EXHIBIT 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

OPERATIONS AND FINANCIAL CONDITION

FOR THE THREE MONTHS ENDED MARCH 31, 2019

CONTENTS

| Page | ||||||||

| 1: | Highlights and Relevant Updates | |||||||

| 2: | Core Business, Strategy and Outlook | |||||||

| 3: | Review of Financial Results | |||||||

| 4: | Operating Segments Performance | |||||||

| 5: | Construction, Development and Exploration | |||||||

| 6: | Financial Condition and Liquidity | |||||||

| 7: | Economic Trends, Business Risks and Uncertainties | |||||||

| 8: | Contingencies | |||||||

| 9: | Critical Accounting Policies and Estimates | |||||||

| 10: | Non-GAAP Financial Measures and Additional Subtotals in Financial Statements | |||||||

| 11: | Disclosure Controls and Procedures | |||||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF OPERATIONS AND FINANCIAL CONDITION

This Management’s Discussion and Analysis of Operations and Financial Condition ("MD&A") should be read in conjunction with Yamana Gold Inc.'s (the "Company" or "Yamana") condensed consolidated interim financial statements for the three months ended March 31, 2019, and the most recently issued annual Consolidated Financial Statements for the year ended December 31, 2018, ("Consolidated Financial Statements"). (All figures are in United States Dollars ("US Dollars") unless otherwise specified and are in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board.

The Company has included certain non-GAAP financial measures, which the Company believes, that together with measures determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. Non-GAAP financial measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The non-GAAP financial measures included in this MD&A include:

•Cash Costs per gold equivalent ounce ("GEO") sold and by-product basis;

•Cash Costs per pound of copper sold;

•All-in Sustaining Costs per GEO sold and by-product basis;

•All-in Sustaining Costs per pound of copper sold;

•Net Debt;

•Net Free Cash Flow;

•Average Realized Price per ounce of gold/silver sold; and

•Average Realized Price per pound of copper sold.

Definitions and reconciliations associated with the above metrics can be found in Section 10: Non-GAAP Financial Measures and Additional Subtotals in Financial Statements of this MD&A.

Cautionary statements regarding forward-looking information and mineral reserves and mineral resources are included in this MD&A.

1

1. HIGHLIGHTS AND RELEVANT UPDATES

For the three months ended March 31, 2019, unless otherwise noted

QUARTERLY OVERVIEW

•The Company exceeded total gold equivalent ounces ("GEO") production expectations, and achieved this at GEO costs in line with expectations. GEO assumes gold ounces plus the gold equivalent of silver ounces using a ratio of 83.76 for the three months ended March 31, 2019 and 76.92 for the comparative period in 2018.

•Strong operating performance was attributed to above-expectation gold production across the Company's operations. Notable increases compared to the first quarter of 2018 included 12% at Jacobina, 6% at Minera Florida and continued strong contributions from Cerro Moro.

•Cash flows from operating activities of $12.4 million and cash flows from operating activities before net change in working capital during the quarter of $103.2 million. These amounts include amortization of deferred revenue of $25.1 million in the first quarter related to deliveries under the Company’s copper advanced sales program during the quarter. The Company's copper advanced sales program's deliveries began in the third quarter of 2018 and will continue through the second quarter of 2019. If not for the timing difference of cash proceeds attributable to this transaction, the Company’s cash flows from operating activities before net change in working capital would have been higher by those amounts during the quarters as follows:

| (In millions of US Dollars, unless otherwise noted) | For the three months ended | ||||||||||||||||||||||

Illustration of impact due to copper advanced sales program | March 31, 2018 | June 30, 2018 | September 30, 2018 | December 31, 2018 | March 31, 2019 | June 30, 2019 ii | Cumulative impact | ||||||||||||||||

Copper to be delivered (millions of pounds) | 13.2 | 10.7 | 8.2 | 8.2 | 40.3 | ||||||||||||||||||

Cash flows from operating activities before net change in working capital i | $ | 206.4 | $ | 157.5 | $ | 86.6 | $ | 115.8 | $ | 103.2 | $ | — | $ | — | |||||||||

| Impact due to copper advanced sales program | (125.0) | — | 41.7 | 33.3 | 25.1 | 24.9 | $ | — | |||||||||||||||

Cash flows from operating activities before net change in working capital, normalized for the copper advanced sales program i | $ | 81.4 | $ | 157.5 | $ | 128.3 | $ | 149.1 | $ | 128.3 | $ | — | $ | — | |||||||||

i.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

ii.For illustration purposes only. The Company intends to provide information each subsequent period reflecting the impact due to copper advanced sales program over its term.

•The Company's strong financial position is expected to improve further over the year with the continuation of robust operating results, the sale of unrefined gold and silver carried over from both 2018 and the first quarter of 2019 and the expected receipt of $800 million in cash from the recently announced sale of Chapada. As anticipated, cyclical high first-quarter payments are reflected in the negative movement in working capital from December 31, 2018, which include the payment of year-end related accruals and timing of regular trades payables, precipitate inventory buildup at Cerro Moro and other mines and indirect tax credit buildup at certain operations. These items also impacted debt and Net Free Cash Flowiv compared to December 31, 2018, as anticipated in the Company's plans. With the reversal of these impacts beginning in the second quarter of 2019, the Company is expected to be positioned to deliver near-term improvements in cash flow and Net Free Cash Flow consistent with its annual plan.

•Subsequent to the quarter end, the Company arranged for the sale of approximately 27,000 GEO in Cerro Moro precipitate inventory, which will be reflected in gross revenue and operating cash flow in the second quarter of approximately $34.5 million. The Company expects a further sale of precipitate in June 2019 with a value in excess of $10 million, following which the normalization of inventory is expected. The Company has procured an additional furnace to mitigate historical capacity constraints and is assessing whether its installation or the established flexibility of selling gold and silver in precipitate is a better solution for managing the stability of inventory. Since the startup of Cerro Moro through the first quarter of 2019, higher silver grades, which were also above mineral reserve grade and with a positive reconciliation factor, created a capacity constraint on the furnaces at the mine. The normalization of silver grade and sales of precipitate during the second quarter are expected to return furnace capability to design levels.

•Continuation of the exploration programs at the Company's existing operations. In the near term, the Company plans to increase its exploration spending during the year, further building mineral reserves and mineral resources at key operations as well as building a pipeline of exploration opportunities to ensure future growth. Exploration plans are focused on extending mine life at Cerro Moro, El Peñón and Minera Florida while increasing grade, mineral resources and mine life at Jacobina and Canadian Malartic, to allow increases in production at low costs. In particular at Jacobina, over the course of the year, exploration spend will be allocated to support the planned expansion and the program targets new mineral reserves at a grade of 3.0 g/t or better.

2

OPERATING

•GEO production increased by 29% for the first quarter of 2019 compared to the same quarter in 2018. Individual mine results included increases of 12% at Jacobina and 6% at Minera Florida, in addition to the contribution of 38,471 ounces of gold from Cerro Moro, which reached commercial production towards the end of the second quarter of 2018.

| For the three months ended March 31, | ||||||||

| 2019 | 2018 | |||||||

GEO i | ||||||||

Production ii, iii | 271,987 | 211,246 | ||||||

Sales ii, iii | 250,886 | 211,154 | ||||||

Per GEO sold data iv | ||||||||

Total cost of sales ii, v | $ | 1,098 | $ | 1,049 | ||||

Cash Costs ii, iv | $ | 666 | $ | 703 | ||||

AISC ii, iv | $ | 930 | $ | 990 | ||||

By-product Cash Costs ii, iv | $ | 526 | $ | 501 | ||||

By-product AISC ii, iv | $ | 865 | $ | 840 | ||||

•Gold and silver production was 18% and 235% higher than in 2018, respectively; mainly from the contribution of Cerro Moro:

| For the three months ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Gold | ||||||||

Production (ounces) ii, iii | 235,958 | 199,555 | ||||||

Sales (ounces) ii, iii | 223,510 | 198,501 | ||||||

| Per ounce data | ||||||||

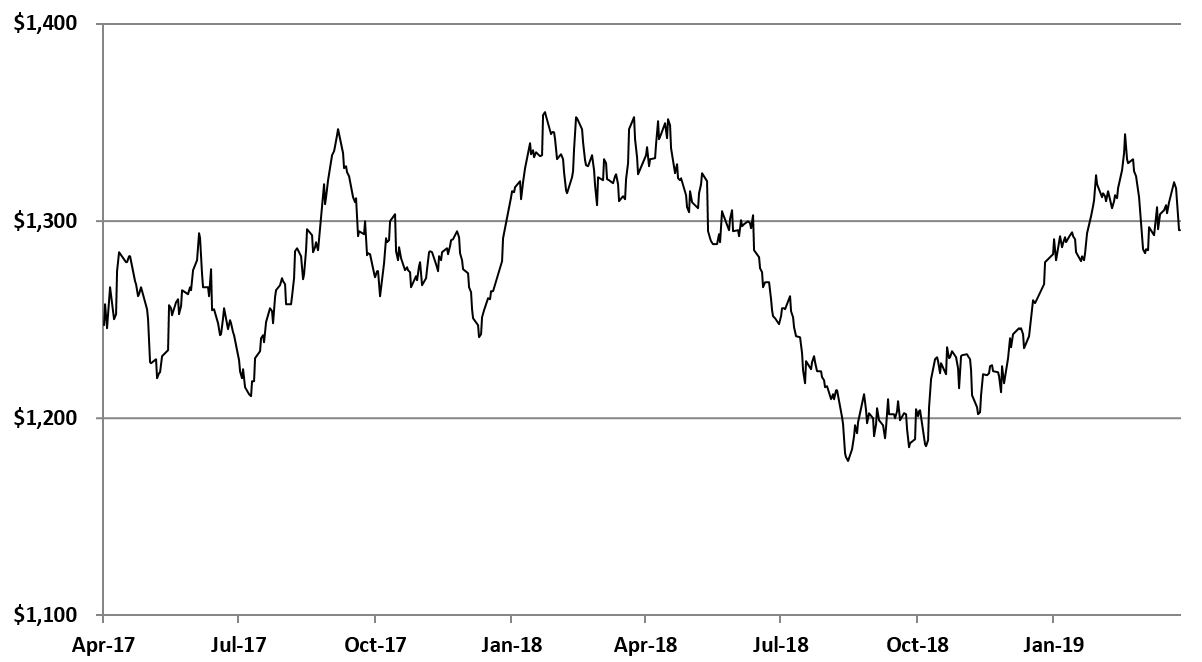

| Revenue | $ | 1,292 | $ | 1,322 | ||||

Average Realized Price iv, vi | $ | 1,301 | $ | 1,328 | ||||

Average market price vii | $ | 1,304 | $ | 1,330 | ||||

| Silver | ||||||||

Production (ounces) ii | 3,016,298 | 899,261 | ||||||

Sales (ounces) ii | 2,297,916 | 973,257 | ||||||

| Per ounce data | ||||||||

| Revenue | $ | 15.52 | $ | 16.50 | ||||

Average Realized Price iv, vi | $ | 15.52 | $ | 16.93 | ||||

Average market price vii | $ | 15.57 | $ | 16.75 | ||||

•Copper production was as follows, in line with expectations.

| For the three months ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Copper | ||||||||

Production (millions of pounds) | 28.1 | 30.4 | ||||||

Sales (millions of pounds) | 26.9 | 30.3 | ||||||

| Per pound data | ||||||||

| Revenue | $ | 3.07 | $ | 2.61 | ||||

Average Realized Price iv, vi | $ | 2.91 | $ | 3.13 | ||||

Average market price vii | $ | 2.82 | $ | 3.16 | ||||

Total cost of sales v | $ | 1.79 | $ | 1.79 | ||||

Cash Costs iv | $ | 1.65 | $ | 1.72 | ||||

AISC iv | $ | 2.35 | $ | 2.08 | ||||

_____________________________________________

i.GEO assumes gold ounces plus the gold equivalent of silver ounces using a ratio of 83.76 for the current period and 76.92 for the comparative period.

ii.Amount is for Yamana Mines, which includes Chapada, El Peñón, Canadian Malartic, Jacobina, Minera Florida and Cerro Moro.

iii.Production excludes Gualcamayo's gold production of 23,846 ounces for the first quarter of 2018. Sales excludes Gualcamayo's gold sales of 25,867 ounces for the first quarter of 2018. Gualcamayo was sold on December 14, 2018.

3

iv.A cautionary note regarding non-GAAP performance measures, their respective reconciliations and previously outlined changes effective January 1, 2019 are included in Section 10: Non-GAAP Financial Measures and Additional Subtotals in Financial Statements of this MD&A. Comparatives have been restated to reflect the changes adopted in the current period.

v.Cost of sales consists of the sum of 'cost of sales excluding Depletion, Depreciation and Amortization' ("DDA") plus DDA.

vi.Realized prices based on gross sales compared to market prices for metals may vary due to the timing of the sales.

vii.Source of information: Bloomberg.

STRATEGIC DEVELOPMENTS

Agua Rica, Argentina

•On March 7, 2019, the Company signed an integration agreement with Glencore International AG ("Glencore") and Newmont Goldcorp Inc. ("Newmont Goldcorp") (collectively the “Parties”) pursuant to which the Agua Rica project would be developed and operated using the existing infrastructure and facilities of Minera Alumbrera Limited in the Catamarca Province of Argentina. The full integration of the Agua Rica project and the Alumbrera mine technically and legally will result in the following ownership structure:

◦ 56.25% by the Company,

◦ 25% by Glencore and

◦ 18.75% by Newmont Goldcorp.

The Parties believe the integration of the Agua Rica project and the Alumbrera mine (the “Integrated Project”) has significant merit given the proximity of the assets and the potential to realize significant synergies by taking full advantage of existing infrastructure associated with the Alumbrera mine for the development and operation of Agua Rica.

A technical committee has been established by the Parties to direct the review and evaluation of the integrated project. It is expected that a pre-feasibility study for the integrated project and permitting will be completed in mid-2019. A full feasibility study with updated mineral reserve, production and project cost estimates will be completed by mid-2020.

First quarter progress has been encouraging and additional value-creating opportunities are being considered. These opportunities include infill drilling with a focus to upgrade approximately 160 million tonnes of inferred mineral resources within the mineral reserve pit shell. Additionally, the Company is considering drilling opportunities adjacent to the pit shell with a focus to increase inferred mineral resources. This pit shell increase would allow additional push-backs that could provide significant increases to the mineral reserves, mine plan optimizations to maximize net present value, construction time optimization and blending strategies to ensure concentrate quality, among other benefits. For additional details, refer to Section 5: Construction, Development and Exploration of this MD&A.

Chapada, Brazil

•Subsequent to the quarter end, the Company announced an agreement to sell the wholly-owned Chapada mine to Lundin Mining Corporation ("LMC") (the "Sale Transaction") for total consideration of over $1.0 billion, which reflects Chapada's full value including the anticipated plant expansion. Consideration components, are as follows:

•$800 million in cash, payable at closing;

•Additional cash payments of up to $125 million based on the price of gold over the five-year period from the date of closing, as follows:

◦$10 million per year for each year over the next 5 years where the gold price averages over $1,350/oz, up to a maximum cash payment of $50 million;

◦Additional $10 million per year for each year over the next 5 years where the gold price averages over $1,400/oz, up to a maximum cash payment of $50 million; and

◦Additional $5 million per year for each year over the next 5 years where the gold price averages over $1,450/oz, up to a maximum cash payment of $25 million.

•$100 million payment contingent on the development of a pyrite roaster at Chapada by LMC; and

•2% net smelter return ("NSR") royalty on gold production from the Suruca deposit.

Contingent payments are structured as rights that can be monetized should the Company choose to do so.

The Sale Transaction enhances the Company’s position as a dominant intermediate precious metals company with a high quality asset portfolio, a robust balance sheet and cash flow profile, and peer-leading jurisdictional focus. The Company will have a greater concentration of precious metals while still maintaining significant copper exposure through Agua Rica. Upon closing of the sale, a significant and immediate improvement to overall financial flexibility is expected to allow for the pursuit of near-term value maximizing opportunities that are currently in the Company's portfolio and also to increase shareholder returns, initially by way of a 100% increase in the annual dividend. In summary, beyond this enhanced industry position, the financial benefits of the sale, on closing, are as follows:

•Improved Financial Flexibility – The sale provides a significant improvement to the Company’s financial flexibility going forward as follows:

◦The lower debt levels will result in interest savings in excess of $35 million per annum over the tenure of the debt.

4

◦Chapada's five-year plan to maintain GEO guidance levels includes total sustaining and expansionary expenditures of $458 millioni and $240 million, respectively, which will now not be incurred by the Company. While Chapada maintains a long life based on mineral inventory, it is expected that sustaining and expansionary expenditures would significantly reduce free cash flows during the period that coincides with reduced production, particularly for gold, resulting in less operating cash flow than in previous periods.

◦The Company’s Net Free Cash Flow that would have been required for Chapada’s sustaining and expansionary capital expenditures can now be applied for the maximization of value enhancing opportunities at the Company’s other operations.

◦These opportunities include further production at Jacobina and Canadian Malartic and improvements to costs at Cerro Moro, which derive significantly better returns, as well as expected costs lower than the previous Phase 2 and Phase 3 expansion plans for Chapada. Consistent with the Company’s strategy, these opportunities are to be funded organically by cash flows from operations with the expected capital requirements to be covered by Net Free Cash Flow.

•Immediate Leverage Reduction – The up-front cash consideration of $800 million provides for significant deleveraging benefits highlighted by a decline in current Net Debt leverage ratio to 1.5x from the year-end 2018 value of 2.5x with an opportunity for further reductions based on the contingent payments. The Company is prioritizing the repayment of the outstanding revolving credit facility and then the repayment of near and medium-term fixed term debt maturities.

•Increased Shareholder Returns, Dividend Increased – The improved balance sheet and interest savings will enable the Company, as approved by the Board of Directors and conditional on closing of the Sale Transaction, to double its dividend to $0.04 per share. This improves returns to shareholders while allowing the Company flexibility of further future capital returns.

The Sale Transaction is subject to customary regulatory and third party approvals and other customary closing conditions and is expected to close in the third quarter of 2019.

Expansion opportunities at Jacobina, Brazil

•At Jacobina, the Company has developed a two-phase plan to increase production beyond 150,000 ounces per year, as follows:

◦The first phase considers production increases to between 165,000 to 170,000 gold-equivalent ounces per year through a mill optimization to 6,500 tonnes per calendar day (“tpd”) from the current operating rate of 5,800 tpd. This compares to prior year production of roughly 145,000 ounces representing approximately 20,000-25,000 additional ounces of production. This phase requires very modest capital and is expected to be implemented by mid-2020.

◦The second phase considers a larger increase in the plant capacity to between 8,000 and 8,500 tpd, which would significantly increase production, estimated to exceed 225,000 ounces per year, with current preliminary estimates of total capital expenditures of $100 million over the expected implementation period up to 2022.

Expansion opportunities at Canadian Malartic, Canada

•At Canadian Malartic, studies show the potential for production increases of approximately 75,000 gold-equivalent ounces per year (50% interest) with project costs and economics currently under evaluation.

Opportunities at Odyssey, East Malartic, Sladen and Sheehan zones have the potential to provide new sources of ore for the Canadian Malartic mill. The extraction is expected to be by way of underground mining methods with ore fed to the existing Malartic mill, displacing a portion of the lower grade open pit ores. The permit allowing for the development of an underground ramp at the Odyssey project was received in December 2018.

i Based on the stockpile additions per National Instruments 43-101 Technical Report dated March 2018, and assuming 2018 actual $1.70/t cost per tonne moved with average 2019 to 2023 strip ratios and actual sustaining unit costs and waste stripping ratios.

5

HEALTH, SAFETY, ENVIRONMENT AND CORPORATE RESPONSIBILITY

•The Company's Total Recordable Injury Frequency Rate was 0.6i for the first quarter of 2019.

•The Company was selected as the "Mining Company of the Year" in the precious metals category, by Brasil Mineral Magazine. This is the 35th annual edition of the award, where final voting is done by readers, a contingent of 15 thousand technicians and entrepreneurs from across Brazil. Criteria for the award is based on growth, technological innovation and approach to human resources, community and environmental management.

•All the Company's operations completed the first month of 2019 with zero Lost Time Injuries. This is an improvement from previous years, as the first quarter has historically seen higher average rates of Health and Safety injuries compared with the remainder of the year.

•In conjunction with the local communities and authorities, Jacobina led an emergency response exercise in February. The simulation helps test the preparedness of the mine, the community and supporting authorities for serious incidents that could affect the community, such as tailings emergencies.

i Calculated on 200,000 hours worked and includes employees and contractors.

FINANCIAL

For the three months ended March 31, 2019

•Revenue was impacted by differences in realized gold and copper prices, partly offset by higher silver sales compared to March 31, 2018. Revenue for the three months ended March 31, 2018 includes Brio Gold and Gualcamayo, assets which were sold in 2018. At Cerro Moro, silver grades were higher-than-expected, and with higher volume of silver, furnace capacity was constrained. This resulted in an increase in gold and silver in precipitate over the first quarter, which as it was not in doré form, impacted sales volumes. This inventory buildup is expected to normalize in the second quarter with sales of precipitate, which take longer than the sale of doré.

•Net loss attributable to the Company's equity holders for the three months ended March 31, 2019 was $4.1 million or $0.00 per share basic and diluted, compared to a net loss of $160.1 million or $0.17 per share basic and diluted for the three months ended March 31, 2018. This includes certain non-cash and other items that may not be reflective of current and ongoing operations reducing the Company's earnings by $28.1 million or $0.03 per share. Such items include non-cash unrealized foreign exchange losses, mark-to-market losses and other provisions, write-downs and adjustments. (Refer to Section 3: Review of Financial Results of this MD&A for additional details).

6

| For the three months ended March 31, | ||||||||

(In millions of US Dollars; unless otherwise noted) | 2019 | 2018 | ||||||

Revenue | $ | 407.1 | $ | 454.7 | ||||

Cost of sales excluding depletion, depreciation and amortization | (205.8) | (264.2) | ||||||

Gross margin excluding depletion, depreciation and amortization | $ | 201.3 | $ | 190.5 | ||||

Depletion, depreciation and amortization | (117.7) | (104.1) | ||||||

Impairment of mining properties | — | (103.0) | ||||||

Mine operating earnings (loss) | $ | 83.6 | $ | (16.6) | ||||

General and administrative | (21.5) | (26.2) | ||||||

Exploration and evaluation | (2.5) | (3.8) | ||||||

Share of loss of associate | (2.0) | — | ||||||

Other operating (expenses) income, net | (5.3) | 25.3 | ||||||

Impairment of non-operating mining properties | — | (78.0) | ||||||

Operating earnings (loss) | $ | 52.3 | $ | (99.3) | ||||

Finance costs | (32.1) | (47.4) | ||||||

Other (costs) income, net | (16.4) | 7.8 | ||||||

Net earnings (loss) before income taxes | $ | 3.8 | $ | (138.9) | ||||

Income tax expense, net | $ | (7.9) | $ | (28.7) | ||||

Net loss | $ | (4.1) | $ | (167.6) | ||||

Attributable to: | ||||||||

Yamana Gold Inc. equity holders | $ | (4.1) | $ | (160.1) | ||||

Non-controlling interests | $ | — | $ | (7.5) | ||||

| $ | (4.1) | $ | (167.6) | |||||

Per share data | ||||||||

Loss per share - basic and diluted i | $ | — | $ | (0.17) | ||||

Dividends declared per share | $ | 0.005 | $ | 0.005 | ||||

Dividends paid per share | $ | 0.005 | $ | 0.005 | ||||

Weighted average number of common shares outstanding (thousands) | ||||||||

Basic and diluted | 949,918 | 948,711 | ||||||

Cash flows ii | ||||||||

Cash flows from operating activities iii | $ | 12.4 | $ | 122.4 | ||||

Cash flows from operating activities before net change in working capital iv | $ | 103.2 | $ | 206.4 | ||||

Cash flows (used in) from investing activities | $ | (92.0) | $ | 14.7 | ||||

Cash flows from (used in) financing activities | $ | 91.1 | $ | (142.5) | ||||

i.Attributable to Yamana Gold Inc. equity holders.

ii.For further information on the Company's liquidity and cash flow position, refer to Section 6: Financial Condition and Liquidity of this MD&A.

iii.Cash flows from operating activities for the three months ended March 31, 2019, include the impact of $36.0 million in non-cash deferred revenue recognized in respect of metal sales agreements and other, including $25.1 million associated with the copper advanced sales program.

iv.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

7

•Net free cash flow was as follows:

(In millions of US Dollars) | For the three months ended March 31, | |||||||

Net free cash flow i, ii | 2019 | 2018 | ||||||

Cash flows from operating activities before income taxes paid and net change in working capital | $ | 136.5 | $ | 290.4 | ||||

Income taxes paid | (33.3) | (16.1) | ||||||

Payments made to Brazilian tax authorities | — | (67.9) | ||||||

Cash flows from operating activities before net change in working capital ii | $ | 103.2 | $ | 206.4 | ||||

Net change in working capital | (90.8) | (84.0) | ||||||

Cash flows from operating activities | $ | 12.4 | $ | 122.4 | ||||

Adjustments to operating cash flows: | ||||||||

Unearned revenue recognized on copper prepay, streaming arrangement and other net of advance payments received iii | 36.0 | (127.8) | ||||||

Payments made to Brazilian tax authorities | — | 67.9 | ||||||

Non-discretionary items related to the current period | ||||||||

Sustaining capital expenditures | (37.9) | (39.8) | ||||||

Interest and other finance expenses paid | (17.8) | (14.2) | ||||||

Net free cash flow | $ | (7.3) | $ | 8.5 | ||||

s

i.For further information on the Company's liquidity and cash flow position, refer to Section 6: Financial Condition and Liquidity of this MD&A.

ii.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A. Net Free Cash Flow is adjusted for payments not reflective of current period operations, advance payments received pursuant to metal purchase agreements, non-discretionary expenditures from sustaining capital expenditures and interest and financing expenses paid related to the current period.

iii.Adjustment represents non-cash deferred revenue recognized in respect of metal sales agreements, the cash payments for which were received in previous periods and were similarly reduced for comparability. Of the total deferred revenue recognized, $25.1 million is attributable to the advanced copper sales and $10.9 million to pre-existing copper and silver streaming arrangements.

Balance Sheet and Liquidity

•As at March 31, 2019, the Company had cash and cash equivalents of $110.4 million and available credit of $585.0 million, for total liquidity of $695.4 million.

As at, (In millions of US Dollars) | March 31, 2019 | December 31, 2018 | ||||||

Total assets | $ | 8,061.4 | $ | 8,012.9 | ||||

Total long-term liabilities | $ | 3,546.7 | $ | 3,492.5 | ||||

Total equity | $ | 4,015.4 | $ | 4,024.0 | ||||

Working capital i | $ | (36.9) | $ | (67.2) | ||||

Cash and cash equivalents | $ | 110.4 | $ | 98.5 | ||||

Debt (current and long-term) | $ | 1,878.9 | $ | 1,758.7 | ||||

Net debt ii | $ | 1,768.5 | $ | 1,660.2 | ||||

i.Working capital is defined as the excess of current assets over current liabilities. Accordingly, working capital is being impacted by the deferred revenue balance from the advanced copper sales agreement of $26.3 million, which is classified as a current liability; however, this balance will decline in future reporting periods with remaining copper deliveries scheduled June 2019. Working capital was also impacted by the current portion of long-term debt of $85.6 million. The Company also has $216.4 million in stockpile inventory classified as other non-current assets as it is not expected to be processed within one year, but is readily available for processing. Of this amount, $121.8 million is long-term inventory at Chapada, which subsequent to the quarter end is part of a sales transaction, and consequently, that value will be monetized through the sale.

ii.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

8

Capital Expenditures

| For the three months ended March 31, | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | ||||||||||||||||||

Sustaining and other | Expansionary | Exploration | Total ii | |||||||||||||||||||||||

Canadian Malartic | 7.4 | 14.0 | 7.7 | 5.2 | 0.3 | 2.1 | $ | 15.4 | $ | 21.3 | ||||||||||||||||

Chapada | $ | 13.3 | $ | 4.5 | $ | 4.8 | $ | 0.4 | $ | 0.5 | $ | 0.7 | $ | 18.6 | $ | 5.6 | ||||||||||

Jacobina | 3.4 | 3.0 | 10.4 | 2.7 | 1.0 | 1.0 | $ | 14.8 | $ | 6.7 | ||||||||||||||||

Cerro Moro | 2.2 | — | 0.5 | 47.3 | 1.7 | 1.5 | $ | 4.4 | $ | 48.8 | ||||||||||||||||

El Peñón | 6.8 | 7.7 | — | — | 3.9 | 3.2 | $ | 10.7 | $ | 10.9 | ||||||||||||||||

Minera Florida | 3.0 | 3.1 | 2.6 | 2.7 | 2.9 | 3.9 | $ | 8.5 | $ | 9.7 | ||||||||||||||||

Other i | 1.8 | 7.5 | 0.9 | 16.9 | 1.8 | 4.4 | $ | 4.5 | $ | 28.8 | ||||||||||||||||

| $ | 37.9 | $ | 39.8 | $ | 26.9 | $ | 75.2 | $ | 12.1 | $ | 16.8 | $ | 76.9 | $ | 131.8 | |||||||||||

0

i.Included in Other for the comparative period are capital expenditures relating to Gualcamayo and Brio Gold, as well as capitalized interest of $4.1 million. These items have no impact in the current period.

ii.Net of movement in accounts payable and advances to suppliers, as applicable. Totals do not include the costs to add to the low-grade long-term ore stockpiles at Chapada of $8.9 million and Canadian Malartic of $10.1 million for the three months ended March 31, 2019.

2. CORE BUSINESS, STRATEGY AND OUTLOOK

Yamana Gold Inc. (the “Company” or “Yamana”) is a Canadian-based precious metals producer with significant gold and silver production, development stage properties, exploration properties, and land positions throughout the Americas, including Canada, Brazil, Chile and Argentina. Yamana plans to continue to build on this base through expansion and optimization initiatives at existing operating mines, development of new mines, the advancement of its exploration properties and, at times, by targeting other consolidation opportunities with a primary focus in the Americas. The Company is listed on the Toronto Stock Exchange (trading symbol "YRI") and the New York Stock Exchange (trading symbol "AUY").

The Company’s principal mining properties comprise the Cerro Moro mine in Argentina, the Canadian Malartic mine (50% interest) in Canada, the El Peñón and Minera Florida mines in Chile and the Jacobina mine in Brazil. The Company’s portfolio also includes the Chapada mine in Brazil which, subsequent to the quarter end, became an asset held for sale, a 20.5% interest in Leagold Mining Corporation ("Leagold") with mining properties in Brazil and Mexico, as well as a 100% interest in Agua Rica, a large-scale copper, gold, silver and molybdenum deposit located in the province of Catamarca, Argentina. Pursuant to a signed integration agreement, the Company has agreed to an ownership interest of 56.25% of the combined Agua Rica and Alumbrera as an integrated project, pursuant to which Agua Rica would be would be developed and operated using existing infrastructure and facilities of Minera Alumbrera.

Over the years, the Company has grown through strategic acquisitions to upgrade its portfolio and by pursuing organic growth to increase cash flows and unlock value at existing mines and non-producing assets. Looking ahead, the Company’s primary objectives include the following:

•Continued focus on the Company’s operational excellence program, advancing near-term and ongoing optimizations related to production, operating costs, and the Company’s key performance objectives in health, safety, environment and community;

•Continuing balance sheet and financial performance improvements. The aforementioned agreement for the sale of the Chapada mine provides a significant reduction in leverage. Net Debt leverage ratio is forecast to decline to 1.5x on closing of the transaction, in line with the Company’s previous target. Going forward, the Company’s updated target is 1.0x or better with a strategic objective to maintain the lower net debt leverage ratio through the metal price cycle as a means to enhance financial flexibility. Additionally, the Company focuses on tenure of debt preferring long-term debt that is consistent with life of mines;

•Maximizing per share metrics related to the Net Asset Values ("NAV"), profitability and free cash flow of Yamana Mines, and cash returns on invested capital, first on producing and then non-producing assets:

◦Within the producing portfolio, attention remains on per share metrics related to the growth and quality of mineral reserves and mineral resources. Primary objectives include mine life extensions, scope for throughput increases, metal grade and recovery improvements, and cost reductions that are expected to improve margins and cash flow returns;

◦For non-producing assets, the focus is on improving NAV through exploration, drilling and technical/financial reviews, the advancements of exploration and mining permits, and community engagement. Over time, the Company will also consider strategic alternatives to enhance returns from the non-producing assets. This may include advancing the projects to producing assets, developing the assets through a joint venture or other strategic arrangements, or through monetization;

•Optimizing and increasing mine life at the Company’s existing operating mines through exploration targeted on the most prospective properties, including:

◦Canadian Malartic, Cerro Moro, Jacobina, and Minera Florida as a result of exploration success and prospective geological settings;

9

◦Minera Florida, El Peñón and Jacobina with the objectives of increasing mine life while also improving grade and delivering potential for production increases through further delineation and infill drilling;

•Advancing several value realization and monetization initiatives over the guidance period through the ongoing strategic and technical reviews of its asset portfolio; and

•"One Team, One Goal: Zero" vision for sustainability, which reflects the Company's commitment to zero harm to employees, the environment and communities near mine operations.

The Company continued to make progress towards these objectives in the first quarter of 2019.

The Company is committed to increasing value by improving cash flows and returns on invested capital and increasing net asset value. In that context, the Company’s development opportunities will be managed towards such increases and improvements within the framework of the Company's balance sheet objectives. In addition to the usual project gating items, project scheduling and expenditures will be largely sequential so as not to interfere with the Company’s balance sheet objectives.

Recent and current initiatives, which have or will further advance these strategic objectives, include:

•The aforementioned integration agreement pursuant to which the Agua Rica project would be developed representing a significant step towards the technical advancement and value realization of Agua Rica.

•The recently announced agreement to sell the wholly-owned Chapada mine to LMC for total expected consideration of over $1.0 billion.

Pro Forma Production Profile

With the announced sale of Chapada, a refocus of the operations occurs, with less revenue derived from Brazil, and with proportionally more revenue from other countries, including Canada. The production platform comprises five high-quality mines in the Americas, including two in Chile, and one in each of Canada, Brazil, and Argentina. Approximately 85% of the Company’s revenue would be derived from gold and another 15% from silver.

With a closing of the Sale Transaction in the third quarter of 2019, attributable production for 2019 is expected to approximate 1 million GEO. The indicative pro forma production outlook through 2021 is presented in the following table. Consolidated unit costs for 2019 excluding Chapada are expected to be within the guidance range, as previously disclosed. An official update to Company guidance will be provided on closing of the transaction.

Indicative Production Forecast | 2019 | 2020 | 2021 | ||||||||

Total GEO i, ii | |||||||||||

1,000,000 | 1,020,000 | 1,035,000 | |||||||||

i.GEO includes gold plus silver with silver converted to a gold equivalent forecast ratio of 82.5:1 for 2019, 2020 and 2021.

ii.Excluding any attribution from Yamana’s interest in Leagold Mining Corporation and excluding Chapada.

Additionally, based on a third quarter 2019 closing of the Sale Transaction in respect to Chapada, the Company would see its 2019 guidance for overall expenditures decline as follows: sustaining capital expenditures by $15 million, costs of adding to long-term stockpiles by $25 million, expansionary capital expenditures by $2 million, and DDA by $25 million. The Company is, however, planning an increase in exploration expenditures going forward with the annualized increase expected to be up to $20 million through the guidance period. This is consistent with plans to use the improved financial flexibility to maximize value enhancing initiatives.

3. REVIEW OF FINANCIAL RESULTS

FOR THE THREE MONTHS ENDED MARCH 31, 2019

Net loss

•Net loss attributable to the Company's equity holders for the three months ended March 31, 2019, was $4.1 million or $0.00 per share basic and diluted, compared to a net loss of $160.1 million or $0.17 per share basic and diluted for the three months ended March 31, 2018. This includes certain non-cash and other items that may not be reflective of current and ongoing operations reducing the Company's earnings by $28.1 million or $0.03 per share including:

◦A $20.2 million non-cash tax on unrealized foreign exchange losses, relating to the weakening of the Brazilian Real and Argentinean Peso against the US Dollar;

◦$10.0 million relating to non-cash unrealized foreign exchange losses; and

◦Mark-to-market losses on derivative contracts of $7.0 million recorded during the period.

10

•The Company refers to the following items, which may be used to adjust or reconcile input models in consensus estimates:

| For the three months ended March 31, | ||||||||

| (In millions of US Dollars; unless otherwise noted) | 2019 | 2018 | ||||||

Non-cash unrealized foreign exchange losses | $ | 10.0 | $ | 3.3 | ||||

Share-based payments/mark-to-market of deferred share units | 3.6 | 0.8 | ||||||

Mark-to-market losses (gains) on derivative contracts | 7.0 | (10.1) | ||||||

Net mark-to-market (gains) losses on investments and other assets | (0.5) | 1.0 | ||||||

Revision in estimates and liabilities including contingencies | (1.2) | 5.2 | ||||||

Gain on sale of subsidiaries | — | (39.0) | ||||||

Impairment of mining and non-operational mineral properties | — | 181.0 | ||||||

Financing costs paid on early note redemption | — | 14.7 | ||||||

Reorganization costs | 0.1 | 2.4 | ||||||

Other provisions, write-downs and adjustments i | 3.2 | 7.8 | ||||||

Non-cash tax on unrealized foreign exchange losses | 20.2 | 4.8 | ||||||

Income tax effect of adjustments and other one-time tax adjustments | (14.3) | 5.3 | ||||||

Total adjustments - increase to earnings attributable to Yamana Gold Inc. equity holders | $ | 28.1 | $ | 177.2 | ||||

Total adjustments - increase to earnings per share attributable to Yamana Gold Inc. equity holders | $ | 0.03 | $ | 0.19 | ||||

i.The balance includes, among other things, the reversal of certain provisions such as tax credits and legal contingencies.

Revenue

•Revenue for the three-month period ended March 31, 2019 was $407.1 million, compared to $454.7 million in 2018, due to 2% lower realized gold prices and 7% lower realized copper prices, which were partly offset by higher silver sales. Revenue for the three months ended March 31, 2018, includes Brio Gold and Gualcamayo, which were sold in 2018. At Cerro Moro, higher-than-expected silver grades continued to create capacity constraints at the mine furnace, resulting in an increase in gold and silver precipitate inventory, which impacted sales volumes.

| For the three months ended March 31, | 2019 | 2018 | |||||||||||||||

Quantity sold | Revenue per ounce/pound | Revenue (In millions of US Dollars) | Revenue (In millions of US Dollars) | ||||||||||||||

Gold i | 223,510 | oz | $ | 1,292 | $ | 288.8 | $ | 358.1 | |||||||||

Silver | 2,297,916 | oz | $ | 15.52 | 35.7 | 17.5 | |||||||||||

Copper i | 26,899,571 | lbs | $ | 3.07 | 82.6 | 79.1 | |||||||||||

Revenue | $ | 407.1 | $ | 454.7 | |||||||||||||

11

| For the three months ended March 31, | 2019 | 2018 | |||||||||||||||

Quantity sold | Average Realized Price | Revenue (In millions of US Dollars) | Revenue (in millions of US Dollars) | ||||||||||||||

Gold i | 223,510 | oz | $ | 1,301 | $ | 290.7 | $ | 359.8 | |||||||||

Silver | 2,268,716 | oz | $ | 15.54 | 35.3 | 16.4 | |||||||||||

Silver subject to metal sales agreement ii | 29,200 | oz | $ | 13.25 | 0.4 | 1.6 | |||||||||||

| 2,297,916 | oz | $ | 15.52 | ||||||||||||||

Copper i | 16,287,930 | lbs | $ | 2.87 | 46.7 | 90.4 | |||||||||||

Copper subject to metal sales agreements ii | 10,611,641 | lbs | $ | 2.97 | 31.5 | 4.4 | |||||||||||

| 26,899,571 | lbs | $ | 2.91 | ||||||||||||||

Gross revenue | $ | 404.6 | $ | 472.6 | |||||||||||||

(Deduct) add: | |||||||||||||||||

- Treatment and refining charges of gold and copper concentrate | (5.7) | (9.3) | |||||||||||||||

- Metal price, MTM, and derivative settlement adjustments | 7.9 | (8.1) | |||||||||||||||

- Other adjustments | 0.2 | (0.5) | |||||||||||||||

Revenue | $ | 407.1 | $ | 454.7 | |||||||||||||

2

1111111

i.Includes payable gold and copper contained in concentrate.

ii.Balances represent the metals sold under the metal sales agreements and the advanced copper sales program.

Cost of Sales

•Cost of sales excluding DDA for the three months ended March 31, 2019 was $205.8 million, comparable to $264.2 million for the same period in 2018, after removing cost of sales excluding DDA relating to Brio Gold and Gualcamayo from the 2018 amount. Cost of sales excluding DDA was impacted by local inflation and export taxes, partly offset by the removal of costs associated with leases on the adoption of the new leasing standard (Refer to Note 3: Recent Accounting Pronouncements to the Company's Condensed Consolidated Interim Financial Statements for additional details) ongoing operational efficiencies improving per unit costs and the depreciation of certain local currencies against the US Dollar.

•Total DDA expense for the three months ended March 31, 2019 was $117.7 million, compared to $104.1 million for the same period in 2018. DDA expense is higher mainly due to new contributions from Cerro Moro and the depreciation of the right-of-use assets on the adoption of the new leasing standard, partially offset by lower DDA related to the sale of certain assets in 2018.

Expenses and Other Income

•General and administrative expenses were $21.5 million for the three months ended March 31, 2019, compared to $26.2 million for the same period in 2018. The Company is implementing a plan for further reductions in general and administrative expenses beginning in the current year.

•Exploration and evaluation expenses were $2.5 million for the three months ended March 31, 2019, compared to $3.8 million for the same period in 2018, in line with lower planned greenfield exploration during the period.

•Share of loss of associate totalled $2.0 million for the three months ended March 31, 2019, representing the equity pick up from the Company's interest in Leagold, which was acquired in May 2018.

•The Company recorded other expenses of $5.3 million for the three months ended March 31, 2019, compared to other income of $25.3 million for the same period in 2018. The income balance in 2018 was primarily driven by the $39.0 million gain on sale of the Canadian Exploration Properties in March 2018.

•Finance costs were $32.1 million for the three months ended March 31, 2019, compared to $47.4 million for the same period in 2018. Financing costs on the early redemption of debt in 2018 totalled $14.7 million for which there is no current period comparative.

•Other costs were $16.4 million in the three months ended March 31, 2019, compared to other income of $7.8 million in the comparative period. Other costs/income were/was comprised primarily of unrealized gains and losses on derivatives and foreign exchange and, given the nature of these items, is expected to fluctuate from period to period.

Income Tax Expense (Recovery)

•The Company recorded an income tax expense of $7.9 million for the three months ended March 31, 2019, compared to an income tax expense of $28.7 million in 2018. The income tax provision reflects a current income tax expense of $19.2 million and a deferred income tax recovery of $11.3 million compared to a current income tax expense of $26.5 million and a deferred income tax expense of $2.2 million for the three months ended March 31, 2018.

12

•A foreign exchange expense of $20.2 million is included in the income tax expense for the three months ended March 31, 2019, compared to an income tax expense of $4.8 million in 2018, relating to the weakening of the Brazilian Real and Argentinean Peso against the US Dollar.

QUARTERLY FINANCIAL SUMMARY

| For the three months ended | Mar. 31 | Dec. 31 | Sep. 30, | Jun. 30 | Mar. 31, | Dec. 31, | Sep. 30, | Jun. 30, | ||||||||||||||||||

| (In millions of US Dollars, unless otherwise noted) | 2019 | 2018 | 2018 | 2018 | 2018 | 2017 | 2017 | 2017 | ||||||||||||||||||

| Financial results | ||||||||||||||||||||||||||

Revenue | $ | 407.1 | $ | 483.4 | $ | 424.7 | $ | 435.7 | $ | 454.7 | $ | 478.8 | $ | 493.4 | $ | 428.1 | ||||||||||

| Attributable to Yamana equity holders: | ||||||||||||||||||||||||||

Net (loss) earnings | $ | (4.1) | $ | (61.4) | $ | (81.3) | $ | 18.0 | $ | (160.1) | $ | (194.4) | $ | 45.7 | $ | (39.9) | ||||||||||

| Per share - basic and diluted | $ | 0.00 | $ | (0.06) | $ | (0.09) | $ | 0.02 | $ | (0.17) | $ | (0.20) | $ | 0.05 | $ | (0.04) | ||||||||||

4. OPERATING SEGMENTS PERFORMANCE

CANADIAN MALARTIC (50% interest), CANADA

Canadian Malartic is an open pit gold mine, located in the Abitibi region of Quebec, Canada. The Company and its partner, Agnico Eagle Mines Limited (Agnico"), each own 50% of Canadian Malartic General Partnership (the "Partnership").

| For the three months ended March 31, | ||||||||

| Operating and Financial Information | 2019 | 2018 | ||||||

| Operating | ||||||||

Ore mined (tonnes) | 3,619,120 | 3,301,457 | ||||||

Waste mined (tonnes) | 3,465,931 | 5,514,300 | ||||||

Ore processed (tonnes) | 2,517,478 | 2,509,908 | ||||||

| GEO | ||||||||

Production (ounces) | 83,670 | 83,403 | ||||||

Sales (ounces) | 79,224 | 81,117 | ||||||

Feed grade (g/t) i | 1.18 | 1.17 | ||||||

Recovery rate (%) i | 88.0 | 88.1 | ||||||

| Total cost of sales per ounce sold | $ | 1,036 | $ | 970 | ||||

Cash Costs per GEO sold ii, iii | $ | 602 | $ | 590 | ||||

AISC per GEO sold i, iii | $ | 716 | $ | 803 | ||||

| DDA per GEO sold | $ | 434 | $ | 381 | ||||

Financial (millions of US Dollars) | ||||||||

| Revenue | $ | 103.2 | $ | 109.4 | ||||

| Cost of sales excluding DDA | (47.7) | (47.8) | ||||||

| Gross margin excluding DDA | $ | 55.5 | $ | 61.6 | ||||

| DDA | (34.4) | (30.9) | ||||||

| Mine operating earnings | $ | 21.1 | $ | 30.7 | ||||

Capital expenditures iv | ||||||||

| Sustaining and other | $ | 7.4 | $ | 14.0 | ||||

| Expansionary | $ | 7.7 | $ | 5.2 | ||||

| Exploration | $ | 0.3 | $ | 2.1 | ||||

iii.Grades and recovery rates relate to gold production.

iv.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

v.Net of the CAD currency hedge impact for the period.

vi.Totals exclude costs to add to the long-term ore stockpiles of $10.1 million in the first quarter of 2019 and $5.6 million in the first quarter of 2018.

Canadian Malartic's production of 83,670 ounces met expectations in the first quarter of 2019. Grades were in line with the mining sequence, while recoveries were comparable to the same period in 2018. Canadian Malartic is well positioned to reach its 2019 production forecast of 330,000 ounces at costs similar to those reported in 2018. Cash Costs during the quarter were impacted by timing of by-product silver sales, resulting in a $12 per GEO impact to Cash Costs, the benefit of which will be realized in the second quarter. AISC were lower than those in 2018 mainly due to timing of expenditures. Total sustaining costs for 2019 are expected to be in line with 2018.

13

The Extension Project is advancing as expected with contributions from Barnat anticipated to begin in late 2019 with more meaningful contributions in 2020 and 2021. On a 50% basis, a total of $4 million has been spent during the quarter from the total Extension Project's expansionary capital expenditures of $34 million. Work continues to focus on the highway 117 road deviation, which is expected to be completed by the end of 2019, and includes overburden stripping and rock excavation.

During the quarter, positive developments on the ongoing discussions with four First Nations groups concerning a potential memorandum of understanding continued.

Exploration programs are ongoing to evaluate several deposits to the east of the Canadian Malartic open pit, including the Odyssey, East Malartic, Sladen and Sheehan zones. These opportunities have the potential to provide new sources of ore for the Canadian Malartic mill. The extraction is expected to be by way of underground mining methods with ore fed to the existing Malartic mill, displacing a portion of the lower grade open pit ores. The permit allowing for the development of an underground ramp at the Odyssey project was received in December 2018. Further evaluation through additional drilling from underground access points, resource delineation, and engineering would be required to advance Odyssey and East Malartic towards development decisions. Additionally, studies show the potential for production increases of approximately 75,000 gold-equivalent ounces per year (50% interest) with project costs and economics currently under evaluation. As aforementioned, these such opportunities, including those for other mines, are expected at total costs lower than the previous expansion plans for Chapada. Consistent with the Company’s strategy, these opportunities are to be funded organically by cash flows from operations with the expected capital requirements to be covered by Net Free Cash Flow.

Rand Malartic Acquisition: Increased Canadian Malartic Land Package

On March 26, 2019, the Partnership acquired the Rand Malartic property adjacent to the east side of the Canadian Malartic property. The Rand Malartic property covers 262 hectares and extends 1.7 kilometres eastward along the Cadillac-Larder Lake break within the Piché Group, immediately east of the Odyssey project.

The Rand Malartic property has the same favourable geological features as the Odyssey project, with several porphyry intrusions in the southernmost portion of Piché Group volcanic rocks. The #39 and #67 zones are porphyry-hosted with similar mineralogy and alteration to Odyssey; the former appears to be geologically continuous with the Odyssey South Zone. In addition, the geological environment is similar to the historical Malartic Gold Fields mine located 3 kilometres to the east on the adjoining Midway property.

A budget of $1.9 million (100% basis) has been allocated for the 2019 exploration program at Rand Malartic including an initial 10,000 metres of drilling to test the eastern extension of the Odyssey project and its possible continuity onto the Rand Malartic property. The near-surface potential will also be investigated. Exploration drilling in the first quarter has focused on defining several internal zones in the Odyssey deposit and expanding Odyssey towards the property boundary with Rand Malartic.

14

CHAPADA, BRAZIL

Chapada is an open pit gold-copper mine located northwest of Brasília in Goías state, Brazil.

| For the three months ended March 31, | ||||||||

| 2019 | 2018 | |||||||

| Operating | ||||||||

Ore mined (tonnes) | 8,916,654 | 6,528,117 | ||||||

Waste mined (tonnes) | 5,424,385 | 6,810,917 | ||||||

Ore processed (tonnes) | 5,749,594 | 5,688,738 | ||||||

| GEO | ||||||||

Production i | 21,520 | 22,753 | ||||||

Sales ii | 22,552 | 23,643 | ||||||

Feed grade (g/t) iii | 0.20 | 0.22 | ||||||

Concentrate grade (g/t) iii | 12.42 | 12.37 | ||||||

Recovery rate (%) iii | 56.9 | 57.3 | ||||||

Total cost of sales per GEO sold ii | $ | 467 | $ | 508 | ||||

Cash Costs per GEO sold iv | $ | 413 | $ | 466 | ||||

AISC per GEO sold iv | $ | 574 | $ | 528 | ||||

| DDA per GEO sold | $ | 90 | $ | 99 | ||||

| Copper | ||||||||

Production (millions of pounds) | 28.1 | 30.4 | ||||||

Sales (millions of pounds) ii | 26.9 | 30.3 | ||||||

Feed grade (%) | 0.28 | 0.31 | ||||||

Concentrate grade (%) | 23.7 | 24.1 | ||||||

Recovery rate (%) | 79.7 | 77.4 | ||||||

Total cost of sales per pound sold ii | $ | 1.77 | $ | 1.77 | ||||

Cash Costs per pound sold iv | $ | 1.65 | $ | 1.72 | ||||

AISC per pound sold i | $ | 2.19 | $ | 1.92 | ||||

| DDA per pound sold | $ | 0.30 | $ | 0.31 | ||||

| Concentrate | ||||||||

Production (tonnes) | 53,882 | 57,191 | ||||||

Sales (tonnes) | 38,755 | 59,519 | ||||||

Treatment and refining charges (millions of US Dollars) | $ | (5.7) | $ | (9.3) | ||||

| Metal price adjustments related to concentrate revenue (millions of US Dollars) | $ | 7.9 | $ | (8.1) | ||||

Financial (millions of US Dollars) | ||||||||

| Revenue | $ | 109.5 | $ | 108.2 | ||||

| Cost of sales excluding DDA | (48.0) | (53.9) | ||||||

| Gross margin excluding DDA | $ | 61.5 | $ | 54.3 | ||||

| DDA | (10.2) | (11.7) | ||||||

| Mine operating earnings | $ | 51.3 | $ | 42.6 | ||||

| Capital expenditures | ||||||||

| Sustaining and other | $ | 13.3 | $ | 4.5 | ||||

| Expansionary | $ | 4.8 | $ | 0.4 | ||||

| Exploration | $ | 0.5 | $ | 0.7 | ||||

1

i.Contained in concentrate/Payable contained in concentrate.

ii.Quantities sold include quantity adjustment on provisional and final invoice settlements.

iii.Grades and recovery rates relate to gold production.

iv.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

v.Totals exclude costs to add to the long-term ore stockpiles of $8.9 million in the first quarter of 2019 and $9.4 million in the first quarter of 2018.

Chapada GEO production in the first quarter of 2019 was in line with expectations. Several initiatives had been implemented to mitigate the effects of the rainy season and contributed to 37% higher ore mined compared to the same quarter in 2018, although this was offset by lower grades which were mainly the result of blending from the stockpile. Mining grades continued as expected. During the first quarter, the mine focused on waste movement in preparation for a push-back scheduled in the second quarter of 2019. First quarter production positions the mine to meet expectations for the remainder of the year with production weighted to the back half of the year. Cost control initiatives implemented and the depreciation of the Brazilian Real against the US Dollar contributed to the lower costs compared to the first quarter of 2018. AISC reflects the spending on optimization plans during the quarter with lower prior year comparative expenditures.

15

While Chapada maintains a long life based on mineral inventory, it is expected that sustaining and expansionary expenditures would significantly reduce free cash flows during the period that coincides with reduced production, particularly for gold, resulting in less operating cash flow than in previous periods.

Approximately 2,200 metres of drilling were completed at Chapada in the first quarter of 2019. The exploration plan focused on expanding the mineral envelopes at the Suruca hanging wall and footwall, Baru NE and Corpo Sul. At Suruca, shallow drilling continues to expand the oxide mineral resource.

As disclosed in Section 1: Highlights and Relevant Updates of this MD&A, subsequent to the quarter end, the Company announced it has agreed to sell Chapada to LMC for total expected consideration of over $1.0 billion. The transaction is subject to customary regulatory and third party approvals and other customary closing conditions and is expected to close in the third quarter of 2019.

JACOBINA, BRAZIL

Jacobina is a complex of underground gold mines located in Bahia state, Brazil.

| For the three months ended March 31, | ||||||||

| Operating and Financial Information | 2019 | 2018 | ||||||

| Operating | ||||||||

Ore mined (tonnes) | 541,471 | 527,897 | ||||||

Ore processed (tonnes) | 534,084 | 502,589 | ||||||

| GEO | ||||||||

| Production | 38,617 | 34,525 | ||||||

| Sales | 38,489 | 33,500 | ||||||

Feed grade (g/t) i | 2.30 | 2.21 | ||||||

Recovery rate (%) i | 97.6 | 96.7 | ||||||

| Total cost of sales per GEO sold | $ | 1,077 | $ | 996 | ||||

Cash Costs per GEO sold ii | $ | 637 | $ | 736 | ||||

AISC per GEO sold ii | $ | 831 | $ | 885 | ||||

| DDA per GEO sold | $ | 440 | $ | 261 | ||||

Financial (millions of US Dollars) | ||||||||

| Revenue | $ | 50.1 | $ | 44.4 | ||||

| Cost of sales excluding DDA | (24.5) | (24.7) | ||||||

| Gross margin excluding DDA | $ | 25.6 | $ | 19.7 | ||||

| DDA | (16.9) | (8.7) | ||||||

| Mine operating earnings | $ | 8.7 | $ | 11.0 | ||||

| Capital expenditures | ||||||||

| Sustaining and other | $ | 3.4 | $ | 3.0 | ||||

| Expansionary | $ | 10.4 | $ | 2.7 | ||||

| Exploration | $ | 1.0 | $ | 1.0 | ||||

1

i.Grades and recovery rates relate to gold production.

ii.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

Jacobina delivered exceptional production, which exceeded expectations and set a new record in the first quarter of 2019, with 12% higher production compared to the same quarter in 2018. Production was also 4% higher than the previous quarter. Higher grades and higher processing rates contributed to the higher production and gross margin excluding DDA. Jacobina is well positioned to meet previously guided 2019 production of 145,000 GEO.

Costs benefited from the higher GEO sales, optimization initiatives and the depreciation of the Brazilian Real, which contributed to higher mine operating earnings compared to the first quarter of 2018. Higher DDA per GEO sold resulted from the higher cost base following the reversal of impairment recorded in 2018. The Company continues to pursue opportunities to increase productivity and reduce costs through improvements relating to mining, plant processing, maintenance and supply chain. A modest investment in 2019 and 2020 is expected to increase processing capacity further.

With a long mineral reserve life at Jacobina and further opportunities for value maximization, the decision was made in 2018 to internalize underground development activities, which was previously under contract. This transition, and the associated expansionary capital expenditures were completed in the first quarter of 2019, in line with prior guidance.

16

Additionally, a two-phase plan is being evaluated to increase production beyond 150,000 ounces per year, with the increase supported by higher grades, as delineated by the 2017 and 2018 drill program, and through the application of higher milling rates. The two-phase plan is as follows:

•The first phase considers production increases to between 165,000 to 170,000 gold-equivalent ounces per year through a mill optimization to 6,500 tonnes per calendar day (“tpd”) from the current operating rate of 5,800 tpd. This compares to prior year production of roughly 145,000 ounces representing approximately 20,000-25,000 additional ounces of production. This phase requires very modest capital and is expected to be implemented by 2020.

•The second phase considers a larger increase in the plant capacity to between 8,000 and 8,500 tpd, which would significantly increase production, estimated to exceed 225,000 ounces per year, with current preliminary estimates of total capital expenditures of $100 million over the expected implementation period up to 2022.

Approximately 2,600 metres of drilling were completed at Jacobina in the first quarter, in line with plan. The focus was primarily to define new inferred mineral resources at grades higher than the life of mine model ("LOM") in the Morro do Vento and Canavieiras sectors. To date, drill results are promising with several holes at significantly higher than LOM grades.

CERRO MORO, ARGENTINA

Cerro Moro is the Company’s newest high-grade underground and open pit gold-silver mine, located in the province of Santa Cruz, Argentina.

| For the three months ended March 31, | ||||||||

Operating and Financial Information | 2019 | 2018 ii | ||||||

Operating | ||||||||

Ore mined (tonnes) | 79,562 | — | ||||||

Waste mined (tonnes) | 1,856,985 | — | ||||||

Ore processed (tonnes) | 91,885 | — | ||||||

| GEO | ||||||||

| Production | 62,616 | — | ||||||

| Sales | 43,360 | — | ||||||

Total cost of sales per ounce sold | $ | 1,215 | $ | — | ||||

Cash Costs per ounce sold i | $ | 701 | $ | — | ||||

AISC per ounce sold i | $ | 841 | $ | — | ||||

| DDA per ounce sold | $ | 514 | $ | — | ||||

Gold | ||||||||

Production (ounces) | 38,471 | — | ||||||

Sales (ounces) | 28,472 | — | ||||||

Feed grade (g/t) | 13.87 | — | ||||||

Recovery rate (%) | 94.1 | — | ||||||

| Silver | ||||||||

Production (ounces) | 2,021,489 | — | ||||||

Sales (ounces) | 1,250,899 | — | ||||||

Feed grade (g/t) | 728 | — | ||||||

Recovery rate (%) | 94.9 | — | ||||||

Financial (millions of US Dollars) | ||||||||

| Revenue | $ | 56.7 | $ | — | ||||

| Cost of sales excluding DDA | (30.4) | — | ||||||

| Gross margin excluding DDA | $ | 26.3 | $ | — | ||||

| DDA | (22.3) | — | ||||||

| Mine operating earnings | $ | 4.0 | $ | — | ||||

| Capital expenditures | ||||||||

| Sustaining and other | $ | 2.2 | $ | — | ||||

| Expansionary | $ | 0.5 | $ | 47.3 | ||||

| Exploration | $ | 1.7 | $ | 1.5 | ||||

11

i.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

ii.Cerro Moro which reached commercial production on June 26, 2018.

17

Cerro Moro is well positioned to meet production expectations for the year. During the first quarter, feed grade was lower than the previous quarter impacted by blending from the stockpile while mined ore grade was consistent with plan. Above-plan silver grades continued to create capacity constraints at the mine's furnace resulting in an increase in gold and silver precipitate. Costs during the period benefited from the depreciation of the local currency, offset by lower sales. Cerro Moro continues to focus on optimizing the underground mining design and processing practices for which development is expected to begin in the second quarter.

Subsequent to the quarter end, the Company arranged for the sale of approximately 27,000 GEO in Cerro Moro precipitate inventory, which will be reflected in gross revenue and operating cash flow in the second quarter of approximately $34.5 million. The Company has procured an additional furnace to mitigate historical capacity constraints and is assessing whether its installation or the established flexibility of selling gold and silver in precipitate is a better solution for managing the stability of inventory. Since the startup of Cerro Moro through the first quarter of 2019, higher silver grades, which were also above mineral reserve grade and with a positive reconciliation factor, created a capacity constraint on the furnaces at the mine. The normalization of silver grade and sales of precipitate during the second quarter are expected to return furnace capability to design levels.

An aggressive drill program is planned for 2019 to delineate near-mine targets and test major near-mine and regional structures. An increase in mineral reserves would unlock opportunities to expand the existing processing plant and to transition to grid power resulting in production increases and a reduction to operating costs. In terms of exploration drilling, approximately 8,200 metres were completed at Cerro Moro during the first quarter of 2019. Exploration has focused on scout drilling of surface targets defined through geochemistry, mapping and geophysics, testing targets in the Michelle, Bella Vista and Naty areas. Minor infill drilling has been completed to date with drilling in progress at Veronica, Martina and Silvia. A strong 2019 budget will allow for aggressive exploration as well as conversion drilling of inferred mineral resources in 2019.

18

EL PEÑÓN, CHILE

El Peñón is a high grade gold-silver underground mine located approximately 160 kilometres southeast of Antofagasta in northern Chile.

| For the three months ended March 31, | ||||||||

| Operating and Financial Information | 2019 | 2018 | ||||||

| Operating | ||||||||

Ore mined (tonnes) | 222,248 | 213,403 | ||||||

Ore processed (tonnes) | 316,441 | 257,844 | ||||||

| GEO | ||||||||

| Production | 45,910 | 52,082 | ||||||

| Sales | 47,299 | 54,002 | ||||||

| Total cost of sales per GEO sold | $ | 1,328 | $ | 1,245 | ||||

Cash Costs per GEO sold i | $ | 816 | $ | 860 | ||||

AISC per GEO sold i | $ | 1081 | $ | 1077 | ||||

| DDA per GEO sold | $ | 512 | $ | 384 | ||||

| Gold | ||||||||

Production (ounces) | 34,025 | 40,391 | ||||||

Sales (ounces) | 34,811 | 41,349 | ||||||

Feed grade (g/t) | 3.56 | 5.07 | ||||||

Recovery rate (%) | 93.2 | 94.8 | ||||||

| Silver | ||||||||

Production (ounces) | 994,809 | 899,261 | ||||||

Sales (ounces) | 1,047,017 | 973,257 | ||||||

Feed grade (g/t) | 115 | 124 | ||||||

Recovery rate (%) | 84.3 | 85.5 | ||||||

Financial (millions of US Dollars) | ||||||||

| Revenue | $ | 61.6 | $ | 71.2 | ||||

| Cost of sales excluding DDA | (38.6) | (46.5) | ||||||

| Gross margin excluding DDA | $ | 23.0 | $ | 24.7 | ||||

| DDA | (24.2) | (20.8) | ||||||

Mine operating (loss) earnings | $ | (1.2) | $ | 3.9 | ||||

| Capital expenditures | ||||||||

| Sustaining and other | $ | 6.8 | $ | 7.7 | ||||

| Expansionary | $ | — | $ | — | ||||

| Exploration | $ | 3.9 | $ | 3.2 | ||||

i.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

GEO production at El Peñón exceeded expectations in the first quarter of 2019. Mine sequencing called for the processing of lower grade stockpiled ore and higher processing rates. Mining grade of 4.3 g/t was in line with expectations. Despite lower sales compared to the same quarter in 2018, Cash Costs during the quarter decreased due to cost containment initiatives and the depreciation of the Chilean Peso relative to the US Dollar, while AISC were higher, in line with expectations. Lower grades also impacted DDA per GEO.

In line with prior guidance for El Peñón, underground mine development activities in the first half of 2019 are expected to increase access to higher gold and silver grades in the second half of 2019, which will afford the operation greater flexibility, including for blending activities.

Approximately 20,850 metres of drilling were completed at El Peñón in the first quarter of 2019, in line with plan. Exploration work focused primarily on converting inferred mineral resources to measured and indicated mineral resources at Dorada Este, Martillo Centro Sur, Aleste SS, Nueva Providencia, Esmeralda, Ventura, Pampa Campamento, Esperanza, Bermuda, Bonanza, Borde Oeste, Fortuna Este, Martillo Flat and Laguna. Surface exploration and drilling is testing new veins in the satellite Laguna deposit as well as testing for new inferred mineral resources in the core mine area, notably in the Aleste and Martillo flat areas.

19

MINERA FLORIDA, CHILE

Minera Florida is an underground gold mine located south of Santiago in central Chile.

| For the three months ended March 31, | ||||||||

| Operating and Financial Information | 2019 | 2018 | ||||||

| Operating | ||||||||

Ore mined (tonnes) | 180,741 | 181,097 | ||||||

Ore processed (tonnes) | 190,066 | 203,043 | ||||||

| GEO | ||||||||

| Production | 19,654 | 18,483 | ||||||

| Sales | 19,962 | 18,893 | ||||||

Feed grade (g/t) | 3.39 | 3.12 | ||||||

Recovery rate (%) | 92.4 | 90.9 | ||||||

| Total cost of sales per GEO sold | $ | 1,206 | $ | 1,507 | ||||

Cash Costs per GEO sold i | $ | 832 | $ | 976 | ||||

AISC per GEO sold i | $ | 1208 | $ | 1,403 | ||||

| DDA per GEO sold | $ | 374 | $ | 531 | ||||

Financial (millions of US Dollars) | ||||||||

| Revenue | $ | 26.0 | $ | 25.1 | ||||

| Cost of sales excluding DDA | (16.6) | (18.4) | ||||||

| Gross margin excluding DDA | $ | 9.4 | $ | 6.7 | ||||

| DDA | (7.5) | (10.0) | ||||||

| Mine operating earnings (loss) | $ | 1.9 | $ | (3.3) | ||||

| Capital expenditures | ||||||||

| Sustaining and other | $ | 3.0 | $ | 3.1 | ||||

| Expansionary | $ | 2.6 | $ | 2.7 | ||||

| Exploration | $ | 2.9 | $ | 3.9 | ||||

1

i.A cautionary note regarding non-GAAP performance measures is included in Section 10: Non-GAAP Performance Measures of this MD&A.

Production at Minera Florida for the first quarter was 6% higher than the same quarter in 2018, resulting from higher grade from the PVS and Pataguas zones, partly offset by lower throughput. Mill optimization initiatives led to an improved average recovery rate, also contributing to higher production. Cost metrics improved by over 10% from the first quarter in 2018 due to higher sales, the implementation of cost control initiatives and the depreciation of the Chilean Peso. Lower DDA per GEO sold resulted from the lower cost base following the impairment recorded in 2018.

In line with the updated life of mine plan at Minera Florida, which emphasizes higher tonnage, ramp up of production is expected to begin in the second quarter, positioning the mine to meet its targets for 2019.

At the processing plant, a modest investment demonstrated initial improvements to the recovery rate. Further studies are suggesting that with additional improvements, an increase in the expected range of up to approximately 2% is possible.

Approximately 12,500 metres of drilling were completed at Minera Florida in the first quarter, in line with plan. The focus of drilling was to convert inferred mineral resources to measured and indicated mineral resources at nine veins within the core mine including Los Patos, Juan Pablo and Fantasma. Results to date suggest continuing additions to reserves as well, new inferred mineral resources for future resource conversion in the Don Leopoldo and Fantasma veins. Both drilling, and surface exploration will focus on the current mine area to add mineral reserves and define new drill targets as well as through surface sampling and scout exploration drilling.

20

5. CONSTRUCTION, DEVELOPMENT AND EXPLORATION

CONSTRUCTION AND DEVELOPMENT

The following highlights key updates during the first quarter of 2019 in respect to certain of the Company's development projects.

Canadian Malartic (50% interest), Canada

The Canadian Malartic Extension Project is continuing according to plan with contributions from Barnat expected to begin in 2019 with more meaningful contributions in 2020. On a 50% basis, expansionary capital expenditures are expected to be $37 million, of which $34 million is earmarked for the extension project in 2019. Work continues to focus on the highway 117 road deviation, which is expected to be completed by the end of 2019, and includes overburden stripping and rock excavation.

OTHER OPTIMIZATION AND MONETIZATION INITIATIVES

A number of project evaluations are underway with a goal of surfacing value from non-strategic or non-producing assets including Agua Rica and Suyai, all of which have well-defined delineated mineral reserves and/or mineral resources. Notable progress relating to some of these initiatives include, but are not limited to the following:

Agua Rica, Argentina

The Company continues to advance its alternatives for the development of the Agua Rica project. On March 7, 2019, the Company announced the signing of an integration agreement with Glencore International AG and Newmont Goldcorp Inc. (collectively the “Parties”). Pursuant to the integration agreement, the Agua Rica project would be developed and operated using the existing infrastructure and facilities of Minera Alumbrera Limited (“Alumbrera”) in the Catamarca Province of Argentina.

The Parties believe the integration of the Agua Rica project and the Alumbrera mine (the “Integrated Project”) has significant merit given the proximity of the assets and the potential to realize significant synergies by taking full advantage of existing infrastructure associated with the Alumbrera mine for the development and operation of Agua Rica. Agua Rica hosts a large scale, long life copper mineral resource with associated gold, silver, and molybdenum while the Alumbrera infrastructure is of significant scale and configuration that is ideally suited for the integration plan.

The agreement represents a significant step towards the optimization and development of Agua Rica. The Alumbrera infrastructure, including the existing infrastructure for concentrate logistics located in northern Argentina between the mine site and the port, presents a unique opportunity to enhance project economics while also reducing the project complexity and environmental footprint.

A Technical Committee has been established by the Parties to direct the review and evaluation of the Integrated Project. It is expected that a pre-feasibility study for the Integrated Project will be completed in mid-2019 and that a full feasibility study with updated mineral reserve, production and project cost estimates will be completed by mid-2020. This will provide the framework for the submission of a new Environmental Impact Assessment (“EIA”) to the authorities of the Catamarca Province and for the continued engagement with local stakeholders and communities. The Company is evaluating beginning the EIA process in 2019, given the level of significant detail in the pre-feasibility study.