UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

| For the fiscal year ended | |||||||||||

| OR | |||||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||

| For the transition period from to | |||||||||||

Commission file number 1-06089

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |||||||

| incorporation or organization) | Identification No.) | |||||||

(Address of principal executive offices, including zip code)

(816 ) 854-3000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, without par value

(Title of Class)

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☑ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant's Common Stock (all voting stock) held by non-affiliates of the registrant, computed by reference to the price at which the stock was sold on December 31, 2021, was $3,979,841,725 .

Number of shares of the registrant's Common Stock, without par value, outstanding on July 29, 2022: 159,947,725 .

Documents incorporated by reference

The definitive proxy statement for the registrant's 2022 Annual Meeting of Shareholders, to be filed no later than 120 days after June 30, 2022, is incorporated by reference in Part III to the extent described therein.

2022 FORM 10-K AND ANNUAL REPORT

TABLE OF CONTENTS

INTRODUCTION

"H&R Block," "the Company," "we," "our" and "us" are used interchangeably to refer to H&R Block, Inc., to H&R Block, Inc. and its subsidiaries, or to H&R Block, Inc.'s operating subsidiaries, as appropriate to the context.

Specified portions of our proxy statement are "incorporated by reference" in response to certain items. Our proxy statement will be made available to shareholders no later than 120 days after June 30, 2022, and will also be available on our website at www.hrblock.com.

FORWARD-LOOKING STATEMENTS

This report and other documents filed with the Securities and Exchange Commission (SEC) may contain forward-looking statements. In addition, our senior management may make forward-looking statements orally to analysts, investors, the media and others. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words or variation of words such as "expects," "anticipates," "intends," "plans," "believes," "commits," "seeks," "estimates," "projects," "forecasts," "targets," "would," "will," "should," "could," "may" or other similar expressions. Forward-looking statements provide management's current expectations or predictions of future conditions, events or results. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future are forward-looking statements. They may include estimates of revenues, client trajectory, income, effective tax rate, earnings per share, cost savings, capital expenditures, dividends, share repurchases, liquidity, capital structure, market share, industry volumes or other financial items, descriptions of management's plans or objectives for future operations, services or products, or descriptions of assumptions underlying any of the above. They may also include the expected impact of the coronavirus (COVID-19) pandemic, including, without limitation, the impact on economic and financial markets, the Company's capital resources and financial condition, future expenditures, potential regulatory actions, such as extensions of tax filing deadlines or other related relief, changes in consumer behaviors and modifications to the Company's operations relating thereto.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made and reflect the Company's good faith beliefs, assumptions and expectations, but they are not guarantees of future performance or events. Furthermore, the Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data or methods, future events or other changes, except as required by law.

By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, a variety of economic, competitive, operational and regulatory factors, many of which are beyond the Company's control. Investors should understand that it is not possible to predict or identify all such factors and, consequently, should not consider any such list to be a complete set of all potential risks or uncertainties.

Details about risks, uncertainties and assumptions that could affect various aspects of our business are included throughout this Form 10-K. Investors should carefully consider all of these risks, and should pay particular attention to Item 1A, Risk Factors, and Item 7 under "Critical Accounting Estimates" of this Form 10-K.

H&R Block, Inc. | 2022 Form 10-K | 1 | ||||

PART I

ITEM 1. BUSINESS

OVERVIEW

H&R Block provides help and inspires confidence in its clients and communities everywhere through global tax preparation services, financial products, and small business solutions. We blend digital innovation with human expertise and care to help people get the best outcome at tax time and also be better with money by using our mobile banking app, Spruce℠. Through Block Advisors® and Wave®, we help small business owners thrive with innovative products like Wave Money®, a mobile-first, small-business bank account that manages bookkeeping automatically.

H&R Block, Inc. was organized as a corporation in 1955 under the laws of the State of Missouri. A complete list of our subsidiaries as of June 30, 2022 can be found in Exhibit 21.

RECENT DEVELOPMENTS

On June 9, 2021, the Board of Directors approved a change of the Company's fiscal year end from April 30 to June 30. The Company's 2022 fiscal year began on July 1, 2021 and ended on June 30, 2022.

On December 20, 2021, we entered into a First Amendment to our August 2020 Program Management Agreement (PMA) with PathwardTM, N.A., formerly known as MetaBank®, N.A. (Pathward), which, among other things, extends the PMA through June 30, 2025, and adds Spruce℠ accounts to the program.

In January 2022, we launched the Spruce℠ mobile banking platform as a part of the Financial Products imperative of our previously-announced Block Horizons 2025 strategic plan. The Spruce℠ platform, built by H&R Block with banking products powered by Pathward, includes a spending account with a debit card, along with a connected savings account that allows for budgeting for specific goals, and other features to help customers be good with money.

In August 2022, the Board of Directors approved a $1.25 billion share repurchase program, effective through fiscal year 2025 and increased the quarterly cash dividend by 7% to $0.29 per share.

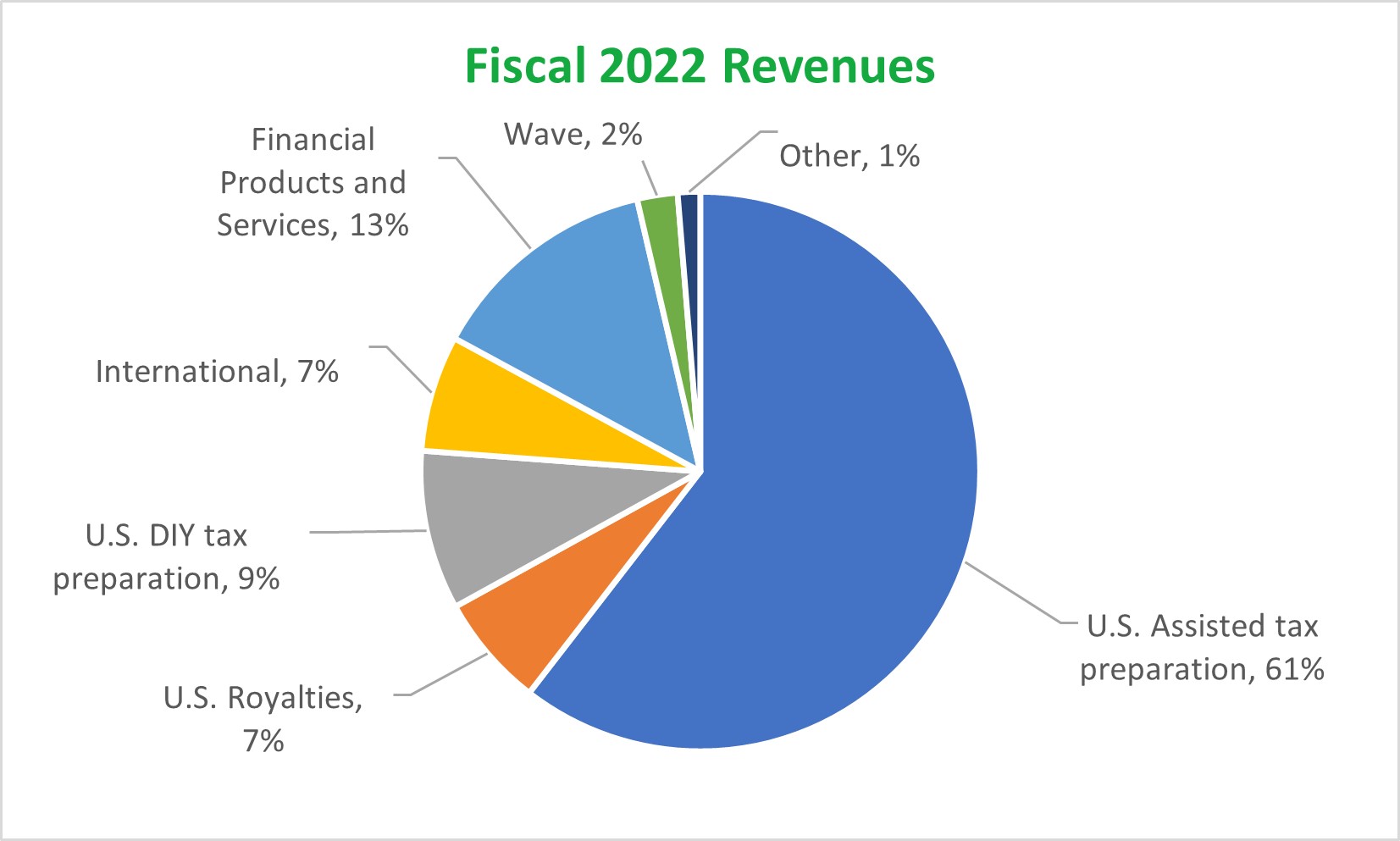

| During fiscal year 2022, we prepared | ||

20.5 million U.S. tax returns(1) | ||

| which contributed to our consolidated revenues of | ||

$3.5 billion, | ||

| net income from continuing operations of | ||

$560.6 million, | ||

EBITDA(2) from continuing operations of | ||

$889.5 million, | ||

| and diluted EPS from continuing operations of | ||

$3.26 per share. | ||

| We repurchased | ||

| 23.1 million shares of our common stock. | ||

(1) U.S. Tax returns prepared includes tax returns prepared in U.S. company and franchise office locations, virtually, and through our DIY solutions.

(2) See "Non-GAAP Financial Information" section within this filing for a reconciliation of non-GAAP measures.

2 | 2022 Form 10-K | H&R Block, Inc. | ||||

FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS

We report a single segment that includes all of our continuing operations, which includes tax preparation, small business services, and financial services and products. See discussion below.

During fiscal year 2021, we introduced Block Horizons, our five year strategy that will leverage our human expertise and technological infrastructure to deliver growth by driving tax solution innovation, helping small businesses to thrive, and support individuals where they need the most help with money.

| Small Business | ||

We are focused on growing our base of tax customers by leveraging the Block Advisors® brand and serving more entrepreneurs through our Wave® platform. In small business, our strong marketing and more advanced tax pro training allowed us to grow our assisted tax clients and our net average charge as we serve more complex businesses. In Wave, we have been successful in attracting new clients and increasing the value of existing clients, as both average revenue per user and average invoicing volume saw accelerating growth trends year over year. | ||

| Financial Products | ||

In January 2022, we launched our new mobile banking platform, SpruceSM. We believe there is an opportunity to combine leading technology and features with our trusted brand and established financial relationships. Throughout the year we tested multiple iterations of our sign-up offer and continued to release updates to improve the product. We introduced clients to SpruceSM only in the DIY channel at launch to learn and gain customer insights. During the next fiscal year, we will test customer acquisition outside the tax season and prepare for launch in the Assisted channel. | ||

| Block Experience | ||

The Block Experience is all about blending technology and digital tools with human expertise. We have been successful in driving digital adoption by leveraging MyBlock features, such as uploading documents, approving returns online, and utilizing virtual chat. We are gaining traction as virtual uptake from our clients more than tripled in the current year. | ||

We provide assisted and do-it-yourself (DIY) tax return preparation solutions through multiple channels (including in-person, online and mobile applications, virtual, and desktop software) and distribute H&R Block-branded services and products, including those of our bank partners, to the general public primarily in the U.S., Canada and Australia. We also offer small business financial solutions through our company-owned and franchise offices and online through Wave. Major revenue sources include fees earned for tax preparation via our assisted and DIY channels, royalties from franchisees, and fees from related services and products.

TAX PREPARATION SERVICES

Assisted income tax return preparation and related services are provided by tax professionals via a system of retail offices operated directly by us or our franchisees. These tax professionals provide assistance to our clients either in person or virtually in a number of ways. Clients can come into an office, digitally "drop off" their documents for their tax professional, approve their return online, have a tax professional review a return they prepared themselves through Tax Pro Review or get their questions answered as they complete their own return through Online Assist.

H&R Block, Inc. | 2022 Form 10-K | 3 | ||||

Our online software may be accessed through our website at www.hrblock.com or in a mobile application, while our desktop software may be purchased online and through third-party retail stores.

Assisted tax returns are covered by our 100% accuracy guarantee, whereby we will reimburse a client for penalties and interest attributable to an H&R Block error on a tax return. DIY tax returns are covered by our 100% accuracy guarantee, whereby we will reimburse a client up to a maximum of $10,000 if our software makes an arithmetic error that results in payment of penalties and/or interest to the IRS that the client would otherwise not have been required to pay.

We offer franchises as a way to expand our presence in certain geographic areas. In the U.S., our franchisees pay us approximately 30% of gross tax return preparation and related service revenues as a franchise royalty.

OTHER OFFERINGS

We also offer U.S. clients a number of additional services, including Refund Transfers (RT), our Peace of Mind® Extended Service Plan (POM), H&R Block Emerald Prepaid Mastercard® (Emerald Card®), Emerald Advances (EA), Tax Identity Shield® (TIS), Refund Advances (RA), and small business financial solutions. For our Canadian clients, we also offer POM, H&R Block's Instant RefundSM, H&R Block Pay With Refund®, and small business financial solutions.

Refund Transfers. RTs enable clients to receive their tax refunds by their chosen method of disbursement and include a feature enabling clients to deduct tax preparation and related fees from their tax refunds. Depending on circumstances, clients may choose to receive their RT proceeds by a load to their Emerald Card, a deposit to their Spruce Spending Account, by receiving a check or by direct deposit to an existing account. RTs are available to U.S. clients and are frequently obtained by those who: (1) do not have bank accounts into which the IRS can direct deposit their refunds; (2) like the convenience and benefits of a temporary account for receipt of their refund; and/or (3) prefer to have their tax preparation fees paid directly out of their refunds. RTs are offered through our relationship with our bank partner. We offer a similar program, H&R Block Pay With Refund®, to our Canadian clients through a Canadian chartered bank.

Peace of Mind® Extended Service Plan. We offer POM to U.S. and Canadian clients who obtain assisted tax preparation services, whereby we (1) represent our clients if they are audited by a taxing authority, and (2) assume the cost, subject to certain limits, of additional taxes owed by a client resulting from errors attributable to H&R Block. The additional taxes paid under POM have a cumulative limit of $6,000 for U.S. clients and $3,000 CAD for Canadian clients with respect to the federal, state/provincial and local tax returns we prepared for applicable clients during the taxable year protected by POM.

H&R Block Emerald Prepaid Mastercard®. The Emerald Card® enables clients to receive their tax refunds from the IRS directly on a prepaid debit card, or to direct RT, EA or RA proceeds to the card. The card can be used for everyday purchases, bill payments and ATM withdrawals anywhere Debit Mastercard® (Mastercard is a registered trademark of Mastercard International Incorporated) is accepted. Additional funds can be added to the card year-round, such as through direct deposit or at participating retail reload providers, and the Emerald Card can be added to clients' mobile wallets. We distribute the Emerald Card® issued by our bank partner.

H&R Block Emerald Advance® Lines of Credit. EAs are lines of credit offered to clients in our offices, from mid-November through mid-January, in amounts up to $1,000. If the borrower meets certain criteria as agreed in the loan terms, the line of credit can be utilized year-round. In addition to the required monthly payments, borrowers may elect to pay down balances on EAs with their tax refunds. These lines of credit are offered by our bank partner, and we subsequently purchase a participation interest in all EAs originated by our bank partner.

Tax Identity Shield®. Our TIS program offers clients assistance in helping protect their tax identity and access to services to help restore their tax identity, and if necessary, access to services to help restore their tax identity. Protection services include a daily scan of the dark web for personal information, a monthly scan for the client's social security number in credit header data, notifying clients if their information is detected on a tax return filed through H&R Block, and obtaining additional IRS identity protections when eligible.

Refund Advance Loans. RAs are interest-free loans offered by our bank partner, which are available to eligible U.S. assisted clients in company-owned and participating franchise locations, including virtual clients. In tax season

4 | 2022 Form 10-K | H&R Block, Inc. | ||||

2022, RAs were offered in amounts of $250, $500, $750, $1,250 and $3,500, based on client eligibility as determined by our bank partner.

H&R Block's Instant RefundSM. Our Canadian operations advance refunds due to certain clients from the Canada Revenue Agency (CRA), for a fee. The fee charged for this service is mandated by federal legislation which is administered by the CRA. The client assigns to us the full amount of the tax refund to be issued by the CRA and the refund amount is then sent by the CRA directly to us.

Small Business Financial Solutions. Our Block Advisor certified tax professionals provide small businesses with financial expertise in taxes, bookkeeping and payroll through our office network. Wave provides small business owners with an online solution to manage their finances, including payment processing, payroll and bookkeeping services.

SEASONALITY OF BUSINESS

Because the majority of our clients file their tax returns during the period from February through April in a typical year, a substantial majority of our revenues from income tax return preparation and related services and products are earned during this period. As a result, we generally operate at a loss through the first two quarters of our fiscal year. As a result of the COVID-19 pandemic and a delayed federal tax filing deadline in the prior year, there has been a shift in the typical seasonality of our business and the comparability of our financial results.

COMPETITIVE CONDITIONS

We provide assisted and DIY tax preparation services and products, as well as small business financial solutions, and face substantial competition in and across each category from tax return preparation firms and software providers, accounting firms, independent tax preparers, and certified public accountants.

We are one of the largest providers of tax return preparation solutions and electronic filing services in the U.S., Canada, and Australia with 23.6 million returns filed by or through H&R Block in fiscal year 2022 via 10,488 tax offices and our virtual tax preparation services, mobile applications, and online and desktop DIY solutions.

GOVERNMENT REGULATION

Our business is subject to various forms of government regulation, including U.S. Federal and state tax preparer regulations, financial consumer protection and privacy regulations, state regulations, franchise regulations and foreign regulations. See further discussion of these items in our Item 1A. Risk Factors and Item 7 under "Regulatory Environment" of this Form 10-K.

HUMAN CAPITAL

Fulfilling our purpose extends to helping and inspiring confidence in our associates. We are committed to our associates’ total well-being—physical, mental, financial, career, team and community. Together, when we balance these components, we achieve personal, team and organizational strength. These commitments extend to both our year-round and seasonal associates.

Associates. We had approximately 3,800 regular full-time associates as of June 30, 2022. Our business is dependent on the availability of a seasonal workforce, including tax professionals, and our ability to hire, train, and supervise these associates. The highest number of persons we employed during the fiscal year ended June 30, 2022, including seasonal associates, was approximately 69,900.

Associate Engagement. We administer an annual survey to all associates to better understand their levels of engagement and identify areas where we can improve. We are pleased with our overall engagement score, meeting or exceeding the global benchmark in all measured categories, and will continue to explore new ways to advance our engagement efforts in the future.

Compensation and Benefits. Our compensation programs are designed to attract and retain top talent that act boldly, demand high standards, crave tough problems and value winning as a team. Our equitable and comprehensive benefits offerings provide access to benefits to help both regular and seasonal associates plan for the health and security of their families. H&R Block provides comprehensive medical insurance to our associates,

H&R Block, Inc. | 2022 Form 10-K | 5 | ||||

and extends the opportunity for medical insurance to our seasonal workforce who satisfy the eligibility guidelines of the Affordable Care Act (ACA). Subject to meeting eligibility requirements, associates can also choose to participate in the H&R Block Retirement Savings Plan 401(k) and Employee Stock Purchase Plan.

Training and Development. We offer a variety of development opportunities for our associates, including in-person classes, online courses, assessments, and a learning library. Our tax professionals receive extensive annual tax training on topics including recent tax code changes and filing practices, and we offer additional education opportunities for tax professionals to enhance their knowledge and skills. In preparation for the upcoming tax season, our tax professionals receive training on H&R Block products, soft skills and tax office best practices. Each year, our tax professionals receive on average over 30 hours of Tax Education and over 16 hours of Continuing Professional Education.

Diversity, Inclusion and Belonging. We continually evaluate our management approaches to improving diversity and inclusion, which includes looking at how we can provide a sense of belonging in the workplace for our associates. We materialized these efforts through our Belonging@Block program which is a council of associates from multiple departments across the organization with the responsibility to represent and improve our diverse and inclusive culture. Because of our efforts to foster a culture of belonging, we are consistently recognized as a top employer in many different categories.

SERVICE MARKS AND TRADEMARKS

We have made a practice of offering our services and products under service marks and trademarks and of securing registration for many of these marks in the U.S. and other countries where our services and products are marketed. We consider these service marks and trademarks, in the aggregate, to be of material importance to our business, particularly our businesses providing services and products under the "H&R Block" brand. The initial duration of U.S. federal trademark registrations is 10 years. Most U.S. federal registrations can be renewed perpetually at 10-year intervals and remain enforceable so long as the marks continue to be used.

6 | 2022 Form 10-K | H&R Block, Inc. | ||||

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

| Jeffrey J. Jones II, 54, became our President and Chief Executive Officer in October 2017 and was our President and Chief Executive Officer-Designate from August 2017 to October 2017. Before joining the Company, he served as the President of Ridesharing at Uber Technologies, Inc. from October 2016 until March 2017. He also served as the Executive Vice President and Chief Marketing Officer of Target Corporation from April 2012 until September 2016. | |||||||

| Tony G. Bowen, 47, became our Chief Financial Officer in May 2016. Prior to that, he served as our Vice President, U.S. Tax Services Finance from May 2013 through April 2016. | |||||||

| Kellie J. Logerwell, 52, became our Chief Accounting Officer in July 2016. Prior to that, she served as our Vice President of Corporate and Field Accounting from December 2014 until July 2016 and as our Assistant Controller from December 2010 until December 2014. | |||||||

| Dara S. Redler, 55, became our Chief Legal Officer in January 2022. Prior to joining the Company, she served as General Counsel and Corporate Secretary for Tilray, Inc. from January 2019 until September 2021. She also held various legal roles of increasing responsibility with The Coca-Cola Company from September 2001 until December 2018. | |||||||

| Karen Orosco, 51, became our President, Global Consumer Tax and Service Delivery in June 2021. Prior to that she served as our Senior Vice President, U.S. Retail beginning in May 2016, and our Vice President of Retail Operations from May 2011 until May 2016. | |||||||

AVAILABILITY OF REPORTS AND OTHER INFORMATION

Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed with or furnished to the SEC are available, free of charge, through our website at www.hrblock.com as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC. The SEC maintains a website at www.sec.gov containing reports, proxy and information statements and other information regarding issuers who file electronically with the SEC.

The following corporate governance documents are posted on our website at www.hrblock.com:

▪The Amended and Restated Articles of Incorporation of H&R Block, Inc.;

▪The Amended and Restated Bylaws of H&R Block, Inc.;

▪The H&R Block, Inc. Corporate Governance Guidelines;

▪The H&R Block, Inc. Code of Business Ethics and Conduct;

▪The H&R Block, Inc. Board of Directors Independence Standards;

▪The H&R Block, Inc. Audit Committee Charter;

▪The H&R Block, Inc. Compensation Committee Charter;

▪The H&R Block, Inc. Finance Committee Charter; and

▪The H&R Block, Inc. Governance and Nominating Committee Charter.

If you would like a printed copy of any of these corporate governance documents, please send your request to H&R Block, Inc., One H&R Block Way, Kansas City, Missouri 64105, Attention: Corporate Secretary.

Information contained on our website does not constitute any part of this report.

H&R Block, Inc. | 2022 Form 10-K | 7 | ||||

ITEM 1A. RISK FACTORS

Our business activities expose us to a variety of risks. Identification, monitoring, and management of these risks are essential to the success of our operations and the financial soundness of H&R Block. Senior management and the Board of Directors, acting as a whole and through its committees, take an active role in our risk management process and have delegated certain activities related to the oversight of risk management to the Company's enterprise risk management team and the Enterprise Risk Committee, which is comprised of Vice Presidents of major business and control functions and members of the enterprise risk management team. The Company’s enterprise risk management team, working in coordination with the Enterprise Risk Committee, is responsible for identifying and monitoring risk exposures and related mitigation and leading the continued development of our risk management policies and practices.

An investment in our securities involves risk, including the risk that the value of that investment may decline or that returns on that investment may fall below expectations. There are a number of factors that could cause actual conditions, events, or results to differ materially from those described in forward-looking statements, many of which are beyond management's control or its ability to accurately estimate or predict, or that could adversely affect our financial position, results of operations, cash flows, and the value of an investment in our securities. The risks described below are not the only ones we face. We could also be affected by other events, factors, or uncertainties that are presently unknown to us or that we do not currently consider to be significant risks to our business.

STRATEGIC AND INDUSTRY RISKS

Changes in applicable tax laws have had, and may in the future have, a negative impact on the demand for and pricing of our services. Government changes in tax filing processes may adversely affect our business and our consolidated financial position, results of operations, and cash flows.

The U.S. government has in the past made, and may in the future make, changes to the individual income tax provisions of the Internal Revenue Code, tax regulations, and the rules and procedures for implementing such laws and regulations. In addition, taxing authorities or other relevant governing bodies in various federal, state, local, and foreign jurisdictions in which we operate may change the income tax laws in their respective jurisdictions, and such laws may vary greatly across the various jurisdictions. It is difficult to predict the manner in which future changes to the Internal Revenue Code, tax regulations, and the rules and procedures for implementing such laws and regulations, and state, local, and foreign tax laws may impact us and the tax return preparation industry. Such future changes could decrease the demand or the amount we charge for our services, and, in turn, have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

In addition, there are various initiatives from time to time seeking to simplify the tax return preparation filing process. Taxing authorities in various state, local, and foreign jurisdictions in which we operate have also introduced measures seeking to simplify or otherwise modify the preparation and filing of tax returns or the issuance of refunds in their respective jurisdictions. For example, from time to time, U.S. federal and state governments have considered various proposals through which the respective governmental taxing authorities would use taxpayer information provided by employers, financial institutions, and other payers to "pre-populate," prepare and calculate tax returns and distribute them to taxpayers. There are various initiatives from time to time seeking to expedite, reduce, or change the timing of refunds, which could reduce the demand for certain of our services or financial products.

The adoption or expansion of any measures that significantly simplify tax return preparation, or otherwise reduce the need for third-party tax return preparation services or financial products, including governmental encroachment at the U.S. federal and state levels, as well as in foreign jurisdictions, could reduce demand for our services and products and could have a material adverse effect on our business and our consolidated financial position, results of operations and cash flows.

Increased competition for clients could adversely affect our current market share and profitability, and we may not be effective in achieving our strategic and operating objectives.

We face substantial competition throughout our businesses. All categories in the tax return preparation industry are highly competitive and we have also announced our Block Horizons strategy, focusing on small businesses,

8 | 2022 Form 10-K | H&R Block, Inc. | ||||

financial products, and the tax client experience, to differentiate ourselves from those competitors. However, additional competitors have entered, and in the future may enter, the market to provide tax preparation services or products. In the assisted tax services category, there are a substantial number of tax return preparation firms and accounting firms offering tax return preparation services. Commercial tax return preparers are highly competitive with regard to price and service. In DIY and virtual, options include various forms of digital electronic assistance, including online and mobile applications, and desktop software, all of which we offer. Our DIY and virtual services and products compete with a number of online and software companies, primarily on price and functionality. Individual tax filers may elect to change their tax preparation method, choosing from among various assisted, DIY, and virtual offerings. While we believe that our strategic objectives reflect opportunities that are appropriate and achievable, it is possible that our objectives may not deliver projected long-term growth in revenue and profitability due to competition, inadequate execution, incorrect assumptions, sub-optimal resource allocation, or other reasons, including any of the other risks described in this “Risk Factors” section. If we are unable to realize the desired benefits from our business strategy, our ability to compete across our business and our consolidated financial position, results of operations, and cash flows could be adversely affected.

Technology advances quickly and in new and unexpected ways, and it is difficult to predict the manner in which these changes will impact the tax return preparation industry, the problems we may encounter in enhancing our services and products or the time and resources we may need to devote to the creation, support, and maintenance of technological enhancements. If we are slow to enhance our services, products, or technologies, if our competitors are able to achieve results more quickly than us, or if there are new and unexpected entrants into the industry, we may fail to capture, or lose, a significant share of the market.

Additionally, we and many other tax return preparation firms compete by offering one or more of RTs, prepaid cards, RAs, other financial services and products, and other tax-related services and products, many of which are subject to regulatory scrutiny, litigation, and other risks. We can make no assurances that we will be able to offer, or continue to offer, all of these services and products and a failure to do so could negatively impact our financial results and ability to compete. Intense competition could result in a reduction of our market share, lower revenues, lower margins, and lower profitability. In addition, we face intense competition with our small business solutions. We may be unsuccessful in competing with other providers, which may diminish our revenue and profitability, and harm our ability to acquire and retain clients.

Offers of free services or products could adversely affect our revenues and profitability.

U.S. federal, state and foreign governmental authorities in certain jurisdictions in which we operate currently offer, or facilitate the offering of, tax return preparation and electronic filing options to taxpayers at no charge, and certain volunteer organizations also prepare tax returns at no charge for low-income taxpayers. In addition, many of our competitors offer certain tax preparation services and products, and other financial services and products, at no charge. Government tax authorities, volunteer organizations, our competitors, and potential new market entrants may also elect to implement or expand free offerings in the future. Free File, Inc., which operates under an agreement that is currently set to expire in October 2023, is currently the sole means through which the IRS offers free DIY tax software to taxpayers, however the IRS is not prohibited from offering competing services.

In order to compete, we have offered certain, and may in the future offer additional, services and products at no charge. There can be no assurance that we will be able to attract clients or effectively ensure the migration of clients from our free offerings to those for which we receive fees, and clients who have formerly paid for our offerings may elect to use free offerings instead. These competitive factors may diminish our revenue and profitability, or harm our ability to acquire and retain clients, resulting in a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

H&R Block, Inc. | 2022 Form 10-K | 9 | ||||

Our businesses may be adversely affected by difficult economic conditions.

Unfavorable changes in economic conditions, which are typically beyond our control, including without limitation, inflation, slowing growth, rising interest rates, recession, changes in the political climate, war (including, but not limited to, the conflict between Russia and Ukraine), supply chain or labor market disruptions, or other adverse changes, could negatively affect our business and financial condition. Difficult economic conditions are frequently characterized by high unemployment levels and declining consumer and business spending. These poor economic conditions may negatively affect demand and pricing for our services and products. In the event of difficult economic conditions that include high unemployment levels, especially within the client segments we serve, clients may elect not to file tax returns or utilize lower cost preparation and filing alternatives.

In addition, difficult economic conditions may disproportionately impact small business owners. Wave’s revenues were negatively impacted during the start of the COVID-19 pandemic, and may again be negatively impacted in the event of a sustained economic slowdown or recession. Difficult economic conditions, including an economic recession or high inflationary period, could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

OPERATIONAL AND EXECUTION RISKS

Our failure to effectively address fraud by third parties using our offerings could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

Many industries have experienced an increased variety and amount of attempted fraudulent activities by third parties, and those fraudulent activities are becoming increasingly sophisticated. A number of companies, including some in the tax return preparation and financial services industries, have reported instances where criminals gained access to consumer information or user accounts maintained on their systems by using stolen identity information (e.g., email, username, password information, or credit history) obtained from third-party sources. We have experienced, and in the future may continue to experience, this form of unauthorized and illegal access to our systems, despite no breach in the security of our systems. Though we do not believe this fraud is uniquely targeted at our offerings, our failure to effectively address any such fraud may adversely impact our business and our consolidated financial position, results of operations, and cash flows.

In addition to losses directly from such fraud, which could occur in some cases, we may also suffer a loss of confidence by our clients or by governmental agencies in our ability to detect and mitigate fraudulent activity, and such governmental authorities may refuse to allow us to continue to offer such services or products. For example, a person with malicious intent may unlawfully take user account and password information from our clients to electronically file fraudulent federal and state tax returns, which could impede our clients' ability to file their tax returns and receive refunds (or other amounts due) and diminish consumers' perceptions of the security and reliability of our services and products, despite no breach in the security of our systems.

Governmental authorities in jurisdictions in which we operate have taken action, and may in the future take additional action, in an attempt to combat identity theft or other fraud, which may require changes to our systems and business practices, or those of third parties on which we rely that cannot be anticipated. These actions may have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

Furthermore, as fraudulent activity becomes more pervasive and sophisticated, we may implement fraud detection and prevention measures that could make it less convenient for legitimate clients to obtain and use our services and products, which may adversely affect the demand for our services and products, our reputation, and our financial performance.

An interruption in our information systems, or those of our franchisees or a third party on which we rely, or an interruption in the internet, could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

We, our franchisees, and other third parties material to our business operations rely heavily upon communications, networks, and information systems and the internet to conduct our business (including third-party internet-based or cloud computing services, and the information systems of our key vendors). These networks, systems, and operations are potentially vulnerable to damage or interruption from upgrades and maintenance, network failure,

10 | 2022 Form 10-K | H&R Block, Inc. | ||||

hardware failure, software failure, power or telecommunications failures, cyberattacks, human error, and natural disasters. As our tax preparation business is seasonal, our systems must be capable of processing high volumes during our peak periods. Therefore, any failure or interruption in our information systems, or information systems of our franchisees or a private or government third party on which we rely, or an interruption in the internet or other critical business capability during our busiest periods, could negatively impact our business operations and reputation, and increase our risk of loss.

There can be no assurance that system or internet failures or interruptions in critical business capabilities will not occur, or, if they do occur, that we, our franchisees or the private or governmental third parties on whom we rely, will adequately address them. The precautionary measures that we, or third parties on whom we rely, have implemented to avoid systems outages and to minimize the effects of any data or communication systems interruptions or failures may not be adequate, and we and such third parties may not have anticipated or addressed all of the potential events that could threaten or undermine our or such third parties information systems or other critical business capabilities. We do not have redundancy for all of our systems and our disaster recovery planning may not account for all eventualities. Our software and computer systems utilize cloud computing services provided by Microsoft Corporation. If the Microsoft Azure Cloud is unavailable for any reason, it could negatively impact our ability to deliver our services and products and our clients may not be able to access certain of our products or features, any of which could significantly impact our operations, business, and financial results.

The occurrence of any systems or internet failure, or business interruption could negatively impact our ability to serve our clients, which in turn could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

Any significant delays in launching our tax service and product offerings, changes in government regulations or processes (including the acceptance of tax returns and the issuance of refunds and other amounts to clients by the IRS or state tax agencies) that affect how we provide such offerings to our clients, or significant problems with such offerings or the manner in which we provide them to our clients may harm our revenue, results of operations, and reputation.

Tax laws and tax forms are subject to change each year, and the nature and timing of such changes are unpredictable. As a part of our business, we must incorporate any changes to tax laws and tax forms into our tax service and product offerings, including our online and mobile applications and desktop software. The unpredictable nature, timing and effective dates of changes to tax laws and tax forms can result in condensed development cycles for our tax service and product offerings because our clients expect high levels of accuracy and a timely launch of such offerings to prepare and file their taxes by the applicable tax filing deadlines and, in turn, receive any tax refund amounts on a timely basis. From time to time, we review and enhance our quality controls for preparing accurate tax returns, but there can be no assurance that we will be able to prevent all inaccuracies. Further, changes in governmental administrations or regulations could result in further and unanticipated changes in requirements or processes, which may require us to make corresponding changes to our client service systems and procedures. Certain of our financial products are dependent on the IRS following the client’s directions to direct deposit the tax refund. If the IRS disregards this direction, and sends the tax refund via check, then it could result in a loss of tax preparation and financial product revenue, negative publicity, and client dissatisfaction. In addition, unanticipated changes in governmental processes, or newly implemented processes, for (1) accepting tax filings and related forms, including the ability of taxing authorities to accept electronic tax return filings, or (2) distributing tax refunds or other amounts to clients may result in processing delays by us or applicable taxing authorities.

Any major defects or delays caused by the above-described complexities may lead to loss of clients and loss of or delay in revenue, negative publicity, client dissatisfaction, a deterioration in our business relationships with our partners or our franchisees, exposure to litigation, and increased operating expenses, even if any such launch delays or defects are not caused by us. Any of the risks described above could have a material adverse effect on our business, our reputation, and our consolidated financial position, results of operations, and cash flows.

H&R Block, Inc. | 2022 Form 10-K | 11 | ||||

We rely on a single vendor or a limited number of vendors to provide certain key services or products, and the loss of such relationships, the inability of these key vendors to meet our needs, or errors by the key vendors in providing services to or for us, could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

Historically, we have contracted, and in the future we will likely continue to contract, with a single vendor or a limited number of vendors to provide certain key services or products for our tax, financial, and other services and products. A few examples of this type of reliance are our relationships with Fidelity National Information Services, Inc. (FIS), Galileo Financial Technologies, LLC, or similar vendors, for data processing and card production services, Pathward, for the issuance of RTs, EAs RAs, Emerald Cards, and Spruce accounts, and Microsoft Corporation, for cloud computing services. In certain instances, we are vulnerable to vendor error, service inefficiencies, service interruptions, or service delays, and such issues by our key vendors in providing services to or for us could result in material losses for us due to the nature of the services being provided or our contractual relationships with our vendors. If any material adverse event were to affect one of our key vendors or if we are no longer able to contract with our key vendors for any reason, we may be forced to find an alternative provider for these critical services. It may not be possible to find a replacement vendor on terms that are acceptable to us or at all.

Our sensitivity to any of these issues may be heightened (1) due to the seasonality of our business, (2) with respect to any vendor that we utilize for the provision of any product or service that has specialized expertise, (3) with respect to any vendor that is a sole or exclusive provider, or (4) with respect to any vendor whose indemnification obligations are limited or that does not have the financial capacity to satisfy its indemnification obligations. Some of our vendors are subject to the oversight of regulatory bodies and, as a result, our product or service offerings may be affected by the actions or decisions of such regulatory bodies. If our vendors are unable to meet our needs and we are not able to develop alternative sources for these services and products quickly and cost-effectively, or if a key vendor were to commit a major error or suffer a material adverse event, it could result in a material and adverse impact on our business and our consolidated financial position, results of operations, and cash flows.

The specialized and highly seasonal nature of our business presents financial risks and operational and human capital challenges.

Our business is highly seasonal, with the substantial portion of our revenue earned from February through April in a typical year. The concentration of our revenue-generating activity during this relatively short period presents a number of challenges for us, including (1) cash and resource management during the remainder of our fiscal year, when we generally operate at a loss and incur fixed costs and costs of preparing for the upcoming tax season, (2) responding to changes in competitive conditions, including marketing, pricing, and new product offerings, which could affect our position during the tax season, (3) disruptions, delays, or extensions in a tax season, including those caused by pandemics, such as the COVID-19 outbreak, (4) client dissatisfaction issues or negative social media campaigns, which may not be timely discovered or satisfactorily addressed, and (5) ensuring optimal uninterrupted operations and service delivery during the tax season. If we experience significant business disruptions during the tax season or if we are unable to effectively address the challenges described above and related challenges associated with a seasonal business, we could experience a loss, disruption, or change in timing of business, which could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

We may be unable to attract and retain key personnel.

Our business depends on our ability to attract, develop, motivate, and retain key personnel in a timely manner, including members of our executive team and those in seasonal tax preparation positions (which may be required on short notice during any extended tax season or to serve extended filers) or with other required specialized expertise, including technical positions. The market for such personnel is extremely competitive, and there can be no assurance that we will be successful in our efforts to attract and retain the required qualified personnel within necessary timeframes, or at expected cost levels. As the global labor market continues to evolve as a result of the COVID-19 pandemic and other changes, our current and prospective key personnel may seek new or different opportunities based on pay levels, benefits, or remote work flexibility that are different from what we offer, or may determine to leave the workforce, making it difficult to attract and retain them. If we are unable to attract, develop, motivate, and retain key personnel, our business, operations, and financial results could be negatively

12 | 2022 Form 10-K | H&R Block, Inc. | ||||

impacted. In addition, if our costs of labor or related costs increase or if new or revised labor laws, rules or regulations are adopted or implemented that impact our seasonal workforce and increase our labor costs, there could be a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

Our business depends on our strong reputation and the value of our brands.

Developing and maintaining awareness of our brands is critical to achieving widespread acceptance of our existing and future services and products and is an important element in attracting new clients. In addition, our franchisees operate their businesses under our brands. Adverse publicity (whether or not justified) relating to events or activities involving or attributed to us, our franchisees, employees, or agents or our services or products, which may be enhanced due to the nature of social media, may tarnish our reputation and reduce the value of our brands. Damage to our reputation and loss of brand equity may reduce demand for our services and products and thus have an adverse effect on our future financial results, as well as require additional resources to rebuild our reputation and restore the value of our brands.

Failure to maintain sound business relationships with our franchisees may have a material adverse effect on our business and we may be subject to legal and other challenges resulting from our franchisee relationships.

Our financial success depends in part on our ability to maintain sound business relationships with our franchisees. The support of our franchisees is also critical for the success of our ongoing operations. Deterioration in our relationships with our franchisees could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

We also grant our franchisees a limited license to use our registered trademarks and, accordingly, there is risk that one or more of the franchisees may be alleged to be controlled by us. Third parties, regulators or courts may seek to hold us responsible for the actions or failures to act by our franchisees. Adverse outcomes related to legal actions could result in substantial damages and could cause our earnings to decline. Negative public opinion could also result from our or our franchisees’ actual or alleged conduct in such claims, possibly damaging our reputation, which, in turn, could adversely affect our business prospects and cause the market price of our securities to decline.

Our international operations are subject to risks that may harm our business and our consolidated financial position, results of operations, and cash flows.

We have international operations, including tax preparation businesses in Canada and Australia, technology centers in India and Ireland, and Wave in Canada. We may consider expansion opportunities in additional countries in the future and there is uncertainty about our ability to generate revenues from new or emerging foreign operations or expand into other international markets. Additionally, there are risks inherent in doing business internationally, including: (1) changes in trade regulations; (2) difficulties in managing foreign operations as a result of distance, language, and cultural differences; (3) profit repatriation restrictions, and fluctuations in foreign currency exchange rates; (4) geopolitical events, including acts of war and terrorism, and economic and political instability; (5) compliance with anti-corruption laws such as the U.S. Foreign Corrupt Practices Act and other applicable foreign anti-corruption laws; (6) compliance with U.S. and international laws and regulations, including those concerning privacy, and data protection and retention; and (7) risks related to other government regulation or required compliance with local laws. These risks inherent in international operations and expansion could prevent us from expanding into other international markets or increase our costs of doing business internationally and could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

In addition, we prepare U.S. federal and state tax returns for taxpayers residing in foreign jurisdictions, including the European Union (EU), and we and certain of our franchisees operate and provide other services in foreign jurisdictions. As a result, certain aspects of our operations are subject, or may in the future become subject, to the laws, regulations, and policies of those jurisdictions that regulate the collection, use, and transfer of personal information, which may be more stringent than those of the U.S., including, but not limited to the EU General Data Protection Regulation, the Canadian Personal Information Protection and Electronic Documents Act, and Canadian Provincial legislation.

H&R Block, Inc. | 2022 Form 10-K | 13 | ||||

Costs for us to comply with such laws, regulations, and policies that are applicable to us could be significant. We may also face audits or investigations by one or more foreign government agencies relating to these laws, regulations, and policies that could result in the imposition of penalties or fines.

Our financial condition and results of operations have been, and may continue to be, adversely affected by the COVID-19 pandemic, and may be impacted by a resurgence of COVID-19 or a variant thereof or a future outbreak of another highly infectious or contagious disease.

During March 2020, the World Health Organization declared the COVID-19 outbreak to be a global pandemic, and the impacts of the pandemic have been felt since that time. Since the beginning of the pandemic, jurisdictions in which we operate have from time-to-time imposed various restrictions on our business, including at various times over the past fiscal year imposing certain operational limitations, and social distancing requirements. Notwithstanding our efforts to address the impacts of the COVID-19 pandemic, or a variant thereof, on our business, there is no certainty that the measures we implemented, or may implement in the future, are or will be sufficient to mitigate the risks posed by COVID-19, or a variant thereof. Alleged failures in this regard could result in negative impacts, including regulatory investigations, claims, legal actions, harm to our reputation and brands, fines, penalties, and other damages.

As a result of the COVID-19 pandemic, the IRS extended the deadline in consecutive tax seasons for 2019 and 2020 individual income tax returns. In addition, substantially all U.S. states with an April individual state income tax filing requirement also extended their respective deadlines. These extensions impacted the typical seasonality of our business and the comparability of our financial results. Though tax return filing deadlines were generally not extended for individual 2021 tax returns, Treasury, the IRS, and state or foreign officials may determine to extend future tax deadlines or take other actions, which could have an additional material adverse effect on our business and our consolidated financial position, results of operations, and cash flows in future years.

The extent to which the COVID-19 pandemic or another outbreak impacts our business, operations, and financial results going forward will depend on numerous evolving factors that we may not be able to accurately predict. The further spread of COVID-19 or a variant thereof or a new global or national outbreak of COVID-19, or a variant thereof, or another highly infectious or contagious disease, the requirements to take action to help limit the spread of illness, and the other risks described above may further impact our ability to carry out our business and may materially adversely impact global economic conditions, our business, results of operations, cash flows, and financial condition.

INFORMATION SECURITY, CYBERSECURITY, AND DATA PRIVACY RISKS

Compliance with the complex and evolving laws, regulations, standards, and contractual requirements regarding privacy and data protection could require changes in our business practices and increase costs of operation; failure to comply could result in significant claims, fines, penalties, and damages.

Due to the nature of our business, we collect, use, and retain large amounts of personal information and data pertaining to clients, including tax return information, financial product and service information, and social security numbers. In addition, we collect, use, and retain personal information and data of our employees in the ordinary course of our business.

We are subject to laws, rules, and regulations relating to the collection, use, disclosure, and security of such consumer and employee personal information, which have drawn increased attention from U.S. federal, state, and foreign governmental authorities in jurisdictions in which we operate. In the U.S., the IRS generally requires a tax return preparer to obtain the written consent of the taxpayer prior to using or disclosing the taxpayer's tax return information for certain purposes other than tax return preparation, which may limit our ability to market revenue-generating products to our clients. In addition, other regulations require financial institutions to adopt and disclose their consumer privacy notice and generally provide consumers with a reasonable opportunity to "opt-out" of having nonpublic personal information disclosed to unaffiliated third parties for certain purposes.

Numerous jurisdictions have passed, and may in the future pass, new laws related to the use and retention of consumer or employee information and this area continues to be an area of interest for U.S. federal, state, and foreign governmental authorities. For example, the State of California adopted the California Consumer Privacy Act (CCPA), which became effective January 1, 2020, as amended by the California Privacy Rights Act (CPRA), which will

14 | 2022 Form 10-K | H&R Block, Inc. | ||||

be effective January 1, 2023. Subject to certain exceptions, these laws impose new requirements on how businesses collect, process, manage, and retain certain personal information of California residents and provide California residents with various rights regarding personal information collected by a business. Colorado, Connecticut, Utah, and Virginia have adopted comprehensive privacy laws, and other jurisdictions have adopted or may in the future adopt their own, different privacy laws. These laws may contain different requirements or may be interpreted and applied inconsistently from jurisdiction to jurisdiction. Our current privacy and data protection policies and practices may not be consistent with all of those requirements, interpretations, or applications. In addition, changes in U.S. federal and state regulatory requirements, as well as requirements imposed by governmental authorities in foreign jurisdictions in which we operate, could result in more stringent requirements and a need to change business practices, including the types of information we can use and the manner in which we can use such information. Establishing systems and processes, or making changes to our existing policies, to achieve compliance with these complex and evolving requirements may increase our costs or limit our ability to pursue certain business opportunities. There can be no assurance that we will successfully comply in all cases, which could result in regulatory investigations, claims, legal actions, harm to our reputation and brands, fines, penalties, and other damages.

We have incurred, and may continue to incur, significant expenses to comply with existing privacy and data security standards and protocols imposed by law, regulation, industry standards or contractual obligations.

A security breach of our systems, or third-party systems on which we rely, resulting in unauthorized access to personal information of our clients or employees or other sensitive, nonpublic information, may adversely affect the demand for our services and products, our reputation, and financial performance.

We offer a range of services and products to our clients, including tax return preparation solutions, financial services and products, and small business solutions through our company-owned or franchise offices and online. Due to the nature of these services and products, we use multiple digital technologies to collect, transmit, and store high volumes of client personal information. We also collect, use, and retain other sensitive, nonpublic information, such as employee social security numbers, healthcare information, and payroll information, as well as confidential, nonpublic business information. Certain third parties and vendors have access to personal information to help deliver client benefits, services and products, or may host certain of our and our clients’ sensitive and personal information and data. Information security risks continue to increase due in part to the increased adoption of and reliance upon digital technologies by companies and consumers. Our risk and exposure to these matters remain heightened due to a variety of factors including, among other things, (1) the evolving nature of these threats and related regulation, (2) the increased activity and sophistication of hostile foreign governments, organized crime, cyber criminals, and hackers that may initiate cyberattacks against us or third-party systems on which we rely, (3) the prominence of our brand, (4) our and our franchisees' extensive office footprint, (5) our plans to continue to implement strategies for our online and mobile applications and our desktop software, (6) our use of third-party vendors, and (7) the usage of remote working arrangements by our associates, franchisees, and third-party vendors, which significantly expanded due to the COVID-19 pandemic.

Cybersecurity risks may result from fraud or malice (a cyberattack), human error, or accidental technological failure. Cyberattacks are designed to electronically circumvent network security for malicious purposes such as unlawfully obtaining personal information, disrupting our ability to offer services, damaging our brand and reputation, stealing our intellectual property, or advancing social or political agendas. We face a variety of cyberattack threats including computer viruses, malicious codes, worms, phishing attacks, social engineering, denial of service attacks, ransomware, and other sophisticated attacks.

Although we use security and business controls to limit access to and use of personal information and expend significant resources to maintain multiple levels of protection to address or otherwise mitigate the risk of a security breach, such measures cannot provide absolute security. We regularly test our systems to discover and address potential vulnerabilities, and we rely on training and testing of our employees regarding heightened phishing and social engineering threats. We also conduct certain background checks on our employees, as allowed by law. Due to the structure of our business model, we also rely on our franchisees and other private and governmental third parties to maintain secure systems and respond to cybersecurity risks. Where appropriate, we impose certain requirements and controls on these third parties, but it is possible that they may not appropriately employ these

H&R Block, Inc. | 2022 Form 10-K | 15 | ||||

controls or that such controls (or their own separate requirements and controls) may be insufficient to protect personal information.

Cybersecurity and the continued development and enhancement of our controls, processes, and practices designed to protect our systems, computers, software, data, and networks from attack, damage, or unauthorized access remain a priority for us. As risks and regulations continue to evolve, we may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate information security vulnerabilities. Notwithstanding these efforts, there can be no assurance that a security breach, intrusion, or loss or theft of personal information will not occur. In addition, the techniques used to obtain unauthorized access change frequently, become more sophisticated, and are often difficult to detect until after a successful attack, causing us to be unable to anticipate these techniques or implement adequate preventive measures in all cases.

Unauthorized access to personal information as a result of a security breach could cause us to determine that it is required or advisable for us to notify affected individuals, regulators, or others under applicable privacy laws and regulations or otherwise. Security breach remediation could also require us to expend significant resources to assist impacted individuals, repair damaged systems, implement modified information security measures, and maintain client and business relationships. Other consequences could include reduced client demand for our services and products, loss of valuable intellectual property, reduced growth and profitability and negative impacts to future financial results, loss of our ability to deliver one or more services or products (e.g., inability to provide financial services and products or to accept and process client credit card transactions or tax returns), modifying or stopping existing business practices, legal actions, harm to our reputation and brands, fines, penalties, and other damages, and further regulation and oversight by U.S. federal, state, or foreign governmental authorities.

A security breach or other unauthorized access to our systems could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

LEGAL AND REGULATORY RISKS

Regulations promulgated by the Consumer Financial Protection Bureau (CFPB) or other regulators may affect our financial services businesses in ways we cannot predict, which may require changes to the financial products we offer, our services and contracts.

The CFPB has broad powers to administer, investigate compliance with, and, in some cases, enforce U.S. federal financial consumer protection laws. The CFPB has broad rule-making authority for a wide range of financial consumer protection laws that apply to certain of the financial products we offer, including the authority to prohibit or allege "unfair, deceptive, or abusive" acts and practices. It is difficult to predict how currently proposed or new regulations may impact the financial products we offer.

The CFPB and state regulators may examine, investigate, and take enforcement actions against our subsidiaries that offer consumer financial services and products, as well as financial institutions and service providers upon which our subsidiaries rely to provide consumer financial services and products. State regulators also have certain authority in enforcing and promulgating financial consumer protection laws, the results of which could be (i) states issuing new and broader financial consumer protection laws, some of which could be more comprehensive than existing U.S. federal regulations, or (ii) state attorneys general bringing actions to enforce federal consumer protection laws.

Currently proposed or new CFPB and state regulations, or expanded interpretations of current regulations, may require changes to the financial products we offer, our services or contracts, and this could have a material adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

Laws and regulations or other regulatory actions could have an adverse effect on our business and our consolidated financial position, results of operations, and cash flows.

Our tax preparation business and operations are subject to various forms of government regulation, including U.S. federal requirements regarding the signature and inclusion of identification numbers on tax returns and tax return retention requirements. U.S. federal laws also subject income tax return preparers to accuracy-related penalties, and preparers may be prohibited from continuing to act as income tax return preparers if they repeatedly engage in specified misconduct. We are also subject to, among other things, advertising standards for electronic tax return

16 | 2022 Form 10-K | H&R Block, Inc. | ||||

filers, and to possible monitoring by the IRS, and if deemed appropriate, the IRS could impose various penalties, including suspension from the IRS electronic filing program. Many states and local jurisdictions have laws regulating tax professionals or the offering of income tax courses, which are in addition to and may be different than federal requirements.

In addition, our franchising activities are subject to various rules and regulations, including requirements to furnish prospective franchisees with a prescribed franchise disclosure document. Substantive state laws regulating the franchisor/franchisee relationship presently exist in a large number of states. These state laws often limit, among other things, the duration and scope of non-competition provisions, the ability of a franchisor to terminate or refuse to renew a franchise contract and the ability of a franchisor to designate sources of supply. In addition, bills have been introduced from time to time that would provide for federal regulation of the franchisor/franchisee relationship in certain respects or that would impact the traditional nature of the relationship between franchisors and franchisees.

Additionally, our offering of consumer financial products and services are subject to various rules and regulations, including potential limitations or restrictions on the amount of interchange fees. There can be no assurance that future regulation or changes by the payment networks will not impact interchange revenues substantially. If interchange rates decline, whether due to actions by the payment networks or future regulation, it could impact the profitability of our consumer financial products and services or our ability to offer such products or services.

Given the nature of our businesses, we are subject to various additional federal, state, local, and foreign laws and regulations, including, without limitation, in the areas of labor, immigration, marketing and advertising, consumer protection, financial services and products, payment processing, privacy and data security, anti-competition, environmental, health and safety, insurance, and healthcare. There have been significant new or proposed regulations and/or heightened focus by the government and others in some of these areas, including, for example, related to privacy and data security, climate change, interchange fees, consumer financial services and products, endorsements and testimonials, telemarketing, restrictive covenants, and labor, including overtime and exemption regulations, state and local laws on minimum wage, worker classification, and other labor-related issues.

The above requirements and business implications are subject to change and evolving application, including by means of new legislation, legislative changes, and/or executive orders, and there may be additional regulatory actions or enforcement priorities, or new interpretations of existing requirements that differ from ours. These developments could impose unanticipated limitations or require changes to our business, which may make elements of our business more expensive, less efficient, or impossible to conduct, and may require us to modify our current or future services or products, which effects may be heightened given the nature, broad geographic scope, and seasonality of our business.

We face legal actions in connection with our various business activities, and current or future legal actions may damage our reputation, impair our product offerings, or result in material liabilities and losses.

We have been named and, in the future will likely continue to be named, in various legal actions, including arbitrations, class or representative actions, actions or inquiries by state attorneys general and other regulators, and other litigation arising in connection with our various business activities, including relating to our various service and product offerings. For example, as previously reported, we are subject to litigation and have received and are responding to certain governmental inquiries relating to the IRS Free File program. These inquiries include requests for information and, in some cases, subpoenas from various regulators and state attorneys general. We cannot predict whether these legal actions could lead to further inquiries, further litigation, fines, injunctions or other regulatory or legislative actions or impacts on our brand, reputation and business. See discussion in Item 8, note 12 to the consolidated financial statements for additional information.

Failure to protect our intellectual property rights may harm our competitive position and litigation to protect our intellectual property rights or defend against third party allegations of infringement may be costly.