net cash provided by operating activities | 118,435 | | 75,002 | |

| Cash flows from investing activities | | |

| Purchase of property and equipment | (6,118) | | (2,779) | |

| Capitalized software and content development costs | (28,392) | | (28,756) | |

| | |

| Net cash used in disposition of business | (1,179) | | — | |

| Other investing activities | (5,029) | | — | |

| Net cash used in investing activities | (40,718) | | (31,535) | |

| Cash flows from financing activities | | |

| Proceeds from issuance of debt | 1,211,600 | | 158,000 | |

| Payments on debt | (966,680) | | (171,824) | |

| Debt issuance costs | (6,458) | | — | |

| | |

| Employee taxes paid for withheld shares upon equity award settlement | (54,483) | | (33,687) | |

| Change in due to customers | 106,851 | | 61,313 | |

| Change in customer funds receivable | (2,577) | | (3,359) | |

| Purchase of treasury stock | (262,596) | | — | |

| Net cash provided by financing activities | 25,657 | | 10,443 | |

| Effect of exchange rate on cash, cash equivalents and restricted cash | (523) | | 2,489 | |

| Net increase in cash, cash equivalents and restricted cash | 102,851 | | 56,399 | |

| Cash, cash equivalents and restricted cash, beginning of period | 728,257 | | 733,931 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 831,108 | | $ | 790,330 | |

The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown above in the condensed consolidated statements of cash flows:

| | | | | | | | |

| (dollars in thousands) | June 30,

2024 | December 31,

2023 |

| Cash and cash equivalents | $ | 30,438 | | $ | 31,251 | |

| Restricted cash | 800,670 | | 697,006 | |

| Total cash, cash equivalents and restricted cash in the statement of cash flows | $ | 831,108 | | $ | 728,257 | |

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 5 |

Blackbaud, Inc.

Condensed Consolidated Statements of Stockholders' Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | | Treasury stock | | Additional

paid-in

capital | Accumulated other comprehensive income (loss) | Retained

earnings | Total

stockholders'

equity |

| Shares | Amount | | Shares | Amount | |

| Balance at December 31, 2023 | 69,188,304 | | $ | 69 | | | (15,562,864) | | $ | (591,557) | | | $ | 1,203,012 | | $ | (1,688) | | $ | 198,869 | | $ | 808,705 | |

| Net income | — | | — | | | — | | — | | | — | | — | | 5,246 | | 5,246 | |

| Purchase of treasury shares under stock repurchase program | — | | — | | | (2,954,211) | | (211,412) | | | (52,244) | | — | | — | | (263,656) | |

| Vesting of restricted stock units | 1,357,125 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (720,189) | | (52,723) | | | — | | — | | — | | (52,723) | |

| Stock-based compensation | — | | — | | | — | | — | | | 33,570 | | — | | — | | 33,570 | |

| Restricted stock grants | 335,237 | | 2 | | | — | | — | | | — | | — | | — | | 2 | |

| Restricted stock cancellations | (19,159) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive income | — | | — | | | — | | — | | | — | | 2,910 | | — | | 2,910 | |

| Balance at March 31, 2024 | 70,861,507 | | $ | 71 | | | (19,237,264) | | $ | (855,692) | | | $ | 1,184,338 | | $ | 1,222 | | $ | 204,115 | | $ | 534,054 | |

| Net income | — | | — | | | — | | — | | | — | | — | | 21,804 | | 21,804 | |

| | | | | | | | | | |

| Vesting of restricted stock units | 10,719 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (22,273) | | (1,760) | | | — | | — | | — | | (1,760) | |

| Stock-based compensation | — | | — | | | — | | — | | | 24,286 | | — | | — | | 24,286 | |

| Restricted stock grants | 21,164 | | — | | | — | | — | | | — | | — | | — | | — | |

| Restricted stock cancellations | (9,902) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive loss | — | | — | | | — | | — | | | — | | (1,047) | | — | | (1,047) | |

| Balance at June 30, 2024 | 70,883,488 | | $ | 71 | | | (19,259,537) | | $ | (857,452) | | | $ | 1,208,624 | | $ | 175 | | $ | 225,919 | | $ | 577,337 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

6 | | Second Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Condensed Consolidated Statements of Stockholders' Equity (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Common stock | | Treasury stock | | Additional

paid-in

capital | Accumulated other comprehensive income | Retained

earnings | Total

stockholders'

equity |

| Shares | Amount | | Shares | Amount | |

| Balance at December 31, 2022 | 67,814,044 | | $ | 68 | | | (14,745,230) | | $ | (537,287) | | | $ | 1,075,264 | | $ | 8,938 | | $ | 197,049 | | $ | 744,032 | |

| Net loss | — | | — | | | — | | — | | | — | | — | | (14,701) | | (14,701) | |

| | | | | | | | | | |

| Vesting of restricted stock units | 954,147 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (533,597) | | (30,990) | | | — | | — | | — | | (30,990) | |

| Stock-based compensation | — | | — | | | — | | — | | | 29,925 | | — | | — | | 29,925 | |

| Restricted stock grants | 427,941 | | 1 | | | — | | — | | | — | | — | | — | | 1 | |

| Restricted stock cancellations | (41,269) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive loss | — | | — | | | — | | — | | | — | | (8,534) | | — | | (8,534) | |

| Balance at March 31, 2023 | 69,154,863 | | $ | 69 | | | (15,278,827) | | $ | (568,277) | | | $ | 1,105,189 | | $ | 404 | | $ | 182,348 | | $ | 719,733 | |

| Net income | — | | — | | | — | | — | | | — | | — | | 2,105 | | 2,105 | |

| | | | | | | | | | |

| Vesting of restricted stock units | 23,550 | | — | | | — | | — | | | — | | — | | — | | — | |

| Shares withheld to satisfy tax withholdings | — | | — | | | (32,540) | | (2,270) | | | — | | — | | — | | (2,270) | |

| Stock-based compensation | — | | — | | | — | | — | | | 33,364 | | — | | — | | 33,364 | |

| Restricted stock grants | 6,031 | | — | | | — | | — | | | — | | — | | — | | — | |

| Restricted stock cancellations | (20,200) | | — | | | — | | — | | | — | | — | | — | | — | |

| Other comprehensive income | — | | — | | | — | | — | | | — | | 8,438 | | — | | 8,438 | |

| Balance at June 30, 2023 | 69,164,244 | | $ | 69 | | | (15,311,367) | | $ | (570,547) | | | $ | 1,138,553 | | $ | 8,842 | | $ | 184,453 | | $ | 761,370 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

|

| | |

| The accompanying notes are an integral part of these condensed consolidated financial statements. |

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 7 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

We are the leading software provider exclusively dedicated to powering social impact. Serving the nonprofit and education sectors, companies committed to social responsibility and individual change makers, our essential software is built to accelerate impact in fundraising, nonprofit financial management, digital giving, grantmaking, corporate social responsibility and education management. A remote-first company, we have operations in the United States, Australia, Canada, Costa Rica and the United Kingdom, supporting users in 100+ countries.

Unaudited condensed consolidated interim financial statements

The accompanying condensed consolidated interim financial statements have been prepared pursuant to the rules and regulations of the United States Securities and Exchange Commission ("SEC") for interim financial reporting. These condensed consolidated statements are unaudited and, in the opinion of management, include all adjustments (consisting of normal recurring adjustments and accruals) necessary to state fairly the consolidated balance sheets, consolidated statements of comprehensive income, consolidated statements of cash flows and consolidated statements of stockholders’ equity, for the periods presented in accordance with accounting principles generally accepted in the United States ("U.S.") ("GAAP"). The condensed consolidated balance sheet at December 31, 2023 has been derived from the audited consolidated financial statements at that date. Operating results and cash flows for the six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2024, or any other future period. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with GAAP have been omitted in accordance with the rules and regulations for interim reporting of the SEC. These unaudited, condensed consolidated interim financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2023, and other forms filed with the SEC from time to time.

Basis of consolidation

The unaudited, condensed consolidated financial statements include the accounts of Blackbaud, Inc. and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation.

Reportable segment

We report our operating results and financial information in one operating and reportable segment. Our chief operating decision maker uses consolidated financial information to make operating decisions, assess financial performance and allocate resources. Our chief operating decision maker is our chief executive officer.

Use of estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting periods. On an ongoing basis, we reconsider and evaluate our estimates and assumptions, including those that impact revenue recognition, long-lived and intangible assets, income taxes, business combinations, stock-based compensation, capitalization of software and content development costs, our allowances for credit losses and sales returns, costs of obtaining contracts, valuation of derivative instruments, loss contingencies and insurance recoveries, among others. Changes in the facts or circumstances underlying these estimates could result in material changes and actual results could materially differ from these estimates.

| | | | | | | | |

8 | | Second Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Recently issued accounting pronouncements

There are no recently issued accounting pronouncements that we expect to have a material impact on our consolidated financial statements when adopted in the future.

Summary of significant accounting policies

There have been no material changes to our significant accounting policies described in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 21, 2024.

| | |

| 3. Business Combinations and Dispositions |

2024 disposition

On March 2, 2024, we completed a transaction to divest our U.K.-based creative services business EVERFI Limited, formerly a wholly-owned subsidiary of EVERFI Inc, which is a wholly-owned subsidiary of Blackbaud, Inc. EVERFI Limited's total revenue during 2023 was $8.4 million. We incurred an insignificant amount of legal costs associated with the disposition of this business. As a result of the disposition, we recorded a $1.6 million loss, which was recorded in general and administrative expense in the unaudited, condensed consolidated statement of comprehensive income for the six months ended June 30, 2024.

| | |

| 4. Earnings (Loss) Per Share |

We compute basic earnings (loss) per share by dividing net income (loss) available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings (loss) per share is computed by dividing net income (loss) available to common stockholders by the weighted average number of common shares and dilutive potential common shares outstanding during the period. Diluted earnings (loss) per share reflects the assumed exercise, settlement and vesting of all dilutive securities using the “treasury stock method” except when the effect is anti-dilutive. Potentially dilutive securities consist of shares issuable upon vesting of restricted stock awards and units. Diluted loss per share for the six months ended June 30, 2023 was the same as basic loss per share as there was a net loss in the period and inclusion of potentially dilutive securities was anti-dilutive.

The following table sets forth the computation of basic and diluted earnings (loss) per share:

| | | | | | | | | | | | | | | | | |

| | Three months ended June 30, | | Six months ended June 30, |

| (dollars in thousands, except per share amounts) | 2024 | 2023 | | 2024 | 2023 |

| Numerator: | | | | | |

| Net income (loss) | $ | 21,804 | | $ | 2,105 | | | $ | 27,050 | | $ | (12,596) | |

| Denominator: | | | | | |

| Weighted average common shares | 50,747,337 | | 52,642,411 | | | 51,399,853 | | 52,389,112 | |

| Add effect of dilutive securities: | | | | | |

| Restricted stock and units | 930,081 | | 1,000,713 | | | 972,074 | | — | |

| Weighted average common shares assuming dilution | 51,677,418 | | 53,643,124 | | | 52,371,927 | | 52,389,112 | |

| Earnings (loss) per share | | | | | |

| Basic | $ | 0.43 | | $ | 0.04 | | | $ | 0.53 | | $ | (0.24) | |

| Diluted | $ | 0.42 | | $ | 0.04 | | | $ | 0.52 | | $ | (0.24) | |

| | | | | |

| Anti-dilutive shares excluded from calculations of diluted earnings (loss) per share | 12,367 | | 9,487 | | | 1,023,093 | | 1,151,974 | |

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 9 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

| | |

| 5. Fair Value Measurements |

We use a three-tier fair value hierarchy to measure fair value. This hierarchy prioritizes the inputs into three broad levels as follows:

•Level 1 - Quoted prices for identical assets or liabilities in active markets;

•Level 2 - Quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets in markets that are not active, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets; and

•Level 3 - Valuations derived from valuation techniques in which one or more significant inputs are unobservable.

Recurring fair value measurements

Financial assets and liabilities that are measured at fair value on a recurring basis consisted of the following, as of the dates indicated below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair value measurement using | | |

| (dollars in thousands) | Quoted Prices in Active Markets for Identical Assets and Liabilities

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total |

| Fair value as of June 30, 2024 | | | | | | | |

| Financial assets: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 14,282 | | | $ | — | | | $ | 14,282 | |

| Foreign currency forward contracts | — | | | 252 | | | — | | | 252 | |

| Total financial assets | $ | — | | | $ | 14,534 | | | $ | — | | | $ | 14,534 | |

| | | | | | | |

| Fair value as of June 30, 2024 | | | | | | | |

| Financial liabilities: | | | | | | | |

| | | | | | | |

| Foreign currency forward contracts | $ | — | | | $ | 56 | | | $ | — | | | $ | 56 | |

| | | | | | | |

| Total financial liabilities | $ | — | | | $ | 56 | | | $ | — | | | $ | 56 | |

| | | | | | | |

| Fair value as of December 31, 2023 | | | | | | | |

| Financial assets: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 16,198 | | | $ | — | | | $ | 16,198 | |

| | | | | | | |

| Total financial assets | $ | — | | | $ | 16,198 | | | $ | — | | | $ | 16,198 | |

| | | | | | | |

| Fair value as of December 31, 2023 | | | | | | | |

| Financial liabilities: | | | | | | | |

| Interest rate swaps | $ | — | | | $ | 5,004 | | | $ | — | | | $ | 5,004 | |

| Foreign currency forward contracts | — | | | 536 | | | — | | | 536 | |

| Contingent consideration obligations | — | | | — | | | 1,403 | | | 1,403 | |

| Total financial liabilities | $ | — | | | $ | 5,540 | | | $ | 1,403 | | | $ | 6,943 | |

Our derivative instruments within the scope of Accounting Standards Codification ("ASC") 815, Derivatives and Hedging, are required to be recorded at fair value. Our derivative instruments that are recorded at fair value include interest rate swaps and foreign currency forward contracts. See Note 8 to these unaudited, condensed consolidated financial statements for additional information about our derivative instruments.

| | | | | | | | |

10 | | Second Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The fair value of our interest rate swaps and foreign currency forward contracts are based on model-driven valuations using Secured Overnight Financing Rate ("SOFR") rates and foreign currency forward rates, respectively, which are observable at commonly quoted intervals. Accordingly, our interest rate swaps and foreign currency forward contracts are classified within Level 2 of the fair value hierarchy.

Contingent consideration obligations arise from business acquisitions. The fair values are based on discounted cash flow analyses reflecting a probability-weighted assessment approach derived from the likelihood of possible achievement of specified performance measures or events and captures the contractual nature of the contingencies, commercial risk, and the time value of money. As the fair value measurements for our contingent consideration obligations contain significant unobservable inputs, they are classified within Level 3 of the fair value hierarchy.

We believe the carrying amounts of our cash and cash equivalents, restricted cash, accounts receivable, trade accounts payable, accrued expenses and other current liabilities and due to customers approximate their fair values at June 30, 2024 and December 31, 2023, due to the immediate or short-term maturity of these instruments.

We believe the carrying amount of our debt approximates its fair value at June 30, 2024 and December 31, 2023, as the debt bears interest rates that approximate market value. As SOFR rates are observable at commonly quoted intervals, our debt under the 2024 Credit Facilities (as defined below) is classified within Level 2 of the fair value hierarchy. The fair value of our fixed rate debt does not exceed the carrying amount.

We did not transfer any assets or liabilities among the levels within the fair value hierarchy during the six months ended June 30, 2024.

Non-recurring fair value measurements

Assets and liabilities that are measured at fair value on a non-recurring basis include long-lived assets, intangible assets, goodwill and operating lease right-of-use ("ROU") assets. These assets are recognized at fair value during the period in which an acquisition is completed or at lease commencement, from updated estimates and assumptions during the measurement period, or when they are considered to be impaired. These non-recurring fair value measurements, primarily for long-lived assets, intangible assets acquired and operating lease ROU assets, are based on Level 3 unobservable inputs. In the event of an impairment, we determine the fair value of these assets other than goodwill using a discounted cash flow approach, which contains significant unobservable inputs and, therefore, is considered a Level 3 fair value measurement. The unobservable inputs in the analysis generally include future cash flow projections and a discount rate. For goodwill impairment testing, we estimate fair value using market-based methods including the use of market capitalization and consideration of a control premium.

In June 2024, we entered into a sublease for an additional portion of our Washington, DC office location, which we previously closed for our own use in February 2023 to align with our remote-first workforce strategy. We considered our entry into the sublease an impairment indicator. As a result, during the three and six months ended June 30, 2024, we recorded noncash impairment charges of $3.1 million against certain operating lease ROU assets and noncash impairment charges against certain property and equipment assets which were insignificant. We present these impairment charges in general and administrative expense on our unaudited, condensed consolidated statements of comprehensive income (loss) and as other non-cash adjustments within operating activities on our unaudited condensed consolidated statements of cash flows.

There were no other significant non-recurring fair value adjustments to our long-lived assets, intangible assets, goodwill or operating lease ROU assets during the six months ended June 30, 2024.

| | |

| 6. Consolidated Financial Statement Details |

Restricted cash

| | | | | | | | |

| (dollars in thousands) | June 30,

2024 | December 31,

2023 |

| Restricted cash due to customers | $ | 799,429 | | $ | 695,489 | |

| | |

Real estate escrow balances and other | 1,241 | | 1,517 | |

| Total restricted cash | $ | 800,670 | | $ | 697,006 | |

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 11 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Prepaid expenses and other assets

| | | | | | | | |

| (dollars in thousands) | June 30,

2024 | December 31,

2023 |

Costs of obtaining contracts(1)(2) | $ | 60,680 | | $ | 62,377 | |

Prepaid software maintenance and subscriptions(3) | 35,600 | | 35,169 | |

| Derivative instruments | 14,534 | | 16,198 | |

Implementation costs for cloud computing arrangements, net(4)(5) | 10,262 | | 9,259 | |

| Prepaid insurance | 7,078 | | 3,940 | |

| Unbilled accounts receivable | 5,789 | | 5,615 | |

Equity method investment(6) | 5,029 | | — | |

| Taxes, prepaid and receivable | 5,549 | | 3,418 | |

| | |

| Other assets | 16,554 | | 14,346 | |

| Total prepaid expenses and other assets | 161,075 | | 150,322 | |

| Less: Long-term portion | 68,785 | | 51,037 | |

| Prepaid expenses and other current assets | $ | 92,290 | | $ | 99,285 | |

(1)Amortization expense from costs of obtaining contracts was $4.9 million and $9.7 million for the three and six months ended June 30, 2024, respectively, and $8.1 million and $16.4 million for the three and six months ended June 30, 2023, respectively.

(2)The current portion of costs of obtaining contracts as of June 30, 2024 and December 31, 2023 was $19.6 million and $25.3 million, respectively.

(3)The current portion of prepaid software maintenance and subscriptions as of June 30, 2024 and December 31, 2023 was $32.1 million and $32.4 million, respectively.

(4)These costs primarily relate to the multi-year implementations of our new global enterprise resource planning, customer relationship management systems and other cloud-based systems.

(5)Amortization expense from capitalized cloud computing implementation costs was $0.7 million and insignificant for the three months ended June 30, 2024 and 2023, respectively, and $1.4 million and $1.1 million for the six months ended June 30, 2024 and 2023, respectively. Accumulated amortization for these costs was $9.1 million and $7.7 million as of June 30, 2024 and December 31, 2023, respectively.

(6)Represents a strategic investment that did not result in Blackbaud having significant influence over the investee.

Accrued expenses and other liabilities

| | | | | | | | |

| (dollars in thousands) | June 30,

2024 | December 31,

2023 |

Accrued legal costs(1) | $ | 10,473 | | $ | 3,659 | |

Taxes payable | 10,428 | | 21,282 | |

| Customer credit balances | 7,631 | | 10,238 | |

| Operating lease liabilities, current portion | 4,887 | | 6,701 | |

| Accrued commissions and salaries | 2,995 | | 4,413 | |

| Accrued vacation costs | 2,594 | | 2,452 | |

| Accrued health care costs | 2,230 | | 3,865 | |

| Accrued transaction-based costs related to payments services | 1,934 | | 4,323 | |

| Derivative instruments | 56 | | 5,540 | |

Contingent consideration liability | — | | 1,403 | |

| | |

| | |

| Other liabilities | 12,816 | | 10,704 | |

| Total accrued expenses and other liabilities | 56,044 | | 74,580 | |

| Less: Long-term portion | 4,362 | | 10,258 | |

| Accrued expenses and other current liabilities | $ | 51,682 | | $ | 64,322 | |

(1)All accrued legal costs are classified as current. See Note 9 to these unaudited, condensed consolidated financial statements for additional information about our loss contingency accruals and other legal expenses.

| | | | | | | | |

12 | | Second Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Other income, net

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (dollars in thousands) | 2024 | 2023 | | 2024 | 2023 |

| Interest income | $ | 2,815 | | $ | 2,308 | | | $ | 4,863 | | $ | 3,544 | |

| Currency revaluation losses | (380) | | (535) | | | (97) | | (779) | |

| Other income, net | 875 | | 1,005 | | | 1,891 | | 2,020 | |

| Other income, net | $ | 3,310 | | $ | 2,778 | | | $ | 6,657 | | $ | 4,785 | |

| | | | | |

| | | | | |

The following table summarizes our debt balances and the related weighted average effective interest rates, which includes the effect of interest rate swap agreements.

| | | | | | | | | | | | | | | | | |

| Debt balance at | | Weighted average

effective interest rate at |

| (dollars in thousands) | June 30,

2024 | December 31,

2023 | | June 30,

2024 | December 31,

2023 |

| Credit facility: | | | | | |

| Revolving credit loans | $ | 167,300 | | $ | 114,100 | | | 7.78 | % | 7.52 | % |

| Term loans | 800,000 | | 607,500 | | | 4.61 | % | 3.51 | % |

| Real estate loans | 55,965 | | 56,745 | | | 5.23 | % | 5.22 | % |

| Other debt | 2,782 | | 2,800 | | | 8.77 | % | 8.42 | % |

| Total debt | 1,026,047 | | 781,145 | | | 5.17 | % | 4.24 | % |

| Less: Unamortized discount and debt issuance costs | 4,190 | | 1,481 | | | | |

| Less: Debt, current portion | 23,786 | | 19,259 | | | 7.28 | % | 7.02 | % |

| Debt, net of current portion | $ | 998,071 | | $ | 760,405 | | | 5.12 | % | 4.17 | % |

2024 refinancing

On April 30, 2024, we entered into the Third Amendment to Credit Agreement (the "Amendment"), by and among us, the lenders party thereto and Bank of America N.A., as administrative agent (the "Agent"). The Amendment amends the Amended and Restated Credit Agreement, dated as of October 30, 2020 (as previously amended, the "2020 Credit Agreement" and the 2020 Credit Agreement as amended by the Amendment, the “2024 Credit Agreement”), by and among us, the lenders from time-to-time party thereto and the Agent.

The Amendment amends the 2020 Credit Agreement to, among other things, (a) refinance the existing $1.1 billion credit facilities under the 2020 Credit Agreement to provide for new credit facilities in the aggregate principal amount of $1.5 billion consisting of (i) a $700.0 million revolving credit facility (the “2024 Revolving Facility”) and (ii) a $800.0 million term loan facility (the “2024 Term Facility” and together with the 2024 Revolving Facility, the “2024 Credit Facilities”), (b) extend the maturity date to April 30, 2029, (c) modify the definition of Applicable Margin (as defined below) and (iv) modify certain negative and financial covenants to provide additional operational flexibility. Upon closing, we borrowed $800.0 million pursuant to the 2024 Term Facility and $208.2 million pursuant to the 2024 Revolving Facility and used the proceeds to repay the outstanding principal balances of the term loans under the 2020 Credit Agreement (the "2020 Term Facilities"), and repay $196.6 million of outstanding revolving credit loans under the 2020 Credit Agreement (the "2020 Revolving Facility").

Certain lenders of the 2024 Term Facility participated in the 2020 Term Facilities and the change in present value of our future cash flows to these lenders under the 2020 Term Facilities and under the 2024 Term Facility was less than 10%. Accordingly, we accounted for the refinancing event for these lenders as a debt modification. Certain lenders of the 2020 Term Facilities did not participate in the 2024 Term Facility. Accordingly, we accounted for the refinancing event for these lenders as a debt extinguishment. Certain lenders of the 2020 Revolving Facility participated in the 2024 Revolving Facility and provided increased borrowing capacities. Accordingly, we accounted for the refinancing event for these lenders as a debt modification. Certain lenders of the 2020 Revolving Facility did not participate in the 2024 Revolving Facility. Accordingly, we accounted for the refinancing event for these lenders as a debt extinguishment.

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 13 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

We recorded an insignificant loss on debt extinguishment related to the write-off of debt discount and deferred financing costs for the portions of the 2020 Credit Agreement considered to be extinguished. This loss was recognized in the consolidated statements of comprehensive income within other income, net.

In connection with our entry into the 2024 Credit Agreement, we paid $6.5 million in financing costs, of which $1.6 million were capitalized in other assets and, together with a portion of the unamortized deferred financing costs from the 2020 Credit Agreement and prior agreements, are being amortized into interest expense over the term of the new facility. As of June 30, 2024, deferred financing costs totaling $1.9 million were included in other assets on our consolidated balance sheets. We recorded aggregate financing costs of $3.6 million as a direct deduction from the carrying amount of our debt liability, which related to debt discount (fees paid to lenders) and debt issuance costs for the 2024 Term Facility.

Summary of the 2024 Credit Facilities

The 2024 Revolving Facility includes (i) a $50.0 million letter of credit subfacility, (ii) a $50.0 million swingline subfacility and (iii) a $150.0 million sublimit available for multicurrency borrowings.

Under the 2024 Credit Facilities, dollar tranche revolving loans and term loans bear interest at a rate per annum equal to, at the option of the Company: (a) a base rate equal to the highest of (i) the Federal Funds Rate plus 0.50%, (ii) the prime rate announced by Bank of America, N.A., and (iii) Term SOFR plus 1.00% (the “Base Rate”), plus an applicable margin as specified in the 2024 Credit Agreement (the “Applicable Margin”); (b) Term SOFR plus the Applicable Margin; or (c) the Daily SOFR Rate plus the Applicable Margin. The Applicable Margin shall be adjusted quarterly, varies based on our net leverage ratio and varies based on whether the loan is a Base Rate Loan (0.375% to 1.500%), or a Term SOFR Loan/Daily SOFR Loan (1.375% to 2.500%). The 2024 Credit Agreement also provides for a commitment fee of between 0.250% and 0.500% of the unused commitment under the 2024 Revolving Facility depending on our net leverage ratio.

Under the 2024 Credit Facilities, designated currency tranche revolving loans bear interest at a rate per annum equal to, at the option of the Company: (a) the Designated Currency Daily Rate (as defined in the 2024 Credit Agreement) plus the Applicable Margin; or (b) the Designated Currency Term Rate (as defined in the 2024 Credit Agreement) plus the Applicable Margin. The Applicable Margin shall be adjusted quarterly and varies based on our net leverage ratio for both Designated Currency Daily Rate Loans and Designated Currency Term Rate Loans (1.375% to 2.500%).

We may prepay the 2024 Credit Agreement in whole or in part at any time without premium or penalty, other than customary breakage costs with respect to certain types of loans.

Under the terms of the 2024 Credit Agreement, we are entitled on one or more occasion, subject to the satisfaction of certain conditions, to request an increase in the commitments under the 2024 Revolving Facility and/or request additional incremental term loans in the aggregate principal amount of up to the sum of (i) the greater of (A) $360.0 million and (B) 100% of EBITDA (as defined in the 2024 Credit Agreement), plus (ii) at our option, up to an amount such that the net leverage ratio shall be no greater than 3.50 to 1.00.

The 2024 Credit Agreement contains various representations, warranties and affirmative, negative and financial covenants customary for financings of this type. Financial covenants include a net leverage ratio and an interest coverage ratio. At June 30, 2024, we were in compliance with our debt covenants under the 2024 Credit Facilities.

Real estate loans

In August 2020, we completed the purchase of our global headquarters facility. As part of the purchase price, we assumed the seller’s obligations under two senior secured notes with a then-aggregate outstanding principal amount of $61.1 million (collectively, the “Real Estate Loans”). The Real Estate Loans require periodic principal payments and the balance of the Real Estate Loans are due upon maturity in April 2038. At June 30, 2024, we were in compliance with our debt covenants under the Real Estate Loans.

Other debt

From time to time, we enter into third-party financing agreements for purchases of software and related services for our internal use. Generally, the agreements are non-interest-bearing notes requiring annual payments. Interest associated with the notes is imputed at the rate we would incur for amounts borrowed under our then-existing credit facility at the inception of the notes.

| | | | | | | | |

14 | | Second Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The following table summarizes our currently effective supplier financing agreements as of June 30, 2024:

| | | | | | | | | | | | | | |

| (dollars in thousands) | Term

in Months | Number of

Annual Payments | First Annual

Payment Due | Original Loan

Value |

Effective dates of agreements (1): | | | | |

| December 2022 | 39 | 3 | | January 2023 | $ | 1,710 | |

| January 2023 | 36 | 3 | | April 2023 | $ | 2,491 | |

| April 2024 | 36 | 3 | | May 2024 | $ | 2,073 | |

| | | | |

(1)Represent noncash investing and financing transactions during the periods indicated as we purchased software and services by assuming directly related liabilities.

The changes in supplier financing obligations during the six months ended June 30, 2024, consisted of the following:

| | | | | |

| (dollars in thousands) | Total |

| Balance at December 31, 2023 | $ | 2,800 | |

Additions | 2,073 | |

Settlements | (2,091) | |

| Balance at June 30, 2024 | $ | 2,782 | |

As of June 30, 2024, the required annual maturities related to the 2024 Credit Facilities, the Real Estate Loans and our other debt were as follows:

| | | | | |

| |

| |

| |

Years ending December 31,

(dollars in thousands) | Annual

maturities |

| 2024 - remaining | $ | 10,829 | |

| 2025 | 23,875 | |

| 2026 | 22,660 | |

| 2027 | 22,166 | |

| 2028 | 22,375 | |

| Thereafter | 924,142 | |

| Total required maturities | $ | 1,026,047 | |

| | |

| 8. Derivative Instruments |

We generally use derivative instruments to manage our interest rate and foreign currency exchange risk. We currently have derivatives classified as cash flow hedges and net investment hedges. We do not enter into any derivatives for trading or speculative purposes.

All of our derivative instruments are governed by International Swap Dealers Association, Inc. master agreements with our counterparties. As of June 30, 2024 and December 31, 2023, we have presented the fair value of our derivative instruments at the gross amounts in the condensed consolidated balance sheets as the gross fair values of our derivative instruments equaled their net fair values.

Cash flow hedges

We have entered into interest rate swap agreements, which effectively convert portions of our variable rate debt under the 2024 Credit Facilities to a fixed rate for the term of the swap agreements. We designated each of the interest rate swaps as cash flow hedges at the inception of the contracts. Our entry into the 2024 Credit Agreement in April 2024 did not affect our interest rate swap agreements, including their designation as cash flow hedges, as the 2024 Credit Agreement has substantially the same critical terms as the the 2020 Credit Agreement. As of June 30, 2024 and December 31, 2023, the aggregate notional values of the interest rate swaps were $935.0 million and $935.0 million, respectively. All of the contracts have maturities on or before October 2028.

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 15 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

We have entered into foreign currency forward contracts to hedge revenues denominated in the Canadian Dollar ("CAD") against changes in the exchange rate with the United States Dollar ("USD"). We designated each of these foreign currency forward contracts as cash flow hedges at the inception of the contracts. As of June 30, 2024 and December 31, 2023, the aggregate notional values of the foreign currency forward contracts designated as cash flow hedges that we held to buy USD in exchange for Canadian Dollars were $32.1 million CAD and $29.9 million CAD, respectively. All of the contracts have maturities of 12 months or less.

Net investment hedges

We have entered into foreign currency forward contracts to hedge a portion of the foreign currency exposure that arises on translation of our investments denominated in British Pounds ("GBP") into USD. We designated each of these foreign currency forward contracts as net investment hedges at the inception of the contracts. As of June 30, 2024 and December 31, 2023, the aggregate notional values of the foreign currency forward contracts designated as net investment hedges to reduce the volatility of the U.S. dollar value of a portion of our GBP-denominated investments was £14.0 million and £13.2 million, respectively.

The fair values of our derivative instruments were as follows as of:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Asset derivatives | | | Liability derivatives |

| (dollars in thousands) | Balance sheet location | June 30,

2024 | December 31,

2023 | | Balance sheet location | June 30,

2024 | December 31,

2023 |

| Derivative instruments designated as hedging instruments: | | | | | | | |

| Interest rate swaps, current portion | Prepaid expenses

and other current assets | $ | 7,362 | | $ | 16,198 | | | Accrued expenses

and other current liabilities | $ | — | | $ | — | |

Foreign currency forward contracts, current portion | Prepaid expenses and other current assets | 252 | | — | | | Accrued expenses

and other

current liabilities | 56 | | 536 | |

Interest rate swaps, long-term | Other assets | 6,920 | | — | | | Other liabilities | — | | 5,004 | |

| Total derivative instruments designated as hedging instruments | | $ | 14,534 | | $ | 16,198 | | | | $ | 56 | | $ | 5,540 | |

| | | | | | | | |

16 | | Second Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The effects of derivative instruments in cash flow and net investment hedging relationships were as follows:

| | | | | | | | | | | | | | | | | |

| Gain (loss) recognized in accumulated other comprehensive income (loss) as of | Location of gain (loss) reclassified from accumulated other comprehensive income (loss) into income (loss) | Gain reclassified from accumulated other comprehensive income (loss) into income (loss) |

| (dollars in thousands) | June 30,

2024 | Three months ended June 30, 2024 | | Six months ended June 30, 2024 |

| Cash Flow Hedges | | | | | |

| Interest rate swaps | $ | 14,282 | | Interest expense | $ | 5,456 | | | $ | 10,929 | |

| Foreign currency forward contracts | $ | 252 | | Revenue | $ | 129 | | | $ | 163 | |

| Net Investment Hedges | | | | | |

| Foreign currency forward contracts | $ | (56) | | | $ | — | | | $ | — | |

| | | | | |

| June 30,

2023 | | Three months ended June 30, 2023 | | Six months ended June 30, 2023 |

| Cash Flow Hedges | | | | | |

| Interest rate swaps | $ | 25,204 | | Interest expense | $ | 5,083 | | | $ | 9,582 | |

| Foreign currency forward contracts | $ | (292) | | Revenue | $ | 109 | | | $ | 234 | |

| Net Investment Hedges | | | | | |

| Foreign currency forward contracts | $ | (401) | | | $ | — | | | $ | — | |

Our policy requires that derivatives used for hedging purposes be designated and effective as a hedge of the identified risk exposure at the inception of the contract. Accumulated other comprehensive income (loss) includes unrealized gains or losses from the change in fair value measurement of our derivative instruments each reporting period and the related income tax expense or benefit. Excluding net investment hedges, changes in the fair value measurements of the derivative instruments and the related income tax expense or benefit are reflected as adjustments to accumulated other comprehensive income (loss) until the actual hedged expense is incurred or until the hedge is terminated at which point the unrealized gain (loss) and related tax effects are reclassified from accumulated other comprehensive income (loss) to current earnings. For net investment hedges, changes in the fair value measurements of the derivative instruments and the related income tax expense or benefit are reflected as adjustments to translation adjustment, a component of accumulated other comprehensive income (loss), and recognized in earnings only when the hedged GBP investment is liquidated. The estimated accumulated other comprehensive income as of June 30, 2024 that is expected to be reclassified into earnings within the next twelve months is $11.6 million. There were no ineffective portions of our interest rate swap or foreign currency forward derivatives during the six months ended June 30, 2024 and 2023. See Note 11 to these unaudited, condensed consolidated financial statements for a summary of the changes in accumulated other comprehensive income (loss) by component. We classify cash flows related to derivative instruments as operating activities in the condensed consolidated statements of cash flows.

| | |

| 9. Commitments and Contingencies |

Leases

We have operating leases for corporate offices, subleased offices and certain equipment and furniture. As of June 30, 2024, we did not have any operating leases that had not yet commenced.

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 17 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The following table summarizes the components of our lease expense:

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (dollars in thousands) | 2024 | 2023 | | 2024 | 2023 |

Operating lease cost(1) | $ | 1,625 | | $ | 2,304 | | | $ | 3,611 | | $ | 4,689 | |

| Variable lease cost | 299 | | 395 | | | 612 | | 827 | |

| Sublease income | (906) | | (854) | | | (1,604) | | (1,665) | |

| Net lease cost | $ | 1,018 | | $ | 1,845 | | | $ | 2,619 | | $ | 3,851 | |

(1)Includes short-term lease costs, which were immaterial.

Maturities of our operating lease liabilities as of June 30, 2024 were as follows:

| | | | | | | |

| | | |

| | | |

| | | |

| | | |

Years ending December 31,

(dollars in thousands) | Operating leases | | |

| 2024 - remaining | $ | 3,376 | | | |

| 2025 | 6,258 | | | |

| 2026 | 6,106 | | | |

| 2027 | 6,207 | | | |

| 2028 | 6,101 | | | |

| | | |

| Thereafter | 20,689 | | | |

| Total lease payments | 48,737 | | | |

| Less: Amount representing interest | 7,560 | | | |

| Present value of future payments | $ | 41,177 | | | |

Other commitments

The term loans under the 2024 Credit Facilities require periodic principal payments. The balance of the term loans and any amounts drawn on the revolving credit loans are due upon maturity of the 2024 Credit Facilities in April 2029. The Real Estate Loans also require periodic principal payments and the balance of the Real Estate Loans are due upon maturity in April 2038.

We have contractual obligations for third-party technology used in our solutions and for other services we purchase as part of our normal operations. In certain cases, these arrangements require a minimum annual purchase commitment by us. As of June 30, 2024, the remaining aggregate minimum purchase commitment under these arrangements was approximately $228.0 million through 2029.

Solution and service indemnifications

In the ordinary course of business, we provide certain indemnifications of varying scope to customers against claims of intellectual property infringement made by third parties arising from the use of our solutions or services. We have not identified any losses that might be covered by these indemnifications.

| | | | | | | | |

18 | | Second Quarter 2024 Form 10-Q |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Legal proceedings

We are subject to legal proceedings and claims that arise in the ordinary course of business, as well as certain other non-ordinary course proceedings, claims and investigations, as described below. We make a provision for a loss contingency when it is both probable that a material liability has been incurred and the amount of the loss can be reasonably estimated. If only a range of estimated losses can be determined, we accrue an amount within the range that, in our judgment, reflects the most likely outcome; if none of the estimates within that range is a better estimate than any other amount, we accrue the low end of the range. For proceedings in which an unfavorable outcome is reasonably possible but not probable and an estimate of the loss or range of losses arising from the proceeding can be made, we disclose such an estimate, if material. If such a loss or range of losses is not reasonably estimable, we disclose that fact. We review any such loss contingency provisions at least quarterly and adjust them to reflect the impacts of negotiations, settlements, rulings, advice of legal counsel and other information and events pertaining to a particular case. We recognize insurance recoveries, if any, when they are probable of receipt. All associated costs due to third-party service providers and consultants, including legal fees, are expensed as incurred.

Legal proceedings are inherently unpredictable. However, we believe that we have valid defenses with respect to the legal matters pending or threatened against us and intend to defend ourselves vigorously against all claims asserted. It is possible that our consolidated financial position, results of operations or cash flows could be materially negatively affected in any particular period by an unfavorable resolution of one or more of such legal proceedings.

Security incident

As previously disclosed, we are subject to risks and uncertainties as a result of a ransomware attack against us in May 2020 in which a cybercriminal removed a copy of a subset of data from our self-hosted environment (the "Security Incident"). Based on the nature of the Security Incident, our research and third party (including law enforcement) investigation, we do not believe that any data went beyond the cybercriminal, has been misused, or has been disseminated or otherwise made available publicly. Our investigation into the Security Incident remains ongoing.

As a result of the Security Incident, we are currently subject to certain legal proceedings, claims and investigations, as discussed below, and could be the subject of additional legal proceedings, claims, inquiries and investigations in the future that might result in adverse judgments, settlements, fines, penalties or other resolution. To limit our exposure to losses related to claims against us, including data breaches such as the Security Incident, we maintain $50 million of insurance above a $250 thousand deductible payable by us. As noted below, this coverage reduced our financial exposure related to the Security Incident in prior years.

We recorded expenses and offsetting insurance recoveries related to the Security Incident as follows:

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (dollars in thousands) | 2024 | 2023 | | 2024 | 2023 |

| Gross expense | $ | 1,822 | | $ | 26,777 | | | $ | 12,145 | | $ | 44,560 | |

| Offsetting insurance recoveries | — | | — | | | — | | — | |

| Net expense | $ | 1,822 | | $ | 26,777 | | | $ | 12,145 | | $ | 44,560 | |

The following summarizes our cumulative expenses, insurance recoveries recognized and insurance recoveries paid as of:

| | | | | | | | |

| (dollars in thousands) | June 30,

2024 | December 31,

2023 |

| Cumulative gross expense | $ | 173,576 | | $ | 161,431 | |

| Cumulative offsetting insurance recoveries recognized | (50,000) | | (50,000) | |

| Cumulative net expense | $ | 123,576 | | $ | 111,431 | |

| | |

| Cumulative offsetting insurance recoveries paid | $ | (50,000) | | $ | (50,000) | |

| | | | | | | | |

Second Quarter 2024 Form 10-Q | | 19 |

Blackbaud, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)