EXHIBIT 99.2

ASPEN INSURANCE HOLDINGS

LIMITED

EARNINGS RELEASE SUPPLEMENT

AS OF SEPTEMBER 30,

2005

INDEX TO SUPPLEMENT

| Page | ||||||

| BASIS OF PREPARATION | 2 | |||||

| INCOME STATEMENT | 3 | |||||

| CONSOLIDATED BALANCE SHEET | 4 | |||||

| PROFORMA SHARHOLDERS’ EQUITY | 5 | |||||

| PER SHARE DATA | 6 | |||||

| FINANCIAL RATIOS | 7 | |||||

| UNDERWRITING RESULTS BY OPERATING SEGMENT | 8 | |||||

| CONSOLIDATED CHANGE IN SHAREHOLDERS’ EQUITY | 17 | |||||

| CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME | 18 | |||||

| SUMMARIZED CASH FLOW | 18 | |||||

| SUPPLEMENTAL FINANCIAL INFORMATION | 19 | |||||

This financial supplement is for information purposes only. It should be read in conjunction with other documents filed or to be filed shortly by Aspen Insurance Holdings Limited with the United States Securities Exchange Commission.

Application of the Safe Harbor of the Private Securities Litigation Reform Act of 1995:

This financial supplement may contain, and Aspen may from time-to-time make, written or oral "forward-looking statements" within the meaning of the U.S. federal securities laws. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as "expect," "intend," "plan," "believe," "project," "anticipate," "seek," "will," "estimate," "may," "continue," and similar expressions of a future or forward-looking nature. All forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and other factors, many of which are outside the Company's control that could cause actual results to differ materially from such statements. Important events that could cause the actual results to differ include, but are not limited to: the impact of acts of terrorism and related legislations and acts of war; the possibility of greater frequency or severity of or unanticipated losses from natural or man-made catastrophes, including Hurricanes Katrina and Rita and the New Orleans Flood; evolving interpretive issues with respect to coverage as a result of Hurricanes Katrina and Rita and the New Orleans Flood; the level of inflation in repair costs due to limited availability of labor and materials after catastrophes; the effectiveness of the Company's loss limitation methods; changes in the availability, cost or quality of reinsurance or retrocessional coverage; the loss of key personnel; a decline in the operating subsidiaries' ratings with Standard & Poor's, A.M. Best or Moody's; changes in general economic conditions; increased competition on the basis of pricing, capacity, coverage terms or other factors; decrease in demand for the Company's insurance or reinsurance products and cyclical downturn of the industry; changes in governmental regulation or tax laws in the jurisdictions where the Company conducts business; the total industry losses resulting from Hurricanes Katrina and Rita and the New Orleans Flood; the actual number of the Company's insureds incurring losses from these storms; the limited actual loss reports received from the Company's insureds to date; the preliminary nature of possible loss information received by brokers to date on behalf of cedants; the Company's reliance on industry loss estimates and those generated by modeling techniques; the impact of these storms on the Company's reinsurers; the amount and timing of reinsurance recoverables and reimbursements actually received by the Company from its reinsurers; the overall level of competition, and the related demand and supply dynamics as contracts come up for renewal. For a more detailed description of these uncertainties and other factors, please see the "Risk Factors" section in Aspen's Annual Report on Form 10-K for the year ended December 31, 2004, filed with the U.S. Securities and Exchange Commission on March 14, 2005 and Aspen's Current Report on Form 8-K dated October 4, 2005. Aspen undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

BASIS OF PREPARATION

Definitions and presentation All financial information contained herein is unaudited except for information for the 12 months ended December 31, 2004. Unless otherwise noted, all data is in US dollars millions, except for per share, percentage and ratio information.

In presenting the Company's results, management has included and discussed certain "non-GAAP financial measures", as such term is defined in Regulation G. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the Company's results of operations in a manner that allows for a more complete understanding of the underlying trends in the Company's business. However, these measures should not be viewed as a substitute for those determined in accordance with GAAP. The reconciliation of such non-GAAP financial measures to their respective most directly comparable GAAP financial measures in accordance with Regulation G is included in this financial supplement.

Operating income (a non-GAAP financial measure): Operating income is an internal performance measure used by the Company in the management of its operations and represents after-tax operational results excluding, as applicable, after-tax net realized capital gains or losses and after-tax net foreign exchange gains or losses.

The Company excludes after tax net realized capital gains or losses and after-tax net foreign exchange gains or losses from its calculation of operating income because the amount of these gains or losses is heavily influenced by, and fluctuates in part, according to the availability of market opportunities. The Company believes these amounts are largely independent of its business and underwriting process and including them distorts the analysis of trends in its operations. In addition to presenting net income determined in accordance with GAAP, the Company believes that showing operating income enables investors, analysts, rating agencies and other users of its financial information to more easily analyze the Company's results of operations in a manner similar to how management analyzes the Company's underlying business performance. Operating income should not be viewed as a substitute for GAAP net income. Please see page 25 for a reconciliation of operating income to net income.

Annualized Operating Return on Average Equity (ROAE) (a non-GAAP financial measure): Annualized Operating Return on Average Equity is calculated using 1) operating income, as defined above and 2) excludes from average equity, the average after tax unrealized appreciation or depreciation on investments and the average after tax unrealized foreign exchange gains or losses. Unrealized appreciation (depreciation) on investments is primarily the result of interest rate movements and the resultant impact on fixed income securities, and unrealized appreciation (depreciation) on foreign exchange is the result of exchange rate movements between the US dollar and the British pound. Such appreciation (depreciation) is not related to management actions or operational performance (nor is it likely to be realized). Therefore the Company believes that excluding these unrealized appreciations (depreciations) provides a more consistent and useful measurement of operating performance, which supplements GAAP information. Average equity is calculated as the arithmetic average on a monthly basis for the stated periods.

The Company presents ROAE as a measure that it is commonly recognized as a standard of performance by investors, analysts, rating agencies and other users of its financial information.

See page 25 for a reconciliation of operating income to net income and page 19 for a reconciliation of average equity.

Diluted book value per share (a non-GAAP financial measure): The Company has included diluted book value per share because it takes into account the effect of dilutive securities; therefore, the Company believes it is a better measure of calculating shareholder returns than book value per share. Please see page 25 for a reconciliation of diluted book value per share to basic book value per share.

Underwriting ratios (are GAAP financial measures): Aspen Insurance Holdings Limited, along with others in the industry, uses underwriting ratios as measures of performance. The loss ratio is the ratio of net claims and claims adjustment expense to net premiums earned. The acquisition expense ratio is the ratio of underwriting expenses (commissions; premium taxes, licenses and fees; as well as other underwriting expenses) to net premiums earned. The general and administrative expense ratio is the ratio of general and administrative expenses to net premiums earned. The combined ratio is the sum of the loss ratio, the acquisition expense ratio and the general and administrative expense ratio. These ratios are relative measurements that describe for every $100 of net premiums earned or written, the cost of losses and expenses, respectively. The combined ratio presents the total cost per $100 of earned premium. A combined ratio below 100% demonstrates underwriting profit; a combined ratio above 100% demonstrates underwriting loss.

Underwriting ratios excluding impact of Hurricanes and Windstorms (are non-GAAP financial measures): In these ratios, the Company excludes the impact of Hurricanes Katrina and Rita (in relation to the 2005 financial year figures) and Hurricanes Charley, Frances, Ivan and Jeanne and Typhoon Songda (in relation to the 2004 comparative figures) from net premiums earned and losses and loss expenses in order to calculate loss ratio and expense ratios excluding the impact of these events. The underwriting ratios excluding the impact of the hurricanes and windstorms are derived by adjusting the net premiums earned and the losses and loss expenses for the period by the impact of the hurricanes and windstorms in the period as shown and calculating loss ratio and expense ratio using these derived balances. In addition to presenting underwriting ratios determined in accordance with GAAP, the Company believes that showing non-GAAP underwriting ratios enables investors, analysts, rating agencies and other users of its financial information to more easily analyze the Company's results of operations in a manner similar to how management analyzes the Company's underlying business performance without these events. In addition, the Company believes that such users wish to have such non-GAAP ratios, as well as the GAAP-based ratios, to compare the performance of the Company's underlying business lines without regard to the impact of these major catastrophes.

GAAP combined ratios differ from statutory combined ratios primarily due to the deferral of certain third party acquisition expenses for GAAP reporting purposes and the use of net premiums earned rather than net premiums written in the denominator when calculating the acquisition expense and the general & administrative expense ratios.

Page 2 of 25

INCOME STATEMENT

The following table summarizes the Company's financial performance for the three and nine months ended September 30, 2005 compared to the three and nine months ended September 30, 2004.

| Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | |||||||||||||||||||

| (in US$ millions) | September 30, 2005 | September 30, 2004 | September 30, 2005 | September 30, 2004 | ||||||||||||||||||

| UNDERWRITING REVENUES | ||||||||||||||||||||||

| Gross premiums written | 494.0 | 349.4 | 1,847.5 | 1,370.0 | ||||||||||||||||||

| Premiums ceded | (149.5 | ) | (53.5 | ) | (384.0 | ) | (201.1 | ) | ||||||||||||||

| Net premiums written | 344.5 | 295.9 | 1,463.5 | 1,168.9 | ||||||||||||||||||

| Change in unearned premiums | 34.9 | (2.5 | ) | (310.4 | ) | (242.7 | ) | |||||||||||||||

| Net premiums earned | 379.4 | 293.4 | 1,153.1 | 926.2 | ||||||||||||||||||

| UNDERWRITING EXPENSES | ||||||||||||||||||||||

| Losses and loss expenses | (683.0 | ) | (303.2 | ) | (1,086.3 | ) | (566.7 | ) | ||||||||||||||

| Acquisition expenses | (71.1 | ) | (40.0 | ) | (218.4 | ) | (164.2 | ) | ||||||||||||||

| General and administrative expenses | (31.5 | ) | (26.5 | ) | (90.6 | ) | (70.7 | ) | ||||||||||||||

| Total Underwriting Expenses | (785.6 | ) | (369.7 | ) | (1,395.3 | ) | (801.6 | ) | ||||||||||||||

| Underwriting Income (Loss) | (406.2 | ) | (76.3 | ) | (242.2 | ) | 124.6 | |||||||||||||||

| OTHER OPERATING REVENUE | ||||||||||||||||||||||

| Net investment income | 29.4 | 19.4 | 82.0 | 46.3 | ||||||||||||||||||

| Interest expense | (4.3 | ) | (2.7 | ) | (12.2 | ) | (3.2 | ) | ||||||||||||||

| Total other operating revenue | 25.1 | 16.7 | 69.8 | 43.1 | ||||||||||||||||||

| Other expense | (4.8 | ) | (2.1 | ) | (9.2 | ) | (2.1 | ) | ||||||||||||||

| OPERATING INCOME (LOSS) BEFORE TAX | (385.9 | ) | (61.7 | ) | (181.6 | ) | 165.6 | |||||||||||||||

| OTHER | ||||||||||||||||||||||

| Net realized exchange gains (losses) | (3.9 | ) | 1.4 | (8.7 | ) | 0.7 | ||||||||||||||||

| Net realized investment gains (losses) | (1.4 | ) | 1.9 | (1.4 | ) | (2.4 | ) | |||||||||||||||

| INCOME (LOSS) BEFORE INCOME TAX | (391.2 | ) | (58.4 | ) | (191.7 | ) | 163.9 | |||||||||||||||

| Income taxes | 29.2 | 15.4 | (16.4 | ) | (41.0 | ) | ||||||||||||||||

| NET INCOME (LOSS) AFTER TAX | (362.0 | ) | (43.0 | ) | (208.1 | ) | 122.9 | |||||||||||||||

| Dividends Paid | (10.4 | ) | (2.0 | ) | (31.2 | ) | (6.2 | ) | ||||||||||||||

| Retained Income | (372.4 | ) | (45.0 | ) | (239.3 | ) | 116.7 | |||||||||||||||

| Components of Net Income (after tax) | ||||||||||||||||||||||

| Operating income | (357.1 | ) | (43.9 | ) | (198.4 | ) | 125.5 | |||||||||||||||

| Net realized investment gains (losses) | (1.0 | ) | (0.1 | ) | (1.0 | ) | (3.1 | ) | ||||||||||||||

| Net realized exchange gains (losses) | (3.9 | ) | 1.0 | (8.7 | ) | 0.5 | ||||||||||||||||

| NET INCOME (LOSS) AFTER TAX | (362.0 | ) | (43.0 | ) | (208.1 | ) | 122.9 | |||||||||||||||

Page 3 of 25

CONSOLIDATED BALANCE SHEET

| (in US$ millions) | As at September 30, 2005 |

As at December 31, 2004 |

||||||||

| ASSETS | ||||||||||

| Investments | ||||||||||

| Fixed Maturities | 2,645.5 | 2,207.2 | ||||||||

| Short term investments | 491.5 | 528.7 | ||||||||

| Total Investments | 3,137.0 | 2,735.9 | ||||||||

| Cash and cash equivalents | 369.4 | 284.9 | ||||||||

| Reinsurance Recoverables | ||||||||||

| Unpaid losses | 894.8 | 197.7 | ||||||||

| Ceded unearned premiums | 155.4 | 40.4 | ||||||||

| Receivables | ||||||||||

| Underwriting premiums | 798.4 | 494.2 | ||||||||

| Other | 31.6 | 39.2 | ||||||||

| Deferred policy acquisition costs | 194.8 | 115.6 | ||||||||

| Derivative at fair value | 16.5 | 23.6 | ||||||||

| Office properties and equipment | 19.1 | 5.0 | ||||||||

| Other assets | 6.2 | |||||||||

| Intangible assets | 8.2 | 6.6 | ||||||||

| Total Assets | 5,631.4 | 3,943.1 | ||||||||

| LIABILITIES | ||||||||||

| Insurance Reserves | ||||||||||

| Losses and loss adjustment expenses | 2,748.6 | 1,277.9 | ||||||||

| Unearned premiums | 1,129.8 | 714.0 | ||||||||

| Total insurance reserves | 3,878.4 | 1,991.9 | ||||||||

| Payables | ||||||||||

| Reinsurance premiums | 205.0 | 54.2 | ||||||||

| Taxation | 11.1 | 57.7 | ||||||||

| Accrued expenses and other payables | 46.7 | 84.3 | ||||||||

| Liabilities under derivative contracts | 17.0 | 24.2 | ||||||||

| Total Payables | 279.8 | 220.4 | ||||||||

| Long term debt | 249.3 | 249.3 | ||||||||

| Total Liabilities | 4,407.5 | 2,461.6 | ||||||||

| SHAREHOLDERS’ EQUITY | ||||||||||

| Ordinary shares | 1,100.2 | 1,096.1 | ||||||||

| Retained earnings | 128.2 | 367.5 | ||||||||

| Accumulated other comprehensive income, net of taxes | (4.5 | ) | 17.9 | |||||||

| Total shareholders’ equity | 1,223.9 | 1,481.5 | ||||||||

| Total Liabilities and Shareholders’ Equity | 5,631.4 | 3,943.1 | ||||||||

Page 4 of 25

PROFORMA SHAREHOLDERS’ EQUITY

| As

at September 30, 2005 |

Proceeds from issue of shares on October 11, 2005 |

Proforma shareholders' equity after the issue of shares |

||||||||||||

| SHAREHOLDERS’ EQUITY | ||||||||||||||

| Ordinary shares | 1,100.2 | 399.5 | 1,499.7 | |||||||||||

| Retained earnings | 128.2 | 128.2 | ||||||||||||

| Accumulated other comprehensive income, net of taxes | (4.5 | ) | (4.5 | ) | ||||||||||

| Total shareholders’ equity | 1,223.9 | 399.5 | 1,623.4 | |||||||||||

| Ordinary shares | 69,342,486 | 17,551,558 | 86,894,044 | |||||||||||

| Book value per share | 17.53 | 18.59 | ||||||||||||

| Diluted book value (treasury stock method) | 17.53 | 18.59 | ||||||||||||

| Debt to total capital | 16.9 | % | 13.3 | % | ||||||||||

Page 5 of 25

PER SHARE DATA

| Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | |||||||||||||||

| (In US$ except for number of shares) | September 30, 2005 | September 30, 2004 | September 30, 2005 | September 30, 2004 | ||||||||||||||

| Basic earnings per share | ||||||||||||||||||

| Net income | (5.22 | ) | (0.62 | ) | (3.00 | ) | 1.78 | |||||||||||

| Operating income | (5.15 | ) | (0.63 | ) | (2.86 | ) | 1.81 | |||||||||||

| Diluted earnings per share | ||||||||||||||||||

| Net income | (5.22 | ) | (0.62 | ) | (3.00 | ) | 1.71 | |||||||||||

| Operating income | (5.15 | ) | (0.63 | ) | (2.86 | ) | 1.75 | |||||||||||

| Weighted average ordinary shares outstanding | 69,343,435 | 69,174,303 | 69,339,484 | 69,175,603 | ||||||||||||||

| Weighted average ordinary shares outstanding and dilutive potential ordinary shares | 69,343,435 | 69,174,303 | 69,339,484 | 71,751,883 | ||||||||||||||

| Book value per share | 17.53 | 20.40 | ||||||||||||||||

| Diluted book value (treasury stock method) | 17.53 | 19.66 | ||||||||||||||||

| Ordinary shares outstanding at end of the period | 69,342,486 | 69,174,303 | ||||||||||||||||

| Ordinary shares outstanding and dilutive potential ordinary shares at end of the period | 69,342,486 | 71,760,480 | ||||||||||||||||

Page 6 of 25

FINANCIAL RATIOS

| Three

Months Ended September 30, 2005 |

Three Months Ended September 30, 2004 |

Nine Months Ended September 30, 2005 |

Nine Months Ended September 30, 2004 |

|||||||||||||||

| (In US$ millions except for percentage figures) | ||||||||||||||||||

| Average Equity | 1,353 | 1,424 | 1,445 | 1,381 | ||||||||||||||

| Return on average equity | ||||||||||||||||||

| Net income | (26.8 | %) | (3.0 | %) | (14.4 | %) | 8.9 | % | ||||||||||

| Operating income | (26.4 | %) | (3.1 | %) | (13.7 | %) | 9.1 | % | ||||||||||

| Loss Ratio | 180.0 | % | 103.3 | % | 94.2 | % | 61.2 | % | ||||||||||

| Expense ratio | 27.1 | % | 22.7 | % | 26.8 | % | 25.3 | % | ||||||||||

| Combined ratio | 207.1 | % | 126.0 | % | 121.0 | % | 86.5 | % | ||||||||||

| Debt to total capital | 16.9 | % | 17.0 | % | 16.9 | % | 17.0 | % | ||||||||||

See pages 19, 24 and 25 for detailed calculation and reconciliation of non-GAAP measures to their respective most directly comparable GAAP financial measures.

Page 7 of 25

UNDERWRITING RESULTS BY OPERATING SEGMENT

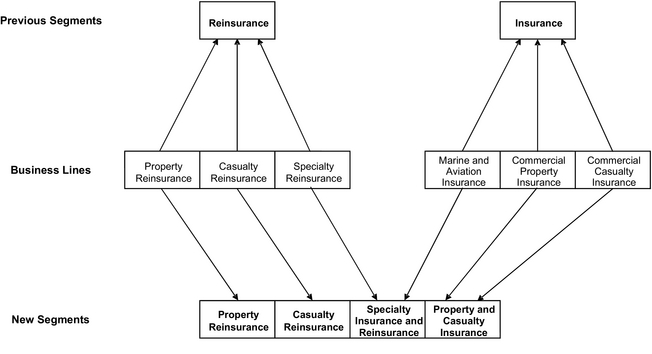

As reported in the first quarter of 2005, management has revised the presentation of underwriting results into four segments to more accurately reflect the organizational structure of the business. A chart explaining the movement between segments is shown on page 14.

The following tables summarize gross and net written and earned premium, losses and loss expenses, policy acquisition, operating and administrative expenses, underwriting results, and combined ratios for each of our four business segments for the three and nine months ended September 30, 2005 and 2004.

| Three Months Ended September 30, 2005 | Three Months Ended September 30, 2004 | |||||||||||||||||||||||||||||||||||||||||

| Property Reinsurance |

Casualty Reinsurance |

Specialty Insurance and Reinsurance |

Property and Casualty Insurance |

Total | Property Reinsurance |

Casualty Reinsurance |

Specialty Insurance and Reinsurance |

Property and Casualty Insurance |

Total | |||||||||||||||||||||||||||||||||

| (in US$ millions) | ||||||||||||||||||||||||||||||||||||||||||

| Gross premiums written | 256.0 | 81.5 | 57.3 | 99.2 | 494.0 | 139.5 | 83.4 | 19.9 | 106.6 | 349.4 | ||||||||||||||||||||||||||||||||

| Net premiums written | 144.6 | 81.2 | 43.5 | 75.2 | 344.5 | 100.6 | 82.5 | 17.1 | 95.7 | 295.9 | ||||||||||||||||||||||||||||||||

| Gross premiums earned | 212.3 | 125.9 | 79.7 | 106.7 | 524.6 | 155.2 | 91.9 | 29.1 | 84.9 | 361.1 | ||||||||||||||||||||||||||||||||

| Net premiums earned | 112.5 | 121.3 | 72.1 | 73.5 | 379.4 | 105.9 | 88.1 | 27.2 | 72.2 | 293.4 | ||||||||||||||||||||||||||||||||

| Losses and loss expenses | (463.3 | ) | (83.1 | ) | (71.5 | ) | (65.1 | ) | (683.0 | ) | (172.6 | ) | (63.9 | ) | (20.0 | ) | (46.7 | ) | (303.2 | ) | ||||||||||||||||||||||

| Policy acquisition, operating and administration expenses | (33.1 | ) | (29.0 | ) | (21.5 | ) | (19.0 | ) | (102.6 | ) | (30.1 | ) | (15.5 | ) | (5.4 | ) | (15.5 | ) | (66.5 | ) | ||||||||||||||||||||||

| Underwriting profit (loss) | (383.9 | ) | 9.2 | (20.9 | ) | (10.6 | ) | (406.2 | ) | (96.8 | ) | 8.7 | 1.8 | 10.0 | (76.3 | ) | ||||||||||||||||||||||||||

| Net reserves for loss and loss adjustment expenses | 635.2 | 608.5 | 202.6 | 407.5 | 1,853.8 | 273.5 | 300.5 | 130.5 | 269.4 | 973.9 | ||||||||||||||||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||||||||||||||||||

| Loss ratio | 411.8 | % | 68.5 | % | 99.2 | % | 88.6 | % | 180.0 | % | 163.0 | % | 72.5 | % | 73.5 | % | 64.7 | % | 103.3 | % | ||||||||||||||||||||||

| Expense ratio | 29.4 | % | 23.9 | % | 29.8 | % | 25.8 | % | 27.1 | % | 28.4 | % | 17.6 | % | 19.9 | % | 21.4 | % | 22.7 | % | ||||||||||||||||||||||

| Combined ratio | 441.2 | % | 92.4 | % | 129.0 | % | 114.4 | % | 207.1 | % | 191.4 | % | 90.1 | % | 93.4 | % | 86.1 | % | 126.0 | % | ||||||||||||||||||||||

| Impact of hurricanes and windstorms (in US$ millions) | ||||||||||||||||||||||||||||||||||||||||||

| On net premiums earned | (14.6 | ) | 0.0 | 0.0 | (7.4 | ) | (22.0 | ) | (9.2 | ) | 0.0 | 0.0 | 0.0 | (9.2 | ) | |||||||||||||||||||||||||||

| On losses and loss expenses | (380.7 | ) | 0.0 | (24.0 | ) | (27.0 | ) | (431.7 | ) | (152.7 | ) | (0.9 | ) | (12.1 | ) | (6.4 | ) | (172.1 | ) | |||||||||||||||||||||||

| Total impact of hurricanes | (395.3 | ) | 0.0 | (24.0 | ) | (34.4 | ) | (453.7 | ) | (161.9 | ) | (0.9 | ) | (12.1 | ) | (6.4 | ) | (181.3 | ) | |||||||||||||||||||||||

| Loss ratio excluding hurricanes | 65.0 | % | 68.5 | % | 65.9 | % | 47.1 | % | 62.6 | % | 17.3 | % | 71.5 | % | 29.0 | % | 55.8 | % | 43.3 | % | ||||||||||||||||||||||

| Expense ratio excluding hurricanes | 26.0 | % | 23.9 | % | 29.8 | % | 23.5 | % | 25.6 | % | 26.1 | % | 17.6 | % | 19.9 | % | 21.5 | % | 22.0 | % | ||||||||||||||||||||||

| Combined ratio excluding impact of hurricanes | 91.0 | % | 92.4 | % | 95.7 | % | 70.6 | % | 88.2 | % | 43.4 | % | 89.1 | % | 48.9 | % | 77.3 | % | 65.3 | % | ||||||||||||||||||||||

Page 8 of 25

| Nine Months Ended September 30, 2005 | Nine Months Ended September 30, 2004 | |||||||||||||||||||||||||||||||||||||||||

| Property Reinsurance |

Casualty Reinsurance |

Specialty Insurance and Reinsurance |

Property and Casualty Insurance |

Total | Property Reinsurance |

Casualty Reinsurance |

Specialty Insurance and Reinsurance |

Property and Casualty Insurance |

Total | |||||||||||||||||||||||||||||||||

| (in US$ millions) | ||||||||||||||||||||||||||||||||||||||||||

| Gross premiums written | 754.8 | 482.5 | 301.7 | 308.5 | 1,847.5 | 618.8 | 393.0 | 82.4 | 275.8 | 1,370.0 | ||||||||||||||||||||||||||||||||

| Net premiums written | 492.0 | 464.7 | 266.4 | 240.4 | 1,463.5 | 474.5 | 383.8 | 78.6 | 232.0 | 1,168.9 | ||||||||||||||||||||||||||||||||

| Gross premiums earned | 562.8 | 364.8 | 199.9 | 289.1 | 1,416.6 | 479.6 | 255.2 | 95.5 | 262.9 | 1,093.2 | ||||||||||||||||||||||||||||||||

| Net premiums earned | 396.1 | 350.7 | 177.7 | 228.6 | 1,153.1 | 361.2 | 248.5 | 91.1 | 225.4 | 926.2 | ||||||||||||||||||||||||||||||||

| Losses and loss expenses | (554.6 | ) | (248.7 | ) | (124.5 | ) | (158.5 | ) | (1,086.3 | ) | (215.9 | ) | (173.6 | ) | (46.0 | ) | (131.2 | ) | (566.7 | ) | ||||||||||||||||||||||

| Policy acquisition, operating and administration expenses | (123.0 | ) | (80.7 | ) | (46.6 | ) | (58.7 | ) | (309.0 | ) | (113.0 | ) | (50.6 | ) | (17.5 | ) | (53.8 | ) | (234.9 | ) | ||||||||||||||||||||||

| Underwriting profit (loss) | (281.5 | ) | 21.3 | 6.6 | 11.4 | (242.2 | ) | 32.3 | 24.3 | 27.6 | 40.4 | 124.6 | ||||||||||||||||||||||||||||||

| Net reserves for loss and loss adjustment expenses | 635.2 | 608.5 | 202.6 | 407.5 | 1,853.8 | 273.5 | 300.5 | 130.5 | 269.4 | 973.9 | ||||||||||||||||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||||||||||||||||||

| Loss ratio | 140.0 | % | 70.9 | % | 70.1 | % | 69.3 | % | 94.2 | % | 59.8 | % | 69.9 | % | 50.5 | % | 58.2 | % | 61.2 | % | ||||||||||||||||||||||

| Expense ratio | 31.1 | % | 23.0 | % | 26.2 | % | 25.7 | % | 26.8 | % | 31.3 | % | 20.3 | % | 19.2 | % | 23.9 | % | 25.3 | % | ||||||||||||||||||||||

| Combined ratio | 171.1 | % | 93.9 | % | 96.3 | % | 95.0 | % | 121.0 | % | 91.1 | % | 90.2 | % | 69.7 | % | 82.1 | % | 86.5 | % | ||||||||||||||||||||||

| Impact of hurricanes and windstorms (in US$ millions) | ||||||||||||||||||||||||||||||||||||||||||

| On net premiums earned | (14.6 | ) | 0.0 | 0.0 | (7.4 | ) | (22.0 | ) | (9.2 | ) | 0.0 | 0.0 | 0.0 | (9.2 | ) | |||||||||||||||||||||||||||

| On losses and loss expenses | (380.7 | ) | 0.0 | (24.0 | ) | (27.0 | ) | (431.7 | ) | (152.7 | ) | (0.9 | ) | (12.1 | ) | (6.4 | ) | (172.1 | ) | |||||||||||||||||||||||

| Total impact of hurricanes | (395.3 | ) | 0.0 | (24.0 | ) | (34.4 | ) | (453.7 | ) | (161.9 | ) | (0.9 | ) | (12.1 | ) | (6.4 | ) | (181.3 | ) | |||||||||||||||||||||||

| Loss ratio excluding hurricanes | 42.3 | % | 70.9 | % | 56.6 | % | 55.7 | % | 55.7 | % | 17.0 | % | 69.5 | % | 37.2 | % | 55.3 | % | 42.2 | % | ||||||||||||||||||||||

| Expense ratio excluding hurricanes | 30.0 | % | 23.0 | % | 26.2 | % | 24.9 | % | 26.3 | % | 30.6 | % | 20.4 | % | 19.2 | % | 23.9 | % | 25.1 | % | ||||||||||||||||||||||

| Combined ratio excluding impact of hurricanes | 72.3 | % | 93.9 | % | 82.8 | % | 80.6 | % | 82.0 | % | 47.6 | % | 89.9 | % | 56.4 | % | 79.2 | % | 67.3 | % | ||||||||||||||||||||||

Page 9 of 25

SPECIALTY INSURANCE AND REINSURANCE

| Three Months Ended September 30, 2005 | Three Months Ended September 30, 2004 | |||||||||||||||||||||||||

| Specialty Insurance |

Specialty Reinsurance |

Total | Specialty Insurance |

Specialty Reinsurance |

Total | |||||||||||||||||||||

| (in US$ millions) | ||||||||||||||||||||||||||

| Gross premiums written | 51.0 | 6.3 | 57.3 | 11.6 | 8.3 | 19.9 | ||||||||||||||||||||

| Net premiums written | 42.5 | 1.0 | 43.5 | 11.1 | 6.0 | 17.1 | ||||||||||||||||||||

| Gross premiums earned | 54.0 | 25.7 | 79.7 | 2.5 | 26.6 | 29.1 | ||||||||||||||||||||

| Net premiums earned | 47.2 | 24.9 | 72.1 | 2.3 | 24.9 | 27.2 | ||||||||||||||||||||

| Losses and loss expenses | (45.5 | ) | (26.0 | ) | (71.5 | ) | (2.1 | ) | (17.9 | ) | (20.0 | ) | ||||||||||||||

| Policy acquisition, operating and administration expenses | (14.4 | ) | (7.1 | ) | (21.5 | ) | (0.6 | ) | (4.8 | ) | (5.4 | ) | ||||||||||||||

| Underwriting profit (loss) | (12.7 | ) | (8.2 | ) | (20.9 | ) | (0.4 | ) | 2.2 | 1.8 | ||||||||||||||||

| Ratios | ||||||||||||||||||||||||||

| Loss ratio | 96.4 | % | 104.4 | % | 99.2 | % | 91.3 | % | 71.9 | % | 73.5 | % | ||||||||||||||

| Expense ratio | 30.5 | % | 28.5 | % | 29.8 | % | 26.1 | % | 19.3 | % | 19.9 | % | ||||||||||||||

| Combined ratio | 126.9 | % | 132.9 | % | 129.0 | % | 117.4 | % | 91.2 | % | 93.4 | % | ||||||||||||||

| Impact of hurricanes and windstorms (in US$ millions) | ||||||||||||||||||||||||||

| On net premiums earned | (2.1 | ) | 2.1 | 0.0 | 0.0 | 0.0 | 0.0 | |||||||||||||||||||

| On losses and loss expenses | (7.2 | ) | (16.8 | ) | (24.0 | ) | 0.0 | (12.1 | ) | (12.1 | ) | |||||||||||||||

| Total impact of hurricanes | (9.3 | ) | (14.7 | ) | (24.0 | ) | 0.0 | (12.1 | ) | (12.1 | ) | |||||||||||||||

| Loss ratio excluding hurricanes | 77.7 | % | 40.4 | % | 65.9 | % | 91.3 | % | 23.3 | % | 29.0 | % | ||||||||||||||

| Expenses ratio excluding hurricanes | 29.2 | % | 31.1 | % | 29.8 | % | 26.1 | % | 19.3 | % | 19.9 | % | ||||||||||||||

| Combined ratio excluding impact of hurricanes | 106.9 | % | 71.5 | % | 95.7 | % | 117.4 | % | 42.6 | % | 48.9 | % | ||||||||||||||

Page 10 of 25

SPECIALTY INSURANCE AND REINSURANCE

| Nine Months Ended September 30, 2005 | Nine Months Ended September 30, 2004 | |||||||||||||||||||||||||

| Specialty Insurance |

Specialty Reinsurance |

Total | Specialty Insurance |

Specialty Reinsurance |

Total | |||||||||||||||||||||

| (in US$ millions) | ||||||||||||||||||||||||||

| Gross premiums written | 214.2 | 87.5 | 301.7 | 11.6 | 70.8 | 82.4 | ||||||||||||||||||||

| Net premiums written | 184.9 | 81.5 | 266.4 | 11.1 | 67.5 | 78.6 | ||||||||||||||||||||

| Gross premiums earned | 114.6 | 85.3 | 199.9 | 2.5 | 93.0 | 95.5 | ||||||||||||||||||||

| Net premiums earned | 94.1 | 83.6 | 177.7 | 2.3 | 88.8 | 91.1 | ||||||||||||||||||||

| Losses and loss expenses | (83.4 | ) | (41.1 | ) | (124.5 | ) | (2.1 | ) | (43.9 | ) | (46.0 | ) | ||||||||||||||

| Policy acquisition, operating and administration expenses | (27.7 | ) | (18.9 | ) | (46.6 | ) | (0.6 | ) | (16.9 | ) | (17.5 | ) | ||||||||||||||

| Underwriting profit (loss) | (17.0 | ) | 23.6 | 6.6 | (0.4 | ) | 28.0 | 27.6 | ||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||

| Loss ratio | 88.6 | % | 49.2 | % | 70.1 | % | 91.3 | % | 49.4 | % | 50.5 | % | ||||||||||||||

| Expense ratio | 29.5 | % | 22.6 | % | 26.2 | % | 26.1 | % | 19.0 | % | 19.2 | % | ||||||||||||||

| Combined ratio | 118.1 | % | 71.8 | % | 96.3 | % | 117.4 | % | 68.4 | % | 69.7 | % | ||||||||||||||

| Impact of hurricanes and windstorms (in US$ millions) | ||||||||||||||||||||||||||

| On net premiums earned | (2.1 | ) | 2.1 | 0.0 | 0.0 | 0.0 | 0.0 | |||||||||||||||||||

| On losses and loss expenses | (7.2 | ) | (16.8 | ) | (24.0 | ) | 0.0 | (12.1 | ) | (12.1 | ) | |||||||||||||||

| Total impact of hurricanes | (9.3 | ) | (14.7 | ) | (24.0 | ) | 0.0 | (12.1 | ) | (12.1 | ) | |||||||||||||||

| Loss ratio excluding hurricanes | 79.2 | % | 29.8 | % | 56.6 | % | 91.3 | % | 35.8 | % | 37.2 | % | ||||||||||||||

| Expenses ratio excluding hurricanes | 28.8 | % | 23.2 | % | 26.2 | % | 26.1 | % | 19.0 | % | 19.2 | % | ||||||||||||||

| Combined ratio excluding impact of hurricanes | 108.0 | % | 53.0 | % | 82.8 | % | 117.4 | % | 54.8 | % | 56.4 | % | ||||||||||||||

Page 11 of 25

PROPERTY AND CASUALTY INSURANCE

| Three Months Ended September 30, 2005 | Three Months Ended September 30, 2004 | |||||||||||||||||||||||||

| Property Insurance |

Casualty Insurance |

Total | Property Insurance |

Casualty Insurance |

Total | |||||||||||||||||||||

| (in US$ millions) | ||||||||||||||||||||||||||

| Gross premiums written | 34.2 | 65.0 | 99.2 | 37.1 | 69.5 | 106.6 | ||||||||||||||||||||

| Net premiums written | 16.3 | 58.9 | 75.2 | 33.2 | 62.5 | 95.7 | ||||||||||||||||||||

| Gross premiums earned | 38.1 | 68.6 | 106.7 | 26.7 | 58.2 | 84.9 | ||||||||||||||||||||

| Net premiums earned | 13.1 | 60.4 | 73.5 | 21.3 | 50.9 | 72.2 | ||||||||||||||||||||

| Losses and loss expenses | (30.2 | ) | (34.9 | ) | (65.1 | ) | (9.9 | ) | (36.8 | ) | (46.7 | ) | ||||||||||||||

| Policy acquisition, operating and administration expenses | (6.5 | ) | (12.5 | ) | (19.0 | ) | (6.4 | ) | (9.1 | ) | (15.5 | ) | ||||||||||||||

| Underwriting profit (loss) | (23.6 | ) | 13.0 | (10.6 | ) | 5.0 | 5.0 | 10.0 | ||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||

| Loss ratio | 230.6 | % | 57.8 | % | 88.6 | % | 46.5 | % | 72.3 | % | 64.7 | % | ||||||||||||||

| Expense ratio | 49.6 | % | 20.7 | % | 25.8 | % | 30.0 | % | 17.9 | % | 21.4 | % | ||||||||||||||

| Combined ratio | 280.2 | % | 78.5 | % | 114.4 | % | 76.5 | % | 90.2 | % | 86.1 | % | ||||||||||||||

| Impact of hurricanes and windstorms (in US$ millions) | ||||||||||||||||||||||||||

| On net premiums earned | (7.4 | ) | 0.0 | (7.4 | ) | 0.0 | 0.0 | 0.0 | ||||||||||||||||||

| On losses and loss expenses | (27.0 | ) | 0.0 | (27.0 | ) | (6.4 | ) | 0.0 | (6.4 | ) | ||||||||||||||||

| Total impact of hurricanes | (34.4 | ) | 0.0 | (34.4 | ) | (6.4 | ) | 0.0 | (6.4 | ) | ||||||||||||||||

| Loss ratio excluding hurricanes | 15.7 | % | 57.8 | % | 47.1 | % | 16.4 | % | 72.3 | % | 55.8 | % | ||||||||||||||

| Expense ratio excluding hurricanes | 31.7 | % | 20.7 | % | 23.5 | % | 30.1 | % | 17.9 | % | 21.5 | % | ||||||||||||||

| Combined ratio excluding impact of hurricanes | 47.4 | % | 78.5 | % | 70.6 | % | 46.5 | % | 90.2 | % | 77.3 | % | ||||||||||||||

Page 12 of 25

PROPERTY AND CASUALTY INSURANCE

| Nine Months Ended September 30, 2005 | Nine Months Ended September 30, 2004 | |||||||||||||||||||||||||

| Property Insurance |

Casualty Insurance |

Total | Property Insurance |

Casualty Insurance |

Total | |||||||||||||||||||||

| (in US$ millions) | ||||||||||||||||||||||||||

| Gross premiums written | 111.9 | 196.6 | 308.5 | 92.8 | 183.0 | 275.8 | ||||||||||||||||||||

| Net premiums written | 65.1 | 175.3 | 240.4 | 70.2 | 161.8 | 232.0 | ||||||||||||||||||||

| Gross premiums earned | 89.9 | 199.2 | 289.1 | 72.3 | 190.6 | 262.9 | ||||||||||||||||||||

| Net premiums earned | 51.5 | 177.1 | 228.6 | 56.2 | 169.2 | 225.4 | ||||||||||||||||||||

| Losses and loss expenses | (49.9 | ) | (108.6 | ) | (158.5 | ) | (27.3 | ) | (103.9 | ) | (131.2 | ) | ||||||||||||||

| Policy acquisition, operating and administration expenses | (18.8 | ) | (39.9 | ) | (58.7 | ) | (16.7 | ) | (37.1 | ) | (53.8 | ) | ||||||||||||||

| Underwriting profit (loss) | (17.2 | ) | 28.6 | 11.4 | 12.2 | 28.2 | 40.4 | |||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||

| Loss ratio | 96.9 | % | 61.3 | % | 69.3 | % | 48.6 | % | 61.4 | % | 58.2 | % | ||||||||||||||

| Expense ratio | 36.5 | % | 22.6 | % | 25.7 | % | 29.7 | % | 21.9 | % | 23.9 | % | ||||||||||||||

| Combined ratio | 133.4 | % | 83.9 | % | 95.0 | % | 78.3 | % | 83.3 | % | 82.1 | % | ||||||||||||||

| Impact of hurricanes and windstorms (in US$ millions) | ||||||||||||||||||||||||||

| On net premiums earned | (7.4 | ) | 0.0 | (7.4 | ) | 0.0 | 0.0 | 0.0 | ||||||||||||||||||

| On losses and loss expenses | (27.0 | ) | 0.0 | (27.0 | ) | (6.4 | ) | 0.0 | (6.4 | ) | ||||||||||||||||

| Total impact of hurricanes | (34.4 | ) | 0.0 | (34.4 | ) | (6.4 | ) | 0.0 | (6.4 | ) | ||||||||||||||||

| Loss ratio excluding hurricanes | 38.9 | % | 61.3 | % | 55.7 | % | 37.2 | % | 61.4 | % | 55.3 | % | ||||||||||||||

| Expense ratio excluding hurricanes | 31.9 | % | 22.6 | % | 24.9 | % | 29.7 | % | 21.9 | % | 23.9 | % | ||||||||||||||

| Combined ratio excluding impact of hurricanes | 70.8 | % | 83.9 | % | 80.6 | % | 66.9 | % | 83.3 | % | 79.2 | % | ||||||||||||||

Page 13 of 25

Page 14 of 25

PREVIOUS SEGMENTAL SPLIT

| Three Months Ended September 30, 2005 | Three Months Ended September 30, 2004 | |||||||||||||||||||||||||

| (in US$ millions) | Reinsurance | Insurance | Total | Reinsurance | Insurance | Total | ||||||||||||||||||||

| Gross premiums written | 343.8 | 150.2 | 494.0 | 231.2 | 118.2 | 349.4 | ||||||||||||||||||||

| Net premiums written | 226.8 | 117.7 | 344.5 | 189.1 | 106.8 | 295.9 | ||||||||||||||||||||

| Gross premiums earned | 363.9 | 160.7 | 524.6 | 273.7 | 87.4 | 361.1 | ||||||||||||||||||||

| Net premiums earned | 258.7 | 120.7 | 379.4 | 218.9 | 74.5 | 293.4 | ||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||

| Losses and loss expenses | (572.4 | ) | (110.6 | ) | (683.0 | ) | (254.4 | ) | (48.8 | ) | (303.2 | ) | ||||||||||||||

| Policy acquisition, operating and administrative expenses | (69.2 | ) | (33.4 | ) | (102.6 | ) | (50.4 | ) | (16.1 | ) | (66.5 | ) | ||||||||||||||

| Underwriting profit (loss) | (382.9 | ) | (23.3 | ) | (406.2 | ) | (85.9 | ) | 9.6 | (76.3 | ) | |||||||||||||||

| Net reserves for loss and loss adjustment expenses | 1,358.6 | 495.2 | 1,853.8 | 702.4 | 271.5 | 973.9 | ||||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||

| Loss ratio | 221.3 | % | 91.6 | % | 180.0 | % | 116.2 | % | 65.5 | % | 103.3 | % | ||||||||||||||

| Expense ratio | 26.7 | % | 27.7 | % | 27.1 | % | 23.0 | % | 21.6 | % | 22.7 | % | ||||||||||||||

| Combined ratio | 248.0 | % | 119.3 | % | 207.1 | % | 139.2 | % | 87.1 | % | 126.0 | % | ||||||||||||||

Page 15 of 25

| Nine Months Ended September 30, 2005 | Nine Months Ended September 30, 2004 | |||||||||||||||||||||||||

| (in US$ millions) | Reinsurance | Insurance | Total | Reinsurance | Insurance | Total | ||||||||||||||||||||

| Gross premiums written | 1,324.8 | 522.7 | 1,847.5 | 1,082.6 | 287.4 | 1,370.0 | ||||||||||||||||||||

| Net premiums written | 1,038.2 | 425.3 | 1,463.5 | 925.8 | 243.1 | 1,168.9 | ||||||||||||||||||||

| Gross premiums earned | 1,012.9 | 403.7 | 1,416.6 | 827.8 | 265.4 | 1,093.2 | ||||||||||||||||||||

| Net premiums earned | 830.4 | 322.7 | 1,153.1 | 698.5 | 227.7 | 926.2 | ||||||||||||||||||||

| Expenses: | ||||||||||||||||||||||||||

| Losses and loss expenses | (844.4 | ) | (241.9 | ) | (1,086.3 | ) | (433.4 | ) | (133.3 | ) | (566.7 | ) | ||||||||||||||

| Policy acquisition, operating and administrative expenses | (222.6 | ) | (86.4 | ) | (309.0 | ) | (180.5 | ) | (54.4 | ) | (234.9 | ) | ||||||||||||||

| Underwriting profit (loss) | (236.6 | ) | (5.6 | ) | (242.2 | ) | 84.6 | 40.0 | 124.6 | |||||||||||||||||

| Net reserves for loss and loss adjustment expenses | 1,358.6 | 495.2 | 1,853.8 | 702.4 | 271.5 | 973.9 | ||||||||||||||||||||

| Ratios | ||||||||||||||||||||||||||

| Loss ratio | 101.7 | % | 75.0 | % | 94.2 | % | 62.1 | % | 58.5 | % | 61.1 | % | ||||||||||||||

| Expense ratio | 26.8 | % | 26.7 | % | 26.8 | % | 25.8 | % | 23.9 | % | 25.4 | % | ||||||||||||||

| Combined ratio | 128.5 | % | 101.7 | % | 121.0 | % | 87.9 | % | 82.4 | % | 86.5 | % | ||||||||||||||

Page 16 of 25

CONSOLIDATED CHANGE IN SHAREHOLDERS’ EQUITY

| (in US$ millions) | Nine Months Ended September 30, 2005 |

Nine Months Ended September 30, 2004 |

||||||||

| Shareholders’ Equity | ||||||||||

| Ordinary shares | ||||||||||

| Beginning of period | 1,096.1 | 1,090.8 | ||||||||

| Shares issued: | ||||||||||

| New share issues | 0.3 | 0.0 | ||||||||

| Share-based compensation | 3.8 | 3.2 | ||||||||

| End of period | 1,100.2 | 1,094.0 | ||||||||

| Retained earnings | ||||||||||

| Beginning of period | 367.5 | 180.7 | ||||||||

| Net income for the period | (208.1 | ) | 122.9 | |||||||

| Dividends paid | (31.2 | ) | (6.2 | ) | ||||||

| End of period | 128.2 | 297.4 | ||||||||

| Cumulative foreign currency translation adjustments | ||||||||||

| Beginning of period | 27.9 | 27.8 | ||||||||

| Change for the period | 0.1 | 2.1 | ||||||||

| End of period | 28.0 | 29.9 | ||||||||

| Gain / loss on derivatives: | ||||||||||

| Beginning of period | (2.2 | ) | 0.0 | |||||||

| Change for the period | 0.1 | (1.9 | ) | |||||||

| End of period | (2.1 | ) | (1.9 | ) | ||||||

| Unrealized gains (losses) on investments, net of taxes | ||||||||||

| Beginning of period | (7.8 | ) | (0.6 | ) | ||||||

| Change for the period | (22.6 | ) | (1.1 | ) | ||||||

| End of period | (30.4 | ) | (1.7 | ) | ||||||

| Total accumulated other comprehensive income | (4.5 | ) | 26.3 | |||||||

| Total Shareholders' Equity | 1,223.9 | 1,417.7 | ||||||||

Page 17 of 25

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

| (in US$ millions) | Nine Months Ended September 30, 2005 |

Nine Months Ended September 30, 2004 |

||||||||

| Net income | (208.1 | ) | 122.9 | |||||||

| Other comprehensive income, net of taxes | ||||||||||

| Change in unrealized losses on investments | (22.6 | ) | (1.1 | ) | ||||||

| Change in unrealized losses on derivatives | 0.1 | (1.9 | ) | |||||||

| Change in unrealized gains on foreign currency translation | 0.1 | 2.1 | ||||||||

| Other comprehensive income | (22.4 | ) | (0.9 | ) | ||||||

| Comprehensive income | (230.5 | ) | 122.0 | |||||||

SUMMARIZED CASH FLOW

| ($ in millions) | Nine Months Ended September 30, 2005 |

Nine Months Ended September 30, 2004 |

||||||||

| Net cash from operating activities | 605.9 | 656.6 | ||||||||

| Net cash from investing activities | (486.5 | ) | (860.1 | ) | ||||||

| Net cash from financing activities | (30.8 | ) | 243.1 | |||||||

| Effect of exchange rate movements on cash and cash equivalents | (4.1 | ) | 7.1 | |||||||

| Increase in cash and cash equivalents: | 84.5 | 46.7 | ||||||||

| Cash at beginning of the period | 284.9 | 230.8 | ||||||||

| Cash at end of the period | 369.4 | 277.5 | ||||||||

Page 18 of 25

SUPPLEMENTAL FINANCIAL INFORMATION

Return on Average Equity Analysis

The return on average equity for the three and nine months ended September 30, 2005 and 2004 was:

| Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | |||||||||||||||

| (US$ millions except for percentages) | September 30, 2005 | September 30, 2004 | September 30, 2005 | September 30, 2004 | ||||||||||||||

| Closing shareholders' equity | 1,224 | 1,418 | 1,224 | 1,418 | ||||||||||||||

| Average adjustment | 129 | 6 | 221 | (37 | ) | |||||||||||||

| Average equity (1) | 1,353 | 1,424 | 1,445 | 1,381 | ||||||||||||||

| Return on average equity from underwriting activity (2) | (30.0 | %) | (5.4 | %) | (16.8 | %) | 9.0 | % | ||||||||||

| Return on average equity from investment and other activity (3) | 1.5 | % | 1.2 | % | 4.2 | % | 3.1 | % | ||||||||||

| Pre-tax operating income return on average equity, for period | (28.5 | %) | (4.2 | %) | (12.6 | %) | 12.1 | % | ||||||||||

| Post tax return on average equity (4) | (26.4 | %) | (3.1 | %) | (13.7 | %) | 9.1 | % | ||||||||||

| Ratios: | ||||||||||||||||||

| Combined ratio | 207.1 | % | 126.0 | % | 121.0 | % | 86.5 | % | ||||||||||

See page 25 for detailed calculation and reconciliation of non-GAAP measures to their respective most directly comparable GAAP finance measures.

| 1) | Average equity is calculated by taking the simple average of the closing shareholders’ equity at latest month end and each previous month end in the period. |

| 2) | Calculated by using underwriting income. |

| 3) | Calculated by using total other operating revenue and other expense. |

| 4) | Calculated by using operating income after tax. |

Page 19 of 25

INVESTMENT PORTFOLIO

Type of investment

| As at September 30, 2005 | ||||||||||||||||||

| (in US$ millions) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||

| Fixed maturities | ||||||||||||||||||

| US government and agencies | 1,151.6 | 0.2 | (20.5 | ) | 1,131.3 | |||||||||||||

| Corporate securities | 731.8 | 1.0 | (8.2 | ) | 724.6 | |||||||||||||

| Foreign government | 274.0 | 1.3 | (0.4 | ) | 274.9 | |||||||||||||

| Municipals | 3.6 | 0.0 | 0.0 | 3.6 | ||||||||||||||

| Asset backed securities | 227.9 | 0.0 | (3.7 | ) | 224.2 | |||||||||||||

| Mortgage backed securities | 290.7 | 0.0 | (3.8 | ) | 286.9 | |||||||||||||

| Total fixed maturities | 2,679.6 | 2.5 | (36.6 | ) | 2,645.5 | |||||||||||||

| Short — term investments | 493.0 | 0.0 | (1.5 | ) | 491.5 | |||||||||||||

| Total Investments | 3,172.6 | 2.5 | (38.1 | ) | 3,137.0 | |||||||||||||

Page 20 of 25

RESERVES FOR LOSSES AND LOSS ADJUSTMENT EXPENSES

The following table represents a reconciliation of beginning and ending consolidated loss and loss expense reserves:

| (in US$ millions) | Nine Months Ended September 30, 2005 |

Twelve Months Ended December 31, 2004 |

||||||||

| Provision for losses and loss expenses at period start January 1, 2005 and 2004 respectively | 1,277.9 | 525.8 | ||||||||

| Less reinsurance recoverable | (197.7 | ) | (43.6 | ) | ||||||

| Net loss and loss expenses at period start January 1, 2005 and 2004 | 1,080.2 | 482.2 | ||||||||

| Loss reserve portfolio transfer | 23.6 | 0.0 | ||||||||

| Provision for losses and loss expenses for claims incurred: | ||||||||||

| Current year | 1,121.7 | 785.6 | ||||||||

| Prior year | (35.4 | ) | (62.0 | ) | ||||||

| Total incurred | 1,086.3 | 723.6 | ||||||||

| Losses and loss expense payments for claims incurred: | (287.0 | ) | (164.6 | ) | ||||||

| Foreign exchange | (49.3 | ) | 39.0 | |||||||

| Net loss and loss expense reserves at September 30 / December 31 | 1,853.8 | 1,080.2 | ||||||||

| Plus reinsurance recoverables on unpaid loss at end of period | 894.8 | 197.7 | ||||||||

| Gross loss and loss expense reserves at September 30 / December 31 | 2,748.6 | 1,277.9 | ||||||||

Page 21 of 25

RESERVES BY BUSINESS SEGMENT

The following table presents our reserves as at September 30, 2005 and December 31, 2004

| As at September 30, 2005 | As at December 31, 2004 | |||||||||||||||||||||||||

| (in US$ millions) | Gross | Reinsurance Recoverable |

Net | Gross | Reinsurance Recoverable |

Net | ||||||||||||||||||||

| Property Reinsurance | 1,178.0 | (542.8 | ) | 635.2 | 341.2 | (118.3 | ) | 222.9 | ||||||||||||||||||

| Casualty Reinsurance | 616.6 | (8.1 | ) | 608.5 | 377.8 | (4.6 | ) | 373.2 | ||||||||||||||||||

| Specialty Insurance | 200.5 | (112.8 | ) | 87.7 | 18.3 | (1.8 | ) | 16.5 | ||||||||||||||||||

| Specialty Reinsurance | 209.3 | (94.4 | ) | 114.9 | 168.8 | (27.4 | ) | 141.4 | ||||||||||||||||||

| Property Insurance | 173.7 | (98.8 | ) | 74.9 | 77.3 | (13.7 | ) | 63.6 | ||||||||||||||||||

| Casualty Insurance | 370.5 | (37.9 | ) | 332.6 | 294.5 | (31.9 | ) | 262.6 | ||||||||||||||||||

| Total losses and loss expense reserve | 2,748.6 | (894.8 | ) | 1,853.8 | 1,277.9 | (197.7 | ) | 1,080.2 | ||||||||||||||||||

Page 22 of 25

REINSURER SECURITY RATING

| (In US$ millions except for percentages) | As at September 30, 2005 | |||||||||

| S&P | ||||||||||

| AAA | 99.8 | 11.1 | % | |||||||

| AA+ | 3.5 | 0.4 | % | |||||||

| AA | 4.8 | 0.5 | % | |||||||

| AA− | 82.9 | 9.3 | % | |||||||

| A+ | 103.1 | 11.5 | % | |||||||

| A | 281.4 | 31.5 | % | |||||||

| A− | 199.6 | 22.3 | % | |||||||

| BBB+ | 16.1 | 1.8 | % | |||||||

| Fully collaterised | 88.5 | 9.9 | % | |||||||

| Not rated | 15.1 | 1.7 | % | |||||||

| Reinsurance recoverable — unpaid losses | 894.8 | 100.0 | % | |||||||

| AM Best | ||||||||||

| A++ | 99.8 | 11.2 | % | |||||||

| A+ | 147.9 | 16.4 | % | |||||||

| A | 342.7 | 38.3 | % | |||||||

| A− | 215.3 | 24.1 | % | |||||||

| Fully collaterised | 88.5 | 9.9 | % | |||||||

| Not rated | 0.6 | 0.1 | % | |||||||

| Reinsurance recoverable — unpaid losses | 894.8 | 100.0 | % | |||||||

Page 23 of 25

DILUTED SHARE ANALYSIS USED FOR EPS CALCULATION

| Three Months Ended | Three Months Ended | Nine months Ended | Nine months Ended | |||||||||||||||

| (shares in millions) | September 30, 2005 | September 30, 2004 | September 30, 2005 | September 30, 2004 | ||||||||||||||

| Basic weighted average shares outstanding | 69.343 | 69.174 | 69.339 | 69.176 | ||||||||||||||

| Add: weighted average of employee options | 0.000 | 0.000 | 0.000 | 1.342 | ||||||||||||||

| Add: weighted average of options issued to Wellington Underwriting Plc | 0.000 | 0.000 | 0.000 | 0.719 | ||||||||||||||

| Add: weighted average of options issued to Appleby Trust (Bermuda) Limited | 0.000 | 0.000 | 0.000 | 0.488 | ||||||||||||||

| Add: weighted average of Restricted Share Units | 0.000 | 0.000 | 0.000 | 0.028 | ||||||||||||||

| Diluted weighted average shares outstanding | 69.343 | 69.174 | 69.339 | 71.751 | ||||||||||||||

The dilutive effect of options has been calculated using the treasury stock method. The treasury stock method assumes that the proceeds received from the exercise of options will be used to repurchase the Company’s ordinary shares at the average market price during the period of calculation. In a loss making period the number of potentially dilutive ordinary shares is considered to be zero.

Page 24 of 25

OPERATING INCOME RECONCILIATION

The reconciliation of operating income to net income is set out in the following table:

| Three Months Ended | Three Months Ended | Nine Months Ended | Nine Months Ended | |||||||||||||||

| (In US$ millions except where stated) | September 30, 2005 | September 30, 2004 | September 30, 2005 | September 30, 2004 | ||||||||||||||

| Net income after tax | (362.0 | ) | (43.0 | ) | (208.1 | ) | 122.9 | |||||||||||

| Add (deduct) after tax income: | ||||||||||||||||||

| Net realized (gains) losses on investments | 1.0 | 0.1 | 1.0 | 3.1 | ||||||||||||||

| Net exchange (gains) losses | 3.9 | (1.0 | ) | 8.7 | (0.5 | ) | ||||||||||||

| Operating income | (357.1 | ) | (43.9 | ) | (198.4 | ) | 125.5 | |||||||||||

| Tax on operating income | 28.8 | 17.8 | (16.8 | ) | (40.1 | ) | ||||||||||||

| Operating income before tax | (385.9 | ) | (61.7 | ) | (181.6 | ) | 165.6 | |||||||||||

| Weighted average common shares outstanding: (millions) | ||||||||||||||||||

| Basic | 69.3 | 69.2 | 69.3 | 69.2 | ||||||||||||||

| Diluted | 69.3 | 69.2 | 69.3 | 71.8 | ||||||||||||||

| Basic per share data: | $ | $ | $ | $ | ||||||||||||||

| Net income | (5.22 | ) | (0.62 | ) | (3.00 | ) | 1.78 | |||||||||||

| Add (deduct) after tax income: | ||||||||||||||||||

| Net realized (gains) losses on investments | 0.01 | 0.00 | 0.01 | 0.04 | ||||||||||||||

| Net exchange (gains) losses | 0.06 | (0.01 | ) | 0.13 | (0.01 | ) | ||||||||||||

| Operating income | (5.15 | ) | (0.63 | ) | (2.86 | ) | 1.81 | |||||||||||

| Diluted per share data | ||||||||||||||||||

| Net income | (5.22 | ) | (0.62 | ) | (3.00 | ) | 1.71 | |||||||||||

| Add (deduct) after tax income: | ||||||||||||||||||

| Net realized (gains) losses on investments | 0.01 | 0.00 | 0.01 | 0.04 | ||||||||||||||

| Net exchange (gains) losses | 0.06 | (0.01 | ) | 0.13 | 0.00 | |||||||||||||

| Operating income | (5.15 | ) | (0.63 | ) | (2.86 | ) | 1.75 | |||||||||||

| Book value per share | ||||||||||||||||||

| Net Assets (excluding intangible assets) | 1,215.7 | 1,215.7 | 1,411.1 | |||||||||||||||

| Number of share in issue at the end of the period | 69,342,486 | 69,174,303 | ||||||||||||||||

| Diluted number of share in issue at the end of the period | 69,342,486 | 71,760,480 | ||||||||||||||||

| $ | $ | |||||||||||||||||

| Book value per share | 17.53 | 20.40 | ||||||||||||||||

| Diluted book value per share | 17.53 | 19.66 | ||||||||||||||||

Page 25 of 25