Table of Contents

As filed with the Securities and Exchange Commission on April 25, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-31914

中国人寿保险股份有限公司

(Exact name of Registrant as specified in its charter)

China Life Insurance Company Limited

(Translation of Registrant’s name into English)

People’s Republic of China

(Jurisdiction of incorporation or organization)

16 Financial Street

Xicheng District

Beijing 100033, China

(Address of principal executive offices)

Yinghui Li

16 Financial Street

Xicheng District

Beijing 100033, China

Tel: (86-10) 6363 1191

Fax: (86-10) 6657 5112

Email: liyh@e-chinalife.com

(Name, Telephone, Email and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| American depositary shares | New York Stock Exchange | |

| H shares, par value RMB 1.00 per share | New York Stock Exchange* |

| * | Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares, each representing 5 H shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2017, 7,441,175,000 H shares and 20,823,530,000 A shares, par value RMB 1.00 per share, were issued and outstanding. H shares are listed on the Hong Kong Stock Exchange. A shares are listed on the Shanghai Stock Exchange. Both H shares and A shares are ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes ☐ No

If this report is an annual report or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐ | ||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S.GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Table of Contents

CHINA LIFE INSURANCE COMPANY LIMITED

| 1 | ||||||

| 2 | ||||||

| PART I | 4 | |||||

| Item 1. |

4 | |||||

| Item 2. |

4 | |||||

| Item 3. |

4 | |||||

| A. |

4 | |||||

| B. |

9 | |||||

| C. |

9 | |||||

| D. |

9 | |||||

| Item 4. |

28 | |||||

| A. |

28 | |||||

| B. |

31 | |||||

| C. |

86 | |||||

| D. |

88 | |||||

| Item 4A. |

88 | |||||

| Item 5. |

88 | |||||

| A. |

105 | |||||

| B. |

121 | |||||

| C. |

124 | |||||

| D. |

124 | |||||

| E. |

125 | |||||

| F. |

125 | |||||

| Item 6. |

125 | |||||

| A. |

125 | |||||

| B. |

132 | |||||

| C. |

134 | |||||

| D. |

135 | |||||

| E. |

136 | |||||

| Item 7. |

136 | |||||

| A. |

136 | |||||

| B. |

137 | |||||

| C. |

150 | |||||

| Item 8. |

150 | |||||

| A. |

Consolidated Financial Statements and Other Financial Information |

150 | ||||

| B. |

152 | |||||

| C. |

152 | |||||

| Item 9. |

158 | |||||

| Item 10. |

159 | |||||

| A. |

159 | |||||

| B. |

159 | |||||

| C. |

174 | |||||

| D. |

175 | |||||

| E. |

175 | |||||

i

Table of Contents

| F. |

184 | |||||

| G. |

184 | |||||

| H. |

184 | |||||

| I. |

184 | |||||

| Item 11. |

184 | |||||

| Item 12. |

193 | |||||

| A. |

193 | |||||

| B. |

193 | |||||

| C. |

193 | |||||

| D. |

193 | |||||

| 194 | ||||||

| Item 13. |

194 | |||||

| Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

194 | ||||

| A. |

194 | |||||

| B. |

194 | |||||

| Item 15. |

195 | |||||

| Item 16A. |

196 | |||||

| Item 16B. |

196 | |||||

| Item 16C. |

196 | |||||

| Item 16D. |

196 | |||||

| Item 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

196 | ||||

| Item 16F. |

197 | |||||

| Item 16G. |

197 | |||||

| Item 16H. |

200 | |||||

| 200 | ||||||

| Item 17. |

200 | |||||

| Item 18. |

200 | |||||

| Item 19. |

200 | |||||

ii

Table of Contents

This annual report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements state our intentions, beliefs, expectations or predictions for the future, in particular under “Item 4. Information on the Company”, “Item 5. Operating and Financial Review and Prospects” and “Item 8. Financial Information—Embedded Value”.

The forward-looking statements include, without limitation, statements relating to:

| • | future developments in the insurance industry in China; |

| • | changes in interest rates and other economic and business conditions in China; |

| • | the industry regulatory environment as well as the industry outlook generally; |

| • | the amount and nature of, and potential for, future development of our business; |

| • | the outcome of litigation and regulatory proceedings that we currently face or may face in the future; |

| • | our business strategy and plan of operations; |

| • | the prospective financial information regarding our business; |

| • | our dividend policy; and |

| • | information regarding our embedded value. |

In some cases, we use words such as “believe”, “intend”, “anticipate”, “estimate”, “project”, “forecast”, “plan”, “potential”, “will”, “may”, “should” and “expect” and similar expressions to identify forward-looking statements. All statements other than statements of historical facts included in this annual report, including statements regarding our future financial position, strategy, projected costs and plans and objectives of management for future operations, are forward-looking statements. Although we believe that the expectations reflected in those forward-looking statements are reasonable, we can give no assurance that those expectations will prove to have been correct, and you are cautioned not to place undue reliance on such statements. Important factors that could cause actual results to differ materially from our expectations are disclosed under “Item 3. Key Information—Risk Factors” and elsewhere in this annual report, including in conjunction with the forward-looking statements included in this annual report. We undertake no obligation to publicly update or revise any forward-looking statements contained in this annual report, whether as a result of new information, future events or otherwise, except as required by law. All forward-looking statements contained in this annual report are qualified by reference to this cautionary statement.

1

Table of Contents

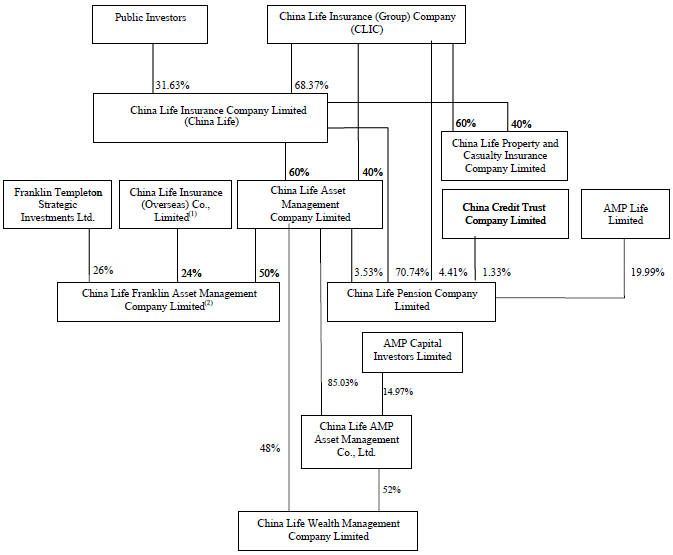

References in this annual report to “we”, “us”, “our”, the “Company” or “China Life” mean China Life Insurance Company Limited and, as the context may require, its subsidiaries. References to “CLIC” mean China Life Insurance (Group) Company and, as the context may require, its subsidiaries, other than China Life. References in this annual report to “AMC” mean China Life Asset Management Company Limited, the asset management company established by us with CLIC on November 23, 2003. References to “CLPCIC” mean China Life Property and Casualty Insurance Company Limited, the property and casualty company established by us with CLIC on December 30, 2006. References to “China Life Pension” mean China Life Pension Company Limited established by us, CLIC and AMC on January 15, 2007.

The statistical and market share information contained in this annual report has been derived from government sources, including the China Insurance Yearbook 2015, the China Insurance Yearbook 2016, the China Insurance Yearbook 2017 and other public sources. The information has not been verified by us independently. Unless otherwise indicated, market share information set forth in this annual report is based on premium information as reported by the CIRC. The reported information includes premium information that is not determined in accordance with HKFRS, U.S. GAAP or IFRS.

References to “A shares” mean the RMB ordinary shares which have been listed on the Shanghai Stock Exchange since January 9, 2007.

References to the “CIRC” mean the China Insurance Regulatory Commission, which was established in 1998 and merged with the China Banking Regulatory Commission in April 2018. References to the “CBRC” mean the China Banking Regulatory Commission, which was established in 2003 and merged with the CIRC in April 2018. References to “CBIRC” mean the China Banking and Insurance Regulatory Commission, which was established in April 2018 as a result of the merger of CIRC and CBRC. In this annual report, references to the “CIRC” mean the China’s insurance regulator prior to April 2018 and references to the “CBIRC” mean the China’s insurance regulator after April 2018, as the context may require.

References to “China” or “PRC” mean the People’s Republic of China, excluding, for purposes of this annual report, Hong Kong, Macau and Taiwan. References to the “central government” mean the government of the PRC. References to “State Council” mean the State Council of the PRC. References to “MOF” or “Ministry of Finance” mean the Ministry of Finance of the PRC. References to “Ministry of Commerce” mean the Ministry of Commerce of the PRC. References to “SAFE” mean the State Administration of Foreign Exchange of the PRC. References to “SAIC” mean the State Administration for Industry and Commerce of the PRC.

References to “HKSE” or “Hong Kong Stock Exchange” mean The Stock Exchange of Hong Kong Limited. References to “NYSE” or “New York Stock Exchange” mean the New York Stock Exchange. References to “SSE” or “Shanghai Stock Exchange” mean the Shanghai Stock Exchange.

References to “IFRS” mean the International Financial Reporting Standards as issued by the International Accounting Standards Board, references to “U.S. GAAP” mean the generally accepted accounting principles in the United States, references to “HKFRS” mean the Hong Kong Financial Reporting Standards, issued by the Hong Kong Institute of Certified Public Accountants, and references to “PRC GAAP” mean the PRC Accounting Standards for Business Enterprises applicable to companies listed in the PRC. Unless otherwise indicated, our financial information presented in this annual report has been prepared in accordance with IFRS.

2

Table of Contents

References to “Renminbi” or “RMB” in this annual report mean the currency of the PRC, references to “U.S. dollars” or “US$” mean the currency of the United States of America, and references to “Hong Kong dollars”, “H.K. dollars” or “HK$” mean the currency of the Hong Kong Special Administrative Region of the PRC.

Unless otherwise indicated, translations of RMB amounts into U.S. dollars for presentation only in this annual report have been made at the rate of US$ 1.00 to RMB 6.5063, the noon buying rate in the City of New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York on December 29, 2017. No representation is made that Renminbi amounts could have been, or could be, converted into U.S. dollars at that rate on December 29, 2017 or at all. Translations of foreign currency amounts into RMB amounts for the purpose of preparing our audited consolidated financial statements included elsewhere in this annual report or our previous annual reports have been made at the exchange rates published by the PBOC.

Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

If there is any discrepancy or inconsistency between the Chinese names of the PRC entities in this annual report and their English translations, the Chinese version shall prevail.

3

Table of Contents

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS.

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE.

Not applicable.

Selected Historical Consolidated Financial Data

The following tables set forth our selected consolidated financial information for the periods indicated. We have derived the consolidated financial information from our audited consolidated financial statements included elsewhere in this annual report or our previous annual reports.

We prepare our consolidated financial statements in accordance with IFRS as issued by the IASB.

You should read this information in conjunction with the rest of the annual report, including our audited consolidated financial statements and the accompanying notes, “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report and the independent registered public accounting firm’s reports.

4

Table of Contents

| For the year ended December 31, | ||||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| Consolidated Statement of Comprehensive Income | (in millions except for per share data) | |||||||||||||||||||||||

| Revenues |

||||||||||||||||||||||||

| Gross written premiums |

326,290 | 331,010 | 363,971 | 430,498 | 511,966 | 78,688 | ||||||||||||||||||

| Less: premiums ceded to reinsurers |

(556 | ) | (515 | ) | (978 | ) | (1,758 | ) | (3,661 | ) | (563 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net written premiums |

325,734 | 330,495 | 362,993 | 428,740 | 508,305 | 78,125 | ||||||||||||||||||

| Net change in unearned premium reserves |

(921 | ) | (390 | ) | (692 | ) | (2,510 | ) | (1,395 | ) | (214 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net premiums earned |

324,813 | 330,105 | 362,301 | 426,230 | 506,910 | 77,911 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Investment income |

82,816 | 93,548 | 97,582 | 109,147 | 122,727 | 18,863 | ||||||||||||||||||

| Net realized gains on financial assets |

5,793 | 7,120 | 32,297 | 6,038 | 42 | 6 | ||||||||||||||||||

| Net fair value gains through profit or loss |

137 | 5,808 | 10,209 | (7,094 | ) | 6,183 | 950 | |||||||||||||||||

| Other income |

4,324 | 4,185 | 5,060 | 6,460 | 7,493 | 1,152 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenues |

417,883 | 440,766 | 507,449 | 540,781 | 643,355 | 98,882 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Benefits, claims and expenses |

||||||||||||||||||||||||

| Insurance benefits and claims expenses |

||||||||||||||||||||||||

| Life insurance death and other benefits |

(193,671 | ) | (192,659 | ) | (221,701 | ) | (253,157 | ) | (259,708 | ) | (39,916 | ) | ||||||||||||

| Accident and health claims and claim adjustment expenses |

(11,263 | ) | (16,752 | ) | (21,009 | ) | (27,269 | ) | (33,818 | ) | (5,198 | ) | ||||||||||||

| Increase in insurance contract liabilities |

(107,354 | ) | (105,883 | ) | (109,509 | ) | (126,619 | ) | (172,517 | ) | (26,515 | ) | ||||||||||||

| Investment contract benefits |

(1,818 | ) | (1,958 | ) | (2,264 | ) | (5,316 | ) | (8,076 | ) | (1,241 | ) | ||||||||||||

| Policyholder dividends resulting from participation in profits |

(18,423 | ) | (24,866 | ) | (33,491 | ) | (15,883 | ) | (21,871 | ) | (3,362 | ) | ||||||||||||

| Underwriting and policy acquisition costs |

(25,690 | ) | (27,147 | ) | (35,569 | ) | (52,022 | ) | (64,789 | ) | (9,958 | ) | ||||||||||||

| Finance costs |

(4,032 | ) | (4,726 | ) | (4,320 | ) | (4,767 | ) | (4,601 | ) | (707 | ) | ||||||||||||

| Administrative expenses |

(24,805 | ) | (25,432 | ) | (27,458 | ) | (31,854 | ) | (35,953 | ) | (5,526 | ) | ||||||||||||

| Other expenses |

(3,864 | ) | (4,151 | ) | (7,428 | ) | (4,859 | ) | (6,426 | ) | (988 | ) | ||||||||||||

| Statutory insurance fund contribution |

(637 | ) | (701 | ) | (743 | ) | (1,048 | ) | (1,068 | ) | (164 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total benefits, claims and expenses |

(391,557 | ) | (404,275 | ) | (463,492 | ) | (522,794 | ) | (608,827 | ) | (93,575 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Share of profit of associates and joint ventures, net |

3,125 | 3,911 | 1,974 | 5,855 | 7,143 | 1,098 | ||||||||||||||||||

| Profit before income tax |

29,451 | 40,402 | 45,931 | 23,842 | 41,671 | 6,405 | ||||||||||||||||||

| Income tax |

(4,443 | ) | (7,888 | ) | (10,744 | ) | (4,257 | ) | (8,919 | ) | (1,371 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net profit |

25,008 | 32,514 | 35,187 | 19,585 | 32,752 | 5,034 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Attributable to: |

||||||||||||||||||||||||

| - Equity holders of the Company |

24,765 | 32,211 | 34,699 | 19,127 | 32,253 | 4,957 | ||||||||||||||||||

| - Non-controlling interests |

243 | 303 | 488 | 458 | 499 | 77 | ||||||||||||||||||

| Basic and diluted earnings per share(1) |

0.88 | 1.14 | 1.22 | 0.66 | 1.13 | 0.17 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | Numbers are based on the weighted average number of 28,264,705,000 shares in issue. |

5

Table of Contents

| For the year ended December 31, | ||||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| (in millions except for per share data) | ||||||||||||||||||||||||

| Other comprehensive income that may be reclassified to profit or loss in subsequent periods: |

||||||||||||||||||||||||

| Fair value gains/(losses) on available-for-sale securities |

(25,135 | ) | 70,342 | 54,080 | (44,509 | ) | (15,003 | ) | (2,306 | ) | ||||||||||||||

| Amount transferred to net profit from other comprehensive income |

(5,793 | ) | (7,120 | ) | (32,297 | ) | (6,038 | ) | (42 | ) | (6 | ) | ||||||||||||

| Portion of fair value changes on available-for-sale securities attributable to participating policyholders |

2,635 | (11,035 | ) | (12,767 | ) | 17,372 | 5,605 | 861 | ||||||||||||||||

| Share of other comprehensive income of associates and joint ventures under the equity method |

(332 | ) | 120 | 353 | (864 | ) | 20 | 3 | ||||||||||||||||

| Exchange differences on translating foreign operations |

— | — | 10 | 21 | (865 | ) | (133 | ) | ||||||||||||||||

| Income tax relating to components of other comprehensive income |

7,050 | (13,023 | ) | (2,242 | ) | 8,242 | 2,359 | 363 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other comprehensive income that may be reclassified to profit or loss in subsequent periods |

(21,575 | ) | 39,284 | 7,137 | (25,776 | ) | (7,926 | ) | (1,218 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other comprehensive income that will not be reclassified to profit or loss in subsequent periods |

— | — | — | — | — | — | ||||||||||||||||||

| Other comprehensive income for the year, net of tax |

(21,575 | ) | 39,284 | 7,137 | (25,776 | ) | (7,926 | ) | (1,218 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total comprehensive income for the year, net of tax |

3,433 | 71,798 | 42,324 | (6,191 | ) | 24,826 | 3,816 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Attributable to: |

||||||||||||||||||||||||

| - Equity holders of the Company |

3,203 | 71,443 | 41,775 | (6,647 | ) | 24,341 | 3,741 | |||||||||||||||||

| - Non-controlling interests |

230 | 355 | 549 | 456 | 485 | 75 | ||||||||||||||||||

6

Table of Contents

| As of December 31, | ||||||||||||||||||||||||

| 2013 | 2014 | 2015 | 2016 | 2017 | 2017 | |||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||

| Consolidated Statement of Financial Position | (in millions) | |||||||||||||||||||||||

| Assets |

||||||||||||||||||||||||

| Property, plant and equipment |

23,393 | 25,348 | 26,974 | 30,389 | 42,707 | 6,564 | ||||||||||||||||||

| Investment properties |

1,329 | 1,283 | 1,237 | 1,191 | 3,064 | 471 | ||||||||||||||||||

| Investments in associates and joint ventures |

34,775 | 44,390 | 47,175 | 119,766 | 161,472 | 24,818 | ||||||||||||||||||

| Held-to-maturity securities |

503,075 | 517,283 | 504,075 | 594,730 | 717,037 | 110,207 | ||||||||||||||||||

| Loans |

118,626 | 166,453 | 207,267 | 226,573 | 383,504 | 58,943 | ||||||||||||||||||

| Term deposits |

664,174 | 690,156 | 562,622 | 538,325 | 449,400 | 69,072 | ||||||||||||||||||

| Statutory deposits - restricted |

6,153 | 6,153 | 6,333 | 6,333 | 6,333 | 973 | ||||||||||||||||||

| Available-for-sale securities |

491,527 | 607,531 | 770,516 | 766,423 | 810,734 | 124,608 | ||||||||||||||||||

| Securities at fair value through profit or loss |

34,172 | 53,052 | 137,990 | 209,124 | 136,809 | 21,027 | ||||||||||||||||||

| Securities purchased under agreements to resell |

8,295 | 11,925 | 21,503 | 43,538 | 36,185 | 5,562 | ||||||||||||||||||

| Accrued investment income |

34,717 | 44,350 | 49,552 | 55,945 | 50,641 | 7,783 | ||||||||||||||||||

| Premiums receivable |

9,876 | 11,166 | 11,913 | 13,421 | 14,121 | 2,170 | ||||||||||||||||||

| Reinsurance assets |

1,069 | 1,032 | 1,420 | 2,134 | 3,046 | 468 | ||||||||||||||||||

| Other assets |

20,430 | 19,411 | 23,642 | 22,013 | 33,952 | 5,218 | ||||||||||||||||||

| Cash and cash equivalents |

21,330 | 47,034 | 76,096 | 67,046 | 48,586 | 7,468 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total assets |

1,972,941 | 2,246,567 | 2,448,315 | 2,696,951 | 2,897,591 | 445,352 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Liabilities and equity |

||||||||||||||||||||||||

| Liabilities |

||||||||||||||||||||||||

| Insurance contracts |

1,494,497 | 1,603,446 | 1,715,985 | 1,847,986 | 2,025,133 | 311,257 | ||||||||||||||||||

| Investment contracts |

65,087 | 72,275 | 84,106 | 195,706 | 232,500 | 35,735 | ||||||||||||||||||

| Policyholder dividends payable |

49,536 | 74,745 | 107,774 | 87,725 | 83,910 | 12,897 | ||||||||||||||||||

| Interest-bearing loans and borrowings |

— | 2,623 | 2,643 | 16,170 | 18,794 | 2,889 | ||||||||||||||||||

| Bonds payable |

67,985 | 67,989 | 67,994 | 37,998 | — | — | ||||||||||||||||||

| Financial liabilities at fair value through profit or loss |

— | 10,890 | 856 | 2,031 | 2,529 | 389 | ||||||||||||||||||

| Securities sold under agreements to repurchase |

20,426 | 46,089 | 31,354 | 81,088 | 87,309 | 13,419 | ||||||||||||||||||

| Annuity and other insurance balances payable |

23,179 | 25,617 | 30,092 | 39,038 | 44,820 | 6,889 | ||||||||||||||||||

| Premiums received in advance |

6,305 | 15,850 | 32,266 | 35,252 | 18,505 | 2,844 | ||||||||||||||||||

| Other liabilities |

18,233 | 20,062 | 26,514 | 36,836 | 47,430 | 7,290 | ||||||||||||||||||

| Deferred tax liabilities |

4,919 | 19,375 | 16,953 | 7,768 | 4,871 | 749 | ||||||||||||||||||

| Current income tax liabilities |

5 | 52 | 5,347 | 1,214 | 6,198 | 953 | ||||||||||||||||||

| Statutory insurance fund |

184 | 223 | 217 | 491 | 282 | 43 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities |

1,750,356 | 1,959,236 | 2,122,101 | 2,389,303 | 2,572,281 | 395,352 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Equity |

||||||||||||||||||||||||

| Share capital |

28,265 | 28,265 | 28,265 | 28,265 | 28,265 | 4,344 | ||||||||||||||||||

| Other equity instruments |

— | — | 7,791 | 7,791 | 7,791 | 1,197 | ||||||||||||||||||

| Reserves |

97,029 | 145,919 | 163,381 | 145,007 | 145,675 | 22,390 | ||||||||||||||||||

| Retained earnings |

95,037 | 109,937 | 123,055 | 122,558 | 139,202 | 21,395 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Attributable to equity holders of the Company |

220,331 | 284,121 | 322,492 | 303,621 | 320,933 | 49,326 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-controlling interests |

2,254 | 3,210 | 3,722 | 4,027 | 4,377 | 673 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total equity |

222,585 | 287,331 | 326,214 | 307,648 | 325,310 | 49,999 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total liabilities and equity |

1,972,941 | 2,246,567 | 2,448,315 | 2,696,951 | 2,897,591 | 445,352 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

7

Table of Contents

Exchange Rate Information

We prepare our consolidated financial statements in Renminbi. This annual report contains translations of Renminbi amounts into U.S. dollars, and U.S. dollars into Renminbi, at RMB 6.5063 to US$ 1.00, the noon buying rate on December 29, 2017 in the City of New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York. You should not assume that Renminbi amounts could actually be converted into U.S. dollars at these rates or at all. Translations of foreign currency amounts into RMB amounts for the purpose of preparing our audited consolidated financial statements included elsewhere in this annual report or our previous annual reports have been made at the exchange rates published by the PBOC.

Since July 21, 2005, the PRC government has followed a managed floating exchange rate system to allow the value of the Renminbi to fluctuate within a regulated band based on market supply and demand and by reference to a basket of currencies. Under this system, the PBOC announces the closing price of a foreign currency traded against the Renminbi in the inter-bank foreign exchange market after the closing of the market on each working day, and makes it the central parity for the trading against the Renminbi on the following working day. On August 11, 2015, the PBOC adjusted the quotation mechanism of the Renminbi central parity to also consider demand and supply in foreign exchange markets and price movements of major currencies, in addition to the closing price on the previous working day. On May 26, 2017, the PBOC introduced a “counter-cyclical factor” into its formula that determines a central parity of Renminbi against the U.S. dollar. Under the current mechanism, the central parity of the Renminbi against the U.S. dollar is determined based on the closing rate, changes in a basket of currencies and the counter-cyclical factor. See “Item 3. Key Information—Risk Factors—Risks Relating to the People’s Republic of China—Government control of currency conversion and the fluctuation of the Renminbi may materially and adversely affect our operations and financial results”. In 2017, the Renminbi appreciated by approximately 6.36% against the U.S. dollar. It remains unclear what further fluctuations may occur or what impact this will have on the value of the Renminbi.

Although PRC governmental policies were introduced in 1996 to reduce restrictions on the convertibility of Renminbi into foreign currency for current account items, conversion of Renminbi into foreign exchange for capital account items, such as foreign direct investments, loans or securities, requires the approval of the SAFE and other relevant authorities. Although experimental policies were recently introduced in certain pilot areas such as the Shanghai free trade zone to reduce foreign exchange control, restrictions on the convertibility of Renminbi into foreign currency are still in force in most parts of China.

The Hong Kong dollar is freely convertible into other currencies, including the U.S. dollar. Since October 17, 1983, the Hong Kong dollar has been linked to the U.S. dollar at the rate of HK$ 7.80 to US$ 1.00. The central element in the arrangements which give effect to the link is that by agreement between the Hong Kong government and the three Hong Kong banknote issuing banks, The Hongkong and Shanghai Banking Corporation Limited, Standard Chartered Bank (Hong Kong) Limited and the Bank of China (Hong Kong) Limited, certificates of debts, which are issued by the Hong Kong Government Exchange Fund to the banknote issuing banks to be held as cover for their banknote issues, are issued and redeemed only against payment in U.S. dollars, at the fixed exchange rate of HK$ 7.80 to US$ 1.00. When the banknotes are withdrawn from circulation, the banknote issuing banks surrender the certificates of debts to the Hong Kong Government Exchange Fund and are paid the equivalent U.S. dollars at the fixed rate.

The market exchange rate of the Hong Kong dollar against the U.S. dollar continues to be determined by the forces of supply and demand in the foreign exchange market. However, against the background of the fixed rate which applies to the issue of the Hong Kong currency in the form of banknotes, as described above, the market exchange rate has not deviated materially from the level of HK$ 7.80 to US$ 1.00 since the link was first established. The Hong Kong government has stated its intention to maintain the link at that rate, and it, acting through the Hong Kong Monetary Authority, has a number of means by which it may act to maintain exchange rate stability. Exchange rates between the Hong Kong dollar and other currencies are influenced by the linked rate between the U.S. dollar and the Hong Kong dollar.

8

Table of Contents

The following tables set forth various information concerning exchange rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates we used in this annual report. The source of these rates is the H.10 statistical release of the Federal Reserve Board. On April 13, 2018, the exchange rates were US$ 1.00 to RMB 6.2725 and US$ 1.00 to HK$ 7.8499, respectively. The following table sets forth the high and low rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for each of the periods shown:

| RMB per US$ | HK$ per US$ | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| October 2017 |

6.6533 | 6.5712 | 7.8106 | 7.7996 | ||||||||||||

| November 2017 |

6.6385 | 6.5967 | 7.8118 | 7.7955 | ||||||||||||

| December 2017 |

6.6210 | 6.5063 | 7.8228 | 7.8050 | ||||||||||||

| January 2018 |

6.5263 | 6.2841 | 7.8230 | 7.8161 | ||||||||||||

| February 2018 |

6.3471 | 6.2649 | 7.8267 | 7.8183 | ||||||||||||

| March 2018 |

6.3565 | 6.2685 | 7.8486 | 7.8275 | ||||||||||||

| April 2018 (through April 13, 2018) |

6.3045 | 6.2655 | 7.8499 | 7.8482 | ||||||||||||

The following table sets forth the period-end rates and the average rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for each of 2013, 2014, 2015, 2016, 2017 and 2018 (through April 13, 2018) (calculated by averaging the rates on the last day of each month of the periods shown):

| Period-end rate | Average rate | |||||||||||||||

| RMB per US$ |

HK$ per US$ | RMB per US$ |

HK$ per US$ | |||||||||||||

| 2013 |

6.0537 | 7.7539 | 6.1412 | 7.7565 | ||||||||||||

| 2014 |

6.2046 | 7.7531 | 6.1704 | 7.7554 | ||||||||||||

| 2015 |

6.4778 | 7.7507 | 6.2869 | 7.7519 | ||||||||||||

| 2016 |

6.9430 | 7.7534 | 6.6549 | 7.7618 | ||||||||||||

| 2017 |

6.5063 | 7.8128 | 6.7350 | 7.7950 | ||||||||||||

| 2018 (through April 13, 2018) |

6.2725 | 7.8499 | 6.2893 | 7.8364 | ||||||||||||

B. CAPITALIZATION AND INDEBTEDNESS

Not Applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable.

Our business, financial condition and results of operations can be affected materially and adversely by any of the following risk factors. The risks and uncertainties described below may not be the only ones that we face. Additional risks and uncertainties that we are not aware of or that we currently believe are immaterial may also adversely affect our business, financial condition or results of operations.

9

Table of Contents

Risks Relating to Our Business

Our investments are subject to risks.

We are exposed to potential investment losses if there is an economic downturn in China.

Until November 2006, we were only permitted to invest the premiums and other income we receive in investments in China. We obtained the approval to invest overseas with our foreign currency denominated funds in November 2006. See “Item 4. Information on the Company—Business Overview—Regulatory and Related Matters—Insurance Company Regulation—Regulation of investments”. However, we continued to make our investments mainly in China and, as of December 31, 2017, approximately 98.90% of our total investment assets were in China. In particular, as of December 31, 2017, approximately 48.43% of our total investment assets consisted of debt securities including Chinese government bonds, government agency bonds, corporate bonds, subordinated bonds and debt and other bonds and debts as approved by relevant government agencies; approximately 17.34% of our total investment assets consisted of term deposits with Chinese banks, of which 58.80% were placed with the five largest Chinese state-owned commercial banks; and approximately 14.80% of our total investment assets consisted of loans provided to Chinese entities and individuals, including policy loans, investment in debt investment plans and trust schemes. A serious downturn in the Chinese economy may lead to investment losses, which would reduce our earnings.

The PRC securities markets are still emerging markets, which may expose us to risks of loss from our investments there.

As of December 31, 2017, we had RMB 409,528 million (US$ 62,943 million) invested in equity securities, among which RMB 132,826 million (US$ 20,415 million) were invested in PRC securities markets, including securities investment funds and shares traded on the securities markets in China. These securities investment funds and shares are primarily invested in equity securities that are issued by Chinese companies and traded on China’s stock exchanges. The PRC securities markets are still emerging markets and are characterized by evolving regulatory, accounting and disclosure requirements. This may from time to time result in significant price volatility, unexpected losses or lack of liquidity. These factors could cause us to incur losses on our publicly traded investments. Also, as one of the largest institutional investors in China, we may from time to time hold significant positions in many securities in which we invest, and any decision to sell or any perception in the market that we are a major seller of a security could adversely affect the liquidity and market price of that security.

Defaults on our debt investments may materially and adversely affect our profitability.

Approximately 48.43% of our investment assets as of December 31, 2017 were comprised of debt securities. The issuers whose debt securities we hold may fail to pay or otherwise default on their obligations due to bankruptcy, a lack of liquidity, a downturn in the economy, operational failures or other reasons. Losses due to these defaults could reduce our profitability.

10

Table of Contents

Defaults on our investments in loans may materially and adversely affect our profitability.

Approximately 14.80% of our investment assets as of December 31, 2017 were comprised of loans, including policy loans, investments in debt investment plans and trust schemes. The borrowers to whom we provided loans may fail to pay or otherwise default on their obligations due to bankruptcy, a lack of liquidity, a downturn in the economy, operational failures or other reasons. Losses due to these defaults could reduce our profitability.

Investments in new investment channels may not lead to improvements in our rate of investment return or we may incur losses.

The CIRC has in recent years significantly broadened the investment channels of Chinese life insurance companies. We have considered these alternative channels when making investments. For example, we made our first domestic private equity fund investment in 2011. In 2012, we made a direct equity investment in COFCO Futures Co., Ltd. by acquiring a 35% equity interest in it. In 2013, we began making investments in commercial real estate properties. In 2014, we made our first overseas real estate investment, first overseas private equity fund investment and first domestic preferred shares investment. In 2016, we made our first investment in shares traded on the Hong Kong Stock Exchange through the Shanghai-Hong Kong Stock Connect between China’s mainland markets and the Hong Kong Stock Exchange, and we also made our first investment in interbank negotiable certificates of deposit. However, our experience with these new investment channels, especially overseas channels, is limited, and these new channels are still subject to evolving regulatory requirements, which may increase the risk exposure of our investments. For example, since January 2013, debt investment plans are no longer required to be filed with and reviewed by the CIRC, and in March 2014, the CIRC warned insurance companies of risks in debt investment plans. The CIRC noted, among other things, that issuers of some debt investment plans are not properly backed by their parent companies which are supposed to guarantee the payments if the plans face financial difficulties. Parent companies of some issuers do not engage in operating activities that can generate cash inflows and do not have effective control over their subsidiaries. As a result, the consolidated financial statements of these companies may not fully reflect their capacity to make payments when the plans face financial difficulties. As of December 31, 2017, the total amount of our investment in debt investment plans was RMB 73,668 million (US$ 11,323 million). These factors could cause us to incur losses for our investments in these new investment channels or limit our ability to improve our rate of investment return.

We may incur foreign exchange and other losses for our investments denominated in foreign currencies.

A portion of our investment assets are held in foreign currencies. We are authorized by the CBIRC (formerly CIRC) to invest our assets held in foreign currencies in the overseas financial markets as permitted by the CBIRC (formerly CIRC). Thus, our investment results may be subject to foreign exchange gains and losses due to changes in exchange rates as well as the volatility and various other factors of overseas capital markets, including, among others, increase in interest rates. We recorded RMB 52 million (US$ 8.0 million) in foreign exchange gains for the year ended December 31, 2017, resulting mainly from the increase in our assets held in foreign currencies and the fluctuation of the Renminbi exchange rate. However, it remains unclear what further fluctuations may occur or what impact this will have on the value of the Renminbi. Future movements in the exchange rate of RMB against the U.S. dollar and other foreign currencies may adversely affect our results of operations and financial condition.

11

Table of Contents

We are exposed to changes in interest rates.

Changes in interest rates may affect our profitability.

Our profitability is affected by changes in interest rates. Interest rates are highly sensitive to many factors, including economic growth rate, inflation, governmental monetary and tax policies, domestic and international economic and political conditions, financial regulatory requirements and other factors beyond our control. If interest rates were to increase significantly in the future, surrenders and withdrawals of life insurance and annuity policies and contracts may increase as policy holders may seek other investments with higher perceived returns. This process may result in cash outflows requiring that we sell investment assets at a time when the prices of those assets are adversely affected by the increase in market interest rates, which may result in realized investment losses. However, if interest rates were to decline in the future, the income we realize from our investments may decrease, affecting our profitability. In addition, as instruments in our investment portfolio mature, we might have to reinvest the funds we receive in investments bearing low interest rates, which may also affect our profitability. See “Item 11 Quantitative and Qualitative Disclosures about Market Risk—Interest Rate Risk”.

For our long-term life insurance products including annuity products, we are obligated to pay contractual benefits to our policyholders or the beneficiaries based on a guaranteed interest rate, which is established when the product is priced. These products expose us to the risk that changes in interest rates may change our “spread”, or the difference between the amount of return that we are able to earn on our investments and the amount of return that we are required to pay based on a guaranteed interest rate under the policies.

On June 10, 1999, the CIRC set the maximum guaranteed interest rate which insurance companies could commit to pay on new policies at 2.50% (compounded annually) and, in response, we set the guaranteed interest rates on our products at a range of between 1.50% and 2.50%. In August 2013, February 2015 and September 2015, the CIRC removed the 2.50% cap on the guaranteed interest rates for traditional non-participating insurance policies, universal life insurance policies and participating life insurance policies, respectively. From October 1, 2015, the guaranteed interest rates of all long-term life insurance products are to be decided by insurance companies at their discretion in accordance with the principle of prudence, but CBIRC (formerly CIRC) approval is required for products with guaranteed interest rates above the maximum valuation rate set by the CIRC. This maximum valuation rate varies by product. Although the removal of the 2.50% cap has not resulted in any material impact on the profitability of our insurance policies in force, it could result in the increase of the guaranteed interest rates of our new products and the decrease of our spread. We cannot assure you that the removal of the 2.50% cap will not lead to a material adverse effect on our business, results of operations or financial condition.

As of December 31, 2017, the average guaranteed rate of return for all of our long-term insurance policies in force was 2.62%, while our investment yields for the years ended December 31, 2017, 2016 and 2015 were 5.16%, 4.61% and 6.47%, respectively. See “Item 4. Information on the Company—Business Overview—Investments—Investment Results”. However, if the rates of return on our investments were to fall below the minimum rates we guarantee, our profitability would be materially and adversely affected.

12

Table of Contents

Because of the general lack of long-term fixed income securities in the Chinese capital markets, we are unable to match closely the duration of our assets and liabilities, which increases our exposure to interest rate risk.

Like other insurance companies, we seek to manage interest rate risk through managing, to the extent possible, the average duration of our investment assets and the insurance policy liabilities they support. Matching the duration of our assets to their related liabilities reduces our exposure to changes in interest rates, because the effect of the changes largely will be offset against each other. However, the limited availability of long-duration investment assets in the markets in which we invest, has resulted in, and in the future may result in, the duration of our assets being shorter than that of our liabilities, particularly with respect to liabilities with durations of more than 20 years. Furthermore, the Chinese financial markets currently do not provide adequate financial derivative products for us to hedge our interest rate risk. We believe that with the development of the Chinese capital markets and the gradual easing of the investment restrictions imposed on insurance companies in China, our ability to match the duration of our assets to that of our liabilities will improve. We also seek to manage the risk of duration mismatch by focusing on product offerings whose maturity profiles are in line with the duration of investments available to us in the prevailing investment environment. However, until we are able to match more closely the duration of our assets and liabilities, we will continue to be exposed to interest rate changes, which may materially and adversely affect our business and earnings.

Our growth is dependent on our ability to attract and retain productive agents.

A substantial portion of our business is conducted through our exclusive agents. Because of differences in productivity, some of our sales agents are responsible for a disproportionately high percentage of our sales of individual products. If we are unable to retain and build on this core group of highly productive agents, our business could be materially and adversely affected. Increasing competition for agents from other insurance companies and business institutions and increasing labor costs in China may also force us to increase the compensation of our agents, which would increase our operating costs and reduce our profitability. In addition, on January 6, 2013, the CIRC issued the Regulatory Rules on Insurance Sales Personnel, or the Sales Personnel Rules, which became effective on July 1, 2013. Among other things, the Sales Personnel Rules provide that exclusive agents must have at least a college degree, instead of a junior high school degree as previously required by the CIRC. See “Item 4. Information on the Company—Business Overview—Regulatory and Related Matters—Regulation of Insurance Agencies, Insurance Brokers and Other Intermediaries”. The CIRC has authorized its local branches to set the education degree requirements for exclusive agents by considering local conditions. We believe that if more CBIRC (formerly CIRC) branches were to impose the requirement of having a college degree or above on new qualified exclusive agents, we cannot guarantee that we will not have difficulty in attracting and retaining productive agents in the future. In addition, as the market competition for qualified agents increases, our costs of attracting and retaining qualified agents may increase.

If we are unable to develop other distribution channels for our products, our growth may be materially and adversely affected.

Commercial banks are rapidly emerging as some of the fastest growing distribution channels in China. Many newly established domestic and foreign-invested life insurance companies have been focusing on commercial banks as one of their main distribution channels. In addition, with the relaxation of the regulatory restrictions of ownership by commercial banks in insurance companies, the number of insurance companies owned or controlled by commercial banks is increasing. Each of the five largest Chinese state-owned commercial banks has set up their own life insurance companies. These insurance companies are able to benefit from their holding relationships with these commercial banks to develop bancassurance as their main distribution channels. We do not have exclusive arrangements with any of the commercial banks through which we sell life insurance and annuity products, and thus our sales may be materially and adversely affected if one or more commercial banks choose to favor our competitors’ products over our own. In addition, as the bancassurance market becomes increasingly competitive, commercial banks may demand higher commission rates, which could increase our cost of sales and reduce our profitability. If we are unable to continue to develop our alternative distribution channels, our growth may be materially and adversely affected.

13

Table of Contents

Agent and employee misconduct is difficult to detect and deter and could harm our reputation or lead to regulatory sanctions or litigation costs.

Agent or employee misconduct could result in violations of law by us, regulatory sanctions, litigation or serious reputational or financial harm. Misconduct could include:

| • | engaging in misrepresentation or fraudulent activities when marketing or selling insurance policies or annuity contracts to customers; |

| • | hiding unauthorized or unsuccessful activities, resulting in unknown and unmanaged risks or losses; or |

| • | otherwise not complying with laws or our control policies or procedures. |

We cannot always deter agent or employee misconduct, and the precautions we take to prevent and detect these activities may not be effective in all cases. We have experienced agent and employee misconduct that has resulted in litigation and administrative actions against us and these agents and employees, and in some cases criminal proceedings and convictions against the agent or employee in question. None of these actions has resulted in material losses, damages, fines or other sanctions against us. We cannot assure you, however, that agent or employee misconduct will not lead to a material adverse effect on our business, results of operations, financial condition or prospects.

Our business is dependent on our ability to attract and retain key personnel, including senior management, underwriting personnel, actuaries, information technology specialists, investment managers and other professionals.

The success of our business is dependent to a large extent on our ability to attract and retain key personnel who have in-depth knowledge and understanding of the life insurance market in China, including members of our senior management, qualified underwriting personnel, actuaries, information technology specialists and experienced investment managers. As of the date of this annual report, we do not carry key personnel insurance for any of these personnel. We compete to attract and retain these key personnel with other life insurance companies and financial institutions, some of which may offer better compensation arrangements. Existing insurers are expanding their operations and the number of other financial institutions is growing. As the insurance and investment businesses continue to expand in China, we expect that competition for these personnel will increase in the future. Although we have not had difficulty in attracting and retaining qualified key personnel in the past, we cannot guarantee that this will continue to be the case. If we were unable to continue to attract and retain key personnel, our business and financial performance could be materially and adversely affected.

Differences in future actual operating results from the assumptions used in pricing and establishing reserves for our insurance and annuity products may materially affect our earnings.

Our earnings depend significantly upon the extent to which our actual operating results are consistent with the assumptions used in pricing and establishing the reserves for insurance contracts in our financial statements. Our assumptions include those for discount rate, mortality, morbidity, lapse rate and expenses. To the extent that trends in actual experiences are less favorable than our underlying assumptions used in establishing these reserves, and these trends are expected to continue in the future, we could be required to increase our reserves. Any such increase could have a material adverse effect on our profitability and, if significant, our financial condition.

14

Table of Contents

We establish the reserves for insurance contracts based on the use of assumptions for discount rate, mortality, morbidity, lapse rate and expenses. These assumptions are based on our previous experience and the data published by other Chinese life insurers, as well as judgments made by the management. These assumptions may deviate from our actual experience, and, as a result, we cannot determine precisely the amounts which we will ultimately pay to fulfill our obligations under the insurance contracts or when these payments will need to be made. These amounts may vary from the estimated amounts, particularly when those payments may not occur until well into the future. The discount rate assumption is affected by certain factors, such as further macro-economy, monetary and exchange rate policies, capital market results and availability of investment channels to invest our insurance funds. We review and update the assumptions used to evaluate the reserves periodically, and establish the reserves for insurance contracts based on such assumptions. If the reserves originally established for future policy benefits prove inadequate, we must increase our reserves established for future policy benefits, which may have a material effect on our earnings and our financial condition.

We have data available for a shorter period of time than life insurance companies operating in some other countries do and, as a result, less claims experience on which to base some of the assumptions used in establishing our reserves. For a discussion of how we establish our assumptions for mortality, morbidity and lapse rate, see “Item 5. Operating and Financial Review and Prospects—Critical Accounting Policies”. Given the limited nature of this experience, it is possible that our actual claims could vary significantly from the assumptions used.

Our risk management and internal reporting systems, policies and procedures may leave us exposed to unidentified or unanticipated risks, which could materially and adversely affect our businesses or result in losses.

Our policies and procedures to identify, monitor and manage risks may not be fully effective. Many of our current methods of managing risk and exposures are based upon our use of observed historical market behavior or statistics based on historical models. As a result, these methods may not fully predict future exposures, which could be significantly greater than what the historical measures indicate. In addition, risk management depends upon the evaluation of information regarding markets, customers or other matters that is publicly available or otherwise accessible to us, which may not always be accurate, complete, up-to-date or properly evaluated. In addition, a significant portion of business information needs to be centralized from our many branch offices. Management of operational, legal and regulatory risks requires, among other things, policies and procedures to record properly and verify a large number of transactions and events, and these policies and procedures may not be fully effective. Failure or the ineffectiveness of these systems could materially and adversely affect our business or result in losses.

We are likely to offer a broader and more diverse range of insurance and investment products in the future as the insurance market in China continues to develop. At the same time, we anticipate that we may invest in a significantly broader range of asset classes. The combination of these factors will require us to continue to enhance our risk management capabilities and is likely to increase the importance of our risk management policies and procedures to our results of operations and financial condition. If we fail to adapt our risk management policies and procedures to our changing business, our business, results of operations and financial condition could be materially and adversely affected.

Catastrophes could materially reduce our earnings and cash flow.

We could in the future experience catastrophic losses that may have an adverse impact on the business, results of operations and financial condition of our insurance business. Catastrophes can be caused by various events, including terrorist attacks, earthquakes, hurricanes, floods, fires and epidemics, such as severe acute respiratory syndrome, or SARS. For example, the snow disaster in South China and earthquake in Wen Chuan in 2008 increased our current claims payments.

15

Table of Contents

We establish liabilities for claims arising from a specific catastrophe after assessing the exposure and damages arising from the event. Although we have purchased catastrophe reinsurance in order to reduce our catastrophe exposure, we cannot assure you that any significant catastrophic event will not have a material adverse effect on us.

Current or future litigation, arbitration and regulatory proceedings could result in financial losses or harm our businesses.

We are involved in litigation and arbitration proceedings involving our insurance operations on an ongoing basis. In addition, the CBIRC (formerly CIRC), as well as other PRC governmental agencies, including tax, commerce and industrial administration and audit bureaus, from time to time make inquiries and conduct examinations or investigations concerning our compliance with PRC laws and regulations. These litigation, arbitration and administrative proceedings have in the past resulted in payments of insurance benefits, damage awards, settlements or administrative sanctions, including fines, which have not been material to us. We currently have control procedures in place to monitor our litigation, arbitration and regulatory exposure and take appropriate actions. See “Item 8. Financial Information—Consolidated Financial Statements and Other Financial Information—Legal and Regulatory Proceedings”. While we cannot predict the outcome of any pending or future litigation, arbitration, examination or investigation, we do not believe that any pending legal matter will have a material adverse effect on our business, financial condition or results of operations. However, we cannot assure you that any future litigation, arbitration or regulatory proceeding will not have an adverse outcome, which could have a material adverse effect on our operating results or cash flows. See “Item 8. Financial Information—Consolidated Financial Statements and Other Financial Information—Legal and Regulatory Proceedings”.

The embedded value information we present in this annual report is based on several assumptions and may vary significantly as those assumptions are changed.

In order to provide investors with an additional tool to understand our economic value and business results, we have disclosed information regarding our embedded value, as discussed in the section entitled “Item 8. Financial Information—Embedded Value”. The embedded value is an estimate of our economic value (excluding the value attributed to new business after the valuation date) and is based on a discounted cash flow valuation determined using commonly applied actuarial methodologies. Standards with respect to the calculation of embedded value are still evolving, however, and there is no universal standard which defines the form, calculation method or presentation format of the embedded value of an insurance company. Assumptions used in embedded value calculations include rate of investment return, discount rate, mortality, morbidity, expenses and surrender rate, as well as certain macro factors, many of which are beyond our control. These assumptions may deviate significantly from our actual experience and therefore the embedded value is consequently not inherently predictive. Furthermore, since our actual market value is determined by investors based on a variety of information available to them, the embedded value should not be construed to be a direct reflection of our performance. The inclusion of the embedded value in this annual report should not be regarded as a representation by us, our management or any other person as to our future profitability. Because of the technical complexity involved in embedded value calculations and the fact that embedded value estimates vary materially as key assumptions are changed, you should read the discussion under the section entitled “Item 8. Financial Information—Embedded Value” in its entirety. You should use special care when interpreting embedded value results and should not place undue reliance solely on them. See also “Forward-Looking Statements”.

16

Table of Contents

A computer system failure, cyber-attacks or other security breaches may disrupt our business, damage our reputation and adversely affect our results of operations and financial condition.

We use computer systems to store, retrieve, evaluate and utilize customer and company data and information. Our business is highly dependent on our ability to access these systems to perform necessary business functions such as developing and selling insurance products, providing customer support, policy management, filing and paying claims, managing our investment portfolios and producing financial statements. Although we have designed and implemented a variety of security measures and backup plans to prevent or limit the effect of failure, our computer systems may be vulnerable to disruptions as a result of natural disasters, man-made disasters, criminal activities, pandemics or other events beyond our control. In addition, our computer systems may be subject to computer viruses or other malicious codes, unauthorized access, cyber-attacks or other computer-related penetrations. The failure of our computer systems for any reason could disrupt our operations and may adversely affect our business, results of operations and financial condition. Although we have not experienced such a computer system failure or security breach in the past, we cannot assure you that we will not encounter a failure or security breach in the future.

We retain confidential information on our computer systems, including customer information and proprietary business information. In addition, for business purposes, from time to time customer information is transmitted between our computer systems and those of third parties, such as third-party agents selling insurance products for us. Any compromise of the security or other errors of our computer systems or those arising during the information transmission process that result in the disclosure of personally identifiable customer information could damage our reputation, expose us to litigation, increase regulatory scrutiny and require us to incur significant technical, legal and other expenses.

United States Foreign Account Tax Compliance Act

The Foreign Account Tax Compliance Act, or FATCA, generally requires a foreign financial institution, or FFI, to enter into an FFI agreement under which it will agree to identify and provide the United States Internal Revenue Service, or the IRS, with information regarding accounts, including certain insurance policies, held by U.S. persons and U.S.-owned foreign entities, or be subject to a 30% withholding tax on “withholdable payments,” which include among other items, payments of U.S.-source interest and dividends and gross proceeds from the sale or other disposition of property that may produce U.S.-source interest or dividends. In addition, an FFI that has entered into an FFI agreement may be required to withhold on certain “foreign passthru payments” that it makes to FFIs that have not entered into their own FFI agreements or to account holders who do not respond to requests to confirm their U.S. person status and/or do not agree to allow the FFI to report certain account related information to the IRS. Withholding on foreign passthru payments will begin no earlier than 2019. Since existing guidance reserves on the definition of “foreign passthru payment,” the scope of any withholding on foreign passthru payments is uncertain at this time.

The United States and the PRC have agreed in substance on the terms of an intergovernmental agreement, or IGA, that is intended to facilitate the type of information reporting required under FATCA. Under the agreed terms, instead of reporting directly to the IRS, Chinese FFIs are required to report specified account information directly to the PRC tax authority, which will then pass that information to the IRS. While compliance with the IGA will not eliminate the risk of withholding described above, it is expected to reduce that risk for FFIs that are resident in China. Although the IGA has not yet been officially signed, the PRC and the United States have agreed to treat the IGA as in effect from June 26, 2014, provided that the PRC continues to demonstrate “firm resolve” to sign the IGA as soon as possible. If the United States and the PRC ultimately fail to reach a final agreement on the terms of the IGA, then the FATCA reporting and withholding regime described in the prior paragraph will apply to Chinese FFIs.

17

Table of Contents

We will closely monitor developments regarding FATCA and the IGA. If we are required to comply with the terms of the IGA or FATCA, as applicable, we expect that our compliance costs will increase. If we do not comply with the terms of the IGA or FATCA, as applicable, then certain payments to us will be subject to withholding under FATCA. However, since the text of the IGA has not been released, and regulations and other guidance remain under development, the future impact of this law on us is uncertain.

The auditors’ reports included in this annual report are prepared by relying on audit work which is not inspected by the Public Company Accounting Oversight Board and, as such, investors may be deprived of the benefits of such inspection.

Auditors of companies that are registered with the SEC and traded publicly in the United States, including our independent registered public accounting firm, must be registered with the US Public Company Accounting Oversight Board (United States), or the PCAOB, and are required by the laws of the United States to undergo regular inspections by the PCAOB to assess their compliance with the laws of the United States and professional standards. Because we have substantial operations within China and our independent registered public accounting firm is based in China, the PCAOB is currently unable to conduct inspections of the work of our auditor as it relates to those operations without the approval of the Chinese authorities, and thus our auditor’s work related to our operations in China is not currently inspected by the PCAOB.

This lack of PCAOB inspection of audit work performed in China prevents the PCAOB from regularly evaluating the audit work of any auditor that was performed in China including those performed by our auditor. As a result, investors may be deprived of the full benefits of PCAOB inspections.

The inability of the PCAOB to conduct inspections of audit work performed in China makes it more difficult to evaluate the effectiveness of our auditor’s audit procedures as compared to auditors in other jurisdictions that are subject to PCAOB inspections on all of their work. Investors may lose confidence in our reported financial information and procedures and the quality of our consolidated financial statements.

We may be adversely affected if additional remedial measures are imposed on the four China-based accounting firms which reached settlement with the SEC in the administrative proceedings brought by the SEC against them.

In December 2012, the SEC initiated administrative proceedings against five accounting firms in China, alleging that they refused to produce audit work papers and other documents related to certain China-based companies under investigation by the SEC for potential accounting fraud. In January 2014, an SEC administrative law judge ruled in favor of the SEC, issuing an initial decision which censured each of the five accounting firms for failure to provide their audit work papers to the SEC and ordered a six-month suspension of the China-based affiliates of four of the five accounting firms’ right to practice before the SEC. The accounting firms have appealed the decision of the administrative law judge to the SEC, and the decision will not come into force unless and until an order of finality is issued by the SEC. We are not subject to any SEC investigations, nor are we involved in the proceedings brought by the SEC against the accounting firms. However, the China affiliate of the independent registered public accounting firm that has issued the auditor’s report included in our annual reports filed with the SEC for the 2013, 2014 and 2015 fiscal years, which is also our independent registered public accounting firm for the 2016 and 2017 fiscal years, is one of the five accounting firms named in the SEC’s proceedings.

18

Table of Contents

In February 2015, four of the five accounting firms, including the China affiliate of the independent registered public accounting firm that has issued the auditor’s report included in our annual report filed with the SEC for the 2013, 2014 and 2015 fiscal years, which is also our independent registered public accounting firm for the 2016 and 2017 fiscal years, each agreed to a censure and to pay a fine to the SEC to settle the dispute and avoid suspension of their ability to practice before the SEC. The settlement required the firms to follow detailed procedures and to seek to provide the SEC with access to audit documents of China-based companies via the CSRC. If future document productions fail to meet the specified criteria, the SEC retains authority to impose a variety of additional remedial measures on the firms depending on the nature of the failure, including an automatic six-month bar on the performance of certain audit work, commencement of a new proceeding or the resumption of the current proceeding by the SEC. While we cannot predict if the SEC will further review the four China-based accounting firms’ compliance with specified criteria or if the results of such a review would result in the SEC imposing penalties, if they are subject to additional remedial measures, we may be adversely affected, along with other U.S.-listed companies in China audited by these accounting firms. If none of the China-based auditors are able to continue to perform audit work for China-based companies listed in the U.S., we will not be able to meet the reporting requirements under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which may ultimately result in our deregistration by the SEC and delisting of our ADSs from the NYSE.

Risks Relating to the PRC Life Insurance Industry

We expect competition in the Chinese insurance industry to increase, which may materially and adversely affect the growth of our business.

We face competitive pressures from both domestic and foreign-invested life insurance companies operating in China, as well as from property and casualty insurance companies, which may compete with our accident and short-term health insurance businesses, and other financial institutions that sell other financial investment products in competition with ours. In addition, the establishment of other professional health insurance companies and pension annuities companies may also lead to greater competition in the health insurance business and commercial pension insurance business. If we are not able to adapt to these increasingly competitive pressures in the future, our growth rate may decline, which could materially and adversely affect our earnings.

Competition among domestic life insurance companies is increasing.