UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED

SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-21432

(Exact Name of Registrant as Specified in Charter)

1700 Broadway, Suite 1850

Denver, CO 80290

(Address of Principal Executive Offices) (Zip Code)

Chris Moore

Reaves Utility Income Fund

1700 Broadway, Suite 1850

Denver, CO 80290

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

800.644.5571

Date of Fiscal Year End: October 31st

Date

of Reporting Period: November 1, 2023 -

Item 1. Reports to Stockholders.

| (a) | The Report to Stockholders is attached herewith. |

Semi-Annual Report

2024

Section 19(b) Disclosure

April 30, 2024 (Unaudited)

Reaves Utility Income Fund (the “Fund”), acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the Fund’s Board of Trustees (the “Board”), has adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, the Fund currently distributes $0.19 per share on a monthly basis.

The fixed amount distributed per share is subject to change at the discretion of the Fund’s Board. Under the Plan, the Fund will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a monthly basis, the Fund will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate the Fund’s Plan without prior notice if it deems such action to be in the best interest of the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading below net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, increased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code.

Please refer to the Additional Information section of this report for a cumulative summary of the Section 19(a) notices for the Fund’s current fiscal period. Section 19(a) notices for the Fund, as applicable, are available on the Fund’s website at www.utilityincomefund.com.

| Reaves Utility Income Fund | Table of Contents |

| Semi-Annual Report | April 30, 2024 | 1 |

| Reaves Utility Income Fund | Shareholder Letter |

April 30, 2024 (Unaudited)

To our Shareholders:

Investment Portfolio Returns: 6 months ended April 30, 2024

Total net assets of the Fund were $2.13 billion on April 30, 2024, or $26.09 of net asset value (“NAV”) per common share. On October 31, 2023, net assets totaled $1.89 billion representing $24.53 of NAV per common share. Changes in the market price of the Fund can and do differ from the underlying changes in the net asset value per common share. As a result, the market return to common shares can be higher or lower than the NAV return. The market return for shareholders in the first half of fiscal year 2024 was 11.64%, as is reflected in the table below. The share price of the Fund traded at a premium 0.65% to NAV at April 30, 2024 versus a premium of 0.12% at the beginning of the fiscal year.

| 6 months | One Year | Three Years^ |

Five Years^ | Ten Years^ | Since Inception^* | |

| UTG (NAV)** | 11.05% | -1.48% | -1.49% | 1.66% | 5.54% | 9.03% |

| UTG (Market)** | 11.64% | -0.73% | -1.57% | 1.71% | 6.17% | 8.82% |

| S&P 500 Utilities Index1 | 13.93% | 0.20% | 3.26% | 6.02% | 8.08% | 9.10% |

| Dow Jones Utility Average2 | 10.70% | -3.14% | 2.70% | 6.12% | 8.61% | 9.89% |

| ^ | Annualized. |

| * | Index data since February 29, 2004. |

| ** | Assumes all distributions being reinvested. |

| 1 | S&P 500 Utilities Index is a capitalization-weighted index containing Electric and Gas Utility stocks (including multi-utilities and independent power producers). Prior to July 1996, this index included telecommunications equities. |

| 2 | The Dow Jones Utility Average is a price-weighted average of 15 utility stocks traded in the United States. |

The performance data quoted represents past performance. Past performance is no guarantee of future results.

Distributions to Common Shareholders

The Fund’s monthly distribution amount of $0.19 per share was unchanged. For the first half of the 2024 fiscal year, the Fund expects total distributions to come from earned income (dividend income) and capital gains. For any given month, however, part of the distribution may be temporarily classified as a return of capital given the irregular realization of capital gains over the course of the year.

Leverage Facility

The Fund ended the period with $545 million in leverage, up $25 million from October 31, 2023. Leverage was about 25.6% of net assets and 20.3% of total assets on April 30, 2024. For details about the leverage facility, please refer to Note 5 of the accompanying financial statements.

Portfolio Discussion and Outlook

The Reaves Utility Income Fund continued to generate tax advantaged income for investors. The Fund increased its leverage slightly since the end of the fiscal year to purchase additional shares of companies trading at attractive relative valuations. Most holdings grew earnings and increased dividends over the past year, highlighting the durability and defensiveness of the business models in which the Fund invests.

In the six-month period ending April 30, 2024, the Fund generated a total return of about 11.05%. It paid approximately $90 million ($1.14 per share) in investor distributions. The results coincided with

| www.utilityincomefund.com | 2 |

| Reaves Utility Income Fund | Shareholder Letter |

April 30, 2024 (Unaudited)

a strong equity market as the S&P 500 Index was up 20.98% in the period. Longer-term interest rates were volatile over the past six months as investors assessed the outlook for inflation. For example, the U.S. 10-Year Treasury Bond yield fell from 4.88% on October 31, 2023 to 3.79% in late December before rising again to 4.69% on April 30, 2024. Short-term interest rates, as measured by the Federal Funds Rate, were unchanged during the same period.

The top five contributors to the Fund’s first-half performance operate in the utilities sector, which appears to have bottomed last October when interest rates peaked. Investor sentiment has been improving due to growing recognition of several factors including growth in demand for power, new investment opportunities related to energy transition, dividend yields well above most other sectors, and potential expansion of price/earnings multiples if the Federal Reserve begins to reduce short-term interest rates later this year.

Other positive contributors included the Fund’s holdings in railroads and midstream energy. Rails rose on optimism of a recovery in volumes on the back of a resilient economy, while improving balance sheets and capital discipline helped midstream energy shares. Broadband cable and wireless tower stocks remained out of favor despite continuing to produce strong levels of free cash flow*. The Fund’s combined exposure to these two sub-sectors was just over 7% of total assets as of April 30, 2024.

Thank you for your investment in the Fund. We encourage you to thoroughly read all of the information provided in this report and to contact us with any questions. The investment team at Reaves remains committed to achieving the Fund’s investment objectives and we look forward to keeping you updated on our progress.

Sincerely,

Timothy O. Porter, CFA, Portfolio Manager, Reaves Asset Management-CIO

John P. Bartlett, CFA, Portfolio Manager, Reaves Asset Management-President

Jay Rhame, Fund President, Portfolio Manager, Reaves Asset Management-CEO

Sources of distributions to shareholders may include net investment income, net realized short-term capital gains, net realized long-term capital gains and return of capital. If a distribution includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate of its distribution sources at that time. Please refer to the Additional Information section of this report for a cumulative summary of the Section 19(a) notices for the Fund’s current period. The actual amounts and sources of distributions for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. The estimates may not match the final tax characterization (for the full year’s distributions) contained in the shareholder’s Form 1099- DIV. Distribution payments are not guaranteed; distribution rates may vary.

You cannot invest directly in an index.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance.

*The money a company has left over after paying its operating expenses and any cash from operations minus capital expenditures.

| Semi-Annual Report | April 30, 2024 | 3 |

| Reaves Utility Income Fund | Shareholder Letter |

April 30, 2024 (Unaudited)

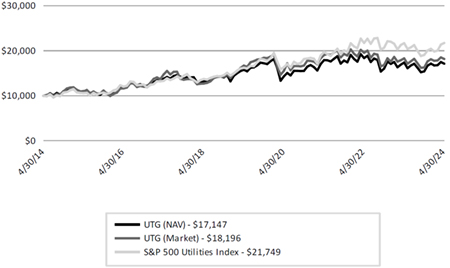

Growth of a hypothetical $10,000 investment

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at NAV or the closing market price (NYSE American: UTG) of $28.91 on April 30, 2014, and tracking its progress through April 30, 2024.

Past performance does not guarantee future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

| www.utilityincomefund.com | 4 |

| Reaves Utility Income Fund | Shareholder Letter |

April 30, 2024 (Unaudited)

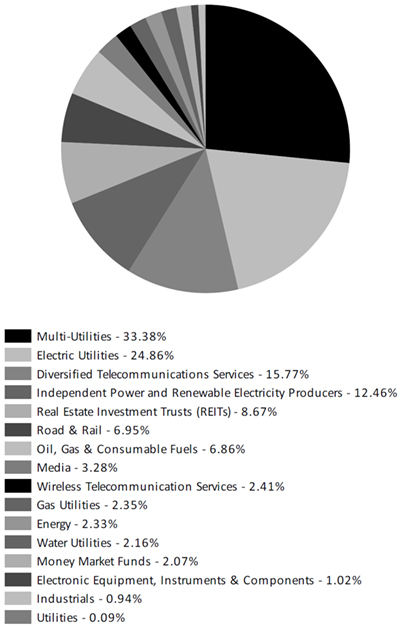

INDUSTRY ALLOCATION AS OF APRIL 30, 2024

Industries are displayed as a % of net assets. Holdings are subject to change.

| Semi-Annual Report | April 30, 2024 | 5 |

| Reaves Utility Income Fund | Statement of Investments |

April 30, 2024 (Unaudited)

| SHARES | VALUE | |||||||

| COMMON STOCKS - 121.11% | ||||||||

| Diversified Telecommunications Services - 15.77% | ||||||||

| BCE, Inc. | 1,378,500 | $ | 45,283,725 | |||||

| Cogent Communications Holdings, Inc.(a) | 415,000 | 26,634,700 | ||||||

| Deutsche Telekom AG | 3,711,042 | 85,109,648 | ||||||

| Frontier Communications Parent, Inc.(a)(b) | 549,200 | 12,708,488 | ||||||

| Rogers Communications, Inc., Class B | 1,658,000 | 62,109,512 | ||||||

| Telus Corp. | 4,170,100 | 66,974,838 | ||||||

| Verizon Communications, Inc. | 938,102 | 37,045,648 | ||||||

| 335,866,559 | ||||||||

| Electric Utilities - 24.86% | ||||||||

| Duke Energy Corp.(a) | 581,000 | 57,089,060 | ||||||

| Edison International(a) | 720,000 | 51,163,200 | ||||||

| Entergy Corp. | 698,900 | 74,551,664 | ||||||

| Exelon Corp.(a) | 572,161 | 21,501,810 | ||||||

| FirstEnergy Corp. | 337,000 | 12,920,580 | ||||||

| Fortis, Inc. | 53,000 | 2,082,370 | ||||||

| IDACORP, Inc.(a) | 278,200 | 26,367,796 | ||||||

| NextEra Energy, Inc.(a) | 609,000 | 40,784,730 | ||||||

| Pinnacle West Capital Corp.(a) | 928,000 | 68,347,200 | ||||||

| PNM Resources, Inc. | 1,474,522 | 54,645,785 | ||||||

| PPL Corp.(a)(c) | 2,561,046 | 70,326,323 | ||||||

| Southern Co. | 677,300 | 49,781,550 | ||||||

| 529,562,068 | ||||||||

| Electronic Equipment, Instruments & Components - 1.02% | ||||||||

| Vertiv Holdings Co. | 233,400 | 21,706,200 | ||||||

| Gas Utilities - 2.35% | ||||||||

| Atmos Energy Corp.(a) | 407,000 | 47,985,300 | ||||||

| Northwest Natural Holding Co.(a) | 55,000 | 2,098,250 | ||||||

| 50,083,550 | ||||||||

| Independent Power and Renewable Electricity Producers - 12.46% | ||||||||

| Constellation Energy Corp. | 631,004 | 117,328,884 | ||||||

| Talen Energy Corp.(b) | 873,105 | 87,310,500 | ||||||

| Vistra Corp. | 800,500 | 60,709,920 | ||||||

| 265,349,304 | ||||||||

| Industrials - 0.94% | ||||||||

| Quanta Services, Inc. | 77,800 | 20,115,968 | ||||||

See Accompanying Notes to Financial Statements.

| www.utilityincomefund.com | 6 |

| Reaves Utility Income Fund | Statement of Investments |

April 30, 2024 (Unaudited)

| SHARES | VALUE | |||||||

| COMMON STOCKS - 121.11% (continued) | ||||||||

| Media - 3.28% | ||||||||

| Charter Communications, Inc., Class A(a)(b) | 73,000 | $ | 18,683,620 | |||||

| Comcast Corp., Class A(a) | 1,343,900 | 51,216,029 | ||||||

| 69,899,649 | ||||||||

| Multi-Utilities - 33.38% | ||||||||

| Alliant Energy Corp.(a) | 1,503,103 | 74,854,529 | ||||||

| Ameren Corp.(a) | 358,000 | 26,445,460 | ||||||

| CenterPoint Energy, Inc.(a) | 3,145,000 | 91,645,300 | ||||||

| CMS Energy Corp.(a) | 1,297,200 | 78,623,292 | ||||||

| DTE Energy Co. | 389,000 | 42,914,480 | ||||||

| Enel SpA | 6,185,257 | 40,800,266 | ||||||

| NiSource, Inc.(a) | 2,877,100 | 80,156,007 | ||||||

| OGE Energy Corp. | 1,339,971 | 46,429,995 | ||||||

| PG&E Corp.(a) | 2,991,000 | 51,176,010 | ||||||

| Public Service Enterprise Group, Inc.(a) | 1,187,000 | 81,997,961 | ||||||

| Sempra Energy | 974,600 | 69,810,598 | ||||||

| WEC Energy Group, Inc.(a) | 28,300 | 2,338,712 | ||||||

| Xcel Energy, Inc.(a) | 436,276 | 23,441,109 | ||||||

| 710,633,719 | ||||||||

| Oil, Gas & Consumable Fuels - 6.86% | ||||||||

| DT Midstream, Inc. | 613,850 | 38,181,470 | ||||||

| ONEOK, Inc.(a) | 200,000 | 15,824,000 | ||||||

| TC Energy Corp. | 1,180,000 | 42,303,000 | ||||||

| Williams Cos., Inc.(a) | 1,300,000 | 49,868,000 | ||||||

| 146,176,470 | ||||||||

| Real Estate Investment Trusts (REITs) - 8.67% | ||||||||

| American Tower Corp.(a) | 267,072 | 45,818,872 | ||||||

| Crown Castle, Inc.(a) | 235,600 | 22,094,568 | ||||||

| Digital Realty Trust, Inc.(a) | 30,000 | 4,163,400 | ||||||

| Equinix, Inc.(a) | 81,000 | 57,599,910 | ||||||

| SBA Communications Corp., Class A | 295,200 | 54,942,624 | ||||||

| 184,619,374 | ||||||||

| Road & Rail - 6.95% | ||||||||

| Canadian National Railway Co. | 435,000 | 52,826,400 | ||||||

| Canadian Pacific Kansas City Ltd. | 315,000 | 24,705,450 | ||||||

| Union Pacific Corp. | 297,100 | 70,460,236 | ||||||

| 147,992,086 | ||||||||

See Accompanying Notes to Financial Statements.

| Semi-Annual Report | April 30, 2024 | 7 |

| Reaves Utility Income Fund | Statement of Investments |

April 30, 2024 (Unaudited)

| SHARES | VALUE | |||||||

| COMMON STOCKS - 121.11% (continued) | ||||||||

| Water Utilities - 2.16% | ||||||||

| American Water Works Co., Inc. | 376,619 | $ | 46,068,036 | |||||

| Wireless Telecommunication Services - 2.41% | ||||||||

| Telenor ASA | 1,012,388 | 11,656,338 | ||||||

| T-Mobile US, Inc. | 241,700 | 39,679,889 | ||||||

| 51,336,227 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $2,620,838,840) | 2,579,409,210 | |||||||

| LIMITED PARTNERSHIPS - 2.33% | ||||||||

| Energy - 2.33% | ||||||||

| Enterprise Products Partners L.P. | 1,768,440 | 49,657,795 | ||||||

| TOTAL LIMITED PARTNERSHIPS | ||||||||

| (Cost $49,255,666) | 49,657,795 | |||||||

| PREFERRED STOCKS - 0.09% | ||||||||

| Utilities - 0.09% | ||||||||

| SCE Trust III, Class H, Perpetual Maturity, 5.750%(a)(d) | 15,473 | 391,003 | ||||||

| SCE Trust IV, Class J, Perpetual Maturity, 5.375%(a)(d) | 63,125 | 1,489,118 | ||||||

| 1,880,121 | ||||||||

| TOTAL PREFERRED STOCKS | ||||||||

| (Cost $1,485,034) | 1,880,121 | |||||||

See Accompanying Notes to Financial Statements.

| www.utilityincomefund.com | 8 |

| Reaves Utility Income Fund | Statement of Investments |

April 30, 2024 (Unaudited)

| SHARES | VALUE | |||||||

| MONEY MARKET FUNDS - 2.07% | ||||||||

| Federated Hermes Treasury Obligations Fund, Institutional Class, 5.160% (7-Day Yield) | 44,121,482 | $ | 44,121,482 | |||||

| TOTAL MONEY MARKET FUNDS | ||||||||

| (Cost $44,121,482) | 44,121,482 | |||||||

| TOTAL INVESTMENTS - 125.60% | ||||||||

| (Cost $2,715,701,022) | 2,675,068,608 | |||||||

| Leverage Facility - (25.59)% | (545,000,000 | ) | ||||||

| Liabilities in Excess of Other Assets - (0.01%) | (172,096 | ) | ||||||

| NET ASSETS - 100% | $ | 2,129,896,512 | ||||||

| (a) | Pledged security; a portion or all of the security is pledged as collateral for borrowings as of April 30, 2024. |

| (b) | Non-income producing security. |

| (c) | A portion of the security is held as collateral for the written call options in the amount of $28,000. |

| (d) | This security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. |

Percentages are stated as a percent of the net assets applicable to common shareholders.

Written Call Options:

| Underlying Security | Counterparty | Exercise Price | Premiums Received | Expiration Date | Number of Contracts | Notional Value | Value (Note 2) | |||||||||||||||||

| PPL Corp. | WallachBeth Capital, LLC | $28 | $33,973 | 5/20/2024 | (1,000 | ) | $(2,746,000 | ) | $(28,000 | ) | ||||||||||||||

| $(2,746,000 | ) | $(28,000 | ) | |||||||||||||||||||||

See Accompanying Notes to Financial Statements.

| Semi-Annual Report | April 30, 2024 | 9 |

| Reaves Utility Income Fund | Statement of Assets and Liabilities |

April 30, 2024 (Unaudited)

| ASSETS: | ||||

| Investments at value Cost ($2,715,701,022) | $ | 2,675,068,608 | ||

| Cash | 699,806 | |||

| Receivable for investments sold | 6,050,137 | |||

| Dividends receivable | 4,696,476 | |||

| Interest receivable | 203,668 | |||

| Receivable for shares sold | 748,781 | |||

| Prepaid offering costs (Note 4) | 11,522 | |||

| Total Assets | 2,687,478,998 | |||

| LIABILITIES: | ||||

| Loan payable | 545,000,000 | |||

| Written options, at value (Premiums received $33,973) | 28,000 | |||

| Interest payable on loan outstanding | 451,757 | |||

| Payable for investments purchased | 10,497,167 | |||

| Investment advisory fees payable (Note 7) | 1,255,449 | |||

| Administration fees payable (Note 7) | 301,584 | |||

| Trustees’ fees payable (Note 7) | 7,802 | |||

| Accrued expenses and other payables | 40,727 | |||

| Total Liabilities | 557,582,486 | |||

| NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | $ | 2,129,896,512 | ||

| NET ASSETS (APPLICABLE TO COMMON SHAREHOLDERS) CONSIST OF: | ||||

| Paid-in capital | 2,160,359,370 | |||

| Total distributable earnings | (30,462,858 | ) | ||

| NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS | $ | 2,129,896,512 | ||

| Shares of common stock outstanding of no par value, unlimited shares authorized | ||||

| Net asset value per common share | $ | |||

See Accompanying Notes to Financial Statements.

| www.utilityincomefund.com | 10 |

| Reaves Utility Income Fund | Statement of Operations |

For the Six Months Ended April 30, 2024 (Unaudited)

| INVESTMENT INCOME: | ||||

| Dividends | ||||

| (net of foreign withholding taxes $1,432,686) | $ | 49,508,953 | ||

| Interest | 970,372 | |||

| Total Investment Income | 50,479,325 | |||

| EXPENSES: | ||||

| Interest on loan | 16,265,829 | |||

| Investment advisory fees | 7,474,336 | |||

| Administration fees | 1,802,640 | |||

| Trustees’ fees | 280,252 | |||

| Miscellaneous fees | 241,825 | |||

| Total Expenses | 26,064,882 | |||

| Net Investment Income | 24,414,443 | |||

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | ||||

| Net realized gain/(loss) on: | ||||

| Investments | 65,524,467 | |||

| Written options | 404,267 | |||

| Foreign currency related transactions | (139,006 | ) | ||

| Net realized gain | 65,789,728 | |||

| Net change in unrealized appreciation/depreciation on: | ||||

| Investments | 121,012,680 | |||

| Written options | 5,973 | |||

| Foreign currency related translations | 1,029 | |||

| Net change in unrealized appreciation | 121,019,682 | |||

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | 186,809,410 | |||

| NET INCREASE IN NET ASSETS APPLICABLE TO COMMON SHAREHOLDERS RESULTING FROM OPERATIONS | $ | 211,223,853 | ||

See Accompanying Notes to Financial Statements.

| Semi-Annual Report | April 30, 2024 | 11 |

| Reaves Utility Income Fund | Statements of Changes in Net Assets |

For the Six Months Ended April 30, 2024 (Unaudited) |

| For the Year Ended October 31, 2023 |

| |||||

| OPERATIONS: | ||||||||

| Net investment income | $ | 24,414,443 | $ | 40,904,434 | ||||

| Net realized gain | 65,789,728 | 121,658,677 | ||||||

| Net change in unrealized appreciation/depreciation | 121,019,682 | (236,934,488 | ) | |||||

| Net Increase/(Decrease) in Net Assets Applicable to Common Shareholders Resulting from Operations | 211,223,853 | (74,371,377 | ) | |||||

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | ||||||||

| From distributable earnings | (90,289,642 | ) | (170,208,291 | ) | ||||

| Total Distributions: Common Shareholders | (90,289,642 | ) | (170,208,291 | ) | ||||

| CAPITAL SHARE TRANSACTIONS: | ||||||||

| Dividends reinvested | 4,428,465 | 7,820,219 | ||||||

| Shares sold, net of offering costs (Note 4) | 110,765,238 | 135,810,703 | ||||||

| Net Increase in Net Assets from Capital Share Transactions | 115,193,703 | 143,630,922 | ||||||

| Net Increase/(Decrease) in Net Assets Applicable to Common Shareholders | 236,127,914 | (100,948,746 | ) | |||||

| NET ASSETS: | ||||||||

| Beginning of period | 1,893,768,598 | 1,994,717,344 | ||||||

| End of period | $ | 2,129,896,512 | $ | 1,893,768,598 | ||||

| See Accompanying Notes to Financial Statements. | |

| www.utilityincomefund.com | 12 |

| Reaves Utility Income Fund | Statement of Cash Flows |

For the Six Months Ended April 30, 2024 (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||

| Net increase in net assets from operations | $ | 211,223,853 | ||

| Adjustments to reconcile change in net assets from operations to net cash provided by operating activities: | ||||

| Purchase of investment securities | (820,858,824 | ) | ||

| Net sales of short-term investment securities | 20,261,612 | |||

| Proceeds from disposition of investment securities | 726,617,649 | |||

| Amortization of premium and accretion of discount on investments | (26,052 | ) | ||

| Premiums received from written options transactions | 737,699 | |||

| Net realized (gain)/loss on: | ||||

| Investments | (65,524,467 | ) | ||

| Written options | (404,267 | ) | ||

| Net change in unrealized (appreciation)/depreciation on: | ||||

| Investments | (121,012,680 | ) | ||

| Written options | (5,973 | ) | ||

| (Increase)/Decrease in assets: | ||||

| Dividends receivable | (1,256,456 | ) | ||

| Interest receivable | 119,155 | |||

| Prepaid offering costs | 10,486 | |||

| Increase/(Decrease) in liabilities: | ||||

| Interest payable on loan outstanding | (326,774 | ) | ||

| Investment advisory fees | 82,609 | |||

| Administration fees | 12,680 | |||

| Trustee fees | 5,450 | |||

| Accrued expenses and other payables | (244 | ) | ||

| Net Cash Used in Operating Activities | (50,344,544 | ) | ||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||

| Proceeds from bank borrowing | $ | 25,000,000 | ||

| Proceeds from sales of shares, net of offering costs | 110,911,009 | |||

| Cash distributions paid on common shares | (85,861,177 | ) | ||

| Net Cash Provided by Financing Activities | 50,049,832 | |||

| Net decrease in cash and foreign cash | (294,712 | ) | ||

| Cash and foreign cash, beginning balance | $ | 994,518 | ||

| Cash, ending balance | $ | 699,806 | ||

| SUPPLEMENTAL DISCLOSURE OF CASHFLOW INFORMATION | ||||

| Cash paid for interest on loan outstanding during the period was: | $ | 16,592,603 | ||

| Non-cash financing activities not included in herein consist of reinvestment of distributions of: | 4,428,465 | |||

| See Accompanying Notes to Financial Statements. | |

| Semi-Annual Report | April 30, 2024 | 13 |

| Reaves Utility Income Fund | Financial Highlights |

Contained below is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the periods indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

| OPERATING PERFORMANCE: |

| Net asset value — Beginning of Period |

| INCOME FROM INVESTMENT OPERATIONS: |

| Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Net Increase/(Decrease) from Operations Applicable to Common Shareholders |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: |

| Distributions from net investment income |

| Distributions from net realized capital gains |

| Total Distributions Paid to Common Shareholders |

| CAPITAL SHARE TRANSACTIONS: |

| Change due to rights offering(b) |

| Common share offering costs charged to paid-in capital |

| Total Capital Share Transactions |

| Common Share Net Asset Value — End of Period |

| Common Share Market Price — End of Period |

| Total Return, Net Asset Value(d) |

| Total Return, Market Price(d) |

| RATIOS AND SUPPLEMENTAL DATA |

| Net Assets Applicable to Common Shareholders, End of Period (000s) |

| Ratio of operating expenses to average net assets attributable to common shares |

| Ratio of operating expenses, excluding interest, to average net assets attributable to common shares |

| Ratio of net investment income to average net assets attributable to common shares Portfolio turnover rate |

| BORROWINGS AT END OF PERIOD |

Aggregate Amount Outstanding (000s) Asset Coverage Per $1,000(f) |

See Accompanying Notes to Financial Statements.

| www.utilityincomefund.com | 14 |

| Reaves Utility Income Fund | Financial Highlights |

| For the Six Months Ended April 30, 2024 (Unaudited) | For the Year Ended October 31, 2023 | For the Year Ended October 31, 2022 | For the Year Ended October 31, 2021 | For the Year Ended October 31, 2020 | For the Year Ended October 31, 2019 | |||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||

| 0.31 | 0.55 | 0.51 | 0.57 | 0.65 | 0.65 | |||||||||||||||||

| 2.39 | (1.45) | (3.61) | 3.95 | (4.24) | 6.21 | |||||||||||||||||

| 2.70 | (0.90) | (3.10) | 4.52 | (3.59) | 6.86 | |||||||||||||||||

| (1.14) | (0.53) | (0.53) | (0.57) | (0.85) | (0.64) | |||||||||||||||||

| – | (1.75) | (1.75) | (1.63) | (1.31) | (1.44) | |||||||||||||||||

| (1.14) | (2.28) | (2.28) | (2.20) | (2.16) | (2.08) | |||||||||||||||||

| – | – | – | – | – | – | |||||||||||||||||

| 0.00(c) | 0.00(c) | 0.00(c) | 0.00(c) | 0.00(c) | – | |||||||||||||||||

| 0.00(c) | 0.00(c) | 0.00(c) | 0.00(c) | 0.00(c) | – | |||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||

| 11.05% | (3.83%) | (10.05%) | 14.92% | (9.89%) | 22.38% | |||||||||||||||||

| 11.64% | (3.40%) | (12.64%) | 15.39% | (9.32%) | 29.94% | |||||||||||||||||

| $ | 2,129,897 | $ | 1,893,769 | $ | 1,994,717 | $ | 2,158,053 | $ | 1,659,754 | $ | 1,779,985 | |||||||||||

| 2.53%(e) | 2.32% | 1.42% | 1.23% | 1.50% | 2.06% | |||||||||||||||||

| 0.95%(e) | 0.94% | 1.04% | 1.05% | 1.09% | 1.17% | |||||||||||||||||

| 2.37%(e) | 1.98% | 1.60% | 1.70% | 2.00% | 1.93% | |||||||||||||||||

| 29% | 32% | 37% | 20% | 38% | 22% | |||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||

| (f) | ||||||||||||||||||||||

See Accompanying Notes to Financial Statements.

| Semi-Annual Report | April 30, 2024 | 15 |

| Reaves Utility Income Fund | Financial Highlights |

| OPERATING PERFORMANCE: |

| Net asset value — Beginning of Period |

| INCOME FROM INVESTMENT OPERATIONS: |

| Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Net Increase/(Decrease) from Operations Applicable to Common Shareholders |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: |

| Distributions from net investment income |

| Distributions from net realized capital gains |

| Total Distributions Paid to Common Shareholders |

| CAPITAL SHARE TRANSACTIONS: |

| Change due to rights offering(b) |

| Common share offering costs charged to paid-in capital |

| Total Capital Share Transactions |

| Common Share Net Asset Value — End of Period |

| Common Share Market Price — End of Period |

| Total Return, Net Asset Value(d) |

| Total Return, Market Price(d) |

| RATIOS AND SUPPLEMENTAL DATA |

| Net Assets Applicable to Common Shareholders, End of Period (000s) |

| Ratio of operating expenses to average net assets attributable to common shares |

| Ratio of operating expenses excluding interest to average net assets attributable to common shares |

| Ratio of net investment income to average net assets attributable to common shares |

| Portfolio turnover rate |

| BORROWINGS AT END OF PERIOD |

| Aggregate Amount Outstanding (000s) |

| Asset Coverage Per $1,000(f) |

See Accompanying Notes to Financial Statements.

| www.utilityincomefund.com | 16 |

| Reaves Utility Income Fund | Financial Highlights |

| For

the Year Ended October 31, 2018 | For

the Year Ended October 31, 2017 | For

the Year Ended October 31, 2016 | For

the Year Ended October 31, 2015 | For

the Year Ended October 31, 2014 | ||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

| 0.84 | 1.00 | 0.84 | 0.84 | 1.80 | ||||||||||||||

| (0.25 | ) | 3.87 | 3.89 | (1.47 | ) | 4.64 | ||||||||||||

| 0.59 | 4.87 | 4.73 | (0.63 | ) | 6.44 | |||||||||||||

| (0.83 | ) | (1.04 | ) | (0.99 | ) | (0.89 | ) | (1.50 | ) | |||||||||

| (1.16 | ) | (1.80 | ) | (0.83 | ) | (0.90 | ) | (0.14 | ) | |||||||||

| (1.99 | ) | (2.84 | ) | (1.82 | ) | (1.79 | ) | (1.64 | ) | |||||||||

| 0.00 | (c) | (1.42 | ) | (0.67 | ) | – | – | |||||||||||

| – | – | – | – | – | ||||||||||||||

| 0.00 | (c) | (1.42 | ) | (0.67 | ) | – | – | |||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

| 2.39 | % | 11.04 | % | 14.31 | % | (1.78 | %) | 24.24 | % | |||||||||

| 4.63 | % | 12.70 | % | 7.62 | % | 1.91 | % | 26.29 | % | |||||||||

| $ | 1,544,961 | $ | 1,612,865 | $ | 1,116,576 | $ | 878,952 | $ | 949,088 | |||||||||

| 1.90 | % | 1.66 | % | 1.59 | % | 1.62 | % | 1.71 | % | |||||||||

| 1.10 | % | 1.09 | % | 1.14 | % | 1.15 | % | 1.16 | % | |||||||||

| 2.62 | % | 2.97 | % | 2.66 | % | 2.67 | % | 6.10 | % | |||||||||

| 24 | % | 15 | % | 34 | % | 32 | % | 26 | % | |||||||||

| $ | $ | $ | $ | $ | ||||||||||||||

| (f) | ||||||||||||||||||

See Accompanying Notes to Financial Statements.

| Semi-Annual Report | April 30, 2024 | 17 |

| Reaves Utility Income Fund | Financial Highlights |

| (a) | Calculated based on the average number of common shares outstanding during each fiscal period. |

| (b) | Effect of rights offerings for common shares at a price below market price. |

| (c) | Amount represents less than $0.005 per common share. |

| (d) | Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period. Total return based on common share market value assumes the purchase of common shares at the market price on the first day and sale of common shares at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s distribution reinvestment plan. |

| (e) | Annualized. |

| (f) |

See Accompanying Notes to Financial Statements.

| www.utilityincomefund.com | 18 |

| Reaves Utility Income Fund | Notes to Financial Statements |

| April 30, 2024 (Unaudited) |

NOTE 1. SIGNIFICANT ACCOUNTING AND OPERATING POLICIES

Reaves Utility Income Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end management investment company. The Fund was organized under the laws of the state of Delaware by an Agreement and Declaration of Trust dated September 15, 2003. The Fund’s investment objective is to provide a high level of after-tax income and total return consisting primarily of tax-advantaged dividend income and capital appreciation. The Fund is a diversified investment company for purpose of the 1940 Act. The Agreement and Declaration of Trust provides that the Trustees may authorize separate classes of shares of beneficial interest. The Fund’s common shares are listed on the NYSE American LLC (the “Exchange”) and trade under the ticker symbol “UTG”.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements is in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”), which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946.

Investment Valuation: The net asset value per common share (“NAV”) of the Fund is determined no less frequently than daily, on each day that the Exchange is open for trading, as of the close of regular trading on the Exchange (normally 4:00 p.m. New York time). The NAV is determined by dividing the value of the Fund’s total assets less its liabilities by the number of shares outstanding.

The Board of Trustees (the “Board”) has established the following procedures for valuation of the Fund’s asset values under normal market conditions. For domestic equity securities, foreign equity securities and funds that are traded on an exchange, the market price is usually the closing sale or official closing price on that exchange. In the case of a domestic and foreign equity security not traded on an exchange, or if such closing prices are not otherwise available, the mean of the closing bid and ask price will be used. The fair value for debt obligations is generally the evaluated mean price supplied by the Fund’s primary and/or secondary independent third-party pricing service, approved by the Board. An evaluated mean is considered to be a daily fair valuation price which may use a matrix, formula or other objective method that takes into consideration various factors, including, but not limited to: structured product markets, fixed income markets, interest rate movements, new issue information, trading, cash flows, yields, spreads, credit quality and other pertinent information as determined by the pricing services evaluators and methodologists. If the Fund’s primary and/ or secondary independent third-party pricing services are unable to supply a price, or if the price supplied is deemed to be unreliable, the market price may be determined using quotations received from one or more broker-dealers that make a market in the security. Investments in non-exchange traded funds are fair valued at their respective net asset values. Exchange-traded options are valued at the close price.

Pursuant to Rule 2a-5 under the 1940 Act, the Board has designated the Fund’s investment adviser, Reaves Asset Management (“Reaves” or the “Adviser”), as the valuation designee with respect to the fair valuation of the Fund’s portfolio securities, subject to oversight by and periodic reporting to the Board. Fair valued securities are those for which market quotations are not readily available, including circumstances under which the Adviser determines that prices received are not reflective of their market values. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following: the fundamental business data relating to

| Semi-Annual Report | April 30, 2024 | 19 |

| Reaves Utility Income Fund | Notes to Financial Statements |

| April 30, 2024 (Unaudited) |

the issuer, borrower or counterparty; an evaluation of the forces which influence the market in which the investments are purchased and sold; the type, size and cost of the investment; the information as to any transactions in or offers for the investment; the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies; the coupon payments, yield data/cash flow data; the quality, value and saleability of collateral, if any, securing the investment; the business prospects of the issuer, borrower or counterparty, as applicable, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s, borrower’s or counterparty’s management; the prospects for the industry of the issuer, borrower or counterparty, as applicable, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry; one or more non-affiliated independent broker quotes for the sale price of the portfolio security; and other relevant factors.

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 — Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that the Fund has the ability to access at the measurement date;

Level 2 — Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

Level 3 — Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date.

| www.utilityincomefund.com | 20 |

| Reaves Utility Income Fund | Notes to Financial Statements |

| April 30, 2024 (Unaudited) |

The following is a summary of the Fund’s investments in the fair value hierarchy as of April 30, 2024:

| Investments in Securities at Value* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 2,579,409,210 | $ | – | $ | – | $ | 2,579,409,210 | ||||||||

| Limited Partnerships | 49,657,795 | – | – | 49,657,795 | ||||||||||||

| Preferred Stocks | 1,880,121 | – | – | 1,880,121 | ||||||||||||

| Money Market Funds | 44,121,482 | – | – | 44,121,482 | ||||||||||||

| TOTAL | $ | 2,675,068,608 | $ | – | $ | – | $ | 2,675,068,608 | ||||||||

| Other Financial | ||||||||||||||||

| Instruments** | ||||||||||||||||

| Written Options | $ | (28,000 | ) | – | – | (28,000 | ) | |||||||||

| TOTAL | $ | (28,000 | ) | $ | – | $ | – | $ | (28,000 | ) | ||||||

| * | For detailed descriptions and other security classifications, see the accompanying Statement of Investments. |

The Fund may hold assets and/or liabilities in which the fair value approximates the carrying amount for financial statement purposes. As of April 30, 2024, the Fund’s outstanding borrowings of $545,000,000 under its Credit Agreement are categorized as Level 2 within the fair value hierarchy.

Cash and Cash Equivalents: Cash and cash equivalents may include demand deposits and highly liquid investments, typically with original maturities of three months or less. Cash and cash equivalents are carried at cost, which approximates fair value.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment valuations and other assets and liabilities initially expressed in foreign currencies are converted each business day the Exchange is open into U.S. dollars based upon current exchange rates. Prevailing foreign exchange rates may generally be obtained at the close of the Exchange (normally, 4:00 p.m. New York time). The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Distributions to Shareholders: The Fund intends to make a level distribution each month to common shareholders after payment of interest on any outstanding borrowings. The level distribution rate may be modified by the Board from time to time. Any net capital gains earned by the Fund are distributed at least annually. Distributions to shareholders are recorded by the Fund on the ex-dividend date.

Income Taxes: The Fund’s policy is to comply with the provisions of the Code applicable to regulated investment companies and to distribute all of its taxable income and gains to its shareholders. See Note 3.

Security Transactions and Investment Income: Security transactions are accounted for as of trade date. Interest income, which includes amortization of premium and accretion of discount, is accrued as earned. Realized gains and losses from investment transactions are determined using identified cost basis for both financial reporting and income tax purposes. Dividend income is recorded on the ex-dividend date, or as soon as information is available to the Fund. Distributions from real estate investment trusts (“REITs”) are recorded as ordinary income, net realized capital gain or return of capital based on information reported by the REITs and management’s estimates of such amounts

| Semi-Annual Report | April 30, 2024 | 21 |

| Reaves Utility Income Fund | Notes to Financial Statements |

| April 30, 2024 (Unaudited) |

based on historical information. Distributions from Limited Partnerships (“LPs”) are recorded as income and return of capital based on information reported by the LPs and management’s estimates of such amounts based on historical information. These estimates are adjusted when the actual source of distributions is disclosed by the REITs and LPs and actual amounts may differ from the estimated amounts.

Options Writing/Purchasing: The Fund may purchase or write (sell) put and call options. The Fund utilizes options to generate return, facilitate portfolio management and mitigate risks. One of the risks associated with purchasing an option among others, is that the Fund pays a premium whether or not the option is exercised. Additionally, the Fund bears the risk relating to options. The Fund pledges cash or liquid assets as collateral to satisfy the current obligations with respect to written options.

When the Fund writes an option of loss of premium and change in value should the counterparty not perform under the contract. The cost of securities acquired through the exercise of call options is increased by premiums paid. The proceeds from securities sold through the exercise of put options are decreased by the premiums paid. The Fund is obligated to pay interest to the broker for any debit balance of the margin account, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains. The difference between the premium received and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is recorded as a realized gain or loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security or currency in determining whether the Fund has realized a gain or loss. If a put option is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund, as writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option. The Fund engaged in written options during the period ended April 30, 2024.

For the period ended April 30, 2024, the effects of derivative instruments on the Statement of Assets and Liabilities were as follows:

| Risk Exposure | Asset Derivatives Statement of Assets and Liabilities Location | Value | Liability Derivatives Statement of Assets and Liabilities Location | Value | ||||||||

| Equity Contracts (Written Options) | N/A | – | Written options, at value | $ | 28,000 | |||||||

| Total | – | $ | 28,000 | |||||||||

| www.utilityincomefund.com | 22 |

| Reaves Utility Income Fund | Notes to Financial Statements |

| April 30, 2024 (Unaudited) |

For the period ended April 30, 2024, the effects of derivative instruments on the Statement of Operations were as follows:

| Risk Exposure | Statement of Operations Location | Realized Gain/ (Loss) on Derivatives | Change in Unrealized Appreciation/ Depreciation on Derivatives | |||||||

| Equity Contracts (Written Options) | Net realized gain on written options/Net change in unrealized appreciation on written options | $ | 404,267 | $ | 5,973 | |||||

| Total | $ | 404,267 | $ | 5,973 | ||||||

The average monthly notional value of written options contracts was $9,671,656 during the period ended April 30, 2024.

NOTE 2. RISKS

The Fund may have elements of risk, including the risk of loss of equity. There is no assurance that the investment process will consistently lead to successful results. An investment concentrated in sectors and industries may involve greater risk and volatility than a more broadly diversified investment.

Concentration Risk. The Fund invests a significant portion of its total assets in securities of utility companies, which may include companies in the electric, gas, water, and telecommunications sectors, as well as other companies engaged in other infrastructure operations. This may make the Fund particularly susceptible to adverse economic, political or regulatory occurrences affecting those sectors. As concentration of the Fund’s investments in a sector increases, so does the potential for fluctuation in the net asset value of common shares.

Risk of Foreign Securities. The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the inability to repatriate foreign currency, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. issuers.

Market Disruption and Geopolitical Risk. Social, political, economic and other conditions and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics), terrorism, conflicts and social unrest, may occur and could significantly impact issuers, industries, governments and other systems, including the financial markets. The value of the Fund’s investment may decrease as a result of such events, particularly if these events adversely impact the operations and effectiveness of the Adviser or other key service providers.

| Semi-Annual Report | April 30, 2024 | 23 |

| Reaves Utility Income Fund | Notes to Financial Statements |

| April 30, 2024 (Unaudited) |

NOTE 3. INCOME TAXES AND TAX BASIS INFORMATION

The Fund complies with the requirements under Subchapter M of the Code applicable to regulated investment companies and intends to distribute substantially all of its net taxable income and net capital gains, if any, each year. The Fund is not subject to income taxes to the extent such distributions are made.

As of and during the period ended April 30, 2024, the Fund did not have a liability for any unrecognized tax benefits in the accompanying financial statements. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The tax character of the distributions paid by the Fund were as follows:

For the Year Ended October 31, 2023 | ||||

| Distributions Paid From: | ||||

| Ordinary Income | $ | 39,221,471 | ||

| Long-Term Capital Gain | 130,986,820 | |||

| Total | $ | 170,208,291 | ||

As of April 30, 2024, net unrealized appreciation/depreciation of investments based on federal tax cost were as follows:

| Gross appreciation (excess of value over tax cost) | 194,949,128 | |||

| Gross depreciation (excess of tax cost over value) | (236,531,802 | ) | ||

| Net depreciation of foreign currency | (7,776 | ) | ||

| Net unrealized depreciation | $ | (41,590,450 | ) | |

| Cost of investments for income tax purposes | $ | 2,716,651,282 |

NOTE 4. CAPITAL TRANSACTIONS

Common Shares: There are an unlimited number of no par value common shares of beneficial interest authorized.

The Fund has a registration statement on file with the SEC (the “Shelf Registration Statement”), pursuant to which the Fund may offer common shares, from time to time, in one or more offerings, up to a maximum aggregate offering price of $600,000,000 on terms to be determined at the time of the offering.

On September 19, 2022, the Fund entered into a distribution agreement (the “Distribution Agreement”) with Paralel Distributors LLC (“Paralel Distributors”), pursuant to which the Fund

| www.utilityincomefund.com | 24 |

| Reaves Utility Income Fund | Notes to Financial Statements |

| April 30, 2024 (Unaudited) |

may offer and sell up to 8,000,000 of the Fund’s common shares from time to time through Paralel Distributors and a sub-placement agent in transactions deemed to be “at the market” as defined in Rule 415 under the Securities Act of 1933, as amended. The Distribution Agreement was amended on February 6, 2024, which increased the number of common shares that may be offered to 16,065,000.

During the period ended April 30, 2024, 4,260,902 common shares under the Distribution Agreement were sold totaling $110,765,238 in proceeds to the Fund, net of offering costs of $12,328. For the shares sold during the period ended April 30, 2024 pursuant to the Distribution Agreement, commissions totaling $1,118,974 were paid, of which $223,795 was retained by Paralel Distributors with the remainder paid to a sub-placement agent.

Offering costs paid as a result of the Fund’s Shelf Registration Statement but not yet incurred as of April 30, 2024 are approximately $11,522.

Transactions in common shares were as follows:

Period Ended April 30, 2024 | Year Ended October 31, 2023 | |||||||

| Common Shares outstanding - beginning of period | ||||||||

| Common Shares issued from sale of shares | 4,260,902 | 4,937,304 | ||||||

| Common Shares issued as reinvestment of dividends | 168,306 | 288,615 | ||||||

| Common Shares outstanding - end of period | ||||||||

NOTE 5. BORROWINGS

The Fund has entered into a Credit Agreement with State Street Bank and Trust Company. Under the terms of the Credit Agreement, the Fund is allowed to borrow up to $650,000,000 (“Commitment Amount”). Interest is charged at a rate of the one month SOFR (“Secured Overnight Financing Rate”) plus 0.65%. Borrowings under the Credit Agreement are secured by all or a portion of assets of the Fund that are held by the Fund’s custodian in a memo-pledged account (the “pledged collateral”). Under the terms of the Credit Agreement, a commitment fee applies when the amount outstanding is less than 80% of the Commitment Amount. This commitment fee is equal to 0.15% times the Commitment Amount less the amount outstanding under the Credit Agreement and is computed daily and payable quarterly in arrears.

For the period ended April 30, 2024, the average amount borrowed under the Credit Agreement was $537,307,692, at a weighted average rate of 5.99%. As of April 30, 2024, the amount of outstanding borrowings was $545,000,000, the interest rate was 5.97% and the fair value of pledged collateral was $1,090,000,016.

NOTE 6. PORTFOLIO SECURITIES

Purchases and sales of investment securities, other than short-term securities, for the period ended April 30, 2024, aggregated $822,092,933 and $732,667,783, respectively.

| Semi-Annual Report | April 30, 2024 | 25 |

| Reaves Utility Income Fund | Notes to Financial Statements |

April 30, 2024 (Unaudited)

NOTE 7. MANAGEMENT FEES, ADMINISTRATION FEES AND TRANSACTIONS WITH AFFILIATES

Reaves serves as the Fund’s investment adviser pursuant to an Investment Advisory and Management Agreement (the “Advisory Agreement”) with the Fund. As compensation for its services to the Fund, Reaves receives an annual investment advisory fee of 0.575% on assets up to $2.5 billion and 0.525% on assets over $2.5 billion based on the Fund’s average daily total assets, computed daily and payable monthly.

Paralel Technologies LLC (“Paralel”) serves as the Fund’s administrator pursuant to an administration and fund accounting agreement (the “Administration Agreement”) with the Fund. As compensation for its services to the Fund, Paralel receives an annual administration fee based on the Fund’s average daily total assets, computed daily and payable monthly. From its fees, Paralel pays all routine operating expenses incurred by the Fund with the exception of advisory fees; taxes and governmental fees; expenses related to portfolio transactions and management of the portfolio; expenses associated with secondary offerings of shares; trustee fees and expenses; expenses associated with tender offers and other share repurchases; and other extraordinary expenses.

NOTE 8. INDEMNIFICATIONS

In the normal course of business, the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

| www.utilityincomefund.com | 26 |

| Reaves Utility Income Fund | Additional Information |

April 30, 2024 (Unaudited)

DIVIDEND REINVESTMENT PLAN

Unless the registered owner of Common Shares elects to receive cash by contacting SS&C Global Investor & Distribution Solutions, Inc. (“SS&C GIDS”) (the “Plan Administrator”), all dividends declared on Common Shares will be automatically reinvested by the Plan Administrator for shareholders in the Fund’s Dividend Reinvestment Plan (the “Plan”), in additional Common Shares. Shareholders who elect not to participate in the Plan will receive all dividends and other distributions in cash paid by check mailed directly to the shareholder of record (or, if the Common Shares are held in street or other nominee name, then to such nominee) by the Plan Administrator as dividend disbursing agent. You may elect not to participate in the Plan and to receive all dividends in cash by contacting the Plan Administrator, as dividend disbursing agent, at the address set forth below. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the dividend record date; otherwise, such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Some brokers may automatically elect to receive cash on your behalf and may re-invest that cash in additional Common Shares for you. If you wish for all dividends declared on your Common Shares to be automatically reinvested pursuant to the Plan, please contact your broker.

The Plan Administrator will open an account for each Common Shareholder under the Plan in the same name in which such Common Shareholder’s Common Shares are registered. Whenever the Fund declares a dividend or other distribution (together, a “Dividend”) payable in cash, nonparticipants in the Plan will receive cash and participants in the Plan will receive the equivalent in Common Shares. The Common Shares will be acquired by the Plan Administrator for the participants’ accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized Common Shares from the Fund (“Newly Issued Common Shares”) or (ii) by purchase of outstanding Common Shares on the open market (“Open- Market Purchases”) on the NYSE American LLC or elsewhere. If, on the payment date for any Dividend, the closing market price plus estimated brokerage commissions per Common Share is equal to or greater than the net asset value per Common Share, the Plan Administrator will invest the Dividend amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant’s account will be determined by dividing the dollar amount of the Dividend by the net asset value per Common Share on the payment date; provided that, if the net asset value is less than or equal to 95% of the closing market value on the payment date, the dollar amount of the Dividend will be divided by 95% of the closing market price per Common Share on the payment date. If, on the payment date for any Dividend, the net asset value per Common Share is greater than the closing market value plus estimated brokerage commissions, the Plan Administrator will invest the Dividend amount in Common Shares acquired on behalf of the participants in Open-Market Purchases. In the event of a market discount on the payment date for any Dividend, the Plan Administrator will have until the last business day before the next date on which the Common Shares trade on an “ex-dividend” basis or 30 days after the payment date for such Dividend, whichever is sooner (the “Last Purchase Date”), to invest the Dividend amount in Common Shares acquired in Open-Market Purchases. It is contemplated that the Fund will pay monthly income Dividends. Therefore, the period during which Open-Market Purchases can be made will exist only from the payment date of each Dividend through the date before the next “ex-dividend” date which typically will be approximately ten days. If, before the Plan Administrator has completed its Open-Market Purchases, the market price per Common Share exceeds the net asset value per Common Share, the average per Common Share purchase price paid by the Plan Administrator may exceed the net asset value of the Common Shares, resulting in the acquisition of fewer Common Shares than if the Dividend had been paid in Newly Issued Common Shares on the Dividend payment date. Because of the foregoing difficulty with respect to Open- Market Purchases, the Plan provides that if the Plan

| Semi-Annual Report | April 30, 2024 | 27 |

| Reaves Utility Income Fund | Additional Information |

April 30, 2024 (Unaudited)

Administrator is unable to invest the full Dividend amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Dividend amount in Newly Issued Common Shares at the net asset value per Common Share at the close of business on the Last Purchase Date, provided that, if the net asset value is less than or equal to 95% of the then current market price per Common Share, the dollar amount of the Dividend will be divided by 95% of the market price on the payment date.

The Plan Administrator maintains all shareholders’ accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common Shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan. The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instructions of the participants.

In the case of Common Shareholders such as banks, brokers or nominees which hold shares for others who are the beneficial owners, the Plan Administrator will administer the Plan on the basis of the number of Common Shares certified from time to time by the record shareholder’s name and held for the account of beneficial owners who participate in the Plan.

There will be no brokerage charges with respect to Common Shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commissions incurred in connection with Open-Market Purchases. The automatic reinvestment of Dividends will not relieve participants of any federal, state or local income tax that may be payable (or required to be withheld) on such Dividends. Participants that request a sale of Common Shares through the Plan Administrator are subject to brokerage commissions.

The Fund reserves the right to amend or terminate the Plan. There is no direct service charge to participants with regard to purchases in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator, SS&C Global Investor & Distribution Solutions, Inc., 430 W 7th Street Kansas City, MO 64105.

APPROVAL OF INVESTMENT ADVISORY AGREEMENT

At the March 7, 2024 meeting (the “Meeting”) of the Board of Trustees (the “Board” or the “Trustees”) of Reaves Utility Income Fund (the “Fund”), the Board, including those Trustees who are not “interested persons” of the Fund, as that term is defined in the 1940 Act (the “Independent Trustees”), approved the renewal of the investment advisory agreement between W.H. Reaves & Co. Inc. (the “Adviser” or “Reaves”) and the Fund (the “Advisory Agreement”), upon the terms and conditions set forth therein, for an additional one-year term.

At the Meeting and throughout the process of considering the renewal of the Advisory Agreement, the Board, including a majority of the Independent Trustees, was advised by its independent legal counsel.

In approving the continuation of the Advisory Agreement, the Board considered such information as the Board deemed reasonably necessary to evaluate the terms of the Advisory Agreement. In its deliberations, the Board did not identify any single factor as being determinative. Rather, the Board’s approvals were based on each Trustee’s business judgment after consideration of the information

| www.utilityincomefund.com | 28 |

| Reaves Utility Income Fund | Additional Information |

April 30, 2024 (Unaudited)

provided as a whole. Individual Trustees may have weighed certain factors differently and assigned varying degrees of materiality to information considered by the Board.

Although not meant to be all-inclusive, the following discussion summarizes the factors considered and conclusions reached by the Trustees in determining to approve the renewal of the Advisory Agreement.

Nature, extent, and quality of services. The Trustees evaluated the nature, extent, and quality of the services that the Adviser provided to the Fund. In assessing the quality of the Adviser’s services. The Trustees also assessed the Fund’s investment performance and evaluated the effectiveness of the Adviser’s compliance program. The Trustees examined the qualifications, experience, and capability of the Adviser’s management team and other personnel. The Board recognized the Adviser’s investment personnel’s deep understanding of the utilities industry and its underlying sectors. The Trustees also took into account information from the Adviser regarding its overall financial strength and the resources that it had available to serve the Fund. Based on the foregoing, the Trustees determined that they were satisfied with the nature, extent, and quality of the services that the Adviser provided to the Fund.

Performance of the Fund and the Adviser. The Trustees reviewed the Fund’s investment performance over time and compared that performance to other funds in its peer group. In making its comparisons, the Trustees utilized a report from an independent provider of investment company data (the “Data Provider”). As reported by the Data Provider, when compared to the Fund’s peer group, the Fund’s net total return (annualized) reflected below the peer group median’s short-term returns, while its longer-term performance outpaced the peer group’s median return. The Board considered the Adviser’s management of the Fund’s distribution plan, noting the steady, sustainable growth of the distribution over the Fund’s history, acknowledging the importance of this fact to the Fund and many of its shareholders.

Costs of Services of the Adviser. The Trustees considered the reasonableness of the compensation paid to the Adviser. To assist with this analysis, the Trustees engaged the Data Provider to provide a report that compares the Fund’s management fee and other costs to the comparable costs of other similar peer funds chosen by the Data Provider. The Trustees reviewed, among other things, information provided by the Data Provider comparing the Fund’s contractual management fee rate (at common asset levels) and actual management fee rate (reflecting fee waivers, if any) as a percentage of total assets and as a percentage of assets attributable to common shares to other funds in the Data Provider’s expense peer group. Based on the data provided on management fee rates, the Trustees noted that the Fund’s contractual management fee rate was lower than the median of the Data Provider peer group, while the actual management fee was slightly above.

The Trustees also received comparative information from the Adviser with respect to its standard fees charged for investment advisory clients other than the Fund. The Trustees noted that the services provided by the Adviser to the Fund differed from the services provided to its other accounts. Furthermore, the Trustees considered, based on the Adviser’s representation, that many of the Adviser’s other clients required different not be considered “like accounts” of the Fund because these accounts are not of similar size and do not have the same investment objectives as, or possess other characteristics similar to, the Fund.

Profitability and Economies of Scale. The Adviser also furnished the Trustees with copies of its financial statements and other information regarding its expenses in providing services to the Fund in order to assist the Board in considering the profits realized by the Adviser from its relationship with the Fund, as well as whether economies of scale had been reached. In reviewing those financial statements and other materials presented, the Trustees examined the profitability of the Adviser,

| Semi-Annual Report | April 30, 2024 | 29 |

| Reaves Utility Income Fund | Additional Information |

April 30, 2024 (Unaudited)

agreeing that its profitability was not unreasonable in consideration of the services provided. The Trustees acknowledged that there were no fee breakpoints in the Advisory Agreement, noting that any increases in the Fund’s assets are primarily attributable to market appreciation, dividend reinvestments, rights offerings, and the at-the-market program. In consideration of these factors, the Board agreed that such fee arrangement remained appropriate.

Indirect benefits. The Trustees considered indirect benefits to the Adviser from its relationship to the Fund, including increased visibility among its institutional asset manager peer group and “sell side” research obtained from broker-dealers that execute trades for the Fund.

Conclusion. Based upon its evaluation of all material factors, including the foregoing, and assisted by the advice of independent legal counsel, the Trustees concluded that the level of fees paid to the Adviser was fair and reasonable in light of the usual and customary charges for such services, and that the continued retention of the Adviser as investment adviser to the Fund through the renewal of the Advisory Agreement was in the best interests of the Fund and its shareholders.

FUND PROXY VOTING POLICIES & PROCEDURES

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling toll-free 1-800-644-5571, or on the Fund’s website at https://www.utilityincomefund.com. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30 is also available without charge upon request by calling toll-free 1-800-644-5571, or on the SEC’s website at https://www.sec.gov.

PORTFOLIO HOLDINGS

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-PORT. Copies of the Fund’s Forms N-PORT are available on the Commission’s website at https://www.sec.gov. Quarterly Holdings statements as of the first and third quarter of each fiscal year, and information on the Fund’s Forms N-PORT, are available on the Fund’s website at https://www.utilityincomefund.com, and are available without a charge, upon request, by contacting the Fund at 1-800-644-5571.

SECTION 19(A) NOTICES

The following table sets forth the estimated amount of the sources of distribution for purposes of Section 19 of the Investment Company Act of 1940, as amended, and the related rules adopted there under. The Fund estimates the following percentages, of the total distribution amount per share, attributable to (i) current and prior fiscal year net investment income, (ii) net realized short-term capital gain, (iii) net realized long-term capital gain and (iv) return of capital or other capital source as a percentage of the total distribution amount. These percentages are disclosed for the fiscal year-to-date cumulative distribution amount per share for the Fund.

The amounts and sources of distributions reported in these 19(a) notices are only estimates and not for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. Shareholders will receive a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

| www.utilityincomefund.com | 30 |

| Reaves Utility Income Fund | Additional Information |

April 30, 2024 (Unaudited)

Total Cumulative Distributions for the period ended April 30, 2024 |

% Breakdown of the Total Cumulative Distributions for the period ended April 30, 2024 | ||||||

Net Investment |

Net Realized Gains |

Return of Capital |

Total Per Common Share |

Income |

Net Capital |

Return

of Capital |

Total Per Common Share |

| $0.27801 | $0.81683 | $0.04516 | $1.14000 | 24.39% | 71.65% | 3.96% | 100.00% |

The Fund’s distribution policy is to distribute all or a portion of its net investment income to its shareholders on a monthly basis. In order to provide shareholders with a more stable level of distributions, the Fund may at times pay out less than the entire amount of net investment income earned in any particular month and may at times in any particular month pay out such accumulated but undistributed income in addition to net investment income earned in that month. As a result, the distributions paid by the Fund for any particular month may be more or less than the amount of net investment income earned by the Fund during such month. The Fund’s current accumulated but undistributed net investment income, if any, is disclosed in the Statement of Assets and Liabilities, which comprises part of the financial information included in this report.

You should not draw any conclusions about the Fund’s investment performance from the amount of the distributions or from the terms of the Fund’s plan to support a level distribution.

ANNUAL MEETING OF SHAREHOLDERS

On April 2, 2024, the Annual Meeting of Shareholders of the Fund was held to elect one Trustee. On January 30, 2024, the record date for the meeting, the Fund had 79,037,478 outstanding common shares. The votes cast at the meeting were as follows:

Proposal 1 – Proposal to elect one Trustee:

Election of E. Wayne Nordberg as Trustee of the Fund:

| # of Votes Cast | % of Votes Cast | |

| For | 54,421,304 | 95.81% |

| Against/Withhold | 2,377,667 | 4.19% |

| TOTAL | 56,798,971 | 100.00% |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM