Exhibit 99.1

BELLUS

HEALTH INC.

ANNUAL

INFORMATION FORM

Fiscal

year ended December 31, 2020

February

25, 2021

TABLE

OF CONTENTS

| CORPORATE

STRUCTURE |

4 |

| |

|

| Name,

Address and incorporation |

4 |

| |

|

| Intercorporate

Relationships |

4 |

| |

|

| BUSINESS |

4 |

| |

|

| Overview |

4 |

| |

|

| 2020

Highlights |

5 |

| |

|

| Our

Strategy |

6 |

| |

|

| Our

Pipeline |

6 |

| |

|

| Intellectual

Property |

21 |

| |

|

| Human

Resources |

23 |

| |

|

| Facilities |

23 |

| |

|

| RISK

FACTORS |

23 |

| |

|

| DIVIDENDS |

42 |

| |

|

| DESCRIPTION

OF CAPITAL STRUCTURE |

42 |

| |

|

| MARKET

FOR SECURITIES NTD: DAVIES TO PROVIDE INFO |

43 |

| |

|

| PRIOR

SALES |

43 |

| |

|

| DIRECTORS

AND OFFICERS |

44 |

| |

|

| LEGAL

PROCEEDINGS AND REGULATORY ACTIONS |

46 |

| |

|

| INTEREST

OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

46 |

| |

|

| AUDIT

COMMITTEE AND PRINCIPAL ACCOUNTANTS FEES AND SERVICES |

46 |

| |

|

| TRANSFER

AGENT AND REGISTRAR |

47 |

| |

|

| INTEREST

OF EXPERTS |

48 |

| |

|

| ADDITIONAL

INFORMATION |

48 |

| |

|

| SCHEDULE

A AUDIT COMMITTEE CHARTER |

49 |

As

used in this annual information form, unless the context otherwise requires, the terms “we”, “us”, “our”,

“BELLUS Health” or the “Company” mean or refer to BELLUS Health Inc. and its subsidiaries and its Affiliates

(as such term is defined in this annual information form). All currency figures reported in this document are in US dollars, unless

otherwise specified.

FORWARD-LOOKING

STATEMENTS

Certain

statements contained in this document may constitute “forward-looking information” within the meaning of applicable

securities laws in Canada and “forward-looking statements” within the meaning of the United States Private Securities

Litigation Reform Act of 1995, as amended (collectively, “forward-looking statements”), which involve known and unknown

risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company, or industry

results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking

statements. These forward-looking statements include information about possible or assumed future results of our business, financial

condition, results of operations, liquidity, objectives and strategies to achieve those objectives, as well as statements with

respect to our beliefs, targets, expectations, anticipations, estimates or intentions. In some cases, you can identify forward-looking

statements by terminology such as “believe”, “may”, “estimate”, “continue”, “anticipate”,

“intend”, “should”, “plan”, “expect”, “predict”, “potential”,

“could”, “assume”, “project”, “guidance” or the negative of these terms or other

similar expressions, although not all forward- looking statements include such words. These statements reflect current expectations

of management regarding future events and operating performance and speak only as of the date of this document. The statements

we make regarding the following matters are forward- looking by their nature and are based on certain of the assumptions noted

below:

| • | our

aim to develop and commercialize BLU-5937 for the treatment of hypersensitization disorders,

including chronic cough and chronic pruritus; |

| • | our

aim to complete additional preclinical studies on BLU-5937; |

| • | our

aim to complete additional clinical Phase 1 trials with BLU-5937; |

| • | our

expectations to release topline results in the fourth quarter of 2021 for our Phase 2b

SOOTHE clinical trial of BLU-5937 for the treatment of patients with refractory chronic

cough and conduct an interim analysis in mid-2021, the results of which we may use to

initiate planning activities for Phase 3 clinical trials; |

| • | our

expectations to release topline results in the fourth quarter of 2021 for our Phase 2

BLUEPRINT clinical trial of BLU-5937 for the treatment of patients with chronic pruritus

associated with atopic dermatitis; |

| • | our

aim to further explore the potential of BLU-5937 for the treatment of other afferent

hypersensitization-related conditions; |

| • | our

expectations with respect to the timing and cost of the research and development activities

of BLU-5937; |

| • | the

function, potential benefits, tolerability profile, effectiveness and safety of our product

candidates, including BLU-5937, including with respect to patient population, pricing

and labeling, and the impact of our enrichment strategy on labeling; |

| • | our

expectations with respect to pre-commercialization activities related to the commercial

launch of BLU-5937; |

| • | our

expectations regarding the potential once-daily dosing with extended release formulation

for BLU-5937 and our aim to begin prototype development of the BLU-5937 once-daily formulation

in 2021; |

| • | our

expectations regarding our ability to arrange for and scale up the manufacturing of BLU-5937

to reach commercial scale; |

| • | our

estimates and assessment of the potential markets (including size) for our product candidates; |

| • | our

expectations regarding pricing and acceptance of our product candidates by the market; |

| • | our

estimates and projections regarding potential pricing for BLU-5937 and how such pricing

compares to other P2X3 inhibitors; |

| • | our

estimates and projections regarding the size of the total addressable global refractory

chronic cough market and associated P2X3 revenue potential; |

| • | the

benefits and risks of our product candidates as compared to others; |

| • | our

aim to obtain regulatory approvals to market our product candidates; |

| • | our

expectations with respect to the cost of preclinical studies and clinical trials and

commercialization of our product candidates, including BLU-5937; |

| • | our

expectation of the continued listing of the common shares on the TSX and Nasdaq; |

| • | our

current and future capital requirements and anticipated sources of financing or revenue; |

| • | our

expectations regarding the COVID-19 pandemic and its impact on our business; |

| • | our

expectations regarding the protection of our intellectual property; |

| • | our

business strategy; and |

| • | our

development and partnership plans and objectives. |

The

preceding list is not intended to be an exhaustive list of all of our forward-looking statements.

Conclusions,

forecasts and projections set out in forward-looking information are based on our current objectives and strategies and on expectations

and estimates and other factors and assumptions that we believe to be reasonable at the time applied but may prove to be incorrect.

These include, but are not limited to:

| • | the

function, potential benefits, effectiveness and safety of BLU-5937; |

| • | the

benefits and risks of our product candidates as compared to others; |

| • | the

accuracy of our belief that selective P2X3 inhibitors have an improved tolerability profile

compared to the most advanced P2X3 receptor inhibitor in development, Merck & Co.’s

gefapixant; |

| • | progress,

timing and costs related to the development, completion and potential commercialization

of our product candidate; |

| • | estimates

and projections regarding our industry; |

| • | market

acceptance of our product candidate; |

| • | future

success of current research and development activities; |

| • | achievement

of development and commercial milestones, including forecasted preclinical study and

clinical trial milestones within the anticipated timeframe; |

| • | our

reliance on third parties to conduct preclinical studies and clinical trials for BLU-5937; |

| • | that

the timeline and costs for our preclinical and clinical programs are not incorrectly

estimated or affected by unforeseen circumstances; |

| • | the

successful development of once daily dosing with extended release formulation for BLU-5937; |

| • | our

ability to achieve intended order of market entry of BLU-5937 relative to other P2X3

inhibitors; |

| • | accuracy

of our findings of statistically significant interaction between baseline cough frequency

and treatment benefit, and realization of the intended benefits of our enrichment strategy; |

| • | accuracy

of our estimates and projections regarding potential pricing for BLU-5937, including

parity to other P2X3 inhibitors; |

| • | accuracy

of our estimates and projections regarding the size of the total addressable global refractory

chronic cough market and associated P2X3 revenue potential; |

| • | the

capacity of our primary supply chain to produce the required clinical supplies to support

a Phase 3 program in refractory chronic cough within the anticipated timeframe; |

| • | absence

of interruption or delays in the operations of our suppliers of components or raw materials,

contract research organizations or other third parties with whom we engage, whether as

a result of disruptions caused by the COVID-19 pandemic or otherwise; |

| • | accuracy

of our expectations regarding label indication for BLU-5937 in refractory chronic cough

and the potential to expand the use of P2X3 inhibitors on all refractory chronic cough

patients; |

| • | absence

of material deterioration in general business and economic conditions, including the

impact on the economy and financial markets of the COVID-19 pandemic and other health

risks; |

| • | the

effectiveness of COVID-19 containment efforts, including the implementation of vaccination

programs and gradual recovery of global environment and global economic conditions; |

| • | the

receipt of regulatory and governmental approvals for research and development projects

and timing thereof; |

| • | the

availability of tax credits and financing for research and development projects, and

the availability of financing on favorable terms; |

| • | our

expectations regarding our status as a passive foreign investment company; |

| • | the

accuracy of our estimates regarding future financing and capital requirements and expenditures; |

| • | the

achievement of our forecasted cash burn rate; |

| • | the

sufficiency and validity of our intellectual property rights; |

| • | our

ability to secure, maintain and protect our intellectual property rights, and to operate

without infringing on the proprietary rights of others or having third parties circumvent

the rights owned or licensed by us; |

| • | our

ability to source and maintain licenses from third-party owners on acceptable terms and

conditions; |

| • | absence

of significant changes in Canadian dollar-U.S. dollar and other foreign exchange rates

or significant variability in interest rates; |

| • | the

absence of material changes in market competition and accuracy of our assumptions and

projections regarding profile and market dynamic amongst more selective agents; |

| • | our

ability to attract and retain skilled staff; |

| • | our

ability to maintain ongoing relations with employees and business partners, suppliers

and other third parties; |

| • | the

accuracy of the market research, third-party industry data and forecasts relied upon

by us; and |

| • | the

absence of adverse changes in relevant laws or regulations. |

There

are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially

from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. See

“Risk Factors” section in this document. Should one or more of the risks, uncertainties or other factors outlined

in this document materialize, our objectives, strategies or intentions change, or any of the factors or assumptions underlying

the forward-looking information prove incorrect, our actual results and our plans and targets could vary significantly from what

we currently foresee. Accordingly, we warn investors to exercise caution when considering statements containing forward-looking

information and that it would be unreasonable to rely on such statements as creating legal rights regarding our future results

or plans or targets. All of the forward-looking information in this document is qualified by the cautionary statements herein.

In

addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject.

These statements are based upon information available to us as of the date of this document, and while we believe such information

forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be

read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information.

These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and

events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law,

we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this document, to

conform these statements to actual results or to changes in our expectations.

Unless

otherwise noted, all information in this annual information form is presented as at December 31, 2020.

CORPORATE

STRUCTURE

Name,

Address and Incorporation

The

company was incorporated on April 12, 2012 under the Canada Business Corporations Act and is the successor of BELLUS

Health Inc., a company incorporated on June 17, 1993 (known as Neurochem Inc. prior to April 15, 2008).

Our

outstanding common shares are listed on the Toronto Stock Exchange (“TSX”) and on the Nasdaq Capital Market

(“NASDAQ”) under the symbol “BLU”.

Our

head office is located at 275 Armand-Frappier Boulevard, Laval, Quebec H7V 4A7, Canada.

Intercorporate

Relationships

As

at February 25, 2021, we have two wholly-owned subsidiaries, BELLUS Health Cough Inc., also incorporated under the Canada Business

Corporations Act, and BELLUS Health Corp., incorporated under the laws of the State of Delaware.

BUSINESS

Overview

We

are a clinical-stage biopharmaceutical company developing novel therapeutics for the treatment of chronic cough and other hypersensitization

disorders. Our lead product candidate, BLU-5937, is an investigational product that is a highly selective antagonist of the P2X3

receptor, a target linked to hypersensitivity. We are developing BLU-5937 for the treatment of chronic cough and chronic pruritus,

or chronic itch. We believe these hypersensitization-related disorders, which share a common pathophysiology that is mediated

through the P2X3 receptor, represent areas of significant unmet medical need and potentially large market opportunities. We believe

BLU-5937’s characteristics observed in our preclinical studies and Phase 1 and 2 clinical trials position it for development

as a potential competitive treatment option in the P2X3 antagonist class.

We

initiated two trials in the fourth quarter of 2020 including SOOTHE, a Phase 2b trial evaluating the efficacy and safety of BLU-5937

in refractory chronic cough (“RCC”) patients and BLUEPRINT, a Phase 2 proof-of-concept trial evaluating the

efficacy and safety of BLU-5937 in patients with chronic pruritus associated with atopic dermatitis (“AD”).

Chronic

cough, our lead indication for BLU-5937, is a cough lasting more than eight weeks, and may have a significant adverse impact on

patients’ quality of life. We estimate 10% of the adult population in developed countries suffer from chronic cough including

the United States, nations in the European Union, the United Kingdom and Japan. This represents approximately 26 million patients

with chronic cough in the United States alone. We estimate that approximately 30% of chronic cough patients, or approximately

nine million patients in the U.S., are uncontrolled or have RCC, which is the expected addressable patient population for BLU-5937.

Many patients report that their condition has a marked effect on their quality of life including sleep disruption, tiredness,

incontinence, and disrupting social interactions. Currently, there is no therapy approved specifically for the treatment of RCC.

Available treatment options are limited and may have inadequate benefit and/or significant safety and tolerability issues, including

significant taste alteration or loss.

Chronic

pruritus, the second indication for BLU-5937, is commonly known as chronic itch, and is an irritating sensation that leads to

scratching and persists for longer than six weeks, which can be debilitating and can significantly impact quality of life. It

is a hallmark of many inflammatory skin diseases, including AD. It is estimated that AD affects approximately 5% of adults in

the United States. Despite currently available treatments targeting AD, there continues to be a lack of options targeting the

burden of pruritus in AD patients.

2020

Highlights

Initiated

the Phase 2b SOOTHE clinical trial of BLU-5937 in patients with RCC in December 2020.

| • | Topline

results from the SOOTHE trial are expected in the fourth quarter of 2021. |

| • | An

interim analysis using a predefined efficacy and probability threshold is expected to

be performed in mid-2021, once 50% of participants have completed the study. |

| • | Phase

2b SOOTHE trial population enriched for participants with cough frequency above 25 coughs/h

at baseline. |

Initiated

the Phase 2 BLUEPRINT clinical trial of BLU-5937 in patients with chronic pruritus associated with AD in December 2020.

| • | Topline

results from the BLUEPRINT trial are expected in the fourth quarter of 2021. |

Announced

topline results from the Phase 2 RELIEF clinical trial of BLU-5937 in patients with RCC in July 2020.

| • | The

RELIEF trial achieved proof-of-concept in reducing cough frequency in RCC patients including

statistically significant and clinically meaningful reductions in two pre-specified sub-group

analyses of participants with baseline awake cough frequency of ≥20 coughs/hour (80%

of trial participants) and ≥32 coughs/hour (50% of trial participants). |

| • | Numerical

differences in favor of BLU-5937 were also observed in the whole study (intention-to-treat)

population; however the trial did not meet its primary endpoint in this population. |

| • | BLU-5937

was well tolerated and showed an adverse event profile comparable to placebo. The taste

disturbance adverse events were limited to 10% or less, confirming the hypothesis that

BLU-5937 has a favorable adverse event profile compared to the first generation P2X3

antagonist. Additionally, no complete loss of taste was observed at any dose, no severe

taste adverse event was reported and no dropouts due to taste disturbance occurred. |

Completed

a $40.3 million offering in October 2020.

| • | In

October 2020, we completed an offering of our common shares resulting in gross proceeds

to BELLUS Health of $40.3 million. |

Acquired

full ownership of the intellectual property rights to BLU-5937 and related P2X3 antagonists in March 2020.

| • | In

March 2020, we acquired all of the remaining BLU-5937 and related P2X3 antagonists intellectual

property rights from adMare BioInnovations’ NEOMED Institute and now own 100% of

BLU-5937 and related P2X3 antagonists intellectual property with no future payments due. |

Appointed

Ramzi Benamar as Chief Financial Officer.

| • | In

December 2020, we appointed Ramzi Benamar to the role of Chief Financial Officer. Mr.

Benamar brings to BELLUS Health extensive experience in corporate strategy, finance and

operations. |

Ended

the year with cash, cash equivalents and short-term investments totaling $98.3 million.

Our

Strategy

We

are focused on the development and commercialization of BLU-5937 as a potential differentiated treatment option for RCC patients,

as well as for the treatment of chronic pruritus associated with AD and other hypersensitization-related disorders. The key elements

of our strategy are:

•

Advance the development of BLU-5937 in the treatment of chronic cough, our lead indication. We are focused on efficiently

developing BLU-5937 to treat patients with chronic cough. We are conducting the Phase 2b SOOTHE clinical trial to evaluate

the efficacy, safety, and tolerability of BLU-5937 in RCC patients at three doses (12.5 mg, 50 mg and 200 mg BID) in 300 patients.

We enrolled the first patient in the SOOTHE trial in December 2020. An administrative interim analysis is expected to be conducted

by an independent statistical team once 50% of patients have completed the main study and is anticipated in mid-2021. Topline

data are expected in the fourth quarter of 2021. If our Phase 2b SOOTHE clinical trial is successful, we expect to initiate

Phase 3 clinical trials to support the submission of a new drug application (“NDA”) to the FDA and a marketing

authorization application (“MAA”) to the European Medicines Agency (“EMA”) for BLU-5937

in chronic cough.

•

Advance the development of BLU-5937 in the treatment of chronic pruritus, our second indication. We are conducting the

Phase 2 BLUEPRINT clinical trial to evaluate the efficacy, safety and tolerability of BLU-5937 in patients with chronic pruritus

associated with AD, a hypersensitization-related disorder, with topline data expected in the fourth quarter of 2021.

•

Maximize the value of BLU-5937 by maintaining flexibility to develop and commercialize our product independently or through

collaborations. In March 2020, we acquire all of the remaining BLU-5937 and related P2X3 antagonists intellectual property

rights (the “BLU-5937 Assets”) and now own 100% of the BLU-5937 Assets. We may choose to pursue the development

and commercialization of BLU-5937 independently or through collaborations with third parties.

•

Leverage our proprietary P2X3 antagonist technology platform to pursue other hypersensitization-related conditions. We

are evaluating the potential role of P2X3 inhibition in the treatment of other afferent hypersensitization-related disorders.

Our

Pipeline

We

are evaluating BLU-5937 in RCC and chronic pruritus associated with AD, as identified in the following pipeline table:

We

are developing BLU-5937, a potent, highly selective, small molecule antagonist of the P2X3 receptor, as an oral therapy to reduce

cough frequency and severity, as well as to improve quality of life in RCC patients.

In

December 2020, we initiated SOOTHE, a Phase 2b trial evaluating the efficacy and safety of BLU-5937 in RCC patients, enriched

for higher cough frequency patients.

Following

a Type C meeting with the U.S. Food and Drug Administration (“FDA”) in November 2020, we decided to proceed

with our planned Phase 2b SOOTHE trial in patients with RCC.

In

July 2020, we announced topline results from our Phase 2 RELIEF clinical trial of BLU-5937 that demonstrated proof-of-concept

in RCC patients. Numerical differences in favor of BLU-5937 were observed in the primary endpoint of reduction in cough frequency.

Clinically meaningful and statistically significant reductions in cough frequency were observed in two pre-specified sub-group

analyses including participants with baseline awake cough frequency of ≥20 coughs/hour (80% of trial participants) and ≥32

coughs/hour (50% of trial participants).

Chronic

cough, our lead indication for BLU-5937, is a cough lasting more than eight weeks, and may have a significant adverse impact on

patients’ quality of life. It is estimated that approximately 26 million adults in the United States suffer from chronic

cough of which approximately 9 million patients are identified as having RCC. Many patients report that their condition has a

marked effect on their quality of life including sleep disruption, tiredness, incontinence, and disruption of social interactions.

Currently, there is no therapy approved specifically for the treatment of RCC. Available treatment options are limited and may

have inadequate benefit and/or significant safety and tolerability issues. We believe that BLU-5937, if approved, may be adopted

by physicians as an oral cough therapy in patients for whom cough-hypersensitivity is the primary etiology.

We

are also developing BLU-5937 as an oral therapy to reduce itch in patients with chronic pruritus associated with AD. On December

14, 2020, we announced that the first patient had been dosed in the Phase 2 BLUEPRINT trial of BLU-5937. We expect to release

top-line data in the fourth quarter of 2021.

Chronic

pruritus, the second indication for BLU-5937, is commonly known as chronic itch, and is an irritating sensation that leads to

scratching and persists for longer than six weeks, which can be debilitating and can significantly impact quality of life. It

is a hallmark of many inflammatory skin diseases, including AD. It is estimated that AD affects approximately 5% of adults in

the United States. Despite currently available treatments targeting AD, there continues to be a lack of options targeting the

burden of pruritus in AD patients.

Chronic

Cough

Highly

Prevalent Condition

Coughing

is a reflex mechanism and the body’s way of clearing irritants or mucus from the airways and can be either acute or chronic

in nature. Chronic cough is classified as a cough lasting for more than eight weeks, and is usually associated with an underlying

respiratory condition, such as asthma or chronic obstructive pulmonary disease (“COPD”), but can also be caused

by other common non-respiratory conditions (e.g. allergic rhinitis or gastroesophageal reflux) or certain medications (e.g. ACE

inhibitors). Notably, many cases of RCC have no identifiable cause, a condition often referred to as unexplained chronic cough.

Chronic

cough occurs when the nerves involved in the cough response become hypersensitive. For example, the coughing that occurs from

a bad cold can sensitize the nerves involved in the cough response. The cough reflex can then become extremely sensitive to the

point where coughing itself triggers more coughing. This can continue for an extended period, even after the trigger, such as

the cold, has resolved.

Chronic

cough can have a significant impact on quality of life, including debilitating physical and psychosocial burden. Fatigue, sleep

disturbance, vomiting, chest pains, and incontinence can occur, and patients with chronic cough often experience social embarrassment.

A study found that more than half of all chronic cough patients suffer from clinical depression.

Limitations

of Current RCC Therapies

Current

treatment options for RCC have demonstrated limited efficacy and/or have safety/tolerability issues. Drug-development within this

field has seen minimal advances over the past 60 years, underscoring a substantial unmet medical need. Commonly used cough

drugs, such as those incorporating dextromethorphan as their primary active ingredient, offer limited benefit, if any, to chronic

cough patients. Benzonatate anesthetizes the stretch receptors in the lungs, but offers only temporary relief and may cause serious

side effects if the capsule is crushed. Off-label treatment options, such as gabapentin and pregabalin, have shown variable efficacy

and significant central nervous system side effects. The use of opioids, such as low-dose morphine and codeine, have shown some

efficacy, but their use is controversial due to the potential for addiction and other serious side effects such as drowsiness,

nausea, constipation, respiratory depression and potential for addiction. Speech therapy has also shown some efficacy, especially

in combination with pharmacotherapy. Nevertheless, such therapy generally requires patient referral to a limited number of specialized

cough clinics with highly-trained medical personnel and a significant effort and time commitment by the patient.

Selective

P2X3 Receptor Inhibition: A Promising and Clinically Validated Therapeutic Approach in Chronic Cough

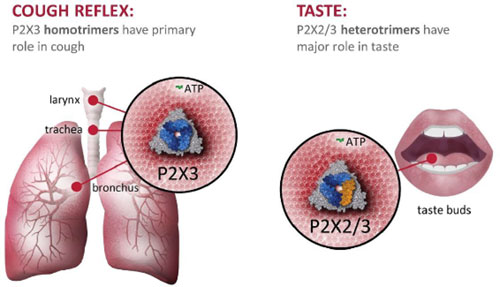

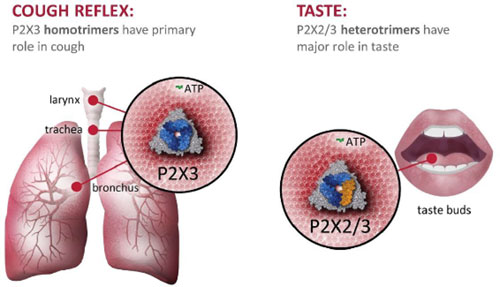

The

only clinically validated treatments in development for RCC are molecules that inhibit the P2X3 receptor. P2X3 receptors are ATP-gated

ion channels that belong to a family of purinergic receptors. Members of this family assemble as homotrimeric (three subunits

of P2X3) or heterotrimeric (two subunits of P2X3 and one subunit of P2X2 (i.e., P2X2/3)) ion channels and are widely expressed

in non-excitatory and excitatory cells, such as afferent neurons. Afferent sensory neurons are the primary conduit for sensory

information and the primary site that may undergo modulation leading to persistently altered sensation, including hypersensitivity.

ATP, acting via P2X3 receptors, is believed to be a key mediator of these changes. The ability to inhibit the binding of ATP to

the P2X3 receptor has been shown to be a promising path in the search for therapeutics to treat disorders driven by neuronal hypersensitivity.

ATP signaling via these P2X receptors is also necessary for successful transmission of information from taste cells to the sensory

neurons that innervate the taste buds. In preclinical studies of double-knock out mice lacking both P2X2 and P2X3 purinoceptors,

abolition of taste sensation was observed, whereas single knock-out of either the P2X2 or P2X3 receptor causes only moderate taste

disturbance. We, therefore, believe that selective P2X3 antagonists, such as BLU-5937, have the potential to mediate aberrant

ATP signaling in conditions like chronic cough, chronic pruritus and other hypersensitization disorders, while limiting or potentially

eliminating taste loss and taste alteration observed with gefapixant, a less selective P2X3 antagonist that also inhibits the

P2X2/3 receptor.

BLU-5937,

Our Highly Selective P2X3 Antagonist Product Candidate

We

are developing BLU-5937, a potent, highly selective, orally bioavailable small molecule antagonist of the P2X3 receptor, as an

oral therapy to reduce cough frequency in chronic cough patients. Advances in the understanding of possible mechanisms underlying

chronic cough have paved the way for product candidates targeting the P2X3 receptors, such as BLU-5937. To date, several clinical

studies have validated the potential of targeting this receptor and ongoing clinical studies seek to further evaluate the efficacy

and safety of P2X3-targeting agents in RCC. We believe BLU-5937’s characteristics shown in Phase 1 and 2 clinical trials

as well as in preclinical studies position it for development as a potential competitive treatment option in the P2X3 antagonist

class. These include:

| • | BLU-5937

is a potent antagonist of P2X3 that has the potential to significantly alleviate RCC

symptoms |

The

high potency and selectivity of BLU-5937 for P2X3 receptors was shown in vitro by inhibiting ATP-evoked P2X3 receptor activity

in cloned human P2X3 channels expressed in mammalian cells. The concentration of BLU-5937 needed to inhibit 50% of the P2X3 activity

(IC50) in this assay was established at 25 nM, which was approximately three times more potent than gefapixant.

In

vitro, BLU-5937 was observed to block ATP-induced sensitization and firing activity of primary nociceptors in rat dorsal root

ganglions through P2X3 receptor inhibition.

In

the guinea pig cough model, we observed that BLU-5937 significantly reduced, in a dose-dependent fashion, the histamine or ATP-induced

enhancement in number of citric acid-induced coughs. In these validated models of cough, the antitussive effect of BLU-5937 was

observed to be comparable to that of gefapixant.

| • | BLU-5937

is highly selective for P2X3 that has the potential to have minimal taste side effects

|

We

believe that BLU-5937, which has been specifically designed to be a highly selective antagonist of the P2X3 receptor, has the

potential to significantly alleviate RCC while maintaining taste function. The high selectivity of BLU-5937 for P2X3 receptors

was observed in vitro by inhibiting receptor activity in cloned human P2X3 and P2X2/3 channels expressed in mammalian cells. The

BLU-5937 selectivity ratio was observed to be, on average, greater than 1,500 times in favor of P2X3 as compared to P2X2/3, whereas

the selectivity ratio for gefapixant was observed to be approximately three to seven fold higher for P2X3 as compared to P2X2/3.

In

a rat behavioral taste model, we observed that BLU-5937 did not alter taste perception compared to control animals, whereas gefapixant

had a significant inhibitory effect on taste perception. We believe that the lack of effect of BLU-5937 on taste perception, even

at high doses, is due to its higher selectivity for the P2X3 versus P2X2/3 receptors on the taste buds.

In

a Phase 1 trial with healthy volunteers given BLU-5937, at the anticipated therapeutic doses of 50 mg to 200 mg, no

subjects reported loss of taste perception and only one subject out of 40 (2.5%) reported a transient and sporadic taste alteration.

In

the Phase 2a RELIEF trial in participants with RCC receiving BLU-5937 at doses of 25, 50, 100 and 200 mg BID, ~10% participants

reported taste disturbance events, compared with ~5% of participants receiving placebo. These taste disturbances were mostly mild

in nature, and none resulted in discontinuation from the study. No complete taste loss was reported at any dose.

| • | BLU-5937

is orally bioavailable and has a half-life that supports dosing as a tablet twice daily

|

The

safety, tolerability and pharmacokinetic profile of BLU-5937 was assessed in preclinical studies in which we observed that BLU-5937

exhibited good oral bioavailability, low predicted clearance in humans, no blood-brain barrier permeability and a favorable tolerability

profile. The Phase 1 data demonstrated a favorable pharmacokinetic profile for BLU-5937: rapid absorption with maximum plasma

concentration achieved within one to two hours post-dose, dose-proportionally plasma concentration increases and a plasma half-life

of four to nine hours that supports a twice a day dosing schedule.

The

pharmacokinetic profile from the Phase 1 trial also supported that the drug can be taken without regard to meals, which is

convenient for patients and supports compliance. In addition, there was no evidence of significant drug accumulation upon repeated

dose administration. Based on achieving targeted receptor inhibition and activity in preclinical studies and on achieving comparative

drug blood levels of a clinically validated comparator, after correcting for pharmacokinetic and potency differences, we anticipate

that drug levels required for optimal inhibition of cough will be achieved at 25 mg to 50 mg BID.

We

believe that BLU-5937, if approved, may be adopted by physicians as an oral cough therapy either as an adjunct to treatments targeting

the underlying cause of the chronic cough or as a monotherapy in patients for whom the cough is the primary etiology.

Competitive

Landscape

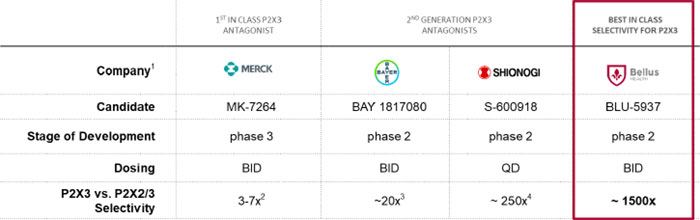

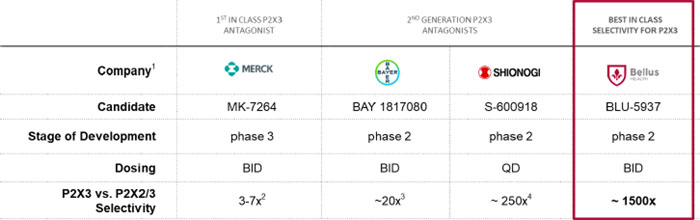

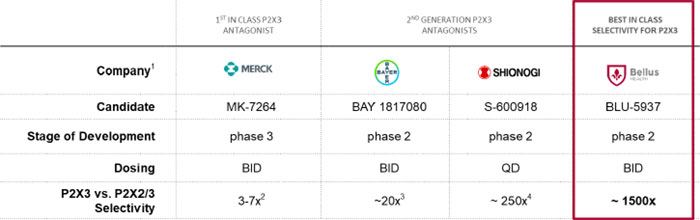

In

addition to BELLUS Health, other companies are developing P2X3 antagonist product candidates for the treatment of RCC, including

Merck & Co. (“Merck”), Bayer AG (“Bayer”) and Shionogi Inc. (“Shionogi”).

1Limited

head to head studies have been conducted; data presented is derived from company specific disclosures.

2Smith

J., Lancet Respir Med 2020: Gefapixant, a P2X3 receptor antagonist, for the treatment of refractory or unexplained chronic cough:

a randomised, double- blind, controlled, parallel group, phase 2b trial.

3Safety

and Efficacy of BAY 1817080, a P2X3 Receptor Antagonist, in Patients with Refractory Chronic Cough (RCC), Presenter Q&A

– ERS 2020.

4Niimi

A, European Respiratory Journal 2019 54: RCT452.

Merck

announced in March of 2020 that the 45mg BID dose MK-7264 had reached statistical significance on the primary efficacy endpoint

in both the COUGH-1 and COUGH-2 study and that the 15mg BID dose had not achieved statistical significance in either the Cough-1

or Cough-2 study. Pursuant to this announcement, in September 2020 at the European Respiratory Society (ERS) International conference,

Merck presented these Phase 3 results. The high dose (45 mg BID) of MK-7264 achieved a statistically significant result in its

primary endpoint of placebo-adjusted reduction in 24-hour cough frequency (18% in the 12-week COUGH-1 trial and 16% in the 24-week

COUGH-2 trial, respectively), but showed significant rates of taste disturbance adverse events (58% and 69% in COUGH-1 and COUGH-2,

respectively). The impact of baseline cough frequency on treatment benefit was not disclosed in the Phase 3 trials, although a

statistically significant interaction between baseline cough frequency and treatment benefit was observed in two Phase 2 trials.

Shionogi

announced top-line results of its Phase 2a trial of S-600918 in patients with RCC at the European Respiratory Society (ERS) International

Congress in October 2019, which included a placebo-adjusted reduction in 24-hour cough frequency of 32% (p=0.055) and rate of

6.5% of taste disturbance adverse events. The average cough per hour frequency at baseline was 56. At the 2020 ERS International

Congress, Shionogi reported that they observed an interaction between baseline cough frequency and treatment effect in their Phase

2a trial; this prompted the utilization of a minimal cough frequency threshold as an inclusion criterion in the Phase 2b trial

of S-600918. Moreover, Shionogi stratified participants by baseline cough frequency to balance trial arms.

In

April 2020, Bayer announced top-line results of its Phase 2a trial evaluating BAY 1817080 at the American Thoracic Society International

Conference, which demonstrated that higher doses of Bayer’s P2X3 antagonist significantly reduced 24-hour cough counts in

patients with RCC (ranging from 15% to 25% cough reduction compared to placebo) and cough severity. Taste disturbance adverse

events were reported by 5% to 21% of participants receiving BAY 1817080 and were dose-dependent. In October 2020, Bayer initiated

a Phase 2b trial evaluating three doses of BAY1817080 in 236 RCC participants.

Market

Opportunity in Chronic Cough

We

estimate 10% of the adult population in developed countries suffer from chronic cough including the United States, nations in

the European Union, the United Kingdom and Japan. This represents approximately 26 million patients with chronic cough in the

United States alone.

We

estimate that approximately 30% of chronic cough patients, or approximately nine million patients in the U.S., are uncontrolled

or have RCC, which is the expected addressable patient population for BLU-5937. These RCC patients continue to cough despite treatment

for potential underlying causes triggering the cough or their cough is unexplained. We estimate that approximately one-third,

or approximately three million, of these RCC patients in the U.S. have been coughing for over a year, a key inclusion criteria

in current RCC trials, including the Phase 2 RELIEF trial of BLU-5937. RCC patients can also be segmented by severity, with about

45% of patients having moderate to severe disease and 55% having mild disease. Severely affected patients have a debilitating

disease, moderately affected patients have important impacts on their quality of life, and mildly affected patients have fewer

but still relevant impact from their disease.

As

for potential pricing considerations for BLU-5937, comparable analogue drugs on the U.S. market have a monthly wholesale acquisition

cost that ranges from $300 to $600. These analogues include, but are not limited to, comparable chronic use drugs for Asthma and

COPD, CIC and IBS-C, Chronic Constipation, Migraine, and High Cholesterol.

Ongoing

Phase 2b SOOTHE Clinical Trial

On

December 8, 2020, we announced that the first participant has been dosed in the Phase 2b SOOTHE trial of BLU-5937. Topline data

from SOOTHE is expected in the fourth quarter of 2021. An interim analysis is expected to be performed in mid-2021, once 50% of

participant have completed the study.

The

SOOTHE trial is a multicenter, randomized, double-blind, four-week, parallel-arm, placebo- controlled Phase 2b trial evaluating

the efficacy and safety of three doses of BLU-5937 (12.5 mg, 50 mg and 200 mg BID) in 300 participants. Two hundred and forty

participants with a baseline awake cough frequency of ≥25 coughs per hour are expected to be randomized across four arms (1:1:1:1)

evaluating the three active doses and placebo in the main study. Treatment arms will be stratified to balance the number of participants

per treatment group with baseline awake cough frequency ≥45 coughs per hour. The primary efficacy endpoint will be the placebo-adjusted

change in the 24-hour cough frequency from baseline to day 28 collected with a cough recorder. An exploratory group of an additional

60 participants with a baseline awake cough frequency of ≥10 and <25 coughs per hour are expected to be randomized across

two arms (1:1) evaluating one active dose (200 mg BID) and placebo to further investigate the effect of BLU-5937 in patients with

lower cough frequency.

The

interim analysis is expected to be conducted by an independent statistical team once 50% of participants have completed the main

study and is anticipated in mid-2021. Using a predefined probability of efficacy hurdle, results from the interim analysis may

be used to initiate planning activities for Phase 3. The SOOTHE trial will continue to completion regardless of the results of

the interim analysis; futility will not be assessed at the interim analysis.

The

trial is expected to enroll participants in approximately 120 sites of which approximately 50% are in the United States.

Phase

2 RELIEF Clinical Trial

The

RELIEF trial established proof-of-concept for BLU-5937 in the treatment of RCC patients. The RELIEF trial did not achieve statistical

significance for the primary endpoint of reduction in placebo-adjusted awake cough frequency at any dose tested in the Intent

to Treat Population (n=67); however, pre-specified analyses regarding the impact of baseline cough frequency on treatment effect,

including subgroup analyses in participants with baseline awake cough frequency of ≥ 20 coughs/hour (“coughs/h”)

and ≥ 32 coughs/h (median), revealed statistically significant and clinically meaningful reductions in cough frequency relative

to placebo:

| • | Participants

with ≥20 coughs/h (representing 80% of total trial participants) at baseline saw placebo-adjusted

reductions in awake cough frequency of 20% (p=0.001), 18% (p=0.02), 19% (p=0.03) and

27% (p=0.003) at doses of 25, 50, 100 and 200 mg twice daily (BID) respectively. |

| • | Participants

with cough frequencies at or above the baseline median of 32 coughs/h at baseline (representing

50% of total trial Participants) saw placebo-adjusted reductions in awake cough frequency

of 28%, 28%, 30% and 32% (all p<0.0015) at doses of 25, 50, 100 and 200 mg BID, respectively. |

| • | A

statistically significant interaction (p=0.0258) was observed between average awake cough

frequency at baseline and treatment effect, linking higher baseline cough frequency with

improved treatment benefit. |

Top-line

results

All

patients — Intent to Treat Patients Population (n=67)

| | |

| |

|

| DOSE | |

PLACEBO-ADJUSTED

REDUCTION

IN

AWAKE

COUGH

FREQUENCY | |

P-VALUE |

| 25 mg BID | |

-11% | |

p=0.14 |

| 50 mg BID | |

-6% | |

p=0.46 |

| 100 mg BID | |

-8% | |

p=0.41 |

| 200 mg BID | |

-17% | |

p=0.09 |

Pre-specified

subgroup — Patients with awake cough frequency at >20 coughs/h (n=54)

| | |

| |

|

| DOSE | |

PLACEBO-ADJUSTED

REDUCTION

IN

AWAKE

COUGH

FREQUENCY | |

P-VALUE |

| 25 mg BID | |

-20% | |

p=0.0010 |

| 50 mg BID | |

-18% | |

p=0.0186 |

| 100 mg BID | |

-19% | |

p=0.0320 |

| 200 mg BID | |

-27% | |

p=0.0026 |

Pre-specified

Subgroup — Patients with awake cough frequency at or above baseline median

(>32.4

cough/h; n=34)

| | |

| |

|

| DOSE | |

PLACEBO-ADJUSTED

REDUCTION

IN

AWAKE

COUGH

FREQUENCY | |

P-VALUE |

| 25 mg BID | |

-28% | |

p=0.0005 |

| 50 mg BID | |

-28% | |

p=0.0003 |

| 100 mg BID | |

-30% | |

p=0.0014 |

| 200 mg BID | |

-32% | |

p=0.0006 |

BLU-5937

was observed to be well tolerated with the most common (≥5%) treatment-emergent adverse events being headache (9.8%), back

pain (8.2%), dysgeusia (8.2%), diarrhea (6.6%), upper respiratory tract infection (6.6%), dizziness (6.6%), and oropharyngeal

pain (4.9%). No treatment-related serious adverse events and no withdrawals due to treatment-related adverse events were reported

at any dose.

Incidence

of Most Frequent Adverse Events (>5% Incidence)

1

One participant diagnosed with non-treatment-related colorectal cancer following trial completion

Taste

disturbance adverse events, including taste alteration and partial taste loss, were reported at all dose levels (6.5%, 9.8%, 10%

and 8.6% at 25, 50, 100 and 200 mg BID, respectively, versus 4.9% on placebo) and were mostly mild in nature. No participant reported

complete taste loss. There were no clinically meaningful changes in vital signs, electrocardiogram or clinical laboratory values.

Incidence

of Taste Disturbance Adverse Events (Safety Population)

1One

subject reported both taste disturbance and partial taste loss during the same period at all dose levels of BLU-5937 but is counted

only once in the total taste adverse events

RELIEF

enrolled participants in 16 sites (8 in the United Kingdom and 8 in the United States) and randomized a total of 68 RCC participants;

67 were included in the Intent to Treat population. 52 participants completed both treatment periods and 16 participants dropped

out in total, including 13 as a result of risk considerations related to the COVID-19 pandemic or the sponsor’s early termination

of the trial. There were three additional non-drug related discontinuations.

Learnings

from RELIEF Phase 2 Data

Based

on the RELIEF trial results, we believe cough frequency at baseline is a key indicator of potential treatment benefit, with subgroup

analysis of participants having baseline awake cough frequencies ≥20 coughs/h and ≥32 coughs/h demonstrating statistically

significant and clinically meaningful benefit at all doses. Based on these analyses and the participant patient level data of

participants with baseline awake cough frequency of ≥20 coughs/h and <32 coughs/h, we have selected a baseline cough frequency

of 25 coughs/h as an inclusion criterion for the Phase 2b trial.

No

dose response was observed in the Phase 2 RELIEF trial, including based on an analysis of within-participant dose response curves.

Plasma concentrations achieved in RELIEF are also consistent with achieving receptor occupancies in the 75-95+% range. Based on

this information, doses of 12.5 mg BID, 50 mg BID and 200 mg BID were selected for the Phase 2b SOOTHE trial.

BLU-5937

Regulatory Pathway in Chronic Cough

If

the results of the SOOTHE trial are positive, we expect to meet with the FDA and European regulatory authorities to discuss the

registration pathway for BLU-5937 in chronic cough patients and the design of the next trials, including the target population,

dose, duration and primary efficacy endpoint. We expect to initiate Phase 3 clinical trials to support the submission of

a new drug application (“NDA”) to the FDA and a marketing authorization application (“MAA”)

to the European Medicines Agency (“EMA”) for BLU-5937 in chronic cough. If the results of these trials are

positive, we would plan to seek approval for BLU-5937 for RCC which, if successful, would lead to the marketing and sale of BLU-5937.

See “Risk Factors”.

Supporting

Preclinical and Clinical Development Activities

Preclinical

and clinical development activities to support an anticipated Phase 3 RCC program start are ongoing or expected to be initiated

in 2021, including: chronic toxicity studies in rats and dogs, a 2-year carcinogenicity study in the rat, a drug-drug interaction

clinical trial in combination with an inhibitor of CYP3A4; an absorption, metabolism and excretion clinical trial, a Phase 1 clinical

trial to assess the potential effect of BLU-5937 on cardiac repolarization as measured by QT/QTc interval; and a pharmacokinetic

study in Asian population.

Chemistry,

Manufacturing, and Controls (“CMC”)

We

have a primary supply chain in place with the capacity to produce the required clinical supplies to support a Phase 3 program

in RCC. Activities related to manufacturing process optimization and upscaling to support a potential commercialization are ongoing.

Development

of a Once-Daily (“QD”) Formulation

We

have initiated activities in preparation for the development of a QD formulation for BLU-5937 using an extended-release tablet

formulation. We are developing a QD formulation since BLU-5937 exhibits favorable physical-chemical and pharmacokinetic characteristics,

including high solubility and permeability, good absorption in the small and large intestine, linear pharmacokinetic profile,

no interaction with food observed to date and a low predicted therapeutic dose. A pharmacokinetic pharmacology-based modelization

study has been completed and we plan to initiate the development of a BLU-5937 QD formulation prototype after the completion of

the Phase 2b RCC trial.

BLU-5937

in Chronic Pruritus

A

Burdensome Condition Effecting Quality of Life

Chronic

pruritus, defined as itching lasting longer than six weeks, can be as burdensome as chronic pain in negatively impacting a patient’s

quality of life. The urge to scratch can be unbearable, and the act of scratching can remove layers of skin and break the skin

barrier leading to bleeding, scarring and greatly increasing the risk of infection. Similar to chronic pain, severe chronic pruritus

causes a number of physical and psychological issues that substantially impact patients’ day-to-day wellbeing. Chronic pruritus

can lead to trouble sleeping, resulting in loss of work productivity and increased anxiety and depression.

Chronic

pruritus is a hallmark of many conditions, including atopic dermatitis. It is estimated that there are 16.9 million adults

in the United States who have atopic dermatitis, a chronic, inflammatory skin disease that is most commonly first diagnosed in

childhood. Atopic dermatitis is characterized by skin barrier disruption and immune dysregulation. Patients with atopic dermatitis

may have chronically inflamed skin lesions and often have persistent pruritus. Physicians and patients report pruritus as the

primary patient complaint associated with this disease. Of the total population of adults affected by atopic dermatitis in the

United States, it is estimated that three million of those are actually diagnosed with the disease, and of those diagnosed, it

is estimated that 2.25 million of these patients are actively being treated by a physician.

For

people suffering with atopic dermatitis, the quality of life impact of the disease is multifaceted and can be constant. Much of

this impact is related to its major symptom, itch, its effect on sleep, its outward visibility and the expense and time-consuming

nature of prescription and topical treatments. Atopic dermatitis affects social, sexual, academic and occupational functioning

and is also associated with increased rates of depression and anxiety.

Creams

and ointments and topical corticosteroids or other topical or systemic anti-inflammatory agents are routinely used to manage skin

health and to reduce skin inflammation in patients with atopic dermatitis. However, despite currently available treatments, an

estimated 40-50% of atopic dermatitis patients report having inadequate relief of their pruritus and are in need of new, efficacious

pruritus therapies.

BLU-5937:

A Promising Potential Therapy for Chronic Pruritus

Based

on similarities between the manifestation of the symptoms between cough and itch, we believe that BLU-5937 may be a promising,

novel therapeutic modality for chronic pruritus associated with atopic dermatitis. Neuronal terminals in the skin are known to

express P2X3 receptors and the hypersensitization of afferent neurons expressing P2X3 receptors may also be involved in chronic

pruritus. We believe that increased release of ATP in atopic dermatitis leads to hyperexcitability of afferent pruriceptive neurons

mediated by P2X3 receptors leading to pruritus. We believe BLU-5937, a potent and selective P2X3 antagonist, therefore has the

potential to address chronic pruritus associated with atopic dermatitis.

Mechanistic

Similarities Between Cough and Itch

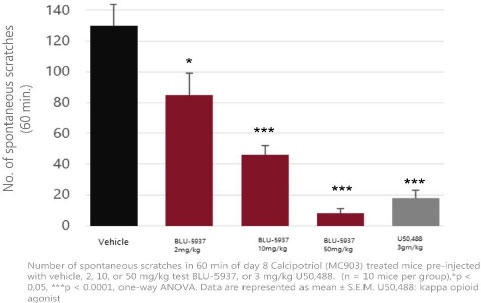

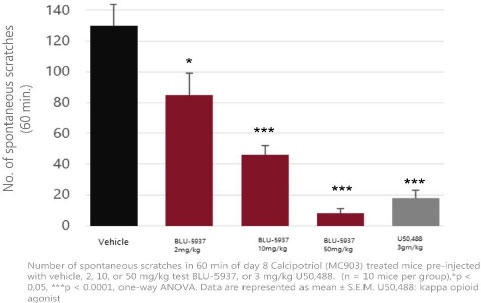

Preclinical

studies conducted by us provided evidence that the ATP-induced hypersensitization mediated by P2X3 receptors in cutaneous C-fibers

plays a key role in pruritus. In multiple animal models of pruritus, we observed that treatment with BLU-5937 resulted in significant

anti-pruritic effect. As shown in the figure below, BLU-5937 was evaluated in the calcipotriol-induced murine model of atopic

dermatitis where it was observed to result in potent, statistically-significant and dose-dependent reductions of spontaneous scratching

compared to placebo. These studies formed the basis for our clinical development plan in chronic pruritus.

Atopic

Dermatitis Mouse Model

Ongoing

Phase 2 BLUEPRINT Clinical Trial

On

December 14, 2020, we announced that the first participant has been dosed in the Phase 2 BLUEPRINT trial of BLU-5937. We expect

to release top-line data in the fourth quarter of 2021.

The

BLUEPRINT trial is a multicenter, randomized, double-blind, placebo-controlled, parallel design Phase 2 trial evaluating the efficacy,

safety, and tolerability of BLU-5937 in approximately 128 adults with moderate to severe chronic pruritus associated with mild

to moderate AD. Participants are randomized into one of two treatment arms (1:1) and will receive either 200 mg BID of BLU-5937

or placebo for a four-week treatment period. The primary efficacy endpoint is the change from baseline in weekly mean Worst Itch-Numeric

Rating Scale (WI-NRS) score at week four. A key secondary endpoint is a responder-rate analysis of at least a four-point WI-NRS

improvement from baseline at week four.

The

BLUEPRINT trial is being conducted at approximately 30 centers located in Canada and the United States.

BLU-5937

in Other P2X3 Hypersensitization-Related Disorders

In

addition to chronic cough and chronic pruritus, BLU-5937 may potentially have clinical benefit in other afferent hypersensitization-related

disorders. We are exploring how P2X3 activation can contribute to irritation and pain, and whether inhibition of P2X3 receptors

can help treat these afferent hypersensitization- related disorders.

Merck,

Bayer and Shionogi are currently developing P2X3 antagonists for other afferent hypersensitization-related disorders, with Phase

2 trials ongoing or planned in four non-cough P2X3 indications: overactive bladder, neuropathic pain, endometriosis pain and sleep

apnea.

P2X3

Sensitization Contributes to Irritation and Pain

BLU-5937

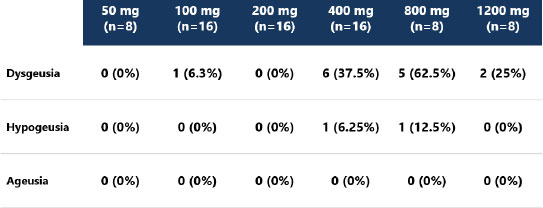

Phase 1 Trial

In

November 2018, we reported positive results from our Phase 1 clinical trial in 90 healthy volunteers, in which we observed

that BLU-5937 had a favorable tolerability and safety profile at all doses tested. At doses of 50 mg to 100 mg, there was only

one subject out of 40 (2.5%) who reported taste alteration, which was transient and sporadic. No subjects (0%) reported total

loss of taste. We believe that doses of 12.5 mg to 200 mg will provide efficacy ranging from sub-optimal to maximal. In contrast,

gefapixant was reported to cause taste alteration and/or taste loss in up to 80% of patients at the therapeutically relevant dose

of 50 mg BID in a Phase 2 clinical trial, as well as 58% and 69% of patients at 45 mg BID in two Phase 3 clinical trials.

Trial

Data

In

November 2018, we completed a Phase 1 trial for BLU-5937 in 90 healthy adult volunteers, in which we observed that BLU-5937

is well tolerated, with a favorable pharmacokinetic profile. BLU-5937 was observed to be rapidly absorbed, achieving maximum plasma

concentration within one to two hours. Plasma half-life was established at four to nine hours, supporting BID dosing. Based on

preclinical efficacy studies and comparison with drug levels achieved with a clinically validated comparator, after correcting

for pharmacokinetic and potency differences, we anticipate that drug levels required for optimal inhibition of cough will be achieved

between 25 and 50 mg BID. As shown in the graphs below, we observed that BLU-5937 plasma concentration (Cmax and AUC) increased

dose-proportionally and was not affected by food, supporting BLU-5937 administration without regard to meals.

Phase I

Pharmacokinetic Profile and Dosing

The

overall incidence of adverse events was comparable between placebo (50%) and BLU-5937 (44%). No subjects who were administered

BLU-5937 reported any loss of taste perception and only one subject out of 40 (2.5%) reported transient and sporadic taste alteration.

No subject reported total loss of taste at any dose levels. This taste effect was reported only on the first day out of seven

days of dosing by a subject receiving 100 mg BID. No subject out of 16 reported any taste loss or taste alteration at 200 mg.

Incidence

of Most Frequent Adverse Events (>5% Incidence) in All Cohorts (SAD + MAD)

At

supra-therapeutic doses (200 mg to 1200 mg), two subjects out of 48 (4%) reported transient and sporadic partial loss of taste,

and 13 subjects out of 48 (27%) reported transient and sporadic taste alteration. All taste-related events were transitory and

sporadic in nature; one was rated moderate and all others were rated mild. The other most frequent adverse events reported in

the Phase 1 trial (>5%) were: headache (11%), hypoaesthesia (11%), nausea (8%), dizziness (6%) and dyspepsia (6%).

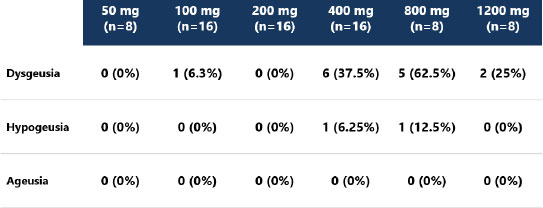

Incidence

of Taste AEs (All SAD and MAD Cohorts)

There

were no serious adverse events and no healthy volunteers withdrew prematurely due to an adverse event during the trial. No significant

trends of mean changes in vital signs, electrocardiogram (ECG) and clinical laboratory values have been observed in the Phase 1

trial of BLU-5937. One subject had a mild elevation of liver enzymes at 400 mg BID that normalized at follow up visit. This increase

in liver enzyme levels was not associated with any signs of liver toxicity (e.g., no increase in bilirubin and no clinical symptoms

of liver toxicity). There was also a slight increase in bilirubin in some subjects dosed at 400 mg BID. This elevation in bilirubin

was not associated with any concomitant increases in liver enzyme levels and returned to baseline value two days after drug discontinuation,

which suggests that it is most likely benign and due to an interaction between BLU-5937 and bilirubin hepatic disposition through

inhibition of OATP.

Trial

Design

The

clinical Phase 1 trial was a randomized, double-blind, placebo-controlled trial of orally administered BLU-5937 in 90 healthy

adult subjects. The primary objectives of this trial were to assess the safety, tolerability (including taste perception) and

pharmacokinetic profile of BLU-5937 in healthy subjects. The trial was divided in two parts:

Part 1.

A single ascending dose (SAD) trial was conducted in 60 healthy subjects. Subjects were randomized into six cohorts

of 10 subjects (8 BLU-5937: 2 placebo). The trial evaluated single oral doses of BLU-5937 from 50 to 1200 mg.

Part 2.

A multiple ascending dose (MAD) trial was conducted in 30 healthy subjects. Subjects were randomized into three cohorts

of 10 subjects (8 BLU-5937: 2 placebo). The trial evaluated multiple oral doses of BLU-5937 of 100, 200 and 400 mg administered

twice-a-day (BID) for seven consecutive days.

Drug-drug

Interaction Clinical Trial

We

completed in December 2019 a clinical Phase 1 drug-drug interaction (DDI) trial in 28 healthy adult subjects to study potential

interactions of BLU-5937 (200 mg BID for 10 days) with CYP3A4, OATP1B1 and BCRP. This trial revealed that BLU-5937 is not a CYP3A4

inducer. BLU-5937 was shown to be a weak inhibitor of OATP1B1 and a very weak inhibitor of BCRP, which is not considered clinically

meaningful at the predicted therapeutic doses studied in the Phase 2b SOOTHE trial. These results indicate that the administration

of BLU-5937 should not affect the elimination of other drugs that are substrates of these enzymes/transporters. Furthermore,

the weak inhibition of OATP1B1 is consistent with the hypothesis that BLU-5937 is affecting bilirubin disposition at predicted

supra-therapeutic doses. BLU-5937 was found to be safe and generally well tolerated in the trial. No serious adverse events were

reported. Three subjects were discontinued from the study due to adverse events (two subjects had mild rash and one subject had

elevated liver enzymes). Only two subjects out of 28 (7%) reported a mild taste alteration, only on the first day of dosing.

BLU-5937

Preclinical Studies

BLU-5937’s

Reduction in Cough Frequency Comparable to the Leading P2X3 Antagonist, Gefapixant

The

antitussive effect of BLU-5937 was compared to that of gefapixant in a guinea pig cough model. Treatments (control, BLU-5937 (0.3,

3 and 30 mg/kg) or gefapixant (0.3, 3 or 30 mg/kg)) were administered orally in seven groups of six animals two hours prior to

tussive agent exposure (citric acid and histamine) and the number of coughs were counted for a period of 15 minutes. Both treatments

showed comparable dose-dependent reduction in cough frequency as compared to the control. The reduction in cough was statistically

significant at 3 mg/kg (39% vs. control) and 30 mg/kg (52% vs. control) with BLU-5937, and at 30 mg/kg (45% vs. control) with

gefapixant.

Guinea

Pig Cough Inhibition Study

BLU-5937’s

Duration of Effect also Comparable to Gefapixant

Using

the same guinea pig cough model, a time course study was conducted to assess the duration of the antitussive effect of BLU-5937

and gefapixant following the administration of a single oral 30 mg/kg dose. In this study, animals in groups of six were exposed

to tussive agents (citric acid and histamine) at various times after the administration of the study drugs (two, four, six, eight

and twelve hours post-dose for BLU-5937 and two and eight hours post-dose for gefapixant) and the number of coughs were measured

for 15 minutes. The reduction in cough frequency compared to control was observed to be statistically significant at two, four

and six hours post-dose with BLU-5937, and at two hours post-dose with gefapixant. The antitussive effect was no longer significant

at eight hours post-dose for both agents.

BLU-5937

Was not Associated with Taste Loss, Whereas Gefapixant Showed Significant Taste Loss in a Rat Taste Model

A

rat taste model was used to compare BLU-5937’s effect on taste perception with that of gefapixant. Animals were water-fasted

overnight and presented with one bottle of water and one bottle of (bitter-tasting) quinine at the time corresponding to the maximum

plasma concentration of study drugs. The volume of liquid consumed from each bottle was measured for 15 minutes. Treatments (control,

BLU-5937 (10 or 20 mg/kg) or gefapixant (10 or 20 mg/kg)) were administered intraperitoneally in two groups of 10 rats. Animals

treated with BLU-5937 did not drink more quinine than the control animals, while those treated with gefapixant drank significantly

(approximately four to five times) more quinine than the control at the two doses tested. These results indicate that BLU-5937

was not associated with taste loss whereas gefapixant led to significant taste loss.

Intellectual

Property

Our

BLU-5937 program is protected by a comprehensive patent estate comprised of issued and allowed patents, as well as pending patent

applications. We have secured composition of matter patent protection for BLU-5937 in all major pharmaceutical markets, including

the United States of America, Europe, Japan and China, all with an expiration date of 2034. Under certain circumstances, such

patent term may be extended for up to five years in certain jurisdictions such as the United States, Europe and Japan. In addition,

we have secured methods of use patent protection in the United States for avoiding loss of taste response while treating a chronic

cough patient through treatment with BLU-5937, expiring in 2038. Patent applications with similarly broad claims are currently

pending in other industrialized nations.

Our

commercial success depends in part on our ability to obtain and maintain proprietary protection for BLU-5937 and its therapeutic

applications, in order to operate without infringing the proprietary rights of others and to prevent others from infringing our

proprietary rights. Our policy is to seek to protect our proprietary position by, among other methods, filing U.S. and foreign

patent applications related to our proprietary technology, inventions and improvements that are important to the development and

implementation of our business. We also rely on trade secrets, know-how and continuing technological innovation to further develop

and maintain our proprietary position.

Composition

of matter patent coverage for BLU-5937 has been secured in all major pharmaceutical markets: the United States of America, Europe,

Japan and China. Patents issued have claims covering the composition of matter of BLU-5937 and related imidazopyridine compounds

and uses thereof. The patents have an expiration date of 2034, excluding any potential patent term extension. Patent applications

with similarly broad claims are currently pending in other industrialized nations.

In

addition, the USPTO has issued patent No. 10,111,883 granting claims for the use of BLU-5937 for the treatment of chronic cough

without affecting taste response. More generally, this patent claims the use of imidazopyridine compounds, including BLU-5937,

that are selective for the P2X3 receptor as a means of minimizing taste perturbation in patients treated for chronic cough. Patent

No. 10,111,883 has an expiration date of 2038, excluding any potential patent term extension. This new U.S. patent extends the

patent protection of BLU-5937 by an additional four years, to 2038.

In

addition to patent protection granting claims to composition of matter, our patent estate also includes patents and patent applications

associated with the use of BLU-5937 and related compounds as a treatment for various hypersensitization disorders, including chronic

cough and chronic pruritus.

The

terms of individual patents depend upon the legal term for patents in the countries in which they are granted. In most countries,

including the United States, the patent term is generally 20 years from the earliest claimed filing date of a nonprovisional

patent application in the applicable country. In the United States, a patent’s term may, in certain cases, be lengthened

by patent term adjustment, which compensates a patentee for administrative delays by the USPTO in examining and granting a patent,

or may be shortened if a patent is terminally disclaimed over a commonly owned patent or a patent naming a common inventor and

having an earlier expiration date. The Drug Price Competition and Patent Term Restoration Act of 1984, or the “Hatch-Waxman

Act”, permits a patent term extension of up to five years beyond the expiration date of a U.S. patent as partial compensation

for the length of time the drug is under regulatory review while the patent is in force. A patent term extension cannot extend

the remaining term of a patent beyond a total of 14 years from the date of product approval, only one patent applicable to

each regulatory review period may be extended and only those claims covering the approved drug, a method for using it or a method

for manufacturing it may be extended. We cannot provide any assurance that any patent term extension with respect to any U.S.

patent will be obtained and, if obtained, the duration of such extension.

Similar

provisions are available in the European Union and certain other non-U.S. jurisdictions to extend the term of a patent that covers

an approved drug. In the future, if BLU-5937 receives approval from the FDA or non-U.S. regulatory authorities, we expect to apply

for patent term extensions on issued patents covering BLU-5937, depending upon the length of the clinical trials for BLU-5937

and other factors. The expiration dates referred to above are without regard to potential patent term extension or other market

exclusivity that may be available to us. However, we cannot provide any assurances that any such patent term extension of a non-U.S.

patent will be obtained and, if obtained, the duration of such extension.

We

also protect our proprietary technology and processes, in part, by confidentiality and invention assignment agreements with our

employees, consultants, scientific advisors and other contractors. These agreements may be breached, and we may not have adequate

remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors.

To the extent that our employees, consultants, scientific advisors or other contractors use intellectual property owned by others

in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

Our

commercial success will also depend in part on not infringing the proprietary rights of third parties. It is uncertain whether

the issuance of any third-party patent would require us to alter our development or commercial strategies, alter our processes,

obtain licenses or cease certain activities. Our breach of any license agreements or failure to obtain a license to proprietary

rights that we may require to develop or commercialize BLU-5937 or any future product candidate may have a material adverse impact

on us. If third parties prepare and file patent applications that also claim technology to which we have rights, we may have to

participate in interference or derivation proceedings to determine priority of invention.

Acquisition

of the Complete Ownership of BLU-5937 Intellectual Property Rights

On

March 25, 2020, we closed an asset purchase and sale agreement to acquire all of the remaining BLU-5937 and related P2X3 antagonists

intellectual property assets (the “BLU-5937 Assets”) from adMare BioInnovations’ NEOMED Institute (“adMare”).

We now own 100% of the BLU-5937 Assets. . The license agreement entered into in February 2017 pursuant to which we had exclusive

rights to develop and commercialize the BLU-5937 Assets was terminated as part of this transaction. In consideration of the forgoing,

we issued to adMare and AstraZeneca AB (“AstraZeneca”) an aggregate of 4,770,000 common shares from treasury,

representing 7.3% of BELLUS Health’s fully diluted equity at that time. In addition, we paid a cash consideration to adMare

of $352,000 (CA $500,000). We no longer have any obligations to adMare, or any other third party, in respect to tiered royalty

obligations and revenue share that would have been otherwise owed to adMare under and subject to the February 2017 license agreement.

In

February 2017, we entered into an agreement with NEOMED Institute a not-for-profit organization originally spun out of AstraZeneca,

for the exclusive, worldwide license to develop and commercialize the BLU-5937 Assets.. The P2X3 antagonist program was initiated

by AstraZeneca and assigned to NEOMED in October 2012. Under the terms of the agreement, we paid NEOMED an upfront fee of $3.2

million, consisting of $1.7 million in cash and $1.5 million in equity with the issuance of 5,802,177 of our common shares.

Appointment

of a Chief Financial Officer

In

December 2020, we appointed Ramzi Benamar to the role of CFO. Mr. Benamar brings to BELLUS Health extensive experience developing

corporate strategy for clinical-stage and commercial biopharma companies, combined with a proven track record in financial leadership.

He earned a M.B.A. and B.B.A. in Marketing and Finance as well as a Master of Healthcare and Pharmaceutical Business Administration.

Prior

to joining BELLUS Health, Mr. Benamar served as Chief Financial Officer of DBV Technologies, where he was responsible

for all matters related to the strategic, operating, financial and accounting undertakings. During his time at DBV, Mr. Benamar was

instrumental in capitalizing the company, strengthening the balance sheet and managing capital deployment. Previously, he was

Vice President and Head of Financial Planning and Analysis for Spark Therapeutics until the acquisition of the company by Roche

Holding. He provided financial leadership across the entire company, strengthened the finance organization and contributed to

the transition to a commercial-stage organization. Earlier in his career, Mr. Benamar held numerous positions of increasing

responsibilities spanning from R&D and global finance to strategy and operations at Merck, Johnson & Johnson, Shire Plc.

and Purdue Pharma.

Human

Resources

As

at February 25, 2021, we employed 32 people.

Facilities

We

leases office space in facilities located in the Parc Scientifique de la Haute Technologie in Laval, Quebec, Canada, pursuant