EXHIBIT 10.1

OFFICE LEASE

by and between

COGNAC DEL MAR OWNER II LLC,

a Delaware limited liability company

(“Landlord”)

and

ONCTERNAL THERAPEUTICS, INC.,

a Delaware corporation

(“Tenant”)

Office lease

THIS OFFICE LEASE (“Lease”) is made between COGNAC DEL MAR OWNER II LLC, a Delaware limited liability company (“Landlord”), and the Tenant described in Item 1 of the Basic Lease Provisions.

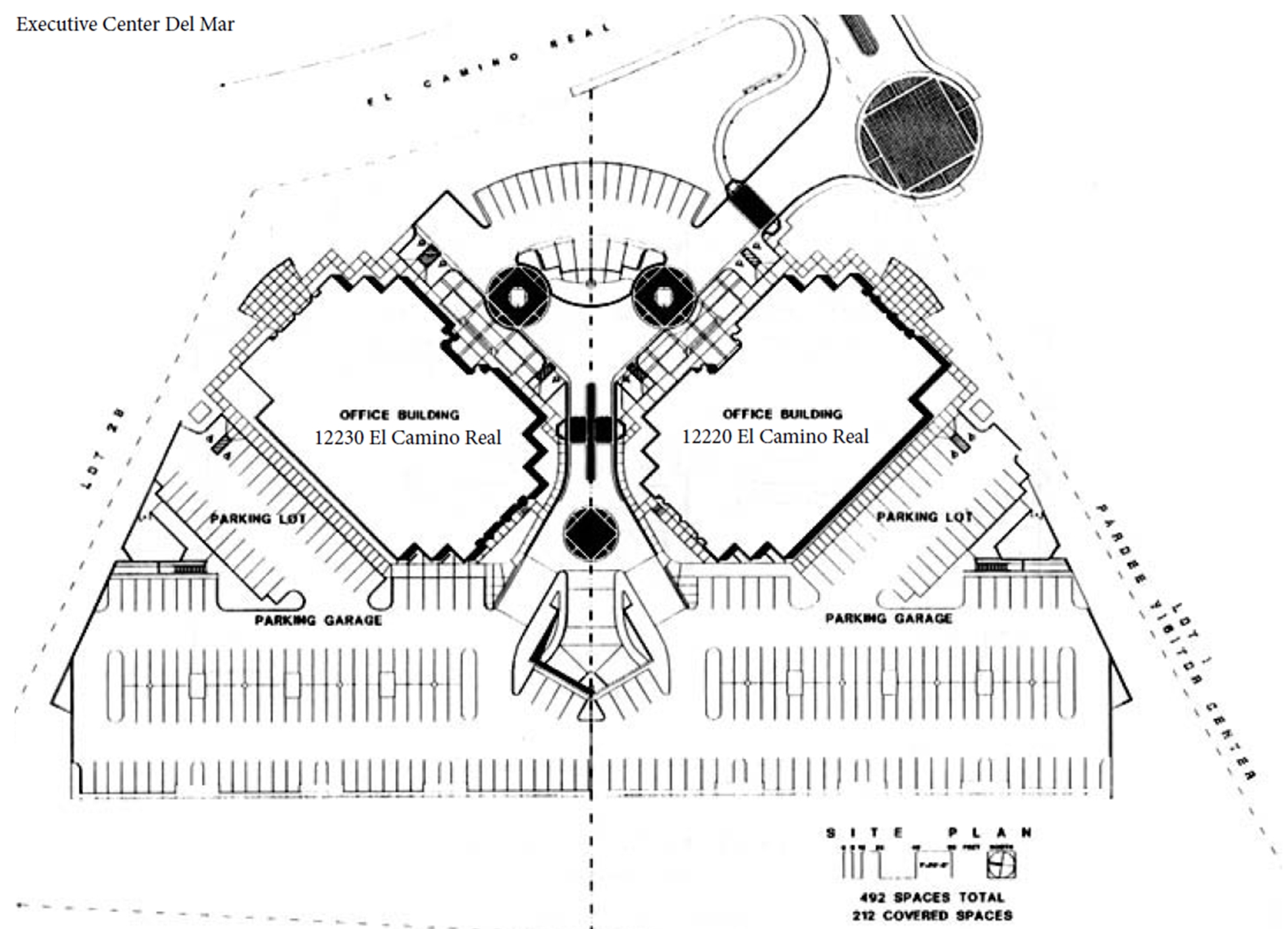

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, subject to all of the terms and conditions set forth herein, those certain premises (the “Premises”) described in Item 3 of the Basic Lease Provisions and as shown in the drawing attached hereto as Exhibit A-1. The Premises are located in the Building described in Item 2 of the Basic Lease Provisions. The Building is located on that certain land (the “Land”), which is a part of a larger tract of land owned by Landlord, all of which is improved with landscaping, parking facilities and other improvements, fixtures and common areas and appurtenances now or hereafter placed, constructed or erected on the Land, including both buildings located at 12220 – 12230 El Camino Real, San Diego, California (sometimes referred to herein as the “Project”), as shown on the site plan attached as Exhibit A-2 to this Lease.

|

1. |

Tenant:

|

Oncternal Therapeutics, Inc., a Delaware corporation (“Tenant”)

|

|

|

2. |

Building:

|

Executive Center Del Mar 12230 El Camino Real San Diego, California 92130

|

|

|

3. |

Description of Premises:

|

Suite(s): 300 |

|

|

|

Rentable Area:

|

4,677 square feet

|

|

|

|

Usable Area: |

3,995 square feet

|

|

|

|

Rentable Area of the Building:

|

57,293 square feet

|

|

|

|

Rentable Area of the Project:

|

115,561 square feet (subject to Paragraph 18)

|

|

|

4. |

(a) Tenant’s Proportionate Share for the Building:

|

8.1633% (4,677 rsf / 57,293 rsf) (See Paragraph 3)

|

|

|

|

(b) Tenant’s Proportionate Share for the Project:

|

4.0472% (4,677 rsf/ 115,561 rsf) (See Paragraph 3) |

|

|

5. |

Basic Annual Rent:

|

(See Paragraph 2)

|

|

|

|

*Months 1 - 14, inclusive: Monthly Installment:

Annual Amount:

|

$15,336.14 (approx. $3.28/sq. ft. of Rentable Area/month) $184,033.78 |

|

|

|

*Each reference to a month in the table above shall refer to a full calendar month (e.g. January 1st through January 31st, February 1st through February 29th, etc.) following the Commencement Date.

|

||

|

6. |

Installment Payable Upon Execution:

|

$15,336.14 |

|

|

7. |

Security Deposit Payable Upon Execution:

|

$15,336.14 (See Paragraph 2(c))

|

|

1

|

8. |

Base Year for Operating Costs:

|

2021 (See Paragraph 3)

|

|

|

9. |

Initial Term:

|

Fourteen (14) full calendar months (See Paragraph 1)

|

|

|

10. |

Commencement Date:

|

April 1, 2021

|

|

|

11. |

Termination Date:

|

May 31, 2022

|

|

|

12. |

Broker(s) (See Paragraph 19(k)):

|

|

|

|

|

Landlord’s Broker:

|

Cushman & Wakefield |

|

|

|

Tenant’s Broker:

|

Re:Align

|

|

|

13. |

Number of Parking Spaces:

|

Four (4) unreserved parking spaces per one thousand (1,000) square feet of Usable Area in the Premises, available to Tenant at the then-current rate generally offered to patrons of the Building, as such rate may change from time-to-time. (See Paragraph 18)

|

|

|

14. |

Addresses for Notices:

|

|

|

|

|

To:TENANT:

|

To:LANDLORD:

|

|

|

|

The Premises

|

Cognac Del Mar Owner II LLC c/o PGIM Real Estate 101 California Street, 40th Floor San Francisco, CA 94111 Attention: PRISA II Asset Manager

|

|

|

|

|

With a copy to:

Cognac Del Mar Owner II LLC c/o PGIM Real Estate 7 Giralda Farms Madison, NJ 07940 Attention: Legal

And

Cognac Del Mar Owner II LLC c/o Unire Real Estate Group, Inc. 675 Placentia Avenue, Suite 200 Brea, CA 92821 Attn: Mark Harryman

|

|

|

15. |

Place of Payment:

|

All payments payable under this Lease shall be sent to Landlord at P.O. Box 100398, Pasadena, CA 91189--0398 (or to such other address that Landlord may later designate in writing).

|

|

|

16. |

Guarantor:

|

None |

|

|

17. |

Date of this Lease:

|

The date executed by Landlord on the signature page of this Lease.

|

|

2

|

18. |

Landlord’s Construction Allowance:

|

None

|

|

|

19. |

The “State” is the State of California.

|

|

|

This Lease consists of the foregoing introductory paragraphs and Basic Lease Provisions, the provisions of the Standard Lease Provisions (the “Standard Lease Provisions”) (consisting of Paragraphs 1 through Paragraph 19 which follow) and Exhibits A-1 through Exhibit A-2 and Exhibits B through Exhibit G, all of which are incorporated herein by this reference. In the event of any conflict between the provisions of the Basic Lease Provisions and the provisions of the Standard Lease Provisions, the Standard Lease Provisions shall control.

3

(a)The Initial Term of this Lease and the Rent (defined below) shall commence on the date set forth in Item 10 of the Basic Lease Provisions (the “Commencement Date”) and the Initial Term shall end on the last day of the fourteenth (14th) full calendar month after the Commencement Date (the “Termination Date”). Unless earlier terminated in accordance with the provisions hereof, the Initial Term of this Lease shall be the period shown in Item 9 of the Basic Lease Provisions. As used herein, “Lease Term” shall mean the Initial Term referred to in Item 9 of the Basic Lease Provisions, together with any extension of the Lease Term hereof exercised or entered in accordance with the terms and conditions expressly set forth herein. This Lease shall be a binding contractual obligation effective upon execution hereof by Landlord and Tenant, notwithstanding the later commencement of the Initial Term of this Lease.

(b)The Premises will be delivered to Tenant on the Commencement Date. If the Commencement Date is delayed or otherwise does not occur on the date, set forth in Item 10 of the Basic Lease Provisions, this Lease shall not be void or voidable, nor shall Landlord be liable to Tenant for any loss or damage resulting therefrom.

(a)Tenant agrees to pay during each partial or whole calendar month of the Lease Term as Basic Annual Rent (“Basic Annual Rent”) for the Premises the sums shown for such periods in Item 5 of the Basic Lease Provisions.

(b)Except as expressly provided to the contrary herein, Basic Annual Rent shall be payable in consecutive monthly installments, in advance, without demand, deduction or offset, commencing on the Commencement Date and continuing on the first day of each calendar month thereafter until the expiration of the Lease Term. The first full monthly installment of Basic Annual Rent (as set forth in Item 6 of the Basic Lease Provisions) shall be payable upon Tenant’s execution of this Lease. The obligation of Tenant to pay Rent and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations. If the Commencement Date is a day other than the first day of a calendar month, or the Lease Term expires on a day other than the last day of a calendar month, then the Rent for such partial month shall be calculated on a per diem basis. In the event Landlord delivers possession of the Premises to Tenant prior to the Commencement Date, Tenant agrees it shall be bound by and subject to all terms, covenants, conditions and obligations of this Lease during the period between the date possession is delivered and the Commencement Date, other than the payment of Basic Annual Rent, in the same manner as if delivery had occurred on the Commencement Date.

(c)Simultaneously with the execution of this Lease, Tenant has paid or will pay Landlord the security deposit (the “Security Deposit”) set forth in Item 7 of the Basic Lease Provisions as security for the performance of the provisions hereof by Tenant. Landlord shall not be required to keep the Security Deposit separate from its general funds and Tenant shall not be entitled to interest thereon.

If Tenant defaults with respect to any provision of this Lease, including, without limitation, the provisions relating to the payment of Rent or the cleaning of the Premises upon the termination of this Lease, or amounts which Landlord may be entitled to recover pursuant to the provisions of Section 1951.2 of the California Civil Code, Landlord may, but shall not be required to, use, apply or retain all or any part of the Security Deposit (i) for the payment of any Rent or any other sum in default, (ii) for the payment of any other amount which Landlord may spend or become obligated to spend by reason of Tenant’s default hereunder, or (iii) to compensate Landlord for any other loss or damage which Landlord may suffer by reason of Tenant’s default hereunder, including, without limitation, costs and reasonable attorneys’ fees incurred by Landlord to recover possession of the Premises following a default by Tenant hereunder. If any portion of the Security Deposit is so used or applied, Tenant shall, upon demand therefor, deposit cash with Landlord in an amount sufficient to restore the Security Deposit to the appropriate amount, as determined hereunder. If Tenant shall fully perform every provision of this Lease to be performed by it (including compliance with Paragraph 5(c) concerning the surrender condition of the Premises),, the Security Deposit or any balance thereof shall be returned to Tenant (or, at Landlord’s option, to the last assignee of Tenant’s interest hereunder) within sixty (60) days following the expiration of the Lease Term; provided, however, that Landlord may retain the Security Deposit until such time as any amount due from Tenant in accordance with Paragraph 3 below has been

4

determined and paid to Landlord in full. Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code. Tenant also waives all provisions of law, now or hereafter in force, which provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums reasonably necessary to compensate Landlord for any other loss or damage, foreseeable or unforeseeable, caused by the act or omission of Tenant or any Tenant Parties (as defined in Paragraph 6(g)(i) below).

(d)The parties agree that for all purposes hereunder the Premises and the Building shall be stipulated to contain the number of square feet of Rentable Area and the number of square feet of Usable Area described in Item 3 of the Basic Lease Provisions, based upon the Standard Method for Measuring Floor Area in Office Buildings (ANSI/BOMA Z65.1, 1996). Tenant has inspected the Premises and is fully familiar with the scope and size thereof. Tenant agrees to pay the full Basic Annual Rent and Additional Rent (defined below) set forth in this Lease in consideration for the use and occupancy of said space, regardless of the actual number of square feet contained therein, and Tenant shall have no right to terminate this Lease or receive any adjustment or rebate of any Basic Annual Rent or Additional Rent payable hereunder if the amount set forth in Item 3 is incorrect. Notwithstanding the foregoing, at Landlord’s election, Landlord’s space planner may verify the exact number of square feet of Rentable Area in the Premises. In the event Landlord’s space planner determines that there is a variation from the number of square feet specified in Item 3 of the Basic Lease Provisions, Landlord and Tenant shall execute an amendment to this Lease for the purpose of making appropriate adjustments to the Basic Annual Rent, the Security Deposit, Tenant’s Proportionate Share and such other provisions hereof as shall be appropriate under the circumstances.

(a)If Operating Costs (defined below) for the Project for any calendar year during the Lease Term exceed Base Operating Costs (defined below), Tenant shall pay to Landlord as Additional Rent an amount equal to Tenant’s Proportionate Share (defined below) of such excess. Tenant shall also pay to Landlord as Additional Rent an amount equal to Tenant’s Proportionate Share of Electricity Utility Charges (defined below) for the Project.

(b)“Tenant’s Proportionate Share” is, subject to the provisions of Paragraph 18, the percentage number described in Item 4 of the Basic Lease Provisions. Tenant’s Proportionate Share represents a fraction, the numerator of which is the number of square feet of Rentable Area in the Premises and the denominator of which is the number of square feet of Rentable Area in the Building or Project, as applicable. To the extent the applicable Operating Costs or Electricity Utility Charges are attributed by Landlord solely to the Building (rather than to the entire Project), then Tenant’s Proportionate Share, with respect to such Operating Costs or Electricity Utility Charges, shall, at Landlord’s election, be a fraction, the numerator of which is the number of square feet of Rentable Area in the Premises and the denominator of which is the number of square feet of Rentable Area in the Building. To the extent the applicable Operating Costs or Electricity Utility Charges are attributed by Landlord to the entire Project, then Tenant’s Proportionate Share, with respect to such Operating Costs or Electricity Utility Charges, shall, at Landlord’s election, be a fraction, the numerator of which is the number of square feet of Rentable Area in the Premises and the denominator of which is the number of square feet of Rentable Area in the Project, as determined by Landlord pursuant to Paragraph 18.

(c)“Electricity Utility Charges” means the cost of electricity serving the Premises and the Project, together with the costs (amortized on a straight line basis over the useful life) incurred by Landlord for capital improvements, capital replacements, capital equipment and capital tools reasonably intended by Landlord to produce a reduction in energy consumption and/or effect other economies in the operation of the Project.

(d)“Base Operating Costs” means all Operating Costs incurred or payable by Landlord during the calendar year specified as Tenant’s Base Year for Operating Costs in Item 8 of the Basic Lease Provisions.

(e)“Operating Costs” means all costs, expenses and obligations incurred or payable by Landlord in connection with the operation, ownership, management, repair or maintenance of the Building and the Project during or allocable to the Lease Term, including without limitation, the following:

5

(i)The cost of services provided to the Premises, the Building or the Project, including, without limitation: (except to the extent paid by Tenant as part of Electricity Utility Charges) water and sewer charges and the costs of electricity, heating, ventilating, air conditioning and other utilities, and utilities surcharges and any other costs, levies or assessments resulting from statutes or regulations promulgated by any government authority in connection with the use or occupancy of the Project or the parking facilities serving the Project; supplies, equipment, tools, materials, service contracts, window cleaning, maintenance and repair of sidewalks and Building exterior and services areas, gardening and landscaping; except to the extent paid by Tenant as part of Electricity Utility Charges, waste disposal and janitorial services; the cost of compensation, including employment, welfare and social security taxes, paid vacation days, disability, pension, medical and other fringe benefits of all persons (including independent contractors) who perform services connected with the operation, maintenance, repair or replacement of the Project; any association assessments, costs, dues and/or expenses relating to the Project, personal property taxes on and maintenance and repair of equipment and other personal property used in connection with the operation, maintenance or repair of the Project; repair and replacement of window coverings provided by Landlord in the premises of tenants in the Project; such reasonable auditors’ fees and legal fees as are incurred in connection with the operation, maintenance or repair of the Project; administration fees; a property management fee and rent for the property management office (which fee and rent may be imputed if Landlord has internalized management or otherwise acts as its own property manager, or does not charge its third-party property manager rent); the maintenance of any easements or ground leases benefiting the Project, whether by Landlord or by an independent contractor; costs allocated by agreements between the owners of the Building or Project; a reasonable allowance for depreciation of personal property used in the operation, maintenance or repair of the Project; license, permit and inspection fees; all costs and expenses required by any governmental or quasi-governmental authority or by applicable law, for any reason, including capital improvements, whether capitalized or not, and the cost of any capital improvements made to the Project by Landlord that improve life-safety systems, reduce operating expenses or are reasonably intended to maintain the Building’s status as a Class A property, and the costs to replace items which Landlord would be obligated to maintain under the Lease (such costs to be amortized over such reasonable periods as Landlord shall reasonably determine together with interest thereon at the rate of ten percent (10%) per annum or such other rate as may have been paid by Landlord on funds borrowed for the purpose of funding such improvements); the cost of air conditioning, heating, ventilating, plumbing, elevator maintenance and repair (to include the replacement of components) and other mechanical and electrical systems repair and maintenance; sign maintenance; and Common Area (defined below) repair, resurfacing, operation and maintenance; the reasonable cost for temporary lobby displays and events commensurate with the operation of a similar class building, the cost of providing security services, if any, deemed appropriate by Landlord; Taxes (as defined below); and all costs and expenses for insurance for the Project, including, but not limited to, public liability, fire, property damage, wind, hurricane, earthquake, terrorism, flood, rental loss, rent continuation, boiler machinery, business interruption, contractual indemnification and All Risk, Causes of Loss ‑ Special Form coverage insurance for up to the full replacement cost of the Project and such other insurance as is customarily carried by operators of other similar class office buildings in the city in which the Project is located, to the extent carried by Landlord in its discretion, and the deductible portion of any insured loss otherwise covered by such insurance.

(ii)“Taxes” means any and all forms of assessment, license fee, license tax, business license fee, commercial rental tax, levy, charge, improvement bond, tax, water and sewer rents and charges, utilities and communications taxes and charges or similar or dissimilar imposition imposed by any authority having the direct power to tax, including any city, county, state or federal government, or any school, agricultural, lighting, drainage or other improvement or special assessment district thereof, or any other governmental charge, general and special, ordinary and extraordinary, foreseen and unforeseen, which may be assessed against any legal or equitable interest of Landlord in the Premises, Building, Common Areas or Project. Taxes shall also include, without limitation:

(A)any tax on Landlord’s “right” to rent or “right” to other income from the Premises or as against Landlord’s business of leasing the Premises;

6

(B)any assessment, tax, fee, levy or charge in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the definition of real property tax, it being acknowledged by Tenant and Landlord that Proposition 13 was adopted by the voters of the State of California in the June, 1978 election and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such services as fire protection, street, sidewalk and road maintenance, refuse removal and for other governmental services formerly provided without charge to property owners or occupants. It is the intention of Tenant and Landlord that all such new and increased assessments, taxes, fees, levies and charges be included within the definition of “Taxes” for the purposes of this Lease;

(C)any assessment, tax, fee, levy or charge allocable to or measured by the area of the Premises or other premises in the Building or the rent payable by Tenant hereunder or other tenants of the Project, including, without limitation, any gross receipts tax or excise tax levied by state, city or federal government, or any political subdivision thereof, with respect to the receipt of such rent, or upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises, or any portion thereof but not on Landlord’s other operations;

(D)any assessment, tax, fee, levy or charge upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises;

(E)any assessment, tax, fee, levy or charge by any governmental agency related to any transportation plan, fund or system (including assessment districts) instituted within the geographic area of which the Project is a part; and/or

(F)any costs and expenses (including, without limitation, reasonable attorneys’ fees) incurred in attempting to protest, reduce or minimize Taxes.

(iii)Notwithstanding anything herein to the contrary, the following items shall be excluded from Operating Costs and Taxes:

(A)interest, principal, points and fees on debt or amortization payments on any mortgages or deeds of trust or any other debt for borrowed money, unless such costs are directly attributable to Tenant’s, its agents’ or employees’ activities in, on or about the Project, or as a result of a Tenant’s breach or default under this Lease;

(B)leasing commissions, attorneys’ fees, costs and disbursements and other expenses incurred in connection with leasing, renovating or improving vacant premises (including permit, license and inspection fees) in the Project for lease by specific tenants or prospective tenants of the Project;

(C)legal fees or other expenses incurred in connection with disputes with other tenants in the Project;

(D)advertising and promotional expenditures except for (i) the Building directory and interior signs identifying any retail use tenants and signage for various equipment room and Common Areas, and (ii) costs of signs in, on, or outside the Building identifying the owner or any tenant of the Building;

(E)all items and services for which Tenant or other tenants reimburse Landlord outside of Operating Costs;

(F)costs of repairs, replacements, or other work occasioned by fire, windstorm or other casualty to the extent that Landlord is actually reimbursed by insurance proceeds (however any deductible Landlord is required to pay with respect to any of the foregoing shall be included in Operating Costs);

7

(G)penalties and interest due to a violation of Law by Landlord relating to the Building (but this provision does not relieve Tenant of liability for penalties or interest incurred due to violations of Law by Tenant);

(H)cost of correcting defects in the design, construction or equipment of the Building or the Project (except the conditions resulting from ordinary wear and tear and use, which shall not be deemed defects for purposes of this category);

(I)except for the costs of capital improvements expressly set forth in this Paragraph 3(e)(i) above, the cost of any item that, under generally accepted accounting principles, are properly classified as capital expenses;

(J)Landlord’s charitable or political contributions;

(K)costs (including permit, license and inspection fees) incurred in renovating or otherwise improving or decorating, painting or redecorating Rentable Area;

(L) any cost representing an amount paid to an employee or affiliate of Landlord that is in excess of the commercially reasonable range of amounts that are customarily paid for such product or service in arm’s-length transactions to third-parties of comparable skill, competence, stature, and reputation;

(M)Landlord’s general corporate overhead expenses for services related solely to the corporate legal and tax filings of the Landlord entity and not related to the Building or Project or the operation or management thereof or the revenues or services generated or related thereto (e.g. the fees paid to Landlord’s property manager shall be expressly includable within Operating Costs);

(N)salaries or other compensation paid to employees of Landlord above the grade of senior property manager (however compensation paid to the property manager, whether an employee or agent of Landlord shall be expressly included), and the salary and compensation of the senior property manager shall be prorated over the portfolio of buildings being managed by an asset manager;

(O)Landlord’s costs of any services sold to tenants for which Landlord is actually reimbursed by such tenants as a separate, additional charge or rental over and above the Basic Annual Rent and Operating Costs payable under the lease with such tenant or other occupant;

(P)late fees, interest, penalties or charges incurred by Landlord due to Landlord’s negligent late payment of expenses and Taxes, except to the extent attributable to Tenant’s actions or inactions;

(Q)costs incurred: (i) to comply with applicable Laws with respect to any Hazardous Materials that were in existence in, on, under or about the Project (or any portion thereof) prior to the Date of this Lease and not caused by Tenant or Tenant Parties (defined herein), and were of such a nature that a federal, state or municipal governmental or quasi-governmental authority, if it had then had knowledge of the presence of such Hazardous Materials, in the state, and under the conditions that they then existed in, on, under or about the Project, would have then required the removal, remediation or other action with respect thereto; and/or (ii) with respect to Hazardous Materials that are disposed of or otherwise introduced into, on, under or about the Project after the Date of this Lease by Landlord or Landlord's agents, employees, contractors or licensees (including any other tenants of the Building) and are of such a nature, at time of disposition or introduction, that a federal, state or municipal governmental or quasi-governmental authority, if it had then had knowledge of the presence of such Hazardous Materials, in the state, and under the conditions, that they then existed in, on, under or about the Project, would have then required the removal, remediation or other action with respect thereto;

(R)costs for acquisition of (as contrasted with the maintenance or rental of) sculptures, paintings, or other objects of art; and

8

(S)any depreciation or amortization of the Project except as expressly permitted herein.

(f)Operating Costs and Electricity Utility Charges for any calendar year during which actual occupancy of the Project is less than ninety‑five percent (95%) of the Rentable Area of the Project shall be appropriately adjusted to reflect ninety‑five percent (95%) occupancy of the existing Rentable Area of the Project during such period. In determining Operating Costs and Electricity Utility Charges, if any services or utilities are separately charged to tenants of the Project or others, Operating Costs or Electricity Utility Charges, as applicable, shall be adjusted by Landlord to reflect the amount of expense which would have been incurred for such services or utilities on a full time basis for normal Project operating hours. Operating Costs for the Base Year (as defined in Item 8 of the Basic Lease Provisions) shall not include (i) Operating Costs attributable to temporary market-wide labor-rate increases and/or utility rate increases due to extraordinary circumstances, including, but not limited to Force Majeure, conservation surcharges, boycotts, embargoes, or other shortages, (ii) one-time special assessments, charges, costs or fees or extraordinary charges or costs incurred in the Base Year only, or (iii) amortization of any capital items including, but not limited to, capital improvements, capital repairs and capital replacements (including such amortized costs where the actual improvement, repair or replacement was made in prior years). In addition, if in any calendar year subsequent to the Base Year, the amount of Operating Costs decreases due to a reduction in the cost of providing utilities, security and/or other services to the Project for any reason, including without limitation, because of deregulation of the utility industry and/or reduction in rates achieved in contracts with utilities and/or service providers, then for purposes of the calendar year in which such decrease in Operating Costs occurred and all subsequent calendar years, the Operating Costs for the Base Year shall be decreased by an amount equal to such decrease. In the event (i) the Commencement Date shall be a date other than January 1, (ii) the date fixed for the expiration of the Lease Term shall be a date other than December 31, (iii) of any early termination of this Lease, or (iv) of any increase or decrease in the size of the Premises, then in each such event, an appropriate adjustment in the application of this Paragraph 3 shall, subject to the provisions of this Lease, be made to reflect such event on a basis determined by Landlord to be consistent with the principles underlying the provisions of this Paragraph 3. In addition, Landlord shall have the right, from time to time, to equitably allocate and prorate some or all of the Operating Costs or Electricity Utility Charges among different tenants and/or different buildings of the Project and/or on a building-by-building basis (the “Cost Pools”), adjusting Tenant’s Proportionate Share as to each of the separately allocated costs based on the ratio of the Rentable Area of the Premises to the Rentable Area of all of the premises to which such costs are allocated. Such Cost Pools may include, without limitation, the office space tenants and retail space tenants of the buildings in the Project.

(g)Prior to the commencement of each calendar year of the Lease Term following the Commencement Date, Landlord shall have the right to give to Tenant a written estimate of Tenant’s Proportionate Share of (i) the Operating Costs for the Project for the ensuing year over the Base Operating Costs and (ii) the Electricity Utility Charges for the Project for the ensuing year. Tenant shall pay such estimated amount to Landlord in equal monthly installments, in advance on the first day of each month. Within a reasonable period after the end of each calendar year, Landlord shall furnish Tenant a statement (the “Year End Statement”) indicating in reasonable detail the excess of Operating Costs over Base Operating Costs, and the total Electricity Utility Charges for such period and the parties shall, within thirty (30) days thereafter, make any payment or allowance necessary to adjust Tenant’s estimated payments to Tenant’s actual share of such excess as indicated the Year End Statement. Any payment due Landlord shall be payable by Tenant on demand from Landlord. Any amount due Tenant shall be credited against installments next becoming due under this Paragraph 3(f) or refunded to Tenant, if requested by Tenant. In no event shall Landlord be liable for damages to Tenant based upon any incorrect or disputed Year End Statement, nor shall Tenant have any right to terminate this Lease by reason of any incorrect or disputed excess Operating Costs. The sole remedy of Tenant regarding any excess Operating Costs dispute shall be refund of any charge which exceeds the amount allowed by this Lease. Tenant may, at its sole expense conduct or require a non-binding audit to be conducted of the Year End Statement, provided that (a) not more than one such audit may be conducted during any calendar year, (b) the records for each calendar year may be audited only once, (c) such audit must be commenced within sixty (60) days following Tenant's receipt of the Year End Statement, (d) such audit must be completed within one hundred twenty (120) days following Tenant's receipt of the Year End Statement (the “Review Period”), and (e) any audit must be conducted by a nationally recognized or regionally recognized accounting firm that (i) is not paid on a contingency fee basis and has at least seven (7) years of experience reviewing financial operating records of comparable buildings, (ii) is acceptable to Landlord in its reasonable discretion, (iii) together with Tenant, executes Landlord’s standard form audit confidentiality agreement, (iv) has not represented, and agrees not to represent, any other tenant of the Project in

9

connection with an audit of the Project, (v) agrees to impartially represent Landlord and Tenant in conducting the audit, and (vi) agrees to promptly provide Landlord with a copy of its audit report. If Tenant fails to commence or complete such non-binding audit within such time frames, it shall be deemed conclusively that the Year End Statement is correct. For purposes of any non-binding audit performed by Tenant, Tenant shall provide Landlord with fifteen (15) days’ prior written notice of its request to inspect Landlord’s books and such non-binding audit shall be conducted at the offices of Landlord or Landlord's managing agent during ordinary business hours, provided that any such audit must be conducted so as not to interfere with Landlord's business operations and must be reasonable as to scope and time. The payment of Rent may never be contingent upon the performance of such non-binding audit. If, within thirty (30) days after the Review Period, Tenant notifies Landlord in writing that Tenant’s non-binding audit has revealed a material error set forth in the Year End Statement and Landlord disputes the results of Tenant’s non-binding audit, then a certification as to the proper amount shall be made pursuant to a binding audit, at Tenant’s expense (except as provided hereinbelow), performed by an independent certified public accountant reasonably selected by Landlord, who meets the qualifications set forth hereinabove. Such certification by the independent certified public accountant shall be binding upon Landlord and Tenant. If, pursuant to the binding audit, Operating Costs or Taxes are determined to have been overstated or understated by Landlord in the Year End Statement for any calendar year, then Landlord shall provide to Tenant the appropriate credit (or, if the Lease Term has expired, the appropriate refund) or Tenant shall immediately make the appropriate payment to Landlord, as is applicable, and if Operating Costs or Taxes are determined to have been overstated in the Year End Statement by Landlord for any calendar year by in excess of five percent (5%), then Landlord shall pay the cost of the independent certified public accountant that performed the binding audit described above up to a maximum amount of $2,500. Landlord may adjust Operating Costs or Taxes and submit a corrected Year End Statement to account for Operating Costs or Taxes that were first billed to Landlord after the date that is ten (10) business days before the date on which the Year End Statement was furnished.

(h)All capital levies or other taxes assessed or imposed on Landlord upon the rents payable to Landlord under this Lease and any excise, transaction, sales, gross receipts, or privilege tax, assessment, levy or charge measured by or based, in whole or in part, upon such rents from the Premises and/or the Project or any portion thereof shall be paid by Tenant to Landlord monthly in estimated installments or upon demand, at the option of Landlord, as Additional Rent to be allocated to monthly Operating Costs.

(i)Tenant shall pay before delinquency all taxes and assessments (i) levied against any personal property, tenant improvements or trade fixtures of Tenant in or about the Premises, (ii) based upon this Lease or any document to which Tenant is a party creating or transferring an interest in this Lease or an estate in all or any portion of the Premises, and (iii) levied for any business, professional, or occupational license fees. If any such taxes or assessments are levied against Landlord or Landlord’s property or if the assessed value of the Project is increased by the inclusion therein of a value placed upon such personal property or trade fixtures, Tenant shall upon demand reimburse Landlord for the taxes and assessments so levied against Landlord, or such taxes, levies and assessments resulting from such increase in assessed value. To the extent that any such taxes are not separately assessed or billed to Tenant, Tenant shall pay the amount thereof as invoiced to Tenant by Landlord.

(j)Any delay or failure of Landlord in (i) delivering any estimate or statement described in this Paragraph 3, or (ii) computing or billing Tenant’s Proportionate Share of excess Operating Costs or Tenant’s Proportionate Share of Electricity Utility Charges shall not constitute a waiver of its right to require an increase in Rent, or in any way impair, the continuing obligations of Tenant under this Paragraph 3.

(k)Even though the Lease Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant’s Proportionate Share of excess Operating Costs and Tenant’s Proportionate Share of Electricity Utility Charges for the year in which this Lease terminates, Tenant shall immediately pay any increase due over the estimated Operating Costs and/or Electricity Utility Charges paid, and conversely, any overpayment made by Tenant shall be promptly refunded to Tenant by Landlord. The provisions of this Paragraph 3 shall survive any termination or expiration of this Lease.

(l)Tenant shall pay all sales and use tax levied or assessed against all Basic Annual Rent, Tenant’s Proportionate Share of Operating Costs and Electricity Utility Charges, and any other payments due under this Lease simultaneously with each installment of Basic Annual Rent, Tenant’s Proportionate Share of Operating Costs and Electricity Utility Charges and any other payment required hereunder.

10

(m)All Operating Costs and any other sums payable by Tenant to Landlord under this Lease (except Basic Annual Rent) shall be “Additional Rent.” The Basic Annual Rent, as adjusted pursuant to Paragraphs 2, 3 and 7, and other Additional Rent, are sometimes collectively referred to as, and shall constitute, “Rent”.

(a)Landlord hereby delivers to Tenant, and Tenant hereby accepts from Landlord, the Premises in its existing “AS-IS”, “WHERE-IS” and “WITH ALL FAULTS” condition, and Tenant acknowledges that Landlord shall have no obligation to refurbish or otherwise improve the Premises after the Date of this Lease.

(b)Any alterations, additions, or improvements made by or on behalf of Tenant to the Premises (“Alterations”) shall be subject to Landlord’s prior written consent. Tenant shall cause, at its sole cost and expense, all Alterations to comply with insurance requirements and with Laws and shall construct, at its sole cost and expense, any alteration or modification required by Laws as a result of any Alterations. All Alterations shall be constructed at Tenant’s sole cost and expense and in a good and workmanlike manner by contractors reasonably acceptable to Landlord and only good grades of materials shall be used. All plans and specifications for any Alterations shall be submitted to Landlord for its approval. Landlord may monitor construction of the Alterations. Landlord’s right to review plans and specifications and to monitor construction shall be solely for its own benefit, and Landlord shall have no duty to see that such plans and specifications or construction comply with applicable Laws. Without limiting the other grounds upon which Landlord may refuse to approve any contractor or subcontractor, Landlord may take into account the desirability of maintaining harmonious labor relations at the Project. Landlord may also require that all life safety related work and all mechanical, electrical, plumbing and roof related work be performed by contractors designated by Landlord. Landlord shall have the right, in its sole discretion, to instruct Tenant to remove any improvements or Alterations from the Premises at the expiration or earlier termination of the Lease. If, upon the termination of this Lease, Landlord requires Tenant to remove any or all of such Alterations from the Premises, then Tenant, at Tenant’s sole cost and expense, shall promptly remove such Alterations and improvements and Tenant shall repair and restore the Premises to its original condition as of the Commencement Date, reasonable wear and tear excepted. Any Alterations remaining in the Premises following the expiration of the Lease Term or following the surrender of the Premises from Tenant to Landlord, shall become the property of Landlord unless Landlord notifies Tenant otherwise. Tenant shall provide Landlord with the identities and mailing addresses of all persons performing work or supplying materials, prior to beginning such construction, and Landlord may post on and about the Premises and record any notices of non-responsibility pursuant to applicable law. Tenant shall assure payment for the completion of all work free and clear of liens and shall provide certificates of insurance for worker’s compensation and other coverage in amounts and from an insurance company reasonably satisfactory to Landlord protecting Landlord against liability for bodily injury or property damage during construction. Upon completion of any Alterations and upon Landlord’s reasonable request, Tenant shall deliver to Landlord sworn statements setting forth the names of all contractors and subcontractors who did work on the Alterations and final lien waivers from all such contractors and subcontractors. Tenant shall pay to Landlord, as Additional Rent, the reasonable costs of Landlord’s engineers and other consultants (but not Landlord’s on-site management personnel) for review of all plans, specifications and working drawings for the Alterations and for the incorporation of such Alterations in the Landlord’s master Building drawings, within ten (10) business days after Tenant’s receipt of invoices either from Landlord or such consultants together with (in any event) an administrative charge of ten percent (10%) of the actual costs of such work. In addition to such costs, Tenant shall pay to Landlord, within ten (10) business days after completion of any Alterations, the actual, reasonable costs incurred by Landlord for services rendered by Landlord’s management personnel and engineers to coordinate and/or supervise any of the Alterations to the extent such services are provided in excess of or after the normal on-site hours of such engineers and management personnel. Together with Tenant’s request for approval of any Alterations and the plans and specifications submitted to Landlord therefor, Tenant may expressly request in writing (in bold upper case letters (in 16 point font or larger) that Landlord specify whether the Alterations (or portions thereof) must be removed from the Premises upon the expiration or earlier termination of the Lease Term (the “Removal Request”), in which case Landlord shall specify such Alterations (or portions thereof) together with Landlord’s written approval thereof (if such approval is granted in accordance with the terms hereof). If Tenant delivers a Removal Request to Landlord with the information regarding the Alterations required herein, and Landlord delivers to Tenant written approval of such Alterations, and together with such approval Landlord specifies that such Alterations (or any portions thereof) are not required to be removed upon the expiration or earlier termination of this Lease, then Tenant shall not be required to remove such Alterations. Notwithstanding the foregoing, Landlord

11

shall have the right, in its sole discretion, to instruct Tenant to remove from the Premises those Alterations that (i) were not approved in writing and in advance by Landlord, (ii) were not built in conformance with the plans and specifications approved in writing by Landlord, or (iii) Landlord specified during its review of the applicable plans and specifications would need to be removed by Tenant upon the expiration or earlier termination of this Lease. However, Tenant will have no obligation to remove, replace or modify any tenant improvements existing as of the Date of this Lease nor will Tenant be obligated to restore the Premises to a condition pre-existing the Date of this Lease.

(c)Tenant shall keep the Premises, the Building and the Project free from any and all liens arising out of any Alterations, work performed, materials furnished, or obligations incurred by or for Tenant. In the event that Tenant shall not, within ten (10) days following the imposition of any such lien, cause the same to be released of record by payment or posting of a bond in a form and issued by a surety acceptable to Landlord, Landlord shall have the right, but not the obligation, to cause such lien to be released by such means as it shall deem proper (including payment of or defense against the claim giving rise to such lien); in such case, Tenant shall reimburse Landlord for all amounts so paid by Landlord in connection therewith, together with all of Landlord’s costs and expenses, with interest thereon at the Default Rate (defined below) and Tenant shall indemnify and defend each and all of the Landlord Indemnitees (defined below) against any damages, losses or costs arising out of any such claim. Tenant’s indemnification of Landlord contained in this Paragraph shall survive the expiration or earlier termination of this Lease. Such rights of Landlord shall be in addition to all other remedies provided herein or by law.

(d)NOTICE IS HEREBY GIVEN THAT LANDLORD SHALL NOT BE LIABLE FOR ANY LABOR, SERVICES OR MATERIALS FURNISHED OR TO BE FURNISHED TO TENANT, OR TO ANYONE HOLDING THE PREMISES THROUGH OR UNDER TENANT, AND THAT NO MECHANICS’ OR OTHER LIENS FOR ANY SUCH LABOR, SERVICES OR MATERIALS SHALL ATTACH TO OR AFFECT THE INTEREST OF LANDLORD IN THE PREMISES.

(a)Landlord shall keep the Common Areas of the Building and the Project in a clean and neat condition. Subject to subparagraph (b) below, Landlord shall make all necessary repairs, within a reasonable period following receipt of notice of the need therefor from Tenant, to the exterior walls, exterior doors, exterior locks on exterior doors and windows of the Building, and to the Common Areas and to public corridors and other public areas of the Project not constituting a portion of any tenant’s premises and shall use reasonable efforts to keep all Building standard equipment used by Tenant in common with other tenants in good condition and repair and to replace same at the end of such equipment’s normal and useful life, reasonable wear and tear and casualty loss excepted. Except as expressly provided in Paragraph 9 of this Lease, there shall be no abatement of Rent and no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements in or to any portion of the Premises, the Building or the Project. Tenant waives the right to make repairs at Landlord’s expense under any law, statute or ordinance now or hereafter in effect (including the provisions of California Civil Code Section 1942 and any successive sections or statutes of a similar nature).

(b)Tenant, at its expense, (i) shall keep the Premises and all fixtures and equipment contained therein in a safe, clean and neat condition, and (ii) shall bear the cost of maintenance and repair, by contractors selected by Landlord, of all facilities which are not expressly required to be maintained or repaired by Landlord and which are located in the Premises, including, without limitation, lavatory, shower, toilet, wash basin and kitchen facilities and supplemental heating and air conditioning systems (including all plumbing connected to said facilities or systems installed by or on behalf of Tenant or existing in the Premises at the time of Landlord’s delivery of the Premises to Tenant). Tenant shall make all repairs to the Premises not required to be made by Landlord under subparagraph (a) above with replacements of any materials to be made by use of materials of equal or better quality. Tenant shall do all decorating, remodeling, alteration and painting required by Tenant during the Lease Term. Tenant shall pay for the cost of any repairs to the Premises, the Building or the Project made necessary by any negligence or willful misconduct of Tenant or any of its assignees, subtenants, employees or their respective agents, representatives, contractors, or other persons permitted in or invited to the Premises or the Project by Tenant. If Tenant fails to make such repairs or replacements within fifteen (15) days after written notice from Landlord, Landlord may at its option

12

make such repairs or replacements, and Tenant shall upon demand pay Landlord for the cost thereof, together with an administration fee equal to fifteen percent (15%) of such costs.

(c)Upon the expiration or earlier termination of this Lease, Tenant shall surrender the Premises in a safe, clean and neat condition, normal wear and tear excepted. Prior to the expiration or earlier termination of this Lease, Tenant shall remove from the Premises (i) all trade fixtures, furnishings and other personal property of Tenant, except as otherwise set forth in Paragraph 4(b) of this Lease, and (ii) all computer and phone cabling and wiring from the Premises, and Tenant shall repair all damage caused by such removal, and shall restore the Premises to its original condition, reasonable wear and tear excepted. In addition to all other rights Landlord may have, in the event Tenant does not so remove any such fixtures, furnishings or personal property, Tenant shall be deemed to have abandoned the same, in which case Landlord may store or dispose of the same at Tenant’s expense, appropriate the same for itself, and/or sell the same in its discretion.

(a)Tenant shall use the Premises only for general office uses and shall not use the Premises or permit the Premises to be used for any other purpose. Landlord shall have the right to deny its consent to any change in the permitted use of the Premises in its sole and absolute discretion. Tenant shall not at any time use or occupy the Premises, or suffer or permit anyone to use or occupy the Premises, or permit anything to be done in the Premises, in any manner that: (i) violates the certificate of occupancy for the Premises or for the Building, (ii) involves the operation of any division, agency or bureau of the United States, of any state or local government, of any foreign government, or of any subdivision thereof, (iii) involves gambling in any form, or the use of lottery, gaming or arcade devices, (iv) involves the sale, rental or viewing of pornographic, obscene or “adult materials,” or involves adult entertainment of any kind, (v) otherwise impairs the character, reputation or appearance of the Building as a first-class Building; (vi) impairs the proper and economic maintenance, operation and repair of the Building and/or its equipment, facilities or systems; (vii) annoys or inconveniences other tenants or occupants of the Building; or (viii) causes any labor dispute in or adjacent to the Building. Tenant shall not at any time keep pets or animals of any kind on the Premises.

(b)Tenant shall not at any time use or occupy the Premises, or permit any act or omission in or about the Premises in violation of any covenant of record, law, statute, building or zoning code, ordinance, or governmental order, condition of approval, rule or regulation (including, but not limited to, Title III of the Americans With Disabilities Act of 1990), as well as the same may be amended and supplemented from time to time (collectively, “Law” or “Laws”) and Tenant shall, upon written notice from Landlord, discontinue any use of the Premises which is declared by any governmental authority to be a violation of Law. If any Law shall, by reason of the nature of Tenant’s use or occupancy of the Premises, impose any duty upon Tenant or Landlord with respect to (i) modification or other maintenance of the Premises, the Building or the Project, or (ii) the use, alteration or occupancy thereof, Tenant shall comply with such Law at Tenant’s sole cost and expense. This Lease shall be subject to and Tenant shall comply with all financing documents encumbering the Building or the Project at any time and all covenants, conditions and restrictions affecting the Premises, the Building or the Project at any time, including, but not limited to, Tenant’s execution of any subordination agreements requested by a mortgagee (which for purposes of this Lease includes any lender or grantee under a deed of trust) of the Premises, the Building or the Project.

(c)Tenant shall not at any time use or occupy the Premises in violation of the certificates of occupancy issued for or restrictive covenants pertaining to the Building or the Premises, and in the event that any architectural control committee or department of the State or the city or county in which the Project is located shall at any time contend or declare that the Premises are used or occupied in violation of such certificate or certificates of occupancy or restrictive covenants, Tenant shall, upon five (5) days’ notice from Landlord or any such governmental agency, immediately discontinue such use of the Premises (and otherwise remedy such violation). The failure by Tenant to discontinue such use shall be considered a default under this Lease and Landlord shall have the right to exercise any and all rights and remedies provided herein or by Law. Any statement in this Lease of the nature of the business to be conducted by Tenant in the Premises shall not be deemed or construed to constitute a representation or guaranty by Landlord that such business is or will continue to be lawful or permissible under any certificate of occupancy issued for the Building or the Premises, or otherwise permitted by Law.

13

(d)Tenant shall not do or permit to be done anything which may invalidate or increase the cost of any fire, All Risk, Causes of Loss – Special Form or other insurance policy covering the Building, the Project and/or property located therein and shall comply with all rules, orders, regulations and requirements of the appropriate fire codes and ordinances or any other organization performing a similar function. In addition to all other remedies of Landlord, Landlord may require Tenant, promptly upon demand, to reimburse Landlord for the full amount of any additional premiums charged for such policy or policies by reason of Tenant’s failure to comply with the provisions of this Paragraph 6.

(e)Tenant shall not in any way interfere with the rights or quiet enjoyment of other tenants or occupants of the Premises, the Building or the Project. Tenant shall not use or allow the Premises to be used for any improper, immoral, unlawful or objectionable purpose, nor shall Tenant cause, maintain, or permit any nuisance in, on or about the Premises, the Building or the Project. Tenant shall not place weight upon any portion of the Premises exceeding the structural floor load (per square foot of area) which such area was designated (and is permitted by Law) to carry or otherwise use any Building system in excess of its capacity or in any other manner which may damage such system or the Building. Tenant shall not create within the Premises a working environment with a density of greater than five (5) persons per 1,000 square feet of Rentable Area. Business machines and mechanical equipment shall be placed and maintained by Tenant, at Tenant’s expense, in locations and in settings sufficient in Landlord’s reasonable judgment to absorb and prevent vibration, noise and annoyance. Tenant shall not commit or suffer to be committed any waste in, on, upon or about the Premises, the Building or the Project.

(f)Tenant shall take all reasonable steps necessary to adequately secure the Premises from unlawful intrusion, theft, fire and other hazards, and shall keep and maintain any and all security devices in or on the Premises in good working order, including, but not limited to, exterior door locks for the Premises and smoke detectors and burglar alarms located within the Premises and shall cooperate with Landlord and other tenants in the Project with respect to access control and other safety matters.

(g)As used herein, the term “Hazardous Material” means any hazardous or toxic substance, material or waste which is or becomes regulated by any local governmental authority, the State or the United States Government, including, without limitation, any material or substance which is (A) defined or listed as a “hazardous waste,” “pollutant,” “extremely hazardous waste,” “restricted hazardous waste,” “hazardous substance” or “hazardous material” under any applicable federal, state or local Law or administrative code promulgated thereunder, (B) petroleum, or (C) asbestos.

(i)Tenant agrees that all operations or activities upon, or any use or occupancy of the Premises, or any portion thereof, by Tenant, its assignees, subtenants, and their respective agents, servants, employees, invitees, representatives and contractors (collectively referred to herein as “Tenant Parties”), throughout the Lease Term, shall be in all respects in compliance with all federal, state and local Laws then governing or in any way relating to the generation, handling, manufacturing, treatment, storage, use, transportation, release, spillage, leakage, dumping, discharge or disposal of any Hazardous Materials.

(ii)Tenant agrees to indemnify, defend and hold Landlord and the Landlord Indemnitees (defined below) harmless for, from and against any and all claims, actions, administrative proceedings (including informal proceedings), judgments, damages, punitive damages, penalties, fines, costs, liabilities, interest or losses, including reasonable attorneys’ fees and expenses, court costs, consultant fees, and expert fees, together with all other costs and expenses of any kind or nature that arise during or after the Lease Term directly or indirectly from or in connection with the presence, suspected presence, or release of any Hazardous Material in or into the air, soil, surface water or groundwater at, on, about, under or within the Premises, or any portion thereof caused by Tenant or Tenant Parties.

(iii)In the event any investigation or monitoring of site conditions or any clean-up, containment, restoration, removal or other remedial work (collectively, the “Remedial Work”) is required under any applicable federal, state or local Law, by any judicial order, or by any governmental entity as the result of operations or activities upon, or any use or occupancy of any portion of the Premises by Tenant or Tenant Parties, Landlord shall perform or cause to be performed the Remedial Work in compliance with such Law or order at Tenant’s sole cost and expense. All Remedial Work shall be performed by one or more

14

contractors, selected and approved by Landlord, and under the supervision of a consulting engineer, selected by Tenant and approved in advance in writing by Landlord. All costs and expenses of such Remedial Work shall be paid by Tenant, including, without limitation, the charges of such contractor(s), the consulting engineer, any costs, fees, penalties or fines imposed by any governmental entity inspecting or certifying the Remedial Work, and Landlord’s reasonable attorneys’ fees and costs incurred in connection with monitoring or review of such Remedial Work.

(iv)Each of the covenants and agreements of Tenant set forth in this Paragraph 6(g) shall survive the expiration or earlier termination of this Lease.

(a)Provided that Tenant is not in default hereunder, Landlord shall furnish, or cause to be furnished to the Premises, the utilities and services described in Exhibit C attached hereto, subject to the conditions and in accordance with the standards set forth therein and in this Lease; however, Landlord may, in its sole discretion, require that Tenant, at its sole cost and expense, obtain the electricity to be consumed at the Premises by contracting directly with utility providers, at its expense (with payments to be made by Tenant directly to Tenant’s electricity provider), in an amount to accommodate seasonal changes to permit comfortable operation of the Premises and to prevent damage to the Premises, which electrical consumption may be separately metered by Landlord. If a separate meter is not installed at Tenant's cost, such excess cost will be established by an estimate agreed upon by Landlord and Tenant, and if the parties fail to agree, as established by an independent licensed engineer. Said estimates to be reviewed and adjusted quarterly.

(b)Tenant agrees to cooperate fully at all times with Landlord and to comply with all regulations and requirements which Landlord may from time to time prescribe for the use of the utilities and services described herein and in Exhibit C. Landlord shall not be liable to Tenant for the failure of any other tenant, or its assignees, subtenants, employees, or their respective invitees, licensees, agents or other representatives to comply with such regulations and requirements.

(c)If Tenant requires utilities or services in quantities greater than or at times other than that generally furnished by Landlord pursuant to Exhibit C, Tenant shall pay to Landlord, upon receipt of a written statement therefor, Landlord’s charge for such use. In the event that Tenant shall require additional electric current, water or gas for use in the Premises and if, in Landlord’s judgment, such excess requirements cannot be furnished unless additional risers, conduits, feeders, switchboards and/or appurtenances are installed in the Building, subject to the conditions stated below, Landlord may proceed to install the same at the sole cost of Tenant, payable upon demand in advance. The installation of such facilities shall be conditioned upon Landlord’s consent, and a determination that the installation and use thereof (i) shall be permitted by applicable Law and insurance regulations, (ii) shall not cause permanent damage or injury to the Building or adversely affect the value of the Building or the Project, and (iii) shall not cause or create a dangerous or hazardous condition or interfere with or disturb other tenants in the Building. Subject to the foregoing, Landlord shall, upon reasonable prior notice by Tenant, furnish to the Premises additional elevator, heating, air conditioning and/or cleaning services upon such reasonable terms and conditions as shall be determined by Landlord, including payment of Landlord’s charge therefor. In the case of any additional utilities or services to be provided hereunder, Landlord may require additional switch and metering systems to be installed so as to measure the amount of such additional utilities or services. The cost of installation, maintenance and repair thereof shall be paid by Tenant upon demand.

(d)Landlord shall not be liable for, and Tenant shall not be entitled to, any damages, abatement or reduction of Rent, or other liability by reason of any failure to furnish any services or utilities described herein or in Exhibit C for any reason (other than Landlord’s gross negligence or willful misconduct), including, without limitation, when caused by accident, breakage, water leakage, flooding, repairs, Alterations or other improvements to the Project, strikes, lockouts or other labor disturbances or labor disputes of any character, governmental regulation, moratorium or other governmental action, inability to obtain electricity, water or fuel, or any other cause beyond Landlord’s control. Tenant shall be required to cooperate with the energy conservation efforts of governmental agencies or utility suppliers or those implemented by Landlord. No such failure, stoppage or interruption of any such utility or service shall be construed as an eviction of Tenant, nor shall the same relieve Tenant from any obligation to perform any

15

covenant or agreement under this Lease. In the event of any failure, stoppage or interruption thereof, Landlord shall use reasonable efforts to attempt to restore all services promptly. No representation is made by Landlord with respect to the adequacy or fitness of the Building’s ventilating, air conditioning or other systems to maintain temperatures as may be required for the operation of any computer, data processing or other special equipment of Tenant. Tenant hereby waives the provisions of California Civil Code Section 1932(1) or any other applicable existing or future law, ordinance or governmental regulation permitting the termination of this Lease due to an interruption, failure or inability to provide any services.

(e)Landlord reserves the right from time to time to make reasonable and nondiscriminatory modifications to the above standards (including, without limitation, those described in Exhibit C) for utilities and services.

(f)Tenant shall not use the Premises in any manner that will cause the Building or any part thereof not to conform with Landlord’s operations and maintenance practices for the Building, whether incorporated into the Rules and Regulations, separate written sustainability policies or otherwise implemented by Landlord, as they may be revised from time to time, addressing energy efficiency; water efficiency; recycling, composting, and waste management; indoor air quality; chemical use; and other best practices adopted by Landlord in connection with the certification of the Building issued pursuant to the applicable Green Building Standard, as hereinafter defined (the “Landlord’s Sustainability Practices”). All Alterations, additions or improvements to the Premises, to the extent permitted in this Lease, shall be in accordance with Rules and Regulations in effect with respect thereto and the requirements of Landlord’s Sustainability Practices, including the applicable Green Building Standard concerning the environmental compliance of the Building, as the same may change from time to time, and with plans and specifications meeting the requirements set forth in the Rules and Regulations and approved in advance by Landlord. Tenant acknowledges that the Building is or may be in the future be certified or rated pursuant to the U.S. EPA’s Energy Star ® Portfolio Manager, the Green Building Initiative’s Green Globes™ building rating system, the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED®) building rating system, the ASHRAE Building Energy Quotient (BEQ), or operated to meet another standard for high performance buildings adopted by Landlord (collectively, the “Green Building Standard”). In addition, as contemplated by Nonresidential Building Energy Use Disclosure Program (AB 1103) Landlord may collect and maintain records regarding energy and utilities usage at the Project. As and when requested by Landlord during the Term, to the extent reasonably available to Tenant, Tenant shall provide Landlord (in the format requested by Landlord and reasonably necessary or desirable to comply with the requirements of the applicable Green Building Standard or any commissioning or retro-commissioning of the Building’s systems or the Nonresidential Building Energy Use Disclosure Program) with data concerning Tenant’s energy consumption, water consumption, and the operation of the Building’s systems. Such data may include, without limitation, Tenant’s operating hours, the number of on-site personnel, the types of equipment used at the Building (including computer equipment, if applicable), office supply purchases, light bulb purchases, cleaning product materials (both chemicals and paper products), as applicable, and energy use and cost. Landlord may post such information to its account with the EPA’s ENERGY STAR® program Portfolio Manager and disclose such information to the California Energy Commission, lenders, its constituents, consultants and advisors and prospective purchasers, investors and lenders. Landlord shall have no liability to Tenant if, once obtained, any such Green Building Standard rating or certification lapses and is not reinstated by Landlord. In addition, Landlord shall not be required to treat the information collected by Landlord pursuant to this paragraph as confidential and shall have no liability to Tenant on account of the disclosure of such information. Tenant shall continually during the Term maintain the Premises in accordance with all present and future laws, Landlord’s Sustainability Practices and the standards recommended by the Board of Fire Underwriters applicable to any work, installation, occupancy, use or manner of use by Tenant of the Premises or any part thereof, and shall, at Tenant's expense, obtain all permits, licenses and the like required by applicable law.

(a)Landlord shall not be liable for any injury, loss or damage suffered by Tenant or to any person or property occurring or incurred in or about the Premises, the Building or the Project from any cause, EVEN IF SUCH LIABILITIES ARE CAUSED SOLELY OR IN PART BY THE NEGLIGENCE OF ANY LANDLORD INDEMNITEE (DEFINED BELOW), BUT NOT TO THE EXTENT SUCH LIABILITIES ARE CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY SUCH LANDLORD INDEMNITEE (DEFINED

16

BELOW). Without limiting the foregoing, neither Landlord nor any of the Landlord Indemnitees shall be liable for and there shall be no abatement of Rent (except in the event of a casualty loss or a condemnation as set forth in Paragraphs 9 and 10 of this Lease) for (i) any damage to Tenant’s property stored with or entrusted to Landlord or the Landlord Indemnitees, (ii) loss of or damage to any property by theft or any other wrongful or illegal act, or (iii) any injury or damage to persons or property resulting from fire, explosion, falling plaster, steam, gas, electricity, water or rain which may leak from any part of the Building or the Project or from the pipes, appliances, appurtenances or plumbing works therein or from the roof, street or sub-surface or from any other place or resulting from dampness or any other cause whatsoever or from the acts or omissions of other tenants, occupants or other visitors to the Building or the Project or from any other cause whatsoever, (iv) any diminution or shutting off of light, air or view by any structure which may be erected on lands adjacent to the Building, whether within or outside of the Project, or (v) any latent or other defect in the Premises, the Building or the Project. Tenant shall give prompt notice to Landlord in the event of (1) the occurrence of a fire or accident in the Premises or in the Building, or (2) the discovery of a defect therein or in the fixtures or equipment thereof. This Paragraph 8(a) shall survive the expiration or earlier termination of this Lease.

(b)Tenant hereby agrees to indemnify, protect, defend and hold harmless Landlord and its designated property management company, the Designated Landlord Parties, and their respective partners, members, affiliates and subsidiaries, and all of their respective officers, directors, shareholders, employees, servants, partners, representatives, insurers and agents (collectively, “Landlord Indemnitees”) for, from and against all liabilities, claims, fines, penalties, costs, damages or injuries to persons, damages to property, losses, liens, causes of action, suits, judgments and expenses (including court costs, attorneys’ fees, expert witness fees and costs of investigation), of any nature, kind or description of any person or entity, directly or indirectly arising out of, caused by, or resulting from (in whole or part) (1) Tenant’s construction of or use, occupancy or enjoyment of the Premises, (2) any activity, work or other things done, permitted or suffered by Tenant and its agents and employees in or about the Premises, (3) any breach or default in the performance of any of Tenant’s obligations under this Lease, (4) any act, omission, negligence or willful misconduct of Tenant or any of its agents, contractors, employees, business invitees or licensees, or (5) any damage to Tenant’s property, or the property of Tenant’s agents, employees, contractors, business invitees or licensees, located in or about the Premises (collectively, “Liabilities”); EVEN IF SUCH LIABILITIES ARE CAUSED SOLELY OR IN PART BY THE NEGLIGENCE OF ANY LANDLORD INDEMNITEE, BUT NOT TO THE EXTENT SUCH LIABILITIES ARE CAUSED BY THE GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY SUCH LANDLORD INDEMNITEE. This Paragraph 8(b) shall survive the expiration or earlier termination of this Lease. Tenant hereby waives the provisions of any present or future law that limits or eliminates the liability of an employer regarding claims for indemnity and/or contribution by Landlord in the event of injury or death of an employee. This Paragraph 8(b) shall survive the expiration or earlier termination of this Lease.

(c)Tenant shall promptly advise Landlord in writing of any action, administrative or legal proceeding or investigation as to which this indemnification may apply, and Tenant, at Tenant’s expense, shall assume on behalf of each and every Landlord Indemnitee and conduct with due diligence and in good faith the defense thereof with counsel reasonably satisfactory to Landlord; provided, however, that any Landlord Indemnitee shall have the right, at its option, to be represented therein by advisory counsel of its own selection and at its own expense. In the event of failure by Tenant to fully perform in accordance with this Paragraph, Landlord, at its option, and without relieving Tenant of its obligations hereunder, may so perform, but all costs and expenses so incurred by Landlord in that event shall be reimbursed by Tenant to Landlord, together with interest on the same from the date any such expense was paid by Landlord until reimbursed by Tenant, at the rate of interest provided to be paid on judgments, by the law of the jurisdiction to which the interpretation of this Lease is subject. The indemnification provided in Paragraph 8(b) shall not be limited to damages, compensation or benefits payable under insurance policies, workers’ compensation acts, disability benefit acts or other employees’ benefit acts.

(d)Insurance.

(i)Tenant at all times during the Lease Term shall, at its own expense, keep in full force and effect (A) commercial general liability insurance providing coverage on an occurrence form against bodily injury and disease, including death resulting therefrom, bodily injury and property damage, and premises operations, products/completed operations hazard and contractual coverage (including for the performance of its indemnity obligations set forth in this Paragraph 8 and in Paragraph 6(g)(ii) of this Lease), to a

17