DocumentExhibit 99.1

ANNUAL INFORMATION FORM

2023

February 28, 2024

TABLE OF CONTENTS

| | | | | |

| Page |

| SELECTED TERMS | |

| ABBREVIATIONS | |

| CONVERSIONS AND CONVENTIONS | |

| SPECIAL NOTES TO READER | |

| CORPORATE STRUCTURE | |

| DEVELOPMENT OF OUR BUSINESS | |

| DESCRIPTION OF OUR BUSINESS | |

| PRINCIPAL PROPERTIES | |

| STATEMENT OF RESERVES DATA | |

| RISK FACTORS | |

| INDUSTRY CONDITIONS | |

| DIVIDENDS | |

| DESCRIPTION OF CAPITAL STRUCTURE | |

| RATINGS | |

| MARKET FOR SECURITIES | |

| DIRECTORS AND OFFICERS | |

| AUDIT COMMITTEE INFORMATION | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | |

| INTEREST OF INSIDERS AND OTHER MATERIAL TRANSACTIONS | |

| TRANSFER AGENT AND REGISTRAR | |

| MATERIAL CONTRACTS | |

| INTERESTS OF EXPERTS | |

| ADDITIONAL INFORMATION | |

APPENDICES:

APPENDIX A REPORT OF MANAGEMENT AND DIRECTORS ON OIL AND GAS DISCLOSURE

APPENDIX B REPORT ON RESERVES DATA BY INDEPENDENT QUALIFIED RESERVES EVALUATOR

APPENDIX C AUDIT COMMITTEE MANDATE AND TERMS OF REFERENCE

SELECTED TERMS

Capitalized terms in this document have the meanings set forth below:

Entities

Baytex or the Corporation means Baytex Energy Corp., a corporation incorporated under the ABCA.

Baytex Energy means Baytex Energy Ltd., a corporation amalgamated under the ABCA.

Baytex Partnership means Baytex Energy Limited Partnership, a limited partnership, the partners of which are Baytex Energy and Baytex Energy (LP) Ltd.

Baytex USA means Baytex Energy USA, Inc., a corporation organized under the laws of the State of Delaware.

Board or Board of Directors means the board of directors of Baytex.

CRA means the Canada Revenue Agency.

NYSE means New York Stock Exchange.

OPEC means the Organization of the Petroleum Exporting Countries.

OPEC+ means OPEC plus a number of other oil exporting countries, including Russia.

Ranger means Ranger Oil Corporation.

Ranger Merger means the acquisition of all of the issued and outstanding Class A common stock of Ranger by Baytex by way of merger of Ranger and Ranger Sub.

Ranger Sub means Nebula Merger Sub, LLC, being an indirect wholly owned subsidiary of Baytex.

SEC means the United States Securities and Exchange Commission.

Shareholders mean the holders from time to time of Common Shares.

subsidiary has the meaning ascribed thereto in the Securities Act (Ontario) and, for greater certainty, includes all corporations, partnerships and trusts owned, controlled or directed, directly or indirectly, by us.

TSX means the Toronto Stock Exchange.

we, us and our means Baytex and all its subsidiaries on a consolidated basis unless the context requires otherwise.

Securities and Other Terms

2014 Debt Indenture means the indenture, as amended, among Baytex, as issuer, certain of its subsidiaries, as guarantors, and Computershare Trust Company, N.A., as indenture trustee, dated June 6, 2014, which was terminated and discharged as of June 28, 2022.

2020 Debt Indenture means the indenture among Baytex, as issuer, certain of its subsidiaries, as guarantors, and Computershare Trust Company, N.A., as indenture trustee, dated February 5, 2020.

2023 Debt Indenture means the indenture among Baytex, as issuer, certain of its subsidiaries, as guarantors, and Computershare Trust Company, N.A., as indenture trustee, dated April 27, 2023.

2024 Notes means the 5.625% senior unsecured notes due June 1, 2024 issued by Baytex pursuant to the 2014 Debt Indenture which were redeemed as of June 2, 2022.

2027 Notes means the 8.750% senior unsecured notes due April 1, 2027 issued by Baytex pursuant to the 2020 Debt Indenture.

2030 Notes means the 8.500% senior unsecured notes due April 30, 2030 issued by Baytex pursuant to the 2023 Debt Indenture.

ABCA means the Business Corporations Act (Alberta), R.S.A. 2000, c. B-9, as amended, including the regulations promulgated thereunder.

AIF means this annual information form of the Corporation dated February 28, 2024 for the year ended December 31, 2023.

Baytex Annual 2023 MD&A means Baytex's annual MD&A dated February 28, 2024 for the year ended December 31, 2023.

Canadian GAAP means generally accepted accounting principles in Canada, which are consistent with International Financial Reporting Standards as issued by the International Accounting Standards Board.

Common Shares means the common shares of Baytex.

Credit Facilities means our US$1.1 billion secured covenant-based revolving credit facilities with a syndicate of financial institutions.

CSS means cyclic steam stimulation.

GHG means greenhouse gas.

MD&A means management's discussion and analysis of operating and financial results.

NCIB normal course issuer bid.

Preferred Shares means preferred shares of Baytex.

SAGD means steam-assisted gravity drainage.

Senior Notes means, collectively, the 2027 Notes and the 2030 Notes.

Tax Act means the Income Tax Act (Canada), R.S.C. 1985, c. 1 (5th Supp.), as amended, including the regulations promulgated thereunder, as amended from time to time.

Independent Engineering

Baytex Reserves Report means the report of McDaniel dated February 1, 2024 entitled ‘‘Baytex Energy Corp., Evaluation of Petroleum Reserves, Based on Forecast Prices and Costs, As of December 31, 2023’’.

COGE Handbook means the Canadian Oil and Gas Evaluation Handbook maintained by the Society of Petroleum Evaluation Engineers (Calgary Chapter), as amended from time to time.

McDaniel means McDaniel & Associates Consultants Ltd., independent petroleum consultants.

NI 51-101 means National Instrument 51-101 "Standards of Disclosure for Oil and Gas Activities" of the Canadian Securities Administrators.

Reserves Definitions

Gross means:

(a)in relation to our interest in production and reserves, our interest (operating and non-operating) share before deduction of royalties and without including any of our royalty interests;

(b)in relation to wells, the total number of wells in which we have an interest; and

(c)in relation to properties, the total area of properties in which we have an interest.

Net means:

(a)in relation to our interest in production and reserves, our interest (operating and non-operating) share after deduction of royalty obligations, plus our royalty interest in production or reserves;

(b)in relation to wells, the number of wells obtained by aggregating our working interest in each of our gross wells; and

(c)in relation to our interest in a property, the total area in which we have an interest multiplied by our working interest.

Forecast Prices and Costs are prices and costs that are:

(a)generally acceptable as being a reasonable outlook of the future; and

(b)if, and only to the extent that, there are fixed or presently determinable future prices or costs to which Baytex is legally bound by a contractual or other obligation to supply a physical product, including those for an extension period of a contract that is likely to be extended, those prices or costs rather than the prices and costs referred to in paragraph (a).

Reserves and Reserve Categories

Reserves are estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on:

(a)analysis of drilling, geological, geophysical and engineering data;

(b)the use of established technology; and

(c)specified economic conditions, which are generally accepted as being reasonable (being the Forecast Prices and Costs used in the estimate).

Proved reserves are those reserves that can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves.

Probable reserves are those additional reserves that are less certain to be recovered than proved reserves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated proved plus probable reserves.

The qualitative certainty levels referred to in the definitions above are applicable to individual reserves entities (which refers to the lowest level at which reserves calculations are performed) and to reported reserves (which refers to the highest level sum of individual entity estimates for which reserves are presented). Reported reserves should target the following levels of certainty under a specific set of economic conditions:

(a)at least a 90 percent probability that the quantities actually recovered will equal or exceed the estimated proved reserves; and

(b)at least a 50 percent probability that the quantities actually recovered will equal or exceed the sum of the estimated proved plus probable reserves.

A qualitative measure of the certainty levels pertaining to estimates prepared for the various reserves categories is desirable to provide a clearer understanding of the associated risks and uncertainties. However, the majority of reserves estimates will be prepared using deterministic methods that do not provide a mathematically derived quantitative measure of probability. In principle, there should be no difference between estimates prepared using probabilistic or deterministic methods.

Development and Production Status

Each of the reserves categories (proved and probable) may be divided into developed and undeveloped categories:

(a)Developed reserves are those reserves that are expected to be recovered from existing wells and installed facilities or, if facilities have not been installed, that would involve a low expenditure (for example, when compared to the cost of drilling a well) to put the reserves on production. The developed category may be subdivided into the following categories:

i.Developed producing reserves are those reserves that are expected to be recovered from completion intervals open at the time of the estimate. These reserves may be currently producing or, if shut-in, they must have previously been on production, and the date of resumption of production must be known with reasonable certainty.

ii.Developed non-producing reserves are those reserves that either have not been on production, or have previously been on production, but are shut-in, and the date of resumption of production is unknown.

(b)Undeveloped reserves are those reserves expected to be recovered from known accumulations where a significant expenditure (for example, when compared to the cost of drilling a well) is required to render them capable of production. They must fully meet the requirements of the reserves classification (proved or probable) to which they are assigned.

ABBREVIATIONS

| | | | | | | | | | | | | | |

| Oil and Natural Gas Liquids | | Natural Gas |

| | | | |

| bbl | barrel | | Mcf | thousand cubic feet |

| Mbbl | thousand barrels | | MMcf | million cubic feet |

| MMbbl | million barrels | | Bcf | billion cubic feet |

| NGL | natural gas liquids | | Mcf/d | thousand cubic feet per day |

| bbl/d | barrels per day | | MMcf/d | million cubic feet per day |

| | | m3 | cubic metres |

| | | MMbtu | million British Thermal Units |

| | | | |

| | | | | | | | | | | | | | |

Other | |

| API | the measure of the density or gravity of liquid petroleum products as compared to water |

| BOE or boe | barrel of oil equivalent, using the conversion factor of six Mcf of natural gas being equivalent to one bbl of oil. BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

| boe/d | barrels of oil equivalent per day | | MEH | Magellan East Houston |

| Mboe | thousand barrels of oil equivalent | | MSW | Mixed Sweet Blend |

| MMboe | million barrels of oil equivalent | | WTI | West Texas Intermediate |

| NYMEX | the New York Mercantile Exchange | | WCS | Western Canadian Select |

| AECO | the natural gas storage facility located at Suffield, Alberta | | $ Million | millions of dollars |

| $000s | thousands of dollars |

CONVERSIONS AND CONVENTIONS

The following table sets forth certain conversions between Standard Imperial Units and the International System of Units (or metric units).

| | | | | | | | |

| To Convert From | To | Multiply By |

| | |

| Mcf | Cubic metres | 28.174 |

| Cubic metres | Cubic feet | 35.494 |

| Bbl | Cubic metres | 0.159 |

| Cubic metres | Bbl | 6.293 |

| Feet | Metres | 0.305 |

| Metres | Feet | 3.281 |

| Miles | Kilometres | 1.609 |

| Kilometres | Miles | 0.621 |

| Acres | Hectares | 0.400 |

| Hectares | Acres | 2.500 |

Certain terms used herein are defined in NI 51-101 and, unless the context otherwise requires, shall have the same meanings in this AIF as in NI 51-101. Unless otherwise indicated, references in this AIF to "$" or "dollars" are to Canadian dollars and references to "US$" are to United States dollars. All financial information contained in this AIF has been presented in Canadian dollars in accordance with Canadian GAAP. All operational information contained in this AIF relates to our consolidated operations unless the context otherwise requires.

SPECIAL NOTES TO READER

Forward-Looking Statements

In the interest of providing our Shareholders and potential investors with information about us, including management's assessment of our future plans and operations, certain statements in this AIF are "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking statements"). In some cases, forward-looking statements can be identified by terminology such as "anticipate", "believe", "continue", "could", "estimate", "expect", "forecast", "intend", "may", "objective", "ongoing", "outlook", "potential", "project", "plan", "should", "target", "would", "will" or similar words suggesting future outcomes, events or performance. The forward-looking statements contained in this AIF speak only as of the date hereof and are expressly qualified by this cautionary statement.

Specifically, this AIF contains forward-looking statements relating to, but not limited to: our business strategies, plans and objectives; our 2024 guidance for exploration and development expenditures and production; our five-year outlook including expected production, production growth and annual capital spending; our intentions to continue allocating our annual free cash flow(1) to shareholder returns through share buybacks and debt reduction; our dividend policy and our intentions to continue paying dividends on a consistent basis and the timing thereof; our goal of building value by developing our assets and completing selective acquisitions; our belief that our asset base is somewhat unique; our commitment to restoring our 2020 end-of-life well inventory to zero and the anticipated timing thereof; our ability to mitigate and adapt to changes in oil and gas prices; that we are competitive with similarly situated companies; that we do not expect to be materially affected by the renegotiation or termination of contracts in 2024; development plans for our properties; the expected benefits and continued performance of our increased Eagle Ford scale as a result of the Merger; undeveloped lease expiries; when we expect to pay material income taxes; our working interest production volume for 2024 based on the future net revenue disclosed in our reserves; our risk management policy's ability to manage our exposure to fluctuations in commodity prices, foreign exchange and interest rates; that we market our production with attention to maximizing value and counterparty performance; the development plans for our undeveloped reserves; our future abandonment and reclamation liabilities; our funding sources for development capital expenditures and our expectations that interest or other funding costs would not make development of any of our properties uneconomic; the impact of existing and proposed governmental and environmental regulation; our assessment of our tax filing position for the years 2011 through 2015; our expectations regarding the timing of receiving a judgement with respect to our notices of appeal with the Tax Court of Canada; and our expectations regarding timing should we be unsuccessful at the Tax of Court of Canada with respect to the aforementioned notices of appeal.

In addition, there are forward-looking statements in this AIF under the headings "General Description of Our Business" and "Statement of Reserves Data" as to our reserves, including with respect thereto, the future net revenues from our reserves, pricing and inflation rates, future development costs, the development of our proved undeveloped reserves and probable undeveloped reserves, future development costs, reclamation and abandonment obligations, tax horizon, exploration and development activities and production estimates.

These forward-looking statements are based on certain key assumptions regarding, among other things: oil and natural gas prices and differentials between light, medium and heavy crude oil prices; well production rates and reserve volumes; our ability to add production and reserves through our exploration and development activities; capital expenditure levels; our ability to borrow under our credit agreements; the receipt, in a timely manner, of regulatory and other required approvals for our operating activities; the availability and cost of labour and other industry services; interest and foreign exchange rates; the continuance of existing and, in certain circumstances, proposed tax and royalty regimes; our ability to develop our crude oil and natural gas properties in the manner currently contemplated; that we will have sufficient financial resources in the future to provide shareholder returns; and current industry conditions, laws and regulations continuing in effect (or, where changes are proposed, such changes being adopted as anticipated). Readers are cautioned that such assumptions, although considered reasonable by Baytex at the time of preparation, may prove to be incorrect.

Actual results achieved will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. Such factors include, but are not limited to: the risk of an extended period of low oil and natural gas prices; risks associated with our ability to develop our properties and add reserves; that we may not achieve the expected benefits of acquisitions and we may sell assets below their carrying value; the availability and cost of capital or borrowing; restrictions or costs imposed by climate change initiatives and the physical risks of climate change; the impact of an energy transition on demand for petroleum productions; availability and cost of gathering, processing and pipeline systems; retaining or replacing our leadership and key personnel; changes in income tax or other laws or government incentive programs; risks associated with large projects; risks associated with higher a higher concentration of activity and tighter drilling spacing; costs to develop and operate our properties; current or future controls, legislation or regulations; restrictions on or access to water or other fluids; public

perception and its influence on the regulatory regime; new regulations on hydraulic fracturing; regulations regarding the disposal of fluids; risks associated with our hedging activities; variations in interest rates and foreign exchange rates; uncertainties associated with estimating oil and natural gas reserves; our inability to fully insure against all risks; risks associated with a third-party operating our Eagle Ford properties; additional risks associated with our thermal heavy crude oil projects; our ability to compete with other organizations in the oil and gas industry; risks associated with our use of information technology systems; adverse results of litigation; that our Credit Facilities may not provide sufficient liquidity or may not be renewed; failure to comply with the covenants in our debt agreements; risks associated with expansion into new activities; the impact of Indigenous claims; risks of counterparty default; impact of geopolitical risk and conflicts; loss of foreign private issuer status; conflicts of interest between the Corporation and its directors and officers; variability of share buybacks and dividends; risks associated with the ownership of our securities, including changes in market-based factors; risks for United States and other non-resident shareholders, including the ability to enforce civil remedies, differing practices for reporting reserves and production, additional taxation applicable to non-residents and foreign exchange risk; and other factors, many of which are beyond our control. Readers are cautioned that the foregoing list of risk factors is not exhaustive. New risk factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Readers should also carefully consider the matters discussed under the heading "Risk Factors" in this AIF.

The above summary of assumptions and risks related to forward-looking statements in this AIF has been provided in order to provide Shareholders and potential investors with a more complete perspective on our current and future operations and such information may not be appropriate for other purposes. There is no representation by us that actual results achieved will be the same in whole or in part as those referenced in the forward-looking statements and we do not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities law. The forward-looking statements contained in this AIF are expressly qualified by this cautionary statement.

The Corporation's future shareholder distributions, including but not limited to the payment of dividends and the future acquisition by the Corporation of Common Shares pursuant to a share buyback (including through its NCIB), if any, and the level thereof is uncertain. Any decision to pay dividends on the Common Shares (including the actual amount, the declaration date, the record date and the payment date in connection therewith) or acquire Common Shares pursuant to a share buyback will be subject to the discretion of the Board and may depend on a variety of factors, including, without limitation, the Corporation's business performance, financial condition, financial requirements, growth plans, expected capital requirements and other conditions existing at such future time including, without limitation, contractual restrictions (including covenants contained in the agreements governing any indebtedness that the Corporation has incurred or may incur in the future, including the terms of the Credit Facilities) and satisfaction of the solvency tests imposed on the Corporation under applicable corporate law. There can be no assurance of the number of Common Shares that the Corporation will acquire pursuant to a share buyback, if any, in the future. Further, the payment of dividends to shareholders is not assured or guaranteed and dividends may be reduced or suspended entirely.

This AIF contains information that may be considered a financial outlook under applicable securities laws about the Corporation's potential financial position, including, but not limited to, our 2024 guidance for development expenditures; our five-year outlook including our expected annual capital spending; our intentions of continuing to allocate our annual free cash flow(1) to shareholder returns through a share buyback and debt reduction; our intentions to continue paying dividends; and when we expect to pay material income taxes, all of which are subject to numerous assumptions, risk factors, limitations and qualifications, including those set forth in the above paragraphs. The actual results of operations of the Corporation and the resulting financial results will vary from the amounts set forth in this AIF and such variations may be material. This information has been provided for illustration only and with respect to

future periods are based on budgets and forecasts that are speculative and are subject to a variety of contingencies and may not be appropriate for other purposes. Accordingly, these estimates are not to be relied upon as indicative of future results. Except as required by applicable securities laws, the Corporation undertakes no obligation to update such financial outlook, whether as a result of new information, future events or otherwise. The financial outlook contained in this AIF was made as of the date of this AIF and was provided for the purpose of providing further information about the Corporation's potential future business operations. Readers are cautioned that the financial outlook contained in this AIF is not conclusive and is subject to change.

(1)Specified financial measure that does not have any standardized meaning prescribed by IFRS and may not be comparable with the calculation of similar measures presented by other entities. See "Specified Financial Measures" in the Baytex Annual 2023 MD&A for information related to this measure, which section has been incorporated by reference herein. The Baytex Annual 2023 MD&A are available on SEDAR+ at www.sedarplus.com.

New York Stock Exchange

As a Canadian corporation listed on the NYSE, we are not required to comply with most of the NYSE's corporate governance standards and, instead, may comply with Canadian corporate governance practices. We are, however, required to disclose the significant differences between our corporate governance practices and the requirements applicable to U.S. domestic companies listed on the NYSE. Except as summarized on our website at www.baytexenergy.com, we are in compliance with the NYSE corporate governance standards.

Foreign Private Issuer Status

The Corporation continues to qualify as a foreign private issuer for the purposes of its U.S. securities filings based on the most recent assessment performed as at June 30, 2023. The Corporation is required to reassess this conclusion annually, at the end of the second quarter. See "Risk Factors – The Corporation could lose its status as a "foreign private issuer" in the United States, which may result in additional compliance costs and restricted access to capital markets.

Access to Documents

Any document referred to in this AIF and described as being accessible on the SEDAR+ website at www.sedarplus.com or on EDGAR at www.sec.gov (including those documents referred to as being incorporated by reference in this AIF) may be obtained free of charge from us at Suite 2800, Centennial Place, East Tower, 520 - 3rd Avenue S.W., Calgary, Alberta, Canada, T2P 0R3.

CORPORATE STRUCTURE

General

Baytex Energy Corp. was incorporated on October 22, 2010 pursuant to the provisions of the ABCA. Baytex is the successor to the business of Baytex Energy Trust, which was transitioned to Baytex on December 31, 2010.

Our head and principal office is located at Suite 2800, Centennial Place, East Tower, 520 – 3rd Avenue S.W., Calgary, Alberta, Canada, T2P 0R3. Our registered office is located at 2400, 525 – 8th Avenue S.W., Calgary, Alberta, Canada, T2P 1G1. The Common Shares are currently traded on the TSX and the NYSE under the symbol "BTE".

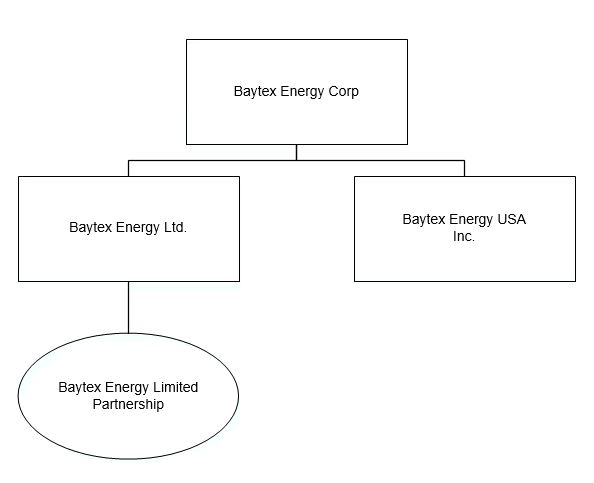

Inter-Corporate Relationships

The following table provides the name, the percentage of voting securities owned by us and the jurisdiction of incorporation, continuance, formation or organization of our material subsidiaries either, direct or indirect, as at the date hereof.

| | | | | | | | | | | |

| Percentage of voting securities

(directly or indirectly) | | Jurisdiction of Incorporation/

Formation |

| Baytex Energy Ltd. | 100% | | Alberta |

| Baytex Energy USA, Inc. | 100% | | Delaware |

| Baytex Energy Limited Partnership | 100% | | Alberta |

Our Organizational Structure

The following simplified diagram shows the inter-corporate relationships among us and our material subsidiaries as of the date hereof.

DEVELOPMENT OF OUR BUSINESS

Developments in the Past Three Years

2021

2021 saw significant improvement in commodity markets. Demand for oil and gas recovered from the impacts of the Covid-19 pandemic and supply increases were limited as a result of the agreement between OPEC+ to limit production and the capital discipline of North American shale producers who did not pursue significant production growth. The price for WTI averaged US$67.92/bbl for the year.

In April of 2021 we announced an exciting exploration discovery in the Clearwater oil play in Peace River along with a five-year outlook (2021-2025) that highlights our financial and operational sustainability and meaningful free cash flow generation capability. As a result of improved commodity prices and the additional activity at our Clearwater discovery, both our annual production guidance and capital budget

were increased. Production for the year averaged 80,156 boe/d, which was comprised of 15,710 bbl/d of light and medium crude oil, 20,449 bbl/d of heavy crude oil, 1,739 bbl/d of bitumen, 15,291 bbl/d of tight oil, 12,032 bbl/d of NGL, 40,051 mcf/d of shale gas and 49,555 mcf/d of conventional natural gas, and exploration and development expenditures were $313 million. During the year our net debt(1) was reduced by $438 million to $1.4 billion and in connection with this debt reduction we repurchased and early redeemed US$200 million principal amount of 2024 Notes.

On December 1, 2021 we announced our anticipated 2022 exploration and development expenditures range of $400-450 million designed to generate average annual production of 80,000-83,000 boe/d. We also announced an update to our five-year outlook that optimizes production in the 85,000 to 90,000 boe/d range and generates annual production growth of 2% to 4% with annual capital spending of $400 to $475 million from 2022 to 2025.

2022

Commodity prices were strong throughout the year, they increased during the first half of the year due to uncertainty surrounding global energy security and then retreated as a result of concerns over high inflation and slowing economic activity. The price for WTI averaged US$94.23/bbl for the year.

In February 2022, as a result of Baytex's significantly improved financial position, we announced an intent to allocate approximately 25% of annual free cash flow(2) to direct shareholder returns through a share buyback with the remainder of free cash flow continuing to be allocated to debt reduction.

On April 1, 2022 we amended our Credit Facilities to, among other things, extend the term by two years to April 2026 and increase the aggregate principal amount available thereunder to US$850 million.

On May 2, 2022 we announced the approval of an NCIB allowing us to purchase up to 56,300,143 Common Shares during the 12-month period commencing May 9, 2022 and ending May 8, 2023. During the year ended December 31, 2022 we repurchased 24.3 million Common Shares at an average price of $6.54 per Common Share. In connection with the NCIB, we entered into entered into an automatic share purchase plan with RBC Dominion Securities Inc. ("RBC") allowing RBC to purchase Common Shares under the NCIB when the Corporation would ordinarily not be permitted to purchase Common Shares due to regulatory restrictions and customary self-imposed blackout periods.

On June 1, 2022 we redeemed and canceled our remaining US$200 million of 2024 Notes. During the year we also made open market repurchases of US$90 million of 2027 Notes.

Effective November 4, 2022 the Board of Directors appointed Mr. Eric Greager to the position of President and Chief Executive Officer and as a Director, replacing Mr. LaFehr. Mr. LaFehr concurrently resigned as a Director, but remained as an advisor to the Board and to the President and Chief Executive Officer until February of 2023.

On November 17, 2022 we announced that Mr. Chad Kalmakoff was promoted to Chief Financial Officer of the Corporation from his previous position of Vice President, Finance, replacing Mr. Rodney Gray. Mr. Rodney Gray concurrently resigned as Executive Vice President and Chief Financial Officer.

On December 7, 2022 we announced our anticipated 2023 exploration and development expenditures range of $575-650 million designed to generate average annual production of 86,000-89,000 boe/d. We also announced that once the Corporation's net debt(1) decreased to $800 million we would increase direct shareholder returns to 50% of free cash flow(2) and an ultimate debt target.

2023

Oil prices were lower in 2023 as a result of global supply growth which resulted in a more balanced crude market relative to 2022 when prices were elevated as the global supply shortfall was exacerbated by uncertainty related to Russian supply. The price for WTI averaged US$77.62/bbl for the year.

On February 8, 2023 the Board of Directors appointed Ms. Angela S. Lekatsas as a Director and announced that Mr. Gregory Melchin did not intend to stand for election at the next annual meeting of shareholders.

On February 23, 2023 the Common Shares commenced trading on the NYSE.

On February 28, 2023 Baytex announced its intention to acquire Ranger by way of the Merger. The Merger was completed on June 20, 2023 pursuant to the agreement and plan of merger dated February 27, 2023, as amended from time to time, between Baytex, Ranger and Ranger Sub. As consideration under the Merger, Baytex issued approximately 311.4 million Common Shares and paid $732.8 million in cash to the former security holders of Ranger. Additionally, Baytex assumed CAD $1.1 billion of Ranger's net debt(1). The cash portion of the Merger was funded with the Corporation's expanded US$1.1 billion revolving Credit Facility, a US$150 million two-year term loan facility and the net proceeds from the issuance of US$800 million 2030 Notes. The term loan facility was fully repaid and cancelled in August of 2023.

The Merger increased our Eagle Ford scale and provided an operating platform to effectively allocate capital across the Western Canadian Sedimentary Basin and the Eagle Ford. Production from the Ranger assets is approximately 80% weighted towards high netback light oil and liquids.

In conjunction with closing of the Merger, we increased direct shareholder returns to 50% of free cash flow(2), which allowed us to increase the value of our share buyback program and introduce a dividend. The remainder of our free cash flow(2) was allocated to debt reduction. On June 23, 2023 we announced the renewal of our NCIB allowing us to purchase up to 68,417,028 Common Shares during the 12-month period commencing June 29, 2023 and ending June 28, 2024. In 2023, we returned approximately $260 million to shareholders through our share buyback program and dividends. As at December 31, 2023, we had repurchased 40.5 million Common Shares under the NCIB for approximately $222 million, representing 4.7% of our issued and outstanding Common Shares, at an average price of $5.48 per Common Share. In addition, during 2023, we declared two quarterly dividends of $0.0225 per Common Share, totaling approximately $38 million.

On closing of the Merger, Jeffrey E. Wojahn and Tiffany ("T.J.") Thom Cepak were appointed to the Board of Directors, providing continuity and experience with the Ranger business and expertise in U.S. regulatory and operating matters.

On November 27, 2023, we announced that we had entered into a definitive agreement to sell certain of our Viking assets located at Forgan and Plato in southwest Saskatchewan (the "Sold Viking Assets"), effective October 1, 2023. On December 11, 2023, we completed the divestiture of the Sold Viking Assets for proceeds of $159.7 million, including closing adjustments. Proceeds from the sale were applied against our Credit Facilities. Production from the Sold Viking Assets at the time of the sale was approximately 4,000 boe/d (100% light and medium crude oil).

(1)Capital management measure. See "Specified Financial Measures" in the Baytex Annual 2023 MD&A for information related to this measure, which section has been incorporated by reference herein. The Baytex Annual 2023 MD&A is available on SEDAR+ at www.sedarplus.com.

(2)Specified financial measure that does not have any standardized meaning prescribed by International Financial Reporting Standards ("IFRS") and may not be comparable with the calculation of similar measures presented by other entities. See "Specified Financial Measures" in the Baytex Annual 2023 MD&A for information related to this measure, which section has been incorporated by reference herein. The Baytex Annual 2023 MD&A is available on SEDAR+ at www.sedarplus.com.

On December 6, 2023 we announced our anticipated 2024 exploration and development expenditures range of $1.2 to $1.3 billion, which is designed to generate average annual production of 150,000-156,000 boe/d.

Significant Acquisitions

The only significant acquisition completed by the Corporation in the year ended December 31, 2023 was the Merger. See "Development of our Business – Developments in the Past Three Years – 2023" above for a summary of the Merger. On June 27, 2023, the Corporation filed a Form 51-102F4 – Business Acquisition Report in respect of the Merger, which is available on SEDAR+ at www.sedarplus.com.

DESCRIPTION OF OUR BUSINESS

Overview

We are engaged in the acquisition, development and production of crude oil and natural gas in the Western Canadian Sedimentary Basin and the Eagle Ford in the United States. Approximately 85% of our production is weighted toward crude oil and NGLs. The Corporation and its predecessors have been in business for more than 30 years and our operating teams are well established with a track record of technical proficiency and operational success. Throughout our history we have endeavoured to add value by developing our assets and completing selective acquisitions and divestitures.

Competitive Conditions

Baytex is in the oil and natural gas industry, which is highly competitive and capital intensive, and many competitors have financial resources which exceed our own. Baytex competes with other companies for all of its business inputs, including development prospects, access to commodity markets, acquisition opportunities, available capital and staffing. Our asset base is somewhat unique in that we have significant oil and gas assets in both Canada and the United States; however, on the whole, our competitive position is similar to that of other oil and natural gas producers of a similar size and production profile. See Industry Conditions and Risk Factors.

Environmental and Social Policies

We have an active program to monitor and comply with all environmental laws, rules and regulations applicable to our operations. Our policies require that all employees and contractors report all breaches or potential breaches of environmental laws, rules and regulations to our senior management and all applicable governmental authorities. Any material breaches of environmental law, rules and regulations must be reported to the Board of Directors. Our Health, Safety and Environment Policy is available on our website at www.baytexenergy.com.

In recognition of the importance of our Health, Safety and Environment Policy and targets, including our GHG reduction target, the mandate for the reserves and sustainability committee of the Board of Directors has been given specific responsibility for the "oversight and monitoring of the Corporation’s performance related to health, safety, environment, climate and other sustainability matters."

We have published a Corporate Responsibility Report since 2012 and published our seventh report in July of 2023. This report details our efforts and performance with respect to people, the environment, our community and stakeholders, and responsible business practices. Over this time period our reporting standards and objectives have developed significantly. Our most recent report which outlined our achievements in 2022 included the following highlights:

•Reduced our corporate GHG emissions intensity by 59% from our 2018 baseline, achieving 90% of our goal of reducing our GHG emissions intensity 65% by 2025.

•Completed 379 well abandonments in 2022, the most in our history as we work towards restoring our 2020 end-of-life well inventory of 4,500 wells to zero by 2040.

•Met our Board gender diversity target by having women make up 30% of our Board prior to our 2023 Annual General Meeting.

At the same time, we also released our second Task Force on Climate-Related Financial Disclosures report.

See "Industry Conditions" and "Risk Factors".

Cyclical and Seasonal Factors

Our operational results and financial condition are dependent on the prices received for our oil and natural gas production. Oil and natural gas prices have fluctuated widely during recent years. Such prices are determined by supply and demand factors, including weather and general economic conditions, as well as conditions in other oil and natural gas regions. Any decline in oil and natural gas prices could have an adverse effect on our financial condition. We mitigate such price risk by closely monitoring commodity markets, implementing our risk management programs and by maintaining financial liquidity. Additionally, we continually review our capital program and implement initiatives to adapt to such price changes. See "Industry Conditions" and "Risk Factors".

The level of activity in the oil and gas industry is dependent on access to areas where operations are conducted. In Canada, seasonal weather variations, including spring break-up which occurs annually, affects access in certain circumstances. In Canada and the United States, unexpected adverse weather conditions, such as flooding, extreme cold weather, heavy snowfall, heavy rainfall and forest fires may restrict the Corporation's ability to access its properties. See "Industry Conditions" and "Risk Factors".

Renegotiation or Termination of Contracts

As at the date hereof, we do not anticipate that any aspects of our business will be materially affected during the remainder of 2024 by the renegotiation or termination of any contracts to which we are a party.

Personnel

As at December 31, 2023, Baytex had 158 employees in our Calgary office, 70 employees in our Houston office, 65 employees in our Canadian field operations and 74 employees in our US field operations.

PRINCIPAL PROPERTIES

The following is a description of our principal oil and natural gas properties on production or under development as at December 31, 2023. Unless otherwise specified, gross and net acres and well count information are as at December 31, 2023 and production information represents average working interest production for the year ended December 31, 2023. All of our properties are located onshore.

Eagle Ford - Texas

Our Eagle Ford assets are located in the Eagle Ford shale of South Texas and are comprised of operated assets and non-operated assets. Our operated assets were acquired through the Ranger Merger and are comprised of operated working interests in approximately 190,939 (166,192 net) acres located principally in the Gonzales, Lavaca, Fayette and Dewitt counties with an average working interest of approximately 88%. Our non-operated assets include working interests in approximately 78,212 (19,931 net) acres, comprised of four areas of mutual interest principally located in Karnes County (Sugarloaf, Longhorn, Ipanema and Excelsior) with an average working interest of approximately 25%. Our non-operated position is operated by an operating subsidiary of Marathon Oil Corporation (NYSE: MRO), pursuant to the terms of industry-standard joint operating agreements, joint venture agreements with non-AMI working interest holders where wells produce from AMI and non-AMI lands as well as negotiated agreements with Marathon and other working interest owners related to facilities, marketing and supplemental development. Production from our Eagle Ford assets occurs from the hydraulic fracturing of horizontal wells.

During 2023, production from the Eagle Ford assets averaged approximately 60,997 boe/d, comprised of 49,905 bbl/d of light and medium crude oil (including condensate and NGL) and 66,556 Mcf/d of shale gas. During this period, Baytex participated in the completion of 83 (42.3 net) wells, resulting in 58 (25.8 net) oil wells and 25 (16.5 net) natural gas wells. As at December 31, 2023, our proved plus probable reserves were 418 million boe (292 million proved; 126 million probable).

As at December 31, 2023, the undeveloped land base associated with the Eagle Ford assets consisted of 35,172 net acres

Peace River - Alberta

In the Peace River area of northwest Alberta we produce heavy gravity crude oil and natural gas from the Bluesky formation and heavy gravity crude oil from the Spirit River (a Clearwater equivalent) formation. The core of our developing Clearwater play is located on the Peavine Métis settlement. Production in the area occurs through primary and polymer flooding recovery methods. During 2023, production from the area averaged approximately 25,537 boe/d, comprised of 23,608 bbl/d of heavy crude oil, 53 bbl/d of NGL and 11,258 Mcf/d of conventional natural gas. In 2023, Baytex drilled 36 (36.0 net) horizontal multi-lateral wells in this area. As at December 31, 2023, we had proved plus probable reserves of 54 million boe (33 million proved; 22 million probable).

Baytex held approximately 284,980 net undeveloped acres in this area as at December 31, 2023.

Lloydminster - Alberta and Saskatchewan

Our Lloydminster assets consist of several geographically dispersed heavy crude oil operations that include primary and thermal production. In some cases, Baytex's heavy crude oil reservoirs are water flooded and polymer flooded. In 2023, production averaged approximately 12,091 boe/d, which was comprised of 10,105 bbl/d of heavy crude oil, 1,747 bbl/d of bitumen, 22 bbl/d of light and medium crude oil, and 1,298 Mcf/d of conventional natural gas. In 2023, Baytex drilled 34 (32.2 net) oil wells in this area. As at December 31, 2023, we had proved plus probable reserves of 84 million boe (25 million proved; 59 million probable).

We held approximately 179,016 net undeveloped acres in this area at December 31, 2023.

Duvernay - Alberta

Baytex holds a large 100% working interest land position in the East Duvernay resource play in central Alberta. Production in the area occurs from the hydraulic fracturing of horizontal wells. In 2023, production averaged 3,719 boe/d, comprised of 3,079 bbl/d of light crude oil and NGL and 3,840 Mcf/d of conventional natural gas. During 2023, Baytex drilled 6 (6.0 net) oil wells. As at December 31, 2023, we

had proved plus probable reserves of 49 million boe (23 million proved; 26 million probable) and net undeveloped lands of approximately 91,844 net acres.

Viking - Alberta and Saskatchewan

Our Viking assets are located in the greater Dodsland area in southwest Saskatchewan and in the Esther area of southeastern Alberta. These assets were acquired through a business combination with Raging River Exploration Inc. in 2018 and produce light oil from the Viking formation. Production in the area occurs primarily from the hydraulic fracturing of horizontal wells. In some areas, reservoirs are placed under waterflood. In 2023, the Viking assets produced 15,295 boe/d, comprised of 13,323 bbl/d of light and medium crude oil and NGL and 11,834 Mcf/d of conventional natural gas. These assets are characterized by shallow wells with short cycle times and a manufacturing approach to development. In 2023, Baytex completed 148 (140.8 net) oil wells. As at December 31, 2023 we had proved plus probable reserves of 46 million boe (29 million proved; 17 million probable). On December 11, 2023, we completed the divestiture of the Sold Viking Assets located at Forgan and Plato in Southwest Saskatchewan for proceeds of $159.7 million, including closing adjustments. Production from the Sold Viking Assets at the time of the sale was approximately 4,000 boe/d (100% light and medium crude oil), represented approximately 25% of our Viking production at the time of sale. The Sold Viking Assets were geographically separated from our core position.

The undeveloped land base associated with the retained Viking assets consisted of 77,732 net acres at December 31, 2023.

Average Production

The following table indicates our average daily production from our principal properties for the year ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Heavy Crude Oil

(bbl/d) | | Bitumen

(bbl/d) | | Light and Medium Crude Oil (bbl/d) | | Tight Oil (bbl/d) | | NGL(1) (bbl/d) | | Shale Gas

(Mcf/d) | | Conventional Natural Gas

(Mcf/d) | | Oil Equivalent

(boe/d) |

| Canada - Heavy | | | | | | | | | | | | | | | | |

| Peace River | | 23,608 | | | — | | | — | | | — | | | 53 | | | — | | | 11,258 | | | 25,537 | |

| | | | | | | | | | | | | | | | |

| Lloydminster | | 10,105 | | | 1,747 | | | 22 | | | — | | | — | | | — | | | 1,298 | | | 12,091 | |

| Total | | 33,713 | | | 1,747 | | | 22 | | | — | | | 53 | | | — | | | 12,556 | | | 37,628 | |

| | | | | | | | | | | | | | | | |

| Canada - Light | | | | | | | | | | | | | | | | |

| Viking | | — | | | — | | | 13,078 | | | — | | | 245 | | | — | | | 11,834 | | | 15,295 | |

| Duvernay | | — | | | — | | | — | | | 1,881 | | | 1,198 | | | 3,840 | | | — | | | 3,719 | |

| Remaining properties | | — | | | — | | | 594 | | | — | | | 715 | | | — | | | 19,224 | | | 4,514 | |

| Total | | — | | | — | | | 13,672 | | | 1,881 | | | 2,158 | | | 3,840 | | | 31,058 | | | 23,528 | |

| | | | | | | | | | | | | | | | |

| United States | | | | | | | | | | | | | | | | |

| Eagle Ford | | — | | | — | | | — | | | 35,908 | | | 13,997 | | | 66,556 | | | — | | | 60,997 | |

| | | | | | | | | | | | | | | | |

| Grand Total | | 33,713 | | | 1,747 | | | 13,694 | | | 37,789 | | | 16,208 | | | 70,396 | | | 43,614 | | | 122,153 | |

Note:

(1)Includes condensate.

Costs Incurred

The following table summarizes the property acquisition, exploration and development costs by country for the year ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | |

| ($000s) | | Canada | | United States | | Total |

| | | | | | |

| Property acquisition costs | | | | | | |

| Proved properties | | 1,556 | | | 18,891 | | | 20,447 | |

| Unproved properties | | 18,467 | | | — | | | 18,467 | |

| Property disposition | | (160,256) | | | — | | | (160,256) | |

| Total Property acquisition costs, net | | (140,233) | | | 18,891 | | | (121,342) | |

| | | | | | |

Development Costs (1) | | 463,198 | | | 549,589 | | | 1,012,787 | |

Exploration Costs (2) | | — | | | — | | | — | |

| Total | | 322,965 | | | 568,480 | | | 891,445 | |

Notes:

(1)Development and facilities expenditures.

(2)Cost of land, geological and geophysical capital expenditures.

Oil and Gas Wells

The following table sets forth the number and status of wells in which we have a working interest as at December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oil Wells | | Natural Gas Wells |

| Producing | | Non-Producing | | Producing | | Non-Producing |

| Gross | | Net | | Gross | | Net | | Gross | | Net | | Gross | | Net |

| | | | | | | | | | | | | | | |

| Alberta | 999 | | | 871.2 | | | 1,160 | | | 685.0 | | | 124 | | | 71.1 | | | 241 | | | 163.5 | |

| BC | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Saskatchewan | 2,577 | | | 2,311.4 | | | 1,520 | | | 1,481.5 | | | 75 | | | 38.3 | | | 190 | | | 174.4 | |

| Texas | 1,576 | | | 893.0 | | | 6 | | | 4.0 | | | 421 | | | 162.0 | | | 3 | | | 2.0 | |

| Total | 5,152 | | | 4,075.6 | | | 2,686 | | | 2,170.5 | | | 620 | | | 271.4 | | | 434 | | | 339.9 | |

Properties with No Attributed Reserves

The following table sets forth our undeveloped land holdings as at December 31, 2023.

| | | | | | | | | | | |

| Undeveloped Acres |

| Gross | | Net |

| Alberta | 677,091 | | | 548,508 | |

| Saskatchewan | 231,220 | | | 178,673 | |

| Texas | 60,212 | | | 35,172 | |

| Total | 968,523 | | | 762,353 | |

Undeveloped land holdings are lands that have not been assigned reserves as at December 31, 2023. None of these undeveloped properties have high expected development or operating costs or contractual sales obligations to produce and sell at substantially lower prices than could be realized under normal market conditions.

We estimate the value of our net undeveloped land holdings at December 31, 2023 to be approximately $248 million, as compared to $166 million as at December 31, 2022. This estimate includes undeveloped land holdings added during 2023 from the Ranger Merger. This internal evaluation generally represents

the estimated replacement cost of our undeveloped land and excludes approximately 47,558 net acres of our undeveloped land that we expect to expire on or before December 31, 2024. In determining replacement cost, we analyzed land sale prices paid at provincial crown land sales for properties in the vicinity of our undeveloped land holdings over the preceding three years.

Tax Horizon

When forecasted using the commodity price forecasts and inflation rates as of January 1, 2024 used to prepare the Reserves Report Baytex does not expect to pay material cash income taxes prior to 2026 in the U.S. and 2027 in Canada.

Despite this tax horizon, Baytex is subject to other taxes, such as taxes related to the repatriation of foreign earnings, certain U.S. state taxes, global minimum taxes, capital taxes and taxes on share buy backs (together, the “Other Taxes”).

Other Taxes amounted to $14 million in 2023 or 1% of EBITDA(1). Baytex forecasts that Other Taxes will average 2% of EBITDA during 2024 and 2025 and that income and Other Taxes combined will increase as a percentage of EBITDA from 2026 onwards, averaging 10 - 15% once available non-capital loss pools are fully utilized, and the full tax horizon is reached.

Exploration and Development Activities

The following table sets forth the gross and net exploratory and development wells in which we participated during the year ended December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exploratory Wells | | Development Wells | | Total Wells |

| Gross | | Net | | Gross | | Net | | Gross | | Net |

| CANADA | | | | | | | | | | | |

| Oil Wells | — | | | — | | | 225 | | | 217.2 | | | 225 | | | 217.2 | |

| Natural Gas Wells | — | | | — | | | — | | | — | | | — | | | — | |

| Stratigraphic Test Wells | — | | | — | | | — | | | — | | | — | | | — | |

| Service Wells | — | | | — | | | — | | | — | | | — | | | — | |

| Dry Holes | — | | | — | | | | | | | — | | | — | |

| Total | — | | | — | | | 225 | | | 217.2 | | | 225 | | | 217.2 | |

| | | | | | | | | | | |

| UNITED STATES | | | | | | | | | | | |

| Oil Wells | — | | | — | | | 60 | | | 23.0 | | | 60 | | | 23.0 | |

| Natural Gas Wells | — | | | — | | | 18 | | | 13.1 | | | 18 | | | 13.1 | |

| Stratigraphic Test Wells | — | | | — | | | — | | | — | | | — | | | — | |

| Service Wells | — | | | — | | | — | | | — | | | — | | | — | |

| Dry Holes | — | | | — | | | — | | | — | | | — | | | — | |

| Total | — | | | — | | | 78 | | | 36.1 | | | 78 | | | 36.1 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)Calculated in accordance with our amended credit facilities agreement which is available on SEDAR+ at www.sedarplus.com.

Production Estimates

The following table sets out the volumes of our working interest production estimated for the year ending December 31, 2024, which is reflected in the estimate of future net revenue disclosed in the forecast price tables contained under "Statement of Reserves Data - Disclosure of Reserves Data".

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Heavy Crude Oil

(bbl/d) | | Bitumen

(bbl/d) | | Light and Medium Crude Oil

(bbl/d) | | Tight Oil

(bbl/d) | | NGL (bbl/d)(1) | | Shale Gas

(Mcf/d) | | Natural Gas

(Mcf/d) | | Oil Equivalent

(boe/d) |

| CANADA | | | | | | | | | | | | | | | |

| Total Proved | 27,541 | | | 2,155 | | | 10,079 | | | 2,602 | | | 2,536 | | | 5,967 | | | 35,476 | | | 51,820 | |

| Total Proved plus Probable | 32,123 | | | 2,580 | | | 10,940 | | | 2,773 | | | 2,744 | | | 6,467 | | | 38,326 | | | 58,626 | |

| UNITED STATES | | | | | | | | | | | | | | | |

| Total Proved | — | | | — | | | — | | | 46,994 | | | 22,092 | | | 100,069 | | | — | | | 85,765 | |

| Total Proved plus Probable | — | | | — | | | — | | | 48,485 | | | 22,821 | | | 103,081 | | | — | | | 88,486 | |

| TOTAL | | | | | | | | | | | | | | | |

| Total Proved | 27,541 | | | 2,155 | | | 10,079 | | | 49,596 | | | 24,629 | | | 106,036 | | | 35,476 | | | 137,585 | |

| Total Proved plus Probable | 32,123 | | | 2,580 | | | 10,940 | | | 51,258 | | | 25,565 | | | 109,549 | | | 38,326 | | | 147,112 | |

Note:

(1)Includes condensate.

The Eagle Ford property is the only property that accounts for 20% or more of the estimated 2024 production volumes. Estimated 2024 production volumes for the Eagle Ford property is 85,765 boe/d on a total proved basis and 88,486 boe/d on a total proved plus probable basis.

Production History

The following table summarizes certain information in respect of the production, product prices received, royalties paid, production costs and resulting netback associated with our reserves data for the periods indicated below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| Dec. 31, 2023 | | Sep. 30, 2023 | | Jun. 30, 2023 | | Mar. 31, 2023 | | Dec. 31, 2023 |

Average Sales Volume (1) | | | | | | | | | |

| | | | | | | | | |

| CANADA | | | | | | | | | |

| Light and Medium Crude Oil (bbl/d) | 11,208 | | | 14,563 | | | 13,831 | | | 15,213 | | | 13,695 | |

| Heavy Crude Oil (bbl/d) | 37,336 | | | 34,030 | | | 31,204 | | | 32,222 | | | 33,713 | |

| Bitumen (bbl/d) | 2,233 | | | 1,175 | | | 1,617 | | | 1,969 | | | 1,747 | |

| Tight Oil (bbl/d) | 2,803 | | | 2,960 | | | 672 | | | 1,060 | | | 1,881 | |

NGL (bbl/d) (2) | 3,069 | | | 2,219 | | | 1,542 | | | 2,000 | | | 2,210 | |

| Total liquids (bbl/d) | 56,649 | | | 54,947 | | | 48,866 | | | 52,464 | | | 53,246 | |

| Shale Gas (Mcf/d) | 6,748 | | | 3,996 | | | 1,946 | | | 2,623 | | | 3,840 | |

| Conventional Natural Gas (Mcf/d) | 41,825 | | | 46,061 | | | 40,097 | | | 46,497 | | | 43,614 | |

| Total (boe/d) | 64,744 | | | 63,289 | | | 55,874 | | | 60,651 | | | 61,157 | |

| | | | | | | | | |

| UNITED STATES | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Tight Oil (bbl/d) | 54,430 | | | 56,458 | | | 18,686 | | | 13,381 | | | 35,908 | |

NGL (bbl/d) (2) | 21,774 | | | 17,567 | | | 9,210 | | | 7,237 | | | 13,997 | |

| Total liquids (bbl/d) | 76,204 | | | 74,025 | | | 27,896 | | | 20,618 | | | 49,905 | |

| Shale Gas (Mcf/d) | 116,548 | | | 79,722 | | | 35,946 | | | 32,946 | | | 66,556 | |

| | | | | | | | | |

| Total (boe/d) | 95,629 | | | 87,311 | | | 33,887 | | | 26,109 | | | 60,997 | |

| | | | | | | | | |

| TOTAL | | | | | | | | | |

| Light and Medium Crude Oil (bbl/d) | 11,208 | | | 14,563 | | | 13,831 | | | 15,213 | | | 13,695 | |

| Heavy Crude Oil (bbl/d) | 37,336 | | | 34,030 | | | 31,204 | | | 32,222 | | | 33,713 | |

| Bitumen (bbl/d) | 2,233 | | | 1,175 | | | 1,617 | | | 1,969 | | | 1,747 | |

| Tight Oil (bbl/d) | 57,233 | | | 59,418 | | | 19,358 | | | 14,441 | | | 37,789 | |

NGL (bbl/d) (2) | 24,843 | | | 19,786 | | | 10,752 | | | 9,237 | | | 16,207 | |

| Total liquids (bbl/d) | 132,853 | | | 128,972 | | | 76,762 | | | 73,082 | | | 103,151 | |

| Shale Gas (Mcf/d) | 123,296 | | | 83,718 | | | 37,892 | | | 35,569 | | | 70,396 | |

| Conventional Natural Gas (Mcf/d) | 41,825 | | | 46,061 | | | 40,097 | | | 46,497 | | | 43,614 | |

| Total (boe/d) | 160,373 | | | 150,600 | | | 89,761 | | | 86,760 | | | 122,154 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| Dec. 31, 2023 | | Sep. 30, 2023 | | Jun. 30, 2023 | | Mar. 31, 2023 | | Dec. 31, 2023 |

| CANADA | | | | | | | | | |

| | | | | | | | | |

Average Prices Received (3) | | | | | | | | | |

| Light and Medium Crude Oil ($/bbl) | 99.72 | | | 106.32 | | | 93.82 | | | 99.22 | | | 99.87 | |

| Heavy Crude Oil ($/bbl) | 62.17 | | | 84.39 | | | 66.26 | | | 51.02 | | | 66.14 | |

| Bitumen ($/bbl) | 67.74 | | | 85.47 | | | 70.02 | | | 53.29 | | | 67.26 | |

| Tight Oil ($/bbl) | 100.99 | | | 110.10 | | | 97.65 | | | 99.39 | | | 104.08 | |

NGL ($/bbl) (2) | 30.26 | | | 34.22 | | | 33.31 | | | 39.90 | | | 33.94 | |

| Shale Gas ($/Mcf) | 2.27 | | | 2.57 | | | 2.32 | | | 3.45 | | | 2.55 | |

| Conventional Natural Gas ($/Mcf) | 2.42 | | | 2.73 | | | 2.66 | | | 3.63 | | | 2.88 | |

Total ($/boe) (8) | 63.06 | | | 79.93 | | | 66.34 | | | 59.71 | | | 67.39 | |

| | | | | | | | | |

| Royalties Paid | | | | | | | | | |

Light and Medium Crude Oil and NGL ($/bbl) (2)(4) | 7.98 | | | 9.49 | | | 9.46 | | | 9.25 | | | 9.08 | |

| Heavy Crude Oil ($/bbl) | 12.08 | | | 14.17 | | | 11.05 | | | 8.63 | | | 11.56 | |

| Bitumen ($/bbl) | 9.22 | | | 9.49 | | | 6.83 | | | 6.54 | | | 7.97 | |

| Tight Oil ($/bbl) | 11.47 | | | 11.56 | | | 9.38 | | | 13.93 | | | 11.66 | |

| Shale Gas ($/Mcf) | 0.08 | | | 0.02 | | | 1.66 | | | 0.34 | | | 0.30 | |

| Conventional Natural Gas ($/Mcf) | 0.23 | | | 0.24 | | | 0.23 | | | 0.46 | | | 0.29 | |

Total ($/boe) (9) | 9.69 | | | 11.03 | | | 9.30 | | | 8.03 | | | 9.55 | |

| | | | | | | | | |

Operating Expenses (5) | | | | | | | | | |

Light and Medium Crude Oil and NGL ($/bbl) (2)(4) | 17.70 | | | 16.45 | | | 19.57 | | | 17.54 | | | 17.78 | |

| Heavy Crude Oil ($/bbl) | 14.86 | | | 15.50 | | | 16.74 | | | 16.36 | | | 15.81 | |

| Bitumen ($/bbl) | 18.27 | | | 30.78 | | | 26.32 | | | 20.52 | | | 22.87 | |

| Tight Oil ($/bbl) | 8.82 | | | 10.88 | | | 17.67 | | | 12.74 | | | 11.05 | |

| Shale Gas ($/Mcf) | 1.47 | | | 1.81 | | | 2.95 | | | 2.12 | | | 1.84 | |

| Conventional Natural Gas ($/Mcf) | 3.07 | | | 2.87 | | | 3.01 | | | 2.68 | | | 2.89 | |

Total ($/boe) (9) | 15.61 | | | 15.98 | | | 17.97 | | | 16.70 | | | 16.51 | |

| | | | | | | | | |

| Transportation Expenses | | | | | | | | | |

Light and Medium Crude Oil and NGL ($/bbl) (2)(4) | 0.56 | | | 0.49 | | | 0.53 | | | 0.92 | | | 0.63 | |

| Heavy Crude Oil ($/bbl) | 4.52 | | | 4.44 | | | 4.01 | | | 4.69 | | | 4.42 | |

| Bitumen ($/bbl) | 2.09 | | | 1.32 | | | 1.68 | | | 3.79 | | | 2.34 | |

| Tight Oil ($/bbl) | 1.15 | | | 0.90 | | | 0.64 | | | 0.29 | | | 0.88 | |

| Shale Gas ($/Mcf) | 0.19 | | | 0.15 | | | 0.11 | | | 0.05 | | | 0.15 | |

| Conventional Natural Gas ($/Mcf) | 0.23 | | | 0.23 | | | 0.22 | | | 0.30 | | | 0.25 | |

Total ($/boe) (9) | 3.02 | | | 2.76 | | | 2.60 | | | 3.12 | | | 2.88 | |

| | | | | | | | | |

Resulting Netback (3)(6) | | | | | | | | | |

Light and Medium Crude Oil and NGL ($/bbl) (2)(4) | 58.55 | | | 70.36 | | | 58.19 | | | 64.62 | | | 63.22 | |

| Heavy Crude Oil ($/bbl) | 30.71 | | | 50.28 | | | 34.46 | | | 21.34 | | | 34.35 | |

| Bitumen ($/bbl) | 38.16 | | | 43.88 | | | 35.19 | | | 22.44 | | | 34.08 | |

| Tight Oil ($/bbl) | 79.55 | | | 86.76 | | | 69.96 | | | 72.43 | | | 80.49 | |

| Shale Gas ($/Mcf) | 0.53 | | | 0.59 | | | (2.40) | | | 0.94 | | | 0.26 | |

| Conventional Natural Gas ($/Mcf) | (1.11) | | | (0.61) | | | (0.80) | | | 0.19 | | | (0.55) | |

Total ($/boe) (8) | 34.74 | | | 50.16 | | | 36.47 | | | 31.86 | | | 38.45 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended |

| Dec. 31, 2023 | | Sep. 30, 2023 | | Jun. 30, 2023 | | Mar. 31, 2023 | | Dec. 31, 2023 |

| | | | | | | | | |

| UNITED STATES | | | | | | | | | |

| | | | | | | | | |

Average Prices Received (3) | | | | | | | | | |

| Tight Oil ($/bbl) | 105.82 | | | 108.99 | | | 97.47 | | | 103.07 | | | 105.74 | |

NGL ($/bbl) (2) | 32.35 | | | 36.03 | | | 41.16 | | | 51.67 | | | 37.42 | |

| Shale Gas ($/Mcf) | 3.07 | | | 3.20 | | | 2.52 | | | 4.02 | | | 3.15 | |

Total ($/boe) (8) | 71.34 | | | 80.64 | | | 67.60 | | | 72.22 | | | 74.27 | |

| | | | | | | | | |

| Royalties Paid | | | | | | | | | |

| Tight Oil ($/bbl) | 29.35 | | | 29.92 | | | 28.61 | | | 30.95 | | | 29.63 | |

NGL ($/bbl) (2) | 8.03 | | | 9.18 | | | 11.85 | | | 13.77 | | | 9.75 | |

| Shale Gas ($/Mcf) | 0.72 | | | 0.76 | | | 0.62 | | | 1.07 | | | 0.76 | |

Total ($/boe) (9) | 19.42 | | | 21.89 | | | 19.66 | | | 21.02 | | | 20.51 | |

| | | | | | | | | |

Operating Expenses (5)(7) | | | | | | | | | |

| Tight Oil ($/bbl) | 8.17 | | | 10.09 | | | 9.11 | | | 9.03 | | | 9.08 | |

NGL ($/bbl) (2) | 8.17 | | | 10.09 | | | 9.11 | | | 9.03 | | | 9.08 | |

| Shale Gas ($/Mcf) | 1.36 | | | 1.68 | | | 1.52 | | | 1.51 | | | 1.51 | |

Total ($/boe) (9) | 8.17 | | | 10.09 | | | 9.11 | | | 9.03 | | | 9.08 | |

| | | | | | | | | |

| Transportation Expenses | | | | | | | | | |

| Tight Oil ($/bbl) | 0.53 | | | 0.46 | | | 0.21 | | | — | | | 0.44 | |

NGL ($/bbl) (2) | 3.34 | | | 4.76 | | | 0.88 | | | — | | | 2.88 | |

| Shale Gas ($/Mcf) | 0.22 | | | 0.25 | | | 0.07 | | | — | | | 0.19 | |

Total ($/boe) (9) | 1.33 | | | 1.48 | | | 0.43 | | | — | | | 1.12 | |

| | | | | | | | | |

Resulting Netback (3)(6) | | | | | | | | | |

| Tight Oil ($/bbl) | 67.77 | | | 68.52 | | | 59.54 | | | 63.09 | | | 66.59 | |

NGL ($/bbl) (2) | 12.81 | | | 12.00 | | | 19.32 | | | 28.87 | | | 15.71 | |

| Shale Gas ($/Mcf) | 0.77 | | | 0.51 | | | 0.31 | | | 1.44 | | | 0.69 | |

| Total ($/boe) | 42.42 | | | 47.18 | | | 38.40 | | | 42.17 | | | 43.56 | |

Notes:

(1)Before deduction of royalties.

(2)NGL includes condensate.

(3)Before the effects of commodity derivative instruments.

(4)In Canada, NGL volumes are grouped with light crude oil volumes for reporting purposes.

(5)Operating expenses are composed of direct costs incurred to operate both oil and gas wells. A number of assumptions are required to allocate these costs between oil, Conventional natural gas and NGL production.

(6)Netback is calculated by subtracting royalties paid, operating and transportation expenses from revenues.

(7)In the U.S., transportation expense is included in operating expenses for reporting purposes.

(8)Non-GAAP measure that does not have any standardized meaning prescribed by IFRS and may not be comparable with the calculation of similar measures presented by other entities. See "Specified Financial Measures" in the Baytex Annual 2023 MD&A for information related to this measure, which section has been incorporated by reference herein. The Baytex Annual 2023 MD&A are available on SEDAR+ at www.sedarplus.com.

(9)Supplementary financial measure. See "Royalties", "Operating Expense", and "Transportation Expense" in the Baytex Annual 2023 MD&A for information related to this measure, which section has been incorporated by reference herein. Baytex Annual 2023 MD&A are available on SEDAR+ at www.sedarplus.com.

Marketing Arrangements and Forward Contracts

We market our operated oil and natural gas production with the objective of maximizing value and counterparty performance. We have a portfolio of sales contracts with a variety of pricing mechanisms, term commitments and customers and we also have several committed transportation and processing contracts with volume and term commitments that enable us to transport our production to sales points. Production from our non-operated assets in the Eagle Ford is marketed by the operator. The Corporation also has a risk management policy pursuant to which we utilize various derivative financial instruments and physical sales contracts to manage our exposure to fluctuations in commodity prices, foreign exchange and interest rates. We also use derivative instruments in various operational markets to optimize our supply or production chain.

When marketing and hedging we engage a number of reputable counterparties to ensure competitiveness, while also managing counterparty credit exposure. For details on our contractual commitments to sell natural gas and crude oil which were outstanding at February 28, 2024, see Note 18 to our audited consolidated financial statements for the year ended December 31, 2023. See Risk Factors.

STATEMENT OF RESERVES DATA

The Baytex Reserves Report has been prepared in accordance with the standards contained in the COGE Handbook and the reserves definitions contained in NI 51‑101. The statement of reserves data and other oil and natural gas information set forth below is dated December 31, 2023. The effective date of the Baytex Reserves Report is December 31, 2023 and the preparation date of the statement is February 1, 2024. The Baytex Reserves Report was prepared using the average commodity price forecasts and inflation rates of McDaniel, GLJ Petroleum Consultants Ltd. and Sproule Associates Limited as of January 1, 2024.

Disclosure of Reserves Data

The following tables are a combined summary as at December 31, 2023 of our proved and probable heavy crude oil, bitumen, light and medium oil, tight oil, NGL, conventional natural gas and shale gas reserves and the net present value of the future net revenue attributable to such reserves evaluated in the Baytex Reserves Report. Our reserves are located in Canada (Alberta and Saskatchewan) and the United States (Texas).

All evaluations of future net revenue are after the deduction of future income tax expenses (unless otherwise noted in the tables), royalties, development costs, production costs and well abandonment costs but before consideration of indirect costs such as administrative, overhead and other miscellaneous expenses. The estimated future net revenue contained in the following tables does not necessarily represent the fair market value of our reserves. There is no assurance that the forecast price and cost assumptions contained in the Baytex Reserves Report will be attained and variations could be material. The tables summarize the data contained in the Baytex Reserves Report and, as a result, may contain slightly different numbers and columns in the tables may not add due to rounding. Other assumptions and qualifications relating to costs and other matters are summarized in the notes to or following the tables below.

The recovery and reserves estimates described herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Readers should review the definitions and information contained in "Selected Terms - Reserves Definitions", "Selected Terms - Reserves and Reserve Categories" and "Selected Terms - Development and Production Status" in conjunction with the following tables and notes. For more information as to the risks involved, see "Risk Factors".

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

SUMMARY OF OIL AND NATURAL GAS RESERVES AS OF DECEMBER 31, 2023 FORECAST PRICES AND COSTS |

| CANADA | | | | | | | | | | | | |

| | TIGHT OIL | | LIGHT AND MEDIUM CRUDE OIL | | HEAVY CRUDE OIL |

| RESERVES CATEGORY | | Gross

(Mbbl) | | Net

(Mbbl) | | Gross

(Mbbl) | | Net

(Mbbl) | | Gross

(Mbbl) | | Net

(Mbbl) |

| PROVED: | | | | | | | | | | | | |

Developed Producing | | 2,613 | | | 2,230 | | | 9,690 | | | 9,128 | | | 31,218 | | | 26,283 | |

Developed Non‑Producing | | — | | | — | | | 414 | | | 383 | | | 1,416 | | | 1,260 | |

Undeveloped | | 7,226 | | | 6,310 | | | 15,699 | | | 14,882 | | | 18,445 | | | 16,292 | |

| TOTAL PROVED | | 9,838 | | | 8,540 | | | 25,803 | | | 24,392 | | | 51,078 | | | 43,834 | |

| PROBABLE | | 11,197 | | | 9,144 | | | 14,997 | | | 13,910 | | | 32,935 | | | 27,331 | |

| TOTAL PROVED PLUS PROBABLE | | 21,035 | | | 17,685 | | | 40,799 | | | 38,302 | | | 84,013 | | | 71,165 | |

| | | | | | | | | | | | |

| CANADA | | | | | | | | | | | | |

| | BITUMEN | | SHALE GAS | | CONVENTIONAL NATURAL GAS (1) |

| RESERVES CATEGORY | | Gross

(Mbbl) | | Net

(Mbbl) | | Gross

(MMcf) | | Net

(MMcf) | | Gross

(MMcf) | | Net (MMcf) |

| PROVED: | | | | | | | | | | | | |

Developed Producing | | 1,679 | | | 1,564 | | | 7,822 | | | 7,114 | | | 52,758 | | | 47,825 | |

Developed Non‑Producing | | — | | | — | | | — | | | — | | | 1,205 | | | 1,076 | |

Undeveloped | | 2,105 | | | 1,916 | | | 20,135 | | | 18,267 | | | 23,948 | | | 20,760 | |

| TOTAL PROVED | | 3,783 | | | 3,480 | | | 27,957 | | | 25,381 | | | 77,910 | | | 69,661 | |

| PROBABLE | | 45,754 | | | 36,517 | | | 32,887 | | | 28,883 | | | 38,246 | | | 33,578 | |

| TOTAL PROVED PLUS PROBABLE | | 49,537 | | | 39,997 | | | 60,844 | | | 54,264 | | | 116,156 | | | 103,238 | |

| | | | | | | | | | | | |

| CANADA | | | | | | | | | | | | |

| | NATURAL GAS LIQUIDS (2) | | TOTAL RESERVES | | | | |

| RESERVES CATEGORY | | Gross

(Mbbl) | | Net

(Mbbl) | | Gross

(Mboe) | | Net

(Mboe) | | | | |

| PROVED: | | | | | | | | | | | | |

Developed Producing | | 3,535 | | | 3,025 | | | 58,830 | | | 51,386 | | | | | |

Developed Non‑Producing | | 45 | | | 35 | | | 2,076 | | | 1,856 | | | | | |

Undeveloped | | 6,524 | | | 5,768 | | | 57,345 | | | 51,672 | | | | | |

| TOTAL PROVED | | 10,105 | | | 8,828 | | | 118,252 | | | 104,914 | | | | | |

| PROBABLE | | 10,452 | | | 8,849 | | | 127,189 | | | 106,161 | | | | | |

| TOTAL PROVED PLUS PROBABLE | | 20,557 | | | 17,677 | | | 245,441 | | | 211,075 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| UNITED STATES | | | | | | | | | | | | |

| | TIGHT OIL | | SHALE GAS | | NATURAL GAS LIQUIDS (2) |

| RESERVES CATEGORY | | Gross

(Mbbl) | | Net

(Mbbl) | | Gross

(MMcf) | | Net

(MMcf) | | Gross

(Mbbl) | | Net

(Mbbl) |

| PROVED: | | | | | | | | | | | | |

Developed Producing | | 67,960 | | | 51,714 | | | 137,735 | | | 104,187 | | | 34,859 | | | 26,155 | |

Developed Non‑Producing | | 3,703 | | | 2,789 | | | 6,761 | | | 5,087 | | | 1,769 | | | 1,327 | |

Undeveloped | | 81,281 | | | 61,843 | | | 181,471 | | | 135,972 | | | 48,107 | | | 35,862 | |

| TOTAL PROVED | | 152,944 | | | 116,346 | | | 325,967 | | | 245,246 | | | 84,735 | | | 63,344 | |

| PROBABLE | | 74,041 | | | 56,404 | | | 118,877 | | | 89,396 | | | 31,882 | | | 23,839 | |

| TOTAL PROVED PLUS PROBABLE | | 226,985 | | | 172,749 | | | 444,844 | | | 334,642 | | | 116,617 | | | 87,183 | |

| | | | | | | | | | | | |

| UNITED STATES | | | | | | | | | | | | |

| | TOTAL RESERVES | | | | | | |

| RESERVES CATEGORY | | Gross

(Mboe) | | Net

(Mboe) | | | | | | | | |

| PROVED: | | | | | | | | | | | | |

Developed Producing | | 125,775 | | | 95,233 | | | | | | | | | |

Developed Non‑Producing | | 6,599 | | | 4,963 | | | | | | | | | |

Undeveloped | | 159,632 | | | 120,368 | | | | | | | | | |

| TOTAL PROVED | | 292,007 | | | 220,564 | | | | | | | | | |

| PROBABLE | | 125,736 | | | 95,142 | | | | | | | | | |

| TOTAL PROVED PLUS PROBABLE | | 417,743 | | | 315,706 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TOTAL | | |

| | TIGHT OIL | | LIGHT AND MEDIUM CRUDE OIL | | HEAVY CRUDE OIL |

| RESERVES CATEGORY | | Gross

(Mbbl) | | Net

(Mbbl) | | Gross

(Mbbl) | | Net

(Mbbl) | | Gross

(Mbbl) | | Net

(Mbbl) |

| PROVED: | | | | | | | | | | | | |

Developed Producing | | 70,573 | | | 53,944 | | | 9,690 | | | 9,128 | | | 31,218 | | | 26,283 | |

Developed Non‑Producing | | 3,703 | | | 2,789 | | | 414 | | | 383 | | | 1,416 | | | 1,260 | |

Undeveloped | | 88,506 | | | 68,154 | | | 15,699 | | | 14,882 | | | 18,445 | | | 16,292 | |

| TOTAL PROVED | | 162,782 | | | 124,886 | | | 25,803 | | | 24,392 | | | 51,078 | | | 43,834 | |

| PROBABLE | | 85,238 | | | 65,548 | | | 14,997 | | | 13,910 | | | 32,935 | | | 27,331 | |

| TOTAL PROVED PLUS PROBABLE | | 248,020 | | | 190,434 | | | 40,799 | | | 38,302 | | | 84,013 | | | 71,165 | |

| | |