Endeavour Silver Corp. - Exhibit 99.1 - Filed by newsfilecorp.com

ANNUAL INFORMATION FORM

(“AIF”)

of

ENDEAVOUR SILVER CORP.

(the “Company” or “Endeavour”)

Suite #301 - 700 West Pender Street

Vancouver, British Columbia, Canada, V6C 1G8

Phone: (604) 685-9775

Fax: (604)

685-9744

Dated: March 8, 2016

TABLE OF CONTENTS

ITEM

1: PRELIMINARY NOTES

1.1

Incorporation of Documents by Reference

All financial information in this Annual Information Form

(“AIF”) has been prepared in accordance with International Financial Reporting

Standards (“IFRS”) as prescribed by the International Accounting Standards

Board.

The information provided in the AIF is supplemented by

disclosure contained in the documents listed below which are incorporated by

reference into this AIF. These documents must be read together with the AIF in

order to provide full, true and plain disclosure of all material facts relating

to Endeavour. The documents listed below are not contained within, nor attached

to this document. The documents may be accessed by the reader at the following

locations:

Type of Document |

Effective Date /

Period Ended |

Date Filed /

Posted |

Document name which may be

viewed at the

SEDAR website at www.sedar.com |

| NI 43-101 Technical Report: Updated Mineral Resource and

Reserve Estimates for the Guanacevi Project, Durango State, Mexico |

December 31, 2015

|

March 9, 2016 |

Technical Report

(NI 43-101) – English Qualification Certificate(s) and Consent(s) |

| NI 43-101 Technical Report: Updated Mineral Resource and

Reserve Estimates for the Bolañitos Project Guanajuato State, Mexico |

December 31, 2015

|

March 9, 2016 |

Technical Report

(NI 43-101) – English Qualification Certificate(s) and Consent(s) |

| NI 43-101 Technical Report: Updated Mineral Resource and

Reserve Estimates for the El Cubo Project, Guanajuato State, Mexico |

December 31, 2015

|

March 9, 2016 |

Technical Report

(NI 43-101) – English Qualification Certificate(s) and Consent(s) |

| NI 43-101 Technical Report Preliminary Economic Assessment

for the Terronera Project, Jalisco State, Mexico |

March 25, 2015 |

May 13, 2015 |

Technical Report

(NI 43-101) – English Qualification Certificate(s) and Consent(s)

|

References to “the Company”, “Endeavour” or “Endeavour Silver”

are to Endeavour Silver Corp. and where applicable and as the context requires,

include its subsidiaries.

1.2

Date of Information

All information in this AIF is as of December 31, 2015 unless

otherwise indicated.

1.3

Forward-Looking Statements

This Annual Information Form contains “forward-looking

statements” within the meaning of applicable Canadian securities legislation.

Such forward-looking statements concern the Company’s anticipated results and

developments in the Company’s operations in future periods, planned exploration

and development of its properties, plans related to its business and other

matters that may occur in the future. These statements relate to analyses and

other information that are based on expectations of future performance,

including silver and gold production and planned work programs.

1

Endeavour Silver Corp.

Statements concerning reserves and mineral resource estimates

constitute forward-looking statements to the extent that they involve estimates

of the mineralization that will be encountered if the property is developed and,

in the case of mineral reserves, such statements reflect the conclusion based on

certain assumptions that the mineral deposit can be economically exploited.

Forward-looking statements are subject to a variety of known

and unknown risks, uncertainties and other factors which could cause actual

events or results to differ from those expressed or implied by the

forward-looking statements, including, without limitation:

| • |

risks related to precious and base metal price

fluctuations; |

| • |

risks related to fluctuations in the currency markets

(particularly the Mexican peso, Canadian dollar and United States dollar);

|

| • |

risks related to the inherently dangerous activity of

mining, including conditions or events beyond our control, and operating

or technical difficulties in mineral exploration, development and mining

activities; |

| • |

uncertainty in our ability to fund the development of our

mineral properties or the completion of further exploration programs;

|

| • |

uncertainty as to actual capital costs, operating costs,

production and economic returns, and uncertainty that our development

activities will result in profitable mining operations; |

| • |

risks related to our reserves and mineral resource

figures being estimates based on interpretations and assumptions which may

result in less mineral production under actual conditions than is

currently estimated and to diminishing quantities or grades of mineral

reserves as properties are mined; |

| • |

risks related to changes in governmental regulations, tax

and labour laws and obtaining necessary licenses and permits; |

| • |

risks related to our business being subject to

environmental laws and regulations which may increase our costs of doing

business and restrict our operations; |

| • |

risks related to our mineral properties being subject to

prior unregistered agreements, transfers, or claims and other defects in

title; |

| • |

risks relating to inadequate insurance or inability to

obtain insurance; |

| • |

risks related to our ability to successfully integrate

acquisitions; |

| • |

uncertainty in our ability to obtain necessary financing;

|

| • |

risks related to increased competition that could

adversely affect our ability to attract necessary capital funding or

acquire suitable producing properties for mineral exploration in the

future; |

| • |

risks related to many of our primary properties being

located in Mexico, including political, economic, and regulatory

instability; and |

| • |

risks related to our officers and directors becoming

associated with other natural resource companies which may give rise to

conflicts of interests. |

This list is not exhaustive of the factors that may affect our

forward-looking statements. Should one or more of these risks and uncertainties

materialize, or should underlying assumptions prove incorrect, actual results

may vary materially from those described in the forward-looking statements. The

Company’s forward-looking statements are based on beliefs, expectations and

opinions of management on the date the statements are made and the Company does

not assume any obligation to update forward-looking statements if circumstances

or management’s beliefs, expectations or opinions change, except as required by

law. For the reasons set forth above, investors should not place undue reliance

on forward-looking statements.

2

Endeavour Silver Corp.

1.4

Currency and Exchange Rates

All dollar amounts in this AIF are expressed in U.S. dollars

unless otherwise indicated. References to “Cdn.$” are to Canadian dollars. On

March 8, 2016, the noon exchange rate for the United States dollar in terms of

Canadian dollars, as quoted by the Bank of Canada, was U.S.$1.00 = Cdn.$1.3389

(Cdn.$1.00 = U.S.$0.7469). On December 31, 2015, the noon exchange rate for the

United States dollar in terms of Canadian dollars, as quoted by the Bank of

Canada, was U.S.$1.00 = Cdn.$1.3840 (Cdn.$1.00 = U.S.$0.7225).

1.5

Classification of Mineral Reserves and Resources

In this AIF, the definitions of proven and probable mineral

reserves, and measured, indicated and inferred mineral resources are those used

by the Canadian provincial securities regulatory authorities and conform to the

definitions utilized by the Canadian Institute of Mining, Metallurgy and

Petroleum, as the CIM Definition Standards on Mineral Resources and Mineral

Reserves adopted by the CIM Council, as amended.

1.6

Cautionary Note to U.S. Investors concerning Estimates of Mineral

Reserves and Measured, Indicated and Inferred Mineral Resources

This AIF has been prepared in accordance with the requirements

of the securities laws in effect in Canada, which differ from the requirements

of United States securities laws. The terms “mineral reserve”, “proven mineral

reserve” and “probable mineral reserve” are Canadian mining terms as defined in

accordance with the Canadian Securities Administrators’ National Instrument

43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the

Canadian Institute of Mining, Metallurgy and Petroleum as the CIM Definition

Standards on Mineral Resources and Mineral Reserves adopted by the CIM Council,

as amended. These definitions differ from the definitions in SEC Industry Guide

7 under the United States Securities Act of 1933, as amended. Under SEC Industry

Guide 7 standards, a “final” or “bankable” feasibility study is required to

report reserves, the three-year historical average price is used in any reserve

or cash flow analysis to designate reserves and the primary environmental

analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral

resource”, “indicated mineral resource” and “inferred mineral resource” are

defined in and required to be disclosed by NI 43-101; however, these terms are

not defined terms under SEC Industry Guide 7 and are normally not permitted to

be used in reports and registration statements filed with the SEC. Investors are

cautioned not to assume that any part or all of mineral deposits in these

categories will ever be converted into reserves. “Inferred mineral resources”

have a great amount of uncertainty as to their existence, and great uncertainty

as to their economic and legal feasibility. It cannot be assumed that all or any

part of an inferred mineral resource will ever be upgraded to a higher category.

Under Canadian rules, estimates of inferred mineral resources may not form the

basis of feasibility or pre-feasibility studies, except in rare cases. Investors

are cautioned not to assume that all or any part of an inferred mineral resource

exists or is economically or legally mineable. Disclosure of “contained ounces”

in a resource is permitted disclosure under Canadian regulations; however, the

SEC normally only permits issuers to report mineralization that does not

constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and

grade without reference to unit measures.

Accordingly, information contained in this AIF contain

descriptions of our mineral deposits that may not be comparable to similar

information made public by U.S. companies subject to the reporting and

disclosure requirements under the United States federal securities laws and the

rules and regulations thereunder.

3

Endeavour Silver Corp.

ITEM

2: CORPORATE

STRUCTURE

2.1

Name, Address and Incorporation

The Company was incorporated under the laws of the Province of

British Columbia on March 11, 1981 under the name, “Levelland Energy &

Resources Ltd”. Effective August 27, 2002 the Company changed its name to

“Endeavour Gold Corp.”, consolidated its share capital on the basis of four old

common shares for one new common share and increased its share capital to

100,000,000 common shares without par value. On September 13, 2004, the Company

changed its name to “Endeavour Silver Corp.”, transitioned from the Company

Act (British Columbia) to the Business Corporations Act (British

Columbia) and increased its authorized share capital to unlimited common shares

without par value.

The Company’s principal business office is located at:

Suite 301 - 700 West Pender Street

Vancouver, British Columbia

Canada, V6C 1G8

and its registered and records office is located at:

19th Floor, 885 West Georgia

Street

Vancouver, British Columbia

Canada, V6C 3H4

2.2

Subsidiaries

The Company conducts its business primarily in Mexico through

subsidiary companies. The following table lists the material subsidiaries,

jurisdiction of incorporation and % ownership held.

| Name of Company |

Incorporated |

% held |

| |

|

|

|

Endeavour Gold Corporation, S.A.

de C.V. |

Mexico |

100 |

|

Minera Paola S.A. de C.V. SOFOM ENR |

Mexico |

100 |

|

Minera Plata Adelante, S.A. de

C.V. |

Mexico |

100 |

|

Minera Santa Cruz Garibaldi S.A. de C.V. |

Mexico |

100 |

|

Refinadora Plata Guanacevi, S.A.

de C.V. |

Mexico |

100 |

|

Mina Bolañitos S.A de C.V. |

Mexico |

100 |

|

Compa Minera del Cubo S.A. de C.V.

|

Mexico |

100 |

|

Minas Lupycal S.A. de C.V. |

Mexico |

100 |

|

Minera Plata Carina S.P.A. |

Chile |

100 |

|

MXRT Holdings Inc. |

Canada |

100 |

|

Endeavour Zilver S.A.R.L. |

Luxembourg |

100 |

ITEM

3: GENERAL

DEVELOPMENT OF THE BUSINESS

3.1

Three Year History

Overview

The Company is a Canadian mineral company engaged in the

evaluation, acquisition, exploration, development and exploitation of precious

metal properties in Mexico and Chile.

4

Endeavour Silver Corp.

Guanacevi Mines

In May 2004, Endeavour signed formal option agreements to

acquire up to a 100% interest in the producing Santa Cruz silver-gold mine,

certain other mining concessions and the Guanacevi mineral processing plant

(collectively, the “Guanacevi Mines Project”) in Durango, Mexico. The terms of

the agreements gave Endeavour the option to acquire an initial 51% interest in

these operating assets by paying a total of approximately $4 million to the

vendors and incurring $1 million in mine exploration and development within one

year. This was completed on January 28, 2006. The balance of the 49% interest

was purchased through the payment of a further $3 million by instalments. The

purchase of the remaining 49% of the mill facility was completed in July 2006

and the purchase of the remaining 49% of the mining assets was completed in

January 2008.

Under the option interest agreement, a scheduled January 28,

2007 payment of $638,000 was made with 176,201 shares of the Company in lieu of

cash. Further to a negotiated early buy-out of the minority shareholders, the

Company acquired the remaining shares of Minera Santa Cruz y Garibaldi S.A. de

C.V. (“Minera Santa Cruz”), which owned 49% of the Santa Cruz silver-gold mine

in May 2007 by the issue of 1,350,000 shares of the Company with a fair market

value of $5.04 per share.

The Company elected to accelerate the buy-out in order to

streamline the mining operations and facilitate additional capital investments

for the mine development program.

Bolañitos Mines

In February 2007, the Company acquired the right to

purchase the exploitation contracts to the producing Unidad Bolañitos silver

(gold) mines located in the northern parts of the Guanajuato and La Luz silver

districts in the state of Guanajuato, Mexico from Minas de la Luz SA de CV

("MdlL") for $3.4 million, comprised of $2.4 million in cash and $1.0 million in

common shares of the Company. On April 30, 2007 the Company completed the

acquisition by paying $2.4 million in cash and issuing 224,215 common shares

priced at $4.46 per share.

In April 2007 the Company entered into an agreement with two

subsidiaries of Industrial Peñoles S.A. de C.V. (“Peñoles”) to purchase all of

the Guanajuato property and plant assets for 800,000 common shares of the

Company and a share purchase warrant exercisable for an additional 250,000

common shares at Cdn.$5.50 per share within a two year period. The acquisition

was completed on May 30, 2007 and the Company has a 100% interest in the

Bolañitos Mines, free and clear of any royalties. The share purchase warrant

expired on May 30, 2009 unexercised.

El Cubo Mines

On July 13, 2012, the Company completed the acquisition of MXRT

Holdings Ltd (formerly Mexgold Resources Inc. (“Mexgold”)) and its three wholly

owned subsidiaries: Compania Minera del Cubo, S.A. de C.V., Minas Lupycal S.A.

de C.V (formerly AuRico Gold GYC, S.A. de C.V.) and Metales Interamericanos,

S.A. de C.V. from AuRico Gold Inc. (“AuRico”).

As a result of the acquisition, the Company owns the El Cubo

silver-gold mine located in Guanajuato, Mexico and the Guadalupe y Calvo

silver-gold exploration project located in Chihuahua, Mexico.

El Cubo is a producing silver-gold mine located in the

southeast part of the historic Guanajuato mining district in central Mexico,

only 10 kilometres (km) from Endeavour's operating Bolañitos silver-gold mine in

the northwest part of the Guanajuato district.

5

Endeavour Silver Corp.

The El Cubo property consists of 61 mineral concessions

covering 8,144 hectares, including several historic and currently active mine

adits, ramps and shafts. Approximately 38 individual veins have been identified

on the El Cubo property. Veins typically strike northwest, dip 70 degrees

southwest and average nearly 2 metres wide.

Terronera Project (formerly San Sebastian Project)

San Sebastián del Oeste is an historic silver and gold mining

district in southwestern Jalisco state, approximately 155 kilometres southwest

of Guadalajara. One small high-grade underground silver and gold mine, Santa

Quitéria, is currently operating in the district, producing 100 tonnes of ore

per day. Our San Sebastián property surrounds the Santa Quitéria mine and

represents a new district-scale silver-and gold exploration and mining

opportunity for Endeavour.

The San Sebastián property displays a classic low-sulphidation

epithermal vein system with four mineralized subdistricts, each consisting of a

cluster of quartz veins (calcite, barite) bearing sulphide minerals (pyrite,

argentite, galena, and sphalerite). Historically, more than 50 small mines have

been developed within at least 20 veins. Although the San Sebastián silver mines

were first discovered in 1542 and there have been several periods of small-scale

mining over the last 450 years, little modern exploration was ever carried out

in the district.

Endeavour identified substantial potential for additional

high-grade mineralized zones within the several dozen kilometres of known veins

on the San Sebastián properties. In 2010, the Company signed an option to

purchase a 100% interest in the San Sebastian properties by paying a total of

$2.7 million over three years and paying a 2% NSR royalty on any future

production. The high-grade discovery in the Terronera vein confirmed our

opinion. Endeavour published an initial resource in 2014 and a Preliminary

Economic Assessment (“Terronera PEA”) in 2015.

The Terronera PEA results in an after-tax base case net present

value of $48.6 million using a 5% discount rate, which achieves a 20% rate of

return and a pay-back period of 3.7 years. Total operating revenue in the

Terronera PEA was estimated at $542 million from estimated sales of 20.4 million

ounces (oz) of silver and 138,500 oz of gold at $18 per oz silver and $1,260 per

oz gold. Mine-site cash operating costs were estimated at $3.93 per oz silver

net of gold credits based on $83 per tonne total operating costs or total

operating costs of $287 million. Additional total sustaining capital costs were

estimated at $75 million, including dry stack tailings and life of mine capital,

exploration and general and administrative expenditures at estimated mine-site

all-in sustaining costs of $7.60 per oz silver net of gold credits for the life

of the project.

The PEA economic analysis is preliminary in nature and is based

on production schedules that include Inferred Mineral Resources, which are

considered too speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as Mineral Reserves.

There is no certainty that the preliminary economic assessment in the Terronera

PEA will be realized or that Inferred Mineral Resources will be upgraded to

Indicated Mineral Resources. Mineral Resources that are not Mineral Reserves do

not have demonstrated economic viability. See “Terronera Project, Jalisco State,

Mexico” under Item 4.4 Mineral Projects for further details of the Terronera

PEA, including the basis for the preliminary economic assessment therein and the

qualifications and assumptions made in connection with such assessment.

6

Endeavour Silver Corp.

Three Year History

2016 to Present

On March 9, 2016 the Company

released updated NI 43-101 Reserve and Resource estimates as at December 31,

2015 for its active silver mining and exploration projects in Mexico, being the

Guanacevi Mines, the Bolañitos Mines and the El Cubo Mines.

Endeavour’s 2016 strategy is to focus on minimizing all-in

sustaining costs and improving after-tax free cash flow rather than metal

output. Endeavour management expects that silver production will be the range of

4.9 -5.3 million oz, gold production will be in the range of 47,000-52,000 oz,

and silver equivalent production will be in the range of 7.9 -8.5 million oz

using a 75:1 silver:gold ratio.

At Guanaceví, production will continue at the 1,200 tonne per

day (tpd) plant capacity primarily from the Santa Cruz, Porvenir Norte, and

Porvenir Centro deposits. Underground exploration and mine development will

continue to be funded from cash flow, and additional mine development is

scheduled for permitting and development subject to financing from existing

sources.

At Bolañitos, mine production will continue at 850 tpd

primarily from the LL-Asunción deposit. The plant will operate closer to its

1,600 tpd capacity in the first half in order to process the 75,000 tonne ore

stockpile. No exploration or mine development is planned at the current metal

prices, but that could change during the year if prices improve.

At El Cubo, production will continue initially from the

V-Asunción, Dolores, Villalpando, San Nicolas and Santa Cecilia veins, but will

decline each month until only V-Asunción is producing prior to going on care and

maintenance in the fourth quarter. Investments on exploration and mine

development have been suspended until metal prices improve.

Subsequent to December 31, 2015, the Company issued an

additional 3,616,043 shares under at-the-market “ATM” facility at an average

price of $1.57 per share for net proceeds of $5.5 million. The common shares

were issued in at-the-market distributions on the New York Stock Exchange

pursuant to our effective registration statement on Form F-10, which registers

the offer and sale of the common shares under our ATM facility.

2015

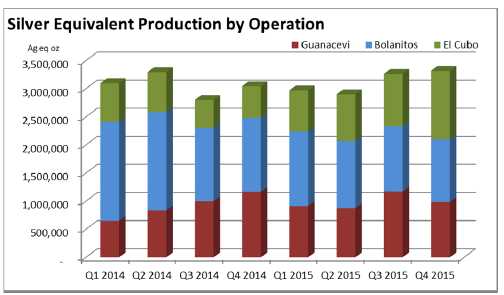

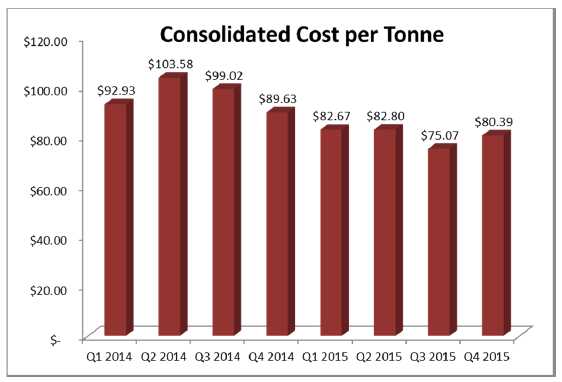

In 2015, the Company delivered silver

production that was above announced guidance and gold production in line with

guidance. The Company produced 7,178,666 oz silver and 59,990 oz gold. Silver

equivalent production totaled 11.4 million ounces at a 70:1 silver:gold ratio.

With continued weakness in precious metal prices, the Company remained focused

on cost improvements and reductions, in particular at the El Cubo operation. The

El Cubo operation increased ore mined and processed by 64%, achieving a

production rate of 2,165 tpd in the fourth quarter, driving costs per tonne down

19%, cash costs down 36% and all-in-sustaining costs down 44% compared to 2014.

At the Bolañitos operation, the mine reduced output from 1,600 tpd to 1,000 tpd

as underground resources focused on the development of the LL-Asuncion ore body,

as the Lucero ore zone discovered in 2009 and 2010 was in its last year as the

primary source of the mined ore. Despite the lower throughput, Bolañitos

operating costs per tonne improved from the previous year, however, lower grade

material increased its cost metrics on a per ounce basis. The Guanaceví mine

continued to perform around its capacity of 1,200 tpd, while cost per tonne also

improved at this operation. Consolidated plant throughput was 1,565,507 tonnes

at average grades of 167 grams per tonne (gpt) silver and 1.41 gpt gold.

7

Endeavour Silver Corp.

In early 2015, the Company released an updated NI 43-101

Reserve and Resource estimate as at October 31, 2014 for its active silver mines

and the Terronera PEA. The Company continued to advance the Terronera project

with additional drilling and studies subsequent to the release of the Terronera

PEA.

On November 25, 2015, the Company entered into an ATM facility

with Cowen and Company, LLC, acting as sole agent. Under the terms of this ATM

facility, we may, from time to time, sell shares of our common stock having an

aggregate offering value of up to US$16.5 million on the New York Stock

Exchange. The Company determines, at its sole discretion, the timing and number

of shares to be sold under this ATM facility. A prospectus supplement to the

Base Shelf was filed on November 25, 2015 to qualify the shares to be sold under

the ATM facility up to a maximum of $16.5 million. During the year ended

December 31, 2015, the Company issued 799,569 common shares under the ATM

facility at an average price of $1.43 per share for net proceeds of $1.1

million.

2014

Endeavour delivered company records of

annual silver production from mining operations in 2014, led by record

performance of the Guanaceví mine. The Company beat the high end of its silver

production guidance by 5%, although gold production fell short of guidance by

3%. Consolidated silver production during 2014 was 7,212,074 ounces, an increase

of 6% compared to 2013, and gold production was 62,895 ounces. Plant throughput

was 1,404,406 tonnes at average grades of 185 grams per tonne silver and 1.62

gpt gold. Silver production increased due to higher grades and recoveries,

partially offset by the lower throughput. Gold production was lower due to lower

grades and throughput. The El Cubo mine output rose throughout 2014 in order to

fill the El Cubo plant to its 1,550 tpd capacity.

The Company continued in 2014 to focus its efforts on the

improvement of the El Cubo mine it acquired in 2012. Cost per tonne fell 13% to

$98.92 as cost cutting initiatives took effect and appeared to be sustainable.

The Company completed 28,000 metres of exploration drilling in 69 holes,

including the expansion and delineation of V-Asuncion ore body.

In early 2014, the Company released an updated NI 43-101

Reserve and Resource estimate as at December 31, 2013 for its active silver

mining and exploration projects in Mexico.

2013

Endeavour recorded its eighth

consecutive year of growing sales revenue in 2013. During 2013, increased

production drove sales 33% higher to $276.8 million and mine operating cash-flow

increased 2% to $116.9 million from the previous year due to slightly higher

margins. Direct operating costs rose as a result of the increased production,

while the Company incurred additional costs with employee layoffs to improve the

long term viability of its operations.

Endeavour reported its eighth consecutive year of growing

silver and gold production for 2013, increasing silver production by 52% to

6,813,069 oz silver and gold production by 95% to 75,578 oz gold compared to

2012. The Company focused its efforts on the improvement of the El Cubo mine it

acquired in 2012. The Company successfully reduced the El Cubo workforce from

980 employees to 576 employees as of December 31, 2013 while improving plant

throughput, ore grades and recoveries in 2013. The Company returned the leased

Las Torres facility to its owner, completely refurbished the El Cubo plant in

seven months and drove 10.6 kilometres of underground development. Furthermore

the Company continued to improve safety programs, site governance and community

initiatives.

Endeavour originally outlined 28 separate target areas in and

around the existing mines at El Cubo with near-term potential to delineate new

reserves and resources. In 2013, the Company drilled 18,450 metres in 47 holes

to discover new high-grade, gold-silver vein mineralization in the historic

Villalpando, V-Asuncion and Dolores veins. Drilling at Dolores helped to extend

and define the hanging-wall and footwall vein ore-bodies that are currently in

production. Drilling in the Villalpando and V-Asuncion veins, discovered in late

2012 and fast-tracked to production last year, successfully extended this newly

discovered mineralized zone over 900 m in strike length, still open for

expansion.

8

Endeavour Silver Corp.

In early 2013, the Company released an updated NI 43-101

Reserve and Resource estimate as at December 15, 2012 for its active silver

mining and exploration projects in Mexico. Endeavour achieved its eighth

consecutive year of combined reserve and resource growth.

3.2

Significant Acquisitions

No significant acquisitions for which disclosure is required

under Part 8 of National Instrument 51-102 were completed by the Company during

its most recently completed financial year.

ITEM

4: DESCRIPTION OF

THE BUSINESS

4.1

General Description

The Business of the Company

The Company’s principal business activities are the evaluation,

acquisition, exploration, development and exploitation of mineral properties.

The Company produces silver-gold from its underground mines at Guanacevi,

Bolañitos and El Cubo in Mexico. The Company also has interests in certain

exploration properties in Mexico and Chile.

The Company’s business is not materially affected by

intangibles such as licences, patents and trademarks, nor is it significantly

affected by seasonal changes. Other than as disclosed in this AIF, the Company

is not aware of any aspect of its business which may be affected in the current

financial year by renegotiation or termination of contracts.

Foreign Operations

As the Company’s producing mines and mineral exploration

interests are principally located in Mexico, the Company’s business is dependent

on foreign operations. As a developing economy, operating in Mexico has certain

risks. See “Risk Factors – Foreign Operations”.

Employees

As at December 31, 2015, the Company had approximately 14

employees based in its Vancouver corporate office and approximately 1,683 full

and part-time employees in Mexico. Additional consultants are also retained from

time to time for specific corporate activities, development and exploration

programs.

Environmental Protection

The Company’s environmental permit requires that it reclaim

certain land it disturbs during mining operations. Significant reclamation and

closure activities include land rehabilitation, decommissioning of buildings and

mine facilities, ongoing care and maintenance and other costs. Although the

ultimate amount of the reclamation and rehabilitation costs to be incurred

cannot be predicted with certainty, the total undiscounted amount of probability

weighted estimated cash flows required to settle the Company’s estimated

obligations is $2.1 million for the Guanacevi mine operations, $1.8 million for

the Bolañitos mine operations and $4.2 million for the El Cubo mine operations.

9

Endeavour Silver Corp.

Community, Environmental and Corporate Safety Policies

Endeavour is focused on the improvement of sustainability

programs for all stakeholders and understands that such programs contribute to

the long term benefit of the Company and society at large. Sustainability

programs implemented by the Company range from improving the Company’s safety

policies and practices; supporting health programs for the Company’s employees

and the local communities; enhancing environmental stewardship and reclamation;

sponsoring educational scholarships and job skills training programs; sponsoring

community cultural events and infrastructure improvements; and supporting

charitable causes.

4.2

Risk Factors

The Company’s ability to generate revenues and profits from its

mineral properties, or any other mineral property it may acquire, is dependent

upon a number of factors, including, without limitation, the following risk

factors.

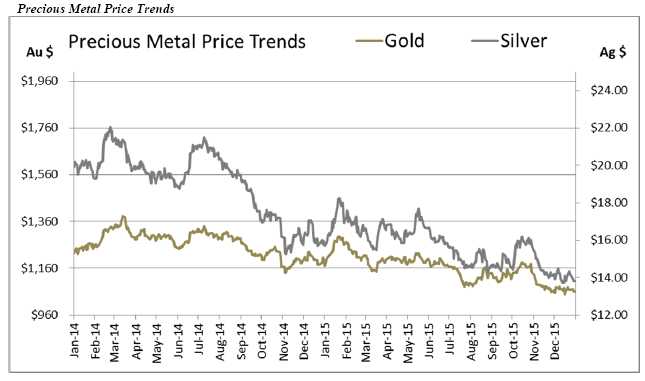

Precious and Base Metal Price Fluctuations

The profitability of the precious metal operations in which the

Company has an interest will be significantly affected by changes in the market

prices of precious metals. Prices for precious metals fluctuate on a daily

basis, have historically been subject to wide fluctuations and are affected by

numerous factors beyond the control of the Company such as the level of interest

rates, the rate of inflation, central bank transactions, world supply of the

precious metals, foreign currency exchange rates, international investments,

monetary systems, speculative activities, international economic conditions and

political developments. The exact effect of these factors cannot be accurately

predicted, but the combination of these factors may result in the Company not

receiving adequate returns on invested capital or the investments retaining

their respective values. Declining market prices for these metals could

materially adversely affect the Company’s operations and profitability.

Fluctuations in the price of consumed commodities

Prices and availability of commodities consumed or used in

connection with exploration, development and mining, such as natural gas,

diesel, oil, electricity, cyanide and other re-agents fluctuate and affect the

costs of production at our operations. These fluctuations can be unpredictable,

can occur over short periods of time and may have a materially adverse impact on

our operating costs or the timing and costs of various projects. Our general

policy is not to hedge our exposure to changes in prices of the commodities that

we use in our business.

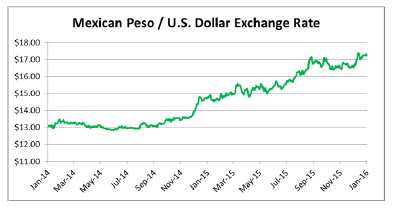

Foreign Exchange Rate Fluctuations

Operations

in Mexico and Canada are subject to foreign currency exchange fluctuations. The

Company raises its funds through equity issuances which are priced in Canadian

dollars, and the majority of the exploration costs of the Company are

denominated in United States dollars and Mexican pesos. The Company may suffer

losses due to adverse foreign currency fluctuations.

Competitive Conditions

Significant

competition exists for natural resource acquisition opportunities. As a result

of this competition, some of which is with large, well established mining

companies with substantial capabilities and significant financial and technical

resources, the Company may be unable to either compete for or acquire rights to

exploit additional attractive mining properties on terms it considers

acceptable. Accordingly, there can be no assurance that the Company will be able

to acquire any interest in additional projects that would yield reserves or

results for commercial mining operations.

10

Endeavour Silver Corp.

Operating Hazards and Risks

Mining operations

generally involve a high degree of risk, which even a combination of experience,

knowledge and careful evaluation may not be able to overcome. These risks

include, but are not limited to, the following: environmental hazards,

industrial accidents, third party accidents, unusual or unexpected geological

structures or formations, fires, power outages, labour disruptions, floods,

explosions, cave-ins, land-slides, acts of God, periodic interruptions due to

inclement or hazardous weather conditions, earthquakes, war, rebellion,

revolution, delays in transportation, inaccessibility to property, restrictions

of courts and/or government authorities, other restrictive matters beyond the

reasonable control of the Company, and the inability to obtain suitable or

adequate machinery, equipment or labour and other risks involved in the

operation of mines.

Operations in which the Company has a direct or indirect

interest will be subject to all the hazards and risks normally incidental to

exploration, development and production of precious and base metals, any of

which could result in work stoppages, delayed production and resultant losses,

increased production costs, asset write downs, damage to or destruction of mines

and other producing facilities, damage to life and property, environmental

damage and possible legal liability for any or all damages. The Company may

become subject to liability for pollution, cave-ins or hazards against which it

cannot insure or against which it may elect not to insure. Any compensation for

such liabilities may have a material, adverse effect on the Company’s financial

position.

Our property, business interruption and liability insurance may

not provide sufficient coverage for losses related to these or other hazards.

Insurance against certain risks, including certain liabilities for environmental

pollution, may not be available to us or to other companies within the industry

at reasonable terms or at all. In addition, our insurance coverage may not

continue to be available at economically feasible premiums, or at all. Any such

event could have a material adverse effect on our business.

Mining Operations

The capital costs required

by the Company’s projects may be significantly higher than anticipated. Capital

and operating costs, production and economic returns, and other estimates

contained in the Company’s current technical reports, may differ significantly

from those provided for in future studies and estimates and from management

guidance, and there can be no assurance that the Company’s actual capital and

operating costs will not be higher than currently anticipated. In addition,

delays to construction and exploration schedules may negatively impact the net

present value and internal rates of return of the Company’s mineral properties

as set forth in the applicable technical report. Similarly, there can be no

assurance that historical rates of production, grades of ore processed, rates of

recoveries or mining cash costs will not experience fluctuations or differ

significantly from current levels over the course of the mining operations

conducted by the Company.

In addition, there can be no assurance that the Company will be

able to continue to extend the production from its current operations through

exploration and drilling programs.

Infrastructure

Mining, processing,

development and exploration activities depend, to one degree or another, on

adequate infrastructure. Reliable roads, bridges, power sources and water supply

are important determinants, which affect capital and operating costs. The lack

of availability on acceptable terms or the delay in the availability of any one

or more of these items could prevent or delay exploitation or development of the

Company’s projects. If adequate infrastructure is not available in a timely

manner, there can be no assurance that the exploitation or development of the

Company’s projects will be commenced or completed on a timely basis, if at all;

the resulting operations will achieve the anticipated production volume, or the

construction costs and ongoing operating costs associated with the exploitation

and/or development of the Company’s advanced projects will not be higher than

anticipated. In addition, unusual or infrequent weather phenomena, sabotage,

government or other interference in the maintenance or provision of such

infrastructure could adversely affect the Company’s operations and

profitability.

11

Endeavour Silver Corp.

Exploration and Development

There is no

assurance given by the Company that its exploration and development programs and

properties will result in the discovery, development or production of a

commercially viable ore body or yield new reserves to replace or expand current

reserves.

The business of exploration for minerals and mining involves a

high degree of risk. Few properties that are explored are ultimately developed

into producing mines. At this time, other than the mineral reserves on the

Company’s Guanacevi Mines Project, Bolañitos Mines Project and El Cubo Mine,

none of the Company’s properties have any defined ore-bodies with proven

reserves.

The economics of developing silver, gold and other mineral

properties are affected by many factors including capital and operating costs,

variations of the tonnage and grade of ore mined, fluctuating mineral markets,

and such other factors as government regulations, including regulations relating

to royalties, allowable production, importing and exporting of minerals and

environmental protection. Depending on the prices of silver, gold or other

minerals produced, the Company may determine that it is impractical to commence

or continue commercial production.

Substantial expenditures are required to discover an ore-body,

to establish reserves, to identify the appropriate metallurgical processes to

extract metal from ore, and to develop the mining and processing facilities and

infrastructure. The marketability of any minerals acquired or discovered may be

affected by numerous factors which are beyond the Company’s control and which

cannot be accurately foreseen or predicted, such as market fluctuations,

conditions for precious and base metals, the proximity and capacity of milling

and smelting facilities, and such other factors as government regulations,

including regulations relating to royalties, allowable production, importing and

exporting minerals and environmental protection. In order to commence

exploitation of certain properties presently held under exploration concessions,

it is necessary for the Company to apply for an exploitation concession. There

can be no guarantee that such a concession will be granted. Unsuccessful

exploration or development programs could have a material adverse impact on the

Company’s operations and profitability.

Calculation of Reserves and Resources and Precious Metal

Recoveries

There is a degree of uncertainty attributable to the

calculation and estimation of reserves and resources and their corresponding

metal grades to be mined and recovered. Until reserves or resources are actually

mined and processed, the quantities of mineralization and metal grades must be

considered as estimates only. Any material change in the quantity of mineral

reserves, mineral resources, grades and recoveries may affect the economic

viability of the Company’s properties.

Decreases in the market price of silver or gold may

render the mining of reserves uneconomic.

The mineral resource and

reserve figures included in the AIF and the documents incorporated by reference

are estimates, which are, in part, based on forward-looking information, and no

assurance can be given that the indicated level of silver and gold will be

produced. Factors such as metal price fluctuations, increased production costs

and reduced recovery rates may render the present proven and probable reserves

unprofitable to develop at a particular site or sites for periods of time.

The NI 43-101 technical reports in respect of the Guanacevi

Mines, the Bolanitos Mines and the El Cubo Mine assume the following metal

prices: $16 per ounce for silver and $1,200 per ounce for gold. The Terronera

PEA assumes the following metal prices in the base case plan: $18 per ounce for

silver and $1,260 per ounce for gold. Mineral reserve and resource estimates

would be lower than estimated to the extent that actual metal prices are lower

than assumed.

12

Endeavour Silver Corp.

Replacement of Reserves and Resources

The

Guanaceví, Bolañitos and El Cubo mines are the Company’s only current sources of

mineral production. Current life-of-mine plans provide for a defined production

life for mining at the Company’s mines. The Bolañitos mine has an expected mine

life of less than two years based on current proven and probable reserves and

production levels. If the Company’s mineral reserves and resources are not

replaced either by the development or discovery of additional reserves and/or

extension of the life-of-mine at its current operating mines or through the

acquisition or development of an additional producing mine, this could have an

adverse impact on the Company’s future cash flows, earnings, financial

performance and financial condition, including as a result of requirements to

expend funds for reclamation and decommissioning.

Acquisition Strategy

As part of the Company’s

business strategy, it has sought and will continue to seek new mining and

development opportunities in the mining industry. In pursuit of such

opportunities, it may fail to select appropriate acquisition candidates,

negotiate appropriate acquisition terms, conduct sufficient due diligence to

determine all related liabilities or to negotiate favourable financing terms.

The Company may encounter difficulties in transitioning the business, including

issues with the integration of the acquired businesses or its personnel into the

Company. The Company cannot assure that it can complete any acquisition or

business arrangement that it pursues, or is pursuing, on favourable terms, or

that any acquisitions or business arrangements completed will ultimately benefit

its business.

Integration of New Acquisitions

The Company’s

success at completing any acquisitions will depend on a number of factors,

including, but not limited to: identifying acquisitions which fit the Company’s

strategy; negotiating acceptable terms with the seller of the business or

property to be acquired; and obtaining approval from regulatory authorities in

the jurisdictions of the business or property to be acquired.

The positive effect on the Company’s results arising from past

and future acquisitions will depend on a variety of factors, including, but not

limited to: assimilating the operations of an acquired business or property in a

timely and efficient manner including the existing work force, union

arrangements and existing contracts; maintaining the Company’s financial and

strategic focus while integrating the acquired business or property;

implementing uniform standards, controls, procedures and policies at the

acquired business, as appropriate; and to the extent that the Company makes an

acquisition outside of markets in which it has previously operated, conducting

and managing operations in a new operating environment and under a new

regulatory regime where it has no direct experience.

Past and future business or property acquisitions could place

increased pressure on the Company’s cash flow if such acquisitions involve cash

consideration or the assumption of obligations requiring cash payments. The

integration of the Company’s existing operations with any acquired business will

require significant expenditures of time, attention and funds. Achievement of

the benefits expected from consolidation would require the Company to incur

significant costs in connection with, among other things, implementing financial

and planning systems. The Company may not be able to integrate the operations of

a recently acquired business or restructure the Company’s previously existing

business operations without encountering difficulties and delays. In addition,

this integration may require significant attention from the Company’s management

team, which may detract attention from the Company’s day-to-day operations. Over

the short-term, difficulties associated with integration could have a material

adverse effect on the Company’s business, operating results, financial condition

and the price of the Company’s common shares. In addition, the acquisition of

mineral properties may subject the Company to unforeseen liabilities, including

environmental liabilities.

13

Endeavour Silver Corp.

Foreign Operations

The Company’s operations

are currently conducted through subsidiaries principally in Mexico and, as such,

its operations are exposed to various levels of political, economic and other

risks and uncertainties which could result in work stoppages, blockades of the

Company’s mining operations and appropriation of assets. Some of the Company’s

operations are located in areas where Mexican drug cartels operate. These risks

and uncertainties vary from region to region and include, but are not limited

to, terrorism; hostage taking; local drug gang activities; military repression;

expropriation; extreme fluctuations in currency exchange rates; high rates of

inflation; labour unrest; the risks of war or civil unrest; renegotiation or

nullification of existing concessions, licenses, permits and contracts; illegal

mining; changes in taxation policies; restrictions on foreign exchange and

repatriation; and changing political conditions, currency controls and

governmental regulations that favour or require the awarding of contracts to

local contractors or require foreign contractors to employ citizens of, or

purchase supplies from, a particular jurisdiction.

Local opposition to mine development projects could arise in

Mexico, and such opposition could be violent. There can be no assurance that

such local opposition will not arise with respect to the Company’s Mexican

operations. If the Company were to experience resistance or unrest in connection

with its Mexican operations, it could have a material adverse effect on its

operations and profitability. To the extent the Company acquires mineral

properties in jurisdictions other than Mexico, it may be subject to similar and

additional risks with respect to its operations in those jurisdictions.

Government Regulation

The Company’s

operations, exploration and development activities are subject to extensive

foreign federal, state and local laws and regulations governing such matters as

environmental protection, management and use of toxic substances and explosives,

management of natural resources, health, exploration and development of mines,

production and post-closure reclamation, safety and labour, mining law reform,

price controls import and export laws, taxation, maintenance of claims, tenure,

government royalties and expropriation of property. There is no assurance that

future changes in such regulation, if any, will not adversely affect the

Company’s operations. The activities of the Company require licenses and permits

from various governmental authorities.

The costs associated with compliance with these laws and

regulations are substantial and possible future laws and regulations, changes to

existing laws and regulations and more stringent enforcement of current laws and

regulations by governmental authorities, could cause additional expenses,

capital expenditures, restrictions on or suspensions of the Company’s operations

and delays in the development of its properties. Moreover, these laws and

regulations may allow governmental authorities and private parties to bring

lawsuits based upon damages to property and injury to persons resulting from the

environmental, health and safety practices of the Company’s past and current

operations, or possibly even those actions of parties from whom the Company

acquired its mines or properties, and could lead to the imposition of

substantial fines, penalties or other civil or criminal sanctions. The Company

retains competent and well trained individuals and consultants in jurisdictions

in which it does business, however, even with the application of considerable

skill the Company may inadvertently fail to comply with certain laws. Such

events can lead to financial restatements, fines, penalties, and other material

negative impacts on the Company.

Mexican Foreign Investment and Income Tax Laws

On October 31, 2013, the Mexican Tax Reform package was approved by

the Mexican Congress and it came into effect on January 1, 2014. This law

applies on a prospective basis and is expected to affect the future earnings of

the Company’s operations in Mexico. The Company has taken the position that the

7.5% mining royalty is an income tax in accordance with IFRS for financial

reporting purpose, as it is based on a measure of revenue less certain specified

costs. On substantial enactment, a taxable temporary difference arises, as

property, plant and equipment and exploration and evaluation assets have book

basis but no tax basis for purposes of the royalty.

14

Endeavour Silver Corp.

In December 2012, the Mexican government amended federal labour

laws with respect to the use of service companies, subcontracting arrangements

and the obligation to compensate employees with appropriate profit-sharing in

Mexico. While the Company believes it is probable that these amended labour laws

will not result in any material obligation or additional profit-sharing

entitlements for its Mexican employees, there can be no assurance that this will

continue to be the case.

Any developments or changes in such legal, regulatory or

governmental requirements as described above or otherwise are beyond the control

of the Company and may adversely affect its business.

Mexican Tax Assessments

As disclosed under

“Legal Proceedings” on page 54 and 55, a subsidiary of the Company in Mexico has

received a tax assessment from Mexican fiscal authorities.

In June 2015, the Superior Court ruled in favour of MSCG on a

number of the matters under appeal; however, the Superior Court ruled against

MSCG for failure to provide appropriate support for certain deductions taken in

MSCG’s 2006 tax return. An assessment by the Tax Court was made, however the Tax

Court did not follow the Superior Court directive as required by law. Therefore

the Company filed another Nullity action for the Tax Court to follow the

Superior Court directive during the year. The Company expects the Tax Court to

make a final assessment based on the Superior Court directive in 2017. The

Company estimates the impact of the Superior Court ruling will result in an

additional tax expense of MXN 31.7 million (~USD $1.8 million) to MSCG for

fiscal 2006 when the Tax Court rules on a final assessment. As of December 31,

2015, the Company estimates additional interest and penalties payable on overdue

taxes by MSCG to be MXN 65.7 million (~USD $3.8 million). If MSCG agrees to pay

the tax assessment, or a lesser settled amount, it is eligible to apply for

forgiveness of 100% of the penalties and 50% of the interest, with the latter

amounting to MXN 22.6 million (~USD $1.3 million) on the MXN 31.7 million

estimated tax assessment.

Included in the Company’s consolidated financial statements,

are net assets of $240,000, including $42,000 in cash, of MSCG. Following the

Tax Court’s rulings, MSCG is in discussions with the tax authorities with

regards to the shortfall of assets within MSCG to settle its estimated tax

liability. An alternative settlement option would be to transfer the shares and

assets of MSCG to the tax authorities. As of September 30, 2015, the Company

recognized an allowance for transferring the shares and assets of MSCG amounting

to $240,000. The Company is currently assessing MSCG’s settlement options,

however the Tax Court assessment must be received before any negotiation can be

finalized or a decision is made.

While the Company is of the view that the tax assessment has no

legal merit and is contesting it, there is no assurance that the Company will be

successful or that the Company will not have to pay the full amount of the

assessment plus interest and penalties. If the Company is unsuccessful this

could negatively impact the Company’s financial position and create difficulties

for the Company in dealing with Mexican fiscal authorities in the future. As a

result of a detailed review of the Company’s financial information and delivery

of appropriate requested documents to the Mexican fiscal authorities, the

Company has estimated that there is no material potential tax exposure arising

under the assessment.

Obtaining and Renewing of Government Permits

In the ordinary course of business, the Company is required to

obtain and renew government permits for the operation and expansion of existing

operations or for the development, construction and commencement of new

operations. Obtaining or renewing the necessary governmental permits is a

complex and time-consuming process involving numerous jurisdictions and possibly

involving public hearings and costly undertakings on the Company’s part. The

duration and success of the Company’s efforts to obtain and renew permits are

contingent upon many variables not within its control including the

interpretation of applicable requirements implemented by the permitting

authority.

15

Endeavour Silver Corp.

The Company may not be able to obtain or renew permits that are

necessary to its operations, or the cost to obtain or renew permits may exceed

what the Company believes it can recover from a given property once in

production. Any unexpected delays or costs associated with the permitting

process could delay the development or impede the operation of a mine, which

could adversely impact the Company’s operations and profitability.

Environmental Factors

All phases of the

Company’s operations are subject to environmental regulation in the various

jurisdictions in which it operates. Environmental legislation is evolving in a

manner which will require stricter standards and enforcement, increased fines

and penalties for non-compliance, more stringent environmental assessments of

proposed projects and a heightened degree of responsibility for companies and

their officers, directors and employees. There is no assurance that any future

changes in environmental regulation will not adversely affect the Company’s

operations. The costs of compliance with changes in government regulations have

the potential to reduce the profitability of future operations. Environmental

hazards that may have been caused by previous or existing owners or operators

may exist on the Company’s mineral properties, but are unknown to the Company at

present.

Title to Assets

Although the Company has or

will receive title opinions for any properties in which it has a material

interest, there is no guarantee that title to such properties will not be

challenged or impugned. The Company has not conducted surveys of the claims in

which it holds direct or indirect interests and, therefore, the precise area and

location of such claims may be in doubt. The Company’s claims may be subject to

prior unregistered agreements or transfers or native land claims and title may

be affected by unidentified or unknown defects. The Company has conducted as

thorough an investigation as possible on the title of properties that it has

acquired or will be acquiring to be certain that there are no other claims or

agreements that could affect its title to the concessions or claims. If title to

the Company’s properties is disputed it may result in the Company paying

substantial costs to settle the dispute or clear title and could result in the

loss of the property, which events may affect the economic viability of the

Company.

Employee Recruitment and Retention

Recruiting

and retaining qualified personnel is critical to the Company’s success. The

Company is dependent on the services of key executives including the Company’s

President and Chief Executive Officer and other highly skilled and experienced

executives and personnel focused on managing the Company’s interests. The number

of persons skilled in acquisition, exploration, development and operation of

mining properties are limited and competition for such persons is intense. As

the Company’s business activity grows, the Company will require additional key

financial, administrative and mining personnel as well as additional operations

staff. We could experience increases in our recruiting and training costs and

decreases in our operating efficiency, productivity and profit margins. If we

are not able to attract, hire and retain qualified personnel, the efficiency of

our operations could be impaired, which could have an adverse impact on the

Company’s future cash flows, earnings, financial performance and financial

condition.

Potential Conflicts of Interest

The directors

and officers of the Company may serve as directors and/or officers of other

public and private companies, and may devote a portion of their time to manage

other business interests. This may result in certain conflicts of interest.

To the extent that such other companies may participate in

ventures in which the Company is also participating, such directors and officers

of the Company may have a conflict of interest in negotiating and reaching an

agreement with respect to the extent of each company’s participation. The laws

of British Columbia, Canada, require the directors and officers to act honestly,

in good faith, and in the best interests of the Company and its shareholders.

However, in conflict of interest situations, directors and officers of the

Company may owe the same duty to another company and will need to balance the

competing obligations and liabilities of their actions.

16

Endeavour Silver Corp.

There is no assurance that the needs of the Company will

receive priority in all cases. From time to time, several companies may

participate together in the acquisition, exploration and development of natural

resource properties, thereby allowing these companies to: (i) participate in

larger properties and programs; (ii) acquire an interest in a greater number of

properties and programs; and (iii) reduce their financial exposure to any one

property or program. A particular company may assign, at its cost, all or a

portion of its interests in a particular program to another affiliated company

due to the financial position of the company making the assignment.

In determining whether or not the Company will participate in a

particular program and the interest therein to be acquired by it, it is expected

that the directors and officers of the Company will primarily consider the

degree of risk to which the Company may be exposed and its financial position at

that time.

Third Party Reliance

The Company’s rights to

acquire interests in certain mineral properties have been granted by third

parties who themselves may hold only an option to acquire such properties. As a

result, the Company may have no direct contractual relationship with the

underlying property holder.

Absolute Assurance on Financial Statements

We

prepare our financial reports in accordance with accounting policies and methods

prescribed by International Financial Reporting Standards. In the preparation of

financial reports, management may need to rely upon assumptions, make estimates

or use their best judgment in determining the financial condition or results of

operations of the Company. Significant accounting details are described in more

detail in the notes to our annual consolidated financial statements for the year

ended December 31, 2015. In order to have a reasonable level of assurance that

financial transactions are properly authorized, assets are safeguarded against

unauthorized or improper use and transactions are properly recorded and

reported, we have implemented and continue to analyze our internal control

systems for financial reporting. Although we believe our financial reporting and

financial statements are prepared with reasonable safeguards to ensure

reliability, we cannot provide absolute assurance in that regard.

General Economic Conditions

The unprecedented

events in global financial markets during the last few years have had a profound

effect on the global economy. Many industries, including the gold and silver

mining industry, are affected by these market conditions. Some of the key

effects of the current financial market turmoil include contraction in credit

markets resulting in a widening of credit risk, devaluations and high volatility

in global equity, commodity, foreign exchange and precious metal markets, and a

lack of market liquidity. A continued or worsened slowdown in the financial

markets or other economic conditions, including but not limited to, consumer

spending, employment rates, business conditions, inflation, fuel and energy

costs, consumer debt levels, lack of available credit, the state of the

financial markets, interest rates, and tax rates may adversely affect the

Company’s growth and profitability.

Specifically:

-

the volatility of gold and silver prices

affects our revenues, profits and cash flow;

-

volatile energy prices,

commodity and consumables prices and currency exchange rates affect our

production costs; and

-

the devaluation and volatility of global stock

markets affects the valuation of our equity securities.

These factors could have a material adverse effect on the

Company’s financial condition and financial performance.

17

Endeavour Silver Corp.

Substantial Volatility of Share Price

The

market prices for the securities of mining companies, including our own, have

historically been highly volatile. The market has from time to time experienced

significant price and volume fluctuations that are unrelated to the operating

performance of any particular company. In addition, because of the nature of our

business, certain factors such as our announcements and the public’s reaction,

our operating performance and the performance of competitors and other similar

companies, fluctuations in the market prices of our resources, government

regulations, changes in earnings estimates or recommendations by research

analysts who track our securities or securities of other companies in the

resource sector, general market conditions, announcements relating to

litigation, the arrival or departure of key personnel and the risk factors

described in this AIF can have an adverse impact on the market price of the

Common Shares. Any negative change in the public’s perception of Endeavour’s

prospects could cause the price of our securities, including the price of our

Common Shares, to decrease dramatically. Furthermore, any negative change in the

public’s perception of the prospects of mining companies in general could

depress the price of our securities, including the price of our Common Shares,

regardless of our results. Following declines in the market price of a company’s

securities, securities class-action litigation is often instituted. Litigation

of this type, if instituted, could result in substantial costs and a diversion

of our management’s attention and resources.

Need for additional financing

The Company’s

current cash and cash-flows may not be sufficient to pursue additional

exploration, development or discovery of additional reserves, extension to

life-of-mines or new acquisitions and, therefore, the Company may require

additional financing. Additional financing may not be available on acceptable

terms, if at all. The Company may need additional financing by way of private or

public offerings of equity or debt or the sale of project or property interests

in order to have sufficient working capital for its business objectives, as well

as for general working capital purposes.

The success and the pricing of any such capital raising and/or

debt financing will be dependent upon the prevailing market conditions at that

time. There can be no assurance that financing will be available to the Company

or, if it is available, that it will be offered on acceptable terms. If

additional financing is raised through the issuance of equity or convertible

debt securities of the Company, this may negatively impact the price of the

Common Shares and the interests of shareholders in the net assets of the Company

may be diluted.

Differences in U.S. and Canadian reporting of mineral

reserves and resources

The Company’s mineral reserve and resource

estimates are not directly comparable to those made in filings subject to SEC

reporting and disclosure requirements as the Company generally reports mineral

reserves and resources in accordance with Canadian practices. These practices

are different from those used to report mineral reserve and resource estimates

in reports and other materials filed with the SEC. It is Canadian practice to

report measured, indicated and inferred resources, which are not permitted in

disclosure filed with the SEC by United States issuers. Under SEC rules,

mineralization may not be classified as a "reserve" unless the determination has

been made that the mineralization could be economically and legally produced or

extracted at the time the reserve determination is made. United States investors

are cautioned not to assume that all or any part of measured or indicated

resources will ever be converted into reserves.

Further, "inferred mineral resources" have a great amount of

uncertainty as to their existence and as to whether they can be mined legally or

economically. Disclosure of "contained ounces" is permitted disclosure under

Canadian regulations; however, the SEC only permits issuers to report

mineralization that does not constitute “reserves” by SEC Industry Guide 7

standards "as in-place tonnage and grade without reference to unit of metal

measures.

Accordingly, information concerning descriptions of

mineralization, reserves and resources contained in this AIF, or in the

documents incorporated herein by reference, may not be comparable to information

made public by United States companies subject to the reporting and disclosure

requirements of the SEC.

18

Endeavour Silver Corp.

Material weaknesses in the internal control over

financial reporting

In connection with the audit of the Company’s

consolidated financial statements for the year ended December 31, 2014, the

auditors discovered a material weakness related to the Company’s ineffective

management review of the recording of the impairment of long-lived assets and

related financial statement disclosures, specifically related to the circular

impact on deferred income taxes. A material weakness is a deficiency, or a

combination of deficiencies, in internal control over financial reporting, such

that there is a reasonable possibility that a material misstatement of the

Company’s annual or interim financial statements will not be prevented or

detected on a timely basis.

Pursuant to the material weakness identified and disclosed as

of December 31, 2014 and due to the inherent complexities in valuing long-lived

assets, the Company remediated its internal controls by engaging as a consultant

a professional valuation company with experience and knowledge in assessing the

financial impact of impairments and will consult with such professional if there

are any future impairments. In addition, no assurance can be provided that the

Company has identified all of its existing significant deficiencies and material

weaknesses, or that it will not in the future have additional significant

deficiencies or material weaknesses. Section 404 of the U.S. Sarbanes-Oxley Act

(“SOX”) requires an annual assessment by management of the effectiveness

of the Company’s internal control over financial reporting and an attestation

report by the independent auditor addressing this assessment. The Company’s

failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely

basis could result in the loss of investor confidence in the reliability of the

Company’s financial statements, which in turn could harm the business and

negatively affect the trading price of the Common Shares. In addition, any

failure to implement required new or improved controls, or difficulties

encountered in their implementation, could harm the Company’s operating results

or cause us to fail to meet reporting obligations. Future acquisitions of

companies may also provide the Company with challenges in implementing the

required processes, procedures and controls in its acquired operations. Acquired

companies may not have disclosure controls and procedures or internal control

over financial reporting that are as thorough or effective as those required by

securities laws currently applicable the Company.

In addition, no evaluation can provide complete assurance that

the internal control over financial reporting will detect or uncover all

failures of persons within the Company to disclose material information required

to be reported. The effectiveness of the Company’s controls and procedures could

also be limited by simple errors or faulty judgments. In addition, as the

Company expands, the challenges involved in implementing appropriate internal

control over financial reporting will increase and will require that it continue

to improve the internal control over financial reporting. Although the Company

intend to devote substantial time and incur substantial costs, as necessary, to

ensure ongoing compliance, it cannot be certain that it will be successful in

complying with Section 404 of SOX.

Company’s Credit Facility with the Bank of Nova Scotia

The Company has a Facility with Scotiabank (terms as defined under

Item 14.1 Material Contracts). The Facility requires the Company to make certain

interest payments, provide a first-ranking security interest over all of its

assets and also contains a number of covenants that impose significant operating

and financial restrictions on the Company and may limit the Company’s ability to

engage in acts that may be in its long-term best interest.

If the Company’s cash flows and cash and cash equivalents are

insufficient to fund its debt service obligations, including repayment or