Document

[Letterhead of Skadden, Arps, Slate, Meagher & Flom LLP]

December 20, 2016

Lisa Larkin

Kathy Churko

Division of Investment Management

Securities and Exchange Commission

Washington, D.C. 20549

Re: Apollo Investment Corporation (File No. 333-205660)

Dear Mses. Larkin and Churko:

Apollo Investment Corporation (the “Company”) has authorized us to make the following responses to the oral comments received from Ms. Larkin on November 10, 2015 and Mses. Larkin and Churko on November 14, 2015 to Post-Effective Amendment No. 1 to the Company’s Registration Statement on Form N-2 (File No. 333-205660) (the “Registration Statement”) as filed with the Securities and Exchange Commission (the “Commission”) on October 4, 2015. The Commission staff’s (the “Staff”) comments are set forth below in bold and are followed by the Company’s response.

Disclosure Comments

| |

1. | Please update the Risk Factors for Brexit. |

The Company has updated Risk Factors for Brexit. Please see page 8 of the Registration Statement.

2. On page 13, in the Risk Factor, “We currently use borrowed funds to make investments and are exposed to the typical risks associated with leverage,” to the extent necessary, please include disclosure regarding outstanding convertible securities of the Company.

The Company currently does not have any outstanding convertible securities.

3. Please add the following bullets to the Risk Factor, “To the extent original issue discount (“OID”) and PIK interest constitute a portion of our income, we will be exposed to typical risks associated with such income being required to be included in taxable and accounting income prior to receipt of cash representing such income:”

Lisa Larkin

Kathy Churko

December 20, 2016

Page 2

| |

◦ | An election to defer PIK interest payments by adding them to loan principal increases our gross assets, thus increasing our investment adviser’s future base management fees, and increases future investment income, thus increasing our investment adviser’s future income incentive fees at a compounding rate. |

| |

◦ | Market prices of zero-coupon or PIK securities may be affected to a greater extent by interest rate changes and may be more volatile than securities that pay interest periodically and in cash. |

The Company has included each of the bullet disclosures in accordance with the comment.

4. Does the Company segregate assets when and if it writes options?

Although the Company has not written any options, if the Company were to enter into such a transaction with respect to securities it does not own, it would segregate assets to the extent required under the principles of Investment Company Release No. 10666 and related no-action letters.

5. Please lower case “Senior Secured Loans” or define the term in the Risk Factor, “We have limited control of the administration and amendment of loans owned by the CLOs in which we invest.”

The Company has lower cased the term “senior secured loans.”

6. The disclosure in the second sentence under “Use of Proceeds” states: “We anticipate that substantially all of the net proceeds of an offering of securities pursuant to this prospectus will be used for the above purposes within two years, depending on the availability of appropriate investment opportunities consistent with our investment objective and market conditions.” Because this period may exceed three months, please disclose the reason for this delay. See Item 7.2 of Form N-2 and Guide 1 to Form N-2.

The Company believes that the statement that it may take as long as two years to invest the proceeds of any takedowns off of this Registration Statement is consistent with Guide I of Form N-2, which provides that:

A business development company (“BDC”) is operated for the purpose of making investments in securities described in paragraphs (1) through (3) of Section 55(a) of the 1940 Act (15 U.S.C. 80a-54(a)(1)-(3)). The Division is of the view that Section 58 of the 1940 Act (U.S.C. 80a-57) requires a BDC to obtain the approval of its stockholders for a change of its business purpose if more than half of its total assets are not invested in the types of securities designed to meet its business purpose, in accordance with Sections 2(a)(48) and 55(a)(1)-(3) of the 1940 Act, within the earlier of: (i) two years after termination or completion of sales; (ii) 2 years after commencement of its initial public offering. The Division will not consider assets invested in money market instruments or cash equivalents to be invested in accordance with a BDC’s business purpose.

Lisa Larkin

Kathy Churko

December 20, 2016

Page 3

The disclosure in the “Use of Proceeds” section provides that “[p]ending our investments in new debt investments, we plan to invest a portion of the net proceeds from an offering in cash equivalents, U.S. government securities and other high-quality debt investments that mature in one year or less from the date of investment.” The ability of the Company to invest the net proceeds of any offering in portfolio companies in accordance with its investment objective is dependent on market conditions and the Company’s investment pipeline and, as a result, it is difficult to predict when substantially all of the net proceeds from any offering will be invested. The Company notes that the timeframe it has presented is consistent with the timeframe presented by many other business development companies in their shelf registration statements.

As a result, the Company believes that the timeframe included in the Registration Statement is consistent with both industry practice and Guide 1 of Form N-2.

7. Please confirm that the Company will include the disclosure required by Item 7.1 of Form N-2 in a prospectus supplement when it conducts an offering under the Registration Statement.

The Company confirms that it will include the disclosure required by Item 7.1 of Form N-2 in a prospectus supplement when it conducts an offering under the Registration Statement.

8. Does the Company segregate assets for its total return swaps?

If, and when, the Company enters into a total return swap, the Company will not segregate the negative variation in value pending periodic settlement.

9. On page 69, pursuant to Item 20.1(a) of Form N-2, please state Apollo’s basis for control of AIM.

The Company has included disclosure in accordance with the comment on page 71.

10. Please provide disclosure regarding the portfolio manager required by Item 9.1(c) of Form N-2.

Information regarding Messrs. Widra and Zelter can be found on page 68 of the Registration Statement. The Company has included disclosure in accordance with the comment for Messrs. Powell and Sendak on page 75.

11. On page 89, footnote 3, please supplementally provide an example of “governing documents that precludes [the Company] from controlling management of the portfolio companies.”

As of March 31, 2016, the Company had an investment in Generation Brands, Inc. (Generation Brands). While the Company maintained a 27.94% stake of the common equity, an unaffiliated third party owns all of the Series A preferred shares. As per

Lisa Larkin

Kathy Churko

December 20, 2016

Page 4

Generation Brands’ company bylaws, there is a seven member Board of Directors in which four seats are granted to the Series A preferred holders, one seat is granted to the Company and one seat is held by Generation Brands’ CEO. All shareholders vote together on the seventh director, a process which is controlled by the Series A preferred holder through its majority on the Board of Directors of Generation Brands. Accordingly, Generation Brands is not controlled by the Company as it does not hold more than 25% of the voting power and has no power to the direction of the policies and management of Generation Brands.

12. On page 91, under Dividend Reinvestment Plan, pursuant to Item 10.1(e) of Form N-2, please disclose “the income tax consequences of participation in the [Company’s] plan (i.e., that capital gains and income are realized, although cash is not received by the shareholder).”

The Company has included disclosure in accordance with the comment.

13. On page 122, under “Regulation—Proxy Voting Policies and Procedures,” pursuant to Item 18.16 of Form N-2, please disclose, “that information regarding how the [Company] voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is available without charge, upon request, by calling a specified toll-free (or collect) telephone number; or on or through the [Company’s] Website at a specified Internet address.”

The Company has included disclosure in accordance with the comment.

14. On page 124, under “Brokerage Allocation and Other Practices,” please update the date in the second sentence to 2016.

The Company has updated the disclosure in accordance with the comment.

15. On page 126, under “Independent Registered Public Accounting Firm,” pursuant to Item 20.7, please disclose a “general description of the services performed” by PricewaterhouseCoopers LLP.

The Company has included disclosure in accordance with the comment.

16. Please explain and represent that the Company reasonably believes that its assets will provide adequate cover to allow the Company to satisfy all of its unfunded commitments.

The Company understands that this comment supersedes prior comments received from the Staff on the status of its unfunded commitments. The Company reasonably believes that its assets will provide adequate cover to allow the Company to satisfy all of its unfunded commitments. The bases for the Company’s belief are primarily that (i) historically it has rarely utilized more than 55% of its revolving credit line, which on average over the previous eight (8) quarters permitted additional borrowings of up to

Lisa Larkin

Kathy Churko

December 20, 2016

Page 5

$840,841,550, whereas its average unfunded commitments over such time was $224,728,251 and over the previous four (4) quarters was $197,031,909; (ii) the Company receives repayments, prepayments and sales proceeds on its portfolio investments that have ranged from $215,054,310 to $699,203,010 over the past eight quarters and have averaged $383,581,726 per quarter over that period; (iii) while the Company does not hold a large amount of highly liquid assets at any one time, it generally holds a substantial amount of large syndicated loans (for example, $242,944,182 as of September 30, 2016), which are liquid and can be sold promptly, and (iv) in addition, a majority of its portfolio assets are of a nature that are salable over a relatively short period to generate cash.

17. Please include the power of attorney for Hilary E. Ackermann or revise the signature page.

The corresponding power of attorney has been included as Exhibit (n)(5).

Accounting Comments

18. Please be sure to include auditor consents in the Fund’s next Registration Statement filing as well as the most current quarterly financial information.

The Company has included the necessary auditor consents in its filing as well as the most current quarterly information.

19. Please reverse the disclosed examples in the Fees and Expense section of the Registration Statement, or explain why the examples should not be reversed.

The first example in the Fees and Expense section of the Registration Statement is required by Item 3.1 of Form N-2. The second example is included by the Company because, as stated in the Registration Statement, “[a]ssuming a 5% annual return, the incentive fee under the investment advisory and management agreement may not be earned or payable and is not included in the example.” Accordingly, the Company includes the second example, which assumes that the incentive fee under the investment advisory and management agreement is earned and payable. The Company believes that it would be inappropriate to reverse the examples because (i) the first example is required by Form N-2, (ii) the disclosure is clear regarding how each example is calculated, and (iii) the Company’s disclosure of the expense examples are the same as its peers.

20. Please confirm that the senior securities table on page 107 is disclosed at par value and not fair value.

The disclosure in the “Total Amount Outstanding” column of the senior securities table is in accordance with Accounting Standards Update (ASU) 2015-03, Interest—Imputation of Interest (Subtopic 835-30) -Simplifying the Presentation of Debt Issuance Costs, which the Company adopted on April 1, 2016. This guidance requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct

Lisa Larkin

Kathy Churko

December 20, 2016

Page 6

deduction from the carrying amount of that debt liability (i.e., versus being capitalized as an asset and amortized as required under previous guidance), consistent with the presentation of debt discounts. Please see Note 2 to the Company’s September 30, 2016 unaudited quarterly financial statements.

21. Please add the reference to footnote 4 in the senior securities table.

The Company has revised disclosure in accordance with the comment. The column labelled “Estimated Market Value” was changed to “Estimated Market Value Per Unit(4)”.

22. Please confirm that the Company performed the tests under Rules 3-09 and 4-08(g) of Regulation S-X and that no further disclosure is required.

The Company confirms that it does not believe that, other than Merx Aviation Finance LLC, any of its portfolio subsidiaries triggers the investment, assets or income tests in S-X 3-09, or the investment, assets or income tests referred to in S-X 4-08(g) for 2016. Please see Note 5 to the Company March 31, 2016 audited financial statements. The Company had included the financial statements of Merx Aviation Finance LLC in the Registration Statement.

Lisa Larkin

Kathy Churko

December 20, 2016

Page 7

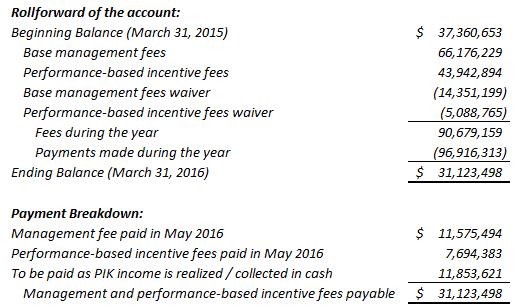

23. Please supplementally explain how the Company arrived at the line item “Management and performance-based incentive fees payable,” in the Company’s Statement of Assets and Liabilities, dated March 31, 2016. In the explanation, please reference the “Management fees,” “Performance-based incentive fees” and “Management and performance-based incentive fees waived.” Also, when is the management and performance-based incentive fees payable generally settled?

Generally, management fee and incentive fee earned during the quarter is paid on the second month of the following quarter, except for incentive fees related to PIK income in which our investment adviser has agreed to be paid when such income is received in cash. Please see below, the roll-forward of the management and performance-based incentive fee payable account.

24. Please supplementally explain what “Other income” comprises of in the Company’s Statement of Operations for the year-ended March 31, 2016.

Other income is mostly composed of amendment fee, bridge fee, structuring fee and administrative fee.

25. For the fiscal year 2016, there was a return of capital of approximately $73.2 million. Please confirm compliance with Section 19(a) of the Investment Company Act of 1940. Please describe how shareholders are notified of the character of distributions, including whether the website is updated to reflect the character of the distributions.

The distributions paid by the Company did not require notices under Section 19(a) as they were paid entirely out of net investment income, without regard to realized gains or

Lisa Larkin

Kathy Churko

December 20, 2016

Page 8

losses. The return of capital disclosed in the statement of changes in net assets is further discussed in note 9 to the financial statements and is reflective of a tax basis return of capital and not a return of capital for purposes of Section 19(a). As noted in note 9, tax information for the fiscal year ended March 31, 2016 is an estimate and will not be finally determined until the Company files its 2016 tax return in December 2016. Shareholders are notified of the tax character of their distribution on Form 1099 in January of each year. Further, the Company updates its website for the characteristics of its distributions. Please note that the Company’s fiscal year ends on March 31st, as opposed to its tax year, which ends on December 31st.

26. Regarding the portfolio companies identified as “Control Investments”, we refer to the October 2014 IM Guidance Update, “Investment Company Consolidation” which states, in part:

“In reviewing registration statements and financial statements, the staff has observed a number of BDCs that have wholly owned subsidiaries, for example, in order to facilitate investment in a portfolio company. Certain of these BDCs do not consolidate such subsidiaries, even though the design and purpose of the subsidiary (e.g., a holding company) may be to act as an extension of the BDC’s investment operations and to facilitate the execution of the BDC’s investment strategy. As part of the registration statement and financial statement review process, the staff has generally suggested BDCs consolidate such subsidiaries because the staff believes that consolidation provides investors with the most meaningful financial presentation in those statements.”

Please confirm that the Company has reviewed this IM Guidance Update and identify any control investments of the Company that represent holding companies that act as an extension of the BDC’s investment operations and were designed to facilitate the execution of the BDC’s investment strategy.

Other than AIC Spotted Hawk Holdings, LLC, AIC SPV Holdings I, LLC, AIC SHD Holdings, LLC and AIC Pelican Holdings, LLC, which are special purpose vehicles and are consolidated in accordance with GAAP, the Company confirms that it has reviewed the IM Guidance Update and determined that it has no additional subsidiaries that were designed to, and do, act as extensions of its investment operations and facilitate the execution of its investment strategy.

27. On page F-17, in the Company’s Schedule of Investments, we note that certain of the investments have “N/A” under the column titled “Shares.” Please explain why the investments have “N/A” under such column.

The referenced investments are limited liability companies and the Company owns membership interests instead of shares. Accordingly, the Company cannot include the number of “shares” owned.

Lisa Larkin

Kathy Churko

December 20, 2016

Page 9

28. On page F-18, footnote 3 of the Company’s Schedule of Investments, we note that there are a number of entities in which the Company owns greater than 25% of the equity, where the governing documents of each entity preclude the Company from exercising a controlling influence over the management or policies of such entity. Please confirm that none of these entities would be a “significant subsidiary” of the Company as defined in Article 1-02(w) of Regulation S-X.

The Company confirms that that these investments do not meet the definition of a significant subsidiary as defined in Article 1-02(w) of Regulation S-X.

29. On page F-20, footnote 17 of the Company’s Schedule of Investments identifies those securities that are considered non-qualifying assets. In future financial statements, please disclose the percentage of the Company’s total assets that are non-qualifying assets.

The Company will include the requested disclosure in future financial statements.

30. On F-62, in Note 8, please supplementally explain what is meant by “outstanding” in the following sentence: “Of the unfunded commitments which existed as of March 31, 2016, $173,200 were outstanding as of May 18, 2016.”

The referenced amount pertains to commitments that were outstanding as of March 31, 2016 reduced by amount of commitments that expired, were sold and were funded during the period from March 31, 2016 through May 18, 2016.

31. In all applicable disclosures, please use the term “distributions” rather than “dividends” since the character of the distributions is not known at the time of declaration. This comment applies to all communications to shareholders.

The Company will use the term “distribution” if the character of the distribution is not known at the time of declaration in future financial statements and shareholder communications.

***********************

Lisa Larkin

Kathy Churko

December 20, 2016

Page 10

If you have additional questions, please call Richard Prins at 212-735-2790 or Steven Grigoriou at 416-777-4727.

Very truly yours,

/s/ Richard T. Prins

Richard T. Prins