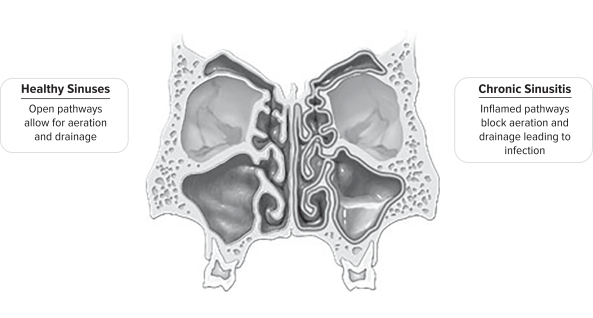

and bacteria. To clear these inhaled pathogens, the sinus lining secretes mucus which is then cleared away by small, hair-like structures called cilia, which act in coordination to sweep the mucus through the sinus pathways and out through the back of the throat.

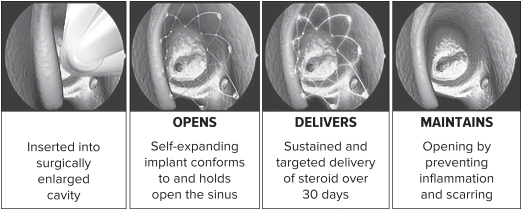

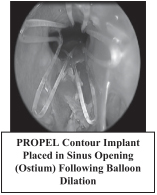

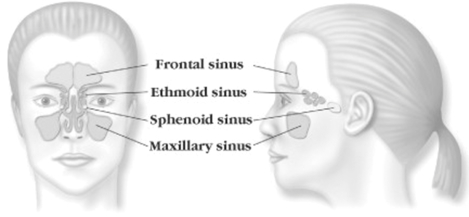

The ethmoid sinuses, which lie between the eyes, are a series of small cells with multiple, often interconnected openings in a honeycomb-like formation. These sinuses serve as the central aeration and drainage pathway for all other sinuses. The frontal, maxillary and sphenoid sinuses are known as dependent sinuses, as they each consist of one large cell that drains through an opening, or ostium, into the ethmoid sinus.

Chronic sinusitis is an inflammatory condition in which the sinus lining becomes swollen and inflamed, leading to significant patient morbidity including difficulty breathing, chronic headaches, recurrent infections, bodily pain and loss of sense of smell and taste. These persistent symptoms can severely impact a patient’s well-being, resulting in frequent doctor visits and can lead to chronic fatigue and depression. The condition significantly reduces work productivity from absenteeism and reduced

on-the-job

effectiveness, which is especially meaningful given the average chronic sinusitis patient age of approximately 37 years.

4