Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2021

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-50484

MEI Pharma, Inc.

(Exact name of registrant as specified in its charter)

| DELAWARE | 51-0407811 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

11455 El Camino Real, San Diego, CA 92130

(Address of principal executive offices) (Zip Code)

(858) 369-7100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered | ||

| Common Stock, $0.00000002 par value | MEIP | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 4, 2021, the number of shares outstanding of the issuer’s common stock, $0.00000002 par value, was 112,591,778.

Table of Contents

MEI PHARMA, INC.

2

Table of Contents

Item 1: Condensed Financial Statements – Unaudited

MEI PHARMA, INC.

(In thousands, except per share amounts)

| March 31, 2021 |

June 30, 2020 |

|||||||

| (unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 9,745 | $ | 12,331 | ||||

| Short-term investments |

154,879 | 170,299 | ||||||

|

|

|

|

|

|||||

| Total cash, cash equivalents and short-term investments |

164,624 | 182,630 | ||||||

| Receivable for foreign tax withholding |

— | 20,420 | ||||||

| Prepaid expenses and other current assets |

11,937 | 5,594 | ||||||

|

|

|

|

|

|||||

| Total current assets |

176,561 | 208,644 | ||||||

| Operating lease right-of-use asset |

7,992 | — | ||||||

| Property and equipment, net |

1,569 | 1,084 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 186,122 | $ | 209,728 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

| |||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 5,571 | $ | 2,437 | ||||

| Accrued liabilities |

7,762 | 6,090 | ||||||

| Deferred revenue |

19,143 | 14,777 | ||||||

| Operating lease liability |

900 | — | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

33,376 | 23,304 | ||||||

| Deferred revenue, long-term |

70,734 | 67,723 | ||||||

| Operating lease liability, long-term |

7,608 | — | ||||||

| Warrant liability |

29,442 | 40,483 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

141,160 | 131,510 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 6) |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.01 par value; 100 shares authorized; none outstanding |

— | — | ||||||

| Common stock, $0.00000002 par value; 226,000 shares authorized; 112,592 and 111,514 shares issued and outstanding at March 31, 2021 and June 30, 2020, respectively |

— | — | ||||||

| Additional paid-in capital |

367,055 | 355,452 | ||||||

| Accumulated deficit |

(322,093 | ) | (277,234 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

44,962 | 78,218 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 186,122 | $ | 209,728 | ||||

|

|

|

|

|

|||||

See accompanying notes to condensed financial statements.

3

Table of Contents

MEI PHARMA, INC.

CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited)

| Three Months Ended March 31, |

Nine Months Ended March 31, |

|||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Revenue |

$ | 2,418 | $ | 1,244 | $ | 15,419 | $ | 3,409 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Cost of revenue |

405 | 860 | 1,408 | 2,189 | ||||||||||||

| Research and development |

17,884 | 8,963 | 53,104 | 26,206 | ||||||||||||

| General and administrative |

6,215 | 3,864 | 17,780 | 12,189 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

24,504 | 13,687 | 72,292 | 40,584 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from operations |

(22,086 | ) | (12,443 | ) | (56,873 | ) | (37,175 | ) | ||||||||

| Other income (expense): |

||||||||||||||||

| Change in fair value of warrant liability |

(9,272 | ) | 7,732 | 11,035 | 8,562 | |||||||||||

| Interest and dividend income |

58 | 382 | 497 | 1,074 | ||||||||||||

| Other income (expense) |

(13 | ) | — | 482 | (1 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (31,313 | ) | $ | (4,329 | ) | $ | (44,859 | ) | $ | (27,540 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss: |

||||||||||||||||

| Basic |

$ | (31,313 | ) | $ | (4,329 | ) | $ | (44,859 | ) | $ | (27,540 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (31,313 | ) | $ | (4,329 | ) | $ | (65,166 | ) | $ | (27,540 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share: |

||||||||||||||||

| Basic |

$ | (0.28 | ) | $ | (0.04 | ) | $ | (0.40 | ) | $ | (0.32 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (0.28 | ) | $ | (0.04 | ) | $ | (0.57 | ) | $ | (0.32 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in computing net loss per share: |

||||||||||||||||

| Basic |

112,557 | 105,999 | 112,505 | 85,995 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

112,557 | 105,999 | 113,991 | 85,995 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to condensed financial statements.

4

Table of Contents

MEI PHARMA, INC.

CONDENSED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

(Unaudited)

| Common Shares |

Additional Paid-In Capital |

Accumulated Deficit |

Total Stockholders’ Equity |

|||||||||||||

| Balance at June 30, 2020 |

111,514 | $ | 355,452 | $ | (277,234 | ) | $ | 78,218 | ||||||||

| Net loss |

— | — | (2,092 | ) | (2,092 | ) | ||||||||||

| Issuance of common stock, net |

958 | 3,136 | — | 3,136 | ||||||||||||

| Exercise of stock options |

50 | 124 | — | 124 | ||||||||||||

| Share-based compensation expense |

— | 2,942 | — | 2,942 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at September 30, 2020 |

112,522 | 361,654 | (279,326 | ) | 82,328 | |||||||||||

| Net loss |

— | — | (11,454 | ) | (11,454 | ) | ||||||||||

| Exercise of stock options |

6 | 15 | — | 15 | ||||||||||||

| Share-based compensation expense |

— | 2,609 | — | 2,609 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at December 31, 2020 |

112,528 | 364,278 | (290,780 | ) | 73,498 | |||||||||||

| Net loss |

— | — | (31,313 | ) | (31,313 | ) | ||||||||||

| Exercise of stock options |

63 | 126 | — | 126 | ||||||||||||

| Exercise of warrants |

1 | 6 | — | 6 | ||||||||||||

| Share-based compensation expense |

— | 2,645 | — | 2,645 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at March 31, 2021 |

112,592 | $ | 367,055 | $ | (322,093 | ) | $ | 44,962 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Common Shares |

Additional Paid-In Capital |

Accumulated Deficit |

Total Stockholders’ Equity |

|||||||||||||

| Balance at June 30, 2019 |

73,545 | $ | 279,148 | $ | (231,218 | ) | $ | 47,930 | ||||||||

| Net loss |

— | — | (2,994 | ) | (2,994 | ) | ||||||||||

| Issuance of common stock, net |

64 | 159 | — | 159 | ||||||||||||

| Exercise of stock options |

46 | 72 | — | 72 | ||||||||||||

| Share-based compensation expense |

— | 2,113 | — | 2,113 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at September 30, 2019 |

73,655 | 281,492 | (234,212 | ) | 47,280 | |||||||||||

| Net loss |

— | — | (20,217 | ) | (20,217 | ) | ||||||||||

| Issuance of common stock, net |

32,344 | 48,451 | — | 48,451 | ||||||||||||

| Share-based compensation expense |

— | 1,771 | — | 1,771 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at December 31, 2019 |

105,999 | 331,714 | (254,429 | ) | 77,285 | |||||||||||

| Net loss |

— | — | (4,329 | ) | (4,329 | ) | ||||||||||

| Issuance of common stock, net |

— | (8 | ) | — | (8 | ) | ||||||||||

| Share-based compensation expense |

— | 1,550 | — | 1,550 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Balance at March 31, 2020 |

105,999 | $ | 333,256 | $ | (258,758 | ) | $ | 74,498 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See accompanying notes to condensed financial statements.

5

Table of Contents

MEI PHARMA, INC.

CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| Nine Months Ended March 31, |

||||||||

| 2021 | 2020 | |||||||

| Cash flows from operating activities: |

||||||||

| Net loss |

$ | (44,859 | ) | $ | (27,540 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

| Change in fair value of warrant liability |

(11,035 | ) | (8,562 | ) | ||||

| Share-based compensation |

8,196 | 5,434 | ||||||

| Depreciation and amortization |

215 | 90 | ||||||

| Non-cash lease expense |

697 | — | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Receivable for foreign tax withholding |

20,420 | — | ||||||

| Prepaid expenses and other current assets |

(6,343 | ) | (169 | ) | ||||

| Accounts payable |

3,134 | (2,295 | ) | |||||

| Accrued liabilities |

1,672 | 667 | ||||||

| Deferred revenue |

7,377 | (2,479 | ) | |||||

| Operating lease liability |

(181 | ) | — | |||||

|

|

|

|

|

|||||

| Net cash used in operating activities |

(20,707 | ) | (34,854 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property and equipment |

(700 | ) | (785 | ) | ||||

| Purchases of short-term investments |

(325,162 | ) | (90,324 | ) | ||||

| Proceeds from maturity of short-term investments |

340,582 | 69,863 | ||||||

|

|

|

|

|

|||||

| Net cash provided by (used in) investing activities |

14,720 | (21,246 | ) | |||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Proceeds from exercise of stock options |

265 | 72 | ||||||

| Proceeds from issuance of common stock, net |

3,136 | 48,602 | ||||||

| Collection of common stock proceeds receivable |

— | 5,274 | ||||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

3,401 | 53,948 | ||||||

|

|

|

|

|

|||||

| Net decrease in cash and cash equivalents |

(2,586 | ) | (2,152 | ) | ||||

| Cash and cash equivalents at beginning of the period |

12,331 | 9,590 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of the period |

$ | 9,745 | $ | 7,438 | ||||

|

|

|

|

|

|||||

| Supplemental disclosures: |

||||||||

| Income taxes paid |

$ | (8 | ) | $ | (1 | ) | ||

| Operating lease right-of-use assets obtained in exchange for operating lease liabilities |

$ | 8,689 | $ | — | ||||

| Warrants issued pursuant to cashless exercise |

$ | 6 | $ | — | ||||

See accompanying notes to condensed financial statements.

6

Table of Contents

MEI PHARMA, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

(Unaudited)

Note 1. The Company and Summary of Significant Accounting Policies

The Company

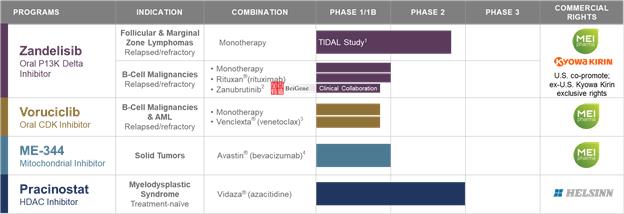

We are a late-stage pharmaceutical company focused on leveraging our extensive development and oncology expertise to identify and advance new therapies intended to meaningfully improve the treatment of cancer. Our portfolio of drug candidates contains four clinical-stage assets, including zandelisib (formerly known as ME-401), currently in an ongoing Phase 2 clinical trial that we intend to submit to the U.S. Food and Drug Administration (“FDA”) to support accelerated approval of a marketing application. Our common stock is listed on the NASDAQ Capital Market under the symbol “MEIP”.

Clinical Development Programs

Our approach to building our pipeline is to license promising cancer agents and build value in programs through development, commercialization and strategic partnerships, as appropriate. Our drug candidate pipeline includes:

| • | Zandelisib (formerly known as ME-401), an oral phosphatidylinositol 3-kinase (“PI3K”) delta inhibitor; |

| • | Voruciclib, an oral cyclin-dependent kinase (“CDK”) inhibitor; |

| • | ME-344, a mitochondrial inhibitor targeting the oxidative phosphorylation (“OXPHOS”) complex; and |

| • | Pracinostat, an oral histone deacetylase (“HDAC”) inhibitor. |

The results of pre-clinical studies and completed clinical trials are not necessarily predictive of future results, and our current drug candidates may not have favorable results in later studies or trials. The commercial opportunity will be reduced or eliminated if competitors develop and market products that are more effective, have fewer side effects or are less expensive than our drug candidates. We will need substantial additional funds to progress the clinical trial programs for the drug candidates zandelisib, voruciclib and ME-344, and to develop new compounds. The actual amount of funds that will be needed will depend upon a number of factors, some of which are beyond our control. Negative U.S. and global economic conditions may pose challenges to our business strategy, which relies on funding from the financial markets or collaborators.

Liquidity

We have accumulated losses of $322.1 million since inception and expect to incur operating losses and generate negative cash flows from operations for the foreseeable future. As of March 31, 2021, we had $164.6 million in cash and cash equivalents and short-term investments. We believe that these resources will be sufficient to meet our obligations and fund our liquidity and capital expenditure requirements for at least the next 12 months from the issuance of these financial statements. Our current business operations are focused on continuing the clinical development of our drug candidates. Changes to our research and development plans or other changes affecting our operating expenses may affect actual future use of existing cash resources. Our research and development expenses are expected to increase in the foreseeable future. We cannot determine with certainty costs associated with ongoing and future clinical trials or the regulatory approval process. The duration, costs and timing associated with the development of our product candidates will depend on a variety of factors, including uncertainties associated with the results of our clinical trials.

To date, we have obtained cash and funded our operations primarily through equity financings and license agreements. In order to continue the development of our drug candidates, at some point in the future we expect to pursue one or more capital transactions, whether through the sale of equity securities, debt financing, license agreements or entry into strategic partnerships. There can be no assurance that we will be able to continue to raise additional capital in the future.

Basis of Presentation

The accompanying unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, the accompanying financial statements do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, the accompanying financial statements reflect all adjustments (consisting of normal recurring adjustments) that are necessary for a fair statement of the financial position, results of operations and cash flows for the periods presented. We have evaluated subsequent events through the date the financial statements were issued.

The accompanying unaudited financial statements should be read in conjunction with the audited financial statements and notes thereto as of and for the fiscal year ended June 30, 2020, included in our Annual Report on Form 10-K (“2020 Annual Report”) filed with the Securities and Exchange Commission on September 9, 2020. Interim results are not necessarily indicative of results for a full year.

7

Table of Contents

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported in the financial statements and disclosures made in the accompanying notes to the financial statements. We use estimates that affect the reported amounts (including assets, liabilities, revenues and expenses) and related disclosures. Actual results could materially differ from those estimates.

Revenue Recognition

ASC Topic 606, Revenue from Contracts with Customers (“Topic 606”)

We recognize revenue when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. For enforceable contracts with our customers, we first identify the distinct performance obligations – or accounting units – within the contract. Performance obligations are commitments in a contract to transfer a distinct good or service to the customer.

Payments received under commercial arrangements, such as licensing technology rights, may include non-refundable fees at the inception of the arrangements, milestone payments for specific achievements designated in the agreements, and royalties on the sale of products. At the inception of arrangements that include milestone payments, we use judgment to evaluate whether the milestones are probable of being achieved and we estimate the amount to include in the transaction price using the most likely method. If it is probable that a significant revenue reversal will not occur, the estimated amount is included in the transaction price. Milestone payments that are not within our or the licensee’s control, such as regulatory approvals, are not included in the transaction price until those approvals are received. At the end of each reporting period, we re-evaluate the probability of achievement of development milestones and any related constraint and, as necessary, we adjust our estimate of the overall transaction price. Any adjustments are recorded on a cumulative catch-up basis, which would affect revenues and earnings in the period of adjustment.

We develop estimates of the stand-alone selling price for each distinct performance obligation. Variable consideration that relates specifically to our efforts to satisfy specific performance obligations is allocated entirely to those performance obligations. Other components of the transaction price are allocated based on the relative stand-alone selling price, over which management has applied significant judgment. We develop assumptions that require judgment to determine the stand-alone selling price for license-related performance obligations, which may include forecasted revenues, development timelines, reimbursement rates for personnel costs, discount rates and probabilities of technical, regulatory and commercial success. We estimate stand-alone selling price for research and development performance obligations by forecasting the expected costs of satisfying a performance obligation plus an appropriate margin.

In the case of a license that is a distinct performance obligation, we recognize revenue allocated to the license from non-refundable, up-front fees at the point in time when the license is transferred to the licensee and the licensee can use and benefit from the license. For licenses that are bundled with other distinct or combined obligations, we use judgment to assess the nature of the performance obligation to determine whether the performance obligation is satisfied over time or at a point in time and, if over time, the appropriate method of measuring progress for purposes of recognizing revenue. If the performance obligation is satisfied over time, we evaluate the measure of progress each reporting period and, if necessary, adjust the measure of performance and related revenue recognition.

The selection of the method to measure progress towards completion requires judgment and is based on the nature of the products or services to be provided. Revenue is recorded proportionally as costs are incurred. We generally use the cost-to-cost measure of progress because it best depicts the transfer of control to the customer which occurs as we incur costs. Under the cost-to-cost measure of progress, the extent of progress towards completion is measured based on the ratio of costs incurred to date to the total estimated costs at completion of the performance obligation (an “input method” under Topic 606). We use judgment to estimate the total cost expected to complete the research and development performance obligations, which include subcontractors’ costs, labor, materials, other direct costs and an allocation of indirect costs. We evaluate these cost estimates and the progress each reporting period and, as necessary, we adjust the measure of progress and related revenue recognition.

For arrangements that include sales-based or usage-based royalties, we recognize revenue at the later of (i) when the related sales occur or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied or partially satisfied. To date, we have not recognized any sales-based or usage-based royalty revenue from license agreements.

8

Table of Contents

We recognized revenue associated with the following license agreements (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| KKC License Agreements |

$ | 2,321 | $ | 812 | $ | 14,979 | $ | 2,282 | ||||||||||||

| Helsinn License Agreement |

97 | 432 | 440 | 1,127 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | 2,418 | $ | 1,244 | $ | 15,419 | $ | 3,409 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Timing of Revenue Recognition: |

||||||||||||||||||||

| Services performed over time |

$ | 2,418 | $ | 1,244 | $ | 15,419 | $ | 3,409 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | 2,418 | $ | 1,244 | $ | 15,419 | $ | 3,409 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

The KKC Commercialization Agreement and KKC Japan License Agreement (Note 3) include other distinct performance obligations that will be satisfied over time, and accordingly we recognized $2.3 million and $0.8 million related to our progress toward satisfying those obligations during the three months ended March 31, 2021 and 2020, respectively, and $15.0 million and $2.3 million during the nine months ended March 31, 2021 and 2020, respectively.

Based on the characteristics of the Helsinn License Agreement (Note 3), control of the remaining deliverables occurs over time and therefore we recognize revenue based on the extent of progress towards completion of the performance obligations. Accordingly, we recognized $0.1 million and $0.4 million related to our progress toward satisfying those obligations during the three months ended March 31, 2021 and 2020, respectively, and $0.4 million and $1.1 million during the nine months ended March 31, 2021 and 2020, respectively.

Contract Balances

Receivables and contract assets are included in our balance sheet in “Prepaid expenses and other current assets”, and contract liabilities are included in “Deferred revenue” and “Deferred revenue, long-term”. The following table presents changes in contract assets and contract liabilities during the nine months ended March 31, 2021 and 2020 (in thousands):

| Nine Months Ended March 31, | ||||||||||

| 2021 | 2020 | |||||||||

| Receivables |

||||||||||

| Receivables, beginning of period |

$ | 2,605 | $ | — | ||||||

| Amounts billed |

15,744 | 1,088 | ||||||||

| Payments received |

(18,349 | ) | (1,014 | ) | ||||||

|

|

|

|

|

|||||||

| Receivables, end of period |

$ | — | $ | 74 | ||||||

|

|

|

|

|

|||||||

| Contract assets |

||||||||||

| Contract assets, beginning of period |

$ | 335 | $ | 511 | ||||||

| Billable amounts |

22,841 | 930 | ||||||||

| Amounts billed |

(15,744 | ) | (1,088 | ) | ||||||

|

|

|

|

|

|||||||

| Contract assets, end of period |

$ | 7,432 | $ | 353 | ||||||

|

|

|

|

|

|||||||

| Contract liabilities |

||||||||||

| Contract liabilities, beginning of period |

$ | 82,497 | $ | 7,771 | ||||||

| Net change |

7,380 | (2,479 | ) | |||||||

|

|

|

|

|

|||||||

| Contract liabilities, end of period |

$ | 89,877 | $ | 5,292 | ||||||

|

|

|

|

|

|||||||

The timing of revenue recognition, invoicing and cash collections results in billed accounts receivable and unbilled receivables (contract assets), which are classified as “prepaid expenses and other current assets” on our Condensed Balance Sheet, and deferred revenue (contract liabilities). We invoice our customers in accordance with agreed-upon contractual terms, typically at periodic intervals or upon achievement of contractual milestones. Invoicing may occur subsequent to revenue recognition, resulting in contract assets. We may receive advance payments from our customers before revenue is recognized, resulting in contract liabilities. The contract assets and liabilities reported on the Condensed Balance Sheet relate to the KKC Agreements and Helsinn License Agreement.

9

Table of Contents

As of March 31, 2021, we had $7.4 million of contract assets related to our remaining performance obligations under the KKC Commercialization Agreement and no contract assets related to the Helsinn License Agreement as the remaining performance obligations have been completed. During the nine months ended March 31, 2021, contract assets increased by $22.8 million, primarily due the recognition of revenue related to the satisfaction or partial satisfaction of performance obligations for which we had not yet billed KKC or Helsinn, partially offset by billings of $15.7 million to KKC and Helsinn.

As of March 31, 2021, we had $89.9 million of deferred revenue associated with our remaining performance obligations under the KKC Commercialization Agreement, of which $64.5 million relates to the U.S. License which is a unit of account under the scope of Topic 808 and is not a deliverable under Topic 606, and $25.4 million relates to the Ex-U.S. license and development services performance obligations which are under the scope of Topic 606. For the three and nine months ended March 31, 2021, we recognized revenue of $2.4 million and $15.4 million, respectively, that was included in the contract liabilities balance at June 30, 2020 related to performance obligations under ASC 606. In addition, as a result of a change in estimated cost of completion related to our remaining performance obligations, we decreased deferred revenue by $2.1 million. To date we have not recognized any amounts related to units of account under Topic 808. For the three and nine months ended March 31, 2020, we recognized revenue of $0.8 million and $2.6 million, respectively, that was included in the contract liabilities balance at June 30, 2019 related to performance obligations under ASC 606 under the KKC Japan License Agreement and Helsinn License Agreement which are described in Note 3.

Revenues from Collaborators

We earn revenue in connection with collaboration agreements, which are described in Note 3, License Agreements, and Note 4, BeiGene Collaboration.

At contract inception, we assess whether the collaboration arrangements are within the scope of ASC Topic 808, Collaborative Arrangements (“Topic 808”), to determine whether such arrangements involve joint operating activities performed by parties that are both active participants in the activities and exposed to significant risks and rewards dependent on the commercial success of such activities. This assessment is performed based on the responsibilities of all parties in the arrangement. For collaboration arrangements within the scope of Topic 808 that contain multiple units of account, we first determine which units of account within the arrangement are within the scope of Topic 808 and which elements are within the scope of Topic 606. For units of account within collaboration arrangements that are accounted for pursuant to Topic 808, an appropriate recognition method is determined and applied consistently, by analogy to authoritative accounting literature. For elements of collaboration arrangements that are accounted for pursuant to Topic 606, we recognize revenue as discussed above. Consideration received that does not meet the requirements to satisfy Topic 606 revenue recognition criteria is recorded as deferred revenue in the accompanying consolidated balance sheets, classified as either short-term or long-term deferred revenue based on our best estimate of when such amounts will be recognized.

Cost of Revenue

Cost of revenue primarily includes external costs paid to third-party contractors to perform research, conduct clinical trials and develop and manufacture drug materials, and internal compensation and related personnel expenses to support our research and development performance obligations associated with the Helsinn License Agreement.

Research and Development Costs

Research and development costs are expensed as incurred and include costs paid to third-party contractors to perform research, conduct clinical trials and develop and manufacture drug materials. Clinical trial costs, including costs associated with third-party contractors, are a significant component of research and development expenses. We expense research and development costs based on work performed. In determining the amount to expense, management relies on estimates of total costs based on contract components completed, the enrollment of subjects, the completion of trials, and other events. Costs incurred related to the purchase or licensing of in-process research and development for early-stage products or products that are not commercially viable and ready for use, or have no alternative future use, are charged to expense in the period incurred.

Share-based Compensation

Share-based compensation expense for employees and directors is recognized in the Condensed Statement of Operations based on estimated amounts, including the grant date fair value and the expected service period. For stock options, we estimate the grant date fair value using a Black-Scholes valuation model, which requires the use of multiple subjective inputs including estimated future volatility, expected forfeitures and the expected term of the awards. We estimate the expected future volatility based on the stock’s historical price volatility. The stock’s future volatility may differ from the estimated volatility at the grant date. For restricted stock unit (“RSU”) equity awards, we estimate the grant date fair value using our closing stock price on the date of grant. We recognize the effect of forfeitures in compensation expense when the forfeitures occur. The estimated forfeiture rates may differ from actual forfeiture rates which would affect the amount of expense recognized during the period. We recognize the value of the awards over the awards’ requisite service or performance periods. The requisite service period is generally the time over which our share-based awards vest.

10

Table of Contents

Income Taxes

Our income tax expense consists of current and deferred income tax expense or benefit. Current income tax expense or benefit is the amount of income taxes expected to be payable or refundable for the current year. A deferred income tax asset or liability is recognized for the future tax consequences attributable to tax credits and loss carryforwards and to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. As of March 31, 2021 and 2020, we have established a valuation allowance to fully reserve our net deferred tax assets. Tax rate changes are reflected in income during the period such changes are enacted. Changes in our ownership may limit the amount of net operating loss carryforwards that can be utilized in the future to offset taxable income.

There have been no material changes in our unrecognized tax benefits since June 30, 2020, and, as such, the disclosures included in our 2020 Annual Report continue to be relevant for the nine months ended March 31, 2021.

Leases

Effective July 1, 2019, we adopted FASB ASC Topic 842, Leases (“ASC 842”), using a modified retrospective basis method under which prior comparative periods are not restated. This standard requires lessees to recognize in the statement of financial position a liability to make lease payments and a right-of-use (“ROU”) asset representing our right to use the underlying asset for the lease term. At the inception of an arrangement, we determine whether the arrangement is or contains a lease based on the unique facts and circumstances within the arrangement. A lease is identified where an arrangement conveys the right to control the use of identified property, plant, and equipment for a period of time in exchange for consideration. Leases which are identified within the scope of ASC 842 and which have a term greater than one year are recognized on our Condensed Balance Sheet as ROU assets and lease liabilities. Operating lease liabilities and their corresponding ROU assets are recorded based on the present value of lease payments over the expected remaining lease term. The lease term includes any renewal options and termination options that we are reasonably certain to exercise. Certain adjustments to the right-of-use asset may be required for items such as initial direct costs paid or incentives received. The present value of lease payments is determined by using the interest rate implicit in the lease, if that rate is readily determinable; otherwise, we use our incremental borrowing rate. The incremental borrowing rate is determined based on the rate of interest that we would pay to borrow on a collateralized basis an amount equal to the lease payments for a similar term and in a similar economic environment. The interest rate implicit in lease contracts to calculate the present value is typically not readily determinable. As such, significant management judgment is required to estimate the incremental borrowing rate.

Rent expense for operating leases is recognized on a straight-line basis over the lease term based on the total lease payments. We have elected the practical expedient to not separate lease and non-lease components for our real estate leases. Our non-lease components are primarily related to property maintenance, which varies based on future outcomes, and thus is recognized in rent expense when incurred.

Note 2. Fair Value Measurements

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques used to measure fair value must maximize the use of observable inputs and minimize the use

11

Table of Contents

of unobservable inputs. The fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be used to measure fair value is as follows:

| • Level 1 – | Observable inputs such as quoted prices in active markets for identical assets or liabilities. | |

| • Level 2 – | Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. | |

| • Level 3 – | Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities. | |

We measure the following financial instruments at fair value on a recurring basis. The fair values of these financial instruments were as follows (in thousands):

| March 31, 2021 | June 30, 2020 | |||||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Warrant liability |

$ | — | $ | — | $ | (29,442 | ) | $ | — | $ | — | $ | (40,483 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

$ | — | $ | — | $ | (29,442 | ) | $ | — | $ | — | $ | (40,483 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

The carrying amounts of financial instruments such as cash equivalents, short-term investments and accounts payable approximate the related fair values due to the short-term maturities of these instruments. We invest our excess cash in financial instruments which are readily convertible into cash, such as money market funds and U.S. government securities. Cash equivalents, where applicable, and short-term investments are classified as Level 1 as defined by the fair value hierarchy.

In May 2018, we issued warrants in connection with our private placement of shares of common stock. Pursuant to the terms of the warrants, we could be required to settle the warrants in cash in the event of an acquisition of the Company and, as a result, the warrants are required to be measured at fair value and reported as a liability in the Condensed Balance Sheet. We recorded the fair value of the warrants upon issuance using the Black-Scholes valuation model and are required to revalue the warrants at each reporting date with any changes in fair value recorded on our Condensed Statement of Operations. The valuation of the warrants is considered under Level 3 of the fair value hierarchy due to the need to use assumptions in the valuation that are both significant to the fair value measurement and unobservable. Inputs used to determine estimated fair value of the warrant liabilities include the estimated fair value of the underlying stock at the valuation date, the estimated term of the warrants, risk-free interest rates, expected dividends and the expected volatility of the underlying stock. The significant unobservable inputs used in the fair value measurement of the warrant liabilities were the volatility rate and the estimated term of the warrants. Generally, increases (decreases) in the fair value of the underlying stock and estimated term would result in a directionally similar impact to the fair value measurement. The change in the fair value of the Level 3 warrant liability is reflected in the Condensed Statement of Operations for the three and nine months ended March 31, 2021 and 2020, respectively.

To calculate the fair value of the warrant liability, the following assumptions were used:

| March 31, 2021 |

June 30, 2020 | |||||||||

| Risk-free interest rate |

0.1 | % | 0.2 | % | ||||||

| Expected life (years) |

2.1 | 2.9 | ||||||||

| Expected volatility |

82.4 | % | 77.4 | % | ||||||

| Dividend yield |

0.0 | % | 0.0 | % | ||||||

| Black-Scholes Fair Value |

$ | 1.83 | $ | 2.52 | ||||||

12

Table of Contents

The following table sets forth a summary of changes in the estimated fair value of our Level 3 warrant liability for the nine months ended March 31, 2021 and 2020 (in thousands):

| Fair Value of Warrants Using Significant Unobservable Inputs (Level 3) | ||||||||||

| 2021 | 2020 | |||||||||

| Balance at July 1, |

$ | (40,483 | ) | $ | (17,613 | ) | ||||

| Reclassification of derivative liability to equity upon exercise of warrants |

6 | — | ||||||||

| Change in estimated fair value of liability classified warrants |

11,035 | 830 | ||||||||

|

|

|

|

|

|||||||

| Balance at March 31, |

$ | (29,442 | ) | $ | (16,783 | ) | ||||

|

|

|

|

|

|||||||

Note 3. License Agreements

KKC License, Development and Commercialization Agreement

In April 2020, we entered into the License, Development and Commercialization Agreement (the “KKC Commercialization Agreement”) with Kyowa Kirin Company (“KKC”). Under the agreement, we granted to KKC a co-exclusive, sublicensable, payment-bearing license under certain patents and know-how controlled by us to develop and commercialize zandelisib and any pharmaceutical product containing zandelisib for all human indications in the U.S. (the “U.S. License”), and an exclusive (subject to certain retained rights to perform obligations under the KKC Commercialization Agreement), sublicensable, payment-bearing, license under certain patents and know-how controlled by us to develop and commercialize zandelisib and any pharmaceutical product containing zandelisib for all human indications in countries outside of the United States (the “Ex-U.S.”) (the “Ex-U.S. license”). KKC granted to us a co-exclusive, sublicensable, license under certain patents and know-how controlled by KKC to develop and commercialize zandelisib for all human indications in the U.S., and a co-exclusive, sublicensable, royalty-free, fully paid license under certain patents and know-how controlled by KKC to perform our obligations in the Ex-U.S. under the KKC Commercialization Agreement. KKC paid us an initial payment of $100 million in May 2020. Of the $100 million paid by KKC, $20.4 million was remitted by KKC to the Japanese taxing authorities as a result of the U.S. Internal Revenue Service being closed due to the COVID pandemic, and therefore being unable to provide necessary documentation to support an exemption from the required foreign withholding. We received the amount remitted to the Japanese taxing authorities in October 2020. Additionally, we may earn up to approximately $582.5 million in potential development, regulatory and commercialization milestone payments, plus royalties on net sales of zandelisib in the Ex-U.S., which are tiered beginning in the teens.

KKC will be responsible for the development and commercialization of zandelisib in the Ex-U.S. and, subject to certain exceptions, will be solely responsible for all costs related thereto. We will co-develop and co-promote zandelisib with KKC in the U.S., with the Company recording all revenue from U.S. sales. We will share U.S. profits and costs (including development costs) on a 50-50 basis with KKC. We will also provide to KKC certain drug supplies necessary for the development and commercialization of zandelisib in the Ex-U.S., with the understanding that KKC will assume responsibility for manufacturing for the Ex-U.S. as soon as practicable.

We assessed the KKC Commercialization Agreement in accordance with Topic 808 and Topic 606 and determined that our obligations comprise the U.S. License, the Ex-U.S. License, and development services (the “Development Services”). We determined that the KKC Commercialization Agreement is a collaborative arrangement in accordance with Topic 808 that contains multiple units of account, as we and KKC are both active participants in the development and commercialization activities and are exposed to significant risks and rewards that are dependent on commercial success of the activities of the arrangement. The U.S. License is a unit of account under the scope of Topic 808 and is not a deliverable under Topic 606, while the Ex-U.S. License and Development Services performance obligations are under the scope of Topic 606.

We determined, at the time of our initial assessment, that the total transaction price of $191.5 million is comprised of the upfront payment of $100.0 million, expected milestone payments of $20.0 million, estimated development cost-sharing of $66.3 million, and deferred revenue of $5.2 million from the KKC Japan License Agreement (as defined below). During the nine months ended March 31, 2021, we updated our initial assessment to reflect estimated development cost-sharing of $94.9 million. We included the amount of estimated variable consideration that is not constrained for development cost-sharing in the transaction price. Any variable consideration related to sales-based royalties and commercial milestones related to licenses of intellectual property will be determined when the sale or usage occurs, and is therefore excluded from the transaction price. In addition, we are eligible to receive future development and regulatory milestones upon the achievement of certain criteria; however, these amounts are excluded from variable consideration as the risk of significant revenue reversal will only be resolved depending on future research and development and/or regulatory approval outcomes. We re-evaluate the estimated variable consideration included in the transaction price and any related constraints at the end of each reporting period.

We allocated the transaction price to each unit of account. Variable consideration that relates specifically to our efforts to satisfy specific performance obligations are allocated entirely to those performance obligations. Other components of the transaction price are allocated based on the relative stand-alone selling price, over which management has applied significant judgment. We developed the estimated stand-alone selling price for the licenses using the risk-adjusted net present values of estimated cash flows, and the estimated stand-alone selling price of the development services performance obligations by estimating costs to be incurred, and an appropriate margin, using an income approach.

13

Table of Contents

We determined that control of the U.S. License and Ex-U.S. License were transferred to KKC during the year ended June 30, 2020, and recognized revenue of $21.0 million related to the Ex-U.S. License. The $64.5 million transaction price allocated to the U.S. License obligation accounted for under Topic 808 is recorded as non-current deferred revenue and will begin to be recognized upon future commercialization as non-ASC 606 revenue. As of March 31, 2021 and June 30, 2020, we recorded deferred revenue of $25.4 million and $18.1 million, respectively, for the transaction price allocated to the Development Services performance obligations and are recognizing this revenue based on the proportional performance of these development activities, which we expect to recognize through fiscal year 2026.

KKC Japan License Agreement

In October 2018, we, as licensor, entered into a license agreement with KKC for zandelisib (“the KKC Japan License Agreement”). Under the terms of the KKC Japan License Agreement, KKC was granted the exclusive right to develop and commercialize zandelisib in Japan. We also granted KKC the right to purchase supply of zandelisib for commercial requirements at cost plus a pre-negotiated percentage, as well as manufacturing rights in Japan. In return, we received an upfront payment of $10.0 million and were eligible to receive additional development and commercialization milestones, as well as royalties on net sales of zandelisib in Japan. In April 2020, we and KKC agreed to terminate the KKC Japan License Agreement. The KKC Japan License Agreement was replaced with the KKC Commercialization Agreement. Pursuant to the terms of the KKC Commercialization Agreement, we agreed to collaborate with KKC on the development, manufacturing and commercialization of zandelisib in Japan.

We assessed the KKC Japan License Agreement in accordance with ASC 606 and determined that our performance obligations comprised the license, research and development obligations, and our obligation to provide clinical trial materials to KKC. We determined that the transaction price amounted to the upfront payment of $10.0 million.

We determined that control of the license was transferred to KKC during the year ended June 30, 2019. Revenue allocated to the research and development obligations was recognized based on the proportional performance of these research and development activities. Revenue allocated to providing clinical trial materials was recognized upon delivery.

Helsinn License Agreement

In August 2016, we entered into an exclusive worldwide license, development, manufacturing and commercialization agreement with Helsinn Healthcare SA, a Swiss pharmaceutical corporation (“Helsinn”) for pracinostat in acute myeloid leukemia (“AML”), myelodysplastic syndrome (“MDS”) and other potential indications (the “Helsinn License Agreement”). Under the terms of the agreement, Helsinn was granted a worldwide exclusive license to develop, manufacture and commercialize pracinostat, and is primarily responsible for funding its global development and commercialization. As compensation for such grant of rights, we received payments of $20.0 million.

We determined that the agreement contains multiple performance obligations for purposes of revenue recognition. Revenue related to the research and development elements of the arrangement is recognized based on the extent of progress toward completion of each performance obligation. Revenue is recognized on a gross basis as we are the primary obligor and have discretion in supplier selection. During the nine months ended March 31, 2021, our only remaining performance obligation under the agreement was the conduct of a Phase 2 dose-optimization study of pracinostat in combination with azacitidine in patients with high and very high risk MDS who are previously untreated with hypomethylating agents (the “POC study”), for which Helsinn has agreed to share third-party expenses. As of March 31, 2021, our performance obligations related to the Helsinn License Agreement have been met, and no future revenue or costs of revenue will be recognized.

Presage License Agreement

In September 2017, we entered into a license agreement with Presage Biosciences, Inc. (“Presage”). Under the terms of such license agreement (the “Presage License Agreement”), Presage granted to us exclusive worldwide rights to develop, manufacture and commercialize voruciclib, a clinical-stage, oral and selective CDK inhibitor, and related compounds. In exchange, we paid $2.9 million. With respect to the first indication, an incremental $2.0 million payment, due upon dosing of the first subject in the first registration trial, will be owed to Presage, for total payments of $4.9 million prior to receipt of marketing approval of the first indication in the U.S., E.U. or Japan. Additional potential payments of up to $179 million will be due upon the achievement of certain development, regulatory and commercial milestones. We will also pay mid-single-digit tiered royalties on the net sales of any product successfully developed. As an alternative to milestone and royalty payments related to countries in which we sublicense product rights, we will pay to Presage a tiered percent (which decreases as product development progresses) of amounts received from such sublicensees.

CyDex License Agreement

We are party to a license agreement with CyDex Pharmaceuticals, Inc. (“CyDex”). Under the license agreement, CyDex granted to us an exclusive, nontransferable license to intellectual property rights relating to Captisol® for use with our isoflavone-based drug compounds (currently ME-344). We agreed to pay to CyDex a non-refundable license issuance fee, future milestone payments, and royalties at a low, single-digit percentage rate on future sales of our approved drugs utilizing Captisol. Contemporaneously with the license agreement, CyDex entered into a commercial supply agreement with us, pursuant to which we agreed to purchase 100% of our requirements for Captisol from CyDex. We may terminate both the license agreement and the supply agreement at any time upon 90 days’ prior written notice.

14

Table of Contents

Note 4. BeiGene Collaboration

In October 2018, we entered into a clinical collaboration with BeiGene, Ltd. (“BeiGene”) to evaluate the safety and efficacy of zandelisib in combination with BeiGene’s zanubrutinib (marketed as Brukinsa®), an inhibitor of Bruton’s tyrosine kinase, for the treatment of patients with B-cell malignancies. Under the terms of the clinical collaboration agreement, we amended our ongoing Phase 1b trial to include evaluation of zandelisib in combination with zanubrutinib in patients with B-cell malignancies. Study costs are being shared equally by the parties, and we agreed to supply zandelisib and BeiGene agreed to supply zanubrutinib. We record the costs reimbursed by BeiGene as a reduction of our research and development expenses. We retained full commercial rights for zandelisib and BeiGene retained full commercial rights for zanubrutinib.

Note 5. Net Loss Per Share

Basic and diluted net loss per share are computed using the weighted-average number of shares of common stock outstanding during the period, less any shares subject to repurchase or forfeiture. There were no shares of common stock subject to repurchase or forfeiture for the three and nine months ended March 31, 2021 and 2020. Diluted net loss per share is computed based on the sum of the weighted average number of common shares and potentially dilutive common shares outstanding during the period.

The following table presents the calculation of net loss used to calculate basic loss and diluted loss per share (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Net loss – basic |

$ | (31,313 | ) | $ | (4,329 | ) | $ | (44,859 | ) | $ | (27,540 | ) | ||||||||

| Change in fair value of warrant liability |

— | — | (20,307 | ) | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss – diluted |

$ | (31,313 | ) | $ | (4,329 | ) | $ | (65,166 | ) | $ | (27,540 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Share used in calculating net loss per share was determined as follows (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Weighted average shares used in calculating basic net loss per share |

112,557 | 105,999 | 112,505 | 85,995 | ||||||||||||||||

| Effect of potentially dilutive common shares from equity awards and liability-classified warrants |

— | — | 1,486 | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted average shares used in calculating diluted net loss per share |

112,557 | 105,999 | 113,991 | 85,995 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Our potentially dilutive shares, which include outstanding stock options, restricted stock units, and warrants, are considered to be common stock equivalents and are only included in the calculation of diluted net loss per share when their effect is dilutive.

The following table presents weighted-average potentially dilutive shares that have been excluded from the calculation of net loss per share because of their anti-dilutive effect (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Stock options |

16,161 | 11,064 | 15,618 | 10,974 | ||||||||||||||||

| Restricted stock units |

430 | — | 430 | — | ||||||||||||||||

| Warrants |

16,060 | 16,062 | 5,354 | 16,062 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total anti-dilutive shares |

32,651 | 27,126 | 21,402 | 27,036 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

15

Table of Contents

Note 6. Commitments and Contingencies

We have contracted with various consultants and third parties to assist us in pre-clinical research and development and clinical trials work for our leading drug compounds. The contracts are terminable at any time, but obligate us to reimburse the providers for any time or costs incurred through the date of termination. We also have employment agreements with certain of our current employees that provide for severance payments and accelerated vesting for share-based awards if their employment is terminated under specified circumstances.

Presage License Agreement

As discussed in Note 3, we are party to a license agreement with Presage under which we may be required to make future payments upon the achievement of certain development, regulatory and commercial milestones, as well as potential future royalties based upon net sales. As of March 31, 2021, we have not accrued any amounts for potential future payments as achievement of the milestones has not been met.

S*Bio Purchase Agreement

We are party to a definitive asset purchase agreement with S*Bio, pursuant to which we acquired certain assets comprised of intellectual property and technology including rights to pracinostat. We agreed to make certain milestone payments to S*Bio based on the achievement of certain clinical, regulatory and net sales-based milestones, as well as to make certain contingent earnout payments to S*Bio. Milestone payments will be made to S*Bio up to an aggregate amount of $74.5 million if certain U.S., E.U. and Japanese regulatory approvals are obtained and if certain net sales thresholds are met in North America, the E.U. and Japan. As of March 31, 2021, we have not accrued any amounts for potential future payments as achievement of the milestones has not been met.

CyDex License Agreement

As discussed in Note 3, we are party to a license agreement with CyDex under which we may be required to make future payments upon the achievement of certain milestones, as well as potential future royalties based upon net sales. Contemporaneously with the license agreement, CyDex entered into a commercial supply agreement with us, pursuant to which we agreed to purchase 100% of our requirements for Captisol from CyDex. As of March 31, 2021, we have not accrued any amounts for potential future payments.

COVID-19

In January 2020, the World Health Organization (“WHO”) announced a global health emergency because of a new strain of coronavirus originating in Wuhan, China (the “COVID-19 outbreak”) and the risks to the international community. In March 2020, the WHO classified the COVID-19 outbreak as a pandemic, based on the rapid increase in exposure globally. As a result of the COVID-19 pandemic, which continues to rapidly evolve, “shelter in place” orders and other public health guidance measures have been implemented across much of the United States, Europe and Asia, including in the locations of our offices, clinical trial sites, key vendors and partners. Despite the relaxation of many governmental orders in mid-2020, the “second wave” of the COVID-19 outbreak has resulted in the re-imposition of many of these measures. In addition, although the FDA has authorized vaccines for the treatment of COVID-19, the effectiveness and timing of distribution of the vaccines remains highly uncertain. The COVID-19 virus has also mutated into different strains, which could be more contagious or severe or for which treatments are unavailable. While we continue to enroll and dose patients in our clinical trials, our clinical development program timelines continue to be subject to potential negative impacts from the ongoing pandemic. The extent to which the outbreak impacts our business, preclinical studies and clinical trials will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the pandemic, the effectiveness and timing of distribution of treatments for COVID-19, travel restrictions and social distancing in the United States and other countries, business closures or business disruptions and the effectiveness of actions taken in the United States and other countries to contain and treat the disease and to minimize its economic impact.

CARES Act

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act was signed into law. The CARES Act, among other things, includes provisions relating to refundable payroll tax credits, deferment of employer side social security payments, net operating loss carryback periods, alternative minimum tax credit refunds, modifications to the net interest deduction limitations, increased limitations on qualified charitable contributions, and technical corrections to tax depreciation methods for qualified improvement property. Regulatory guidance has indicated that public companies are ineligible to participate in certain of the loan programs provided by the CARES Act. There is substantial uncertainty with respect to the scope, content or timing of any further economic stimulus programs to address the economic downturn related to the COVID-19 outbreak. We do not expect that the CARES Act will have a material impact on our financial condition, results of operation, or liquidity.

Legal Proceedings

On August 10, 2020, Guy Bahat, an individual who allegedly purchased 50 shares of our common stock filed a putative securities class action lawsuit (the “Securities Class Action”) in the United States District Court for the Southern District of California against the Company, Dr. Daniel P. Gold, and Mr. Brian G. Drazba, asserting claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder. Mr. Bahat did not seek appointment as lead plaintiff, and the court appointed another

16

Table of Contents

individual, Ramesh Mahalingham, as lead plaintiff. The plaintiff seeks to sue on behalf of all purchasers of our securities from August 2, 2017 through July 1, 2020 and alleges, among other things, that we made false and misleading statements relating to pracinostat during the proposed class period. On February 16, 2021, the lead plaintiff filed a notice of voluntary dismissal without prejudice, thereby concluding the class action litigation.

On October 21, 2020, Peter D’Arcy, an individual who alleges that he is a Company stockholder, filed a putative stockholder derivative action nominally on behalf of the Company in the United States District Court for the District of Delaware (the “Derivative Action”) against Dr. Gold, Mr. Drazba, Mr. Charles V. Baltic, III, Dr. Kevan E. Clemens, Mr. Frederick W. Driscoll, Dr. Nicholas R. Glover, Ms. Tamar D. Howson, Dr. Thomas C. Reynolds, Mr. William D. Rueckert, and Dr. Christine A. White, and naming the Company as a nominal defendant. Additional putative stockholder derivative suits were filed in the same court naming the same defendants plus Dr. Robert D. Mass on December 2, 2020 and December 15, 2020 by Gerald Wright and William Trablicy, respectively, who also allege that they are Company stockholders, and these additional suits were consolidated into the Derivative Action by court order. The Derivative Action is based upon the pracinostat-related allegations in the Securities Class Action described above, and alleges claims under Section 14(a) of the Exchange Act and claims for breach of fiduciary duty, unjust enrichment, corporate waste, and contribution. On February 24, 2021, following the resolution of the class action litigation, the parties stipulated request for voluntary dismissal without prejudice, which the court granted on February 25, 2021.

Note 7. Leases

In December 2019, we entered into a lease agreement for approximately 32,800 square feet of office space in San Diego, California. We have accounted for the lease as an operating lease. The contractual lease term began in July 2020 and is scheduled to expire in March 2028. The lease contains an option to renew and extend the lease terms. We have not included the lease extension within the ROU asset and lease liability on the balance sheet as it is not reasonably certain to be exercised. The lease includes variable non-lease components (e.g., common area maintenance, maintenance, etc.) that are not included in the ROU asset and lease liability and are reflected as an expense in the period incurred. We do not have any other operating or finance leases. Upon commencement of the lease, we recognized an operating lease ROU asset of $8.7 million and a corresponding operating lease liability of $8.7 million.

The total operating lease costs were as follows (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Operating lease cost |

$ | 377 | $ | 201 | $ | 1,130 | $ | 603 | ||||||||||||

Supplemental cash flow information related to our operating leases were as follows (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Cash paid for amounts included in the measurement of lease liabilities: |

||||||||||||||||||||

| Operating cash flows from operating leases |

$ | 369 | $ | 201 | $ | 615 | $ | 603 | ||||||||||||

| Right-of-use assets obtained in exchange for operating lease obligations: |

— | — | 8,689 | — | ||||||||||||||||

17

Table of Contents

The following is a schedule of the future minimum rental payments for our operating lease, reconciled to the lease liability as of March 31, 2021 (in thousands):

| March 31, 2021 | |||||

| Remainder of fiscal year ending June 30, 2021 |

$ | 368 | |||

| Years ending June 30, |

|||||

| 2022 |

1,519 | ||||

| 2023 |

1,565 | ||||

| 2024 |

1,612 | ||||

| 2025 |

1,168 | ||||

| 2026 |

1,710 | ||||

| Thereafter |

3,122 | ||||

|

|

|

||||

| Total lease payments |

11,064 | ||||

| Less: Present value discount |

(2,556 | ) | |||

|

|

|

||||

| Total operating lease liability |

$ | 8,508 | |||

|

|

|

||||

| Balance Sheet Classification – Operating Lease |

|||||

| Operating lease liability |

$ | 900 | |||

| Operating lease liability, long-term |

7,608 | ||||

|

|

|

||||

| Total operating lease liability |

$ | 8,508 | |||

|

|

|

||||

| Other Balance Sheet Information – Operating Lease |

|||||

| Weighted average remaining lease term (in years) |

7.0 | ||||

| Weighted average discount rate |

7.50 | % | |||

Note 8. Short-Term Investments

As of March 31, 2021 and June 30, 2020, our short-term investments consisted of $154.9 million and $170.3 million, respectively, in U.S. government securities. The short-term investments held as of March 31, 2021 and June 30, 2020 had maturity dates of less than one year, are considered to be “held to maturity” and are carried at amortized cost. As of March 31, 2021 and June 30, 2020, the gross holding gains and losses were immaterial.

Note 9. Stockholders’ Equity

Equity Transactions

At-The-Market Equity Offering

On November 10, 2020, we entered into an At-The-Market Equity Offering Sales Agreement (the “2020 ATM Sales Agreement”), pursuant to which we may sell an aggregate of up to $60.0 million of our common stock pursuant to the shelf registration statement. We had previously entered into an At-The-Market Equity Offering Sales Agreement in November 2017 (the “2017 ATM Sales Agreement”), pursuant to which we could sell an aggregate of up to $30.0 million of our common stock pursuant to the shelf registration statement. The 2017 ATM Sales Agreement expired on November 8, 2020. During the nine months ended March 31, 2021, we sold 958,083 shares under the 2017 ATM Sales Agreement for net proceeds of $3.1 million, after costs of $0.1 million. As of March 31, 2021, there is $60.0 million remaining available under the 2020 ATM Sales Agreement.

Shelf Registration Statement

We have a shelf registration statement that permits us to sell, from time to time, up to $200.0 million of common stock, preferred stock and warrants. The shelf registration was filed and declared effective in May 2020, replacing our prior shelf registration statement that was filed and declared effective in May 2017, and carrying forward approximately $107.5 million of unsold securities registered under the prior shelf registration statement. As of March 31, 2021, there is $175.7 million aggregate value of securities available under the shelf registration statement, including up to $60.0 million remaining available under the 2020 ATM Sales Agreement.

Warrants

As of March 31, 2021, we have outstanding warrants to purchase 16,058,985 shares of our common stock. The warrants are fully vested, exercisable at a price of $2.54 per share and expire in May 2023. Pursuant to the terms of the warrants, we could be required to settle the warrants in cash in the event of an acquisition of the Company and, as a result, the warrants are required to be

18

Table of Contents

measured at fair value and reported as a liability in the Condensed Balance Sheet. Therefore, we are required to account for the warrants as liabilities and record them at fair value. The warrants were revalued as of March 31, 2021 at $29.4 million and as of June 30, 2020 at $40.5 million; the changes in fair value were recorded in our Condensed Statement of Operations. During the nine months ended March 31, 2021, a warrant holder completed a cashless exercise of 2,617 warrants for 964 shares of common stock. No warrants were exercised during the nine months ended March 31, 2020.

Note 10. Share-based Compensation

We use equity-based compensation programs to provide long-term performance incentives for our employees. These incentives consist primarily of stock options and RSUs. In December 2008, we adopted the MEI Pharma, Inc. 2008 Stock Omnibus Equity Compensation Plan (“2008 Plan”), as amended and restated in 2011, 2013, 2014, 2015, 2016, 2018 and 2020, under which 29,014,794 shares of common stock are authorized for issuance. The 2008 Plan provides for the grant of options and/or other stock-based or stock-denominated awards to our non-employee directors, officers, employees and advisors. As of March 31, 2021, there were 10,284,365 shares available for future grant under the 2008 Plan.

Total share-based compensation expense for all stock awards consists of the following (in thousands):

| Three Months Ended March 31, |

Nine Months Ended March 31, | |||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||

| Research and development |

$ | 1,207 | $ | 696 | $ | 3,496 | $ | 2,220 | ||||||||||||

| General and administrative |

1,438 | 854 | 4,700 | 3,214 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total share-based compensation |

$ | 2,645 | $ | 1,550 | $ | 8,196 | $ | 5,434 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Stock Options

Stock option activity for the nine months ended March 31, 2021 was as follows:

| Number of Options |

Weighted- Average Exercise Price |

Weighted-Average Remaining Contractual Term (in years) |

Aggregate Intrinsic Value | |||||||||||||||||

| Outstanding at June 30, 2020 |

11,252,976 | $ | 2.81 | |||||||||||||||||

| Granted |

5,763,300 | 3.40 | ||||||||||||||||||

| Exercised |

(119,042 | ) | 2.22 | |||||||||||||||||

| Forfeited / Cancelled |

(223,828 | ) | 3.65 | |||||||||||||||||

|

|

|

|||||||||||||||||||

| Outstanding at March 31, 2021 |

16,673,406 | 3.01 | 7.9 | $ | 9,775,096 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Vested and exercisable at March 31, 2021 |

7,802,361 | 2.74 | 6.7 | $ | 7,006,856 | |||||||||||||||