June 22, 2018

Office of Healthcare and Insurance

Division of Corporation Finance

Securities and Exchange Commission

100 F Street NE

Washington, D.C. 20549

U.S.A.

| Attention: | Mark Brunhofer |

| Keira Nakada |

China Life Insurance Company Limited

Form 20-F for the Fiscal Year Ended December 31, 2017

Dear Mr. Mark Brunhofer and Ms. Keira Nakada:

We refer to your letter, dated June 11, 2018 (the “Comment Letter”), to China Life Insurance Company Limited (the “Company”) containing comments of the Staff of the Securities and Exchange Commission (the “Staff”) relating to the Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2017 (File No. 001-31914) (the “2017 Form 20-F”).

The Company is grateful for the comments from the Staff, and has carefully considered the matters raised in the Comment Letter. On behalf of the Company, we have set forth below their response to the Comment Letter.

Comment:

Item 5. Operating and Financial Review and Prospects

Factors Affecting Our Results of Operations

Investments, page 91

| 1. | Please address the following regarding your available for sale investments in the tables on page 93: |

| • | Explain to us the reason for the increase in fair value of debt securities in an unrealized loss position for more than one year to RMB 45.8 billion at December 31, 2017 compared to December 31, 2016 and the reason for the increase in the related unrealized losses both in terms of renminbi amount and as a percentage of the fair value of those debt securities. Provide your explanations segregated by the types of securities presented in the first table on page 93 (e.g., government bonds, government agency bonds, etc.). |

1

Response:

As presented in the first table on page 93 of the 2017 Form 20-F, the Company’s investment in debt securities include government bonds, government agency bonds, corporate bonds, subordinated bonds/debt and other debt securities. The increase in fair value of these five types of debt securities in an unrealized loss position for more than one year and the increase in the proportion of loss amounts to carrying amounts is primarily due to the increase in Chinese interest rates from the fourth quarter of 2016 to 2017.

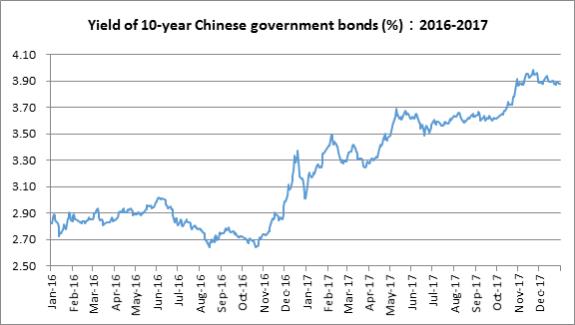

The diagram below is the yield to maturity of 10-year Chinese government bonds from 2016 to 2017. As the diagram shows, the yield to maturity of 10-year government bonds increased since the fourth quarter of 2016 and the trend extended to 2017.

Because changes in the fair value of all types of debt securities are inversely related to changes in interest rates, the fair value of an increasing number of debt securities declined to below its original carrying value since the fourth quarter of 2016 when the interest rates in the Chinese market started to increase. The following tables set out the breakdown of debt securities in an unrealized loss position for more than one year as of December 31, 2017 and debt securities in an unrealized loss position as of December 31, 2016.

2

Breakdown of debt securities in an unrealized loss position for more than one year as of December 31, 2017:

| As of December 31, 2017 | ||||||||||||

| Unrealized losses | Carrying amounts | Unrealized losses as a percentage of carrying amounts |

||||||||||

| (RMB in millions) | ||||||||||||

| Debt securities |

||||||||||||

| Government bonds |

214 | 1,386 | 15 | % | ||||||||

| Government agency bonds |

3,706 | 25,671 | 14 | % | ||||||||

| Corporate bonds |

1,276 | 17,213 | 7 | % | ||||||||

| Subordinated bonds/debt |

47 | 1,053 | 4 | % | ||||||||

| Other |

31 | 465 | 7 | % | ||||||||

| Total |

5,274 | 45,788 | 12 | % | ||||||||

Breakdown of debt securities in an unrealized loss position as of December 31, 2016:

| As of December 31, 2016 | 0-6 months |

7-12 months | More than 12 months |

Total | ||||||||||||

| (RMB in millions) | ||||||||||||||||

| Debt securities |

||||||||||||||||

| Government bonds |

||||||||||||||||

| Unrealized losses |

2 | — | 107 | 109 | ||||||||||||

| Carrying amounts |

19 | — | 1,473 | 1,492 | ||||||||||||

| Unrealized losses as a percentage of carrying amounts |

11% | 0% | 7% | 7% | ||||||||||||

| Government agency bonds |

||||||||||||||||

| Unrealized losses |

785 | — | 2 | 787 | ||||||||||||

| Carrying amounts |

24,675 | — | 187 | 24,862 | ||||||||||||

| Unrealized losses as a percentage of carrying amounts |

3% | 0% | 1% | 3% | ||||||||||||

| Corporate bonds |

||||||||||||||||

| Unrealized losses |

408 | 40 | 90 | 538 | ||||||||||||

| Carrying amounts |

21,524 | 1,040 | 1,296 | 23,860 | ||||||||||||

| Unrealized losses as a percentage of carrying amounts |

2% | 4% | 7% | 2% | ||||||||||||

| Subordinated bonds/debt |

||||||||||||||||

| Unrealized losses |

27 | — | — | 27 | ||||||||||||

| Carrying amounts |

1,772 | — | — | 1,772 | ||||||||||||

| Unrealized losses as a percentage of carrying amounts |

2% | 0% | 0% | 2% | ||||||||||||

| Other |

||||||||||||||||

| Unrealized losses |

— | — | 1 | 1 | ||||||||||||

| Carrying amounts |

154 | — | 148 | 302 | ||||||||||||

| Unrealized losses as a percentage of carrying amounts |

0% | 0% | 1% | 0% | ||||||||||||

| Total |

||||||||||||||||

| Unrealized losses |

1,222 | 40 | 200 | 1,462 | ||||||||||||

| Carrying amounts |

48,144 | 1,040 | 3,104 | 52,288 | ||||||||||||

| Unrealized losses as a percentage of carrying amounts |

3% | 4% | 6% | 3% | ||||||||||||

3

By comparing the unrealized losses of debt securities in an unrealized loss position for less than 6 months as of December 31, 2016 and the unrealized losses of debt securities in an unrealized loss position for more than one year as of December 31, 2017 presented in the tables above, you will find that:

(i) As of December 31, 2016, the carrying value of debt securities in an unrealized loss position for less than 6 months was RMB 48,144 million, accounting for 92% of the debt securities in an unrealized position, which shows that the Company started to incur unrealized losses for a growing amount of debt securities since the second half of 2016; and

(ii) Since the interest rate continued to increase in 2017 and the Company still held the majority of the debt securities in an unrealized loss position, these debt securities, which were previously in an unrealized loss position for less than six months, remained in an unrealized loss position and as a result were presented as debt securities in an unrealized loss position more than one year. Accordingly, the amount of unrealized losses of these debt securities and the proportion of unrealized loss amounts to carrying amounts further increased as of the end of 2017. As of December 31, 2017, the increase in unrealized losses is primarily due to the Company’s investments in government agency bonds and corporate bonds, which accounted for 94% of total unrealized losses of debt securities in an unrealized loss position for more than one year.

Comment:

| • | Reconcile for us why the RMB 3,562 million difference between the aggregate cost/amortized cost at December 31, 2017 of RMB 814,296 million and the aggregate estimated fair value of RMB 810,734 million is not the same as the RMB 1,717 million net unrealized losses derived from the disclosed gross unrealized gains of RMB 25,120 million net of gross unrealized losses of RMB 26,837 million. |

Response:

Please find the reconciliation table as below:

| 2017/12/31 | RMB in million | |||

| Aggregate cost/amortized cost |

814,296 | |||

| Add: Gross unrealized gains |

25,120 | |||

| Gross unrealized losses |

(26,837 | ) | ||

| Impairment |

(1,845 | ) | ||

|

|

|

|||

| Aggregate estimated fair value |

810,734 | |||

|

|

|

|||

The difference of RMB 1,845 million is the incurred impairment of available-for-sale investments for the year ended December 31, 2017, which is presented in accordance with the Company’s accounting policy in “Impairment of financial assets other than securities at fair value through profit or loss.” (see page 101 of the 2017 Form 20-F).

4

Comment:

B. Liquidity and Capital Resources

Contractual Obligations and Commitments, page 124

| 2. | According to your disclosure following the table on page 124, you include both cash inflows and cash outflows associated with insurance contracts and investment contracts in your table. Please tell us how your net presentation complies with Item 5F of Form 20-F and the nature of and amount of cash inflows netted in each column for each of these line items in your table. |

Response:

Cash inflows of insurance contracts and investment contracts mainly include cash inflows of future premiums (renewal premiums) arising from the undertaking of insurance obligations, while cash outflows mainly include cash outflows incurred to fulfil contractual obligations such as guaranteed benefits based on contractual terms, additional non-guaranteed benefits and reasonable expenses incurred to manage insurance contracts or to process claims.

Item 5.F of the Form 20-F requires registrants to present cash requirements arising from contractual obligations, in order to assist in understanding an issuer’s liquidity and capital resources. The Company believes its net presentation appropriately reflects its obligations in respect of its insurance contracts and investment contracts and complies with Item 5.F in following aspects:

| a) | The cash outflows incurred to fulfil contractual obligations under the insurance contracts and investment contracts are closely related to the cash inflows from such contracts. Only as policyholders pay the renewal premiums of the contract provisions over time will the insurance company have the obligation to pay benefits under the insurance contracts; otherwise the insurance policy ceases to be in effect. For both insurance and investment contracts, if there is no future cash inflows, the corresponding future cash outflows will be reduced. Accordingly, if the Company only shows cash outflows of the insurance contract and investment contracts rather than net cash flows, the Company believes that its obligations under its insurance contracts and investment contracts will be overstated. |

| b) | The Company’s management uses net cash flows to make budget estimates, assess liquidity gap and analyze funding needs, among other purposes. The presentation of net cash flows is consistent with the Company’s accounting policy, as well as the cash requirements of its insurance contracts. The Company’s accounting policy provides, “the reasonable estimate of liability for long-term insurance contracts is the present value of reasonable estimates of future cash outflows less future cash inflows.”(page F-29). Pursuant to the instructions to Item 5.F of the Form 20-F, the contractual obligations in the table required by Item 5.F.1 should be based on the classifications used in the generally accepted accounting principles under which the company prepares its primary financial statements. Accordingly, the Company believes it is appropriate for it to present the net cash flows in Item 5.F. |

The Company further notes that many insurance companies listed in United States (including MetLife, Inc., Prudential Financial, Inc., AXA Equitable Life Insurance Company and Voya Insurance) also present the net amount of future cash flows involving the future premium income in the corresponding part of their annual reports on Form 10-K. Therefore, the Company considers its presentation is in line with the general practice of disclosure of the insurance industry.

5

Comment:

Notes to the Consolidated Financial Statements

Note 4: Risk Management

Note 4. 3: Fair Value Hierarchy, page F-48

| 3. | Please address the following comments regarding your fair value and fair value hierarchy disclosures: |

| • | Tell us how your disaggregation of your investments into only debt securities and equity securities qualifies as appropriate classes under paragraph 94 of IFRS 13 and paragraph 6 of IFRS 7. In this regard, it appears that your disaggregation presented in the first table on page 93 may be more appropriate. |

Response:

Paragraph 94 of IFRS13 requires the entity to determine appropriate classes of assets and liabilities on the basis as following: a) the nature, characteristics and risks of the asset or liability; and b) the level of the fair value hierarchy within which the fair value measurement is categorized. In addition, it states that the number of classes may need to be greater for fair value measurements categorized within Level 3 of the fair value hierarchy, and the determination of appropriate classes of assets and liabilities for which disclosures about fair value measurements should be provided requires judgment. Paragraph 6 of IFRS 7 requires the disclosure of financial instrument by class as well, which is very similar to the aforementioned paragraph 94 a) of IFRS 13.

The Company disclosed the breakdown of the available for sale securities and securities at fair value through profit and loss by security type in Note 9.5 (page F-67) and Note 9.6 (page F-69) of the consolidated financial statements, respectively, contained in the 2017 Form 20-F, which the Company believes complies with the requirements in paragraph 94 a) of IFRS 13. The Company provided fair value hierarchy disclosure in Note 4.3 (pages F-48 & 49) of the consolidated financial statements, which the Company believes complies with the requirements in paragraph 94 b) of IFRS 13.

The Company disaggregated the financial instruments in the fair value hierarchy into equity and debt securities but not into security type. The majority of equity securities of the Company are stock shares and mutual funds whose fair values are linked closely to the performance of equity capital markets. The majority of debt securities of the Company are government bonds, government agency bonds and corporate bonds whose fair value are mainly affected by changes in market interest rates. The Company’s management usually reviews the investment performance by the category of debt and equity investments. It believes that the current disaggregation ensures information about the fair value measurement of financial instruments with different characteristics and risks are not presented together. As to Level 3, the Company did not disclose a further disaggregation because the assets under Level 3 accounted for only a small proportion (about 5% at December 31, 2017) of the total assets, and their fair value is not significantly sensitive to a significant change of unobservable inputs.

The Company notes that others in the insurance industry present disaggregated securities similar to the Company’s presentation. An IASB staff paper for the meeting on IASB Project Post-implementation Review of IFRS 13 Fair Value Measurement recommended that the IASB provide more guidance on how to disaggregate, and provide illustrative examples or case studies of good disaggregation. The Company will continue to follow this IASB project closely and optimize its disaggregation according to the latest developments.

6

Comment:

| • | Tell us why you do not provide information in your tables beginning on page F-49 for your held-to-maturity securities. In this regard, paragraph 97 of IFRS 13 requires the disclosure of some information from paragraph 93 of that standard for each class of assets and liabilities not measured at fair value on your balance sheet if fair value information is required to be disclosed by another standard. It appears that paragraph 25 of IFRS 7 requires fair value information for all financial assets and liabilities, not just those carried at fair value on either a recurring or non-recurring basis. |

Response:

Page F-49 presents the quantitative disclosures of fair value measurement hierarchy for assets and liabilities measured at fair value as at year end. The hierarchy of held-to-maturity securities is disclosed in Note (ii) of 10 “Fair value on financial assets and liabilities” on F-70.

Comment:

| • | Tell us your consideration for disclosing the specific valuation techniques used to value each class of your Level 2 investments and the related inputs as stipulated in paragraph 93(d) of IFRS 13. |

Response:

Paragraph 93 (d) of IFRS 13 requires a description of the valuation technique(s) and the inputs used in the fair value measurement categorized within Level 2 and Level 3.

The composition of fair value measurement categorized within Level 2 mainly included two categories: a) stocks and bonds with recent quoted market prices available from China’s exchange market and interbank market (except for those with a quoted market price at the reporting date which were categorized in Level 1); and b) bonds without recent quoted market prices whose valuations were generally obtained from third party pricing services. The proportion of these assets within the Level 2 assets was 30% and 61% at December 31, 2017, respectively.

For bonds described in b) above without recent quoted market prices, the Company uses the valuation results provided by the China Central Depository & Clearing Co., Ltd., which conducts valuations through widely accepted valuation techniques (discounted cash flow method). This pricing service provider is the most publicly recognized pricing service provider in China, and the Company understands that its pricing information is used by the mutual fund industry and almost all companies in China. This pricing service provider typically gathers, analyzes and interprets information related to market transactions and other key valuation model inputs from multiple sources.

In Note 4.3 to the consolidated financial statements on F-48, the Company described the valuation techniques and observable market inputs, and the Company’s practice to apply the valuation of the pricing service provider. On page 102 of the 2017 Form 20-F, the Company described the authoritativeness of the pricing services provider and the specific valuation technique it used in valuation for bonds.

7

Comment:

| • | Tell us why you do not appear to provide the quantitative information about the significant unobservable inputs used in the fair value measurement of your Level 3 investments as required by paragraph 93(d) of IFRS 13. To the extent you rely upon the further guidance in that paragraph indicating that you are not required to create the quantitative information if it is supplied by a third-party pricing service, tell us how the quantitative information is not reasonably available to you considering your disclosure in the second paragraph on page F-48 indicating the validation procedures you undertake associated with values received from pricing services. |

The quantitative information of Level 3 is available as all of the unobservable inputs of Level 3 investments are developed by the Company’s internal valuation team or the employed pricing services. The Company’s considerations for not having the disclosures on the quantitative information about the significant unobservable inputs in the fair value measurement of Level 3 investments in the financial report are as follows:

| a) | The level 3 investments only accounted for 5% of the total assets as of December 31, 2017. The Company’s evaluation showed that the fair value of Level 3 investments was not significantly sensitive to reasonable changes in the unobservable inputs used in fair value. |

| b) | The Company invests in a diversified Level 3 portfolio, such as unlisted equities, private equity funds, debt investment schemes, trust schemes and preferred stocks. The valuation techniques and unobservable inputs vary for different investment products, which would lead to a redundant disclosure with less focus. |

Moreover, the Discussion Paper published by IFRS Foundation in Mar 2017, Disclosure Initiative-Principles of Disclosures proposed seven principles of effective communication, one of which encouraged the information provided to be described in as simple and direct a manner as possible, without a loss of material information and without unnecessarily increasing the length of the financial statements. The Company believes that eliminating redundant and immaterial disclosure is an important facet of providing investors with useful disclosure as well. Accordingly, the Company believes that the current disclosure made by the Company is consistent with IFRS and best disclosure principles.

* * * * *

If you have any questions or comments regarding the foregoing, please contact the undersigned at +4420 7786 9010 or jcscoville@debevoise.com.

| Very truly yours, |

| /s/ James C. Scoville |

| James C. Scoville |

8