xent-20211231false2021FY0001271214P2YP3Yhttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesCurrent.064350100012712142021-01-012021-12-3100012712142021-06-30iso4217:USD00012712142022-03-01xbrli:shares00012712142021-12-3100012712142020-12-31iso4217:USDxbrli:shares0001271214us-gaap:ConvertiblePreferredStockMember2021-12-310001271214us-gaap:ConvertiblePreferredStockMember2020-12-3100012712142020-01-012020-12-3100012712142019-01-012019-12-310001271214us-gaap:CommonStockMember2018-12-310001271214us-gaap:AdditionalPaidInCapitalMember2018-12-310001271214us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001271214us-gaap:RetainedEarningsMember2018-12-3100012712142018-12-310001271214us-gaap:CommonStockMember2019-01-012019-12-310001271214us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001271214us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001271214us-gaap:RetainedEarningsMember2019-01-012019-12-310001271214us-gaap:CommonStockMember2019-12-310001271214us-gaap:AdditionalPaidInCapitalMember2019-12-310001271214us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001271214us-gaap:RetainedEarningsMember2019-12-3100012712142019-12-310001271214us-gaap:CommonStockMember2020-01-012020-12-310001271214us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001271214us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001271214us-gaap:RetainedEarningsMember2020-01-012020-12-310001271214us-gaap:CommonStockMember2020-12-310001271214us-gaap:AdditionalPaidInCapitalMember2020-12-310001271214us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001271214us-gaap:RetainedEarningsMember2020-12-310001271214us-gaap:CommonStockMember2021-01-012021-12-310001271214us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001271214us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001271214us-gaap:RetainedEarningsMember2021-01-012021-12-310001271214us-gaap:CommonStockMember2021-12-310001271214us-gaap:AdditionalPaidInCapitalMember2021-12-310001271214us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001271214us-gaap:RetainedEarningsMember2021-12-310001271214xent:MergerAgreementIntersectENTIncMemberxent:MedtronicIncMember2021-08-060001271214srt:MinimumMember2021-01-012021-12-310001271214srt:MaximumMember2021-01-012021-12-310001271214xent:EmployeeTerminationMemberus-gaap:EmployeeSeveranceMember2020-01-012020-12-31xent:employeexbrli:pure0001271214us-gaap:EmployeeSeveranceMemberxent:FurloughedEmployeesMember2020-01-012020-12-31xent:facility0001271214us-gaap:EmployeeSeveranceMember2020-01-012020-12-31xent:segment0001271214us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001271214us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001271214us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001271214xent:MarketBasedPerformanceStockOptionsMember2021-01-012021-12-310001271214xent:MarketBasedPerformanceStockOptionsMember2020-01-012020-12-310001271214xent:MarketBasedPerformanceStockOptionsMember2019-01-012019-12-310001271214us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001271214us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001271214us-gaap:RestrictedStockUnitsRSUMember2019-01-012019-12-310001271214xent:MarketBasedPerformanceStockUnitsMember2021-01-012021-12-310001271214xent:MarketBasedPerformanceStockUnitsMember2020-01-012020-12-310001271214xent:MarketBasedPerformanceStockUnitsMember2019-01-012019-12-310001271214us-gaap:EmployeeStockMember2021-01-012021-12-310001271214us-gaap:EmployeeStockMember2020-01-012020-12-310001271214us-gaap:EmployeeStockMember2019-01-012019-12-310001271214us-gaap:ConvertibleDebtSecuritiesMember2021-01-012021-12-310001271214us-gaap:ConvertibleDebtSecuritiesMember2020-01-012020-12-310001271214us-gaap:ConvertibleDebtSecuritiesMember2019-01-012019-12-3100012712142021-12-312021-12-3100012712142020-12-312020-12-310001271214us-gaap:ComputerEquipmentMember2021-12-310001271214us-gaap:ComputerEquipmentMember2020-12-310001271214us-gaap:FurnitureAndFixturesMember2021-12-310001271214us-gaap:FurnitureAndFixturesMember2020-12-310001271214us-gaap:EquipmentMember2021-12-310001271214us-gaap:EquipmentMember2020-12-310001271214us-gaap:LeaseholdImprovementsMember2021-12-310001271214us-gaap:LeaseholdImprovementsMember2020-12-310001271214us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-12-310001271214us-gaap:OtherNoncurrentAssetsMember2021-12-310001271214xent:PropelFamilyOfProductsMember2021-01-012021-12-310001271214xent:PropelFamilyOfProductsMember2020-01-012020-12-310001271214xent:PropelFamilyOfProductsMember2019-01-012019-12-310001271214xent:SinuvaMember2021-01-012021-12-310001271214xent:SinuvaMember2020-01-012020-12-310001271214xent:SinuvaMember2019-01-012019-12-310001271214xent:VenSureCUBEAndAccessoriesMember2021-01-012021-12-310001271214xent:VenSureCUBEAndAccessoriesMember2020-01-012020-12-310001271214xent:VenSureCUBEAndAccessoriesMember2019-01-012019-12-310001271214us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashMember2021-12-310001271214us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001271214us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001271214us-gaap:FairValueMeasurementsRecurringMember2021-12-310001271214us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashMember2020-12-310001271214us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001271214us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasuryBillSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2020-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001271214us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001271214us-gaap:FairValueMeasurementsRecurringMember2020-12-310001271214us-gaap:FairValueInputsLevel3Member2019-12-310001271214us-gaap:FairValueInputsLevel3Member2020-01-012020-12-310001271214us-gaap:FairValueInputsLevel3Member2020-12-310001271214us-gaap:FairValueInputsLevel3Member2021-01-012021-12-310001271214us-gaap:FairValueInputsLevel3Member2021-12-310001271214us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-12-310001271214us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-12-31iso4217:EUR0001271214us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-12-310001271214us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-12-310001271214us-gaap:OtherNoncurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-12-310001271214us-gaap:OtherNoncurrentAssetsMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-12-310001271214us-gaap:OtherCurrentLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2021-12-310001271214us-gaap:OtherCurrentLiabilitiesMemberus-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2020-12-310001271214us-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-12-310001271214us-gaap:NondesignatedMemberus-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:ForeignExchangeContractMember2020-12-310001271214us-gaap:ForeignExchangeContractMember2021-01-012021-12-310001271214us-gaap:ForeignExchangeContractMember2020-01-012020-12-310001271214xent:FiagonAGMedicalMember2020-10-022020-10-020001271214xent:FiagonAGMedicalMember2021-10-012021-10-310001271214xent:FiagonAGMedicalMember2020-10-020001271214xent:FiagonAGMedicalMember2021-01-012021-12-310001271214xent:FiagonAGMedicalMember2020-01-012020-12-310001271214srt:ProFormaMemberxent:FiagonAGMedicalMember2020-01-012020-12-310001271214srt:ProFormaMemberxent:FiagonAGMedicalMember2019-01-012019-12-310001271214us-gaap:DevelopedTechnologyRightsMember2020-12-310001271214us-gaap:DistributionRightsMember2020-12-310001271214us-gaap:CustomerRelationshipsMember2020-12-310001271214us-gaap:TrademarksMember2020-12-310001271214us-gaap:TrademarksMemberxent:FiagonAGMedicalMember2021-01-012021-12-310001271214us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberxent:FiagonAGMedicalMember2021-12-310001271214us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberxent:FiagonAGMedicalMember2021-01-012021-12-310001271214us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberus-gaap:InventoriesMemberxent:FiagonAGMedicalMember2021-01-012021-12-310001271214us-gaap:AccountsPayableMemberus-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberxent:FiagonAGMedicalMember2021-01-012021-12-310001271214us-gaap:ConvertiblePreferredStockMember2019-12-310001271214xent:TwoThousandFourteenEquityIncentivePlanMember2014-07-310001271214xent:TwoThousandFourteenEquityIncentivePlanMember2021-01-012021-12-310001271214xent:TwoThousandFourteenEquityIncentivePlanMemberxent:IncentiveStockOptionMember2021-01-012021-12-310001271214xent:TwoThousandFourteenEquityIncentivePlanMember2021-01-012021-01-010001271214xent:TwoThousandFourteenEquityIncentivePlanMember2021-01-010001271214xent:TwoThousandFourteenEquityIncentivePlanMember2021-12-310001271214us-gaap:RestrictedStockUnitsRSUMemberxent:TwoThousandFourteenEquityIncentivePlanMember2017-01-012017-01-310001271214us-gaap:EmployeeStockOptionMember2020-12-310001271214us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001271214us-gaap:EmployeeStockOptionMember2021-12-310001271214us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001271214us-gaap:EmployeeStockOptionMember2019-01-012019-12-310001271214us-gaap:RestrictedStockUnitsRSUMember2020-12-310001271214us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001271214us-gaap:RestrictedStockUnitsRSUMember2021-12-310001271214xent:PerformanceStockUnitsMember2020-12-310001271214xent:PerformanceStockUnitsMember2021-01-012021-12-310001271214xent:PerformanceStockUnitsMember2021-12-310001271214xent:PerformanceStockUnitsMember2021-02-012021-02-280001271214xent:PerformanceStockUnitsMember2021-04-012021-04-300001271214xent:PerformanceStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-02-012021-04-300001271214xent:PerformanceStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-02-012021-04-300001271214xent:PerformanceStockUnitsMembersrt:MinimumMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-02-012021-04-300001271214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxent:PerformanceStockUnitsMembersrt:MinimumMember2021-02-012021-04-300001271214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxent:PerformanceStockUnitsMember2021-02-012021-04-300001271214xent:PerformanceStockUnitsMemberxent:MonteCarloSimulationModelMember2021-02-012021-04-300001271214xent:PerformanceStockUnitsMemberxent:MonteCarloSimulationModelMember2021-01-012021-12-310001271214xent:PerformanceStockUnitsMember2020-02-012020-02-290001271214xent:PerformanceStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2020-02-290001271214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxent:PerformanceStockUnitsMember2020-02-290001271214xent:PerformanceStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2020-02-290001271214xent:PerformanceStockUnitsMember2020-01-012020-12-310001271214xent:PerformanceStockUnitsMemberxent:MonteCarloSimulationModelMember2020-02-012020-02-290001271214xent:MarketBasedVestingOptionMember2019-07-012019-07-310001271214xent:MarketBasedVestingOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-07-310001271214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxent:MarketBasedVestingOptionMember2019-07-310001271214xent:MarketBasedVestingOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2019-07-310001271214xent:MarketBasedVestingOptionMemberxent:MonteCarloSimulationModelMember2019-07-012019-07-310001271214xent:PerformanceStockUnitsMember2019-11-012019-11-300001271214xent:PerformanceStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2019-11-300001271214us-gaap:ShareBasedCompensationAwardTrancheTwoMemberxent:PerformanceStockUnitsMember2019-11-300001271214xent:PerformanceStockUnitsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2019-11-300001271214xent:PerformanceStockUnitsMemberxent:MonteCarloSimulationModelMember2019-11-012019-11-300001271214us-gaap:EmployeeStockMember2014-07-310001271214us-gaap:EmployeeStockMember2018-06-012018-06-300001271214us-gaap:EmployeeStockMember2018-06-300001271214us-gaap:EmployeeStockMember2021-01-012021-12-310001271214us-gaap:EmployeeStockMember2020-01-012020-12-310001271214us-gaap:EmployeeStockMember2019-01-012019-12-310001271214us-gaap:CostOfSalesMember2021-01-012021-12-310001271214us-gaap:CostOfSalesMember2020-01-012020-12-310001271214us-gaap:CostOfSalesMember2019-01-012019-12-310001271214us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001271214us-gaap:SellingGeneralAndAdministrativeExpensesMember2020-01-012020-12-310001271214us-gaap:SellingGeneralAndAdministrativeExpensesMember2019-01-012019-12-310001271214us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001271214us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-12-310001271214us-gaap:ResearchAndDevelopmentExpenseMember2019-01-012019-12-310001271214us-gaap:ConvertibleDebtMember2020-05-110001271214us-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2020-05-110001271214us-gaap:ConvertibleDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2020-05-112020-05-11xent:day0001271214us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:ConvertibleDebtMember2020-05-110001271214us-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:ConvertibleDebtMember2020-05-112020-05-110001271214us-gaap:ConvertibleDebtMembersrt:MinimumMember2020-05-112020-05-110001271214us-gaap:ConvertibleDebtMembersrt:MaximumMember2020-05-112020-05-110001271214us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2020-05-110001271214us-gaap:ConvertibleDebtMember2021-12-310001271214us-gaap:ConvertibleDebtMember2020-12-310001271214us-gaap:ConvertibleDebtMember2021-01-012021-12-310001271214us-gaap:ConvertibleDebtMember2020-01-012020-12-310001271214xent:DeerfieldTermLoansMemberus-gaap:SeniorLoansMember2021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorLoansMember2021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:SeniorLoansMember2021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SeniorLoansMember2021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:SeniorLoansMember2021-07-222021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:SeniorLoansMember2021-07-222021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:SeniorLoansMember2021-07-222021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SeniorLoansMember2021-07-222021-07-220001271214xent:DeerfieldTermLoansMemberus-gaap:SeniorLoansMember2021-12-310001271214us-gaap:OtherCurrentLiabilitiesMemberxent:DeerfieldTermLoansMemberus-gaap:SeniorLoansMember2021-12-310001271214xent:MedtronicFinancingMemberus-gaap:SubordinatedDebtMember2021-09-250001271214xent:MedtronicFinancingMemberus-gaap:SubordinatedDebtMember2021-09-252021-09-250001271214xent:MedtronicFinancingMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:SubordinatedDebtMember2021-09-250001271214xent:MedtronicFinancingMemberus-gaap:SubordinatedDebtMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2021-09-250001271214xent:MedtronicFinancingMemberus-gaap:DebtInstrumentRedemptionPeriodFourMemberus-gaap:SubordinatedDebtMember2021-09-250001271214us-gaap:DebtInstrumentRedemptionPeriodFiveMemberxent:MedtronicFinancingMemberus-gaap:SubordinatedDebtMember2021-09-250001271214us-gaap:DebtInstrumentRedemptionPeriodTwoMemberxent:MedtronicFinancingMemberus-gaap:SubordinatedDebtMember2021-09-250001271214xent:MedtronicFinancingMemberus-gaap:SubordinatedDebtMember2021-12-310001271214xent:MedtronicFinancingMember2021-12-310001271214us-gaap:ConvertibleDebtMember2020-05-112020-05-110001271214srt:ScenarioForecastMemberus-gaap:DeferredBonusMemberxent:EmployeesMember2021-09-012022-07-310001271214us-gaap:DeferredBonusMemberxent:EmployeesMember2021-01-012021-12-310001271214us-gaap:DeferredBonusMember2021-12-310001271214xent:WangComplaintMember2021-09-012021-09-01xent:claim0001271214xent:LawsonComplaintMembersrt:DirectorMember2021-09-152021-09-15xent:defendant0001271214xent:LawsonComplaintMemberxent:DirectorFormerMember2021-09-152021-09-150001271214xent:LawsonComplaintMember2021-09-232021-09-23xent:plantiff00012712142007-01-012007-01-310001271214us-gaap:EmbeddedDerivativeFinancialInstrumentsMember2021-01-012021-12-310001271214us-gaap:DomesticCountryMember2021-12-310001271214us-gaap:StateAndLocalJurisdictionMember2021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

Form 10-K

______________________

(Mark One)

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 001-36545

______________________

INTERSECT ENT, INC.

(Exact name of registrant as specified in its charter)

______________________

| | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 20-0280837 (I.R.S. Employer Identification No.) |

| |

1555 Adams Drive Menlo Park, CA (Address of principal executive offices) | 94025 (zip code) |

Registrant’s telephone number, including area code:

(650) 641-2100

______________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class Common Stock, 0.001 par value | Trading Symbol XENT | Name of Exchange on Which Registered The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

______________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | |

| Large accelerated filer | ¨ | Accelerated filer | þ |

| Non-accelerated filer | ¨ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No þ

As of June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates, was approximately $565,464,000. Shares of common stock held by each officer and director have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of common stock outstanding as of March 1, 2022 was 33,787,505.

Documents Incorporated by Reference

Portions of the registrant’s definitive Proxy Statement for its 2022 Annual Stockholders’ Meeting are incorporated by reference into Part III of this Annual Report on Form 10-K, to be filed within 120 days of the registrant’s fiscal year ended December 31, 2021.

INTERSECT ENT, INC.

Annual Report on Form 10-K

For the Fiscal Year Ended

December 31, 2021

TABLE OF CONTENTS

CAUTIONARY INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K for the year ended December 31, 2021, or “Form 10-K,” contains forward-looking statements concerning our business, operations, and financial performance and condition as well as our plans, objectives, and expectations for business operations and financial performance and condition. All forward-looking statements are based upon our current expectations and various assumptions. In addition, forward-looking statements include the impact that the COVID-19 pandemic will have on our business, and our belief that we will be able to return to revenue growth as the current crisis subsides. Any statements contained herein that are not of historical facts may be deemed to be forward-looking statements. You can identify these statements by words such as “anticipate,” “assume,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “should,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends. These forward-looking statements are based on current expectations, estimates, forecasts, and projections about our business and the industry in which we operate and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Form 10-K may turn out to be inaccurate. Factors that could materially affect our business operations and financial performance and condition include, but are not limited to: the duration and severity of the COVID-19 pandemic is unknown and could continue, and be more severe than we currently expect; the unknown state of the U.S. economy following the pandemic; the level of demand for our products as the pandemic subsides, and the time it will take for the economy to recover from the pandemic; and among others, those risks and uncertainties described herein under “Item 1A. Risk Factors.” You are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on the forward-looking statements. The forward-looking statements are based on information available to us as of the filing date of this Form 10-K. Unless required by law, we do not intend to publicly update or revise any forward-looking statements to reflect new information or future events or otherwise. You should, however, review the factors and risks we describe in the reports we will file from time to time with the Securities and Exchange Commission, or SEC, after the date of this Form 10-K.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

RISK FACTORS SUMMARY

You should carefully consider the information set forth below in the section titled “Item 1A. Risk Factors” before deciding whether to invest in our securities. Below is a summary of the principal risks associated with an investment in our securities.

•The impact of COVID-19, and the various medical, social and economic measures being implemented to combat its proliferation, has had and will continue to have a material adverse effect on our business, financial condition, results of operations, and liquidity.

•The pendency of our agreement to be acquired by Medtronic may have an adverse effect on our business, operating results and our stock price, and may result in the loss of employees, customers, suppliers and other business partners.

•While the Merger is pending, we are subject to contractual restrictions that could harm our business, operating results and our stock price.

•The failure to complete the Merger may adversely affect our business and our stock price.

•While the Merger is pending, our ability to maintain our competitive position depends on our ability to attract and retain highly qualified personnel.

•The Merger Agreement with Medtronic limits our ability to pursue alternative transactions which could deter a third party from proposing an alternative transaction.

•We have incurred significant operating losses since inception and may not be able to achieve profitability.

•Our revenue is generated primarily from our PROPEL® family of products and, to a lesser extent, SINUVA®, VenSure, and CUBE. Our revenue is dependent on the success of these products, and if these products fail to grow or to continue experiencing expanded adoption, our business will suffer.

•A track record of adequate coverage and reimbursement is important for sales of our products in the physician office setting of care. Inadequate coverage and negative reimbursement policies for our products could affect their adoption and our future revenue.

•We utilize third-party, single source suppliers and service providers for many of the components, materials and services used in the production of our steroid releasing implants, and the loss of, or disruption by, any of these suppliers or service providers could harm our business.

•We rely on specialty pharmacies and specialty distributors for distribution of SINUVA in the United States, and the failure of those specialty pharmacies and specialty distributors to distribute SINUVA effectively would adversely affect sales of SINUVA.

•Our long-term growth depends on our ability to develop and successfully commercialize additional ENT products.

•Consolidation in the healthcare industry could lead to demands for price concessions, which may impact our ability to sell our products at prices necessary to support our current business strategies.

•We compete or may compete in the future against other companies, some of which have longer operating histories, more established products and greater resources, which may prevent us from achieving significant market penetration or improved operating results.

•If our facilities or the facility of a supplier or customer become inoperable, we will be unable to continue to research, develop, manufacture, commercialize and sell our products and, as a result, our business will be harmed until we are able to secure a new facility.

•As our company diversifies its portfolio of products and expands its international reach, we continue to expand the complexity of our operations. We may encounter difficulties in managing this expansion, which could disrupt our business.

•If clinical studies of our future products or product indications do not produce results necessary to support regulatory clearance or approval in the United States or, with respect to our current or future products, elsewhere, we will be unable to commercialize these products.

•Reimbursement in international markets may require us to undertake country-specific reimbursement activities, including additional clinical studies, which could be time-consuming and expensive and may not yield acceptable reimbursement rates.

•Pricing for pharmaceutical products has come under increasing scrutiny by governments, legislative bodies and enforcement agencies. These activities may result in actions that have the effect of reducing our revenue or harming our business or reputation.

•If we elect to pursue but fail to successfully acquire or effectively and efficiently integrate new third-party businesses, products, and/or technologies, we may not realize expected benefits of the transaction or our existing business may be harmed by the distraction, resource demands or unforeseen consequences of the endeavor.

•We expect gross profit margins to vary over time, and changes in our gross profit margins could adversely affect our financial condition or results of operations.

•We may incur losses associated with currency fluctuations and may not be able to effectively hedge our exposure.

•If we experience significant disruptions in our information technology systems, our business may be adversely affected.

•Our products are subject to extensive regulation by the FDA, and other agencies, including the requirement to obtain approval/clearance and/or register products prior to commercializing our products, maintaining compliance with Quality System, GMP practices, applicable regulations, maintaining product quality, and the requirement to report adverse events and other ongoing reporting requirements. If we fail to obtain necessary FDA or other agency device or drug approvals for our products or fail to maintain compliance with applicable regulations and standards or are subject to regulatory enforcement action as a result of our failure to properly report adverse events or otherwise comply with regulatory requirements and standards, maintain compliance with Quality System and GMP requirements and product quality, our commercial operations would be harmed.

•We cannot predict whether or when we will obtain regulatory approval to commercialize product candidates or our ability to maintain product approvals/clearances/registrations and we cannot, therefore, predict the timing of any future revenue from product candidates. Regulatory approval of a product candidate is not guaranteed, and the approval process is expensive, uncertain and lengthy.

•If we participate in but fail to comply with our reporting and payment obligations under the Medicaid Drug Rebate Program, or other governmental pricing programs, we could be subject to additional reimbursement requirements, penalties, sanctions and fines which could have a material adverse effect on our business, financial condition and results of operations.

•If we materially modify our approved products, we may need to seek and obtain new approvals, which, if not granted, would prevent us from selling our modified products.

•We may fail to obtain foreign regulatory approvals to market our products in other countries.

•If we, our suppliers or service providers fail to comply with ongoing FDA or foreign regulatory authority requirements, or if we experience unanticipated problems with our products, these products could be subject to restrictions or withdrawal from the market.

•If the third parties on which we rely to conduct our clinical trials do not perform as contractually required or expected, we may not be able to obtain regulatory approval for or commercialize such product candidates.

•We may be subject to enforcement action if we engage in improper marketing or promotion of our products.

•If we fail to comply with U.S. federal and state healthcare regulatory laws and applicable international healthcare regulatory laws, we could be subject to penalties, including, but not limited to, administrative, civil and criminal penalties, damages, fines, disgorgement, exclusion from participation in governmental healthcare programs, and the curtailment of our operations, any of which could adversely impact our reputation and business operations.

•Legislative or regulatory healthcare reforms may make it more difficult and costly for us to obtain regulatory approval of new products and to produce, market and distribute our products after approval is obtained.

•Changes in funding for the FDA, the SEC and other government agencies could hinder their ability to hire and retain key leadership and other personnel, prevent new products and services from being developed or commercialized in a timely manner or otherwise prevent those agencies from performing normal functions on which the operation of our business may rely, which could negatively impact our business.

•Intellectual property rights may not provide adequate protection, which may permit third parties to compete against us more effectively.

•We may need substantial additional funding and may be unable to raise capital when needed, which would force us to delay, reduce, eliminate or abandon our commercialization efforts or product development programs.

•Our debt obligations under our facility agreements with Deerfield and Medtronic could impair our financial condition and limit our operating flexibility.

•Provisions in our corporate charter documents and under Delaware law could make an acquisition of us more difficult and may prevent attempts by our stockholders to replace or remove our current management.

PART I

Item 1. Business

Overview

We are a global ear, nose and throat (“ENT”) medical technology leader dedicated to transforming patient care. Our U.S. Food and Drug Administration (“FDA”) approved steroid releasing products are designed to provide mechanical spacing and deliver targeted therapy (mometasone furoate) to the site of disease. These products include our PROPEL® family of products (PROPEL®, PROPEL® Mini and PROPEL® Contour) and the SINUVA® (mometasone furoate) Sinus Implant. The PROPEL family of products are used in adult patients to reduce inflammation and maintain patency following sinus surgery, primarily in hospitals and ambulatory surgery centers (“ASC”), with increasing applications in the physician office setting of care in conjunction with balloon dilation and following post-surgical debridement. SINUVA is a physician administered drug, designed to be used in the physician office setting of care to treat adult patients who have had ethmoid sinus surgery yet suffer from recurrent sinus obstruction due to polyps. In October 2020, we acquired Fiagon AG Medical Technologies (“Fiagon”), a global leader of electromagnetic surgical navigation solutions with an expansive portfolio of ENT product offerings, including the VenSure sinus dilation platform (“VenSure”) and the CUBE surgical navigation system and instrumentation (“CUBE”), that complement our PROPEL and SINUVA sinus implants across all settings of care and extend our geographic reach. The PROPEL family of products are combination products regulated as devices approved under a Premarket Approval (“PMA”) and SINUVA is a combination product regulated as a drug that was approved under a New Drug Application (“NDA”). The VenSure products received 510(k) clearance in August 2020. CUBE and VenSure are both regulated as medical devices.

Pending Acquisition

On August 6, 2021, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Medtronic, Inc., a Minnesota Corporation and wholly-owned subsidiary of Medtronic public limited company (“Medtronic”), and Project Kraken Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of Medtronic (“Merger Sub”), providing for the merger of Merger Sub with and into Intersect ENT (the “Merger”), with Intersect ENT surviving the Merger as a wholly-owned subsidiary of Medtronic. On October 8, 2021, our stockholders adopted the Merger Agreement at a special meeting of our stockholders.

Under the terms of the Merger Agreement, Medtronic will acquire all outstanding shares of our common stock, including all vested and unvested awards, in exchange for consideration of $28.25 per share in cash. Vested and unvested stock options will be redeemed for the difference between $28.25 per option and the respective exercise price. The Merger Agreement contains representations and warranties customary for transactions of this type. The closing of the Merger is subject to the satisfaction or waiver of a number of closing conditions, including approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The Merger Agreement provides Medtronic and us with certain termination rights and, under certain circumstances, may require that Medtronic or we pay a termination fee.

In anticipation of the Merger and with respect to antitrust considerations, we have committed to a plan to divest of the recently acquired Fiagon business, which we expect to be contingent on and coterminous with the anticipated Merger.

The Merger Agreement includes restrictions on the conduct of our business prior to the completion of the Merger, generally requiring us to conduct our business in the ordinary course, consistent with past practice, and restricting us from taking certain specified actions absent Medtronic’s prior written consent. Accordingly, our ability to advance our business during the pendency of the Merger is subject to these restrictions.

Our Strategy

We are focused on becoming a comprehensive provider of ENT outcomes-based solutions and achieving consistent growth by increasing our market share and improving our operating efficiencies through:

•continuing to expand our portfolio of products based on our unique localized steroid releasing technology;

•utilizing our existing technology for further penetration among ENT physicians across sites of care;

•generating clinical evidence to support unencumbered access and expanded use cases;

•continuing to expand internationally;

•investing in appropriate infrastructure to remediate, upgrade, and scale;

•managing working capital and cash burn; and

•establishing sustainable long-term growth.

We are continuing to develop our sales force in order to expand communication of the benefits of our commercial products to physicians in the two different markets that PROPEL and SINUVA serve as well as the added benefits of VenSure and CUBE navigation across the continuum of care. This is also being accomplished through building clinical evidence and the health economic case with third-party payors to establish reimbursement, as seen with the evolution from a single J-code for both PROPEL and SINUVA to separate codes as well as Pass-Through status during 2020 and early 2021. SINUVA in particular enjoys strong payor coverage and is covered for 75% of patients with private health insurance and 90% of patients with government-sponsored health insurance. We seek to grow our revenue by increasing the frequency of use of our products among current physician customers, by adding new physician users, increasing patient enrollment rates, and entering new markets.

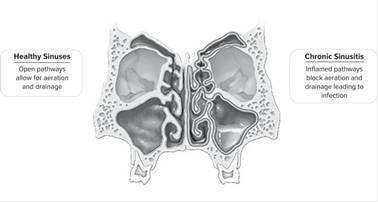

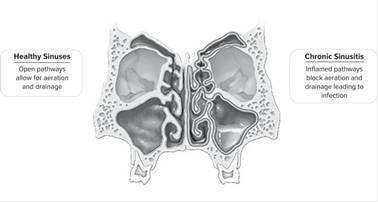

CRS and Market Opportunity

Chronic rhinosinusitis (“CRS”) is an inflammatory condition in which the sinus lining becomes swollen and inflamed, leading to significant patient morbidity including difficulty breathing, chronic headaches, recurrent infections, bodily pain and loss of sense of smell and taste. These persistent symptoms can severely impact a patient’s well-being, resulting in frequent doctor visits and can lead to chronic fatigue and depression. The condition significantly reduces work productivity from absenteeism and reduced on-the-job effectiveness, which is especially meaningful given the average CRS patient age of approximately 37 years. The debilitating patient symptoms and quality of life impairments attributed to CRS create a significant healthcare burden to patients, insurers and employers.

We believe the significant unmet need across the continuum of CRS equates to a global market of approximately $20 billion with multiple technology segments in which to compete. Included in this is a significant demand in the U.S. market. According to the Centers for Disease Control and Prevention (“CDC”), approximately 12% of the U.S. adult population, or 29

million people, are affected by CRS, making it more prevalent than heart disease and asthma. We estimate that there are more than 2 million adults with CRS who are managed by ENT physicians in the United States every year, many of whom we believe could benefit from products that incorporate our drug releasing bioabsorbable implant technology. We estimate that the total addressable market of the PROPEL family of products was approximately $650 million in 2019, of which we had a 16% penetration. We further estimate that the total addressable market of SINUVA was approximately $300 million in 2019, of which we had a 2% penetration. Our recent acquisition of Fiagon allowed us access to the estimated $250 million U.S. sinus balloon market and to expand our European presence. While our primary commercial focus is the U.S. market, the PROPEL family of products has received CE Markings, permitting them to be marketed in Europe. Our commercialization strategy considers several factors including regulatory requirements, reimbursement coverage for our products, and key opinion leader support. Our initial focus is on Germany and the United Kingdom, where we have begun to build our capabilities and develop a market, particularly with the increased adoption of PROPEL. In addition, we believe the use of SINUVA in the hospital setting, along with the increased adoption of PROPEL in the physician office setting of care, in conjunction with balloon dilation and following post-surgical debridement will contribute to early success in these markets. Going forward, we will continue to assess our capability to penetrate additional markets in Asia Pacific and Japan.

For the years ended December 31, 2021, 2020 and 2019, we generated revenue of $106.7 million, $80.6 million and $109.1 million, respectively, and incurred a net loss of $159.6 million, $72.3 million and $43.0 million, for each respective year. Our revenues have been generated predominantly from the sale of our PROPEL family of products and SINUVA, and is almost entirely derived from within the United States. No single customer accounted for more than 10% of our revenue during the years ended December 31, 2021, 2020 and 2019. As of December 31, 2021, we had an accumulated deficit of $462.7 million. The net losses are a result of our election to invest in long-term growth initiatives such as research and development, commercialization of our existing and future products, as well as enhancing our executive and management functions. For more information, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Current Treatments and Their Limitations

The treatment of CRS often entails a combination of medical management and surgical intervention to treat the underlying inflammation of the sinus lining, while addressing the secondary symptoms caused by obstruction of the natural drainage pathways. The first line of therapy for CRS is medical management, which typically includes prescribed antibiotics, anti-inflammatory steroids, and decongestants. Topical steroid sprays have poor efficacy due to their limited ability to reach the site of the disease, fast clearance of drug from the site of delivery, and poor patient compliance. Prolonged use of oral steroids may also lead to systematic complications which limit their use to short courses.

In cases where patients’ symptoms continue to persist despite medical management, a physician may recommend functional endoscopic sinus surgery (“FESS”). In the FESS procedure, the physician enlarges the inflamed and obstructed sinus pathways by displacing and/or removing inflamed tissue and bone in order to facilitate normal sinus drainage and aeration. First introduced in the United States in the 1980s, FESS is considered the standard of care for surgical intervention to treat CRS. During most procedures, the honeycomb-like cells of the ethmoid sinuses are removed, resulting in one large open cavity. ENTs may also enlarge the frontal and other sinuses by either surgically removing tissue or dilating the ostia, or opening, with a balloon.

FESS is typically performed under general anesthesia in an operating room. During the procedure, a physician inserts an endoscope into the nasal cavity to provide visualization of the patient’s anatomy. Surgical instruments, powered cutting tools and balloon dilation devices are used to remove or dilate obstructive tissue and bone. Following the surgical intervention, physicians often pack the newly opened ethmoid sinuses with gauze or other obstructive sinus packing materials to hold the sinus cavities open. Although FESS can improve symptoms and quality of life, it does not correct the underlying cause of the inflammation and patients who undergo FESS procedures often experience significant pain and require continued post-operative therapy to maintain improvements. We believe that the limitations of medical management and lack of disease resolution after FESS lead to undertreatment of many CRS patients. We estimate that only a third of patients recommended for sinus surgery proceed with the potentially beneficial procedure, which we believe is due to its limitations and high risk for additional medical management and surgical revision.

Trend for treatment in the physician office setting of care

Multiple technological advances, including balloon sinus dilation devices, have expanded the treatable CRS patient population. Sinus dilation is now utilized by physicians in their offices to treat patients with mild CRS who may not be willing to undergo or are not candidates for sinus surgery performed under general anesthesia in the operating room setting. The ability to treat patients in the office with sinus dilation has spurred interest in the ENT physician community for additional products that facilitate treatment of patients in the office setting of care.

While balloon dilation has been introduced to open frontal, maxillary and sphenoid sinuses, or dependent sinuses, in a less invasive manner, balloon dilation procedures are not designed to treat disease in the most commonly involved sinuses, the

ethmoids, and this procedure does not address the underlying inflammation associated with CRS. We believe an opportunity exists to reach these undertreated patients by providing a more effective option to address inflammatory disease, while improving the overall outcomes of FESS.

Our Product Offerings

The PROPEL Family

Our PROPEL family of steroid releasing implants are clinically proven to improve outcomes for CRS patients following sinus surgery. PROPEL implants mechanically prop open the sinuses and release mometasone furoate, an advanced corticosteroid with anti-inflammatory properties, directly into the sinus lining, and then dissolve over time. PROPEL’s safety and effectiveness is supported by Level 1a clinical evidence from multiple clinical trials, which demonstrates that PROPEL implants reduce inflammation and scarring after surgery, thereby reducing the need for postoperative oral steroids and repeat surgical interventions. The following is a description of the products in the PROPEL family.

•PROPEL is a self-expanding implant designed to conform to and hold open the surgically enlarged sinus while gradually releasing an anti-inflammatory steroid over a period of approximately 30 days and is absorbed into the body over a period of approximately six weeks. PROPEL clinical outcomes have been reported in a meta-analysis of prospective, multicenter, randomized, controlled, double-blind clinical studies to improve surgical outcomes, demonstrating a 35% relative reduction in the need for postoperative interventions compared to surgery alone. A physician may treat a patient with PROPEL by inserting it into the ethmoid sinuses.

•PROPEL Mini is a smaller version of PROPEL and is approved for use in both the ethmoid and frontal sinuses. PROPEL Mini is used preferentially by physicians compared with PROPEL when treating smaller anatomies or following less extensive procedures. PROPEL Mini has also been shown by our clinical studies to reduce the need for postoperative interventions, including a 38% relative reduction in the need for postoperative interventions in the frontal sinus, compared to surgery alone with standard postoperative care.

•PROPEL Contour is designed to facilitate treatment of the frontal and maxillary sinus ostia, or openings, of the dependent sinuses in procedures performed in both the operating room and in the office setting of care. PROPEL Contour’s lower profile, hourglass shape and malleable delivery system are designed for use in the narrow and difficult to access sinus ostia. In PROPEL Contour’s pivotal clinical study, the product demonstrated a 65% relative reduction in the need for postoperative interventions in the frontal sinus ostia compared to surgery alone with standard postoperative care as well as a 63% reduction in occlusion and 73% reduction in the need for surgical interventions.

The graphic below illustrates the operation of the PROPEL family in the ethmoid sinuses:

We designed the steroid drug release of the PROPEL products to have a duration of approximately 30 days to match the postoperative healing cycle characterized in published medical literature. We selected mometasone furoate as the anti-inflammatory agent among numerous evaluated compounds based on three important characteristics: absorbability, binding affinity and low systemic bioavailability. The compound preferentially absorbs into the sinus lining instead of the surrounding mucous fluid. The drug has a high glucocorticoid receptor binding affinity, making it highly potent in preventing inflammation once within tissue. Glucocorticoid receptors are the molecules in the surface membranes of cells throughout the body to which corticosteroids chemically bind. Additionally, the compound has low systemic bioavailability, meaning that it has negligible systemic safety side effects.

As of December 31, 2021, we estimate that approximately 3,200 accounts have stocked our PROPEL family of products for use by ENT physicians. Based on the number of units shipped as of December 31, 2021, we estimate that physicians have treated approximately 456,000 patients with our PROPEL family of products.

SINUVA

Following sinus surgery, the underlying chronic inflammation associated with CRS can lead to recurrent obstruction of the sinus cavity over time, especially in patients afflicted with polyps, a sign of severe inflammation. Improving care of such chronic patients holds meaningful opportunity to significantly reduce healthcare costs by reducing the need for revision surgery. We have designed the SINUVA steroid releasing implant to be placed in the physician office setting following a routine visit as an alternative treatment option for patients who are candidates for revision surgery. The implant is based on the same drug releasing bioabsorbable implant technology as the PROPEL family of products but is designed to have greater radial strength in order to dilate an obstructed, polyp-filled sinus cavity, and deliver drug for an extended period of time. SINUVA was subject to regulation as a drug product and we received approval from the FDA to commercialize SINUVA in the United States under an NDA. We believe SINUVA could be an appealing alternative to patients who have previously undergone FESS but continue to suffer from polyp recurrence.

Our family of drug releasing implants consists of polymers that control local drug release and provide structural support to adjacent tissues during the healing process. We believe the development, manufacturing and regulatory approval for products incorporating this technology requires capabilities in polymer science, drug delivery, analytical testing and combination products. These competencies allow our technical team to tailor drug formulation, polymer design, drug release duration, implant radial strength, and degradation period to meet different clinical needs. We may apply these competencies to the development of new products over time. Such new products, or changes that we make in the therapeutic agent used in our products will require FDA approval prior to commercialization in the United States.

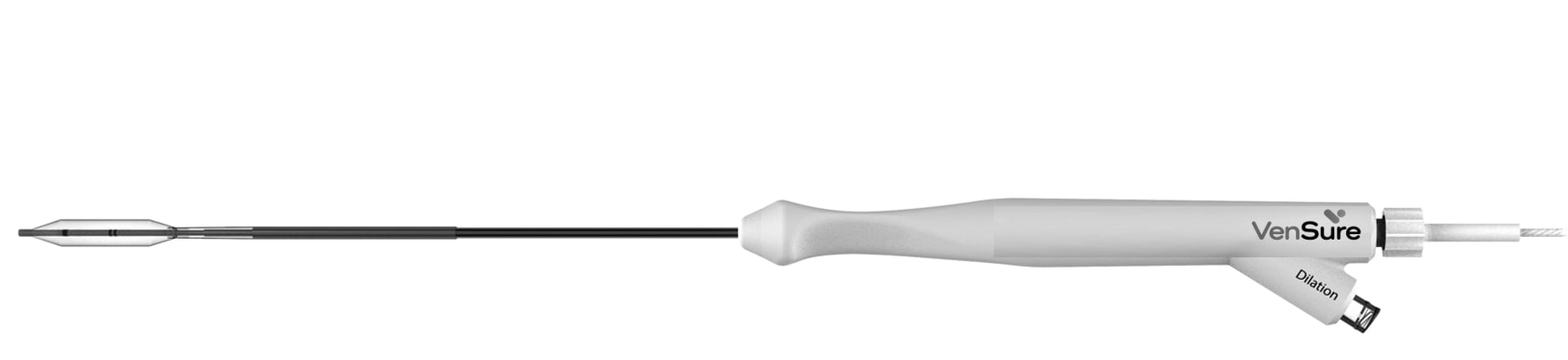

VenSure

The VenSure Navigable and Stand-alone balloon offerings are sterile, single-use devices designed to remodel the bony structures within the sinuses. The distal end of the device includes an atraumatic tip and can be shaped to fit the frontal, maxillary, and sphenoid sinuses using the bending tool provided with the device. Since the distal end of the device is re-shapeable, one balloon can be modified to work on multiple sinuses within the same patient. Both versions of the product enable a physician to track the device into the sinuses using endoscopic visualization, while the VenSure Navigable balloon allows for image-guided visualization when connected to the CUBE Navigation system. After confirmation of placement of both devices, the balloon can be inflated with saline solution, using the inflator to expand the outflow track of the targeted

sinus. A suction tube may be connected directly to the fitting of the Stand-alone balloon device to provide active suction. We believe VenSure provides for complementary use with PROPEL Contour for dilation and localized drug delivery as navigation becomes more prevalent.

CUBE Navigation

The CUBE Navigation System is an innovative virtual guidance platform for high precision ENT and ENT related skull-base surgeries. The system’s unique photo registration technology, VirtuEye™, enhances the user’s navigation experience and improves pre-surgery efficiency. This novel 4D-imaging technology mitigates common tactile tracing errors by collecting thousands of patient reference points in one camera shot. The entire photo registration process can be achieved in under 30 seconds without touching the patient. The sensor carrier containing localizer elements detects a signal within a low-energy magnetic field delivered from the navigation unit. The navigation software then displays the location of the sinus dilation instrument’s tip within multiple patient imaging planes and other anatomic renderings. CUBE can be integrated seamlessly into existing video towers and microscopes. We believe that CUBE navigation supports surgery and balloon dilation in all settings of care.

Our Technology Platform

Our drug releasing bioabsorbable implant technology consists of a polymer-based implant that is coated with a drug and polymer matrix. In fabricating the implant, we use polymers that are bioabsorbable and, over time, gradually and fully absorb into the body. The polymers chosen are materials with established safety profiles and have been used in medical devices for over 30 years.

Our implants are designed to be self-expanding, which facilitates insertion when compressed, and expand to conform to the surrounding anatomy after insertion. The ability to control radial strength is important in enabling us to address different diseases at different states. For example, in some instances an implant may be used to maintain an already open passageway. In other situations, an implant with significantly greater strength may mechanically dilate a diseased passageway.

Our expertise in drug delivery allows us to effectively pair appropriate polymer delivery matrices with desired therapeutic agents. This allows selection of a therapeutic agent based on its clinical effectiveness and tailoring of the platform accordingly. In the case of PROPEL, we considered the wide range of off-patent corticosteroids, chose the one best suited for treatment of sinus inflammation, and customized the polymer coating to achieve the desired drug delivery.

Clinical Trial Highlights

PROPEL and PROPEL Mini

PROPEL Ethmoid Sinus Studies. The safety and efficacy of PROPEL in the ethmoid sinuses has been studied in three prospective, multicenter clinical trials conducted in the United States enrolling a total of 205 patients. The principal safety and efficacy information is derived from the ADVANCE II randomized clinical trial and is supported by the ADVANCE clinical trial and an initial pilot study. A meta-analysis that pooled data from the ADVANCE II study and the initial pilot study provides

further evidence of efficacy. In all three studies, implants were placed following ethmoid sinus surgery, or ethmoidectomy, which entails removal of the honeycomb-like partitions between the ethmoid sinuses in order to create larger sinus cavities.

Compared to the control implant, the drug releasing implant provided a 35% relative reduction in postoperative interventions, a 51% relative reduction in adhesion lysis and a 40% relative reduction in oral steroid intervention. The relative reduction in frank polyposis was 46%. Additional efficacy endpoints of significant, or severe, adhesions and middle turbinate lateralization, determined by clinical investigators at the study centers, were reduced by 70% (p=0.0013) and 75% (p=0.0225), respectively.

PROPEL Mini Frontal Sinus Study. We have completed a prospective, randomized blinded multicenter clinical trial to support an expanded indication for placement of PROPEL Mini in the frontal sinuses called PROGRESS. Approximately 30% of patients undergoing sinus surgery for CRS suffer from frontal sinus disease. We enrolled 80 patients in the study using an intra-patient control design to assess both safety and efficacy of PROPEL Mini when placed following surgery of the frontal sinus, compared to surgery alone. The primary efficacy endpoint is the reduction in need for postoperative interventions such as the need for surgical intervention or oral steroids. In August 2015, we announced preliminary topline data from the PROGRESS trial, designed to evaluate the safety and efficacy of PROPEL Mini when placed in the frontal sinuses following surgery, showing that the study met its primary efficacy endpoint and demonstrating a statistically significant 38% relative reduction in the need for postoperative interventions compared to surgery alone. In March 2016, we received approval to expand the indication of PROPEL Mini to treat patients undergoing frontal sinus surgery.

PROPEL Contour

In February 2017, we received FDA approval for PROPEL Contour, a steroid releasing implant designed to facilitate treatment of the frontal and maxillary sinus ostia, or openings, of the dependent sinuses, which we believe represents opportunity for adoption in a variety of settings. In the operating room, PROPEL Contour has the potential to lead to expanded adoption of steroid releasing implants overall by providing physicians with a range of products needed to customize treatment based on their patients’ disease and anatomy. We believe PROPEL Contour’s lower profile, malleable delivery system will increase usage particularly in those patients whose frontal sinuses are more challenging to access. Since sinus surgeries typically involve treatment of one or more of the ethmoid, maxillary or frontal sinuses, we believe the PROPEL Contour greatly increases the chance that a PROPEL product will be used. We announced results of the second cohort of patients in the PROGRESS study in May 2016. This phase of the PROGRESS study was an 80-patient prospective randomized blinded multicenter trial designed to assess the safety and efficacy of PROPEL Contour when placed in the frontal sinuses following sinus surgery. This study demonstrated a statistically significant 65% relative reduction in the need for post-operative interventions, such as the need for additional surgical procedures or need for oral steroid prescription, compared to surgery alone with standard post-operative care.

SINUVA

In December 2017, we received FDA approval for SINUVA, a steroid releasing implant for the treatment of nasal polyposis in adult patients who have had ethmoid surgery. The SINUVA implant is intended to be placed in the physician office setting of care. This product’s primary mode of action is as a drug, and for this reason we were required to obtain an NDA approval from the FDA, rather than a PMA approval. In order to support the NDA application with the FDA, we completed four studies of SINUVA: a pilot study, a pharmacokinetic study, RESOLVE and RESOLVE II. In July 2016, we completed enrollment of the RESOLVE II pivotal trial, which was a prospective, multicenter, randomized, controlled, blinded study of 300 patients. Both co-primary endpoints were met, including improvement in patient-reported nasal obstruction/congestion score (p=0.0074) and reduction in bilateral polyp grade as evaluated by a panel of three sinus surgeons (p=0.0073). In addition, several pre-specified secondary endpoints were met, including the reduction in the proportion of patients still indicated for repeat sinus surgery, reduction in ethmoid obstruction, and improvement in sense of smell. The RESOLVE study (n=100) included ocular exams, and patients were followed for six months to assess longer-term outcomes. Compared to the control group, the treatment group demonstrated greater reduction from baseline to day 90 in nasal congestion/obstruction score and bilateral polyp grade (judged by an independent panel), but these primary endpoint results did not reach statistical significance (p=0.1365 and 0.0985, respectively). According to clinical investigator grading, the treatment group demonstrated statistically significant improvements in both bilateral polyp grade (p<0.02) and percent ethmoid sinus obstruction (p<0.0001) throughout the entire six-month study period. In a post-hoc analysis of nasal congestion/obstruction scores in a subset of 67 patients with at least grade 2 polyposis on each side at baseline, this outcome trended towards statistical significance in favor of the treatment group (p=0.0505). Longer-term, the study showed that at six months, control patients were at 3.6x higher risk of remaining indicated for revision surgery than treated patients. The findings from the RESOLVE study were used to inform the pivotal RESOLVE II study design.

In November 2017, we commenced the ENCORE study, a 50-patient multicenter, open-label study focused on evaluation of the safety of a repeat placement of SINUVA in a population of CRS patients with nasal polyps. Study findings

showed no serious adverse events related to the implants during the measurement period and no serious adverse events related to a repeat placement during the interval studied.

Research and Development

We continue to invest in research and development in order to expand our portfolio of products and improve our existing products. This will be achieved through a series of clinical studies on existing as well as pipeline products. We initiated our EXPAND study in the second quarter of 2021 to assess the VenSure balloon and PROPEL Contour’s collective ability to improve healing and patency rates through localized drug delivery post-balloon dilation, as well as other outcomes. The primary endpoint will be evaluated at 45 days. In order to expand our global reach, we also plan to make clinical and regulatory investments to expand PROPEL in Europe. The PROPEL OPEN registry trial will be initiated in Q3 2022 to fulfill EU Medical Device Regulation (“MDR”) requirements and generate long-term post-market data to support our commercial efforts. Other clinical trials initiated in the past include our investigational ASCEND drug-coated sinus balloon study. The ASCEND study was a prospective, randomized, blinded, multi-center trial of 70 patients that assessed the safety and efficacy of our ASCEND product. The trial did not meet its primary endpoint of frontal sinus patency grade at day 30, as judged by an independent reviewer, and was not pursued further.

Impact of the COVID-19 Pandemic

Prior to the COVID-19 pandemic, our efforts to enhance commercial execution and improve market access infrastructure were beginning to yield benefits as sales until the end of February 2020 were consistent with our expectations. However, sales declined towards the end of the first quarter and throughout the second quarter of 2020 as the various COVID-19 restrictions were implemented and remained in effect. However, we began to see meaningful change in the business environment towards the end of May with increased procedure volumes as select areas of the country eased restrictions on elective medical procedures. This trend continued from June 2020 through to the end of 2021 as we continued to see improvements in the elective procedure market. However, our business has been and will continue to be impacted by patients’ decisions to undergo sinus surgeries as ENT ASC and office procedure volumes recover. Our operations may be further impacted by COVID-19 due to changes in our manufacturing operations as a result of any future regulations or guidance issued by local and federal authorities. The COVID-19 pandemic may continue to create severe disruptions and volatility in global capital markets and increase economic uncertainty and instability.

As a result of the COVID-19 pandemic and the impact of the various restrictions implemented, we took the following actions, most of which remain in effect:

•Protected Health and Safety: Virtually all roles where physical presence for manufacturing operations was not required remained working from home, based on state and county guidelines, and non-essential business travel was limited.

•Maintained Customer Focus: All patient-support teams remained available to assist customers and patients, while strictly adhering to applicable restrictions, safety precautions and procedures.

•Reduced Costs: In response to the COVID-19 pandemic, we took pre-emptive actions in the first quarter of 2020 to curtail spending and to reduce use of cash as revenues are and will continue to be materially impacted. We also considered the incremental costs of business operations during the pandemic and expect these costs to remain until the current crisis subsides. The cost reduction actions included a) reducing our workforce by approximately 25% and furloughing an additional 5% of our workforce, b) substantially reducing new hiring, c) suspending near-term production, d) reducing discretionary operating expenses and capital expenditures, and e) delaying clinical research projects. As a result of these actions, we achieved significant cost reductions that, along with an improved operating environment as the pandemic restrictions eased, allowed us to meet our target liquidity levels at year end. We expect cost control measures to remain in place until the current crisis subsides. However, we will still continue to support our customers, physicians and patients.

We continue to remain flexible in our approach to continuing our operations in light of rapidly developing laws and restrictions surrounding the COVID-19 pandemic.

Seasonality

We expect revenue from our PROPEL family of products, SINUVA, VenSure, CUBE, and accessories to fluctuate from quarter to quarter due to seasonal variations in the volume of sinus surgery procedures performed, which has been impacted historically by factors including the status of patient healthcare insurance plan deductibles and the seasonal nature of allergies, which can impact sinus-related symptoms.

Competition

Our industry is highly competitive, subject to change and significantly affected by new product introductions and other activities of industry participants. Many of the companies developing or marketing ENT products are publicly traded companies, including Medtronic Inc., Olympus Corp., Johnson & Johnson, Stryker Corp., Lyra Therapeutics, and Smith & Nephew Group PLC. These companies could develop drug releasing products that could compete with our products and most of these companies enjoy several competitive advantages, including:

•greater financial and human capital resources;

•significantly greater name recognition;

•established relationships with ENT physicians, referring physicians, customers and third-party payors;

•additional lines of products, and the ability to offer rebates or bundle products to offer greater discounts or incentives to gain a competitive advantage; and

•established sales, marketing and worldwide distribution networks.

Because of the size of the market opportunity for the treatment of CRS, potential competitors have historically dedicated and will continue to dedicate significant resources to aggressively promote their products or develop new products. New product developments that could compete with us more effectively are possible because of the prevalence of CRS and the extensive research efforts and technological progress that exist within the market. Large medical device companies with ENT divisions, such as Medtronic, also have capability in drug releasing stents. Companies may also market alternatives to current modes of treatment, such as OptiNose. Finally, there are established pharmaceutical companies marketing monoclonal antibodies for the treatment of CRS, such as Regeneron Pharmaceuticals, Inc.’s Dupixent for CRS with nasal polyposis.

Further, several more cost-effective alternatives exist to our products which include, but are not limited to: oral steroids, packing materials, spacers, and off-label practices not supported by clinical data. While we believe our products have significant advantages over sinus packing materials, spacers and other treatment options, they are expensive relative to packing materials and may not be fully reimbursed by third-party payors. As a result, ENT physicians may choose to use oral steroid delivery or packing/spacing materials or a combination of the two, which are less expensive, in lieu of our products.

We believe that our continued ability to compete favorably depends on:

•expanding our commercial operations to incorporate acquired products, customers, and new markets;

•continuing to innovate and maintain scientifically-advanced technology;

•having reimbursement in place to support broad adoption of our products;

•developing technologies for applications in the sinuses and other areas of ENT;

•attracting and retaining skilled personnel;

•obtaining patents or other intellectual property protection for our products; and

•conducting clinical studies and obtaining and maintaining regulatory approvals.

Intellectual Property

As of December 31, 2021, we owned 193 issued patents globally, of which 50 were issued U.S. patents, and we owned 109 pending patent applications globally, of which 22 were pending patent applications in the United States. Subject to payments of required maintenance fees, annuities and other charges, our issued patents have expiration dates between 2024 and 2039, of which 40 will expire between 2024 and 2027, and the remaining 153 will expire after 2027. While we have patents expiring in the relative near term related to our initial patent filings, we believe that our patent portfolio will continue to have sufficient scope and coverage to adequately protect our commercial products.

As of December 31, 2021, our trademark portfolio contained 90 trademark registrations, 13 of which were U.S. trademark registrations, as well as 25 pending trademark applications, 11 of which were U.S. trademark applications.

We also rely upon trade secrets, know-how, continuing technological innovation, and may rely upon licensing opportunities in the future, to develop and maintain our competitive position. We protect our proprietary rights through a variety of methods, including confidentiality agreements and proprietary information agreements with suppliers, employees, consultants and others who may have access to proprietary information.

Manufacturing and Supply

We predominantly manufacture our steroid releasing implants at our facility in Menlo Park, California with components supplied by external suppliers. CUBE navigation equipment and instruments are manufactured in Hennigsdorf, Germany, and VenSure sinus dilation balloons are procured from a third-party manufacturer located in the U.S. We perform inspections of these components before use in our manufacturing operations. Using these components, we assemble, inspect, test and package our implants, and send them to a third-party sterilization vendor. After sterilization, we perform inspections of the finished implants internally and via third-party laboratories to determine compliance with our specifications, after which we place the implants into our inventory and ultimately ship the finished products to customers. In addition, with the acquisition of Fiagon, we inherited the relationships with their existing distribution network which allows us to expand our global reach.

The active pharmaceutical ingredient (“API”) and a number of our critical components used in our implants are supplied to us from single source suppliers. We rely on single source suppliers for some of our polymer materials, extrusions, molded components, and off-the-shelf components. Our ability to commercially supply our products and to develop our product candidates depends, in part, on our ability to successfully obtain the API and polymer materials used in these products in accordance with regulatory requirements and in sufficient quantities for commercialization and clinical testing. We have manufacturing, supply or service agreements with a number of our single source suppliers. Each of these suppliers manufactures the components they produce for us or tests our components and devices to our specifications. For example, in January 2020, we extended the agreement we had entered into in 2014 with Hovione Inter Ltd. (“Hovione”) pursuant to which we are required to purchase 80% of our API produced according to our specifications from Hovione, in quantities to be specified in 12-month forecasts provided by us and updated on a quarterly basis. This agreement is in effect until January 2025. In addition, we have agreements with companies that provide sterilization services and analytical testing for our products, as well as suppliers from which we purchase injection molded components to our specifications, our API and our customized packaging components. We typically seek to negotiate new agreements with these vendors in advance of the expiration of the current agreements. We intend to maintain sufficient supplies of the API and components from these single source suppliers in the event that our agreements with one or more of these suppliers were to terminate to enable us to continue to manufacture our implants for a sufficient amount of time necessary to obtain another source of API or components. To date, we have not experienced any significant supply constraints or delays in procuring components and materials despite the COVID-19 pandemic, and while our suppliers have generally met our demand for their products or services on a timely basis in the past, they may be unable or unwilling to meet our needs in the future.

We continue to improve our manufacturing capabilities and increase capacity as we plan for enhanced commercialization of our portfolio of products. We are committed to continuous improvement and to maintaining compliance with applicable regulations. We have facilities that are FDA-registered medical device and facilities that are FDA-registered drug manufacturers. Additionally, our facilities are ISO certified, as applicable. We are required to maintain compliance with the regulations required for the countries we distribute our products. We are periodically audited by such agencies, including the FDA and European regulatory authorities (“Notified Bodies”) as applicable. During 2020, we extended the lease term of the Menlo Park facility to December 31, 2027.

Government Regulation

United States Regulation of Medical Devices and Drugs