UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 10-K

______________

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31, 2022

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Transition Period From to

| Commission File Number: | |||||

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

(Address of Principal Executive Offices) | (Zip Code) | ||||||||||

(203 905-7801

(Registrant's telephone number, including area code)

Securities registered pursuant to section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

Large accelerated filer o Accelerated filer o Non-accelerated filer ☐ ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

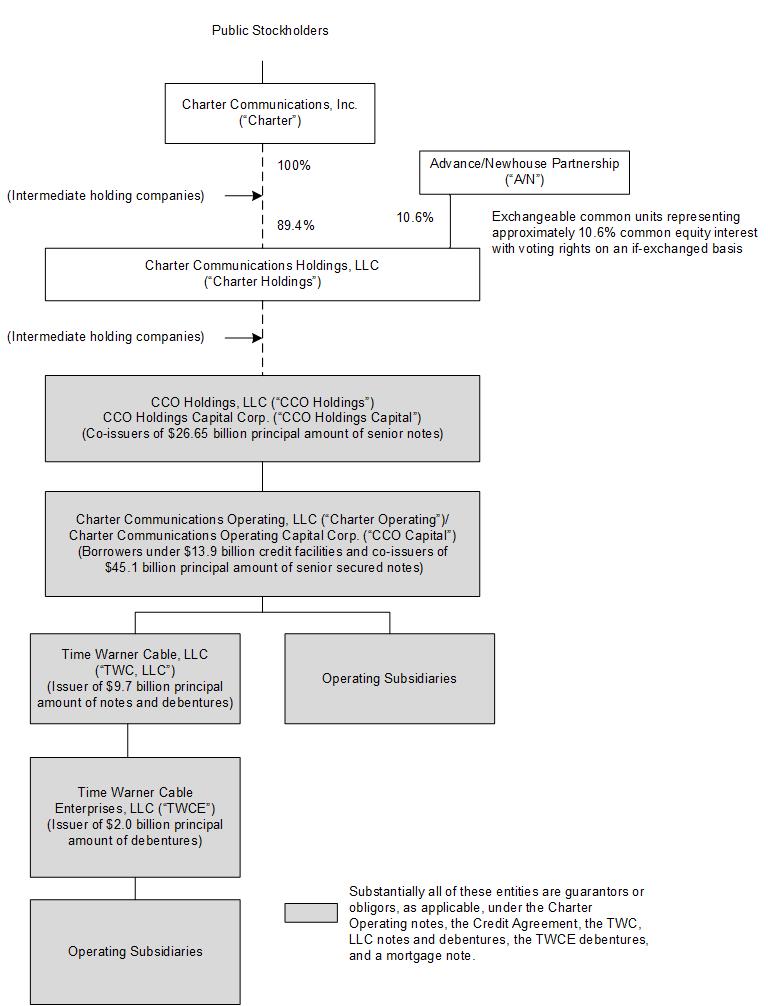

All of the issued and outstanding shares of capital stock of CCO Holdings Capital Corp. are held by CCO Holdings, LLC. All of the limited liability company membership interests of CCO Holdings, LLC are held by CCH I Holdings, LLC (a subsidiary of Charter Communications, Inc., a reporting company under the Exchange Act). There is no public trading market for any of the aforementioned limited liability company membership interests or shares of capital stock.

CCO Holdings, LLC and CCO Holdings Capital Corp. meet the conditions set forth in General Instruction I(1)(a) and (b) to Form 10-K and are therefore filing with the reduced disclosure format.

Number of shares of common stock of CCO Holdings Capital Corporation outstanding as of December 31, 2022: 1

Documents Incorporated By Reference: None

CCO HOLDINGS, LLC

CCO HOLDINGS CAPITAL CORP.

FORM 10-K — FOR THE YEAR ENDED DECEMBER 31, 2022

This annual report on Form 10-K is for the year ended December 31, 2022. The United States Securities and Exchange Commission (“SEC”) allows us to “incorporate by reference” information that we file with the SEC, which means that we can disclose important information to you by referring you directly to those documents. Information incorporated by reference is considered to be part of this annual report. In addition, information that we file with the SEC in the future will automatically update and supersede information contained in this annual report. In this annual report, “CCO Holdings,” “we,” “us” and “our” refer to CCO Holdings, LLC and its subsidiaries.

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS:

This annual report includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, our plans, strategies and prospects, both business and financial including, without limitation, the forward-looking statements set forth in Part I. Item 1. under the heading “Business” and in Part II. Item 7. under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions, including, without limitation, the factors described in Part I. Item 1A. under “Risk Factors” and in Part II. Item 7. under the heading, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this annual report. Many of the forward-looking statements contained in this annual report may be identified by the use of forward-looking words such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “on track,” “target,” “opportunity,” “tentative,” “positioning,” “designed,” “create,” “predict,” “project,” “initiatives,” “seek,” “would,” “could,” “continue,” “ongoing,” “upside,” “increases,” “grow,” “focused on” and “potential,” among others. Important factors that could cause actual results to differ materially from the forward-looking statements we make in this annual report are set forth in this annual report and in other reports or documents that we file from time to time with the SEC, and include, but are not limited to:

•our ability to sustain and grow revenues and cash flow from operations by offering Internet, video, voice, mobile, advertising and other services to residential and commercial customers, to adequately meet the customer experience demands in our service areas and to maintain and grow our customer base, particularly in the face of increasingly aggressive competition, the need for innovation and the related capital expenditures;

•the impact of competition from other market participants, including but not limited to incumbent telephone companies, direct broadcast satellite ("DBS") operators, wireless broadband and telephone providers, digital subscriber line (“DSL”) providers, fiber to the home providers and providers of video content over broadband Internet connections;

•general business conditions, unemployment levels and the level of activity in the housing sector and economic uncertainty or downturn;

•our ability to obtain programming at reasonable prices or to raise prices to offset, in whole or in part, the effects of higher programming costs (including retransmission consents and distribution requirements);

•our ability to develop and deploy new products and technologies including consumer services and service platforms;

•any events that disrupt our networks, information systems or properties and impair our operating activities or our reputation;

•the effects of governmental regulation on our business including subsidies to consumers, subsidies and incentives for competitors, costs, disruptions and possible limitations on operating flexibility related to, and our ability to comply with, regulatory conditions applicable to us;

•the ability to hire and retain key personnel;

•our ability to procure necessary services and equipment from our vendors in a timely manner and at reasonable costs including in connection with our network evolution and rural construction initiatives;

•the availability and access, in general, of funds to meet our debt obligations prior to or when they become due and to fund our operations and necessary capital expenditures, either through (i) cash on hand, (ii) free cash flow, or (iii) access to the capital or credit markets; and

•our ability to comply with all covenants in our indentures and credit facilities, any violation of which, if not cured in a timely manner, could trigger a default of our other obligations under cross-default provisions.

All forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by this cautionary statement. We are under no duty or obligation to update any of the forward-looking statements after the date of this annual report.

ii

PART I

Item 1. Business.

Introduction

We are a leading broadband connectivity company and cable operator serving more than 32 million customers in 41 states through our Spectrum brand. Over an advanced high-capacity, two-way telecommunications network, we offer a full range of state-of-the-art residential and business services including Spectrum Internet®, TV, Mobile and Voice. For small and medium-sized companies, Spectrum Business® delivers the same suite of broadband products and services coupled with special features and applications to enhance productivity, while for larger businesses and government entities, Spectrum Enterprise™ provides highly customized, fiber-based solutions. Spectrum Reach® delivers tailored advertising and production for the modern media landscape. We also distribute award-winning news coverage and sports programming to our customers through Spectrum Networks.

CCO Holdings is a holding company whose principal assets are the equity interests in its operating subsidiaries. CCO Holdings is a direct subsidiary of CCH I Holdings, LLC, which is an indirect subsidiary of Charter Communications, Inc. (“Charter”), Charter Communications Holdings, LLC (“Charter Holdings”) and Spectrum Management Holding Company, LLC.

Our network, which we own and operate, passes over an estimated 55 million households and businesses across the United States. Our strategy is focused on the evolution of our network, expansion of our footprint, and the execution of high quality operations, including customer service. It allows us to maintain a state-of-the-art network delivering the most compelling converged connectivity services in a capital and time-efficient manner, and in turn, offer advanced services to consumers at highly attractive prices, together with outstanding customer service. Offering high quality, competitively priced products and outstanding service allows us to increase both the number of customers we serve over our fully deployed network and the number of products we sell to each customer. This combination also reduces the number of service transactions we perform per relationship, yielding higher customer satisfaction and lower customer churn, which results in lower costs to acquire and serve customers and greater profitability.

Evolution – Expanding the Capability of Our Network

Over the next three years, we plan to evolve our hybrid fiber coaxial network using a number of technologies, including spectrum expansion, initially to 1.2 GHz and then to 1.8 GHz, high splits to increase upstream speeds, Distributed Access Architecture ("DAA") and DOCSIS 4.0 technology. Through this process, which we expect to essentially complete by year end 2025, we will transform our network to enable multi-gigabit data speeds to customers. Those faster speeds will be offered in conjunction with our Spectrum mobile product and Advanced WiFi, providing customers seamless and convenient, ultra-fast converged connectivity in attractively priced packages, including Spectrum One, introduced in October 2022. In addition, we expect our network evolution to enable us to offer fiber on demand across the majority of our footprint. We also offer a comprehensive video product, and Xumo, a next generation streaming platform jointly owned with Comcast Corporation ("Comcast"), will create an app-based video platform with the ability to provide streaming video packages, leverage our Spectrum TV® application, aggregate consumer streaming applications, and provide an industry leading voice search.

Expansion – Building Our Future by Extending Our Network

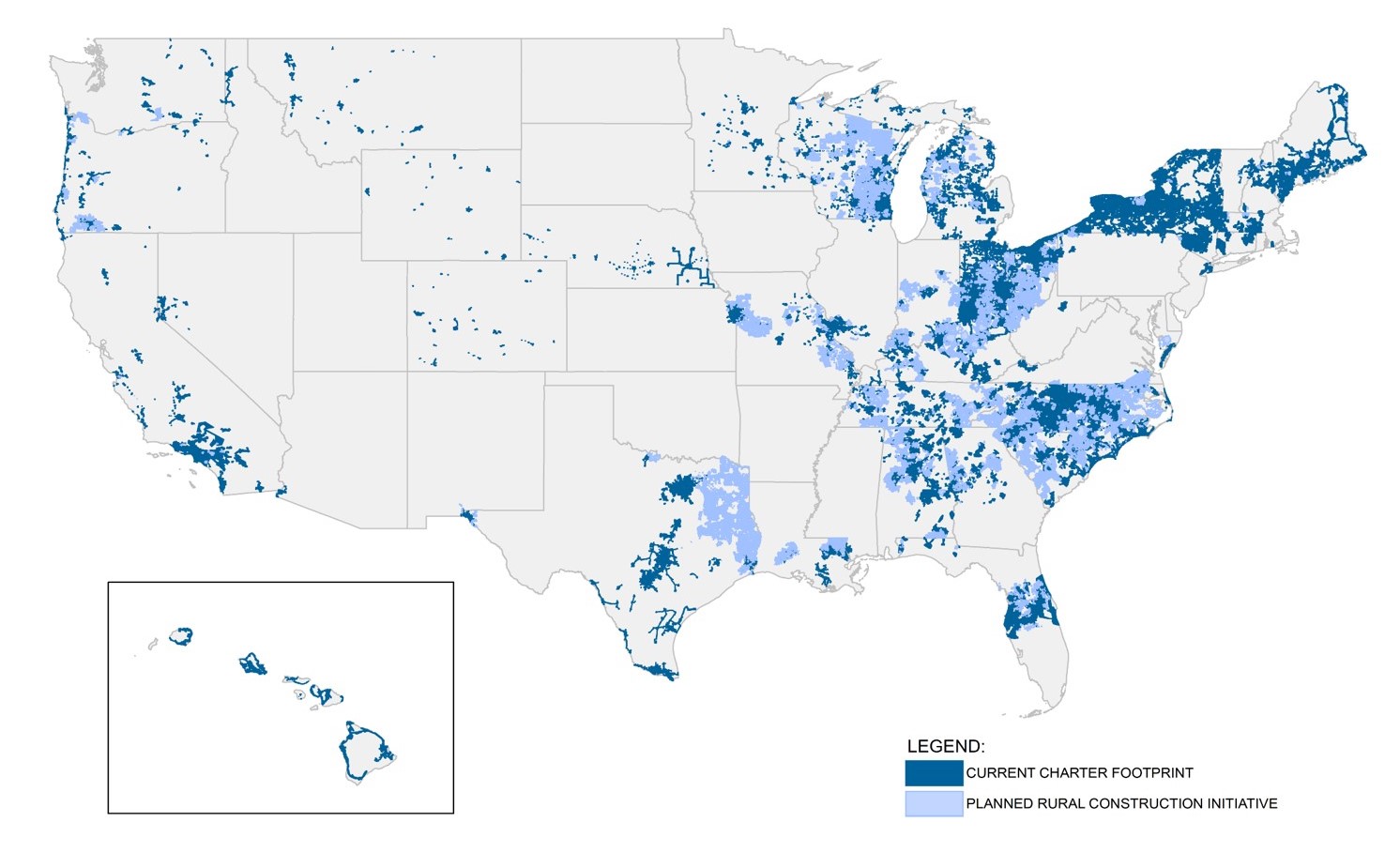

Rural builds present strategic expansion opportunities of our footprint to unserved and underserved passings. Over the next several years, we expect to invest over $6 billion, a portion of which we expect to offset with government funding including over $1.7 billion of support awarded through December 31, 2022 in the Rural Development Opportunity Fund (“RDOF”) auction and other federal, state and municipal grants. We expect to participate in additional federal, state and municipal grant programs over the coming years. This investment will allow us to offer a suite of broadband connectivity services including fixed Internet, WiFi and mobile to more than one million estimated passings in unserved areas in states where we currently operate. We have also renewed our focus on building to more passings inside and at the edge of our existing network. To accomplish all of this, we have invested in new teams, new training and new equipment. These investments will allow us to generate long-term infrastructure-style returns by taking further advantage of the efficiencies of the scale and quality of our network and construction capabilities while offering our high quality products and services to more homes and businesses.

1

Execution – Turning Our Strategy Into Success

We have competitive services and promote and package our services in ways that allow customers to have better products and save money. In addition, our focus on service quality complements our products and price. We improve the customer experience by digitizing service where customers prefer, performing proactive maintenance, and investing in systems and in our operations teams. As part of our investment in operations teams, we are making targeted adjustments to job structure, pay and benefits and career paths to improve the skills and tenure of our workforce.

Our principal executive offices are located at 400 Washington Blvd., Stamford, Connecticut 06902. Our telephone number is (203) 905-7801, and Charter has a website accessible at ir.charter.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and all amendments thereto, are available on Charter's website free of charge as soon as reasonably practicable after they have been filed. The information posted on Charter's website is not incorporated into this annual report.

2

Corporate Entity Structure

The chart below sets forth our entity structure and that of our direct and indirect parents and subsidiaries. The chart does not include all of our affiliates and subsidiaries and, in some cases, we have combined separate entities for presentation purposes. The equity ownership percentages shown below for Charter Holdings are approximations. Indebtedness amounts shown below are principal amounts as of December 31, 2022. See Note 8 to the accompanying consolidated financial statements contained in “Part II. Item 8. Financial Statements and Supplementary Data,” which also includes the accreted values of the indebtedness described below.

3

Footprint

We operate in geographically diverse areas which are managed centrally on a consolidated level. The map below highlights our footprint along with our planned rural expansion over the next several years based on grants awarded as of December 31, 2022.

Products and Services

We offer our customers subscription-based Internet services, video services, and mobile and voice services. Our services are offered to residential and commercial customers on a subscription basis, with prices and related charges based on the types of service selected, whether the services are sold as a “bundle” or on an individual basis, and based on the equipment necessary to receive our services. Bundled services including some combination of our Internet, video, voice and/or mobile products are available to substantially all of our passings.

4

The following table summarizes our customer statistics for Internet, video, voice and mobile as of December 31, 2022 and 2021 (in thousands except per customer data and footnotes).

| Approximate as of | |||||||||||

| December 31, | |||||||||||

2022 (a) | 2021 (a) | ||||||||||

Customer Relationships (b) | |||||||||||

| Residential | 29,988 | 29,926 | |||||||||

| Small and Medium Business ("SMB") | 2,207 | 2,143 | |||||||||

| Total Customer Relationships | 32,195 | 32,069 | |||||||||

Monthly Residential Revenue per Residential Customer (c) | $ | 114.66 | $ | 113.61 | |||||||

Monthly SMB Revenue per SMB Customer (d) | $ | 164.50 | $ | 165.50 | |||||||

| Internet | |||||||||||

| Residential | 28,412 | 28,137 | |||||||||

| SMB | 2,021 | 1,952 | |||||||||

| Total Internet Customers | 30,433 | 30,089 | |||||||||

| Video | |||||||||||

| Residential | 14,497 | 15,216 | |||||||||

| SMB | 650 | 617 | |||||||||

| Total Video Customers | 15,147 | 15,833 | |||||||||

| Voice | |||||||||||

| Residential | 7,697 | 8,621 | |||||||||

| SMB | 1,286 | 1,282 | |||||||||

| Total Voice Customers | 8,983 | 9,903 | |||||||||

Mobile Lines (e) | |||||||||||

| Residential | 5,116 | 3,448 | |||||||||

| SMB | 176 | 116 | |||||||||

| Total Mobile Lines | 5,292 | 3,564 | |||||||||

Enterprise Primary Service Units ("PSUs") (f) | 284 | 272 | |||||||||

(a)We calculate the aging of customer accounts based on the monthly billing cycle for each account. On that basis, as of December 31, 2022 and 2021, customers include approximately 144,100 and 128,300 customers, respectively, whose accounts were over 60 days past due, approximately 52,800 and 26,800 customers, respectively, whose accounts were over 90 days past due, and approximately 214,100 and 43,200 customers, respectively, whose accounts were over 120 days past due. Bad debt expense associated with these past due accounts has been reflected in our consolidated statements of operations. The increase in past due accounts is predominately due to pre-existing and incremental unsubsidized services, including video services, for those customers participating in government assistance programs. These customers are downgraded to a fully subsidized Internet-only service.

(b)Customer relationships include the number of customers that receive one or more levels of service, encompassing Internet, video and voice services, without regard to which service(s) such customers receive. Customers who reside in residential multiple dwelling units (“MDUs”) and that are billed under bulk contracts are counted based on the number of billed units within each bulk MDU. Total customer relationships exclude enterprise and mobile-only customer relationships.

(c)Monthly residential revenue per residential customer is calculated as total residential annual revenue divided by twelve divided by average residential customer relationships during the respective year and excludes mobile revenue and customers.

(d)Monthly SMB revenue per SMB customer is calculated as total SMB annual revenue divided by twelve divided by average SMB customer relationships during the respective year and excludes mobile revenue and customers.

5

(e)Mobile lines include phones and tablets which require one of our standard rate plans (e.g., "Unlimited" or "By the Gig"). Mobile lines exclude wearables and other devices that do not require standard phone rate plans.

(f)Enterprise PSUs represent the aggregate number of fiber service offerings counting each separate service offering at each customer location as an individual PSU.

Residential Services

Connectivity Services

We provide our customers with a suite of broadband connectivity services including fixed Internet, WiFi and mobile which when bundled together provides our customers with a differentiated converged connectivity experience while saving consumers and businesses money.

We offer Spectrum Internet products with speeds up to 1 Gbps across our entire footprint. Spectrum Internet bundled with our in-home Advanced WiFi allows multiple people within a single household to stream high definition (“HD”) video content while simultaneously using our Internet service for other purposes including two-way video conferencing, among other things.

Our in-home WiFi product provides our Internet customers with high performance wireless routers and a managed WiFi service to maximize their wireless Internet experience. We offer Advanced WiFi service across nearly all of our residential footprint along with WiFi 6 routers capable of delivering speeds over 1 Gbps. With Advanced WiFi, customers enjoy a cloud-optimized WiFi connection and have the ability to view and control their WiFi network through our Spectrum application (“My Spectrum App”). The service enables parental control schedules to be set for children’s devices or limit access entirely to unknown devices attempting to access the network.

Customers also have the option to add Spectrum WiFi pods to Advanced WiFi. WiFi pods are small, discreet access points that plug into electrical outlets in the home, providing broader and more consistent WiFi coverage. In 2022, we began rolling out Spectrum Security Shield across the residential footprint which protects all devices in the home using network-based security. This free security suite provides end point protection to computers in the home, enabling protection against computer viruses, spyware and threats from malicious actors across the Internet.

We also offer the capabilities of the Advanced WiFi service to MDUs as Advanced Community WiFi (“ACW”). With ACW, tenants will receive the same visibility and control over their apartment’s WiFi networks through the My Spectrum App, while building managers will be able to see and manage the entire building’s network through a purpose-built property service portal.

Our Spectrum Mobile service is offered to customers subscribing to our Internet service, and runs on Verizon Communications Inc.’s ("Verizon") mobile network, combined with Spectrum WiFi. We offer nationwide fifth generation ("5G") service at no incremental cost to our mobile customers enabling them to stream content several times faster and reducing latency when connecting to apps or webpages where 5G coverage exists. In addition, we continue to focus on improving the customer experience and integrating our mobile and fixed Internet products, providing greater WiFi access, speeds and performance using more than 500,000 of our out-of-home WiFi access points across our footprint combined with approximately 25 million out-of-home WiFi access points from other networks with which we partner, providing near nationwide coverage. In 2022, we launched an enhancement to our connectivity services with Spectrum Mobile Speed Boost at Home (“Speed Boost”). Customers are eligible for Speed Boost if they have both Spectrum Mobile and Spectrum Internet, a DOCSIS 3.1 modem and an Advanced WiFi router. When connected on their Spectrum Mobile device through their secure in-home WiFi private service set identifier (“SSID”), customers are now experiencing the fastest overall speeds up to 1 Gbps. The Spectrum Mobile SSID accelerates offload data from our mobile virtual network operator ("MVNO") cellular network to our own WiFi network and we expect it to be available across our footprint in 2023.

We provide wireline voice communications services using voice over Internet protocol ("VoIP") technology to transmit digital voice signals over our network. Our voice services include unlimited local and long distance calling to the United States, Canada, Mexico and Puerto Rico, voicemail, call waiting, caller ID, call forwarding and other features and offers international calling either by the minute, or through packages of minutes per month. For customers that subscribe to both our voice and video offerings, caller ID on TV is also available in most areas. We also offer Call Guard, an advanced caller ID and robocall blocking solution, for our residential and SMB voice customers. Call Guard reduces customer frustration and improves security by blocking malicious calls while ensuring our customers continue to receive the legitimate automated calls they need from schools or healthcare providers.

6

Video Services

We provide our customers with a choice of video programming services on a variety of platforms including through a digital set-top box or an Internet Protocol ("IP") device. Video customers have access to a variety of programming packages with approximately 375 channels available in home and out of home allowing our customers to access the programming they want, when they want it, on any device. Our video customers also have access to programmer authenticated applications such as Fox Now, Showtime and ESPN and direct to consumer applications such as Netflix and YouTube on certain set-top boxes. In June 2022, we entered into a joint venture with Comcast to develop and offer a next-generation streaming platform, Xumo, with the ability to provide streaming video packages, leverage our Spectrum TV® application, aggregate consumer streaming applications, and provide an industry leading voice search, with the benefit of new revenue streams.

Our video service also includes access to an interactive programming guide with parental controls and in virtually all of our footprint, video on demand (“VOD”) or pay-per-view services. VOD service allows customers to select from approximately 90,000 titles at any time. VOD programming options may be accessed at no additional cost if the content is associated with a customer’s linear subscription, or for a fee on a transactional basis. VOD services are also offered on a subscription basis included in a digital tier premium channel subscription or for a monthly fee. Pay-per-view channels allow customers to pay on a per-event basis to view a single showing of a one-time special sporting event, music concert, or similar event on a commercial-free basis. We also offer digital video recorder (“DVR”) service that enables customers to digitally record programming and to pause and rewind live programming on set-top boxes and cloud DVR service, which allows customers to schedule, record and watch their favorite programming anytime from connected IP devices as well as SpectrumTV.com.

Customers are increasingly accessing their subscription video content through our highly rated Spectrum TV application via mobile devices and connected IP devices, such as Roku, Xumo TV and Samsung TV. Access to the Spectrum TV application is included in all Spectrum TV video plans and allows users to stream content across a growing number of platforms as well as access their full TV lineup, watch on demand content and gives them the ability to program their DVR from anywhere. Customers are also able to purchase their video services within the Spectrum TV application.

Commercial Services

We offer scalable broadband communications solutions for businesses and carrier organizations of all sizes, selling Internet access, data networking, fiber connectivity to cellular towers and office buildings, video entertainment services and business telephone services.

Small and Medium Business

Spectrum Business offers Internet, voice and video services to SMBs over our hybrid fiber coaxial network. In addition, we offer our Spectrum Mobile service to SMB customers. Spectrum Business includes a full range of video programming and offers Internet speeds up to 1 Gbps across our entire footprint. Spectrum Business also includes a set of business services including static IP and business WiFi, e-mail and security, and voice services through either a traditional voice offering or hosted voice solution. In December 2022, we launched Spectrum Business Connect with RingCentral as our new SMB communications solution that includes Spectrum Internet, voice and complementary mobility features, and allows our customers’ remote and office employees to stay more easily connected regardless of their location. We also offer Wireless Internet Backup to our SMB customers which is designed to enhance and protect Internet service for SMBs in the event of a network disruption.

Enterprise

Spectrum Enterprise offers tailored communications products and managed service solutions over a high-capacity last-mile network with speeds up to 100 Gbps to larger businesses and government entities (local, state and federal), in addition to wholesale services to mobile and wireline carriers. The Spectrum Enterprise product portfolio includes connectivity services such as Internet Access (fiber, wireless and coax delivered); Wide Area Network ("WAN") solutions (Ethernet, Software Defined (“SD”)-WAN and cloud connectivity) that privately and securely connect geographically dispersed customer locations and cloud service providers; and Managed Services which address a wide range of enterprise networking (e.g. routing, Local Area Network (“LAN”), WiFi) and security (e.g. firewall, Distributed Denial of Service (“DDoS”) protection) challenges. To meet the communications needs of these more sophisticated customers, Spectrum Enterprise also offers an array of voice trunking services and unified messaging, communications and collaboration solutions. In December 2022, we launched Unified Communications with RingCentral, which integrates Spectrum Enterprise’s managed services to complement its other solutions and gives customers more choices for enhancing their digital experience across locations and devices. In addition, for

7

industries such as hospitality, education and healthcare where specialized video solutions are demanded, Spectrum Enterprise offers a wide range of solutions designed to meet those requirements. Spectrum Enterprise serves businesses nationally by combining its large serviceable footprint with a robust portfolio of fiber lit buildings and a significant wholesale partner network. As a result, these customers benefit by obtaining advanced solutions from a single provider who is committed to an exceptional customer experience and who delivers compelling value by simplifying procurement and offering competitive pricing potentially reducing our customers' costs.

Advertising Services

Our advertising sales division, Spectrum Reach, offers local, regional and national businesses the opportunity to advertise in individual and multiple service areas on cable television networks, various streaming services and numerous advanced advertising platforms. We receive revenues from the sale of local advertising across various platforms for networks such as TBS, CNN and ESPN. We insert local advertising on up to 100 channels in over 90 markets. Our large footprint provides opportunities for advertising customers to address broader regional audiences from a single provider and thus reach more customers with a single transaction. Our size also provides scale to invest in new technology to create more targeted and addressable advertising capabilities.

Available advertising time is generally sold by our advertising sales force. In some service areas, we have formed advertising interconnects or entered into representation agreements with other video distributors, including, among others, Verizon, DirecTV and Comcast, under which we sell advertising on behalf of those operators. In other service areas, we enter into representation agreements under which another operator in the area will sell advertising on our behalf. These arrangements enable us and our partners to represent and deliver commercials on their inventory across wider geographic areas, replicating the reach of local broadcast television stations to the extent possible. In addition, we enter into interconnect agreements from time to time with other cable operators, which, on behalf of a number of video operators, sells advertising time to national and regional advertisers in individual or multiple service areas.

Additionally, we sell the advertising inventory of our owned and operated local sports and news channels, of our regional sports networks that carry Los Angeles Lakers’ basketball games and other sports programming and of SportsNet LA, a regional sports network that carries Los Angeles Dodgers’ baseball games and other sports programming.

In 2022, we expanded our deployment of household addressability ("HHA"), which allows for more precise targeting across our footprint. Additionally, in conjunction with other MVPDs, Spectrum Reach enables multi-channel cable networks (e.g. AMC, Discovery) to deploy HHA on their own inventory in our footprint, charging them an enablement fee. We also continue to further enhance our Ad Portal, which allows small businesses to purchase local cable advertising and/or creative services via our web portal with limited sales personnel interaction at a price within their budgets. Our fully deployed Audience App, which uses our proprietary set-top box viewership data (all anonymized and aggregated), allows us to create data-driven linear TV campaigns for local advertisers. In 2022, Spectrum Reach launched its first programmatic sales platform allowing advertising agencies and advertisers to buy inventory in a fully automated way. Streaming TV, which is largely comprised of Spectrum TV application impressions, as well as those from numerous over-the-top streaming content providers, is part of our suite of advanced advertising products available to the marketplace. Spectrum Reach is also now employing multi-screen deterministic attribution services for television and streaming services that lets advertisers know the effectiveness of their advertising on Spectrum Reach’s platform.

Other Services

Regional Sports Networks

We have an agreement with the Los Angeles Lakers for rights to distribute all locally available Los Angeles Lakers’ games through 2033. We broadcast those games on our regional sports network, Spectrum SportsNet. American Media Productions, LLC ("American Media Productions"), an unaffiliated third party, owns SportsNet LA, a regional sports network carrying the Los Angeles Dodgers’ baseball games and other sports programming. In accordance with agreements with American Media Productions, we act as the network’s exclusive affiliate and advertising sales representative and have certain branding and programming rights with respect to the network. In addition, we provide certain production and technical services to American Media Productions. The affiliate, advertising, production and programming agreements continue through 2038. We also own 26.8% of Sterling Entertainment Enterprises, LLC (doing business as SportsNet New York), a New York City-based regional sports network that carries New York Mets’ baseball games as well as other regional sports programming.

8

News Channels

We own and manage 37 local news channels, including Spectrum News NY1® and Spectrum News SoCal, 24-hour news channels focused on New York City and Los Angeles, respectively. Our local news channels connect the diverse communities and neighborhoods we serve providing 24/7 hyperlocal content, focusing on news, programming and storytelling that addresses the deeper needs and interests of our customers. Customers can also read, watch and listen to news stories by our Spectrum News journalists and local partner publications on their mobile device on our Spectrum News application and certain smart TVs and streaming devices.

Pricing of Our Products and Services

Our revenues are principally derived from the monthly fees customers pay for the services we provide. We typically charge a one-time installation fee which is sometimes waived or discounted in certain sales channels during certain promotional periods.

Our Spectrum pricing and packaging ("SPP") generally offers a standardized price across our services and add-on services allowing customers to design a bundle offering that fits their needs. We believe SPP:

•offers a higher quality and more value-based set of services relative to our competitors, including fast Internet speeds, hundreds of HD channels and a transparent pricing structure;

•offers simplicity for customers to understand our offers, and for our employees in service delivery;

•drives our ability to package more services at the time of sale, thus increasing revenue per customer;

•drives higher customer satisfaction, lower service calls and churn; and

•allows for gradual price increases at the end of promotional periods.

We also have specialized offerings to enhance affordability of our Internet product for qualified low-income households, including Spectrum Internet Assist, a 30 megabits per second ("Mbps") service, and Internet 100, a 100 Mbps service. Both are low cost and include a modem for no additional charge. In addition, many of our customers are eligible for a subsidy through the Federal Communications Commission's ("FCC") Affordable Connectivity Program ("ACP") which provides eligible low-income households with up to $30 per month towards Internet service.

In October 2022, we introduced Spectrum One, which brings together in a high-value package, Spectrum Internet, Advanced WiFi and Unlimited Spectrum Mobile, offering consumers fast, reliable and secure online connections on their favorite devices at home and on-the-go. Alternatively, our mobile customers can choose one of two simple ways to pay for data. Customers can choose from unlimited or by-the-gig data usage plans and can easily switch between mobile data plans during the month. All plans include 5G service, free nationwide talk and text, and simple pricing that includes all taxes and fees. Customers can also purchase mobile devices and accessory products and have the option to pay for devices under interest-free monthly installment plans. Our device portfolio includes 5G models from Apple, Google and Samsung and we offer trade-in options along with a bring-your-own-device (“BYOD”) program which lowers the costs for our customers switching to Spectrum Mobile from other mobile operators.

Our Network Technology

Our network includes three key components: a national backbone, regional/metro networks and a “last-mile” network. Both our national backbone and regional/metro network components utilize a redundant IP ring/mesh fiber architecture. The national backbone component provides connectivity from regional demarcation points to nationally centralized content, connectivity and services. The regional/metro network components provide connectivity between the regional demarcation points and headends within a specific geographic area and enable the delivery of content and services between these network components.

Our last-mile network utilizes a hybrid fiber coaxial cable (“HFC”) architecture, which combines the use of fiber optic cable with coaxial cable. In most systems, we deliver our signals via fiber optic cable from the headend to a group of nodes, and use coaxial cable to deliver the signal from individual nodes to the homes served by that node. Our design standard allows spare fiber strands to each node to be utilized for additional residential traffic capacity, and enterprise customer needs as they arise. For our Spectrum Enterprise customers, fiber optic cable is extended to the customer’s site. For certain new buildouts, including for our rural construction initiative, and MDU sites, we utilize a fiber deployment. We believe that this hybrid network design provides high capacity and signal quality with a cost efficient path to increased speeds.

9

HFC architecture benefits include:

•bandwidth capacity to enable traditional and two-way video and broadband services;

•dedicated bandwidth for delivering two-way services, signal quality and higher service reliability, which provides an advantage over fixed wireless offerings;

•the ability to upgrade capacity at a lower incremental capital cost relative to our competitors; and

•a powered network enabling Advanced WiFi out-of-home and our future 5G small cell access points.

Our systems currently provide a two-way all-digital platform, leveraging DOCSIS 3.1 technology and bandwidth of 750 megahertz or greater, to virtually all of our estimated passings. This bandwidth-rich network enables us to offer a large selection of HD channels and Spectrum Internet Gig across all of our footprint which enables us to provide fast, reliable and secure online connections and meet nearly all current residential customer demands today. Over the next three years, we intend to deploy network enhancements to upgrade our footprint initially expanding our spectrum to 1.2 Ghz through a module upgrade in the hub, node and amplifier and using high splits to deliver multi-gig speed capabilities while using the current DOCSIS 3.1 customer premise equipment. Later, we will continue to expand our spectrum to 1.2 Ghz but will use DAA to deliver even faster speeds when using the next generation of DOCSIS modem, DOCSIS 4.0. Next, we will begin to deploy DOCSIS 4.0 technology, to further increase our spectrum to 1.8 Ghz enabling even higher speed capabilities. This network evolution will also allow us to extend fiber services to the home in a success based “Fiber on Demand” manner and is the technology currently deployed in our rural fiber buildouts. We plan to complement our wireline investments with planned WiFi upgrades for in-home routers. With nearly 500 million devices connected wirelessly to our network in our customer's homes and businesses, we will unlock our network investments for multi-gigabit speeds through the deployment of WiFi 6E in 2023.

We own 210 Citizen Broadband Radio Service ("CBRS") Priority Access Licenses ("PALs") and intend to use these licenses along with unlicensed CBRS spectrum to build our own 5G data-only mobile network on targeted 5G small cell sites leveraging our HFC network to provide power and data connectivity to the majority of the sites. These 5G small cells, combined with growing WiFi capabilities, increase speed and reliability along with improving our cost structure through offload onto our owned networks. In 2022, we began a trial of the 5G network, which will inform our deployment plan for 5G small cell sites, as part of our broader multi-year 5G mobile network buildout, based on disciplined cost reduction targets.

Rural Construction Initiative

In 2022, we continued our rural broadband construction initiative in which we intend to expand our network to offer a suite of broadband connectivity services including fixed Internet, WiFi and mobile to more than one million estimated passings in unserved areas in states where we currently operate. We expect to invest over $6 billion over the next several years, a portion of which we expect to offset with government funding including over $1.7 billion of support awarded through December 31, 2022 in the RDOF auction and other federal, state and municipal grants, and we expect to participate in additional federal, state and municipal grant programs over the coming years. In addition to construction in areas subsidized by various government grants, we expect to continue rural construction in areas near our current plant and in areas surrounding subsidized construction where synergies can be achieved. These investments will allow us to generate long-term infrastructure-style returns by further taking advantage of the efficiencies of the scale and quality of our network and construction capabilities while offering our high quality products and services to more homes and businesses. We expect these newly-served homes will be enabled to engage in distance learning, remote work, telemedicine and other bandwidth-heavy applications that require high speed broadband connectivity. Newly-served rural areas will also benefit from our high-value SPP structure including our voice and mobile offerings, as well as our comprehensive selection of video products. The successful and timely execution of such fiber-based construction is dependent on a variety of external factors, including the make-ready and utility pole permitting processes. With fewer homes and businesses in these areas, broadband providers need to access multiple poles per home, as opposed to multiple homes per pole in higher-density settings. As a result, pole applications, pole replacement rules and their affiliated issue resolution processes are all factors that can have a significant impact on construction timing and speed to completion. The RDOF auction rules and other subsidy grants establish construction milestones for the build-out utilizing subsidized funding. Failure to meet those milestones could subject us to financial penalties.

Management, Customer Operations and Marketing

Our operations are centralized, with senior executives responsible for coordinating and overseeing operations, including establishing company-wide strategies, policies and procedures. Sales and marketing, field operations, customer operations, network operations, engineering, advertising sales, human resources, legal, government relations, information technology and finance are all directed at the corporate level. Regional and local field operations are responsible for customer premise service transactions and maintaining and constructing that portion of our network which is located outdoors. Our field operations

10

strategy includes completing a significant portion of our activity with our employees which we find drives consistent and higher quality services. In 2022, our in-house field operations workforce handled approximately 80% of our customer premise service transactions.

We continue to focus on improving the customer experience through enhanced product offerings, reliability of services, and delivery of quality customer service. As part of our operating strategy, we insource most of our customer operations workload. Our in-house call centers handle nearly all of our total customer service calls. We manage our customer service call centers centrally to ensure a consistent, high quality customer experience. In addition, we route calls by call type to specific agents that only handle such call types, enabling agents to become experts in addressing specific customer needs, creating a better customer experience. Service from our call centers continues to become more efficient as a result of new tool enhancements that give our front-line customer service agents more context and real-time information about the customer and their services which allows them to more effectively troubleshoot and resolve issues. Our call center agent desktop interface tool enables virtualization of all call centers thereby better serving our customers. Virtualization allows calls to be routed across our call centers regardless of the location origin of the call, reducing call wait times, and saving costs.

We also provide customers with the opportunity to interact with us in the manner they choose through self-service options on our customer website and mobile device application, or via telephonic communication, online chat and social media. Our customer websites and mobile applications enable customers to pay their bills, manage their accounts, order and activate new services and utilize self-service help and support. In addition, our self-install program has been beneficial for customers who need flexibility in the timing of their installation.

We sell our residential and commercial services using national brand platforms known as Spectrum, Spectrum Business, Spectrum Enterprise and Spectrum Reach. These brands reflect our comprehensive approach to industry-leading products, driven by speed, performance and innovation. Our marketing strategy emphasizes the sale of our bundled services through targeted direct response marketing programs to existing and potential customers, and increases awareness and the value of the Spectrum brand. Our marketing organization creates and executes marketing programs intended to grow customer relationships, increase the number of services we sell per relationship, retain existing customers and cross-sell additional products to current customers. We monitor the effectiveness of our marketing efforts, customer perception, competition, pricing, and service preferences, among other factors, in order to increase our responsiveness to our customers and to improve our sales and customer retention. The marketing organization manages all residential and SMB sales channels including inbound, direct sales, on-line, outbound telemarketing and stores.

Programming

We believe that offering a wide variety of video programming choices influences a customer’s decision to subscribe to and retain our cable video services. We obtain basic and premium programming, usually pursuant to written contracts from a number of suppliers. Media corporation and broadcast station group consolidation has, however, resulted in fewer suppliers and additional selling power on the part of programming suppliers.

Programming is usually made available to us for a license fee, which is generally paid based on the number of customers to whom we make that programming available. Programming license fees may include “volume” discounts and other financial incentives and/or ongoing marketing support, as well as discounts for channel placement or service penetration. For home shopping channels, we typically receive a percentage of the revenue attributable to our customers’ purchases. We also offer VOD and pay-per-view channels of movies and events that are subject to a revenue split with the content provider.

Competition

Residential Services

We face intense competition for residential customers, both from existing competitors and, as a result of the rapid development of new technologies, services and products, from new entrants.

Internet Competition

Our residential Internet service faces competition across our footprint from fiber-to-the-home ("FTTH"), fixed wireless broadband, Internet delivered via satellite and DSL services. AT&T Inc. ("AT&T"), Frontier Communications Corporation (“Frontier”) and Verizon are our primary FTTH competitors. Given the FTTH deployments of our competitors, launches of broadband services offering 1 Gbps speed have recently grown. Several competitors, including AT&T, Frontier, Verizon,

11

WideOpenWest, Inc. ("WOW") and Google Fiber, deliver 1 Gbps broadband speed (and some deliver multi Gbps) in at least a portion of their footprints which overlap our footprint. Additionally, several national mobile network operators offer Long Term Evolution (“LTE”) or 5G delivered fixed wireless home Internet service in our markets. In several markets, we also face competition from one or more fixed wireless providers that deliver point-to-point Internet connectivity. DSL service is offered across our footprint often at prices lower than our Internet services, although typically at speeds much lower than the minimum speeds we offer as part of SPP. In addition, a growing number of commercial areas, such as retail malls, restaurants and airports, offer WiFi Internet service. Numerous local governments are also considering or actively pursuing publicly subsidized WiFi Internet access networks. These options offer alternatives to cable-based Internet access. We face terrestrial broadband Internet (defined as at least 25 Mbps) competition from three primary competitors, AT&T, Frontier and Verizon, in approximately 35%, 11% and 5% of our operating footprint, respectively.

Video Competition

Our residential video service faces competition from DBS service providers, which have a national footprint and compete in all of our operating areas. DBS providers offer satellite-delivered pre-packaged programming services that can be received by relatively small and inexpensive receiving dishes. DBS providers offer aggressive promotional pricing, exclusive programming and video services that are comparable in many respects to our residential video service. Our residential video service also faces competition from large telecommunications companies, primarily Verizon, which offer wireline video services in significant portions of our operating areas.

Our residential video service also faces growing competition across our footprint from a number of other sources, including companies that deliver linear network programming, movies and television shows on demand and other video content over broadband Internet connections to televisions, computers, tablets and mobile devices. These competitors include virtual multichannel video programming distributors (“vMVPDs”) such as Hulu Live, YouTube TV, Sling TV, Philo and DirecTV Stream. Other online video business models and products have also developed, some offered by programmers that have not traditionally sold programming directly to consumers, including, (i) subscription video on demand (“SVOD”) services such as Netflix, Apple TV+, Amazon Prime, Hulu Plus, Disney+, HBO Max, Peacock, Paramount+, AMC+, Starz and Showtime Anytime, (ii) ad-supported free online video products, including YouTube and Pluto TV, some of which offer programming for free to consumers that we currently purchase for a fee, (iii) pay-per-view products, such as iTunes, and (iv) additional offerings from mobile providers which continue to integrate and bundle video services and mobile products. Historically, we have generally viewed SVOD online video services as complementary to our own video offering. As the proliferation of online video services grows, however, services from vMVPDs and direct to consumer offerings, as well as piracy and password sharing, negatively impact the number of customers purchasing our video product.

Voice Competition

Our residential voice service competes with wireless and wireline phone providers across our footprint, as well as other forms of communication, such as text messaging on cellular phones, instant messaging, social networking services, video conferencing and email. We also compete with “over-the-top” phone providers, such as Vonage, Skype, magicJack, Google Voice and Ooma, Inc., as well as companies that sell phone cards at a cost per minute for both national and international service. The increase in the number of different technologies capable of carrying voice services and the number of alternative communication options available to customers as well as the replacement of wireline services by wireless have intensified the competitive environment in which we operate our residential voice service.

Mobile Competition

Our mobile service faces competition from national mobile network operators including AT&T, Verizon and T-Mobile US, Inc. ("T-Mobile"), fixed wireless providers, as well as a variety of regional operators and mobile virtual network operators. Most carriers offer unlimited data packages to customers while some also offer free devices. Various operators also offer wireless Internet services delivered over networks which they continue to enhance to deliver faster speeds. AT&T, Verizon and T-Mobile continue to expand 5G mobile services. Additionally, in connection with Dish Network Corporation’s acquisition of Sprint Corporation’s (“Sprint”) prepaid mobile services businesses, the FCC and Department of Justice ("DOJ") have imposed a timeline on Dish Network Corporation (70% by June 2023) for 5G network development and expansion. We also compete for retail activations with other resellers that buy bulk wholesale service from wireless service providers for resale.

12

Regional Competitors

In some of our operating areas, other competitors have built networks that offer Internet, video and voice services that compete with our services. For example, in certain service areas, our residential Internet, video and voice services compete with WOW, altafiber, Google Fiber and Astound Broadband.

Additional Competition

In addition to multi-channel video providers, cable systems compete with other sources of news, information and entertainment, including over-the-air television broadcast reception, live events, movie theaters and the Internet. Competition is also posed by fixed wireless and satellite master antenna television ("SMATV") systems serving MDUs, such as condominiums, apartment complexes, and private residential communities.

Business Services

We face intense competition across each of our business services product offerings. Our SMB Internet, video and voice services face competition from a variety of providers as described above. Our enterprise solutions also face competition from the competitors described above as well as cloud-based application-service providers, managed service providers and other telecommunications carriers, such as metro and regional fiber-based carriers.

Advertising

We face intense competition for advertising revenue across many different platforms and from a wide range of local and national competitors. Advertising competition has increased and will likely continue to increase as new advertising platforms seek to attract the same advertisers. We compete for advertising revenue against, among others, local broadcast stations, national cable and broadcast networks, radio stations, print media and online advertising companies and content providers.

Seasonality and Cyclicality

Our business is subject to seasonal and cyclical variations. Our results are impacted by the seasonal nature of customers receiving our cable services in college and vacation service areas. Our revenue is subject to cyclical advertising patterns and changes in viewership levels. Our advertising revenue is generally higher in the second and fourth calendar quarters of each year, due in part to increases in consumer advertising in the spring and in the period leading up to and including the holiday season. U.S. advertising revenue is also cyclical, benefiting in even-numbered years from advertising related to candidates running for political office and issue-oriented advertising. Our capital expenditures and trade working capital are also subject to significant seasonality based on the timing of subscriber growth, network programs, specific projects and construction.

Regulation and Legislation

The following summary addresses the key regulatory and legislative developments affecting the cable industry and our services for both residential and commercial customers. Cable systems and related communications networks and services are extensively regulated by the federal government (primarily the FCC), certain state governments and many local governments. A failure to comply with these regulations could subject us to substantial penalties. Our business can be dramatically impacted by changes to the existing regulatory framework, whether triggered by legislative, administrative, or judicial rulings. Congress and the FCC have frequently revisited the subject of communications regulation and they are likely to do so again in the future. We could be materially disadvantaged in the future if we are subject to new laws, regulations or regulatory actions that do not equally impact our key competitors. For example, Internet-delivered streaming video services compete with our traditional video service, but they are not subject to the same level of federal, state, and local regulation. We cannot provide assurance that the already extensive regulation of our business will not be expanded in the future. In addition, through May 2023, we are subject to Charter-specific conditions regarding certain business practices as a result of the FCC’s approval of the merger in 2016 with Time Warner Cable Inc. (“TWC”) and acquisition of Bright House Networks, LLC (“Bright House”).

Video Service

Must Carry/Retransmission Consent

There are two alternative legal methods for carriage of local broadcast television stations on cable systems. Federal “must carry” regulations require cable systems to carry local broadcast television stations upon the request of the local broadcaster.

13

Alternatively, federal law includes “retransmission consent” regulations, by which popular commercial television stations can prohibit cable carriage unless the cable operator first negotiates for “retransmission consent,” which may be conditioned on significant payments or other concessions. Popular stations routinely invoke “retransmission consent” and demand substantial compensation increases in their negotiations with cable operators, thereby significantly increasing our operating costs.

Pole Attachments

The Communications Act of 1934, as amended (the “Communications Act”), requires many investor-owned utilities owning utility poles to provide cable systems with access to poles and conduits and also subjects the rates charged for this access to either federal or state regulation. The federally regulated rates now applicable to pole attachments used for cable or telecommunications services, including when offered together with Internet service, are substantially similar. The FCC's approach does not directly affect the rate in states that self-regulate, but many of those states have substantially the same rate for all communications attachments. We sometimes face challenges getting access to poles in rural areas when the FCC pole attachment rules do not apply.

Other FCC Regulatory Matters

The Communications Act and FCC regulations cover a variety of additional areas applicable to our video services, including, among other things: (1) licensing of systems and facilities, including the grant of various spectrum licenses; (2) equal employment opportunity obligations; (3) customer service standards; (4) technical standards; (5) mandatory blackouts of certain network and syndicated programming; (6) restrictions on political advertising; (7) restrictions on advertising in children’s programming; (8) ownership restrictions; (9) posting of certain information on an FCC “public file” website, including but not limited to political advertising records, equal employment opportunity practices, compliance with children’s programming requirements, policies for commercial leased access, system information, and channel carriage information including disclosure of our ownership interests in channels we carry; (10) emergency alert systems; (11) inside wiring and contracts for MDU complexes; (12) accessibility of content, including requirements governing video-description and closed-captioning; (13) competitive availability of cable equipment; (14) the provision of up to 15% of video channel capacity for commercial leased access by unaffiliated third parties; and (15) public, education and government entity access requirements. Each of these regulations restricts our business practices to varying degrees and may impose additional costs on our operations.

The FCC regulates spectrum usage in ways that could impact our operations including for microwave backhaul, broadcast, unlicensed WiFi and CBRS. Our ability to access and use spectrum that may become available in the future is uncertain and may be limited by further FCC auction or allocation decisions. New spectrum obtained by other parties could also lead to additional wireless competition to our existing and future services.

It is possible that Congress or the FCC will expand or modify its regulation of cable systems or the services delivered over cable systems and competing services in the future, and we cannot predict at this time how that might impact our business.

Copyright

The carriage of television and radio broadcast signals by cable systems are subject to a federal compulsory copyright license. The copyright law provides copyright owners the right to audit our payments under the compulsory license, and the Copyright Office is currently considering modifications to the license’s royalty calculations and reporting obligations. The possible modification or elimination of this license is the subject of continuing legislative proposals and administrative review and could adversely affect our ability to obtain desired broadcast programming.

Franchise Matters

Our cable systems generally are operated pursuant to nonexclusive franchises, permits, and similar authorizations granted by a municipality or other state or local government entity in order to utilize and cross public rights-of-way.

Cable franchises generally are granted for fixed terms and in many cases include monetary penalties for noncompliance and may be terminable if the franchisee fails to comply. The specific terms and conditions of cable franchises vary significantly between jurisdictions. They generally contain provisions governing cable operations, franchise fees, system construction, maintenance, technical performance, customer service standards, supporting and carrying public, education and government access channels, and changes in the ownership of the franchisee. Although local franchising authorities have considerable discretion in establishing franchise terms, certain federal protections benefit cable operators. For example, federal law imposes a cap on franchise fees of 5% of gross revenues from the provision of cable services over the cable system. In 2019, the FCC

14

clarified that the value of in-kind contribution requirements set forth in cable franchises is subject to the statutory cap on franchise fees, and it reaffirmed that state and local authorities are barred from imposing franchise fees on revenues derived from non-cable services, such as Internet services, provided by cable operators over cable systems. Those rules were generally upheld by a federal court in 2021.

A number of states have adopted franchising laws that provide for state-issued franchising. Generally, state-issued cable franchises are for a fixed term (or in perpetuity), streamline many of the traditional local cable franchise requirements and eliminate local negotiation and enforcement of terms.

The Communications Act provides for an orderly franchise renewal process in which granting authorities may not unreasonably deny renewals. If we fail to obtain renewals of franchises representing a significant number of our customers, it could have a material adverse effect on our consolidated financial condition, results of operations, or our liquidity. Similarly, if a franchising authority’s consent is required for the purchase or sale of a cable system, the franchising authority may attempt to impose more burdensome requirements as a condition for providing its consent.

Internet Service

The FCC originally classified broadband Internet access services, such as those we offer, as an “information service,” which exempted the service from traditional communications common carrier laws and regulations. In 2015, the FCC reclassified broadband Internet access services as “telecommunications service” and, on that basis, imposed a number of “net neutrality” rules governing the provision of broadband service. In 2017, the FCC reversed its 2015 decision and eliminated the 2015 rules, other than a transparency requirement, which obligates us to disclose performance statistics and other service information to consumers. It is possible that the FCC might again revise its approach to broadband Internet access, or that Congress might enact legislation affecting the rules applicable to the service. The application of new legal requirements to our Internet services could adversely affect our business.

The FCC recently adopted new rules to expand the surviving transparency requirement by requiring us to post standardized labels similar to the format of food nutrition labels for each of our currently available consumer Internet offerings. These new rules are scheduled to take effect six months after approval by the federal Office of Management and Budget.

The 2017 FCC decision reclassifying Internet access services also ruled that state regulators may not impose obligations similar to federal network neutrality obligations that the FCC eliminated, but this blanket prohibition was vacated by the U.S. Court of Appeals in 2019. The court left open the possibility that individual state laws could be deemed preempted on a case by case basis if it is shown that they conflict with federal law. Several states have adopted rules similar to the network neutrality requirements that were eliminated by the FCC, and the California rules were upheld in federal court.

California has also adopted other regulations on Internet services, including network resiliency rules to assure backup power is available after natural disasters and other outages, and it has an open proceeding to consider the imposition of service quality metrics on Internet service providers. New York adopted legislation that would have required Internet service providers to offer a discounted Internet service to qualifying low-income consumers, but a federal district judge enjoined enforcement as likely to be deemed rate regulation of Internet service that would be preempted by federal law. That decision is currently being appealed. We cannot predict what other legislation and regulations may be adopted by states or how challenges to such requirements will be resolved.

In recent years, the federal, state and local governments have offered billions of dollars in subsidies to companies deploying broadband to areas deemed to be “unserved” or “underserved,” using funds from the FCC’s RDOF auction in 2020, The American Rescue Plan Act of 2021 (“ARPA”), and The Infrastructure Investment and Jobs Act of 2021 (the “IIJA”). We support such subsidies, provided they are not directed to areas that are already served, and have sought and expect to continue to seek subsidies for our own broadband construction in unserved and underserved areas through programs including RDOF and those created pursuant to ARPA and, if regulatory requirements are reasonable, the IIJA. We have been awarded over $1.7 billion in the RDOF auction and other federal, state and municipal grants that will partially fund, along with our substantial additional investment, the construction of new broadband infrastructure to more than one million estimated passings. Our awards through RDOF and ARPA include a number of regulatory requirements, such as serving as the carrier of last resort and completing increasingly larger portions of the network construction by certain dates. If we fail to meet these obligations, we could be subject to substantial government penalties.

The market for our Internet services is affected by participation in and the general availability of programs that offer federal subsidies for certain low-income consumers for the purchase of Internet access service. In 2021, pursuant to Congressional

15

appropriation for COVID relief, the FCC established a temporary monthly Emergency Broadband Benefit Program ("EBBP") subsidy of up to $50 for most eligible low-income households. With the funding for EBBP set to run out, Congress in the IIJA authorized $14.2 billion for the successor ACP that provides up to a $30 monthly discount for most eligible customers paid to the household’s broadband provider. We elected to participate in the EBBP and ACP, and the FCC regulates many of the terms on which we provide ACP services, including restrictions on our ability to refuse service to prospective eligible customers based upon their credit or payment history. The ACP discount enables eligible households to purchase our Spectrum Internet Assist service at no cost to them, and we cannot predict whether Congress or the FCC will provide additional funding to extend the ACP, or on what terms, when ACP funding runs out, which is expected to be at some point in 2024.

Wireline Voice Service

The FCC has never classified the VoIP wireline telephone services we offer as “telecommunications services” that are subject to traditional federal common carrier regulation, but instead has imposed some of these regulatory requirements on a case-by-case basis, such as requirements relating to 911 emergency services (“E911”), Communications Assistance for Law Enforcement Act (“CALEA”) (the statute governing law enforcement access to and surveillance of communications), Universal Service Fund contributions, customer privacy and Customer Proprietary Network Information protections, number portability, network outage reporting, rural call completion, disability access, regulatory fees, back-up power, robocall mitigation and discontinuance of service. It is possible that the FCC or Congress will impose additional federal requirements on our VoIP telephone services in the future.

Our VoIP telephone services are subject to certain state and local regulatory fees such as E911 fees and contributions to state universal service funds. Additionally, to comply with RDOF program requirements, we have chosen in the RDOF areas to offer Lifeline VoIP telephone services subject to traditional federal and state common carrier regulations. Except where we have chosen to offer VoIP telephone services in such a manner, we believe that our VoIP telephone services should be governed primarily by federal regulation. A federal appellate court affirmed our successful challenge to Minnesota's attempt to generally apply telephone regulation to our VoIP services, but that ruling is limited to the seven states in the 8th Circuit. Some states have attempted to subject cable VoIP services, such as our VoIP telephone service, to state level regulation. California has imposed reporting and other obligations on our VoIP services, including backup power requirements, and has proposed the imposition of service quality metrics on VoIP services. We have registered with or obtained certificates or authorizations from the FCC and the state regulatory authorities in those states in which we offer competitive voice services in order to ensure the continuity of our services. However, it is unclear whether and how these and other ongoing regulatory matters ultimately will be resolved. State regulatory commissions and legislatures may continue to consider imposing regulatory requirements on our fixed telephone services.

Mobile Service

Our Spectrum Mobile service offers mobile Internet access and telephone service. We provide this service as an MVNO using Verizon’s network and our network through Spectrum WiFi. As an MVNO, we are subject to many of the same FCC regulations that apply to facilities-based wireless carriers, as well as certain state or local regulations, including (but not limited to): E911, local number portability, customer privacy, CALEA, universal service fund contribution, robocall mitigation and hearing aid compatibility and safety and emission requirements for mobile devices. Spectrum Mobile’s broadband Internet access service is also subject to the FCC’s transparency rule. The FCC or other regulatory authorities may adopt new or different regulations for MVNOs and/or mobile service providers in the future, or impose new taxes or fees applicable to Spectrum Mobile, which could adversely affect the service offering or our business generally. For example, California has proposed the imposition of service quality metrics on mobile services.

Privacy and Information Security Regulation

The Communications Act limits our ability to collect, use, and disclose customers’ personally identifiable information for our Internet, video and voice services. We are subject to additional federal, state, and local laws and regulations that impose additional restrictions on the collection, use and disclosure of consumer information. All broadband providers are also obliged by CALEA to configure their networks in a manner that facilitates the ability of state and federal law enforcement, with proper legal process authorized under the Electronic Communications Privacy Act, to obtain records and information concerning our customers, including the content of their communications. Further, the FCC, Federal Trade Commission (“FTC”), and many states regulate and restrict the marketing practices of communications service providers, including telemarketing and sending unsolicited commercial emails. The FTC currently has the authority, pursuant to its general authority to enforce against unfair or deceptive acts and practices, to protect the privacy of Internet service customers, including our use and disclosure of certain customer information.

16

Our operations are also subject to federal and state laws governing information security. In the event of an information security breach, such rules may require consumer and government agency notification and may result in regulatory enforcement actions with the potential of monetary forfeitures. The FCC, the FTC and state attorneys general regularly bring enforcement actions against companies related to information security breaches and privacy violations.

Various security standards provide guidance to telecommunications companies in order to help identify and mitigate cybersecurity risks. One such standard is the voluntary framework released by the National Institute for Standards and Technology (“NIST”) in 2014 and updated in 2018, in cooperation with other federal agencies and owners and operators of U.S. critical infrastructure. The NIST cybersecurity framework provides a prioritized and flexible model for organizations to identify and manage cyber risks inherent to their business. It was designed to supplement, not supersede, existing cybersecurity regulations and requirements. Several government agencies have encouraged compliance with the NIST cybersecurity framework, including the FCC and Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency (“CISA”). We voluntarily follow NIST as part of our overall cybersecurity program. The FCC is considering expansion of its cybersecurity guidelines or the adoption of cybersecurity requirements. CISA is also developing cyber incident reporting rules, pursuant to 2022 legislative requirements, that require critical infrastructure entities to report substantial cyber incidents within 72 hours of their discovery.