Table of Contents

As filed with the Securities and Exchange Commission on July 11, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENERGY TRANSFER EQUITY, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 4922 | 30-0108820 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3738 Oak Lawn Avenue

Dallas, Texas 75219

(214) 981-0700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John W. McReynolds

President

Energy Transfer Equity, L.P.

3738 Oak Lawn Avenue

Dallas, Texas 75219

(214) 981-0700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

William N. Finnegan IV

Jonathan Rod

Latham & Watkins LLP

811 Main Street, Suite 3700

Houston, Texas 77002

(713) 546-5400

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after the effective date of this registration statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee | |||

| 5.875% Senior Notes due 2024 |

$700,000,000 | $700,000,000 | $90,160 | |||

|

| ||||||

|

| ||||||

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f) of the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offering is not permitted.

SUBJECT TO COMPLETION, DATED JULY 11, 2014

PROSPECTUS

Energy Transfer Equity, L.P.

Offer to Exchange

Up to $700,000,000 of

5.875% Senior Notes due 2024 (CUSIP Nos. 29273V AE0 and U29268 AA4)

That Have Not Been Registered Under

The Securities Act of 1933

For

Up to $700,000,000 of

5.875% Senior Notes due 2024 (CUSIP No. 29273V AD2)

That Have Been Registered Under

The Securities Act of 1933

Terms of the New Notes Offered in the Exchange Offer:

| • | The terms of the new 5.875% senior notes due 2024 (CUSIP No. 29273V AD2 (the “New Notes”)) are identical to the terms of the old 5.875% senior notes due 2024 that were issued on May 28, 2014 (CUSIP Nos. 29273V AE0 and U29268 AA4 (the “Old Notes” and, together with the New Notes, the “Additional 2024 Notes”)), except that the New Notes will be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will not contain restrictions on transfer, registration rights or provisions for additional interest. |

| • | The Additional 2024 Notes are additional notes issued pursuant to the Indenture dated as of September 20, 2010, between us and U.S. Bank National Association, as supplemented by the Fourth Supplemental Indenture thereto dated as of December 2, 2013, the Fifth Supplemental Indenture thereto dated as of May 28, 2014 and the Sixth Supplemental Indenture thereto dated as of May 28, 2014 (as so amended and supplemented, the “Indenture”), pursuant to which we previously issued $450 million aggregate principal amount of 5.875% senior notes due 2024 (the “Existing 2024 Notes”). The Additional 2024 Notes, together with the Existing 2024 Notes, will be treated as a single series for all purposes under the Indenture, including notices, consents, waiver, amendments, redemptions and any other action permitted under the indenture. Following the completion of this exchange offer, any Additional 2024 Notes accepted for exchange will be fungible with the Existing 2024 Notes and will trade under the same CUSIP as the Existing 2024 Notes. We refer to the Additional 2024 Notes and the Existing 2024 Notes as the “Notes.” We currently have $1.15 billion aggregate principal amount of Notes outstanding. |

Terms of the Exchange Offer:

| • | We are offering to exchange up to $700,000,000 of our Old Notes for New Notes, with materially identical terms, that have been registered under the Securities Act and are freely tradable. |

| • | We will exchange all Old Notes that you validly tender and do not validly withdraw before the exchange offer expires for an equal principal amount of New Notes. |

| • | The exchange offer expires at 5:00 p.m., New York City time, on , 2014, unless extended. |

| • | Tenders of Old Notes may be withdrawn at any time prior to the expiration of the exchange offer. |

| • | The exchange of Old Notes for New Notes will not be a taxable event for U.S. federal income tax purposes. |

| • | Broker-dealers who receive New Notes pursuant to the exchange offer acknowledge that they will deliver a prospectus in connection with any resale of such New Notes. |

| • | Broker-dealers who acquired the Old Notes as a result of market-making or other trading activities may use the prospectus for the exchange offer, as supplemented or amended, in connection with resales of the New Notes. |

You should carefully consider the risk factors beginning on page 15 of this prospectus before participating in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014

Table of Contents

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission (the “SEC”). In making your investment decision, you should rely only on the information contained or incorporated by reference in this prospectus and in the accompanying letter of transmittal. We have not authorized anyone to provide you with any other information. We are not making an offer to sell these securities or soliciting an offer to buy these securities in any jurisdiction where an offer or solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone whom it is unlawful to make an offer or solicitation. You should not assume that the information contained in this prospectus, as well as the information we previously filed with the SEC that is incorporated by reference herein, is accurate as of any date other than its respective date.

| Page | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 15 | ||||

| 21 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 41 | ||||

| 70 | ||||

| 72 | ||||

| 73 | ||||

| 73 | ||||

| A-1 | ||||

This prospectus incorporates important business and financial information about us that is not included or delivered with this prospectus. Such information is available without charge to holders of Old Notes upon written or oral request made to Energy Transfer Equity, L.P., 3738 Oak Lawn Avenue, Dallas, Texas 75219, Attention: Thomas P. Mason (Telephone (214) 981-0700). To obtain timely delivery of any requested information, holders of Old Notes must make any request no later than five business days prior to the expiration of the exchange offer.

i

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports and other information with the SEC. You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains information we file electronically with the SEC, which you can access over the Internet at http://www.sec.gov.

Our web site is located at http://www.energytransfer.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the SEC are available free of charge through our web site as soon as reasonably practicable after those reports or filings are electronically filed or furnished to the SEC. Information on or accessible through our web site or any other web site is not incorporated by reference in this prospectus and does not constitute a part of this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We are incorporating by reference in this prospectus certain information filed with the SEC, which means that we are disclosing important information to you by referring you to those documents. The information we incorporate by reference is an important part of this prospectus, and later information that we file with the SEC automatically will update and supersede this information and will be considered a part of this prospectus from the date those documents are filed. We incorporate by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, excluding any information in those documents that is deemed by the rules of the SEC to be furnished not filed, after the date of the initial registration statement prior to the effectiveness of the registration statement and between the date of this prospectus and the termination of this offering:

| • | our Annual Report on Form 10-K for the year ended December 31, 2013; |

| • | our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014; |

| • | our Current Reports on Form 8-K filed January 29, 2014, February 19, 2014, March 3, 2014, March 25, 2014, April 24, 2014, April 28, 2014 (two Form 8-K filings), May 22, 2014, May 28, 2014, June 5, 2014 and July 11, 2014 (two Form 8-K filings) (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of any such Current Reports on Form 8-K); |

| • | Item 1A—Risk Factors of the Annual Report on Form 10-K for the year ended December 31, 2013 of ETP; |

| • | Item 1A—Risk Factors of the Annual Report on Form 10-K for the year ended December 31, 2013 and of the Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 of Regency; and |

| • | Item 1A—Risk Factors of the Annual Report on Form 10-K for the year ended December 31, 2013 of Sunoco Logistics. |

You may obtain any of the documents incorporated by reference in this prospectus from the SEC through the SEC’s web site at the address provided above. You also may request a copy of any document incorporated by reference in this prospectus (including exhibits to those documents specifically incorporated by reference in this document), at no cost, by visiting our web site at the address provided above or by writing or calling us at the address set forth below.

Energy Transfer Equity, L.P.

3738 Oak Lawn Avenue

Dallas, Texas 75219

Attention: Sonia Aubé

Telephone: (214) 981-0700

ii

Table of Contents

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we incorporate by reference herein contain various forward-looking statements and information that are based on our beliefs and those of our general partner, LE GP, LLC, as well as assumptions made by and information currently available to us. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. When used in this prospectus , words such as “anticipate,” “project,” “expect,” “plan,” “goal,” “forecast,” “estimate,” “intend,” “could,” “believe,” “may,” “will” and similar expressions and statements regarding our plans and objectives for future operations are intended to identify forward-looking statements. Although we and our general partner believe that the expectations on which such forward-looking statements are based are reasonable, neither we nor our general partner can give assurances that such expectations will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. If one or more of these risks or uncertainties materialize, or if underlying assumptions prove incorrect, our actual results may vary materially from those anticipated, estimated, projected or expected. Among the key risk factors that may have a direct bearing on our results of operations and financial condition are:

| • | a reduction in distributions from ETP, Regency or Sunoco Logistics; |

| • | the volumes transported on our subsidiaries’ pipelines and gathering systems; |

| • | our consolidated debt level and ability to service our debt; |

| • | the level of throughput in our subsidiaries’ processing and treating facilities; |

| • | the fees our subsidiaries charge and the margins they realize for their gathering, treating, processing, storage and transportation services; |

| • | fluctuations in the prices and market demand for, and the relationship between, natural gas, NGLs and oil; |

| • | the general level of petroleum product demand and the availability and price of NGL supplies; |

| • | the level of domestic natural gas, NGL and oil production, imports and exports; |

| • | actions taken by foreign natural gas, NGL and oil producing nations; |

| • | the political and economic stability of petroleum producing nations; |

| • | the effect of weather conditions on demand for natural gas, NGLs and oil; |

| • | availability of local, intrastate and interstate storage, terminal and transportation systems, and refining; |

| • | the continued ability to find and contract for new sources of natural gas supply; |

| • | reductions in the capacity or allocations of third-party pipelines that connect with our subsidiaries’ pipelines and facilities; |

| • | availability and marketing of competitive fuels; |

| • | the impact of energy conservation and fuel efficiency efforts; |

| • | governmental regulation and taxation; |

| • | competition from other midstream, transportation and storage and retail marketing companies; |

| • | changes to, and the application of, regulation of tariff rates and operational requirements related to our subsidiaries’ interstate and intrastate pipelines; |

| • | hazards or operating risks incidental to the gathering, processing, transportation and storage of natural gas and NGLs; |

| • | loss of key personnel; |

iii

Table of Contents

| • | loss of key natural gas producers or the providers of fractionation services; |

| • | the effectiveness of risk-management policies and procedures and the ability of our subsidiaries’ liquids marketing counterparties to satisfy their financial commitments; |

| • | the nonpayment or nonperformance by our subsidiaries’ customers; |

| • | regulatory, environmental, political and legal uncertainties that may affect the timing and cost of our subsidiaries’ internal growth projects, such as our subsidiaries’ construction of additional pipeline systems; |

| • | risks associated with the construction of new pipelines and treating and processing facilities or additions to our subsidiaries’ existing pipelines and facilities, including difficulties in obtaining permits and rights-of-way or other regulatory approvals and the performance by third-party contractors; |

| • | the availability and cost of capital and our subsidiaries’ ability to access certain capital sources; |

| • | a deterioration of the credit and capital markets; |

| • | risks associated with the assets and operations of entities in which our subsidiaries own less than a controlling interest, including risks related to management actions at such entities that our subsidiaries may not be able to control or exert influence; |

| • | the ability to successfully identify and consummate strategic acquisitions at purchase prices that are accretive to our financial results and to successfully integrate acquired businesses; |

| • | dependency on key producers and key customers; |

| • | risks associated with natural disasters, terrorist attacks and cyber security breaches that could result in personal injury, property damage and environmental damage; |

| • | risks associated with changes in laws and regulations to which we are subject, including tax, environmental, transportation and employment regulations or new interpretations by regulatory agencies concerning such laws and regulations and with product liability claims and litigation; and |

| • | the costs and effects of legal and administrative proceedings. |

You should not put undue reliance on any forward-looking statements. When considering forward-looking statements, please review the risk factors described under “Risk Factors” in this prospectus, as well as the risk factors set forth in our, ETP’s, Regency’s and Sunoco Logistics’ Annual Reports on Form 10-K for the year ended December 31, 2013, in each case as updated by our, ETP’s, Regency’s and Sunoco Logistics’ subsequent Quarterly Reports on Form 10-Q, and the other risks identified in the documents incorporated by reference herein. Any forward-looking statement made by us in this prospectus and the documents incorporated by reference herein is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

iv

Table of Contents

The following is a summary of some of the information contained in this prospectus. It is not complete and may not contain all of the information that is important to you. You should read carefully the entire prospectus, the documents incorporated by reference herein and the other documents to which we refer herein, including the risk factors beginning on page 15 and the financial statements incorporated by reference in this prospectus . Unless the context requires otherwise, (i) references to “we,” “us,” “our,” the “Partnership” and “ETE” mean Energy Transfer Equity, L.P. and its consolidated subsidiaries, which include ETP, Regency and Sunoco Logistics; (ii) references to “ETP” mean Energy Transfer Partners, L.P. and its consolidated subsidiaries; (iii) references to “Regency” mean Regency Energy Partners LP and its consolidated subsidiaries; and (iv) references to “Sunoco Logistics” mean Sunoco Logistics Partners L.P. and its consolidated subsidiaries. Please see the Glossary in Appendix A of certain defined terms used in this prospectus.

Energy Transfer Equity, L.P.

We are a publicly-traded Delaware limited partnership (NYSE: ETE) that directly and indirectly owns equity interests in ETP, Regency and Sunoco Logistics, all of which are publicly-traded master limited partnerships engaged in diversified energy-related businesses. As of June 30, 2014, our equity interests in ETP, Regency and Sunoco Logistics consisted of:

| Incentive Distribution Rights (“IDRs”) |

General Partner Interest |

Limited Partner Interests |

||||||||||

| ETE’s Interests in ETP |

100 | % | 100 | % | 30,841,069 Common Units | (1) | ||||||

| 50,160,000 Class H Units | (2) | |||||||||||

| ETE’s Interests in Regency |

100 | % | 100 | % | 40,665,639 Common Units | (3) | ||||||

| ETE’s Interests in Sunoco Logistics |

0.1 | %(2) | 0.1 | %(2) | — | |||||||

| ETP’s Interests in Regency |

— | — | 31,372,419 Common Units | (4) | ||||||||

| 6,274,483 Class F Units | (5) | |||||||||||

| ETP’s Interests in Sunoco Logistics |

99.9 | % | 99.9 | % | 67,061,274 Common Units | (6) | ||||||

| (1) | Represents an approximate 9.5% limited partner interest in ETP. |

| (2) | The Class H Units entitle ETE to receive 50.05% of the cash distributions related to the IDRs and general partner interest of Sunoco Logistics received by ETP. As a result of ETE’s ownership of the Class H Units and a 0.1% membership interest in Sunoco Logistics’ general partner, ETE is entitled to receive 50.05% of the cash distributions related to the IDRs and general partner interest of Sunoco Logistics. |

| (3) | Represents an approximate 10.9% limited partner interest in Regency. On July 1, 2014, ETE’s wholly owned subsidiary, ETE Common Holdings, purchased 16,491,717 Regency common units from Regency, which increased ETE’s limited partner interest in Regency to approximately 14.4% as of such date. |

| (4) | Represents an approximate 8.4% limited partner interest in Regency. |

| (5) | The Regency Class F units were issued to Southern Union in connection the SUGS Contribution on April 30, 2013. The Class F units are not entitled to participate in Regency’s distributions for 24 months post-transaction closing and will convert into common units on a one-for-one basis in May 2015. |

| (6) | Represents an approximate 31.9% limited partner interest in Sunoco Logistics. The amount shown is subsequent to a two-for-one split of Sunoco Logistics common units, effected through the distribution of additional Sunoco Logistics common units on June 12, 2014. |

In addition to the equity interests in ETP, Regency and Sunoco Logistics, ETE owns all of the membership interests in Trunkline LNG, an entity that owns an LNG regasification facility in Lake Charles, Louisiana, and a 60% membership interest in ET LNG, an entity whose subsidiary is developing an LNG project adjacent to the existing LNG regasification facility. ETP owns the remaining 40% membership interest in ET LNG. The

1

Table of Contents

proposed LNG project will include the construction of three liquefaction trains and will use the existing LNG storage and marine berthing facilities owned by Trunkline LNG. Trunkline will provide pipeline transportation services to supply natural gas to the LNG project. ETE expects the addition of liquefaction capabilities to the existing infrastructure at the Trunkline LNG Lake Charles facility to provide the bi-directional capabilities of liquefying and exporting natural gas as well as importing and regasifying LNG from other countries.

Trunkline LNG Export, LLC has secured all property rights required for the site of the liquefaction facility. Additionally, the Department of Energy has given conditional authorization for export from the LNG liquefaction facility of up to 15.0 million metric tonnes of LNG per annum to countries that are not parties to any free trade agreements with the United States and unlimited quantities of LNG to countries that are parties to free trade agreements with the United States. In September 2013, Trunkline LNG Export, LLC and related Energy Transfer entities entered into a project development agreement with BG Group to jointly develop the LNG project. In accordance with the project development agreement, ETE will own and finance the liquefaction facility, and BG Group will have a long-term tolling agreement with ETE for a majority of the offtake, a portion of which it may choose to assign to third parties. The BG Group will oversee the engineering and design and manage the construction of the liquefaction facility, as well as operate the facility. In connection with entering into the project development agreement, Trunkline LNG and Trunkline LNG Export, LLC filed an application with the FERC seeking authorization for the siting, construction, ownership and operation of the LNG project. The FERC filing represents the culmination of significant front-end engineering design work and pre-filing consultations with the FERC and other federal, state and local agencies that have been underway since mid-2012. In conjunction therewith, Trunkline LNG filed an application with the FERC to abandon certain facilities and services under Section 7(b) of the Natural Gas Act for authorization under Section 3, and Trunkline Gas Company, LLC filed an application for an order approving abandonment and issuing a Certificate of Public Convenience and Necessity in connection with the pipeline delivering gas into the proposed liquefaction facility. We expect to complete certain studies, permits and approvals through 2014, and we do not anticipate making any significant capital expenditures related to this project prior to the completion of those items.

Cash Distributions Received from ETP, Regency and Sunoco Logistics IDRs

ETP

The ETP IDRs entitle us, as the indirect holder of those rights, to receive the following percentages of cash distributed by ETP as the following target cash distribution levels are reached:

| • | 13.0% of all incremental cash distributed in a fiscal quarter after $0.275 has been distributed in respect of each common unit of ETP for that quarter; |

| • | 23.0% of all incremental cash distributed in a fiscal quarter after $0.3175 has been distributed in respect of each common unit of ETP for that quarter; and |

| • | the maximum sharing level of 48.0% of all incremental cash distributed in a fiscal quarter after $0.4125 has been distributed in respect of each common unit of ETP for that quarter. |

Regency

Additionally, the Regency IDRs entitle us, as the indirect holder of those rights, to receive the following percentages of cash distributed by Regency as the following target cash distribution levels are reached:

| • | 13% of all incremental cash distributed in a fiscal quarter after $0.4025 has been distributed in respect of each common unit of Regency for that quarter; |

| • | 23% of all incremental cash distributed in a fiscal quarter after $0.4375 has been distributed in respect of each common unit of Regency for that quarter; and |

| • | the maximum sharing level of 48% of all incremental cash distributed in a fiscal quarter after $0.525 has been distributed in respect of each common unit of Regency for that quarter. |

2

Table of Contents

Sunoco Logistics

Following the two-for-one split of Sunoco Logistics common units on June 12, 2014 and the related amendment to the Sunoco Logistics partnership agreement, the Sunoco Logistics IDRs entitle ETP, as the indirect holder of those rights, to receive the following percentages of cash distributed by Sunoco Logistics as the following target cash distribution levels are reached:

| • | 13% of all incremental cash distributed in a fiscal quarter after $0.0833 has been distributed in respect of each common unit of Sunoco Logistics for that quarter; |

| • | 35% of all incremental cash distributed in a fiscal quarter after $0.0958 has been distributed in respect of each common unit of Sunoco Logistics for that quarter; and |

| • | the maximum sharing level of 48.0% of all incremental cash distributed in a fiscal quarter after $0.2638 has been distributed in respect of each common unit of Sunoco Logistics for that quarter. |

The percentages reflected above do not give effect to certain incentive distributions that have been relinquished for future periods, as discussed under “Cash Distributions Received from ETP, Regency and Sunoco Logistics” below.

Cash Distributions Received from ETP, Regency and Sunoco Logistics

ETP

The following are distributions declared and/or paid by ETP subsequent to June 30, 2013:

| Quarter Ended |

Record Date | Payment Date | Rate | |||

| June 30, 2013 |

August 5, 2013 | August 14, 2013 | $0.89375 | |||

| September 30, 2013 |

November 4, 2013 | November 14, 2013 | 0.90500 | |||

| December 31, 2013 |

February 7, 2014 | February 14, 2014 | 0.92000 | |||

| March 31, 2014 |

May 5, 2014 | May 15, 2014 | 0.93500 |

In connection with previous transactions between ETP and ETE and in connection with ETP’s pending merger with Susser, ETE has agreed to relinquish its right to certain incentive distributions in future periods, and ETP has agreed to make incremental distributions on the Class H Units in future periods. For the distributions paid for the three months ended March 31, 2014, the net impact of these adjustments resulted in a reduction of $26 million in the distributions from ETP to ETE. The following is a summary of the net reduction in total distributions that would potentially be made to ETE in current and future quarters (in millions) assuming that ETP’s pending merger with Susser closes in the third quarter of 2014:

| Total Year | ||||

| 2014 (remainder) |

$ | 97 | ||

| 2015 |

86 | |||

| 2016 |

107 | |||

| 2017 |

85 | |||

| 2018 |

80 | |||

| 2019 |

70 | |||

3

Table of Contents

Regency

The following are distributions declared and/or paid by Regency subsequent to June 30, 2013:

| Quarter Ended |

Record Date | Payment Date | Rate | |||

| June 30, 2013 |

August 5, 2013 | August 14, 2013 | $0.465 | |||

| September 30, 2013 |

November 4, 2013 | November 14, 2013 | 0.470 | |||

| December 31, 2013 |

February 7, 2014 | February 14, 2014 | 0.475 | |||

| March 31, 2014 |

May 8, 2014 | May 15, 2014 | 0.480 |

In conjunction with the SUGS Contribution on April 30, 2013, ETE agreed to forego incentive distributions with respect to the Regency common units issued in the transaction for the first eight consecutive quarters following the closing.

Sunoco Logistics

The following are distributions declared and/or paid by Sunoco Logistics subsequent to June 30, 2013, after giving effect to the two-for-one split of Sunoco Logistics common units on June 12, 2014:

| Quarter Ended | Record Date | Payment Date | Rate | |||

| June 30, 2013 |

August 8, 2013 | August 14, 2013 | $0.30000 | |||

| September 30, 2013 |

November 8, 2013 | November 14, 2013 | 0.31500 | |||

| December 31, 2013 |

January 29, 2014 | February 14, 2014 | 0.33125 | |||

| March 31, 2014 |

May 9, 2014 | May 15, 2014 | 0.34750 |

The aggregate amount of ETP’s, Regency’s and Sunoco Logistics’ cash distributions to us in respect of any given quarter will vary depending on several factors, including the total outstanding partnership interests of such entity on the record date for the distribution, the aggregate cash distributions made by such entity and the amount of such entity’s partnership interests we own. In addition, the level of distributions we receive may be affected by the various risks associated with an investment in ETE and the underlying business of ETP, Regency and Sunoco Logistics. See “Risk Factors” beginning on page 15, as well as the risk factors set forth in our, ETP’s, Regency’s and Sunoco Logistics’ Annual Reports on Form 10-K for the year ended December 31, 2013, in each case as updated by our, ETP’s, Regency’s and Sunoco Logistics’ subsequent Quarterly Reports on Form 10-Q.

ETP’s Business

ETP is one of the largest publicly-traded master limited partnerships in the United States in terms of equity market capitalization (approximately $18.78 billion as of June 30, 2014). ETP is managed by its general partner, ETP GP, and ETP GP is managed by its general partner, ETP LLC, which is owned by ETE. The primary activities in which ETP is engaged, all of which are in the United States, and the operating subsidiaries through which ETP conducts those activities are as follows:

| • | Natural gas operations, including the following: |

| • | natural gas midstream and intrastate transportation and storage through La Grange Acquisition, L.P.; and |

| • | interstate natural gas transportation and storage through ET Interstate and Panhandle. ET Interstate is the parent company of Transwestern, ETC Fayetteville Express Pipeline, LLC, ETC Tiger Pipeline, LLC and CrossCountry Energy, LLC. Panhandle is the parent company of the Trunkline and Sea Robin transmission systems. |

| • | NGL transportation, storage and fractionation services primarily through Lone Star, a joint venture with Regency in which ETP owns a 70% membership interest and Regency owns a 30% membership interest. |

4

Table of Contents

| • | Refined product and crude oil operations, including the following: |

| • | refined product and crude oil transportation through Sunoco Logistics as described in more detail below under “—ETP’s Investment in Sunoco Logistics Partners L.P.”; and |

| • | retail marketing of gasoline and middle distillates through Sunoco and mid-atlantic convenience stores. |

ETP’s Investment in Sunoco Logistics Partners L.P.

In connection with its acquisition of Sunoco in October 2012, ETP acquired all of the IDRs and general partner interest in Sunoco Logistics, as well as approximately 33.5 million common units of Sunoco Logistics. Through its ownership of ETP Class H Units, ETE is entitled to 50.05% of the cash distributions that ETP receives from Sunoco Logistics in respect of Sunoco Logistics’ IDRs and general partner interest.

Sunoco Logistics owns and operates a logistics business, consisting of a geographically diverse portfolio of complementary pipeline, terminaling and acquisition and marketing assets, which are used to facilitate the purchase and sale of crude oil, refined products and NGLs. Sunoco Logistics’ portfolio of geographically diverse assets earns revenues in more than 30 states located throughout the United States, and its business is comprised of the following four segments:

| • | Crude Oil Pipelines transports crude oil principally in Oklahoma and Texas. The segment contains approximately 4,900 miles of crude oil trunk pipelines for high-volume, long-distance transportation, and approximately 500 miles of crude oil gathering lines that supply the trunk pipelines. The segment includes controlling financial interests in the West Texas Gulf Pipe Line Company and Mid-Valley Pipeline Company. |

| • | Crude Oil Acquisition and Marketing business gathers, purchases, markets and sells crude oil principally in the mid-continent United States. The segment utilizes Sunoco Logistics’ proprietary fleet of approximately 300 crude oil transport trucks and approximately 130 crude oil truck unloading facilities, as well as third-party assets. |

| • | Terminal Facilities operate with an aggregate storage capacity of approximately 46 million barrels. This segment includes the 22 million barrel Nederland, Texas crude oil terminal; the 5 million barrel Eagle Point, New Jersey refined products and crude oil terminal; the 5 million barrel Marcus Hook, Pennsylvania refined products and NGL facility; 39 active refined products marketing terminals located in the northeast, midwest and southwest United States; and several refinery terminals located in the northeast United States. |

| • | Refined Products Pipelines consist of approximately 2,500 miles of refined products pipelines, and joint venture interests in four refined products pipelines in the northwest and midwest United States. This segment includes a controlling financial interest in Inland Corporation. |

Retail Marketing

ETP’s retail marketing business segment consists of Sunoco’s marketing operations, which sell gasoline and middle distillates at retail and operate convenience stores in 24 states, primarily on the East Coast and in the Midwest region of the United States. The highest concentrations of outlets are located in Connecticut, Florida, Maryland, Massachusetts, Michigan, New Jersey, New York, Ohio, Pennsylvania and Virginia. Some of these outlets are traditional locations that sell fuel products under the Sunoco® and Coastal® brands whereas others are APlus® convenience stores or Ultra Service Centers® that provide automotive diagnostics and repair. ETP’s branded fuels sales (including middle distillates) averaged 315,700 Bbls/d in 2013. The Sunoco® brand is positioned as a premium brand, and is the official fuel of NASCAR® and the INDYCAR® series through 2019 and 2014, respectively. Additionally, ETP’s APlus® convenience stores are the official convenience stores of NASCAR®.

5

Table of Contents

Other Operations

ETP’s other operations consist of (i) natural gas compression services and a natural gas compression equipment business; (ii) an approximate 4.7% limited partner interest in AmeriGas Partners, L.P. (“AmeriGas”), which is engaged in retail propane marketing; (iii) an approximate 33% non-operating interest in a joint venture with The Carlyle Group, L.P., which owns a refinery in Philadelphia; and (iv) ownership of 31.4 million common units representing limited partner interests in Regency and 6.3 million Regency Class F common units.

Regency’s Business

Regency is a growth-oriented, publicly-traded Delaware limited partnership engaged in the gathering and processing, compression, treating and transportation of natural gas, the transportation, fractionation and storage of NGLs, the gathering, transportation and terminaling of oil (crude and/or condensate), and the management of coal and natural resources. Regency focuses on providing midstream services in some of the most prolific natural gas producing regions in the United States, including the Eagle Ford, Haynesville, Barnett, Fayetteville, Marcellus, Utica, Bone Spring, Avalon and Granite Wash shales. Its assets are primarily located in Texas, Louisiana, Arkansas, Pennsylvania, California, Mississippi, Alabama, New Mexico and the mid-continent region of the United States, which includes Kansas, Colorado and Oklahoma. On July 1, 2014, Regency completed its acquisition of Eagle Rock’s midstream business. The entities acquired by Regency are engaged in the business of gathering, compressing, treating, processing and transporting natural gas; fractionating and transporting NGLs, crude oil and condensate logistics and marketing, and natural gas marketing and trading. The Eagle Rock midstream business is located in four significant natural gas producing regions: (i) the Texas Panhandle, (ii) East Texas/Louisiana, (iii) South Texas and (iv) the Gulf of Mexico. These four regions are productive, mature, natural gas producing basins that have historically experienced significant drilling activity. The Eagle Rock transaction is expected to complement Regency’s core gathering and processing business, and, when combined with its merger with PVR that was completed in March 2014, further diversify its basin exposure in the Texas Panhandle, East Texas and South Texas.

Regency’s operations are divided into six business segments:

| • | Gathering and Processing. Regency provides “wellhead-to-market” services to producers of natural gas, which include transporting raw natural gas from the wellhead through gathering systems, processing raw natural gas to separate NGLs from the raw natural gas and selling or delivering pipeline-quality natural gas and NGLs to various markets and pipeline systems, the gathering, transportation and terminaling of oil (crude and/or condensate, a lighter oil) received from producers, and the gathering and disposing of salt water. This segment also includes Edwards Lime Gathering LLC, which operates natural gas gathering, oil pipeline, and oil stabilization facilities in south Texas, Regency’s 33.33% membership interest in Ranch Westex JV, which processes natural gas delivered from NGL-rich shale formations in west Texas, and Regency’s 51% interest in Aqua—PVR Water Services, LLC, which transports and supplies fresh water to natural gas producers in the Marcellus shale in Pennsylvania. |

| • | Natural Gas Transportation. Regency owns a 49.99% general partner interest in RIGS Haynesville Partnership Co., which owns the Regency Intrastate Gas System, a 450-mile intrastate pipeline that delivers natural gas from northwest Louisiana to downstream pipelines and markets, and a 50% membership interest in Midcontinent Express Pipeline LLC, which owns a 500-mile interstate natural gas pipeline stretching from southeast Oklahoma through northeast Texas, northern Louisiana and central Mississippi to an interconnect with the Transcontinental Gas Pipe Line system in Butler, Alabama. This segment also includes Gulf States Transmission LLC, which owns a 10-mile interstate pipeline that extends from Harrison County, Texas to Caddo Parish, Louisiana. |

| • | NGL Services. Regency owns a 30% membership interest in Lone Star, an entity owning a diverse set of midstream energy assets including NGL pipelines, storage, fractionation and processing facilities located in Texas, New Mexico, Mississippi and Louisiana. |

6

Table of Contents

| • | Contract Services. Regency owns and operates a fleet of compressors used to provide turn-key natural gas compression services for customer specific systems. Regency also owns and operates a fleet of equipment used to provide treating services, such as carbon dioxide and hydrogen sulfide removal, natural gas cooling, and dehydration. |

| • | Natural Resources. Regency is involved in the management and leasing of coal properties and the related collection of royalties. Regency also earns revenues from other land management activities, such as selling standing timber, leasing coal-related infrastructure facilities, and collecting oil and gas royalties. This segment also includes Regency’s 50% interest in Coal Handling Solutions LLC, which owns and operates end-user coal handling facilities. |

| • | Corporate. The Corporate segment comprises Regency’s corporate assets. |

Recent Developments

On April 27, 2014, ETP and Susser entered into a definitive merger agreement pursuant to which ETP will acquire Susser for approximately $1.8 billion in cash and ETP common units. Under the terms of the merger agreement, Susser shareholders can elect to receive, for each Susser common share they own, either $80.25 in cash, 1.4506 ETP common units or a combination of $40.125 in cash and 0.7253 ETP common units. The aggregate cash paid and common units issued will be capped so that the cash and common units will each represent approximately 50% of the aggregate consideration. Elections in excess of the cash or common unit limits will be subject to proration. The merger is expected to close in the third quarter of 2014.

Our Management and Management of ETP, Regency and Sunoco Logistics

Our general partner, LE GP, LLC, manages and directs all of our activities. Our officers and directors are officers and directors of LE GP, LLC. The members of our general partner elect our general partner’s board of directors. The board of directors of our general partner has the authority to appoint our executive officers, subject to provisions in the limited liability company agreement of our general partner. Pursuant to other authority, the board of directors of our general partner may appoint additional management personnel to assist in the management of our operations and, in the event of the death, resignation or removal of our president, may appoint a replacement.

Each of ETP, Regency and Sunoco Logistics is managed by its general partner, which is ultimately responsible for the business and operations of ETP, Regency and Sunoco Logistics, as the case may be. Accordingly, the board of directors and officers of each entity’s general partner make decisions on behalf of ETP, Regency and Sunoco Logistics, as the case may be. For example, the amount of distributions paid under each entity’s cash distribution policy is subject to the determination of its general partner’s board of directors, taking into consideration the terms of such entity’s partnership agreement. Of the seven current directors of our general partner, three also serve on the board of directors of ETP’s general partner, two serve as a director on the board of directors of Regency’s general partner and one serves on the board of directors of Sunoco Logistics’ general partner.

Our Principal Executive Offices

Our principal executive offices are located at 3738 Oak Lawn Avenue, Dallas, Texas 75219. Our telephone number is (214) 981-0700. Our web site address is www.energytransfer.com. Information contained on our web site is not incorporated into or otherwise a part of this prospectus.

7

Table of Contents

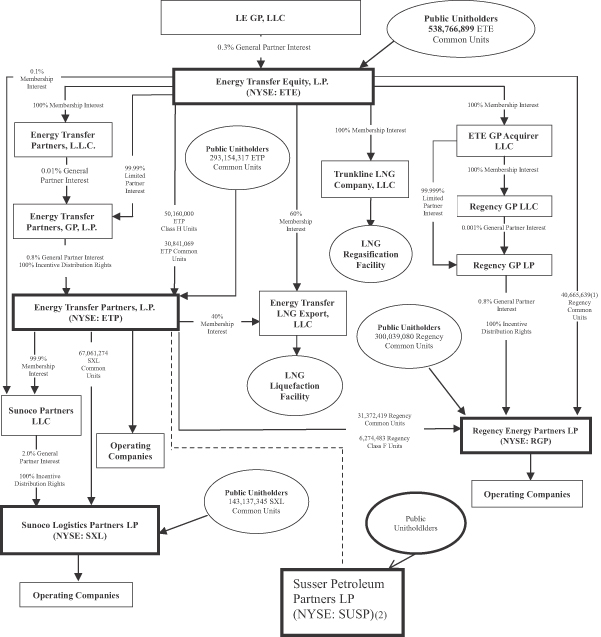

Organizational Structure

The following chart summarizes our organizational structure as of June 30, 2014.

| (1) | On July 1, 2014, ETE’s wholly owned subsidiary, ETE Common Holdings, purchased 16,491,717 Regency common units from Regency. |

| (2) | Assumes the completion of ETP’s merger with Susser, which is expected to close in the third quarter of 2014. See “Summary—Recent Developments.” |

8

Table of Contents

The Exchange Offer

On May 28, 2014, we completed a private offering of the Old Notes. We entered into a registration rights agreement with the initial purchasers in the private offering in which we agreed to deliver to you this prospectus and to use commercially reasonable efforts to cause the registration statement to be declared effective within 180 days after the date we issued the Old Notes.

| Exchange Offer |

We are offering to exchange New Notes for Old Notes. |

| Expiration Date |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2014 unless we decide to extend it. |

| Condition to the Exchange Offer |

The registration rights agreement does not require us to accept Old Notes for exchange if the exchange offer, or the making of any exchange by a holder of the Old Notes, would violate any applicable law or interpretation of the staff of the SEC. The exchange offer is not conditioned on a minimum aggregate principal amount of Old Notes being tendered. |

| Procedures for Tendering Old Notes |

To participate in the exchange offer, you must follow the procedures established by The Depository Trust Company, or DTC, for tendering Old Notes held in book-entry form. These procedures, which we call “ATOP” (“Automated Tender Offer Program”), require that (i) the exchange agent receive, prior to the expiration date of the exchange offer, a computer generated message known as an “agent’s message” that is transmitted through DTC’s automated tender offer program, and (ii) DTC has received: |

| • | your instructions to exchange your Old Notes, and |

| • | your agreement to be bound by the terms of the letter of transmittal. |

| For more information on tendering your Old Notes, please refer to the sections in this prospectus entitled “Exchange Offer—Terms of the Exchange Offer,” “Exchange Offer—Procedures for Tendering,” and “Description of the New Notes,” and “Book-Entry; Delivery and Form.” |

| Guaranteed Delivery Procedures |

None. |

| Withdrawal of Tenders |

You may withdraw your tender of Old Notes at any time prior to the expiration date. To withdraw, you must submit a notice of withdrawal to the exchange agent using ATOP procedures before 5:00 p.m., New York City time, on the expiration date of the exchange offer. Please refer to the section in the prospectus entitled “Exchange Offer—Withdrawal of Tenders.” |

| Acceptance of Old Notes and Delivery of New Notes |

If you fulfill all conditions required for proper acceptance of the Old Notes, we will accept any and all Old Notes that you properly tender in the exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will return any Old Notes that we do not accept for exchange to you without expense promptly after the expiration date. Please refer to the section in this prospectus entitled “Exchange Offer—Terms of the Exchange Offer.” |

9

Table of Contents

| Fees and Expenses |

We will bear expenses related to the exchange offer. Please refer to the section in this prospectus entitled “Exchange Offer—Fees and Expenses.” |

| Use of Proceeds |

The issuance of the New Notes will not provide us with any new proceeds. We are making the exchange offer solely to satisfy our obligations under our registration rights agreement. |

| Consequences of Failure to Exchange Old Notes |

If you do not exchange your Old Notes in the exchange offer, you will no longer be able to require us to register the Old Notes under the Securities Act except in limited circumstances provided under the registration rights agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the Old Notes unless we have registered the Old Notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. |

| In addition, after the consummation of the exchange offer, it is anticipated that the outstanding principal amount of the Old Notes available for trading will be significantly reduced. The reduced float may adversely affect the liquidity and market price of the Old Notes. A smaller outstanding principal amount of Old Notes available for trading may also make the price of the Old Notes more volatile. |

| U.S. Federal Income Tax Consequences |

The exchange of New Notes for Old Notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. Please refer to the section in this prospectus entitled “Certain United States Federal Tax Consequences.” |

| Exchange Agent |

We have appointed U.S. Bank National Association as exchange agent for the exchange offer. You should direct questions and requests for assistance, requests for additional copies of this prospectus or the letter of transmittal to the exchange agent addressed as follows: by First Class Mail: U.S. Bank National Association, Attn: Specialized Finance, 60 Livingston Avenue—EP-MN-WS2N, St. Paul, MN 55107-2292 or By Courier or Overnight Delivery: U.S. Bank National Association, Attn: Specialized Finance, 111 Fillmore Avenue, St. Paul, MN 55107-1402. Eligible institutions may make requests by facsimile transmission at (651) 495-8158, Attn: Specialized Finance. |

| Further Information |

Questions or requests for assistance related to the exchange offer may be directed to Mauri Cowen, U.S. Bank National Association, at (713) 235-9206. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the exchange offer. |

10

Table of Contents

Terms of the New Notes

The New Notes will be identical to the Old Notes except that the New Notes will be registered under the Securities Act and will not have restrictions on transfer, registration rights or provisions for additional interest. The New Notes will evidence the same debt as the Old Notes, and the Indenture will govern the Old Notes and the New Notes.

The following summary contains basic information about the New Notes and is not intended to be complete. It does not contain all information that may be important to you. For a more complete understanding of the New Notes, please refer to the section entitled “Description of New Notes” in this prospectus.

| Issuer |

Energy Transfer Equity, L.P. |

| Notes Offered |

$700,000,000 aggregate principal amount of 5.875% senior notes due 2024. The Additional 2024 Notes are additional notes under the Indenture, pursuant to which we issued $450 million aggregate principal amount of the Existing 2024 Notes. The Additional 2024 Notes, together with the Existing 2024 Notes, will be treated as a single series for all purposes under the Indenture, including notices, consents, waivers, amendments, redemptions and any other action permitted under the Indenture. Following the completion of this exchange offer, any Additional 2024 Notes accepted for exchange will be fungible with the Existing 2024 Notes and will trade under the same CUSIP number as the Existing 2024 Notes. We currently have $1.15 billion aggregate principal amount of Notes outstanding. |

| Maturity |

January 15, 2024. |

| Interest Rate |

Interest on the New Notes accrues from December 2, 2013 (the date of issuance of the Existing 2024 Notes) at the per annum rate of 5.875%. |

| Interest Payment Dates |

Interest on the New Notes is payable semi-annually on January 15 and July 15 of each year, with the next interest payment on July 15, 2014. |

| Ranking |

Our obligations under the New Notes will be secured on a first-priority basis with our obligations under our revolving credit facility, term loan facility, our existing 7.500% senior notes due 2020 (the “2020 Notes”) and the Existing 2024 Notes, by a lien on substantially all of our and certain of our subsidiaries’ tangible and intangible assets, including (i) approximately 30.8 million ETP common units and approximately 50.2 million ETP Class H units that are held through our ownership interests in ETE Common Holdings Member and ETE Common Holdings; (ii) ETE’s 100% equity interest in ETP LLC and ETP GP, through which ETE indirectly holds all of the outstanding general partnership interests and 100% of the outstanding IDRs in ETP; (iii) approximately 57.2 million Regency common units held by ETE and ETE Common Holdings; (iv) ETE’s 100% interest in ETE GP Acquirer; and (v) ETE GP Acquirer’s 100% interest in Regency GP LLC and Regency GP, through which ETE indirectly holds all of the outstanding the general partnership interests and IDRs |

11

Table of Contents

| in Regency, subject to certain exceptions and permitted liens. The liens securing the New Notes will be subject to the terms of a collateral agency agreement, under which the collateral agent (the “collateral agent”), acting at the direction of one or more of the administrative agents under our revolving credit facility and term loan facility, is generally entitled to sole control of all decisions and actions, including foreclosure, with respect to the collateral, even if an event of default under the New Notes has occurred, and neither the holders of New Notes nor the trustee will generally be entitled to independently exercise remedies with respect to the collateral. In addition, subject to limitations adversely affecting the equal and ratable treatment of the security interest of the trustee or imposing new material obligations on the trustee, the collateral agent is entitled, without the consent of holders of New Notes or the trustee, to amend the terms of the security documents securing the notes and to release the liens of the secured parties on any part of the collateral at any time. See “Description of New Notes—Collateral Agency Agreement.” |

| The New Notes will be our senior obligations. The New Notes will rank equally in right of payment with all of our other existing and future unsubordinated indebtedness and senior to any of our future subordinated indebtedness. As of March 31, 2014, after giving effect to the amendment to our term loan facility to increase the amount thereunder to $1.4 billion and the offering of the Old Notes and the application of the net proceeds therefrom, ETE would have had approximately $3.7 billion of indebtedness outstanding (including the Old Notes for which we are exchanging the New Notes) that would rank equally in right of payment to the New Notes. See “Description of New Notes—Ranking” and “—Security for the Notes.” |

| The New Notes initially will not be guaranteed by any of our subsidiaries. However, if at any time following the issue date of the Existing 2024 Notes, any of our subsidiaries guarantees or becomes a co-obligor with respect to any indebtedness of ETE, or if at any time following the issue date of the Existing 2024 Notes any restricted subsidiary of ETE otherwise incurs any indebtedness, then such subsidiary or restricted subsidiary, as the case may be, will also guarantee the New Notes on terms provided for in the Indenture. With respect to the assets of our subsidiaries that do not guarantee the New Notes, including ETP and Regency, the New Notes will effectively rank junior to all existing and future obligations of those subsidiaries. As of March 31, 2014, after giving effect to (i) the issuance by Sunoco Operations of $1.0 billion aggregate principal amount of senior notes in April 2014 and the use of net proceeds therefrom to repay amounts outstanding under Sunoco Logistics’ revolving credit facility and for general partnership purposes, (ii) the redemption by Regency of approximately $300 million aggregate principal amount of senior notes assumed in the PVR merger in April 2014 with borrowings under Regency’s revolving credit facility and (iii) the |

12

Table of Contents

| issuance by Regency of approximately $500 million aggregate principal amount of senior notes in connection with the acquisition of Eagle Rock’s midstream business (collectively, the “subsidiary financing transactions”), our subsidiaries, including ETP, Regency and their respective subsidiaries, had outstanding approximately $23.7 billion of principal amount of indebtedness that would effectively rank senior to the notes with respect to the assets of those subsidiaries. |

| Optional Redemption |

We may redeem the New Notes in whole, at any time, or in part, from time to time, prior to maturity, at a redemption price that includes accrued and unpaid interest and a make-whole premium. See “Description of New Notes—Optional Redemption.” We also have the option at any time on or after October 15, 2023 (which is the date that is three months prior to the maturity date of the New Notes) to redeem the New Notes, in whole or in part, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest thereon to the redemption date. |

| Covenants |

We will issue the New Notes under the Indenture. The covenants in the Indenture include a limitation on liens, a limitation on transactions with affiliates, a restriction on sale-leaseback transactions and limitations on mergers and sales of all or substantially all of our assets. The covenants will generally not apply to ETP, Regency and their respective subsidiaries. Each covenant is subject to a number of important exceptions, limitations and qualifications that are described in “Description of New Notes—Covenants.” |

| Mandatory Offer to Repurchase |

If we experience a Change of Control together with a Rating Decline, each as defined in the Indenture, we must offer to repurchase the New Notes at an offer price in cash equal to 101% of their principal amount, plus accrued and unpaid interest, if any, to the date of repurchase. See “Description of New Notes—Covenants—Change of Control.” |

| Limited Trading Market for the New Notes |

The New Notes generally will be freely transferable, but will also be securities for which the public market may be limited. There can be no assurance as to the development, persistence or liquidity of any market for the New Notes. We do not intend to apply for a listing of the New Notes on any securities exchange or included in any automated dealer quotation system. We cannot assure you that a liquid market for the New Notes will develop or be maintained. |

| Use of Proceeds |

We will not receive any cash proceeds for the exchange offer. We are making the exchange offer solely to satisfy our obligations under our registration rights agreement. |

| Governing Law |

The Indenture and the New Notes provide that they will be governed by, and construed in accordance with, the laws of the State of New York. |

13

Table of Contents

| Risk Factors |

Investing in the New Notes involves risks. See “Risk Factors” beginning on page 15 of this prospectus, as well as the risk factors set forth in our, ETP’s, Regency’s and Sunoco Logistics’ Annual Reports on Form 10-K for the year ended December 31, 2013, in each case as updated by our, ETP’s, Regency’s and Sunoco Logistics’ subsequent Quarterly Reports on Form 10-Q, and the other risks identified in the documents incorporated by reference herein and therein for information regarding risks you should consider before investing in the New Notes. |

14

Table of Contents

Before deciding whether to participate in the exchange offer, you should consider carefully the following risk factors and the risk factors set forth in our, ETP’s, Regency’s and Sunoco Logistics’ Annual Reports on Form 10-K for the year ended December 31, 2013, in each case as updated by our, ETP’s, Regency’s and Sunoco Logistics’ subsequent Quarterly Reports on Form 10-Q, together with all of the other information included in, or incorporated by reference into, this prospectus , when evaluating an investment in the New Notes. These are not all the risks we face and other factors currently considered immaterial or unknown to us may impact our future operations. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Statement Concerning Forward-Looking Statements.”

Risks Related to Our Indebtedness and the New Notes

If you do not properly tender your Old Notes, you will continue to hold unregistered Old Notes that will not be fungible with the Existing 2024 Notes and your ability to transfer Old Notes will remain restricted and may be adversely affected.

We will only issue New Notes in exchange for Old Notes that you timely and properly tender. Therefore, you should allow sufficient time to ensure timely delivery of the Old Notes and you should carefully follow the instructions on how to tender your Old Notes. Neither we nor the exchange agent is required to tell you of any defects or irregularities with respect to your tender of Old Notes.

If you do not exchange your Old Notes for New Notes pursuant to the exchange offer, the Old Notes you hold will continue to be subject to the existing transfer restrictions. In general, you may not offer or sell the Old Notes except under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not plan to register Old Notes under the Securities Act unless our registration rights agreement with the initial purchasers of the Old Notes requires us to do so. Further, although the Old Notes are part of the same issue as the Existing 2024 Notes, the Old Notes were issued in a private offering exempt from registration under the Securities Act and bear CUSIP numbers that differ from the original CUSIP number assigned to the Existing 2024 Notes. Therefore, if you continue to hold any Old Notes after the exchange offer is consummated, you may have trouble selling them because there will be fewer of the Old Notes outstanding and because they will continue to trade under CUSIP numbers that differ from that assigned to the Existing 2024 Notes and will not be fungible with the Existing 2024 Notes.

The New Notes will be effectively subordinated to liabilities and indebtedness of our subsidiaries.

We do not own any operating assets. Our principal assets consist of our ownership interests in ETP, Sunoco Logistics, Regency and Trunkline LNG. Initially, none of our subsidiaries will guarantee our obligations with respect to the New Notes. Creditors of our subsidiaries that do not guarantee the New Notes will have claims with respect to the assets of those subsidiaries that rank effectively senior to claims of the holders of the New Notes. In the event of any distribution or payment of assets of such subsidiaries in any dissolution, winding up, liquidation, reorganization or other bankruptcy proceeding, the claims of those creditors must be satisfied prior to making any such distribution or payment to us in respect of our direct or indirect equity interests in such subsidiaries. Accordingly, after satisfaction of the claims of such creditors, there may be little or no amounts left available to make payments in respect of the New Notes. Also, there are federal and state laws that could invalidate any guarantee of our subsidiary or subsidiaries that guarantee the New Notes. If that were to occur, the claims of creditors of a guaranteeing subsidiary would also rank effectively senior to the New Notes, to the extent of the assets of that subsidiary. Furthermore, such subsidiaries are not prohibited under the Indenture from incurring additional indebtedness.

15

Table of Contents

None of ETP, Regency or any of their respective subsidiaries will initially guarantee the payment of the New Notes, and our ability to pay principal and interest on the New Notes is primarily dependent upon ETP, Regency and Sunoco Logistics having sufficient cash available for distributions on their respective ownership interests and IDRs after satisfaction of their respective debt obligations.

None of ETP, Regency or any of their respective subsidiaries will initially guarantee our obligations with respect to the New Notes. Therefore, none of ETP, Regency or any of their respective subsidiaries will have any obligations to pay amounts due under the New Notes or to make any funds available to pay those amounts. Our ability to pay principal and interest on the New Notes is primarily dependent upon our receipt of cash distributions from ETP, Regency and Sunoco Logistics in respect of our ownership interests and IDRs in such entities, which cash distributions are subject to the priority rights of their and their subsidiaries’ respective creditors. Accordingly, creditors of ETP, Regency, Sunoco Logistics and their respective subsidiaries will have claims, with respect to the assets of ETP, Regency, Sunoco Logistics and their respective subsidiaries, that rank effectively senior to the New Notes. In the event of any distribution or payment of assets of ETP, Regency, Sunoco Logistics and their respective subsidiaries in any dissolution, winding up, liquidation, reorganization or other bankruptcy proceeding, the claims of the creditors of ETP, Regency, Sunoco Logistics and their respective subsidiaries must be satisfied prior to ETP, Regency or Sunoco Logistics making any such distribution to us in respect of our direct or indirect equity interests in such entity. Accordingly, after satisfaction of the claims of such creditors, there may be little or no amounts distributed to us to make payments in respect of the notes. As of March 31, 2014, after giving effect to the subsidiary financing transactions, the New Notes would have been effectively subordinated to approximately $23.7 billion of principal amount of outstanding indebtedness of ETP, Regency, Sunoco Logistics and their respective subsidiaries, as well as other significant liabilities. Furthermore, none of ETP, Regency, Sunoco Logistics or any of their respective subsidiaries is subject to any provisions of the Indenture, and therefore the indenture does not prohibit such entities from incurring additional indebtedness.

We have a substantial amount of indebtedness outstanding, which may adversely affect our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness, including the New Notes.

We have significant debt obligations. If we are unable to meet our debt obligations, we may need to consider refinancing or amending credit agreements or debt indentures or adopting alternative strategies to reduce or delay expenditures or seeking additional equity capital. As of March 31, 2014, after giving effect to the amendment to our term loan facility to increase the amount thereunder to $1.4 billion and the offering of the Old Notes and the application of the net proceeds therefrom, ETE would have had approximately $3.7 billion of indebtedness outstanding (including the Old Notes for which we are exchanging the New Notes). In addition, as of March 31, 2014, after giving effect to the subsidiary financing transactions our subsidiaries, including ETP, Regency, Sunoco Logistics and their respective subsidiaries, would have had outstanding approximately $23.7 billion of indebtedness that would effectively rank senior to the New Notes with respect to the assets of those subsidiaries, as well as other significant liabilities.

Our substantial debt could have important consequences to you. For example, it could make it more difficult for us to satisfy our obligations with respect to the New Notes, increase our vulnerability to general adverse economic and industry conditions, and limit our ability to borrow additional funds, even when necessary to maintain adequate liquidity. In addition, the indentures governing our senior notes, the agreements governing our revolving and term loan facilities and any of our future debt agreements may contain financial and other restrictive covenants that will limit our ability to decide how to operate our business. Our failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our outstanding indebtedness.

We may incur substantially more debt, which could further exacerbate the risks related to our indebtedness.

As of March 31, 2014, after giving effect to the amendment to our term loan facility to increase the amount thereunder to $1.4 billion and the offering of the Old Notes and the application of the net proceeds therefrom,

16

Table of Contents

ETE would have had approximately $3.7 billion of indebtedness outstanding (including the Old Notes for which we are exchanging the New Notes). In addition, as of March 31, 2014, after giving effect to the subsidiary financing transactions our subsidiaries, including ETP, Regency, Sunoco Logistics and their respective subsidiaries, would have had approximately $23.7 billion of principal amount of indebtedness, as well as other significant liabilities. We and our subsidiaries, including ETP and Regency, may incur substantial additional indebtedness in the future, and the terms of the Indenture do not prohibit us from doing so. If we incur any additional indebtedness, including trade payables, that ranks equally with the New Notes, the holders of that debt will be entitled to share ratably with you in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding up of our partnership to unsecured creditors to the extent our collateral is either released or inadequate to satisfy the claims of the holders of the New Notes. This may have the effect of reducing the amount of proceeds paid to you. If new debt is added to our current debt levels, the related risks that we now face could intensify. See “Description of New Notes” and “Description of Other Indebtedness.”

In the event of a default, we may have insufficient funds to make any payments due on the New Notes.

A breach of any covenant in the indentures governing our senior notes, the credit agreements governing our revolving credit facility and term loan facility and any other debt that we may have outstanding from time to time could result in a default under that agreement after any applicable grace periods. A default, if not waived, could result in acceleration of the debt outstanding under the agreement and a default with respect to, and an acceleration of, the debt outstanding under other debt agreements. The accelerated debt would become immediately due and payable. If that occurs, we may not be able to make all of the required payments or borrow sufficient funds to refinance such debt. Even if new financing were available at that time, it may not be on terms that are acceptable to us. If our debt is in default for any reason, our business, financial condition and results of operations could be materially adversely affected. See “Description of Other Indebtedness.”

Your right to take enforcement action with respect to the liens securing the New Notes is limited, and you will receive the proceeds from such enforcement pro rata with the holders of the 2020 Notes and the lenders under our revolving credit facility and term loan facility.

The New Notes, the 2020 Notes and the indebtedness and other obligations under our revolving credit facility and term loan facility will be secured by liens on the same collateral. However, under the terms of the collateral agency agreement, the holders of the New Notes will not have any independent power to enforce any liens or to exercise any rights or powers arising under the security documents except through the administrative agents for the lenders under our revolving credit facility and term loan facility and the collateral agent. The proceeds of any collection, sale, disposition or other realization of the collateral received in connection with the exercise of remedies (including distributions of any part of the collateral in a bankruptcy, insolvency, reorganization or similar proceedings) will be shared pro rata with the holders of the 2020 Notes and the lenders under our revolving credit facility and term loan facility. By investing in the New Notes, you will have deemed to have agreed to these restrictions. As a result of these restrictions, holders of the New Notes will have limited remedies and recourse against us in the event of a default.

There may not be sufficient collateral to pay all or any of the New Notes.

Our indebtedness and other obligations under our revolving credit facility and term loan facility, the 2020 Notes and the Notes are, and certain other secured indebtedness that we may incur in the future will be, secured by a first-priority lien on substantially all of our and certain of our subsidiaries’ assets, subject to certain exceptions and permitted liens and subject to the terms of the collateral agency agreement. No fair market value appraisals of any collateral have been prepared by us. The value of the collateral at any time will depend on market and other economic conditions, including the availability of suitable buyers for the collateral. By its nature, some or all of the collateral may be illiquid and may have no readily ascertainable market value. Although a public trading market exists for the portion of the collateral represented by the common units of ETP

17

Table of Contents

and Regency, the market may not be sufficiently liquid for you to realize that value. The value of the assets pledged as collateral for the New Notes could be impaired in the future as a result of changing economic conditions, competition or other future trends.

In addition, the collateral securing the New Notes is subject to liens permitted under the terms of the Indenture and the collateral agency agreement, whether arising on or after the date the New Notes are issued. To the extent that third parties hold prior liens, such third parties may have rights and remedies with respect to the property subject to such liens that, if exercised, could adversely affect the value of the collateral securing the New Notes. The collateral securing the New Notes may be released in certain circumstances without a release of collateral securing other obligations if such obligations do not exceed a threshold level or qualify as permitted liens. In such an event, the holders of the New Notes would recover less in a bankruptcy, foreclosure, liquidation or similar proceeding than the holders of such other obligations to the extent of the value of the collateral securing such obligations. The Indenture does not require that we maintain the current level of collateral or maintain a specific ratio of indebtedness to asset values.

In the event of a foreclosure, liquidation, bankruptcy or similar proceeding, no assurance can be given that the proceeds from any sale or liquidation of the collateral will be sufficient to pay our senior secured debt obligations, including the New Notes, in full or at all. Accordingly, there may not be sufficient collateral to pay all or any of the amounts due on the New Notes. Any claim for the difference between the amount, if any, realized by holders of the New Notes from the sale of the collateral securing the New Notes and the obligations under the New Notes will rank equally in right of payment with all of our unsecured senior indebtedness and other obligations, including trade payables.

The collateral securing the New Notes may be diluted under certain circumstances.