Exhibit 99.1

The Company is a life insurance company established in Beijing, China on 30 June 2003 according to the Company Law and Insurance Law of the People’s Republic of China. The Company was successfully listed on the New York Stock Exchange, the Hong Kong Stock Exchange and the Shanghai Stock Exchange on 17 and 18 December 2003, and 9 January 2007, respectively. The Company’s registered capital is RMB28,264,705,000.

The Company is the largest life insurance company in China. Our distribution network, comprising exclusive agents, direct sales representatives, and dedicated and non-dedicated agencies, is the most extensive one in China. The Company is one of the largest institutional investors in China, and through its controlling shareholding in China Life Asset Management Company Limited, the Company is the largest insurance asset management company in China. The Company also has controlling shareholding in China Life Pension Company Limited.

Our products and services include individual life insurance, group life insurance, and accident and health insurance. The Company is a leading provider of individual and group life insurance, annuity products and accident and health insurance in China. As at 31 December 2015, the Company had approximately 216 million long-term individual and group life insurance policies, annuity contracts, and long-term health insurance policies in force. We also provide both individual and group accident and short-term health insurance policies and services.

China Life Insurance Company Limited Annual Report 2015

Contents

| Definitions and Material Risk Alert |

2 | |||

| Company Profile |

3 | |||

| Financial Summary |

5 | |||

| Chairman’s Statement |

6 | |||

| Management Discussion and Analysis |

9 | |||

| Report of the Board of Directors |

28 | |||

| Report of the Supervisory Committee |

38 | |||

| Significant Events |

41 | |||

| Changes in Ordinary Shares and Shareholders Information |

54 | |||

| Directors, Supervisors, Senior Management and Employees |

58 | |||

| Corporate Governance |

73 | |||

| Internal Control |

97 | |||

| Honors and Awards |

101 | |||

| Independent Auditors’ Report |

102 | |||

| Consolidated Statement of Financial Position |

103 | |||

| Consolidated Statement of Comprehensive Income |

105 | |||

| Consolidated Statement of Changes in Equity |

107 | |||

| Consolidated Statement of Cash Flows |

108 | |||

| Notes to the Consolidated Financial Statements |

110 | |||

| Embedded Value |

228 | |||

1

China Life Insurance Company Limited Annual Report 2015

Definitions and Material Risk Alert

In this annual report, unless the context otherwise requires, the following expressions have the following meanings:

| The Company1 | China Life Insurance Company Limited and its subsidiaries | |

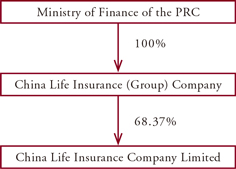

| CLIC | China Life Insurance (Group) Company, the controlling shareholder of the Company | |

| AMC | China Life Asset Management Company Limited, a non-wholly owned subsidiary of the Company | |

| Pension Company | China Life Pension Company Limited, a non-wholly owned subsidiary of the Company | |

| CLP&C | China Life Property and Casualty Insurance Company Limited, a non-wholly owned subsidiary of CLIC | |

| CLI | China Life Investment Holding Company Limited, a wholly owned subsidiary of CLIC | |

| AMP | China Life AMP Asset Management Co., Ltd., an indirect non-wholly owned subsidiary of the Company | |

| CLWM | China Life Wealth Management Company Limited, an indirect non-wholly owned subsidiary of the Company | |

| CIRC | China Insurance Regulatory Commission | |

| CSRC | China Securities Regulatory Commission | |

| HKSE | The Stock Exchange of Hong Kong Limited | |

| SSE | Shanghai Stock Exchange | |

| Company Law | Company Law of the People’s Republic of China | |

| Insurance Law | Insurance Law of the People’s Republic of China | |

| Securities Law | Securities Law of the People’s Republic of China | |

| Articles of Association | Articles of Association of China Life Insurance Company Limited | |

| China or PRC | for the purpose of this report, “China” or “PRC” refers to the People’s Republic of China, excluding the Hong Kong Special Administrative Region, Macau Special Administrative Region and Taiwan region | |

| RMB | Renminbi Yuan | |

Material Risk Alert:

The Company has stated in this report the details of its existing risks including risks relating to macro trends, risks relating to business and risks relating to investments. Please refer to the analysis of the risks which the Company may face in its future development in the section headed “Management Discussion and Analysis”.

| 1 | Except for “the Company” referred to in the Consolidated Financial Statements. |

2

China Life Insurance Company Limited Annual Report 2015

Company Profile

Registered Name in Chinese:

Registered Name in English:

China Life Insurance Company Limited (“China Life”)

Legal Representative: Yang Mingsheng

Board Secretary: Zheng Yong

Office Address: 16 Financial Street, Xicheng District, Beijing, P.R. China 100033

Telephone: 86-10-63631191

Fax: 86-10-66575112

Email: ir@e-chinalife.com

Securities Representative: Lan Yuxi

Office Address: 16 Financial Street, Xicheng District, Beijing, P.R. China 100033

Telephone: 86-10-63631068

Fax: 86-10-66575112

Email: lanyuxi@e-chinalife.com

| * | Mr. Lan Yuxi, Securities Representative of the Company, is also the main contact person of the external Company Secretary engaged by the Company |

Registered Office Address:

16 Financial Street, Xicheng District, Beijing, P.R. China 100033

Current Office Address:

16 Financial Street, Xicheng District, Beijing, P.R. China 100033

Telephone: 86-10-63633333

Fax: 86-10-66575722

Website: www.e-chinalife.com

Email: ir@e-chinalife.com

Hong Kong Office:

Office Address: 1403, 14/F., C.L.I. Building, 313 Hennessy Road, Wanchai, Hong Kong

Telephone: 852-29192628

Fax: 852-29192638

Media for the Company’s A Share Disclosure:

China Securities Journal

Shanghai Securities News

Securities Times

CSRC’s Designated Website for the Company’s Annual Report Disclosure:

www.sse.com.cn

3

China Life Insurance Company Limited Annual Report 2015

Company Profile

The Company’s H Share Disclosure Websites:

HKExnews website at www.hkexnews.hk

The Company’s website at www.e-chinalife.com

The Company’s Annual Reports may be obtained at:

12/F, China Life Plaza, 16 Financial Street, Xicheng District, Beijing, P.R. China

| Stock Information: | ||||||

| Stock Type | A Share | H Share | ADR | |||

| Exchanges on which the Stocks are Listed |

Shanghai Stock Exchange |

The Stock Exchange of Hong Kong Limited |

New York Stock Exchange | |||

| Stock Short Name | China Life | China Life | — | |||

| Stock Code | 601628 | 2628 | LFC | |||

H Share Registrar and Transfer Office:

Computershare Hong Kong Investor Services Limited

Shops 1712-1716, 17th Floor, Hopewell Centre, 183 Queen’s Road East, Wanchai, Hong Kong

Depositary of ADR:

Deutsche Bank

60 Wall Street, New York, NY 10005

Domestic Legal Adviser:

King & Wood Mallesons

International Legal Advisers:

Latham & Watkins

Debevoise & Plimpton LLP

Auditors of the Company:

| Domestic Auditor: | Ernst & Young Hua Ming LLP | |||

| Address: | Level 16, Ernst & Young Tower, Oriental Plaza, No.1 East Changan Avenue, Dongcheng District, Beijing, P.R. China | |||

| Name of the Signing Auditors: Zhang Xiaodong, Huang Yuedong | ||||

| International Auditor: | Ernst & Young | |||

| Address: | 22/F, CITIC Tower, 1 Tim Mei Avenue, Central, Hong Kong | |||

4

China Life Insurance Company Limited Annual Report 2015

Financial Summary

| RMB million | ||||||||||||||||||||||||

| Under International Financial | ||||||||||||||||||||||||

| Reporting Standards (IFRS) | ||||||||||||||||||||||||

| Major Financial Data1 |

2015 | 2014 | Change | 2013 | 2012 | 2011 | ||||||||||||||||||

| For the year ended |

||||||||||||||||||||||||

| Total revenues |

507,449 | 440,766 | 15.1% | 417,883 | 371,485 | 370,899 | ||||||||||||||||||

| Net premiums earned |

362,301 | 330,105 | 9.8% | 324,813 | 322,126 | 318,276 | ||||||||||||||||||

| Benefits, claims and expenses |

463,492 | 404,275 | 14.6% | 391,557 | 363,554 | 352,599 | ||||||||||||||||||

| Insurance benefits and claims expenses |

352,219 | 315,294 | 11.7% | 312,288 | 300,562 | 290,717 | ||||||||||||||||||

| Profit before income tax |

45,931 | 40,402 | 13.7% | 29,451 | 10,968 | 20,513 | ||||||||||||||||||

| Net profit attributable to equity holders of the Company |

34,699 | 32,211 | 7.7% | 24,765 | 11,061 | 18,331 | ||||||||||||||||||

| Net profit attributable to ordinary share holders of the Company |

34,514 | 32,211 | 7.1% | 24,765 | 11,061 | 18,331 | ||||||||||||||||||

| Net cash inflow/(outflow) from operating activities |

(18,811 | ) | 78,247 | N/A | 68,292 | 132,182 | 133,953 | |||||||||||||||||

| As at 31 December |

||||||||||||||||||||||||

| Total assets |

2,448,315 | 2,246,567 | 9.0% | 1,972,941 | 1,898,916 | 1,583,907 | ||||||||||||||||||

| Investment assets2 |

2,287,639 | 2,100,870 | 8.9% | 1,848,681 | 1,790,838 | 1,494,969 | ||||||||||||||||||

| Total liabilities |

2,122,101 | 1,959,236 | 8.3% | 1,750,356 | 1,675,815 | 1,390,519 | ||||||||||||||||||

| Total equity holders’ equity |

322,492 | 284,121 | 13.5% | 220,331 | 221,085 | 191,530 | ||||||||||||||||||

| Per share (RMB) |

||||||||||||||||||||||||

| Earnings per share (basic and diluted) |

1.22 | 1.14 | 7.1% | 0.88 | 0.39 | 0.65 | ||||||||||||||||||

| Equity holders’ equity per share |

11.41 | 10.05 | 13.5% | 7.80 | 7.82 | 6.78 | ||||||||||||||||||

| Net cash inflow/(outflow) from operating activities per share |

(0.67 | ) | 2.77 | N/A | 2.42 | 4.68 | 4.74 | |||||||||||||||||

| Major financial ratio |

||||||||||||||||||||||||

| Weighted average ROE (%) |

11.56 | 12.83 | |

decrease of 1.27 percentage points |

|

11.22 | 5.38 | 9.16 | ||||||||||||||||

| Ratio of assets and liabilities3 (%) |

86.68 | 87.21 | |

decrease of 0.53 percentage point |

|

88.72 | 88.25 | 87.79 | ||||||||||||||||

| Gross investment yield4 (%) |

6.24 | 5.36 | |

increase of 0.88 percentage point |

|

4.86 | 2.79 | 3.51 | ||||||||||||||||

Notes:

| 1. | Net profit refers to net profit attributable to equity holders of the Company, while equity holders’ equity refers to equity attributable to equity holders of the Company. |

| 2. | Investment assets = Cash and cash equivalents + Securities at fair value through profit or loss + Available-for-sale securities + Held-to-maturity securities + Term deposits + Securities purchased under agreements to resell + Loans + Statutory deposits - restricted + Investment properties |

| 3. | Ratio of assets and liabilities = Total liabilities/Total assets |

| 4. | Gross investment yield = (Investment income + Net realised gains/(losses) on financial assets + Net fair value gains/(losses) through profit or loss + Total income from investment properties – Business tax and extra charges for investment)/((Investment assets at the beginning of the period + Investment assets at the end of the period)/2) |

5

China Life Insurance Company Limited Annual Report 2015

Chairman’s Statement

In 2015, faced with the complicated international environment and the challenging tasks of carrying out reform and development and maintaining stability at home, China experienced stable economic development as a whole together with progress being achieved and stability ensured, which provided a favorable environment for the sound and fast development of insurance industry. In this year, the Company proactively adapted to the new normal state of economic development by firmly adhering to the operation ideas of “emphasizing value, strengthening sales force, optimizing structure and achieving stable growth”, implementing the “innovation-driven development strategy” in great depth, capturing opportunities, responding calmly and confidently, staying realistic and pragmatic and forging ahead with determination, and thus achieved the best operation results since the “12th Five-Year Plan”. The Company achieved new heights in its business development, with the growth rate of first-year regular premiums achieving a new high record since the share restructuring and listing of the Company, and the growth rates of both gross written premiums and first-year regular premiums with 10 years or longer payment duration being the highest over the past seven years. The Company’s efficiency was continuously improved due to structure optimization, with the one-year new business value hitting a record high. The Company’s sales force reached a new high level with its number surpassing one million for the first time in the Company’s history. The Company’s development achieved the balance between speed and efficiency, size and structure, and short-term and long-term operation, bringing a successful close to the Company’s “12th Five-Year Plan”.

6

China Life Insurance Company Limited Annual Report 2015

Chairman’s Statement

During the Reporting Period, the Company’s total revenue was RMB507,449 million, a 15.1% increase year-on-year; net profit attributable to equity holders of the Company was RMB34,699 million, a 7.7% increase year-on-year; earnings per share (basic and diluted) were RMB1.22, a 7.1% increase year-on-year. One-year new business value was RMB31,528 million, a 35.6% increase year-on-year. The Company’s market share2 in 2015 was approximately 23.0%, maintaining a leading position in the life insurance market. As at the end of the Reporting Period, the Company’s total assets reached RMB2,448,315 million, an increase of 9.0% from the end of 2014; embedded value was RMB560,277 million, an increase of 23.2% from 2014. As at 31 December 2015, the Company’s solvency ratio was 330.10%.

The Board of Directors of the Company proposes the payment of a final dividend of RMB0.42 per share (inclusive of tax), subject to the shareholders’ approval at the 2015 Annual General Meeting to be held on Monday, 30 May 2016.

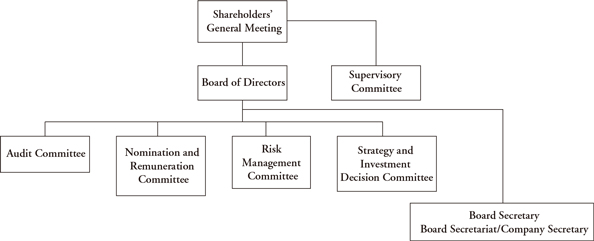

The Company has continually improved its corporate governance. During the Reporting Period, the Company successfully completed the change of sessions of the Board of Directors and the Supervisory Committee and elected the fifth sessions of the Board of Directors and the Supervisory Committee. Mr. Xu Hengping, Mr. Xu Haifeng, Mr. Liu Jiade, Mr. Robinson Drake Pike and Mr. Tang Xin joined the new session of the Board of Directors, and Mr. Miao Ping, Mr. Zhan Zhong and Ms. Wang Cuifei joined the new session of the Supervisory Committee. The new sessions of the Board of Directors and the Supervisory Committee continue to play roles of decision-making and supervision in a variety of areas, such as strategic planning, risk management, internal control and compliance, and performance appraisal, etc. Meanwhile, the Company would like to express its gratitude to the resigned/retired Directors, Mr. Su Hengxuan, Mr. Miao Ping, Mr. Bruce Douglas Moore and Mr. Huang Yiping, and the retired Supervisors, Ms. Xia Zhihua, Ms. Yang Cuilian and Mr. Li Xuejun for their contributions to the development of the Company during their tenure.

The Company actively pushed forward the development of policy-oriented businesses. Relying on its competitive advantages in professionalism and business scale, the Company continued to develop policy-oriented businesses including Supplementary Major Medical Insurance for Urban and Township Residents, New Village Cooperative Medical Insurance and New Rural Pension Insurance. The Company’s inclusive businesses such as micro-insurance business realized nationwide coverage, and the insurance products designed for particular population groups such as senior citizens benefited over 10 million people. In addition, the Company provided insurance coverage for over 120,000 college-graduate village officials, and actively offered a career development platform for college-graduate village officials, with the number of the retired college-graduate village officials introduced to the Company’s local branches amounting to over 1,000. The Company was constantly committed to the participation of public welfare and charitable undertakings. During the Reporting Period, the Company donated over RMB36 million through the China Life Foundation to provide support for several poverty alleviation projects and purchasing of medical vehicles in poverty-stricken areas. The Company also continually provided assistance for orphans from major disasters.

During the period of “12th Five-Year Plan”, although the Company was confronted with the most complicated situation and the most challenges, it managed to overcome the difficulties and made progress in adjustment and transformation, laying a solid foundation for building a world-class life insurance company. The past five years helped us better recognize that the golden keys for opening up a new dimension of the Company’s development were accelerating development by adhering to market orientation, optimizing structure by adhering to value guidance, improving service quality by emphasizing customer experience, enhancing information technology level by equipping the Company with high technologies, and strengthening local branches by building strong basis and solid foundation.

| 2 | Calculated according to the premium data of life insurance companies in 2015 released by the CIRC. |

7

China Life Insurance Company Limited Annual Report 2015

Chairman’s Statement

The year 2016 is the beginning of the “13th Five-Year Plan” and also a critical year for the Company to comprehensively deepen the reforms and push forward the “innovation-driven development strategy” in great depth. Facing new challenges and development opportunities, the Company will concentrate efforts and resources, reinforce execution in accordance with the general requirements of the “13th Five-Year Plan”, and strive to create a good beginning for its development during the “13th Five-Year Plan” period. The Company will seek to accelerate the development of core businesses, push forward sales transformation, boost the development of comprehensive sales and interactive businesses, and actively expand policy-oriented businesses. The exclusive individual agent channel will focus on developing businesses of regular premiums with 10 years or longer payment duration as well as the distributed short-term insurance businesses. The group insurance channel will seek to maintain its current profitability while further expanding its business scale and improving the profits. The bancassurance channel will make more efforts in transformation and development of regular premium businesses with long payment duration, good value and high quality. Meanwhile, the development of new business channels will be enhanced by adhering to the combination of online and offline sales, integration of online, tele and mobile sales, and the direct sales over the counter will be continually promoted. The Company will continue to make strategic investment in the development of its sales force with an aim to improve the quantity and quality of the sales team and enhance the hard power. While reinforcing and improving its competitive advantages in county-level markets, the Company will further accelerate its business development in key cities, thus firmly maintaining its leading position in the market. As to the Company’s investment level, we will focus on enhancing the investment capabilities, improving the asset allocation management system and investment management framework, and optimizing the asset allocation structure, so as to improve the level of investment income. The Company will further implement the “innovation-driven development strategy”, actively facilitate innovation in various fields, and push forward the construction of a “new generation” comprehensive business processing system with great efforts. By deepening its reforming progress, the Company will continue to enhance its development momentum. Moreover, the Company will be in full compliance with the requirements of China Risk Oriented Solvency System (C-ROSS), improve its effectiveness in risk control, strictly stick to the risk bottom line and steadily push forward the healthy and rapid development of the Company.

In retrospect, the development experiences accumulated during the “12th Five-Year Plan” period are valuable; looking forward, the “13th Five-Year Plan” period will present important opportunities for the Company to accelerate its development. The Company will stick to the general strategy of innovation-driven development and the main theme of transformation and upgrading, follow the operation ideas of “emphasizing value, strengthening sales force, optimizing structure, achieving stable growth and guarding against risks”, strengthen benchmarking practice and focus on making breakthroughs. The Company will also put more efforts in accelerating business development, transforming business model, deepening reforms and laying strong basis and solid foundation, so as to enable everyone to enjoy the high-quality services provided by the Company, to create greater value for investors, and to strive for building a world-class life insurance company.

| By Order of the Board Yang Mingsheng Chairman |

| Beijing, China 23 March 2016 |

8

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| I | BUSINESS OVERVIEW OF 2015 |

In 2015, the Company achieved a fast growth of its business and maintained its leading position in the market, with its business structure continuously optimized and the operating results noticeably improved. During the Reporting Period, the Company’s net premiums earned was RMB362,301 million, an increase of 9.8% from 2014, with RMB308,081 million from life insurance business, increased by 7.9% from 2014, RMB40,855 million from health insurance business, increased by 25.2% from 2014, RMB13,365 million from accident insurance business, increased by 12.2% from 2014; first-year premiums for policies with insurance duration of more than one year increased by 20.1% from 2014, first-year regular premiums increased by 32.9% from 2014, and the percentage of first-year regular premiums in first-year premiums for policies with insurance duration of more than one year increased to 44.22% in 2015 from 39.94% in 2014; first-year regular premiums with 10 years or longer payment duration increased by 25.4% from 2014, and the percentage of first-year regular premiums with 10 years or longer payment duration in first-year regular premiums was 52.20%; renewal premiums increased by 1.9% from 2014, and the percentage of renewal premiums in gross written premiums was 52.64%. As at 31 December 2015, the number of in-force policies increased by 9.6% from the end of 2014; the Policy Persistency Rate (14 months and 26 months)3 reached 90.00% and 85.50%, respectively; and the Surrender Rate4 was 5.55%, a 0.09 percentage point increase from 2014.

| 3 | The Persistency Rate for long-term individual policy is an important operating performance indicator for life insurance companies. It measures the ratio of in-force policies in a pool of policies after a certain period of time. It refers to the proportion of policies that are still effective during the designated month in the pool of policies whose issue date was 14 or 26 months ago. |

| 4 | Surrender Rate = Surrender payment/(Liability of long-term insurance contracts at the beginning of the period + Premium of long-term insurance contracts) |

9

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

With respect to the exclusive individual agent channel, the Company has achieved a relatively rapid increase in business scale and a remarkable increase in business value based on the continued business structure optimization. During the Reporting Period, gross written premiums from the exclusive individual agent channel increased by 10.0% year-on-year; first-year regular premiums increased by 39.2% year-on-year; the percentage of first-year regular premiums in first-year premiums was 98.97%; first-year regular premiums with 10 years or longer payment duration increased by 24.5% year-on-year; the percentages of first-year regular premiums with 5 years or longer payment duration and first-year regular premiums with 10 years or longer payment duration in gross first-year regular premiums were 90.50% and 61.15%, respectively; and renewal premiums increased by 3.9% year-on-year and the percentage of renewal premiums in gross written premiums of the exclusive individual agent channel was 75.96%. The Company has made significant achievements in its persistent implementation of the “effective expansion” strategy for team building. As at the end of the Reporting Period, the Company had a total of 979,000 exclusive individual agents which increased by 31.7% from the end of 2014. The Company continued to promote the professional development for the exclusive individual agent channel, and its sustainable development capacities have been enhanced remarkably.

With respect to the group insurance channel, businesses maintained a steady growth. During the Reporting Period, gross written premiums from the group insurance channel increased by 15.3% year-on-year; short-term insurance premiums increased by 14.6% year-on-year and short-term accident insurance premiums increased by 12.5% year-on-year. The group insurance channel actively provided services for economic and social development, effectively pushed forward the development of micro-insurance business, insurance for college-graduate village officials, birth planning insurance, accident insurance for senior citizens and new village cooperative supplementary accident insurance, etc. The Company also actively developed the medical insurance business in the high-end market, and further operated the multinational co-insurance business and the international insurance business such as the travel insurance for Sino-Russian tourism. As at the end of the Reporting Period, the Company had a total of 45,000 group insurance sales representatives in the group insurance channel.

With respect to the bancassurance channel, the Company actively responded to new challenges from market competition by rapidly expanding the sales team, deepening cooperation between different sales channels and strengthening sales support, enhancing the fundamental management and promoting business development. While maintaining the business scale as well as the steady growth of regular premiums, the Company made great efforts in developing businesses with medium- to long-term regular premiums (particularly the regular premiums with 10 years or longer payment duration) and achieved remarkable results in its channel transformation. During the Reporting Period, gross written premiums from the bancassurance channel increased by 6.2% year-on-year, first-year premiums for policies with insurance duration of more than one year increased by 12.0% year-on-year, first-year regular premiums increased by 14.6% year-on-year, and first-year regular premiums with 10 years or longer payment duration increased by 35.9% year-on-year. As at the end of the Reporting Period, the number of intermediary bancassurance outlets was 56,000, with a total of 131,000 sales representatives which increased by 84.5% from the end of 2014.

In 2015, the Company improved its asset allocation capacity representing the core value and operation characteristics of life insurance, made continuous efforts in diversifying its investment products, channels and regions, and gradually formed a management structure, which was based on a strategic asset allocation, and relied on diversified and market-oriented investments with the entrustors’ active allocation and arrangement as well as the organization and implementation by the investment managers. In terms of investment portfolios, in regard to the falling interest rates, an unsteadily increasing bond market and the narrowed credit spread, the Company actively responded to the fixed income investment environment by increasing its allocation in transactional bonds and other financial products. Meanwhile, in view of the increasing fluctuations and distinct divisions of the stock market, the Company highly boosted market operations with the advantage of a market-

10

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

oriented agency, and actively promoted allocation globally and made investments in sophisticated markets and high-quality assets while considering the prospective movement of exchange rate. As at the end of the Reporting Period, the Company’s investment assets reached RMB2,287,639 million, an increase of 8.9% from the end of 2014. Among the major types of investments, the percentage of bonds was 43.55%, the percentage of term deposits was 24.59%, the percentage of stocks and funds5 was 9.34%, and the percentage of financial assets6, such as the debt investment plans, equity investment plans and trust schemes etc., was 5.26%. During the Reporting Period, interest and dividend income increased steadily, and net investment yield7 was 4.30%. Spread income increased significantly, the gross investment yield was 6.24%, and the gross investment yield including net share of profit of associates and joint ventures8 was 6.20%. The comprehensive investment yield taking into account the current net fair value changes of available-for-sale financial assets recognized in other comprehensive income9 was 7.23%.

In 2015, the Company further implemented the “innovation-driven development strategy”. On the basis of further optimizing and improving its IT governance structure, the Company initiated the construction of the “new generation” comprehensive business processing system which featured as customer oriented, Internet-based, responsive and reliable. The Company fully promoted Cloud Assistant, Cloud Signage, Cloud Desktop and Total Internet Connection in order to speed up its mobile Internet-based operation. The Company stepped up the efforts in product innovation, further optimized its product development mechanism, and introduced several new products aimed at specific market segments and meeting customers’ emerging demands. The Company innovated a new mobile Internet-based sales model, which enabled a whole electronic process from product advertising, purchase, premium payment to policy generation. The Company further promoted the application of E-China Life and E-Store across sales channels, effectively promoting the sales of its major products. The Company reinforced the innovation of operation and services by launching E-customer Service with Internet services and mobile app services as its core, marking a new beginning of the Company’s “Internet plus” service. The nationwide promotion of “Counter Pass” system provided “four-pass” services of policy enquiry, claim acceptance, settlement and payment across provinces without geographical restrictions. The Company put more efforts in promoting centralized operation and realized centralized underwriting and claim assessment across eight provinces and municipalities, which accumulated precious experiences for the implementation of the Company’s “Rui Operation” strategy. With automation rate of insurance underwriting and preservation reaching 74% and 81%, respectively, and the launch of a smart claim settlement platform, a pilot program of quick claim settlement and direct payment at hospitals, the Company’s operational productivity and efficiency was further improved.

| 5 | Exclusive of currency fund. |

| 6 | Including debt investment plans, equity investment plans, trust schemes, project asset-backed plans, asset-backed securities and specialized asset management plans, etc. |

| 7 | Net investment yield = (Investment income + Net income from investment properties – Business tax and extra charges for investment) / ((Investment assets at the beginning of the period + Investment assets at the end of the period) / 2) |

| 8 | Gross investment yield including net share of profit of associates and joint ventures = (Investment income + Net realised gains/ (losses) on financial assets + Net fair value gains/(losses) through profit or loss + Total income from investment properties – Business tax and extra charges for investment + Net share of profit of associates and joint ventures) / ((Investment assets at the beginning of the period + Investments in associates and joint ventures at the beginning of the period + Investment assets at the end of the period + Investments in associates and joint ventures at the end of the period) / 2) |

| 9 | Comprehensive investment yield = (Investment income + Net realised gains/(losses) on financial assets + Net fair value gains/ (losses) through profit or loss + Current net fair value changes of available-for-sale securities recognized in other comprehensive income + Total income from investment properties – Business tax and extra charges for investment) / ((Investment assets at the beginning of the period + Investment assets at the end of the period) / 2) |

11

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

The Company fully completed the promotion of comprehensive counter service system, with one-stop services becoming available at 2,578 counters nationwide. To improve customer experience, the Company launched global emergency services and VIP services for all long-term policy holders, which covered multi-layer and various classes of global emergency services, health consultation and VIP care services. The Company continued to support children education and development and participate in public welfare undertakings, and held painting and drawing events for children across China for five consecutive years. The Company also cared about physical and mental health of customers, and actively held various customer activities, such as sports events and lectures, etc. The results of customer satisfaction and customer loyalty were increased by 1.2% and 4.8% year-on-year, reaching a record high.

The Company continuously complied with Section 404 of the U.S. Sarbanes-Oxley Act. Meanwhile, it implemented procedures for the compliance with standard systems of corporate internal control by following the “Standard Regulations on Corporate Internal Control” and the “Implementation Guidelines for Corporate Internal Control” jointly issued by five PRC ministries including the Ministry of Finance, etc, and the “Basic Standards of Internal Control for Insurance Companies” issued by the CIRC. In addition, the Company updated and benchmarked its internal control system to the “Internal Control-Integrated Framework (2013)” issued by the U.S. Committee of Sponsoring Organizations (COSO). In accordance with the CIRC’s requirements on the commissioning in the C-ROSS transition period, the Company launched programs to build up its solvency risk management system, fully benchmarked itself to the regulatory rules, strengthened the soundness, compliance and validity of its risk management system, and optimized the formation and transmission mechanisms of risk preference. The Company complied with the “Guidelines for the Implementation of Comprehensive Risk Management of Life Insurance Companies” issued by the CIRC, continued the work in relation to risk alert classification management, and created a monitoring system on key risks and explored a remote and vertical monitoring mode based on its information system. The Company also took the opportunity of the CIRC’s special inspection, namely “two strengthens and two containments”, to identify internal control problems and make effective adjustments. All the above measures helped to improve the Company’s risk management framework, secure the risk bottom line and optimize the internal control process, which enhanced the Company’s capability in risk management.

| II | ANALYSIS OF MAJOR ITEMS OF CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME |

| (1) | Total Revenues |

| For the year ended 31 December |

2015 | RMB million 2014 |

||||||

| Net premiums earned |

362,301 | 330,105 | ||||||

| Life insurance business |

308,081 | 285,574 | ||||||

| Health insurance business |

40,855 | 32,624 | ||||||

| Accident insurance business |

13,365 | 11,907 | ||||||

| Investment income |

97,582 | 93,548 | ||||||

| Net realised gains on financial assets |

32,297 | 7,120 | ||||||

| Net fair value gains through profit or loss |

10,209 | 5,808 | ||||||

| Other income |

5,060 | 4,185 | ||||||

|

|

|

|

|

|||||

| Total |

507,449 | 440,766 | ||||||

|

|

|

|

|

|||||

12

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

Net Premiums Earned

| 1. | Life Insurance Business |

During the Reporting Period, net premiums earned from life insurance business increased by 7.9% year-on-year. This was primarily due to an increase in the first-year premiums for policies with insurance duration of more than one year resulting from the Company’s enhanced efforts in team building and business development.

| 2. | Health Insurance Business |

During the Reporting Period, net premiums earned from health insurance business increased by 25.2% year-on-year. This was primarily due to the Company’s enhanced efforts in developing health insurance business.

| 3. | Accident Insurance Business |

During the Reporting Period, net premiums earned from accident insurance business increased by 12.2% year-on-year. This was primarily due to the Company’s continuous efforts in developing accident insurance business.

Gross written premiums categorized by business:

| For the year ended 31 December |

2015 | RMB million 2014 |

||||||

| Life Insurance Business |

308,169 | 285,619 | ||||||

| First-year business |

134,449 | 111,346 | ||||||

| Single |

78,068 | 70,006 | ||||||

| First-year regular |

56,381 | 41,340 | ||||||

| Renewal business |

173,720 | 174,273 | ||||||

| Health Insurance Business |

42,041 | 33,192 | ||||||

| First-year business |

24,435 | 19,525 | ||||||

| Single |

18,993 | 14,459 | ||||||

| First-year regular |

5,442 | 5,066 | ||||||

| Renewal business |

17,606 | 13,667 | ||||||

| Accident Insurance Business |

13,761 | 12,199 | ||||||

| First-year business |

13,480 | 12,049 | ||||||

| Single |

13,403 | 11,888 | ||||||

| First-year regular |

77 | 161 | ||||||

| Renewal business |

281 | 150 | ||||||

|

|

|

|

|

|||||

| Total |

363,971 | 331,010 | ||||||

|

|

|

|

|

|||||

13

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

Gross written premiums categorized by channel:

| For the year ended 31 December |

2015 | RMB million 2014 |

||||||

| Exclusive Individual Agent Channel |

225,957 | 205,417 | ||||||

| First-year business of long-term insurance |

47,974 | 34,455 | ||||||

| Single |

495 | 335 | ||||||

| First-year regular |

47,479 | 34,120 | ||||||

| Renewal business |

171,632 | 165,131 | ||||||

| Short-term insurance business |

6,351 | 5,831 | ||||||

| Group Insurance Channel |

20,107 | 17,440 | ||||||

| First-year business of long-term insurance |

3,571 | 2,989 | ||||||

| Single |

3,372 | 2,878 | ||||||

| First-year regular |

199 | 111 | ||||||

| Renewal business |

553 | 506 | ||||||

| Short-term insurance business |

15,983 | 13,945 | ||||||

| Bancassurance Channel |

106,028 | 99,825 | ||||||

| First-year business of long-term insurance |

87,222 | 77,881 | ||||||

| Single |

73,508 | 65,918 | ||||||

| First-year regular |

13,714 | 11,963 | ||||||

| Renewal business |

18,558 | 21,815 | ||||||

| Short-term insurance business |

248 | 129 | ||||||

| Other Channels1 |

11,879 | 8,328 | ||||||

| First-year business of long-term insurance |

1,209 | 1,262 | ||||||

| Single |

701 | 889 | ||||||

| First-year regular |

508 | 373 | ||||||

| Renewal business |

864 | 638 | ||||||

| Short-term insurance business |

9,806 | 6,428 | ||||||

|

|

|

|

|

|||||

| Total |

363,971 | 331,010 | ||||||

|

|

|

|

|

|||||

Notes:

| 1. | Other channels mainly include supplementary major medical insurance business, telephone sales, etc. |

| 2. | The Company’s channel premium breakdown was presented based on the separate groups of sales personnels including exclusive individual agent team, direct sales representatives, bancassurance sales team, and other distribution channels. |

14

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

Investment Income

| For the year ended 31 December |

2015 | RMB million 2014 |

||||||

| Investment income from securities at fair value through profit or loss |

1,708 | 1,677 | ||||||

| Investment income from available-for-sale securities |

27,476 | 23,029 | ||||||

| Investment income from held-to-maturity securities |

24,541 | 25,357 | ||||||

| Investment income from bank deposits |

32,285 | 34,934 | ||||||

| Investment income from loans |

11,115 | 8,138 | ||||||

| Other investment income |

457 | 413 | ||||||

|

|

|

|

|

|||||

| Total |

97,582 | 93,548 | ||||||

|

|

|

|

|

|||||

| 1 | Investment Income from Securities at Fair Value through Profit or Loss |

During the Reporting Period, investment income from securities at fair value through profit or loss increased by 1.8% year-on-year. This was primarily due to an increase in dividend income from stocks at fair value through profit or loss.

| 2 | Investment Income from Available-for-Sale Securities |

During the Reporting Period, investment income from available-for-sale securities increased by 19.3% year-on-year. This was primarily due to an increase in dividend income from available-for-sale funds, wealth management products and other equity investments.

| 3 | Investment Income from Held-to-Maturity Securities |

During the Reporting Period, investment income from held-to-maturity securities decreased by 3.2% year-on-year. This was primarily due to a decrease in the allocation of treasury bonds.

| 4 | Investment Income from Bank Deposits |

During the Reporting Period, investment income from bank deposits decreased by 7.6% year-on-year. This was primarily due to a decrease in the allocation of negotiated deposits and the investment yield of newly increased allocation under the low interest rate environment.

| 5 | Investment Income from Loans |

During the Reporting Period, investment income from loans increased by 36.6% year-on-year. This was primarily due to an increase in the scale of policy loans and trust schemes, etc.

15

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

Net Realised Gains on Financial Assets

During the Reporting Period, net realised gains on financial assets increased by 353.6% year-on-year. This was primarily due to a significant increase in the spread income of available-for-sale stocks and funds.

Net Fair Value Gains through Profit or Loss

During the Reporting Period, net fair value gains through profit or loss increased by 75.8% year-on-year. This was primarily due to a significant increase in the spread income of stocks at fair value through profit of loss.

Other Income

During the Reporting Period, other income increased by 20.9% year-on-year. This was primarily due to an increase in the commission fees earned from CLP&C resulting from the Company’s increased efforts in promoting its interactive business.

| (2) | Benefits, Claims and Expenses |

| For the year ended 31 December |

2015 | RMB million 2014 |

||||||

| Insurance benefits and claims expenses |

352,219 | 315,294 | ||||||

| Life insurance business |

313,612 | 288,868 | ||||||

| Health insurance business |

34,398 | 22,434 | ||||||

| Accident insurance business |

4,209 | 3,992 | ||||||

| Investment contract benefits |

2,264 | 1,958 | ||||||

| Policyholder dividends resulting from participation in profits |

33,491 | 24,866 | ||||||

| Underwriting and policy acquisition costs |

35,569 | 27,147 | ||||||

| Finance costs |

4,320 | 4,726 | ||||||

| Administrative expenses |

27,458 | 25,432 | ||||||

| Other expenses |

7,428 | 4,151 | ||||||

| Statutory insurance fund contribution |

743 | 701 | ||||||

|

|

|

|

|

|||||

| Total |

463,492 | 404,275 | ||||||

|

|

|

|

|

|||||

16

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

Insurance Benefits and Claims Expenses

| 1 | Life Insurance Business |

During the Reporting Period, insurance benefits and claims expenses attributable to life insurance business increased by 8.6% year-on-year. This was primarily due to an increase in the scale of life insurance business.

| 2 | Health Insurance Business |

During the Reporting Period, insurance benefits and claims expenses attributable to health insurance business increased by 53.3% year-on-year. This was primarily due to an increase in the scale of health insurance business and the update of actuarial assumptions, such as discount rate assumption of reserves of traditional insurance contracts.

| 3 | Accident Insurance Business |

During the Reporting Period, insurance benefits and claims expenses attributable to accident insurance business increased by 5.4% year-on-year. This was primarily due to an increase in the scale of accident insurance business.

Investment Contract Benefits

During the Reporting Period, investment contract benefits increased by 15.6% year-on-year. This was primarily due to an increase in the scale of investment contracts.

Policyholder Dividends Resulting from Participation in Profits

During the Reporting Period, policyholder dividends resulting from participation in profits increased by 34.7% year-on-year. This was primarily due to an increase in investment yields of the participating products.

Underwriting and Policy Acquisition Costs

During the Reporting Period, underwriting and policy acquisition costs increased by 31.0% year-on-year. This was primarily due to an increase in underwriting costs for first-year regular premium business resulting from the growth of the Company’s business and the optimization of its business structure.

Finance Costs

During the Reporting Period, finance costs decreased by 8.6% year-on-year. This was primarily due to a decrease in interest payments for securities sold under agreements to repurchase.

Administrative Expenses

During the Reporting Period, administrative expenses increased by 8.0% year-on-year. This was primarily due to the Company’s increased investment in team building for the purpose of enhancing its sustainable development capacity.

Other Expenses

During the Reporting Period, other expenses increased by 78.9% year-on-year. This was primarily due to an increase in business taxes and surcharges expenses resulting from an increase in taxable income from investments.

17

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| (3) | Profit before Income Tax |

| For the year ended 31 December |

2015 | RMB million 2014 |

||||||

| Life insurance business |

40,921 | 30,651 | ||||||

| Health insurance business |

557 | 3,252 | ||||||

| Accident insurance business |

1,753 | 1,546 | ||||||

| Other business |

2,700 | 4,953 | ||||||

|

|

|

|

|

|||||

| Total |

45,931 | 40,402 | ||||||

|

|

|

|

|

|||||

| 1 | Life Insurance Business |

During the Reporting Period, profit before income tax in life insurance business increased by 33.5% year-on-year. This was primarily due to the growth of business and an increase in income from investments as compared to the corresponding period of 2014.

| 2 | Health Insurance Business |

During the Reporting Period, profit before income tax in health insurance business decreased by 82.9% year-on-year. This was primarily due to the update of actuarial assumptions, such as discount rate assumption of reserves of traditional insurance contracts, which partially reduced the profit for the period.

| 3 | Accident Insurance Business |

During the Reporting Period, profit before income tax in accident insurance business increased by 13.4% year-on-year. This was primarily due to an increase in the scale of accident insurance business as compared to the corresponding period of 2014.

| 4 | Other Business |

During the Reporting Period, profit before income tax in other business decreased by 45.5% year-on-year. This was primarily due to a decrease in net profits of associates and the impairment of investments in associates.

| (4) | Income Tax |

During the Reporting Period, income tax of the Company was RMB10,744 million, a 36.2% increase year-on-year. This was primarily due to an increase in profit before income tax.

| (5) | Net Profit |

During the Reporting Period, net profit attributable to equity holders of the Company was RMB34,699 million, a 7.7% increase year-on-year. This was mainly attributable to factors such as the increase in investment income. However, update of actuarial assumptions, such as discount rate assumption of reserves of traditional insurance contracts, partially reduced the profit for the period.

18

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| III | ANALYSIS OF MAJOR ITEMS OF CONSOLIDATED STATEMENT OF FINANCIAL POSITION |

| (1) | Major Assets |

| As at 31 December 2015 |

RMB million As at 31 December 2014 |

|||||||

| Investment assets |

2,287,639 | 2,100,870 | ||||||

| Term deposits |

562,622 | 690,156 | ||||||

| Held-to-maturity securities |

504,075 | 517,283 | ||||||

| Available-for-sale securities |

770,516 | 607,531 | ||||||

| Securities at fair value through profit or loss |

137,990 | 53,052 | ||||||

| Securities purchased under agreements to resell |

21,503 | 11,925 | ||||||

| Cash and cash equivalents |

76,096 | 47,034 | ||||||

| Loans |

207,267 | 166,453 | ||||||

| Statutory deposits – restricted |

6,333 | 6,153 | ||||||

| Investment properties |

1,237 | 1,283 | ||||||

| Other assets |

160,676 | 145,697 | ||||||

|

|

|

|

|

|||||

| Total |

2,448,315 | 2,246,567 | ||||||

|

|

|

|

|

|||||

Term Deposits

As at the end of the Reporting Period, term deposits decreased by 18.5% year-on-year. This was primarily due to a decrease in the allocation of negotiated deposits.

Held-to-Maturity Securities

As at the end of the Reporting Period, held-to-maturity securities decreased by 2.6% year-on-year. This was primarily due to a decrease in the allocation of treasury bonds.

Available-for-Sale Securities

As at the end of the Reporting Period, available-for-sale securities increased by 26.8% year-on-year. This was primarily due to an increase in the allocation of funds, wealth management products and unlisted equities in light of market conditions in a timely manner.

Securities at Fair Value through Profit or Loss

As at the end of the Reporting Period, securities at fair value through profit or loss increased by 160.1% year-on-year. This was primarily due to an increase in the allocation of bonds at fair value through profit or loss.

19

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

Cash and Cash Equivalents

As at the end of the Reporting Period, cash and cash equivalents increased by 61.8% year-on-year. This was primarily due to the needs for liquidity management.

Loans

As at the end of the Reporting Period, loans increased by 24.5% year-on-year. This was primarily due to an increase in the scale of policy loans and trust schemes, etc.

Investment Properties

As at the end of the Reporting Period, investment properties decreased by 3.6% year-on-year. This was primarily due to the depreciation of the investment properties.

As at the end of the Reporting Period, our investment assets are categorized as below in terms of asset classes:

| RMB million | ||||||||||||||||

| As at 31 December 2015 | As at 31 December 2014 | |||||||||||||||

| Amount | Percentage | Amount | Percentage | |||||||||||||

| Fixed-maturity investments |

1,777,180 | 77.69 | % | 1,804,598 | 85.90 | % | ||||||||||

| Term deposits |

562,622 | 24.59 | % | 690,156 | 32.85 | % | ||||||||||

| Bonds |

996,236 | 43.55 | % | 940,619 | 44.77 | % | ||||||||||

| Insurance asset management products1 |

67,569 | 2.95 | % | 62,348 | 2.97 | % | ||||||||||

| Other fixed-maturity investments2 |

150,753 | 6.60 | % | 111,475 | 5.31 | % | ||||||||||

| Equity investments |

411,623 | 17.99 | % | 236,030 | 11.23 | % | ||||||||||

| Common stocks |

111,516 | 4.87 | % | 94,933 | 4.52 | % | ||||||||||

| Funds |

169,485 | 7.41 | % | 83,620 | 3.98 | % | ||||||||||

| Other equity investments3 |

130,622 | 5.71 | % | 57,477 | 2.73 | % | ||||||||||

| Investment properties |

1,237 | 0.05 | % | 1,283 | 0.06 | % | ||||||||||

| Cash, cash equivalents and others4 |

97,599 | 4.27 | % | 58,959 | 2.81 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

2,287,639 | 100.00 | % | 2,100,870 | 100.00 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Notes:

| 1. | Insurance asset management products under fixed-maturity investments include infrastructure and real estate debt investment plans and project asset-backed plans. |

| 2. | Other fixed-maturity investments include policy loans, trust schemes, statutory deposits – restricted, etc. |

| 3. | Other equity investments include private equity funds, unlisted equities, preference stocks, equity investment plans, wealth management products, etc. |

| 4. | Cash, cash equivalents and others include cash and cash equivalents, and securities purchased under agreements to resell. |

20

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| (2) | Major Liabilities |

| As at 31 December 2015 |

RMB million As at 31 December 2014 |

|||||||

| Insurance contracts |

1,715,985 | 1,603,446 | ||||||

| Investment contracts |

84,106 | 72,275 | ||||||

| Securities sold under agreements to repurchase |

31,354 | 46,089 | ||||||

| Policyholder dividends payable |

107,774 | 74,745 | ||||||

| Annuity and other insurance balances payable |

30,092 | 25,617 | ||||||

| Interest-bearing loans and borrowings |

2,643 | 2,623 | ||||||

| Bonds payable |

67,994 | 67,989 | ||||||

| Deferred tax liabilities |

16,953 | 19,375 | ||||||

| Other liabilities |

65,200 | 47,077 | ||||||

|

|

|

|

|

|||||

| Total |

2,122,101 | 1,959,236 | ||||||

|

|

|

|

|

|||||

Insurance Contracts

As at the end of the Reporting Period, insurance contracts liabilities increased by 7.0% year-on-year. This was primarily due to the accumulation of insurance liabilities from new insurance business and renewal business. As at the date of the statement of financial position, the Company’s insurance contracts reserves passed liability adequacy testing.

Investment Contracts

As at the end of the Reporting Period, account balance of investment contracts increased by 16.4% year-on-year. This was primarily due to an increase in the scale of certain investment contracts.

Securities Sold under Agreements to Repurchase

As at the end of the Reporting Period, securities sold under agreements to repurchase decreased by 32.0% year-on-year. This was primarily due to the needs for liquidity management.

Policyholder Dividends Payable

As at the end of the Reporting Period, policyholder dividends payable increased by 44.2% year-on-year. This was primarily due to an increase in investment yields of participating products.

Annuity and Other Insurance Balances Payable

As at the end of the Reporting Period, annuity and other insurance balances payable increased by 17.5% year-on-year. This was primarily due to an increase in maturities payable.

Interest-bearing Loans and Borrowings

As at the end of the Reporting Period, interest-bearing loans and borrowings remained stable compared to the end of 2014, and there were no new loans and borrowings in 2015. In June 2014, to meet the needs of overseas investment, one of the Company’s subsidiaries applied for a fixed-interest rate bank loan of GBP275 million with a term of five years. As at the end of the Reporting Period, the loan balance was equivalent to RMB2,643 million.

21

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

Bonds Payable

As at the end of the Reporting Period, bonds payable remained stable compared to the end of 2014. This was primarily due to the fact that no subordinated debts were issued by the Company in 2015.

Deferred Tax Liabilities

As at the end of the Reporting Period, deferred tax liabilities decreased by 12.5% year-on-year. This was primarily due to an increase in the deductible temporary differences.

| (3) | Equity Holders’ Equity |

As at the end of the Reporting Period, equity holders’ equity was RMB322,492 million, a 13.5% increase year-on-year. This was primarily due to the combined effect of an increase in the fair value of available-for-sale financial assets and the profit earned during the Reporting Period.

| IV | ANALYSIS OF CASH FLOWS |

| (1) | Liquidity Sources |

Our principal cash inflows come from insurance premiums, deposits from investment contracts, proceeds from sales and maturity of investment assets, and investment income. The primary liquidity risks with respect to these cash inflows are the risk of early withdrawals by contract holders and policyholders, as well as the risks of default by debtors, interest rate changes and other market volatilities. We closely monitor and manage these risks.

Our cash and bank deposits can provide us with a source of liquidity to meet normal cash outflows. As at the end of the Reporting Period, the amount of cash and cash equivalents was RMB76,096 million. In addition, substantially all of our term deposits with banks allow us to withdraw funds on deposit, subject to a penalty interest charge. As at the end of the Reporting Period, the amount of term deposits was RMB562,622 million.

Our investment portfolio also provides us with a source of liquidity to meet unexpected cash outflows. We are also subject to market liquidity risk due to the large size of our investments in some of the markets in which we invest. In some circumstances, some of our holdings of investment securities may be large enough to have an influence on the market value. These factors may adversely affect our ability to sell these investments or sell them at a fair price.

| (2) | Liquidity Uses |

Our principal cash outflows primarily relate to the payables for the liabilities associated with our various life insurance, annuity, accident insurance and health insurance products, operating expenses, income taxes and dividends that may be declared and paid to our equity holders. Cash outflows arising from our insurance activities primarily relate to benefit payments under these insurance products, as well as payments for policy surrenders, withdrawals and loans.

We believe that our sources of liquidity are sufficient to meet our current cash requirements.

22

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| (3) | Consolidated Cash Flows |

| For the year ended 31 December |

2015 | RMB million 2014 |

||||||

| Net cash inflow/(outflow) from operating activities |

(18,811 | ) | 78,247 | |||||

| Net cash inflow/(outflow) from investing activities |

67,047 | (69,257 | ) | |||||

| Net cash inflow/(outflow) from financing activities |

(19,415 | ) | 16,704 | |||||

| Foreign exchange gains on cash and cash equivalents |

241 | 10 | ||||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

29,062 | 25,704 | ||||||

|

|

|

|

|

|||||

We have established a cash flow testing system. We conduct regular tests to monitor the cash inflows and outflows under various changing circumstances and adjust accordingly the asset portfolio to ensure sufficient sources of liquidity. During the Reporting Period, the change of net cash flow from operating activities was primarily due to an increase in securities at fair value through profit or loss. The change of net cash flow from investing activities was primarily due to the needs for investment management. The change in net cash flow from financing activities was primarily due to the needs for liquidity management.

| V | SOLVENCY RATIO |

The solvency ratio of an insurance company is a measure of capital adequacy, which is calculated by dividing the actual capital of the company (which is its admitted assets less admitted liabilities, determined in accordance with relevant regulatory rules) by the minimum required capital. The following table shows our solvency ratio as at the end of the Reporting Period:

| As at 31 December 2015 |

RMB million As at 31 December 2014 |

|||||||

| Actual capital |

282,820 | 236,151 | ||||||

| Minimum capital |

85,676 | 80,193 | ||||||

| Solvency ratio |

330.10 | % | 294.48 | % | ||||

|

|

|

|

|

|||||

The increase in the Company’s solvency ratio was primarily due to a significant increase in the comprehensive income during the Reporting Period and the issue of Core Tier 2 Capital Securities.

23

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| VI | ANALYSIS OF CORE COMPETITIVENESS |

The Company has the advantage of very strong brand recognition. It is the only life insurance company in China with shares listed on the Shanghai Stock Exchange, the Hong Kong Stock Exchange and the New York Stock Exchange. It is also a core member of China Life Insurance (Group) Company which is one of the “Fortune Global 500” and the “World’s 500 Most Influential Brands”. In 2015, the brand of China Life has been ranked as one of the “World’s 500 Most Influential Brands” published by World Brand Lab for nine consecutive years. The brand was also ranked as No.5 on the “China’s 500 Most Valuable Brands” list, with brand value estimated at RMB182,272 million, ranking No.1 in the insurance industry.

The Company has an extensive services and distribution network in China, with its business outlets and services counters covering both urban and rural areas. The 979,000 exclusive individual agents, 45,000 direct sales representatives, 56,000 intermediary bancassurance outlets and 131,000 sales representatives at those bancassurance outlets form a unique distribution and services network in China, and make the Company the life insurance service provider closest to the customers. Making use of internationally leading information technology and expanding telephone, Internet, email and other electronic service channels, the Company strives to meet customer demand for purchasing insurance products through multiple channels.

The Company has the most extensive customer base. As at 31 December 2015, the Company had approximately 216 million long-term individual and group life insurance policies, annuity contracts and long-term health insurance policies in force.

The Company possesses great financial strength. As at 31 December 2015, the registered capital and the total assets of the Company were RMB28,265 million and RMB2,448,315 million, respectively, which ranked No.1 in China’s life insurance industry. As at the end of 2015, the total market capitalization of the Company was US$114,921 million, which ranked No.2 among all listed insurance companies in the world.

The Company is one of the largest institutional investors in China, and through its controlling shareholding in China Life Asset Management Company Limited, the Company is the largest insurance asset management company in China. As at 31 December 2015, the investment assets reached RMB2,287,639 million, an increase of 8.9% from the end of 2014.

The Company has rich experience in life insurance management. The predecessor of China Life was the first enterprise to underwrite life insurance business in China, and played the role of an explorer and pioneer in China’s life insurance industry. During the long course of its development, the Company has accumulated a wealth of experience in operation and management, has a stable, professional management team, and has become well versed in the art of management in China’s life insurance market. The Company’s key management team and personnel comprise those who have in-depth knowledge and understanding of the life insurance market in China, including members of the Company’s senior management, qualified underwriting personnel, actuaries and experienced investment managers, etc. During the Reporting Period, there was no movement of these personnel which might have material impacts on the Company.

24

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| VII | MAJOR INVESTMENTS |

Investment business is one of the principal businesses of the Company, among which, equity investment consists of listed equities, unlisted equities and private equity funds, etc; non-equity investment consists of bank deposits, bonds and financial assets such as debt investment plans, trust schemes and wealth management products, etc.

On 8 December 2015, the Company and Postal Savings Bank of China Co., Ltd. (“Postal Savings Bank”) entered into the Share Subscription Agreement, pursuant to which, Postal Savings Bank conditionally agreed to allot and issue, and the Company conditionally agreed to subscribe for, 3,341,900,000 shares of Postal Savings Bank for a total consideration of RMB12,999,991,000. Upon the completion of the transaction on 17 December 2015, the Company holds no more than 5% of the enlarged issued share capital of Postal Savings Bank. For details, please refer to the announcement published by the Company on the website of the SSE and the HKExnews website of the Hong Kong Exchanges and Clearing Limited on 8 December 2015.

During the Reporting Period, there was no other material equity investment or non-equity investment with a total investment amount of more than 10% of the Company’s audited net asset as at the end of last year.

| VIII | SALES OF MATERIAL ASSETS AND EQUITY |

During the Reporting Period, there was no sale of material assets and equity of the Company.

| IX | BUSINESS OPERATIONS OF OUR MAIN SUBSIDIARIES AND AFFILIATES |

| Company Name |

Major Business Scope |

Registered Capital |

Shareholding Percentage |

Total Assets |

Net Assets |

RMB million Net Profit |

||||||||||||||||

| China Life Asset Management Company Limited |

Management and utilization of proprietary funds; acting as agent or trustee for asset management business; consulting business relevant to the above businesses; other asset management businesses permitted by applicable PRC laws and regulations | 4,000 | 60 | % | 7,608 | 6,940 | 1,096 | |||||||||||||||

| China Life Pension Company Limited |

Group pension insurance and annuity; individual pension insurance and annuity; short-term health insurance; accident insurance; reinsurance of the above insurance businesses; business for the use of insurance funds that are permitted by applicable PRC laws and regulations; pension insurance asset management product business; management of funds in RMB or foreign currency as entrusted by entrusting parties for the retirement benefit purpose; other businesses permitted by the CIRC | 3,400 | |

70.74% is held by the Company, and 3.53% is held by AMC |

|

3,440 | 2,931 | 117 | ||||||||||||||

| China Life Property and Casualty Insurance Company Limited |

Property loss insurance; liability insurance; credit insurance and bond insurance; short-term health insurance and accident insurance; reinsurance of the above insurance businesses; businesses for the use of insurance funds that are permitted by applicable PRC laws and regulations; other businesses permitted by the CIRC | 15,000 | 40 | % | 65,634 | 19,531 | 2,258 | |||||||||||||||

25

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

| X | STRUCTURED ENTITIES CONTROLLED BY THE COMPANY |

Details of structured entities controlled by the Company is set out in Note 39(c) in the Notes to the Consolidated Financial Statements in this annual report.

| XI | FUTURE PROSPECT AND RISK ANALYSIS |

In 2016, the Company will strengthen its in-depth analysis of macro-economic trends and complex risk factors to maintain its continuous and healthy growth. The major risk factors which may have an impact on the Company’s future development strategy and business objectives include:

| 1. | Risks relating to macro trends |

The global economy is experiencing profound changes with insufficient momentum for recovery; the growth of international trade is sluggish; the volatility is seen in the financial and bulk commodity markets; the geopolitical risks are mounting; and the instabilities and uncertainties in the external environment are increasing. The impact of all the above factors on China’s development cannot be underestimated. Domestic conflicts and risks that have been building up over the years become more obvious. With the change of pace in economic growth, the difficulties associated with structural adjustments, and the interwoven problems arising from the transformation of the drivers of growth, the downward pressure on the economy is growing. Changes in international and domestic markets will be transferred to the insurance industry through multiple channels such as the real economy, financial markets and consumer demands, which will in turn affect the business development, use of funds and solvency in various aspects.

| 2. | Risks relating to our business |

As the financial reform steadily moves forward within a certain period of time in future, the effects from the further implementation of the exchange rate reform and the falling of the risk-free interest rate etc. will become increasingly apparent. Further, the market-oriented reform of premium rate for life insurance, the intensified market competition and the application of new technologies, etc. will bring about various challenges and uncertainties to the business development of the Company. Generally affected by these factors, the Company is experiencing more difficulties in maintaining steady business growth, as well as facing more uncertainties and complexities. Due to factors such as investment income and the cost of liabilities, there may be higher possibility of fluctuation of the Company’s profits. In addition, the operational and financial risks of associated enterprises and the fluctuation in their profitability may undermine the expected returns on investment, which would have an impact on the Company’s profitability.

| 3. | Risks relating to investments |

Given that the interest rate in China maintains at a low level, the investment yield of the newly allocated fixed income assets may decline, the difficulty of asset allocation may increase, and the risk relating to asset misallocation may increase. In light of the complexity of the domestic and international economies, as well as the greater volatility of the financial markets, the market risk relating to investment portfolios and credit risk may go up. In the meanwhile, the Company may develop new investment channels, utilize new investment vehicles or appoint new investment managers. All of the above may considerably affect the Company’s investment income and the book value of its assets, and thus result in a greater fluctuation of the Company’s profits. Moreover, some of the Company’s assets are held in foreign currencies, which may be adversely affected by exchange rate movements.

26

China Life Insurance Company Limited Annual Report 2015

Management Discussion and Analysis

In 2016, under the guidance of the “innovation-driven development strategy”, and with adherence to the business philosophy of “focusing on value, enhancing personnel, optimizing structure, maintaining growth and guarding against risks”, the Company will focus on breakthroughs and strengthen benchmarking, and pay more attention to the acceleration of its development, sales transformation, team quality improvement, market benchmarking, as well as reform and innovation, in order to improve the Company’s core competitiveness and sustainable development capability as a whole and to lay a solid foundation for achieving the Company’s development objectives of the “13th Five-Year Plan”. Given the above mentioned risk factors, the Company will firmly adhere to its core development objectives, and fine-tune its business development objectives in accordance with market trends to an appropriate degree, so as to efficiently respond to challenges from market competitors and changes in the external environment. Meanwhile, the Company will focus on innovation in mechanisms, building of sales force, innovation in products, services and technology, in order to constantly enhance its vitality, creativity, competitiveness and capacity for sustainable development. The Company believes that it will have sufficient capital to meet its insurance business expenditures and general new investment needs in 2016. At the same time, if there is any further capital demand, the Company will make corresponding arrangements based on capital market conditions to further implement its future business development strategies.

27

China Life Insurance Company Limited Annual Report 2015

Report of the Board of Directors

Directors of the Company during the Reporting Period and up to the date of this report were as follows:

| Executive Directors | Yang Mingsheng (Chairman) Lin Dairen | |||

| Su Hengxuan Miao Ping Xu Hengping Xu Haifeng |

(resigned with effect from 8 May 2015) (retired upon expiry of the term with effect from 28 May 2015) (appointed as Director with effect from 11 July 2015) (appointed as Director with effect from 11 July 2015) | |||

| Non-executive Directors | Miao Jianmin Zhang Xiangxian Wang Sidong |

|||

| Liu Jiade | (appointed as Director with effect from 11 July 2015) | |||

| Independent Directors | Bruce Douglas Moore Anthony Francis Neoh Chang Tso Tung Stephen |

(retired upon expiry of the term with effect from 28 May 2015) | ||

| Huang Yiping Robinson Drake Pike Tang Xin |

(resigned with effect from 7 March 2016) (appointed as Director with effect from 11 July 2015) (appointed as Director with effect from 7 March 2016) | |||

28

China Life Insurance Company Limited Annual Report 2015

Report of the Board of Directors

| 1. | PRINCIPAL BUSINESS |

The Company is the largest life insurance company in China’s life insurance market and possesses the most extensive distribution network in China, comprising exclusive agents, direct sales representatives as well as dedicated and non-dedicated agencies. The Company provides products and services such as individual and group life insurance, accident and health insurance. The Company is one of the largest institutional investors in China, and is China’s largest insurance asset management company through its controlling shareholding in China Life Asset Management Company Limited. The Company also has controlling shareholding in China Life Pension Company Limited.

| 2. | BUSINESS REVIEW |

| (I) | Overall operation of the Company during the Reporting Period |