UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21488

Cohen & Steers Global Infrastructure Fund, Inc.

(Exact name of Registrant as specified in charter)

1166 Avenue of the Americas, 30th Floor, New York, New York 10036

(Address of principal executive offices) (Zip code)

Dana A. DeVivo

Cohen & Steers Capital Management, Inc.

1166 Avenue of the Americas, 30th Floor

New York, New York 10036

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 832-3232

Date of fiscal year end: December 31

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

(a)

| semi-annual shareholder report as of |

|

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class A | $ |

The share class had a 3.74% total return in the six months ended June 30, 2024, compared with the Linked Index,1 which returned 2.29%.

Security selection and an overweight allocation to marine ports contributed to relative performance in the period. An overweight investment in Santos Brasil positively contributed on better-than-expected results as the company is benefiting from an ongoing shortage in container terminal capacity in Brazil. Also in the sector, an out-of-benchmark investment in JSW Infrastructure positively contributed, on speculation that India would privatize port operations, with JSW being a key beneficiary of the policy change. Security selection and an overweight in midstream energy also contributed to relative performance, in part due to an overweight in Targa Resources, which outperformed amid continued strong natural gas liquids volumes in the Permian Basin. Security selection in electric utilities further aided relative returns. This included an overweight in Public Service Enterprise Group, which rose on investor excitement around the potential for the company to benefit from the increased electricity demand from data center customers. An out-of-index position in NTPC also positively contributed; largely due to continued strong power demand in India.

An overweight allocation in the communications sector detracted from relative performance. Tower companies performed poorly due to higher interest rates and a slowdown in leasing activity. Security selection in airports also detracted from relative performance, led by an out-of-benchmark investment in Japan Airport Terminal Company, which declined due to both disappointing passenger traffic and more severe cost pressures than expected. There were no other detractors at the sector level in the period.

The currency impact of the Fund's investments in foreign securities detracted from absolute performance during the period, as, overall, foreign currencies depreciated against the dollar.

Top contributors |

Top detractors |

Marine Ports |

Communications |

Electric |

Airports |

Midstream |

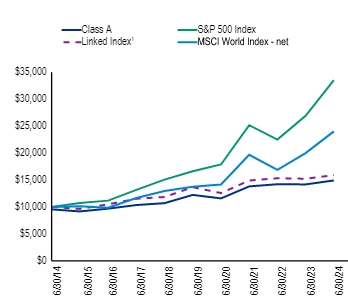

The chart below shows the performance of a hypothetical $10,000 investment in the share class noted over the period reflected, as compared to the performance of the Fund's benchmarks, and assumes the maximum sales charge, if applicable, and the reinvestment of dividends and distributions.

(as of June 30, 2024)

| 1 Year | 5 Years | 10 Years | |

|---|---|---|---|

| With sales charge2 | |

|

|

| Without sales charge | |

|

|

| Linked Index1 | |

|

|

| S&P 500 Index | |

|

|

| MSCI World Index - net | |

|

|

*

| Net assets | $ |

| Number of portfolio holdings (excluding derivatives) | |

| Portfolio turnover rate |

| Top ten holdings3,4 | (%) |

|---|---|

| NextEra Energy, Inc. | |

| American Tower Corp. | |

| Duke Energy Corp. | |

| TC Energy Corp. | |

| NiSource, Inc. | |

| Cheniere Energy, Inc. | |

| Public Service Enterprise Group, Inc. | |

| PG&E Corp. | |

| PPL Corp. | |

| Pembina Pipeline Corp. |

| Sector diversification3,5 | (%) |

|---|---|

| Electric | |

| Midstream | |

| Gas Distribution | |

| Communications | |

| Marine Ports | |

| Airports | |

| Railways | |

| Toll Roads | |

| Water | |

| Other (includes short-term investments) |

| Country diversification3,5 | (%) |

|---|---|

| United States | |

| Canada | |

| Australia | |

| India | |

| Japan | |

| United Kingdom | |

| Spain | |

| China | |

| Mexico | |

| Other (includes short-term investments) |

There have been no material changes to the Fund since the beginning of the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request by calling 1-800-330-7348 or visiting www.cohenandsteers.com/fund-literature.

Additional information is available on the Fund's website address included at the beginning of this report, including the Fund's prospectus, financial information, holdings and proxy voting information.

1 |

The Linked Index consists of the UBS Global 50/50 Infrastructure & Utilities Index-Net (UBS 50/50) from June 1, 2008 through March 31, 2015 and the FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) thereafter. |

2 |

Reflects a 4.50% front-end sales charge. |

3 |

Based on net assets. |

4 |

Determined on the basis of the value of individual securities held, excluding short-term investments and derivative instruments, if any. |

5 |

Excludes derivative instruments, if any. |

| semi-annual shareholder report as of June 30, 2024 |

|

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class C | $ |

The share class had a 3.43% total return in the six months ended June 30, 2024, compared with the Linked Index,1 which returned 2.29%.

Security selection and an overweight allocation to marine ports contributed to relative performance in the period. An overweight investment in Santos Brasil positively contributed on better-than-expected results as the company is benefiting from an ongoing shortage in container terminal capacity in Brazil. Also in the sector, an out-of-benchmark investment in JSW Infrastructure positively contributed, on speculation that India would privatize port operations, with JSW being a key beneficiary of the policy change. Security selection and an overweight in midstream energy also contributed to relative performance, in part due to an overweight in Targa Resources, which outperformed amid continued strong natural gas liquids volumes in the Permian Basin. Security selection in electric utilities further aided relative returns. This included an overweight in Public Service Enterprise Group, which rose on investor excitement around the potential for the company to benefit from the increased electricity demand from data center customers. An out-of-index position in NTPC also positively contributed; largely due to continued strong power demand in India.

An overweight allocation in the communications sector detracted from relative performance. Tower companies performed poorly due to higher interest rates and a slowdown in leasing activity. Security selection in airports also detracted from relative performance, led by an out-of-benchmark investment in Japan Airport Terminal Company, which declined due to both disappointing passenger traffic and more severe cost pressures than expected. There were no other detractors at the sector level in the period.

The currency impact of the Fund's investments in foreign securities detracted from absolute performance during the period, as, overall, foreign currencies depreciated against the dollar.

Top contributors |

Top detractors |

Marine Ports |

Communications |

Electric |

Airports |

Midstream |

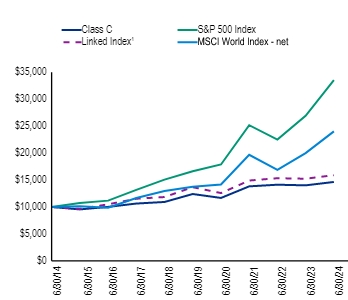

The chart below shows the performance of a hypothetical $10,000 investment in the share class noted over the period reflected, as compared to the performance of the Fund's benchmarks, and assumes the maximum sales charge, if applicable, and the reinvestment of dividends and distributions.

(as of June 30, 2024)

| 1 Year | 5 Years | 10 Years | |

|---|---|---|---|

| With sales charge | |

|

|

| Without sales charge | |

|

|

| Linked Index1 | |

|

|

| S&P 500 Index | |

|

|

| MSCI World Index - net | |

|

|

*

| Net assets | $ |

| Number of portfolio holdings (excluding derivatives) | |

| Portfolio turnover rate |

| Top ten holdings3,4 | (%) |

|---|---|

| NextEra Energy, Inc. | |

| American Tower Corp. | |

| Duke Energy Corp. | |

| TC Energy Corp. | |

| NiSource, Inc. | |

| Cheniere Energy, Inc. | |

| Public Service Enterprise Group, Inc. | |

| PG&E Corp. | |

| PPL Corp. | |

| Pembina Pipeline Corp. |

| Sector diversification3,5 | (%) |

|---|---|

| Electric | |

| Midstream | |

| Gas Distribution | |

| Communications | |

| Marine Ports | |

| Airports | |

| Railways | |

| Toll Roads | |

| Water | |

| Other (includes short-term investments) |

| Country diversification3,5 | (%) |

|---|---|

| United States | |

| Canada | |

| Australia | |

| India | |

| Japan | |

| United Kingdom | |

| Spain | |

| China | |

| Mexico | |

| Other (includes short-term investments) |

There have been no material changes to the Fund since the beginning of the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request by calling 1-800-330-7348 or visiting www.cohenandsteers.com/fund-literature.

Additional information is available on the Fund's website address included at the beginning of this report, including the Fund's prospectus, financial information, holdings and proxy voting information.

1 |

The Linked Index consists of the UBS Global 50/50 Infrastructure & Utilities Index-Net (UBS 50/50) from June 1, 2008 through March 31, 2015 and the FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) thereafter. |

2 |

Reflects a contingent deferred sales charge of 1.00%. |

3 |

Based on net assets. |

4 |

Determined on the basis of the value of individual securities held, excluding short-term investments and derivative instruments, if any. |

5 |

Excludes derivative instruments, if any. |

| semi-annual shareholder report as of June 30, 2024 |

|

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class I | $ |

The share class had a 3.96% total return in the six months ended June 30, 2024, compared with the Linked Index,1 which returned 2.29%.

Security selection and an overweight allocation to marine ports contributed to relative performance in the period. An overweight investment in Santos Brasil positively contributed on better-than-expected results as the company is benefiting from an ongoing shortage in container terminal capacity in Brazil. Also in the sector, an out-of-benchmark investment in JSW Infrastructure positively contributed, on speculation that India would privatize port operations, with JSW being a key beneficiary of the policy change. Security selection and an overweight in midstream energy also contributed to relative performance, in part due to an overweight in Targa Resources, which outperformed amid continued strong natural gas liquids volumes in the Permian Basin. Security selection in electric utilities further aided relative returns. This included an overweight in Public Service Enterprise Group, which rose on investor excitement around the potential for the company to benefit from the increased electricity demand from data center customers. An out-of-index position in NTPC also positively contributed; largely due to continued strong power demand in India.

An overweight allocation in the communications sector detracted from relative performance. Tower companies performed poorly due to higher interest rates and a slowdown in leasing activity. Security selection in airports also detracted from relative performance, led by an out-of-benchmark investment in Japan Airport Terminal Company, which declined due to both disappointing passenger traffic and more severe cost pressures than expected. There were no other detractors at the sector level in the period.

The currency impact of the Fund's investments in foreign securities detracted from absolute performance during the period, as, overall, foreign currencies depreciated against the dollar.

Top contributors |

Top detractors |

Marine Ports |

Communications |

Electric |

Airports |

Midstream |

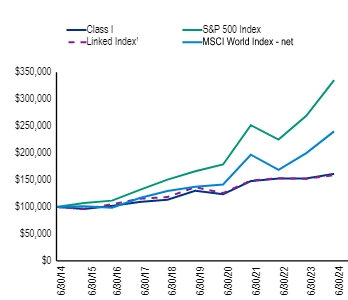

The chart below shows the performance of a hypothetical $100,000 investment in the share class noted over the period reflected, as compared to the performance of the Fund's benchmarks, and assumes the maximum sales charge, if applicable, and the reinvestment of dividends and distributions.

(as of June 30, 2024)

| 1 Year | 5 Years | 10 Years | |

|---|---|---|---|

| Class I2 | |

|

|

| Linked Index1 | |

|

|

| S&P 500 Index | |

|

|

| MSCI World Index - net | |

|

|

*

| Net assets | $ |

| Number of portfolio holdings (excluding derivatives) | |

| Portfolio turnover rate |

| Top ten holdings3,4 | (%) |

|---|---|

| NextEra Energy, Inc. | |

| American Tower Corp. | |

| Duke Energy Corp. | |

| TC Energy Corp. | |

| NiSource, Inc. | |

| Cheniere Energy, Inc. | |

| Public Service Enterprise Group, Inc. | |

| PG&E Corp. | |

| PPL Corp. | |

| Pembina Pipeline Corp. |

| Sector diversification3,5 | (%) |

|---|---|

| Electric | |

| Midstream | |

| Gas Distribution | |

| Communications | |

| Marine Ports | |

| Airports | |

| Railways | |

| Toll Roads | |

| Water | |

| Other (includes short-term investments) |

| Country diversification3,5 | (%) |

|---|---|

| United States | |

| Canada | |

| Australia | |

| India | |

| Japan | |

| United Kingdom | |

| Spain | |

| China | |

| Mexico | |

| Other (includes short-term investments) |

There have been no material changes to the Fund since the beginning of the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request by calling 1-800-330-7348 or visiting www.cohenandsteers.com/fund-literature.

Additional information is available on the Fund's website address included at the beginning of this report, including the Fund's prospectus, financial information, holdings and proxy voting information.

1 |

The Linked Index consists of the UBS Global 50/50 Infrastructure & Utilities Index-Net (UBS 50/50) from June 1, 2008 through March 31, 2015 and the FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) thereafter. |

2 |

This share class does not impose a sales charge. |

3 |

Based on net assets. |

4 |

Determined on the basis of the value of individual securities held, excluding short-term investments and derivative instruments, if any. |

5 |

Excludes derivative instruments, if any. |

| semi-annual shareholder report as of June 30, 2024 |

|

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class R | $ |

The share class had a 3.69% total return in the six months ended June 30, 2024, compared with the Linked Index,1 which returned 2.29%.

Security selection and an overweight allocation to marine ports contributed to relative performance in the period. An overweight investment in Santos Brasil positively contributed on better-than-expected results as the company is benefiting from an ongoing shortage in container terminal capacity in Brazil. Also in the sector, an out-of-benchmark investment in JSW Infrastructure positively contributed, on speculation that India would privatize port operations, with JSW being a key beneficiary of the policy change. Security selection and an overweight in midstream energy also contributed to relative performance, in part due to an overweight in Targa Resources, which outperformed amid continued strong natural gas liquids volumes in the Permian Basin. Security selection in electric utilities further aided relative returns. This included an overweight in Public Service Enterprise Group, which rose on investor excitement around the potential for the company to benefit from the increased electricity demand from data center customers. An out-of-index position in NTPC also positively contributed; largely due to continued strong power demand in India.

An overweight allocation in the communications sector detracted from relative performance. Tower companies performed poorly due to higher interest rates and a slowdown in leasing activity. Security selection in airports also detracted from relative performance, led by an out-of-benchmark investment in Japan Airport Terminal Company, which declined due to both disappointing passenger traffic and more severe cost pressures than expected. There were no other detractors at the sector level in the period.

The currency impact of the Fund's investments in foreign securities detracted from absolute performance during the period, as, overall, foreign currencies depreciated against the dollar.

Top contributors |

Top detractors |

Marine Ports |

Communications |

Electric |

Airports |

Midstream |

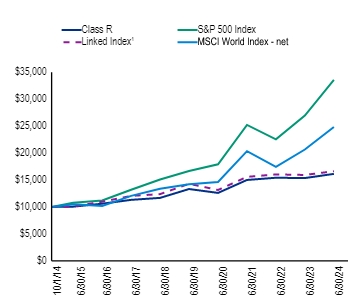

The chart below shows the performance of a hypothetical $10,000 investment in the share class noted over the period reflected, as compared to the performance of the Fund's benchmarks, and assumes the maximum sales charge, if applicable, and the reinvestment of dividends and distributions.

(as of June 30, 2024)

| 1 Year | 5 Years | Since Inception ( | |

|---|---|---|---|

| Class R2 | |

|

|

| Linked Index1 | |

|

|

| S&P 500 Index | |

|

|

| MSCI World Index - net | |

|

|

*

| Net assets | $ |

| Number of portfolio holdings (excluding derivatives) | |

| Portfolio turnover rate |

| Top ten holdings3,4 | (%) |

|---|---|

| NextEra Energy, Inc. | |

| American Tower Corp. | |

| Duke Energy Corp. | |

| TC Energy Corp. | |

| NiSource, Inc. | |

| Cheniere Energy, Inc. | |

| Public Service Enterprise Group, Inc. | |

| PG&E Corp. | |

| PPL Corp. | |

| Pembina Pipeline Corp. |

| Sector diversification3,5 | (%) |

|---|---|

| Electric | |

| Midstream | |

| Gas Distribution | |

| Communications | |

| Marine Ports | |

| Airports | |

| Railways | |

| Toll Roads | |

| Water | |

| Other (includes short-term investments) |

| Country diversification3,5 | (%) |

|---|---|

| United States | |

| Canada | |

| Australia | |

| India | |

| Japan | |

| United Kingdom | |

| Spain | |

| China | |

| Mexico | |

| Other (includes short-term investments) |

There have been no material changes to the Fund since the beginning of the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request by calling 1-800-330-7348 or visiting www.cohenandsteers.com/fund-literature.

Additional information is available on the Fund's website address included at the beginning of this report, including the Fund's prospectus, financial information, holdings and proxy voting information.

1 |

The Linked Index consists of the UBS Global 50/50 Infrastructure & Utilities Index-Net (UBS 50/50) from June 1, 2008 through March 31, 2015 and the FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) thereafter. |

2 |

This share class does not impose a sales charge. |

3 |

Based on net assets. |

4 |

Determined on the basis of the value of individual securities held, excluding short-term investments and derivative instruments, if any. |

5 |

Excludes derivative instruments, if any. |

| semi-annual shareholder report as of June 30, 2024 |

|

| Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

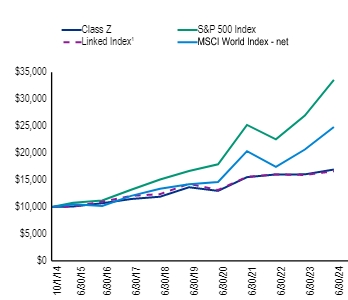

| Class Z | $ |

The share class had a 3.91% total return in the six months ended June 30, 2024, compared with the Linked Index,1 which returned 2.29%.

Security selection and an overweight allocation to marine ports contributed to relative performance in the period. An overweight investment in Santos Brasil positively contributed on better-than-expected results as the company is benefiting from an ongoing shortage in container terminal capacity in Brazil. Also in the sector, an out-of-benchmark investment in JSW Infrastructure positively contributed, on speculation that India would privatize port operations, with JSW being a key beneficiary of the policy change. Security selection and an overweight in midstream energy also contributed to relative performance, in part due to an overweight in Targa Resources, which outperformed amid continued strong natural gas liquids volumes in the Permian Basin. Security selection in electric utilities further aided relative returns. This included an overweight in Public Service Enterprise Group, which rose on investor excitement around the potential for the company to benefit from the increased electricity demand from data center customers. An out-of-index position in NTPC also positively contributed; largely due to continued strong power demand in India.

An overweight allocation in the communications sector detracted from relative performance. Tower companies performed poorly due to higher interest rates and a slowdown in leasing activity. Security selection in airports also detracted from relative performance, led by an out-of-benchmark investment in Japan Airport Terminal Company, which declined due to both disappointing passenger traffic and more severe cost pressures than expected. There were no other detractors at the sector level in the period.

The currency impact of the Fund's investments in foreign securities detracted from absolute performance during the period, as, overall, foreign currencies depreciated against the dollar.

Top contributors |

Top detractors |

Marine Ports |

Communications |

Electric |

Airports |

Midstream |

The chart below shows the performance of a hypothetical $10,000 investment in the share class noted over the period reflected, as compared to the performance of the Fund's benchmarks, and assumes the maximum sales charge, if applicable, and the reinvestment of dividends and distributions.

(as of June 30, 2024)

| 1 Year | 5 Years | Since Inception ( | |

|---|---|---|---|

| Class Z2 | |

|

|

| Linked Index1 | |

|

|

| S&P 500 Index | |

|

|

| MSCI World Index - net | |

|

|

*

| Net assets | $ |

| Number of portfolio holdings (excluding derivatives) | |

| Portfolio turnover rate |

| Top ten holdings3,4 | (%) |

|---|---|

| NextEra Energy, Inc. | |

| American Tower Corp. | |

| Duke Energy Corp. | |

| TC Energy Corp. | |

| NiSource, Inc. | |

| Cheniere Energy, Inc. | |

| Public Service Enterprise Group, Inc. | |

| PG&E Corp. | |

| PPL Corp. | |

| Pembina Pipeline Corp. |

| Sector diversification3,5 | (%) |

|---|---|

| Electric | |

| Midstream | |

| Gas Distribution | |

| Communications | |

| Marine Ports | |

| Airports | |

| Railways | |

| Toll Roads | |

| Water | |

| Other (includes short-term investments) |

| Country diversification3,5 | (%) |

|---|---|

| United States | |

| Canada | |

| Australia | |

| India | |

| Japan | |

| United Kingdom | |

| Spain | |

| China | |

| Mexico | |

| Other (includes short-term investments) |

There have been no material changes to the Fund since the beginning of the reporting period that are required to be disclosed in this report. For more complete information about other changes to the Fund, you may review the Fund's current prospectus, which is available upon request by calling 1-800-330-7348 or visiting www.cohenandsteers.com/fund-literature.

Additional information is available on the Fund's website address included at the beginning of this report, including the Fund's prospectus, financial information, holdings and proxy voting information.

1 |

The Linked Index consists of the UBS Global 50/50 Infrastructure & Utilities Index-Net (UBS 50/50) from June 1, 2008 through March 31, 2015 and the FTSE Global Core Infrastructure 50/50 Net Tax Index (FTSE 50/50) thereafter. |

2 |

This share class does not impose a sales charge. |

3 |

Based on net assets. |

4 |

Determined on the basis of the value of individual securities held, excluding short-term investments and derivative instruments, if any. |

5 |

Excludes derivative instruments, if any. |

(b) Not applicable.

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Included in Item 7 below.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a)

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

We would like to share with you our report for the six months ended June 30, 2024. The total returns for Cohen & Steers Global Infrastructure Fund, Inc. (the Fund) and its comparative benchmarks were:

| Six Months Ended June 30, 2024 |

||||

| Cohen & Steers Global Infrastructure Fund: |

||||

| Class A |

3.74 | % | ||

| Class C |

3.43 | % | ||

| Class I |

3.96 | % | ||

| Class R |

3.69 | % | ||

| Class Z |

3.91 | % | ||

| FTSE Global Core Infrastructure 50/50 Net Tax Index(a) |

2.29 | % | ||

| S&P 500 Index(a) |

15.29 | % | ||

| MSCI World Index (Net)(a) |

11.75 | % | ||

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. All share class returns assume the reinvestment of all dividends and distributions at net asset value (NAV). Fund performance figures reflect fee waivers and/or expense reimbursements, where applicable, without which the performance would have been lower. Performance quoted does not reflect the deduction of the maximum 4.50% initial sales charge on Class A shares or the 1.00% maximum contingent deferred sales charge on Class C shares. The 1.00% maximum contingent deferred sales charge on Class C shares applies if redemption occurs on or before the one year anniversary date of their purchase. If such charges were included, returns would have been lower. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

Please note that distributions paid by the Fund to shareholders are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund’s investment company taxable income and net realized gains. Distributions in excess of the Fund’s investment company taxable income and net realized gains are a return of capital distributed from the Fund’s assets.

| (a) | The FTSE Global Core Infrastructure 50/50 Net Tax Index is a market-capitalization-weighted index of worldwide infrastructure and infrastructure-related securities and is net of dividend withholding taxes. Constituent weights are adjusted semi-annually according to three broad industry sectors: 50% utilities, 30% transportation, and a 20% mix of other sectors, including pipelines, satellites and telecommunication towers. The S&P 500 Index is an unmanaged index of 500 large-capitalization stocks that is frequently used as a general measure of U.S. stock market performance. The MSCI World Index (Net) is a free-float-adjusted index that measures performance of large- and mid-capitalization companies representing developed market countries and is net of dividend withholding taxes. |

1

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

June 30, 2024 (Unaudited)

| Shares/ Units |

Value | |||||||||||

| COMMON STOCK |

99.2% | |||||||||||

| AUSTRALIA |

4.5% | |||||||||||

| ENVIRONMENTAL SERVICES |

1.0% | |||||||||||

| Cleanaway Waste Management Ltd. |

|

4,348,008 | $ | 8,034,538 | ||||||||

|

|

|

|||||||||||

| TOLL ROADS |

2.7% | |||||||||||

| Atlas Arteria Ltd.(a) |

|

1,892,063 | 6,449,816 | |||||||||

| Transurban Group(a) |

|

1,725,516 | 14,273,534 | |||||||||

|

|

|

|||||||||||

| 20,723,350 | ||||||||||||

|

|

|

|||||||||||

| TRANSPORT LOGISTICS |

0.8% | |||||||||||

| Qube Holdings Ltd. |

|

2,427,606 | 5,911,013 | |||||||||

|

|

|

|||||||||||

| TOTAL AUSTRALIA |

|

34,668,901 | ||||||||||

|

|

|

|||||||||||

| BRAZIL |

2.4% | |||||||||||

| ELECTRIC |

0.4% | |||||||||||

| Equatorial Energia SA |

|

619,870 | 3,403,125 | |||||||||

|

|

|

|||||||||||

| MARINE PORTS |

2.0% | |||||||||||

| Santos Brasil Participacoes SA |

|

6,246,520 | 15,252,857 | |||||||||

|

|

|

|||||||||||

| TOTAL BRAZIL |

|

18,655,982 | ||||||||||

|

|

|

|||||||||||

| CANADA |

7.4% | |||||||||||

| MIDSTREAM |

6.8% | |||||||||||

| Pembina Pipeline Corp. |

|

590,983 | 21,927,778 | |||||||||

| TC Energy Corp. |

|

803,250 | 30,449,578 | |||||||||

|

|

|

|||||||||||

| 52,377,356 | ||||||||||||

|

|

|

|||||||||||

| RAILWAYS |

0.6% | |||||||||||

| Canadian Pacific Kansas City Ltd. |

|

56,564 | 4,454,666 | |||||||||

|

|

|

|||||||||||

| TOTAL CANADA |

|

56,832,022 | ||||||||||

|

|

|

|||||||||||

| CHINA |

2.6% | |||||||||||

| GAS DISTRIBUTION |

1.0% | |||||||||||

| ENN Energy Holdings Ltd., (H Shares) |

|

940,700 | 7,751,781 | |||||||||

|

|

|

|||||||||||

| MARINE PORTS |

0.8% | |||||||||||

| China Merchants Port Holdings Co. Ltd., (H Shares) |

|

4,316,000 | 6,422,282 | |||||||||

|

|

|

|||||||||||

| TOLL ROADS |

0.4% | |||||||||||

| Zhejiang Expressway Co. Ltd., (H Shares) |

|

4,709,382 | 3,178,164 | |||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

2

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

| Shares/ Units |

Value | |||||||||||

| WATER |

0.4% | |||||||||||

| Guangdong Investment Ltd., (H shares) |

|

4,820,000 | $ | 2,820,753 | ||||||||

|

|

|

|||||||||||

| TOTAL CHINA |

|

20,172,980 | ||||||||||

|

|

|

|||||||||||

| GERMANY |

1.3% | |||||||||||

| AIRPORT |

0.9% | |||||||||||

| Fraport AG Frankfurt Airport Services Worldwide(b) |

|

136,371 | 7,039,445 | |||||||||

|

|

|

|||||||||||

| ELECTRIC |

0.4% | |||||||||||

| E.ON SE |

|

244,235 | 3,205,462 | |||||||||

|

|

|

|||||||||||

| TOTAL GERMANY |

|

10,244,907 | ||||||||||

|

|

|

|||||||||||

| HONG KONG |

1.7% | |||||||||||

| ELECTRIC |

|

|||||||||||

| CLP Holdings Ltd. |

|

487,000 | 3,935,139 | |||||||||

| Power Assets Holdings Ltd. |

|

1,691,500 | 9,151,674 | |||||||||

|

|

|

|||||||||||

| 13,086,813 | ||||||||||||

|

|

|

|||||||||||

| INDIA |

3.7% | |||||||||||

| ELECTRIC |

1.5% | |||||||||||

| NTPC Ltd. |

|

2,480,812 | 11,290,279 | |||||||||

|

|

|

|||||||||||

| MARINE PORTS |

2.2% | |||||||||||

| Adani Ports & Special Economic Zone Ltd. |

|

490,063 | 8,668,481 | |||||||||

| JSW Infrastructure Ltd.(b) |

|

2,141,345 | 8,433,131 | |||||||||

|

|

|

|||||||||||

| 17,101,612 | ||||||||||||

|

|

|

|||||||||||

| TOTAL INDIA |

|

28,391,891 | ||||||||||

|

|

|

|||||||||||

| ITALY |

0.9% | |||||||||||

| GAS DISTRIBUTION |

||||||||||||

| Snam SpA |

|

1,502,252 | 6,646,108 | |||||||||

|

|

|

|||||||||||

| JAPAN |

3.3% | |||||||||||

| AIRPORT |

0.4% | |||||||||||

| Japan Airport Terminal Co. Ltd. |

|

88,700 | 3,025,029 | |||||||||

|

|

|

|||||||||||

| ELECTRIC |

1.6% | |||||||||||

| Kansai Electric Power Co., Inc. |

|

495,200 | 8,316,430 | |||||||||

| Tokyo Electric Power Co. Holdings, Inc.(b) |

|

689,400 | 3,711,594 | |||||||||

|

|

|

|||||||||||

| 12,028,024 | ||||||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

3

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

| Shares/ Units |

Value | |||||||||||

| GAS DISTRIBUTION |

0.9% | |||||||||||

| Tokyo Gas Co. Ltd. |

|

328,700 | $ | 7,058,602 | ||||||||

|

|

|

|||||||||||

| RAILWAYS |

0.4% | |||||||||||

| East Japan Railway Co. |

|

204,300 | 3,383,413 | |||||||||

|

|

|

|||||||||||

| TOTAL JAPAN |

|

25,495,068 | ||||||||||

|

|

|

|||||||||||

| LUXEMBOURG |

0.6% | |||||||||||

| COMMUNICATIONS |

||||||||||||

| SES SA |

|

842,986 | 4,293,699 | |||||||||

|

|

|

|||||||||||

| MEXICO |

2.6% | |||||||||||

| AIRPORT |

||||||||||||

| Grupo Aeroportuario del Sureste SAB de CV, Class B |

|

647,597 | 19,523,483 | |||||||||

|

|

|

|||||||||||

| NETHERLANDS |

1.1% | |||||||||||

| MARINE PORTS |

||||||||||||

| Koninklijke Vopak NV |

|

194,228 | 8,062,412 | |||||||||

|

|

|

|||||||||||

| PHILIPPINES |

1.9% | |||||||||||

| MARINE PORTS |

||||||||||||

| International Container Terminal Services, Inc. |

|

2,383,360 | 14,224,766 | |||||||||

|

|

|

|||||||||||

| SPAIN |

2.8% | |||||||||||

| AIRPORT |

1.9% | |||||||||||

| Aena SME SA(c) |

|

71,604 | 14,416,655 | |||||||||

|

|

|

|||||||||||

| COMMUNICATIONS |

0.9% | |||||||||||

| Cellnex Telecom SA(c) |

|

211,125 | 6,866,791 | |||||||||

|

|

|

|||||||||||

| TOTAL SPAIN |

|

21,283,446 | ||||||||||

|

|

|

|||||||||||

| THAILAND |

1.6% | |||||||||||

| AIRPORT |

||||||||||||

| Airports of Thailand PCL |

|

7,676,900 | 11,924,063 | |||||||||

|

|

|

|||||||||||

| UNITED KINGDOM |

3.0% | |||||||||||

| ELECTRIC |

2.3% | |||||||||||

| National Grid PLC |

|

1,579,362 | 17,620,850 | |||||||||

|

|

|

|||||||||||

| WATER |

0.7% | |||||||||||

| Pennon Group PLC |

|

742,889 | 5,385,656 | |||||||||

|

|

|

|||||||||||

| TOTAL UNITED KINGDOM |

|

23,006,506 | ||||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

4

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

| Shares/ Units |

Value | |||||||||||

| UNITED STATES |

57.8% | |||||||||||

| COMMUNICATIONS |

7.3% | |||||||||||

| American Tower Corp. |

|

205,529 | $ | 39,950,727 | ||||||||

| Crown Castle, Inc. |

|

162,319 | 15,858,566 | |||||||||

|

|

|

|||||||||||

| 55,809,293 | ||||||||||||

|

|

|

|||||||||||

| ELECTRIC |

29.1% | |||||||||||

| Alliant Energy Corp. |

|

156,822 | 7,982,240 | |||||||||

| Ameren Corp. |

|

134,757 | 9,582,570 | |||||||||

| CenterPoint Energy, Inc. |

|

314,891 | 9,755,323 | |||||||||

| Consolidated Edison, Inc. |

|

162,491 | 14,529,945 | |||||||||

| Duke Energy Corp. |

|

305,046 | 30,574,761 | |||||||||

| Eversource Energy |

|

251,951 | 14,288,141 | |||||||||

| NextEra Energy, Inc. |

|

732,672 | 51,880,504 | |||||||||

| PG&E Corp. |

|

1,401,038 | 24,462,124 | |||||||||

| PPL Corp. |

|

832,131 | 23,008,422 | |||||||||

| Public Service Enterprise Group, Inc. |

|

344,067 | 25,357,738 | |||||||||

| Southern Co. |

|

147,541 | 11,444,755 | |||||||||

|

|

|

|||||||||||

| 222,866,523 | ||||||||||||

|

|

|

|||||||||||

| GAS DISTRIBUTION |

8.7% | |||||||||||

| Atmos Energy Corp. |

|

136,582 | 15,932,290 | |||||||||

| NiSource, Inc. |

|

1,009,455 | 29,082,399 | |||||||||

| Sempra |

|

282,301 | 21,471,814 | |||||||||

|

|

|

|||||||||||

| 66,486,503 | ||||||||||||

|

|

|

|||||||||||

| MIDSTREAM |

7.3% | |||||||||||

| Cheniere Energy, Inc. |

|

148,004 | 25,875,539 | |||||||||

| Targa Resources Corp. |

|

105,906 | 13,638,575 | |||||||||

| Williams Cos., Inc. |

|

377,961 | 16,063,343 | |||||||||

|

|

|

|||||||||||

| 55,577,457 | ||||||||||||

|

|

|

|||||||||||

| RAILWAYS |

5.4% | |||||||||||

| Norfolk Southern Corp. |

|

99,360 | 21,331,598 | |||||||||

| Union Pacific Corp. |

|

88,946 | 20,124,922 | |||||||||

|

|

|

|||||||||||

| 41,456,520 | ||||||||||||

|

|

|

|||||||||||

| TOTAL UNITED STATES |

|

442,196,296 | ||||||||||

|

|

|

|||||||||||

| TOTAL COMMON STOCK |

|

758,709,343 | ||||||||||

|

|

|

|||||||||||

See accompanying notes to financial statements.

5

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2024 (Unaudited)

| Shares/ Units |

Value | |||||||||||

| SHORT-TERM INVESTMENTS |

0.7% | |||||||||||

| MONEY MARKET FUNDS |

||||||||||||

| State Street Institutional Treasury Plus Money Market Fund, Premier Class, 5.25%(d) |

|

3,319,342 | $ | 3,319,342 | ||||||||

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.25%(d) |

|

1,800,000 | 1,800,000 | |||||||||

|

|

|

|||||||||||

| TOTAL SHORT-TERM INVESTMENTS |

|

5,119,342 | ||||||||||

|

|

|

|||||||||||

| TOTAL INVESTMENTS IN SECURITIES |

99.9% | 763,828,685 | ||||||||||

| OTHER ASSETS IN EXCESS OF LIABILITIES |

0.1 | 783,125 | ||||||||||

|

|

|

|||||||||||

| NET ASSETS |

100.0% | $ | 764,611,810 | |||||||||

|

|

|

|||||||||||

Note: Percentages indicated are based on the net assets of the Fund.

| (a) | Stapled security. A security contractually bound to one or more other securities to form a single saleable unit which cannot be sold separately. |

| (b) | Non–income producing security. |

| (c) | Securities exempt from registration under Rule 144A of the Securities Act of 1933. These securities may only be resold to qualified institutional buyers. Aggregate holdings amounted to $21,283,446 which represents 2.8% of the net assets of the Fund, of which 0.0% are illiquid. |

| (d) | Rate quoted represents the annualized seven–day yield. |

See accompanying notes to financial statements.

6

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2024 (Unaudited)

| ASSETS: |

| |||

| Investments in securities, at value (Identified cost—$668,135,254) |

$ | 763,828,685 | ||

| Foreign currency, at value (Identified cost—$912,636) |

913,826 | |||

| Receivable for: |

||||

| Investment securities sold |

3,448,881 | |||

| Dividends |

2,947,728 | |||

| Fund shares sold |

1,022,316 | |||

| Other assets |

10,762 | |||

|

|

|

|||

| Total Assets |

772,172,198 | |||

|

|

|

|||

| LIABILITIES: |

| |||

| Payable for: |

||||

| Fund shares redeemed |

2,790,231 | |||

| Investment securities purchased |

1,462,577 | |||

| Foreign capital gains tax |

1,301,741 | |||

| Dividends and distributions declared |

1,158,621 | |||

| Investment advisory fees |

435,714 | |||

| Shareholder servicing fees |

177,939 | |||

| Administration fees |

25,668 | |||

| Distribution fees |

14,654 | |||

| Directors’ fees |

270 | |||

| Other liabilities |

192,973 | |||

|

|

|

|||

| Total Liabilities |

7,560,388 | |||

|

|

|

|||

| NET ASSETS |

$ | 764,611,810 | ||

|

|

|

|||

| NET ASSETS consist of: |

||||

| Paid-in capital |

$ | 688,684,483 | ||

| Total distributable earnings/(accumulated loss) |

75,927,327 | |||

|

|

|

|||

| $ | 764,611,810 | |||

|

|

|

|||

See accompanying notes to financial statements.

7

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES—(Continued)

June 30, 2024 (Unaudited)

| CLASS A SHARES: |

||||

| NET ASSETS |

$ | 51,950,760 | ||

| Shares issued and outstanding ($0.001 par value common stock outstanding) |

2,344,735 | |||

|

|

|

|||

| Net asset value and redemption price per share |

$ | 22.16 | ||

|

|

|

|||

| Maximum offering price per share ($22.16 ÷ 0.955)(a) |

$ | 23.20 | ||

|

|

|

|||

| CLASS C SHARES: |

||||

| NET ASSETS |

$ | 6,071,751 | ||

| Shares issued and outstanding ($0.001 par value common stock outstanding) |

273,922 | |||

|

|

|

|||

| Net asset value and offering price per share(b) |

$ | 22.17 | ||

|

|

|

|||

| CLASS I SHARES: |

||||

| NET ASSETS |

$ | 704,513,136 | ||

| Shares issued and outstanding ($0.001 par value common stock outstanding) |

31,681,983 | |||

|

|

|

|||

| Net asset value, offering and redemption price per share |

$ | 22.24 | ||

|

|

|

|||

| CLASS R SHARES: |

||||

| NET ASSETS |

$ | 73,324 | ||

| Shares issued and outstanding ($0.001 par value common stock outstanding) |

3,290 | |||

|

|

|

|||

| Net asset value, offering and redemption price per share |

$ | 22.29 | ||

|

|

|

|||

| CLASS Z SHARES: |

||||

| NET ASSETS |

$ | 2,002,839 | ||

| Shares issued and outstanding ($0.001 par value common stock outstanding) |

90,055 | |||

|

|

|

|||

| Net asset value, offering and redemption price per share |

$ | 22.24 | ||

|

|

|

| (a) | On investments of $100,000 or more, the offering price is reduced. |

| (b) | Redemption price per share is equal to the net asset value per share less any applicable contingent deferred sales charge of 1.00% on shares held for less than one year. |

See accompanying notes to financial statements.

8

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2024 (Unaudited)

| Investment Income: |

| |||

| Dividend income (net of $810,485 of foreign withholding tax) |

$ | 14,576,617 | ||

|

|

|

|||

| Expenses: |

| |||

| Investment advisory fees |

2,929,466 | |||

| Distribution fees—Class A |

64,945 | |||

| Distribution fees—Class C |

23,490 | |||

| Distribution fees—Class R |

178 | |||

| Shareholder servicing fees—Class A |

25,978 | |||

| Shareholder servicing fees—Class C |

7,830 | |||

| Shareholder servicing fees—Class I |

270,774 | |||

| Administration fees |

203,298 | |||

| Custodian fees and expenses |

54,643 | |||

| Professional fees |

54,552 | |||

| Registration and filing fees |

54,461 | |||

| Shareholder reporting expenses |

38,618 | |||

| Transfer agent fees and expenses |

38,015 | |||

| Directors’ fees and expenses |

17,741 | |||

| Miscellaneous |

19,548 | |||

|

|

|

|||

| Total Expenses |

3,803,537 | |||

| Reduction of Expenses (See Note 2) |

(270,774 | ) | ||

|

|

|

|||

| Net Expenses |

3,532,763 | |||

|

|

|

|||

| Net Investment Income (Loss) |

11,043,854 | |||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss): |

| |||

| Net realized gain (loss) on: |

| |||

| Investments in securities (net of $1,091,212 of foreign capital gains tax) |

14,863,529 | |||

| Written option contracts |

225,325 | |||

| Foreign currency transactions |

(149,641 | ) | ||

|

|

|

|||

| Net realized gain (loss) |

14,939,213 | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on: |

| |||

| Investments in securities (net of increase in accrued foreign capital gains tax of $298,808) |

3,846,010 | |||

| Written option contracts |

(26,288 | ) | ||

| Foreign currency translations |

(16,271 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) |

3,803,451 | |||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss) |

18,742,664 | |||

|

|

|

|||

| Net Increase (Decrease) in Net Assets Resulting from Operations |

$ | 29,786,518 | ||

|

|

|

|||

See accompanying notes to financial statements.

9

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS (Unaudited)

| For the Six Months Ended June 30, 2024 |

For the Year Ended December 31, 2023 |

|||||||

| Change in Net Assets: |

||||||||

| From Operations: |

||||||||

| Net investment income (loss) |

$ | 11,043,854 | $ | 20,968,437 | ||||

| Net realized gain (loss) |

14,939,213 | (25,163,682 | ) | |||||

| Net change in unrealized appreciation (depreciation) |

3,803,451 | 23,636,916 | ||||||

|

|

|

|

|

|||||

| Net increase (decrease) in net assets resulting from operations |

29,786,518 | 19,441,671 | ||||||

|

|

|

|

|

|||||

| Distributions to Shareholders: |

||||||||

| Class A |

(627,357 | ) | (1,205,639 | ) | ||||

| Class C |

(52,201 | ) | (97,234 | ) | ||||

| Class I |

(9,665,023 | ) | (19,054,782 | ) | ||||

| Class R |

(825 | ) | (1,953 | ) | ||||

| Class Z |

(27,363 | ) | (54,587 | ) | ||||

| Tax Return of Capital to Shareholders: |

||||||||

| Class A |

— | (64,965 | ) | |||||

| Class C |

— | (7,758 | ) | |||||

| Class I |

— | (868,150 | ) | |||||

| Class R |

— | (83 | ) | |||||

| Class Z |

— | (4,967 | ) | |||||

|

|

|

|

|

|||||

| Total distributions |

(10,372,769 | ) | (21,360,118 | ) | ||||

|

|

|

|

|

|||||

| Capital Stock Transactions: |

||||||||

| Increase (decrease) in net assets from Fund share transactions |

(72,238,971 | ) | (102,277,587 | ) | ||||

|

|

|

|

|

|||||

| Total increase (decrease) in net assets |

(52,825,222 | ) | (104,196,034 | ) | ||||

| Net Assets: |

||||||||

| Beginning of period |

817,437,032 | 921,633,066 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 764,611,810 | $ | 817,437,032 | ||||

|

|

|

|

|

|||||

See accompanying notes to financial statements.

10

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)

The following tables include selected data for a share outstanding throughout each period and other performance information derived from the financial statements. They should be read in conjunction with the financial statements and notes thereto.

| Class A | ||||||||||||||||||||||||

| For the Six Months Ended June 30, 2024 |

For the Year Ended December 31, | |||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||

| Per Share Operating Data: |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$21.62 | $21.65 | $23.64 | $20.96 | $21.61 | $17.67 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.27 | 0.44 | 0.33 | 0.32 | 0.19 | 0.27 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.54 | (0.00 | ) | (1.55 | ) | 3.08 | (0.57 | ) | 4.00 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

0.81 | 0.44 | (1.22 | ) | 3.40 | (0.38 | ) | 4.27 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less dividends and distributions to shareholders from: |

||||||||||||||||||||||||

| Net investment income |

(0.27 | ) | (0.45 | ) | (0.31 | ) | (0.31 | ) | (0.18 | ) | (0.25 | ) | ||||||||||||

| Net realized gain |

— | — | (0.46 | ) | (0.41 | ) | — | (0.08 | ) | |||||||||||||||

| Tax return of capital |

— | (0.02 | ) | — | — | (0.09 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total dividends and distributions |

(0.27 | ) | (0.47 | ) | (0.77 | ) | (0.72 | ) | (0.27 | ) | (0.33 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value |

0.54 | (0.03 | ) | (1.99 | ) | 2.68 | (0.65 | ) | 3.94 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$22.16 | $21.62 | $21.65 | $23.64 | $20.96 | $21.61 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total return(b)(c) |

3.74 | %(d) | 2.08 | % | -5.21 | % | 16.36 | % | -1.66 | % | 24.26 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (in millions) |

$ 52.0 | $ 54.2 | $ 65.3 | $ 78.6 | $ 47.3 | $ 49.1 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average daily net assets: |

||||||||||||||||||||||||

| Expenses |

1.22 | %(e) | 1.21 | % | 1.21 | % | 1.24 | % | 1.29 | % | 1.29 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss) |

2.52 | %(e) | 2.07 | % | 1.44 | % | 1.43 | % | 0.97 | % | 1.33 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

57 | %(d) | 101 | % | 83 | % | 64 | % | 89 | % | 65 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Calculation based on average shares outstanding. |

| (b) | Return assumes the reinvestment of all dividends and distributions at net asset value. |

| (c) | Does not reflect sales charges, which would reduce return. |

| (d) | Not annualized. |

| (e) | Annualized. |

See accompanying notes to financial statements.

11

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| Class C | ||||||||||||||||||||||||

| For the Six Months Ended June 30, 2024 |

For the Year Ended December 31, | |||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||

| Per Share Operating Data: |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$21.62 | $21.65 | $23.63 | $20.96 | $21.58 | $17.63 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.20 | 0.30 | 0.18 | 0.17 | 0.06 | 0.13 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.54 | (0.00 | ) | (1.53 | ) | 3.07 | (0.57 | ) | 4.00 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

0.74 | 0.30 | (1.35 | ) | 3.24 | (0.51 | ) | 4.13 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less dividends and distributions to shareholders from: |

||||||||||||||||||||||||

| Net investment income |

(0.19 | ) | (0.31 | ) | (0.17 | ) | (0.16 | ) | (0.02 | ) | (0.10 | ) | ||||||||||||

| Net realized gain |

— | — | (0.46 | ) | (0.41 | ) | — | (0.08 | ) | |||||||||||||||

| Tax return of capital |

— | (0.02 | ) | — | — | (0.09 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total dividends and distributions |

(0.19 | ) | (0.33 | ) | (0.63 | ) | (0.57 | ) | (0.11 | ) | (0.18 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value |

0.55 | (0.03 | ) | (1.98 | ) | 2.67 | (0.62 | ) | 3.95 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$22.17 | $21.62 | $21.65 | $23.63 | $20.96 | $21.58 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total return(b)(c) |

3.43 | %(d) | 1.39 | % | -5.79 | % | 15.56 | % | -2.32 | % | 23.46 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (in millions) |

$ 6.1 | $ 6.7 | $ 7.6 | $ 8.3 | $ 6.8 | $ 13.5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average daily net assets: |

||||||||||||||||||||||||

| Expenses |

1.87 | %(e) | 1.86 | % | 1.86 | % | 1.89 | % | 1.94 | % | 1.94 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss) |

1.83 | %(e) | 1.42 | % | 0.79 | % | 0.76 | % | 0.30 | % | 0.62 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

57 | %(d) | 101 | % | 83 | % | 64 | % | 89 | % | 65 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Calculation based on average shares outstanding. |

| (b) | Return assumes the reinvestment of all dividends and distributions at net asset value. |

| (c) | Does not reflect sales charges, which would reduce return. |

| (d) | Not annualized. |

| (e) | Annualized. |

See accompanying notes to financial statements.

12

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| Class I | ||||||||||||||||||||||||

| For the Six Months Ended June 30, 2024 |

For the Year Ended December 31, | |||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||

| Per Share Operating Data: |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$21.69 | $21.72 | $23.72 | $21.03 | $21.68 | $17.72 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.31 | 0.52 | 0.41 | 0.41 | 0.26 | 0.34 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.55 | (0.00 | ) | (1.56 | ) | 3.07 | (0.56 | ) | 4.02 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

0.86 | 0.52 | (1.15 | ) | 3.48 | (0.30 | ) | 4.36 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less dividends and distributions to shareholders from: |

||||||||||||||||||||||||

| Net investment income |

(0.31 | ) | (0.53 | ) | (0.39 | ) | (0.38 | ) | (0.26 | ) | (0.32 | ) | ||||||||||||

| Net realized gain |

— | — | (0.46 | ) | (0.41 | ) | — | (0.08 | ) | |||||||||||||||

| Tax return of capital |

— | (0.02 | ) | — | — | (0.09 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total dividends and distributions |

(0.31 | ) | (0.55 | ) | (0.85 | ) | (0.79 | ) | (0.35 | ) | (0.40 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value |

0.55 | (0.03 | ) | (2.00 | ) | 2.69 | (0.65 | ) | 3.96 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$22.24 | $21.69 | $21.72 | $23.72 | $21.03 | $21.68 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total return(b) |

3.96 | %(c) | 2.44 | % | -4.90 | % | 16.73 | % | -1.30 | % | 24.71 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (in millions) |

$704.5 | $754.2 | $840.2 | $767.6 | $367.9 | $314.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average daily net assets: |

||||||||||||||||||||||||

| Expenses (before expense reduction) |

0.95 | %(d) | 0.94 | % | 0.93 | % | 0.95 | % | 1.01 | % | 1.01 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Expenses (net of expense reduction) |

0.87 | %(d) | 0.86 | % | 0.86 | % | 0.89 | % | 0.94 | % | 0.94 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss) |

2.78 | %(d) | 2.36 | % | 1.74 | % | 1.72 | % | 1.24 | % | 1.59 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss) |

2.86 | %(d) | 2.44 | % | 1.81 | % | 1.78 | % | 1.31 | % | 1.66 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

57 | %(c) | 101 | % | 83 | % | 64 | % | 89 | % | 65 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Calculation based on average shares outstanding. |

| (b) | Return assumes the reinvestment of all dividends and distributions at net asset value. |

| (c) | Not annualized. |

| (d) | Annualized. |

See accompanying notes to financial statements.

13

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| Class R | ||||||||||||||||||||||||

| For the Six Months Ended June 30, 2024 |

For the Year Ended December 31, | |||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||

| Per Share Operating Data: |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$21.74 | $21.78 | $23.81 | $21.11 | $21.75 | $17.71 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.26 | 0.42 | 0.35 | 0.28 | 0.17 | 0.19 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.54 | (0.01 | ) | (1.61 | ) | 3.10 | (0.58 | ) | 4.06 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

0.80 | 0.41 | (1.26 | ) | 3.38 | (0.41 | ) | 4.25 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less dividends and distributions to shareholders from: |

||||||||||||||||||||||||

| Net investment income |

(0.25 | ) | (0.43 | ) | (0.31 | ) | (0.27 | ) | (0.14 | ) | (0.13 | ) | ||||||||||||

| Net realized gain |

— | — | (0.46 | ) | (0.41 | ) | — | (0.08 | ) | |||||||||||||||

| Tax return of capital |

— | (0.02 | ) | — | — | (0.09 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total dividends and distributions |

(0.25 | ) | (0.45 | ) | (0.77 | ) | (0.68 | ) | (0.23 | ) | (0.21 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value |

0.55 | (0.04 | ) | (2.03 | ) | 2.70 | (0.64 | ) | 4.04 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$22.29 | $21.74 | $21.78 | $23.81 | $21.11 | $21.75 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total return(b) |

3.69 | %(c) | 1.94 | % | -5.37 | % | 16.14 | % | -1.80 | % | 24.05 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ 73.3 | $ 70.4 | $ 66.4 | $ 12.9 | $ 11.4 | $ 13.2 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average daily net assets: |

||||||||||||||||||||||||

| Expenses |

1.38 | %(d) | 1.36 | % | 1.36 | % | 1.39 | % | 1.44 | % | 1.44 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss) |

2.42 | %(d) | 1.97 | % | 1.53 | % | 1.25 | % | 0.83 | % | 0.95 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

57 | %(c) | 101 | % | 83 | % | 64 | % | 89 | % | 65 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Calculation based on average shares outstanding. |

| (b) | Return assumes the reinvestment of all dividends and distributions at net asset value. |

| (c) | Not annualized. |

| (d) | Annualized. |

See accompanying notes to financial statements.

14

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| Class Z | ||||||||||||||||||||||||

| For the Six Months Ended June 30, 2024 |

For the Year Ended December 31, | |||||||||||||||||||||||

| 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||

| Per Share Operating Data: |

||||||||||||||||||||||||

| Net asset value, beginning of period |

$ 21.70 | $ 21.73 | $ 23.72 | $ 21.03 | $ 21.69 | $17.73 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from investment operations: |

||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.30 | 0.49 | 0.41 | 0.40 | 0.28 | 0.30 | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

0.55 | 0.03 | (1.55 | ) | 3.08 | (0.59 | ) | 4.06 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total from investment operations |

0.85 | 0.52 | (1.14 | ) | 3.48 | (0.31 | ) | 4.36 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Less dividends and distributions to shareholders from: |

||||||||||||||||||||||||

| Net investment income |

(0.31 | ) | (0.53 | ) | (0.39 | ) | (0.38 | ) | (0.26 | ) | (0.32 | ) | ||||||||||||

| Net realized gain |

— | — | (0.46 | ) | (0.41 | ) | — | (0.08 | ) | |||||||||||||||

| Tax return of capital |

— | (0.02 | ) | — | — | (0.09 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total dividends and distributions |

(0.31 | ) | (0.55 | ) | (0.85 | ) | (0.79 | ) | (0.35 | ) | (0.40 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net increase (decrease) in net asset value |

0.54 | (0.03 | ) | (1.99 | ) | 2.69 | (0.66 | ) | 3.96 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net asset value, end of period |

$ 22.24 | $ 21.70 | $ 21.73 | $ 23.72 | $ 21.03 | $21.69 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total return(b) |

3.91 | %(c) | 2.44 | % | -4.85 | % | 16.73 | % | -1.34 | % | 24.69 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios/Supplemental Data: |

||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$2,002.8 | $2,300.8 | $8,460.4 | $8,557.0 | $6,913.3 | $ 11.8 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Ratios to average daily net assets: |

||||||||||||||||||||||||

| Expenses |

0.87 | %(d) | 0.86 | % | 0.86 | % | 0.89 | % | 0.94 | % | 0.93 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net investment income (loss) |

2.78 | %(d) | 2.25 | % | 1.80 | % | 1.75 | % | 1.42 | % | 1.49 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Portfolio turnover rate |

57 | %(c) | 101 | % | 83 | % | 64 | % | 89 | % | 65 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Calculation based on average shares outstanding. |

| (b) | Return assumes the reinvestment of all dividends and distributions at net asset value. |

| (c) | Not annualized. |

| (d) | Annualized. |

See accompanying notes to financial statements.

15

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1. Organization and Significant Accounting Policies

Cohen & Steers Global Infrastructure Fund, Inc. (the Fund) was incorporated under the laws of the State of Maryland on January 13, 2004 and is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The Fund’s investment objective is total return. The authorized shares of the Fund are divided into six classes designated Class A, C, F, I, R and Z shares. Each of the Fund’s shares has equal dividend, liquidation and voting rights (except for matters relating to distribution and shareholder servicing of such shares). Class F shares are currently not available for purchase.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification (ASC) Topic 946—Investment Companies. The accounting policies of the Fund are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price. Exchange-traded options are valued at their last sale price as of the close of options trading on applicable exchanges on the valuation date. In the absence of a last sale price on such day, options are valued based upon prices provided by a third-party pricing service. Over-the-counter (OTC) options are valued based upon prices provided by a third-party pricing service or counterparty.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.