DEF 14Afalse000128005800012800582023-01-012023-12-31iso4217:USDxbrli:pure00012800582022-01-012022-12-3100012800582021-01-012021-12-3100012800582020-01-012020-12-310001280058ecd:PeoMemberblkb:EquityAwardsReportedValueMember2023-01-012023-12-310001280058ecd:NonPeoNeoMemberblkb:EquityAwardsReportedValueMember2023-01-012023-12-310001280058blkb:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2023-01-012023-12-310001280058ecd:NonPeoNeoMemberblkb:EquityAwardsGrantedDuringTheYearUnvestedMember2023-01-012023-12-310001280058ecd:PeoMemberblkb:EquityAwardsGrantedDuringTheYearVestedMember2023-01-012023-12-310001280058ecd:NonPeoNeoMemberblkb:EquityAwardsGrantedDuringTheYearVestedMember2023-01-012023-12-310001280058ecd:PeoMemberblkb:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001280058ecd:NonPeoNeoMemberblkb:EquityAwardsGrantedInPriorYearsUnvestedMember2023-01-012023-12-310001280058ecd:PeoMemberblkb:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001280058ecd:NonPeoNeoMemberblkb:EquityAwardsGrantedInPriorYearsVestedMember2023-01-012023-12-310001280058ecd:PeoMemberblkb:EquityAwardsForfeitedDuringTheYearMember2023-01-012023-12-310001280058ecd:NonPeoNeoMemberblkb:EquityAwardsForfeitedDuringTheYearMember2023-01-012023-12-31000128005812023-01-012023-12-31000128005822023-01-012023-12-31000128005832023-01-012023-12-31000128005842023-01-012023-12-31000128005852023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

þ Filed by the Registrant ¨ Filed by a Party other than the Registrant

| | | | | |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Blackbaud, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| þ | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| |

| |

| |

| |

| |

| |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| |

| |

| |

| |

TABLE OF CONTENTS | | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Proposal 5—Adoption of the Amendment to the Company’s Amended and Restated Certificate of Incorporation to Limit the Liability of Certain Officers as Permitted by Delaware Law | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | |

| | LETTER TO STOCKHOLDERS

FROM OUR BOARD OF DIRECTORS |

Dear Blackbaud Stockholders:

As the world's leading cloud software company powering social good, Blackbaud offers its customers a comprehensive solution set combined with domain expertise. As stewards of our Company, we are committed to achieving long-term performance and delivering stockholder value through a strong business model and strategy. The Board of Directors is pleased with the Company’s progress over the past year.

In 2023, Blackbaud:

•Made substantial progress on our five-point operating plan spanning all areas of the business including: 1) Product Innovation and Delivery; 2) Bookings Growth and Acceleration; 3) Transactional Revenue Optimization and Expansion; 4) Modernized Approach to Pricing and Multi-year Contracts; and 5) Keen Attention to Cost Management. This five-point plan drove accelerated revenue growth and greatly increased profitability in 2023;

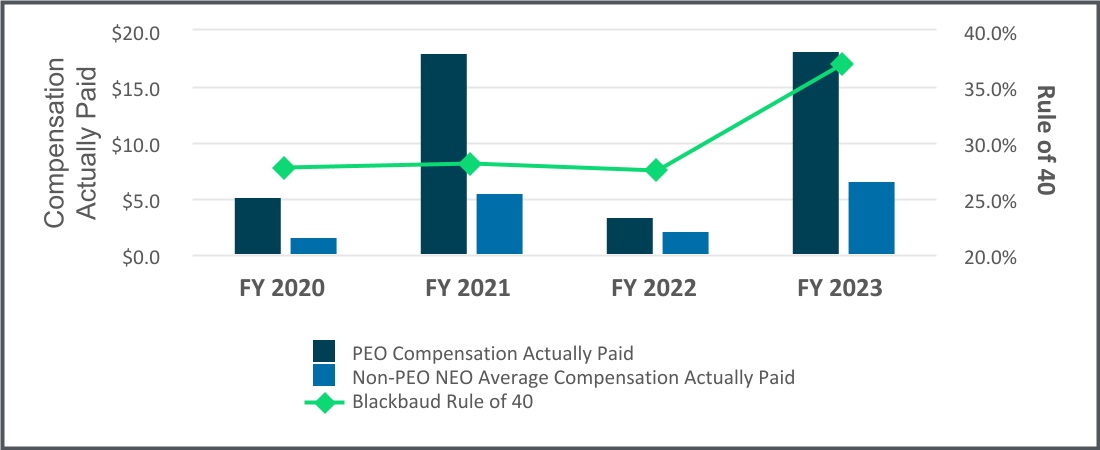

•Achieved Rule of 40 in the third and fourth quarters of 2023, earlier than previously anticipated;

•Reduced our debt to EBITDA ratio from 3.0 in the first quarter of 2023 to 2.0 in the fourth quarter of 2023, enabling the Company to resume returning capital to stockholders in the form of stock repurchases beginning in December 2023. As part of this initiative, Blackbaud increased its stock repurchase authorization to $500 million in January 2024 and intends to repurchase between 7% and 10% of outstanding common stock in 2024;

•Launched a major new wave of Blackbaud’s Intelligence for Good® strategy, with an extensive agenda of initiatives and investments to be implemented on a rolling basis, targeted at making artificial intelligence (AI) more accessible, powerful and responsible across the social impact sector. In 2023 we announced new generative AI capabilities for JustGiving®, the development of Impact Edge™ for our corporate customers, and the release of Prospect Insights Pro for Blackbaud Raiser's Edge NXT®;

•Completed a strategic investment in Momentum, a generative AI startup for social impact, a Blackbaud partner, and a graduate of Blackbaud's Social Good Startup tech accelerator program;

•Appointed Todd Lant as Chief Customer Officer. Lant, a 20-year Blackbaud veteran, leads the global customer success team to drive customer value and outcomes; and

•Surpassed £6 billion ($8.5 billion) in donations on the JustGiving platform (since 2000) .

As we look ahead, we expect our five-point operating plan to drive sustained, high single-digit revenue growth and continued adjusted EBITDA margin expansion. Strong adjusted free cash flow supports our capital allocation plans, with a focus on repurchasing between 7% and 10% of outstanding common stock in 2024. We are confident in the outlook for Blackbaud and we expect to deliver significant, enhanced stockholder value.

We remain committed to continuous and transparent stockholder communication and engagement to better understand your views on the Company's strategy and performance as well as our executive compensation program. In 2023, as we do every year, we reviewed our executive compensation program with our Compensation Committee’s independent compensation consultant, Compensia, Inc., and evaluated our program against our industry peers.

Our compensation decisions, including the continued practice of granting annual equity awards to our executive officers that are at least 50% performance-based, reinforce our strong pay-for-performance compensation philosophy. We are committed to providing competitive, performance-based compensation opportunities to our executive officers, who collectively are responsible for making our Company successful, and we are confident that our compensation program achieves this objective.

We appreciate your investment in Blackbaud and value your input and continued support.

| | | | | | | | |

| The Board of Directors of Blackbaud, Inc. |

| | April 23, 2024 |

| | | | | | | | |

| | NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS |

Virtual Meeting

Wednesday, June 12, 2024 4:00 p.m., Eastern Time

Dear Blackbaud Stockholders:

The 2024 Annual Meeting of Stockholders of Blackbaud, Inc. will be a live virtual meeting held via the Internet at https://www.virtualshareholdermeeting.com/BLKB2024 on Wednesday, June 12, 2024 at 4:00 p.m., Eastern Time, to take action on the following business:

| | | | | |

| 1. | To elect the three Class B directors named in the Proxy Statement, each for a three-year term expiring in 2027; |

| 2. | To hold an advisory vote to approve the 2023 compensation of our named executive officers; |

| |

| 3. | To approve the amendment and restatement of the Blackbaud, Inc. 2016 Equity and Incentive Compensation Plan; |

| 4. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| |

| 5. | To adopt an amendment to the Company’s Amended and Restated Certificate of Incorporation to limit the liability of certain officers as permitted by Delaware Law; and |

| 6. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

These matters are more fully described in the Proxy Statement accompanying this Notice. In particular, the text of the proposed amendment to the Company’s Amended and Restated Certificate of Incorporation is set forth on page 80 of the accompanying Proxy Statement and is incorporated herein by reference. Because the 2024 Annual Meeting of Stockholders will be held via the Internet only, the accompanying proxy materials include instructions on how to attend the meeting and the means by which you may vote and submit questions during the meeting. We are committed to ensuring that our stockholders will be afforded the same rights and opportunities to participate in our virtual meeting as they would at an in-person meeting. Stockholders of record as of the record date will be able to attend the meeting online, vote your shares electronically and submit questions during the virtual meeting. If you were a stockholder of record of Blackbaud common stock as of the close of business on April 15, 2024, you are entitled to receive this Notice and vote at the Annual Meeting of Stockholders and any adjournments or postponements thereof.

You are cordially invited to attend the virtual meeting; however, to assure your representation at the meeting, you are urged to vote by proxy by following the instructions contained in the accompanying Proxy Statement. You may revoke your proxy in the manner described in the Proxy Statement at any time before it has been voted at the meeting. Any stockholder attending the meeting may vote electronically even if he or she has returned a proxy.

Your vote is important. Whether or not you plan to attend the meeting, we hope that you will vote as soon as possible.

| | | | | | | | |

| | |

| By order of the Board of Directors |

| |

| Jon W. Olson |

| Senior Vice President, General Counsel and Corporate Secretary |

| | Dated: April 23, 2024 |

| | | | | | | | |

| | CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

This proxy statement contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. Words such as “believes,” “seeks,” “expects,” “may,” “might,” “should,” “intends,” “could,” “would,” “likely,” “will,” “targets,” “plans,” “anticipates,” “aims,” “projects,” “estimates,” or any variations of such words and similar expressions are intended to identify such forward-looking statements. Actual results may differ from those set forth in the forward-looking statements due to a variety of factors, including those contained in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 and the Company's other filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update or revise any forward-looking statement.

This proxy summary is intended to provide a broad overview of the items that you will find elsewhere in this proxy statement. Because this is only a summary, it does not contain all of the information that you should consider, and you should read the entire proxy statement carefully prior to voting.

| | |

|

| ANNUAL MEETING OF STOCKHOLDERS |

| | | | | | | | | | | |

| TIME AND DATE: | June 12, 2024, 4:00 p.m., Eastern Time |

| | | |

| VIRTUAL MEETING: | The meeting will be held live via the Internet - to attend please visit www.virtualshareholdermeeting.com/BLKB2024 |

| | | |

| RECORD DATE: | April 15, 2024 |

| | | |

| VOTING: | Stockholders as of the record date are entitled to vote. Each share of Blackbaud common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

| Even if you plan to attend the 2024 Annual Meeting of Stockholders, please vote right away using one of the following advance voting methods (see page 82 for additional details). Make sure you have your proxy card or voting instruction form in hand and follow the instructions. |

| Use the Internet | Call Toll-Free | Mail Your Proxy Card |

| | | |

| | | |

| www.proxyvote.com | 1-800-690-6903 | Follow the instructions on

your proxy materials |

| ADMISSION: | Visit www.virtualshareholdermeeting.com/BLKB2024 and enter the 16-digit control number found on your Notice of Annual Meeting of Stockholders or proxy card. |

| |

| MAILING OF NOTICE: | A Notice of Internet Availability of Proxy Materials (or this Proxy Statement and the accompanying materials) are being mailed on or about April 23, 2024 to stockholders as of the record date. |

Virtual Stockholder Meeting

The 2024 Annual Meeting of Stockholders will be held via the Internet only. You will be able to attend the meeting online only if you were a stockholder of record as of the close of business on April 15, 2024, the record date. You also will be able to vote and submit your questions during the meeting. To be admitted to the 2024 Annual Meeting of Stockholders at www.virtualshareholdermeeting.com/BLKB2024, you will need the 16-digit control number included on your proxy card or on the instructions that accompanied your proxy materials. In the event that you do not have a control number, please contact your broker, bank, or other nominee as soon as possible so that you can be provided with a control number.

The meeting webcast will begin promptly at 4:00 p.m. Eastern Time on June 12, 2024. Online access will begin at 3:45 p.m. Eastern Time, and we encourage you to access the meeting prior to the start time.

A complete list of stockholders entitled to vote at the 2024 Annual Meeting of Stockholders will be available at least 10 days prior to the meeting at our principal executive offices at 65 Fairchild Street, Charleston, South Carolina 29492.

Submitting questions at the 2024 Annual Meeting of Stockholders

Stockholders may submit questions during the 2024 Annual Meeting of Stockholders. If you wish to submit a question during the 2024 Annual Meeting of Stockholders, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/BLKB2024, typing your question into the “Ask a Question” field, and clicking “Submit.” As part of the 2024 Annual Meeting of Stockholders, we intend to answer all questions submitted during the meeting which are pertinent to the meeting matters and as time permits in accordance with the Rules of Conduct. The Rules of Conduct will be posted at www.virtualshareholdermeeting.com/BLKB2024 and will address the ability of stockholders to ask questions during the meeting and rules for how questions and comments will be recognized and disclosed to meeting participants.

If you have technical difficulties or trouble accessing the virtual meeting

We will have technicians ready to assist you with any technical difficulties you may have accessing or participating in the virtual meeting. If you encounter any difficulties accessing the virtual meeting or during the meeting time, please call the technical support number that will be posted on the Virtual Stockholder Meeting log in page.

| | |

|

| MEETING AGENDA AND VOTING MATTERS |

| | | | | | | | | | | | | | |

| Proposal | Board's Voting

Recommendation | Voting

Standard | Page Number

(for more details) |

| No. 1 | Election of three Class B directors, each for a three-year term expiring in 2027. | ü FOR (each nominee) | Majority of votes present or represented by proxy and entitled to vote on the proposal | |

| No. 2 | Advisory vote to approve the 2023 compensation of our named executive officers. | ü FOR | Majority of votes present or represented by proxy and entitled to vote on the proposal | |

| | | | |

| No. 3 | Approval of the amendment and restatement of the Blackbaud, Inc. 2016 Equity and Incentive Compensation Plan. | ü FOR | Majority of votes present or represented by proxy and entitled to vote on the proposal | |

| No. 4 | Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. | ü FOR | Majority of votes present or represented by proxy and entitled to vote on the proposal | |

| | | | |

| No. 5 | Adoption of an amendment to the Company’s Amended and Restated Certificate of Incorporation to limit the liability of certain officers as permitted by Delaware Law. | ü FOR | Holders of a majority of the outstanding shares of common stock entitled to vote | |

| | |

|

MEMBERS OF OUR BOARD OF DIRECTORS (pages 13-22) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Age | Director

Since | Class | Current

Term

Expires | Expiration

of Term

For Which

Nominated | Independent | Other

Public

Company

Boards | | | | | Committee Memberships |

Name,

Primary Occupation | | | | | AC | CC | NCGC | ROC |

Deneen M. DeFiore Vice President and Global Chief Information Security Officer of United Airlines, Inc. | 50 | 2022 | B | 2024 | 2027 | Yes | None | | | | | | | | l |

George H. Ellis(1) Chief Financial Officer of Accumen, Inc. | 75 | 2006 | B | 2024 | - | Yes | 1 | | | | | l | | l | |

Michael P. Gianoni Chief Executive Officer, President and Vice Chairman of the Board of Blackbaud, Inc. | 63 | 2014 | C | 2025 | - | No | 1 | | | | | | | | |

Yogesh K. Gupta President and Chief Executive Officer of Progress Software Corporation, Inc. | 63 | 2022 | A | 2026 | - | Yes | 1 | | | | | | l | | |

Rupal S. Hollenbeck President of Check Point Software Technologies, Inc. | 52 | 2022 | A | 2026 | - | Yes | None | | | | | | | l | |

Andrew M. Leitch(2) Chairman of the Board of Blackbaud, Inc., Regional Partner - Asia of Deloitte & Touche LLP (Retired) | 80 | 2004 | B | 2024 | 2027 | Yes | None | | | | | l | l | l | l |

D. Roger Nanney Vice Chairman and Senior Partner of Deloitte LLP (Retired) | 66 | 2021 | C | 2025 | - | Yes | None | | | | | l | | | |

Sarah E. Nash Owner, Chair and CEO of Novagard, Inc. | 70 | 2010 | C | 2025 | - | Yes | 1 | | | | | | l | l | |

Kristian P. Talvitie Executive Vice President and Chief Financial Officer of PTC, Inc. | 54 | 2024 | B | 2024 | 2027 | Yes | None | | | | | l | | | |

l - Committee Chair

AC - Audit Committee

CC - Compensation Committee

NCGC - Nominating and Corporate Governance Committee

ROC - Risk Oversight Committee

(1)Mr. Ellis is not eligible to be nominated as a director at the 2024 Annual Meeting of Stockholders in accordance with the director tenure limits contained in our Corporate Governance Guidelines. Accordingly, his term will end at the conclusion of the 2024 Annual Meeting.

(2)Mr. Leitch is eligible for nomination at the 2024 Annual Stockholders Meeting in accordance with an exception to the director tenure limits contained in our Corporate Governance Guidelines granted by the Board of Directors. For additional information, see page 27. | | |

|

INFORMATION ABOUT OUR BOARD AND COMMITTEES (pages 22-28) |

| | | | | | | | | | | |

| Number of Members | Independence | Number of Meetings During Fiscal Year 2023 |

| Full Board | 9 | 88.9% | 10 |

| Audit Committee | 4 | 100% | 13 |

| Compensation Committee | 3 | 100% | 5 |

| Nominating and Corporate Governance Committee | 4 | 100% | 4 |

| Risk Oversight Committee | 2 | 100% | 4 |

| | | | | | | | | | | |

| Governance Matter | Summary Highlights | Page

Number

(for more

details) |

| Board Independence | ü | Independent Board, except CEO | |

| ü | Independent Board Chairman | |

| ü | 100% Independent Committee Members | |

| ü | Regular Executive Sessions of Independent Directors | |

| ü | Committee Authority to Retain Independent Advisors | |

| Director Elections | ü | Majority Voting | |

| ü | One Share, One Vote Standard | |

| Meeting Attendance | ü | All Current Directors Attended At Least 75% of the Total Number of Meetings of our Board and of all Committees on which the Director Served in 2023 | |

| Evaluating and Improving Board Performance | ü | Annual Board Evaluations | |

| ü | Annual Committee Evaluations | |

| ü | Independent Director Tenure Limits for Regular Board Refreshment | |

| ü | Continuing Director Education | |

| Aligning Director and Stockholder Interests | ü | Director Stock Ownership Guidelines | |

| ü | Annual Director Equity Awards | |

| Aligning Executive Officer and Stockholder Interests | ü | Executive Officer Stock Ownership Guidelines | |

| ü | Executive Compensation Driven by Pay-For-Performance Philosophy | |

| ESG | ü | Board Oversight of Program | |

| ü | Annual Environmental, Social and Governance Report | |

| ü | Employee-Led ESG Steering Committee | |

| ü | Employee-Led Diversity & Inclusion Council | |

| ü | Focus on Board Diversity | |

| ü | Strong Board and Management Commitment | |

| ü | Participant in UN Global Compact | |

| Other | ü | Annual Stockholder Advisory ("Say-on-Pay") Vote | |

| ü | Robust Stockholder Engagement Program | |

| ü | Risk Oversight Committee of the Board | |

| | | |

| ü | Prohibition on Pledging and Hedging of Company Securities | |

| ü | Clawback Policy Applicable to Executive Officers | |

| ü | Equity Plan Prohibits Stock Option Exchanges or Repricing Without Stockholder Approval | |

| | |

|

2023 PERFORMANCE HIGHLIGHTS(1) (page 38) |

| | | | | | | | | | | | | | | | | | | |

Total

Revenue | Recurring

Revenue | Gross Dollar Retention(2)(3) | | | | Non-GAAP Organic Recurring Revenue on a Constant Currency Basis(4) | | | Rule of 40 on a Constant Currency Basis(4) |

| $1,105.4M | 96.9% | 90.1% | | | | $1,072.0M | | | 37.1% |

| (increased 4.5%) | (vs. 95.6%) | (vs. 91.2%) | | | | (increased 6.3%) | | | (vs. 29.0%) |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1)All comparisons are to fiscal year 2022.

(2)See definition of gross dollar retention within our discussion of Long-term Incentive Compensation beginning on page 47. (3)During 2023, our gross dollar retention rate was slightly lower than our rate for the full year ended December 31, 2022 primarily due to the inclusion of EVERFI beginning in 2023. Excluding EVERFI, our gross dollar retention during 2023 was slightly higher than our rate for the full year ended December 31, 2022.

(4)See Appendix A for a reconciliation of non-GAAP financial measures to results reported in accordance with generally accepted accounting principles.

| | |

|

COMPONENTS OF EXECUTIVE COMPENSATION PROGRAM (page 40) |

| | | | | |

| Component | Description |

| Base Salary | Fixed compensation component payable in cash |

| Short-term Incentive ("STI") Compensation | Variable short-term compensation component consisting of performance-based restricted stock units ("PRSUs") based on performance against pre-established short-term performance objectives |

| Long-term Incentive ("LTI") Compensation | Variable long-term compensation component consisting of a combination of 1) time-based restricted stock awards ("RSAs") or restricted stock units ("RSUs"); and 2) at least 50% PRSUs that are based on separate performance metrics than the STI, and for which one half of the PRSU awards are measured over multi-year periods |

“Double-Trigger”

Change in Control

Severance Arrangements | Provide change in control payments and benefits to executive officers only upon a qualifying termination of employment within 12 months of a change in control of our Company |

| Other Benefits | Generally provide the same health and welfare benefits as offered to all of our employees |

| | |

|

2023 EXECUTIVE COMPENSATION ACTIONS (page 39) |

Base Salaries

•Maintained the base salaries of Messrs. Gianoni and Boor at their 2022 levels;

•Increased the base salary of Mr. Benjamin 18.08% from his 2022 level; and

•Increased the base salaries of our remaining named executive officers ("NEO" or "NEOs") 3.25% from their 2022 levels.

STI Compensation

•Provided our NEOs the opportunity to earn annual variable compensation in the form of PRSUs granted in February 2023 (the "2023 STI PRSUs") that were eligible to be earned based on Company financial performance in fiscal 2023. Based on overall Company performance in 2023, determined that 122.3% of the target number of shares of our common stock subject to the 2023 STI PRSUs were earned and would vest in February 2024 subject to each NEO's continued employment as of the vesting date. See the discussion of the 2023 STI PRSU Awards to NEOs beginning on page 45 for more information. LTI Compensation

•Granted our NEOs annual long-term equity awards in February 2023 consisting of 50% RSAs or RSUs and 50% PRSUs (the "2023 LTI PRSUs"). This design is intended to be aligned with competitive market practices, supported our retention objectives and rewarded overall Company performance. Based on overall Company performance in 2023, determined that 98.1% of the target number of shares of our common stock subject to the 2023 LTI PRSUs based on one-year performance and 119.8% of the target number of shares of our common stock subject to the 2023 LTI PRSUs based on the first of three one-year performance periods were earned and would vest in February 2024 subject to each NEO's

continued employment as of the vesting date. See the discussion of the 2023 LTI PRSU Awards to NEOs beginning on page 47 for more information; and •Determined, based on the Company's Rule of 40 performance in 2023, that 200.0% of the shares of our common stock subject to the 2022 LTI Three-year PRSUs based on the second of three one-year performance periods and 200.0% of the shares of our common stock subject to the 2021 LTI Three-year PRSUs based on the third of three one-year performance periods were earned and would vest in February 2024 subject to each NEO's continued employment as of each vesting date.

| | |

|

2023 NEO COMPENSATION SUMMARY (page 55) |

Set forth below is the 2023 compensation for each of our NEOs as determined under SEC rules. This table is not a substitute for the compensation tables, including the Summary Compensation Table, required by the SEC and set forth elsewhere in this proxy statement. See the notes accompanying the 2023 Summary Compensation Table beginning on page 55 for more information. | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | Salary | | Stock

Awards | Option

Awards | Non-Equity

Incentive Plan

Compensation | All Other

Compensation | Total |

Michael P. Gianoni Chief Executive Officer, President and Vice Chairman of the Board | $ | 800,031 | | | $ | 8,778,735 | | $ | — | | $ | — | | $ | 17,957 | | $ | 9,596,722 | |

Anthony W. Boor Executive Vice President and Chief Financial Officer | 518,598 | | | 3,552,224 | | — | | — | | 18,707 | | 4,089,530 | |

David J. Benjamin Executive Vice President and Chief Commercial Officer | 413,312 | | | 2,759,338 | | — | | — | | 735,804 | | 3,908,454 | |

Kevin P. Gregoire Executive Vice President and Chief Operating Officer | 482,307 | | | 3,021,823 | | — | | — | | 12,383 | | 3,516,512 | |

Kevin R. McDearis Executive Vice President and Chief Technology Officer | 463,894 | | | 2,510,811 | | — | | — | | 20,365 | | 2,995,070 | |

| | | | | |

| |

| |

| 65 FAIRCHILD STREET | |

| CHARLESTON, SC 29492 | |

| |

| |

April 23, 2024

The Board of Directors (the "Board" or "Board of Directors") of Blackbaud, Inc. (the "Company") is furnishing you this Proxy Statement to solicit proxies on its behalf to be voted at the 2024 Annual Meeting of Stockholders of Blackbaud, Inc. The meeting will be a live virtual meeting held via the Internet at https://www.virtualshareholdermeeting.com/BLKB2024 on Wednesday, June 12, 2024 at 4:00 p.m. Eastern Time. The proxies also may be voted at any adjournments or postponements of the meeting.

We are first furnishing the proxy materials including the Notice of Annual Meeting of Stockholders, this Proxy Statement, our 2023 Annual Report to Stockholders, including financial statements, and a proxy card for the meeting, by providing access to them via the Internet on April 23, 2024. All properly completed proxies submitted by Internet or telephone and properly executed written proxies that are delivered pursuant to this solicitation will be voted at the meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to completion of voting at the meeting.

Only owners of record and beneficial owners of common stock of the Company as of the close of business on the record date, April 15, 2024, are entitled to notice of, and to vote at, the meeting or at any adjournments or postponements of the meeting. Each owner of record and beneficial owner on the record date is entitled to one vote for each share of common stock held. Stockholders’ votes will be tabulated by persons appointed by the Board to act as inspectors of election for the meeting.

| | | | | | | | |

| | |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 12, 2024. | |

| | |

| The Notice of Annual Meeting of Stockholders, Proxy Statement and 2023 Annual Report to Stockholders, including financial statements, are available at www.proxyvote.com. | |

| | |

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board of Directors consists of nine members and is divided into three classes, the members of which each serve for a staggered three-year term. The term of office of one class of directors expires each year in rotation so that one class is elected at each annual meeting for a full three-year term. Each of our existing Class B directors, Deneen M. DeFiore, Andrew M. Leitch and Kristian P. Talvitie, have been nominated to fill a three-year term expiring in 2027. George H. Ellis is not eligible to be nominated as a director at the 2024 Annual Stockholders Meeting in accordance with the director tenure limits contained in our Corporate Governance Guidelines and accordingly his term will end at the conclusion of the 2024 Annual Meeting. Mr. Leitch is eligible for nomination at the 2024 Annual Stockholders Meeting in accordance with an exception to the director tenure limits contained in our Corporate Governance Guidelines granted by the Board of Directors and as further described in "Board of Directors and Committees — Information Regarding Meetings of the Board and Committees — Board Tenure and Refreshment" on page 27 of this proxy statement. The two other classes of directors, who were elected for terms expiring at the annual meetings in 2025 and 2026, respectively, will continue as directors. If you are a stockholder of record, unless you mark your Proxy Card otherwise, the proxy holders will vote the proxies received by them for the three Class B nominees named above, each of whom is currently a director and each of whom has consented to be named in this Proxy Statement and to serve if elected. In the event that any of the current nominees is unable or declines to serve as a director at the time of the meeting, your proxy will be voted for any nominee designated by the Board of Directors to fill the vacancy. We do not expect that any nominee will be unable or will decline to serve as a director.

If you are a beneficial owner of shares held in street name and you do not provide your broker with voting instructions, your broker may not vote your shares on the election of directors. Therefore, it is important that you vote.

| | | | | | | | | | | |

| | | |

| ü | The Board of Directors unanimously recommends that stockholders vote FOR the three Class B director nominees. | |

| | | |

The voting requirements for this Proposal 1 are described above and under "Additional Information" on page 82 of this Proxy Statement.

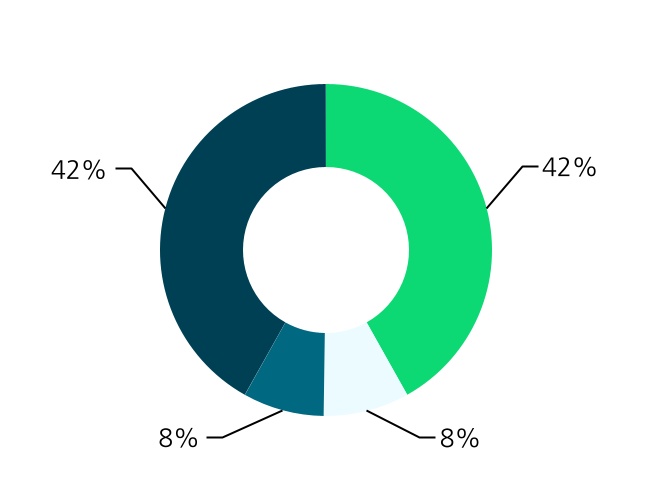

The Board has identified particular qualifications, attributes, skills and experience that are important to be represented on the Board as a whole in light of the Company's current business. The following table highlights the number of our directors who share certain categories of attributes and experiences that uniquely qualify them to serve on our Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Knowledge, Skills and Experience | Deneen M.

DeFiore | George H.

Ellis | Michael P.

Gianoni | Yogesh K.

Gupta | Rupal S.

Hollenbeck | Andrew M.

Leitch | D. Roger

Nanney | Sarah E.

Nash | Kristian P.

Talvitie |

| Leadership | l | l | l | l | l | l | l | l | l |

| Accounting & Finance | | l | | | | l | l | l | l |

| Technology & Software Industries | l | l | l | l | l | l | | l | l |

| Nonprofit Industry | | l | l | l | l | | l | l | |

| Public Company Board Service | | l | l | l | | l | | l | |

| Corporate Governance | l | l | l | l | l | l | l | l | l |

| Business Development & Corporate Transactions | | | l | l | l | l | l | l | l |

| Business Operations | l | | l | l | l | l | l | l | l |

| ESG | | l | l | l | l | | | | |

| Cybersecurity | l | l | | | l | l | | | |

| | |

| Biographies of Our Director Nominees |

The biographies of our directors as of April 15, 2024 are set forth below. There are no family relationships among our directors, director nominees or executive officers. The business address for each of our directors, director nominees and executive officers for matters regarding Blackbaud is 65 Fairchild Street, Charleston, South Carolina 29492.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | DENEEN M. DEFIORE | Age | 50 | Director since July 2022 |

| | | | | | |

| Vice President and Global Chief Information Security Officer of United Airlines, Inc. |

| | | | | | |

| INDEPENDENT DIRECTOR Class B | Current Term Expires 2024 |

| | | | | | | |

| Blackbaud Board Committees Risk Oversight (Chair) | Other Public Boards None |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Ms. DeFiore joined the Board of Directors in July 2022. Ms. DeFiore has served as the Vice President and Global Chief Information Security Officer of United Airlines, Inc., a commercial airline company, since January 2020. Prior to that, she served as Senior Vice President, Global Chief Information & Product Security Officer of GE Aviation, an aerospace company, from February 2017 through December 2019, as Senior Vice President, Global Chief Technology & Risk Officer of GE Aviation from August 2015 to January 2017 and in various leadership roles across GE Corporate, GE Aviation and GE Power from April 2001 through July 2015. Ms. DeFiore is Chair of the Board of the Aviation Information Sharing Analysis Center and Chair of the Airlines for America (A4A) Cybersecurity Committee. In 2022, she was appointed to the President’s National Infrastructure Advisory Council (NIAC), advising the White House on how to reduce physical and cyber risks and improve the security and resilience of the nation’s critical infrastructure sectors. She has received numerous industry awards and honors, including being inducted of CSO Hall of Fame for her work advancing the CSO/CISO role, securing businesses and inspiring others in the industry. Ms. DeFiore holds a BS in Biology from Kent State University.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Ms. DeFiore’s knowledge in cybersecurity, technology and risk management as a senior leader with notable public companies and industry groups led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that she is well qualified to serve as a director of our Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | ANDREW M. LEITCH | Age | 80 | Director since February 2004 |

| | | | | | |

| Chairman of the Board of Blackbaud, Inc., Regional Partner - Asia of Deloitte & Touche LLP (Retired) |

| | | | | | |

| INDEPENDENT DIRECTOR Class B | Current Term Expires 2024 |

| | | | | | | |

| Blackbaud Board Committees Nominating and Corporate Governance (Chair), Audit, Compensation, Risk Oversight | Other Public Boards None |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Mr. Leitch joined the Board of Directors in February 2004 and has served as our Chairman since July 2009. Mr. Leitch was with Deloitte & Touche LLP, an accounting firm, for over 27 years, serving in various senior roles including Regional Partner for Asia. Mr. Leitch has served on the board of directors of STR Holdings, Inc. since November 2009. He served on the board of directors of Gene Biotherapeutics, Inc. from August 2007 through May 2020. Mr. Leitch has also served as director of various private equity portfolio companies, including several in the Hellman & Friedman LLC and JMI Equity portfolios over time, including companies such as Vertafore, Inc. and ServiceNow, Inc., within the software sector. He is a licensed CPA in the State of New York and a Chartered Accountant in Ontario, Canada.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Mr. Leitch’s experience in auditing and accounting, corporate governance, previous board service on various other public companies as well as his leadership as our Board Chairman since July 2009, led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that he is well qualified to serve as a director of our Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | KRISTIAN P. TALVITIE | Age | 54 | Director since January 2024 |

| | | | | | |

| Executive Vice President and Chief Financial Officer of PTC, Inc. |

| | | | | | |

| INDEPENDENT DIRECTOR Class B | Current Term Expires 2024 |

| | | | | | | |

| Blackbaud Board Committees Audit (Chair) | Other Public Boards None |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Mr. Talvitie has served as Executive Vice President and Chief Financial Officer of PTC, Inc., a global industrial and manufacturing software company, since May 2019, and was previously at PTC from 2008 to 2016 in several roles including Corporate Vice President of Finance and Vice President of Investor Relations and Corporate Communications. Before returning to PTC in 2019, he served as Chief Financial Officer of Syncsort, Inc. (currently Precisely Holdings, LLC), a privately held provider of data integrity SaaS services, from October 2018 through April 2019. Prior to that, he served as Chief Financial Officer of Sovos Compliance, LLC, a global provider of tax, compliance and trust solutions and services, from July 2016 through October 2018. He holds an MS in Management from Boston University and a BA in Psychology from Allegheny College.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Mr. Talvitie’s knowledge and experience in leading large organizations in the information technology industry, accounting and finance and business operations led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that he is well qualified to serve as a director of our Company.

| | |

| Biographies of Our Directors Not Up For Re-election At This Meeting |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | MICHAEL P. GIANONI | Age | 63 | Director since January 2014 |

| | | | | | |

| Chief Executive Officer, President and Vice Chairman of the Board of Blackbaud, Inc. |

| | | | | | |

| NON-INDEPENDENT DIRECTOR Class C | Current Term Expires 2025 |

| | | | | | | |

| Blackbaud Board Committees None | Other Public Boards Teradata Corporation |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Mr. Gianoni joined us as Chief Executive Officer and President in January 2014 and was appointed Vice Chairman of the Board in January 2024. Prior to joining us, he served as Executive Vice President and Group President, Financial Institutions at Fiserv, Inc., a global technology provider serving the financial services industry, from January 2010 to December 2013. He joined Fiserv as President of its Investment Services division in December 2007. Mr. Gianoni was Executive Vice President and General Manager of CheckFree Investment Services, which provided investment management solutions to financial services organizations, from June 2006 until December 2007 when CheckFree was acquired by Fiserv. From May 1994 to November 2005, he served as Senior Vice President of DST Systems Inc., a global provider of technology-based service solutions. Mr. Gianoni is a member of the Board of Directors of Teradata Corporation, a publicly traded global big data analytics company, and has been Chairman of the Board since February 2020. Mr. Gianoni has served on several nonprofit boards across several segments, including relief organizations, hospitals and higher education. He currently is a board member of the International African American Museum. He holds an AS in electrical engineering from Waterbury State Technical College, a BS with a business concentration from Charter Oak State College, and an MBA and an honorary Doctorate from the University of New Haven.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Mr. Gianoni's unique knowledge and experience in the technology industry and his experience with nonprofit organizations, as well as his leadership as our CEO and President since January 2014, led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that he is well qualified to serve as a director of our Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | YOGESH K. GUPTA | Age | 63 | Director since December 2022 |

| | | | | | |

| President and Chief Executive Officer of Progress Software Corporation, Inc. |

| | | | | | |

| INDEPENDENT DIRECTOR Class A | Current Term Expires 2026 |

| | | | | | | |

| Blackbaud Board Committees Compensation Committee | Other Public Boards Progress Software Corporation, Inc. |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Mr. Gupta joined the Board of Directors in December 2022. Mr. Gupta has served as the President and Chief Executive Officer of Progress Software Corporation, Inc., a provider of application development and infrastructure software, since October 2016 and is a member of its Board of Directors. He previously served as President and Chief Executive Officer at Kaseya, Inc., a software company providing IT management software solutions to managed service providers, from June 2013 to July 2015. Prior to that, he served as the President and Chief Executive Officer of FatWire Software, Inc. (acquired by Oracle Corporation in 2011), a marketing automation software company, from August 2007 to July 2011. Mr. Gupta co-authored the MassTLC 2030 Challenge – an initiative to drive the doubling of the percentage representation of BIPOC employees in tech companies in Massachusetts by 2030. He also holds a patent in the field of neural networks. Mr. Gupta serves on the boards of Beth Israel Lahey Health System and Massachusetts Technology Leadership Council (MassTLC). He holds a BS in electronics engineering from the Indian Institute of Technology, Madras and an MCS from the University of Wisconsin.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Mr. Gupta's extensive software industry background, commitment to technology for social good and proficiency in innovation and leadership led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that he is well qualified to serve as a director of our Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | RUPAL S. HOLLENBECK | Age | 52 | Director since December 2022 |

| | | | | | |

| President of Check Point Software Technologies, Inc. |

| | | | | | |

| INDEPENDENT DIRECTOR Class A | Current Term Expires 2026 |

| | | | | | | |

| Blackbaud Board Committees Nominating and Corporate Governance | Other Public Boards None |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Ms. Hollenbeck joined the Board of Directors in December 2022. Ms. Hollenbeck is currently President of Check Point Software Technologies, Inc., a provider of cybersecurity solutions to governments and corporate enterprises globally, having joined the company in March 2022. She previously served as a member of Check Point’s Board of Directors from January 2021 to March 2022. She previously served as Vice President and Chief Marketing Officer at Cerebras Systems, Inc., an artificial intelligence hardware start-up in Silicon Valley, from March 2021 to March 2022. Prior to that, Ms. Hollenbeck served as Senior Vice President & Chief Marketing Officer at Oracle Corporation, an American multinational computer technology corporation, from September 2018 to January 2020. Prior to joining Oracle, she was with Intel Corporation for over 23 years and held many senior leadership positions including Corporate Vice President and General Manager of Global Data Center Sales and Vice President and General Manager of Intel China. Ms. Hollenbeck is a founding member of Neythri, a non-profit organization dedicated to the professional advancement of South Asian women and is a founding limited partner in the venture capital firm Neythri Futures Fund. Ms. Hollenbeck is also the industry advisor for the Women in Leadership Program at California State University East Bay. She serves on the Board of Directors of The Asian Pacific Fund, a non-profit organization in Silicon Valley. She holds a BS in Finance and International Studies from Boston College and an MBA in International Management from the Thunderbird School of Global Management at Arizona State University.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Ms. Hollenbeck's expertise in cybersecurity solutions, artificial intelligence hardware and global enterprises, as well as her passion for inclusive organizations and women’s development led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that she is well qualified to serve as a director of our Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | D. ROGER NANNEY | Age | 66 | Director since October 2021 |

| | | | | | |

| Vice Chairman and Senior Partner of Deloitte LLP (Retired) |

| | | | | | |

| INDEPENDENT DIRECTOR Class C | Current Term Expires 2025 |

| | | | | | | |

| Blackbaud Board Committees Audit Committee | Other Public Boards None |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Mr. Nanney joined the Board of Directors in October 2021. Prior to joining us, he was Vice Chairman and Senior Partner of Deloitte LLP, an accounting firm, from June 2018 until his retirement in May 2020. Prior to that, he served as Vice Chairman and US National Managing Partner, Deloitte Private, from June 2012 through May 2018. Mr. Nanney joined Deloitte in August 1982 and served as a partner, including various other senior leadership roles, beginning in June 1990. Mr. Nanney is a member of the board of directors of privately held Freeman Company and serves as advisory board member for Stephen Gould Corporation. He is also a Trustee and Chairman of the University of South Carolina Business Partnership Foundation. Mr. Nanney was a leader in the effort to develop the AT&T Performing Arts Center in Dallas TX, ultimately serving as Board Chair. He was Board Chair and Campaign Chair for United Way of Metropolitan Dallas and United Way of Tampa Bay and served as a board member of the United Way of America. Mr. Nanney holds BS in Business Administration and MACC degrees from the University of South Carolina. He is a CPA, CMA and a member of National Association of Corporate Directors.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Mr. Nanney’s experience in auditing and accounting, corporate governance, and his senior leadership roles and operational experience in large organizations led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that he is well qualified to serve as a director of our Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | SARAH E. NASH | Age | 70 | Director since July 2010 |

| | | | | | |

| Owner, Chair and CEO of Novagard, Inc. |

| | | | | | |

| INDEPENDENT DIRECTOR Class C | Current Term Expires 2025 |

| | | | | | | |

| Blackbaud Board Committees Compensation (Chair), Nominating and Corporate Governance | Other Public Boards Bath & Body Works, Inc. |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Biography

Ms. Nash joined the Board of Directors in July 2010. Since 2018, Ms. Nash has served as Chairman and CEO of Novagard, Inc. and is the owner of this privately held innovator and manufacturer of silicone, hybrid and foam solutions for the building systems, electronics, EV and battery, industrial and transportation markets. She is Chair of the Board of Bath & Body Works (BBWI is a NYSE listed company) where she served as Executive Chair from February 2022 to January 2023 and as the Interim CEO from May 2022 to November 2022. Prior to being appointed Executive Chair, she served as Chair of the Board between May 2020 and February 2022 after having joined the Board in May 2019. Ms. Nash also serves on the board of directors of privately held HBD Industries, Inc. Ms. Nash spent nearly 30 years in investment banking at JPMorgan Chase & Co. (and predecessor companies), a financial services firm, retiring as Vice Chairman in July 2005. Ms. Nash is trustee of the New York-Presbyterian Hospital, Chair of the International Friends Advisory Board of the Montreal Museum of Fine Arts and a board member of the Smithsonian Tropical Research Institute (STRI), Panama. Ms. Nash holds a BA in political science from Vassar College.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Ms. Nash’s knowledge and experience in capital markets, strategic transactions, corporate governance and nonprofit organizations led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that she is well qualified to serve as a director of our Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | GEORGE H. ELLIS | Age | 75 | Director since March 2006 |

| | | | | | |

| Chief Financial Officer of Accumen, Inc. |

| | | | | | |

| INDEPENDENT DIRECTOR Class B | Current Term Expires 2024 |

| | | | | | | |

| Blackbaud Board Committees Audit, Nominating and Corporate Governance | Other Public Boards Liquidity Services, Inc. |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Leadership | Accounting & Finance | Technology & Software Industries | Nonprofit Industry | Public Company Board Service | Corporate Governance | Business Development & Corporate Transactions | Business Operations | ESG | Cybersecurity |

| | | | | | | | | |

Mr. Ellis will be retiring from the Board effective upon the conclusion of the 2024 Annual Meeting. The Company and our Board would like to recognize and thank Mr. Ellis for his many years of dedicated service.

Biography

Mr. Ellis joined the Board of Directors in March 2006. Mr. Ellis has served as the Chief Financial Officer of Accumen Inc., a provider of health system performance optimization solutions, since November 2020. From February 2015 to November 2020, Mr. Ellis was a Managing Director of Huron Consulting Group, Inc., a Nasdaq traded consulting and services company. Prior to that, Mr. Ellis served as the Chief Financial Officer of The Studer Group L.L.C., a private company in the health care industry, from September 2011 to February 2015. From July 2006 to August 2011, Mr. Ellis was Chief Financial Officer of Global 360, Inc., now OpenText Corporation, a private company offering business process management services. Since May 2010, Mr. Ellis has served on the board of Liquidity Services, Inc., formerly as Chairman of its Audit Committee and currently as a member of the Audit and Nominating and Governance Committees. He has also served in several capacities at Softbrands, Inc., as a member of its board of directors from October 2001 to August 2009, serving as Chairman from October 2001 to June 2006, and Chief Executive Officer from October 2001 to January 2006. Mr. Ellis was the Chairman and Chief Executive Officer of AremisSoft Corporation from October 2001 to confirmation of its plan of reorganization under Chapter 11 of the Federal Bankruptcy Code in August 2002. Mr. Ellis, who served as a director of AremisSoft from April 1999 until February 2001, accepted the position at AremisSoft to assist in the reorganization. Mr. Ellis served on the board of directors of PeopleSupport, Inc. from October 2004 to October 2008. Mr. Ellis served as the Chief Operating Officer of the Community Foundation of Texas from August 1999 to July 2001. Mr. Ellis has served on the board of directors and advisory boards of several nonprofit companies in the Dallas area. Mr. Ellis is a licensed CPA and an attorney in the State of Texas. Mr. Ellis is a National Association of Corporate Directors (“NACD”) Board Leadership Fellow. He has demonstrated his commitment to boardroom excellence by completing NACD's comprehensive program of study for corporate directors, earned the NACD certificate for Directors Cyber Security Oversight and supplements his skill set through ongoing engagement with the director community and access to leading practices. Mr. Ellis holds a BS in accounting from Texas Tech University and a JD from Southern Methodist University Dedman School of Law.

Experience, Skills and Qualifications of Particular Relevance to Blackbaud

Among other experience, qualifications, attributes and skills, Mr. Ellis’ knowledge and experience in leading large organizations in the information technology industry, his experience with financial, auditing and legal matters, as well as with nonprofit companies, and his commitment to cybersecurity oversight education led to the conclusion of our Nominating and Corporate Governance Committee, and of our full Board, that he is well qualified to serve as a director of our Company.

BOARD OF DIRECTORS AND COMMITTEES

The Board of Directors currently comprises nine members, namely Chairman Andrew M. Leitch, Vice Chairman Michael P. Gianoni, Deneen M. DeFiore, George H. Ellis, Yogesh K. Gupta, Rupal S. Hollenbeck, D. Roger Nanney, Sarah E. Nash and Kristian P. Talvitie. George H. Ellis will serve as a director until his retirement from the Board on June 12, 2024 in accordance with the tenure limits set forth in the Company's Corporate Governance Guidelines.

We have historically separated the positions of Chairman, currently independent director Andrew M. Leitch, and Chief Executive Officer (“CEO”), currently Michael P. Gianoni. While the Board of Directors believes the separation of these positions has served our Company well, and intends to maintain this separation where appropriate and practicable, the Board does not believe that it is appropriate to prohibit one person from serving as both Chairman and CEO and has recently appointed Mr. Gianoni to serve as Vice Chairman of the Board of Directors. We believe our leadership structure is appropriate given the size of our Company in terms of number of employees. Mr. Leitch’s experience on boards of directors and management skills led to the conclusion of our Nominating and Corporate Governance Committee, and that of our full Board, that he is well qualified to serve as Chairman.

| | |

| Independence of Directors |

The Board of Directors has adopted categorical standards or guidelines to assist it in making independence determinations with respect to each director. These standards are published in Section 1 of our Corporate Governance Guidelines and are available under Corporate Governance in the Company – Investor Relations section of our website at www.blackbaud.com. Each of our directors and executive officers completes an annual questionnaire to confirm that there are no material relationships or related person transactions between such individuals and the Company other than those previously disclosed to Blackbaud and agrees to notify the Company in the event of any changes to that information. Based on its review of a summary of the answers to the questionnaires, the Board has determined that the following eight directors are independent within the meaning of Rule 5605(a)(2) of the Nasdaq Marketplace Rules: Ms. DeFiore, Mr. Ellis, Mr. Gupta, Ms. Hollenbeck, Mr. Leitch, Mr. Nanney, Ms. Nash and Mr. Talvitie. As part of such determination of independence, the Board has affirmatively determined that none of these directors has a relationship with the Company or the Company's management that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors. Mr. Gianoni, our CEO, President and Vice Chairman of the Board, is the only member of management serving as a director.

Each Board committee is composed entirely of independent directors in accordance with Rule 5605(a)(2) of the Nasdaq Marketplace Rules, the Sarbanes-Oxley Act and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”), as applicable. The Board and each committee have the authority to obtain, at the Company's expense, the advice and assistance from independent advisors, experts and others as they may deem necessary, and to the extent they engage any such advisors they consider the independence of such advisors and any conflict of interest that may exist.

Furthermore, our Compensation Committee consists entirely of independent directors in accordance with Nasdaq Marketplace Rule 5605(d)(2)(A). The Board has also determined that each member of the Compensation Committee qualifies as a "non-employee director" under Rule 16b-3 of the Exchange Act.

| | |

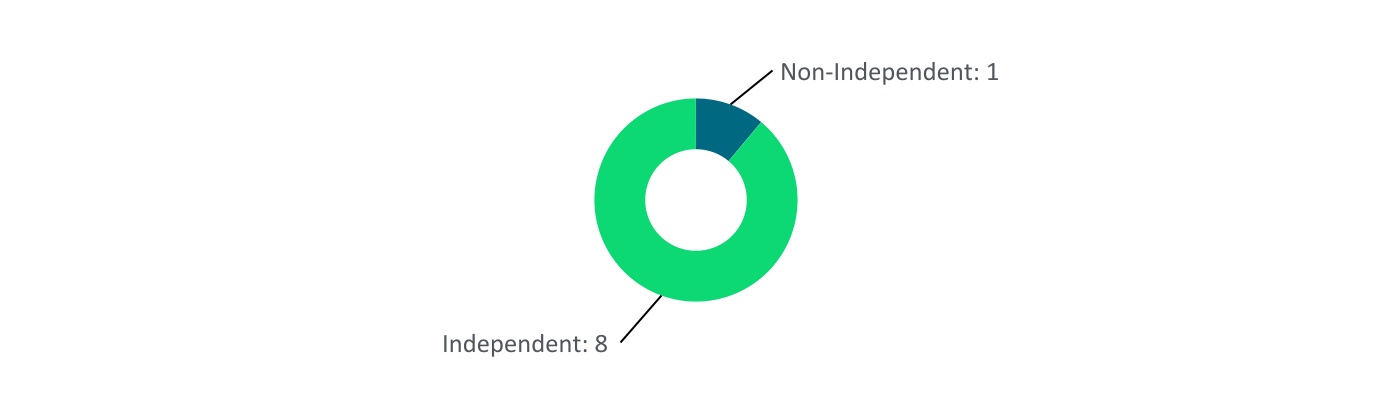

| Director Independence |

| (88.9% Independent) |

| | |

| Corporate Governance Guidelines |

We believe in sound corporate governance practices and have adopted formal Corporate Governance Guidelines to enhance our effectiveness. The Board of Directors adopted these Corporate Governance Guidelines in order to ensure that it has the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The Corporate Governance Guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the Board follows, including, but not limited to, Board and Committee composition and selection, director responsibilities and tenure, director access to executive officers and employees, and CEO performance evaluation and succession planning. A copy of our Corporate Governance Guidelines is available under Corporate Governance in the Company – Investor Relations section of our website at www.blackbaud.com.

| | |

| Code of Business Conduct and Ethics and Code of Ethics |

The Board of Directors has adopted a Code of Business Conduct and Ethics that applies to all of our directors and employees. The Board has also adopted a separate Code of Ethics for our CEO and Senior Financial Officers, including our Chief Financial Officer (“CFO”), who is our principal accounting officer, our Chief Accounting Officer, or persons performing similar functions. We will provide copies of our Code of Business Conduct and Ethics and Code of Ethics without charge upon request. To obtain a copy of our Code of Business Conduct and Ethics or Code of Ethics, please send your written request to Blackbaud, Inc., 65 Fairchild, Charleston, South Carolina 29492, Attn: General Counsel. Our Code of Business Conduct and Ethics and Code of Ethics are also available under Corporate Governance in the Company – Investor Relations section of our website at www.blackbaud.com. We intend to disclose any amendment to or waiver of a provision of the Code of Business Conduct and Ethics or the Code of Ethics by posting such information on our website.

| | |

| Communication with the Board of Directors |

Stockholders who wish to communicate with members of the Board of Directors, including the directors individually or as a group, may send correspondence to them in care of our Corporate Secretary at our principal executive offices. Such communication will be forwarded to the intended recipient(s). We currently do not intend to have our Corporate Secretary screen this correspondence, but we may change this policy if directed by the Board due to the nature or volume of correspondence.

| | |

| Information Regarding Meetings of the Board and Committees |

During 2023, the Board of Directors held ten meetings. Each of our current directors attended at least 75% of the aggregate of all meetings of the Board and of all the committees on which he or she served during 2023.

The Board has established four standing committees. The following table provides membership and meeting information for each of the committees during 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Audit

Committee | Compensation

Committee | | Nominating and

Corporate Governance

Committee | | Risk Oversight

Committee |

Deneen M. DeFiore(1) | | | | | | | | | | | | l |

George H. Ellis(2) | | | l | † | | | | | | l | | |

| Michael P. Gianoni | | | | | | | | | | | | |

| Yogesh K. Gupta | | | | | | | l | | | | | |

| Rupal S. Hollenbeck | | | | | | | | | | l | | |

Andrew M. Leitch(3) | | | l | † | | | l | | | l | | l |

| D. Roger Nanney | | | l | † | | | | | | | | |

| Sarah E. Nash | | | | | | | l | | | l | | |

Kristian P. Talvitie(4) | | | l | † | | | | | | | | |

| 2023 Meetings | | | 13 | | | | 5 | | | 4 | | 4 |

| | | | | | | | |

| l | - | Committee Chair |

| † | - | Audit Committee Financial Expert |

(1)Ms. DeFiore was named Chair of the Risk Oversight Committee effective April 1, 2024.

(2)Mr. Ellis stepped down as Chair of the Audit Committee effective April 1, 2024 and will be retiring from the Board effective upon the conclusion of the 2024 Annual Meeting.

(3)Mr. Leitch stepped down as Chair of the Risk Oversight Committee effective April 1, 2024.

(4)Mr. Talvitie joined the Board of Directors and the Audit Committee effective January 11, 2024, was designated as an Audit Committee Financial expert in March 2024 and was named Chair of the Audit Committee effective April 1, 2024.

Although we do not have a formal written policy with respect to directors’ attendance at our annual meetings of stockholders, we strongly encourage all directors to attend. All directors attended our 2023 Annual Meeting of Stockholders. In addition to the meetings held by the above-referenced committees, the independent non-employee members of the Board of Directors regularly meet in executive session without our CEO or any executive officers present. One purpose of these executive sessions is to evaluate the performance of management.

Each of the above-referenced committees operates pursuant to a formal written charter. The charters for each committee, which have been adopted by the Board of Directors, contain a detailed description of the respective committee’s duties and responsibilities and are available under Corporate Governance in the Company – Investor Relations section of our website at www.blackbaud.com.

| | | | | | | | | | | |

| AUDIT COMMITTEE |

| Committee Members | Primary Responsibilities |

| (all independent) | Pursuant to its charter, the Committee assists the Board in its oversight of: |

| l | the integrity of our financial statements; |

Kristian P. Talvitie† (Chair)(1) George H. Ellis†(2) Andrew M. Leitch† D. Roger Nanney† | l | the performance of our internal audit function; |

| l | the qualifications, independence and performance of our independent registered public accounting firm, for whose appointment the Committee bears primary responsibility; |

| l | the review of our annual audited financial statements and quarterly financial statements; |

| l | the review of our capital management; |

2023 Meetings: 13 | l | the review of our public disclosures related to earnings, guidance, cybersecurity incidents and other matters as appropriate; and |

† Audit Committee Financial Expert |

| l | the review of our compliance with certain financial, regulatory and legal requirements. |

(1)Mr. Talvitie joined the Audit Committee effective January 11, 2024, was designated as an Audit Committee Financial expert in March 2024 and was named Chair of the Audit Committee effective April 1, 2024.

(2)Mr. Ellis stepped down as Chair of the Audit Committee effective April 1, 2024 and will be retiring from the Board effective upon the conclusion of the 2024 Annual Meeting.

Additionally, the Audit Committee regularly coordinates with the Risk Oversight Committee to review and evaluate any matter arising out of the Risk Oversight Committee that could impact financial reporting.

The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act. For more information regarding the duties and operations of the Audit Committee, see “Audit Committee Report” on page 78 of this Proxy Statement. | | | | | | | | | | | |

| COMPENSATION COMMITTEE |

| Committee Members | Primary Responsibilities |

| (all independent) | Pursuant to its charter, the Committee: |

| l | reviews and approves all compensation decisions relating to our executive officers, including approving the compensation decisions for the CEO; |

Sarah E. Nash (Chair)

Yogesh K. Gupta

Andrew M. Leitch

| l | annually reviews and approves the compensation of our non-employee members of the Board of Directors; |

| l | periodically reviews and makes recommendations to the Board of Directors with respect to incentive compensation plans and equity-based plans; |

2023 Meetings: 5 | l | periodically reviews and makes recommendations to the Board of Directors with respect to stock ownership guidelines for the Company's executive officers and non-employee directors; |

| l | administers and amends the Company's various incentive compensation and other similar plans; and |

| l | administers and enforces the Company's executive incentive compensation clawback policy; and |

| l | reviews and assesses on a periodic basis the Company's compliance with laws and regulations relating to compensation and employee benefits, and other human resource matters. |

Compensation Decisions

In evaluating incentive and other compensation and equity-based plans, the Compensation Committee carefully considers the feedback from our stockholders through the results of the most recent non-binding stockholder advisory ("Say-on-Pay") vote on NEO compensation as well as through our communications with stockholders throughout the year and the recommendations of its independent compensation consultant. As part of its review, the Compensation Committee also considers compensation data with respect to the executive officers' counterparts at the companies in our compensation peer group and the recommendations of the CEO regarding compensation for those executive officers reporting directly to him as well as our other officers. See “Compensation Discussion and Analysis” beginning on page 38 of this Proxy Statement.

| | | | | | | | | | | |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| Committee Members | Primary Responsibilities |

| (all independent) | Pursuant to its charter, the Committee has responsibility for: |

| l | identifying individuals qualified to become Board members; |

Andrew M. Leitch (Chair) George H. Ellis(1) Rupal S. Hollenbeck Sarah E. Nash | l | recommending to the Board director nominees for the next Annual Meeting of Stockholders; |

| l | reviewing the qualifications and independence of the members of the Board and its various committees; |

| l | recommending to the Board the Corporate Governance Guidelines and reviewing such Guidelines on a regular basis to ensure compliance with sound corporate governance practices and legal, regulatory and Nasdaq requirements; |

2023 Meetings: 4 | l | leading the Board and its committees in their annual self-evaluation process; |

| l | reviewing our Company’s governance scores and ratings from third parties; and |

| l | overseeing our Company's corporate responsibility and ESG matters, including evaluating the Company's integration of ESG principles into business strategy and decision-making and reviewing reports published by the Company on ESG matters. |

(1)Mr. Ellis will be retiring from the Board effective upon the conclusion of the 2024 Annual Meeting.

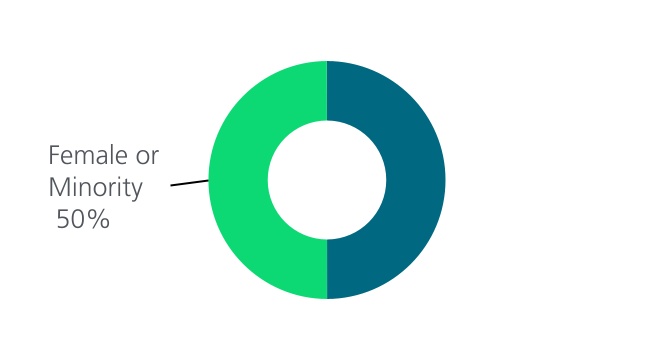

Selection of Nominees for the Board of Directors

The Nominating and Corporate Governance Committee is responsible for establishing the criteria for recommending which directors should stand for re-election to the Board and the selection of new directors to serve on the Board. In addition, the Committee is responsible for establishing the procedures for our stockholders to nominate candidates to the Board. The Committee has not formulated any specific minimum qualifications for director candidates, but has determined certain desirable characteristics, including strength of character, mature judgment, career specialization, relevant technical skills, diversity of race, ethnicity, gender identity, age, cultural background and professional experience, and independence. With the assistance of an independent search firm, the Committee regularly identifies individuals who have expertise that would complement and enhance the current Board’s skills and experience, and is committed to adding any such individuals to the Board when and if the opportunity arises. While it does not have a specific written policy with regard to the consideration of diversity in identifying director nominees, the Committee does consider diversity to be an additional desirable characteristic in potential nominees because the Board believes that a variety of points of view contributes to a more effective decision-making process. This commitment to diversity is part of our Corporate Governance Guidelines, which are available under Corporate Governance in the Company – Investor Relations section of our website at www.blackbaud.com.

Stockholder Nominations of Directors

Our Bylaws permit any stockholder of record to nominate directors. Stockholders wishing to nominate a director must deliver written notice of the nomination to the Corporate Secretary at our principal executive offices and any such notice must comply with the provisions set forth in our Bylaws, including the requirements as to the timing for providing such notice and the information to be included in the notice. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders and will evaluate a nominee recommended by a stockholder in the same manner in which the Committee evaluates nominees recommended by other persons as well as its own nominee recommendations.

CEO and Executive Management Succession Planning

Assuring we have appropriate executive management talent to successfully pursue our strategies is one of the Board's primary responsibilities. To this end, at least annually, the Board discusses succession planning for our CEO and the remainder of our executive management. To help fulfill the Board's responsibility, pursuant to our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee is responsible for ensuring that we have in place appropriate planning to address CEO succession both in the ordinary course of business and in emergency situations. Our CEO provides the Board with recommendations and evaluations of potential successors, along with a review of their development plans when the individuals are internal candidates.

| | |

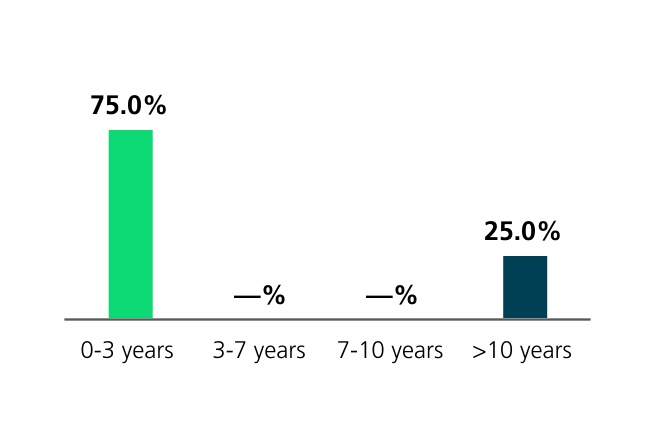

| Board Tenure and Refreshment |

|

We believe that a variety of tenures on our Board helps to provide an effective mix of deep experience and fresh perspective to our boardroom. In December 2023, the Board amended the tenure limits for its independent directors within our Corporate Governance Guidelines, which state that an independent director of the Company will not be nominated for election as a director if he or she has, or will have, served on the Board for twelve years or more as of the date scheduled for his or her next election. Notwithstanding the foregoing, the Nominating and Corporate Governance Committee may recommend to the Board that, based on specific circumstances the director's tenure should be extended beyond twelve years of service. The Board may in such case waive or modify the retirement date if it determines that there is good cause to do so and that such action would be in the best interests of the Company and its stockholders. For example, the Board recently determined that Andrew Leitch's exemplary service and extensive experience as a director of the Company, including as Chairman of the Board, provide valuable benefits to the Board, the Company and our stockholders, particularly in light of significant recent Board refreshment.

Therefore, the Board waived the foregoing tenure limits to allow Mr. Leitch to be nominated for one additional three-year term as a director. If all director nominees are elected at the 2024 Annual Meeting, the average tenure of Blackbaud directors will be 4.8 years after considering the upcoming retirement of Mr. Ellis.

| | |

| Director Tenure |

| (as of April 15, 2024) |

Board Diversity Matrix (as of April 15, 2024)

The following diversity statistics assume that all director nominees will be elected at the 2024 Annual Meeting and reflect the upcoming retirement of Mr. Ellis.

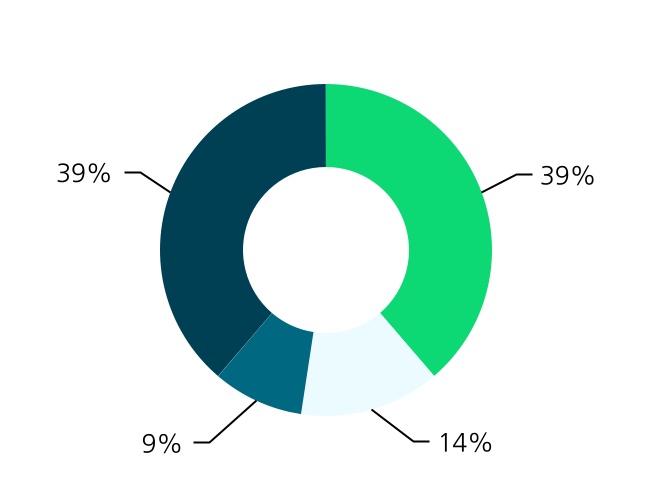

| | | | | | | | | | |