Exhibit 99.2

|

Management’s

Discussion and Analysis

Third Quarter Ended

September 30, 2017

(Expressed in United States

dollars, except per share amounts and where otherwise noted) |

November 10, 2017

This Management’s Discussion and

Analysis ("MD&A") should be read in conjunction with the consolidated financial statements for the third quarter

ended September 30, 2017 and related notes thereto which have been prepared in accordance with generally accepted accounting principles

in the United States of America ("US GAAP"). References to "Entrée" and the "Company" are

to Entrée Resources Ltd. and/or one or more of its wholly-owned subsidiaries. For further information on the Company, reference

should be made to its continuous disclosure (including its most recently filed annual information form ("AIF")), which

is available on SEDAR at www.sedar.com. Information is also available on the Company’s website at www.entreeresourcesltd.com.

Information on risks associated with investing in the Company’s securities is contained in the Company’s most recently

filed AIF. Technical and scientific information under National Instrument 43-101 - Standards of Disclosure for Mineral Projects

("NI 43-101") concerning the Company’s material property, including information about mineral resources and reserves,

is contained in the Company’s most recently filed AIF and in its technical report titled "Lookout Hill Feasibility Study

Update" dated March 29, 2016 prepared by OreWin Pty Ltd.

Q3 2017

HIGHLIGHTS

Entrée/Oyu Tolgoi JV Property

| · | Entrée has engaged its consultants, Amec Foster Wheeler Americas Limited ("Amec

Foster

Wheeler")

to commence

work on

an

updated

National Instrument 43-101 Technical Report (the "Technical Report") on Entrée’s 20% participating interest in

the

Entrée/Oyu Tolgoi joint venture ("Entrée/Oyu Tolgoi JV") in Mongolia. Completion of the Technical Report

will

be a

significant

milestone for

the Company as it will enable management to discuss preliminary economics for potential future phases of the Oyu Tolgoi

mine,

where a significant amount of the Entrée/Oyu Tolgoi JV’s mineralization occurs, thereby helping investors

to understand the underlying value of Entrée’s flagship asset. |

The updated Technical Report is expected

to be completed by January 2018 and will include:

| - | an updated reserve case for the first lift ("Lift

1") of the Hugo North Extension block cave on the Entrée/Oyu Tolgoi JV property. The reserve will be based on information

contained within the 2016 Oyu Tolgoi Feasibility Study finalized in May 2016 by Entrée’s joint venture partner Oyu

Tolgoi LLC ("OTLLC"). First development production from Lift 1 on the Entrée/Oyu Tolgoi JV property is expected

in approximately 2021; and |

| - | a Preliminary Economic Assessment of Entrée’s

interest in both Lift 2 of the Hugo North Extension copper-gold deposit ("Lift 2") and the Heruga copper-gold-molybdenum

deposit ("Heruga"). |

| · | Entrée management visited the Oyu Tolgoi mine and had an opportunity to tour some of the

main surface infrastructure, including the concentrator and tailings facilities and to also go underground to observe some of the

development work completed to date during Q3. This visit included a review of plans with OTLLC for the immediate and medium-term

future. Entrée is pleased to report that project development, including both direct production and supporting infrastructure,

appears to be on track and is being completed to the highest safety and operating standards. |

| · | The development of Shaft 4, which is the first physical development work on the Entrée/Oyu

Tolgoi JV, is expected to commence in 2018. Shaft 4 will provide the necessary ventilation required to support mining of the northern

part of the Hugo North deposit (including Hugo North Extension on the Entrée/Oyu Tolgoi JV property), which is reported

to contain some of the highest-grade copper-gold mineralization in the entire Oyu Tolgoi project. Completion of Shaft 4 is expected

in 2021, at which time Entrée is expected to achieve its first production. |

| · | As reported by Turquoise Hill Resources Ltd.

("Turquoise Hill") on November 2, 2017, production from the Lift 1

underground mine, which starts on OTLLC’s Oyu Tolgoi mining license, remains on track for first draw bell in mid-2020

and sustainable first production in 2021. Activities reported in Q3 2017 include: |

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

| - | Underground lateral development made good progress

with approximately 1.4 equivalent kilometres completed. Since the re-start of development, a total of 5.4 equivalent kilometres

of lateral development has been completed. |

| - | The third development crew was deployed. Crews four

and five were in training during the quarter and are expected to be deployed during Q4’17. Also during Q3’17, commissioning

of the new 3,500 tonne per day development crusher was completed. With the deployment of crews four and five, a step up in lateral

development rates is expected to begin in Q4’17. |

| - | At the end of Q3’17, Shaft 2 sinking was at

1,249 metres and work had commenced on the service-level excavation that has a floor at 1,256 metres. Shaft 2 sinking is expected

to be complete in 2017 at a final depth of 1,284 metres with fit out occurring over 2018. Shaft 2 is key to future increases in

lateral development activity. |

| - | Shaft 5 sinking progressed approximately 214 metres

during Q3’17. During September, the underground team achieved the best sinking rate for Shaft 5 since project re-start averaging

2.6 metres per day. Sinking of Shaft 5 began slower than expected due to an extended construction re-start period and lower productivity

with completion now likely in early 2018. When completed, Shaft 5 will be dedicated to ventilation thereby increasing the capacity

for underground activities; however, with good early progress and continued on-plan lateral development, the completion of Shaft

5 sinking in early 2018 is not expected to materially impact the lateral development plan. |

| - | Development of the convey-to-surface decline continued

to progress with month-on-month improvement resulting from the use of project-wide process optimization techniques. The convey-to-surface

system is the eventual route of the full 95,000 tonne per day underground ore delivery system to the concentrator; however, it

is not a critical path item for first draw bell planned in mid-2020. Expected completion of the convey-to-surface system is 2022,

which will facilitate the ramp up to full production by 2027. |

Corporate

| · | Q3 2017 net loss from continuing operations, was $0.1 million as compared to Q3 2016 ($0.6 million),

a reduction of 80% from the comparative period of 2016. |

| · | As at September 30, 2017, cash on hand was $7.7 million and there was a working capital

balance of

$7.8 million. |

OVERVIEW

OF BUSINESS

Entrée is a mineral resource company

with interests in development and exploration properties in Mongolia, Peru and Australia.

The Company’s principal asset is

its interest in the Entrée/Oyu Tolgoi JV – a carried interest

in two of the Oyu Tolgoi project deposits in Mongolia as well as a large underexplored, highly prospective land package adjacent

on three sides to OTLLC’s Oyu Tolgoi mining licence.

The Oyu Tolgoi project

upon completion of the underground mine will be one of the world’s largest new copper-gold mines and is located in the

South Gobi region of Mongolia. The project includes two separate land holdings: the Oyu Tolgoi mining licence, which is held

by OTLLC (66% Turquoise Hill and 34% the Government of Mongolia), and the Entrée/Oyu Tolgoi JV property (the "Entrée/Oyu Tolgoi JV Property"), which

is a partnership between Entrée and OTLLC. The Entrée/Oyu Tolgoi JV Property comprises the eastern portion of

the Shivee Tolgoi mining licence, and all of the Javhlant mining licence. The Shivee Tolgoi and Javhlant mining licences are

held by Entrée. The terms of the Entrée/Oyu Tolgoi JV state that Entrée has a right to receive 20%

of all mineralization extracted from deeper than 560 metres below surface and 30% of all mineralization extracted from

above 560 metres depth.

Rio Tinto is the operator of the existing

open pit mine on the Oyu Tolgoi mining licence, and is currently managing the construction of Lift 1

of the Hugo North underground block cave on both the Oyu Tolgoi mining licence and the Entrée/Oyu Tolgoi JV Property. The

portion of the Hugo North deposit that lies on the Entrée/Oyu Tolgoi JV Property is known as Hugo North Extension. Lift

1 underground development recommenced in mid-2016.

In addition to the Hugo North Extension

copper-gold deposit, the Entrée/Oyu Tolgoi JV Property includes approximately 94% of the resource tonnes outlined at the

Heruga copper-gold-molybdenum deposit, and a large exploration land package, which together form a significant component of the

overall Oyu Tolgoi project.

Entrée also holds a 100% interest

in the western portion of the Shivee Tolgoi mining licence ("Shivee West"). Since 2015 Shivee West has been the subject

of a License Fees Agreement between Entrée and OTLLC and may ultimately be included in the Entrée/Oyu Tolgoi JV Property.

The first two phases of Oyu Tolgoi are

fully financed, with the Oyut open pit mine (Phase 1) currently in production and construction of Lift 1 of the Hugo North underground

block cave (Phase 2) currently in progress.

The Company also has the following assets:

| · | Blue Rose JV – a 56.31% interest in the Blue Rose joint venture property ("Blue Rose")

in the Olary Region of South Australia; and |

| · | Cañariaco Project Royalty – a 0.5% net smelter returns royalty on Candente Copper

Corp.’s Cañariaco copper porphyry project in Peru ("Cañariaco Royalty"). |

The Company’s corporate headquarters

are located in Vancouver, British Columbia, Canada. Field operations are conducted out of local offices in Mongolia.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Trading of the Company’s common shares

commenced on the NYSE MKT effective July 18, 2005, under the trading symbol "EGI". On April 24, 2006, the Company’s

common shares began trading on the Toronto Stock Exchange ("TSX") and discontinued trading on the TSX Venture Exchange.

The trading symbol remained "ETG".

OUTLOOK

AND STRATEGY

Entrée/Oyu Tolgoi JV Property

Amec Foster Wheeler has completed its initial

data review, and has commenced work on an updated Technical Report relating to Entrée’s 20% participating interest

in the Entrée/Oyu Tolgoi JV in Mongolia.

The updated Technical Report will include:

| · | an updated reserve case for Lift 1 of the Hugo North Extension block cave on the Entrée/Oyu

Tolgoi JV Property. The reserve will be based on information contained within the 2016 Oyu Tolgoi Feasibility Study finalized in

May 2016 by Entrée’s joint venture partner OTLLC. First development production from Lift 1 on the Entrée/Oyu

Tolgoi JV Property is expected in approximately 2021; and |

| · | a Preliminary Economic Assessment of Entrée’s interest in both Lift 2 and Heruga. |

Completion of the Technical Report

will be a significant milestone for the Company as it will enable management to discuss preliminary economics for potential

future phases of the Oyu Tolgoi mine, where a significant amount of the Entrée/Oyu Tolgoi JV’s mineralization

occurs, thereby helping investors to understand the underlying value of Entrée’s flagship asset. The Company estimates

the cost to be approximately $0.5 million to complete and publish the report. The Technical Report is expected to be

completed by January 2018.

Entrée management and representatives

from Amec Foster Wheeler recently visited the Oyu Tolgoi underground development project and supporting infrastructure in Mongolia.

Based on the visit and recent disclosure by Turquoise Hill, Entrée is pleased to confirm that the development

of Shaft 4, which will be the first physical development work on the Entrée/Oyu Tolgoi JV Property, is scheduled to commence

in 2018. Shaft 4 will provide the necessary ventilation required to support mining of the northern part of the Hugo North deposit

(including Hugo North Extension on the Entrée/Oyu Tolgoi JV Property), which is reported to contain some of the highest-grade

copper-gold mineralization in the entire Oyu Tolgoi project. Completion of Shaft 4 is expected in 2021, with first development

production from Hugo North Extension Lift 1 also expected in 2021.

The site visit, led by senior OTLLC team

members, provided Entrée management with an opportunity to tour some of the main surface infrastructure, including the concentrator

and tailings facilities and to also go underground to observe some of the development work completed to date. In addition, Entrée

management was able to review plans with OTLLC for the immediate and medium-term future. Entrée is pleased to report that

project development, including both direct production and supporting infrastructure, appears to be on track and is being completed

to the highest safety and operating standards.

Corporate

With the completion of

the restructuring done early in the year and the commencement of the Technical Report, the Company’s focus will be

to maximize investor awareness of the impending Technical Report and what the results of this report mean to the Company and

all stakeholders, both current and potential. Corporate costs going forward are estimated at $0.3 million per quarter,

which include marketing and compliance costs, and the Company continues to estimate total corporate costs of between $1.6

million and $1.8 million for the 2017 year, which includes the one-time restructuring costs that have already been incurred

in the year.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

ENTRÉE/OYU

TOLGOI JV PROPERTY AND SHIVEE WEST PROPERTY – MONGOLIA

The Entrée/Oyu Tolgoi JV Property

is subject to a joint venture between Entrée and OTLLC. The Entrée/Oyu Tolgoi JV Property includes the Hugo North

Extension copper-gold deposit, the Heruga copper-gold-molybdenum deposit, and an extensive highly prospective exploration land

package, which together form a significant component of the overall Oyu Tolgoi project. A portion of Hugo North Extension is included

in Hugo North Lift 1 underground development. The Entrée/Oyu Tolgoi JV Property and Entrée’s 100% owned Shivee

West are collectively referred to as the "Lookout Hill" property.

The following is a summary of information

that is contained in the Company’s most recently filed AIF and in its technical report titled "Lookout Hill Feasibility

Study Update" dated March 29, 2016 prepared by OreWin Pty Ltd. This information should be read in conjunction with the Company’s

AIF and Technical Report, which are available on the Company’s website (www.entreeresourcesltd.com) or on SEDAR (www.sedar.com).

Description of the Entrée/Oyu

Tolgoi JV Structure

Capital Development and Financing

The Entrée/Oyu Tolgoi JV Property

is being explored and developed on behalf of joint venture manager OTLLC by Rio Tinto, through various agreements among OTLLC,

Rio Tinto and Turquoise Hill. Under the terms of the Entrée/Oyu Tolgoi JV, any mill, smelters and other processing facilities

and related infrastructure are owned exclusively by OTLLC ("OTLLC Facilities") and all costs of constructing and operating

OTLLC Facilities are solely for the account of OTLLC.

All other costs of operations on the Entrée/Oyu

Tolgoi JV Property, including capital costs, are allocated as follows:

| · | OTLLC shall bear and pay for 100% of such costs allocated to the Oyu Tolgoi mining licence and

all associated liabilities including for environmental compliance; and |

| · | The balance of such costs shall be borne and paid by Entrée and OTLLC in accordance with

their respective joint venture interests. |

For illustration purposes only, if a shaft

is sunk on the Entrée/Oyu Tolgoi JV Property which also provides access to the Oyu Tolgoi mining licence and fifty-five

percent (55%) of mineral production is from the Oyu Tolgoi licence and forty-five percent (45%) of mineral production is from the

Entrée/Oyu Tolgoi JV Property, Entrée would have responsibility for a share of those costs equal to its twenty percent

participating interest (20%) multiplied by forty-five percent (45%).

Underground development of Hugo North (including

Hugo North Extension) Lift 1 has been fully financed by a syndicate of banks through OTLLC. Entrée has elected to have OTLLC

debt finance its share of costs with interest accruing at OTLLC’s actual cost of capital or prime plus 2%, whichever is less,

at the date of the advance.

Debt repayment may be made in whole or

in part from (and only from) 90% of monthly available cash flow arising from the sale of Entrée’s share of products.

Such amounts will be applied first to payment of accrued interest and then to repayment of principal. Available cash flow means

all net proceeds of sale of Entrée’s share of products in a month less Entrée’s share of costs of operations

for the month.

Entrée is not responsible for contributing

any upfront cash or for sourcing its own debt financing for the development of the Entrée/Oyu Tolgoi JV Property, which

is being undertaken by OTLLC in accordance with OTLLC’s 2016 Oyu Tolgoi Feasibility Study ("OTFS16").

Operations and Operating Cash Flow

The Entrée/Oyu Tolgoi JV Property

will be managed on behalf of joint venture manager OTLLC by Rio Tinto, through various agreements among OTLLC, Rio Tinto and Turquoise

Hill.

Entrée’s share of concentrates

will, unless Entrée otherwise agrees, be processed at the OTLLC Facilities by paying milling and smelting charges. The OTLLC

Facilities are not intended to be profit centres and therefore, minerals from the Entrée/Oyu Tolgoi JV Property will be

processed at cost (using industry standards for calculation of cost including an amortisation of capital costs). The amortization

allowance for capital costs will be calculated in accordance with generally accepted accounting principles determined yearly based

on the estimated quantity of minerals to be processed for Entrée’s account during that year relative to the total

design capacity of the processing facilities over their useful life.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

As defined in the agreement governing the

Entrée/Oyu Tolgoi JV (the "JVA"), net cash flow resulting from the sale of Entrée’s share of concentrates

will be allocated to repayment of debt to OTLLC and operating cash proceeds for Entrée.

OTLLC as manager of the joint venture is

responsible for operating activities on behalf of both joint venture participants.

As at September 30, 2017 Rio Tinto International Holdings Limited

beneficially owned 30,366,129 common shares (including 13,799,333 common shares held by Turquoise Hill), or 17.4% of the outstanding

shares of the Company.

Entrée/Oyu Tolgoi JV Property

Summary

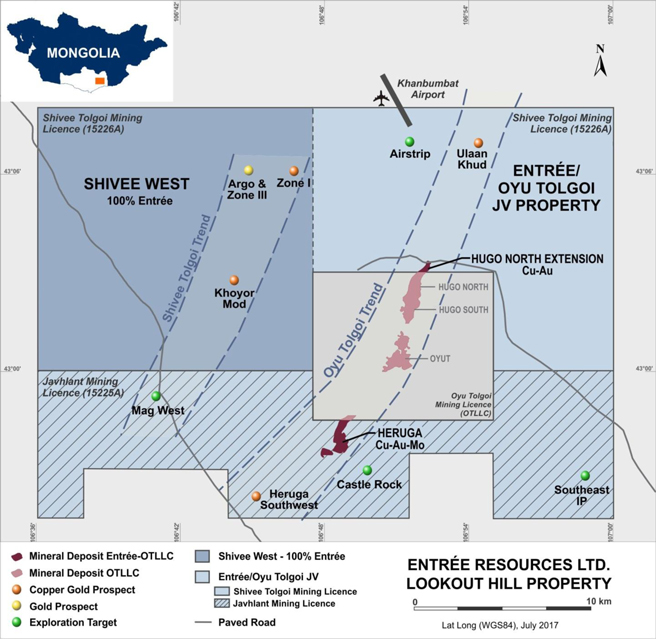

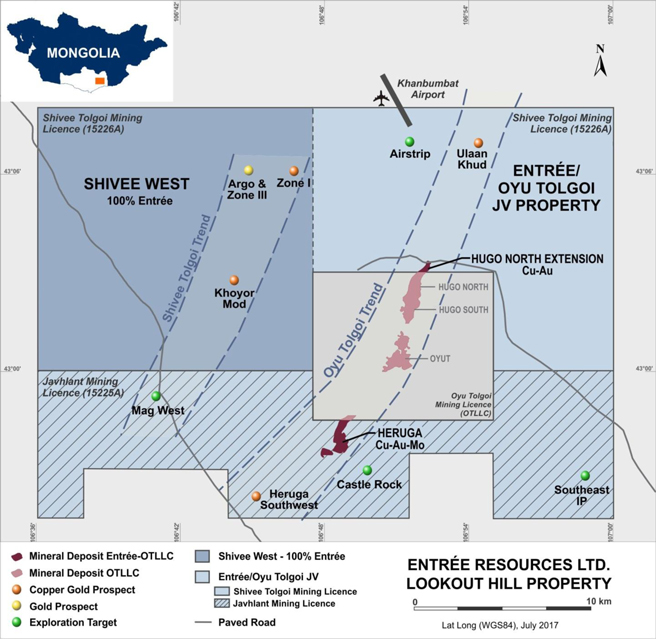

The Lookout Hill property, which completely

surrounds OTLLC’s Oyu Tolgoi mining licence, is located within the Aimag (province) of Ömnögovi in the South Gobi

region of Mongolia, about 570 kilometres south of the capital city of Ulaanbaatar and 80 kilometres north of the border with China.

Entrée’s most advanced asset

is its interest in two world class porphyry deposits in Mongolia: Hugo North Extension and Heruga. These deposits are the northern-most

and southern-most, respectively, in the Oyu Tolgoi series of deposits, which stretches over 12 kilometres across three mining licences.

The 39,807 hectare Entrée/Oyu Tolgoi

JV Property is comprised of the eastern portion of the Shivee Tolgoi mining licence, which hosts the Hugo North Extension copper-gold

deposit, and all of the Javhlant mining licence, which hosts the Heruga copper-gold-molybdenum deposit. The 23,114 hectare western

portion of the Shivee Tolgoi mining licence (Shivee West) is not currently included in the Entrée/Oyu Tolgoi JV Property,

although it is the subject of a License Fees Agreement with OTLLC and may ultimately be included in the Entrée/Oyu Tolgoi

JV Property. OTLLC also has a right of first refusal with respect to any proposed disposition by Entrée of an interest in

Shivee West.

The illustration below depicts the mining licences that comprise

the Entrée/Oyu Tolgoi JV Property and Shivee West:

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The Entrée/Oyu Tolgoi JV Property

includes Measured, Indicated and Inferred mineral resources at the Hugo North Extension deposit and Inferred mineral resources

at the Heruga deposit, as reported in Entrée’s technical report titled "Lookout Hill Feasibility Study Update"

dated March 29, 2016, prepared for Entrée by OreWin Pty Ltd ("LHTR16"). The Indicated resources at Hugo North

Extension contain a Probable reserve, which is included in Lift 1 of the Oyu Tolgoi underground block cave mining operation. The

Probable reserve (September 20, 2014) reported in LHTR16 for Hugo North Extension totals approximately 35 million tonnes ("Mt")

grading 1.59% copper, 0.55 grams per tonne ("g/t") gold, and 3.72 g/t silver. Entrée holds a 20% carried interest

in this mineral reserve through the Entrée/Oyu Tolgoi JV. First development production from Lift 1 is expected in approximately

2021. A second lift ("Lift 2") for the Oyu Tolgoi underground block cave operation, including additional resources from

Hugo North Extension, has been proposed but has not yet been modeled within the existing mine plan. Lift 1 is the most significant

value driver for the Oyu Tolgoi project.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

LHTR16 Mineral Reserve –

Entrée/Oyu Tolgoi JV

Entrée/Oyu Tolgoi JV – LTHR16

Mineral Reserve

Hugo North Extension Lift 1, Effective 20 September 2014

| | |

Ore | | |

NSR | | |

Cu | | |

Au | | |

Ag | | |

Recovered Metal | |

| Classification | |

(Mt) | | |

($/t) | | |

(%) | | |

(g/t) | | |

(g/t) | | |

Cu (Mlb) | | |

Au (Koz) | | |

(Ag(Koz) | |

| Probable | |

| 35 | | |

| 100.57 | | |

| 1.59 | | |

| 0.55 | | |

| 3.72 | | |

| 1,121 | | |

| 519 | | |

| 3,591 | |

Notes:

| 1. | Entrée has a 20% interest in the Hugo North Extension Lift 1 mineral reserve. |

| 2. | Metal prices used for calculating the Hugo North Extension underground net smelter return ("NSR")

are as follows: copper at $3.01/lb; gold at $1,250/oz; and silver at $20.37/oz, all based on long-term metal price forecasts at

the beginning of the mineral reserve work. The analysis indicates that the mineral reserve is still valid at these metal prices. |

| 3. | The NSR has been calculated with assumptions specific to Hugo North Extension for smelter refining

and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries and royalties. |

| 4. | The block cave shell was defined using a NSR cut-off of $15/t NSR. |

| 5. | For the underground block cave, all mineral resources within the shell have been converted to mineral

reserves, however, low-grade Indicated mineral resources and Inferred mineral resources have been assigned a zero grade and are

treated as dilution. |

| 6. | Only Indicated mineral resources were used to report Probable mineral reserves. |

| 7. | The base case financial analysis has been prepared using the following current long-term metal

price estimates: copper at $3.08/lb; gold at $1,304/oz; and silver at $21.46/oz. |

| 8. | The mineral reserves reported above are not additive to the mineral resources. |

LHTR16 Mineral Resources – Entrée/Oyu

Tolgoi JV

Entrée/Oyu Tolgoi JV – LTHR16

Mineral Resources

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Contained Metal | |

| Classification | |

Tonnage

(Mt) | | |

Cu

(%) | | |

Au

(g/t) | | |

Ag

(g/t) | | |

Mo

(ppm) | | |

CuEq

(%) | | |

Cu

(Mlb) | | |

Au

(Koz) | | |

Ag

(Koz) | | |

Mo

(Mlb) | | |

CuEq

(Mlb) | |

| Hugo North Extension (>0.37% CuEq Cut-Off) |

| Measured | |

| 1.2 | | |

| 1.38 | | |

| 0.12 | | |

| 2.77 | | |

| 38.4 | | |

| 1.47 | | |

| 36 | | |

| 4.4 | | |

| 105 | | |

| 0.1 | | |

| 38 | |

| Indicated | |

| 128 | | |

| 1.65 | | |

| 0.55 | | |

| 4.12 | | |

| 33.6 | | |

| 1.99 | | |

| 4,663 | | |

| 2,271 | | |

| 16,988 | | |

| 9.5 | | |

| 5,633 | |

| Inferred | |

| 179 | | |

| 0.99 | | |

| 0.34 | | |

| 2.68 | | |

| 25.4 | | |

| 1.20 | | |

| 3,887 | | |

| 1,963 | | |

| 15,418 | | |

| 10.0 | | |

| 4,730 | |

| Heruga (>0.37% CuEq Cut-Off) |

| Inferred | |

| 1,700 | | |

| 0.39 | | |

| 0.37 | | |

| 1.39 | | |

| 113.2 | | |

| 0.64 | | |

| 14,610 | | |

| 20,428 | | |

| 75,955 | | |

| 424 | | |

| 24,061 | |

Notes:

| 1. | Entrée has a 20% interest in the Hugo North Extension and Heruga mineral resources. |

| 2. | "CuEq" is copper-equivalent grade, expressed in percent. |

| 3. | The effective date for the Hugo North Extension resource estimate is March 28, 2014; for Heruga

the effective date is March 30, 2010. |

| 4. | The 0.37% CuEq cut-off is equivalent to the underground mineral reserve cut-off as determined by

OTLLC. |

| 5. | CuEq has been calculated using assumed metal prices ($3.01/lb for copper, $1,250/oz for gold, $20.37/oz

for silver, and $11.90/lb for molybdenum). |

| 6. | Hugo North Extension CuEq% = Cu% + (( Au (g/t) x 1,250 x 0.0321507 x 0.913) + ( Ag (g/t) x 20.37

x 0.0321507 x 0. 942)) / (3.01 x 22.0462). |

| 7. | Heruga CuEq% = Cu% + (( Au (g/t) x 1,250 x 0.0321507 x 0.911) + ( Ag (g/t) x 20.37 x 0.0321507

x 0. 949) + (Mo (ppm) x 11.9 x 0.0022046 x 0.736)) / (3.01 x 22.0462). |

| 8. | The contained copper, gold, silver and molybdenum in the tables have not been adjusted for metallurgical

recovery. |

| 9. | Totals may not match due to rounding. |

| 10. | Mineral resources that are not mineral reserves do not have demonstrated economic viability. |

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

LHTR16 Entrée/Oyu Tolgoi JV Summary Production and

Economic Analysis Results

| Description | |

Units | |

Total | |

| Metal Prices |

| Copper | |

$/lb | |

| 3.08 | |

| Gold | |

$/oz | |

| 1,304 | |

| Silver | |

$/oz | |

| 21.46 | |

| Entrée/Oyu Tolgoi JV Property Results (Lift 1) |

| Processed | |

Mt | |

| 34.8 | |

| NSR | |

$/t | |

| 100.57 | |

| Cu Grade | |

% | |

| 1.59 | |

| Au Grade | |

g/t | |

| 0.55 | |

| Ag Grade | |

g/t | |

| 3.72 | |

| Copper Recovered | |

Mlb | |

| 1,121 | |

| Gold Recovered | |

koz | |

| 519 | |

| Silver Recovered | |

koz | |

| 3,591 | |

| Total Cash Costs After Credits | |

$/lb Payable Copper | |

| 0.99 | |

| NPV8% Before Tax (Entrée’s 20% interest only) | |

$M | |

| 142 | |

| NPV8% After Tax (Entrée’s 20% interest only) | |

$M | |

| 106 | |

Notes:

| 1. | Entrée has a 20% interest in Entrée/Oyu Tolgoi JV Property mineralization. Unless

otherwise noted above, results are for the entire Entrée/Oyu Tolgoi JV. |

| 2. | Metal prices used for calculating the Hugo North Extension underground NSR are as follows: copper

at $3.01/lb; gold at $1,250/oz; and silver at $20.37/oz, all based on long-term metal price forecasts at the beginning of the mineral

reserve work. The analysis indicates that the mineral reserve is still valid at these metal prices. |

| 3. | The NSR has been calculated with assumptions specific to Hugo North Extension for smelter refining

and treatment charges, deductions and payment terms, concentrate transport, metallurgical recoveries and royalties. |

| 4. | The block cave shell was defined using a NSR cut-off of $15/t NSR. |

| 5. | For the underground block cave, all Indicated mineral resources within the shell have been converted

to mineral reserves. Low-grade Indicated mineral resources and Inferred mineral resources have been assigned a zero grade and treated

as dilution. |

| 6. | The mineral reserves reported are not additive to the mineral resources. |

In addition to the mine plan for Lift 1,

LHTR16 discusses several alternative production cases that would include mineral resources from other Oyu Tolgoi deposits, including

Hugo North Extension Lift 2 and Heruga, and allow for continuous improvement in plant throughput and potential plant expansions

up to 350 thousand tonnes per day. Due to the nature of the deposits associated with Oyu Tolgoi, the project has the flexibility

to consider several options for optimizing the overall mine plan for the benefit of stakeholders. Separate development decisions

will need to be made based on future prevailing conditions and the experience obtained from developing and operating the initial

phases of the project.

A complete description and the Company’s

related history of the Entrée/Oyu Tolgoi JV is available in the Company’s AIF dated March 10, 2017, available for

review on SEDAR at www.sedar.com. For additional information regarding the assumptions, qualifications and procedures associated

with the scientific and technical information regarding the Entrée/Oyu Tolgoi JV Property, reference should be made to the

full text of LHTR16, which is available for review on SEDAR.

Shivee West Property Summary

Shivee West comprises

the northwest portion of the Lookout Hill property, and adjoins the Entrée/Oyu Tolgoi JV Property and OTLLC’s Oyu

Tolgoi mining licence.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

To date, no economic

zones of precious or base metals mineralization have been outlined on Shivee West. However, zones of gold and copper mineralization

have previously been identified at Zone III/Argo Zone and Khoyor Mod. There has been no drilling on the ground since 2011, and

no exploration work has been completed since 2012. In 2015, in light of the ongoing requirement to pay approximately $350,000 annually

in licence fees for Shivee West and a determination that no further exploration work would likely be undertaken in the near future,

Entrée began to examine options to reduce expenditures in Mongolia. These options included further reducing the area of

the mining licence, looking for a purchaser or partner for Shivee West, and rolling the ground into the Entrée/Oyu Tolgoi

JV. Management determined that it was in the best interests of Entrée to roll Shivee West into the Entrée/Oyu

Tolgoi JV, and Entrée entered into a License Fees Agreement with OTLLC on October 1, 2015. The License Fees Agreement provides

the parties will use their best efforts to amend the JVA to include Shivee West in the definition of Entrée/Oyu Tolgoi JV

Property. Entrée determined that rolling Shivee West into the Entrée/Oyu Tolgoi JV would provide the joint venture

partners with continued security of tenure; Entrée shareholders would continue to benefit from any exploration or development

that the Entrée/Oyu Tolgoi JV management committee approves on Shivee West; and Entrée would no longer have to pay

licence fees, as the parties agreed that the licence fees would be for the account of each joint venture participant in proportion

to their respective interests, with OTLLC contributing Entrée’s 20% share charging interest at prime plus 2%.

To date, no amended JVA has been entered into, and Entrée retains a 100% interest in Shivee West.

Q3 2017 Review

Exploration and development of the Entrée/Oyu

Tolgoi JV Property is under the control of Rio Tinto on behalf of manager OTLLC.

As reported by Turquoise Hill on November 2,

2017, production from the Lift 1 underground mine, which starts on the OTLLC Oyu Tolgoi mining license, remains on track for first

draw bell in mid-2020 and sustainable first production in 2021. Activities reported in Q3 2017 include:

| · | Underground lateral development made good progress with approximately 1.4 equivalent kilometres

completed. Since the re-start of development, a total of 5.4 equivalent kilometres of lateral development has been completed. |

| · | The third development crew was deployed. Crews four and five were in training during the quarter

and are expected to be deployed during Q4’17. Also during Q3’17, commissioning of the new 3,500 tonne per day development

crusher was completed. With the deployment of crews four and five, a step up in lateral development rates is expected to begin

in Q4’17. |

| · | At the end of Q3’17, Shaft 2 sinking was at 1,249 metres and work had commenced on the service-level

excavation that has a floor at 1,256 metres. Shaft 2 sinking is expected to be complete in 2017 at a final depth of 1,284 metres

with fit out occurring over 2018. Shaft 2 is key to future increases in lateral development activity. |

| · | Shaft 5 sinking progressed approximately 214 metres during Q3’17. During September, the underground

team achieved the best sinking rate for Shaft 5 since project re-start averaging 2.6 metres per day. Sinking of Shaft 5 began slower

than expected due to an extended construction re-start period and lower productivity with completion now likely in early 2018.

When completed, Shaft 5 will be dedicated to ventilation thereby increasing the capacity for underground activities; however, with

good early progress and continued on-plan lateral development, the completion of Shaft 5 sinking in early 2018 is not expected

to materially impact the lateral development plan. |

| · | Development of the convey-to-surface decline continued to progress with month-on-month improvement

resulting from the use of project-wide process optimization techniques. The convey-to-surface system is the eventual route of the

full 95,000 tonne per day underground ore delivery system to the concentrator; however, it is not a critical path item for first

draw bell planned in mid-2020. Expected completion of the convey-to-surface system is 2022, which will facilitate the ramp up to

full production by 2027. |

For the three and nine months ended September

30, 2017, Entrée expenses related to Mongolian operations were $0.1 million and $0.2 million, respectively, compared to

$0.1 million and $0.3 million for the same periods of 2016. These costs represented in-country administration costs in 2017. In

the comparative period of 2016, there were camp closure costs in addition to the general administration costs for the assets.

The lower expenses in 2017 compared to 2016 resulted from a reduction of operational activities, personnel and overhead in Mongolia.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

BLUE

ROSE PROPERTY – AUSTRALIA

Summary

The Blue Rose silver-iron-gold-copper

property is located in the Olary Region of South Australia, 300 kilometres northeast of Adelaide and 130 kilometres

west-southwest of Broken Hill. Entrée (operator) has a 56.31% interest in the property, with Giralia Resources Pty

Ltd., now a subsidiary of Atlas Iron Limited, retaining a 43.69% interest. The property consists of one exploration licence,

EL6006, totalling 257 square kilometres, expiring on July 18, 2019.

In October 2013, the Blue Rose joint venture

filed a Part 9B native title application under the South Australia Mining Act and the Wilyakali and Ngadjuri groups registered

as native title claimants. A native title agreement was signed with the Wilyakali group in December 2013 and an agreement with

the Ngadjuri group was signed in March 2014.

The Braemar Iron Formation is the host

rock to magnetite mineralization on both EL6006 and Magnetite Mines Limited’s Razorback Iron project, located immediately

west of EL6006. Aeromagnetic anomalies coincident with the outcropping and sub-cropping magnetite units extend from Razorback into

EL6006. The mineralization within the Braemar Iron Formation forms a simple dipping tabular body with only minor faulting, folding

and intrusives. Grades, thickness, dip, and outcropping geometry remain very consistent over kilometres of strike. While the bedded

magnetite has the highest iron content, the tillitic unit is diluted by the inclusion of lithic fragments, such as iron-poor granite

and metasedimentary dropstones.

On April 18, 2017, the Blue Rose joint

venture partners entered into a Deed of Consent, Sale and Variation (the "Deed") with Lodestone Equities Limited and

Fe Mines Limited (formerly Braemar Iron Pty Ltd) ("FML"). FML has certain rights in respect of the exploration for, and

development of, iron ore on EL6006 pursuant to a prior agreement.

Under the Deed, the Blue Rose joint venture

partners agreed to transfer title to EL6006 and assign the native title agreements to FML, and vary a payment required to be made

to the Blue Rose joint venture partners under the prior agreement. Under the Deed, FML must now pay to the Blue Rose joint venture

partners an aggregate A$100,000 at completion, and grant to them (a) the right to receive an additional payment(s) upon completion

of an initial or subsequent iron ore resource estimate on EL6006, to a maximum of A$2 million in aggregate; and (b) a royalty equal

to 0.65% of the free on board value of iron ore product extracted and recovered from EL6006. Under the Deed, an additional A$285,000

must also be paid to the Blue Rose joint venture partners upon the commencement of Commercial Production (as such term is defined

in the Deed).

The Blue Rose joint venture partners will

retain their existing rights to explore for, develop and mine all minerals other than iron ore on EL6006.

On May 23, 2017, the Blue Rose joint venture

partners entered into an agreement with Hamelin Gully Pty Ltd, for the sale of data and information relating to ground surrendered

by the Blue Rose joint venture partners and subsequently acquired by Hamelin Gully. The purchase price for the data and information

was A$150,000. The transaction closed on July 11, 2017.

Q3 2017 Review

Expenditures in Q3 2017 were minimal and

related to administrative costs in Australia.

CAñARIACO

PROJECT ROYALTY – PERU

Summary

In July 2015, the Company entered into

an agreement with Candente Copper Corp. (TSX:DNT) ("Candente") to acquire a 0.5% NSR royalty on Candente's 100% owned

Cañariaco project in Peru for a purchase price of $500,000.

The Cañariaco project includes the

Cañariaco Norte copper-gold-silver deposit, as well as the adjacent Cañariaco Sur and Quebrada Verde copper prospects,

located within the western Cordillera of the Peruvian Andes in the Department of Lambayeque, Northern Peru.

There was no activity or expenditures related

to this royalty in Q3 2017.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

SUMMARY OF CONSOLIDATED FINANCIAL

OPERATING RESULTS

Plan of arrangement and discontinued

operations

On May 9, 2017, the Company completed

a plan of arrangement (the "Arrangement") under Section 288 of the Business Corporations Act (British Columbia)

pursuant to which Entrée transferred its wholly owned subsidiaries that directly or indirectly hold the Ann Mason

Project in Nevada and the Lordsburg property in New Mexico including $8,843,232 in cash and cash equivalents to a

newly incorporated company, Mason Resources Corp. ("Mason Resources") in exchange for 77,804,786 common shares of

Mason Resources ("Mason Common Shares"). Mason Resources commenced trading on the TSX on May

12, 2017 under the symbol "MNR".

As part of the Arrangement, Entrée

then distributed 77,805,786 Mason Common Shares to Entrée shareholders by way of a share exchange, pursuant to which

each existing share of Entrée was exchanged for one "new" share of Entrée and 0.45 of a Mason Common Share.

Optionholders and warrantholders of Entrée received replacement options and warrants of Entrée and options and warrants

of Mason Resources which were proportionate to, and reflective of the terms of, their existing options and warrants of Entrée.

The assets and liabilities that were

transferred to Mason Resources were classified as discontinued operations and classified on the balance sheet as assets /

liabilities held for spin-off ("Spin-off"). The discontinued operations include three entities transferred to

Mason Resources pursuant to the Arrangement, Mason U.S. Holdings Inc. (formerly Entrée U.S. Holdings Inc.), Mason

Resources (US) Inc. (formerly Entrée Gold (US) Inc., and M.I.M. (U.S.A.) Inc. (collectively the "US

Subsidiaries"). The Spin-off distribution was accounted for at the carrying amount, without gain or loss, and resulted

in a reduction of stockholders’ equity (deficiency) of $44.2 million.

The closing of the Arrangement resulted

in the following Spin-off assets and liabilities being distributed to Mason Resources on May 9, 2017:

| | |

May 9, 2017 | | |

December 31, 2016 | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 8,843 | | |

$ | 129 | |

| Receivables and prepaids | |

| 137 | | |

| 219 | |

| | |

| 8,980 | | |

| 348 | |

| Long-term assets | |

| | | |

| | |

| Equipment | |

| 25 | | |

| 25 | |

| Mineral property interest | |

| 37,699 | | |

| 38,379 | |

| Reclamation deposits and other | |

| 481 | | |

| 481 | |

| | |

| 38,205 | | |

| 38,885 | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

| (34 | ) | |

| (230 | ) |

| Long-term liabilities | |

| | | |

| | |

| Deferred income taxes | |

| (2,937 | ) | |

| (3,015 | ) |

| Net assets | |

$ | 44,214 | | |

$ | 35,988 | |

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Operating Results

The Company’s operating results for

the three and nine months ended September 30 were:

| | |

Three months ended September 30 | | |

Nine months ended September 30 | |

| | |

2017 | | |

2016 | | |

2015 | | |

2017 | | |

2016 | | |

2015 | |

| Expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exploration | |

$ | 95 | | |

$ | 50 | | |

$ | 284 | | |

$ | 273 | | |

$ | 419 | | |

$ | 1,172 | |

| General and administration | |

| 258 | | |

| 525 | | |

| 729 | | |

| 1,632 | | |

| 1,553 | | |

| 2,515 | |

| Restructuring costs | |

| 14 | | |

| - | | |

| - | | |

| 210 | | |

| - | | |

| - | |

| Depreciation | |

| 7 | | |

| 3 | | |

| 5 | | |

| 14 | | |

| 11 | | |

| 16 | |

| Foreign exchange loss (gain) | |

| (349 | ) | |

| (39 | ) | |

| (1,137 | ) | |

| (406 | ) | |

| 397 | | |

| (2,517 | ) |

| Other | |

| - | | |

| - | | |

| - | | |

| (52 | ) | |

| - | | |

| - | |

| Operating loss (income) | |

| 25 | | |

| 539 | | |

| (119 | ) | |

| 1,671 | | |

| 2,380 | | |

| 1,186 | |

| Interest expense, net | |

| 49 | | |

| 45 | | |

| 66 | | |

| 122 | | |

| 129 | | |

| 123 | |

| Loss from equity investee | |

| 55 | | |

| 62 | | |

| 25 | | |

| 157 | | |

| 169 | | |

| 78 | |

| Operating loss (income) before income taxes | |

| 129 | | |

| 646 | | |

| (28 | ) | |

| 1,950 | | |

| 2,678 | | |

| 1,387 | |

| Income tax recovery | |

| - | | |

| - | | |

| (662 | ) | |

| (72 | ) | |

| - | | |

| (897 | ) |

| Net loss (income) from continuing

operations | |

| 129 | | |

| 646 | | |

| (690 | ) | |

| 1,878 | | |

| 2,678 | | |

| 490 | |

| Net loss from discontinued operations | |

| - | | |

| 363 | | |

| 836 | | |

| 176 | | |

| 1,017 | | |

| 3,266 | |

| Net loss | |

| 129 | | |

| 1,009 | | |

| 146 | | |

| 2,054 | | |

| 3,695 | | |

| 3,756 | |

| Foreign currency translation adjustment | |

| 893 | | |

| 172 | | |

| 1,889 | | |

| 2,505 | | |

| (1,176 | ) | |

| 4,171 | |

| Net loss and comprehensive loss | |

$ | 1,022 | | |

$ | 1,181 | | |

$ | 2,035 | | |

$ | 4,559 | | |

$ | 2,519 | | |

$ | 7,927 | |

| Net loss per common share | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic/diluted - continuing operations | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | 0.00 | | |

$ | (0.01 | ) | |

$ | (0.02 | ) | |

$ | (0.00 | ) |

| Basic/diluted - discontinued operations | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | (0.02 | ) |

| Total assets | |

$ | 8,807 | | |

$ | 54,515 | | |

$ | 65,733 | | |

$ | 8,807 | | |

$ | 54,515 | | |

$ | 65,733 | |

| Total non-current liabilities | |

$ | 32,428 | | |

$ | 34,339 | | |

$ | 39,084 | | |

$ | 32,428 | | |

$ | 34,339 | | |

$ | 39,084 | |

During the three and nine months ended

September 30, 2017, the Company’s net loss from continuing operations was $0.1 million and $1.9 million, respectively, compared

to $1.0 million and $2.7 million for the same periods in 2016. This reduction was due to reduced corporate administration expenses with the spin-out of Mason Resources. In addition, positive foreign exchange fluctuations primarily

related to the USD:CAD exchange rate and a reduction in exploration related expenditures contributed to the decrease.

General and administration costs in Q3

2017 were lower than in 2016 due to completion of the Mason Resources spin-out in Q2 2017 resulting in lower corporate costs subsequent

to the date of the spin-out. During the nine month period ended September 30, 2017, general and administration costs were higher

than in the corporative period of 2016 due to the costs to complete the restructuring in Q2 2017.

Exploration costs in Mongolia were lower

in 2017 due to a reduction in staffing and general administrative costs.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The resulting foreign exchange gain of

$0.4 million in 2017 was primarily the result of movements between the C$ and US$ as the Company holds its cash in both currencies.

Interest expense (net) was primarily

related to the loan payable to OTLLC pursuant to the Entrée/Oyu Tolgoi JV Property, and is subject to a variable

interest rate.

The loss from equity investee was

related to the Entrée/Oyu Tolgoi JV Property and was consistent with comparative periods.

Net loss from discontinued operations

was due to the Arrangement that was completed during Q2 2017 and the amount was related to exploration costs of the assets

that were spun-out to Mason Resources.

The total assets as of September 30,

2017 are substantially lower than the comparative periods due to the completion of the restructuring and resulting roll out

of the assets into Mason Resources. The non-current liabilities are lower than past periods due to repayment in 2016 of the

deferred revenue balance to Sandstorm Gold Ltd. (‘Sandstorm”).

Quarterly Financial Data – 2 year historic trend

| | |

Q3 17 | | |

Q2 17 | | |

Q1 17 | | |

Q4 16 | | |

Q3 16 | | |

Q2 16 | | |

Q1 16 | | |

Q4 15 | |

| Exploration | |

$ | 95 | | |

$ | 109 | | |

$ | 69 | | |

$ | 70 | | |

$ | 50 | | |

$ | 142 | | |

$ | 227 | | |

$ | 487 | |

| General and administrative | |

| 272 | | |

| 613 | | |

| 905 | | |

| 937 | | |

| 525 | | |

| 476 | | |

| 552 | | |

| 2,153 | |

| Depreciation | |

| 7 | | |

| 4 | | |

| 3 | | |

| 4 | | |

| 3 | | |

| 4 | | |

| 4 | | |

| 5 | |

| Foreign exchange (gain) loss | |

| (349 | ) | |

| (100 | ) | |

| 43 | | |

| (54 | ) | |

| (39 | ) | |

| 4 | | |

| 432 | | |

| (403 | ) |

| Operating loss | |

| 25 | | |

| 626 | | |

| 1,020 | | |

| 957 | | |

| 539 | | |

| 626 | | |

| 1,215 | | |

| 2,242 | |

| Interest expense, net | |

| 49 | | |

| 38 | | |

| 35 | | |

| 48 | | |

| 45 | | |

| 43 | | |

| 41 | | |

| 289 | |

| Loss from equity investee | |

| 55 | | |

| 55 | | |

| 48 | | |

| 68 | | |

| 62 | | |

| 60 | | |

| 47 | | |

| 41 | |

| Income tax (recovery) expense | |

| - | | |

| (72 | ) | |

| - | | |

| (553 | ) | |

| - | | |

| - | | |

| - | | |

| 1,057 | |

| Net loss from continuing operations | |

$ | 129 | | |

$ | 647 | | |

$ | 1,103 | | |

$ | 520 | | |

$ | 646 | | |

$ | 729 | | |

$ | 1,303 | | |

$ | 3,629 | |

| Net loss from discontinued operations | |

| - | | |

| 23 | | |

| 153 | | |

$ | 448 | | |

$ | 363 | | |

$ | 325 | | |

$ | 329 | | |

$ | 446 | |

| Net loss | |

$ | 129 | | |

$ | 670 | | |

$ | 1,256 | | |

$ | 968 | | |

$ | 1,009 | | |

$ | 1,054 | | |

$ | 1,632 | | |

$ | 4,075 | |

| Basic/diluted loss per share – continuing operations | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.01 | ) | |

$ | (0.02 | ) |

| Basic/diluted loss per share – discontinued operations | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

Exploration costs trended lower since the

peak in Q4 2015 as the Company reduced its technical review work related to the Entrée/Oyu Tolgoi JV Property and placed

all non-material properties on care and maintenance through 2015 and 2016.

General and administrative costs

in Q4 2015 included termination and shutdown costs primarily attributable to a reduction of employee

levels in Canada as well as a reduction in certain other overhead expenditures. There costs have trended lower since then in

line with the reduction in exploration activities with the exception of Q4 2016 and Q1 2017 which incurred one-time

costs associated with the strategic reorganization initiatives.

Interest expense is primarily due to accrued interest on the

OTLLC loan payable, partially offset by interest income earned on invested cash. Interest expense remains consistent quarter on

quarter, with the exception of Q4 2015, which included an adjustment to accrued interest income from prior periods. Interest income

continues to decrease every quarter due to lower principal amounts invested as a result of cash expenditures on operations throughout

the year.

The loss from equity investee remains consistent quarter on

quarter.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

LIQUIDITY AND CAPITAL RESOURCES

| | |

Three months ended September 30 | | |

Nine months ended September 30 | |

| | |

2017 | | |

2016 | | |

2015 | | |

2017 | | |

2016 | | |

2015 | |

| Cash used in operating activities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| - Before changes in working capital items | |

$ | (467 | ) | |

$ | (902 | ) | |

$ | (1,835 | ) | |

$ | (2,528 | ) | |

$ | (1,875 | ) | |

$ | (6,899 | ) |

| - After changes in working capital items | |

| (596 | ) | |

| (1,117 | ) | |

| (1,252 | ) | |

| (2,553 | ) | |

| (9,460 | ) | |

| (7,187 | ) |

| Cash flows from financing activities | |

| 159 | | |

| 17 | | |

| 2 | | |

| 5,237 | | |

| 53 | | |

| 7 | |

| Cash flows from (used in) investing activities | |

| - | | |

| - | | |

| (508 | ) | |

| (8,937 | ) | |

| 34 | | |

| (515 | ) |

| Net cash outflows | |

| (437 | ) | |

| (1,100 | ) | |

| (1,758 | ) | |

| (6,253 | ) | |

| (9,373 | ) | |

| (7,695 | ) |

| Effect of exchange rate changes on cash | |

| 322 | | |

| 3 | | |

| (132 | ) | |

| 513 | | |

| 187 | | |

| (337 | ) |

| Cash balance | |

$ | 7,651 | | |

$ | 13,600 | | |

$ | 25,485 | | |

$ | 7,651 | | |

$ | 13,600 | | |

$ | 25,485 | |

For Q3 2017, cash expenditures after

working capital items was lower than the comparative period in 2016 due to the completion of the restructuring in Q2 2017

resulting in lower corporate costs going forward. For the nine month period ended September 30, 2017, cash expenditures after

working capital items was lower than the comparative period in 2016 due to the $5.5 million cash refund to Sandstorm (see "Amended Sandstorm Agreement" below) and approximately $1.0 million to reduce the

accounts payable balance in Q1 2016.

For the nine month period ended September

30, 2017, cash flows from financing activities included $5.2 million received from the non-brokered private placement which closed

in January 2017 and some minor stock option proceeds. During the three month period ended September 30, 2017, cash flows from financing

activities related to stock option exercises in the quarter.

For the nine month period ended September

30, 2017, cash flows from investing activities included the transfer of $8,750,000 to Mason Resources on May 1, 2017 as a capital

contribution in connection with the Arrangement. The transaction costs associated with the Arrangement totaled $0.4 million, of

which $0.2 million was recovered from Mason Resources.

The Company is an exploration stage company

and has not generated positive cash flow from its operations. As a result, the Company has been dependent on equity and production-based

financings for additional funding. Working capital on hand at September 30, 2017 was approximately $7.8 million with a cash balance

of approximately $7.7 million. Management believes it has adequate financial resources to satisfy its obligations over the next

12 month period and up to the expected time when the Company believes it will commence production. The Company does not anticipate

the need for additional funding during this time.

Loan Payable to Oyu Tolgoi LLC

Under the terms of the Entrée/Oyu

Tolgoi JV, OTLLC will contribute funds to approved joint venture programs and budgets on the Company’s behalf. Interest on

each loan advance shall accrue at an annual rate equal to OTLLC’s actual cost of capital or the prime rate of the Royal Bank

of Canada, plus two percent (2%) per annum, whichever is less, as at the date of the advance. The loan will be repayable by the

Company monthly from ninety percent (90%) of the Company’s share of available cash flow from the Entrée/Oyu Tolgoi

JV. In the absence of available cash flow, the loan will not be repayable. The loan is not expected to be repaid within one year.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Contractual Obligations

As at September 30, 2017, the Company had the following contractual

obligations outstanding:

| | |

Total | | |

Less than 1 year | | |

1 - 2 years | | |

Thereafter | |

| Accounts payable and accrued liabilities | |

$ | 188 | | |

$ | 188 | | |

$ | - | | |

$ | - | |

| Lease commitments | |

$ | 594 | | |

$ | 105 | | |

$ | 233 | | |

$ | 256 | |

STOCKHOLDERS’

EQUITY

The Company’s authorized share capital

consists of unlimited common shares without par value.

On May 9, 2017, the Company completed

the spin-out of its Ann Mason Project and Lordsburg property (the "US Projects") into Mason Resources through the

Arrangement. As part of the Arrangement, Entrée shareholders received Mason Common Shares by way of a share

exchange, pursuant to which each existing share of Entrée was exchanged for one "new" share of Entrée

and 0.45 of a Mason Common Share. Optionholders and warrantholders of Entrée received replacement options and warrants

of Entrée and options and warrants of Mason Resources which were proportionate to, and reflective of the terms of,

their existing options and warrants of Entrée. As a result of the completed Arrangement, Stockholders’ equity

was reduced by $44.2 million.

At September 30, 2017, the Company had

173,573,572 shares issued and outstanding and at November 10, 2017, the Company had 173,573,572 shares issued and outstanding.

On January 11 and 13, 2017, the Company

closed a non-brokered private placement in two tranches issuing a total of 18,529,484 units at a price of C$0.41 per unit for aggregate

gross proceeds of C$7.6 million. Each unit consisted of one common share of the Company and one-half of one transferable Warrant.

Each whole Warrant entitled the holder to acquire one additional common share of the Company at a price of C$0.65 per

share for a period of 5 years. No commissions or finders' fees were payable in connection with the private placement. Pursuant

to the Arrangement, on May 23, 2017 each Warrant was exchanged for one replacement Entrée Warrant and 0.45 of a Mason Resources

transferable common share purchase warrant with the same attributes as the original Warrants. The exercise price of the replacement

Entrée Warrants was adjusted based on the market value of the two companies after completion of the Arrangement.

Share Purchase Warrants

At September 30, 2017, and at the

date of this MD&A, the following share purchase warrants were outstanding:

Number of share

purchase warrants

(000’s) | | |

Pre-Arrangement

exercise price per share

C$ | | |

Post-Arrangement

adjusted exercise price

per share C$ | | |

Expiry date |

| | 8,655 | | |

| 0.65 | | |

| 0.55 | | |

January 10, 2022 |

| | 610 | | |

| 0.65 | | |

| 0.55 | | |

January 12, 2022 |

Stock Option Plan

The Company has adopted a stock option

plan (the "Plan") to grant options to directors, officers, employees and consultants. Under the Plan, the Company may

grant options to acquire up to 10% of the issued and outstanding shares of the Company. Options granted can have a term of up to

ten years and an exercise price typically not less than the Company's closing stock price on the TSX on the last trading day before

the date of grant. Vesting is determined at the discretion of the Board.

Under the Plan, an option holder may elect

to terminate an option, in whole or in part and, in lieu of receiving shares to which the terminated option relates (the "Designated

Shares"), receive the number of shares, disregarding fractions, which, when multiplied by the weighted average trading price

of the shares on the TSX during the five trading days immediately preceding the day of termination (the "Fair Value"

per share) of the Designated Shares, has a total dollar value equal to the number of Designated Shares multiplied by the difference

between the Fair Value and the exercise price per share of the Designated Shares.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

Pursuant to the Arrangement, on May 23,

2017 each outstanding option was exchanged for one replacement Entrée option with the same expiry date and 0.45 of a Mason

Resources option. The exercise prices of the replacement Entrée options were adjusted based on the market value of the two

companies after completion of the Arrangement.

As at September 30, 2017, the Company had 7,345,000

stock options outstanding, of which 7,312,500 had vested and were exercisable. Subsequent to September 30, 2017, the Company granted

a total of 1,835,000 options at a price of C$0.52 to directors, officers, employees and consultants of the Company.

During the three month period ended September

30, 2017, 860,000 stock options were exercised or terminated and transformed into stock appreciation rights. An aggregate 670,605

common shares were issued, and the Company received gross proceeds of C$199,350 from the option exercises. Additionally, 100,000

stock options with an exercise price of C$0.61 expired. Subsequent to September 30, 2017 5,000 stock options with an exercise price

of C$0.47 expired.

For the nine months ended

September 30, 2017, the total stock-based compensation charges related to stock options granted and vested and the inducement

bonus shares was $0.2 million (2016 – $0.1 million). The increase in stock-based compensation was primarily due to the

issuing of 100,000 common shares pursuant to a grant of previously reserved employment inducement bonus shares.

The following is a summary of stock options

outstanding as at the date of this report:

Number of shares

(000`s) | | |

Vested (000`s) | | |

Aggregate

intrinsic value C$

(000’s) | | |

Pre-Arrangement

exercise price

per share C$ | | |

Post-

Arrangement

adjusted exercise

price per share C$ | | |

Expiry date |

| | 2,855 | | |

| 2,855 | | |

| 906 | | |

| 0.30 – 0.56 | | |

| 0.26 – 0.47 | | |

Mar – Dec 2018 |

| | 860 | | |

| 860 | | |

| 464 | | |

| 0.21 | | |

| 0.18 | | |

Dec 2019 |

| | 1,320 | | |

| 1,320 | | |

| 567 | | |

| 0.33 – 0.38 | | |

| 0.28 – 0.32 | | |

July – Dec 2020 |

| | 2,240 | | |

| 2,240 | | |

| 809 | | |

| 0.39 – 0.42 | | |

| 0.33 – 0.36 | | |

Mar – Nov 2021 |

| | 65 | | |

| 33 | | |

| 4 | | |

| n/a | | |

| 0.62 | | |

May 2022 |

| | 1,835 | | |

| 1,835 | | |

| 367 | | |

| n/a | | |

| 0.52 | | |

Oct 2022 |

| | 9,175 | | |

| 9,143 | | |

| 3,117 | | |

| | | |

| | | |

|

PLAN

OF ARRANGEMENT

On May 9, 2017, the Company completed

the spin-out of its U.S. Projects into Mason Resources through the Arrangement. The Mason Common Shares commenced trading on

the TSX on May 12, 2017 under the symbol "MNR".

The Arrangement was designed to deliver

greater value to shareholders by unlocking the value of the Ann Mason Project in Nevada while minimizing dilution to Entrée’s

flagship asset in Mongolia. With the spin-out of Mason Resources complete, the Company is focused on completion of an updated Technical

Report which will include a Preliminary Economic Assessment of the Entrée/Oyu Tolgoi JV’s Hugo North Extension Lift

2 and Heruga deposits, assessing other high quality, value accretive royalty and development opportunities, and identifying opportunities

to streamline Entrée’s joint venture interest or crystalize value ahead of production from the Entrée/Oyu Tolgoi

JV Property.

AMENDED

SANDSTORM AGREEMENT

On February 14, 2013, the Company entered

into an Equity Participation and Funding Agreement with Sandstorm (the "2013 Agreement"). Pursuant to the 2013 Agreement,

Sandstorm provided an upfront refundable deposit (the "Deposit") of $40 million to the Company. The Company will use

future payments that it receives from its mineral property interests to purchase and deliver metal credits to Sandstorm, in amounts

that are indexed to the Company’s share of gold, silver and copper production from the currently defined Entrée/Oyu

Tolgoi JV Property. Upon the delivery of metal credits, Sandstorm will also make the cash payment outlined below. In addition,

the 2013 Agreement provided for a partial refund of the Deposit and a pro rata reduction in the number of metal credits deliverable

to Sandstorm in the event of a partial expropriation of Entrée’s economic interest, contractually or otherwise, in

the Entrée/Oyu Tolgoi JV Property.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

On February 23, 2016, the Company and Sandstorm

entered into an Agreement to Amend the 2013 Agreement, whereby the Company refunded 17% of the Deposit ($6.8 million) (the "Refund")

in cash and shares thereby reducing the Deposit to $33.2 million for a 17% reduction in the metal credits that the Company is required

to deliver to Sandstorm. At closing on March 1, 2016, the parties entered into an Amended and Restated Equity Participation and

Funding Agreement (the "Amended Sandstorm Agreement"). Under the terms of the Amended Sandstorm Agreement, the Company

will purchase and deliver gold, silver and copper credits equivalent to:

| · | 28.1% of Entrée’s share of gold and silver, and 2.1% of Entrée’s share

of copper, produced from the Shivee Tolgoi mining licence (excluding Shivee West); and |

| · | 21.3% of Entrée’s share of gold and silver, and 2.1% of Entrée’s share

of copper, produced from the Javhlant mining licence. |

Upon the delivery of metal credits, Sandstorm

will make a cash payment to the Company equal to the lesser of the prevailing market price and $220 per ounce of gold, $5 per ounce

of silver and $0.50 per pound of copper (subject to inflation adjustments). After approximately 8.6 million ounces of gold, 40.3

million ounces of silver and 9.1 billion pounds of copper have been produced from the entire Entrée/Oyu Tolgoi JV Property

(as currently defined) the cash payment will be increased to the lesser of the prevailing market price and $500 per ounce of gold,

$10 per ounce of silver and $1.10 per pound of copper (subject to inflation adjustments). To the extent that the prevailing market

price is greater than the amount of the cash payment, the difference between the two will be credited against the Deposit (the

net amount of the Deposit being the "Unearned Balance").

This arrangement does not require the delivery

of actual metal, and the Company may use revenue from any of its assets to purchase the requisite amount of metal credits.

Under the Amended Sandstorm Agreement,

Sandstorm has a right of first refusal, subject to certain exceptions, on future production-based funding agreements. The Amended

Sandstorm Agreement also contains other customary terms and conditions, including representations, warranties, covenants and events

of default. The initial term of the Amended Sandstorm Agreement is 50 years, subject to successive 10-year extensions at the discretion

of Sandstorm.

In addition, the Amended Sandstorm Agreement

provides that the Company will not be required to make any further refund of the Deposit if Entrée’s economic interest

is reduced by up to and including 17%. If there is a reduction of greater than 17% up to and including 34%, the Amended Sandstorm

Agreement provides the Company with the ability to refund a corresponding portion of the Deposit in cash or common shares of the

Company or any combination of the two at the Company’s election, in which case there would be a further corresponding reduction

in deliverable metal credits. If the Company elects to refund Sandstorm with common shares of the Company, the value of each common

share shall be equal to the volume weighted average price ("VWAP") for the five (5) trading days immediately preceding

the 90th day after the reduction in Entrée’s economic interest. In no case will Sandstorm become a "control

person" under the Amended Sandstorm Agreement. In the event an issuance of shares would cause Sandstorm to become a "control

person", the maximum number of shares will be issued, and with respect to the value of the remaining shares, 50% will not

be refunded (and there will not be a corresponding reduction in deliverable metal credits) and the remaining 50% will be refunded

by the issuance of shares in tranches over time, such that the number of shares that Sandstorm holds does not reach or exceed 20%.

All shares will be priced in the context of the market at the time they are issued.

In the event of a full expropriation, the

remainder of the Unearned Balance after the foregoing refunds must be returned in cash.

The Amended Sandstorm Agreement does not

impact Sandstorm's requirement to vote its shares as Entrée's Board specifies with respect to any potential acquisition

of the Company, provided the potential acquirer agrees to execute and deliver to Sandstorm a deed of adherence to the Amended Sandstorm

Agreement.

For accounting purposes, the Deposit is

accounted for as deferred revenue on the balance sheet and the original Deposit was recorded at the historical amount of $40.0

million. As a result of the Amended Sandstorm Agreement, the deferred revenue amount was adjusted to reflect the $6.8 million Refund

which was recorded at the foreign exchange amount at the date of the Refund resulting in a net balance of C$30.9 million. This amount

is subject to foreign currency fluctuations upon conversion to US dollars at each reporting period.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

The $6.8 million Refund was paid

with $5.5 million in cash and the issuance of $1.3 million of common shares of the Company. On March 1, 2016, the Company issued

5,128,604 common shares to Sandstorm at a price of C$0.3496 per common share pursuant to the Agreement to Amend. The price was

calculated using the VWAP of Entrée's shares on the TSX for the 15 trading days preceding February 23, 2016, the effective

date of the Agreement to Amend.

As at September 30, 2017 Sandstorm owned

23,900,380 common shares, or 13.8% of the outstanding shares of the Company.

OTHER

DISCLOSURES

Off-Balance Sheet Arrangements

Entrée has no off-balance sheet

arrangements except for the contractual obligation noted above.

Financial Instruments

The following table provides the fair value

of each classification of financial instrument:

| | |

September 30, 2017 | | |

December 31, 2016 | |

| Financial assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 7,651 | | |

$ | 13,262 | |

| Receivables | |

| 256 | | |

| 37 | |

| Deposits | |

| 15 | | |

| 9 | |

| Total financial assets | |

$ | 7,922 | | |

$ | 13,308 | |

| Financial liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 188 | | |

$ | 225 | |

| Loans payable | |

| 7,754 | | |

| 7,334 | |

| Total financial liabilities | |

$ | 7,942 | | |

$ | 7,559 | |

Fair value measurement is based on a fair

value hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs

when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value which are:

Level 1 — Quoted prices that are

available in active markets for identical assets or liabilities.

Level 2 — Quoted prices in active

markets for similar assets that are observable.

Level 3 — Unobservable inputs that

are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

At September 30, 2017, the Company had

Level 1 financial instruments, consisting of cash and cash equivalents, with a fair value of $7.7 million.

INTERNATIONAL

FINANCIAL REPORTING STANDARDS

The Company is a "domestic" issuer

under Canadian securities law and a "foreign private issuer" under United States Securities and Exchange Commission ("SEC")

regulations. The Company files its financial statements with both Canadian and US securities regulators in accordance with US GAAP,

as permitted under current regulations. In 2008, the Accounting Standards Board in Canada and the Canadian Securities Administrators

("CSA") confirmed that domestic issuers were required to transition to International Financial Reporting Standards ("IFRS")

for fiscal years beginning on or after January 1, 2011. On September 27, 2008, the CSA Staff issued Staff Notice 52-321 "Early

Adoption of International Financial Reporting Standards, Use of US GAAP and References to IFRS-IASB" which confirmed that

domestic issuers that are also SEC registrants are able to continue to use US GAAP. Consequently, the Company was not required

to convert to IFRS effective January 1, 2011 and has elected to continue using US GAAP.

| Q3 2017 MD&A (table amounts expressed in thousands of US Dollars, except per share amounts and where otherwise noted) |

NON-US

GAAP PERFORMANCE MEASUREMENT

"Cash Costs" and all-in sustaining

cost ("AISC") are non-US GAAP Performance Measurements. These performance measurements are included because these statistics

are widely accepted as the standard of reporting cash costs of production in North America. These performance measurements do not

have a meaning within US GAAP and, therefore, amounts presented may not be comparable to similar data presented by other mining

companies. These performance measurements should not be considered in isolation as a substitute for measures of performance in

accordance with US GAAP.

CRITICAL

ACCOUNTING ESTIMATES, RISKS AND UNCERTAINTIES

The preparation of financial statements

in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial

statements and accompanying notes. Actual results could differ materially from those estimates.

Measurement of the Company’s assets