0001261333DEF 14Afalse00012613332022-02-012023-01-310001261333docu:MrThygesenMember2022-02-012023-01-31iso4217:USD0001261333docu:MsWilderotterMember2022-02-012023-01-310001261333docu:MrSpringerMember2022-02-012023-01-310001261333docu:MrSpringerMember2021-02-012022-01-3100012613332021-02-012022-01-310001261333docu:MrSpringerMember2020-02-012021-01-3100012613332020-02-012021-01-310001261333docu:MrThygesenMemberdocu:StockAwardsAdjustmentsMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberdocu:MrThygesenMemberecd:PeoMember2022-02-012023-01-310001261333docu:MrThygesenMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-02-012023-01-310001261333docu:MrThygesenMemberdocu:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberdocu:MrThygesenMemberecd:PeoMember2022-02-012023-01-310001261333docu:MrThygesenMemberdocu:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2022-02-012023-01-310001261333docu:MsWilderotterMemberdocu:StockAwardsAdjustmentsMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberdocu:MsWilderotterMemberecd:PeoMember2022-02-012023-01-310001261333docu:MsWilderotterMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedDuringTheYearVestedMemberdocu:MsWilderotterMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberdocu:MsWilderotterMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsThatFailedToMeetVestingConditionsMemberdocu:MsWilderotterMemberecd:PeoMember2022-02-012023-01-310001261333docu:MrSpringerMemberdocu:StockAwardsAdjustmentsMemberecd:PeoMember2020-02-012021-01-310001261333docu:MrSpringerMemberdocu:StockAwardsAdjustmentsMemberecd:PeoMember2021-02-012022-01-310001261333docu:MrSpringerMemberdocu:StockAwardsAdjustmentsMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberdocu:MrSpringerMemberecd:PeoMember2020-02-012021-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberdocu:MrSpringerMemberecd:PeoMember2021-02-012022-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberdocu:MrSpringerMemberecd:PeoMember2022-02-012023-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2020-02-012021-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2021-02-012022-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMember2022-02-012023-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2020-02-012021-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2021-02-012022-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsGrantedDuringTheYearVestedMemberecd:PeoMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberdocu:MrSpringerMemberecd:PeoMember2020-02-012021-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberdocu:MrSpringerMemberecd:PeoMember2021-02-012022-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberdocu:MrSpringerMemberecd:PeoMember2022-02-012023-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2020-02-012021-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2021-02-012022-01-310001261333docu:MrSpringerMemberdocu:EquityAwardsThatFailedToMeetVestingConditionsMemberecd:PeoMember2022-02-012023-01-310001261333ecd:NonPeoNeoMemberdocu:StockAwardsAdjustmentsMember2020-02-012021-01-310001261333ecd:NonPeoNeoMemberdocu:StockAwardsAdjustmentsMember2021-02-012022-01-310001261333ecd:NonPeoNeoMemberdocu:StockAwardsAdjustmentsMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-02-012021-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-02-012022-01-310001261333docu:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-02-012023-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMember2020-02-012021-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMember2021-02-012022-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsGrantedInPriorYearsUnvestedMember2022-02-012023-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsGrantedDuringTheYearVestedMember2020-02-012021-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsGrantedDuringTheYearVestedMember2021-02-012022-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsGrantedDuringTheYearVestedMember2022-02-012023-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-02-012021-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-02-012022-01-310001261333docu:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-02-012023-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsThatFailedToMeetVestingConditionsMember2020-02-012021-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsThatFailedToMeetVestingConditionsMember2021-02-012022-01-310001261333ecd:NonPeoNeoMemberdocu:EquityAwardsThatFailedToMeetVestingConditionsMember2022-02-012023-01-31000126133312022-02-012023-01-31000126133322022-02-012023-01-31000126133332022-02-012023-01-31000126133342022-02-012023-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | | | | | | | | | | | | | | | | |

| Filed by the Registrant | | ☒ | | Filed by a Party other than the Registrant | ☐ | | |

| | | | | | | | |

| Check the appropriate box: |

| | |

| ☐ | | Preliminary Proxy Statement |

| | |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | | Definitive Proxy Statement |

| | |

| ☐ | | Definitive Additional Materials |

| | |

| ☐ | | Soliciting Material under §240.14a-12 |

DocuSign, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| | |

| ☒ | | No fee required |

| | |

| ☐ | | Fee paid previously with preliminary materials |

| | |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | | | | | | | |

Notice of 2023 Annual Meeting of Stockholders |

Dear Stockholder: You are cordially invited to attend the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) of DocuSign, Inc., a Delaware corporation (the “Company”). The Annual Meeting will be held in a virtual format via an online live webcast. A virtual format allows us to improve sustainability and reduce our environmental footprint, save us and stockholders time and money, and ensure all stockholders have the opportunity to efficiently and effectively participate in the Annual Meeting regardless of location. We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement: | | | Date May 31, 2023 |

| | |

| | Time 9:00 a.m. Pacific Time |

| | |

| | Location www.virtualshareholdermeeting.com/DOCU2023 |

|

| | | |

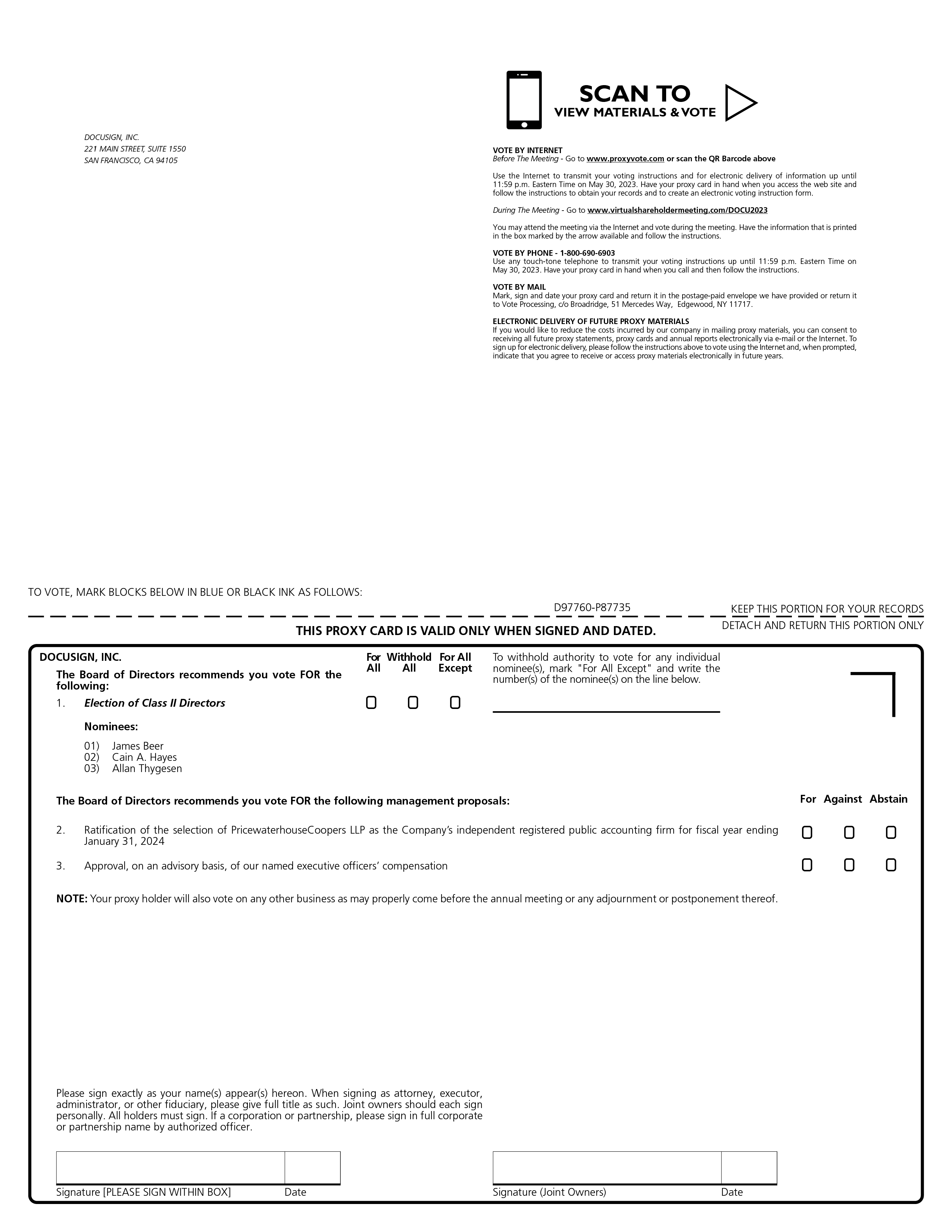

| 01 | To elect the Board of Directors’ nominees, James Beer, Cain A. Hayes, and Allan Thygesen, to the Board of Directors to hold office until the 2026 Annual Meeting of Stockholders. | | |

| |

| | |

| | Record Date The record date for the Annual Meeting is April 6, 2023. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof. On or about April 18, 2023, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and annual report. |

| 02 | To ratify the selection of PricewaterhouseCoopers LLP by the Audit Committee of the Board of Directors as the independent registered public accounting firm of the Company for its fiscal year ending January 31, 2024. | |

| |

| 03 | To conduct an advisory vote on our named executive officers’ compensation. | | |

| 04 | To conduct any other business properly brought before the meeting. | | |

| | | |

These items of business are more fully described in the Proxy Statement accompanying this Notice. The record date for the Annual Meeting is April 6, 2023. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof. On or about April 18, 2023, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and annual report. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/DOCU2023, where you will be able to listen to the meeting live, submit questions and vote online. We encourage you to check the Annual Meeting website and our press releases on our investor relations website at investor.docusign.com prior to the virtual Annual Meeting if you plan to attend. By Order of the Board of Directors, Allan Thygesen President & Chief Executive Officer San Francisco, California, April 18, 2023 | | |

All stockholders are cordially invited to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, you are encouraged to submit your proxy and voting instructions via the Internet, by telephone or, if you received a paper proxy card and voting instructions by mail, you may vote your shares by completing, signing and dating the proxy card as promptly as possible and returning it in the enclosed envelope (to which no postage need be affixed if mailed in the United States). Even if you have given your proxy, you may still vote online if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain from the record holder a proxy issued in your name. You may revoke a previously delivered proxy at any time prior to the Annual Meeting. You may do so automatically by voting online at the Annual Meeting, or by delivering to us a written notice of revocation or a duly executed proxy bearing a date later than the date of the proxy being revoked.

Table of Contents

Questions and Answers About These Proxy Materials and Voting

Why did I receive a notice regarding the availability of proxy materials on the Internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors (the “Board”) of DocuSign, Inc., a Delaware corporation (sometimes referred to as the “Company” or “DocuSign”) is soliciting your proxy to vote at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the Annual Meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 18, 2023 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after April 18, 2023.

How do I attend the annual meeting?

The Annual Meeting will be held on Wednesday, May 31, 2023 online via live webcast at 9:00 a.m. Pacific Time. Information on how to vote online at the Annual Meeting is discussed below.

Will the annual meeting be held in person or virtually?

We currently intend to hold our Annual Meeting virtually. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/DOCU2023, where you will be able to listen to the meeting live, submit questions and vote online. We will announce any updates through a press release, on our Annual Meeting website (www.virtualshareholdermeeting.com/DOCU2023) and in a Current Report on Form 8-K. We encourage you to check the Annual Meeting website and our press releases on our investor relations website at investor.docusign.com prior to the meeting if you plan to attend.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 6, 2023 will be entitled to vote at the Annual Meeting. On this record date, there were 202,317,157 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on April 6, 2023, your shares were registered directly in your name with DocuSign’s transfer agent, American Stock Transfer and Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote online at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 6, 2023, your shares were not held in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and this Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 1 |

| | | | | | | | |

| | QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

What are my voting choices on each matter? What are the Board’s recommendations?

| | | | | | | | | | | |

| Proposal | Voting Choices | Board

Recommendation |

| | | |

| 01 | Election of Directors | For(1) Withhold(1) | FOR(1) |

| 02 | Ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year ending January 31, 2024 | For

Against

Abstain | FOR |

| 03 | Approval, on an advisory basis, of our named executive officers’ compensation | For

Against

Abstain | FOR |

1.The voting choices and Board recommendation are with respect to each director nominee.

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker

non-votes.

| | | | | | | | | | | | | | |

| Proposal | Vote Required

for Approval | Effect of

Abstentions or Withhold Votes | Effect of

Broker Non-Votes |

| | | | |

| 01 | Election of Directors | Nominees receiving the most “For” votes will be elected; withheld votes will have no effect | Not applicable | No effect |

| 02 | Ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year ending January 31, 2024 | “For” votes from the holders of a majority of shares present or represented by proxy and entitled to vote on the matter | Against | Not applicable(1) |

| 03 | Approval, on an advisory basis, of our named executive officers’ compensation | “For” votes from the holders of a majority of shares present or represented by proxy and entitled to vote on the matter | Against | No effect |

1.This proposal is considered to be a “routine” matter. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority under applicable exchange rules to vote your shares on this proposal.

What if another matter is properly brought before the meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

| | | | | | | | |

2 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | | |

How do I vote?

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting.

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote by proxy over the telephone, vote by proxy through the Internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting even if you have already voted by proxy. In such case and if you vote at the meeting, your previously submitted proxy will be disregarded.

| | | | | | | | | | | | | | | | | | | | | | | |

| To vote online during the virtual Annual Meeting visit www.virtualshareholdermeeting.com/DOCU2023. Please have your 16-digit control number included in the Notice, on your proxy card or in the instructions that accompanied your proxy materials. | | To vote using the proxy card, simply complete, sign and date the proxy card and return it promptly in the envelope provided (if you elected to receive printed materials). If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. | | To vote over the telephone, dial 1-800-690-6903 (toll-free within the United States) using a touch-tone phone and follow the recorded instructions (have your Notice or proxy card in hand when you call). You will be asked to provide the company number and 16-digit control number from the Notice. Your telephone vote must be received by 11:59 p.m. Eastern Time on May 30, 2023 to be counted. | | To vote through the Internet, go to www.proxyvote.com to complete an electronic proxy card (have your Notice or proxy card in hand when you visit the website). You will be asked to provide the company number and 16-digit control number from the Notice. Your Internet vote must be received by 11:59 p.m. Eastern Time on May 30, 2023 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice containing voting instructions from that organization rather than from DocuSign. Follow the voting instructions in the Notice to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote online at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact that organization to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of April 6, 2023, the record date for the meeting.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the Internet or online at the Annual Meeting, your shares will not be voted.

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 3 |

| | | | | | | | |

| | QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “For” the election of the three nominees for director, “For” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2024, and “For” the advisory vote on our named executive officers’ compensation. If any other matter is properly presented at the meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

Broker non-votes occur when shares held by a broker for a beneficial owner are not voted either because (i) the broker did not receive voting instructions from the beneficial owner or (ii) the broker lacked discretionary authority to vote the shares. Abstentions represent a stockholder’s affirmative choice to decline to vote on a proposal, and occur when shares present at the meeting are marked “abstain.” Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. Broker non-votes have no effect on the outcome of matters voted. Abstentions or withhold votes have no effect on the outcome of matters voted (except for Proposals 2 and 3, for which an abstention or withhold counts as an ‘Against’ vote, as noted above).

A broker has discretionary authority to vote shares held for a beneficial owner on “routine” matters without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on “non-routine” matters.

Proposal 1, the election of our Class I directors, and Proposal 3, the advisory vote on our named executive officers’ compensation, are non-routine matters, so your broker or nominee may not vote your shares on Proposal 1 or Proposal 3 without your instructions. Proposal 2, the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2024, is a routine matter, so your broker or nominee may vote your shares on Proposal 2 even in the absence of your instruction.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

•You may submit another properly completed proxy card with a later date.

•You may grant a subsequent proxy by telephone or through the Internet.

•You may send a timely written notice that you are revoking your proxy to DocuSign’s Corporate Secretary at 221 Main Street, Suite 1550, San Francisco, California 94105.

•You may attend the virtual Annual Meeting and vote online. Simply attending the virtual Annual Meeting will not, by itself, revoke your proxy.

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

| | | | | | | | |

4 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING | | |

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, for the proposal to elect directors, votes “For,” “Withhold” and broker non-votes; and, with respect to other proposals, votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding a majority of the outstanding shares entitled to vote are present virtually at the meeting or represented by proxy. On the record date, there were 202,317,157 shares outstanding and entitled to vote. Thus, the holders of at least 101,158,579 shares must be present virtually or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the virtual Annual Meeting or represented by proxy may adjourn the Annual Meeting to another date.

Who is paying for this proxy solicitation?

DocuSign will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K, which we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 20, 2023, to our Corporate Secretary at 221 Main Street, Suite 1550, San Francisco, California 94105, and you must comply with all applicable requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Pursuant to our Amended and Restated Bylaws (the “Bylaws”), if you wish to submit a proposal (including a director nomination) at the meeting that is to be included in next year’s proxy materials, you must do so no later than 5:00 p.m. Eastern Time on March 2, 2024 and no earlier than 5:00 p.m. Eastern Time on February 1, 2024; provided, however, that if next year’s annual meeting is advanced more than 30 days prior to or delayed by more than 30 days after May 31, 2024, your proposal must be submitted not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of such meeting is first made. Please refer to our Bylaws for more information and additional requirements about advance notice of stockholder proposals and director nominations.

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 5 |

Fiscal Year 2023 in Review

Business Overview

DocuSign is the global leader in the eSignature category. We offer products that address broader agreement workflows and digital transformation, including the world’s leading electronic signature product, enabling agreements to be signed electronically on a wide variety of devices, from virtually anywhere in the world, securely. DocuSign’s product offerings, including DocuSign eSignature, allow organizations to do business faster with less risk and lower costs, while providing better experiences for customers and employees. We offer applications for automating pre- and post-signature processes, including automatically generating an agreement from data in other systems, supporting negotiation workflow, verifying identities, enabling remote online notarization, collecting payment after signatures, and using artificial intelligence to analyze a collection of agreements for risks and opportunities. DocuSign has over 400 partner integrations with the world’s most used applications, so agreement processes can integrate with larger business processes and data where work happens.

As of January 31, 2023, over 1.3 million customers and more than a billion users in over 180 countries use the DocuSign platform to accelerate and simplify the process of doing business.

Financial Highlights

In fiscal 2023, we delivered another strong year of financial performance and execution. Highlights include:

| | | | | | | | | | | | | | | | | | | | |

$2.5B Total revenue, an increase of 19% year-over-year. | | | $2.7B Billings, an increase of 13% year-over-year. | | | 79% GAAP gross margin, compared to 78% in fiscal 2022. Non-GAAP gross margin was 82% for both periods. |

| | | | | | |

| | | | | | |

$0.49 GAAP net loss per basic and diluted share, on 201 million shares outstanding, compared to $0.36 on 197 million shares outstanding in fiscal 2022. | | | $2.03 Non-GAAP net income per diluted share, on 206 million shares outstanding, compared to $1.98 on 208 million shares outstanding in fiscal 2022. | | | >1.3M Total customers increased to more than $1.3 million. |

To supplement our consolidated financial statements, which are prepared in accordance with United States Generally Accepted Accounting Principles (“GAAP”), we provide investors with certain non-GAAP financial measures, including billings, non-GAAP gross margin, and non-GAAP net income per share. For a full reconciliation for each non-GAAP financial measure set forth above to the most directly comparable financial measure stated in accordance with GAAP, please see our Annual Report for the fiscal year ended January 31, 2023 filed on March 27, 2023 and Exhibit 99.1 to our Current Report on Form 8-K filed on March 9, 2023.

| | | | | | | | |

6 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| FISCAL YEAR 2023 IN REVIEW | | |

Stockholder Engagement

DocuSign consistently engages with our stockholders as an important part of our corporate governance program. In addition to our Annual Meeting each year, we regularly provide stockholders with opportunities to deliver feedback on topics of interest to them, including our corporate governance, executive and director compensation, and environmental, social and governance (“ESG”) practices through a year-round stockholder engagement program. In addition, our Investor Relations team regularly meets with investors, prospective investors, and investment analysts. Meetings can include participation by our Board Chair, Chief Executive Officer, Chief Financial Officer, or other business leaders, and are often focused on company performance, technology initiatives, and company strategy.

In fiscal 2023, our management team held over 140 meetings with current and prospective stockholders, including meetings with approximately 70% of our top 25 active stockholders. We also actively participate in various investor roadshows, analyst meetings, and investor conferences. We continue to communicate with stockholders and other stakeholders through various media, including our annual report and SEC filings, proxy statement, news releases and our website. We believe it is important to engage with our stockholders and solicit their feedback for our management and Board for consideration in their decision-making.

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 7 |

Environmental, Social and Governance (ESG)1

At DocuSign, our values are reflected in six pillars: Trust, Customer Focus, Simplicity, Innovation, Unity, and Sustainability. In addition, our mission is to redefine how the world comes together and agrees. As part of this mission, we are committed to building trust and engaging with our employees, customers and the communities in which we live and work in a manner consistent with and in furtherance of our values. We believe this commitment shapes our unique company culture and brings long-term value to our stockholders.

| | | | | | | | | | | | | | | | | | | | | | | |

| Sustainability We believe that managing the risks and opportunities associated with reducing our environmental footprint contributes to the long-term benefit of our company and our stockholders. | | Our Communities We believe that engagement with our communities is an important aspect of our company culture and contributes to the long-term benefit of our company. | | Empowering Our Employees We believe that commitment to our company culture allows us to attract and retain the best talent, which not only aligns with our strategic goals but also provides long-term value for our stockholders. | | Governance We believe that Governance is foundational to our business and the success of our employees and customers depends on our ability to manage our business ethically, transparently and responsibly. |

For more information on Sustainability and our ESG Fact Sheet, please see our ESG section at investor.docusign.com.

Sustainability

Environmental sustainability has been an important part of the DocuSign story since its inception. At DocuSign, we endeavor to promote environmental sustainability throughout our business globally, including our operations, our sourcing practices, and our products. We achieve this by enabling customers to incorporate paperless processes through the use of our products (including our flagship product, DocuSign eSignature) and also investing directly in organizations that are making a sustainable impact. We believe that managing the risks and opportunities associated with reducing our environmental footprint contributes to the long-term benefit of our company and our stockholders.

In 2019, we launched the DocuSign for Forests™ initiative to help protect and preserve the world’s forests. To date, we have donated over $2.6 million to organizations doing critical work to safeguard the world’s forests.

We are also committed to reducing our own impact on the environment. In March 2022, DocuSign announced that it signed onto the Science Based Targets Initiative’s (SBTi) Business Ambition for 1.5°C campaign, which has pursued setting 1.5 degree science-based emissions reduction targets in order to combat climate change. As part of this pledge, DocuSign is committing to halving its Scope 1 and 2 carbon emissions by 2030 and reaching science-based net-zero no later than 2050. DocuSign has also been carbon neutral certified since 2022.

Additionally, to align and accelerate our sustainability initiatives, beginning in fiscal 2023, all of our executive officers, including our named executive officers, had a component of their incentive compensation plans tied to the achievement of certain Company ESG measures, including environmental sustainability measures. Please see the section entitled “Executive Compensation Discussion and Analysis” below for more information on executive compensation and our ESG Modifier.

1 Statements regarding the Company’s goals are aspirational and not guarantees or promises that they will be met. Content available at websites and in documents referenced are not incorporated herein and are not part of this proxy statement.

| | | | | | | | |

8 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| ENVIRONMENTAL, SOCIAL AND GOVERNANCE | | |

Our Communities

DocuSign is dedicated to corporate responsibility and putting our values into action. We believe that this engagement with our communities is an important aspect of our company culture and brings long-term value to our stockholders, while making the world a better place.

DocuSign Impact

With DocuSign IMPACT, we are committed to harnessing the power of DocuSign's people, products and profits to make a difference in the global communities where our employees and customers live and work. In 2018, we committed to donating at least $30 million in cash or stock to DocuSign IMPACT over the next 10 years. In addition, the use of our products is associated with decreased paper use for our customers and we specifically donate to forest-protection and other environmental impact causes.

We believe in promoting a culture of giving back and community support throughout our organization. As a company, we ensure that thousands of charitable organizations have the opportunity to use our products for free or at a discount every year. We also encourage our employees to take action in their own communities by volunteering and are proud to support their efforts by providing up to 24 hours of paid time off a year for volunteering. Our employees have volunteered thousands of hours collectively, including at organizations promoting healthier forests, echoing our company-wide commitment to environmental savings. Additionally, we match funds given by our employees to qualifying non-profits.

Empowering Our Employees

We believe in empowering employees to do challenging and meaningful work in an environment where each employee can be heard, exchange ideas openly, learn new skills and build lasting relationships. We are a global and inclusive organization with an increasingly international footprint, but we believe in the importance of creating a culture that aligns with our company values. We believe this commitment to our company culture allows us to attract and retain the best talent, which not only aligns with our strategic goals but also provides long-term value for our stockholders.

As of January 31, 2023, we had 7,336 employees, of which approximately 67% of our employees were based in the U.S. and the remainder in international locations.

Compensation and Benefits

Our compensation programs are designed to recruit, reward and retain talented individuals who possess the skills necessary to support our business, contribute to our strategic goals and create long-term value for our stockholders. We aim to provide employees with competitive compensation packages that include base salary, bonus or commission plan and equity awards tied to the value of our stock.

We also provide a range of competitive health, savings, retirement, time-off and wellness benefits for our employees, which vary based on local regulations and norms. These benefits include: up to six months of paid parental leave in the U.S., wellness reimbursement programs and employee assistance programs.

Diversity, Equity and Inclusion

We believe that having diverse teams working in an inclusive environment will help us achieve better business results—across product innovation, customer experience and employee success. To further this commitment to recruiting and retaining a diverse workforce, we announced the appointment of Iesha Berry as our first Chief Diversity and Engagement Officer in March 2022.

The key pillars to our diversity and inclusion strategy include:

•Pipeline: We seek to increase the diversity of individual candidates applying to help us develop our products and our business.

•Candidate Experience: We have developed specialized interview training in which employees learn how to implement bias interrupters and understand the importance of building diverse candidate slates and interviewers panels.

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 9 |

| | | | | | | | |

| | ENVIRONMENTAL, SOCIAL AND GOVERNANCE |

•Education: Through management training, speaker series and online learning, we are actively raising awareness, cultivating an inclusive culture and building practical skills for mitigating bias.

•Community: DocuSign’s Employee Resource Groups (“ERGs”) serve as culture carriers and provide employees a way for colleagues to connect, network and build cross team collaboration. Through our ERG program, employees are able to participate in personal and professional learning and development and give back to the community through volunteering, donation drives and awareness campaigns.

•Transparency: We publish employee diversity information by gender and race/ethnicity on our website to promote accountability and underscore our commitment to diversity.

Recognition

We are honored to be recognized by organizations and media for our innovation and for our efforts to be a great place to work. During fiscal 2023, we were recognized as one of the World’s Best Employers and World’s Top Female-Friendly Companies by Forbes and were also listed as one of America's Greatest Workplaces for Diversity by Newsweek. In 2023, we were also named by Newsweek as one of America’s Greatest Workplaces for Women.

Governance

Corporate Governance

Governance is foundational to our ESG programs and we work actively with our Board on our ESG initiatives. Our Board oversees our ESG programs and assesses risk oversight over our initiatives. For further information, please see the later sections entitled “Role of the Board in Risk Oversight” and “ESG Oversight”.

We understand that part of our employee and customer success depends on our ability to manage our business ethically, transparently and responsibly. Our Code of Business Conduct and Ethics (our “Code of Conduct”) is publicly available and, in conjunction with other internal policies, describes the way we treat employees and key stakeholders and clearly communicates our values and expectations. Our Code of Conduct also describes our commitment to ethical business practices, including our human rights policy, our policies against human trafficking and modern slavery, and (in conjunction with our Global Anti-Corruption Policy) our adherence to global anti-corruption laws. Our Corporate Governance Guidelines, which detail our corporate governance practices with respect to our Board and Committees, are reviewed periodically by our Nominating and Corporate Governance Committee and are also publicly available.

For more information about our corporate governance practices, please visit investor.docusign.com.

Commitment to Security and Trust

One of DocuSign’s core values is Trust. Businesses around the globe leverage DocuSign products for some of their most sensitive and time-critical transactions, and we are committed to maintaining the secure, compliant and available environment our customers have come to trust.

•Cybersecurity. We have a dedicated global information security team comprised of trained cybersecurity professionals who work to protect DocuSign’s services, networks and other IT assets. We also invest in threat intelligence in order to enhance our proactive monitoring programs.

•Privacy. We have a strong emphasis on privacy that is embedded as part of DocuSign’s culture. We take the protection and use of personal data seriously and have a commitment to being transparent on how we use data. We support that commitment with company-wide resources and training, including mandatory trainings on data privacy and cybersecurity. We also operate in accordance with our binding corporate rules to support our privacy commitments to users and customers.

•Compliance. DocuSign adheres to some of the most stringent U.S., EU, and global security standards. Our commitment to and significant ongoing investment toward protecting customer data extends to all of DocuSign’s operating environments.

To learn more about our security, privacy and system performance, please visit www.docusign.com/trust.

| | | | | | | | |

10 | Proxy Statement | DocuSign, Inc. |

Directors and Corporate Governance

Board Overview and Highlights

The following table sets forth information as of April 6, 2023 with respect to our directors who we expect to continue in office after the 2023 Annual Meeting, including the three nominees standing for election at this Annual Meeting:

| | | | | | | | | | | | | | | | | | | | |

| Name | Age | Director Since | Independent | Audit

Committee | Compensation Committee(1) | Nominating Committee(2) |

| | | | | | |

| Class I Directors - Continuing in Office until the 2025 Annual Meeting |

| Teresa Briggs | 61 | May 2020 | Yes | l | | |

| Blake J. Irving | 63 | August 2018 | Yes | | l | l |

| Daniel D. Springer | 59 | January 2017 | No | | | |

| Class II Directors - Nominees for Election at the Current Annual Meeting |

| James Beer | 61 | August 2020 | Yes | l | | |

| Cain A. Hayes | 53 | December 2020 | Yes | | l | |

| Allan Thygesen* | 60 | October 2022 | No | | | |

| Class III Directors - Continuing in Office until the 2024 Annual Meeting |

| Enrique Salem | 57 | August 2013 | Yes | l | | |

| Peter Solvik | 64 | March 2006 | Yes | | l | l |

| Maggie Wilderotter** | 68 | March 2018 | Yes | | | |

* President and CEO of DocuSign ** Board Chair l = Committee Chair l = Member

1.Formally named the Compensation and Leadership Development Committee (the “Compensation Committee”)

2.Formally named the Nominating and Corporate Governance Committee (the “Nominating Committee”)

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 11 |

| | | | | | | | |

| | DIRECTORS AND CORPORATE GOVERNANCE |

Director Skills Matrix

DocuSign is governed by a Board consisting of a highly experienced group of directors with a diversity of skills and backgrounds. This diversity of skills enables the Board to provide guidance to the Company from a multi-faceted and nuanced perspective. Our Board considers many skills and qualifications that our nominees and directors can bring to the Company, including:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skill/Knowledge/Experience | T. Briggs | B. Irving | D. Springer | J. Beer | C. Hayes | E. Salem | P. Solvik | M. Wilderotter | A. Thygesen |

| | | | | | | | | |

| Public or large scale private company CEO | | l | l | | l | l | | l | l |

| Public or large scale private senior or C-suite executive | l | | l | l | l | | l | | |

| Public Board Member | l | l | l | l | | l | l | l | l |

| Technology Industry senior executive | | l | l | l | | l | l | l | l |

| Vertical Industry company senior executive | l | | | | l | | | | |

| Government / Non-profit | | | | | l | | | | |

| ACFE (Audit Committee Financial Expert) | l | l | | l | l | l | | l | |

| Information Security / Cyber | l | | | l | l | l | l | | |

| Regulatory, Risk Management, Audit (direct oversight or board) | l | | | l | l | | | | |

| Corporate Governance | l | | | | l | l | l | l | |

| Marketing | | l | l | | | l | | | l |

| Product / Engineering | | l | | | | l | | | |

| Operational | | l | l | | l | l | l | l | l |

| | | | | | | | |

12 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| DIRECTORS AND CORPORATE GOVERNANCE | | |

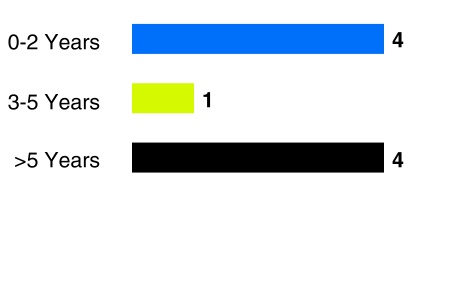

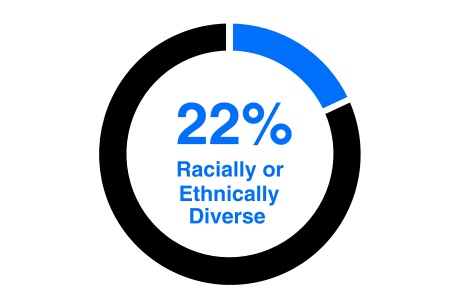

Board Diversity & Tenure

We believe that diverse teams can achieve better business results for all of our stakeholders. By focusing on building diverse, inclusive teams across every level and within each department, we hope to create an environment where everyone can contribute to our success. Our commitment to diversity is reflected in the composition of our Board, as shown below as of the date of this Proxy Statement filing. Diversity and tenure information for our Board as of March 31, 2022 is included in our definitive proxy for our 2022 Annual Meeting of Stockholders, as filed with the SEC on April 22, 2022.

| | | | | | | | |

| Tenure | Race or Ethnicity | Gender |

Additionally, as a Nasdaq-listed company, we are required annually to publicly disclose certain demographic and gender statistics for our Board. Please see the Board Diversity Matrix below:

| | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix (As of March 31, 2023) | | | | | | |

| | | | | | |

| Board Size: 9 | | | | | | |

| Part I: Gender | Male | Female | | Non-Binary | | Undisclosed |

| Number of Directors | 7 | 2 | | — | | — |

| Part II: Number of directors who identify in any of the categories below |

| African American or Black | 1 | — | | — | | — |

| Hispanic or Latinx | 1 | — | | — | | — |

| White | 5 | 2 | | — | | — |

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 13 |

| | | | | | | | |

| | DIRECTORS AND CORPORATE GOVERNANCE |

Biographies

The following is a brief biography of each nominee and each director whose term will continue after the Annual Meeting.

CLASS I DIRECTORS

| | | | | | | | | | | | | | |

| | | | Teresa Briggs has served on our Board since May 2020. From June 2013 to August 2019, Ms. Briggs served as Vice Chair & West Region Managing Partner of Deloitte LLP and from June 2011 to August 2019 as Managing Partner, San Francisco. Ms. Briggs also served as an adjunct member of Deloitte’s Center for Board Effectiveness. Ms. Briggs currently serves on the boards of directors of ServiceNow, Inc., a provider of software-as-a-service for managing businesses’ digital workflows; Snowflake Inc., a cloud-based data management company; and Warby Parker Inc., an eyeglasses brand company. Ms. Briggs previously served on the boards of directors of VG Acquisition Corp., a special purpose acquisition company and Deloitte USA LLP. Ms. Briggs is a CPA and holds a B.S. in Accounting from the University of Arizona, Eller College of Management. We believe that Ms. Briggs possesses specific attributes that qualify her to serve as a member of the Board, including her extensive finance and audit background and board governance experience. |

|

Teresa Briggs Age | 61 Director Since | May 2020 Committees | Audit |

| | | | | | | | | | | | | | |

| | | | Blake J. Irving has served on our Board since August 2018. From January 2013 to January 2018, Mr. Irving served as the Chief Executive Officer of GoDaddy, Inc., a domain registrar and web hosting company. Mr. Irving previously served as the Executive Vice President and the Chief Product Officer at Yahoo! Inc, a web services provider; as Professor in the M.B.A. program at Pepperdine University; and in various senior and management roles at Microsoft Corporation, a multinational technology company, including most recently as Corporate Vice President of the Windows Live Platform Group. Mr. Irving currently serves on the boards of directors of Autodesk Inc., a software company, and ZipRecruiter, Inc. Mr. Irving previously served on the board of directors of GoDaddy Inc. Mr. Irving holds a B.A. in Fine Arts from San Diego State University and an M.B.A. from Pepperdine University. We believe that Mr. Irving possesses specific attributes that qualify him to serve as a member of the Board, including his significant public company leadership experience in the operations of large, complex companies. |

|

Blake J. Irving Age | 63 Director Since | August 2018 Committees | Compensation and Nominating |

| | | | | | | | | | | | | | |

| | | | Daniel D. Springer previously served as our President and Chief Executive Officer from January 2017 to June 2022 and has served on our Board since January 2017. From May 2015 to January 2017, Mr. Springer served as an Operating Partner at Advent International Corp., a private equity investment firm. Prior to Advent International Corp., Mr. Springer served as Chairman and Chief Executive Officer of Responsys, Inc., a marketing software company that was acquired by Oracle Corp. in 2014. Prior to joining Responsys, Inc., Mr. Springer served as the Managing Director of Modem Media, Inc., a marketing strategy and services firm, the Chief Executive Officer of Telleo, Inc., an internet services company, and Chief Marketing Officer of NextCard, Inc., a consumer credit company. Mr. Springer currently serves on the boards of directors of UI Path, a software company, and the Boys and Girls Club of San Francisco. Mr. Springer previously served on the board of directors of YuMe Inc., a digital advertising company. Mr. Springer holds a B.A. in Mathematics and Economics from Occidental College and an M.B.A. from Harvard University. We believe that Mr. Springer possesses specific attributes that qualify him to serve as a member of the Board, including his former service as our Chief Executive Officer and his experience in senior management and board service at other technology and software companies. |

|

Daniel D. Springer Age | 59 Director Since | January 2017 Committees | none |

| | | | | | | | |

14 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| DIRECTORS AND CORPORATE GOVERNANCE | | |

CLASS II DIRECTORS

| | | | | | | | | | | | | | |

| | | | James Beer has served on our Board since August 2020. From February 2018 to June 2022, Mr. Beer served as Chief Financial Officer of Atlassian Corporation Plc, an enterprise software company. From September 2013 to December 2017, Mr. Beer served as Executive Vice President and Chief Financial Officer of McKesson Corporation, a healthcare services and information technology company. Prior to McKesson Corporation, Mr. Beer served as Executive Vice President and Chief Financial Officer of Symantec Corporation, now known as NortonLifeLock Inc., a cybersecurity company, where he managed the worldwide finance organization. Prior to his work at Symantec, Mr. Beer served as Chief Financial Officer of AMR Corp. and American Airlines Group Inc., AMR’s principal subsidiary. Mr. Beer currently serves on the board of directors of Alaska Air Group, parent company of Alaska Airlines. Mr. Beer previously served on the board of directors of Forescout Technologies, Inc., a network security software company. Mr. Beer holds a B.S. in Aeronautical Engineering from Imperial College, London University, and an M.B.A. from Harvard University. We believe that Mr. Beer possesses specific attributes that qualify him to serve as a member of the Board, including his substantial experience in corporate finance and with public technology companies. |

|

James Beer Age | 61 Director Since | August 2020 Committees | Audit |

| | | | | | | | | | | | | | |

| | | | Cain A. Hayes has served on our Board since December 2020. Since July 2021, Mr. Hayes has served as chief executive officer of Point32Health, a leading health and well-being organization that includes Harvard Pilgrim Health Care and Tufts Health Plan. From November 2018 to June 2021, Mr. Hayes served as President and Chief Executive Officer of Gateway Health Plan, a leading managed care organization. From April 2017 to November 2018, Mr. Hayes served as President and Chief Operating Officer of the Health Business for Blue Cross and Blue Shield of Minnesota, a Minnesota health plan organization. From November 2010 to March 2017, Mr. Hayes held a variety of senior executive leadership roles at Aetna, a managed care company, including President of National Accounts. Prior to Aetna, Mr. Hayes held senior executive roles at Nationwide Insurance and Principal Financial Group. Mr. Hayes holds a B.S. in Business Administration from Drake University, and an M.B.A. from Webster University. In addition, he has earned the Certified Employee Benefit Specialist (CEBS) designation from The Wharton School, University of Pennsylvania. We believe that Mr. Hayes possesses specific attributes that qualify him to serve as a member of the Board, including his substantial experience in managing and growing large complex organizations, and his experience in the financial services and healthcare industries, which are key market segments for DocuSign. |

|

Cain A. Hayes Age | 53 Director Since | December 2020 Committees | Compensation |

| | | | | | | | | | | | | | |

| | | | Allan Thygesen has served as our Chief Executive Officer, President and member of our Board since October 2022. Mr. Thygesen served as President, Americas & Global Partners at Google Inc. (a subsidiary of Alphabet Inc.) from June 2021 to October 2022, as President, Americas from February 2017 to May 2021, as President, Google Marketing Solutions from September 2014 to February 2017, and as Vice President, Global SMB Sales and Operations from September 2011 to September 2014. Before joining Google, Mr. Thygesen consulted to Google and other companies in 2010 and until September 2011 and previously co-founded an early stage venture firm and was a managing director and partner in the U.S. venture and growth funds of The Carlyle Group, where he led investments in startups in sectors including e-commerce, enterprise software, mobile advertising and imaging. Earlier, Mr. Thygesen served as an executive in several public and private companies, including Wink Communications, Inc., an interactive television technology company, which he helped take public in 1999. He also served as a lecturer at the Stanford Graduate School of Business from 2014 to 2021. Mr. Thygesen has served on the board of directors of RingCentral, Inc. (NYSE: RNG) since October 2015 and has served on the boards of directors of various private companies. Mr. Thygesen holds an M.Sc. in Economics from the University of Copenhagen and an M.B.A. from Stanford University. We believe that Mr. Thygesen possesses specific attributes that qualify him to serve as a member of the Board, including his service as our Chief Executive Officer and his experience in senior management and board service at other technology and software companies. |

|

Allan Thygesen Age | 60 Director Since | October 2022 Committees | none |

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 15 |

| | | | | | | | |

| | DIRECTORS AND CORPORATE GOVERNANCE |

CLASS III DIRECTORS

| | | | | | | | | | | | | | |

| | | | Enrique Salem has served on our Board since August 2013. Since July 2014, Mr. Salem has been a Partner at Bain Capital Ventures, a venture capital firm. Prior to Bain Capital, Mr. Salem served as President, Chief Executive Officer, and Chief Operating Officer, at Symantec Corp., now known as NortonLifeLock Inc., a cybersecurity company. Mr. Salem currently serves on the boards of directors of FireEye, Inc., an enterprise cybersecurity company, and Atlassian Corporation Plc, an enterprise software company. Mr. Salem previously served on the boards of directors of ForeScout Technologies, Inc., a network security software company, and Symantec Corp, now known as NortonLifeLock Inc. Mr. Salem holds an A.B. in Computer Science from Dartmouth College. We believe that Mr. Salem possesses specific attributes that qualify him to serve as a member of the Board, including his substantial board experience in addition to his cybersecurity, investment, management and senior leadership experience at technology companies. |

|

Enrique Salem Age | 57 Director Since | August 2013 Committees | Audit |

| | | | | | | | | | | | | | |

| | | | Peter Solvik has served on our Board since March 2006. Since 2011, Mr. Solvik has been a Managing Director at Jackson Square Ventures, a venture capital firm. Since 2002, Mr. Solvik has been a Managing Director at Sigma Partners, a venture capital firm. Previously, Mr. Solvik served as Chief Information Officer and Senior Vice President at Cisco Systems, Inc., an information technology and networking company. Mr. Solvik holds a B.S. in Business Administration from the University of Illinois at Urbana-Champaign College of Business. We believe that Mr. Solvik possesses specific attributes that qualify him to serve as a member of the Board, including his extensive experience investing in and serving in senior leadership positions at technology companies. |

|

Peter Solvik Age | 64 Director Since | March 2006 Committees | Compensation and Nominating |

| | | | | | | | | | | | | | |

| | | | Maggie Wilderotter has served on our Board since March 2018 and as Board Chair since January 2019. From June 2022 to October 2022, Ms. Wilderotter served as our interim President and Chief Executive Officer. Since August 2016, Ms. Wilderotter has been Chairman and Chief Executive Officer of the Grand Reserve Inn, a luxury inn on Wilderotter Vineyards. Prior to Ms. Wilderotter’s role at Grand Reserve Inn, she served in various senior and management roles at Frontier Communications Corp., a telecommunications company, including as President and Chief Executive Officer. Ms. Wilderotter currently serves on the boards of directors of Costco Wholesale Corp., a wholesale retailer; Lyft, Inc., a ride-sharing service company; and Sana Biotechnologies, a biotechnology company. Ms. Wilderotter previously served on the boards of directors of Hewlett Packard Enterprise Co., a technology company; Frontier Communications Corp; Xerox Corp; DreamWorks Animation SKG Inc., an entertainment company; The Procter & Gamble Company, a consumer products company; Juno Therapeutics, Inc., a biopharmaceutical company; and Cadence Design Systems, an electronic design automation software and engineering services company. Ms. Wilderotter holds a B.A. in Economics from the College of the Holy Cross. We believe that Ms. Wilderotter possesses specific skills and attributes that qualify her to serve as a member of the Board and as our Board Chair, including her significant public company leadership experience as both a board member and an officer, as well as her broad-ranging corporate experience, including senior leadership positions in the areas of marketing and technology. |

|

Maggie Wilderotter Age | 68 Director Since | March 2018 Committees | none |

| | | | | | | | |

16 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| DIRECTORS AND CORPORATE GOVERNANCE | | |

Director Independence

Our common stock is listed on The Nasdaq Global Select Market (“Nasdaq”). Under Nasdaq’s listing rules and requirements, independent directors must comprise a majority of our board of directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Under Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Compensation and Leadership Development Committee members must not have a relationship with us that is material to the director’s ability to be independent from management in connection with the duties of a Compensation and Leadership Development Committee member. Additionally, our Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. To be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or be an affiliated person of the listed company or any of its subsidiaries.

Our Board has undertaken a review of the independence of the directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning such director’s background, employment and affiliations, including family relationships, our Board determined that Mses. Briggs and Wilderotter and Messrs. Beer, Hayes, Irving, Salem and Solvik, representing seven of our nine directors, are “independent directors” as defined under current rules and regulations of the SEC and Nasdaq listing standards. In determining that Ms. Wilderotter is independent, the Board considered her former service as interim President and CEO, as well as the compensation received in connection with such service, and determined that such service and compensation does not interfere with her exercise of independent judgment in carrying out the responsibilities of a director. The eighth, Mr. Thygesen, currently serves as our President and Chief Executive Officer, and the ninth, Mr. Springer, previously served as our President and Chief Executive Officer until June 2022. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances that our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director and the transactions involving them as described in the section entitled “Transactions with Related Persons.”

The Board has an independent Board Chair, Ms. Wilderotter, who has authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Board Chair has substantial ability to shape the work of the Board. The Company believes that separation of the positions of Board Chair and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, the Company believes that having an independent Board Chair creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the best interests of the Company and its stockholders. As a result, the Company believes that having an independent Board Chair enhances the effectiveness of the Board as a whole. In order to promote these objectives, the Board appointed Peter Solvik as lead independent director during Ms. Wilderotter’s service as our interim Chief Executive Officer.

Board Meetings

Our Board is responsible for the oversight of company management and the strategy of our company and for establishing corporate policies. Our Board and its committees meet throughout the year on a regular schedule, and also hold special meetings and act by written consent from time to time. The Board held twenty meetings during the last fiscal year. Each Board member attended 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

It is our policy to encourage our directors and nominees for director to attend our annual meeting of stockholders. All of our continuing directors and nominees attended the 2022 Annual Meeting of Stockholders.

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 17 |

| | | | | | | | |

| | DIRECTORS AND CORPORATE GOVERNANCE |

Board Committees and Responsibilities

Our Board has established an Audit Committee, a Compensation and Leadership Development Committee (the “Compensation Committee”) and a Nominating and Corporate Governance Committee (the “Nominating Committee”). From time to time, our Board may establish other committees to facilitate the management of our business. In 2020, the Board established an M&A and Investments Committee to facilitate the review and approval of certain acquisitions and investment opportunities, and to provide additional long-term oversight over the effectiveness of completed transactions. The composition and responsibilities of the Audit Committee, the Compensation Committee and the Nominating Committee are described below. Members serve on these committees until their resignation or until otherwise determined by the Board.

The Board has determined that each member of each committee meets the applicable Nasdaq rules and regulations regarding “independence” and each member is free of any relationship that would impair his or her individual exercise of independent judgment with regard to the Company.

Each committee operates under a written charter that satisfies the applicable rules of the SEC and Nasdaq listing standards. Copies of the charters of our Audit Committee, Compensation Committee and Nominating Committee are posted on our website at investor.docusign.com. The inclusion of our website address in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement.

For additional detail regarding the Board oversight of risk management and ESG specifically, please see the sections entitled “Role of the Board in Risk Oversight” and “ESG Oversight.”

| | | | | | | | | | | |

Audit Committee | | | The Audit Committee of the Board was established by the Board in accordance with Section 3(a)(58)(A) of the Exchange Act to oversee the Company’s corporate accounting and financial reporting processes and audits of its financial statements. The principal duties and responsibilities of our audit committee include, among other things: 01helping our Board oversee the Company’s corporate accounting and financial reporting processes, systems of internal control, and financial statement audits and the integrity of the Company’s financial statements; 02managing the selection, engagement terms, fees, qualifications, independence, and performance of the registered public accounting firm engaged as the Company’s independent outside auditor for the purpose of preparing or issuing an audit report or performing audit services and for performing any non-audit services for which the Company may engage the auditor; 03reviewing any reports or disclosures required by applicable rules and regulations of the SEC and applicable Nasdaq rules, regulations and listing requirements, or such other stock exchange on which any of the Company’s capital stock is then listed; 04overseeing the organization and performance of the Company’s internal audit function; 05overseeing the Company’s risk assessment and risk management practices and policies, including with respect to cybersecurity risk; 06helping our Board oversee the Company’s legal and regulatory compliance; 07providing regular reports and information to the Board with respect to material issues within the scope of its responsibilities; and 08assisting with any additional duties and responsibilities that the Board mandates. |

| | |

Members: Teresa Briggs (Chair) James Beer Enrique Salem Meetings held in FY23: 7 Committee Report: All Committee members are independent and each member is determined to be an “audit committee financial expert,” as defined in applicable SEC rules and “financially sophisticated” as defined in applicable Nasdaq rules. | | |

The Board has determined that each member of the Audit Committee is independent (as independence is currently defined in Rule 5605(c)(2)(A)(i) and (ii) of the Nasdaq listing standards), and qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. The Board made a qualitative assessment of each of these directors’ levels of knowledge and experience based on a number of factors, including formal education and experience as a chief financial officer for public reporting companies.

| | | | | | | | |

18 | Proxy Statement | DocuSign, Inc. |

| | | | | | | | |

| DIRECTORS AND CORPORATE GOVERNANCE | | |

| | | | | | | | | | | |

| Compensation Committee | | | The primary purpose of the Compensation Committee of the Board is to discharge the responsibilities of our Board to oversee our compensation policies, plans and programs and to review and determine the compensation to be paid to our executive officers, directors and other senior management, as appropriate. The principal duties and responsibilities of our Compensation Committee include, among other things: 01acting on behalf of the Board, pursuant to delegated authority, in order to oversee the Company’s compensation policies, plans and programs and review and determine the compensation to be paid to the Company’s executive officers and directors or recommend the same to the Board for approval; 02reviewing and discussing with management the Company’s disclosures contained under the caption “Executive Compensation Discussion and Analysis” for use in any of the Company’s annual reports on Form 10-K, registration statements, proxy statements, information statements or similar documents; 03preparing and reviewing the Compensation Committee report on executive compensation included in the Company’s annual proxy statement (and incorporated by reference in the Company’s Form 10-K) in accordance with applicable rules and regulations of the SEC in effect from time to time; 04reviewing the Company’s strategy and policies relating to human capital management, including leadership development and succession planning for the Company’s Chief Executive Officer and other members of senior management; and 05performing the other responsibilities set forth in its charter as in effect from time to time. |

| | |

Members: Blake Irving (Chair) Cain Hayes Peter Solvik Meetings held in FY23: 8 Committee Report: All Committee members are independent. | | |

The Board has determined each member of the Compensation Committee is independent under Nasdaq listing standards, is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act and is an “outside director” as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”).

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is or has been an officer or employee of our Company. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

| | | | | | | | |

| DocuSign, Inc. | Proxy Statement | 19 |

| | | | | | | | |

| | DIRECTORS AND CORPORATE GOVERNANCE |

| | | | | | | | | | | |

| Nominating Committee | | | The Nominating Committee of the Board is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company (consistent with criteria approved by the Board), reviewing and evaluating incumbent directors, recommending for selection by the Board candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of management and the Board, and reviewing and recommending any amendments to our Corporate Governance Guidelines. The Nominating Committee’s responsibilities include, among other things: 01overseeing all aspects of the Company’s corporate governance functions on behalf of our Board; 02making recommendations to our Board regarding corporate governance issues; 03periodically reviewing and recommending, as appropriate, desired Board qualifications, expertise, diversity and experience, including experience in technology, finance, management, corporate governance or any other areas the Nominating Committee expects to contribute to an effective Board; 04identifying, reviewing and evaluating candidates to serve as directors of the Company consistent with criteria approved by the Board; 05serving as a focal point for communication between such candidates, non-committee directors and the Company’s management; 06reviewing and evaluating incumbent directors; 07recommending that the Board select nominees for election or appointment to the Board; and 08making other recommendations to the Board regarding affairs relating to the directors of the Company, including director compensation. |

| | |

Members: Peter Solvik (Chair) Blake Irving Meetings held in FY23: 7 All Committee members are independent. | | |

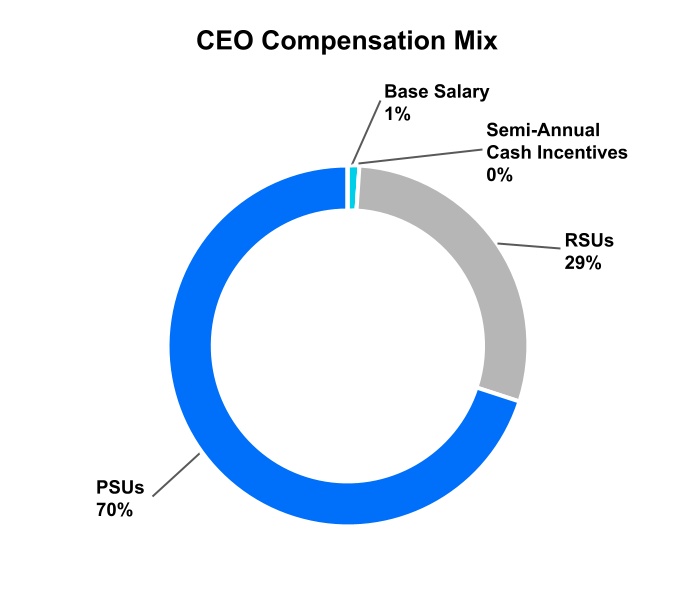

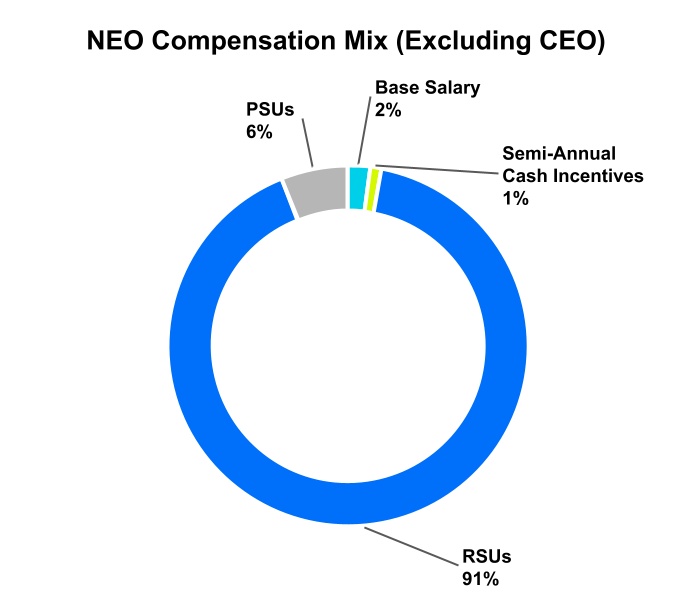

Evaluation of Director Nominees