p

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

OR

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-36370

APPLIED GENETIC TECHNOLOGIES CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware |

59-3553710 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

(I.R.S. Employer

Identification No.) |

11801 Research Drive

Suite D

Alachua, Florida 32615

(Address of Principal Executive Offices, Including Zip Code)

(386) 462-2204

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

Non-accelerated filer |

x (Do not check if a smaller reporting company) |

Smaller reporting company |

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of April 30, 2015, a total of 16,475,654 shares of the registrant’s outstanding common stock, $0.001 par value per share, were outstanding.

APPLIED GENETIC TECHNOLOGIES CORPORATION

FORM 10-Q

FOR THE QUARTER ENDED MARCH 31, 2015

TABLE OF CONTENTS

2

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

APPLIED GENETIC TECHNOLOGIES CORPORATION

CONDENSED BALANCE SHEETS

(Unaudited)

|

|

|

March 31, |

|

|

June 30, |

|

|

In thousands, except per share data |

|

2015 |

|

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

44,483 |

|

|

$ |

8,623 |

|

|

Investments |

|

|

17,796 |

|

|

|

64,450 |

|

|

Grants receivable |

|

|

1,255 |

|

|

|

487 |

|

|

Prepaid and other current assets |

|

|

1,575 |

|

|

|

1,876 |

|

|

Total current assets |

|

|

65,109 |

|

|

|

75,436 |

|

|

Investments |

|

|

29,489 |

|

|

|

— |

|

|

Property and equipment, net |

|

|

533 |

|

|

|

402 |

|

|

Intangible assets, net |

|

|

1,447 |

|

|

|

1,565 |

|

|

Other assets |

|

|

7 |

|

|

|

4 |

|

|

Total assets |

|

$ |

96,585 |

|

|

$ |

77,407 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

764 |

|

|

$ |

949 |

|

|

Accrued and other liabilities |

|

|

3,028 |

|

|

|

1,585 |

|

|

Total current liabilities |

|

|

3,792 |

|

|

|

2,534 |

|

|

Total liabilities |

|

|

3,792 |

|

|

|

2,534 |

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Common stock, par value $.001 per share, 150,000 shares authorized; 16,486 and

14,082 shares issued; 16,476 and 14,082 shares outstanding at March 31, 2015 and June 30, 2014, respectively |

|

|

16 |

|

|

|

14 |

|

|

Additional paid-in capital |

|

|

173,468 |

|

|

|

139,193 |

|

|

Accumulated deficit |

|

|

(80,691 |

) |

|

|

(64,334 |

) |

|

Total stockholders' equity |

|

|

92,793 |

|

|

|

74,873 |

|

|

Total liabilities and stockholders' equity |

|

$ |

96,585 |

|

|

$ |

77,407 |

|

The accompanying notes are an integral part of the financial statements.

3

APPLIED GENETIC TECHNOLOGIES CORPORATION

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

|

|

|

For the Three Months Ended March 31, |

|

|

For the Nine Months Ended March 31, |

|

|

In thousands, except per share amounts |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Grant revenue |

|

$ |

284 |

|

|

$ |

182 |

|

|

$ |

1,541 |

|

|

$ |

648 |

|

|

Sponsored research and other revenue |

|

|

— |

|

|

|

50 |

|

|

|

100 |

|

|

|

357 |

|

|

Total revenue |

|

|

284 |

|

|

|

232 |

|

|

|

1,641 |

|

|

|

1,005 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

4,104 |

|

|

|

2,128 |

|

|

|

11,975 |

|

|

|

5,801 |

|

|

General and administrative |

|

|

2,571 |

|

|

|

1,364 |

|

|

|

6,168 |

|

|

|

3,335 |

|

|

Total operating expenses |

|

|

6,675 |

|

|

|

3,492 |

|

|

|

18,143 |

|

|

|

9,136 |

|

|

Loss from operations |

|

|

(6,391 |

) |

|

|

(3,260 |

) |

|

|

(16,502 |

) |

|

|

(8,131 |

) |

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income |

|

|

67 |

|

|

|

8 |

|

|

|

147 |

|

|

|

23 |

|

|

Fair value adjustments to warrant liabilities |

|

|

— |

|

|

|

(336 |

) |

|

|

— |

|

|

|

(441 |

) |

|

Fair value adjustments to Series B purchase rights |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2,838 |

) |

|

Other expense |

|

|

(2 |

) |

|

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

Total other income (expense), net |

|

|

65 |

|

|

|

(328 |

) |

|

|

145 |

|

|

|

(3,256 |

) |

|

Net loss |

|

$ |

(6,326 |

) |

|

$ |

(3,588 |

) |

|

$ |

(16,357 |

) |

|

$ |

(11,387 |

) |

|

Net loss per share, basic and diluted |

|

$ |

(0.38 |

) |

|

$ |

(25.45 |

) |

|

$ |

(1.01 |

) |

|

$ |

(95.69 |

) |

|

Weighted average shares outstanding, basic and diluted |

|

|

16,463 |

|

|

|

141 |

|

|

|

16,172 |

|

|

|

119 |

|

The accompanying notes are an integral part of the financial statements.

4

APPLIED GENETIC TECHNOLOGIES CORPORATION

CONDENSED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

|

For the Nine Months Ended March 31, |

|

|

In thousands |

|

2015 |

|

|

2014 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(16,357 |

) |

|

$ |

(11,387 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

2,120 |

|

|

|

200 |

|

|

Depreciation and amortization |

|

|

279 |

|

|

|

242 |

|

|

Fair value adjustments to warrant liabilities |

|

|

— |

|

|

|

441 |

|

|

Fair value adjustments to Series B purchase rights |

|

|

— |

|

|

|

2,838 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Increase in grants receivable |

|

|

(768 |

) |

|

|

(220 |

) |

|

Decrease (increase) in prepaid and other assets |

|

|

392 |

|

|

|

(1,963 |

) |

|

(Decrease) increase in accounts payable |

|

|

(185 |

) |

|

|

461 |

|

|

Decrease in deferred revenues |

|

|

— |

|

|

|

(212 |

) |

|

Increase in accrued and other liabilities |

|

|

1,443 |

|

|

|

562 |

|

|

Net cash used in operating activities |

|

|

(13,076 |

) |

|

|

(9,038 |

) |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(225 |

) |

|

|

(89 |

) |

|

Purchase of and capitalized costs related to intangible assets |

|

|

(68 |

) |

|

|

(113 |

) |

|

Maturity of investments |

|

|

108,130 |

|

|

|

22,000 |

|

|

Purchase of investments |

|

|

(91,058 |

) |

|

|

(24,500 |

) |

|

Net cash provided by (used in) investing activities |

|

|

16,779 |

|

|

|

(2,702 |

) |

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock, net of issuance costs |

|

|

32,009 |

|

|

|

— |

|

|

Proceeds from exercise of common stock options |

|

|

148 |

|

|

|

194 |

|

|

Proceeds from issuance of preferred stock and Series B purchase rights, |

|

|

|

|

|

|

|

|

|

net of issuance costs |

|

|

— |

|

|

|

10,683 |

|

|

Net cash provided by financing activities |

|

|

32,157 |

|

|

|

10,877 |

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

35,860 |

|

|

|

(863 |

) |

|

Cash and cash equivalents, beginning of period |

|

|

8,623 |

|

|

|

8,893 |

|

|

Cash and cash equivalents, end of period |

|

$ |

44,483 |

|

|

$ |

8,030 |

|

The accompanying notes are an integral part of the financial statements.

5

APPLIED GENETIC TECHNOLOGIES CORPORATION

NOTES TO CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

|

(1) |

Organization and Operations: |

Applied Genetic Technologies Corporation (the “Company” or “AGTC”) was incorporated as a Florida corporation on January 19, 1999 and reincorporated as a Delaware corporation on October 24, 2003. The Company is a clinical-stage biotechnology company developing gene therapy products designed to transform the lives of patients with severe diseases, primarily in ophthalmology.

On April 1, 2014, the Company completed its initial public offering (“IPO”) in which it sold 4,166,667 shares of common stock at a price of $12.00 per share. The shares began trading on the Nasdaq Global Select Market on March 27, 2014 under the ticker symbol AGTC. On April 3, 2014, the Company sold an additional 625,000 shares of common stock at the offering price of $12.00 per share pursuant to the exercise of the underwriters’ over-allotment option. The aggregate net proceeds received by the Company from the IPO offering, including exercise of the over-allotment option, amounted to $51.6 million, net of underwriting discounts and commissions and other issuance costs incurred by the Company.

On July 30, 2014, the Company completed a follow on public offering in which it sold 2,000,000 shares of common stock at a public offering price of $15.00 per share. On August 1, 2014, the Company sold an additional 300,000 shares of common stock at a public offering price of $15.00 per share pursuant to the full exercise of an overallotment option granted to the underwriters in connection with the follow on offering. The aggregate net proceeds received by the Company from the follow on offering, including exercise of the overallotment option, amounted to $32.0 million, net of underwriting discounts and commissions and other offering expenses.

The Company has devoted substantially all of its efforts to research and development, including clinical trials. The Company has not completed the development of any products. The Company has generated revenue from collaboration agreements, sponsored research payments and grants, but has not generated product revenue to date and is subject to a number of risks similar to those of other early stage companies in the biotechnology industry, including dependence on key individuals, the difficulties inherent in the development of commercially viable products, the need to obtain additional capital necessary to fund the development of its products, development by the Company or its competitors of technological innovations, risks of failure of clinical studies, protection of proprietary technology, compliance with government regulations and ability to transition to large-scale production of products. As of March 31, 2015, the Company had an accumulated deficit of $80.7 million and expects to continue to incur losses for the foreseeable future. The Company has funded its operations primarily through the private placement of preferred stock, common stock, convertible notes and warrants to purchase preferred stock and through public offerings consummated in 2014. At March 31, 2015, the Company’s capital resources, consisting of cash, cash equivalents, and investments, amounted to $91.8 million.

|

(2) |

Summary of Significant Accounting Policies: |

|

(a) |

Basis of Presentation – The accompanying unaudited condensed financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”) and, in the opinion of management, include all adjustments necessary for a fair presentation of the Company’s financial position, results of operations, and cash flows for each period presented. |

The adjustments referred to above are of a normal and recurring nature. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to U.S. Securities and Exchange Commission (“SEC”) rules and regulations for interim reporting.

The Condensed Balance Sheet as of June 30, 2014 was derived from audited financial statements, but does not include all disclosures required by GAAP. These Condensed Financial Statements should be read in conjunction with the audited financial statements included in the Company’s 2014 Annual Report on Form 10-K. Results of operations for the three and nine months ended March 31, 2015 are not necessarily indicative of the results to be expected for the full year or any other interim period.

|

(b) |

Use of estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates. |

|

(c) |

Cash and cash equivalents— The Company considers all highly liquid investments with a maturity of 90 days or less at the time of purchase to be cash equivalents. Cash and cash equivalents include cash held in banks, investments in money market accounts, certificates of deposit, and debt securities. The fair values of cash equivalents approximate their carrying amounts. |

6

|

(d) |

Investments—The Company’s investments consist of certificates of deposit and debt securities classified as held-to-maturity. Management determines the appropriate classification of debt securities at the time of purchase and reevaluates such designation as of each balance sheet. Debt securities are classified as held-to-maturity when the Company has the positive intent and ability to hold the securities to maturity. Held-to-maturity securities are stated at amortized cost, adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization is included in investment income. Interest on securities classified as held-to-maturity is included in investment income. |

The Company uses the specific identification method to determine the cost basis of securities sold.

Investments are considered to be impaired when a decline in fair value is judged to be other-than-temporary. The Company evaluates an investment for impairment by considering the length of time and extent to which market value has been less than cost or amortized cost, the financial condition and near-term prospects of the issuer as well as specific events or circumstances that may influence the operations of the issuer and the Company’s intent to sell the security or the likelihood that it will be required to sell the security before recovery of the entire amortized cost. Once a decline in fair value is determined to be other-than-temporary, an impairment charge is recorded to other income (expense) and a new cost basis in the investment is established.

New information and the passage of time can change these judgments. The Company manages its investment portfolio to limit its exposure to any one issuer or market sector, and largely limits its investments to U.S. government and agency securities, commercial paper, and corporate debt obligations, all of which are investment grade quality. Securities downgraded below policy minimums after purchase will be disposed of in accordance with the investment policy.

|

(e) |

Fair value of financial instruments—The Company is required to disclose information on all assets and liabilities reported at fair value that enables an assessment of the inputs used in determining the reported fair values. The Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures (“ASC 820”), establishes a hierarchy of inputs used when available. Observable inputs are inputs that market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the inputs that market participants would use in pricing the asset or liability, and are developed based on the best information available in the circumstances. The fair value hierarchy applies only to the valuation inputs used in determining the reported fair value of financial instruments and is not a measure of the investment credit quality. The three levels of the fair value hierarchy are described below: |

Level 1—Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2—Valuations based on quoted prices for similar assets or liabilities in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3—Valuations that require inputs that reflect the Company’s own assumptions that are both significant to the fair value measurement and unobservable.

To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by the Company in determining fair value is greatest for instruments categorized in Level 3. A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement.

|

(f) |

Intangible assets – Intangible assets include licenses and patents. The Company obtains licenses from third parties and capitalizes the costs related to exclusive licenses that have alternative future use in multiple potential programs. The Company also capitalizes costs related to filing, issuance, and prosecution of patents. The Company reviews its capitalized costs periodically to determine that costs recorded include costs for patent applications that have future value. The Company evaluates costs related to patents that it is not actively pursuing and writes off any of these costs. Amortization expense is computed using the straight-line method over the estimated useful lives of the assets, which are generally eight to twenty years. The Company amortizes in-licensed patents and patent applications from the date of the applicable license and internally developed patents and patent applications from the date of the initial application. Licenses and patents converted to research use only are expensed immediately. |

|

(g) |

Revenue recognition – The Company has generated revenue through collaboration agreements, sponsored research arrangements with nonprofit organizations for the development and commercialization of product candidates and revenues from federal research and development grant programs. The Company recognizes revenue when amounts are realized or realizable and earned. Revenue is considered realizable and earned when the following criteria are met: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred or services have been rendered; (3) the price is fixed or determinable; and (4) collection of the amounts due is reasonably assured. |

7

Amounts received prior to satisfying the revenue recognition criteria are recorded as deferred revenue in the Company’s balance sheets. Amounts expected to be recognized as revenue within the 12 months following the balance sheet date are classified as current liabilities. The Company recognizes revenue for reimbursements of research and development costs under collaboration agreements as the services are performed. The Company records these reimbursements as revenue and not as a reduction of research and development expenses, as the Company has the risks and rewards as the principal in the research and development activities.

The Company evaluates the terms of sponsored research agreement grants and federal grants to assess the Company’s obligations and if the Company’s obligations are satisfied by the passage of time, revenue is recognized on a straight-line basis. In situations where the performance of the Company’s obligations has been satisfied when the grant is received, revenue is recognized upon receipt of the grant. Certain grants contain refund provisions. The Company reviews those refund provisions to determine the likelihood of repayment. If the likelihood of repayment of the grant is determined to be remote, the grant is recognized as revenue. If the probability of repayment is determined to be more than remote, the Company records the grant as a deferred revenue liability, until such time that the grant requirements have been satisfied.

|

(h) |

Research and development – Research and development costs include costs incurred in identifying, developing and testing product candidates. Costs consist primarily of payroll expenses for research related employees, laboratory costs, animal and laboratory maintenance and supplies, rent, utilities, and clinical and pre-clinical expenses, as well as payments for sponsored research, scientific and regulatory consulting fees and testing. Costs are charged to expense as incurred. Costs for certain development activities are recognized based on an evaluation of the progress to completion of specific tasks using information and data provided by the Company’s vendors and clinical sites. When outside contracts for research products or testing require advance payments, these payments are recorded on the balance sheet as a prepaid expense and subsequently recognized as an operating expense when the service is provided or when a specific milestone outlined in the contract is reached. Advance payments related to research and development were $1.3 million and $1.4 million at March 31, 2015 and June 30, 2014, respectively, and are included in other current assets on the balance sheets. |

|

(i) |

Share-based compensation – The Company measures the cost of employee services received in exchange for an award of equity instruments based on the grant date fair value of the award. That cost is recognized on a straight-line basis over the period during which the employee is required to provide service in exchange for the award. The fair value of stock options on the date of grant is calculated using the Black-Scholes option pricing model based on key assumptions such as expected volatility, risk-free interest rate and expected term. For stock options awarded to employees, an assumption is also made for the estimated forfeiture rate based on the historical behavior of employees. The forfeiture rate reduces the total fair value of the awards to be recognized as compensation expense. The fair value of restricted stock awards is based on the Company’s closing share price on the date of grant. |

The Company accounts for stock options and awards of restricted stock issued to non-employees in accordance with the provisions of FASB ASC Subtopic 505-50, Equity-Based Payments to Non-employees, which states that equity instruments issued in exchange for the receipt of goods or services should be measured at the fair value of the consideration received or the fair value of the equity instruments issued, whichever is more reliably measurable.

|

(j) |

Comprehensive loss – Comprehensive loss consists of net loss and changes in equity during a period from transactions and other equity and circumstances generated from non-owner sources. The Company's net loss equals comprehensive loss for all periods presented. |

|

(k) |

New Accounting Pronouncements – In August 2014, the FASB issued Accounting Standard Update No. 2014-15, Disclosure of Uncertainties About an Entity’s Ability to Continue as a Going Concern. The amendments require management to perform interim and annual assessments of an entity’s ability to continue as a going concern and provides guidance on determining when and how to disclose going concern uncertainties in the financial statements. The standard applies to all entities and is effective for annual and interim reporting periods ending after December 15, 2016, with early adoption permitted. The Company is currently evaluating the impact that this new guidance will have on its financial statements. |

In May 2014, the FASB issued guidance that requires companies to recognize revenue to depict the transfer of goods or services to customers in amounts that reflect the consideration to which the company expects to be entitled in exchange for those goods or services. It also requires enhanced disclosures about revenue, provides guidance for transactions that were not previously addressed comprehensively, and improves guidance for multiple-element arrangements. The guidance applies to any entity that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets unless those contracts are within the scope of other standards. The guidance is effective for public companies for annual periods beginning after December 15, 2016 as well as interim periods within those annual periods using either the full retrospective approach or modified retrospective approach. Early adoption is not permitted. The Company is currently evaluating the impact of the new guidance on its financial statements.

8

In July 2013, the FASB issued amended guidance on the financial statement presentation of an unrecognized tax benefit when a net operating loss carryforward, similar tax loss, or tax credit carryforward exists. The guidance requires an unrecognized tax benefit, or a portion of an unrecognized tax benefit, to be presented as a reduction of a deferred tax asset when a net operating loss carryforward, similar tax loss, or tax credit carryforward exists, with certain exceptions. This accounting guidance was effective for annual and interim periods beginning after December 15, 2013. The Company adopted this new guidance beginning with its interim financial statements for the three months ended March 31, 2014. The adoption of this standard did not have a material impact on the Company’s financial statements.

|

(3) |

Share-based Compensation Plans: |

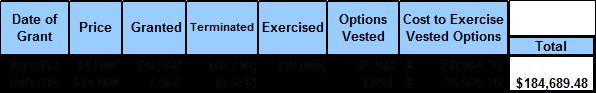

The Company uses stock options and awards of restricted stock to provide long-term incentives for its employees, non-employee directors and certain consultants. A summary of the stock option activity for the nine months ended March 31, 2015 and 2014 is as follows:

|

|

|

For the Nine Months Ended March 31, |

|

|

|

|

2015 |

|

|

2014 |

|

|

(In thousands, except per share amounts) |

|

Shares |

|

|

Weighted

Average

Exercise

Price |

|

|

Shares |

|

|

Weighted

Average

Exercise

Price |

|

|

Outstanding, June 30 |

|

|

1,024 |

|

|

$ |

6.21 |

|

|

|

380 |

|

|

$ |

1.45 |

|

|

Granted |

|

|

409 |

|

|

|

19.64 |

|

|

|

559 |

|

|

|

6.88 |

|

|

Exercised |

|

|

(46 |

) |

|

|

3.24 |

|

|

|

(57 |

) |

|

|

3.39 |

|

|

Terminated |

|

|

(109 |

) |

|

|

6.43 |

|

|

|

(10 |

) |

|

|

3.50 |

|

|

Outstanding, March 31 |

|

|

1,278 |

|

|

$ |

10.59 |

|

|

|

872 |

|

|

$ |

4.78 |

|

|

Exercisable, end of period |

|

|

408 |

|

|

|

|

|

|

|

166 |

|

|

|

|

|

|

Weighted average fair value of options granted

during the period |

|

$ |

14.43 |

|

|

|

|

|

|

$ |

4.48 |

|

|

|

|

|

For the three and nine months ended March 31, 2015, share-based expense related to stock options awarded to employees, non-employee directors and consultants amounted to $746 thousand and $1.7 million, respectively.

In addition, during the three and nine months ended March 31, 2015, the Company granted restricted share awards of 10 thousand and 43 thousand shares to employees and non-employee consultants and recorded share-based expense of $147 thousand and $444 thousand, respectively, associated with these awards. For the three and nine months ended March 31, 2014, share-based expense related to stock options awarded to employees, non-employee directors and consultants amounted to $89 thousand and $200 thousand, respectively.

As of March 31, 2015, there was $7.4 million of unrecognized compensation expense related to non-vested stock options and $232 thousand of unrecognized compensation expense associated with non-vested restricted share awards.

The following is a summary of the Company’s investments by category for each of the periods presented:

|

|

|

March 31, |

|

|

June 30, |

|

|

In thousands |

|

2015 |

|

|

2014 |

|

|

Investments - Current: |

|

|

|

|

|

|

|

|

|

Certificates of deposit |

|

$ |

10,350 |

|

|

$ |

64,450 |

|

|

Debt securities - held-to-maturity |

|

|

7,446 |

|

|

|

— |

|

|

|

|

$ |

17,796 |

|

|

$ |

64,450 |

|

|

Investments - Noncurrent: |

|

|

|

|

|

|

|

|

|

Certificates of deposit |

|

$ |

3,133 |

|

|

$ |

— |

|

|

Debt securities - held-to-maturity |

|

|

26,356 |

|

|

|

— |

|

|

|

|

$ |

29,489 |

|

|

$ |

— |

|

9

As of March 31, 2015, a summary of the debt securities that were held-to-maturity is as follows:

|

In thousands |

|

Amortized Cost |

|

|

Gross

Unrealized

Gains |

|

|

Gross

Unrealized

Losses |

|

|

Fair Value |

|

|

Investments - Current: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial paper |

|

$ |

1,999 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

1,999 |

|

|

Corporate obligations |

|

|

5,447 |

|

|

|

— |

|

|

|

(6 |

) |

|

|

5,441 |

|

|

|

|

$ |

7,446 |

|

|

$ |

— |

|

|

$ |

(6 |

) |

|

$ |

7,440 |

|

|

Investments - Noncurrent: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government and agency obligations |

|

$ |

23,835 |

|

|

$ |

5 |

|

|

$ |

(13 |

) |

|

$ |

23,827 |

|

|

Corporate obligations |

|

|

2,521 |

|

|

|

5 |

|

|

|

— |

|

|

|

2,526 |

|

|

|

|

$ |

26,356 |

|

|

$ |

10 |

|

|

$ |

(13 |

) |

|

$ |

26,353 |

|

The amortized cost and fair value of held-to-maturity debt securities as of March 31, 2015, by contractual maturity, were as follows:

|

In thousands |

|

Amortized Cost |

|

|

Fair Value |

|

|

Due in one year or less |

|

$ |

7,446 |

|

|

$ |

7,440 |

|

|

Due after one year through two years |

|

|

26,356 |

|

|

|

26,353 |

|

|

|

|

$ |

33,802 |

|

|

$ |

33,793 |

|

The Company believes that the unrealized losses disclosed above were primarily driven by interest rate changes rather than by unfavorable changes in the credit ratings associated with these securities and as a result, the Company continues to expect to collect the principal and interest due on its debt securities that have an amortized cost in excess of fair value. At each reporting period, the Company evaluates securities for impairment when the fair value of the investment is less than its amortized cost. The Company evaluated the underlying credit quality and credit ratings of the issuers, noting neither a significant deterioration since purchase nor other factors leading to an other-than-temporary impairment. Therefore, the Company believes these losses to be temporary. As of March 31, 2015, the Company did not have the intent to sell any of the securities that were in an unrealized loss position at that date.

|

(5) |

Fair Value of Financial Instruments and Investments: |

Certain assets and liabilities are measured at fair value in the Company’s financial statements or have fair values disclosed in the notes to the financial statements. These assets and liabilities are classified into one of three levels of a hierarchy defined by GAAP. The Company’s assessment of the significance of a particular item to the fair value measurement in its entirety requires judgment, including the consideration of inputs specific to the asset or liability.

The following methods and assumptions were used to estimate the fair value and determine the fair value hierarchy classification of each class of financial instrument included in the table below:

Cash and Cash Equivalents. The carrying value of cash and cash equivalents approximates fair value as maturities are less than three months.

Certificates of Deposit. The Company’s certificates of deposit are placed through an account registry service. The fair value measurement of the Company’s certificates of deposit is considered Level 2 of the fair value hierarchy as the inputs are based on quoted prices for identical assets in markets that are not active. The carrying amounts of the Company’s certificates of deposit reported in the balance sheets approximate fair value.

Debt securities – held-to-maturity. The Company’s investments in debt securities classified as held-to-maturity include U.S. Treasury Securities, government agency obligations, commercial paper, and corporate obligations. U.S. Treasury Securities are valued using quoted market prices. Valuation adjustments are not applied. Accordingly, U.S. Treasury Securities are considered Level 1 of the fair value hierarchy. The fair values of U.S. government agency obligations, commercial paper and corporate obligations are generally determined using recently executed transactions, broker quotes, market price quotations

10

where these are available or other observable market inputs for the same or similar securities. As such, the Company classifies its investments in U.S. government agency obligations, commercial paper and corporate obligations within Level 2 of the hierarchy.

The following fair value hierarchy table presents information about each major category of the Company’s financial assets and liabilities measured at fair value on a recurring basis:

|

In thousands |

|

Quoted prices

in active

markets

(Level 1) |

|

|

Significant

other observable inputs

(Level 2) |

|

|

Significant unobservable

inputs

(Level 3) |

|

|

Total Fair

Value |

|

|

Total

Carrying

Value |

|

|

March 31, 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

44,483 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

44,483 |

|

|

$ |

44,483 |

|

|

Certificates of deposit |

|

|

— |

|

|

|

13,483 |

|

|

|

— |

|

|

|

13,483 |

|

|

|

13,483 |

|

|

Held-to-maturity investments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial paper |

|

|

— |

|

|

|

1,999 |

|

|

|

— |

|

|

|

1,999 |

|

|

|

1,999 |

|

|

Corporate obligations |

|

|

— |

|

|

|

7,967 |

|

|

|

— |

|

|

|

7,967 |

|

|

|

7,968 |

|

|

U.S. government and agency obligations |

|

|

3,838 |

|

|

|

19,989 |

|

|

|

— |

|

|

|

23,827 |

|

|

|

23,835 |

|

|

Total assets |

|

$ |

48,321 |

|

|

$ |

43,438 |

|

|

$ |

— |

|

|

$ |

91,759 |

|

|

$ |

91,768 |

|

|

June 30, 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

8,623 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

8,623 |

|

|

$ |

8,623 |

|

|

Certificates of deposit |

|

|

— |

|

|

|

64,450 |

|

|

|

— |

|

|

|

64,450 |

|

|

|

64,450 |

|

|

Total assets |

|

$ |

8,623 |

|

|

$ |

64,450 |

|

|

$ |

— |

|

|

$ |

73,073 |

|

|

$ |

73,073 |

|

(6) Stockholders’ Equity:

On April 1, 2014, the Company completed its IPO in which it sold 4,166,667 shares of common stock at a price of $12.00 per share. The shares began trading on the Nasdaq Global Select Market on March 27, 2014. On April 3, 2014, an additional 625,000 shares were sold pursuant to the exercise of the underwriters’ over-allotment option, also at the offering price of $12.00 per share. The aggregate net proceeds received by the Company from the offering, including exercise of the over-allotment option, amounted to $51.6 million, net of underwriting discounts and commissions and other issuance costs incurred by the Company. Upon the closing of the IPO, all outstanding shares of convertible preferred stock converted into 9,120,081 shares of common stock; and warrants exercisable for convertible preferred stock were automatically converted into warrants exercisable for 49,811 shares of common stock, resulting in the reclassification of the related convertible preferred stock warrant liability of $551 thousand to additional paid-in capital.

On July 30, 2014, the Company completed a follow on public offering in which it sold 2,000,000 shares of common stock at a public offering price of $15.00 per share. On August 1, 2014, the Company sold an additional 300,000 shares of common stock at a public offering price of $15.00 per share pursuant to the full exercise of an overallotment option granted to the underwriters in connection with the follow on offering. The aggregate net proceeds received by the Company from the offering, including the exercise of the overallotment option, amounted to $32.0 million, net of underwriting discounts and commissions.

11

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis provides an overview of our financial condition as of March 31, 2015, and results of operations for the three and nine months ended March 31, 2015 and 2014. This discussion should be read in conjunction with the accompanying Condensed Financial Statements and accompanying notes, as well as our Annual Report on Form 10-K for the year ended June 30, 2014. In addition to historical financial information, the following discussion contains forward-looking statements that reflect our plans, estimates, assumptions and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to these differences include those discussed below and elsewhere in this report under “Part II, Other Information—Item 1A, Risk Factors.” Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies and operations, financing plans, potential growth opportunities, potential market opportunities and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s plans, estimates, assumptions and beliefs only as of the date of this report. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

As used herein, except as otherwise indicated by context, references to “we,” “us,” “our,” or the “Company” refer to Applied Genetic Technologies Corporation.

Overview

We are a clinical-stage biotechnology company that uses our proprietary gene therapy platform to develop products designed to transform the lives of patients with severe diseases in ophthalmology. Our lead product candidates, which are each in the preclinical stage, are treatments for X-linked retinoschisis, or XLRS, achromatopsia, or ACHM, and X-linked retinitis pigmentosa, or XLRP. These rare diseases of the eye are caused by mutations in single genes, significantly affect visual function and currently lack effective medical treatments. During the three months ended March 31, 2015, we filed an Investigational New Drug (“IND”) application for our XLRS product candidate. This application was recently accepted by the U.S. Food and Drug Administration (“FDA”) and we expect to report initial clinical data for this program during the second half of calendar year 2015. For our ACHM product candidate, we plan to file an IND later this year and expect to initiate a Phase I/II clinical trial thereafter, subject to the FDA’s review and acceptance of that application. We have also begun preclinical studies for our product candidate addressing XLRP, a disease characterized by progressive degeneration of the retina, leading to total blindness in adult men. We also plan to develop new treatments for AMD by leveraging our experience developing products in orphan ophthalmology and our work with a partner on a first generation product for wet AMD. In the longer term, we will seek opportunities to take advantage of the adaptability of our gene therapy platform to address a range of genetic diseases, both within and beyond our initial focus area of orphan ophthalmology.

In addition to our lead programs summarized above, we have been in development of a product candidate for treatment of the inherited orphan lung disease, alpha-1 antitrypsin deficiency, or AAT deficiency, and have previously completed preclinical proof-of-concept studies and Phase 1 and Phase 2 clinical trials. During the three months ended December 31, 2014, we obtained results from a non-human primate model of a vascular delivery method that raised no safety-related issues but were less encouraging with respect to the efficacy of this method of delivery than we had expected (i.e. we did not see higher levels of protein expression). As a result and because this may have been due to device/procedure related issues, we have decided to conduct additional pre-clinical studies of vascular routes of administration for this product candidate. The timing of any subsequent clinical trials in this program will depend on the results of these additional preclinical studies.

Since our inception, we have devoted substantially all of our resources to development efforts relating to our proof-of-concept programs in ophthalmology and AAT deficiency, including activities to manufacture product in compliance with good manufacturing practices, preparing to conduct and conducting clinical trials of our product candidates, providing general and administrative support for these operations and protecting our intellectual property. We do not have any products approved for sale and have not generated any revenue from product sales. We have funded our operations primarily through the private placement of preferred stock, common stock, convertible notes and warrants to purchase preferred stock and through our public offerings consummated in 2014.

We do not expect to generate revenue from product sales unless and until we successfully complete development and obtain regulatory approval for one or more of our product candidates, which we expect will take a number of years and which we believe is subject to significant uncertainty. As a result, we expect to incur losses for the foreseeable future, and we expect these losses to increase as we continue our development of, and seek regulatory approvals for, our product candidates and begin to commercialize any approved products. Because of the numerous risks and uncertainties associated with product development, we are unable to predict the timing or amount of increased expenses or when or if we will be able to achieve or maintain profitability.

12

Critical Accounting Policies

Our management’s discussion and analysis of our financial condition and results of operations are based on our financial statements, which have been prepared in accordance with U.S. generally accepted accounting principles. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, and expenses and the disclosure of contingent assets and liabilities in our financial statements. On an ongoing basis, we evaluate our estimates and judgments, including those related to accrued expenses and share-based compensation. We base our estimates on historical experience, known trends and events, and various other factors that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

For a description of those of our accounting policies that, in our opinion, involve the most significant application of judgment or involve complex estimation and which could, if different judgments or estimates were made, materially affect our reported results of operations, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates” in our Annual Report on Form 10-K for the year ended June 30, 2014. There have been no material changes to our critical accounting policies and estimates from the information provided in our Annual Report on Form 10-K for the year ended June 30, 2014.

New Accounting Pronouncements

Refer to Note 2 of the condensed financial statements for further information on recently issued accounting standards.

Results of Operations

Comparison of three months ended March 31, 2015 to three months ended March 31, 2014

Revenue

|

|

|

For the Three Months Ended March 31, |

|

|

Increase |

|

|

% Increase |

|

|

|

|

2015 |

|

|

2014 |

|

|

(Decrease) |

|

|

(Decrease) |

|

|

|

|

(dollars in thousands) |

|

|

Grant revenue |

|

$ |

284 |

|

|

$ |

182 |

|

|

$ |

102 |

|

|

|

56 |

% |

|

Sponsored research revenue |

|

|

— |

|

|

|

50 |

|

|

|

(50 |

) |

|

|

(100 |

)% |

|

Total revenue |

|

$ |

284 |

|

|

$ |

232 |

|

|

$ |

52 |

|

|

|

22 |

% |

Total revenue for the three months ended March 31, 2015 increased by $52 thousand to $284 thousand compared to the same period in 2014. The increase was primarily driven by higher grant revenue resulting from increased activity in grant-funded projects, partially offset by a reduction to zero of our sponsored research revenue due to the fact that no milestones associated with the sponsored research arrangements were attained during the quarter.

Research and development expense

|

|

|

For the Three Months Ended March 31, |

|

|

Increase |

|

|

% Increase |

|

|

|

|

2015 |

|

|

2014 |

|

|

(Decrease) |

|

|

(Decrease) |

|

|

|

|

(dollars in thousands) |

|

|

Research and development expense |

|

$ |

4,104 |

|

|

$ |

2,128 |

|

|

$ |

1,976 |

|

|

|

93 |

% |

Research and development expense for the three months ended March 31, 2015 increased by $2.0 million to $4.1 million compared to the same period in 2014. The increase was primarily the result of increased activity relating to our XLRS, ACHM, XLRP and other product candidates, including higher facilities and other costs associated with laboratory expansions. In addition, employee-related costs increased during the more recent period primarily as a result of higher expenses associated with share-based compensation plans and the hiring of additional employees.

13

General and administrative expense

|

|

|

For the Three Months Ended March 31, |

|

|

Increase |

|

|

% Increase |

|

|

|

|

2015 |

|

|

2014 |

|

|

(Decrease) |

|

|

(Decrease) |

|

|

|

|

(dollars in thousands) |

|

|

General and administrative expense |

|

$ |

2,571 |

|

|

$ |

1,364 |

|

|

$ |

1,207 |

|

|

|

88 |

% |

General and administrative expense for the three months ended March 31, 2015 increased by $1.2 million to $2.6 million compared to the same period in 2014. The increase was primarily the result of higher employee-related costs associated with our share-based compensation plans and the hiring of additional employees. In addition, our legal and other administrative expenses have increased primarily due to the additional costs associated with operating as a publicly-traded company.

Other income (expense), net

Other income (expense), net of $65 thousand for the three months ended March 31, 2015 was primarily comprised of investment income compared to $328 thousand of expense in the same period of 2014. The expense recorded in 2014 was primarily attributable to fair value adjustments that were associated with our former warrant liabilities, extinguished in connection with our initial public offering in April 2014.

Comparison of nine months ended March 31, 2015 to nine months ended March 31, 2014

Revenue

|

|

|

For the Nine Months Ended March 31, |

|

|

Increase |

|

|

% Increase |

|

|

|

|

2015 |

|

|

2014 |

|

|

(Decrease) |

|

|

(Decrease) |

|

|

|

|

(dollars in thousands) |

|

|

Grant revenue |

|

$ |

1,541 |

|

|

$ |

648 |

|

|

$ |

893 |

|

|

|

138 |

% |

|

Sponsored research |

|

|

— |

|

|

|

357 |

|

|

|

(357 |

) |

|

|

(100 |

)% |

|

Other |

|

|

100 |

|

|

|

— |

|

|

|

100 |

|

|

|

100 |

% |

|

Total revenue |

|

$ |

1,641 |

|

|

$ |

1,005 |

|

|

$ |

636 |

|

|

|

63 |

% |

Total revenue for the nine months ended March 31, 2015 increased by $636 thousand to $1.6 million compared to the same period in 2014. The increase was primarily driven by higher grant revenue resulting from increased activity in grant-funded projects and revenue generated from a new right of reference agreement that was entered into with a strategic partner during the three months ended September 30, 2014. The higher revenue was partially offset by decreased sponsored research revenue as a result of a decrease in attained milestones associated with the sponsored research arrangements.

Research and development expense

|

|

|

For the Nine Months Ended March 31, |

|

|

Increase |

|

|

% Increase |

|

|

|

|

2015 |

|

|

2014 |

|

|

(Decrease) |

|

|

(Decrease) |

|

|

|

|

(dollars in thousands) |

|

|

Research and development expense |

|

$ |

11,975 |

|

|

$ |

5,801 |

|

|

$ |

6,174 |

|

|

|

106 |

% |

Research and development expense for the nine months ended March 31, 2015 increased by $6.2 million to $12.0 million compared to the corresponding period in 2014. The increase was primarily the result of increased activity relating to our XLRS, ACHM, XLRP and other product candidates, including higher facilities and other costs associated with laboratory expansions. In addition, employee-related costs increased during the more recent period primarily as a result of higher expenses associated with our share-based compensation plans and the hiring of additional employees.

14

General and administrative expense

|

|

|

For the Nine Months Ended March 31, |

|

|

Increase |

|

|

% Increase |

|

|

|

|

2015 |

|

|

2014 |

|

|

(Decrease) |

|

|

(Decrease) |

|

|

|

|

(dollars in thousands) |

|

|

General and administrative expense |

|

$ |

6,168 |

|

|

$ |

3,335 |

|

|

$ |

2,833 |

|

|

|

85 |

% |

General and administrative expense for the nine months ended March 31, 2015 increased by $2.8 million to $6.2 million compared to the same period in 2014. The increase was primarily the result of higher employee-related costs associated with our share-based compensation plans and the hiring of additional employees. In addition, our legal, accounting and other administrative expenses have increased due to the additional costs associated with operating as a publicly-traded company.

Other income (expense), net

Other income (expense), net of $145 thousand for the nine months ended March 31, 2015 was primarily comprised of investment income compared to an expense of $3.3 million in the same period of 2014. The $3.3 million of expense recorded in 2014 was primarily attributable to fair value adjustments that were associated with our former Series B purchase rights and warrant liabilities, extinguished in connection with our initial public offering in April 2014.

Liquidity and capital resources

We have incurred cumulative losses and negative cash flows from operations since our inception, and as of March 31, 2015, we had an accumulated deficit of $80.7 million. It will be several years, if ever, before we have a product candidate ready for commercialization, and we anticipate that we will continue to incur losses for at least the next several years. We expect that our research and development and general and administrative expenses will continue to increase and, as a result, we will need additional capital to fund our operations, which we may raise through a combination of equity offerings, debt financings, other third-party funding, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements.

During the nine months ended March 31, 2015, we successfully completed a follow on public offering of common stock from which we received proceeds of $32.0 million, net of underwriters’ commissions and discounts and other related expenses. Cash in excess of immediate requirements is invested in accordance with our investment policy which primarily seeks to maintain adequate liquidity and preserve capital by generally limiting investments to certificates of deposit and investment-grade debt securities that mature within 24 months. As of March 31, 2015, we had cash, cash equivalents, and investments totaling $91.8 million. Currently, our cash and cash equivalents are held in bank accounts, money market funds and in other investment accounts maturing within three months of the date of purchase. As of March 31, 2015, our current investments consist of certificates of deposit, commercial paper, and corporate bonds that mature within 12 months of the balance sheet date. Our noncurrent investments consist of certificates of deposit and corporate and government bonds that mature within 12 and 24 months of the balance sheet date, consistent with our investment policy that seeks to maintain adequate liquidity and preserve capital.

Cash flows

The following table sets forth the primary sources and uses of cash for each of the periods set forth below:

|

|

|

For the Nine Months Ended March 31, |

|

|

|

|

2015 |

|

|

2014 |

|

|

|

|

(in thousands) |

|

|

Net cash provided by (used in): |

|

|

|

|

|

|

|

|

|

Operating activities |

|

$ |

(13,076 |

) |

|

$ |

(9,038 |

) |

|

Investing activities |

|

|

16,779 |

|

|

|

(2,702 |

) |

|

Financing activities |

|

|

32,157 |

|

|

|

10,877 |

|

|

Net increase (decrease) in cash and cash equivalents |

|

$ |

35,860 |

|

|

$ |

(863 |

) |

Operating activities. For the nine months ended March 31, 2015 and 2014, net cash used in operating activities was $13.1 million and $9.0 million, respectively. The use of net cash in both periods primarily resulted from our net losses and changes in our working capital accounts.

15

Investing activities. Net cash provided by investing activities for the nine months ended March 31, 2015 was $16.8 million and consisted primarily of $108.1 million of proceeds from the maturity of investments, partially offset by cash outflows of $91.1 million related to the purchase of investments and $293 thousand related to the acquisition and maintenance of intellectual property and purchase of property and equipment. Net cash used in investing activities for the nine months ended March 31, 2014 was $2.7 million, consisting primarily of $24.5 million used for the purchase of investments and $202 thousand related to the acquisition and maintenance of intellectual property and purchase of property and equipment, partially offset by proceeds of $22.0 million from the maturity of investments.

Financing activities. Net cash provided by financing activities for the nine months ended March 31, 2015 was $32.2 million, of which $32.0 million was related to our follow on public offering that was completed during our first quarter ended September 30, 2014. For the nine months ended March 31, 2014, net cash provided by financing activities of $10.9 million was primarily related to the issuance of preferred stock and Series B purchase rights, extinguished in connection with our initial public offering in April 2014.

Operating capital requirements

To date, we have not generated any revenue from product sales. We do not know when, or if, we will generate any revenue from product sales. We do not expect to generate significant revenue from product sales unless and until we obtain regulatory approval of and commercialize one of our current or future product candidates. We anticipate that we will continue to generate losses for the foreseeable future, and we expect the losses to increase as we continue the development of, and seek regulatory approvals for, our product candidates, and begin to commercialize any approved products. We are subject to all of the risks incident in the development of new gene therapy products, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. Since the closing of our initial public offering, we have incurred additional costs associated with operating as a public company. We anticipate that we will need substantial additional funding in connection with our continuing operations.

16

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Refer to Part II, Item 7A, “Quantitative and Qualitative Disclosures About Market Risk” in our Annual Report on Form 10-K for the year ended June 30, 2014, which is incorporated by reference herein, for a description of our market risks.

ITEM 4. CONTROLS AND PROCEDURES

Material Weakness in Internal Control over Financial Reporting

As discussed in our Annual Report on Form 10-K for the year ended June 30, 2014, our management has determined that we have material weaknesses in our internal control over financial reporting which relate to the design and operation of our closing and financial reporting processes and our accounting for debt, equity and convertible instruments. We have concluded that these material weaknesses in our internal control over financial reporting are due to the fact that we do not have the appropriate resources with the appropriate level of experience and technical expertise to oversee our closing and financial reporting processes and to address the accounting and financial reporting requirements related to our issuances of convertible notes, preferred stock warrants, stock options, preferred stock and preferred stock purchase rights. Refer to Part II, Item 9A, “Controls and Procedures,” in our Annual Report on Form 10-K for the year ended June 30, 2014 for a discussion of the actions that we have undertaken and are currently undertaking to remediate these material weaknesses, which have not been remediated as of March 31, 2015.

Notwithstanding the material weaknesses described above, our management has concluded that the financial statements covered by this report present fairly, in all material respects, our financial position, results of operation and cash flows in conformity with U.S. generally accepted accounting principles.

Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the rules and forms, and that such information is accumulated and communicated to us, including our Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. In designing and evaluating our disclosure controls and procedures, we recognize that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, as ours are designed to do, and we necessarily were required to apply our judgment in evaluating whether the benefits of the controls and procedures that we adopt outweigh their costs.

As required by Rule 13a-15(b) of the Securities Exchange Act of 1934, as amended, an evaluation of the effectiveness of our disclosure controls and procedures (as defined in Rule 13a-15(e) under the Securities Exchange Act of 1934, as amended) as of March 31, 2015 was conducted under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures, as of March 31, 2015, were effective for the purposes stated above.

Changes in Internal Control over Financial Reporting

As described under “Material Weakness in Internal Control over Financial reporting,” above, during the period covered by this Quarterly Report on Form 10-Q we have taken and are taking remedial actions intended to correct material weaknesses in our system of internal controls over financial reporting, which remedial actions have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting. Except for those remedial actions, there was no change in our internal control over financial reporting identified in connection with the evaluation required by Rule 13a-15(d) and 15d-15(d) of the Exchange Act that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

17

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We are not a party to any pending legal proceedings. However, because of the nature of our business, we may be subject at any particular time to lawsuits or other claims arising in the ordinary course of our business, and we expect that this will continue to be the case in the future.

ITEM 1A. RISK FACTORS

Refer to Part I, Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the year ended June 30, 2014 for a listing of our risk factors. There has been no material change in such risk factors since June 30, 2014.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

(a) |

Unregistered Sales of Equity Securities |

During the three months ended March 31, 2015, we made no unregistered sales of equity securities.

On April 1, 2014, we consummated the closing of the initial public offering, or IPO, of our common stock pursuant to our Registration Statement on Form S-1 (File No. 333-193309), which was declared effective by the Securities and Exchange Commission on March 26, 2014. The underwriters for the offering were BMO Capital Markets Corp., Wedbush Securities Inc., Cantor Fitzgerald & Co. and Roth Capital Partners, LLC. We used approximately $5.0 million of the net proceeds from this offering to finance our operating activities in the three months ended March 31, 2015.

|

Exhibit

Number |

Description |

|

|

|

|

3.1 |

Fifth Amended and Restated Certificate of Incorporation of Applied Genetic Technologies Corporation (incorporated by reference to Exhibit 3.1 to the Company’s Current Report on Form 8-K, event date March 26, 2014, filed on April 1, 2014) |

|

|

|

|

3.2 |

Amended and Restated Bylaws of Applied Genetic Technologies Corporation (incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K, event date March 26, 2014, filed on April 1, 2014) |

|

|

|

|

10.1* |

Employment Agreement dated as of January 29, 2015 between Applied Genetic Technologies Corporation and Stephen W. Potter † |

|

|

|

|

10.2* |

Separation Agreement dated as of March 3, 2015 between Applied Genetic Technologies Corporation and Daniel L. Menichella † |

|

|

|

|

31.1* |

Rule 13a-14(a)/15d-14(a) Certification of Principal Executive Officer of Applied Genetic Technologies Corporation |

|

|

|

|

31.2* |

Rule 13a-14(a)/15d-14(a) Certification of Principal Financial Officer of Applied Genetic Technologies Corporation |

|

|

|

|

32.1** |

Section 1350 Certification of Principal Executive Officer and Principal Financial Officer of Applied Genetic Technologies Corporation |

|

|

|

|

101* |

Interactive Data Files pursuant to Rule 405 of Regulation S-T (XBRL) |

|

† |

Management contract or compensatory plan or arrangement. |

18

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

APPLIED GENETIC TECHNOLOGIES CORPORATION

(Registrant) |

|

|

|

|

By: |

/s/ Lawrence E. Bullock |

|

|

Lawrence E. Bullock |

|

|

|

|

|

Date: May 11, 2015 |

19