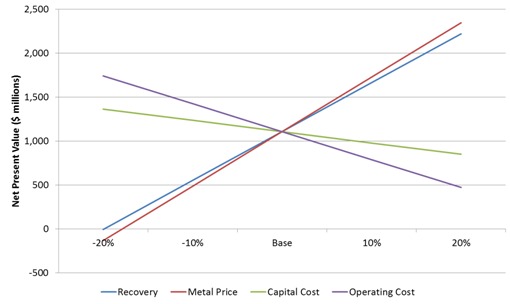

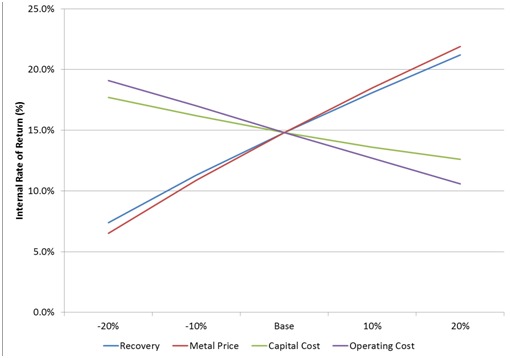

The greatest sensitivity for developing the Ann Mason deposit is metal prices. The Base Case prices that are used consider a price of copper at $3.00/lb. Three-year trailing average price for copper as of September 17, 2012 was $3.61/lb. The Base Case copper price is 27% lower than the three-year average. A further 20% reduction of that price would see a copper price of $2.40/lb.

The second most sensitive parameter is recovery. To calculate the sensitivity to recovery, a percentage factor was applied to each metal recovery in the same proportion. Therefore, while sensitivity exists, actual practice may show less fluctuation than is considered in this analysis. Recovery testwork has not indicated recoveries in the range of 75% which the -20% change in recovery would represent. As copper represents 93.2% of the revenue, this large a swing in recovery has the obvious effect of influencing the economics, but may not be realistic.

The operating cost is the next most sensitive item. With the mine being a bulk mining operation, focus on this cost is instrumental to maintaining attractive project economics. Any opportunity to shorten waste hauls would have a positive effect on the economics.

The least most sensitive item is capital cost. While changes in the cost have an effect, in comparison to the other three parameters, its effect is more muted. If the capital costs go up by 20%, the net present value change from the base drops to $849 million from $1,106.

The discounted cash flows in the PEA are pre-tax. Taxable income for income tax purposes is as defined in the Internal Revenue Code and regulations issued by the Department of Treasury and the Internal Revenue Service. The Federal income tax rate is approximately 35% in accordance with Internal Revenue Service Publication 542.

Nevada does not have a State corporate income tax. However, Nevada has a Net Proceeds of Mining Tax, which is an ad valorem property tax assessed on minerals mined or produced in Nevada when they are sold or removed from the State. The tax is separate from, and in addition to, any property tax paid on land, equipment and other assets. In general, while the tax rate applied to the net proceeds is based on a sliding scale depending on the net proceeds as a percentage of gross proceeds, the effective rate is 5%.

No royalties are payable to the United States Government for the Ann Mason Project, as set out in the PEA.

Environmental

In the course of considering Entrée’s approved PoO, the BLM prepared an Environmental Assessment (the “EA”) that considered the potential impact of the PoO on the environment. Substantial environmental studies were conducted in the preparation of the EA. These studies documented that historic and pre-historic cultural resources, habitat of certain special interest species of plants and/or wildlife, and other concerns exist or could exist in the vicinity of Ann Mason.

Mining has been a significant business in Nevada for many years, and many mines have been permitted on the public lands in Nevada. Consequently the regulatory agencies are familiar with mining activities, and complying with the respective agency permit application requirements allows permits to be issued in a rather timely manner. The most important, time consuming, and costly permits/approvals required for the development of Ann Mason are:

|

·

|

Plan of Operations approval by the BLM.

|

|

·

|

Water Pollution Control Permit from the NDEP - BMRR.

|

|

·

|

Reclamation Permit from the BMRR.

|

|

·

|

Air Quality Permit from the NDEP - Bureau of Air Pollution Control.

|

|

·

|

Special Use Permit from Lyon County and Development Permit from Douglas County.

|

With the PEA completed and better understanding of the size and scope of the Ann Mason Project, the data collection and testwork can begin to prepare for the next stage of study and ultimately permit applications.

Basic data collection needs to commence as soon as possible covering a wide range of diverse subjects: weather, water flows, vegetation, wildlife, and socioeconomic. A comprehensive program will need to be established to collect the required information necessary to comply with the respective agency permit application requirements. This is of critical importance to ensure that the permits may be issued in a timely manner.

A detailed Prefeasibility plan will be required to build upon the other information collected. Data collection and testwork should coincide with portions of the permit application process. Detailed environmental and engineering information must be collected in at least the following areas:

|

·

|

Seasonal data of at least 12 months may be required for some of the elements above.

|

|

·

|

Reclamation of mine activities will be a significant part of the BLM Plan of Operations and the BMRR, and plans for closure must be approved by both agencies prior to initiation of mining activities. Entrée will work with both agencies to develop cost effective reclamation methods including reclamation concurrently with mine operations as appropriate. Reclamation costs will be developed along with detailed mine development plans, and an acceptable reclamation bond will be posted with the BLM.

|

All aspects of the Ann Mason Project must be designed and operated to avoid and/or minimize environmental impacts as required by the permits. Air quality, water quality, and operating parameters will be monitored, also as required by the permits. Specific details of Ann Mason design, operation, and monitoring will be developed through consultation with the appropriate agencies and through preparation of specific permit applications.

In general, Lyon and Douglas Counties and the state of Nevada are receptive to metal mining activities, and mining provides a large part of local and state revenue. The Company will work with Lyon and Douglas Counties and nearby towns including Yerington, Weed Heights, Mason and communities in Smith Valley to reduce potential impacts.

Near Term Exploration and Development Plans

With the successful completion of the PEA in 2012, Entrée intends to commence work at Ann Mason focused on additional drilling, baseline environmental studies and further optimization of project economics. The primary objectives of the planned work are to confirm that advancement of Ann Mason to Pre-Feasibility is warranted and to collect long lead time baseline data.

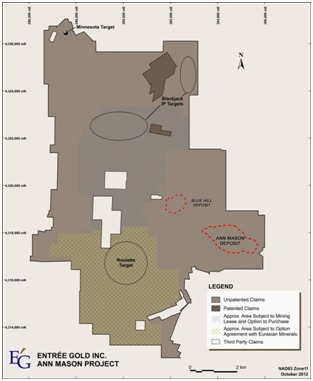

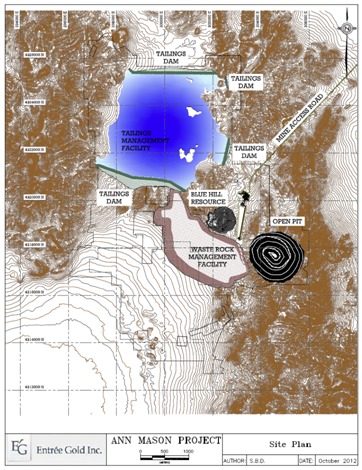

Planned drilling will focus on extending and upgrading the Ann Mason deposit within current pit shell designs, expanding the Blue Hill oxide and sulphide zones of mineralization and testing multiple exploration targets that have the potential to result in the discovery of new zones of oxide and sulphide mineralization on the property.

At the northeast, north and northwest margins of the Ann Mason deposit, drilling to potentially extend mineralization within the current pit design could reduce the waste-to-mineralization strip ratio, resulting in improvements to Ann Mason Project economics. The northeast margin of the Ann Mason deposit is currently defined by strong mineralization encountered in drill holes D149, D167, D172 and EG-AM-11-014. The drill holes intersected 120 m to more than 450 m of ≥ 0.3% Cu within current pit shells. Chalcopyrite and bornite are the dominant copper sulphide minerals. This zone of mineralization remains open to the northeast along a distance of more than 550 m and up to 500 m between the drill holes and the proposed pit shell. At the northwest margin of the deposit, mineralization encountered in drill holes EG-AM-11-015 and 029 remains open along a distance of more than 200 m.

At Blue Hill, copper oxide and mixed oxide-sulphide mineralization remains open in several directions. To the southeast, oxide and mixed mineralization occurs in thinner, locally higher grade zones below the low angle Blue Hill Fault but remains open. Recent mapping at Blue Hill, accompanied by re-logging of selected drill holes, indicates oxide mineralization remains open to the west and northwest. Two previous drill holes, interpreted to have penetrated late, weakly mineralized or unmineralized dykes require drilling of adjacent holes to determine if mineralization can be extended to the west, beyond the current limit of drilling. Drilling of the underlying sulphide target at Blue Hill remains very widely-spaced, having identified a target area more than one kilometre in width, which remains open in most directions. Significant molybdenum mineralization was also intersected in two of the drill holes targeting the sulphide mineralization.

The area between the Ann Mason and Blue Hill deposits has seen some wide-spaced, mostly shallow drilling and therefore the potential to host additional sulphide and oxide mineralization remains as a strong target. Drill hole EG-BH-11-031, located approximately one kilometre east of Blue Hill, returned a weighted average of 0.28% oxide copper over 13.8 metres, starting at 22.2 metres depth. Further drilling will be required in this area and if successful could provide additional mineralization for a potential SX/EW operation. South of Ann Mason, recent soil surveying and mapping indicates potential for near surface oxide copper mineralization that could be included in an overall study of alternatives to optimize the Ann Mason Project and reduce the current strip ratio in the Ann Mason deposit PEA mine design.

Other high-priority targets on the Ann Mason Project property require further exploration and development. These include the Roulette sulphide target, the Blackjack IP and copper-oxide targets and the Minnesota copper skarn target. In the Blackjack area, IP and surface copper oxide exploration targets have been identified for drill testing. The Minnesota skarn target requires further drilling to test deeper IP and magnetic anomalies.

Baseline environmental studies, to include wildlife, biology and cultural surveys, are planned for the first half of 2013.

NON-MATERIAL PROPERTIES

Entrée has interests in other non-material properties in the United States, Australia and Peru as follows. For additional information regarding these non-material properties, including Entrée’s ownership interest and obligations, see the Company’s Management’s Discussion and Analysis for the financial year ended December 31, 2012, which is available on SEDAR at www.sedar.com.

|

·

|

Lordsburg and Oak Grove Properties, New Mexico. The Lordsburg claims cover 2,013 ha adjacent to the historic Lordsburg copper-gold-silver district in New Mexico. Drilling at Lordsburg has been successful in discovering a new porphyry copper-gold occurrence in an area previously known only for vein-style gold mineralization. No work was completed in 2012. Future drilling will be directed towards expanding the existing drill defined copper and gold zone.

Work on the 1,435 hectare Oak Grove property to date has consisted of permitting, negotiation of access agreements, a 17 line-kilometre IP survey and a 50 line-kilometre magnetic survey. The work defined moderate chargeability anomalies associated with a strong, circular magnetic feature. No work was completed in 2012.

|

|

·

|

Shamrock Property, Nevada. The Shamrock property is a copper skarn exploration target located in the Yerington copper porphyry district in western Nevada, approximately 5 km southeast of the Ann Mason Project.

|

|

·

|

Eagle Flats Property, Nevada. The Eagle Flats property consists of 58 unpatented lode claims, 65 kilometres east of Yerington, in Mineral County, Nevada.

|

|

·

|

Blue Rose Joint Venture, Australia. The Blue Rose copper-iron-gold-molybdenum joint venture property covers exploration licence 5129 in the Olary Region of South Australia, 300 kilometres north-northeast of Adelaide. Magnetite iron formations occur in the southern portion of this 1,000 square kilometre tenement, and a zone of copper oxide mineralization and a gold target (Golden Sophia) are located in the north-central area of the tenement.

A soil sampling program was completed over the Golden Sophia shallow gold target in August 2011. The survey confirmed the previous Battle Mountain gold in soil anomaly and defined a new, linear gold anomaly located approximately 700 m to the northeast.

|

|

·

|

Mystique Farm-Out, Australia. Mystique is an early stage gold exploration property comprised of exploration licence E28/1915, held by Entrée. The property is located in the Albany-Fraser Province of West Australia.

|

|

·

|

Lukkacha Property, Peru. The Lukkacha property is located in Tacna Province of southeastern Peru. The property consists of seven concessions totalling 4,400 ha which cover two large areas of surface alteration, iron oxides and quartz veining approximately 50 kilometres along the structural trend southeast from the giant Toquepala mining operation of Grupo Mexico. The property has never been drilled and represents a unique opportunity for early stage exploration within an under-explored major copper district. The property is situated within 50 kilometres of the international border with Chile, and initiation of further exploration (geophysics and drilling) is subject to Entrée obtaining a Supreme Decree allowing it to work on the property.

|

RISK FACTORS

This AIF contains forward-looking statements, and any assumptions upon which they are based are made in good faith and reflect our current judgment regarding the direction of our business. Actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested in this AIF. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

An investment in the Company’s Common Shares involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this AIF in evaluating Entrée and our business before purchasing the Company’s Common Shares. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are not the only ones facing Entrée. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Legal and Political Risks

On February 27, 2013, Entrée received Notice from MRAM regarding the Entrée-OTLLC Joint Venture’s mining licences.

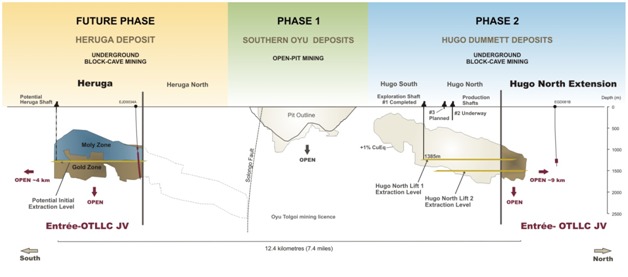

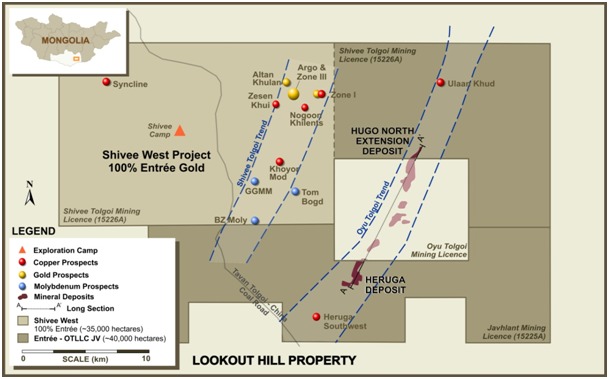

On February 27, 2013, Notice was delivered to Entrée by MRAM that by Order No. 43 dated February 22, 2013, the Ministry of Mining has cancelled the 2009 Order of the Ministry of Mineral Resources and Energy registering the Hugo Dummett (including the Hugo North Extension) and Heruga reserves, and has requested that the Minerals Resource Council go over its previous conclusion that the reserves should be submitted to MRAM. The registration of reserves is a pre-condition to applying for the conversion of an exploration licence into a mining licence. The Notice states that the 2009 Order breached Clause 48.4 of the Minerals Law of Mongolia and Clause 9 of the Charter of the Minerals Resource Council because it was not within the authority of the Ministry of Mineral Resources and Energy to order that the reserves be registered. The Notice, which is not explicitly concerned with the issuance of the mining licences, further advises that any transfer, sale or lease of the Shivee Tolgoi and Javhlant mining licences is temporarily suspended. The mining licences have not been revoked or cancelled.

Entrée is currently working to determine the full implications of the Notice and to resolve the temporary suspension of the transfer, sale or lease of the licences, including by filing an official complaint with the Prime Minister asking him to amend Order No. 43 and an official compliant with the Head of MRAM asking him to revoke the Notice. However, any future action by the Government of Mongolia to suspend, revoke, withdraw or cancel the Shivee Tolgoi and Javhlant mining licences, whether legitimate or not, would have an adverse effect on the business, assets and financial condition of Entrée as well as the Company’s share price.

The Earn-In Agreement requires OTLLC to enter into a form of joint venture agreement that bestows upon it certain powers and duties as manager of the Entrée-OTLLC Joint Venture, including the duty to cure title defects, the duty to prosecute and defend all litigation or administrative proceedings arising out of operations, and the duty to do all acts reasonably necessary to maintain the Joint Venture Property assets, including the mining licences. Pursuant to the Assignment Agreement dated March 1, 2005 between the Company, Turquoise Hill and OTLLC, the Company is also entitled to look to Turquoise Hill for the performance of OTLLC’s obligations under the Earn-In Agreement, which is governed by British Columbia law. In addition, the Shivee Tolgoi and Javhlant mining licences are included in the contract area of the Investment Agreement. The Investment Agreement restricts the grounds upon which the Mongolian State administrative authority in charge of geology and mining may revoke a mining licence covered by the Investment Agreement. The Investment Agreement also includes a dispute resolution clause that requires the parties to resolve disputes through international commercial arbitration procedures. Entrée is not a party to the Investment Agreement and does not have any direct rights under the Investment Agreement. In the event that the Government of Mongolia suspends, revokes, withdraws or cancels the Shivee Tolgoi and Javhlant mining licences, there can be no assurance that OTLLC, Turquoise Hill or Rio Tinto will invoke the international arbitration procedures, or that Entrée will be able to enforce the terms of the Earn-In Agreement to cause OTLLC or Turquoise Hill to do all acts reasonably necessary to maintain the Joint Venture Property assets, including by invoking the international arbitration procedures under the Investment Agreement. There may also be limitations on OTLLC, Turquoise Hill and Rio Tinto’s ability to enforce the terms of the Investment Agreement against the Government of Mongolia, which is a sovereign entity, regardless of the outcome of an arbitration proceeding. Without an effective means of enforcing the terms of the Earn-In Agreement or the Investment Agreement, Entrée could be deprived of substantial rights and benefits with little or no recourse for fair and reasonable compensation.

Irrespective of the ultimate outcome of any potential dispute, any requirement to engage in discussions or proceedings with the Government of Mongolia, OTLLC, Turquoise Hill or Rio Tinto, whether or not formal, would likely result in significant expense and diversion of management’s attention.

Entrée may have to make certain concessions to the Government of Mongolia.

The Minerals Law of Mongolia, which became effective on August 26, 2006, defines a mineral deposit of strategic importance (a “Strategic Deposit”) as a mineral resource that may have the potential to impact national security, or the economic and social development of the country at the national and regional levels, or that is generating or has the potential to generate more than five percent (5%) of Mongolia’s Gross Domestic Product in any given year. Either the Mongolian Government or Parliament may initiate proposals to declare a mineral resource as being a Strategic Deposit, but Parliament must approve any such proposal. Essentially, a Strategic Deposit is any deposit that Parliament has deemed, or may hereafter deem, to be large and/or valuable enough to warrant being so designated.

The 15 Strategic Deposits that have to date been specified as such by Parliament have no defined coordinates. They each consist of concentrations of mineralization in a general area that is identified only by a name. Licence areas, on the other hand, are precisely defined by coordinates. Thus it is not feasible to definitively determine whether or not any given licence area is within, or overlaps, a Strategic Deposit.

The Minerals Law of Mongolia provides that the State may be an equity participant with any private legal entity, up to a 34% equity interest, in the exploitation of any Strategic Deposit where the quantity and grade of the deposit have been defined by exploration that has not been funded from the State budget.

While Entrée has never received any formal notification from MRAM that the Hugo North Extension deposit or the Heruga deposit are Strategic Deposits, the Ministry of Mining has indicated that it considers the deposits on the Joint Venture Property to be part of the series of Oyu Tolgoi deposits, which were declared to be Strategic Deposits under Resolution No 57 dated July 16, 2009 of the State Great Khural. If the Hugo North Extension and Heruga deposits are Strategic Deposits, the Government of Mongolia may seek to enter into an agreement with Entrée pursuant to which it may acquire up to 34% of Entrée’s interest in the Joint Venture Property. It is not certain what form this agreement would take, or on what terms the Government of Mongolia would seek to acquire 34% of Entrée’s interest in the Joint Venture Property.

Entrée’s ability to carry on business in Mongolia is subject to legal and political risk.

Entrée’s interest in the Joint Venture Property and Shivee West are not covered by the Investment Agreement. Government policy may change to discourage foreign investment, nationalization of the mining industry may occur and other government limitations, restrictions or requirements may be implemented. There can be no assurance that Entrée’s assets will not be subject to nationalization, requisition or confiscation, whether legitimate or not, by any authority or body. The political, social and economic environment in Mongolia presents a number of serious risks, including: corruption, requests for improper payments or other corrupt practices; uncertain legal enforcement; invalidation, confiscation, expropriation or rescission of governmental orders, permits, licences, agreements and/or property rights; the effects of local political, labour and economic developments, instability and unrest; currency fluctuations; and significant or abrupt changes in the applicable regulatory or legal climate. In addition, there can be no assurance that neighbouring countries’ political and economic policies in relation to Mongolia will not have adverse economic effects on the development of the Lookout Hill property, including the ability to access power, transport and sell product and access labour, supplies and materials.

There is no assurance that provisions under Mongolian law for compensation and reimbursement of losses to investors under such circumstances would be effective to restore the full value of Entrée’s original investment or to compensate for the loss of the current value of its interest in the Lookout Hill property. Entrée’s interest in the Lookout Hill property may be affected in varying degrees by, among other things, government regulations with respect to restrictions on foreign ownership, state ownership of Strategic Deposits, production, price controls, export controls, income taxes, expropriation of property, employment, land use, water use, environmental legislation, mine safety and annual fees to maintain mining licences in good standing. The regulatory environment is in a state of continuing change, and new laws, regulations and requirements may be retroactive in their effect and implementation. There can be no assurance that Mongolian laws protecting foreign investments will not be amended or abolished or that existing laws will be enforced or interpreted to provide adequate protection against any or all of the risks described above.

The legal framework in Mongolia is, in many instances, based on recent political reforms or newly enacted legislation, which may not be consistent with long-standing local conventions and customs. Although some legal title risks in respect of Lookout Hill may be mitigated by the fact that the licences are included in the contract area of the Investment Agreement, there may still be ambiguities, inconsistencies and anomalies in the agreements, licences and title documents through which Entrée holds its interest in the Lookout Hill property, or the underlying legislation upon which that interest is based, which are atypical of more developed legal systems and which may affect the interpretation and enforcement of Entrée’s rights and obligations. Local institutions and bureaucracies responsible for administering laws may lack a proper understanding of the laws or the experience necessary to apply them in a modern business context. Many laws have been enacted, but in many instances they are neither understood nor enforced and may be applied in an inconsistent, arbitrary and unfair manner, while legal remedies may be uncertain, delayed or unavailable. In addition, Entrée’s licences, permits and assets are often affected in varying degrees, by political instability and governmental regulations and bureaucratic processes, any one or more of which could preclude Entrée from carrying out business activities fairly in Mongolia. Legal redress for such actions, if available, is uncertain and can often involve significant delays.

Entrée may be subject to risks inherent in legal proceedings.

In the course of its business, Entrée may from time to time become involved in various claims, arbitration and other legal proceedings, with and without merit. The nature and results of any such proceedings cannot be predicted with certainty. Any potential future claims and proceedings are likely to be of a material nature. In addition, such claims, arbitration and other legal proceedings can be lengthy and involve the incurrence of substantial costs and resources by Entrée, and the outcome, and Entrée’s ability to enforce any ruling(s) obtained pursuant to such proceedings, are subject to inherent risk and uncertainty. The initiation, pursuit and/or outcome of any particular claim, arbitration or legal proceeding could have a material adverse affect on Entrée’s financial position and results of operations, and on Entrée’s business, assets and prospects. In addition, if Entrée is unable to resolve any existing or future potential disputes and proceedings favourably, or obtain enforcement of any favourable ruling, if any, that may be obtained pursuant to such proceedings, it is likely to have a material adverse impact on Entrée’s business, financial condition and results of operations and Entrée’s assets and prospects.

Entrée may be unable to enforce its legal rights in certain circumstances.

In the event of a dispute arising at or in respect of Entrée’s foreign operations, Entrée may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in Canada or other jurisdictions. Entrée may also be hindered or prevented from enforcing its rights with respect to a governmental entity or instrumentality because of the doctrine of sovereign immunity. Any adverse or arbitrary decision of a court, arbitrator or other governmental or regulatory body, or Entrée’s inability to enforce its contractual rights, may have a material adverse impact on Entrée’s business, assets, prospects, financial condition and results of operation.

Entrée’s rights to use and access certain land area could be adversely affected by the application of Mongolia’s Resolution 140 or Resolution 175.

In June 2010, the Government of Mongolia passed Resolution 140, the purpose of which is to authorize the designation of certain land areas for “state special needs” within certain defined areas, some of which include or are in proximity to the Oyu Tolgoi mining complex. These state special needs areas are to be used for Khanbogd village development and for infrastructure and plant facilities necessary in order to implement the development and operation of the Oyu Tolgoi mining complex. A portion of the Shivee Tolgoi licence is included in the land area that is subject to Resolution 140.

In June 2011, the Government of Mongolia passed Resolution 175, the purpose of which is to authorize the designation of certain land areas for “state special needs” within certain defined areas in proximity to the Oyu Tolgoi mining complex. These state special needs areas are to be used for infrastructure facilities necessary in order to implement the development and construction of the Oyu Tolgoi mining complex. Portions of the Shivee Tolgoi and Javhlant licences are included in the land area that is subject to Resolution 175.

It is expected but not yet formally confirmed by the Government that to the extent that a consensual access agreement exists or is entered into between OTLLC and an affected licence holder, the application of Resolution 175 to the land area covered by the access agreement will be unnecessary. OTLLC has existing access and surface rights to the Joint Venture Property pursuant to the Earn-In Agreement. If Entrée is unable to reach a consensual arrangement with OTLLC with respect to Shivee West, Entrée’s right to use and access a corridor of land included in the state special needs areas for a proposed power line may be adversely affected by the application of Resolution 175. While the Mongolian Government would be responsible for compensating Entrée in accordance with the mandate of Resolution 175, the amount of such compensation is not presently quantifiable.

The Investment Agreement contains provisions restricting the circumstances under which the Shivee Tolgoi and Javhlant licences may be expropriated. As a result, Entrée considers that the application of Resolution 140 and Resolution 175 to the Joint Venture Property will likely be considered unnecessary.

Recent and future amendments to Mongolian laws could adversely affect Entrée’s interest in the Lookout Hill property or make it more difficult or expensive to develop the property and carry out mining.

The Government of Mongolia has, in the past, expressed its strong desire to foster, and has to date protected the development of, an enabling environment for foreign investment. However, there are political constituencies within Mongolia that have espoused ideas that would not be regarded by the international mining community as conducive to foreign investment if they were to become law or official government policy. This was evidenced by revisions to the Minerals Law in 2006. In October 2011, Prime Minister Batbold stated in his 2012 budget speech that the Government of Mongolia is revisiting all treaties for the avoidance of double taxation, including the 2002 convention between Canada and Mongolia for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and on capital (the “Canadian Double Tax Treaty”).

On May 17, 2012, the Mongolian Parliament adopted SEFIL, which regulates investment by foreign investors and state owned legal entities into sectors of strategic importance, including minerals. The full impact of SEFIL is not yet known as there is a lack of clarity in many of the provisions and some of the regulations setting out the procedure for reviewing requests and making decisions in accordance with SEFIL have not yet been formalized.

On December 7, 2012, the Office of the President of Mongolia published a draft revised Minerals Law, which proposes to introduce a new regulatory regime with new legal concepts. The draft law reaffirms the exiting list of Strategic Deposits approved by Parliamentary Resolution #27 dated February 6, 2007, and provides for “mining agreements” to be entered into between the Government of Mongolia and licence holders. Under these mining agreements, the Mongolian State has the right to take an equity interest in the licence holder for no consideration. The draft law also provides: that licence transfer agreements will only be valid upon registration with MRAM and state-owned entities shall have a pre-emptive right to licences being transferred; for more extensive grounds under which licences may be revoked; and that not less than 34% of the equity in a foreign-invested mining licence holder must be held by a Mongolian citizen. As currently drafted, the draft law does not provide for any transitional provisions relating to existing licences nor the rights and obligations of licence holders under the existing system. It is expected that a new working group will be formed to further develop the draft law before it is submitted to Parliament, sometime after the spring session.

If the Government of Mongolia revises, amends or cancels the Canadian Double Tax Treaty, if SEFIL is implemented or interpreted in a manner that is not favourable to foreign investment, or if a new Minerals Law that is not favourable to foreign investment is adopted, it could have an adverse effect on Entrée’s operations in Mongolia and future cashflow, earnings, results of operations and financial condition.

There can be no assurance that the present government, or a future government, will refrain from enacting legislation or adopting government policies that are adverse to Entrée’s interests or that impair Entrée’s ability to explore Shivee West and/or OTLLC’s ability to develop and operate the Oyu Tolgoi mining complex on the basis presently contemplated, which may have a material, adverse impact on Entrée and the Company’s share price.

Changes in, or more aggressive enforcement of, laws and regulations could adversely impact Entrée’s business.

Mining operations and exploration activities are subject to extensive laws and regulations. These relate to production, development, exploration, exports, imports, taxes and royalties, labour standards, occupational health, waste disposal, protection and remediation of the environment, mine decommissioning and reclamation, mine safety, toxic substances, transportation safety and emergency response and other matters.

Compliance with these laws and regulations increases the costs of exploring, drilling, developing, constructing, operating and closing mines and other facilities. It is possible that the costs, delays and other effects associated with these laws and regulations may impact Entrée’s decision as to whether to continue to operate in a particular jurisdiction or whether to proceed with exploration or development of properties. Since legal requirements change frequently, are subject to interpretation and may be enforced to varying degrees in practice, Entrée is unable to predict the ultimate cost of compliance with these requirements or their effect on operations. Changes in governments, regulations and policies and practices could have an adverse impact on Entrée’s future cash flows, earnings, results of operations and financial condition, which may have a material, adverse impact on Entrée and the Company’s share price.

Entrée is not presently a party to the Investment Agreement, and there can be no assurance that Entrée will be entitled to all of the benefits of the Investment Agreement.

Entrée is not presently a party to the Investment Agreement. Although OTLLC has agreed under the terms of the Earn-In Agreement to use its best efforts to cause Entrée to be brought within the ambit of, made subject to and be entitled to the benefits of the Investment Agreement or a separate stability agreement on substantially similar terms to the Investment Agreement, unless and until Entrée becomes a party to the Investment Agreement, there can be no assurance that Entrée will be entitled to all of the benefits of the Investment Agreement, including stability with respect to taxes payable. Until such time as Entrée becomes a party to the Investment Agreement, it could be subject to the surtax royalty which came into effect in Mongolia on January 1, 2011. The rates of the surtax royalty vary from 1% to 5% for minerals other than copper. For copper, the surtax royalty rates range between 22% and 30% for ore, between 11% and 15% for concentrates, and between 1% and 5% for final products. No surtax royalty is charged on any minerals below a certain threshold market price, which varies depending on the type of minerals. This is in addition to the standard royalty rates of 2.5% for coal sold in Mongolia and commonly occurring minerals sold in Mongolia, and 5% for all other minerals. In order to become a party to the Investment Agreement or another similar type of agreement, the Government of Mongolia may require Entrée or the Entrée-OTLLC Joint Venture to agree to certain concessions, including with respect to the ownership of the Entrée-OTLLC Joint Venture, Entrée LLC or the economic benefit of Entrée’s interest in the Joint Venture Property or the scope of the lands to be covered by the Investment Agreement or other similar type of agreement.

Entrée may experience difficulties with its joint venture partners.

While the Entrée-OTLLC Joint Venture is operating under the terms of the form of joint venture agreement appended to the Earn-in Agreement, the joint venture agreement has not been formally executed by the parties. There can be no assurance that OTLLC or its shareholders will not attempt to renegotiate some or all of the material terms governing the joint venture relationship in a manner which could have an adverse effect on Entrée’s future cashflow, earnings, results of operations and financial condition.

Entrée is and will be subject to the risks normally associated with the conduct of joint ventures, which include disagreements as to how to develop, operate and finance a project, inequality of bargaining power, incompatible strategic and economic objectives and possible litigation between the participants regarding joint venture matters. These matters may have an adverse effect on Entrée’s ability to realize the full economic benefits of its interest in the property that is the subject of a joint venture, which could affect its results of operations and financial condition.

Risks Associated With The Development of the Oyu Tolgoi Mining Complex.

The Joint Venture Property forms part of the Oyu Tolgoi mining complex. As a result, certain risk factors associated with the development of the Oyu Tolgoi mining complex are also applicable to Entrée and may adversely affect Entrée, including the following.

There can be no assurance that Turquoise Hill will be capable of raising the additional funding that it needs to complete the development of the Oyu Tolgoi mining complex, including the Hugo North Extension and Heruga deposits.

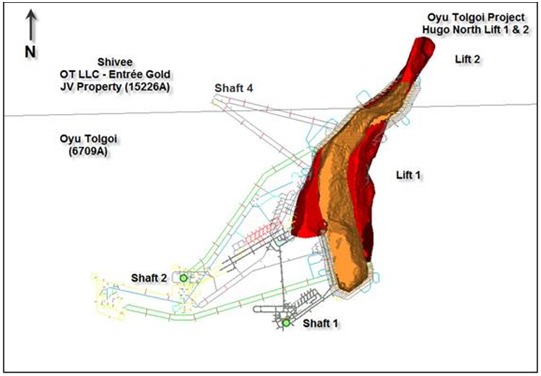

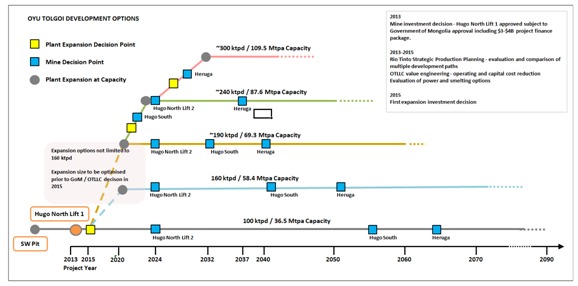

Timely development of the Oyu Tolgoi mining complex depends upon Turquoise Hill’s ability to maintain an adequate and reliable source of funding. Under the MOA, Turquoise Hill and Rio Tinto agreed to a comprehensive financing plan for the completion and start-up of phase 1 of the Oyu Tolgoi mining complex; however, volatility in the capital markets and other factors may adversely affect Turquoise Hill’s ability to acquire the remaining project finance component. The Oyu Tolgoi mining complex is in a region of the world that is prone to economic and political upheaval and instability, which may make it more difficult to obtain sufficient debt financing from project lenders. Failure to obtain sufficient additional financing would likely have a materially adverse impact on OTLLC’s ability to maintain the current development plans and schedule for future phases of the Oyu Tolgoi mining complex, including Lift 1 and Lift 2 of the Hugo North Extension deposit and the Heruga deposit.

Development of the Oyu Tolgoi mining complex may involve unexpected problems or delays.

Development of the Oyu Tolgoi mining complex may be subject to unexpected problems or delays for any number of reasons, including OTLLC’s inability to raise the additional funding that it needs to complete the development of the Oyu Tolgoi mining complex, Government of Mongolia requests to renegotiate the Investment Agreement and Government proposals to levy additional taxes and royalties against OTLLC. On October 15, 2012, Turquoise Hill announced that it, along with OTLLC and Rio Tinto, had rejected a request from the Mongolia Ministry of Mining to renegotiate the Investment Agreement. In its proposed 2013 budget, the Government of Mongolia included revenue from the application of a progressive royalty scheme to Oyu Tolgoi. However, the Investment Agreement provides a stabilized royalty rate of 5% over the life of the agreement and specifies that new laws made after its signing will not apply to Oyu Tolgoi. Turquoise Hill has stated that any change to Oyu Tolgoi’s royalty rate would require the agreement of all parties to the Investment Agreement. In early 2013, Turquoise Hill announced that a number of substantive issues had been raised by the Government of Mongolia relating to implementation of the Investment Agreement, including Oyu Tolgoi project development and costs, operating budget, project financing, management fees and governance. According to Turquoise Hill, it and Rio Tinto are continuing discussions with the Government of Mongolia with a goal of resolving the issues in the near term. On February 28, 2013, the OTLLC board of directors approved continued funding to progress the Oyu Tolgoi project as discussions with the Government of Mongolia proceed. Turquoise Hill has stated that phase 1 commercial production from the Southern Oyu open pits is expected to be reached by the end of June 2013, subject to the resolution of the issues being discussed with the Government. There can be no assurance that the present or a future Parliament will refrain from enacting legislation that undermines the Investment Agreement or that the present or a future government will refrain from adopting government policies or seeking to renegotiate the terms of the Investment Agreement that impair the ability of OTLLC, Turquoise Hill or Rio Tinto to develop and operate the Oyu Tolgoi mining complex on the basis presently contemplated, which may have a material adverse impact on Entrée and the Company’s share price.

There are a number of uncertainties inherent in the development and construction of any new mine, including the Oyu Tolgoi mining complex. These uncertainties include: the timing and cost, which can be considerable, of the construction of mining and processing facilities; the availability and cost of skilled labour, power and transportation, including costs of transport for the supply chain for the Oyu Tolgoi mining complex, which requires routing approaches which have not been fully tested; the annual usage costs to the local province for sand, aggregate and water; the availability and cost of appropriate smelting and refining arrangements; the need to obtain necessary environmental and other government permits, and the timing of those permits; the availability of funds to finance construction and development activities; and delays in any of the steps required to achieve commercial production, and the costs which would result from those delays (which could significantly exceed those currently projected). The cost, timing and complexities of mine construction and development are increased by the remote location of the Oyu Tolgoi mining complex. It is common in new mining operations to experience unexpected problems and delays during development, construction and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, there is no assurance that future development activities will result in profitable mining operations.

Rio Tinto controls the development of the Oyu Tolgoi mining complex, including the Joint Venture Property.

OTLLC has earned either a 70% or 80% interest in the Joint Venture Property, depending on the depth at which minerals are extracted, and has effective control of the Entrée-OTLLC Joint Venture management committee. Rio Tinto, which beneficially owns 20.7% of the Company’s issued and outstanding shares, controls the business and affairs of Turquoise Hill and OTLLC. Under the Heads of Agreement and MOA, Rio Tinto: is responsible for the management of the building and operation of the Oyu Tolgoi mining complex (which includes the Heruga and Hugo North Extension deposits on the Joint Venture Property); is responsible for all exploration operations on behalf of OTLLC, including exploration on the Joint Venture Property; and prepares all programs and budgets for approval by the OTLLC board. The interest of Rio Tinto, Turquoise Hill and OTLLC and the interests of the Company’s other shareholders are not necessarily aligned and there can be no assurance that Rio Tinto, Turquoise Hill or OTLLC will exercise its rights or act in a manner that is consistent with the best interests of the Company’s other shareholders.

The Investment Agreement includes a number of future covenants that may be outside of the control of the investors to complete.

The Investment Agreement commits Turquoise Hill and Rio Tinto to perform many obligations in respect of the development and operation of the Oyu Tolgoi mining complex. While performance of many of these obligations is within the effective control of Turquoise Hill and Rio Tinto, the scope of certain obligations may be open to interpretation. Further, the performance of other obligations may require co-operation from third parties or may be dependent upon circumstances that are not necessarily within the control of Turquoise Hill and Rio Tinto. For example, OTLLC is obligated to utilize only Mongolian power sources within four years of commencing commercial production. Such sources of power may not be available or may be available upon commercial terms that are less advantageous than those available from other potential power suppliers. Non-fulfillment of any obligation may result in a default under the Investment Agreement. Such a default could result in a termination of the Investment Agreement, which may have a material adverse impact on Entrée and the Company’s share price.

Risks Associated With the Funding Agreement

Short term fluctuations in mineral prices may expose the Company to trading losses.

Under the Funding Agreement, the Company agreed to use future cash flows from its mineral property interests to purchase and deliver metal credits to Sandstorm. The Funding Agreement does not require the Company to deliver actual metal production, therefore the Company will have to use revenue it receives from the sale of its share of metal production to purchase the requisite amount of metal credits for delivery to Sandstorm. To the extent metal prices on the day on which the Company’s production is sold are different from metal prices on the day on which the Company purchases metal credits for delivery to Sandstorm, the Company may suffer a gain or loss on the difference.

Certain events outside of Entrée’s control may be an event of default under the Funding Agreement.

If an event of default occurs under the Funding Agreement, the Company may be required to immediately pay to Sandstorm a default fee, which it may not have sufficient funds to cover. Some potential events of default may be outside of Entrée’s control, including a partial or full expropriation of Entrée’s interest in the Joint Venture Property which is not reversed during the abeyance period provided for in the Funding Agreement. If an event of default occurs and the Company is required to pay a default fee to Sandstorm, it will have a material adverse impact on Entrée’s business, financial condition assets and prospects, and on the Company’s share price.

Risks Associated With Mining

Resource and reserve estimates, including estimates for the Hugo North Extension, Heruga, Ann Mason and Blue Hill deposits, are estimates only, and are subject to change based on a variety of factors.

The estimates of reserves and resources, including the anticipated tonnages and grades that will be achieved or the indicated level of recovery that will be realized, are estimates only and no assurances can be given as to their accuracy. Such estimates are, in large part, based on interpretations of geological data obtained from drill holes and other sampling techniques, and large scale continuity and character of the deposits will only be determined once significant additional drilling and sampling has been completed and analyzed. Actual mineralization or formations may be different from those predicted. It may also take many years from the initial phase of drilling before production is possible, and during that time the economic feasibility of exploiting a deposit may change. Reserve and resource estimates are materially dependent on prevailing market prices and the cost of recovering and processing minerals at the mine site. Market fluctuations in the price of metals or increases in the costs to recover metals may render the mining of ore reserves uneconomical and materially adversely affect operations. Moreover, various short-term operating factors may cause a mining operation to be unprofitable in any particular accounting period.

Prolonged declines in the market price of metals may render reserves containing relatively lower grades of mineralization uneconomic to exploit and could reduce materially reserves and resources. Should such reductions occur, the discontinuation of development or production might be required. The estimates of mineral reserves and resources attributable to a specific property are based on accepted engineering and evaluation principles. The estimated amount of contained metals in probable mineral reserves does not necessarily represent an estimate of a fair market value of the evaluated property.

There are numerous uncertainties inherent in estimating quantities of mineral reserves and resources. The estimates in the Company’s disclosure documents are based on various assumptions relating to commodity prices and exchange rates during the expected life of production, mineralization, the projected cost of mining, and the results of additional planned development work. Actual future production rates and amounts, revenues, taxes, operating expenses, environmental and regulatory compliance expenditures, development expenditures, and recovery rates may vary substantially from those assumed in the estimates. Any significant change in the assumptions underlying the estimates, including changes that result from variances between projected and actual results, could result in material downward revision to current estimates, which may have a material adverse impact on Entrée and the Company’s share price.

Mineral prices are subject to dramatic and unpredictable fluctuations.

Entrée expects to derive revenues, if any, from the extraction and sale of precious and base metals such as copper, gold, silver and molybdenum. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond Entrée’s control, including international economic and political trends, expectations of inflation, global and regional demand, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities, increased production due to improved extraction and production methods and economic events, including the performance of Asia’s economies. The ongoing European sovereign debt crisis has created significant uncertainty and could lead to a prolonged recession in Europe which may, in turn, adversely affect the economic outlook for countries in other regions of the world and result in reduced demand for commodities, including base and precious metals.

The effect of these factors on the price of base and precious metals, and, therefore, the economic viability of any of Entrée’s exploration projects, cannot accurately be predicted. Should prevailing metal prices remain depressed, there may be a curtailment or suspension of mining, development and exploration activities. Entrée would have to assess the economic impact of any sustained lower metal prices on recoverability and, therefore, the cut-off grade and level of reserves and resources. These factors could have an adverse impact on Entrée’s future cash flows, earnings, results of operations, stated reserves and financial condition, which may have an adverse impact on Entrée and the Company’s share price.

Entrée has interests in properties that are in the exploration and development stages. There is no assurance that the existence of any mineral reserves will be established on any of the exploration properties in commercially exploitable quantities.

Mineral reserves have been established on the Hugo North Extension deposit at Lookout Hill. Mineral resources have been outlined on the Hugo North Extension and Heruga deposits at Lookout Hill and the Ann Mason and Blue Hill deposits in Nevada. Unless and until mineral reserves are established in economically exploitable quantities on a deposit, and the property is brought into commercial production, Entrée cannot earn any revenues from operations on that deposit or recover all of the funds that it has expended on exploration.

Development of a mineral property is contingent upon obtaining satisfactory exploration results. Mineral exploration and development involves substantial expenses and a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to adequately mitigate. There is no assurance that commercial quantities of ore will be discovered on any of the exploration properties in which Entrée has an interest. There is also no assurance that, even if commercial quantities of ore are discovered, a mineral property will be brought into commercial production. The discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit, once discovered, is also dependent upon a number of factors, some of which are the particular attributes of the deposit, such as size, grade and proximity to infrastructure, metal prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. Most of the above factors are beyond the control of Entrée.

The probability of an individual prospect ever having mineral reserves that meet the requirements of the definition is extremely remote. In all probability, exploration properties in which Entrée has an interest do not contain any mineral reserves and any funds that Entrée spends on exploration will be lost.

There can be no assurance that Entrée or its joint venture partners will be able to obtain or maintain any required permits.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labour standards, water rights, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that Entrée or its joint venture partners will be able to obtain or maintain any of the permits required for the continued exploration of mineral properties in which Entrée has an interest or for the construction and operation of a mine on those properties at economically viable costs. If required permits cannot be obtained or maintained, Entrée or its joint venture partners may be delayed or prohibited from proceeding with planned exploration or development of the mineral properties in which Entrée has an interest and Entrée’s business could fail.

Entrée is subject to substantial environmental and other regulatory requirements and such regulations are becoming more stringent. Non-compliance with such regulations could materially adversely affect Entrée.

Entrée’s operations are subject to environmental regulations in the various jurisdictions in which it operates. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Environmental legislation is evolving in a manner which will likely require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect Entrée’s operations. Environmental hazards may exist on the properties in which Entrée holds interests which are presently unknown to Entrée and which have been caused by previous or existing third-party owners or operators of the properties. Government approvals and permits are also often required in connection with various aspects of Entrée’s operations. To the extent that such approvals are required and not obtained, Entrée may be delayed or prevented from proceeding with planned exploration or development of its mineral properties, which may have a material, adverse impact on Entrée and its share price.

In Mongolia, Entrée is required to deposit 50% of its proposed reclamation budget with the local Soum Governor’s office (a soum is the local Mongolian equivalent of a township or district) which will be refunded only on acceptable completion of land rehabilitation after mining operations have concluded. Even if Entrée relinquishes its licences, Entrée will still remain responsible for any required reclamation.

In the United States, exploration companies are required to apply to federal and state authorities for a work permit that specifically details the proposed work program. A reclamation bond based on the amount of surface disturbance may be requested prior to the issuance of the appropriate permit.

There can be no assurance that the interest held by Entrée in exploration and development properties is free from defects.

Entrée’s title to its resource properties may be challenged by third parties or the licences that permit Entrée to explore its properties may expire if Entrée fails to timely renew them and pay the required fees.

Entrée has investigated title to the Shivee Tolgoi and Javhlant mining licences and Entrée is satisfied that the title to these licences is properly registered in the name of Entrée LLC, and that all required fees have been paid. Entrée has investigated the title to the claims comprising the Ann Mason Project and is satisfied that the title to these claims is properly registered in the name of MIM, Entrée US or the party from whom Entrée is acquiring its interest, and that the claims are currently in good standing.

Entrée cannot guarantee that the rights to explore its properties will not be revoked or altered to its detriment as a result of actions by the Mongolian Ministry of Mining, MRAM, Mongolia’s Resolution 140 and/or 175 or otherwise. The ownership and validity of mining claims and concessions are often uncertain and may be contested.

In Mongolia, should a third party challenge to the boundaries or registration of ownership arise, the Government of Mongolia may declare the property in question a special reserve for up to three years to allow resolution of disputes or to clarify the accuracy of its mining licence register.

Entrée is not aware of any third party challenges to the location or area of any of the mining concessions and mining claims in any of the jurisdictions in which it operates. There is, however, no guarantee that title to the claims and concessions will not be challenged or impugned in the future. If Entrée fails to pay the appropriate annual fees or if Entrée fails to timely apply for renewal, then these licences may expire or be forfeit.

If mineral reserves in commercially exploitable quantities are established on any of Entrée’s properties (other than the Joint Venture Property), Entrée will require additional capital and may need to acquire additional lands in order to develop the property into a producing mine. If Entrée cannot raise this additional capital or acquire additional lands, Entrée will not be able to exploit the resource, and its business could fail.

If mineral reserves in commercially exploitable quantities are established on any of Entrée’s properties (other than the Joint Venture Property, in which Entrée has a carried interest), Entrée will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although Entrée may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that Entrée will be able to raise the funds required for development on a timely basis. If Entrée cannot raise the necessary capital or complete the necessary facilities and infrastructure, its business may fail.

Entrée may be required to acquire rights to additional lands in order to develop a mine if a mine cannot be properly located on Entrée’s properties. There can be no assurance that Entrée will be able to acquire such additional lands on commercially reasonable terms, if at all.

Mineral exploration and development is subject to extraordinary operating risks. Entrée does not currently insure against these risks.

Mineral exploration and development involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Entrée’s operations will be subject to all of the hazards and risks inherent in the exploration and development of resources, including liability for pollution or hazards against which Entrée cannot insure or against which Entrée may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. Entrée does not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material, adverse impact on Entrée.

Climatic Conditions can affect operations.

Mongolia's weather varies to the extremes, with summer temperatures ranging up to 35° Celsius or more to winter lows of minus 31° Celsius. Such adverse conditions often preclude normal work patterns and can severely limit exploration and mining operations, usually making work difficult from November through to March. Although good project planning can ameliorate these factors, unseasonable weather can upset programs with resultant additional costs and delays.

The mining industry is highly competitive and there is no assurance that Entrée will continue to be successful in acquiring mineral claims. If Entrée cannot continue to acquire properties to explore for mineral resources, Entrée may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. Entrée competes with other exploration companies looking for mineral resource properties and the resources that can be produced from them.

Entrée competes with many companies possessing greater financial resources and technical facilities. This competition could adversely affect its ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that Entrée will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

Risks Related To Our Company

Entrée can provide investors with no assurances that it will generate any operating revenues or ever achieve profitable operations.

Although Entrée has been in the business of exploring mineral resource properties since 1995, mineral reserves have only recently been established on a deposit in which Entrée has an interest. As a result, Entrée has never had any revenues from its operations. In addition, its operating history has been restricted to the acquisition and exploration of its mineral properties. Entrée anticipates that it will continue to incur operating costs without realising any revenues until such time as the Joint Venture Property is brought into production. Entrée expects to continue to incur significant losses into the foreseeable future. Entrée recognises that if it is unable to generate significant revenues from mining operations and any dispositions of its interests in properties, Entrée will not be able to earn profits or continue operations. Entrée can provide investors with no assurance that it will generate any operating revenues or ever achieve profitable operations.

The fact that Entrée has not earned any operating revenues since its incorporation may impact its ability to explore certain of its mineral properties or require that exploration be scaled back.

Entrée has not generated any revenue from operations since its incorporation. Entrée anticipates that it will continue to incur operating expenses without revenues unless and until it is able to generate cash flows from the Entrée-OTLLC Joint Venture or it is able to identify a mineral reserve in a commercially exploitable quantity on one or more of its mineral properties and it builds and operates a mine. As at December 31, 2012, Entrée had working capital of approximately $4.7 million. Subsequent to December 31, 2012, Entrée received approximately US$55 million from Sandstorm pursuant to a comprehensive funding package. Entrée’s average monthly operating expenses in 2012 were approximately $1.2 million, including exploration, general and administrative expenses and investor relations expenses. Entrée has a carried interest on all exploration activity carried out on the Joint Venture Property and, due to the nature of Entrée’s other mineral property interests, Entrée has the ability to alter its exploration expenditures and, to a lesser extent, its general and administrative expenses. As a result, Entrée believes that it will not have to raise any additional funds to meet its currently budgeted operating requirements for the next 12 months. If these funds are not sufficient, or if Entrée does not begin generating revenues from operations sufficient to pay its operating expenses when Entrée has expended them, Entrée will be forced to raise necessary funds from outside sources. While Entrée may be able to raise funds through strategic alliances, joint ventures, product streaming or other arrangements, it has traditionally raised its operating capital from sales of equity, but there can be no assurance that Entrée will continue to be able to do so. If Entrée cannot raise the money that it needs to continue exploration of its mineral properties, there is a risk that Entrée may be forced to delay, scale back, or eliminate certain of its exploration activities.

Recent global financial conditions may adversely impact operations and the value and price of the Company’s Common Shares.

Recent global financial and market conditions have been subject to increased volatility. This increased volatility may impact the ability of Entrée to obtain equity or debt financing in the future and, if obtained, on terms favourable to Entrée. If these increased levels of volatility and market turmoil continue, Entrée’s operations could be adversely impacted and the value and the price of the Company’s Common Shares could be adversely affected.

As a result of their existing shareholdings and OTLLC’s right of first refusal, Rio Tinto, Turquoise Hill and OTLLC potentially have the ability to influence Entrée’s business and affairs.

Rio Tinto’s beneficial shareholdings in the Company potentially give Rio Tinto the voting power to influence the policies, business and affairs of Entrée and the outcome of any significant corporate transaction or other matter, including a merger, business combination or a sale of all, or substantially all, of Entrée’s assets. In addition, Rio Tinto on behalf of OTLLC has operational control over the Joint Venture Property. OTLLC has a right of first refusal with respect to any proposed disposition by Entrée of an interest in Shivee West, which is not subject to the Entrée-OTLLC Joint Venture. The share position in the Company of each of Turquoise Hill and Rio Tinto may have the effect of delaying, deterring or preventing a transaction involving a change of control of the Company in favour of a third party that otherwise could result in a premium in the market price of the Company’s Common Shares in the future. This risk is somewhat mitigated by the Funding Agreement, which provides that Sandstorm will vote its shares in the manner specified by the Company’s Board with respect to a take-over of the Company, provided the acquirer has agreed to deliver to Sandstorm a deed of adherence to the Funding Agreement.

The Company’s Articles and indemnity agreements between the Company and its officers and directors indemnify its officers and directors against costs, charges and expenses incurred by them in the performance of their duties.

The Company’s Articles contain provisions requiring the Company to indemnify Entrée’s officers and directors against all judgements, penalties or fines awarded or imposed in, or an amount paid in settlement of, a legal proceeding or investigative action in which such party, by reason of being a director or officer of Entrée, is or may be joined. The Company also has indemnity agreements in place with its officers and directors. Such limitations on liability may reduce the likelihood of derivative litigation against the Company’s officers and directors and may discourage or deter the Company’s shareholders from suing its officers and directors based upon breaches of their duties to Entrée, though such an action, if successful, might otherwise benefit Entrée and the Company’s shareholders.

Investors' interests in the Company will be diluted and investors may suffer dilution in their net book value per Common Share if the Company issues stock options or if the Company issues additional Common Shares to finance its operations.

Entrée has never generated revenue from operations. Entrée is currently without a source of revenue and the Company will most likely be required to issue additional Common Shares to finance Entrée’s operations and, depending on the outcome of the exploration programs, may issue additional Common Shares to finance additional exploration programs on any or all of Entrée’s properties or to acquire additional properties.

The Company may also in the future grant to some or all of Entrée’s directors, officers, consultants, and employees options to purchase Common Shares as non-cash incentives to those persons. Such options may be granted at prices equal to market prices, or at prices as allowable under the policies of the TSX and the Company’s Stock Option Plan, when the public market is depressed. The issuance of any equity securities could, and the issuance of any additional Common Shares will, cause the Company’s existing shareholders to experience dilution of their ownership interests.

If the Company issues additional Common Shares, investors' interests in the Company will be diluted and investors may suffer dilution in their net book value per Common Share depending on the price at which such securities are sold. As at December 31, 2012 Entrée had outstanding options exercisable into 9,223,000 Common Shares which, if exercised as at March 28, 2013 would represent approximately 6.29% of its issued and outstanding Common Shares. If all of these options are exercised and the underlying Common Shares are issued, such issuance will cause a reduction in the proportionate ownership and voting power of all other shareholders. The dilution may result in a decline in the market price of the Company’s Common Shares.

Earnings and Dividend Record.

The Company has no earnings or dividend record. The Company has not paid dividends on its Common Shares since incorporation and does not anticipate doing so in the foreseeable future. The Company’s current intention is to apply any future net earnings to increase its working capital. Prospective investors seeking or needing dividend income or liquidity should, therefore, not purchase the Company’s Common Shares. The Company currently has no revenue and a history of losses, so there can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of Common Shares.

Conflicts of Interest.

Peter Meredith is a director of Turquoise Hill and is also a director of the Company. In addition, certain of Entrée’s officers and directors may be or become associated with other natural resource companies that acquire interests in mineral properties. Such associations may give rise to conflicts of interest from time to time. Entrée’s directors are required by law to act honestly and in good faith with a view to its best interests and to disclose any interest which they may have in any of its projects or opportunities. In general, if a conflict of interest arises at a meeting of the board of directors, any director in a conflict will disclose his interest and abstain from voting on such matter or, if he does vote, his vote does not count.

Dependence on Key Management Employees.

Entrée’s ability to continue its exploration and development activities and to develop a competitive edge in the marketplace depends, in large part, on its ability to attract and maintain qualified key management personnel. Competition for such personnel is intense, and there can be no assurance that Entrée will be able to attract and retain such personnel. Its development now, and in the future, will depend on the efforts of key management figures. The loss of any of these key people could have a material adverse effect on Entrée’s business. Entrée does not currently maintain key-man life insurance on any of its key employees.

Fluctuations in Currency Exchange Rates.

Fluctuations in currency exchange rates, particularly operating costs denominated in currencies other than United States dollars, may significantly impact Entrée’s financial position and results. Entrée faces risks associated with fluctuations in Canadian, United States, Australian, Peruvian and Mongolian currencies.

The Company is subject to the U.S. Foreign Corrupt Practices Act.

The Company is subject to the U.S. Foreign Corrupt Practices Act (the “FCPA”), which prohibits Entrée or any officer, director, employee or agent of Entrée or any shareholder of the Company on its behalf from paying, offering to pay, or authorizing the payment of anything of value to any foreign government official, government staff member, political party, or political candidate in an attempt to obtain or retain business or to otherwise influence a person working in an official capacity. The FCPA also requires public companies to make and keep books and records that accurately and fairly reflect their transactions and to devise and maintain an adequate system of internal accounting controls. Entrée’s international activities create the risk of unauthorized payments or offers of payments by its employees, consultants or agents, even though they may not always be subject to its control. Entrée discourages these practices by its employees and agents. However, Entrée’s existing safeguards and any future improvements may prove to be less than effective, and its employees, consultants and agents may engage in conduct for which it might be held responsible. Any failure by Entrée to adopt appropriate compliance procedures and ensure that its employees and agents comply with the FCPA and applicable laws and regulations in foreign jurisdictions could result in substantial penalties or restrictions on Entrée’s ability to conduct business in certain foreign jurisdictions, which may have a material adverse impact on Entrée and its share price.

The Company believes that it was a passive foreign investment company during 2012, which may have a material effect on U.S. holders.

The Company believes it was a “passive foreign investment company” (“PFIC”) during the year ended December 31, 2012 and may be a PFIC for subsequent tax years, which may have a material effect on United States shareholders (“US Holders”). United States income tax legislation contains rules governing PFICs, which can have significant tax effects on US Holders of foreign corporations. A US Holder who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC is subject to United States federal income taxation under one of two alternative tax regimes at the election of each such US Holder. The United States federal income tax consequences to a US Holder of the acquisition, ownership, and disposition of common shares will depend on whether such US Holder makes an election to treat the Company as a “qualified electing fund” or “QEF” under Section 1295 of the Code (“QEF Election”) or a mark-to-market election under Section 1296 of the Code (“Mark-to-Market Election”). Upon written request by a US Holder, the Company will make available the information necessary for such US Holder to make QEF Elections with respect to the Company. Additional adverse rules would apply to US Holders for any year the Company is a PFIC and Entrée owns or disposes of shares in another corporation which is a PFIC.

It may be difficult to enforce judgements or bring actions outside the United States against the Company and certain of its directors.