Use these links to rapidly review the document

As filed with the Securities and Exchange Commission on November 18, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________________________________________

NOODLES & COMPANY

(Exact name of registrant as specified in its charter)

_____________________________________________________________

Delaware (State or other jurisdiction of incorporation or organization) | 5812 (Primary Standard Industrial Classification Code Number) | 84-1303469 (I.R.S. Employer Identification Number) | ||

_____________________________________________________________

520 Zang Street, Suite D

Broomfield, CO 80021

(720) 214-1900

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

_____________________________________________________________

Kevin Reddy

Chairman & Chief Executive Officer

Noodles & Company

520 Zang Street, Suite D

Broomfield, CO 80021

(720) 214-1900

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

_____________________________________________________________

Copies to: | ||||

Andrew L. Fabens Steven R. Shoemate Gibson, Dunn & Crutcher LLP 200 Park Avenue New York, NY 10166 (212) 351-4000 | Paul A. Strasen Executive Vice President, General Counsel & Secretary Noodles & Company 520 Zang Street, Suite D Broomfield, CO 80021 (720) 214-1900 | Joshua N. Korff Michael Kim Kirkland & Ellis LLP 601 Lexington Avenue New York, NY 10022 (212) 446-4800 | ||

_____________________________________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o | |||

CALCULATION OF REGISTRATION FEE

TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED | AMOUNT TO BE REGISTERED(1) | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE PER SHARE(2) | PROPOSED MAXIMUM AGGREGATE OFFERING PRICE(2) | AMOUNT OF REGISTRATION FEE |

Class A Common Stock, par value $0.01 per share | 5,175,000 | $43.05 | $222,783,750 | $28,695 |

(1) Includes shares that may be purchased by the underwriters to cover the underwriters’ option to purchase additional shares of our common stock from the selling stockholders at the public offering price less the underwriters’ discount. See “Underwriting.”

(2) Estimated solely for the purpose of calculating the registration fee based on the average of the high and low prices for the registrant’s common stock on November 12, 2013 pursuant to Rule 457(c) under the Securities Act of 1933, as amended.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to such section 8(a) may determine.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we and the selling stockholders are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued December , 2013

Shares

CLASS A COMMON STOCK

______________________________________________

Noodles & Company is offering shares of the Class A common stock. The selling stockholders identified in this prospectus are offering an additional shares of Noodles & Company Class A common stock. We will not receive any proceeds from the sale of shares of our Class A common stock by the selling stockholders.

Our Class A common stock is listed on the Nasdaq Global Select Market under the symbol NDLS. On November , 2013 the last sale price of the shares on the Nasdaq Global Select Market was $ per share.

Noodles & Company is an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements in future reports after the closing of this offering.

________________________________________________

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 12.

________________________________________________

PRICE $ A SHARE

________________________________________________

Per Share | Total | |

Price to Public | $ | $ |

Underwriting discounts and commissions | $ | $ |

Proceeds, before expenses, to Noodles & Company | $ | $ |

Proceeds, before expenses, to the selling stockholders | $ | $ |

________________________________________________

The selling stockholders have granted the underwriters the right to purchase up to an additional shares of Class A common stock to cover over-allotments. We expect to enter into an agreement with , to repurchase shares of our common stock directly from certain of our officers in a private, non-underwritten transaction at a price per share equal to the net proceeds per share the selling stockholders receive in this offering.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock to purchasers on or about December , 2013.

________________________________________________

MORGAN STANLEY | UBS INVESTMENT BANK |

________________________________________________

BofA MERRILL LYNCH | JEFFERIES | BAIRD | PIPER JAFFRAY | RBC CAPITAL MARKETS |

, 2013

TABLE OF CONTENTS

Page | |

You should rely only on the information contained in this prospectus or in any free-writing prospectus we may authorize to be delivered or made available to you. We have not, and the selling stockholders have not and the underwriters have not, authorized anyone to provide you with additional or different information. We and the selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information in this prospectus or any free-writing prospectus is accurate only as of its date, regardless of its time of delivery or of any sale of shares of our Class A common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: We have not, the selling stockholders have not and the underwriters have not, done anything that would permit this offering, or possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

In this prospectus, "Noodles & Company," "Noodles," "we," "us" and the "Company" refer to Noodles & Company and, where appropriate, its subsidiaries, unless expressly indicated or the context otherwise requires. We refer to our Class A common stock as "common stock," unless the context otherwise requires. We sometimes refer to our common stock, Class B common stock and Class C common stock as "equity interests" when described on an aggregate basis. The rights of the holders of our Class A common stock and our Class B common stock are identical in all respects, except that our Class B common stock does not vote on the election or removal of directors unless converted on a share for share basis into Class A common stock.

i

PROSPECTUS SUMMARY | ||

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before deciding to invest in our Class A common stock, which we refer to in this prospectus as “common stock,” unless the context otherwise requires. You should read the entire prospectus carefully, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes to those consolidated financial statements, before making an investment decision. | ||

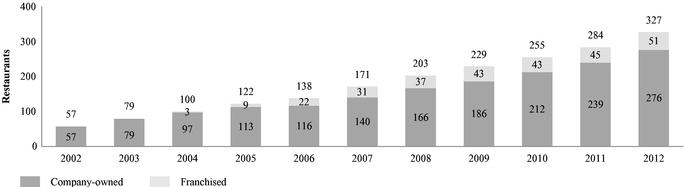

NOODLES & COMPANY A World of Flavors Under One Roof | ||

Noodles & Company is a high growth, fast casual restaurant concept offering lunch and dinner within a fast growing segment of the restaurant industry. We opened our first location in 1995, offering noodle and pasta dishes, staples of many cuisines, with the goal of delivering fresh ingredients and flavors from around the world under one roof-from Pad Thai to Mac & Cheese. Today, our globally inspired menu includes a wide variety of high quality, cooked-to-order dishes, including noodles and pasta, soups, salads and sandwiches, which are served on china by our friendly team members. We believe we offer our customers value with per person spend of approximately $8.00 for the twelve months ended October 1, 2013. We have 372 restaurants, comprised of 311 company-owned and 61 franchised locations, across 29 states and the District of Columbia, as of November 15, 2013. Our revenue and income from operations have grown from $170 million and $2 million in 2008 to $300 million and $16 million in 2012. | ||

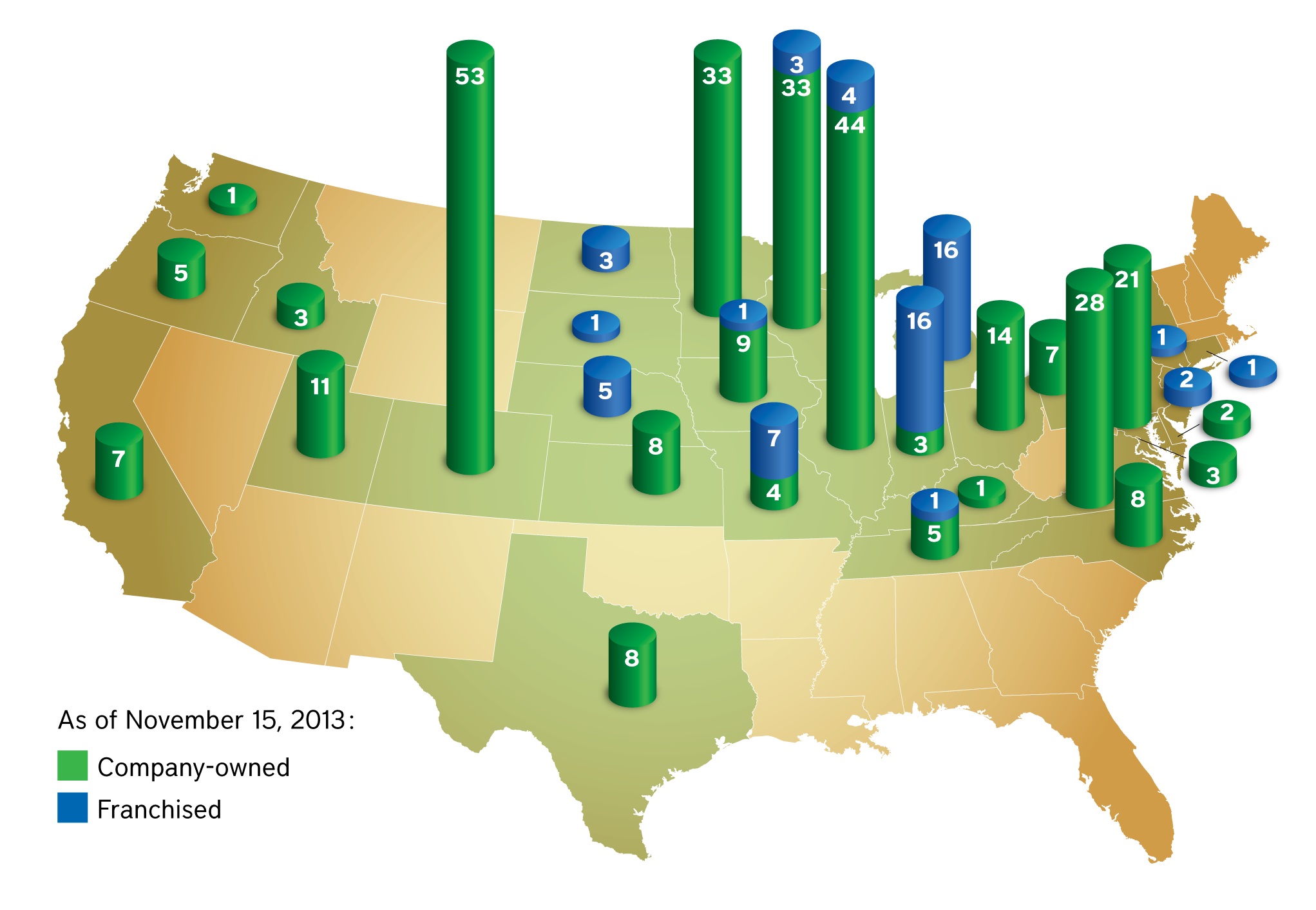

YOUR WORLD KITCHEN Our Differentiated Offering | ||

Your World Kitchen captures the breadth of our differentiated offering and defines our customers’ experience. Our company was founded on the core principle that food can be served quickly and conveniently in an inviting environment without sacrificing quality, freshness or flavor. | ||

“Your” . . . On trend with our world today, where customization is commonplace, we put control into our customers’ hands. Each dish is cooked-to-order and can be customized to each customer’s personal tastes. “Your” also represents the control our customers have over their dining experience, whether they want a meal to go, a quick sit-down lunch or a leisurely dinner with friends or family. | ||

“World” . . . We offer globally inspired flavors with more than 25 Asian, Mediterranean and American dishes together in a single menu. At many restaurants, people are limited to a particular ethnic cuisine or type of dish, such as a sandwich, burrito or burger. At Noodles & Company, we aim to eliminate the “veto vote” by satisfying the preferences of a wide range of customers, whether a mother with kids, a group of coworkers, an individual or a large party. | ||

“Kitchen” . . . Open kitchens are the focal point of our restaurants. Our customers can see the freshness of our ingredients and watch their food being cooked. “Kitchen” says “cooking” and emphasizes that we cook each dish to order. | ||

LEADING RESTAURANT GROWTH AND PERFORMANCE | ||

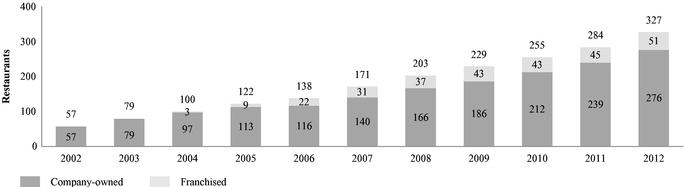

From 2004 to 2012, we increased the number of our total restaurants from 100 to 327, representing a CAGR of 16.0%. | ||

Total Restaurants at End of Fiscal Year | ||

| ||

1

We have experienced steady growth in comparable restaurant sales (at restaurants open for at least 18 full periods) in 30 of the last 31 quarters, due primarily to an increase in customer traffic. System-wide comparable restaurant sales growth for 2010, 2011 and 2012 was 3.7%, 4.8% and 5.4%, respectively. Our company-owned restaurant average unit volumes (“AUVs”) grew from $1,098,000 at the beginning of 2010 to $1,178,000 at the end of 2012. In 2012, our company-owned restaurant contribution margin (restaurant revenue less restaurant operating costs) was 21.2% for all restaurants and 23.2% for restaurants in the comparable base, which we believe places us in the top-tier of the restaurant industry. | ||

Our new restaurant investment model calls for a total cash investment of approximately $725,000, net of tenant allowances. Our current target cash-on-cash return on investments we make in restaurant development for a new company-owned restaurant is 30% in its third full-year of operations. Company-owned restaurants that were open a full three years by January 1, 2013, achieved an average cash-on-cash return on investments made in restaurant development of 35.1% in their third full year of operations. There can be no guarantee the Company’s comparable restaurant sales growth and cash-on-cash return rates will continue at similar rates in future periods. | ||

OUR INDUSTRY | ||

We operate in the fast casual segment of the restaurant industry. According to Technomic, in 2012, fast casual concepts in the 500 overall largest restaurant chains grew sales by 13.2% to $24.2 billion, compared with 4.9% for all of the 500 overall largest restaurant chains in the United States. While the fast casual segment of the restaurant industry has grown faster than the restaurant industry as a whole in recent years, there can be no guarantee that this trend will continue. | ||

We believe we are the only national fast casual restaurant concept offering a menu with a wide variety of noodle and pasta dishes, soups, salads and sandwiches inspired by global flavors. We believe our attributes-global flavors, variety and fast service-allow us to compete against multiple segments throughout the restaurant industry and provide us a larger addressable market for lunch and dinner than competitors who focus on a single cuisine. We believe we provide a pleasant dining experience by quickly delivering fresh food with friendly service at a price point we believe is attractive to our customers. You do not have to jostle your gear or carry trays of food to or from your table. Grab a drink, have a seat and we will deliver your food to your table-all without the need to tip. | ||

Our Strengths | ||

We believe the following strengths set us apart from our competitors: | ||

Variety Makes Togetherness Possible | ||

We have purposefully chosen a range of healthy to indulgent dishes to satisfy carnivores and vegetarians. Our menu encourages customers to customize their meals to meet their tastes and nutritional preferences with our selection of 14 fresh vegetables and six proteins-beef, pork, chicken, meatballs, shrimp and organic tofu. We believe our variety ensures that even the pickiest of eaters can find something to crave, which eliminates the “veto vote” and encourages people with different tastes to enjoy a meal together. | ||

All of our dishes are cooked-to-order with fresh, high quality ingredients sourced from our carefully selected suppliers. Our commitment to the freshness of our ingredients is further demonstrated by our use of seasonal ingredients and healthy add-in options, such as organic tofu, and by the daily freshness inspection of our ingredients. Our culinary team strives to develop new dishes and limited time offers ("LTOs") to further reinforce our Your World Kitchen positioning and regularly provide our guests additional options. For example, we recently introduced a Winter World Tour menu featuring three new dishes from different parts of the world: Thai Hot Pot soup, Adobo Flatbread, with flavors from Latin America, and Alfredo MontAmore. This focus on culinary innovation, combined with our commitment to classic cooking methods, allows us to prepare and serve high quality food. | ||

Value That Is Greater Than Our Competitive Price Point | ||

The value we offer, the quality of our food and the warmth of our restaurants create an overall customer experience that we believe is second-to-none. Our per person spend of approximately $8.00 for the twelve months ended October 1, 2013 is competitive not only within the fast casual segment, but also within the quick-service segment. We believe the speed of our service and the quality of our food contributes to a value proposition that enables us to take market share from casual dining restaurants. We deliver value by combining a family-friendly dining environment with the opportunity to enjoy many dishes containing ingredients like our award-winning slow-braised, naturally raised pork. | ||

2

Everything Is a Little Nicer Here | ||||||

We design each location individually, which we believe creates an inviting restaurant environment. We believe the ambience is warm and welcoming, with muted lighting and colors, comfortable seating and our own custom music mix, which is intended to make our customers feel relaxed and at home. | ||||||

We design each location individually, which we believe creates an inviting restaurant environment. We believe the ambience is warm and welcoming, with muted lighting and colors, comfortable seating and our own custom music mix, which is intended to make our customers feel relaxed and at home. | ||||||

Consistent with our culture of enhanced customer-service, we seek to hire individuals who will deliver prompt, attentive service by engaging customers the moment they enter our restaurants. Our training philosophy empowers both our restaurant managers and team members to add a personal touch when serving our customers, such as coming out from behind the counter to explain our menu and guide customers to the right dish. Our restaurant managers are critical to our success, as we believe that their entrepreneurial spirit and outreach efforts build our brand in our communities. | ||||||

After our customers order at the counter, their food is served on china by our friendly team members. To further enhance our customers’ dining experience, we check on them throughout their meal. We offer them drink refills, a glass of wine or dessert, so they do not have to leave their seats. | ||||||

Desirable and Loyal Consumer Base | ||||||

A report that we commissioned based on customer data and surveys estimates that approximately 40% of our customers visit our restaurants at least once each month. Our customers skew slightly younger and more affluent than the general population, and according to a recent Gallup survey, this demographic spends more on dining than others. We believe the variety of our food and our ability to accommodate a customer’s desire to eat quickly or to enjoy a longer meal enable us to draw sales almost equally between lunch and dinner. Our broad appeal and customer loyalty have led to industry and media recognition: | ||||||

l | Nation’s Restaurant News, MenuMasters Award, 2013, Golden Chain Winner, 2010, awarded on the basis of the impact of menu items on the restaurant industry. | |||||

l | The International Foodservice Manufacturers Association, COEX Innovator Award, 2013, awarded annually to a national chain shaping the restaurant industry through innovation. | |||||

l | DigitalCoco, Top 10 “Most Loved” food and beverage brands in social media, 2012, awarded on the basis of positive comments made by customers on social media. | |||||

l | Restaurant Social Media Index, Top Social Media Brands and Top Social Consumer Sentiment, 2012, awarded on the basis of comments made by customers on social media. | |||||

l | Parents Magazine, Parents Top 10 Family-Friendly Restaurant Chains, 2011 and 2009, awarded on the basis of the healthfulness and quality of ingredients of menu items. | |||||

l | Health Magazine, America’s Top 10 Healthiest Fast Food Restaurants, 2009, America’s Healthiest Restaurants, 2008, awarded on the basis of healthfulness of dishes and use of organic produce, among other factors. | |||||

Consistent Restaurant Economics and a Flexible Footprint | ||||||

Our restaurant model generates strong cash flow, consistent restaurant-level financial results and a high return on investments we make in restaurant development. Our restaurants have been successful in diverse geographic regions, with a broad range of population densities and real estate settings. We believe we are an attractive tenant to the owners and developers of a wide variety of real estate development types, which allows us to be highly selective in our evaluation of potential new sites. Our disciplined approach to site selection is grounded in an analytical data-driven model with strict criteria including population density, demographics and traffic generators. We take pride in selecting sites where we can design and construct a comfortable, warm environment for our customers. | ||||||

3

Experienced Leadership | ||||||

Our strategic vision and culture have been developed and nurtured by our senior management team under the stewardship of our Chairman and Chief Executive Officer, Kevin Reddy, and our President and Chief Operating Officer, Keith Kinsey. Kevin and Keith joined Noodles in 2005 after working at McDonald’s and, more recently, Chipotle. At Chipotle, they were instrumental in growing the concept from a small number of restaurants to more than 400 across the country between 2000 and 2005 with the financial backing of McDonald’s. They delivered a similar growth trajectory when they joined Noodles eight years ago, increasing the restaurant base from 100 to 327 between 2005 and 2012, a CAGR of 16.0%. Kevin and Keith have assembled a talented senior management team with restaurant experience across a broad range of disciplines. We believe our management team is integral to our success and has positioned us well for long-term growth. | ||||||

Steady, Reliable Financial Performance | ||||||

Our globally inspired flavors and differentiated dining experience have resonated with our customers and have resulted in our track record of building profitable restaurants. We achieved our sales growth through a combination of new restaurant openings and comparable restaurant sales increases. Our approach has resulted in stable gross margins despite minimal price increases and allows us to stay true to our principle of quality food at a price we believe is attractive to our customers. By design, our selection of dishes is comprised of a diverse collection of ingredients, mitigating exposure to commodity price inflation. | ||||||

A Clear Path Forward | ||||||

We believe we have significant growth potential because of our brand positioning, strong unit economics, financial results and broad customer appeal. We believe there are significant opportunities to expand our business, strengthen our competitive position and enhance our brand through the continued implementation of the following strategies: | ||||||

Continuing to Grow Our Restaurant Base | ||||||

We have more than doubled our restaurant base in the last six years to 372 locations in 29 states and the District of Columbia, as of November 15, 2013, including the 35 company-owned restaurants and 10 franchise restaurants opened in 2013. In 2012, we opened 39 company-owned restaurants and six franchise restaurants. In 2013, we have or plan to open between 41 and 42 company-owned restaurants and 10 franchise restaurants. For 2014, we anticipate increasing our company owned restaurant count by 13-15% and our franchise restaurant count by 15-20%. | ||||||

Although we expect the majority of our expansion to continue to be from company-owned restaurants, we are strategically expanding our base of franchise restaurants. Our franchise program is a low cost and high return model that allows us to expand our footprint and build brand awareness in markets that we do not plan to enter in the short to medium term. As of November 15, 2013, we have 61 franchise units in 13 states operated by 10 franchisees. Our franchise partners have opened 10 new restaurants in 2013. | ||||||

Improving Our Performance | ||||||

Our system-wide comparable restaurant sales growth for the first three quarters of 2013 was 2.7%. We plan to build on our growth performance by increasing brand awareness, customer frequency, new customer visits, per person spend and sales outside our restaurants. The following is our plan to achieve these goals: | ||||||

l | Heighten brand awareness. We believe that our food is our best currency and that once people try it they become loyal and repeat customers; however, before customers can try our food, they need to know about us. We differentiate Noodles & Company through an innovative, community-based marketing strategy at the corporate and restaurant level to build brand awareness and customer loyalty. Our restaurant managers engage in local relationship marketing where they approach nearby businesses, groups and individuals for appreciation days, tastings and hero lunches to introduce our neighbors to our food. We also communicate directly to the 833,000 members in our Noodlegram club and use our other social media outlets to promote brand awareness. | |||||

l | Increase existing customer frequency. In the past twelve months we refreshed the interior signage in all of our restaurants to encourage menu exploration, which we believe will increase customer frequency. Our new Welcome Wall menu board, placed at the entrance of each of our company-owned restaurants, shows pictures of our dishes in an easily understandable layout so customers can fully grasp our world of flavors without feeling overwhelmed. We believe this merchandising enables our customers to peruse our offerings without feeling the pressure of holding up a line of hungry people. This new merchandising has already resulted in meaningful improvements to AUVs in the restaurants where it has been implemented, and we expect similar results in the rest of our restaurant base. | |||||

4

l | Increase new customer visits. We would like to be top-of-mind for customers whenever they need to eat, drink or simply find a place where they feel welcome. Although we serve our food quickly, we would like customers to view our restaurants as places to dine and enjoy the company of friends and family. To further drive customer visits at dinner, we have recently enhanced our beer and wine offerings and expanded our appetizer selection. | |||||

l | Improve our per person spend. While we have generally implemented modest price increases to offset rising costs, we also strive to increase the per person spend by offering additional items, including our expanded beverage selection and appetizers. Our menu development team periodically creates LTOs, which we believe are innovative and sometimes become permanent menu items, such as our Spinach & Fresh Fruit Salad. This strategy allows us to offer our customers greater variety and entices them to “opt-up” to a premium menu offering. | |||||

l | Grow sales outside of our restaurants. We are taking steps to sell more food outside our restaurants. We currently offer our larger Square Bowls to families and local business, and we believe the convenience and price point of these offerings will drive take-out sales. In addition, we believe our commitment to freshly prepared food and variety provides us with an opportunity to expand catering sales. | |||||

Our Equity Sponsors | ||||||

Catterton Partners (“Catterton”) is one of the largest consumer focused private equity firms in the United States, with over $4.0 billion of equity capital under active management. Catterton’s investment professionals bring complementary strategic and operating experience to their portfolio companies and support management teams in accelerating the value creation process after investment. Catterton invests in all major consumer segments, including food and beverage, retail and restaurants, consumer products and services, and media and marketing services. As of October 1, 2013, Catterton and its affiliates owned approximately 35.7% of our outstanding equity interests and will own approximately % of our outstanding equity interests immediately following the closing of this offering. | ||||||

Argentia Private Investments Inc. (“Argentia”) is a wholly owned subsidiary of the Public Sector Pension Investment Board (“PSPIB”), a Canadian Crown corporation established to invest the amounts transferred by the Canadian government equal to the proceeds of the net contributions since April 1, 2000, for the pension plans of the Public Service, the Canadian Forces and the Royal Canadian Mounted Police, and since March 1, 2007, for the Reserve Force Pension Plan. PSPIB is one of Canada’s largest pension investment managers, with $76.1 billion of assets under management at March 31, 2013. Their skilled and dedicated team of approximately 450 employees manages a diversified global portfolio including stocks, bonds and other fixed-income securities, and investments in private equity, real estate, infrastructure and renewable resources. Immediately prior to this offering, Argentia owned approximately 35.3% of our outstanding equity interests and will own approximately % of our outstanding equity interests immediately following the consummation of this offering. See “Certain Relationships and Related Transactions.” | ||||||

Corporate Information | ||||||

We were incorporated in 2002 in Delaware and merged with The Noodles Shop Co., Inc., a Colorado corporation, in 2003. In June of 2013, we became a public company. We opened the first Noodles & Company in 1995 in Denver, Colorado. In December 2010, Catterton, certain of its affiliated entities and Argentia collectively became our majority stockholders (the “2010 Equity Recapitalization”) and, as of October 1, 2013, own approximately 71% of our outstanding equity interests. Our central support office is located at 520 Zang Street, Suite D, Broomfield, Colorado 80021, and our telephone number is (720) 214-1900. Our website is www.noodles.com. The information on, or that can be accessed through, our website is not part of this prospectus. | ||||||

5

Risks Associated with Our Business | ||||||

Investing in our common stock involves significant risks. You should carefully consider the risks described in “Risk Factors” before making a decision to invest in our common stock. If any of these risks actually occur, our business, financial condition or results of operations would likely be materially adversely affected. In such case, the trading price of our common stock would likely decline, and you may lose all or part of your investment. Below is a summary of some of the principal risks we face. | ||||||

l | We may not be able to successfully implement our growth strategy if we are unable to identify appropriate sites for restaurant locations, obtain favorable lease terms, attract customers to our restaurants or hire and retain personnel. | |||||

l | We may not be able to maintain or improve levels of our comparable restaurant sales. | |||||

l | The restaurant industry is a highly competitive industry with many well-established competitors. | |||||

l | We may be unable to protect our brand name, trademarks and other intellectual property rights. | |||||

l | We may be unable to protect our brand name, trademarks and other intellectual property rights. | |||||

l | Minimum wage increases and mandated employee benefits could cause a significant increase in our labor costs. | |||||

l | We may face negative publicity or damage to our reputation, which could arise from concerns regarding food safety and foodborne illness or other matters. | |||||

l | We may fail to secure customers’ confidential or credit card information or other private data relating to our employees or us. | |||||

6

THE OFFERING | |||||||||

Class A common stock offered by Noodles & Company | shares | ||||||||

Class A common stock offered by the selling stockholders | shares | ||||||||

Total shares of Class A common stock offered | shares | ||||||||

Class A common stock outstanding after this offering (assuming no exercise of the underwriters’ over-allotment option) | shares | ||||||||

Class B common stock outstanding after this offering(1) | shares | ||||||||

Over-allotment option | shares | ||||||||

Use of proceeds | We intend to use the net proceeds from this offering to repurchase shares of Class A common stock from . See “Use of Proceeds.” | ||||||||

Risk Factors | See “Risk Factors” for a discussion of factors that you should consider carefully before deciding whether to purchase shares of our Class A common stock. | ||||||||

Nasdaq Global Select Market Symbol | NDLS | ||||||||

We expect to enter into an agreement with , to repurchase $ million worth of common stock, or approximately shares (estimated based on the closing price of our common stock on November , 2013), directly from in a private, non-underwritten transaction at a price per share equal to the net proceeds per share the selling stockholders receive in this offering | |||||||||

The number of shares beneficially owned after the offering does not reflect shares we expect to repurchase from the upon the completion of this offering. After the offering and after giving effect to our repurchase of shares of our common stock from , there will be shares outstanding. | |||||||||

Except as otherwise indicated, all information in this prospectus: | |||||||||

l | excludes (i) 3,472,437 shares of our common stock issuable upon the exercise of stock options outstanding as of October 1, 2013 and (ii) 3,262,482 shares of our common stock reserved for future grants under our stock incentive plan and 735,673 shares reserved for future purchase under our employee stock purchase plan; | ||||||||

l | assumes no exercise of the warrant to purchase up to 57,700 shares of our Class B common stock held by Fahrenheit 212, LLC, and no change to the 6,315,929 shares of Class B common stock outstanding as of October 1, 2013; and | ||||||||

l | assumes no exercise by the underwriters of their option to purchase up to additional shares from the selling stockholders. | ||||||||

______________________________ | |||||||||

(1) | The rights of the holders of Class A common stock and Class B common stock are identical, except that our Class B common stock does not vote on the election or removal of directors unless converted on a share-for-share basis into Class A common stock | ||||||||

7

SUMMARY CONSOLIDATED FINANCIAL DATA | ||||||||||||||||||||||

The following table summarizes our consolidated historical financial and operating data. The statements of income data for the fiscal years ended January 1, 2013, January 3, 2012 and December 28, 2010 and the balance sheet data as of January 1, 2013 and January 3, 2012, have been derived from our audited consolidated financial statements included elsewhere in this prospectus and the balance sheet data as of December 28, 2010 have been derived from our audited consolidated financial statements not included in this prospectus. The statements of income data for the three quarters ended October 1, 2013 and October 2, 2012 and the balance sheet data as of October 1, 2013 have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The balance sheet data as of October 2, 2012 have been derived from our unaudited consolidated financial statements not included in this prospectus. The reclassification of restaurant-level marketing costs, as discussed in the accompanying notes to our unaudited consolidated financial statements, is reflected in all periods presented in this prospectus. The financial data presented includes all normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations for such periods. | ||||||||||||||||||||||

The historical results presented below are not necessarily indicative of the results to be expected for any future period. This information should be read in conjunction with “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes included elsewhere in this prospectus. | ||||||||||||||||||||||

We operate on a 52 or 53 week fiscal year ending on the Tuesday closest to December 31. Fiscal years 2012 and 2010, which ended on January 1, 2013 and December 28, 2010, respectively, each contained 52 weeks. Fiscal year 2011, which ended on January 3, 2012, contained 53 weeks. We refer to our fiscal years as 2012, 2011 and 2010. Our fiscal quarters each contain thirteen weeks, with the exception of the fourth quarter of a 53 week fiscal year, which contains fourteen weeks. | ||||||||||||||||||||||

Fiscal Year Ended | Three Fiscal Quarters Ended | |||||||||||||||||||||

January 1, 2013 | January 3, 2012 | December 28, 2010 | October 1, 2013 (unaudited) | October 2, 2012 (unaudited) | ||||||||||||||||||

(in thousands, except share and per share data) | ||||||||||||||||||||||

Statements of Income Data: | ||||||||||||||||||||||

Revenue: | ||||||||||||||||||||||

Restaurant revenue | $ | 297,264 | $ | 253,467 | $ | 218,560 | $ | 256,744 | $ | 220,261 | ||||||||||||

Franchising royalties and fees | 3,146 | 2,599 | 2,272 | 2,711 | 2,220 | |||||||||||||||||

Total revenue | 300,410 | 256,066 | 220,832 | 259,455 | 222,481 | |||||||||||||||||

Costs and Expenses: | ||||||||||||||||||||||

Restaurant Operating Costs (exclusive of depreciation and amortization shown separately below): | ||||||||||||||||||||||

Cost of sales | 78,997 | 66,419 | 56,869 | 67,524 | 58,423 | |||||||||||||||||

Labor | 89,435 | 75,472 | 64,942 | 77,464 | 66,002 | |||||||||||||||||

Occupancy | 29,323 | 25,208 | 21,650 | 25,824 | 21,669 | |||||||||||||||||

Other restaurant operating costs(1) | 36,380 | 32,031 | 27,403 | 32,962 | 27,449 | |||||||||||||||||

General and administrative(1)(2) | 29,081 | 26,463 | 27,302 | 27,808 | 21,426 | |||||||||||||||||

Depreciation and amortization | 16,719 | 14,501 | 13,932 | 15,074 | 12,165 | |||||||||||||||||

Pre-opening | 3,145 | 2,327 | 2,088 | 2,873 | 2,000 | |||||||||||||||||

Asset disposals, closure costs and restaurant impairments | 1,278 | 1,629 | 2,815 | 837 | 663 | |||||||||||||||||

Total costs and expenses | 284,358 | 244,050 | 217,001 | 250,366 | 209,797 | |||||||||||||||||

Income from operations | 16,052 | 12,016 | 3,831 | 9,089 | 12,684 | |||||||||||||||||

Debt extinguishment expense | 2,646 | 275 | — | — | 2,646 | |||||||||||||||||

Interest expense | 5,028 | 6,132 | 1,819 | 2,199 | 3,894 | |||||||||||||||||

Income before income taxes | 8,378 | 5,609 | 2,012 | 6,890 | 6,144 | |||||||||||||||||

Provision (benefit) for income taxes | 3,215 | 1,780 | (366 | ) | 2,633 | 2,540 | ||||||||||||||||

Net income | $ | 5,163 | $ | 3,829 | $ | 2,378 | $ | 4,257 | $ | 3,604 | ||||||||||||

8

Fiscal Year Ended | Three Fiscal Quarters Ended | ||||||||||||||||||||||

January 1, 2013 | January 3, 2012 | December 28, 2010 | October 1, 2013 (unaudited) | October 2, 2012 (unaudited) | |||||||||||||||||||

(in thousands, except share and per share data) | |||||||||||||||||||||||

Earnings per Class A and Class B common share, combined: | |||||||||||||||||||||||

Basic | $ | 0.22 | $ | 0.16 | $ | 0.10 | $ | 0.17 | $ | 0.16 | |||||||||||||

Diluted | $ | 0.22 | $ | 0.16 | $ | 0.09 | $ | 0.16 | $ | 0.16 | |||||||||||||

Weighted average Class A and Class B common shares outstanding, combined: | |||||||||||||||||||||||

Basic | 23,238,984 | 23,237,698 | 24,386,059 | 25,382,805 | 23,238,984 | ||||||||||||||||||

Diluted | 23,265,542 | 23,237,698 | 25,226,989 | 26,528,004 | 23,250,745 | ||||||||||||||||||

Selected Operating Data: | |||||||||||||||||||||||

Company-owned restaurants at end of period | 276 | 239 | 212 | 310 | 261 | ||||||||||||||||||

Franchise-owned restaurants at end of period | 51 | 45 | 43 | 58 | 48 | ||||||||||||||||||

Company-owned: | |||||||||||||||||||||||

Average unit volumes(3) | $ | 1,178 | $ | 1,147 | $ | 1,126 | $ | 1,181 | $ | 1,174 | |||||||||||||

Comparable restaurant sales(4) | 5.2 | % | 4.2 | % | 3.2 | % | 3.1 | % | 5.6 | % | |||||||||||||

Restaurant contribution(5) | $ | 63,129 | $ | 54,337 | $ | 47,697 | $ | 52,970 | $ | 46,718 | |||||||||||||

as a percentage of restaurant revenue | 21.2 | % | 21.4 | % | 21.8 | % | 20.6 | % | 21.2 | % | |||||||||||||

EBITDA(6) | $ | 30,125 | $ | 26,242 | $ | 17,763 | $ | 24,163 | $ | 22,203 | |||||||||||||

Adjusted EBITDA(6) | $ | 36,283 | $ | 30,488 | $ | 26,472 | $ | 32,040 | $ | 27,183 | |||||||||||||

as a percentage of revenue | 12.1 | % | 11.9 | % | 12.0 | % | 12.3 | % | 12.2 | % | |||||||||||||

As of | |||||||||||||||||||||||

January 1, 2013 | January 3, 2012 | December 28, 2010 | October 1, 2013 (unaudited) | October 2, 2012 (unaudited) | |||||||||||||||||||

(in thousands) | |||||||||||||||||||||||

Balance Sheet Data(7): | |||||||||||||||||||||||

Total current assets | $ | 16,154 | $ | 12,879 | $ | 214,498 | $ | 18,512 | $ | 12,904 | |||||||||||||

Total assets | 156,995 | 126,325 | 311,148 | 181,810 | 144,002 | ||||||||||||||||||

Total current liabilities | 23,760 | 20,557 | 213,664 | 27,562 | 25,009 | ||||||||||||||||||

Total long-term debt | 93,731 | 77,523 | 77,030 | 1,714 | 83,557 | ||||||||||||||||||

Total liabilities | 142,987 | 118,802 | 309,070 | 59,298 | 131,922 | ||||||||||||||||||

Temporary equity | 3,601 | 2,572 | 2,572 | — | — | ||||||||||||||||||

Total stockholders' equity | 10,407 | 4,951 | (494 | ) | 122,512 | 12,080 | |||||||||||||||||

______________________________ | |||||||||||||||||||||||

(1) | In the third quarter of 2013 we changed the manner in which we report marketing expenses between general and administrative expenses and other restaurant operating costs to more appropriately reflect only those costs directly related to restaurant-level marketing in other restaurant operating costs. Marketing costs previously reported as restaurant operating costs, that were not directly related to restaurant-level marketing, have been reclassified to general and administrative expense in our consolidated financial statements in all periods presented. In 2012, 2011 and 2010 and in the first two quarters of 2013 and the first two quarters of 2012, $2.9 million, $2.6 million and $2.4 million and $1.0 million and $1.3 million, respectively, have been reclassified from restaurant operating costs to general and administrative expense. The change has no impact on income from operations. | ||||||||||||||||||||||

(2) | 2010 included $3.7 million of non-cash stock-based compensation expense and $0.3 million of expense for our portion of payroll taxes related to the 2010 Equity Recapitalization. See Note 2 of our consolidated financial statements, Equity Recapitalization. 2012 and 2011 each included $1.0 million of management fee expense and the first three quarters of 2013 and 2012 included $500,000 and $750,000, respectively, of management fee expense, in accordance with our management services agreement and through the Class C common stock dividend paid to the holder of the one outstanding share of our Class C common stock. In connection with our IPO, the management services agreement expired and the one share of Class C common stock was redeemed. In the second quarter of 2013, we incurred $ 5.7 million of IPO related expenses: $ 2.0 million of stock-based compensation related to accelerated vesting of outstanding stock options, $ 1.2 million of stock-based compensation related to stock options granted to our Chief Executive Officer and President and Chief Operating Officer of which 50% were vested at grant, $ 1.7 million of transaction bonuses and related payroll taxes and $ 0.8 million in transaction payments to our Equity Sponsors. | ||||||||||||||||||||||

(3) | AUVs consist of average annualized sales of all company-owned restaurants over the trailing 12 periods in a typical operating year. | ||||||||||||||||||||||

(4) | Comparable restaurant sales represent year-over-year sales for restaurants open for at least 18 full periods. | ||||||||||||||||||||||

(5) | Restaurant contribution represents restaurant revenue less restaurant operating costs which are cost of sales, labor, occupancy and other restaurant operating costs. | ||||||||||||||||||||||

9

(6) | EBITDA and adjusted EBITDA are supplemental measures of operating performance that do not represent and should not be considered as alternatives to net income or cash flow from operations, as determined by U.S. generally accepted accounting principals (“US GAAP”), and our calculation thereof may not be comparable to that reported by other companies. These measures are presented because we believe that investors’ understanding of our performance is enhanced by including these non-GAAP financial measures as a reasonable basis for evaluating our ongoing results of operations. | |||||||||||||||||||||||

EBITDA is calculated as net income before interest expense, provision (benefit) for income taxes and depreciation and amortization. Adjusted EBITDA further adjusts EBITDA to reflect the additions and eliminations described in the table below. | ||||||||||||||||||||||||

EBITDA and adjusted EBITDA are presented because: (i) we believe they are useful measures for investors to assess the operating performance of our business without the effect of non-cash charges such as depreciation and amortization expenses and asset disposals, closure costs and restaurant impairments and (ii) we use adjusted EBITDA internally as a benchmark for certain of our cash incentive plans and to evaluate our operating performance or compare our performance to that of our competitors. The use of adjusted EBITDA as a performance measure permits a comparative assessment of our operating performance relative to our performance based on our US GAAP results, while isolating the effects of some items that vary from period to period without any correlation to core operating performance or that vary widely among similar companies. Companies within our industry exhibit significant variations with respect to capital structures and cost of capital (which affect interest expense and income tax rates) and differences in book depreciation of property, plant and equipment (which affect relative depreciation expense), including significant differences in the depreciable lives of similar assets among various companies. Our management believes that adjusted EBITDA facilitates company-to-company comparisons within our industry by eliminating some of these foregoing variations. Adjusted EBITDA as presented may not be comparable to other similarly-titled measures of other companies, and our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by excluded or unusual items. | ||||||||||||||||||||||||

Because of these limitations, EBITDA and adjusted EBITDA should not be considered in isolation or as a substitute for performance measures calculated in accordance with US GAAP. We compensated for these limitations by relying primarily on our US GAAP results and using EBITDA and adjusted EBITDA only supplementally. Our management recognizes that EBITDA and adjusted EBITDA have limitations as analytical financial measures, including the following: | ||||||||||||||||||||||||

l | EBITDA and adjusted EBITDA do not reflect our capital expenditures or future requirements for capital expenditures; | |||||||||||||||||||||||

l | EBITDA and adjusted EBITDA do not reflect interest expense or the cash requirements necessary to service interest or principal payments, associated with our indebtedness; | |||||||||||||||||||||||

l | EBITDA and adjusted EBITDA do not reflect depreciation and amortization, which are non-cash charges, although the assets being depreciated and amortized will likely have to be replaced in the future, and do not reflect cash requirements for such replacements; | |||||||||||||||||||||||

l | Adjusted EBITDA does not reflect the cost of stock-based compensation; and | |||||||||||||||||||||||

l | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs. | |||||||||||||||||||||||

The following tables present a reconciliation of net income to EBITDA and adjusted EBITDA: | ||||||||||||||||||||||||

Fiscal Year Ended | Three Fiscal Quarters Ended | |||||||||||||||||||||||

January 1, 2013 | January 3, 2012 | December 28, 2010 | October 1, 2013 (unaudited) | October 2, 2012 (unaudited) | ||||||||||||||||||||

(in thousands) | ||||||||||||||||||||||||

Net income, as reported | $ | 5,163 | $ | 3,829 | $ | 2,378 | $ | 4,257 | $ | 3,604 | ||||||||||||||

Depreciation and amortization | 16,719 | 14,501 | 13,932 | 15,074 | 12,165 | |||||||||||||||||||

Interest expense | 5,028 | 6,132 | 1,819 | 2,199 | 3,894 | |||||||||||||||||||

Provision (benefit) for income taxes | 3,215 | 1,780 | (366 | ) | 2,633 | 2,540 | ||||||||||||||||||

EBITDA | $ | 30,125 | $ | 26,242 | $ | 17,763 | $ | 24,163 | $ | 22,203 | ||||||||||||||

Debt extinguishment expense | 2,646 | 275 | — | — | 2,646 | |||||||||||||||||||

Asset disposals, closure costs and restaurant impairment | 1,278 | 1,629 | 2,815 | 837 | 663 | |||||||||||||||||||

Management fees(a) | 1,000 | 1,014 | — | 500 | 750 | |||||||||||||||||||

Stock-based compensation expense(b) | 1,234 | 1,328 | 5,894 | 873 | 921 | |||||||||||||||||||

IPO related expenses(c) | 5,667 | — | ||||||||||||||||||||||

Adjusted EBITDA | $ | 36,283 | $ | 30,488 | $ | 26,472 | $ | 32,040 | $ | 27,183 | ||||||||||||||

______________________________ | ||||||||||||||||||||||||

(a) | Fiscal years 2012 and 2011 each included $1.0 million of management fee expense and the first three quarters of 2013 and 2012 included $500,000 and $750,000 of management fee expense, in accordance with our management services agreement and through the Class C common stock dividend paid to the holder of the one outstanding share of our Class C common stock. In connection with our IPO, the management services agreement expired and the one share of Class C common stock was redeemed. | |||||||||||||||||||||||

(b) | 2010 included $3.7 million of non-cash stock-based compensation expense and $0.3 million of expense for our portion of payroll taxes related to the 2010 Equity Recapitalization. See Note 2 of our consolidated financial statements, Equity Recapitalization. | |||||||||||||||||||||||

(c) | Reflects certain expenses incurred in conjunction with the closing of our initial public offering. Amount includes $2.0 million of stock-based compensation related to accelerated vesting of outstanding stock options, $1.2 million of stock-based compensation related to stock options granted to our Chief Executive Officer and President and Chief Operations Officer of which 50% were vested at grant, $1.7 million of transaction bonuses and related payroll tax and $0.8 million in transaction payments to our Equity Sponsors. | |||||||||||||||||||||||

(7) | As of December 28, 2010, the consolidated balance sheet included $189.4 million in restricted cash and current liabilities that were temporarily held due to timing of the 2010 Equity Recapitalization. See Note 2 of our consolidated financial statements, Equity Recapitalization. | |||||||||||||||||||||||

10

RISK FACTORS

An investment in our Class A common stock, which we refer to in this prospectus as our "common stock," involves a high degree of risk. You should carefully consider the risks and uncertainties described below before deciding whether to purchase shares of our common stock. In assessing these risks, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and related notes. If any of the risks described below actually occur, our business, financial conditions or results of operations could be materially adversely affected. In any such case, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business and Industry

Our sales growth rate depends primarily on our ability to open new restaurants and is subject to many unpredictable factors.

One of the key means of achieving our growth strategy will be through opening new restaurants and operating those restaurants on a profitable basis. We expect this to be the case for the foreseeable future. In 2013, we have or plan to open between 41 and 42 company-owned restaurants and 10 franchise restaurants, including the 35 company-owned restaurants and 10 franchise restaurants already opened as of November 15, 2013. We may not be able to open new restaurants as quickly as planned. In the past, we have experienced delays in opening some restaurants and that could happen again. Delays or failures in opening new restaurants could materially and adversely affect our growth strategy and our expected results. As we operate more restaurants, our rate of expansion relative to the size of our restaurant base will eventually decline.

In addition, one of our biggest challenges is locating and securing an adequate supply of suitable new restaurant sites in our target markets. Competition for those sites is intense, and other restaurant and retail concepts that compete for those sites may have unit economic models that permit them to bid more aggressively for those sites than we can. There is no guarantee that a sufficient number of suitable sites will be available in desirable areas or on terms that are acceptable to us in order to achieve our growth plan. Our ability to open new restaurants also depends on other factors, including:

• | negotiating leases with acceptable terms; |

• | identifying, hiring and training qualified employees in each local market; |

• | managing construction and development costs of new restaurants, particularly in competitive markets; |

• | obtaining construction materials and labor at acceptable costs, particularly in urban markets; |

• | securing required governmental approvals and permits (including construction and other permits) in a timely manner and responding effectively to any changes in local, state or federal laws and regulations that adversely affect our costs or ability to open new restaurants; and |

• | avoiding the impact of inclement weather, natural disasters and other calamities. |

Our progress in opening new restaurants from quarter to quarter may occur at an uneven rate. If we do not open new restaurants in the future according to our current plans, the delay could materially adversely affect our business, financial condition or results of operations.

Our long-term success is highly dependent on our ability to effectively identify and secure appropriate sites for new restaurants.

We intend to develop new restaurants in our existing markets, expand our footprint into adjacent markets and selectively enter into new markets. In order to build new restaurants, we must first identify target markets where we can enter or expand our footprint, taking into account numerous factors, including the location of our current restaurants, local economic trends, population density, area demographics and geography. Then we must locate and secure appropriate sites, which is one of our biggest challenges. There are numerous factors involved in identifying and securing an appropriate site, including

• | identification and availability of locations with the appropriate size, traffic patterns, local retail and business attractions and infrastructure that will drive high levels of customer traffic and sales per unit; |

• | competition in new markets, including competition for restaurant sites; |

11

• | financial conditions affecting developers and potential landlords, such as the effects of macro-economic conditions and the credit market, which could lead to these parties delaying or canceling development projects (or renovations of existing projects), in turn reducing the number of appropriate locations available; |

• | developers and potential landlords obtaining licenses or permits for development projects on a timely basis; |

• | proximity of potential development sites to an existing location; |

• | anticipated commercial, residential and infrastructure development near our new restaurants; and |

• | availability of acceptable lease arrangements. |

We may not be able to successfully develop critical market presence for our brand in new geographical markets, as we may be unable to find and secure attractive locations, build name recognition or attract new customers. If we are unable to fully implement our development plan, our business, financial condition or results of operations could be materially adversely affected.

Our expansion into new markets may present increased risks.

We plan to open restaurants in markets where we have little or no operating experience. Restaurants we open in new markets may take longer to reach expected sales and profit levels on a consistent basis and may have higher construction, occupancy or operating costs than restaurants we open in existing markets, thereby affecting our overall profitability. New markets may have competitive conditions, consumer tastes and discretionary spending patterns that are more difficult to predict or satisfy than our existing markets. We may need to make greater investments than we originally planned in advertising and promotional activity in new markets to build brand awareness. We may find it more difficult in new markets to hire, motivate and keep qualified employees who share our vision, passion and business culture. We may also incur higher costs from entering new markets, if, for example, we assign area managers to manage comparatively fewer restaurants than we assign in more developed markets. As a result, these new restaurants may be less successful or may achieve target AUVs at a slower rate. If we do not successfully execute our plans to enter new markets, our business, financial condition or results of operations could be materially adversely affected.

New restaurants, once opened, may not be profitable, and the increases in average restaurant sales and comparable restaurant sales that we have experienced in the past may not be indicative of future results.

Our new restaurants typically open with above average volumes, which then decline after the initial sales surge that comes with interest in a restaurant’s grand opening. Recent openings have stabilized in sales after approximately 32 to 36 weeks of operation, at which time the restaurant’s sales typically begin to grow on a consistent basis. In new markets, the length of time before average sales for new restaurants stabilize is less predictable and can be longer as a result of our limited knowledge of these markets and consumers’ limited awareness of our brand. New restaurants may not be profitable and their sales performance may not follow historical patterns. In addition, our average restaurant sales and comparable restaurant sales may not increase at the rates achieved over the past several years. Our ability to operate new restaurants profitably and increase average restaurant sales and comparable restaurant sales will depend on many factors, some of which are beyond our control, including

• | consumer awareness and understanding of our brand; |

• | general economic conditions, which can affect restaurant traffic, local labor costs and prices we pay for the food products and other supplies we use; |

• | changes in consumer preferences and discretionary spending; |

• | competition, either from our competitors in the restaurant industry or our own restaurants; |

• | temporary and permanent site characteristics of new restaurants; and |

• | changes in government regulation. |

If our new restaurants do not perform as planned, our business and future prospects could be harmed. In addition, if we are unable to achieve our expected average restaurant sales, our business, financial condition or results of operations could be adversely affected.

12

Our sales and profit growth could be adversely affected if comparable restaurant sales are less than we expect.

The level of comparable restaurant sales, which represent the change in year-over-year sales for restaurants open for at least 18 full periods, will affect our sales growth and will continue to be a critical factor affecting profit growth because the profit margin on comparable restaurant sales is generally higher than the profit margin on new restaurant sales. Our ability to increase comparable restaurant sales depends in part on our ability to successfully implement our initiatives to build sales. It is possible such initiatives will not be successful, that we will not achieve our target comparable restaurant sales growth or that the change in comparable restaurant sales could be negative, which may cause a decrease in sales and profit growth that would materially adversely affect our business, financial condition or results of operations. See “Management’s Discussion and Analysis of Financial Condition—Highlights and Trends.”

Our failure to manage our growth effectively could harm our business and operating results.

Our growth plan includes a significant number of new restaurants. Our existing restaurant management systems, financial and management controls and information systems may be inadequate to support our planned expansion. Managing our growth effectively will require us to continue to enhance these systems, procedures and controls and to hire, train and retain managers and team members. We may not respond quickly enough to the changing demands that our expansion will impose on our management, restaurant teams and existing infrastructure which could harm our business, financial condition or results of operations.

We believe our culture—from the restaurant level up through management-is an important contributor to our success. As we grow, however, we may have difficulty maintaining our culture or adapting it sufficiently to meet the needs of our operations. Among other important factors, our culture depends on our ability to attract, retain and motivate employees who share our enthusiasm and dedication to our concept. Our business, financial condition or results of operations could be materially adversely affected if we do not maintain our infrastructure and culture as we grow.

The planned rapid increase in the number of our restaurants may make our future results unpredictable.

In 2013, we have or plan to open between 41 and 42 company-owned restaurants and 10 franchise restaurants, and we plan to continue to increase the number of our restaurants in the next several years. This growth strategy and the substantial investment associated with the development of each new restaurant may cause our operating results to fluctuate and be unpredictable or adversely affect our profits. Our future results depend on various factors, including successful selection of new markets and restaurant locations, local market acceptance of our restaurants, consumer recognition of the quality of our food and willingness to pay our prices, the quality of our operations and general economic conditions. In addition, as has happened when other restaurant concepts have tried to expand, we may find that our concept has limited appeal in new markets or we may experience a decline in the popularity of our concept in the markets in which we operate. Newly opened restaurants or our future markets and restaurants may not be successful or our system-wide average restaurant sales may not increase at historical rates, which could materially adversely affect our business, financial condition or results of operations.

Opening new restaurants in existing markets may negatively affect sales at our existing restaurants.

The consumer target area of our restaurants varies by location, depending on a number of factors, including population density, other local retail and business attractions, area demographics and geography. As a result, the opening of a new restaurant in or near markets in which we already have restaurants could adversely affect the sales of these existing restaurants. Existing restaurants could also make it more difficult to build our consumer base for a new restaurant in the same market. Our core business strategy does not entail opening new restaurants that we believe will materially affect sales at our existing restaurants, but we may selectively open new restaurants in and around areas of existing restaurants that are operating at or near capacity to effectively serve our customers. Sales cannibalization between our restaurants may become significant in the future as we continue to expand our operations and could affect our sales growth, which could, in turn, materially adversely affect our business, financial condition or results of operations.

Competition from other restaurant companies could adversely affect us.

We face competition from the casual dining, quick-service and fast casual segments of the restaurant industry. These segments are highly competitive with respect to taste, price, food quality and presentation, service, location and the ambience and condition of each restaurant, among other things. Our competition includes a variety of locally owned restaurants and national and regional chains who offer dine-in, carry-out and delivery services. Many of our competitors have existed longer and have a more established market presence with substantially greater financial, marketing, personnel and other resources than we have. Among our competitors are a number of multi-unit, multi-market fast casual restaurant concepts, some of which are expanding

13

nationally. As we expand, we will face competition from these concepts and new competitors that strive to compete with our market segments. For example, additional competitive pressures come from the deli sections and in-store cafés of grocery store chains, as well as from convenience stores and online meal preparation sites. These competitors may have, among other things, lower operating costs, better locations, better facilities, better management, more effective marketing and more efficient operations.

Several of our competitors compete by offering menu items that are specifically identified as low in carbohydrates, gluten-free or healthier for consumers. In addition, many of our competitors emphasize lower-cost value options or meal packages or have loyalty programs, strategies we do not currently pursue. Any of these competitive factors may materially adversely affect our business, financial condition or results of operations.

Negative publicity relating to one of our restaurants, including our franchised restaurants, could reduce sales at some or all of our other restaurants.

Our success is dependent in part upon our ability to maintain and enhance the value of our brand, consumers’ connection to our brand and positive relationships with our franchisees. We may, from time to time, be faced with negative publicity relating to food quality, restaurant facilities, customer complaints or litigation alleging illness or injury, health inspection scores, integrity of our or our suppliers’ food processing, employee relationships or other matters, regardless of whether the allegations are valid or whether we are held to be responsible. The negative impact of adverse publicity relating to one restaurant may extend far beyond the restaurant or franchise involved to affect some or all of our other restaurants. The risk of negative publicity is particularly great with respect to our franchised restaurants because we are limited in the manner in which we can regulate them, especially on a real-time basis. The considerable expansion in the use of social media over recent years can further amplify any negative publicity that could be generated by such incidents. A similar risk exists with respect to unrelated food service businesses, if consumers associate those businesses with our own operations.

Additionally, employee claims against us based on, among other things, wage and hour violations, discrimination, harassment or wrongful termination may also create negative publicity that could adversely affect us and divert our financial and management resources that would otherwise be used to benefit the future performance of our operations. A significant increase in the number of these claims or an increase in the number of successful claims could materially adversely affect our business, financial condition or results of operations. Consumer demand for our products and our brand’s value could diminish significantly if any such incidents or other matters create negative publicity or otherwise erode consumer confidence in us or our products, which would likely result in lower sales and could materially adversely affect our business, financial condition or results of operations.

Governmental regulation may adversely affect our ability to open new restaurants or otherwise adversely affect our business, financial condition or results of operations.

We are subject to various federal, state and local regulations. Our restaurants are subject to state and local licensing and regulation by health, alcoholic beverage, sanitation, food and occupational safety and other agencies. We may experience material difficulties or failures in obtaining the necessary licenses, approvals or permits for our restaurants, which could delay planned restaurant openings or affect the operations at our existing restaurants. In addition, stringent and varied requirements of local regulators with respect to zoning, land use and environmental factors could delay or prevent development of new restaurants in particular locations.

We are subject to the U.S. Americans with Disabilities Act and similar state laws that give civil rights protections to individuals with disabilities in the context of employment, public accommodations and other areas, including our restaurants. We may in the future have to modify restaurants, for example, by adding access ramps or redesigning certain architectural fixtures, to provide service to or make reasonable accommodations for disabled persons. The expenses associated with these modifications could be material.

Our operations are also subject to the U.S. Occupational Safety and Health Act, which governs worker health and safety, the U.S. Fair Labor Standards Act, which governs such matters as minimum wages and overtime, and a variety of similar federal, state and local laws that govern these and other employment law matters. In addition, federal, state and local proposals related to paid sick leave or similar matters could, if implemented, materially adversely affect our business, financial condition or results of operations.

Food safety and foodborne illness concerns could have an adverse effect on our business.

We cannot guarantee that our internal controls and training will be fully effective in preventing all food safety issues at our restaurants, including any occurrences of foodborne illnesses such as salmonella, E. coli and hepatitis A. In addition, there is

14

no guarantee that our franchise locations will maintain the high levels of internal controls and training we require at our company-owned restaurants. Furthermore, we and our franchisees rely on third-party vendors, making it difficult to monitor food safety compliance and increasing the risk that foodborne illness would affect multiple locations rather than a single restaurant. Some foodborne illness incidents could be caused by third-party vendors and transporters outside of our control. New illnesses resistant to our current precautions may develop in the future, or diseases with long incubation periods could arise, that could give rise to claims or allegations on a retroactive basis. One or more instances of foodborne illness in any of our restaurants or markets or related to food products we sell could negatively affect our restaurant sales nationwide if highly publicized on national media outlets or through social media. This risk exists even if it were later determined that the illness was wrongly attributed to us or one of our restaurants. A number of other restaurant chains have experienced incidents related to foodborne illnesses that have had a material adverse effect on their operations. The occurrence of a similar incident at one or more of our restaurants, or negative publicity or public speculation about an incident, could materially adversely affect our business, financial condition or results of operations.

Compliance with environmental laws may negatively affect our business.

We are subject to federal, state and local laws and regulations concerning waste disposal, pollution, protection of the environment, and the presence, discharge, storage, handling, release and disposal of, and exposure to, hazardous or toxic substances. These environmental laws provide for significant fines and penalties for noncompliance and liabilities for remediation, sometimes without regard to whether the owner or operator of the property knew of, or was responsible for, the release or presence of hazardous toxic substances. Third parties may also make claims against owners or operators of properties for personal injuries and property damage associated with releases of, or actual or alleged exposure to, such hazardous or toxic substances at, on or from our restaurants. Environmental conditions relating to releases of hazardous substances at prior, existing or future restaurant sites could materially adversely affect our business, financial condition or results of operations. Further, environmental laws, and the administration, interpretation and enforcement thereof, are subject to change and may become more stringent in the future, each of which could materially adversely affect our business, financial condition or results of operations.

We rely heavily on certain vendors, suppliers and distributors, which could adversely affect our business.

Our ability to maintain consistent price and quality throughout our restaurants depends in part upon our ability to acquire specified food products and supplies in sufficient quantities from third-party vendors, suppliers and distributors at a reasonable cost. We do not control the businesses of our vendors, suppliers and distributors and our efforts to specify and monitor the standards under which they perform may not be successful. Furthermore, certain food items are perishable, and we have limited control over whether these items will be delivered to us in appropriate condition for use in our restaurants. If any of our vendors or other suppliers are unable to fulfill their obligations to our standards, or if we are unable to find replacement providers in the event of a supply or service disruption, we could encounter supply shortages and incur higher costs to secure adequate supplies, which could materially adversely affect our business, financial condition or results of operations.

In addition, we use various third-party vendors to provide, support and maintain most of our management information systems. We also outsource certain accounting, payroll and human resource functions to business process service providers. The failure of such vendors to fulfill their obligations could disrupt our operations. Additionally, any changes we may make to the services we obtain from our vendors, or new vendors we employ, may disrupt our operations. These disruptions could materially adversely affect our business, financial condition or results of operations.

The effect of changes to healthcare laws in the United States may increase the number of employees who choose to participate in our healthcare plans, which may significantly increase our healthcare costs and negatively impact our financial results.