UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| x | Soliciting Material Pursuant to 14a-12 | |

TRW Automotive Holdings Corp.

(Name of Registrant as Specified In Its Charter)

ZF Friedrichshafen AG

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

This filing consists of:

| 1. | The press release of ZF Friedrichshafen AG, dated September 15, 2014, announcing ZF Friedrichshafen AG has entered into a definitive agreement under which it will acquire TRW Automotive Holdings Corp. for $105.60 per share in cash. |

| 2. | A presentation used in connection with a press call regarding ZF Friedrichshafen AG’s announced acquisition of TRW Automotive Holdings Corp., which took place on September 15, 2014. |

| PRESSEINFORMATION | ||||||

| PRESS INFORMATION | ||||||

| Seite 1 /7, September 15, 2014 |

ZF Friedrichshafen Agrees to Acquire TRW Automotive

| • | Combined Company With Pro Forma Sales of More Than € 30 Billion and 138,000 Employees |

| • | Complementary Portfolio of Acknowledged Products and Technologies Benefitting from Megatrends Such as Fuel Efficiency, Increased Safety Requirements and Autonomous Driving |

| • | Balanced Regional and Customer Portfolio in Both Volume and Premium Segments |

| • | All Cash Transaction at Full and Certain Value for TRW Stockholders |

Friedrichshafen, Germany and Livonia, MI, USA. ZF Friedrichshafen AG and TRW Automotive Holdings Corp. (NYSE: TRW) today announced that they have entered into a definitive agreement under which ZF will acquire TRW. The combined company will be a global leader in the automotive supplier business with pro forma combined sales of about € 30 billion (approx. US$ 41 billion) and 138,000 employees. Together, ZF and TRW will be uniquely positioned to benefit from the megatrends of the automotive industry on a global basis.

Combination of two Highly Successful Technology Leaders

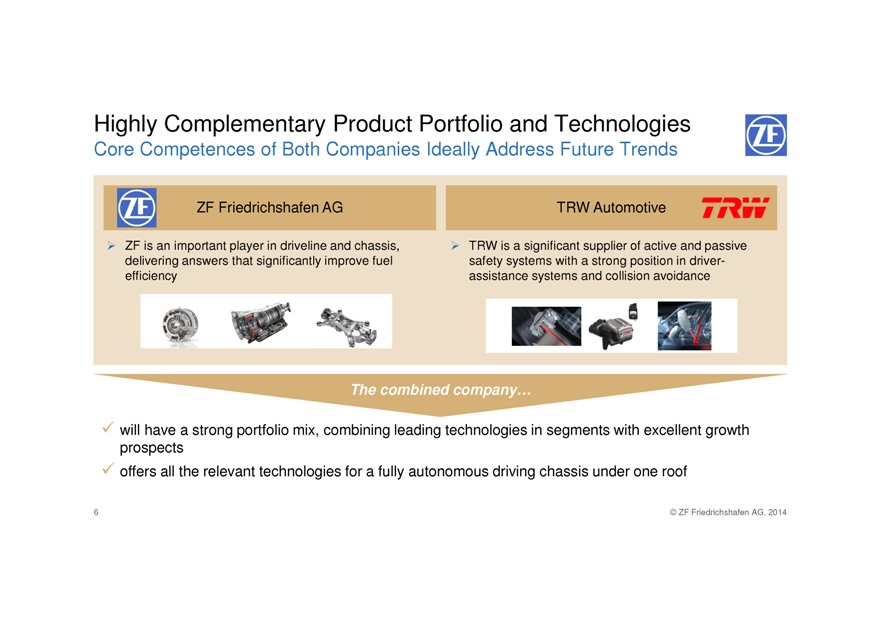

Both companies have acknowledged technology positions in high-growth segments that profit from the megatrends towards fuel efficiency, increased safety requirements and autonomous driving. ZF is an important player in driveline and chassis technologies, whereas TRW is a significant supplier of active and passive safety technologies, including advanced driver assistance systems. Both companies have demonstrated a strong track record based on high product quality and continued innovation for their customers.

| ZF Friedrichshafen AG Konzernkommunikation Corporate Communications 88038 Friedrichshafen Deutschland • Germany |

| PRESSEINFORMATION | ||||||

| PRESS INFORMATION | ||||||

| Seite 2 /7, September 15, 2014 |

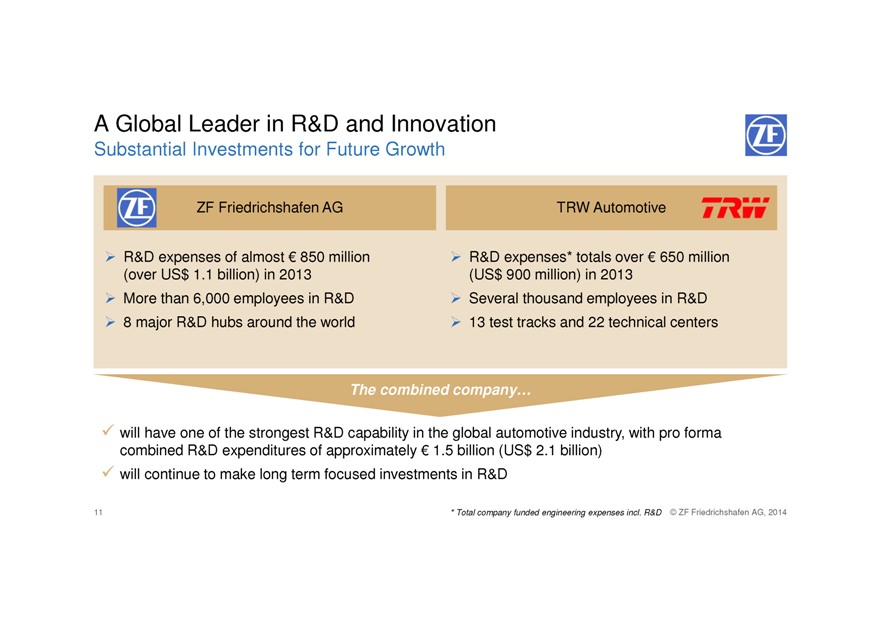

Globally, pro-forma combined R&D investments (total company funded engineering expenses incl. R&D, ref. to FY 2013) will amount to approximately € 1.5 billion (about US$ 2.1 billion), making ZF a global leader in R&D.

Stefan Sommer, Chief Executive Officer of ZF, said: “The acquisition of TRW fits perfectly into our long-term strategy. The transaction combines two highly successful companies that have remarkable track records of innovation and growth and solid financial positions. We are strengthening our future prospects by enlarging our product portfolio with acknowledged technologies in the most attractive segments.”

Sommer continued: “This is an acquisition in the spirit of a partnership. We look forward to welcoming TRW’s employees to our company and are committed to working closely with them to realize the potential of this exciting combination. The Detroit metro area will remain a major business center for the company, and we expect employees from both companies to benefit from the enhanced career opportunities at a larger, more diversified company.”

John C. Plant, Chairman and CEO of TRW, said: “We have long respected ZF as a very successful company in our industry with similar values and focus on innovation. This transaction provides significant benefits for our shareholders who will receive a full and certain value for their shares, as well as for our employees, customers and communities, all of which will reap the benefits of being part of a larger, more diversified global organization. Our employees have shown admirable dedication in growing TRW into the formidable company it is today, and our strong performance is a testament to their hard work.”

| ZF Friedrichshafen AG Konzernkommunikation Corporate Communications 88038 Friedrichshafen Deutschland • Germany |

| PRESSEINFORMATION | ||||||

| PRESS INFORMATION | ||||||

| Seite 3 /7, September 15, 2014 |

U.S. and China Sales Volumes to More Than Double

With the acquisition of TRW, ZF would more than double its sales in two of the most significant countries of the world for automotive sales: China and the United States.

ZF has done business in the U.S. since 1979 and currently operates 12 sites, including a production site for automatic transmission systems in South Carolina that was opened in mid-2013. Through the transaction, ZF would significantly increase its annual sales volume in the U.S. from € 2.8 billion (US$ 3.9 billion) to € 6.5 billion (US$ 9.0 billion).

ZF’s presence in China, accounting for two thirds of the company’s total regional sales of € 3 billion (US$ 4.1 billion) in Asia-Pacific, would be significantly strengthened as a result of the combination. Together with TRW, which also has a strong presence in China, ZF would achieve a sales volume of € 4.0 billion (US$ 5.5 billion) in China. Furthermore, the combined company would achieve annual sales of about € 5.4 billion (approx. US$ 7.5 billion) in the Asia-Pacific region.

Both companies have invested heavily into expanding their production footprint over recent years. Further, both have major production sites and strong R&D operations in China: ZF is currently expanding its R&D Center in Shanghai to 800 employees which is a 30 minute drive away from TRW’s new R&D facility. The TRW facility will eventually house 1,200 employees, making it TRW’s largest R&D site worldwide.

Balanced Regional and Customer Portfolio

The combined group will generate about half of its sales in Europe and half in North America, Asia-Pacific and the rest of the world. The transaction will also lead to a balanced portfolio of customers in both the premium and the volume segments. TRW achieves a large portion of sales in the volume segment and maintains strong relationships with US and European volume manufacturers. ZF possesses a broader customer base and is strong among premium car producers. Further, the combined company will be well positioned to supply car manufacturers in Asia.

| ZF Friedrichshafen AG Konzernkommunikation Corporate Communications 88038 Friedrichshafen Deutschland • Germany |

| PRESSEINFORMATION | ||||||

| PRESS INFORMATION | ||||||

| Seite 4 /7, September 15, 2014 |

TRW to Become a Separate Business Division of ZF

ZF will remain headquartered in Friedrichshafen. TRW will be integrated into ZF as a separate business division. No decisions about management responsibilities for the TRW business have been made yet. The companies plan to establish integration teams consisting of balanced representation from both companies to ensure a seamless integration that positions the combined company for accelerated growth while addressing potential challenges for employees and customers. Due to the complementarity of the two companies the main focus will be on growth while cost synergies are expected to be mainly derived from greater purchasing power and sharing best practise standards.

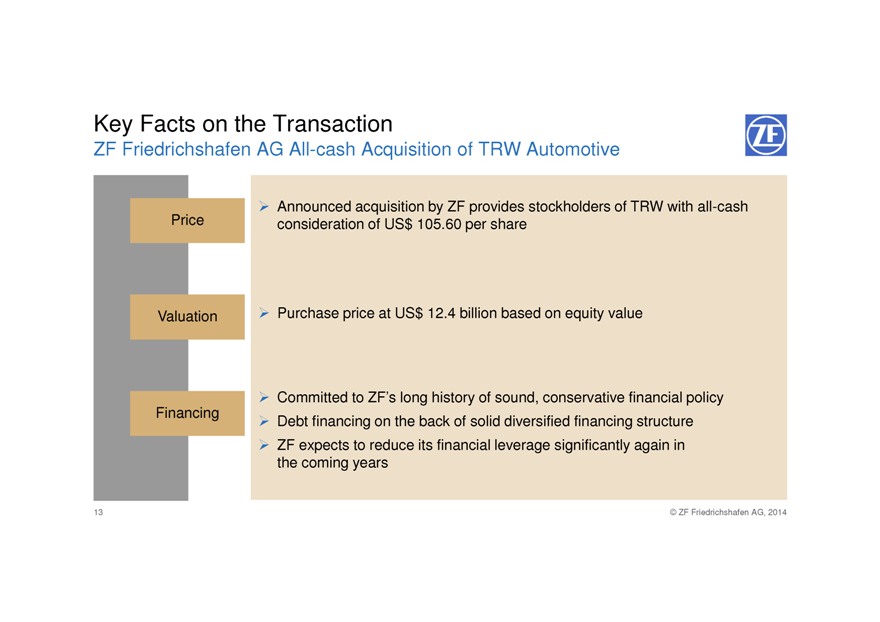

Full and Certain Value for TRW Stockholders

Under the terms of the agreement, ZF will acquire TRW in an all-cash transaction valued at approximately US$ 12.4 billion based on equity value. The agreement has been approved by ZF’s Supervisory Board and Management Board and TRW’s Board of Directors. TRW stockholders will receive US$ 105.60 in cash for each share of TRW stock.

Transaction Fully Financed on Conservative Terms

ZF has received firm financing commitments from Citigroup and Deutsche Bank and remains committed to its conservative financial policy. Due to the strong growth and cash flow profile of the combined company, ZF expects to reduce its financial leverage significantly again in the coming years.

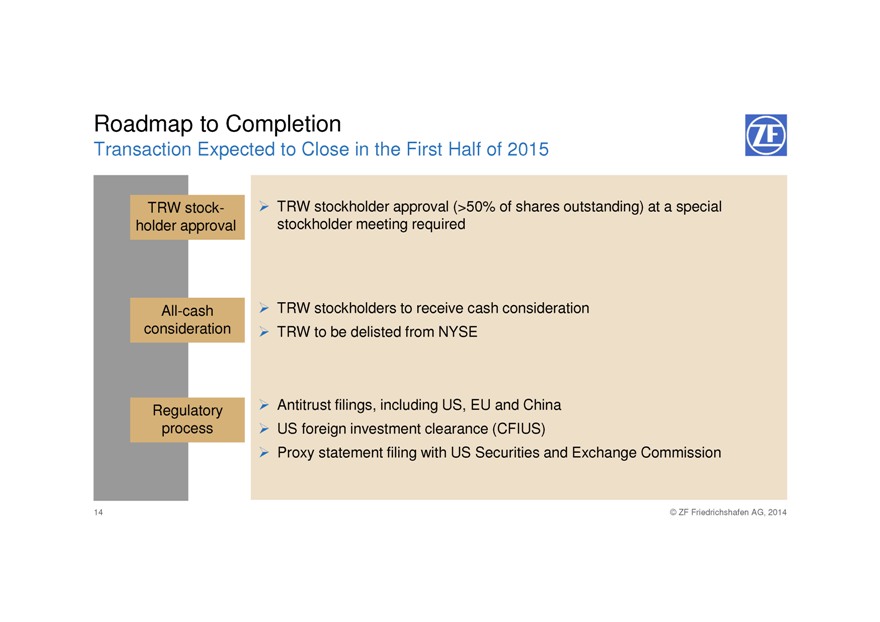

Transaction Closing Conditions

The transaction is subject to several customary closing conditions, including antitrust and US foreign investment clearance and the approval of TRW’s stockholders representing more than 50 percent

| ZF Friedrichshafen AG Konzernkommunikation Corporate Communications 88038 Friedrichshafen Deutschland • Germany |

| PRESSEINFORMATION | ||||||

| PRESS INFORMATION | ||||||

| Seite 5 /7, September 15, 2014 |

of TRW’s outstanding shares. ZF expects the transaction to close in the first half of 2015. Following the closing, TRW will be delisted from the New York Stock Exchange.

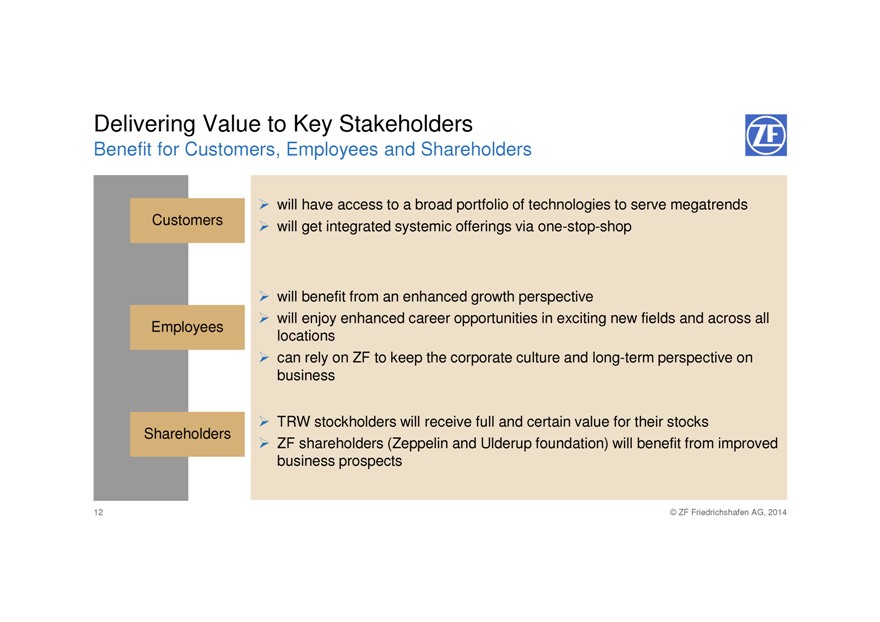

Benefits for all Stakeholders

Stefan Sommer added: “The combination makes sense for all of our constituencies: Customers of both companies will have access to a broader offering under one roof and employees from ZF and TRW will enjoy enhancements that result from the combined organization. TRW stockholders will receive an attractive valuation and our own shareholders – the Zeppelin and Ulderup foundations – will benefit from improved future prospects and diversification of the combined company.” Prof. Dr. Giorgio Behr, Chairman of the ZF Supervisory Board, underlined that “both companies make this step from a position of strength. They have excellent growth prospects”.

Citigroup and Deutsche Bank acted as financial advisors to ZF, Sullivan & Cromwell as legal advisor.

Media Contacts:

Andreas Veil, Business Press, phone +49 (0)7541 77-7925, email: andreas.veil@zf.com

Dr. Jochen Mayer, Business Press, phone +49 (0)7541 77-7028, email: jochen.mayer@zf.com

Charles Burgess (Abernathy McGregor Group), U.S. Business Press, phone: +1 212 371 5999, email: clb@abmac.com

About ZF Friedrichshafen

ZF is a global leader in driveline and chassis technology with 122 production companies in 26 countries. In 2013, the Group

| ZF Friedrichshafen AG Konzernkommunikation Corporate Communications 88038 Friedrichshafen Deutschland • Germany |

| PRESSEINFORMATION | ||||||

| PRESS INFORMATION | ||||||

| Seite 6 /7, September 15, 2014 |

achieved a sales figure of € 16.8 billion with approximately 72 600 employees. In order to continue to be successful with innovative products, ZF annually invests about 5% of its sales (2013: € 836 million) in research and development. ZF is one of the ten largest automotive suppliers worldwide.

For further press information and photos please visit: www.zf.com

About TRW Automotive Holdings

With 2013 sales of $17.4 billion, TRW Automotive ranks among the world’s leading automotive suppliers. Headquartered in Livonia, Michigan, USA, the company, through its subsidiaries, operates in 24 countries and employs approximately 65,000 people worldwide. TRW Automotive products include integrated vehicle control and driver assist systems, braking systems, steering systems, suspension systems, occupant safety systems (seat belts and airbags), electronics, engine components, fastening systems and aftermarket replacement parts and services.

For further press information and photos please visit: www.trw.com

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements”. By their nature, forward-looking statements involve a number of risks and uncertainties. Actual results could differ materially from those projected or forecast in the forward-looking statements. The factors that could cause actual results to differ materially include the following: the possibility that the parties may be unable to achieve expected synergies in the acquisition within the expected timeframes or at all and to successfully integrate TRW’s operations into those of ZF; such integration may be more difficult, time-consuming or costly than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, suppliers or other business partners) may be greater than expected following the transaction; the retention of certain key employees at TRW may prove more difficult than expected; the conditions to the completion of the transaction may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected

| ZF Friedrichshafen AG Konzernkommunikation Corporate Communications 88038 Friedrichshafen Deutschland • Germany |

| PRESSEINFORMATION | ||||||

| PRESS INFORMATION | ||||||

| Seite 7 /7, September 15, 2014 |

or on the anticipated schedule; the intense competition to which ZF and TRW are subject; the requirements of changing operating environments; the significant amount of debt ZF is incurring in connection with the transaction; and the other factors discussed in ZF’s public reports, which are available at http://www.zf.com and TRW’s filings with the SEC which are available at http://www.sec.gov. ZF assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed acquisition of TRW by ZF. In connection with the proposed acquisition, ZF and TRW intend to file relevant materials with the SEC, including TRW’s proxy statement on Schedule 14A. STOCKHOLDERS OF TRW ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING TRW’S PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, http://www.sec.gov, and TRW stockholders will receive information at an appropriate time on how to obtain transaction-related documents for free from TRW.

Participants in Solicitation

ZF and its supervisory and management board members, and TRW and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of TRW common stock in respect of the proposed transaction. Information about the supervisory and management board members can be found in ZF’s 2013 annual report and on ZF’s website. Information about the directors and executive officers of TRW is set forth in the proxy statement for TRW’s 2014 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2014. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the acquisition when it becomes available.

| ZF Friedrichshafen AG Konzernkommunikation Corporate Communications 88038 Friedrichshafen Deutschland • Germany |

MOTION AND MOBILITY ZF

ZF Friedrichshafen AG Agrees to Acquire TRW Automotive

Press Call: Sept 15, 2014

Dr. Stefan Sommer

Chief Executive Officer

ZF Friedrichshafen AG

Dr. Konstantin Sauer

Chief Financial Officer

ZF Friedrichshafen AG

Disclaimer ZF

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking statements”. By their nature, forward-looking statements involve a number of risks and uncertainties. Actual results could differ materially from those projected or forecast in the forward-looking statements. The factors that could cause actual results to differ materially include the following: the possibility that the parties may be unable to achieve expected synergies in the acquisition within the expected timeframes or at all and to successfully integrate TRW’s operations into those of ZF; such integration may be more difficult, time-consuming or costly than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, suppliers or other business partners) may be greater than expected following the transaction; the retention of certain key employees at TRW may prove more difficult than expected; the conditions to the completion of the transaction may not be satisfied, or the regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; the intense competition to which ZF and TRW are subject; the requirements of changing operating environments; the significant amount of debt ZF is incurring in connection with the transaction; and the other factors discussed in ZF’s public reports, which are available at www.zf.com and TRW’s filings with the SEC which are available at http://www.sec.gov. ZF assumes no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed acquisition of TRW by ZF. In connection with the proposed acquisition, ZF and TRW intend to file relevant materials with the SEC, including TRW’s proxy statement on Schedule 14A. STOCKHOLDERS OF TRW ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED

WITH THE SEC, INCLUDING TRW’S PROXY STATEMENT, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents free of charge at the SEC’s web site, http://www.sec.gov, and TRW stockholders will receive information at an appropriate time on how to obtain transaction-related documents for free from TRW.

Participants in Solicitation

ZF and its supervisory and management board members, and TRW and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of TRW common stock in respect of the proposed transaction. Information about the supervisory and management board members can be found in ZF’s 2013 annual report and on ZF’s website. Information about the directors and executive officers of TRW is set forth in the proxy statement for TRW’s 2014 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2014. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the acquisition when it becomes available.

2

© ZF Friedrichshafen AG, 2014

ZF Friedrichshafen AG and TRW Automotive

Transaction Follows a Clear Strategic Rationale ZF

The combined company

of two successful automotive suppliers

ZF TRW

with pro forma revenues of more than € 30 billion (US$ 41 billion)

and 138,000 employees

… brings together a broad, complementary portfolio of acknowledged products including driveline, chassis, safety and electronic technologies

… is an R&D leader that benefits from global megatrends towards fuel efficiency, increased safety requirements and autonomous driving

… has a balanced regional and customer portfolio in both volume and premium segments

… ideally addresses two of the most significant countries of the world: US and China

… meets the increasing demand from OEMs* for integrated offerings from their suppliers

3

* Original Equipment Manufacturers

© ZF Friedrichshafen AG, 2014

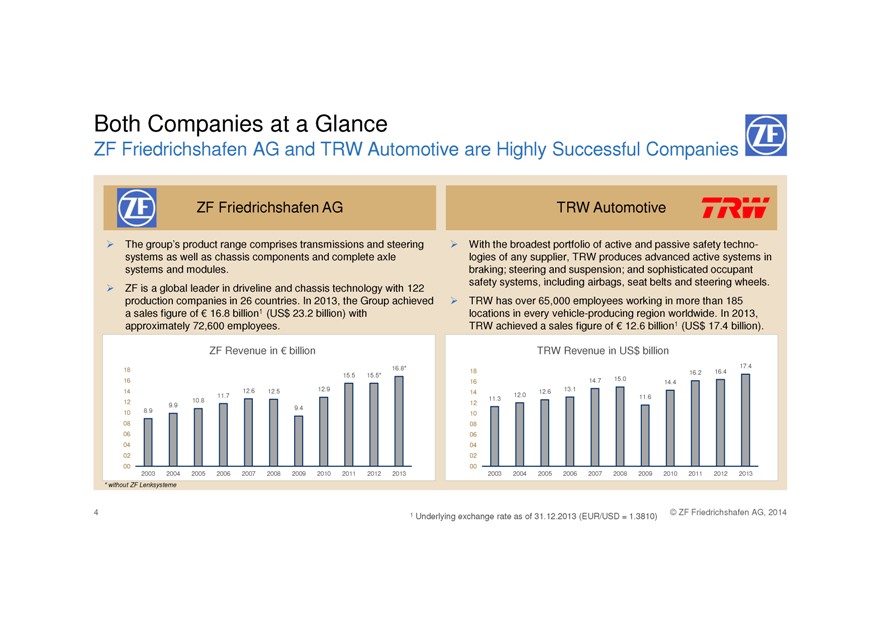

Both Companies at a Glance

ZF Friedrichshafen AG and TRW Automotive are Highly Successful Companies ZF

ZF ZF Friedrichshafen AG

The group’s product range comprises transmissions and steering systems as well as chassis components and complete axle systems and modules.

ZF is a global leader in driveline and chassis technology with 122 production companies in 26 countries. In 2013, the Group achieved a sales figure of € 16.8 billion1 (US$ 23.2 billion) with approximately 72,600 employees.

ZF Revenue in € billion

18

16

14

12

10

08

06

04

02

00

8.9 9.9 10.8 11.7 12.6 12.5 9.4 12.9 15.5 15.5* 16.8*

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

* without ZF Lenksysteme

TRW Automotive TRW

With the broadest portfolio of active and passive safety technologies of any supplier, TRW produces advanced active systems in braking; steering and suspension; and sophisticated occupant safety systems, including airbags, seat belts and steering wheels.

TRW has over 65,000 employees working in more than 185 locations in every vehicle-producing region worldwide. In 2013, TRW achieved a sales figure of € 12.6 billion1 (US$ 17.4 billion).

TRW Revenue in US$ billion

18

16

14

12

10

08

06

04

02

00

11.3 12.0 14.7 15.0 12.6 13.1 14.4 11.6 16.2 16.4 17.4

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

4

1 Underlying exchange rate as of 31.12.2013 (EUR/USD = 1.3810)

© ZF Friedrichshafen AG, 2014

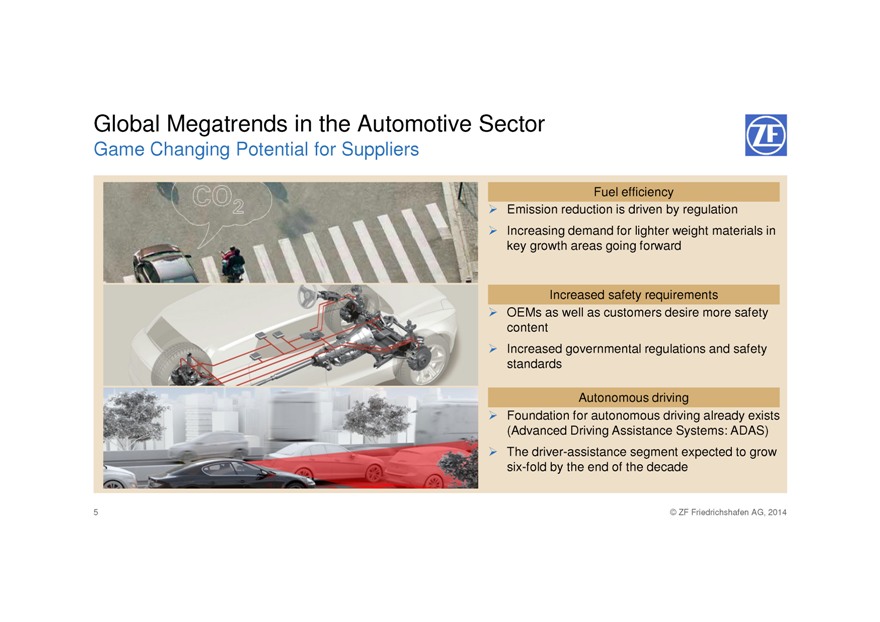

Global Megatrends in the Automotive Sector ZF

Game Changing Potential for Suppliers

Fuel efficiency

Emission reduction is driven by regulation

Increasing demand for lighter weight materials in key growth areas going forward

Increased safety requirements

OEMs as well as customers desire more safety content

Increased governmental regulations and safety standards

Autonomous driving

Foundation for autonomous driving already exists (Advanced Driving Assistance Systems: ADAS)

The driver-assistance segment expected to grow six-fold by the end of the decade

5

© ZF Friedrichshafen AG, 2014

Highly Complementary Product Portfolio and Technologies

Core Competences of Both Companies Ideally Address Future Trends

ZF Friedrichshafen AG

ZF is an important player in driveline and chassis, delivering answers that significantly improve fuel efficiency

TRW Automotive

TRW is a significant supplier of active and passive safety systems with a strong position in driver-assistance systems and collision avoidance

The combined company...

will have a strong portfolio mix, combining leading technologies in segments with excellent growth prospects

offers all the relevant technologies for a fully autonomous driving chassis under one roof

6

C ZF Friedrichshafen AG, 2014

ZF ZF TRW

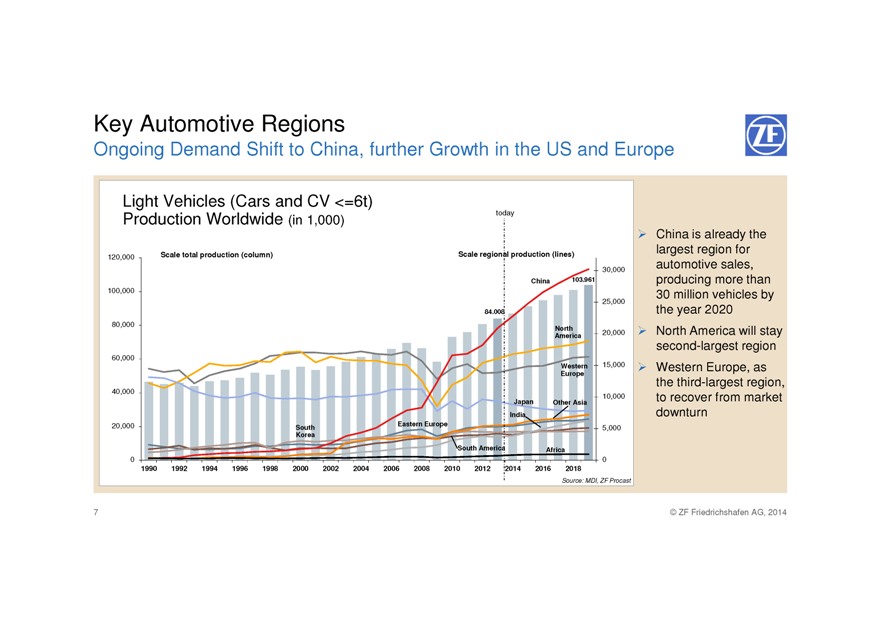

Key Automotive Regions

Ongoing Demand Shift to China, further Growth in the US and Europe

Light Vehicles (Cars and CV <=6t)

Production Worldwide (in 1,000)

120,000

100,000

80,000

60,000

40,000

20,000

0

today

Scale total production (column)

Scale regional production (lines)

China

103.961

84.008

North America

Western Europe

Japan

Other Asia

India

South Korea

Eastern Europe

South America Africa

30,000

25,000

20,000

15,000

10,000

5,000

0

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018

Source: MDI, ZF Procast

China is already the largest region for automotive sales, producing more than 30 million vehicles by the year 2020

North America will stay second-largest region

Western Europe, as the third-largest region, to recover from market downturn

7

C ZF Friedrichshafen AG, 2014

ZF

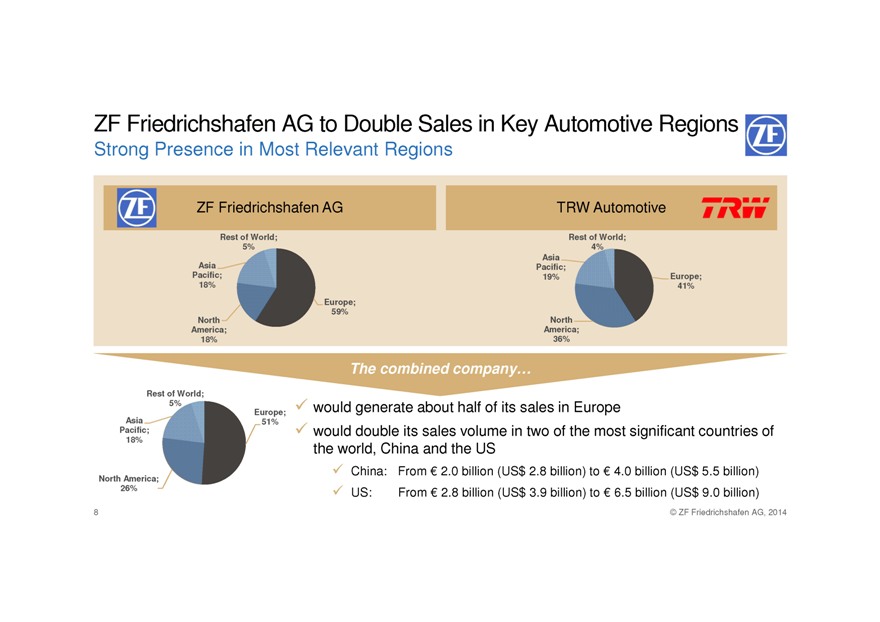

ZF Friedrichshafen AG to Double Sales in Key Automotive Regions

Strong Presence in Most Relevant Regions

ZF Friedrichshafen AG

Rest of World;

5%

Asia

Pacific;

18%

Europe;

59%

North

America;

18%

TRW Automotive

Rest of World;

4%

Asia

Pacific;

19% Europe;

41%

North

America;

36%

The combined company...

Rest of World;

5%

Europe;

Asia Pacific;

51%

18%

North America;

26%

would generate about half of its sales in Europe

would double its sales volume in two of the most significant countries of the world, China and the US

China: From € 2.0 billion (US$ 2.8 billion) to € 4.0 billion (US$ 5.5 billion)

US: From € 2.8 billion (US$ 3.9 billion) to € 6.5 billion (US$ 9.0 billion)

8

C ZF Friedrichshafen AG, 2014

ZF ZF TRW

Balanced Portfolio of Customers

Partner of Choice for Important OEMs around the Globe

ZF Friedrichshafen AG

ZF has a diversified customer base

Strong in the premium segment

TRW Automotive

TRW with a large portion of sales in the volume segment

Strong relationships with US & European volume manufacturers

The combined company...

will have access to a broader customer base

will be a key supplier to some of the fastest growing OEMs in emerging markets

9

C ZF Friedrichshafen AG, 2014

ZF ZF TRW

Relevance of R&D in the Automotive Industry

Customers Call for Innovative Solutions

10

C ZF Friedrichshafen AG, 2014

ZF

A Global Leader in R&D and Innovation

Substantial Investments for Future Growth

ZF Friedrichshafen AG

R&D expenses of almost € 850 million (over US$ 1.1 billion) in 2013

More than 6,000 employees in R&D

8 major R&D hubs around the world

ZF

TRW Automotive TRW

R&D expenses* totals over € 650 million (US$ 900 million) in 2013

Several thousand employees in R&D

13 test tracks and 22 technical centers

The combined company…

will have one of the strongest R&D capability in the global automotive industry, with pro forma combined R&D expenditures of approximately € 1.5 billion (US$ 2.1 billion)

will continue to make long term focused investments in R&D

11

* Total company funded engineering expenses incl. R&D

© ZF Friedrichshafen AG, 2014

Delivering Value to Key Stakeholders

Benefit for Customers, Employees and Shareholders

ZF

Customers

Employees

Shareholders

will have access to a broad portfolio of technologies to serve megatrends

will get integrated systemic offerings via one-stop-shop

will benefit from an enhanced growth perspective

will enjoy enhanced career opportunities in exciting new fields and across all locations

can rely on ZF to keep the corporate culture and long-term perspective on business

TRW stockholders will receive full and certain value for their stocks

ZF shareholders (Zeppelin and Ulderup foundation) will benefit from improved business prospects

12

© ZF Friedrichshafen AG, 2014

Key Facts on the Transaction

ZF Friedrichshafen AG All-cash Acquisition of TRW Automotive

ZF

Price

Valuation

Financing

Announced acquisition by ZF provides stockholders of TRW with all-cash consideration of US$ 105.60 per share

Purchase price at US$ 12.4 billion based on equity value

Committed to ZF’s long history of sound, conservative financial policy

Debt financing on the back of solid diversified financing structure

ZF expects to reduce its financial leverage significantly again in the coming years

13

© ZF Friedrichshafen AG, 2014

Roadmap to Completion

Transaction Expected to Close in the First Half of 2015

ZF

TRW stockholder approval

All-cash consideration

Regulatory process

TRW stockholder approval (>50% of shares outstanding) at a special stockholder meeting required

TRW stockholders to receive cash consideration

TRW to be delisted from NYSE

Antitrust filings, including US, EU and China

US foreign investment clearance (CFIUS)

Proxy statement filing with US Securities and Exchange Commission

14

© ZF Friedrichshafen AG, 2014

Post-Transaction-Integration

TRW Automotive to Become Separate Business Division of ZF Friedrichshafen AG

ZF

Organisation

Integration process

ZF will remain headquartered in Friedrichshafen

TRW will be integrated into ZF as a separate business division

The companies will establish integration teams with balanced representation from each in a common spirit of innovation and quality

15

© ZF Friedrichshafen AG, 2014

Thank You for Your Attention!

ZF

ZF Friedrichshafen AG behält sich sämtliche Rechte an den gezeigten technischen Informationen einschließlich der Rechte zur Hinterlegung von Schutzrechtsanmeldungen und an daraus entstehenden Schutzrechten im In- und Ausland vor.

ZF Friedrichshafen AG reserves all rights regarding the shown technical information including the right to file industrial property right applications and the industrial property rights resulting from these in Germany and abroad.