EXHIBIT 99.1

YAMANA GOLD INC.

ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

March 27, 2018

200 Bay Street, Suite 2200

Royal Bank Plaza, North Tower

Toronto, Ontario M5J 2J3

1

EXHIBIT 99.1

Table of Contents | ||

INTRODUCTORY NOTES | 3 | |

Cautionary Note Regarding Forward-Looking Statements | 3 | |

Cautionary Note to United States Investors Concerning Estimates of Mineral Reserves and Mineral Resources | 4 | |

Currency Presentation and Exchange Rate Information | 5 | |

CORPORATE STRUCTURE | 5 | |

GENERAL DEVELOPMENT OF THE BUSINESS | 7 | |

Overview of Business | 7 | |

History | 7 | |

DESCRIPTION OF THE BUSINESS | 11 | |

Principal Products | 11 | |

Competitive Conditions | 12 | |

Operations | 12 | |

Environment and Communities | 12 | |

Risks of the Business | 18 | |

Technical Information | 34 | |

Mineral Projects | 37 | |

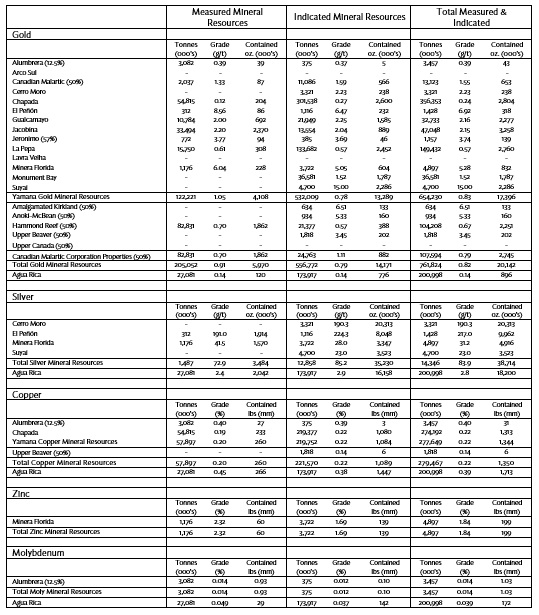

Summary of Mineral Reserve and Mineral Resource Estimates | 37 | |

Chapada Mine | 42 | |

El Peñón Mine | 52 | |

Canadian Malartic Mine | 59 | |

Jacobina Mining Complex | 68 | |

Minera Florida Mine | 69 | |

Gualcamayo Mine | 70 | |

Cerro Moro Project | 72 | |

Agua Rica Project | 74 | |

Suyai Project | 75 | |

Monument Bay | 75 | |

DIVIDENDS | 75 | |

DESCRIPTION OF CAPITAL STRUCTURE | 76 | |

MARKET FOR SECURITIES | 76 | |

DIRECTORS AND OFFICERS | 77 | |

PROMOTER | 85 | |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 85 | |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 86 | |

TRANSFER AGENTS AND REGISTRAR | 86 | |

MATERIAL CONTRACTS | 86 | |

AUDIT COMMITTEE | 86 | |

INTERESTS OF EXPERTS | 88 | |

ADDITIONAL INFORMATION | 89 | |

SCHEDULE ”A” – CHARTER OF THE AUDIT COMMITTEE | 89 | |

2

EXHIBIT 99.1

ITEM 1

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Statements

This annual information form contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” under applicable Canadian securities legislation. Except for statements of historical fact relating to the Company (as defined herein), information contained herein constitutes forward-looking statements, including, but not limited to, any information as to the Company’s strategy, plans or future financial or operating performance. Forward-looking statements are characterized by words such as “plan”, “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. In particular, forward looking information included in this annual information form includes, without limitation, statements with respect to:

• | the Company’s expectations in connection with the production and exploration, development and expansion plans at the Company’s projects discussed herein being met; |

• | the Company’s plans to continue building on its base of significant gold production, gold development stage properties, exploration properties and land positions in Canada, Brazil, Chile, and Argentina through existing operating mine expansions, throughput increases, development of new mines, advancement of its exploration properties and by targeting other gold consolidation opportunities with a primary focus in the Americas; |

• | the Company’s expectations regarding the timing of construction completion, and production at the Cerro Moro Project; |

• | the impact of proposed optimizations at the Company’s projects; |

• | the effect of government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people, mine safety and receipt of necessary permits; |

• | the impact of the new mining law in Brazil and the Argentina tax reform package; |

• | Yamana’s expectations relating to the performance of the Canadian Malartic Mine; |

• | Yamana’s evaluation of various monetization opportunities for its Brio Gold holding from time to time; |

• | the Company’s investments and development of infrastructure improvements to enhance community relations in the locations where it operates and the further development of the Company’s social responsibility programs; |

• | the payment of any future dividends; |

• | the outcome of any current or pending litigation against the Company; and |

• | the outcome of any current or pending tax assessments involving the Company. |

Forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the impact of general domestic and foreign business, economic and political conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, fluctuating metal prices (such as gold, copper, silver and zinc), currency exchange rates (such as the Brazilian real, the Chilean peso, the Argentine peso, and the Canadian dollar versus the United States dollar), interest rates, possible variations in ore grade or recovery rates, changes in the Company’s hedging program, changes in accounting policies, changes in Mineral Resources (as defined herein) and Mineral Reserves (as defined herein), and risks related to acquisitions and/or dispositions, changes in project parameters as plans continue to be refined, changes in project development, construction, production and commissioning time frames, risks related to joint venture operations, the possibility of project cost overruns or unanticipated costs and expenses, potential impairment charges, higher prices for fuel, steel, power, labour and other consumables contributing to higher costs and general risks of the mining industry, including but not limited to, failure of plant, equipment or processes to operate as anticipated, unexpected changes in mine life, final pricing for concentrate sales, unanticipated results of future studies, seasonality and unanticipated weather

3

EXHIBIT 99.1

changes, costs and timing of the development of new deposits, success of exploration activities, permitting timelines, environmental and government regulation and the risk of government expropriation or nationalization of mining operations, risks related to relying on local advisors and consultants in foreign jurisdictions, environmental risks, unanticipated reclamation expenses, title disputes or claims, limitations on insurance coverage and timing and possible outcome of pending and outstanding litigation and labour disputes, risks related to enforcing legal rights in foreign jurisdictions, vulnerability of information systems, as well as those risk factors discussed or referred to herein and in the Company’s annual management’s discussion and analysis filed with the securities regulatory authorities in all provinces of Canada and available under the Company’s SEDAR profile at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results as at and for the periods ended on the dates presented in the Company’s plans and objectives and may not be appropriate for other purposes.

Cautionary Note to United States Investors Concerning Estimates of Mineral Reserves and Mineral Resources

This annual information form has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements of United States securities laws. The terms “Mineral Reserve”, “Proven Mineral Reserve” and “Probable Mineral Reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). These definitions differ significantly from the definitions in the disclosure requirements promulgated by the Securities and Exchange Commission (the “Commission”) and contained in Industry Guide 7 (“Industry Guide 7”) under the United States Securities Act of 1933, as amended (the “Securities Act”). In particular, under Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report Mineral Reserves, the three-year historical average price is used in any Mineral Reserve or cash flow analysis to designate Mineral Reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority. In addition, Industry Guide 7 applies different standards in order to classify mineralization as a mineral reserve. As a result, the definitions of Proven Mineral Reserves (as defined herein) and Probable Mineral Reserves (as defined herein) used in NI 43-101 differ from the definitions used in Industry Guide 7. Under Commission standards, mineralization may not be classified as a mineral reserve unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the mineral reserve determination is made. Among other things, all necessary permits would be required to be in hand or the issuance must be imminent in order to classify mineralized material as mineral reserves under the Commission’s standards. Accordingly, Mineral Reserve estimates contained in this annual information form may not qualify as mineral reserves under Commission standards.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101. However, the Commission does not recognize Mineral Resources and United States companies are generally not permitted to disclose Mineral Resources of any category in documents they file with the Commission. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into Mineral Reserves as defined in NI 43-101 or Industry Guide 7. Further, Inferred Mineral Resources (as defined herein) have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or pre-feasibility studies. Investors are cautioned not to assume that all or any part of an Inferred Mineral Resource exists or is economically or legally mineable, or that all or any part of Measured Mineral Resources (as defined herein), Indicated Mineral Resources (as defined herein), or Inferred Mineral Resources will ever be upgraded to a higher category. In addition, disclosure of “contained ounces” in a Mineral Resource is permitted disclosure under Canadian regulations. In contrast, the Commission only permits United States companies to report mineralization that does not constitute Mineral Reserves by Commission standards as in place tonnage and grade, without reference to unit measures. Investors are cautioned that information contained in this annual information form may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations of the Commission thereunder.

4

EXHIBIT 99.1

Currency Presentation and Exchange Rate Information

This annual information form contains references to both United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and Canadian dollars are referred to as “Canadian dollars” or “Cdn$”.

The closing, high, low and average exchange rates for the United States dollar in terms of Canadian dollars for the years ended December 31, 2017, December 31, 2016, December 31, 2015 and December 31, 2014 based on the closing rate reported by the Bank of Canada, were as follows:

Year-Ended December 31 | ||||||||

2,017 | 2,016 | 2,015 | 2,014 | |||||

Closing | Cdn$1.2545 | Cdn$1.34 | Cdn$1.38 | Cdn$1.16 | ||||

High | 1.3743 | 1.46 | 1.40 | 1.16 | ||||

Low | 1.2128 | 1.25 | 1.17 | 1.06 | ||||

Average(1) | 1.2986 | 1.32 | 1.28 | 1.10 | ||||

(1)Calculated as an average of the daily close rates for each period.

On March 27, 2018, the Bank of Canada rate of exchange was $1.00 = Cdn$0.7771 or Cdn$1.00 = $1.2869.

ITEM 2

CORPORATE STRUCTURE

Yamana Gold Inc. (the “Company” or “Yamana”) was continued under the Canada Business Corporations Act by Articles of Continuance dated February 7, 1995. On February 7, 2001, pursuant to Articles of Amendment, the Company created and authorized the issuance of a maximum of 8,000,000 first preference shares, Series 1. On July 30, 2003, pursuant to Articles of Amendment, the name of the Company was changed from Yamana Resources Inc. to Yamana Gold Inc. On August 12, 2003, the authorized capital of the Company was altered by consolidating all of the then issued and outstanding common shares of the Company on the basis of one new common share for 27.86 existing common shares.

The Company’s head office is located at 200 Bay Street, Royal Bank Plaza, North Tower, Suite 2200, Toronto, Ontario M5J 2J3 and its registered office is located at 2100 Scotia Plaza, 40 King Street West, Toronto, Ontario M5H 3C2.

The corporate chart that follows on the next page illustrates the Company’s principal subsidiaries (collectively, the “Subsidiaries”) as of March 28, 2018, together with the jurisdiction of incorporation of each company and the percentage of voting securities beneficially owned, controlled or directed, directly or indirectly, by the Company. As used in this annual information form, except as otherwise required by the context, reference to the “Company” or “Yamana” means Yamana Gold Inc. and the Subsidiaries.

5

EXHIBIT 99.1

6

EXHIBIT 99.1

ITEM 3

GENERAL DEVELOPMENT OF THE BUSINESS

Overview of Business

Yamana is a Canadian-based gold producer with significant gold production, gold development stage properties, exploration properties and land positions in Canada, Brazil, Chile, and Argentina. Yamana plans to continue to build on this base through existing operating mine expansions and optimization initiatives, development of new mines, the advancement of its exploration properties and, at times, by targeting other gold consolidation opportunities with a primary focus in the Americas.

The Company’s portfolio includes six operating gold mines, one development stage project currently under construction and various advanced and near development stage projects and exploration properties in Canada, Brazil, Chile, and Argentina. Yamana operates its mines and projects under common corporate oversight. Within this structure, Chapada, El Peñón and Canadian Malartic are the Company’s material producing mines and the largest contributors to cash flow. In addition, the Company holds a majority interest in Brio Gold Inc. (“Brio Gold”), a public company which holds the Pilar mine (gold), the Fazenda Brasileiro mine (gold), the Riachos dos Machados mine (gold) (“RDM”), the C1 Santa Luz project (gold), and some related exploration concessions.

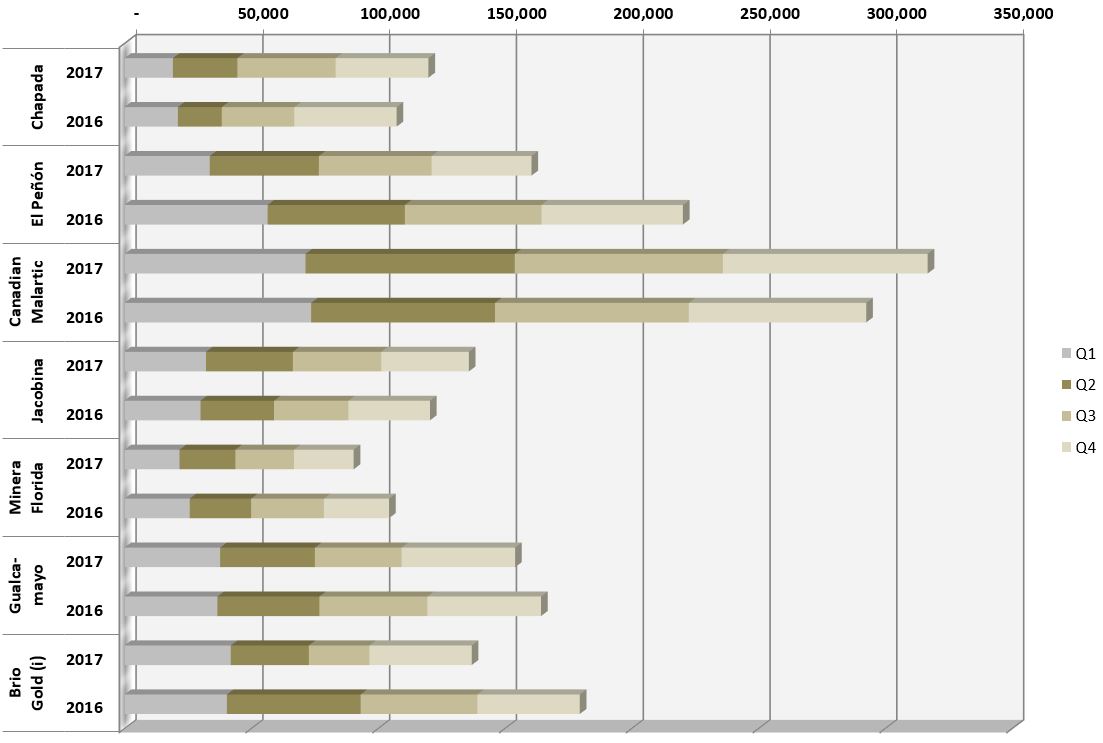

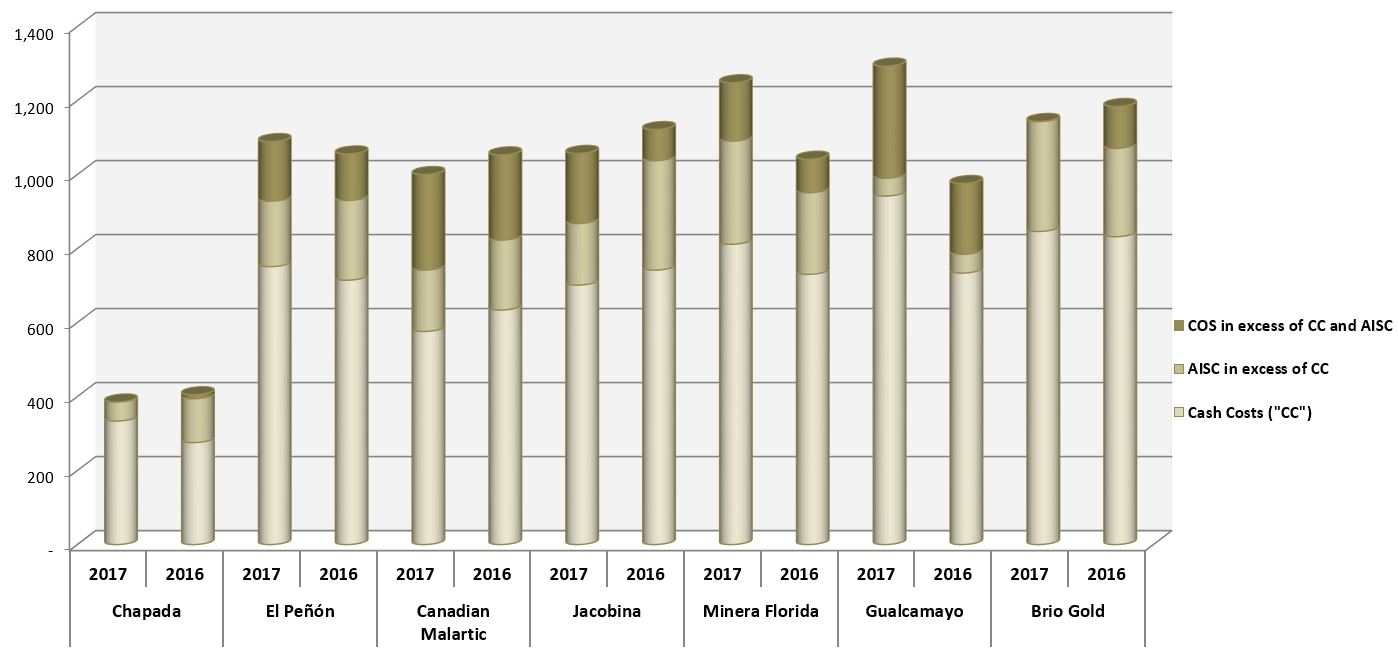

Set out below is a list of Yamana’s main properties and mines:

Material Producing Mines

• Chapada Mine (Brazil)

• El Peñón Mine (Chile)

• Canadian Malartic Mine (Canada) – 50% indirect interest

Other Producing Mines

• Jacobina Mining Complex (Brazil)

• Minera Florida Mine (Chile)

• Gualcamayo Mine (Argentina)

Development Projects

• Cerro Moro Project (Argentina)

Additional Projects

• Agua Rica Project (Argentina)

• Suyai Project (Argentina)

• Monument Bay Project (Canada)

History

Over the three most recently completed financial years, the following events contributed materially to the development of the Company’s business:

Copper Sales Agreement

On January 12, 2018, Yamana entered into a copper advanced sales program pursuant to which the Company received $125.0 million in exchange for approximately 40.3 million pounds of copper to be delivered in the second half of 2018 and first half of 2019. This production represents approximately one third of planned production in the period of the program or approximately 16% of the total production for 2018 and 2019. Copper is expected to be delivered against these prepaid volumes coincident with planned shipments of concentrate from the Chapada Mine.

Sale of Exploration Properties

On December 21, 2017, the Company announced that it entered into an agreement to sell certain jointly owned exploration properties of the Canadian Malartic Corporation ("CMC") including the Kirkland Lake and Hammond Reef properties. The transaction is structured as a sale of assets by CMC (in which Yamana holds a 50% indirect interest) pursuant to which Agnico Eagle Mines Limited ("Agnico Eagle") will acquire all of Yamana's indirect 50% interest in the Canadian exploration assets of

7

EXHIBIT 99.1

CMC in consideration of cash proceeds to Yamana of $162.5 million. The transaction will not affect the Canadian Malartic Mine and related assets including Odyssey, East Malartic, Midway, and East Amphi. The transaction closed on March 28, 2018.

Notes Offering

On November 29, 2017, the Company priced an offering of $300 million aggregate principal amount of 4.625% Senior Notes due December 15, 2027 (the “Initial Notes”) in a transaction that was exempt from registration under the Securities Act. In connection with the issuance of the Initial Notes, the Company entered into a registration rights agreement, dated as of December 4, 2017, with the initial purchasers of the Initial Notes, providing for the issuance of new notes in exchange for up to a like aggregate principal amount of Initial Notes. The Initial Notes are unsecured, senior obligations of Yamana and are unconditionally guaranteed by certain of Yamana’s subsidiaries that are also guarantors under Yamana's credit facility. The offering closed on November 27, 2017.

Brio Gold

On February 16, 2018, Brio Gold announced that it had entered into a definitive agreement with Leagold Mining Corporation (“Leagold”) whereby Leagold will acquire all of the issued and outstanding common shares of Brio Gold (“Brio Shares”). As a result of a series of transactions that the Company completed in 2016 and 2017, the Company currently owns 62,535,922 common shares of Brio Gold (the “Brio Shares”), representing in the aggregate approximately 53.6% of the issued and outstanding Brio Shares on a basic basis and approximately 52.8% on a fully diluted basis. The Company entered into a support agreement with Leagold, pursuant to which it agreed, among other things, to vote its Brio Shares in favour of this transaction. Based on the share exchange ratio to be provided under the offer, the Company is expected to receive 58,115,953 shares of Leagold, representing approximately 22% ownership in the combined entity. It is anticipated that the special meeting of Brio Gold shareholders to consider the transaction will be held on April 12, 2018. Currently, as a result of Yamana owning more than 50% of the issued and outstanding Brio Shares, Yamana accounts for Brio Gold on a consolidated basis. Assuming the successful completion of the acquisition by Leagold, Yamana expects it will account for Leagold on an equity accounting basis.

Initially a wholly-owned subsidiary of Yamana, Brio Gold became a stand-alone public company on December 23, 2016, whereby, through a series of transactions, Yamana sold a total of 17,324,507 Brio Shares at a price of Cdn$3.25 per share for aggregate proceeds of Cdn$56,304,648 to Yamana. Further, on March 6, 2017, the Company announced the sale to an arm’s length institutional shareholder of 6,000,000 Brio Shares at a price of Cdn$3.35 per share, for total proceeds to Yamana of Cdn$20,100,000. On June 2, 2017, the Company completed a secondary offering of 26,667,000 Brio Shares at a price of Cdn$3.00 per share for total gross proceeds to Yamana of Cdn$80,001,000.

Board and Management Update

On February 15, 2018, the Company announced that Henry Marsden was formally promoted to Senior Vice President, Exploration upon the retirement of William Wulftange. Previously serving as Yamana’s Chief Geologist, Mr. Marsden was hired by Mr. Wulftange and has been with the Company since 2016. Mr. Marsden has over 30 years of exploration experience, including over 20 years as a consulting geologist working with a variety of clients and focusing on field exploration work. He also played a key role in the discovery and advancement of several deposits including Rio Blanco and Pico Machay in Peru, and the Timmins West gold deposit in Timmins, Ontario where he was responsible for the first mineral resource which ultimately lead to mine construction. Mr. Marsden will be responsible for the development, implementation and management of Yamana’s overall exploration strategy and activities, with a focus on expanding Mineral Reserves and Mineral Resources, as well as for forging partnerships with companies focused on early stage exploration opportunities.

On September 29, 2017, the Company announced that Darcy Marud, Executive Vice President, Enterprise Strategy, would be leaving the Company. This development arose in the context of a continuation of efforts to consolidate the Company’s executive management in the Toronto office, with Barry Murphy, Senior Vice President, Technical Services, now reporting directly to Daniel Racine, Chief Operating Officer.

On August 28, 2017, the Company announced the appointment of Robert Gallagher to its board of directors. Mr. Gallagher has more than 35 years of experience in the mining industry and is a Professional Engineer with a specialty in mineral processing. Most recently, he held the position of President and Chief Executive Officer at New Gold Inc. During Mr. Gallagher's tenure, New Gold expanded its portfolio through organic growth and the addition of both producing assets and development projects. Prior to New Gold, Mr. Gallagher held increasingly senior management roles at Newmont Mining Corporation over a seven-year period, including Vice President Operations, Asia Pacific; Vice President, Indonesian Operations; and General Manager, Batu Hijau. Earlier in his career, Mr. Gallagher worked at a number of operating mines located throughout the Americas and Asia in various plant engineer, metallurgical, and mine management roles, including most notably 15 years at Placer Dome Inc.

8

EXHIBIT 99.1

On July 27, 2017, the Company announced the appointment of Andrea Bertone to its board of directors. Ms. Bertone has nearly 20 years of senior management experience in the energy industry in the Americas and most recently held the position of President of Duke Energy International LLC ("Duke Energy"), where she reported directly to the Chief Executive Officer of the largest utility in the United States. In this role, and based in the United States, she was responsible for operations across South and Central America. Prior to her role as President of Duke Energy, Ms. Bertone spent nearly 10 years in increasingly senior management roles with Duke Energy and its subsidiary companies. Also on July 27, 2017, the Company announced that Mr. Carl Renzoni and Mr. Patrick Mars would be retiring from the board of directors before the next annual meeting of shareholders. They subsequently retired in December 2017.

On May 15, 2017, Steve Parsons joined the Company in the role of Senior Vice President, Investor Relations and Corporate Communications. Mr. Parsons will be responsible for managing relationships with investors and other capital markets participants, and Yamana's internal and external communications strategies, including social media and media relations. Mr. Parsons comes to Yamana most recently from National Bank Financial Inc. where he was a senior gold mining analyst and had coverage of Yamana in addition to a number of its peers. Mr. Parsons spent 13 years in the investment industry with the majority of that time as a senior mining analyst covering gold and base metal companies for National Bank Financial and Wellington West Capital Markets. Prior to that, Mr. Parsons worked in the mining industry for eight years, principally as a mineral processing engineer for Placer Dome Inc. and a leading consulting firm based in Toronto. He is a mining engineer with a specialty in metallurgy.

On February 15, 2017, the Company announced the formal appointment of Mr. Jason LeBlanc as Chief Financial Officer (“CFO”) upon the retirement of Mr. Charles Main, Executive Vice President, Finance and CFO. Mr. LeBlanc joined the Company in January 2006 and has over 15 years of research-based and financial experience in the mining industry. During his time at Yamana, Mr. LeBlanc has held increasingly senior positions including most recently the position of Senior Vice President, Finance as of February 2016 as part of his transition to CFO. Mr. LeBlanc has a Master of Finance from the University of Toronto, a Bachelor of Commerce from the University of Windsor and holds a Chartered Financial Analyst designation.

Also on February 15, 2017, the Company announced the appointment of Ms. Kimberly Keating to the Company’s board of directors. Ms. Keating has nearly 20 years of experience in the Canadian energy industry with extensive engineering and project management expertise. Ms. Keating is currently Vice President, Fabrication with the Cahill Group, where among other things she has overseen the construction of the largest offshore accommodation facility built in Canada. In Ms. Keating’s career, she has made significant engineering and project management contributions to key projects in the North Atlantic offshore oil and gas industry.

On July 27, 2016, Mr. Yohann Bouchard was promoted into the role of Senior Vice President, Operations. Mr. Bouchard joined Yamana in October 2014. Mr. Bouchard has progressive technical and operating experience with a solid background of more than 20 years of mining in underground and open pit operations. Also on July 27, 2016, Gerardo Fernandez was promoted into the role of Senior Vice President, Operations. Mr. Fernandez has been with the Company since 2000, having worked in several positions in mine operations, mine planning and project development.

On May 4, 2016, the Company announced the promotion of Daniel Racine from the position of Senior Vice President, Northern Operations to the position of Executive Vice President and Chief Operating Officer. In this role, Mr. Racine will assume full oversight responsibility for the Company's operations. Mr. Racine is a registered engineer with L'Ordre des Ingenieurs du Quebec, a professional engineer with Professional Engineers Ontario and a member of the Ontario Society of Professional Engineers. Mr. Racine joined Yamana Gold in May 2014.

On February 18, 2016, Mr. Greg McKnight was promoted into the role of Executive Vice President, Business Development. He previously held the role of Senior Vice President, Business Development of the Company.

On April 28, 2015, the Company announced the appointment of Ross Gallinger as Senior Vice President, Health, Safety and Sustainable Development. Mr. Gallinger is responsible for the oversight, strategic development, delivery and management of the Company’s health, safety, environment and community policies, programs, and activities to ensure the effectiveness of such programs with the objective to improve the Company’s overall performance.

Cerro Moro Construction Decision

The Company announced, in early 2015, the formal decision to proceed with the construction of the Cerro Moro Project and provided updated project parameters with respect to timing and capital investment. During the course of 2015, detailed engineering for the 1,000 tonnes per day processing plant and mine was advanced to approximately 50% completion, in line with the published project execution schedule. Included in the 2015 work program was the upgrading and extension of the site access

9

EXHIBIT 99.1

road, conclusion of the locked-cycle metallurgical test work program, the placement of orders on various long-lead time items such as the tailings thickeners, and the continuation of the first stage of the construction camp. The 2016 work program included the ramp-up of site construction activities; the continuation of detailed engineering; and the advancement of underground mining in order to gain a better understanding of in-situ mining conditions. In 2017, underground development progressed according to plan, with completion of the mechanical displine at the processing facility achieved in 2017. Open pit operations commenced with mobilization beginning in December, 2017. For the first quarter of 2018, the focus will move from construction to commissioning and operational readiness, with remaining construction works on piping, electrical, instrumentation installation staged to suit the commissioning plan, and the recruitment, onboarding and training of the operational staff aligned to the start of operations in the second quarter of 2018. See “Description of the Business – Additional Projects – Cerro Moro Project”.

Sale of Mercedes

On July 28, 2016, the Company entered into an agreement with Premier Gold Inc. (“Premier”) to sell 100% of its interest in the Mercedes mine through the sale of its Mexican subsidiaries. As consideration for the sale, the Company received cash consideration of $122.5 million, six million Premier common shares, and three million Premier common share purchase warrants exercisable at Cdn$4.75 per common share for 24 months. In addition, the Company received a 1% net smelter return royalty on the Mercedes mine, that becomes payable upon the earlier of six years from the completion of the sale and the date upon which cumulative production of 450,000 ounces of gold equivalent from the Mercedes mine has been achieved, as well as a 2% net smelter return royalty on the La Silla property in Sinaloa, Mexico and the La Espera property in Sonora, Mexico. The sale was completed on September 30, 2016.

Altius

On March 31, 2016, the Company announced that it had entered into a copper purchase agreement with Altius Minerals Corporation (“Altius”) pursuant to which Altius agreed to pay Yamana total advanced payments of $60 million in cash consideration plus 400,000 Altius common share purchase warrants. The agreement provides Altius with the right to receive payments of copper related to the production from the Company’s Chapada mine in Brazil. A non-refundable deposit of $8 million was paid to Yamana on signing with the balance paid on May 3, 2016. The proceeds from this agreement were used to finance the acquisition of RDM.

Dividend Policy

In January 2016, the Company’s board of directors amended the Company’s dividend policy to set the quarterly dividends paid per common share at $0.02 annually, beginning with the declaration and payment of the first quarter 2016 dividend. Payment of any future dividends will be at the discretion of the Company’s board of directors after taking into account many factors, including the Company’s operating results, financial condition, comparability of the dividend yield to peer group gold companies and current and anticipated cash needs.

Sandstorm Gold Transactions

On October 27, 2015, the Company announced that it had entered into three metal purchase agreements with Sandstorm Gold Ltd. (“Sandstorm”), for which Sandstorm paid the Company total cash payments of $148 million and issued the Company 15 million Sandstorm common share purchase warrants with a five year term and strike price of $3.50. The warrants are exercisable when the Company has incurred an additional $40 million in capital expenditures in respect of the development and construction of the Cerro Moro mine. Sandstorm will also pay the Company an additional cash payment of $4 million in April 2016. The metal purchase agreements include a silver purchase contract related to production from the Cerro Moro mine, Minera Florida and Chapada, a copper purchase transaction related to production from Chapada, and a gold purchase transaction related to production from Agua Rica. All amounts received were used by the Company to reduce the balance outstanding on its revolving credit facility.

On October 3, 2016, the Company announced the sale of the Sandstorm warrants for total net proceeds of approximately $33.55 million, or approximately $2.24 per warrant.

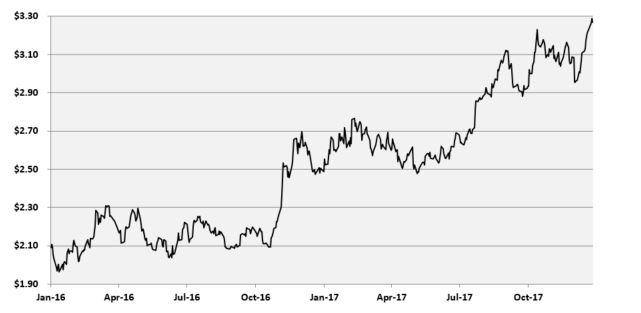

Hedge Programs

As at December 31, 2017, the Company had 23 million pounds of copper forward contracts at an average sales price of $3.07 per pound and 45 million pounds of copper option contracts providing a minimum price of $2.85 per pound and a maximum price of $3.33 per pound. These contracts mature over the first half of 2018.

As at December 31, 2017, the Company had 131,900 ounces of gold option contracts providing a minimum price of $1300 per ounce and a maximum price of $1,414 per ounce. These contracts mature over the first three months of 2018.

10

EXHIBIT 99.1

Mega Precious – Acquisition

On June 22, 2015, the Company acquired all of the issued and outstanding common shares of Mega Precious Metals Inc. (“Mega Precious”). Mega Precious was a Canadian-based exploration company with a high quality pipeline of projects located in Manitoba, Northwestern Ontario and Nunavut. The most significant and advanced project is the Monument Bay gold/tungsten project located in northeastern Manitoba. The transaction is expected to advance the Company’s strategy to expand its presence in Canada.

Total consideration paid for the acquisition of Mega Precious was $14.5 million which consisted of approximately $0.2 million in cash, $14.0 million in Yamana common shares (4,366,675 shares) and transaction costs. Each Mega Precious shareholder received $0.068 per share comprised of Cdn$0.001 in cash and 0.02092 of a Yamana common share for each Mega common share held. As part of the acquisition and included in the total consideration paid, the Company acquired the convertible notes of Pacific Road Capital II Pty Limited, as trustee for Pacific Road Resources Fund II, and Pacific Road Capital Management GP II Limited, as general partner of Pacific Road Resources Fund II L.P. (collectively, “Pacific Road”) totaling $2.4 million, and issued 744,187 Yamana common shares at $3.21 per share, which concurrently terminated the existing agreement between Pacific Road and Mega Precious.

Dividend Reinvestment Plan

On February 18, 2015, the Company announced the implementation of a dividend reinvestment plan (the “DRIP”), effective for the first quarter dividend of 2015 forward, which provides eligible holders of the Company’s common shares with the option of reinvesting all or a portion of the dividends paid to them as shareholders (less any withholding tax) to purchase additional common shares of the Company. Participation in the DRIP is optional. The common shares acquired on behalf of eligible participants by the DRIP agent, CST Trust Company, will, at the sole option of the Company, be common shares issued from the treasury of the Company or common shares acquired on the open market through the facilities of the Toronto Stock Exchange (the “TSX”), the New York Stock Exchange (the “NYSE”) or any other stock exchange on which the common shares of the Company are then listed (each a “Listed Market”). The purchase price of the common shares purchased under the DRIP shall be the volume weighted average price of the common shares on the applicable Listed Market for the five trading days preceding the dividend payment date.

Public Offering

On February 3, 2015, the Company closed a bought deal offering (the “Public Offering”) of common shares of the Company. A total of 56,465,000 common shares were issued at a price of Cdn$5.30 per share, for aggregate gross proceeds of Cdn$299,264,500 (which included the full exercise by the underwriters of the over-allotment option for 7,365,000 common shares). The common shares of the Company were sold pursuant to an underwriting agreement (the “Underwriting Agreement”) dated January 15, 2015 between the Company and a syndicate of underwriters led by Canaccord Genuity Corp. and National Bank Financial Inc., and including CIBC World Markets Inc., RBC Dominion Securities Inc., Scotia Capital Inc., TD Securities Inc., Merrill Lynch Canada Inc., Credit Suisse Securities (Canada), Inc., Raymond James Ltd., Citigroup Global Markets Canada Inc., Cormark Securities Inc., Macquarie Capital Markets Canada Ltd., Morgan Stanley Canada Limited, and Barclays Capital Canada Inc. The net proceeds of the Public Offering were used to repay amounts under the Company’s $1 billion revolving credit facility, in order to reduce the Company’s debt position and further strengthen its balance sheet.

ITEM 4

DESCRIPTION OF THE BUSINESS

Yamana is a Canadian-based gold producer with significant gold production, gold development stage properties, exploration properties and land positions in Canada, Brazil, Chile, and Argentina. Yamana plans to continue to build on this base through existing operating mine expansions, throughput increases, development of new mines, advancement of its exploration properties and by targeting other gold consolidation opportunities with a primary focus in the Americas.

Principal Products

The Company’s principal product is gold, with gold production forming a significant part of revenues. There is a global gold market into which Yamana can sell its gold and, as a result, the Company is not dependent on a particular purchaser with regard to the sale of the gold that it produces.

11

EXHIBIT 99.1

The Company produces gold-copper concentrate at its Chapada Mine, gold and silver doré bars at its El Peñón Mine, gold doré bars at its Jacobina Mining Complex (the “JMC”) and Gualcamayo Mine, and gold and silver doré bars and zinc concentrate at its Minera Florida Mine. Additionally, the Company has a 50% indirect interest in the Canadian Malartic Mine, which produces gold and silver doré bars. The Company has contracts with a number of smelters, refineries and trading companies to sell gold and silver doré and gold-copper and zinc concentrate.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties. The ability of the Company to acquire precious metal mineral properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

Operations

Employees

As at December 31, 2017, the Company had the following employees and contractors at its operations:

Country | Employees | Contractors | Total |

Canada, Corporate | 143 | 2 | 145 |

Canada, Canadian Malartic (50% indirect interest) | 758 | 555 | 1,313 |

Argentina | 1,286 | 1,040 | 2,326 |

Brazil | 1,437 | 1,851 | 3,288 |

Chile | 1,743 | 2,015 | 3,758 |

Netherlands | 1 | - | 1 |

United States | 4 | 1 | 5 |

Total | 5,372 | 5,464 | 10,836 |

Domestic and Foreign Operations

The Company’s mine and mineral projects are located in Brazil, Chile, Argentina, and Canada. See “General Development of the Business – Overview of Business” for a summary of the Company’s projects. Any changes in regulations or shifts in political attitudes in any of these jurisdictions, or other jurisdictions in which Yamana has projects from time to time, are beyond the control of the Company and may adversely affect its business. Future development and operations may be affected in varying degrees by such factors as government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people, mine safety and receipt of necessary permits. The effect of these factors cannot be accurately predicted. See “– Risks of the Business”.

Environment and Communities

Protecting the environment and its employees, and maintaining a social license with the communities where the Company operates are key to Yamana’s success.

Yamana developed a mission statement in 2016 that emphasizes the importance of integrating health, safety, environment and community (HSEC) into its operational and corporate culture. One Team, One Goal: Zero reflects the belief that everyone at Yamana is responsible for the Company’s HSEC performance.

Yamana’s HSEC performance is described in its material issues report, which is available on its website (www.yamana.com).

12

EXHIBIT 99.1

Recognition

Yamana’s HSEC management and performance were recognized in the following ways in 2017:

• | Yamana was named one of the Best 50 Corporate Citizens in Canada by Corporate Knights magazine for the seventh year in a row. |

• | Yamana was included in Sustainalytics’ Jantzi Social Index for the ninth consecutive year. The index partners with the Dow Jones Sustainability Index to screen the 50 top performing Canadian companies from an environmental, social and governance perspective. |

• | Chapada received first place in central Brazil and second nationally in the risk management category of the Proteção awards, considered the most important health and safety honour given to a Brazilian company. |

Governance

Overall governance of HSEC is supported by the Company’s board of directors, the corporate HSEC team, and an HSEC team and committee at each site.

The board of directors The sustainability committee of the board of directors oversees all aspects of health, safety and sustainability matters. It reviews policies, compliance issues and incidents, and ensures that Yamana has been diligent in carrying out the Company’s responsibilities and activities. | Corporate The corporate HSEC team is led by the Senior Vice President, Health, Safety and Sustainable Development. The team implements policy and strategy, and facilitates dialogue with external stakeholders. It also collaborates with the mine sites to co-develop standards and procedures and share best practices, with any policy or strategy modifications reviewed by Yamana’s general managers, regional directors, senior executive team and the board of directors. | Site Each site has an HSEC team and a committee chaired by the site’s general manager. The committees meet at least monthly to discuss HSEC issues and solutions and other operational practices. The committees monitor the effectiveness and performance of their site’s sustainability programs and report any material issues to the general manager who escalates matters as necessary. |

Management

Yamana uses an integrated HSEC Framework to guide its approach to health, safety and sustainability. Based on industry best practices and the legal environment in the jurisdictions where the Company operates, the framework empowers sites and provides them with strategic guidance to identify areas to improve performance and implement best practices. It also provides guidelines for engaging with stakeholders and managing the impact of an operation on the local community.

Three key principles support the Company’s approach to HSEC Management – risk management, integration and external reporting and assessment:

1. Risk management

The basis of Yamana’s management approach is effective risk management. Using the HSEC Framework and specific standards within the Yamana Management System (YMS), each operation effectively maps its HSEC risks and develops an approach to:

• | planning and risk assessment |

• | standard operating procedures |

• | identifying legal and contractual requirements |

• | industry best practices |

• | company objectives |

• | the link between outcomes and action plans for key performance metrics, development plans and internal auditing systems. |

Operating sites are audited against the policies, standards and procedures in the YMS.

High level risks, including risks associated with tailings dam facilities, waste rock dumps, heap leach piles or cyanide usage, among others, have enhanced, specific management measures for mitigating potential failures, spills or slides.

13

EXHIBIT 99.1

These include permanent monitoring of each structure, and tools to help monitor specific risks. The Company also reviews monthly reports on the tailings dams, which are prepared by third party consultants. See “Risks of the Business”.

Canadian Malartic Mine, a jointly-owned operation with Agnico Eagle, operates under Agnico Eagle’s HSEC management systems. These systems are based on international best practices and are consistent with the YMS.

2. Integration

Yamana’s HSEC process involves every operation, starting with risk assessment through to implementation and monitoring. Making operational management responsible for integrating HSEC improves strategic planning and implementation, and means the outcome is owned by the entire site instead of a specific department.

3. External reporting and assessment

Yamana reports on HSEC performance annually in its material issues report following the most current guidelines produced by the Global Reporting Initiative.

Audit reports for Yamana’s cyanide management can be found on the International Cyanide Management Code website, and Yamana’s energy and emissions performance is reported to the Carbon Disclosure Project.

Yamana also maintains certifications with several external agencies, including:

• | International Cyanide Management Code |

• | ISO 14001 Environmental Management Systems |

• | OHSAS 18001 Occupational Health and Safety Management Systems |

• | World Gold Council’s Conflict-Free Gold Standard. |

Performance

Yamana regularly reports on its performance in six material areas:

• | health and safety |

• | social license and human rights |

• | climate change |

• | tailings and waste management |

• | water management |

• | mine closure. |

The Company has had no significant spills, releases or incidents since 2014.

Health and safety

Yamana improved its overall health and safety performance in 2017, and there were no workplace fatalities. Unfortunately, in February 2018, the Company reported a motor vehicle accident double fatality at the Gualcamayo Mine involving a local contractor. The company continues to work with authorities and the contractor to identify and implement measures to prevent future incidents.

While the frequency of lost time incidents (LTIs) increased from 0.13 to 0.22, the total recordable incident rate decreased from 0.84 to 0.75 (all data excludes Canadian Malartic). Chapada achieved a new record of 619 consecutive days without the occurrence of a lost time injury.

Yamana’s stable safety performance reflects the efforts it has made toward reaching its goal of zero serious injuries. The Company recognizes, however, that there is still significant work to be done, and has continuous learning and improvement initiatives across the organization aimed at identifying ways to make step changes in safety performance.

Yamana’s health and safety team had the following priorities in 2017 (which continue into 2018):

• | increase measurement and reporting of preventative or ‘leading’ indicators |

• | increase focus on high potential incidents and sharing learnings across sites |

• | ensure fatal risk controls are best-in-class and verified in the field |

• | develop new leadership standards. |

14

EXHIBIT 99.1

Social license and human rights

As in previous years, Yamana had no significant community conflicts or incidents in 2017.

Yamana’s social performance is guided by a specific set of community relations standards contained in the YMS. Underpinning these standards are a number of social policies, including Yamana’s Human Rights Policy, which is on the Company website. Yamana is committed to acting in accordance with Voluntary Principles on Security and Human Rights and requires the same adherence from its service providers. The HSEC Framework also provides best practices guidelines for stakeholder engagement, impact and benefit management.

Each operation has a community relations team that regularly engages with the local community through formal and informal engagement mechanisms. Activities in 2017 included:

• | hosting 64 community and other formal meetings at its operations, with over 1,780 participants |

• | responding to 46 formal grievances, mainly related to vibration, dust and noise, all within the designated closeout period (typically 7 to 14 days). |

Yamana makes substantial commitments to local community development every year. In 2017, the Company:

• | contributed $5.9 million to communities where it operates through direct community investment, donations and sponsorships. Yamana typically focuses on sustainable income generation, education, health and culture |

• | maintained a local employment rate of 64% |

• | maintained a host-country procurement rate of 95%. |

Climate change

Yamana’s operations are balancing improved energy use and emissions, while also adapting to and mitigating the impacts related to climate change.

Yamana has a three-fold approach to climate change:

1. Adaptation – the Company monitors existing climate changes and extreme weather events that could affect its operations and modifies its facilities as necessary. It regularly examines each operation to make sure that they are prepared to withstand extreme weather events.

2. Mitigation – each operation is responsible for developing its own energy reduction strategy and setting its own targets. The Company also has energy efficiency programs that focus on decreasing fossil fuel use and reducing its carbon footprint wherever possible.

3. Preparedness – each operation has developed an emergency preparedness and response plan for extreme weather events and other foreseeable crises and emergencies. These plans, which are periodically updated and tested, ensures that if extreme events occur, site personnel and local communities understand their roles and responsibilities and are trained accordingly.

Tailings and waste management

Yamana maintains a unique, best-practice tailings management and reporting system that allows the operations and the corporate office to maintain regular vigilance over the management of each operation’s tailings-related risks.

The Company has always prioritized the management of tailings, and diligently adheres to SYGBAR, its six-point tailings management system that focuses on:

• | standards for design and construction, and use of design reviews |

• | constant tailings management facility (“TMF”) monitoring and site-specific key performance indicators development and performance management |

• | periodic safety inspections |

• | risk assessment |

• | training and continuous improvement |

• | emergency response plans with dam failure analysis. |

A dedicated senior corporate manager is responsible for overseeing this system and providing support to the operations to make sure they are in compliance.

15

EXHIBIT 99.1

Yamana has completed independent third-party reviews of its TMF facilities that were part of its robust internal management system. A renowned global expert in the field did the reviews in 2016 and followed up in 2017 by examining the design, construction and operation of the tailings facilities, as well as Yamana’s policies, procedures and management systems. The reviewer concluded there were no significant weaknesses or discrepancies from international best practices. The reviewer also identified opportunities for improvement, and action plans have since been put in place for implementing the improvements.

Sound environmental management also includes the responsible management of general waste, both hazardous and non-hazardous. Waste is minimized and segregated to enhance recyclability, reuse and proper disposal. If a material is considered hazardous under local legislation, it is disposed of according to specific practices.

Water management

Yamana works towards reducing its consumption of fresh water and maximizing the reuse and recycling of mine water discharges to the environment.

Water management continues to be one of the single most important areas of focus at Yamana’s sites, because of the water-intensive nature of processing ore, the scarcity of water in some areas, the wide array of climatic environments where the Company operates and the importance of water for communities and other stakeholders. Non-compliance can present a risk to a site’s license to operate, with human and aquatic health issues remaining the most significant concern.

There have been no significant spills at the Company’s operations since 2014 and all operations remain compliant with the International Cyanide Management Code. None of Yamana’s operations had process water discharges to the environment in 2017.

Yamana’s water focus has two components:

1. Monitoring – each operation has monitoring programs to confirm that mining activities do not significantly impact water supplies and to ensure there are no significant impacts on downstream users. In South America, some of these monitoring programs include community participation.

2. Management – each operation also maintains its own unique water management strategy that:

• | reflects its location-specific challenges |

• | reduces freshwater consumption while recycling as much water as possible. |

More than two-thirds of the water that Yamana uses to process ore is reused or recycled. Most of the fresh water comes from within the mine site or precipitation, with a small amount from rivers, lakes or streams.

Mine closure

Mine closure is closely managed by the operations with corporate oversight. Each operation has a comprehensive mine closure plan and a corresponding Asset Retirement Obligation that is updated annually. Yamana’s total liabilities for reclamation and closure cost obligations as at December 31, 2017 were $274.3 million.

Other Disclosure Relating to Ontario Securities Commission Requirements for Companies Operating in Emerging Markets

Due to the risks inherent in mineral production and the desire to organize and structure its affairs in a tax efficient manner, the Company holds each of its material properties in a separate corporate entity (through local subsidiary companies in foreign jurisdictions and other holding companies in various jurisdictions).

The risks of the corporate structure of the Company and its subsidiaries are risks that are typical and inherent for companies who have material assets and property interests held indirectly through foreign subsidiaries and located in foreign jurisdictions. The Company’s business and operations in emerging markets are exposed to various levels of political, economic and other risks and uncertainties associated with operating in a foreign jurisdiction such as difference in laws, business cultures and practices, banking systems and internal control over financial reporting. See below under “– Risks of the Business”.

The Company has implemented a system of corporate governance, internal controls over financial reporting and disclosure controls and procedures that apply at all levels of the Company and its wholly-owned subsidiaries. These systems are overseen

16

EXHIBIT 99.1

by the Company’s board of directors, and implemented by the Company’s senior management. The relevant features of these systems are set out below.

Control over Foreign Subsidiaries

The Company controls its foreign subsidiaries by virtue of corporate oversight and by its ownership of 100% of the shares issued by such entities (exclusive of non-material subsidiaries). The Company’s management has the (i) power to appoint and dismiss, at any time, any and all of the foreign subsidiaries’ officers and directors, (ii) power to instruct the foreign subsidiaries’ officers to pursue business activities in accordance with the Company’s wishes, and (iii) legal right, as a shareholder, to require the officers of each such foreign subsidiaries to comply with their fiduciary obligations. The Company can also enforce its rights by way of various shareholder remedies available to it under local laws. As a result, the management of the Company can effectively align its business objectives with those of the foreign subsidiaries and implement such objectives at the subsidiary level.

Board and Management Expertise

A majority of the Company’s directors have been directors for a period in excess of five years. Likewise, a majority of the Company’s senior officers have at least five years of experience in senior leadership positions with the Company. As a result of their tenure, these officers and directors have gained extensive experience conducting business in the emerging jurisdictions. Please see the biographical information on pages 81 of this AIF for further information on the senior officers’ and directors’ experience.

In addition, the board of directors, through its corporate governance practices, regularly receives management and technical updates and progress reports in connection with the foreign subsidiaries, and in so doing, maintains effective oversight of their business and operations. Further, the Company’s directors and senior officers visit the Company’s operations in foreign jurisdictions on a regular basis in order to ensure effective control and management of the Company’s foreign operations. During these visits they come into contact with local employees, government officials and business persons; such interactions enhance the visiting directors’ and officers’ knowledge of local culture and business practices. Generally, the Company’s directors visit at least one of the Company’s operations in each calendar year, on a rotating basis. Certain senior and non-senior officers visit the Company’s operations quarterly, or more frequently if circumstances require, on a rotating basis.

Internal Control Over Financial Reporting and Funds

The Company maintains internal control over financial reporting with respect to its operations in emerging jurisdictions by taking various measures. Several of the Company’s Vice Presidents have the relevant language proficiency (Spanish and Brazilian Portuguese), local cultural understanding and relevant work experience in each of the Company’s operating jurisdictions which facilitates better understanding and oversight of the Company’s operations in the foreign jurisdictions in the context of internal controls over financial reporting.

Pursuant to the requirements of NI 52-109, the Company assesses the design of its internal controls over financial reporting on an annual basis. Furthermore, key controls for the accounts in scope are tested across the Company on an annual basis and the working papers of these tests performed at all the locations are reviewed at the head office level. Please refer to the Company’s annual audited consolidated financial statements for the year ended December 31, 2017, as filed under the Company’s profile on SEDAR and on the Company’s website.

Differences in banking systems and controls between Canada and the emerging jurisdictions are addressed by having stringent controls over cash in all locations; especially over access to cash, cash disbursements, appropriate authorization levels, performing and reviewing bank reconciliations in the applicable jurisdiction on at least a monthly basis and the segregation of duties.

The difference in cultures and practices between Canada and the emerging jurisdictions is addressed by employing competent staff in Canada and the emerging jurisdictions who are familiar with the local laws, business culture and standard practices, have local language proficiency, are experienced in working in the applicable emerging jurisdiction and in dealing with the respective government authorities; and have experience and knowledge of the local banking systems and treasury requirements.

The foreign subsidiaries’ also have established practices, protocols and routines in place for the distribution of its excess cash to its foreign owners. Furthermore, the opening and closing of bank accounts in the name of a foreign subsidiary is controlled, overseen and approved by the Company’s Senior Vice President, Finance and Chief Financial Officer and the Treasurer.

17

EXHIBIT 99.1

The Company ensures the flow of funds between Canada and each emerging jurisdiction functions as intended by:

• | appointing common officers of the Company and the foreign subsidiary; |

• | involving the Company’s Chief Financial Officer, located in Toronto, in hiring key finance personnel in each of the emerging jurisdictions; and |

• | closely monitoring the finance departments in each of the emerging jurisdictions, and by regular personal visits by the Chief Financial Officer and other key executives to the emerging jurisdictions. |

Communication

The Company maintains open communication with each of its foreign operations through many senior and non-senior officers who are fluent in either Brazilian Portuguese or Spanish, as applicable. In addition, all management team members in local jurisdictions are fluent in the jurisdiction’s primary language and are proficient in English. The primary language used in management and board meetings is English and material documents relating to the Company that are provided to the board of directors are in English. Although the Company does not currently have a formal communication plan, it has implemented several communications policies, including a disclosure policy and crisis communications protocols. To date, the Company has not experienced any communication-related issues.

Records

All of the minute books and corporate records and documents of the foreign subsidiaries are filed at the relevant entity’s headquarters, and with the relevant governmental or regulatory body in each applicable jurisdiction in which the applicable entity’s headquarters are located. The custodians of such documents report directly to the Company’s head office and senior management team to ensure continued oversight.

Risks of the Business

The operations of the Company are speculative due to the high-risk nature of its business, which is the acquisition, financing, exploration, development and operation of mining properties. These risk factors could materially affect the Company’s future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. The risks and uncertainties described below are not the only risks and uncertainties that the Company faces. Additional risks and uncertainties not presently known to the Company or that the Company currently deems immaterial may also impair the Company’s business operations. If any of the adverse consequences described in those risks actually occurs, the Company’s business, results of operations, cash flows and financial position would suffer. See “Cautionary Note Regarding Forward-Looking Statements.”

Gold, Copper and Silver Prices

The Company’s profitability and long-term viability depend, in large part, upon the market prices of metals that may be produced from its properties, primarily gold, copper and silver. Market price fluctuations of these commodities could adversely affect profitability of the Company’s operations and lead to impairments and write downs of mineral properties. Metal prices fluctuate widely and are affected by numerous factors beyond the Company’s control, including:

• | global and regional supply and demand for industrial products containing metals generally; |

• | changes in global or regional investment or consumption patterns; |

• | increased production due to new mine developments and improved mining and production methods; |

• | decreased production due to mine closures; |

• | interest rates and interest rate expectation; |

• | expectations with respect to the rate of inflation or deflation; |

• | fluctuations in the value of the United States dollar and other currencies; |

• | availability and costs of metal substitutes; |

• | global or regional political or economic conditions; and |

• | sales by central banks, holders, speculators and other producers of metals in response to any of the above factors. |

There can be no assurance that metal prices will remain at current levels or that such prices will improve. A decrease in the market prices could adversely affect the profitability of the Company’s existing mines and projects as well as its ability to finance the exploration and development of additional properties, which would have a material adverse effect on the Company’s results of operations, cash flows and financial position. A decline in metal prices may require the Company to write-down Mineral Reserve and Mineral Resource estimates by removing ores from Mineral Reserves that would not be economically processed at lower metal prices and revise life-of-mine plans (“LOM Plans”), which could result in material write-downs of investments in

18

EXHIBIT 99.1

mining properties. Any of these factors could result in a material adverse effect on the Company’s results of operations, cash flows and financial position. Further, if revenue from metal sales declines, the Company may experience liquidity difficulties. Its cash flow from mining operations may be insufficient to meet its operating needs, and as a result the Company could be forced to discontinue production and could lose its interest in, or be forced to sell, some or all of its properties.

In addition to adversely affecting Mineral Reserve and Mineral Resource estimates and the Company’s results of operations, cash flows and financial position, declining metal prices can impact operations by requiring a reassessment of the feasibility of a particular project. Even if a project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays and/or may interrupt operations until the reassessment can be completed, which may have a material adverse effect on the Company’s results of operations, cash flows and financial position. In addition, lower metal prices may require the Company to reduce funds available for exploration with the result that the depleted reserves may not be replaced.

Exploration, Development and Operating Risks

Mining operations are inherently dangerous and generally involve a high degree of risk. Yamana’s operations are subject to all the hazards and risks normally encountered in the exploration, development and production of gold, copper and silver, including, without limitation, unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding, pit wall failure and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, personal injury or loss of life, damage to property and environmental damage, all of which may result in possible legal liability. Although the Company expects that adequate precautions to minimize risk will be taken, mining operations are subject to hazards such as fire, rock falls, geomechanical issues, equipment failure or failure of retaining dams around tailings disposal areas which may result in environmental pollution and consequent liability. The occurrence of any of these events could result in a prolonged interruption of the Company’s operations that would have a material adverse effect on its business, financial condition, results of operations and prospects.

The exploration for and development of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish Mineral Reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by Yamana will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices that are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Yamana not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Yamana towards the search and evaluation of mineral deposits will result in discoveries or development of commercial quantities of ore.

Health, Safety and Environmental Risks and Hazards

Mining, like many other extractive natural resource industries, is subject to potential risks and liabilities due to accidents that could result in serious injury or death and/or material damage to the environment and Company assets. The impact of such accidents could affect the profitability of the operations, cause an interruption to operations, lead to a loss of licenses, affect the reputation of the Company and its ability to obtain further licenses, damage community relations and reduce the perceived appeal of the Company as an employer.

All phases of the Company’s operations are subject to environmental and safety regulations in the various jurisdictions in which it operates. These regulations mandate, among other things, worker safety, water quality, water management, land reclamation, waste disposal (including the generation, transportation, storage and disposal of hazardous waste), mine development and protection of endangered and other special status species. Failure to comply with applicable health, safety and environmental laws and regulations could result in injunctions, fines, suspension or cancellation of permits and approvals and could include other penalties. Health, safety and environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that the Company has been or will at all times be in full compliance with all environmental laws and regulations or hold, and be in full compliance with, all required environmental and health and safety permits. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations

19

EXHIBIT 99.1

to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations, including the Company, may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations. The potential costs and delays associated with compliance with such laws, regulations and permits could prevent the Company from proceeding with the development of a project or the operation or further development of a mine, and any non-compliance therewith may adversely affect the Company’s business, financial condition and results of operations.

Government environmental approvals and permits are currently, or may in the future be, required in connection with the Company’s operations. To the extent such approvals are required and not obtained, the Company may be curtailed or prohibited from proceeding with planned exploration or development of mineral properties.

The Company may also be held financially responsible for remediation of contamination at current or former sites, or at third party sites. The Company could also be held responsible for exposure to hazardous substances. The costs associated with such instances and liabilities could be significant.

In certain jurisdictions, the Company may be required to submit, for government approval, a reclamation plan for each of its mining/project sites. The reclamation plan establishes the Company’s obligation to reclaim property after minerals have been mined from the sites. In some jurisdictions, bonds or other forms of financial assurances are required as security to ensure performance of the required reclamation activities. The Company may incur significant reclamation costs which may materially exceed the provisions the Company has made for such reclamation. In addition, the potential for additional regulatory requirements relating to reclamation or additional reclamation activities may have a material adverse effect on the Company’s financial condition, liquidity or results of operations. When a previously unrecognized reclamation liability becomes known or a previously estimated cost is increased, the amount of that liability or additional cost may be expensed, which may materially reduce net income in that period.

The extraction process for gold and metals can produce tailings, which are the sand like materials which remain from the extraction process. Tailings are stored in engineered facilities which are designed, constructed, operated and closed in conformance with local requirements and best practices. Should a breach of these facilities occur due to extreme weather, seismic event, or other incident, the Company could suffer a material financial impact on the Company’s operations and financial condition.

Production at certain of the Company’s mines involves the use of cyanide which is a toxic material if not handled properly. Should cyanide leak or otherwise be discharged from the containment system, the Company could suffer a material impact on its business, financial condition and results of operations. The Company became a signatory to the International Cyanide Management Code in September 2008 to ensure the safe transport and use of cyanide in the production of gold. Conformance with this code is verified by independent audits, and the Company’s operations are in full compliance with this code.

The Company actively engages with local communities to provide timely information about the operations and participates in a variety of activities to contribute to the wellbeing of local communities. Health, safety, environmental or other incidents, real or perceived, could cause community unrest that manifest into protests, road blockages, or other civil disobedience activities that could materially disrupt the Company’s operations.

The mineral exploration activities of the Company are subject to various laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substances and other matters. Although the Company believes that its exploration activities are currently carried out in accordance with all applicable rules and regulations, new rules and regulations may be enacted or existing rules and regulations may be applied in a manner that could limit or curtail production or development of the Company’s properties. Amendments to current laws and regulations governing the operations and activities of the Company or more stringent implementation thereof could have a material adverse effect on the Company’s business, financial condition and results of operations. See “– Foreign Operations and Political Risk”.

Among the other environmental risks that Yamana has identified across all of its operations are general water management (which includes cyanide management), tailings management, closure and a range of climate-change related risks. For more details regarding Yamana’s management approach to each of these areas see “Description of the Business – Environment and Communities.”

Nature and Climatic Condition Risk