Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

Form 10-K

|

| |

(Mark One) |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended June 30, 2016 |

or |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission file number 000-51539

_________________________________

Cimpress N.V.

(Exact Name of Registrant as Specified in Its Charter)

_________________________________

|

| | |

The Netherlands | | 98-0417483 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

Hudsonweg 8

5928 LW Venlo

The Netherlands

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: 31-77-850-7700

Securities Registered Pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Exchange on Which Registered |

Ordinary Shares, €0.01 par value | | NASDAQ Global Select Market |

_________________________________

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Exchange Act Rule 12b-2).

|

| | | | |

Large accelerated filer þ | | Accelerated filer o | | Non-accelerated filer o |

| | Smaller reporting company o | | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No þ

The aggregate market value of the ordinary shares held by non-affiliates of the registrant was approximately $2.38 billion on December 31, 2015 (the last business day of the registrant’s most recently completed second fiscal quarter) based on the last reported sale price of the registrant’s ordinary shares on the NASDAQ Global Select Market.

As of August 5, 2016, there were 31,593,022 of Cimpress N.V. ordinary shares, par value €0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The registrant intends to file a definitive proxy statement pursuant to Regulation 14A within 120 days of the end of the fiscal year ended June 30, 2016. Portions of such proxy statement are incorporated by reference into Items 10, 11, 12, 13, and 14 of Part III of this Annual Report on Form 10-K

CIMPRESS N.V.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended June 30, 2016

TABLE OF CONTENTS

|

| | |

| | Page |

PART I | | |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

| | |

PART II | | |

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issued Purchases of Equity Securities | |

Item 6. | Selected Financial Data | |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements With Accountants and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

| | |

PART III | | |

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

| | |

PART IV | | |

Item 15. | Exhibits and Financial Statement Schedules | |

Signatures | | |

PART I

Item 1. Business

Overview

We are a technology driven company that aggregates, via the Internet, large volumes of small, individually customized orders for a broad spectrum of print, signage, apparel and similar products. We fulfill those orders with manufacturing capabilities that include Cimpress owned and operated manufacturing facilities and a network of third-party fulfillers to create customized products for customers on-demand. We bring our products to market through a portfolio of focused brands serving the needs of micro, small and medium sized businesses, resellers and consumers. These brands include Vistaprint, our global brand for micro business marketing products and services, as well as brands that we have acquired that serve the needs of various market segments, including resellers, small and medium businesses with differentiated service needs, and consumers purchasing products for themselves and their families.

Our Priorities

We manage our business according to two uppermost objectives:

| |

1. | Strategic: To be the world leader in mass customization. |

| |

2. | Financial: To maximize intrinsic value per share, defined as (a) the unlevered free cash flow per share that, in our best judgment, will occur between now and the long-term future, appropriately discounted to reflect our cost of capital, minus (b) net debt per share. |

World Leader in Mass Customization

Cimpress’ strategic objective is to defend and extend our position as the world leader in mass customization. Mass customization is a business model that allows companies to deliver major improvements to customer value across a wide variety of printed product categories. Companies that master mass customization are able to produce, with the reliability, quality and affordability of mass production, small individual orders where each one embodies the personal relevance inherent to customized products.

|

| | |

| | The chart illustrates this concept. The horizontal axis represents the volume of production of a given product; the vertical axis represents the cost of producing one unit of that product. Traditionally, the only way to manufacture at a low unit cost was to produce a large volume of that product: mass-produced products fall in the lower right hand corner of the chart. Custom-made products (i.e., those produced in small volumes for a very specific purpose) historically incurred very high unit costs: they fall in the upper left hand side of the chart. Mass customization breaks this trade off, enabling low volume, low cost production of individually unique products. Very importantly, relative to traditional alternatives mass customization creates value in many ways, not just lower cost. Other advantages can include faster production, greater personal relevance, elimination of obsolete stock, better design, flexible shipping options, more product choice, and higher quality.

|

Mass customization delivers a breakthrough in customer value particularly in markets in which the worth of a physical product is inherently tied to a specific, unique use or application. For instance, there is limited value to a marketing brochure that is the same brochure as is used by many other companies: the business owner needs to describe what is unique about his or her endeavor. Likewise, a photo mug is more personally relevant if it shows pictures of someone’s own friends and family. Before mass customization, producing a high quality custom product

required high per-order setup costs, so it simply was not economical to produce a customized product in low quantities.

Cimpress’ focus on mass customization lies at the intersection of three overlapping areas:

| |

• | Empowering People to Make an Impression (what we are passionate about) - Cimpress empowers people to make an impression through individually meaningful physical products. In other words, we make it easy and affordable for our customers to convey, in tangible and enduring media, the thoughts, design aesthetics, messages and/or sentiments that are important to them, their customers, their organization or their loved ones. |

| |

• | Computer Integrated Manufacturing (where we can be the best in the world) - Low-volume custom products traditionally have a very high per-unit cost because of significant fixed costs related to conveying and using information that is required to process each order. Throughout our history, a differentiating capability of Cimpress has been our ability to develop systems to integrate every step of the value chain, from design creation to delivery. This greatly reduces the marginal cost of processing information related to each individual, customized order. We use computer integrated manufacturing, which harnesses the power of software and IT networks to automate the flow of information, allowing individual processes to exchange information with each other, to schedule activities, to initiate actions, and to route and control a broad range of activities related to the specification and production of physical goods. |

| |

• | Large Scale in Small Quantities (what drives our economic engine) - By large scale we mean a large volume of orders; by small quantities we mean small individual orders. Large scale is an important driver of our competitive advantage because increasingly larger volumes of orders allow us to sort and then produce those orders in increasingly focused processes. This allows us to generate economic value by capturing a portion of the per-unit cost difference that exists between relatively high-volume, specialized processes and low volume (job shop) processes. When we have increased the volume of orders that we process and produce we have seen material improvements in quality, product selection, speed and cost. In fiscal 2016, we processed over 46 million uniquely customized items. |

Our Corporate Strategy

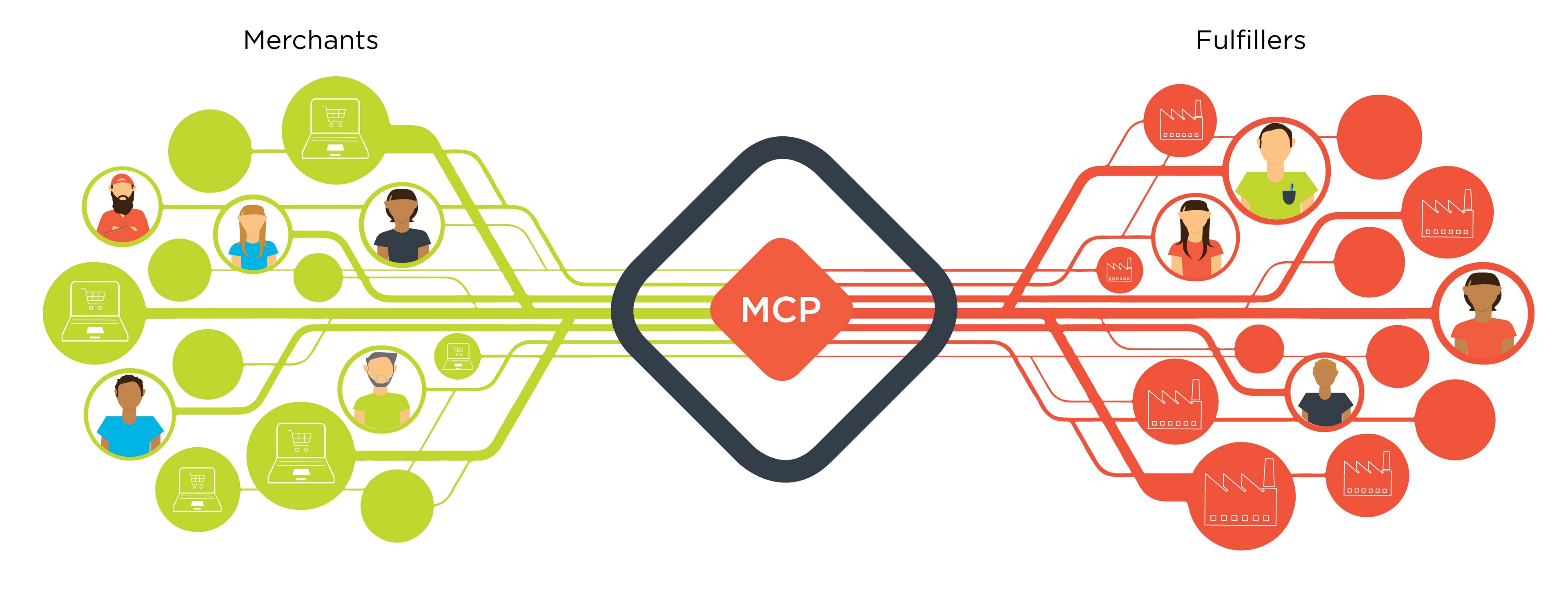

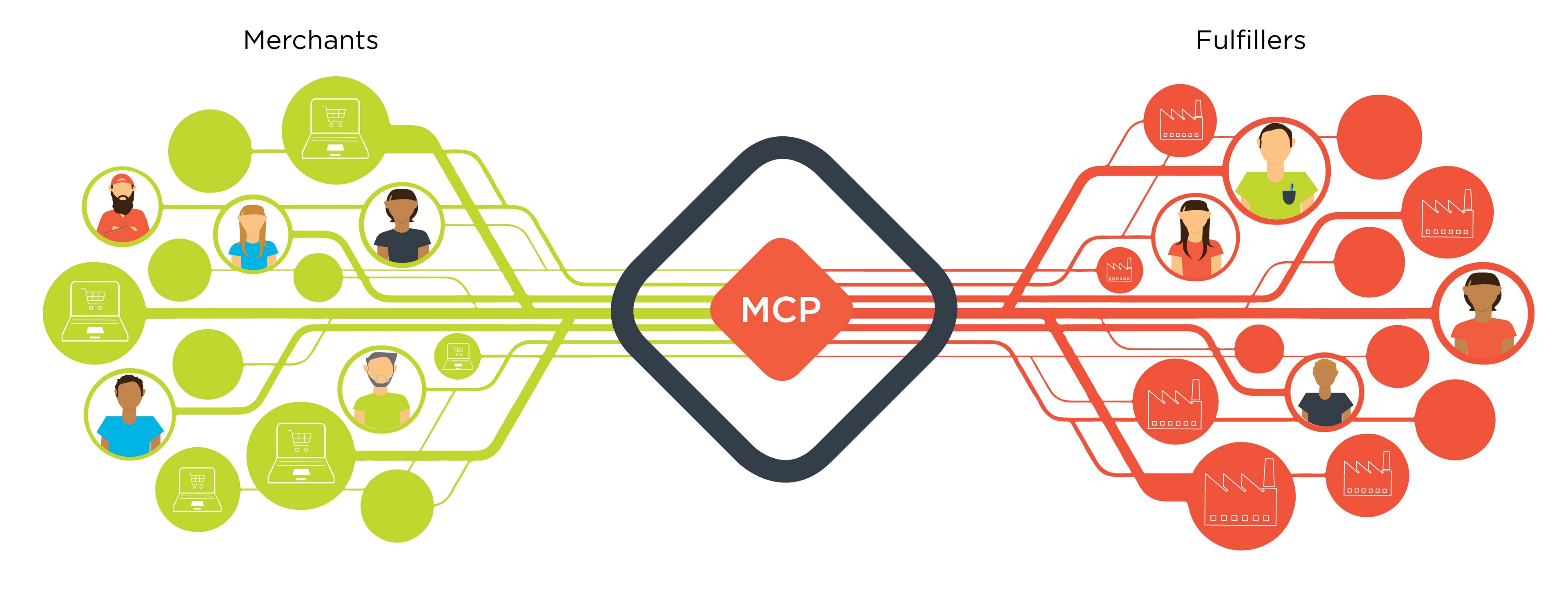

A key corporate strategy is to build a mass customization platform (MCP) and a related ecosystem of owned and third party merchants and fulfillers. We are designing the Cimpress platform to consist of a robust collection of software micro services that enables mass customization that provides:

| |

• | Merchants with tools and services such as pre-press document processing and production capabilities. |

| |

• | Fulfillers with tools and opportunities to expand their business. |

By “merchants” we mean organizations that sell mass customized products to customers, including both our Cimpress-owned business units and third parties. By “fulfillers” we mean organizations that produce mass-customized products; these include both our own production facilities and those of third parties.

As of July 2016, the Cimpress MCP is currently still under development and functioning only in small initial increments. However, we anticipate that, in the future when the MCP is more established, we can create significant value via the platform. As more fulfillers join the platform, merchants would be able to get access to more products, more delivery options, more finishing options and lower cost. As new merchants join, fulfillers would be able to gain access to markets and production volume that would have otherwise been inaccessible to them. Both fulfillers and merchants would get access to a robust set of software services that they can assemble into solutions according to their needs. We are designing the mass customization platform to sort individual orders from many different merchants into homogeneous streams of production workflow that are routed to specialized production lines.

Market and Industry Background

Mass Customization Opportunity

|

| | |

Product: | Geography: | Customer: |

- Small format | - North America | - Businesses (micro, small, |

- Large format | - Europe | medium, large) |

- Promotional products, | - Australia/New Zealand | - Graphic designers, resellers, |

apparel and gifts | - Other | and print providers |

- Packaging | | - Teams, associations and |

- Photo products, invitations | | groups |

and announcements | | - Consumers (home and family) |

Large traditional markets undergoing disruptive innovation

We believe that our mass customization business model can deliver great customer value across a diverse set of product applications, including marketing materials such as business cards, brochures, catalogs and flyers; signage and displays; promotional products; decorated apparel and bags; fabrics and textiles; keepsakes and gifts, packaging, photo products, invitations and announcements. Many different customers appreciate access to affordable, high quality, customized products in these categories, including businesses of all sizes, teams, associations and groups, consumers, and resellers and designers who serve customers in these groups.

The product categories and customers listed above constitute a large market opportunity that is highly fragmented. We believe that a vast majority of the markets to which mass customization could apply is still served by traditional business models that force customers either to produce in large quantities per order or to pay a high price per unit.

We believe that these large and fragmented markets are moving away from small traditional suppliers that employ job shop business models to fulfill a relatively small number of customer orders and toward companies such as Cimpress that aggregate a relatively large number of orders and fulfill them via focused supply chain and production capabilities at relatively high volumes, thereby achieving the benefits of mass customization. We believe we are early in the process of what will be a multi-decade shift from job shop to mass customization.

Cimpress' current revenue represents a very small fraction of this market opportunity. Even though we believe Cimpress is the largest single player in this market, there are many other companies who are pursuing mass customization and/or business models that incorporate many of the tenets of mass customization. These non-traditional suppliers include both large firms and hundreds of focused smaller firms. We believe that Cimpress and other competitors who have built their business around a mass customization model are “disruptive innovators” to these large markets because we enable small volume production of personalized high quality products at an affordable price. Disruptive innovation, a term of art coined by Harvard Business School professor Clayton Christensen, describes a process by which a product or service takes root initially in simple applications at the bottom of a market (such as free business cards for the most price sensitive of micro-businesses) and then moves up market, eventually displacing established competitors (such as the markets mentioned above).

We believe this opportunity to deliver substantially better customer value and to therefore disrupt very large traditional industries can translate into tremendous future opportunity for Cimpress if we execute well and constantly improve our business model over a long period of time. Until recently, we focused primarily on a narrow set of customers within the list above (micro businesses and consumers) with a very limited product offering. With acquisitions and via internal investments over the last several years, we have extended our ability to serve our

traditional customers and have also gained a capability to serve larger businesses as well as resellers who, in turn, serve many different types of customers.

As we continue to evolve as a business, our understanding of these markets and their relative attractiveness will also evolve. Our expansion into the “upload and print” space via acquisition, promotional products, apparel, packaging and gifts, as well as new geographic markets has significantly increased the size of our addressable market opportunity. We base our market size and inherent profitability estimates upon considerable research and analysis; however we consider our estimates to be only approximate. Despite the imprecise nature of our estimates, we are confident that our understanding is directionally correct and that we operate in an enormous aggregate market with significant opportunity for Cimpress to grow should we be successful in delivering a differentiated and attractive value proposition to customers.

Today, we believe that the global revenue opportunity for low-to-medium order quantities (i.e. still within our focus of small-sized individual orders) in the four product categories below is over $100 billion annually in North America and Europe. The addition of other geographies and the consumer products space adds at least 50% to this number:

| |

• | Small format marketing materials such as business cards, flyers, leaflets, inserts, brochures and magazines. Businesses of all sizes are the main end users of short-and-medium run lengths (per order quantities below 2,500 units for business cards and below 20,000 units for other materials). |

| |

• | Large format products such as banners, signs, tradeshow displays, and point-of-sale displays. Businesses of all sizes are the main end users of short-and-medium run lengths (less than 1,000 units). |

| |

• | Promotional products, apparel and gifts including decorated apparel, bags and textiles, and hard goods such as pens, USB sticks, and drinkware. The end users of short-and-medium runs of these products range from businesses to teams, associations and groups, as well as consumers. |

| |

• | Packaging products, such as corrugated board packaging, folded cartons, bags and labels. Businesses are the primary end users for short-and-medium runs (below 10,000 units). |

Our Business

Today’s Cimpress includes 12 previously independent companies which we have acquired plus Vistaprint, which we grew organically. Prior to their acquisitions, each of our acquired entities pursued business models which embodied the principles of mass customization. In other words, each provided a standardized set of products that could be configured and customized by customers, ordered in relatively low volumes, and would produce via relatively standardized, homogeneous production processes either internally and/or at sub-contractors.

At the largest of our constituent brands, which include Vistaprint, Pixartprinting, Albumprinter, WIRmachenDRUCK and Exaprint, our business is driven by sophisticated, standardized processes and software. These technologies are designed to readily scale as the number of orders received per day increases. In particular, the more individual jobs we receive in a given time period, the more efficiently we can sort and route jobs with homogeneous production processes to given nodes of our production systems or of our third party supply chain. This sortation and subsequent process automation improves production efficiency. We believe that our strategy of systematizing our service and production systems enables us to deliver value to customers much more effectively than traditional competitors.

We operate internal production facilities in Canada, the Netherlands, Australia, Austria, France, Italy, the UK, Japan, India, Brazil and China. Importantly, we also work with a network of several hundred external fulfillers located across the globe. We believe that the improvements we have made and the future improvements we intend to make in software technologies that support the design, sortation, scheduling, production and delivery processes provide us with significant competitive advantage. In many cases we can produce and ship an order the same day we receive it. Our systems and processes seek to drive reduced inventory and working capital requirements as well as faster delivery to customers. In certain of our company-owned manufacturing facilities, software schedules the near-simultaneous production of customized products that have been ordered by the same customer, allowing us to produce and deliver multi-part orders quickly and efficiently.

We believe that the standard business cards sold by our Vistaprint business unit provide a concrete example of the potential of our mass customization business model to deliver significant customer value and to develop strong

profit franchises in large markets that were previously low growth and commoditized. The current Cimpress operations for a typical order of 250 business cards in Europe and North America require less than 14 seconds of human labor for all of pre-press, printing, cutting and packaging, versus an hour or more for traditional printers. Combined with advantages of scale in purchasing of materials, our self-service ordering, pre-press automation, auto-scheduling and automated manufacturing processes enable us to produce standard business cards at a fraction of the cost of typical traditional printers with very consistent quality and delivery reliability. Achieving this type of efficiency took us more than a decade and required massive volume, significant engineering investments and significant capital. Standard Vistaprint business cards (which account for approximately 29% of the Vistaprint business unit total bookings for fiscal 2016) represent a mature, highly refined, and highly profitable example of the power of mass customization. Even though we do not expect many other products to reach this extreme level of automation, we do currently produce multiple other product categories (such as flyers, brochures, signage, mugs, calendars, t-shirts, hats, embroidered soft goods, rubber stamps, photobooks, labels and holiday cards) via analogous methods whose volume and processes are well along the spectrum of mass customization relative to traditional suppliers and thus provide great customer value and a strong, profitable and growing revenue stream.

We believe that the potential for scale-based advantages are not limited to large, automated production lines. Other advantages include the ability to systematically and automatically sort through large volumes of diverse orders for the “long tail” (i.e. those formats and process requirements that are relatively uncommon), to group these diverse orders into more homogeneous categories, and to route them to production nodes that are specialized for that category of operations and/or which are geographically proximate to the customer. In such cases, even though the daily production volume of a given production node is small in comparison to our highest volume production lines, the homogeneity and volume we are able to achieve is nonetheless significant relative to traditional suppliers of the long tail product in question; thus our relative efficiency gains remain substantial. For this type of long tail production, we rely heavily on third-party fulfillment partnerships, which allow us to offer a very diverse set of products. We acquired most of our capabilities in this area via our investments in Exaprint, Printdeal, Pixartprinting and WIRmachenDRUCK. For instance, the product assortment of each these four brands are measured in the tens of thousands, versus just a few hundred at Vistaprint traditionally. This deep and broad product offering is important to many customers.

Our products

Customers visiting our websites can select the type of product they wish to design from our broad range of available products and services for the business, reseller and home and family markets. The combined product assortment across our brands is extensive, including offerings in the following product categories: business cards, marketing materials such as flyers and postcards, digital and marketing services, signage, decorated apparel, promotional products and gifts, packaging, textiles and magazines and catalogs.

Supply chain management

We are focused on achieving the lowest total cost in our strategic sourcing efforts by concentrating on quality, logistics, technology and cost, while also striving to use responsible sourcing practices within our supply chain. Our efforts include the procurement of high quality materials and equipment that meet our strict specifications at a low total cost across a growing number of manufacturing locations, with an increasing focus on supplier compliance with our sustainable paper procurement policy as well as our Supplier Code of Conduct. Additionally, we work to develop and implement logistics, warehousing, and outbound shipping strategies to provide a balance of low-cost material availability while limiting our inventory exposure. We believe investing in a strategic supply chain management capability that is tightly integrated with our other manufacturing teams helps us benefit from our large scale, improve efficiency and reduce costs, and increase the sustainability of our business.

As part of our corporate social responsibility program, we regularly evaluate ways to minimize the impact of our operations on the environment. Past efforts have substantially reduced the energy consumption of our operations. In fiscal 2017, we will be initiating a program to convert a substantial portion of the paper we use in our Cimpress owned production facilities to FSC (Forest Stewardship Council) certified paper. FSC is an international non-profit organization committed to promoting the practice of sustainable forestry worldwide. FSC certification confirms that the paper comes from responsibly managed forests that meet FSC’s environmental and social standards.

Our Proprietary Technology

We rely on our advanced proprietary technology to market to, attract and retain our customers, to enable customers to create graphic designs and place orders on our websites, and to aggregate and produce multiple orders from all over the world. We separate our software teams into teams that focus on customer-facing brands (merchant technologies) and teams that focus on manufacturing, supply chain and logistics technologies (fulfiller technologies).

Merchant Technologies

Each of our customer-facing brands sells via an e-commerce model and uses a mix of proprietary and third-party software to support the marketing and sale of its offerings. Since our upload and print businesses require the upload of press-ready files from their customers, there is less proprietary technology for upload and print merchants than there is for our Vistaprint and Albumprinter business units, which target a broader base of smaller customers and offer those customers the ability to create or modify designs within their web browser via functionality that is intuitive to customers who are not skilled in more sophisticated graphic design software.

Our proprietary merchant technology includes:

| |

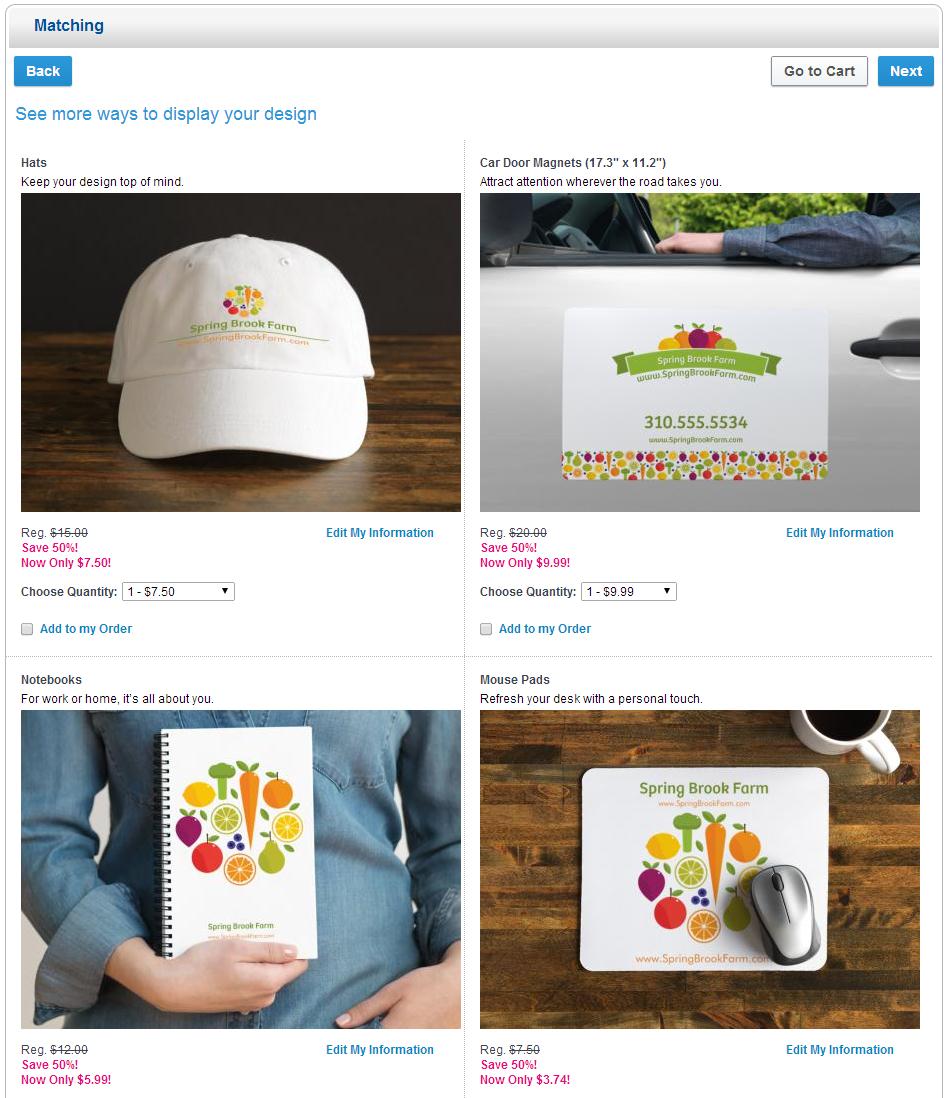

• | Design and Document Creation Technologies - Our design creation technologies, primarily deployed through our Albumprinter business unit and our Vistaprint-branded websites, enable customers, by themselves or together with the assistance of our design support staff, to design and create high quality customized products in a "do it yourself" (DIY) manner. We also have proprietary technologies to help customers see their designs in on-screen simulations of real-world settings in real time in order to gain an appreciation for what the finished product will look like, as well as software that algorithmically generates customized product designs in real time based on key-word searches, enabling professional-looking graphic layouts to be easily and quickly created by customers without the need for graphic arts training. |

| |

• | Cross-Selling and Content Management Technologies - On our Vistaprint-branded websites, we combine the aforementioned proprietary document creation technologies with proprietary cross-selling technologies to automatically generate and display additional products incorporating the customer’s initial design, facilitating the cross-sale of related products and services. In addition, through a global content management system, we ensure that changes and updates to our site experience are reflected across our network of localized Vistaprint websites in multiple languages and currencies. Our Vistaprint software automatically generates and displays one or more additional customized product designs based upon a customer’s existing design. |

Fulfiller Technologies

Across our company, our pre-production and production technologies efficiently process and aggregate customer orders, prepare orders for high-quality production and manage production, addressing and shipment of these orders. These technologies allow us to efficiently store, process and aggregate tens of thousands of orders every day. Automated workflows help lower production cost while ensuring quality conformance and on-time delivery to our customers.

Technology Development

We intend to continue developing and enhancing our merchant and fulfiller technologies and our manufacturing processes. We have designed our website technologies and infrastructure to accommodate future geographic expansion and growth in the number of customer visits, orders, and product and service offerings. This architecture makes our applications highly scalable and offers our customers fast system responsiveness. In addition, our production technologies for aggregating jobs in preparation for manufacturing are designed to readily scale as we grow. We have engineering and research and development centers in Winterthur, Switzerland and Quarto d'Altino, Italy that are constantly seeking to strengthen our manufacturing and supply chain capabilities through engineering disciplines such as automation, manufacturing, choice of equipment, product manufacturability, materials science, process control and color control. We also have software engineering teams located around the world. Our technology and development expenses were approximately $221 million (12% of total revenues), $194 million (13% of total revenues) and $176 million (14% of total revenues) in the fiscal years ended June 30, 2016, 2015, and 2014, respectively.

Our Brands

We have adopted a multi-brand approach, which we believe will help us effectively develop value propositions that resonate strongly with very different parts of our large and heterogeneous addressable market for mass customization. As such, we have structured our organization to provide significant autonomy and decentralization for the individual business units who manage our brands. We believe that this autonomy allows for greater customer responsiveness, increased focus, and more innovation than if we were to manage our customer value proposition centrally.

We have many localized websites serving countries in North America, Europe, Asia Pacific and South America. Our websites offer a broad assortment of tools and features allowing customers to create a product design or upload their own complete design, and place an order on a completely self-service basis or with varying levels of assistance. There are many types of customer needs that can be addressed differentially. Some examples of where we expect differential approaches by our various business units and brands are customer targets, advertising levels and methods, website user experience, nationally or regionally-specific content or product formats, product breadth and depth, merchandising, creation methods for graphic designs, price, quantity focus, quality attributes, delivery speed and service.

|

| | |

Brands that target micro businesses Our Vistaprint brand helps micro businesses create beautiful, professional quality marketing products at affordable prices and at low volumes. Today, micro businesses make up a large part of our customers. To help our customers market in the digital world, the teams at our Pagemodo and Webs brands develop intuitive DIY solutions that are brought to market via their own brands as well as via the Vistaprint brand.

| | |

|

| | |

Brands that target graphic professionals Businesses regularly turn to trusted graphic professionals (either internal to their firm or at third parties) for advice and design services in order to create great looking, customized products like magazines, brochures, flyers, catalogs, packaging, posters, presentation folders, signs, banners, logo apparel, business cards, labels, corporate gifts and more. These Cimpress brands focus on serving graphic professionals: local printers, print resellers, graphic artists, advertising agencies and other customers with professional desktop publishing skillsets.

| | |

|

| | |

Brands that target consumers (home and family) Our photo and consumer product brands help preserve and share memories of friends and loved ones, commemorate important life events, and more. Each brand goes to market in a specific country or set of countries. But together, these brands constitute one of the world’s leading suppliers of photo merchandise such as photo books, wall décor, photo gifts, calendars, invitations, announcements, Christmas cards, New Year cards and other seasonal greeting cards.

| | |

Many of our brands that target graphic professionals also market their product and service offerings to a wider customer base which includes small and micro businesses. In addition to these brands, our Corporate Solutions business unit is focused on developing products and solutions for the needs of small and medium sized businesses as well as larger enterprises through partnership relationships with a value proposition that differs from the traditional Vistaprint brand.

Plans for our Mass Customization Platform

By “mass customization platform” we mean a constellation of software services and application programming interfaces, plus related technology, services and management operations, which matches fulfiller capabilities and capacity (our manufacturing and supply chain network) with demand from our merchants (our brands). As of July 2016, this shared platform is still under development: we expect to shift a significant portion of our activity to the platform by the end of fiscal 2017. That being said, we expect that we will continue to improve and further develop the mass customization platform for years to come.

Once the mass customization platform is in use, we plan to route production jobs to the production node in the fulfiller network that is best suited and cost efficient for the type of product ordered, inclusive of delivery. We believe that we can generate significant future customer and shareholder value from increased specialization of production facilities, aggregated scale from multiple brands, increased product offerings and shared technology development costs.

Competition

The markets for the products we produce and sell are intensely competitive, highly fragmented and geographically dispersed, with many existing and potential competitors. We compete on the basis of breadth and depth of product offerings; price; convenience; quality; technology; design content, tools, and assistance; customer service; ease of use; and production and delivery speed. It is our intention to offer a broad selection of high-quality products as well as related services at low price points and in doing so, offer our customers an attractive value proposition. Our current competition includes a combination of the following:

| |

• | online companies, many of which provide products and services similar to ours; |

| |

• | providers that outsource production to third party suppliers; |

| |

• | online photo product companies; |

| |

• | internet firms and retailers; |

| |

• | traditional offline printers, sign shops, t-shirt suppliers and graphic design providers; |

| |

• | office superstores, drug store chains, food retailers and other major retailers targeting small business and consumer markets; |

| |

• | self-service desktop design and publishing using personal computer software with a laser or inkjet printer and specialty paper; |

| |

• | suppliers of customized apparel, promotional products and gifts; |

| |

• | email marketing and other digital services companies; |

| |

• | website design and hosting companies; and |

| |

• | providers of other digital marketing such as social media, local search directories and other providers. |

As we expand our geographic reach, product and service portfolio and customer base, our competition increases. Our geographic expansion creates competition with companies that have a multi-national presence as well as experienced local vendors. Product offerings such as photo products, websites, email marketing, signage, apparel and promotional products have resulted in new competition as we entered those markets. We encounter competition from large retailers offering a wide breadth of products and highly focused companies specializing in a subset of our customers or product offerings. Given the state of maturity of the online mass customization market, we believe our biggest competition is still offline providers.

Barriers to entry have been lowered in many of our markets, and new players have entered the mass customization space, enabled by asset-light models, software-driven print-fulfillment platforms, innovation in

production technology, and/or benefits of an intense focus on a niche product or geographic market. We believe that the long-term leaders in mass customization will be the companies that are innovative and agile, but also bring significant scale-based advantages to drive value to customers in the form of product selection, quality and cost, as well as service.

Intellectual Property

We seek to protect our proprietary rights through a combination of patents, copyrights, trade secrets, and trademarks and contractual restrictions. We enter into confidentiality and proprietary rights agreements with our employees, consultants and business partners, and control access to, and distribution of, our proprietary information.

As of June 30, 2016, we held 263 issued patents worldwide, and we continue to file new patent applications around the world. Subject to our continued payment of required patent maintenance fees, our currently issued patents will expire between December 2017 and May 2034. We hold 73 trademark registrations in various jurisdictions globally.

Business Segment and Geographic Information

As of June 30, 2016, our reportable operating segments consisted of the (a) Vistaprint business unit, (b) Upload and Print business units, which includes our druck.at, Exagroup, Easyflyer, Printdeal, Pixartprinting, Tradeprint, and WIRmachenDRUCK branded businesses, and (c) All Other business units, which includes our Albumprinter business unit, our Most of World business units and our newly formed Corporate Solutions business unit. Our Most of World business unit operates in India and in Brazil and Japan (via partial equity ownerships), and we have nascent fully owned operations in China. For more segment and geographic information about our revenues, adjusted net operating profit and long-lived assets, see Item 8 of Part II, “Financial Statements and Supplementary Data — Note 17 — Segment Information” and Item 7 of Part II, “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The descriptions of our business, products, and markets in this section apply to all of our operating segments.

Seasonality

Our profitability has historically been highly seasonal. Our second fiscal quarter, ending December 31, includes the majority of the holiday shopping season and has become our strongest quarter for sales of our consumer-oriented products, such as holiday cards, calendars, photo books, and personalized gifts. Operating income during the second fiscal quarter represented 86%, 62%, and 61% of annual operating income in the years ended June 30, 2016, 2015, and 2014, respectively. The increase in operating income seasonality for fiscal 2016 was impacted by a goodwill impairment charge recognized during the third quarter of the current period. When excluding the impact of the goodwill impairment charge, operating income seasonality is consistent with prior periods.

Employees

As of June 30, 2016, we had approximately 7,500 full-time and approximately 500 temporary employees worldwide.

Corporate Information

Cimpress N.V. (formerly named Vistaprint N.V.) was incorporated under the laws of the Netherlands on June 5, 2009 and on August 30, 2009 became the publicly traded parent company of the Cimpress group of entities. We maintain our registered office at Hudsonweg 8, 5928 LW Venlo, the Netherlands. Our telephone number in the Netherlands is +31-77-850-7700. As a result of our change of domicile from Bermuda to the Netherlands on August 30, 2009, the common shareholders of Vistaprint Limited became ordinary shareholders of Vistaprint N.V. and Vistaprint N.V. became the publicly traded parent company of the Vistaprint group of entities. Vistaprint Limited, the immediate predecessor corporation to Vistaprint N.V., was incorporated under the laws of Bermuda in April 2002.

Available Information

We are registered as a reporting company under the U.S. Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. Accordingly, we file or furnish with the U.S. Securities and Exchange Commission, or the SEC, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and proxy statements as required by the Exchange Act and the rules and regulations of the SEC. The public may

read and copy our reports, proxy statements and other materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room is available by calling 1-800-SEC-0330. In addition, the SEC maintains an Internet website that contains reports, proxy and information statements and other information regarding issuers, such as Cimpress N.V, that file electronically with the SEC. The address of this website is www.sec.gov. We make available, free of charge through our United States website, the reports, proxy statements, amendments and other materials we file with or furnish to the SEC as soon as reasonably practicable after we electronically file or furnish such materials with or to the SEC. The address of our United States website is www.cimpress.com. We are not including the information contained on our website, or information that can be accessed by links contained on our website, as a part of, or incorporating it by reference into, this Annual Report on Form 10-K.

Item 1A. Risk Factors

Our future results may vary materially from those contained in forward-looking statements that we make in this Report and other filings with the SEC, press releases, communications with investors, and oral statements due to the following important factors, among others. Our forward-looking statements in this Report and in any other public statements we make may turn out to be wrong. These statements can be affected by, among other things, inaccurate assumptions we might make or by known or unknown risks and uncertainties or risks we currently deem immaterial. Consequently, no forward-looking statement can be guaranteed. We undertake no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Risks Related to Our Business

If our long-term growth strategy is not successful, our business and financial results could be harmed.

We may not achieve the objectives of our long-term investment and financial strategy, and our investments in our business may fail to impact our results and growth as anticipated. Some of the factors that could cause our business strategy to fail to achieve our objectives include, among others:

| |

• | our failure to adequately execute our operational strategy or anticipate and overcome obstacles to achieving our strategic goals; |

| |

• | our failure to develop our mass customization platform or the failure of the platform to drive the efficiencies and competitive advantage we expect; |

| |

• | our failure to manage the growth, complexity, and pace of change of our business and expand our operations; |

| |

• | our failure to acquire, at a value-accretive price or at all, businesses that enhance the growth and development of our business or to effectively integrate the businesses we do acquire into our business; |

| |

• | our inability to purchase or develop technologies and other key assets to increase our efficiency, enhance our competitive advantage, and scale our operations; |

| |

• | the failure of our current supply chain to provide the resources we need at the standards we require and our inability to develop new or enhanced supply chains; |

| |

• | our failure to acquire new customers and enter new markets, retain our current customers, and sell more products to current and new customers; |

| |

• | our failure to identify and address the causes of our revenue weakness in some markets; |

| |

• | our failure to sustain growth in relatively mature markets; |

| |

• | our failure to promote, strengthen, and protect our brands; |

| |

• | our failure to effectively manage competition and overlap within our brand portfolio; |

| |

• | the failure of our current and new marketing channels to attract customers; |

| |

• | our failure to realize expected returns on our capital allocation decisions; |

| |

• | unanticipated changes in our business, current and anticipated markets, industry, or competitive landscape; |

| |

• | our failure to attract and retain skilled talent needed to execute our strategy and sustain our growth; and |

| |

• | general economic conditions. |

If our strategy is not successful, or if there is a market perception that our strategy is not successful, then our revenue, earnings, and value may not grow as anticipated or may decline, we may not be profitable, our reputation and brands may be damaged, and the price of our shares may decline. In addition, we may change our strategy from time to time, which can cause fluctuations in our financial results and volatility in our share price.

Purchasers of customized products may not choose to shop online, which would limit our acquisition of new customers that are necessary to the success of our business.

Although we increasingly sell our products and services via reseller channels, our interface to those channels is almost exclusively through the Internet. The online market for most of our products and services is not mature, and our success depends in part on our ability to attract customers who have historically purchased products and services we offer through offline channels. Specific factors that could prevent prospective customers from purchasing from us as an online retailer include:

| |

• | concerns about buying customized products without face-to-face interaction with design or sales personnel; |

| |

• | the inability to physically handle and examine product samples; |

| |

• | delivery time associated with Internet orders; |

| |

• | concerns about the security of online transactions and the privacy of personal information; |

| |

• | delayed shipments or shipments of incorrect or damaged products; |

| |

• | limited access to the Internet; and |

| |

• | the inconvenience associated with returning or exchanging purchased items. |

In addition, our internal research shows that an increasing number of current and potential customers access our websites using smart phones or tablet computing devices and that our website visits using traditional desktop computers may be declining. Designing and purchasing custom designed products on a smart phone, tablet, or other mobile device is more difficult than doing so with a traditional computer due to limited screen sizes and bandwidth constraints. If our customers and potential customers have difficulty accessing and using our websites and technologies, then our revenue could decline.

We may not succeed in promoting and strengthening our brands, which could prevent us from acquiring new customers and increasing revenues.

A primary component of our business strategy is to promote and strengthen our brands to attract new and repeat customers to our websites, and we face significant competition from other companies in our markets who also seek to establish strong brands. To promote and strengthen our brands, we must incur substantial marketing expenses and establish a relationship of trust with our customers by providing a high-quality customer experience. Providing a high-quality customer experience requires us to invest substantial amounts of resources in our website development, design and technology, graphic design operations, production operations, and customer service operations. Our ability to provide a high-quality customer experience is also dependent on external factors over which we may have little or no control, including the reliability and performance of our suppliers, third-party carriers, and communication infrastructure providers. If we are unable to promote our brands or provide customers with a high-quality customer experience, we may fail to attract new customers, maintain customer relationships, and sustain or increase our revenues.

We manage our business for long-term results, and our quarterly and annual financial results will often fluctuate, which may lead to volatility in our share price.

Our revenues and operating results often vary significantly from period to period due to a number of factors, and as a result comparing our financial results on a period-to-period basis may not be meaningful. We prioritize our two uppermost objectives (leadership in mass customization and maximizing intrinsic value per share) even at the expense of shorter-term results and generally do not manage our business to maximize current period financial results, including our GAAP net income and operating cash flow and other results we report. Many of the factors that lead to period-to-period fluctuations are outside of our control; however, some factors are inherent in our business strategies. Some of the specific factors that could cause our operating results to fluctuate from quarter to quarter or year to year include among others:

| |

• | investments in our business in the current period intended to generate longer-term returns, where the shorter-term costs will not be offset by revenue or cost savings until future periods, if at all; |

| |

• | seasonality-driven or other variations in the demand for our products and services, in particular during our second fiscal quarter; |

| |

• | currency and interest rate fluctuations, which affect our revenues, costs, and fair value of our assets and liabilities; |

| |

• | our ability to attract visitors to our websites and convert those visitors into customers; |

| |

• | our ability to retain customers and generate repeat purchases; |

| |

• | shifts in revenue mix toward less profitable products and brands; |

| |

• | the commencement or termination of agreements with our strategic partners, suppliers, and others; |

| |

• | our ability to manage our production, fulfillment, and support operations; |

| |

• | costs to produce and deliver our products and provide our services, including the effects of inflation; |

| |

• | our pricing and marketing strategies and those of our competitors; |

| |

• | expenses and charges related to our compensation arrangements with our executives and employees, including expenses and charges relating to the new long-term incentive compensation program we launched at the beginning of fiscal year 2017; |

| |

• | costs and charges resulting from litigation; |

| |

• | significant increases in credits, beyond our estimated allowances, for customers who are not satisfied with our products; |

| |

• | changes in our income tax rate; |

| |

• | costs to acquire businesses or integrate our acquired businesses; |

| |

• | impairments of our tangible and intangible assets including goodwill; and |

| |

• | the results of our minority investments and joint ventures. |

Some of our expenses, such as office leases, depreciation related to previously acquired property and equipment, and personnel costs, are relatively fixed, and we may be unable to, or may not choose to, adjust operating expenses to offset any revenue shortfall. Accordingly, any shortfall in revenue may cause significant variation in operating results in any period. Our operating results may sometimes be below the expectations of public market analysts and investors, in which case the price of our ordinary shares will likely decline.

We may not be successful in developing our mass customization platform or in realizing the anticipated benefits of the platform.

A key component of our strategy is the development of a mass customization platform that acts as an interface between fulfillers (owned and third party production facilities) and our merchants (business units and brands). The process of developing new technology is complex, costly, and uncertain, and the development effort could be disruptive to our business and existing systems. We must make long-term investments, develop or obtain appropriate intellectual property, and commit significant resources before knowing whether our mass customization platform will be successful and make us more effective and competitive. As a result, there can be no assurance that we will successfully complete the development of the platform or that we will realize expected returns on the capital expended to develop the platform.

In addition, we are aware that other companies are developing platforms that could compete with ours. If a competitor were to develop and reach scale with a platform before we do, our competitive position could be harmed.

Our global operations and expansion place a significant strain on our management, employees, facilities, and other resources and subject us to additional risks.

We are a global company with production facilities, offices, and localized websites in multiple countries across six continents. We expect to establish operations, acquire or invest in businesses, and sell our products and services in additional geographic regions, including emerging markets, where we may have limited or no experience. We may not be successful in all regions in which we invest or where we establish operations, which may be costly to us. We are subject to a number of risks and challenges that relate to our global operations and expansion, including, among others:

| |

• | difficulty managing operations in, and communications among, multiple locations and time zones; |

| |

• | difficulty complying with multiple tax laws, treaties, and regulations and limiting our exposure to onerous or unanticipated taxes, duties, and other costs; |

| |

• | our failure to improve and expand our financial and operational controls to manage our business and comply with our legal obligations; |

| |

• | local regulations that may restrict or impair our ability to conduct our business as planned; |

| |

• | protectionist laws and business practices that favor local producers and service providers; |

| |

• | our inexperience in marketing and selling our products and services within unfamiliar countries and cultures; |

| |

• | challenges of working with local business partners; |

| |

• | our failure to properly understand and develop graphic design content and product formats and attributes appropriate for local tastes; |

| |

• | disruptions caused by political and social instability that may occur in some countries; |

| |

• | corrupt business practices, such as bribery or the willful infringement of intellectual property rights, that may be common in some countries; |

| |

• | difficulty expatriating cash from some countries; |

| |

• | difficulty importing and exporting our products across country borders and difficulty complying with customs regulations in the many countries where we sell products; |

| |

• | disruptions or cessation of important components of our international supply chain; |

| |

• | the challenge of complying with disparate laws in multiple countries; |

| |

• | restrictions imposed by local labor practices and laws on our business and operations; and |

| |

• | failure of local laws to provide a sufficient degree of protection against infringement of our intellectual property. |

There is considerable uncertainty about the economic and regulatory effects of the June 23, 2016 referendum in which United Kingdom voters approved an exit from the European Union (commonly referred to as "Brexit"). The UK is one of our largest markets in Europe, but we currently ship products to UK customers primarily from continental Europe. If the Brexit results in greater restrictions on imports and exports between the UK and the EU or increased regulatory complexity, then our operations and financial results could be negatively impacted.

In addition, we are exposed to fluctuations in currency exchange rates that may impact items such as the translation of our revenues and expenses, remeasurement of our intercompany balances, and the value of our cash and cash equivalents and other assets and liabilities denominated in currencies other than the U.S. dollar, our reporting currency. While we engage in hedging activities to mitigate some of the net impact of currency exchange rate fluctuations, our financial results may differ materially from expectations as a result of such fluctuations. For example, the Brexit vote has caused significant currency volatility that was mitigated in the near term by our currency hedging programs but that could potentially hurt our financial results in the future.

Acquisitions and strategic investments may be disruptive to our business.

An important way in which we pursue our strategy is to selectively acquire businesses, technologies, and services and to make minority investments in businesses and joint ventures. The time and expense associated with finding suitable businesses, technologies, or services to acquire or invest in can be disruptive to our ongoing business and divert our management's attention. In addition, we have needed in the past, and may need in the future, to seek financing for acquisitions and investments, which may not be available on terms that are favorable to us, or at all, and can cause dilution to our shareholders, cause us to incur additional debt, or subject us to covenants restricting the activities we may undertake.

Our acquisitions and strategic investments may fail to achieve our goals.

An acquisition or investment may fail to achieve our goals and expectations for a number of reasons including the following:

| |

• | The business we acquired or invested in may not perform as well as we expected. |

| |

• | We may overpay for acquired businesses, which can, among other things, negatively affect our intrinsic value per share. |

| |

• | We may fail to integrate acquired businesses, technologies, services, or internal systems effectively, or the integration may be more expensive or take more time than we anticipated. |

| |

• | The management of our minority investments may be more expensive or may take more resources than we expected. |

| |

• | We may not realize the anticipated benefits of integrating acquired businesses into our mass customization platform. |

| |

• | We may encounter unexpected cultural or language challenges in integrating an acquired business or managing our minority investment in a business. |

| |

• | We may not be able to retain customers and key employees of the acquired businesses, and we and the businesses we acquire or invest in may not be able to cross sell products and services to each other's customers. |

We generally assume the liabilities of businesses we acquire, which could include liability for an acquired business' violation of law that occurred before we acquired it. In addition, we have historically acquired smaller, privately held companies that may not have as strong a culture of legal compliance or as robust financial controls as

a larger, publicly traded company like Cimpress, and if we fail to implement adequate training, controls, and monitoring of the acquired companies, we could also be liable for post-acquisition legal violations.

Our acquisitions and minority investments can negatively impact our financial results.

Acquisitions and minority investments can be costly, and some of our acquisitions and investments may be dilutive, leading to reduced earnings. Acquisitions and investments can result in increased expenses including impairments of goodwill and intangible assets if financial goals are not achieved, assumptions of contingent or unanticipated liabilities, amortization of acquired intangible assets, and increased tax costs.

In addition, the accounting for our acquisitions requires us to make significant estimates, judgments, and assumptions that can change from period to period, based in part on factors outside of our control, which can create volatility in our financial results. For example, we often pay a portion of the purchase price for our acquisitions in the form of an earn-out based on performance targets for the acquired companies, which can be difficult to forecast. We accrue liabilities for estimated future contingent earn-out payments based on an evaluation of the likelihood of achievement of the contractual conditions underlying the earn-out and weighted probability assumptions of the required outcomes. If in the future our assumptions change and we determine that higher levels of achievement are likely under our earn-outs, we will need to pay and record additional amounts to reflect the increased purchase price. These additional amounts could be significant and could adversely impact our results of operations. In addition, earn-out provisions can lead to disputes with the sellers about the achievement of the earn-out performance targets, and earn-out performance targets can sometimes create inadvertent incentives for the acquired company's management to take short-term actions designed to maximize the earn-out instead of benefiting the business.

If we are unable to attract visitors to our websites and convert those visitors to customers, our business and results of operations could be harmed.

Our success depends on our ability to attract new and repeat customers in a cost-effective manner. We rely on a variety of methods to draw visitors to our websites and promote our products and services, such as purchased search results from online search engines such as Google and Yahoo!, email, direct mail, advertising banners and other online links, broadcast media, and word-of-mouth customer referrals. If the search engines on which we rely modify their algorithms, terminate their relationships with us, or increase the prices at which we may purchase listings, our costs could increase, and fewer customers may click through to our websites. If we are not effective at reaching new and repeat customers, if fewer customers click through to our websites, or if the costs of attracting customers using our current methods significantly increase, then traffic to our websites would be reduced, our revenue and net income could decline, and our business and results of operations would be harmed.

Seasonal fluctuations in our business place a strain on our operations and resources.

Our profitability has historically been highly seasonal. Our second fiscal quarter includes the majority of the holiday shopping season and accounts for a disproportionately high portion of our earnings for the year, primarily due to higher sales of home and family products such as holiday cards, calendars, photo books, and personalized gifts. Our operating income during the second fiscal quarter represented 86%, 62%, and 61% of annual operating income in the years ended June 30, 2016, 2015, and 2014, respectively. In anticipation of increased sales activity during our second fiscal quarter holiday season, we typically incur significant additional capacity related expenses each year to meet our seasonal needs, including facility expansions, equipment purchases and leases, and increases in the number of temporary and permanent employees. Lower than expected sales during the second quarter would likely have a disproportionately large impact on our operating results and financial condition for the full fiscal year. In addition, if our manufacturing and other operations are unable to keep up with the high volume of orders during our second fiscal quarter, we and our customers can experience delays in order fulfillment and delivery and other disruptions. If we are unable to accurately forecast and respond to seasonality in our business, our business and results of operations may be materially harmed.

Our hedging activity could negatively impact our results of operations and cash flows.

We have entered into derivatives to manage our exposure to interest rate and currency movements. If we do not accurately forecast our results of operations, execute contracts that do not effectively mitigate our economic exposure to interest rates and currency rates, elect to not apply hedge accounting, or fail to comply with the complex accounting requirements for hedging, our results of operations and cash flows could be volatile, as well as

negatively impacted. Also, our hedging objectives may be targeted at non-GAAP financial metrics, which could result in increased volatility in our GAAP results.

We face risks related to interruption of our operations and lack of redundancy.

Our production facilities, websites, infrastructure, supply chain, customer service centers, and operations may be vulnerable to interruptions, and we do not have redundancies or alternatives in all cases to carry on these operations in the event of an interruption. In addition, because we are dependent in part on third parties for the implementation and maintenance of certain aspects of our communications and production systems, we may not be able to remedy interruptions to these systems in a timely manner or at all due to factors outside of our control. Some of the events that could cause interruptions in our operations or systems are, among others:

| |

• | fire, natural disasters, or extreme weather |

| |

• | labor strike, work stoppage, or other issues with our workforce |

| |

• | political instability or acts of terrorism or war |

| |

• | power loss or telecommunication failure |

| |

• | attacks on our external websites or internal network by hackers or other malicious parties |

| |

• | undetected errors or design faults in our technology, infrastructure, and processes that may cause our websites to fail |

| |

• | inadequate capacity in our systems and infrastructure to cope with periods of high volume and demand |

| |

• | human error, including poor managerial judgment or oversight |

Any interruptions to our systems or operations could result in lost revenue, increased costs, negative publicity, damage to our reputation and brands, and an adverse effect on our business and results of operations. Building redundancies into our infrastructure, systems and supply chain to mitigate these risks may require us to commit substantial financial, operational, and technical resources, in some cases before the volume of our business increases with no assurance that our revenues will increase.

We face intense competition, and we expect our competition to continue to increase.

The markets for small business marketing products and services and home and family custom products, including the printing and graphic design market, are intensely competitive, highly fragmented, and geographically dispersed. The competitive landscape for e-commerce companies continues to change as new e-commerce businesses are introduced and traditional “bricks and mortar” businesses establish an online presence. Competition may result in price pressure, reduced profit margins and loss of market share and brand recognition, any of which could substantially harm our business and financial results. Current and potential competitors include (in no particular order):

| |

• | traditional offline suppliers and graphic design providers; |

| |

• | online printing and graphic design companies, many of which provide products and services similar to ours; |

| |

• | office superstores, drug store chains, food retailers and other major retailers targeting small business and consumer markets; |

| |

• | self-service desktop design and publishing using personal computer software; |

| |

• | email marketing services companies; |

| |

• | website design and hosting companies; |

| |

• | suppliers of customized apparel, promotional products and gifts; |

| |

• | online photo product companies; |

| |

• | Internet firms and retailers; |

| |

• | online providers of custom printing services that outsource production to third party printers; and |

| |

• | providers of other digital marketing such as social media, local search directories and other providers. |

Many of our current and potential competitors have advantages over us, including longer operating histories, greater brand recognition or loyalty, more focus on a given subset of our business, or significantly greater financial, marketing, and other resources. Many of our competitors currently work together, and additional competitors may do so in the future through strategic business agreements or acquisitions. Competitors may also develop new or enhanced products, technologies or capabilities that could render many of the products, services and content we offer obsolete or less competitive, which could harm our business and financial results.

In addition, we have in the past and may in the future choose to collaborate with some of our existing and potential competitors in strategic partnerships that we believe will improve our competitive position and financial results, such as through a retail in-store or web-based collaborative offering. It is possible, however, that such ventures will be unsuccessful and that our competitive position and financial results will be adversely affected as a result of such collaboration.

Failure to meet our customers' price expectations would adversely affect our business and results of operations.

Demand for our products and services is sensitive to price for almost all of our brands, and changes in our pricing strategies have had a significant impact on the numbers of customers and orders in some regions, which in turn affects our revenues and results of operations. Many factors can significantly impact our pricing and marketing strategies, including the costs of running our business, our competitors' pricing and marketing strategies, and the effects of inflation. If we fail to meet our customers' price expectations, our business and results of operations may suffer.

Failure to protect our networks and the confidential information of our customers, employees, and business partners against security breaches or thefts could damage our reputation and brands and substantially harm our business and results of operations.

Businesses like ours are increasingly becoming targets for cyber attacks and other thefts of data. We may need to expend significant resources to protect against security breaches and thefts of data or to address problems caused by breaches or thefts. Any compromise or breach of our network, websites, offices, or retail locations, our employee personal data, or our customer transaction data, including credit and debit card information, could, among other things:

| |

• | damage our reputation and brands; |

| |

• | expose us to losses, litigation, and possible liability; |

| |

• | result in a failure to comply with legal and industry privacy regulations and standards; |

| |

• | lead to the misappropriation of our and our customers' proprietary or personal information; or |

| |

• | cause interruptions in our operations. |

In addition, some of our vendors collect and maintain personal data about our employees, and some of our partners collect information from transactions with our customers. We may be liable or our reputation may be harmed if our vendors or partners fail to protect this information or use it in a manner that is inconsistent with legal and industry privacy regulations or our practices.

If we fail to address risks associated with payment fraud, our reputation and brands could be damaged, and our business and results of operations could be harmed.

We may be liable for fraudulent transactions conducted on our websites, such as through the use of stolen credit card numbers. To date, quarterly losses from payment fraud have not exceeded 1% of total revenues in any quarter, but we continue to face the risk of significant losses from this type of fraud.

We rely heavily on email to market to and communicate with customers, and email communications are subject to regulatory and reputation risks.

Various private entities attempt to regulate the use of commercial email solicitation by blacklisting companies that the entities believe do not meet their standards, which results in those companies' emails being blocked from some Internet domains and addresses. Although we believe that our commercial email solicitations comply with all applicable laws, from time to time some of our Internet protocol addresses appear on some of these blacklists, which can interfere with our ability to market our products and services, communicate with our customers, and operate and manage our websites and corporate email accounts. In addition, as a result of being blacklisted, we have had disputes with, or concerns raised by, various service providers who perform services for us, including co-location and hosting services, Internet service providers and electronic mail distribution services.

Further, we have contractual relationships with partners that market our products and services on our behalf, and some of our marketing partners engage third-party email marketers with which we do not have any contractual or other relationship. Although we believe we comply with all applicable laws relating to email solicitations and our contracts with our partners require that they do the same, we do not always have control over the third-party email marketers that our partners engage. If such a third party were to send emails marketing our products and services in violation of applicable anti-spam or other laws, then our reputation could be harmed and we could potentially be liable for their actions.

We are subject to safety, health, and environmental laws and regulations, which could result in

liabilities, cost increases or restrictions on our operations.

We are subject to a variety of safety, health and environmental, or SHE, laws and regulations in each of the jurisdictions in which we operate. These laws and regulations govern, among other things, air emissions, wastewater discharges, the storage, handling and disposal of hazardous and other regulated substances and wastes, soil and groundwater contamination and employee health and safety. We use regulated substances such as inks and solvents, and generate air emissions and other discharges at our manufacturing facilities, and some of our facilities are required to hold environmental permits. If we fail to comply with existing SHE requirements, or new, more stringent SHE requirements applicable to us are imposed, we may be subject to monetary fines, civil or criminal sanctions, third-party claims, or the limitation or suspension of our operations. In addition, if we are found to be responsible for hazardous substances at any location (including, for example, offsite waste disposal facilities or facilities at which we formerly operated), we may be responsible for the cost of cleaning up contamination, regardless of fault, as well as to claims for harm to health or property or for natural resource damages arising out of contamination or exposure to hazardous substances.