UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number

(Exact name of Registrant as specified in its Charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

The |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

☒ |

Smaller reporting company |

||

|

|

|

|

Emerging growth company |

|

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of June 30, 2021 (the last business day of the Registrant’s most recently completed second fiscal quarter), the aggregate market value of the Registrant’s common stock held by non-affiliates of the Registrant was approximately $

The number of shares of Registrant’s common stock ($0.0001 par value) outstanding as of March 18, 2022, was

DOCUMENTS INCORPORATED BY REFERENCE

AIRGAIN, INC.

TABLE OF CONTENTS

FORM 10-K

For the Year Ended December 31, 2021

|

|

Page

|

|

|

|

Item 1. |

4 |

|

Item 1A. |

19 |

|

Item 1B. |

43 |

|

Item 2. |

43 |

|

Item 3. |

43 |

|

Item 4. |

43 |

|

|

|

|

|

|

|

Item 5. |

44 |

|

Item 6. |

44 |

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 |

Item 7A. |

56 |

|

Item 8. |

56 |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

56 |

Item 9A. |

56 |

|

Item 9B. |

57 |

|

Item 9C |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

57 |

|

|

|

|

|

|

Item 10. |

58 |

|

Item 11. |

58 |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

58 |

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

58 |

Item 14. |

58 |

|

|

|

|

|

|

|

Item 15. |

59 |

|

Item 16. |

59 |

2

PART I

FORWARD-LOOKING STATEMENTS AND MARKET DATA

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact contained in this annual report, including statements regarding our future operating results, financial position and cash flows, the impact of COVID-19, our business strategy and plans and our objectives for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. This annual report on Form 10-K also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,” “could,” “should,” “expect,” “plan,” “anticipate,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this annual report are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, operating results, business strategy, short-term and long-term business operations and objectives. These forward-looking statements speak only as of the date of this annual report and are subject to a number of risks, uncertainties and assumptions, including those described in Part I, Item 1A, “Risk Factors.” The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

Airgain, the Airgain logo, and other trademarks or service marks of Airgain appearing in this annual report are the property of Airgain, Inc. This annual report also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this annual report appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

3

ITEM 1. BUSINESS

Overview

Airgain is a leading provider of advanced wireless connectivity solutions and technologies used to enable high performance networking across a broad range of devices and markets, including consumer, enterprise, and automotive. Our mission is to connect the world through optimized integrated wireless solutions. Combining design-led thinking with testing and development, our technologies are deployed in carrier, fleet, enterprise, residential, private, government, and public safety wireless networks and systems, including set-top boxes, access points, routers, modems, gateways, media adapters, portables, digital televisions, sensors, fleet tracking, in-vehicle networking, and asset tracking devices. Through our pedigree in the design, integration, and testing of high-performance wireless modules and antenna technology, we have become a leading provider of integrated communications products that solve critical connectivity needs.

We built the foundation of our business through the evolution of the IEEE 802.11 protocol standards. Over the years, we have diversified our wireless connectivity solutions into cellular communications, starting with 3G technology, leading to LTE and more recently, 5G. As the number of wireless standards has increased, we have adapted to develop the necessary solutions to meet end customer needs.

Airgain’s core business primarily focuses on the following three key targeted markets:

4

As a wireless connectivity solution provider that has a history in radio frequency technology, we are leveraging our experience in embedded antenna solutions and embedded modems to transition from a components provider to a wireless system solutions provider. In 2020 we announced our new patented AirgainConnect® platform. We believe this flagship platform offers a novel solution in our public safety and fleet focused automotive markets and will play a key role in our future strategy for 5G solutions internationally for automotive and enterprise markets. The first product from the AirgainConnect platform is the FirstNet Ready™ AirgainConnect AC-HPUE antenna-modem, targeting vehicles used by first responders like police, fire and EMS and public safety support vehicles which include bus, rail, courier, utility, waste or water management, and security. The AirgainConnect AC-HPUE antenna-modem includes an integrated high-power LTE modem supporting the 3GPP Band 14 HPUE (or high power user equipment) output power functionality known as MegaRange™ by AT&T. This compact vehicle antenna-modem solution tightly couples essential LTE radio components with the antenna system to provide improved connectivity for public safety and fleet vehicles certified to run on the AT&T FirstNet network. The AirgainConnect AC-HPUE more than doubles the range of existing solutions, a result of its ability to transmit 10 times the power of existing solutions today. The incremental power improves the ability to communicate in challenging environments including dense urban areas, underground garages and tunnels, and provides a significant advantage for first responders in poor signal coverage areas like rural areas or mountain ranges. Through technological innovation, the AirgainConnect AC-HPUE antenna-modem combines the modem and antenna elements designed to deal with complexities of integration and heat dissipation, while maintaining a sleek form factor that is suitable for placement on a vehicle, which is a reason why AirgainConnect AC-HPUE is the first antenna-modem product servicing AT&T FirstNet.

The AirgainConnect AC-HPUE antenna-modem initially targets the U.S. first responder market, which we believe represents a $500 million plus addressable market for products in the AirgainConnect platform. The average selling price of the AC-HPUE is near the $1,000 range, which represents a significant increase over the average selling price for our portfolio of antenna products, which were sold in the tens of cents to tens of dollars range.

We have already begun developing products to address other U.S. carriers, global carriers, and enterprise fleet opportunities leveraging the AirgainConnect platform that will expand the $500 million plus addressable market significantly with a global total addressable market for the AirgainConnect platform we estimate at $4 billion today. We are very excited about this first product, the potential of the AirgainConnect platform overall, and the related growth potential as we further our transition to a wireless systems solutions provider.

We use third parties to manufacture our embedded antenna solutions while maintaining oversight for critical quality, test, and calibration functions. As of December 31, 2021, we had over 270 issued and pending patents worldwide.

NimbeLink Acquisition

On January 7, 2021 we purchased 100% of the outstanding shares of Minnesota-based NimbeLink Corp. NimbeLink is an IIoT company focused on the design, development, and delivery of cellular solutions for enterprise customers. NimbeLink provides carrier-certified embedded modems and asset tracking solutions that minimize or often eliminate RF design and certification time from project schedules, significantly reducing costs and time to market.

5

NimbeLink’s smart simple cellular solutions allow its customers to get their machines and asset connected to the internet quickly providing a quick time to market, driving data to the enterprise and allowing them to make better business decisions. Nimbelink’s go to market strategy is business to business with a core set of internal sales resources focused on leveraging a set of distributors and VARs. NimbeLink focuses on medium to large OEMs.

The acquisition of NimbeLink supports Airgain’s transition toward becoming a system-level company and will play an important role in our overall growth strategy to broaden market diversification, especially within the IIoT space. NimbeLink’s expertise in IIoT puts them squarely in one of our targeted submarkets, within the bigger enterprise market, and extends the breadth and opportunity for our AirgainConnect platform. For NimbeLink, Airgain’s worldwide salesforce represents a present opportunity to expand NimbeLink’s reach and NimbeLink will now gain access to design opportunities they were not previously able to win. The result is an increase in the opportunities for Airgain in the enterprise market and a more diverse offering of products and expertise for our customers. We plan to include products with the NimbeLink brand under our broader Enterprise IIoT product lines.

Industry Background and Market Opportunity

Global adoption of Wi-Fi has been a major contributor to our growth history to date. An increasing amount of people rely on Wi-Fi as the primary means to connect to the internet. Wi-Fi has become critical and vital to every public venue (retail shopping centers, airports, sports venues, the hospitality space, among others), and has become the key method for in-home consumer connectivity. As we transition to a more comprehensive wireless systems solution provider and continue to drive increased growth in the enterprise and automotive markets, mobile network (cellular) connectivity, and 5G in particular, is becoming an increasingly significant portion of our business, underpinned by the growth in cellular connectivity and data consumption demands globally. While historically Wi-Fi adoption was the primary contributor to our market potential, as we transition into a wireless systems solution provider we will consider mobile network connected device trends as an equal, if not more important indicator of our company’s market opportunity. We believe the greater proportion of traffic being transmitted and received over wireless technologies, and the transition to new and more capable wireless technology standards, are direct indicators of future opportunity for our antenna and wireless connectivity solutions and services.

During the COVID-19 pandemic Wi-Fi connectivity has grown in importance as consumers use it for connecting to videoconferencing, telehealth, and other critical applications and services. Wi-Fi has long been leveraged as one of the main solutions to meet the increasing demand for bandwidth, which enables operators to scale capacity to meet their subscribers’ needs. With advances and ratifications in Wi-Fi standards, dense environments with many concurrently connecting devices and IoT connections such as airports, public transportation, retail, healthcare, smart cities, stadiums, among others, result in public WI-FI use cases across multiple industry segments. Wi-Fi 4 and 5 Wi-Fi (IEEE 802.11ac) standards are expected to represent 66.8% of all WLAN endpoints by 2023 providing a range of speeds that allow users to view medium-resolution video streaming because of the higher throughput. Wi-Fi 5, with very high theoretical speeds, is considered a true wired complement or equivalent and can enable higher definition video streaming and services with use cases that require higher data rates. The latest Wi-Fi 6 (802.11ax) standard further improves the average throughput per user by a theoretical factor of at least four times in dense user environments, which will allow for dense IoT deployments. By 2023, 27% of all WLAN endpoints are expected to be equipped with Wi-Fi 6.

To help meet the increasing demand for Wi-Fi and other unlicensed services, the Federal Communications Commission, or FCC, has led the way making additional blocks of frequency spectrum such as 5.9GHz and 6-7GHz spectrum available. More spectrum and larger channel bandwidth provide the needed capacity to support even more devices, at even faster speeds. We believe this new available spectrum will represent an opportunity for our solutions in fixed wireless access deployments.

6

Mobile network devices are evolving from lower-generation network connectivity (3G) to higher-generation network connectivity (3.5G, 4G or LTE and now also 5G), combining device capabilities with faster, higher bandwidth and more intelligent networks will contribute to increased mobile and Wi-Fi traffic. According to the Cisco Annual Internet Report (2018-2023), over 70% of the global population will have mobile connectivity by 2023. The total number of global mobile subscribers will grow from 5.1 billion (66% of population) in 2018 to 5.7 billion (71% of population) by 2023. 5G devices and connections will be over 10% of global mobile devices and connections by 2023. By 2023 global mobile devices will grow from 8.8 billion in 2018 to 13.1 billion by 2023 – 1.4 billion of those will be 5G capable. The fastest growing mobile device category is M2M followed by smartphones. The mobile M2M category is projected to grow at a 30% CAGR from 2018 to 2023. Smartphones will grow at a 7% CAGR within the same period. This transition from 3G and below to 4G and now 5G deployment is a global trend and by 2023, nearly 60% of the mobile devices and connections globally will have 4G+ capability. North America will have the highest share of its devices and connections on 4G+ connectivity – 62% by 2023. By 2023 North America will be the region with highest share of connections on 5G at 17%.

Technology Benefits

We continuously strive to remain at the forefront of wireless technologies. We work closely with leading wireless chipset manufacturers, carriers and OEM’s on the cutting edge of new wireless technology introduction, while we continue to focus on extending our core competencies in product innovation, quality, levels of integration and OTA performance verification processes, helping to ensure we continue to deliver on our promise of optimal antenna and wireless system performance.

Benefits to our Customers

We have developed strong relationships with leading WLAN chipset vendors, OEMs, and key service providers, keeping us at the forefront of new developments in wireless technologies and industry requirements. We share our expertise with customers in several areas including design, engineering, and testing, and provide insights based on years of experience across hundreds of devices. By harnessing our specialized experience and expertise, we offer solutions that can improve our customers’ product performance, reduce their staff costs and allow our customers to focus on non-antenna related factors in the face of short design, engineering and production windows. Rather than rely upon a captive engineering group that only works on in-house opportunities, we act as an outsourced antenna design, engineering, and test group for our customers. We also bring years of experience in delivering high performance, ultra-reliable wireless connectivity for mobile, fleet, and IIoT and machine-to-machine, or M2M, applications.

Benefits to Wireless Users

By focusing on performance, we strive to improve product satisfaction with customers. Often, competing makers of wireless devices use chips that are made by the same semiconductor manufacturer. Antenna reliability depends on numerous factors including material, mount position, physical connection and resistance to oxidation. However, the selection and placement of an antenna, or antennas, can change the performance characteristics measurably. Each sale of a wireless solution is customized according to the needs and requirements of the customer. Tradeoffs exist on placement, power, price, and other variables. By focusing on performance, we challenge our engineers to deliver the optimal solution given the customer’s product constraints. This commitment to performance has established us as one of the recognized leaders in the design, testing, and performance of wireless systems, and led to what we believe is one of the broadest blue-chip customer lists in the industry.

Products

Our products are found in a broad range of applications and end-user devices that are deployed in carrier, fleet, enterprise, residential, private, government, and public safety wireless networks and systems, including set-top boxes, access points, routers, modems, gateways, media adapters, Wi-Fi extenders, portables, digital televisions, sensors, and fleet and asset tracking devices. Our products have been adopted by some of the world’s leading telecom manufacturers and networking companies and are now being used by millions of carrier subscribers in the

7

United States, Canada, Europe, and Asia Pacific. We offer several product categories designed to maximize the performance of wireless devices while providing cost and design flexibility:

8

Design Partnerships

We have entered into joint development efforts with WLAN chipset vendors to collaborate on next-generation WLAN reference designs, where we jointly pursue the development of reference design platforms optimized for use with integrated embedded antenna solutions. These WLAN reference designs are intended to provide ODMs with high performance, embedded antenna solutions that provide consistent, measurable results and provide a path to reduced product development costs and cycle times.

Our collaborative relationships with 802.11 chipset vendors offer opportunities for market access and improved sales of both chipsets and antennas. Early access to chipset vendors’ offerings, including industrial design tradeoffs in enclosure, board layout and design, all offer chipset vendors the advantage of optimized performance in their reference designs. When our antennas are consequently listed in the reference bill of materials for the major chipset vendors’ products, these antennas become the default performance recommendation for all products utilizing that chipset. Ongoing contact with the OEM’s and ODM’s, along with default use of the reference bill of materials components specified by chipset vendors, generates a dependable flow of sales opportunities for us.

Growth Strategy

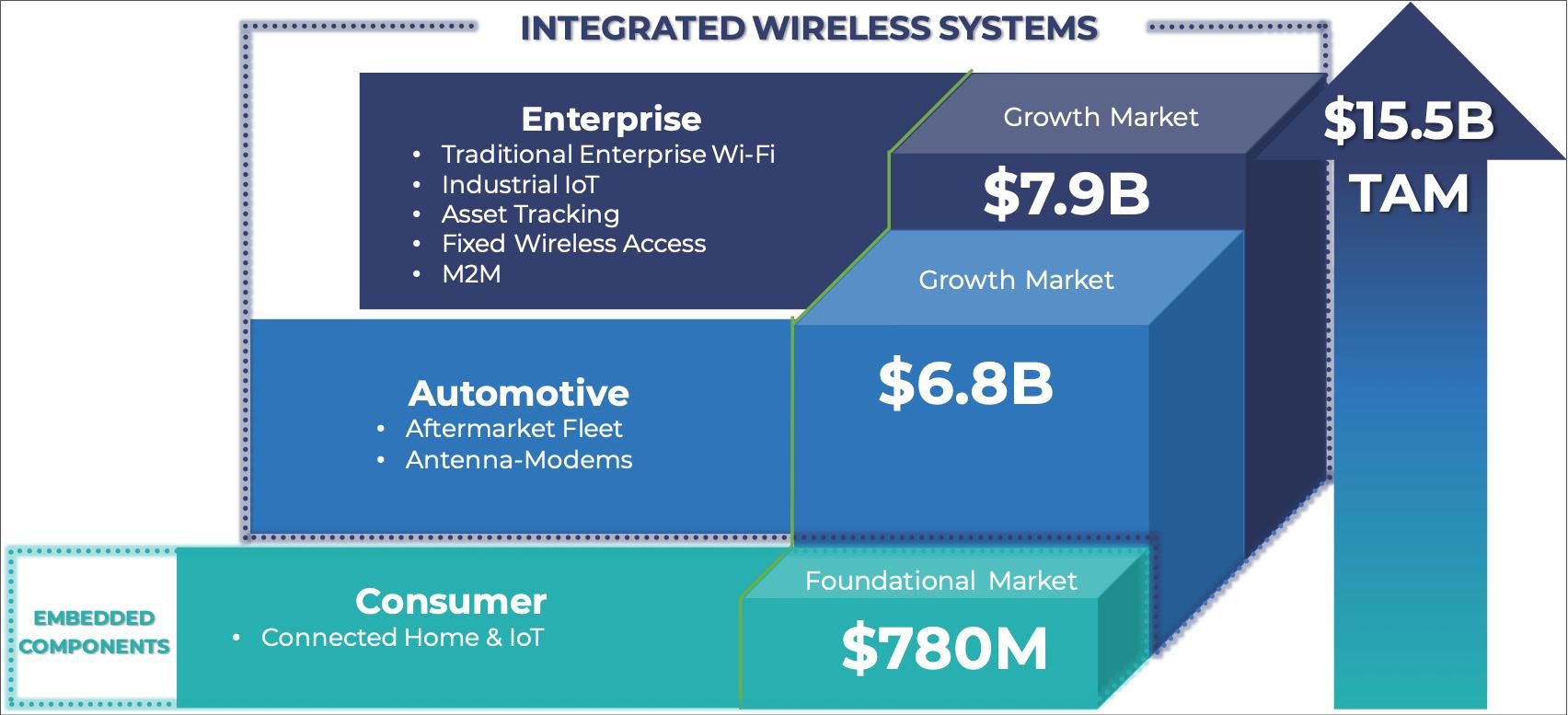

We are in the process of transitioning from a passive antenna and related services provider to a wireless system solutions provider, targeting higher levels of integration and complexity, and therefore, higher selling prices and margins. Climbing the value curve and expanding our presence in adjacent markets are key ingredients to our growth strategy. In terms of markets, our growth strategy is centered around targeting three key markets, specifically, consumer, enterprise and automotive. We consider our consumer market as foundational revenue, with enterprise and automotive markets representing our primary growth markets. The following graphic provides a summary of our estimated total addressable market within each of these three markets. As highlighted in the graphic below, based on ABI Research and our internal ASP estimates, by the end of 2022, we estimate a total addressable market, or TAM, to be in excess of $15.5 billion.

9

Within our foundational consumer market most of our revenue comes from gateways and routers that are sold to cable multiple system operators, or MSOs. While the MSO companies have faced “cord-cutting” in favor of over-the-top, or OTT, internet-based programming, the cord-cutting trends have not impacted the market for gateways and routers, as OTT devices still need access to the internet in the home through Wi-Fi via the gateway.

The transition towards Wi-Fi 5 and Wi-Fi 6 standards, and more recently the 6GHz extension to Wi-Fi 6, labelled Wi-Fi 6E is driving a new wave in device upgrades. The shift toward Gigabit Wi-Fi 6 is creating increased demand for our solutions as the number of antennas per device increases substantially. Wi-Fi 6 provides a theoretical ability to deliver speeds in excess of 14Gbps using 4x4 MIMO which is comparable to full duplex DOCSIS 3.1 and 5G bandwidths, resulting in wireless bandwidth delivery achieving parity with wireline speeds. Given the performance improvements over existing systems, service providers around the world are expediting their upgrade cycle towards higher performing consumer devices, driving a device design refresh cycle.

We continue to penetrate an increasing scope of adjacent wireless device applications within the consumer market such as home security, smart appliances, and connected healthcare devices. We are also expanding our footprint in these markets through support of an increasing range of IoT wireless standards, such as Bluetooth, ZigBee, Z-Wave, Thread, NB-IoT and LoRa WAN. Our engineering team provides custom antenna solutions to support a variety of device constraints, including flexible antenna technology for curved and smaller form factors, and specific absorption rate, or SARs, compliant antennas for body worn applications.

In the automotive market, the trend towards the ubiquitous connected car and the demand for increasingly complex aftermarket/fleet wireless connectivity solutions, are key growth drivers for us. The automotive market represents a significant growth opportunity both near and long term. Connected cars require embedded and external mounted antennas for a complete wireless solution. We have a leading portfolio of automotive antenna connectivity solutions, from embedded solutions for OBD II, IHU and connected car gateways, to custom ‘shark fin’ style antennas for automotive applications, mainly targeting mobile and automotive fleet applications for government, public safety, and enterprise applications. Our strategy is to continue to leverage our Antenna Plus brand in the North American fleet and public safety automotive aftermarket segments to generate near-term revenue. For longer term revenue growth opportunities, we are pursuing the European and other international aftermarket fleets and motorhome antenna markets. In 2020 we launched Centurion Next, the first of the 5G family with Wi-Fi 6 support, as part of the 5G refresh of our Antenna Plus fleet antenna product lines. For international markets, we obtained our first European compliance qualification in 2020 opening the door to the distribution of our 5G capable fleet and M2M antenna products.

10

Our new patented AirgainConnect antenna-modem platform is expected to be the biggest growth contributor to the automotive market. The first AirgainConnect product, the AC-HPUE, is currently one of only two HPUE products certified for use on the AT&T FirstNet network. AT&T activated the first HPUE on the FirstNet network in January 2021. While FirstNet primary users are first responders, there are extended-primary users from transit agencies; public-utility and tow-truck companies; school districts; a state child-protective-services agency, airports, and television/media news outlets. The AirgainConnect platform has the potential to address a very broad set of sub-market applications. In addition, AC-HPUE supports all AT&T LTE bands, so is usable with or without HPUE. We are developing our next generation AirgainConnect product to feature a global modem. The patented AirgainConnect AC-HPUE is the first HPUE antenna-modem product available for vehicles and we have certain exclusive rights to the use of the HPUE modem module from our partner Assured Wireless Corporation, for rooftop vehicular applications.

Within the enterprise market, we are targeting new 5G device programs primarily sub-6GHz, citizens broadband radio service, or CBRS, and Wi-Fi 6, for integrated smart antenna systems. This allows us to leverage our core competencies in advanced antenna designs in a market that offers significantly higher selling prices in the 10s of dollars to hundreds of dollars range. CBRS is driving new use cases including private LTE, leading to private 5G, and cellular operators for fixed wireless access, or FWA, and for secondary indoor spectrum. New 5G spectrum is creating opportunities for operators to establish or expand FWA offerings, to compete with wired incumbents, driving development of a new wave of 5G-enabled customer-premises equipment devices and small cells. The enterprise market is characterized by various submarket segments, each having different characteristics and therefore different growth strategies. Our strategy in the enterprise Wi-Fi submarket is to focus on customized embedded, and external antenna systems for the top two global OEMs in this market. In 2020 we were on-boarded as a supplier to a global leader in Enterprise Wi-Fi for the award of an active stand-alone high-gain Wi-Fi antenna system that we entered into volume production in Q3 2021. On the cellular side of the enterprise market, we are currently developing core 5G antenna systems designs and associated intellectual property, while being actively engaged in a new wave of 5G small cell and FWA device. We expect this trend in 5G enabled device opportunities to continue to ramp in 2022. Technical challenges relate to the complexity of integration and coverage of a broader range of frequency bands, including C-Band, new millimeter wave, or mmW 5G NR spectrum. Our first phase of active beam steering mmW 5G antenna technology was successfully demonstrated to our customers in a live demonstration at CES in January 2020.

Within the M2M and IoT infrastructure submarket of the enterprise market, serviced by our Antenna Plus products, we see expect to see growth in demand for in-building, out-building, and on-building connectivity solutions for commercial, retail, and office, outdoor kiosk, signage, and fixed asset connectivity and tracking. According to ABI research, by 2023, there will be approximately 12 million new M2M wireless modem shipments per year, up from approximately six million new modem shipments in 2018. We expect the addition of NimbeLink products to our portfolio to immediately help us drive growth in the IIoT segment of the enterprise market.

We provide a comprehensive set of services for single and multi-client OTA performance testing, characterization, and validation for wireless devices utilizing the common wireless standards including WLAN, Bluetooth, ZigBee, Z-Wave, LoRa, LTE, CBRS, and 5G. Our service offering includes early-stage system design, custom engineering support, and superior OTA testing services for service providers and OEMs. Our proprietary OTA testing process has become highly regarded in wireless throughput evaluation, enabling our service offering to create stickiness with customers as they depend on our testing services to evaluate their products. Some of our customers have implemented their own performance testing capability in-house, reducing their need to purchase OTA performance testing services from us, thereby limiting the growth potential of our services revenue in the enterprise market. Despite these challenges, we continue to see demand for these services and we plan to continue to leverage this offering to customers and applications in adjacent markets.

Over the next several years, we believe the adoption of 5G on a global basis will offer incremental growth opportunities for us. According to ABI Research, 25% of network traffic will be 5G by 2023. 5G wireless antenna systems are more complex and highly integrated as they need to support complex active architectures for new configurations such as active beam forming, and new frequency block allocations and auctions in the sub-6GHz and mmWave, frequency bands. We believe this shift in antenna complexity and integration will allow us to leverage our expertise and antenna performance, including integration between antenna and the RF front end, to enhance the value proposition to our customers. Furthermore, highly integrated and complex designs demanded by 5G will

11

require closer coordination between the ecosystem of component vendors, OEMs and Chipset Vendors, a key strength of ours.

In the United States we have a strong position with service providers, carriers, and MSO’s that supply in-home residential wireless equipment. That said, we believe there are growth opportunities on the international front. This includes Europe, especially in areas of the connected home and aftermarket automotive markets which will offer meaningful opportunities.

Our mission is to connect the world through advanced antenna systems and integrated wireless solutions. The key elements of our strategy are listed below.

Customers

Our customers are global. Our top customers, Synnex Technology International (HK) Ltd., Syntech Asia Ltd. and Get Wireless, LLC accounted for more than 45% of sales for the year ended December 31, 2021. We generally

12

work with Engineering, Product Management, Product Line Management, Product Marketing, Design, and similar groups to provide antenna solutions. While the sale of the product may be to an OEM and ODM, or via a distributor, we also consider our customers to include chipset vendors and service providers. We market our design capabilities directly to chipset vendors and service providers to generate demand.

13

Sales and Marketing

Our sales and marketing organizations work together closely to improve market awareness, build a strong sales pipeline, and cultivate ongoing customer relationships to drive sales growth.

Sales

Our global sales effort consists of direct and indirect sales teams, and indirect channel partners. Our direct sales team consists of inside sales personnel based in the United States, China and Taiwan and our outside field sales teams based in the United States, the United Kingdom, South Korea, China, and Taiwan. Our outside field sales teams consist of business, sales, account, technical marketing and program managers, and field application engineers, or FAEs. Our indirect channel partners consist of distributors, engineering design companies and outside sales representatives.

Our outside sales team is engaged in pre-sales, account management, and creating partnership opportunities with third parties such as service providers and semiconductor manufacturers. They are assigned quotas and have defined sales territories and/or accounts. The sales process includes meeting and qualifying potential programs and customers, and actively managing the planning stage of devices they plan to bring to market. Our FAEs assist these managers by providing technical support to existing customers.

Our indirect channel partners provide lead generation, pre-sales support, product fulfillment and, in certain circumstances, post-sales customer service and support. This channel partner network often co-sells with our inside sales and field sales teams. Our channel provides us with additional sales leverage by sourcing new prospects, providing technical support to existing customers, upselling for additional use cases and daily indexing capacities, and maintaining repeat business with existing customers. These channels provide added coverage to customers and prospects we cannot reach directly.

Marketing

Our marketing strategy is focused on building a competitive advantage for Airgain’s brands and products in the marketplace. We target two types of customers. For our embedded products, such as our embedded antennas and Skywire modems, we target design teams within OEMs and ODMs. For our integrated products, such as our asset trackers and AirgainConnect, we target end user markets. We use both direct and indirect promotional methods to engage our audiences. Direct methods include advertising, web properties, marketing collateral, email campaigns, paid and organic social media, search engine marketing, media relations, content marketing, direct mail, tradeshows and events, and general lead generation tactics. Indirect methods include co-marketing efforts together with resellers, distributors, system integrators, hardware and software partners, and carriers. Both are areas where we plan to invest greater efforts in the future.

The three primary goals of the marketing team are to uncover new opportunities in the marketplace, support any existing opportunities currently in the pipeline, and increase deal size by introducing customers and prospects to the breadth of our product line. We continue to see increased benefit from our marketing technology and marketing automation efforts in accomplishing these goals. In addition, digital channels have proven to be more effective in generating additional interest and leads for both the field sales team as well as the channel, so we will continue to shift our focus accordingly.

14

Competition

The antenna and wireless solutions market is highly competitive and is characterized by rapid technological change and evolving standards. Our principal competitors fall into four categories:

15

The principal competitive factors in our markets include:

We compete primarily based on antenna and RF system performance, our intellectual product portfolio, design and testing capabilities, and reputation. We believe we generally compete favorably on the basis of these factors. However, some of our existing and potential competitors may have advantages over us. Many of our competitors are significantly larger in scale than we are and have access to greater financial, technical, marketing, and other resources. In most instances, competition among these vendors creates some level of pricing pressure and forces us to lower prices below our established list prices. Many direct competitors compete primarily based upon price and do not provide the same level of design collaboration and services as we do. For example, some high-volume Asia-based competitors are prepared to operate at less than 20% gross product margins.

Manufacturing and Operations

We have had limited in-house manufacturing capability, solely with respect to antennas deployed in the fleet and M2M antenna market, where final assembly of these antenna products was performed at our facility located in Scottsdale, Arizona. However, we have recently determined to cease production at our Scottsdale facility in the first quarter of 2022, and at that point all of the manufacturing of our products will be done at contract manufacturers, or CMs, located in the United States, China, Vietnam, Mexico and Myanmar. We have long-term relationships with certain of these CMs, and work together to control raw materials, assembly, test, quality and shipment of our antenna products. We perform quality assurance and testing at our California and Scottsdale facilities and monitor the quality performance of our CMs through quality reports and periodic audits.

We maintain a close direct relationship with our CMs to help ensure supply and quality meet our requirements. The contract manufacturing services required to manufacture and assemble our products can be satisfied by one or more of our CMs, however it may be time consuming and costly to qualify and implement new CM relationships. If our CMs suffer an interruption in their businesses, or experiences delays, disruptions, or quality control problems in their manufacturing operations, or we otherwise need to change or add additional CMs or suppliers, our ability to ship products to our customers could be delayed, and our business could be adversely affected. Our qualified CMs manufacture antenna products according to our design specification, materials specification, quality standards, and delivery requirements. We have full control and authority over the selection of materials, manufacturing processes, and inspection processes. Since our products manufactured in China are predominantly shipped to ODM’s and CM’s within Asia, we have not experienced significant impact as a result of the tariffs imposed on exports from China to the United States. Furthermore, the recent supply disruptions and chip shortages have had and may continue to have a direct impact on our business.

16

Research and Development

We invest considerable time and financial resources in research and development to enhance our antenna design and system integration capabilities and conduct quality assurance testing to improve our technology. As of December 31, 2021, we had a total of 70 employees and dedicated representatives within our research and development organization representing approximately 48% of our workforce. Our engineering team consists of engineers located in research, design, and test centers in California, Arizona, and Florida, as well as the United Kingdom and China. Our engineering team actively participates in research and development activities to expand our capabilities and target applications for the consumer, enterprise and automotive markets. We expect to continually expand our product offerings and technology solutions over time and to continue to invest significantly in ongoing research and development efforts.

In the connected home, we are developing a series of antenna products for the home security market, including designs ranging from Z-Wave applications for door sensors to customized connectivity solutions for smart metering using LTE and LPWAN standards, and antenna modules enabling gigabit speed last meter connectivity for broadband operators. We continue to architect and improve our antenna systems for our enterprise class smart antenna customers, as well as new high performance designs for the outdoor Wi-Fi and small cell markets. We continually review alternative antenna designs for increasingly complex carrier gateway products, which are expanding beyond just delivering Wi-Fi to also include 5G, ZigBee, Z-Wave, DECT, LPWAN, NB-IoT and Bluetooth applications. Finally, we are engaged in the design and evaluation of antenna systems for next generation 802.11ax technology, including reference designs with industry leading chipset vendors.

Seasonality

Our operating results historically have not been subject to significant seasonal variations. However, our operating results are affected by how customers make purchasing decisions around local holidays in China. For example, a national holiday the first week of October in China may cause customers to purchase product in the third quarter ahead of their holiday season to account for higher volume requirements in the fourth quarter. In addition, although it is difficult to make broad generalizations, our sales tend to be lower in the first quarter of each year compared to other quarters due to the Chinese New Year. The broader economic impacts caused by the COVID-19 pandemic may contribute to the traditionally slower first quarter sales this year. Results for any quarter may not be indicative of the results that may be achieved for the full fiscal year and these patterns may change as a result of general customer demand or product cycles.

Intellectual Property

We rely on patent, trademark, copyright and trade secret laws, confidentiality procedures, and contractual provisions to protect our technology. As of December 31, 2021, we had 236 issued U.S. patents covering our products as well as our embedded and external antenna technology with expiration dates ranging from 2021 to 2039, and 13 pending patent applications in the United States Patent and Trademark Office. Outside of the United States we have 21 issued patents and 7 pending patent applications with expiration dates ranging from 2022 to 2037, which entail counterparts of U.S. patent applications. The patents consist of several broad areas as summarized by the following patent groups:

Taken together, these patents with priority dates as far back as November 2001 form both a barrier to competition and a licensable asset for customers in the MIMO and antenna assembly categories.

17

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or obtain and use information that we regard as proprietary. We generally enter into confidentiality agreements with our employees, consultants, vendors and customers, and generally limit access to and distribution of our proprietary information. However, we cannot assure you that the steps taken by us will prevent misappropriation of our technology. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as the laws of the United States, and many foreign countries do not enforce these laws as diligently as government agencies and private parties in the United States.

Our industry is characterized by the existence of many patents and frequent claims and related litigation regarding patent and other intellectual property rights. In particular, leading companies in the technology industry have extensive patent portfolios. Third parties, including certain of these leading companies, may in the future assert patent, copyright, trademark and other intellectual property rights against us, our channel partners or our customers.

Employees

As of December 31, 2021, we had a total of 145 employees and dedicated representatives including 102 in the United States, 30 in China, 5 in Taiwan, 1 in South Korea and 7 in the United Kingdom. Among the total 145 employees and dedicated representatives, 18 of them were primarily engaged in manufacturing operations, 70 of them were primarily engaged in research and development, 39 of them were primarily engaged in sales and marketing and 18 of them were primarily engaged in general and administration functions. None of our employees are covered by a collective bargaining agreement or represented by a labor union. We consider our relationship with our employees to be good.

Available Information

We file electronically with the Securities and Exchange Commission, or SEC, our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make available on our investor relations website at investors.airgain.com, free of charge, copies of these reports, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The public may read or copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that website is www.sec.gov.

We use our investor relations website as a means of disclosing material non-public, information and for complying with our disclosure obligations under Regulation FD. Investors should monitor such website, in addition to following our press releases, SEC filings and public conference calls and webcasts. Information relating to our corporate governance is also included on our investor relations website. The information in or accessible through the SEC and our website are not incorporated into, and are not considered part of, this filing. Further, our references to the URLs for these websites are intended to be inactive textual references only.

18

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors, together with the other information contained in this annual report on Form 10-K, including our financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before making a decision to purchase or sell shares of our common stock. We cannot assure you that any of the events discussed in the risk factors below will not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition and growth prospects. If that were to happen, the trading price of our common stock could decline. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations or financial condition.

Summary of Risks Related to our Business

Our business is subject to numerous risks and uncertainties, including those described below. The principal risks and uncertainties affecting our business include, but are not limited to the following:

Risks Related to Our Business and Industry

The markets for our antenna solutions are developing and may not develop as we expect.

The wireless industry is characterized by rapidly evolving technologies, and the markets for our antenna systems and wireless connectivity solutions may not develop as we expect. It is difficult to predict customer adoption rates, customer demand for our antennas, the size and growth rate of our target markets, the entry of competitive products, or the success of existing competitive products. We have historically driven revenue growth

19

primarily through the top North American video service providers, largely in the consumer market. Moving forward, our goal is to drive growth in the enterprise and automotive markets. These markets may develop at varying growth rates and our success in penetrating these markets will depend on various competitive factors across a number of developing industries. Any expansion in our markets depends on several factors. For example, the continued growth in the consumer market and any increase in demand for antenna products will depend on, among things, the cost, performance, and perceived value associated with our antennas and the ability for our antenna products to meet increased performance demands, refresh cycles and device form factors. Further, as we continue to transition to a wireless systems solution provider, increased growth in the enterprise and automotive markets will depend on, among things, acceptance of our solutions by our customers and performance of the networks on which our products operate. For example, the market for our AirgainConnect AC-HPUE product is highly dependent on the overall first responders market and AT&T’s FirstNet network, and this market has not to date resulted in significant sales of our product and the market may not further develop on the timeframes we expect, or at all.

If our wireless solutions do not achieve widespread adoption, if there is a slower rollout than we expect in certain markets or there is a reduction in demand for our wireless connectivity solutions or antennas in our markets caused by a lack of customer acceptance, technological challenges, competing technologies and products, decreases in corporate spending, weakening economic conditions, or otherwise, it could result in reduced customer orders, early order cancellations, or decreased sales, any of which would adversely affect our business, operating results and financial condition.

Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance.

Our quarterly and annual operating results have fluctuated in the past and may fluctuate significantly in the future, which makes it difficult for us to predict our future operating results. The timing and size of sales of our products are variable and difficult to predict and can result in fluctuations in our net sales from period to period. In addition, our budgeted expense levels depend in part on our expectations of future sales. Because any substantial adjustment to expenses to account for lower levels of sales is difficult and takes time, we may not be able to reduce our costs sufficiently to compensate for an unexpected shortfall in net sales, and even a small shortfall in net sales could disproportionately and adversely affect our operating margin and operating results for a given quarter.

Our operating results may also fluctuate due to a variety of other factors, many of which are outside of our control, including the changing and volatile U.S., European, Asian and global economic environments, and any of which may cause our stock price to fluctuate. Besides the other risks in this “Risk Factors” section, factors that may affect our operating results include:

20

The cumulative effects of the factors above could result in large fluctuations and unpredictability in our quarterly and annual operating results. For example, the ongoing tension on global trade and macroenvironment are impacting the whole supply chain to varying degrees, which, in addition to the slowdown in customer specific product rollouts, has negatively affected our business and may continue to do so. In 2021 a global supply shortage caused a delay in customer specific rollouts and a delay in our ability to source required components for certain of our products, as well as the ability of our customers to source required components for end products that incorporate our products. These supply chain interruptions have caused and may continue to result in a delay in our sales, as well as fluctuations in timing of our supply chain purchases as we look to secure components in advance to account for longer lead times. Together with inflationary and other effects, this has resulted and may continue to result in higher prices from our suppliers that have negatively affected, and could continue to negatively affect, gross margins and operating expenses. As a result, comparing our operating results on a period-to-period basis may not be meaningful. You should not rely on our past results as an indication of future performance.

In addition, the financial markets and the global economy may be adversely affected by the current or anticipated impact of military conflict, including the conflict between Russia and Ukraine, terrorism or other geopolitical events. Sanctions imposed by the United States and other countries in response to such conflicts, including the one in Ukraine, may also adversely impact the financial markets and the global economy, and any economic countermeasures by affected countries and others could exacerbate market and economic instability. There can be no assurance that further deterioration in credit and financial markets and confidence in economic conditions will not occur. Our general business strategy and operating results may be adversely affected by any such economic downturn, volatile business environment, or continued unpredictable and unstable market conditions. In addition, there is a risk that one or more of our current manufacturers, suppliers or customers may not survive an economic downturn, which could adversely affect our business and operating results.

Our antenna solutions and wireless connectivity solutions are subject to intense competition, including competition from the customers to whom we sell.

Antenna solutions is an established technical field with low intellectual property and technological barriers to entry. Antenna competition exists globally for all areas of our business and product lines. The markets in which we compete are rapidly evolving and intensely competitive, and we expect competition to increase in the future from established competitors and new market entrants. The markets are influenced by, among others, brand awareness and reputation, price, strength and scale of sales and marketing efforts, professional services and customer support, product features, reliability and performance, scalability of products, and breadth of product offerings. Due to the proprietary nature of some of our products, competition occurs primarily at the design stage. As a result, a design win by our competitors or by us typically limits further competition regarding that design. This competition could result in increased pricing pressure, reduced profit margins, increased sales and marketing expenses and failure to increase, or the loss of, market share, any of which would likely seriously harm our business, operating results or financial condition. In addition, some of our ODM, OEM and carrier and retail-focused end-customers that drive the use of our antenna solutions have and, in the future, may build internal antenna design teams that compete with our products. From a cost and control perspective, our products generally cost more than our competitors’ products. If our ability to design antenna solutions is deemed to be on par or of lesser value than competing solutions, we could lose our customers and prospects.

Additionally, our movement into more system-based solutions may bring more competitors into our markets than we have traditionally faced. As our solutions begin to contain more system components and commensurate higher average selling prices, the resulting product categories may attract additional competitors or our customers

21

may be more likely to begin to develop competing products. Our AirgainConnect product is the only HPUE antenna-modem certified by AT&T for the FirstNet network, and currently one of only two HPUE products certified by AT&T for FirstNet MegaRange, with the other such product being a stand-alone modem product marketed by our supplier of the HPUE modem module, and so our supplier competes with us for sales to certain customers. While we believe our intellectual property estate and limited exclusivity agreement with Assured Wireless for use of their HPUE modem module in a vehicular antenna-modem product provide us a competitive advantage, we cannot assure you that other competitors will not enter the market and limit the growth potential of our AirgainConnect platform. Our exclusivity with Assured Wireless is limited in duration and subject to termination if we fail certain of our obligations under our agreement. In addition, if our relationship with Assured Wireless is terminated, or AT&T decertifies our products on its networks, our business and operating results and financial condition may be materially affected.

New entrants and the introduction of other distribution models in our markets may harm our competitive position.

The markets for development, distribution, and sale of our products are rapidly evolving. New entrants seeking to gain market share by introducing new technology and new products may make it more difficult for us to sell our products, and could create increased pricing pressure, reduced profit margins, increased sales and marketing expenses, or the loss of market share or expected market share, any of which may significantly harm our business, operating results and financial condition.

Our future success depends on our ability to develop and successfully introduce new and enhanced products and services for the wireless market that meet the needs of our customers.

Our sales depend on our ability to anticipate our existing and prospective customers’ needs and develop products that address those needs. Our future success will depend on our ability to introduce new products for the wireless market, anticipate improvements and enhancements in wireless technology and wireless standards, and to develop products that are competitive in the rapidly changing wireless industry. In furtherance of these efforts, we expect to invest significantly in ongoing research and development. If we do not adequately fund our research and development efforts, or if our research and development investments do not translate into material enhancements to our antenna products, we may not be able to compete effectively and our business, results of operations, and financial condition may be harmed. As we transition to a wireless systems solutions provider, we anticipate the need to increase our investment in research and development to stay on the leading edge of next generation development and to alight ourselves with the rapidly evolving technology needs of the industry. Moreover, the introduction of new products and product enhancements will require coordination of our efforts with those of our customers, suppliers, and manufacturers to rapidly achieve volume production and to support those products when they are in the field. We expect these coordination efforts to increase substantially in the future as we work with chipset vendors and OEM partners on new proof-of-concept and reference designs earlier in the development cycle. If we fail to coordinate these efforts, develop product enhancements or introduce new products that meet the needs of our customers as scheduled, our operating results will be materially and adversely affected, and our business and prospects will be harmed. We cannot assure that product introductions will meet the anticipated release schedules or that our wireless products will be competitive in the market.

In May 2020 we announced the AirgainConnect platform, including AirgainConnect AC-HPUE, an integrated FirstNet Ready™ high-power LTE modem. The introduction of the AirgainConnect platform represents a new platform that integrates high-power mobile modem technology with an antenna into the same package, enabling performance for 4G and 5G communications. The introduction of the new AirgainConnect platform, and the transition to a more expansive level of advanced product solutions, will require coordination of efforts and increased time and resources. If we fail to gain market acceptance with our customers, suppliers and manufacturers, our operating results will be materially and adversely affected, and our business and prospects will be harmed.

Furthermore, given the rapidly evolving nature of the wireless market, there can be no assurance our products and technology will not be rendered obsolete by alternative or competing technologies. The markets in which we operate are characterized by changing technology and evolving industry standards, which includes the introduction and implementation of Wi-Fi 6 and emerging 5G cellular standards. Despite years of experience in meeting customer design requirements with the latest in technological solutions, we may not be successful in identifying, developing and marketing products or systems that respond to rapid technological change, evolving technical

22

standards and systems developed by others. Our competitors may develop technology that better meets the needs of our customers. If we do not continue to develop, manufacture and market innovative technologies or applications that meet customers’ requirements, sales may suffer, and our business may not continue to grow in line with historical rates or at all.

Our embedded antenna solutions business is characterized by short product development windows and short product lifecycles.

Certain of our antenna solutions are purchased and integrated by customers in the electronics industry. In many cases, the products that include our solutions are subject to short product development windows and short product lifecycles. In the case of the short product development window, we may be pressured to provide solutions that are the lowest in cost to be accepted. Customer pressure could force us to reduce our price to win designs with short development windows. Regarding short product lifecycles, we might provide up-front design and engineering work, but ultimately lose the design to a competitor, or even if we win the design, such design could be extremely short-lived due to our customers’ inability to sell the product in significant volume. Our up-front costs associated with a design can be significant, particularly for new and emerging technology trends and industry standards, and if the sales volumes are inadequate due to lack of acceptance and/or short lifecycle, our financial performance will be impaired. Additionally, these products are dependent on the demand for and sales of the customers’ products, and any issues our customers suffer with their product sales could have an adverse impact on our sales.

Any delays in our sales cycles could result in customers canceling purchases of our products.

Sales cycles for some of our products can be lengthy, often lasting several months to a year or longer. In addition, it can take additional time before a customer commences volume production of equipment that incorporates our products. Sales cycles can be lengthy for several reasons, including:

A significant portion of our operating expense is relatively fixed and is based in large part on our forecasts of volume and timing of orders. The lengthy sales cycles make forecasting the volume and timing of product orders difficult. In addition, the delays inherent in lengthy sales cycles raise additional risks of customer decisions to cancel or change product phases. If customer cancellations or product changes were to occur, this could result in the loss of anticipated sales without sufficient time for us to reduce our operating expenses. We currently maintain significant inventories to meet forecasted future demand due to the supply chain shortages. If the forecasted demand does not materialize into purchase orders for these products, we may be required to write off our inventory balances or reduce the value of our inventory, based on a reduced sales price. A write off of the inventory, or a reduction in the inventory value due to a sales price reduction, could have an adverse effect on our financial condition and operating results.

We have a history of losses, and we may not be profitable in the future.

Before 2013 we had incurred net losses in each year since our inception. As a result, we had an accumulated deficit of $57.4 million at December 31, 2021. Because the market for our antenna products is rapidly evolving, it is difficult for us to predict our operating results. We expect our operating expenses to increase over the next several years as we hire additional personnel, particularly in engineering, sales, and marketing, and continue to develop new antenna products to address new and evolving markets. In addition, as a public company we will incur additional significant legal, accounting, and other expenses. If our sales do not increase to offset these increases in our operating expenses, we may not be profitable in future periods. Our historical sales growth has been inconsistent and

23

should not be considered indicative of our future performance. Any failure to sustain or increase our profitability consistently could cause the value of our common stock to materially decline.

A limited number of customers and devices represent a significant portion of our sales. If we were to lose any of these customers or devices, our sales could decrease significantly.

Our top customers, Synnex Technology International (HK) Ltd., Syntech Asia Ltd., and GetWireless, LLC accounted for more than 45% of sales for the year ended December 31, 2021. Although our top customers that pay for our products have historically been ODMs and distributors, it is primarily the OEMs, carrier customers and retail-focused end-customers that drove the use of our antenna solutions and the purchase by the ODMs and distributors of our antenna solutions. In addition, a few end-customer devices which incorporate our antenna products comprise a significant amount of our sales, and the discontinuation or modification of such devices may materially and adversely affect our sales and results of operations. Moving forward, as we transition to a wireless system solutions provider, we expect a shift toward external wireless solutions and antenna technologies in the automotive and enterprise markets that may result in a corresponding shift in the customer mix. Any significant loss of, or a significant reduction in purchases by, these other significant customers or customers that drive the use of our antenna solutions or a modification or discontinuation of a device which constitutes a significant portion of sales could have an adverse effect on our financial condition and operating results.

We sell to customers who are price conscious.

Our customers compete in segments of the electronics market. The electronics market is characterized by intense competition as companies strive to come to market with innovative designs that attract customers based upon design, performance, cost, ease of use, and convenience. Product lifecycles can be extremely short as companies try to gain advantage over their competitors. Because of the high design and engineering costs, companies that are customers or prospects for antenna solutions are cost conscious. As a result, our customers and prospects demand price cuts in established products and negotiate aggressively for lower pricing on new products. Because of the intense competition in the antenna solution market, we encounter situations that lead to difficult price negotiations potentially resulting in lower margins than forecast. Our products generally cost more than our competitors’ products. To address these pricing constraints and remain competitive, we must consistently design high quality antenna solutions that are deemed a better value than competing solutions, while also decreasing costs.

Our financial condition and results of operations could be adversely affected by outbreak of contagious disease such as the COVID-19 pandemic which has had an impact on our business operations and our business could continue to be materially affected, directly or indirectly.

Our business could be adversely affected by the effects of a widespread outbreak of contagious disease, including the outbreak of COVID-19, which has created considerable instability and disruption in the U.S. and world economies. The continued spread of COVID-19 and its related effects on our business have had a material and adverse effect on our business operations and our business could continue to be materially affected, directly or indirectly.

Governmental authorities in impacted regions have taken actions in an effort to slow COVID-19’s spread, resulting in business closures and a limit on consumer and employee travel. Any outbreak of contagious diseases, and other adverse public health developments could have a material and adverse effect on our business operations. In late January 2020, in response to intensifying efforts to contain the spread of COVID-19, we began to monitor or modify our hours of operation and the hours of our employees based in China, as did our contract manufacturers. As the situation progressed and the outbreak was stabilized in China, our workers and facilities, as well as those of our contract manufacturers, returned to full function with precautions in place to help prevent outbreak or spread of the virus. In the United States, most of our employees in the San Diego office are working from home and our offices are reserved for only those who cannot perform certain functions remotely, such as prototyping and testing. In accordance with local regulations, engineering, testing, and production operations in our Scottsdale office, as well as testing operations in our remote facilities, have resumed with protocols in place to prevent and limit the spread of the virus. In each work location, protocols have been established and remain in place, in accordance with government guidance, in order to minimize the risk to those employees whose presence in the office is necessary or allowed. Our sales representatives continue to engage with customers in order to secure sales of, and opportunities for, our products and services, often remotely rather than in-person. Specifically, the COVID-19 pandemic has

24

caused, and may continue to cause, a disruption and restrictions on our ability to travel, temporary closures of our office buildings and the facilities of our customers or suppliers, cancellations or modification of key industry marketing events, and disruptions with our contract manufacturers and suppliers located in Asia. Related to sales, we have also seen disruptions and delays in shipments and product launches, although orders have begun to rebound as of the second and third quarter of 2020. Such disruptions of our customers, suppliers, and contract manufacturers have had a negative impact on our sales and operating results and may continue to have a negative effect in future quarters.

The impact of the COVID-19 pandemic on the U.S. and world economies generally, and our future results in particular, could be significant and will largely depend on future developments, which are highly uncertain and cannot be predicted at this time. To the extent the COVID-19 pandemic continues to adversely affect our business and financial results, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section.

We generally rely on a limited number of contract manufacturers to produce and ship our products, and the failure to manage our relationships with these parties successfully could adversely affect our ability to market and sell our products.

We have limited manufacturing capability, solely with respect to antennas deployed in the fleet automotive market for which we primarily manufacture in our facilities in Scottsdale, Arizona. For all of our other products, we outsource the manufacturing, assembly and testing of products. We historically relied on two contract manufacturers, which are located in China, to manufacture, control quality of, and ship our products. We have over the past two years engaged additional contract manufacturers outside of China, including Vietnam, Myanmar, and Mexico, to expand our capacity, and to diversify the countries in which our products are manufactured. We have also recently engaged two additional contract manufacturers as we transition away from our in-house manufacturing of products for the fleet automotive market and with the acquisition of NimbeLink, we added a contract manufacturer in the United States. We do not have long-term contracts with these manufacturers that commit them to manufacture products for us and we have limited direct control over their activities. In addition, we may experience delays or quality issues as we begin to ramp up our new contract manufacturers and transition production from our Scottsdale facility to contract manufacturers. Furthermore, political unrest in Myanmar, or political instability or military conflict in any country in which our CMs are located, may have an adverse effect on our contract manufacturer’s ability to deliver quality products on time. Any significant change in our relationship with these manufacturers could have a material adverse effect on our business, operating results, and financial condition. We make substantially all of our purchases from our contract manufacturers on a purchase order basis. Our contract manufacturers are not required to manufacture our products for any specific period or in any specific quantity. We expect that it would take approximately six to nine months to transition manufacturing, quality assurance, and shipping services to new providers. Relying on contract manufacturers for manufacturing, quality assurance, and shipping also presents significant risks to us, including the inability of our contract manufacturers to:

As we transfer the manufacture of products at our Scottsdale facility to contract manufacturers we may not be able to receive products with consistent and satisfactory quality or in sufficient quantities to meet demand. We also may experience delays or disruptions at our manufacturing facilities, which could result in delays of product shipments to our customers. Any failure by us or our contract manufacturers to timely deliver products of satisfactory quality or in sufficient quantities in compliance with applicable laws could hurt our reputation, cause

25

customers to cancel orders or refrain from placing new orders for our products, which could have a material adverse effect on our business, operating results, and financial condition.

We may experience delays in obtaining product from manufacturers and may not be a high priority for our manufacturers.