Use these links to rapidly review the document

Table of Contents

Index to Consolidated Financial Statements

As filed with the Securities and Exchange Commission on December 6, 2011

No. 333-175475

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GSE Holding, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3081 | 77-0619069 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

19103 Gundle Road

Houston, Texas 77073

(281) 443-8564

Mark C. Arnold

President and Chief Executive Officer

GSE Holding, Inc.

19103 Gundle Road

Houston, Texas 77073

(281) 443-8564

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Gerald T. Nowak, P.C. Theodore A. Peto Kirkland & Ellis LLP 300 North LaSalle Chicago, Illinois 60654 (312) 862-2000 |

Colin J. Diamond White & Case LLP 1155 Avenue of the Americas New York, New York 10036 (212) 819-8200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price per Share(2) |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.01 par value per share |

10,350,000 | $15.00 | $155,250,000 | $17,792 | ||||

|

||||||||

- (1)

- Includes 1,350,000 shares of common stock that may be purchased by the underwriters to cover over-allotments, if any.

- (2)

- Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(a) under the Securities Act.

- (3)

- Calculated pursuant to Rule 457(a) based on an estimate of the proposed maximum aggregate offering price. Registration fees of $16,689 were paid previously on July 11, 2011 pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information contained in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject To Completion, Dated December 6, 2011

PRELIMINARY PROSPECTUS

9,000,000 Shares

GSE Holding, Inc.

Common Stock

$ per share

We are offering 5,400,000 shares of our common stock and the selling stockholders identified in this prospectus are offering 3,600,000 shares of our common stock. This is our initial public offering and no public market currently exists for our common stock. We expect the initial public offering price to be between $13.00 and $15.00 per share. Our common stock has been approved for listing on The New York Stock Exchange, or NYSE, under the symbol "GSE".

Investing in our common stock involves a high degree of risk. Please read "Risk Factors" beginning on page 18 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Public Offering Price |

$ | $ | |||||

Underwriting Discounts and Commissions |

$ | $ | |||||

Proceeds to GSE Holding, Inc. before expenses |

$ | $ | |||||

Proceeds to the selling stockholders before expenses |

$ | $ | |||||

Delivery of the shares of common stock is expected to be made on or about , 2011. The selling stockholders have granted the underwriters an option for a period of 30 days to purchase an additional 1,350,000 shares of our common stock on the same terms and conditions set forth above solely to cover over-allotments.

| Oppenheimer & Co. | FBR |

| William Blair & Company | BMO Capital Markets | Macquarie Capital |

The date of this prospectus is , 2011

You should rely only on the information contained in this prospectus, in any amendment or supplement to this prospectus or in any free-writing prospectus prepared by us or on our behalf. We have not, and the underwriters have not, authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

1

We obtained the industry, market and competitive position data throughout this prospectus from our own internal estimates and research, as well as from industry and general publications and research and surveys and studies conducted by third parties, including a report by Alvarez & Marsal Private Equity Performance Improvement Group, LLC, or A&M, that we commissioned in July 2011 in connection with the preparation of this prospectus. The information in these sources represents the most recently available data of which we are aware. Industry and general publications, surveys and studies conducted by third parties generally state that they have been obtained from sources believed to be reliable. We believe the industry, market and competitive data and our internal company estimates and research included in this prospectus are reliable and the definitions of our market and industry are appropriate. However, projections, assumptions and estimates of our future performance and the future performance of the industries in which we operate necessarily involve a high degree of uncertainty and risk and are subject to change based on a variety of factors, including those described under "Risk Factors" in this prospectus. These and other factors could cause actual results to differ materially from those expressed in the estimates made by third parties and by us.

Trademarks, Service Marks and Trade Names

This prospectus includes our trademarks, service marks and trade names, such as "GSE," our logo, and "Gundle," which are protected under applicable intellectual property laws and are the property of GSE Holding, Inc. or its subsidiaries. This prospectus also contains trademarks, service marks and trade names of other companies, which are the property of their respective owners. Solely for convenience, marks and trade names referred to in this prospectus may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these marks and trade names. Third-party marks and trade names used herein are for informational purposes only and in no way constitute or are intended to be a commercial use of such names and marks. The use of such third-party names and marks in no way constitutes or should be construed to be an approval, endorsement or sponsorship of us, or our products or services, by the owners of such third-party names and marks.

2

This summary highlights key information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. For a more complete understanding of us and this offering, you should read and carefully consider the entire prospectus, including the more detailed information set forth under "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes. Some of the statements in this prospectus are forward-looking statements. See "Forward-Looking Statements." Unless we state otherwise or the context otherwise requires, the terms "we," "us," "our," "GSE," "GSE Holding," "our business" and "our company" refer to GSE Holding, Inc. and its consolidated subsidiaries as a combined entity.

Our Business

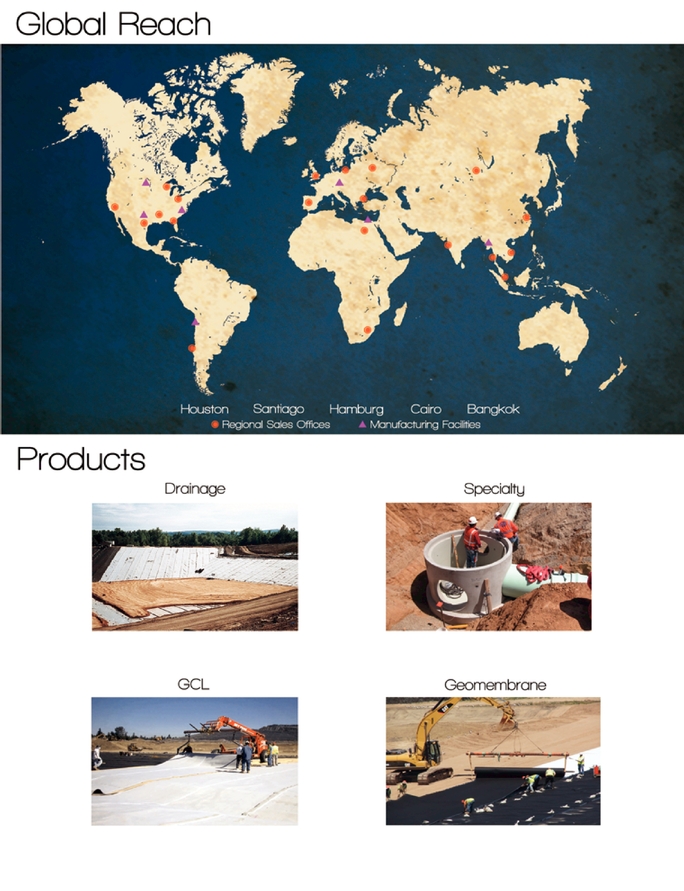

We are the leading global provider by sales of highly engineered geosynthetic containment solutions for environmental protection and confinement applications. Our products are used in a wide range of infrastructure end markets such as mining, waste management, liquid containment (including water infrastructure, agriculture and aquaculture), coal ash containment and shale oil and gas. We are one of a few providers with the full suite of products required to deliver customized solutions for complex projects on a worldwide basis, including geomembranes, drainage products, geosynthetic clay liners, or GCLs, nonwoven geotextiles, and specialty products. We sell our products in over 110 countries and a global infrastructure that includes seven manufacturing facilities located in the United States, Germany, Chile, Egypt and Thailand, 18 regional sales offices located in 12 countries and engineers and technical salespeople located on four continents. We generate the majority of our sales outside of North America, including 38% from sales into high-growth emerging and frontier markets in Asia, Latin America, Africa and the Middle East. Our comprehensive product offering and global infrastructure, along with our extensive relationships with customers and end-users, provide us with access to high-growth markets worldwide, visibility into upcoming projects and the flexibility to serve customers regardless of geographic location.

Geosynthetic lining solutions are mission-critical, and often mandated by regulatory authorities, for the safe containment of materials and groundwater protection across a wide range of applications. Our technologically advanced products are manufactured primarily from polyethylene resins and proprietary additives, and are engineered to high performance specifications such as relative impermeability, structural integrity and resistance to weathering, ultraviolet degradation and extended chemical exposure. Our products are low in cost relative to the total development expenditure of a typical project, as well as to the remediation cost and adverse environmental impact that would result from not using a geosynthetic lining solution. We believe that we derive a pricing premium and margin advantage from our technologically advanced products and our brand name that is well-recognized in the industry for quality, reliability and innovation, each of which are critical factors when purchasing a product that is often required to last in perpetuity.

We are one of a few providers that possess the manufacturing capabilities and product breadth to develop solutions that meet the specific performance and regulatory standards required to supply large, complex projects on a global basis. Our manufacturing facilities have one of the broadest geographic presences in the industry and are strategically located to allow us to serve the fastest growing end markets and geographies, to effectively manage our cost structure and to maintain proximity to our customers and suppliers. In addition, we have a global network of engineers and salespeople that work with customers to provide customized solutions. Our engineers also collaborate with international standards organizations to develop regional specifications and standards for existing and new

3

applications; consequently, we help public and private industry engineers to establish the framework of specifications for our industry's products. We believe that our global infrastructure provides us with a competitive advantage, particularly in emerging and frontier markets, as we are well positioned to capture new opportunities from the implementation and enforcement of more stringent environmental regulations driven by increasing environmental awareness globally.

We serve leading mining, waste management and power companies; independent installers and dealers; general contractors and government agencies. Our solutions have been integral components of projects by large, well-established and well-known companies such as Arizona Public Service Company, Inc., Barrick Gold Corp., BHP Billiton plc, the Charoen Pokphand Group Co. Ltd., Newmont Mining Corp., Rio Tinto Limited, Veolia Environnement S.A. and Waste Management, Inc. Our customer base is geographically diversified with 58% of our sales in 2010 generated outside North America including in emerging and frontier markets in Asia (14%), Latin America (11%), Africa (10%) and the Middle East (3%). We define emerging markets as nations with rapid growth in business activity and industrialization, such as China and India, and frontier markets as countries that are earlier in their development cycles but could exhibit similar characteristics in the future, such as Vietnam and many African countries. We serve over 1,300 customers annually, and our largest customer accounted for less than 5% of our sales in 2010. We maintain strong, longstanding relationships with our customer base, with an average tenure of 13 years with our top 10 customers.

Our sales grew by 40% to $443.5 million in the twelve months ended September 30, 2011 from $316.2 million in the twelve months ended September 30, 2010. In the twelve months ended September 30, 2011, we had net income of $4.0 million compared to a net loss of $29.8 million in the same prior year period, a 113% increase. Our Adjusted EBITDA grew by 162% to $44.6 million from $17.0 million in the same prior year period. See "Management's Discussion and Analysis of Financial Condition and Results of Operations – Quarterly Financial Information" for a reconciliation of Adjusted EBITDA to net income or loss. Growth in the twelve months ended September 30, 2011 has been driven, in part, by our focus on product innovation and strategic growth initiatives in new markets and applications, as exemplified by the ongoing diversification of our sales. Despite challenging economic conditions in early 2010, we were able to meaningfully streamline our operations and implement successful performance improvements that have enhanced our profitability and provided us with significant operating leverage. As a result of these initiatives, we increased our gross margins by 3% to 15% in the nine months ended September 30, 2011 from 12% in the same period in the prior year and we believe there is an ongoing opportunity for improvement. Our adjusted gross margins increased by 2% to 17% in the nine months ended September 30, 2011 from 15% in the same period in the prior year. See note (3) to the table set forth in "– Summary Historical Consolidated Financial and Operating Data" for a reconciliation of adjusted gross margin to gross margin. Our recent historical sales have been variable, however, and we recorded a net loss in each of the last three fiscal years. In addition, our sales typically fluctuate from quarter to quarter due to seasonal weather patterns and our long sales cycle. As of September 30, 2011, our total outstanding debt was $197.2 million.

Our Industry

A&M estimates that the market for geosynthetics used in environmental containment applications will be approximately $1.7 billion in 2011, and is expected to grow at an annual rate of 7% to approximately $2.2 billion by 2015. According to A&M, we are the largest market participant with 24% global geomembrane market share, and we are the market leader in several key markets and geographies, as shown by our 40% market share in the mining end market, our 19% market share in the waste management end market, and our 11% market share in the liquid containment end market. Our industry is highly fragmented due to its relevance to a wide variety of products, applications, end markets and geographies. For the most part, other market participants are small, privately held companies that compete on a local or regional basis and offer only one or a few products. Globally,

4

demand for geosynthetics is influenced by environmental regulations, particularly those involving heap leach mining, landfills and waste ponds for industrial and energy process by-products. For these markets, some type of geosynthetic is typically required to comply with environmental standards for groundwater protection. In the United States, one example of applicable legislation is the Resource Conservation and Recovery Act of 1976, as amended, or RCRA, which provides legal guidelines for the storage, treatment and disposal of hazardous and nonhazardous solid waste.

We focus primarily on the global mining, waste management and liquid containment end markets, and are developing new end markets such as coal ash containment and shale oil and gas. Although the businesses of many of our customers are, to varying degrees, cyclical and experience periodic upturns and downturns, we believe that there are highly attractive near- to medium-term global macroeconomic trends in each of these sectors.

Mining. In the heap leach extraction process used in the mining industry, geosynthetic systems prevent the leakage of the valuable leachate into which the metal is dissolved, protect the ground and soil from contamination and provide drainage solutions. In all other processes, geosynthetics are used as containment solutions for the tailing ponds in which water borne tailings are stored in order to allow the separation of solid particles from water. The size of the geosynthetic opportunity in mining end markets is directly related to the amount of global mining activity, which is driven by demand for metals and minerals and the need for new mining infrastructure to satisfy this demand. Our products are especially relevant to mining applications focused on copper, gold, silver, uranium and phosphate. According to The Datamonitor Group, or Datamonitor, the global copper industry alone is expected to produce 19.4 million metric tons in 2015, representing an increase of 22.5% over 2010 production levels. The global mining industry is expected to increase annual capital expenditures by 113% to $168 billion in 2018 from $79 billion in 2009, according to the McKinsey Basic Materials Institute.

Waste Management. Geosynthetics are used in the management of municipal solid waste, or MSW, as liners to prevent landfill runoff from entering the surrounding environment and as caps to prevent the escape of greenhouse gases, control odors and limit rainwater infiltration. Key Note Publications, or Key Note, estimates that 2.0 billion tons of MSW were generated worldwide in 2006 and nearly 3.0 billion tons are expected to be generated in 2011, representing annual growth of approximately 8%. While growth in North American and European waste management markets has historically trended with growth in gross domestic product, or GDP, we believe the construction and expansion of landfills for the containment of this waste will drive global geosynthetic demand in emerging markets. According to Key Note, developing nations, such as China and India, represent more than half of global MSW generation and also require the most investment in their waste management infrastructure. We believe that increased wealth, the positive correlation between MSW generation and per capita GDP and heightened environmental regulation will move disposal practices in Asia and other emerging markets away from current open dumping and open burning practices towards landfilling and other more environmentally friendly methods of disposal. China has addressed the need for increased sound waste disposal resources in its twelfth five-year plan, the most recent in a series of economic development initiatives, which mandates the investment of 180 billion Yuan, or approximately $28 billion, in the urban waste disposal sector between 2011 and 2015.

Liquid Containment. Geosynthetic products are used in a wide variety of liquid containment applications in civil engineering and infrastructure end markets such as water infrastructure, agriculture and aquaculture.

- •

- Water Infrastructure. Our products are used to prevent water leakage in water transportation and storage applications, such as reservoirs and canals. Frost & Sullivan estimates that approximately $6 trillion of global investment in the water industry will be required through the next twenty years, and that investment in water infrastructure alone will exceed $525 billion by 2016. This will be magnified in emerging economies in South America, Asia Pacific, Middle East and Africa, where

5

population expansion and urbanization coupled with water scarcity and pollution will cause investment to outpace global rates.

- •

- Agriculture and Aquaculture. Irrigation waterways for agriculture end markets and fish farming ponds for aquaculture end markets employ geosynthetic products to prevent the leakage of water. According to the World Fish Center, aquaculture is among the fastest growing food production sectors in the world, with fish production expected to increase by as much as 67% between 2008 and 2030 to 110 million tons. In 2008, Asia represented over 90% of global aquaculture production, driven by increasing urbanization and affluence, higher per capita consumption and more protein-rich diets.

Coal Ash Containment. Coal-burning power plants produce coal ash, a pollutant that can contaminate soil and groundwater, as a byproduct of the combustion process. In December 2008, a coal ash containment failure at The Tennessee Valley Authority's fossil fuel plant in Kingston, Tennessee resulted in the release of approximately 5.4 million cubic yards of coal ash into the Emory River. The clean-up costs and timeline associated with the failure are estimated to be in excess of $1 billion and four years, respectively. Following this incident, between May and November 2010, the United States Environmental Protection Agency, or EPA, announced plans to regulate the disposal of coal ash generated by coal-fired electric utilities under RCRA, published proposed rules for the regulation and held a public comment period. The EPA's proposed rules may never become enforceable, however, because the United States House of Representatives recently passed legislation that proposes national standards which the states, and not the EPA, will enforce. A companion bill has been introduced in the United States Senate, but has not yet been considered. Based on market research, A&M believes that the coal ash containment market for geosynthetic products in North America is projected to grow from $12 million in 2011 to $74 million in 2015, representing a compounded annual growth rate of approximately 57%. Utilities have already begun capping existing noncompliant disposal facilities and constructing new disposal facilities that meet the requirements of the regulation in advance of it coming into effect.

Shale Oil and Gas. Geosynthetic solutions are used in a number of applications in the drilling and production of shale oil and gas, including to effectively line storage and disposal ponds for both the freshwater required for hydraulic fracturing, or fracking, and for flowback water, a by-product containing high levels of the salt, down-well chemicals and metals used in the fracking process. According to Spears & Associates, Inc., $1.2 trillion of capital is expected to be spent in onshore oil and gas drilling and completion in the United States between 2011 and 2017. A portion of this capital will be used to develop over 140,000 horizontal wells in this period, the significant majority of which we believe will be in shale plays. We believe that the majority of producing shale wells will ultimately require appropriately lined ponds for the containment of freshwater, fracking chemicals and flowback water. These expenditures will support anticipated growth in domestic shale oil and gas production. While total domestic natural gas production is projected by the Energy Information Administration, or EIA, to grow by 25% to 26.3 trillion cubic feet, or tcf, in 2035 from 21.0 tcf in 2009, shale gas production is expected to grow by over 250% to account for 47% of total natural gas production by 2035 compared to 16% in 2009.

Our Competitive Strengths

Market leader with strong brand recognition. We are the largest producer of polyethylene geomembranes in the world. We believe this market position provides us with a number of competitive advantages, including the ability to attract and retain large multinational customers that rely on our global scale and full product breadth for on-time product delivery, as well as flexibility and economies of scale in manufacturing and raw materials procurement. We believe that our established reputation for quality, reliability and technological innovation is an important factor in our customers' purchasing decisions, and is supported by our 30-year corporate history without a product failure resulting in

6

significant liability or environmental damage. Our market position and brand name also create barriers to entry, given the importance of long-term customer relationships, the necessity of meeting the global logistical needs of customers, and the significant investment that would be required to replicate our existing footprint.

Global infrastructure provides key competitive advantages. Our network of manufacturing facilities and sales and engineering personnel strategically located around the world positions us well to:

- •

- Opportunistically access the most attractive regions and sub-sectors of our

markets. Sustained high prices for precious and industrial metals combined with global industrialization and demand, especially from

emerging markets, has expanded mine production in areas such as Chile, Africa, China and Indonesia. In addition, we believe that continued urbanization, GDP growth and increasing environmental

regulation will create ongoing demand for environmentally sound waste management infrastructure in China and India. We have a strong, established local presence in the regions where each of these

opportunities is located.

- •

- Focus on complex, high-priority

applications. Our ability to supply customers with products from any of our seven manufacturing facilities located on five continents

allows us to target large and complex projects for which geosynthetics must be delivered on a strict schedule, particularly for our customers in the mining industry. We are able to provide our

customers the confidence of on-time delivery, even for large orders delivered over the course of several months, which provides us with an advantage over regional competitors who may have

capacity constraints as a result of their limited facilities. In addition, our global engineering presence allows us to have a local technical dialogue with our customers that allows us to effectively

tailor our solutions for these complex projects, which we believe differentiates us from other industry participants and reduces the risk of our customers switching to one of our competitors.

- •

- Capitalize on regional differences in the costs of our raw

materials. Our suppliers sell resins through local markets, and we are able to source raw materials, which primarily consist of resin,

for our global operations from the most cost-efficient region. We regularly take advantage of more attractive prices for resin, net of transportation costs, in regions other than where it

is ultimately utilized. Although resins are subject to price fluctuation in response to market demand and other factors, our ability to source resins on a global basis provides us with leverage over

regional raw material suppliers, which allows us to ensure a consistent supply of competitively priced raw materials.

- •

- Maintain strong, global relationships with our customers and end-users. We have been able to develop strong, long-term relationships with our multinational customers and end-users as a result of our ability to serve as a value-added partner on a global basis, despite the potentially remote locations of their projects.

Mission-critical solutions customized from broad product offering. Reliable geosynthetic solutions are critical to the safe and profitable operation of our customers' facilities. In addition, remediation cost and environmental impact of a product failure can be significant relative to the cost of our solutions. We believe we are able to command premium pricing relative to the industry due to the quality and reliability of our products and the significance that our customers place on these factors when purchasing geosynthetics. In addition, we are among a limited number of geosynthetic providers with the product breadth to provide solutions that can be customized for each application. Our ability to create a tailored solution for each project that achieves the necessary physical characteristics using layers of geomembranes, drainage products, GCLs and nonwoven geotextiles provides us with a competitive advantage against regional competitors that have more limited product offerings.

Innovation-driven culture with a history of new product and application development and commercialization. We believe we are the pioneer in the industry as the first company to have

7

developed lining systems from high-density polyethylene. We have continued our tradition of innovation through our 30-year history. We believe we act as the primary innovator in the industry by applying our global engineering expertise to originate new, proprietary products, develop new applications for our products and work with customers to tailor solutions to their requirements. We have a portfolio of over 35 patents worldwide that have been developed by our in-house engineering personnel. Our engineers work closely with customers and end-users to develop new applications and end markets for our products, and with international standards development organizations to gain acceptance for these uses by these parties. We are a leader in the national and international standards setting process for the geosynthetics industry and hold leadership positions on numerous industry standards development organizations.

Highly experienced management team. Our senior management team averages over 25 years of experience in geosynthetics and related industries and is responsible for the operational transformation and strategic realignment that was undertaken during 2009 and 2010 to more effectively serve our global customer base, improve our profitability and further diversify our end markets. See "Business – Our History" and "Business – Supply Chain Management" for additional information on our rationalized global infrastructure and strategically repositioned manufacturing capacity. Our new executive management team has instilled a pervasive culture based on innovation, customer service and profitability. Acting as a cohesive global group, our management team is well-equipped to execute on our strategic growth and profitability initiatives.

Our Growth Strategy

Leverage global infrastructure to expand market share in certain geographies and end markets. We are focused on continuing to utilize our international presence to improve our penetration of high-growth emerging markets, where we generated 38% of our sales in 2010. We are particularly focused on pursuing attractive growth opportunities in Asia, the Middle East and Africa. We plan to expand sales and engineering coverage in certain of these regions and evaluate the deployment of manufacturing lines so that regional production capacity and market opportunities are aligned to address these regions. In addition, we seek to continue expanding our share in key end markets by further developing our targeted product offering for these markets and continuing to grow relationships with existing and new customers globally. By pursuing these strategies, we believe we can improve our access to high-growth regions and markets, enhance our operational flexibility and continue to target high-value projects globally.

Focus on continued sales and operational excellence. We believe we have a clear strategy for ongoing improvement in our profitability by focusing on both higher-margin products and end markets, as well as continued operational improvement. We anticipate that as our product mix continues to shift towards higher-value proprietary products, our pricing power and profitability will continue to improve. We also expect that our core product strategy of matching product specifications with the application will have a positive impact on our profitability. In addition, we expect to continue to see the benefits of the operational transformation we implemented in 2010. Among other initiatives, we diversified our resin sources on a global basis, implemented margin management and pricing programs, eliminated two high-cost manufacturing locations, sold a non-core labor-intensive installation business and permanently reduced our headcount by approximately 38% since December 2008. We believe that as our volumes increase, the operating leverage we have created through facility and business line rationalizations will continue to have a positive impact on our profitability. Finally, we expect our margin management and supply chain diversification initiatives to become increasingly effective as they continue to become refined.

Accelerate new product development. We plan to continue to expand the breadth of our product offering, which allows us to customize products for specific applications and deepen our relevance to

8

key end markets. Through our extensive global engineering and product development capabilities, we plan to enhance our core products as well as develop new higher-margin proprietary products and solutions. While our higher-margin proprietary products and solutions are currently only manufactured at our Houston facility, we plan to expand our production capabilities for these products globally. With respect to our core products, our strategy focuses on developing tiers of products that are fit-for-purpose, so that product specifications are determined by the application, thereby maximizing our overall customer value proposition. For instance, heap leach mining applications, in which valuable metals dissolved in harsh chemicals need to be contained require different geosynthetic products than aquaculture applications, where water needs to be contained. With respect to our new products, our strategy involves developing solutions engineered to resolve common problems in our end markets and applications. These next generation products often provide higher technical capabilities and higher margins. For instance, we offer our customers a lining solution that allows for leak detection during installation and throughout the project lifecycle, thereby reducing the risk of long-term environmental damage and providing a liability management tool for the end-user.

Continue to develop new end markets and applications for our products. As environmental regulations continue to be adopted in our domestic and international end markets, we will continue to respond to these regulations by cultivating new applications for our products. We believe we are well-positioned to develop new addressable markets as a result of our position as the innovator in the industry, our strong engineering and product development capabilities, our deep relationships with customers and end-users and our experience working with relevant governmental agencies. For instance, we are developing a proprietary product that effectively addresses the requirements of the emerging domestic coal ash containment market. We have been proactively working with coal-fired electric utilities that must ultimately comply with pending coal ash regulation to discuss the merits of this proprietary product and form partnerships to address this market. We have developed a similar approach to address the increasing demand for our products in the shale oil and gas end markets. As a result of these efforts, we anticipate having the critical first-mover advantage in these important high-growth, high-margin markets.

Selectively pursue investment and acquisition opportunities. We plan to pursue strategic investment opportunities, both organic and acquisitive in nature. In an effort to ensure we have manufacturing capacity located where it would be most advantageous, we intend to make capital investments in our facilities that serve the Asian, Middle Eastern and African markets, as well as in our facilities which we expect will serve the domestic coal ash containment markets. In addition, given the fragmented nature of the geosynthetics industry, we believe that there may be opportunities to pursue value-added acquisitions at attractive valuations in the future, which may augment our geographic footprint, broaden our product offerings, expand our technological capabilities and capitalize on potential operating synergies.

Risk Factors

Investing in shares of our common stock involves a high degree of risk. See "Risk Factors" beginning on page 18 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. If any of these risks actually occurs, our business, financial condition, results of operations, cash flows and prospects would likely be materially and adversely affected. As a result, the trading price of our common stock would likely decline, and you could lose all or part of your investment. Below is a summary of some of the principal risks related to our business.

- •

- Our business depends on the levels of capital investment expenditures by our customers, which are affected by factors such as the state of domestic and global economics, the cyclical nature of our customers' markets, our customers' liquidity and the condition of global credit and capital markets.

9

- •

- Our future sales depend, in part, on our ability to bid and win new orders. Our failure to effectively obtain future

orders could adversely affect our profitability.

- •

- Increases in prices or disruptions in supply of our raw materials could adversely impact our financial condition.

- •

- Our future growth depends, in part, on developing new applications and end markets for our products.

- •

- Unexpected equipment failures or significant damage to one or more of our manufacturing facilities would increase our

costs and reduce our sales due to production curtailments or shutdowns.

- •

- We operate in a highly competitive industry.

Our Principal Stockholder

Our principal stockholder, CHS Capital LLC, or CHS, acquired its interest in us on May 18, 2004, which we refer to as the Acquisition. CHS beneficially owns substantially all of our outstanding shares of common stock. CHS is a Chicago-based private equity firm with 23 years of experience investing in the middle market. Targeting well-managed companies with enterprise values between $75 million and $500 million, CHS partners with management teams to focus on accelerating growth and enhancing capabilities and resources. CHS has specialized expertise in the consumer and business services; distribution; and industrial, infrastructure and energy sectors and has completed 74 platform investments and 235 add-on investments. Founded in 1988, CHS has formed five private equity funds and has $2.9 billion of committed capital in active investment funds. CHS currently manages 15 portfolio investments with combined annual revenues in excess of $4.5 billion.

Our Corporate Information

We are incorporated in Delaware and our corporate offices are located at 19103 Gundle Road, Houston, Texas 77073. Our telephone number is (281) 443-8564. Our website address is www.gseworld.com. None of the information on our website or any other website identified herein is part of this prospectus or the registration statement of which it forms a part.

10

Common stock offered by us |

5,400,000 shares. | |

Common stock offered by the selling stockholders |

3,600,000 shares (4,950,000 shares if the underwriters exercise their over-allotment in full). | |

Common stock outstanding after this offering |

17,012,045 shares. | |

Use of proceeds |

We estimate that the net proceeds to us from this offering will be approximately $68.3 million, based upon an assumed initial public offering price of $14.00 per share (the midpoint of the range set forth on the cover page of this prospectus) after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds to us from this offering: | |

|

• to repay $40.3 million of borrowings under our Second Lien Term Loan and $18.0 million of borrowings under our Revolving Credit Facility; |

|

|

• to pay a one-time fee of $3.0 million to Code Hennessy & Simmons IV LP, or CHS IV, in consideration for the termination of the management agreement between us and CHS IV; and |

|

|

• for working capital and general corporate purposes. |

|

|

See "Use of Proceeds" and "Management's Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources." | |

|

We will not receive any proceeds from the shares sold by the selling stockholders. | |

Dividend policy |

We have no current plans to pay dividends on our common stock in the foreseeable future. See "Dividend Policy." | |

Risk factors |

See "Risk Factors" for a discussion of risks you should carefully consider before deciding to invest in our common stock. | |

New York Stock Exchange symbol |

"GSE" |

The number of shares of our common stock to be outstanding following this offering is based on (i) 10,809,987 shares of our common stock outstanding as of September 30, 2011, (ii) 5,400,000 shares of our common stock to be issued and sold by us in this offering, (iii) 464,715 shares of our common stock to be issued to certain of our executive officers pursuant to bonus letter agreements and (iv) 337,343 shares of our common stock to be issued pursuant to the exercise of vested options by certain selling stockholders for the purpose of selling such shares in this offering. In this prospectus, unless otherwise indicated, the number of shares of common stock outstanding and the other information based thereon does not reflect 4,276,703 shares of common stock that have been reserved for issuance under our Amended and Restated 2004 Stock Option Plan, or our 2004 Stock Option Plan, and our 2011 Omnibus Incentive Compensation Plan, or our 2011 Plan (excluding shares of common stock to be issued to certain selling stockholders as described above), under which, as of September 30, 2011, options to purchase 1,771,248 shares of common stock had been granted at a weighted average exercise price of $2.58 per share.

11

Unless otherwise indicated, this prospectus:

- •

- assumes an initial public offering price of $14.00 per share (the midpoint of the range set forth on the cover page of

this prospectus);

- •

- assumes no exercise of the underwriters' option to purchase up to an additional 1,350,000 shares of common stock

from the selling stockholders to cover over-allotments; and

- •

- gives effect to a 3.621-for-1 stock split effected on November 22, 2011.

12

Summary Historical and Pro Forma Consolidated Financial and Operating Data

The following tables set forth our summary historical consolidated financial and operating data and our summary unaudited pro forma condensed consolidated financial data as of the dates and for the periods indicated. Our summary historical consolidated financial data as of December 31, 2009 and 2010 and for the years ended December 31, 2008, 2009 and 2010 have been derived from our audited consolidated financial statements that are included elsewhere in this prospectus. Our summary historical consolidated financial data as of September 30, 2011 and for the nine months ended September 30, 2010 and 2011 have been derived from our unaudited condensed consolidated financial statements that are included elsewhere in this prospectus and contain all adjustments, consisting of normal recurring adjustments, that management considers necessary for a fair presentation of our financial position, results of operations and cash flows for the periods presented.

The following summary historical consolidated financial data have been restated for the years ended December 31, 2008, 2009 and 2010. See note 3, "Restatement of Previously Issued Financial Statements," to our audited consolidated financial statements included elsewhere in this prospectus.

The following summary historical consolidated financial data have been retrospectively reclassified to exclude discontinued operations for all periods presented. In March 2008, we exited the synthetic turf business, which operated as GSE GeoSport Surfaces, or GeoSport. In April 2010, we sold our 75.5% interest in GSE Bentoliner (Canada), Inc., or Bentoliner. In June 2010, we divested our United States Installation Business, or U.S. Installation. In July 2010, we closed GSE Lining Technology Limited, or GSE UK, our manufacturing facility located in the United Kingdom. See note 4, "Discontinued Operations," to our audited consolidated financial statements included elsewhere in this prospectus.

Our summary unaudited pro forma condensed consolidated financial data for the year ended December 31, 2010 and as of and for the nine months ended September 30, 2010 have been derived from our unaudited pro forma condensed consolidated financial statements set forth under "Unaudited Pro Forma Condensed Consolidated Financial Statements." Our unaudited pro forma condensed consolidated statements of operations for the year ended December 31, 2010 and the nine months ended September 30, 2011 give effect to (i) the Refinancing Transactions (as defined below), (ii) this offering and the use of proceeds therefrom as set forth under "Use of Proceeds" and (iii) the issuance of shares pursuant to bonus letter agreements and the exercise of vested options (see "Capitalization"), in each case as if they had occurred on January 1, 2010. Our unaudited pro forma condensed consolidated balance sheet as of September 30, 2011 gives effect to (i) this offering and the use of proceeds therefrom as set forth under "Use of Proceeds" and (ii) the issuance of shares and payment of cash bonuses pursuant to bonus letter agreements and the issuance of shares pursuant to the exercise of vested options (see "Capitalization"), in each case as if they had occurred on September 30, 2011.

For a description of the assumptions used in preparing the unaudited pro forma condensed consolidated financial statements, see "Unaudited Pro Forma Condensed Consolidated Financial Statements." The summary unaudited pro forma condensed consolidated financial data are presented for informational purposes only and are not intended to represent or be indicative of the consolidated results of operations or financial position that we would have reported had the Refinancing Transactions or this offering been completed as of the dates and for the periods presented, and should not be taken as representative of our consolidated results of operations or financial condition following the completion of this offering.

The summary financial and operating data presented below should be read together with "Capitalization," "Unaudited Pro Forma Condensed Consolidated Financial Statements," "Selected Historical Consolidated Financial and Operating Data," "Management's Discussion and Analysis of

13

Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| |

Years Ended December 31, | Nine Months Ended September 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||

| |

(Restated) |

(Restated) |

(Restated) |

(Unaudited) |

||||||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||||

Consolidated Statement of Operations Data: |

||||||||||||||||||

Sales |

$ | 408,995 | $ | 291,199 | $ | 342,783 | $ | 253,038 | $ | 353,791 | ||||||||

Cost of products |

357,010 | 258,037 | 298,900 | 222,836 | 300,925 | |||||||||||||

Gross profit |

51,985 | 33,162 | 43,883 | 30,202 | 52,866 | |||||||||||||

Selling, general and administrative expenses |

27,407 | 31,776 | 40,078 | 31,064 | 31,499 | |||||||||||||

Amortization of intangibles |

3,044 |

2,619 |

2,284 |

1,710 |

1,057 |

|||||||||||||

Operating income (loss) |

21,534 | (1,233 | ) | 1,521 | (2,572 | ) | 20,310 | |||||||||||

Other expenses (income): |

||||||||||||||||||

Interest expense, net of interest income |

20,819 | 19,188 | 19,454 | 14,531 | 14,978 | |||||||||||||

Foreign currency transaction (gain) loss |

(413 | ) | 375 | (1,386 | ) | (718 | ) | 36 | ||||||||||

Change in fair value of derivatives |

(2,682 | ) | 210 | 59 | 59 | – | ||||||||||||

Loss on extinguishment of debt |

– | – | – | – | 2,016 | |||||||||||||

Other income, net |

(690 | ) | (3,031 | ) | (2,193 | ) | (1,457 | ) | (928 | ) | ||||||||

Income (loss) from continuing operations before income taxes |

4,500 | (17,975 | ) | (14,413 | ) | (14,987 | ) | 4,208 | ||||||||||

Income tax expense (benefit) |

6,414 | (4,537 | ) | (2,069 | ) | (322 | ) | 2,401 | ||||||||||

Income (loss) from continuing operations |

(1,914 | ) | (13,438 | ) | (12,344 | ) | (14,665 | ) | 1,807 | |||||||||

Income (loss) from discontinued operations, net of income taxes |

(746 | ) | (2,846 | ) | (4,428 | ) | (4,220 | ) | 83 | |||||||||

Net income (loss) |

(2,660 |

) |

(16,284 |

) |

(16,772 |

) |

(18,885 |

) |

1,890 |

|||||||||

Non-controlling interest in consolidated subsidiary |

14 | (51 | ) | 25 | 25 | – | ||||||||||||

Net income (loss) attributable to GSE Holding, Inc. |

$ | (2,646 | ) | $ | (16,335 | ) | $ | (16,747 | ) | $ | (18,860 | ) | $ | 1,890 | ||||

Income (loss) from continuing operations per share: |

||||||||||||||||||

Basic |

$ | (0.18 | ) | $ | (1.24 | ) | $ | (1.14 | ) | $ | (1.36 | ) | $ | 0.17 | ||||

Diluted(1) |

$ | (0.18 | ) | $ | (1.24 | ) | $ | (1.14 | ) | $ | (1.36 | ) | $ | 0.15 | ||||

Net income (loss) per common share: |

||||||||||||||||||

Basic |

$ | (0.25 | ) | $ | (1.51 | ) | $ | (1.55 | ) | $ | (1.75 | ) | $ | 0.17 | ||||

Diluted(1) |

$ | (0.25 | ) | $ | (1.51 | ) | $ | (1.55 | ) | $ | (1.75 | ) | $ | 0.16 | ||||

Weighted average common shares used in computing net income (loss) per share (in thousands): |

||||||||||||||||||

Basic |

10,810 | 10,810 | 10,810 | 10,810 | 10,810 | |||||||||||||

Diluted |

10,810 | 10,810 | 10,810 | 10,810 | 11,830 | |||||||||||||

14

| |

Years Ended December 31, | Nine Months Ended September 30, |

||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||||

| |

(Restated) |

(Restated) |

(Restated) |

(Unaudited) |

||||||||||||||

| |

(in thousands, except per share data) |

|||||||||||||||||

Pro Forma Statement of Operations Data(2): |

||||||||||||||||||

Pro forma income (loss) from continuing operations |

$ | (5,477 | ) | $ | 8,167 | |||||||||||||

Pro forma net income (loss) per common share from continuing operations: |

||||||||||||||||||

Basic |

$ | (0.33 | ) | $ | 0.50 | |||||||||||||

Diluted |

$ | (0.33 | ) | $ | 0.47 | |||||||||||||

Pro forma weighted average common shares outstanding: |

||||||||||||||||||

Basic |

16,472 | 16,472 | ||||||||||||||||

Diluted |

16,472 | 17,242 | ||||||||||||||||

Other Financial Data (unaudited): |

||||||||||||||||||

Adjusted gross margin(3) |

15.0 | % | 14.5 | % | 15.5 | % | 14.6 | % | 16.9 | % | ||||||||

Adjusted EBITDA(4) |

38,399 | 19,151 | 28,064 | 19,127 | 35,710 | |||||||||||||

Capital expenditures |

5,836 | 2,842 | 3,337 | 1,887 | 7,713 | |||||||||||||

Operating Data (unaudited): |

||||||||||||||||||

Volume shipped (thousands of pounds)(5) |

339,251 | 298,620 | 337,811 | 249,570 | 288,169 | |||||||||||||

|

||||||||||||||||||

| |

|

|

|

As of September 30, 2011 | ||||||||||||||

| |

|

|

|

Actual | As Adjusted(6) | |||||||||||||

| |

|

|

|

(Unaudited) |

||||||||||||||

| |

|

|

|

(in thousands) |

||||||||||||||

Consolidated Balance Sheet Data: |

||||||||||||||||||

Cash and cash equivalents |

$ | 8,720 | $ | 11,771 | ||||||||||||||

Accounts receivable, net |

97,052 | 97,052 | ||||||||||||||||

Inventories, net |

54,652 | 54,652 | ||||||||||||||||

Total assets |

303,062 | 310,227 | ||||||||||||||||

Total debt, including current portion |

197,246 | 139,734 | ||||||||||||||||

Total stockholders' equity |

34,420 | 99,097 | ||||||||||||||||

- (1)

- We

recorded a net loss in each of the periods presented excluding the nine months ended September 30, 2011. Potential common shares are anti-dilutive

in periods in which we record a net loss because they would reduce the respective period's net loss per share. Anti-dilutive potential common shares are excluded from the calculation of diluted

earnings per share. As a result, diluted net loss per share was equal to basic net loss per share in each of the periods presented excluding the nine months ended September 30, 2011.

- (2)

- Pro

forma statement of operations data give effect to (i) the Refinancing Transactions, (ii) this offering and the use of proceeds therefrom

as set forth under "Use of Proceeds" and (iii) the issuance of shares and payment of cash bonuses pursuant to bonus letter agreements and the issuance of shares pursuant to the exercise of

vested options (see "Capitalization"), in each case as if they had occurred on January 1, 2010. In accordance with Rule 11-02(c)(2) of Regulation S-X, we

have only presented the pro forma statement of operations data for the most recent fiscal year (i.e., 2010) and the period from the most recent fiscal year end to the most recent interim date

for which a balance sheet is required (i.e., the nine months ended September 30, 2011).

- (3)

- Adjusted gross margin represents the difference between sales and cost of products, excluding depreciation expense included in cost of products, divided by sales and, accordingly, does not take into account the non-cash impact of depreciation expense included in the cost of products of $9.4 million, $9.1 million and $9.1 million in 2008, 2009 and 2010, respectively, and of $6.8 million and $7.1 million in the nine months ended September 30, 2010 and 2011, respectively. Disclosure in this

15

prospectus of adjusted gross margin, which is a "non-GAAP financial measure," as defined under the rules of the Securities and Exchange Commission, or SEC, is intended as a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. We believe this measure is helpful in understanding our past performance as a supplement to gross margin and other performance measures calculated in conformity with GAAP.

We believe this measure is meaningful to our investors because it provides a measure of operating performance that is unaffected by non-cash accounting measures. Adjusted gross margin has limitations as an analytical tool because it excludes the impact of depreciation expense included in cost of products, and it should be considered in addition to, not as a substitute for, measures of financial performance reported in accordance with GAAP such as gross margin. Our calculation of adjusted gross margin may not be comparable to similarly titled measures reported by other companies. The following table reconciles gross margin to adjusted gross margin for the periods presented in this table and elsewhere in this prospectus.

| |

Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||

| |

(Restated) |

(Restated) |

(Restated) |

|

|

||||||||||||

Gross margin |

12.7 | % | 11.4 | % | 12.8 | % | 11.9 | % | 14.9 | % | |||||||

Depreciation expense (as a percentage of sales) |

2.3 | 3.1 | 2.7 | 2.7 | 2.0 | ||||||||||||

Adjusted gross margin |

15.0 | % | 14.5 | % | 15.5 | % | 14.6 | % | 16.9 | % | |||||||

- (4)

- Adjusted

EBITDA represents net income or loss before interest expense, income tax expense, depreciation and amortization of intangibles, change in the fair

value of derivatives, loss (gain) on foreign currency transactions, restructuring expenses, extraordinary and non-recurring professional fees, stock-based compensation expense, loss (gain) on asset

sales, loss on extinguishment of debt and management fees paid to CHS.

- Disclosure

in this prospectus of Adjusted EBITDA, which is a "non-GAAP financial measure," as defined under the rules of the SEC, is intended as

a supplemental measure of our performance that is not required by, or presented in accordance with, GAAP. Adjusted EBITDA should not be considered as an alternative to net income, income from

continuing operations or any other performance measure derived in accordance with GAAP. Our presentation of Adjusted EBITDA should not be construed to imply that our future results will be unaffected

by unusual or non-recurring items.

- We believe this measure is meaningful to our investors to enhance their understanding of our financial performance. Although Adjusted EBITDA is not necessarily a measure of our ability to fund our cash needs, we understand that it is frequently used by securities analysts, investors and other interested parties as a measure of financial performance and to compare our performance with the performance of other companies that report Adjusted EBITDA. Adjusted EBITDA should be considered in addition to, not as a substitute for, net income, income from continuing operations and other measures of financial performance reported in accordance with GAAP. Our calculation of Adjusted EBITDA may not be

16

comparable to similarly titled measures reported by other companies. The following table reconciles net loss to Adjusted EBITDA for the periods presented in this table and elsewhere in this prospectus.

| |

Year Ended December 31, | Nine Months Ended September 30, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2008 | 2009 | 2010 | 2010 | 2011 | |||||||||||

| |

(Restated) |

(Restated) |

(Restated) |

|

|

|||||||||||

| |

(in thousands) |

|||||||||||||||

Net income (loss) attributable to GSE Holding, Inc. |

$ | (2,646 | ) | $ | (16,335 | ) | $ | (16,747 | ) | $ | (18,860 | ) | $ | 1,890 | ||

(Income) loss from discontinued operations, net of income taxes |

746 | 2,846 | 4,428 | 4,220 | (83 | ) | ||||||||||

Interest expense, net of interest rate swap |

20,398 | 18,005 | 18,935 | 14,025 | 14,983 | |||||||||||

Income tax expense (benefit) |

6,414 | (4,537 | ) | (2,069 | ) | (322 | ) | 2,401 | ||||||||

Depreciation and amortization expense |

13,219 | 12,703 | 12,700 | 9,486 | 9,340 | |||||||||||

Change in the fair value of derivatives(a) |

(2,682 | ) | 210 | 59 | 59 | – | ||||||||||

Foreign currency transaction (gain) loss(b) |

(413 | ) | 375 | (1,386 | ) | (718 | ) | 36 | ||||||||

Restructuring expense(c) |

– | 1,444 | 1,096 | 1,183 | 381 | |||||||||||

Professional fees(d) |

262 | 1,436 | 8,904 | 8,462 | 3,143 | |||||||||||

Stock-based compensation expense(e) |

450 | 28 | 67 | 14 | 75 | |||||||||||

Management fees(f) |

2,004 | 2,004 | 2,019 | 1,519 | 1,520 | |||||||||||

Loss on extinguishment of debt(g) |

– | – | – | – | 2,016 | |||||||||||

Other(h) |

647 | 972 | 58 | 59 | 8 | |||||||||||

Adjusted EBITDA |

$ | 38,399 | $ | 19,151 | $ | 28,064 | $ | 19,127 | $ | 35,710 | ||||||

- (a)

- Represents

the mark-to-market change in the value of three interest rate swaps, including one entered into in July 2010 in connection with our German

revolving credit facility, one entered into in January 2005 and one in June 2009, each as a mechanism to convert $75.0 million of fixed rate debt to variable rate debt.

- (b)

- Primarily

related to gains and losses incurred on purchases, sales, intercompany loans and dividends denominated in non-functional currencies.

- (c)

- Represents

severance costs primarily related to the restructuring and productivity improvement programs we adopted during the fourth quarter of 2009.

- (d)

- Represents

consulting and other advisory fees related to recruiting a new chief executive officer in 2008 and 2009 and the restructuring and productivity

improvement programs adopted by us during the fourth quarter of 2009, which primarily consists of fees related to the engagement of an independent consulting firm that specializes in performance

improvements for portfolio companies of private equity firms.

- (e)

- Represents

the compensation expense attributable to each respective period based on the calculated value of employee stock options.

- (f)

- Represents

management fees that will terminate in connection with this offering. See "Certain Relationships and Related Party

Transactions – Management Agreement."

- (g)

- Represents

the loss recognized in connection with the refinancing of our Senior Notes as described in "Management's Discussion and Analysis of Financial

Condition and Results of Operations – Liquidity and Capital Resources – The Refinancing Transactions; Description of Long Term Indebtedness."

- (h)

- 2008 and 2009 include $0.6 million of disaster recovery expense associated with Hurricane Ike and $1.0 million of death benefits paid to the estate of our former President and Chief Executive Officer, respectively. Otherwise, relates to gains and losses on asset sales.

- (5)

- Includes

12,984, 12,118 and 9,935 volume shipped (in thousands of pounds) related to our discontinued operations for the years ended December 31,

2008, 2009 and 2010, respectively, and 8,076 and 0 volume shipped (in thousands of pounds) related to our discontinued operations for the nine months ended September 30, 2010 and 2011,

respectively.

- (6)

- As adjusted to reflect (i) our one-time payment of $3.0 million to CHS IV, in consideration for the termination of the management agreement between us and CHS IV, as described in "Certain Relationships and Related Party Transactions – Management Agreement," (ii) our issuance of 186,593 shares of our common stock and payment of $3.5 million of cash bonuses immediately prior to the closing of this offering to certain of our executive officers as bonuses for the successful completion of this offering pursuant to bonus letter agreements, as described in "Executive Compensation – Compensation Discussion and Analysis – Bonus Letter Agreements," (iii) our issuance of 1,127,326 shares of our common stock pursuant to the exercise of vested options by certain selling stockholders for the purpose of selling such shares in this offering, (iv) our receipt of net proceeds from this offering of $68.3 million after deducting underwriting discounts and commissions and estimated offering expenses and (v) the application of the net proceeds from this offering as described in "Use of Proceeds."

17

This offering and an investment in our common stock involve a high degree of risk. You should carefully consider the risks described below, together with the financial and other information contained in this prospectus, before you decide to purchase shares of our common stock. If any of the following risks actually occurs, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks related to our business

Our business depends on the levels of capital investment expenditures by our customers, which are affected by factors such as the state of domestic and global economies, the cyclical nature of our customers' markets, our customers' liquidity and the condition of global credit and capital markets.

Our products are generally integrated into complex, large-scale projects undertaken by our customers. As such, demand for most of our products depends on the levels of new capital investment expenditures by our customers. The levels of capital expenditures by our customers, in turn, depend on general economic conditions, availability of credit, economic conditions within their respective industries and geographies and expectations of future market behavior. The ability of our customers to finance capital investment may also be affected by factors independent of the conditions in their industry, such as the condition of global credit and capital markets.

The businesses of many of our customers, particularly mining, waste management and liquid containment companies are, to varying degrees, cyclical and have experienced periodic downturns that may adversely impact our sales in the future as they have in the past. The demand for our products by these customers depends, in part, on overall levels of industrial production and construction, general economic conditions and business confidence levels. During economic downturns, our customers in these industries have historically tended to delay large capital projects, as they did during the global recession in 2007 through 2009, which had a negative effect on our results of operations. Additionally, fluctuating energy demand forecasts and lingering uncertainty concerning commodity pricing can cause our customers to be more conservative in their capital planning, which may also reduce demand for our products. Significant fluctuations or reductions in copper, gold and silver prices, for example, generally depress the level of mining activity and result in a corresponding decline in the demand for our products among mining customers, as occurred during 2007 through 2009. Reduced demand for our products could result in the delay or cancellation of existing orders or lead to excess manufacturing capacity, which unfavorably impacts our absorption of fixed manufacturing costs. Any of these outcomes could adversely affect our business, financial condition, results of operations and cash flows.

While growth in North American and European markets have historically trended with GDP growth, emerging markets present significant growth opportunities. If we are not successful in shifting sales to the growing emerging and frontier markets, the growth in our sales could moderate. Additionally, some of our customers may delay capital investment even during favorable conditions in their markets. Lingering effects of global financial markets and banking systems disruptions experienced in 2007 through 2009 continue to make credit and capital markets difficult for some companies to access. Difficulties in accessing these markets and the associated costs can have a negative effect on investment in large capital projects, even during favorable market conditions. In addition, the liquidity and financial position of our customers could impact their ability to pay in full or on a timely basis. Any of

18

these factors, whether individually or in the aggregate, could have a material adverse effect on our customers and, in turn, our business, financial condition, results of operations and cash flows.

Our future sales depend, in part, on our ability to bid and win new orders. Our failure to effectively obtain future orders could adversely affect our profitability.

Our future sales and overall results of operations require us to successfully bid on new orders that are frequently subject to competitive bidding processes. For example, in 2010, the substantial majority of our sales consisted of supplying products for projects pursuant to competitive bids. Our sales from major projects depend, in part, on the level of capital expenditures in our principal end markets, including the mining, waste management, liquid containment, coal ash containment and shale oil and gas industries. The number of such projects we win in any particular year fluctuates, and is dependent on the number of projects available and our ability to bid successfully for such projects. Proposals and negotiations are complex and frequently involve a lengthy bidding and selection process, which is affected by a number of factors, such as competitive position, market conditions, financing arrangements and required governmental approvals. If negative market conditions arise, or if we fail to secure adequate financial arrangements or required governmental approvals, we may not be able to pursue particular projects, which could adversely affect our profitability.

Increases in prices or disruptions in supply of our raw materials could adversely impact our financial condition.

Pricing for our products is driven to a large extent by the costs of polyethylene resin and other raw materials, which significantly impact our operating results. In 2010, raw materials cost represented 80% of our cost of products. Our principal raw material, polyethylene resin, is occasionally in short supply and subject to price fluctuation in response to availability of manufacturing capacity, market demand and the price of feedstocks, including crude oil and natural gas. In recent months, for example, the industrywide price of polyethylene resin has increased from $0.78 per pound in June 2010 to $0.96 per pound in May 2011 based on publicly available data from Chemical Data LLC, or CDI. Our performance depends, in part, on our ability to reflect changes in resin costs in the selling prices for our products. In the past we have generally been successful in managing increased raw material costs and have increased selling prices only when necessary, but we may not be able to do so in the future.

We do not enter into long-term purchase orders for the delivery of raw materials. Our orders with suppliers are flexible and do not contain minimum purchase volumes or fixed prices. Accordingly, our suppliers may change their prices and other purchase terms on a monthly basis. We believe we have improved our raw material purchasing practices over recent years with the implementation of advanced pricing and forecasting tools, more centralized procurement and additional sourcing relationships, which has decreased our raw material costs. However, competitive market conditions in our industry and contractual arrangements with certain of our customers may limit our ability to pass the full cost of higher resin or other raw material pricing through to our customers promptly or completely. Even in cases in which our contractual arrangements with our customers permit us to pass on the cost of higher resin, enforcing such provisions may have a negative effect on our relationships with our customers. For example, in early 2010, we sought to enforce re-pricing provisions against a number of our customers to offset a dramatic increase in resin prices. As a result, we experienced a slower customer order rate for several months following the re-pricing, which adversely affected our results of operations. Raw material shortages or significant increases in the price of raw materials increase our costs and may reduce our operating income if we are not able to pass through all of the increases to our customers.

Additionally, if any of our key polyethylene resin suppliers were unable to deliver resin to us for an extended period of time, or if we were no longer able to purchase resin at competitively advantageous

19

prices, we may not be able to satisfy our resin requirements through other suppliers on competitive terms, or at all, which could have a material adverse effect on our results of operations. Increases in resin prices or a significant interruption in resin supply could have a material adverse effect on our financial condition, results of operations or cash flows. We do not currently enter into derivative instruments to offset the impact of resin price fluctuations and do not intend to do so for the foreseeable future.

Our future growth depends, in part, on developing new applications and end markets for our products.

Changes in legislative, regulatory or industry requirements or competitive technologies may render certain of our products obsolete. We place a high priority on developing new products, as well as enhancing our existing products, and our success depends on our ability to anticipate changes in regulatory and technology standards and to cultivate new applications for our products as the geosynthetics industry evolves. If we are unable to develop and introduce new applications and new addressable markets for our products in response to changes in environmental regulations, changing market conditions or customer requirements or demands, our competitiveness could be materially and adversely affected. For example, we have spent considerable resources developing higher-value products that are currently only sold in the North American market. If we are unable to introduce these products to other markets, our margin growth may be moderated. Furthermore, we cannot be certain that any new or enhanced product will generate sufficient sales to justify the expenses and resources devoted to such product diversification effort.

Unexpected equipment failures or significant damage to one or more of our manufacturing facilities would increase our costs and reduce our sales due to production curtailments or shutdowns.

We operate seven manufacturing facilities on five continents. Our operations have been centrally managed and coordinated from our facility in Houston, Texas since 2010. An interruption or suspension of production capabilities at these facilities, or significant damage to one or more of our facilities, as a result of equipment failure, fire, explosions, long-term mechanical breakdowns, violent weather conditions or other natural disasters, work stoppages, power outages, war, terrorist activities, political conflict or other hostilities or any other cause, could result in our inability to manufacture our products, which would reduce our sales and earnings for the affected period, affect our relationships with our most significant customers and distributors and cause us to lose future sales. For example, our facility in Houston, Texas was impacted by Hurricane Ike in 2008 and had to be shut down for a period of 12 days. A similar natural disaster in the future could have a material adverse effect on our global operations. Our business interruption insurance may not be sufficient to cover all of our losses from a natural disaster, in which case our reimbursed losses could be substantial.

We operate in a highly competitive industry.