Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

REYNOLDS AMERICAN INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

March 23, 2012

Dear Shareholder:

You are cordially invited to attend the 2012 annual meeting of shareholders of Reynolds American Inc. The meeting will be held at 9:00 a.m. (Eastern Time), on Thursday, May 3, 2012, in the Reynolds American Plaza Building Auditorium at RAI’s corporate offices, 401 North Main Street, Winston-Salem, North Carolina.

The matters to be acted on at the annual meeting are described in the accompanying notice of meeting and proxy statement. Please give careful attention to these proxy materials.

Pursuant to rules promulgated by the U.S. Securities and Exchange Commission, we are providing to most of our shareholders access to our proxy materials over the Internet through a process informally called “e-proxy.” We believe these rules allow us to deliver proxy materials to our shareholders in a cost-efficient and an environmentally sensitive manner, while preserving the ability of shareholders to receive paper copies of these materials if they wish.

It is important that your shares be represented and voted at the annual meeting regardless of the size of your holdings. Whether or not you plan to attend the annual meeting, we encourage you to vote your shares in advance of the annual meeting by using one of the methods described in the accompanying proxy materials.

Attendance at the annual meeting will be limited to our shareholders as of the record date of March 12, 2012, and to guests of RAI, as more fully described in the proxy statement. Admittance tickets will be required. If you are a shareholder and plan to attend, you MUST pre-register for the meeting and request an admittance ticket no later than Wednesday, April 25, 2012, by writing to the Office of the Secretary, Reynolds American Inc., 401 North Main Street, P.O. Box 2990, Winston-Salem, North Carolina 27102-2990. If your shares are not registered in your own name, evidence of your stock ownership as of March 12, 2012, must accompany your letter. You can obtain this evidence from your bank or brokerage firm, typically in the form of your most recent monthly statement. An admittance ticket will be held in your name at the registration desk, not mailed to you in advance of the meeting. Proper identification will be required to obtain your admittance ticket at the annual meeting.

We anticipate that a large number of shareholders will attend the meeting. Seating is limited, so we suggest that you arrive early. The auditorium will open at 8:30 a.m.

If you have questions or need assistance in voting your shares, please contact our Shareholder Services Department at (866) 210-9976 (toll-free).

Thank you for your support and continued interest in RAI.

Sincerely,

Thomas C. Wajnert

Chairman of the Board

Table of Contents

Reynolds American Inc.

401 North Main Street

P.O. Box 2990

Winston-Salem, North Carolina 27102-2990

Notice of Annual Meeting of Shareholders

To be Held on Thursday, May 3, 2012

March 23, 2012

To our Shareholders:

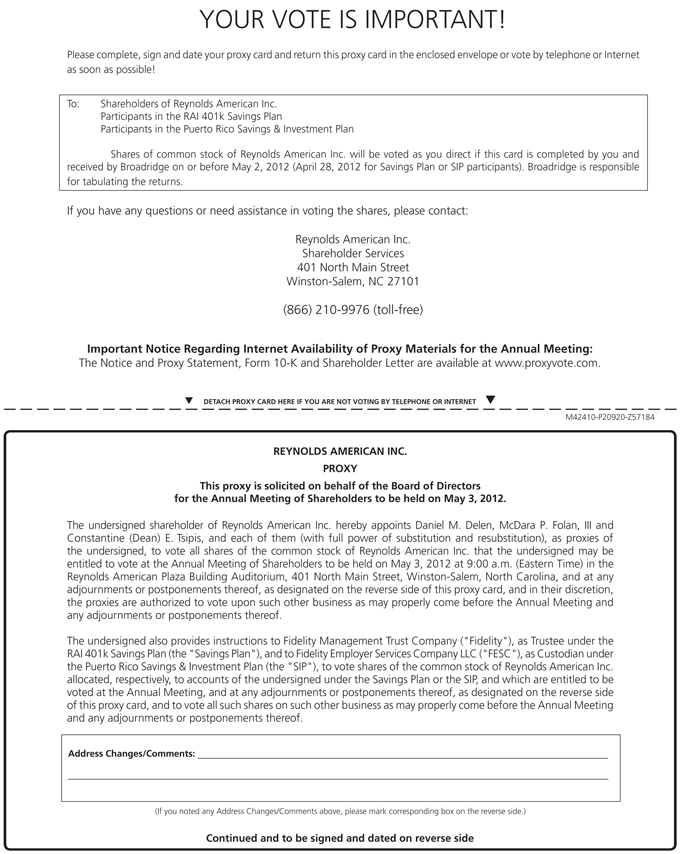

The 2012 annual meeting of shareholders of Reynolds American Inc. will be held at 9:00 a.m. (Eastern Time) on Thursday, May 3, 2012, in the Reynolds American Plaza Building Auditorium at RAI’s corporate offices, 401 North Main Street, Winston-Salem, North Carolina. At the meeting, shareholders will be asked to take the following actions:

| (1) | to elect five Class II directors to serve until the 2015 annual meeting of shareholders and one Class I director to serve until the 2014 annual meeting of shareholders; |

| (2) | to approve, on an advisory basis, the compensation of RAI’s named executive officers; |

| (3) | to approve an amendment to RAI’s Amended and Restated Articles of Incorporation implementing a majority voting standard in uncontested director elections; |

| (4) | to ratify the appointment of KPMG LLP as independent auditors for RAI’s 2012 fiscal year; |

| (5) | to act on a shareholder proposal, if presented by its proponents; and |

| (6) | to transact any other business as may be properly brought before the meeting or any adjournment or postponement thereof. |

Only holders of record of RAI common stock as of the close of business on March 12, 2012, are entitled to notice of, and to vote at, the 2012 annual meeting of shareholders of RAI.

Whether or not you plan to attend the meeting, we urge you to vote your shares using a toll-free telephone number or the Internet, or by completing, signing and mailing the proxy card that either is included with these materials or will be sent to you at your request. Instructions regarding the different voting methods are contained in the accompanying proxy statement.

By Order of the Board of Directors,

McDara P. Folan, III

Secretary

Table of Contents

Reynolds American Inc.

401 North Main Street

P.O. Box 2990

Winston-Salem, North Carolina 27102-2990

Proxy Statement

i

Table of Contents

| Page | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| Effect of Termination of Governance Agreement on RAI Shareholder Rights Plan |

19 | |||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

34 | |||

| 34 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

ii

Table of Contents

| Page | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 55 | ||||

iii

Table of Contents

iv

Table of Contents

Information about the Annual Meeting and Voting

The Board of Directors, sometimes referred to as the Board, of Reynolds American Inc. is soliciting your proxy to vote at our 2012 annual meeting of shareholders (or any adjournment or postponement of the annual meeting). (References in this proxy statement to “RAI,” “we,” “our,” or “us” are references to Reynolds American Inc.) This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the 2012 annual meeting. Please read it carefully.

In accordance with certain rules of the U.S. Securities and Exchange Commission, referred to as the SEC, we are making our proxy materials (consisting of this proxy statement, our 2011 Annual Report on Form 10-K and a letter from our Chairman of the Board and our President and Chief Executive Officer) available over the Internet, rather than mailing a printed copy of our proxy materials to every shareholder, which process we refer to as e-proxy. We began mailing a Notice of Internet Availability of Proxy Materials, referred to as the Notice, on or about March 23, 2012, to all shareholders entitled to vote, except shareholders who already had requested a printed copy of our proxy materials and except participants in our Savings Plan and SIP, defined below, to whom we began mailing proxy materials (including a proxy card) on or about March 23, 2012. More information about e-proxy is provided in the following set of questions and answers, including information on how to receive by mail, free of charge, paper copies of the proxy materials, in the event you received a Notice.

When and where will the annual meeting be held?

The date, time and place of our 2012 annual meeting are set forth below:

| Date: | Thursday, May 3, 2012 | |||

| Time: | 9:00 a.m. (Eastern Time) | |||

| Place: | Reynolds American Plaza Building Auditorium RAI Corporate Offices 401 North Main Street Winston-Salem, North Carolina | |||

What is required to attend the annual meeting?

Attendance at our 2012 annual meeting will be limited to our shareholders as of the record date of March 12, 2012, referred to as the record date, and to pre-approved guests of RAI. All shareholder guests must be pre-approved by RAI and will be limited to spouses, persons required for medical assistance and properly authorized representatives of our shareholders as of the record date. Admittance tickets will be required to attend the meeting. If you are a shareholder and plan to attend, you MUST pre-register and request an admittance ticket for you (and any guest for whom you are requesting pre-approval) no later than Wednesday, April 25, 2012, by writing to the Office of the Secretary, Reynolds American Inc., P.O. Box 2990, Winston-Salem, North Carolina 27102-2990. If your shares are not registered in your own name, evidence of your stock ownership as of March 12, 2012, must accompany your letter. You can obtain this evidence from your bank or brokerage firm, typically in the form of your most recent monthly statement. An admittance ticket will be held in your name at the registration desk — not mailed to you in advance of the meeting. Proper identification will be required to obtain your admittance ticket at the annual meeting.

The 2012 annual meeting is a private business meeting. In accordance with RAI’s Amended and Restated Bylaws, referred to as Bylaws, and North Carolina law, our Chairman of the Board has the right and authority to determine and maintain the rules, regulations and procedures for the conduct of the meeting, including, but not limited to, maintaining order and the safety of those in attendance, dismissing business not properly submitted, opening and closing the polls for voting and limiting time allowed for discussion of the business at the meeting. Failure to abide by the meeting rules will not be tolerated and may result in expulsion from the meeting. A copy of the meeting rules will be provided to all properly pre-registered shareholders and guests with their admittance ticket.

1

Table of Contents

We anticipate that a large number of shareholders will attend the meeting. Seating is limited, so we suggest you arrive early. The auditorium will open at 8:30 a.m.

If you have a disability, we can provide reasonable assistance to help you participate in the meeting. If you plan to attend the meeting and require assistance, please write or call the Office of the Secretary of RAI no later than April 27, 2012, at P.O. Box 2990, Winston-Salem, North Carolina 27102-2990, telephone number (336) 741-5162.

What is the purpose of the annual meeting?

At our 2012 annual meeting, shareholders will vote upon the matters outlined in the notice of meeting: (1) the election of directors; (2) an advisory vote to approve the compensation of our executive officers named in the 2011 Summary Compensation Table below (each officer named in such table is referred to as a named executive officer); (3) approval of an amendment to our Amended and Restated Articles of Incorporation, referred to as the Articles of Incorporation; (4) ratification of the appointment of our independent auditors; and (5) a shareholder proposal, if such proposal is presented by its proponents at the meeting. Also, RAI’s management will report on RAI’s performance during the last fiscal year and respond to questions from shareholders.

What are the Board’s recommendations regarding the matters to be acted on at the annual meeting?

The Board recommends a vote:

| • | FOR the election of all director nominees, |

| • | FOR the approval, on an advisory basis, of the compensation of our named executive officers, |

| • | FOR the approval of an amendment to the Articles of Incorporation implementing a majority voting standard in uncontested director elections, |

| • | FOR the ratification of the appointment of KPMG LLP as our independent auditors for our 2012 fiscal year, |

| • | AGAINST the shareholder proposal described on pages 81 to 83 of this proxy statement, and |

| • | FOR or AGAINST any other matters that come before the annual meeting, as the proxy holders deem advisable. |

What is e-proxy, and why is RAI using it?

E-proxy refers to the process allowed under SEC rules permitting companies to make their proxy materials available over the Internet, instead of mailing paper copies of the proxy materials to every shareholder. We are using e-proxy to distribute proxy materials to most of our shareholders because it will be cost effective for RAI and our shareholders (by lowering printing and mailing costs), reduce the consumption of paper and other resources, and provide shareholders with more choices for accessing proxy information.

2

Table of Contents

I received the Notice, but I prefer to read my proxy materials on paper — can I get paper copies?

Yes. In addition to providing instructions on accessing the proxy materials on the Internet (by visiting a web site referred to in the Notice), the Notice has instructions on how to request paper copies by phone, e-mail or on the Internet. You will be sent, free of charge, printed materials within three business days of your request. Once you request paper copies, you will continue to receive the materials in paper form until you instruct us otherwise.

I had consented before to the electronic delivery of proxy materials — will I continue to receive them via e-mail?

Yes. The e-proxy rules work in harmony with the existing rules allowing shareholders to consent to electronic delivery of proxy materials. If you have already registered to receive materials electronically, you will continue to receive them that way. If you have not already done so, but desire now to consent to electronic delivery, please see the question below “Can I receive future proxy materials from RAI electronically?”

Who is entitled to vote at the annual meeting?

Shareholders who owned RAI common stock at the close of business on March 12, 2012, the record date, are entitled to vote. As of the record date, we had 572,023,264 shares of RAI common stock outstanding. Each outstanding share of RAI common stock is entitled to one vote. The number of shares you own is reflected on your Notice and/or proxy card.

Is there a difference between holding shares “of record” and holding shares in “street name”?

Yes. If your shares are registered directly in your name with RAI’s transfer agent (Computershare), then you are considered to be the shareholder “of record” with respect to those shares, and the Notice and/or these proxy materials are being sent directly to you by RAI. If your shares are held in the name of a bank, broker or other nominee, then you are considered to hold those shares in “street name” or to be the “beneficial owner” of such shares. If you are a beneficial owner, then the Notice and/or these proxy materials are being forwarded to you by your nominee who is considered the shareholder of record with respect to the shares.

How many votes must be present to hold the annual meeting?

A quorum of shareholders is necessary to hold a valid meeting. The holders of record, present in person or by proxy at the meeting, of a majority of the shares entitled to vote constitute a quorum. Once a share is represented for any purpose at the meeting, it is considered present for quorum purposes for the remainder of the meeting. Abstentions, shares that are withheld as to voting with respect to one or more of the director nominees and “broker non-votes” will be counted in determining the existence of a quorum. A “broker non-vote” occurs on an item when a nominee is not permitted to vote without instructions from the beneficial owner of the shares and the beneficial owner fails to provide the nominee with such instructions.

You may vote in person at our 2012 annual meeting or you may designate another person — your proxy — to vote your stock. The written document used to designate someone as your proxy also is called a proxy or proxy card. We urge you to vote your shares by proxy even if you plan to attend the annual meeting. You can always change your vote at the meeting. If you are a shareholder of record, then you can vote by proxy over the Internet by following the instructions in the Notice, or, if you request printed copies of the proxy materials by mail, you can also vote by mail or telephone.

If you are a beneficial owner and you want to vote by proxy, then you may vote by proxy over the Internet, or if you request printed copies of the proxy materials by mail, you can also vote by mail or by telephone by following the instructions in the Notice.

3

Table of Contents

If I want to vote my shares in person at the annual meeting, what must I do?

If you plan to attend the meeting and vote in person and you hold your shares directly in your own name, then we will give you a ballot when you arrive. However, if you hold your shares in street name, then you must obtain a legal proxy assigning to you the right to vote your shares from the nominee who is the shareholder of record. The legal proxy must accompany your ballot to vote your shares in person.

If I hold shares in an employee benefit plan sponsored by RAI, how will those shares be voted?

If you participate in the RAI 401k Savings Plan, referred to as the Savings Plan, or in the Puerto Rico Savings & Investment Plan, referred to as the SIP, then your proxy card will serve as voting instructions for the trustee of the Savings Plan or the custodian of the SIP for shares of RAI common stock allocated to your account under the Savings Plan or the SIP. Shares for which no instructions are received will be voted by the trustee of the Savings Plan and the custodian of the SIP in the same proportion as the shares for which instructions are received by each of them.

What are my choices when voting?

You may specify whether your shares should be voted for all, some or none of the director nominees. You also may specify whether your shares should be voted for or against, or whether you abstain from voting with respect to, each of the other proposals.

What if I do not specify how I want my shares voted?

If you sign and return a proxy card, one of the individuals named on the card (your proxy) will vote your shares as you have directed. If you are a shareholder of record and return a signed proxy card, or if you give your proxy by telephone or over the Internet, but do not make specific choices, your proxy will vote your shares in accordance with the Board’s recommendations listed above. Please see the discussion below under “How many votes are required to elect directors and adopt the other proposals?” for further information on the voting of shares.

If any other matter is presented at our 2012 annual meeting, then your proxy will vote in accordance with his or her best judgment. At the time this proxy statement went to press, we knew of no other matters that had been properly presented to be acted upon at the annual meeting.

Yes. You may revoke or change your proxy by:

| • | sending in another signed proxy card with a later date, |

| • | notifying our Secretary in writing before the meeting that you have revoked your proxy, or |

| • | voting in person at the meeting or through Internet or telephone voting. Your latest telephone or Internet vote is the one that is counted. |

4

Table of Contents

How many votes are required to elect directors and adopt the other proposals?

The required number of votes depends upon the particular item to be voted upon:

| Item |

Vote Necessary* | |||

| • Item 1: |

Election of Directors | Directors are elected by a “plurality” of the votes cast at the meeting, meaning that the director nominee with the most votes for a particular slot is elected for that slot. Director nominees do not need a majority of the votes cast at the meeting to be elected. | ||

| • Item 2: |

Advisory vote to approve the compensation of our named executive officers | Approval requires the affirmative vote of a majority of the votes cast at the meeting, although such vote is only advisory and will not be binding on us. | ||

| • Item 3: |

Approval of the amendment to the Articles of Incorporation | Approval requires the affirmative vote of a majority of the votes cast at the meeting. | ||

| • Item 4: |

Ratification of the appointment of independent auditors | Approval requires the affirmative vote of a majority of the votes cast at the meeting. | ||

| • Item 5: |

Shareholder proposal | Approval requires the affirmative vote of a majority of the votes cast at the meeting. | ||

| * | Under the rules of the New York Stock Exchange, referred to as the NYSE, if you hold your shares in street name, your bank or broker may not vote your shares on Items 1, 2, 3 and 5 without instructions from you. Without your voting instructions, a broker non-vote will occur on Items 1, 2, 3 and 5. Your bank or broker is permitted to vote your shares on Item 4 even if it does not receive voting instructions from you. Abstentions, shares that are withheld as to voting with respect to nominees for director and broker non-votes will not be counted as votes cast. |

We will retain an independent party, Broadridge Financial Solutions, Inc., to receive and tabulate the proxies, and to serve as the inspector of election to certify the results.

The votes of all shareholders will be held in confidence from our directors, officers and employees, except:

| • | as necessary to meet applicable legal requirements and to assert or defend claims for or against RAI, |

| • | in case of a contested proxy solicitation, |

| • | if a shareholder makes a written comment on the proxy card or otherwise communicates his or her vote to management, or |

| • | to allow the independent inspectors of election to certify the results of the vote. |

5

Table of Contents

How do I obtain the voting results?

Preliminary voting results will be announced at the 2012 annual meeting, and will be set forth in a press release that we intend to issue after the annual meeting. The press release will be available on our web site at www.reynoldsamerican.com. Final voting results are expected to be published in a Current Report on Form 8-K filed with the SEC within four business days after the 2012 annual meeting. A copy of this Current Report on Form 8-K will be available on our web site after its filing with the SEC.

Can I receive future proxy materials from RAI electronically?

Yes. Shareholders can elect to receive an e-mail that will provide electronic links to these materials in the future. If you are a registered shareholder, and have not already elected to view documents issued by us over the Internet, then you can choose to receive these documents electronically by following the appropriate prompts when you vote using the Internet. (If you hold your RAI common stock in nominee name, then you should review the information provided by your nominee for instructions on how to elect to view future proxy materials and annual reports using the Internet.) By choosing to receive shareholder materials electronically, you support us in our effort to control escalating printing and postage costs, and to protect the environment. We hope that our shareholders find this service convenient and useful. Costs normally associated with electronic access, such as usage and telephonic charges, will be your responsibility.

If you elect to view our annual reports and proxy materials using the Internet, we will send you a notice at the e-mail address provided by you explaining how to access these materials, but we will not send you paper copies of these materials unless you request them. We also may choose to send one or more items to you in paper form even though you elected to receive them electronically. Your consent to receive materials electronically rather than by mail will be effective until you revoke it by terminating your registration by going to the web site http://enroll.icsdelivery.com/rai, writing to the Office of the Secretary, Reynolds American Inc., P.O. Box 2990, Winston-Salem, North Carolina 27102-2990, or calling us at (336) 741-5162. If at any time you would like to receive a paper copy of the annual report, proxy statement or other documents issued by us, you may request any of these documents by writing to the address above, calling us at (336) 741-5162 or going to our web site at www.reynoldsamerican.com.

By consenting to electronic delivery, you are stating to us that you currently have access to the Internet and expect to have access to the Internet in the future. If you do not have access to the Internet, or do not expect to have access in the future, please do not consent to electronic delivery because we may rely on your consent and not deliver paper copies of documents, including, for example, future annual meeting materials or other documents issued by us.

Can RAI deliver only one set of annual meeting materials to multiple shareholders who share the same address?

Yes. SEC rules allow us to send a single Notice or copy of our proxy materials to two or more of our shareholders sharing the same address, subject to certain conditions, in a process called “householding.” To take advantage of the cost savings offered by householding, we have delivered only one Notice or copy of proxy materials to multiple shareholders who share an address, unless we received contrary instructions from the impacted shareholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the Notice or proxy materials, as requested, to any shareholder at the shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the Notice, proxy statement or Form 10-K, contact Broadridge Financial Solutions, Inc. at 1-800-542-1061, or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

If you are currently a shareholder sharing an address with another shareholder and wish to receive only one copy of future Notices, proxy statements and Annual Reports on Form 10-K for your household, please contact Broadridge at the above phone number or address.

6

Table of Contents

How will RAI solicit votes, and who will pay for the proxy solicitation?

We are soliciting this proxy on behalf of your Board of Directors and will bear the solicitation expenses. We are making this solicitation by mail, but our directors, officers and employees also may solicit by telephone, e-mail, facsimile or in person. We will pay for the cost of these solicitations, but these individuals will receive no additional compensation for their solicitation services. We will reimburse nominees, if they request, for their expenses in forwarding proxy materials to beneficial owners.

Is a list of shareholders available?

Yes, an alphabetical list of the names of all shareholders of record, as of the close of business on the record date, will be available for inspection by any shareholder or his or her representative, upon written demand, during the period from March 27, 2012, to May 3, 2012. This list can be viewed at RAI’s corporate offices located at 401 North Main Street, Winston-Salem, North Carolina between the hours of 8:30 a.m. and 5:00 p.m. Under applicable North Carolina law, a shareholder or his or her representative may, under certain circumstances and at the shareholder’s expense, copy the list during the period it is available for inspection. A shareholder desiring to inspect and/or copy the shareholder list should contact RAI’s Secretary at 401 North Main Street, Winston-Salem, North Carolina 27101 (phone: (336) 741-5162), to make necessary arrangements. In addition, we will make the shareholder list available for inspection to any shareholder or his or her representative during the 2012 annual meeting.

Whom should I contact if I have questions about voting at the annual meeting?

If you have any questions or need further assistance in voting your shares, please contact:

Reynolds American Inc.

Shareholder Services

P.O. Box 2990

Winston-Salem, NC 27102-2990

(866) 210-9976 (toll-free)

7

Table of Contents

| Item 1: | Election of Directors |

The business and affairs of RAI are managed under the direction of your Board of Directors. The Board currently consists of 13 directors who are divided into three classes, two classes of four directors each and one class of five directors, with each class serving staggered terms of three years. The four Class I directors, except as otherwise noted below, have a term ending on the date of the 2014 annual meeting, the five Class II directors have a term ending on the date of the 2012 annual meeting, and the four Class III directors have a term ending on the date of the 2013 annual meeting. Pursuant to our Articles of Incorporation, each class is to consist, as nearly as may reasonably be possible, of one-third of the total number of directors constituting the Board.

Each of the following persons currently serving on the Board as a Class II director has been nominated for re-election to such class at the 2012 annual meeting: John P. Daly, Holly K. Koeppel, H.G.L. (Hugo) Powell, Richard E. Thornburgh and Thomas C. Wajnert. If re-elected at the 2012 annual meeting, such persons will hold office until the 2015 annual meeting or until their successors have been elected and qualified.

In addition to the foregoing persons nominated for re-election as Class II directors, H. Richard Kahler has been nominated for re-election to Class I at the 2012 annual meeting. Mr. Kahler was first elected to serve at the Board’s July 2011 meeting, when he was elected to Class I. Although the terms of the other Class I directors end on the date of the 2014 annual meeting, Mr. Kahler’s current term as a Class I director is scheduled to expire on the date of the 2012 annual meeting because, under the law of North Carolina (the state in which RAI is incorporated), he was elected to fill a vacancy on the Board. If re-elected at the 2012 annual meeting, Mr. Kahler, like the other Class I directors, will hold office until the 2014 annual meeting.

Pursuant to the terms of the Governance Agreement, dated July 30, 2004, as amended, referred to as the Governance Agreement, by and among RAI, Brown & Williamson Holdings, Inc. (formerly known as Brown & Williamson Tobacco Corporation), referred to as B&W, and British American Tobacco p.l.c., the parent corporation of B&W and referred to as BAT, B&W has designated Messrs. Daly and Powell as nominees for re-election as Class II directors and Mr. Kahler as a nominee for re-election as a Class I director. (The material terms of the Governance Agreement relating to the nomination of directors are described below under “— Governance Agreement.”) The Board’s Corporate Governance and Nominating Committee, referred to as the Governance Committee, has recommended Ms. Koeppel and Messrs. Thornburgh and Wajnert as nominees for re-election to the Board as Class II directors. The other persons who have been designated by B&W pursuant to the Governance Agreement as directors of RAI are Martin D. Feinstein (a Class III director) and Neil R. Withington (a Class III director).

As previously disclosed, Susan M. Ivey resigned from the Board effective February 28, 2011, coincident with her retirement as President and Chief Executive Officer of RAI.

Your proxy will vote for each of the nominees for directors unless you specifically withhold authority to vote for a particular nominee. If any such nominee is unable to serve, your proxy may vote for another nominee proposed by the Board, or the Board may reduce the number of directors to be elected.

Your Board of Directors recommends a vote FOR the election of each of the five Class II director nominees and the one Class I director nominee.

8

Table of Contents

Certain biographical information regarding the persons nominated for election to the Board at our 2012 annual meeting and regarding the other persons serving on the Board is set forth below:

Director Nominees

| Name |

Age | Business Experience | ||||

| Class II Directors (terms expiring in 2015) | ||||||

| John P. Daly |

55 | Mr. Daly has been the Chief Operating Officer of BAT, the world’s second largest publicly traded tobacco group, since September 2010, and has served as a director of BAT since January 2010. After the 1999 merger of Rothmans International with BAT, Mr. Daly became BAT’s Regional Manager for the Middle East, Subcontinent and Central Asia, and was appointed Area Director for the Middle East and North Africa in 2001. Mr. Daly joined the management board of BAT upon his appointment as Regional Director for Asia-Pacific in 2004. Prior to joining the tobacco industry, Mr. Daly spent 14 years in the pharmaceutical industry in the United Kingdom and Ireland. Mr. Daly commenced serving on the Board of RAI as of December 1, 2010. | ||||

| The Board believes that Mr. Daly, with his more than 21 years of experience in the tobacco industry and with BAT, brings to the Board strong leadership skills, extensive knowledge of the tobacco industry and valuable expertise on the operational and financial issues related to the tobacco industry; and his 14 years of experience in the pharmaceutical industry brings additional knowledge in the area of governmental regulation of food and drugs. Mr. Daly’s service on the board of directors of BAT also brings valuable experience and insight to the Board. In addition, Mr. Daly is one of the executive officers of BAT designated by B&W under the terms of the Governance Agreement. | ||||||

| Holly K. Koeppel |

53 | Ms. Koeppel has served as the Co-Head of Citi Infrastructure Investors, an investment fund focused on investment opportunities within the infrastructure sectors, since January 2010. Previously, Ms. Koeppel was an executive vice president of American Electric Power Company, Inc., referred to as AEP, one of the largest power generators and distributors in the United States, from 2002 to December 2009. She also was the chief financial officer of AEP from 2006 to September 2009. Prior to 2006, Ms. Koeppel held various other management positions with AEP, which she joined in 2000. Ms. Koeppel commenced serving on the board of RAI as of July 16, 2008. She also currently serves on the boards of directors of Itínere Infraestructuras S.A., Kelda Group, and DP World Australia, where she serves as chairperson. Ms. Koeppel also is a member of The Ohio State University Dean’s Advisory Council. | ||||

| The Board believes that Ms. Koeppel, with her more than 31 years of operational and financial management experience, including her service as the chief financial officer of a large power company in a regulated industry, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; financial reporting, accounting and controls; governmental regulation; mergers and acquisitions; and executive compensation. In addition, Ms. Koeppel’s service on other boards brings valuable experience and insight to the Board. | ||||||

9

Table of Contents

| Name |

Age | Business Experience | ||||

| H.G.L. (Hugo) Powell |

67 | Mr. Powell retired in 2002 from Interbrew S.A., an international brewer that in 2004 became part of InBev S.A., where he served as Chief Executive Officer beginning in 1999. During Mr. Powell’s tenure as Chief Executive Officer, he led Interbrew through a crucial period in its expansion and evolution, including the completion of 33 acquisitions. Between 1984 and 1999, Mr. Powell held various operational positions within John Labatt Ltd. and Interbrew, including Chief Executive Officer of Interbrew Americas from 1995 to 1999. Mr. Powell commenced serving on the Board of RAI as of July 30, 2004. He also currently serves on the board of directors of ITC Limited. | ||||

| The Board believes that Mr. Powell, with his nearly 40 years of operational and executive management experience in the consumer goods industry, including 18 years of service as the chief executive officer of an international brewer, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; mergers and acquisitions; international trade; financial reporting, accounting and controls; corporate governance; and executive compensation. Mr. Powell’s service on other public and private company boards and committees also brings valuable experience and insight to the Board. In addition, Mr. Powell is one of the independent directors designated by B&W under the terms of the Governance Agreement. | ||||||

| Richard E. Thornburgh |

59 | Mr. Thornburgh has been Vice Chairman of Corsair Capital, LLC, a private equity firm focused on investing in the global financial services industry, since 2006. Prior to joining Corsair, Mr. Thornburgh held various executive positions with Credit Suisse Group AG, a global banking and financial services company, most recently serving as Executive Vice Chairman of Credit Suisse First Boston, referred to as CSFB and now called Credit Suisse. From 1996 to 2005, he served on the Executive Board of Credit Suisse Group as the Chief Financial Officer of Credit Suisse Group, Vice Chairman of the Executive Board of CSFB and Chief Risk Officer of Credit Suisse Group. Mr. Thornburgh served on the boards of directors of National City Corporation from May 2008 to December 2008 and Dollar General Corporation from June 2006 to December 2007. Mr. Thornburgh commenced serving on the Board of RAI as of December 2, 2011. He also currently serves on the boards of directors of Credit Suisse Group AG, The McGraw-Hill Companies, Inc. and NewStar Financial, Inc. | ||||

| The Board believes that Mr. Thornburgh, with his over 35 years of operational and financial management experience in the banking and financial services industry, including his service as the executive vice chairman of a global banking and financial services company, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; corporate finance and credit; management of global operations; financial reporting, accounting and controls; mergers and acquisitions; risk management; and corporate governance. Mr. Thornburgh’s service on other public and private company boards and committees also brings valuable experience and insight to the Board. | ||||||

10

Table of Contents

| Name |

Age | Business Experience | ||||

| Thomas C. Wajnert |

68 | Mr. Wajnert has been the Non-Executive Chairman of the Board of RAI, referred to as the Non-Executive Chairman, since November 1, 2010. Prior to that date, he served as the Board’s Lead Director from May 2008 to October 2010. Mr. Wajnert has been a Senior Managing Director of The AltaGroup, LLC, a global consulting organization providing advisory services to the financial services industry, since January 2011. He was self-employed from July 2006 to December 2010 providing advisory services to public and private companies and private equity firms. From January 2002 to June 2006, he was Managing Director of Fairview Advisors, LLC, a merchant bank he co-founded. Mr. Wajnert retired as Chairman of the Board and Chief Executive Officer of AT&T Capital Corporation, a commercial finance and leasing company, where he was employed from November 1984 until December 1997. Mr. Wajnert served on the boards of directors of NYFIX, Inc. from October 2004 to November 2009, and JLG Industries, Inc. from 1993 to 2007. Mr. Wajnert served on the board of directors of RJR Nabisco, Inc. (now known as R.J. Reynolds Tobacco Holdings, Inc., a wholly owned subsidiary of RAI and formerly a publicly traded company, referred to as RJR) from June 1999 to July 2004, and commenced serving on the Board of RAI as of July 30, 2004. He currently serves on the boards of directors of UDR, Inc., Solera Holdings, Inc. and the St. Helena Hospital Foundation, and is Non-Executive Chairman of FGIC, Inc., a privately held financial guarantee insurance company. | ||||

| The Board believes that Mr. Wajnert, with his nearly 37 years of operational and executive management experience, including 17 years of service as the chairman and chief executive officer of a national commercial finance and leasing company and the managing director and co-founder of a merchant bank, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; corporate finance and credit; restructurings; management of global operations; financial reporting, accounting and controls; marketing and brand leadership; corporate governance; and executive compensation. In addition, Mr. Wajnert’s service on other public and private company boards and committees, and his role in providing advisory services to public and private companies and private equity firms, bring valuable experience and insight to the Board. Based on this combination of experience, qualifications, attributes and skills, RAI’s directors elected Mr. Wajnert as the Non-Executive Chairman, effective November 1, 2010, and the Board’s Lead Director from May 2008 to October 2010. | ||||||

11

Table of Contents

| Name |

Age | Business Experience | ||||

| Class I Director (term expiring in 2014) | ||||||

| H. Richard Kahler |

64 | Mr. Kahler retired in 2002 from Caterpillar, Inc., a leading manufacturer of construction and mining equipment, engines, turbines and locomotives, where he served as Managing Director, Operations, of Caterpillar’s Asia Pacific Division in 2001 and 2002, and the President of Caterpillar China, based in Hong Kong, from 1994 to 2001. He served as Managing Director of P.T. Natra Raya, Caterpillar’s operations in Indonesia, from 1990 to 1993, and from 1975 to 1990 held various positions within Caterpillar. Mr. Kahler commenced serving on the Board of RAI as of July 14, 2011. He also currently serves on the board of directors, and as an advisor to the chairman, of Van Shung Chong Holdings Limited. | ||||

| The Board believes that Mr. Kahler, with his more than 25 years of operational management experience, including his service as the managing director for the Asia Pacific division of a global manufacturing company, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; operational efficiencies; marketing and brand leadership; international trade; and executive compensation. Mr. Kahler’s service on another company board also brings additional experience and insight to the Board. In addition, Mr. Kahler is one of the independent directors designated by B&W under the terms of the Governance Agreement. | ||||||

Continuing Directors

| Class III Directors (terms expiring in 2013) | ||||||

| Daniel M. Delen |

46 | Mr. Delen has been President and Chief Executive Officer of RAI since March 1, 2011. He served as the President and Chief Executive Officer-Elect of RAI from January 1, 2011 to February 28, 2011. Mr. Delen also has served as the President of RAI Services Company, referred to as RAISC, a wholly owned subsidiary of RAI, since January 2011. Mr. Delen served as Chairman of the Board of R. J. Reynolds Tobacco Company, a wholly owned subsidiary of RAI, referred to as RJR Tobacco, from May 2008 to December 2010. From January 2007 to December 2010, he also served as the President and Chief Executive Officer of RJR Tobacco. Prior to joining RJR Tobacco, Mr. Delen was President of BAT Ltd. — Japan from August 2004 to December 2006, and prior to that time, held various other positions with BAT after joining BAT in 1989. Mr. Delen commenced serving on the Board of RAI as of January 1, 2011. He also is a member of the boards of directors of the United Way of Forsyth County and the Winston-Salem Alliance. | ||||

| The Board believes that Mr. Delen, with his more than 21 years of domestic and international experience in the tobacco industry, including his current service as the President and Chief Executive Officer of RAI, brings to the Board strong leadership skills and comprehensive knowledge of the tobacco industry; marketing and brand leadership expertise; and essential insight and perspective regarding the strategic and operational opportunities and challenges of RAI and its operating companies. Mr. Delen’s service on non-profit boards also brings additional experience and insight to the Board. In addition, Mr. Delen, as the Chief Executive Officer of RAI, has been nominated by the Governance Committee under the terms of the Governance Agreement. | ||||||

12

Table of Contents

| Name |

Age | Business Experience | ||||

| Martin D. Feinstein |

63 | Mr. Feinstein was the Chairman of Farmers Group, Inc., a provider of personal property/casualty insurance, and Farmers New World Life Insurance Company, a provider of life insurance and annuities, from 1997 to July 2005, and served as the Chief Executive Officer of Farmers Group, Inc. from 1997 to April 2005 and as President and Chief Operating Officer of Farmers Group, Inc. from 1995 to 1996. Prior to 1995, Mr. Feinstein held various management positions with Farmers Group, Inc. He retired from Farmers Group, Inc. in July 2005. Farmers Group, Inc. was an indirect, wholly owned subsidiary of B.A.T. Industries p.l.c., an affiliate of BAT, from 1988 to 1998. Mr. Feinstein was a member of the board of directors of Clear Technology, Inc. from April 2005 to December 2007. Mr. Feinstein commenced serving on the Board of RAI as of November 30, 2005. He also currently serves on the boards of directors of GeoVera Holdings, Inc. and Almin p.l.c. | ||||

| The Board believes that Mr. Feinstein, with his nearly 35 years of operational and financial management experience in the insurance industry, including 10 years of service as the chairman, chief executive officer and chief operating officer of a national insurance company, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; financial reporting, accounting and controls; insurance and risk management; and corporate governance. Mr. Feinstein’s service on other public and private company boards and committees also brings valuable experience and insight to the Board. In addition, Mr. Feinstein is one of the independent directors designated by B&W for nomination to the Board under the terms of the Governance Agreement. | ||||||

| Lionel L. Nowell, III |

57 | Mr. Nowell retired in 2009 from PepsiCo, one of the world’s largest food and beverage companies, where he served as the Senior Vice President and Treasurer from August 2001 to May 2009. Prior to that time, he served as Chief Financial Officer for The Pepsi Bottling Group, a position he assumed in 2000 after serving as Controller for PepsiCo since July 1999. Mr. Nowell joined PepsiCo in July 1999 from RJR, where he was Senior Vice President, Strategy and Business Development from January 1998 to July 1999. Mr. Nowell commenced serving on the Board of RAI as of September 26, 2007. Mr. Nowell also currently serves on the board of directors of American Electric Power Company, Inc. In addition, he serves on the Dean’s Advisory Board at The Ohio State University Fisher College of Business and is an active member of the Executive Leadership Council, American Institute of Certified Public Accountants and the Ohio Society of CPAs. | ||||

| The Board believes that Mr. Nowell, with his more than 30 years of operational and financial management experience in the consumer products industry, including his service as the senior vice president and treasurer of a multi-national food and beverage company, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; corporate finance, credit and treasury; financial reporting, accounting and controls; and risk management. In addition, Mr. Nowell’s service on other public and private company boards and committees brings valuable experience and insight to the Board. | ||||||

13

Table of Contents

| Name |

Age | Business Experience | ||||

| Neil R. Withington |

55 | Mr. Withington has been Director, Legal and Security, and Group General Counsel of BAT, the world’s second largest publicly traded tobacco group, since August 2000. Mr. Withington joined BAT in 1993 as a Senior Lawyer and served in that capacity until 1995. He was named as the Assistant General Counsel and Head of Product Liability Litigation Group of BAT in 1996. Mr. Withington then served as the Deputy General Counsel of BAT from 1998 until 2000. Mr. Withington commenced serving on the Board of RAI as of July 30, 2004. | ||||

| The Board believes that Mr. Withington, with his more than 18 years of experience in the tobacco industry and with BAT, brings to the Board strong leadership skills, extensive knowledge of the tobacco industry and valuable legal expertise on the legal issues related to the tobacco industry, including smoking and health litigation. In addition, Mr. Withington is one of the executive officers of BAT designated by B&W for nomination to the Board under the terms of the Governance Agreement. | ||||||

| Class I Directors (terms expiring in 2014) | ||||||

| Luc Jobin |

52 | Mr. Jobin has been Executive Vice President and Chief Financial Officer of Canadian National Railway Company, referred to as CN, a rail and related transportation business, since June 2009. Prior to joining CN, Mr. Jobin was Executive Vice President of Power Corporation of Canada, referred to as PCC, an international management and holding company, from February 2005 to April 2009, with responsibility for overseeing PCC’s diversified portfolio of investments. Prior to joining PCC, he spent 22 years in a variety of financial and executive management positions with Imasco Limited and its Canadian tobacco subsidiary, Imperial Tobacco. Imasco, a major Canadian consumer products and services corporation, became a BAT subsidiary in 2000. Mr. Jobin served as President and Chief Executive Officer of Imperial Tobacco from the fall of 2003 until he joined PCC. Mr. Jobin commenced serving on the Board of RAI as of July 16, 2008. He also currently serves on the boards of directors of On the Tip of the Toes Foundation, which organizes therapeutic adventure expeditions for teenagers living with cancer, Mount Royal Club and The Tolerance Foundation. | ||||

| The Board believes that Mr. Jobin, with his 32 years of operational and financial management experience, including 22 years in the tobacco industry, where he served as the chief executive officer of a major Canadian tobacco company, and his current service as the chief financial officer of a major rail and transportation company, brings to the Board strong leadership skills, comprehensive knowledge of the tobacco industry and extensive knowledge in the areas of strategy development and execution; financial reporting, accounting and controls; corporate finance, credit and investments; risk management; and mergers and acquisitions. Mr. Jobin’s service on non-profit boards also brings additional experience and insight to the Board. | ||||||

14

Table of Contents

| Name |

Age | Business Experience | ||||

| Nana Mensah |

59 | Mr. Mensah has been the Chairman and Chief Executive Officer of ‘XPORTS, Inc., a privately held company that exports food packaging and food processing equipment and pharmaceuticals to foreign markets, since January 2005, and previously served in those same positions from April 2003 until July 2003 and from October 2000 until December 2002. He served as the Chief Operating Officer — Domestic of Church’s Chicken, a division of AFC Enterprises, Inc. and one of the world’s largest quick-service restaurant chains, from August 2003 to December 2004, when it was sold to a private equity firm. Mr. Mensah commenced serving on the Board of RAI as of July 30, 2004, and served on the board of directors of RJR from June 1999 to July 2004. Mr. Mensah is a Distinguished Fellow at Georgetown College in Kentucky. He also currently serves on the boards of trustees of the Children’s Miracle Network and the Kentucky Children’s Hospital, and the board of directors of World Trade Center Kentucky, a non-profit organization assisting Kentucky companies with imports, exports and overseas operations. | ||||

| The Board believes that Mr. Mensah, with his 35 years of operational management experience in the consumer and packaged goods industries, including his service as the chief operating officer of national quick service restaurant chains, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; marketing and brand leadership for consumer products and packaged goods; operational efficiencies; corporate governance; and executive compensation. In addition, Mr. Mensah’s service on private company and non-profit boards brings valuable experience and insight to the Board. | ||||||

| John J. Zillmer |

56 | Mr. Zillmer has served as President and Chief Executive Officer of Univar, a leading global distributor of industrial and specialty chemicals and related services, since October 2009. Prior to joining Univar, he was Chairman and Chief Executive Officer of Allied Waste Industries, Inc., the nation’s second-largest waste management company, from May 2005 until December 2008, when Allied Waste merged with Republic Services, Inc. Prior to joining Allied Waste, Mr. Zillmer had been retired since January 2004. From May 2000 to January 2004, Mr. Zillmer served as Executive Vice President of ARAMARK Corporation. Prior to 2000, he served in various management positions with ARAMARK, which he joined in 1995. Mr. Zillmer served on the boards of directors of Allied Waste Industries, Inc. from May 2005 to December 2008; Pathmark Stores, Inc. from May 2006 to December 2007; and United Stationers Inc. from October 2005 to May 2008. Mr. Zillmer commenced serving on the Board of RAI as of July 12, 2007. He also currently serves on the boards of directors of Univar and Ecolab Inc. | ||||

| The Board believes that Mr. Zillmer, with his 36 years of operational and financial management experience, including his service as the chief executive officer of both a global chemical company and a national waste management company, brings to the Board strong leadership skills and extensive knowledge in the areas of strategy development and execution; operational efficiencies; management of global operations; capital investments; and executive compensation. In addition, Mr. Zillmer’s service on other public and private company boards and committees brings valuable experience and insight to the Board. | ||||||

15

Table of Contents

Nomination and Election of Directors and Related Matters

In connection with the business combination transactions consummated on July 30, 2004, pursuant to which, among other things, the U.S. cigarette and tobacco business of B&W was combined with the business of RJR Tobacco, collectively referred to as the Business Combination, RAI, B&W and BAT entered into the Governance Agreement, which sets forth the parties’ agreement regarding various aspects of the governance of RAI, including the nomination of RAI directors. As noted above, under “— Item 1: Election of Directors,” the Board currently consists of 13 persons. Under the terms of the Governance Agreement, the Board’s nominated slate, referred to as management’s slate of nominees, is chosen as follows:

| Nominator |

Nominee | |

| B&W |

B&W has the right to designate for nomination five directors, at least three of whom are required to be independent directors and two of whom may be executive officers of BAT or any of its subsidiaries. | |

| Governance Committee |

The Governance Committee will recommend to the Board for nomination: | |

| • the chief executive officer of RAI or equivalent senior executive officer of RAI, and | ||

| • the remaining directors, each of whom is required to be an independent director. | ||

The number of directors B&W is entitled to designate for nomination to the Board could be lower due to future reductions in the amount of RAI common stock which B&W owns. (As of the date of this proxy statement, B&W owns approximately 42% of RAI common stock.) Specifically, the Governance Agreement provides that designations by B&W will be subject to the following limitations:

| If B&W’s ownership interest in RAI as of a specified date is: |

B&W will have the right to designate: | |

| • less than 32% but greater than or equal to 27% |

• two independent directors, and | |

| • two directors who may be executive officers of BAT or any of its subsidiaries. | ||

| • less than 27% but greater than or equal to 22% |

• two independent directors, and | |

| • one director who may be an executive officer of BAT or any of its subsidiaries. | ||

| • less than 22% but greater than or equal to 15% |

• one independent director, and | |

| • one director who may be an executive officer of BAT or any of its subsidiaries. | ||

| • less than 15% |

• no directors. |

The ownership thresholds described above will not reflect any decreases in B&W’s percentage ownership due to issuances of equity securities by RAI.

In addition, the Governance Agreement provides that in no event will the number of directors designated by B&W, divided by the total number of directors then comprising the Board, exceed the number of directors which B&W is then entitled to designate pursuant to the terms of the Governance Agreement divided by 12, rounded up to the nearest whole number. B&W is entitled to approximately proportionate representation on all Board committees so long as any BAT nominee is on the Board.

For purposes of the Governance Agreement, an independent director means a director who would be considered an “independent director” of RAI under the NYSE listing standards, as such listing standards may be amended from time to time, and under any other applicable law mandating, or imposing as a condition to any material benefit to RAI or any of its subsidiaries, the independence of one or more members of the Board,

16

Table of Contents

excluding, in each case, requirements that relate to “independence” only for members of a particular committee or directors fulfilling a particular function. In no event will any person be deemed to be an “independent director” if such person is, or at any time during the three years preceding the date of determination was, a director, officer or employee of BAT or any of its subsidiaries, other than RAI and its subsidiaries, if applicable. In addition, no person will be deemed to be an “independent director” unless such person also would be considered to be an “independent director” of BAT under the NYSE listing standards, whether or not such person is in fact a director of BAT, assuming the NYSE listing standards were applicable to BAT. Under the Governance Agreement, the fact that a person has been designated by B&W for nomination will not by itself disqualify that person as an “independent director.”

Pursuant to the Governance Agreement, in any election of directors, as long as after that election the Board will include the number of directors properly designated by B&W (and assuming that management’s entire slate of nominees is elected at the meeting), BAT and its subsidiaries are required to vote, and have given RAI an irrevocable proxy to vote, their shares of RAI common stock in favor of management’s slate of nominees (and against the removal of any director elected as one of management’s slate of nominees). For the 2012 annual meeting, management’s slate of nominees consists of Ms. Koeppel and Messrs. Daly, Powell, Thornburgh and Wajnert for Class II, and Mr. Kahler for Class I. Under the Governance Agreement, however, BAT and its subsidiaries would not be required to vote in favor of management’s slate of nominees (or against a removal) at a particular shareholders’ meeting if an unaffiliated third party has made a material effort to solicit proxies in favor of a different slate of directors for that meeting. In any other matter submitted to a vote of RAI’s shareholders, BAT and its subsidiaries may vote their RAI shares in their sole discretion.

The Governance Agreement requires the approval of B&W, as an RAI shareholder, or the B&W-designated directors in order for RAI to take various actions. The approval of a majority of the B&W-designated directors is required for:

| • | RAI’s issuance of securities comprising (either directly or upon conversion or exercise) 5% or more of RAI’s voting power other than certain issuances for cash, if B&W’s percentage interest in RAI is at least 32%; and |

| • | RAI’s repurchase of its shares of common stock, subject to certain exceptions (including if a dividends-declared threshold has been met), if B&W’s percentage interest in RAI is at least 25%. |

The approval of B&W, as an RAI shareholder, is required for:

| • | any RAI action which would discriminatorily impose limitations, or deny benefits to, BAT and its subsidiaries as RAI shareholders; |

| • | any RAI disposition of RAI intellectual property relating to certain B&W international brands, subject to exceptions; |

| • | specified amendments to RAI’s Articles of Incorporation, Bylaws or Board committee charters related to matters covered by the Governance Agreement; and |

| • | the adoption of takeover defense measures applicable to the acquisition of beneficial ownership of any RAI equity securities by BAT or its subsidiaries, other than the replacement or extension of RAI’s current shareholder rights plan. |

The Governance Agreement also requires that any material contract or transaction between RAI or its subsidiaries and BAT or its subsidiaries be approved by a majority of RAI’s independent directors not designated by B&W.

The nomination, election and other provisions described above will remain in effect indefinitely, unless terminated as described below.

17

Table of Contents

Standstill Provisions; Transfer Restrictions

In addition to provisions relating to the nomination and election of directors to RAI’s Board, the Governance Agreement, among other things, prohibits BAT and its subsidiaries from acquiring, or making a proposal to acquire, beneficial ownership of additional shares of RAI common stock during the Standstill Period (as defined below), referred to as the standstill provisions. (However, BAT and its subsidiaries may acquire additional RAI shares if their total RAI percentage ownership would not exceed approximately 42%, as adjusted downwards to reflect their prior dispositions of RAI shares.) Under the Governance Agreement, BAT and its subsidiaries also are prohibited during the Standstill Period from taking certain other actions, including, without limitation, seeking or soliciting a merger or a sale of RAI stock or assets, forming a “group” with other shareholders with respect to RAI common stock, participating in certain proxy solicitations with respect to RAI common stock, and seeking additional representation on RAI’s Board or the removal of any RAI director not nominated by B&W. The Governance Agreement provides several exceptions to the foregoing prohibitions, including, without limitation, permitting BAT and its subsidiaries to acquire additional shares of RAI common stock in connection with certain BAT counteroffers made to the RAI Board (and, in certain circumstances, to RAI shareholders if the RAI Board rejects the BAT offer) following a third party offer to enter into a significant transaction. For purposes of the Governance Agreement, a significant transaction means any sale, merger, acquisition or other business combination involving RAI or its subsidiaries pursuant to which more than 30% of the share voting power or the consolidated total assets of RAI would be acquired by any person or group.

These standstill provisions will expire on the earlier of July 30, 2014 (the tenth anniversary of the Governance Agreement) and the date on which a significant transaction is consummated (such period prior to expiration is referred to as the Standstill Period) unless terminated as described below.

The Governance Agreement also restricts the ability of BAT and its subsidiaries to sell or transfer shares of RAI common stock. These transfer restrictions will remain in effect indefinitely unless terminated as described below. Specifically, BAT and its subsidiaries may not, except in a third party tender offer that the RAI Board has not rejected:

| • | sell or transfer RAI common stock if, to B&W’s knowledge, the acquiring party or group would beneficially own (or have the right to acquire) 7.5% or more of the voting power of all of RAI’s voting stock after giving effect to such sale or transfer, or |

| • | in any six-month period, sell or transfer RAI common stock representing more than 5% of the voting power of all of RAI’s voting stock without first obtaining the consent of a majority of the independent members of RAI’s Board not designated by B&W. |

Notwithstanding these restrictions, B&W may transfer any of its shares of RAI common stock to BAT or its subsidiaries, and any such transferee may make similar transfers, provided the transferee agrees to be bound by the terms of the Governance Agreement and, provided further, that all shares of RAI common stock held by B&W and a permitted transferee will be taken into account for purposes of calculating any ownership thresholds applicable to B&W and/or its affiliates under the Governance Agreement.

Termination of the Governance Agreement

The Governance Agreement will terminate automatically and in its entirety if B&W’s ownership interest in RAI increases to 100%, or falls below 15%, referred to as a 15% termination, or if a third party or group beneficially owns or controls more than 50%, referred to as a third party termination, of the voting power of all of RAI’s voting stock.

BAT and B&W may elect to terminate the Governance Agreement in its entirety, in each case after notice and opportunity to cure, if B&W nominees proposed in accordance with the Governance Agreement are not elected to serve on the RAI Board or its committees, referred to as an election termination, or if RAI has deprived B&W nominees of such representation for “fiduciary” reasons, referred to as a fiduciary termination, or has willfully deprived B&W or its board nominees of any veto rights, referred to as a veto termination.

18

Table of Contents

BAT and B&W also may terminate the standstill, the restriction on Board representation in excess of proportionate representation, the obligation to vote its shares of RAI common stock for the management’s slate of director nominees (and related irrevocable proxy), and the RAI share transfer restrictions of the Governance Agreement if RAI willfully and deliberately breaches, after notice and opportunity to cure, the provisions regarding B&W’s Board and Board committee representation, referred to as a willful termination.

RAI may elect to terminate BAT and B&W’s board representation rights and voting obligations under the Governance Agreement, while the other obligations and restrictions on BAT and B&W continue, if BAT or B&W willfully and deliberately takes any action or fails to take an action, after notice and opportunity to cure, that results in a breach of the standstill provisions of the Governance Agreement. This termination is referred to as a BAT standstill breach termination.

Effect of Termination of the Governance Agreement on RAI Shareholder Rights Plan

RAI has a shareholder rights plan, referred to as the rights plan, which imposes a substantial penalty upon any person or group that acquires beneficial ownership of 15% or more of the outstanding shares of RAI common stock without the approval of the RAI Board. However, B&W and BAT are generally exempted from the application of the rights plan.

However, termination of some or all of the provisions of the Governance Agreement would have differing effects on the applicability of the rights plan to B&W and BAT. If a 15% termination occurred, the rights plan would fully apply to B&W and BAT. If a third party termination occurred, the rights plan would not apply to B&W and BAT. If an election termination, a fiduciary termination, or a veto termination occurred, the rights plan would apply if B&W or BAT were to increase their RAI share ownership above approximately 43% (or higher if the termination occurred after the July 30, 2014 expiration of the standstill provisions and B&W and BAT had increased their RAI share ownership above 43%). If a willful termination occurred, the rights plan would not apply to B&W and BAT. If a BAT standstill breach termination occurred, the rights plan would continue to apply to B&W and BAT at the level of ownership to which they are restricted under the standstill provisions.

Although the Governance Agreement requires the approval of B&W for RAI or any of its subsidiaries to adopt or implement any takeover defense measures, including a shareholder rights plan, that would apply to the acquisition of beneficial ownership of shares of RAI common stock by BAT or any of its subsidiaries, RAI is permitted to enter into a replacement or extension of its current rights plan, which expires on July 30, 2014, as long as it is in the same form.

The Governance Agreement also grants BAT and its subsidiaries the right to have shares of RAI common stock held by them to be registered under the securities laws in certain circumstances. The disposition of RAI common stock by BAT and its subsidiaries using registration rights is subject to the transfer restrictions described above.

In November 2011, RAI and B&W entered into an agreement pursuant to which B&W agreed to participate in RAI’s share repurchase program on a basis approximately proportionate with B&W’s 42% ownership of RAI’s equity, and the Governance Agreement was amended accordingly. For more information, see “Certain Relationships and Related Transactions — 2011 Related Person Transactions” below.

The preceding is a summary of the material terms of the Governance Agreement and is qualified in its entirety by reference to the full text of the Governance Agreement, which, together with Amendments No. 1, No. 2 and No. 3 to the Governance Agreement, are included as Exhibits 10.4, 10.5, 10.6 and 10.7, respectively, to our 2011 Annual Report on Form 10-K, as defined below. You are encouraged to read the Governance Agreement carefully as it contains important information about the governance of RAI.

19

Table of Contents

Determination of Independence of Directors

The NYSE listing standards require that all listed companies have a majority of independent directors. For a director to be “independent” under the NYSE listing standards, the board of directors of a listed company must affirmatively determine that the director has no material relationship with the company, or its subsidiaries or affiliates, either directly or as a partner, shareholder or officer of an organization that has a relationship with the company or its subsidiaries or affiliates. In accordance with the NYSE listing standards, RAI’s Board has adopted the following standards to assist it in its determination of director independence; a director will be determined not to be independent under the following circumstances:

| • | the director is, or has been within the last three years, an employee of RAI, or an immediate family member is, or has been within the last three years, an executive officer, of RAI, |

| • | the director has received, or has an immediate family member who has received, during any 12-month period within the last three years, more than $120,000 in direct compensation from RAI, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service), |

| • | (1) the director is a current partner or employee of a firm that is RAI’s internal or external auditor; (2) the director has an immediate family member who is a current partner of such a firm; (3) the director has an immediate family member who is a current employee of such a firm and currently works on RAI’s audit; or (4) the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on RAI’s audit within that time, |

| • | the director or an immediate family member is, or has been within the last three years, employed as an executive officer of another company where any of RAI’s present executive officers at the same time serves or served on that company’s compensation committee, or |

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, RAI for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues. |

The foregoing director independence standards are set forth in RAI’s Corporate Governance Guidelines, which can be found in the “Governance” section of our web site at www.reynoldsamerican.com, or can be requested, free of charge, by writing to the Office of the Secretary, Reynolds American Inc., P.O. Box 2990, Winston-Salem, North Carolina 27102-2990.

The Board has determined that the following directors are independent within the meaning of the foregoing NYSE listing standards: Martin D. Feinstein, Luc Jobin, H. Richard Kahler, Holly K. Koeppel, Nana Mensah, Lionel L. Nowell, III, H.G.L. (Hugo) Powell, Richard E. Thornburgh, Thomas C. Wajnert and John J. Zillmer. None of the foregoing independent directors had any relationship with RAI, other than being a director and/or shareholder of RAI, except Mr. Thornburgh, who serves on the boards of directors of two companies — one of which has a subsidiary that is one of the lenders under RAI’s senior credit facility and the other of which has a subsidiary that provides credit rating services to RAI — and Mr. Zillmer, who is the President and Chief Executive Officer of a company from which two of RAI’s subsidiaries purchased certain raw materials during 2011 and to which an RAI subsidiary sold an airplane in 2011. Such relationships and transactions were approved under RAI’s Related Person Transaction Policy and it was determined that none constituted a related party transaction requiring disclosure under the heading “Certain Relationships and Related Transactions — 2011 Related Person Transactions” below.

20

Table of Contents

Committees and Meetings of the Board of Directors