Filed Pursuant to Rule

File No. 333-265533

PROSPECTUS SUPPLEMENT

(to Prospectus dated September 26, 2022)

Up to 16,633,723 Shares of Common Stock

Issuable Upon Exercise of Rights

to Subscribe for Such Shares

_______________________________________________

We operate as a closed-end management investment company and have elected to be regulated as a business development company, or “BDC,” under the Investment Company Act of 1940, as amended, or the “1940 Act.” Our investment objective is to maximize our portfolio’s total return. Our primary current focus is to seek an attractive risk-adjusted total return by investing primarily in corporate debt securities and collateralized loan obligation, or “CLO,” structured finance investments that own corporate debt securities. CLO investments may also include warehouse facilities, which are financing structures intended to aggregate loans that may be used to form the basis of a traditional CLO vehicle. We may also invest in publicly traded debt and/or equity securities. The portfolio companies in which we invest, however, will generally be considered below investment grade, and their debt securities may in turn be referred to as “junk.” A portion of our investment portfolio may consist of debt investments for which issuers are not required to make significant principal payments until the maturity of the senior loans, which could result in a substantial loss to us if such issuers are unable to refinance or repay their debt at maturity. In addition, many of the debt securities we hold typically contain interest reset provisions that may make it more difficult for a borrower to repay the loan in a raising interest rate environment, heightening the risk that we may lose all or part of our investment. The CLO vehicles in which we invest are formed by raising various classes or “tranches” of debt (with the most senior tranches being rated “AAA” to the most junior tranches typically being rated “BB” or “B”) and equity. The tranches of CLO vehicles rated “BB” or “B” may be referred to as “junk.” The equity of a CLO vehicle, which is the most common tranche of a CLO vehicle in which we invest, is generally required to absorb the CLO’s losses before any of the CLO’s other tranches and it also has the lowest level of payment priority among the CLO’s tranches; therefore, the equity is typically the riskiest of CLO investments.

We are issuing transferable subscription rights to our stockholders of record as of 5:00 p.m., New York City time, on May 23, 2023, entitling the holders thereof to subscribe for up to an aggregate of 16,633,723 shares of our common stock. Record date stockholders will receive one right for each three outstanding shares of common stock owned on the record date. The rights entitle the holders to purchase one new share of common stock for every right held. In addition, record date stockholders who fully exercise their rights will be entitled to subscribe, subject to the limitations described in this prospectus supplement and subject to allotment, for additional shares that remain unsubscribed as a result of any unexercised rights. Rights holders who exercise their rights will have no right to rescind their subscriptions after receipt of their completed subscription certificates together with payment for shares or a notice of guaranteed delivery by the subscription agent.

Members of our senior management, who own approximately 3.26 million shares of our common stock, have indicated that they intend to fully exercise their primary subscription rights.

As a result of the terms of this offering, stockholders who do not fully exercise their rights will own, upon completion of this offering, a smaller proportional interest in us than they owned prior to the offering. In addition, because the subscription price per share will likely be less than the net asset value per share of our common stock, based on our current market price, the offering will likely result in an immediate dilution of net asset value per share for all of our stockholders. This offering will also cause dilution in the net investment income per share of our common stock, which may affect the amount per share we are able to distribute subsequent to completion of the offering. Such dilution is not currently determinable because it is not known how many shares will be subscribed for or what the net asset value or market price of our common stock will be on the expiration date for the offer. If the subscription price per share is substantially less than the current net asset value per share, such dilution could be substantial. Any such dilution will disproportionately affect non-exercising stockholders. If the subscription price is less than our net asset value per share, then all stockholders will experience a decrease in the net asset value per share held by them, irrespective of whether they exercise all or any portion of their rights. See “Risk Factors — Your economic and voting interest in us, as well as your proportionate interest in our net asset value, could be diluted as a result of this rights offering” and “Dilution” in this prospectus supplement for more information.

After giving effect to the sale of shares of our common stock in this offering, as of March 31, 2023, assuming all rights are exercised at the estimated subscription price of $2.87 per share and our receipt of the estimated net proceeds from that sale (which includes the deduction of estimated offering costs of $236,000), our “as adjusted” net asset value would have been approximately $185.5 million, or approximately $2.79 per share, representing immediate net asset value dilution of approximately $0.01 per share to our existing stockholders.

Our common stock is traded on the Nasdaq Global Select Market under the symbol “OXSQ”. The last reported closing price for our common stock on May 22, 2023 was $2.87 per share. The net asset value of our common stock as of March 31, 2023 (the last date prior to the date of this prospectus supplement on which we determined net asset value) was $2.80 per share. The subscription rights are transferable and we have applied to list the rights on the Nasdaq Global Select Market under the symbol “OXSQR”. See “The Offering” for a complete discussion of the terms of this offering.

The subscription price per share will be the greater of (1) 92.5% of the volume-weighted average of the sales prices of our shares of common stock on the Nasdaq Global Select Market for the five consecutive trading days preceding the expiration date of the offering and (2) 95.0% of our last reported net asset value. Because the subscription price will be determined on the expiration date, rights holders will generally not know the subscription price at the time of exercise. The rights will expire if they are not exercised by 5:00 p.m., New York City time, on June 14, 2023, the expiration date of the offering, unless extended as described in this prospectus supplement. We, in our sole discretion, can extend the period for exercising the subscription rights.

Shares of closed-end investment companies, including business development companies, frequently trade at a discount to their net asset value. If our shares trade at a discount to our net asset value after this offering, it will likely increase the risk of loss for purchasers in this offering. Investing in our securities involves a high degree of risk. Before buying any securities, you should read the discussion of the material risks of investing in the rights and our common stock, including the risk of leverage and dilution, in “Risks Factors” beginning on page S-11 of this prospectus supplement and in “Risk Factors” on page S-11 of the accompanying prospectus or otherwise included in or incorporated by reference herein or the accompanying prospectus and in any free writing prospectuses we have authorized for use in connection with this offering, and under similar headings in the other documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus.

Please read this prospectus supplement, the accompanying prospectus, and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus before investing in the rights, and keep each for future reference. This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus contain important information about us that a prospective investor should know before investing in the rights. We are required to file annual, quarterly and current reports, proxy statements, and other information about us with the Securities and Exchange Commission, or the “SEC.” This information is available free of charge by contacting us by mail at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830, by telephone at (203) 983-5275 or on our website at http://www.oxfordsquarecapital.com. The SEC also maintains a website at http://www.sec.gov that contains such information. Information contained on our website is not incorporated by reference into this prospectus supplement or the accompanying prospectus, and you should not consider that information to be part of this prospectus supplement or the accompanying prospectus, except documents incorporated by reference into this prospectus supplement or the accompanying prospectus.

|

Per Share |

Total(4) |

|||||

|

Estimated subscription price(1) |

$ |

2.87 |

$ |

47,738,785 |

||

|

Estimated sales load (underwriting discounts and commissions)(2)(3) |

$ |

0.11 |

$ |

1,829,710 |

||

|

Proceeds to us, before estimated expenses(1)(3) |

$ |

2.76 |

$ |

45,909,075 |

||

____________

(1) Estimated on the basis of 92.5% of the volume-weighted average of the sales prices of our shares of common stock on the Nasdaq Global Select Market for the five consecutive trading days preceding May 16, 2023. See “The Offering — Subscription Price.”

(2) In connection with this offering, Ladenburg Thalmann & Co. Inc., the dealer manager for this offering, will receive a fee for certain financial advisory, marketing and soliciting services equal to (i) 4.00% of the subscription price per share for each share issued other than any shares issued pursuant to exercise of the primary subscription and/or the over-subscription privilege by our affiliates and affiliates of Oxford Square Management, LLC, (ii) 0.00% of the subscription price per share for each share issued pursuant to exercise of the primary subscription to our affiliates and affiliates of Oxford Square Management, LLC and (iii) 2.00% of the subscription price per share for each share issued pursuant to exercise of the over-subscription privilege to our affiliates and affiliates of Oxford Square Management, LLC. The estimated sales load assumes all shares are purchased other than by our affiliates and affiliates of Oxford Square Management, LLC. See “The Offering — Distribution Arrangements.”

(3) We estimate that we will incur offering expenses of approximately $236,000 in connection with this offering. We estimate that net proceeds to us after expenses will be $45,673,075 assuming all of the rights are exercised at the estimated subscription price.

(4) Assumes all rights are exercised at the estimated subscription price. All of the rights may not be exercised.

Neither the SEC nor any other regulatory body has approved or disapproved of these securities or determined if either this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Ladenburg Thalmann

The date of this prospectus supplement is May 24, 2023.

ABOUT THIS PROSPECTUS SUPPLEMENT

We have filed a registration statement on Form N-2 (File No. 333-265533) utilizing a shelf registration process relating to the securities described in this prospectus supplement, which registration statement was declared effective on September 26, 2022.

This document is in two parts. The first part is the prospectus supplement, which describes the terms of this offering and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from or is additional to the information contained in the accompanying prospectus, you should rely only on the information contained in this prospectus supplement and the documents incorporated by reference herein. Please carefully read and consider all of the information contained in this prospectus supplement and the accompanying prospectus, including the information described under the headings “Incorporation of Certain Information by Reference” and “Risk Factors” in this prospectus supplement and under the headings “Incorporation of Certain Information by Reference” and “Risk Factors” included in the accompanying prospectus, respectively, before investing in our rights.

Neither we nor Ladenburg Thalmann & Co. Inc. has authorized any dealer, salesman or other person to give any information or to make any representation other than those contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus or in any free-writing prospectus prepared by or on behalf of us that relates to this offering. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus is accurate as of their respective dates or such earlier date as indicated therein. Our financial condition, results of operations and prospects may have changed since those dates. To the extent required by law, we will amend or supplement the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus to reflect any material changes subsequent to the date of this prospectus supplement and the accompanying prospectus and prior to the completion of any offering pursuant to this prospectus supplement and the accompanying prospectus.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

Page |

||

|

S-1 |

||

|

S-4 |

||

|

S-8 |

||

|

S-11 |

||

|

S-12 |

||

|

S-14 |

||

|

S-15 |

||

|

S-16 |

||

|

S-17 |

||

|

S-20 |

||

|

S-21 |

||

|

S-33 |

||

|

S-33 |

||

|

S-33 |

||

|

S-33 |

PROSPECTUS

|

Page |

||

|

1 |

||

|

4 |

||

|

6 |

||

|

7 |

||

|

8 |

||

|

10 |

||

|

11 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

12 |

|

|

13 |

||

|

14 |

||

|

24 |

||

|

27 |

||

|

28 |

||

|

29 |

||

|

30 |

||

|

31 |

||

|

33 |

||

|

34 |

||

|

40 |

||

|

41 |

||

|

47 |

||

|

48 |

||

|

50 |

||

|

51 |

||

|

65 |

i

|

Page |

||

|

66 |

||

|

68 |

||

|

CUSTODIAN, TRANSFER AND DISTRIBUTION PAYING AGENT AND REGISTRAR |

68 |

|

|

68 |

||

|

68 |

||

|

68 |

||

|

69 |

ii

PROSPECTUS SUPPLEMENT SUMMARY

The following summary contains basic information about this offering included elsewhere, or incorporated by reference, in this prospectus supplement and the accompanying prospectus. It is not complete and may not contain all the information that is important to you. For a more complete understanding of this offering pursuant to this prospectus supplement, we encourage you to read this entire prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein or therein, as well as the documents to which we have referred in this prospectus supplement and the accompanying prospectus. Together, these documents describe the specific terms of this rights offering. You should carefully read “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of our most recent Annual Report on Form 10-K, and in Part 1, Item 2 of our most recent Quarterly Report on Form 10-Q for more information and the sections entitled “Risk Factors,” “Business” and “Incorporation of Certain Information by Reference” included in the accompanying prospectus and “Risks Factors” and “Incorporation of Certain Information by Reference” in this prospectus supplement.

Except where the context requires otherwise, the terms “OXSQ,” “Company,” “we,” “us” and “our” refer to Oxford Square Capital Corp.; “Oxford Square Management” refers to Oxford Square Management, LLC; and “Oxford Funds” refers to Oxford Funds, LLC.

Overview

We are a closed-end management investment company that has elected to be regulated as a business development company, or “BDC,” under the Investment Company Act of 1940, as amended, or the “1940 Act.” We have elected to be treated for tax purposes as a regulated investment company, or “RIC,” under Subchapter M of the Internal Revenue Code of 1986, as amended, or the “Code,” beginning with our 2003 taxable year. Our investment objective is to maximize our portfolio’s total return. Our primary current focus is to seek an attractive risk-adjusted total return by investing primarily in corporate debt securities and collateralized loan obligation, “CLO,” structured finance investments that own corporate debt securities. CLO investments may also include warehouse facilities, which are early-stage CLO vehicles intended to aggregate loans that may be used to form the basis of a traditional CLO vehicle. We may also invest in publicly traded debt and/or equity securities. As a BDC, we may not acquire any asset other than “qualifying assets” unless, at the time we make the acquisition, the value of our qualifying assets represents at least 70% of the value of our total assets.

Our capital is generally used by our corporate borrowers to finance organic growth, acquisitions, recapitalizations and working capital. Our investment decisions are based on extensive analysis of potential portfolio companies’ business operations supported by an in-depth understanding of the quality of their recurring revenues and cash flow, variability of costs and the inherent value of their assets, including proprietary intangible assets and intellectual property. In making our CLO investments, we consider the indenture structure for that vehicle, its operating characteristics and compliance with its various indenture provisions, as well as its corporate loan-based collateral pool.

We generally expect to invest between $5.0 million and $30.0 million in each of our portfolio investments, although this investment size may vary as the size of our capital base changes and market conditions warrant. We invest in both fixed and variable interest rate structures. We expect that our investment portfolio will be diversified among a large number of investments with few investments, if any, exceeding 5% of the total portfolio.

The structures of our investments will vary and we seek to invest across a wide range of different industries. We seek to invest in entities that, as a general matter, have been operating for at least one year prior to the date of our investment and that will, at the time of our investment, have employees and revenues, and which are cash flow positive. Many of these companies are expected to have financial backing provided by other financial or strategic sponsors at the time we make an investment. The portfolio companies in which we invest, however, will generally be considered below investment grade, and their debt securities may in turn be referred to as “junk.” A portion of our investment portfolio may consist of debt investments for which issuers are not required to make significant principal payments until the maturity of the senior loans, which could result in a substantial loss to us if such issuers are unable to refinance or repay their debt at maturity. In addition, many of the debt securities we hold typically contain interest reset provisions that may make it more difficult for a borrower to repay the loan in a raising interest rate environment, heightening the risk that we may lose all or a part of our investment.

S-1

We also purchase portions of equity and junior debt tranches of CLO vehicles. Substantially all of the CLO vehicles in which we may invest would be deemed to be investment companies under the 1940 Act but for the exceptions set forth in section 3(c)(1) or section 3(c)(7). Other than CLO vehicles, we do not intend to invest, and we would be limited to 15% of our net assets if we did invest, in any types of entities that rely on the exceptions set forth in section 3(c)(1) or section 3(c)(7) of the 1940 Act. Structurally, CLO vehicles are entities that are formed to originate and manage a portfolio of loans. The loans within the CLO vehicle are limited to loans which meet established credit criteria and are subject to concentration limitations in order to limit a CLO vehicle’s exposure to a single credit. A CLO vehicle is formed by raising various classes or “tranches” of debt (with the most senior tranches being rated “AAA” to the most junior tranches typically being rated “BB” or “B”) and equity. The tranches of CLO vehicles rated “BB” or “B” may be referred to as “junk.” The equity of a CLO vehicle is generally required to absorb the CLO’s losses before any of the CLO’s other tranches and it also has the lowest level of payment priority among the CLO’s tranches; therefore, the equity is typically the riskiest of CLO investments. We primarily focus on investing in the junior tranches and the equity of CLO vehicles. The CLO vehicles which we focus on are collateralized primarily by senior secured loans made to companies whose debt is unrated or is rated below investment grade, and generally have very little or no direct exposure to real estate, mortgage loans or to pools of consumer-based debt, such as credit card receivables or auto loans. However, there can be no assurance that the collateral securing such senior secured loans would satisfy all of the unpaid principal and interest of our investment in the CLO vehicle in the event of default and the junior tranches, especially the equity tranches, of CLO vehicles are the last tranches to be paid, if at all, in the event of a default. Our investment strategy may also include warehouse facilities, which are early-stage CLO vehicles intended to aggregate loans that may be used to form the basis of a traditional CLO vehicle.

We have historically borrowed funds to make investments and may continue to do so. As a result, we are exposed to the risks of leverage, which may be considered a speculative investment technique. Borrowings, also known as leverage, magnify the potential for gain and loss on amounts invested and therefore increase the risks associated with investing in our securities. In addition, the costs associated with our borrowings, including any increase in the advisory fee payable to Oxford Square Management will be borne by our common stockholders.

See “Business” in Part I, Item 1 in our most recent Annual Report on Form 10-K for additional information about us and Oxford Square Management.

6.50% Unsecured Notes due March 31, 2024 (the “6.50% Unsecured Notes”)

On April 12, 2017, we completed an underwritten public offering of approximately $64.4 million in aggregate principal amount of the 6.50% Unsecured Notes. The 6.50% Unsecured Notes will mature on March 30, 2024, and may be redeemed in whole or in part at any time or from time to time at our option on or after March 30, 2020. The 6.50% Unsecured Notes bear interest at a rate of 6.50% per year payable quarterly on March 30, June 30, September 30, and December 30 of each year. The 6.50% Unsecured Notes are listed on the NASDAQ Global Select Market under the trading symbol “OXSQL.”

6.25% Unsecured Notes due April 30, 2026 (the “6.25% Unsecured Notes”)

On April 3, 2019, we completed an underwritten public offering of approximately $44.8 million in aggregate principal amount of the 6.25% Unsecured Notes. The 6.25% Unsecured Notes will mature on April 30, 2026, and may be redeemed in whole or in part at any time or from time to time at our option on or after April 30, 2022. The 6.25% Unsecured Notes bear interest at a rate of 6.25% per year payable quarterly on January 31, April 30, July 31 and October 31 of each year. The 6.25% Unsecured Notes are listed on the NASDAQ Global Select Market under the trading symbol “OXSQZ.”

5.50% Unsecured Notes due July 31, 2028 (the “5.00% Unsecured Notes”)

On May 20, 2021, we completed an underwritten public offering of approximately $80.5 million in aggregate principal amount of the 5.50% Unsecured Notes. The 5.50% Unsecured Notes will mature on July 31, 2028, and may be redeemed in whole or in part at any time or from time to time at our option on or after May 31, 2024. The 5.50% Unsecured Notes bear interest at a rate of 5.50% per year payable quarterly on January 31, April 30, July 31, and October 31, of each year. The 5.50% Unsecured Notes are listed on the NASDAQ Global Select Market under the trading symbol “OXSQG.”

S-2

Organizational and Regulatory Structure

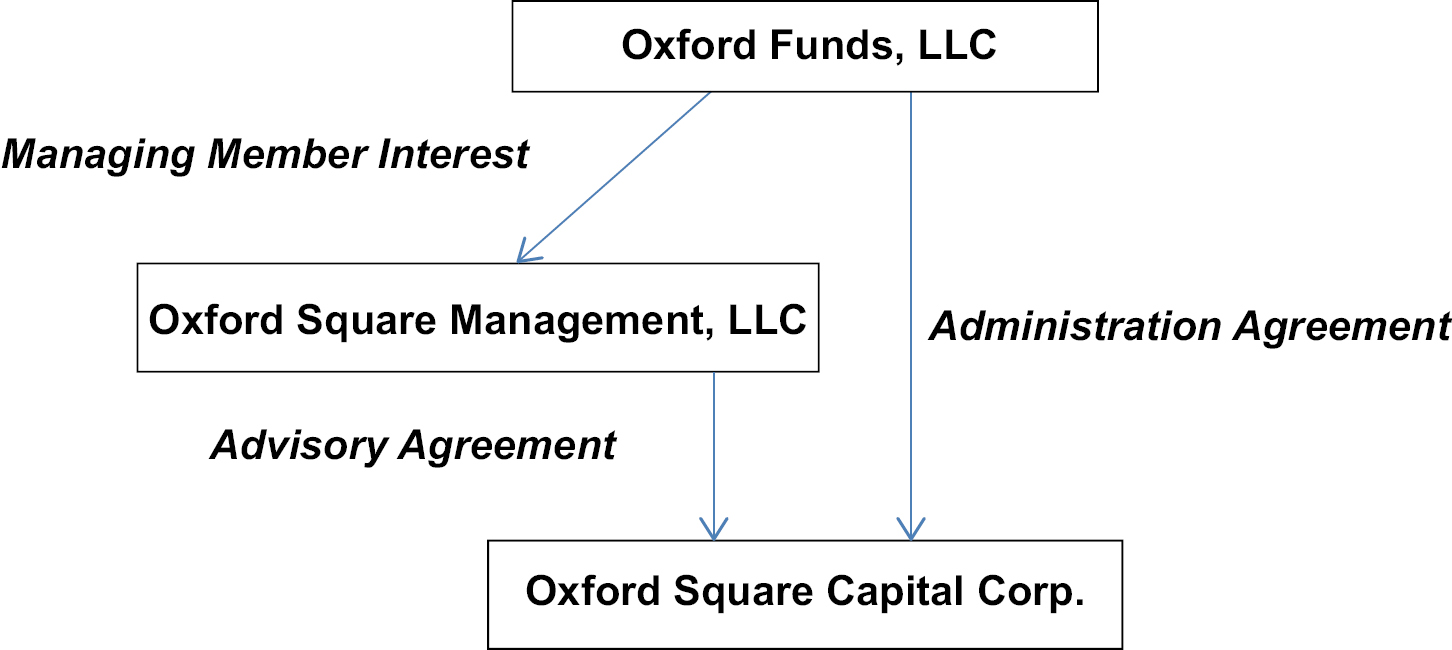

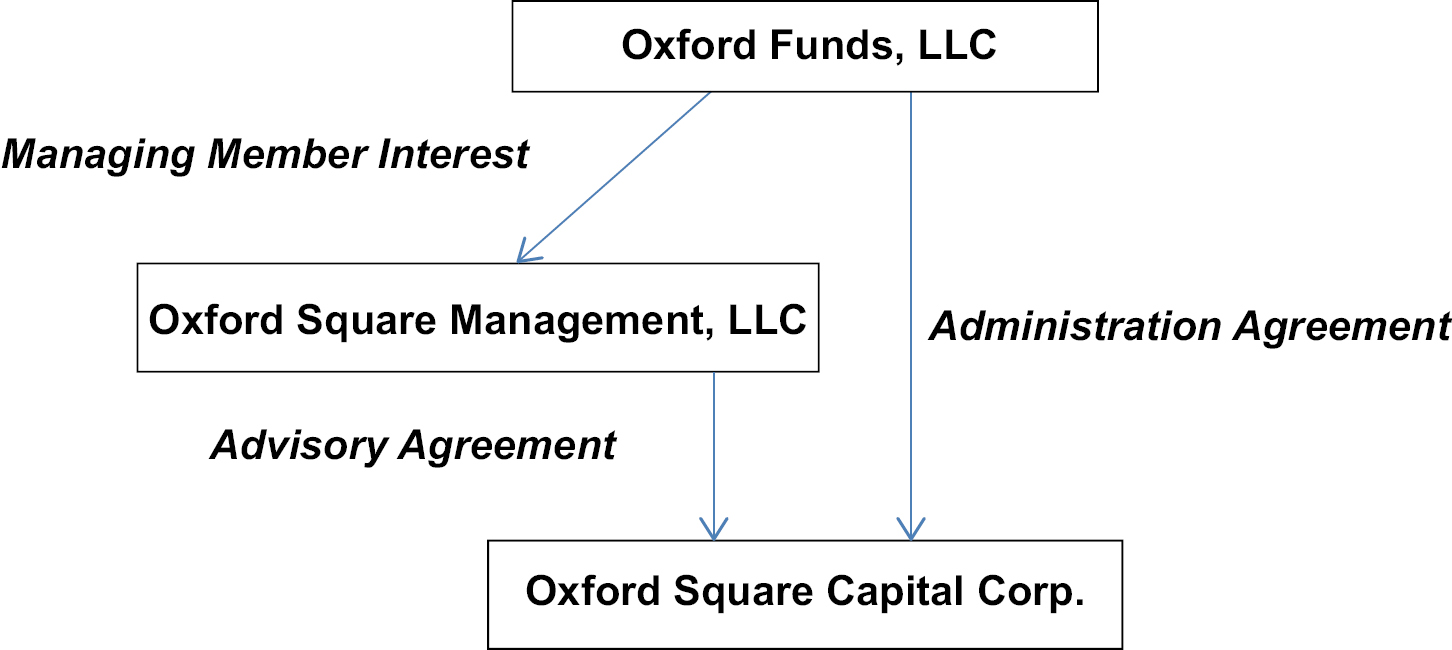

Our investment activities are managed by Oxford Square Management. Oxford Square Management is an investment adviser registered under the Investment Advisers Act of 1940, as amended, or the “Advisers Act.” Oxford Square Management is owned by Oxford Funds, its managing member, and Charles M. Royce, a member of our Board of Directors who holds a minority, non-controlling interest in Oxford Square Management. Jonathan H. Cohen, our Chief Executive Officer, and Saul B. Rosenthal, our President and Chief Operating Officer, directly or indirectly own or control all of the outstanding equity interests of Oxford Funds. Under the investment advisory agreement, or the “Investment Advisory Agreement,” we have agreed to pay Oxford Square Management an annual base management fee based on our gross assets as well as an incentive fee based on our performance. See “Management and Other Agreements” in the accompanying prospectus.

We were founded in July 2003 and completed an initial public offering of shares of our common stock in November 2003. We are a Maryland corporation and a closed-end management investment company that has elected to be regulated as a BDC under the 1940 Act. As a BDC, we are required to meet certain regulatory tests, including the requirement to invest at least 70% of our total assets in eligible portfolio companies. For more information, see “Item 1. Business — Regulation as a Business Development Company” in our most recent Annual Report on Form 10-K. In addition, we have elected to be treated for U.S. federal income tax purposes, and intend to qualify annually, as a RIC under Subchapter M of the Code.

Set forth below is a chart detailing our current organizational structure.

Our Corporate Information

Our headquarters are located at 8 Sound Shore Drive, Suite 255 Greenwich, Connecticut 06830, and our telephone number is (203) 983-5275.

Where You Can Find Additional Information

We have filed with the SEC a registration statement on Form N-2 together with all amendments and related exhibits under the Securities Act of 1933, as amended, or the “Securities Act.” The registration statement contains additional information about us and the securities being offered by this prospectus supplement.

We file annual, quarterly and current reports, proxy statements and other information with the SEC under the Securities Exchange Act of 1934, as amended, or the “Exchange Act”. The information we file with the SEC is available free of charge by contacting us at 8 Sound Shore Drive, Suite 255, Greenwich, CT 06830, by telephone at (203) 983-5275 or on our website at www.oxfordsquarecapital.com. Information contained on our website or on the SEC’s web site about us is not incorporated into this prospectus and you should not consider information contained on our website or on the SEC’s website to be part of this prospectus.

S-3

SUMMARY OF THE OFFERING

The Offering

We are issuing to stockholders of record, or record date stockholders, on May 23, 2023, or the record date, one transferable right for each three shares of our common stock held on the record date. Each holder of the rights, or rights holder, is entitled to subscribe for one share of our common stock for every right held, which we refer to as the primary subscription right. We will not issue fractional shares of our common stock upon the exercise of rights; accordingly, rights can be exercised only in multiples of one.

The rights will be evidenced by subscription certificates that will be mailed to stockholders, except as discussed below under “The Offering — Foreign Stockholders.” We will not issue fractional rights.

Rights can be exercised at any time during the subscription period, which commences on May 24, 2023, the date following the record date, and ends at 5:00 p.m., New York City time, on June 14, 2023, unless extended by us, the expiration date. The rights will expire on the expiration date of the offering and cannot be exercised thereafter.

The rights are transferable and an application has been submitted for the rights to trade on the Nasdaq Global Select Market under the ticker “OXSQR”. The shares of common stock to be issued pursuant to this offering will be listed for trading on the Nasdaq Global Select Market under the symbol “OXSQ”. See “The Offering.”

For purposes of determining the number of shares a record date stockholder can acquire pursuant to the offering, broker-dealers, trust companies, banks or others whose shares are held of record by Cede & Co., or “Cede,” or by any other depository or nominee will be deemed to be the holders of the rights that are issued to Cede or the other depository or nominee on their behalf.

There is no minimum number of rights that must be exercised in order for the offering to close.

Subscription Price

The subscription price per share will be the greater of (1) 92.5% of the volume-weighted average of the sales prices of our shares of common stock on the Nasdaq Global Select Market for the five consecutive trading days preceding the expiration date of the offering and (2) 95.0% of our last reported net asset value. Because the subscription price will be determined on the expiration date, rights holders who decide to acquire shares pursuant to their primary subscription rights or pursuant to the over-subscription privilege will generally not know the actual purchase price of those shares when they make that decision. The actual purchase price of the shares could exceed the estimated subscription price per share set forth on the cover page of this prospectus supplement. See “The Offering — Subscription Price.” Rights holders who exercise their rights will have no right to rescind their subscriptions after receipt of their completed subscription certificates together with payment for shares or a notice of guaranteed delivery by the subscription agent, even if the purchase price per share exceeds the estimated subscription price per share set forth on the cover of this prospectus supplement.

Over-Subscription Privilege

Rights holders who fully exercise their rights are entitled to subscribe for additional shares of our common stock that were not subscribed for by other stockholders, which we refer to as the remaining shares. If sufficient remaining shares of our common stock are available, all over-subscription requests will be honored in full.

Members of our senior management, who own approximately 3.26 million shares of our common stock, have indicated that they intend to fully exercise their primary subscription rights.

Shares acquired pursuant to the over-subscription privilege are subject to certain other limitations and pro rata allocations. See “The Rights Offering — Over-Subscription Privilege.”

S-4

Purpose of the Offer

Our board of directors has determined that the offering would result in a net benefit to the stockholders and that it is in the best interest of us and our stockholders to raise additional capital (i) to repay outstanding indebtedness, (ii) to fund investments in debt securities and CLO investments in accordance with our investment objective and (iii) for general corporate purposes.

All costs of this rights offering will be borne by our stockholders whether or not they exercise their subscription rights. In connection with the approval of this rights offering, our board of directors considered the following factors:

• the increased capital to be available upon completion of the rights offering for us to repay outstanding indebtedness, to fund investments in debt securities and CLO investments in accordance with our investment objective and for general corporate purposes;

• the subscription price relative to the market price and to our net asset value, or NAV, per share, including the substantial likelihood that the subscription price will be below our NAV per share and the resulting effect that the offering would have on our NAV per share;

• the dilution in ownership and voting power to be experienced by non-exercising stockholders;

• the dilutive effect the offering will have on the dividends per share we distribute subsequent to completion of the offering;

• the terms and expenses in connection with the offering relative to other alternatives for raising capital, including fees payable to the dealer manager;

• the size of the offering in relation to the number of shares outstanding;

• alternative sources of financing;

• the market price of our common stock, both before and after the announcement of the rights offering;

• the general condition of the securities markets; and

• any impact on operating expenses associated with an increase in capital, including an increase in fees payable to Oxford Square Management.

We cannot provide you any assurance of the amount of dilution, if any, that a stockholder will experience, that the current offering will be successful, or that by increasing the amount of our available capital, our aggregate expenses and, correspondingly, our expense ratio will be lowered. In addition, Oxford Square Management’s base management fee is based upon our gross assets, which include any cash or cash equivalents that we have not yet invested in the securities of portfolio companies.

In determining that this offering is in our best interest and in the best interests of our stockholders, we have retained Ladenburg Thalmann & Co. Inc., the dealer manager for this offering, to provide us with certain financial advisory, marketing and soliciting services relating to this offering, including advice with respect to the structure, timing and terms of the offer. In this regard, we considered current secondary market trading conditions, using a fixed pricing versus variable pricing mechanism, the benefits and drawbacks of conducting a non-transferable versus a transferable rights offering, the effect on us if this offering is not fully subscribed, the experience of the dealer manager in conducting rights offerings, and the inclusion of an over-subscription privilege.

Although we have no present intention to do so, we have the ability, in the future and in our discretion, to choose to make additional rights offerings from time to time for a number of shares and on terms which could be similar to or different from this offering, provided that our board of directors must determine that each subsequent rights offering is in the best interest of our stockholders. Any such future rights offering will be made in accordance with the 1940 Act.

S-5

Use of Proceeds

We intend to use the net proceeds from this offering primarily (i) to repay outstanding indebtedness, (ii) to fund investments in debt securities and CLO investments in accordance with our investment objective and (iii) for general corporate purposes. See “Use of Proceeds.”

Sale of Rights

The rights will be evidenced by a subscription certificate and will be transferable until the trading day immediately preceding the expiration date of the offering (or if the offering is extended, until the trading day immediately prior to the extended expiration date). We have applied to list the rights on the Nasdaq Global Select Market under the symbol “OXSQR”. While the dealer manager will use its best efforts to ensure that an adequate trading market for the rights will exist, we can offer no assurance that a market for the rights will develop. Trading in the rights on the Nasdaq Global Select Market can be conducted until the close of trading on the Nasdaq Global Select Market on the trading day immediately prior to the expiration date (or if the offering is extended, until the day immediately prior to the expiration date as so extended). See “The Offering — Sale of Rights.”

Dilutive Effects

Any stockholder who chooses not to participate in the offering should expect to own a smaller interest in us upon completion of the offering. The offering will dilute the ownership interest and voting power of stockholders who do not fully exercise their primary subscription rights. The amount of dilution that a stockholder experiences could be substantial. Further, because the net proceeds per share of our common stock from the offering will likely be lower than the then-current net asset value per share of our common stock, the offering will likely reduce the net asset value per share of our common stock. The amount of dilution, if any, that a stockholder experiences could be substantial. See “Dilution.”

The transferable feature of the rights will afford non-participating stockholders the potential of receiving cash upon the sale of their rights, receipt of which could be viewed as partial compensation for the dilution of their interests.

Amendments and Termination

We reserve the right to amend the terms and conditions of this offering, whether the amended terms are more or less favorable to you. We will comply with all applicable laws, including the federal securities laws, in connection with any such amendment. In addition, we have the ability to terminate this offering at any time prior to delivery of the rights and the shares of our common stock offered hereby. In addition, the dealer manager has the right to terminate the dealer manager agreement. If this rights offering is terminated, all rights will expire without value, and the subscription agent will return as soon as practicable all exercise payments, without interest. All monies received by the subscription agent in connection with the offering will be held by the subscription agent, on our behalf, in a segregated interest-bearing account at a negotiated rate. All such interest shall be payable to us even if we determine to terminate the offering and return your subscription payment. In addition, no amounts paid to acquire the rights on the Nasdaq Global Select Market or otherwise will be returned.

Offering Expenses

The expenses of the offering are expected to be approximately $236,000 and will be borne by holders of our common stock. See “Use of Proceeds.”

How to Obtain Subscription Information

• Contact your broker-dealer, trust company, bank or other nominee where your rights are held, or

• Contact the information agent, Alliance Advisors, LLC, toll-free at 1-888-490-5078.

S-6

How to Subscribe

• Deliver a completed subscription certificate and payment to the subscription agent of the estimated subscription price by the expiration date of the rights offering, or

• If your shares are held in an account with your broker-dealer, trust company, bank or other nominee, which qualifies as an Eligible Guarantor Institution under Rule 17Ad-15 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, have your Eligible Guarantor Institution deliver a notice of guaranteed delivery and payment to the subscription agent by the expiration date of the rights offering.

Subscription Agent

Computershare Trust Company, N.A. will act as the subscription agent in connection with this offering.

Information Agent

Alliance Advisors, LLC, will act as the information agent in connection with this offering. You should contact Alliance Advisors, LLC, toll-free with questions at 1-888-490-5078.

Distribution Arrangements

Ladenburg Thalmann & Co. Inc. will act as dealer manager for the offering. Under the terms and subject to the conditions contained in the dealer manager agreement, the dealer manager will provide certain financial advisory services and marketing assistance in connection with the offering and will solicit the acquisition and/or exercise of rights by our stockholders and others and participation in the over-subscription privilege by our stockholders and others. The offer is not contingent upon any number of rights being exercised. We have agreed to pay the dealer manager a fee for certain financial advisory, marketing and soliciting services equal to (i) 4.00% of the subscription price per share for each share issued pursuant to exercise of the primary subscription and/or the over-subscription privilege other than our affiliates and affiliates of Oxford Square Management, (ii) 0.00% of the subscription price per share for each share issued pursuant to exercise of the primary subscription to our affiliates and affiliates of Oxford Square Management and (iii) 2.00% of the subscription price per share for each share issued pursuant to exercise of the over-subscription privilege to our affiliates and affiliates of Oxford Square Management, provided that the dealer manager is permitted to waive certain of the amounts to which it is entitled. In addition, we will reimburse the dealer manager for its reasonable expenses incurred in connection with the offering in an amount up to $50,000. See “The Offering — Distribution Arrangements.” The dealer manager may reallow a portion of its fees to other broker-dealers that have assisted in soliciting the exercise of rights.

Important Dates to Remember(1)

|

Record Date |

May 23, 2023 |

|

|

Subscription Period |

from May 24, 2023 to June 14, 2023(1) |

|

|

Rights Expected to Begin Trading on Nasdaq |

May 24, 2023 |

|

|

Last Day it is Expected that Rights Can be Traded |

June 14, 2023(1) |

|

|

Expiration Date |

June 14, 2023 at 5:00 p.m. New York City Time(1) |

|

|

Deadline for Delivery of Subscription Certificates and Payment for Shares |

|

|

|

Deadline for Delivery of Notice of Guaranteed Delivery and Payment for Shares |

|

|

|

Deadline for Delivery of Subscription Certificates for Shares pursuant to Notice of Guaranteed Delivery(2) |

|

|

|

Final Payment Date(3) |

June 28, 2023(1) |

____________

(1) Unless the offer is extended.

(2) Participating rights holders must, by the expiration date of the offer (unless the offer is extended), either (i) deliver a subscription certificate and payment for shares or (ii) cause to be delivered on their behalf a notice of guaranteed delivery and payment for shares.

(3) Any additional amount due (in the event the subscription price exceeds the estimated subscription price).

S-7

FEES AND EXPENSES

The following table is intended to assist you in understanding the costs and expenses that you will bear directly or indirectly. We caution you that some of the percentages indicated in the table below are estimates and may vary. Except where the context suggests otherwise, whenever this prospectus supplement contains a reference to fees or expenses paid by “us” or “OXSQ,” or that “we” will pay fees or expenses, you will indirectly bear such fees or expenses as an investor in OXSQ.

| Stockholder transaction expenses: |

| ||

Sales load (as a percentage of offering price) | %(1) | ||

Offering expenses (as a percentage of offering price) | %(2) | ||

Dividend reinvestment plan expenses | (3) | ||

Total stockholder transaction expenses (as a percentage of offering price) | % | ||

| Annual expenses (as a percentage of net assets attributable to common stock): |

| ||

Base Management fee | %(4) | ||

Incentive fees payable under our investment advisory agreement | %(5) | ||

Interest payments on borrowed funds | %(6) | ||

Other expenses | %(7) | ||

Total annual expenses | %(8) |

____________

(1)

(2)

(3)

(4)

(5)

S-8

the amount of the “Pre-Incentive Fee Net Investment Income” for such quarter. In addition, effective April 1, 2016, the calculation of the Company’s net investment income incentive fee is subject to a total return requirement, (the “Total Return Requirement”) which provides that a net investment income incentive fee will not be payable to Oxford Square Management except to the extent 20% of the “cumulative net increase in net assets resulting from operations” (which is the amount, if positive, of the sum of the “Pre-Incentive Fee Net Investment Income,” realized gains and losses and unrealized appreciation and depreciation) during the calendar quarter for which such fees are being calculated and the eleven (11) preceding quarters (or if shorter, the number of quarters since April 1, 2016) exceeds the cumulative net investment income incentive fees accrued and/or paid for such eleven (11) preceding quarters (or if shorter, the number of quarters since April 1, 2016). The second part of the incentive fee equals 20.0% of our net realized gains for the calendar year less any unrealized losses for such year and will be payable at the end of each calendar year. It should be noted that no capital gains incentive fee was calculated as of March 31, 2023, which is calculated based upon an assumed liquidation of the entire portfolio, and no other changes in realized or unrealized gains and losses, as of March 31, 2023 and the termination of the Investment Advisory Agreement on such date. For a detailed discussion of the calculation of the incentive fees, see “Management and Other Agreements” in the accompanying prospectus.

(6)

(7)

(8)

Example

The following example demonstrates the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical investment in our common stock, assuming (1) a 4.00% sales load (underwriting discounts and commissions) and offering expenses totaling 0.49%, (2) total net estimated annual expenses of 12.44% of average net assets attributable to our common stock as set forth in the table above and (3) a 5% annual return.

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return(1) | $ | | $ | | $ | | $ | | ||||

| You would pay the following expenses on a $1,000 investment, assuming a 5% annual return entirely from realized gains(2) | $ | | $ | | $ | | $ | | ||||

____________

(1)

(2)

S-9

The example and the expenses in the tables above should not be considered a representation of our future expenses, and actual expenses may be greater or less than those shown. Moreover, while the example assumes, as required by the SEC, a 5.0% annual return, our performance will vary and may result in a return greater or less than 5.0%. The income incentive fee under our Investment Advisory Agreement, which, assuming a 5% annual return, would either not be payable or would have an insignificant impact on the expense amounts shown above, is not included in the example. If we achieve sufficient returns on our investments to trigger an income incentive fee of a material amount, our expenses, and returns to our investors, would be higher. In addition, while the example assumes reinvestment of all distributions at net asset value, participants in our distribution reinvestment plan may receive shares valued at the market price in effect at that time. This price may be at, above or below net asset value. See “Distribution Reinvestment Plan” in the accompanying prospectus for additional information regarding our distribution reinvestment plan.

S-10

RISK FACTORS

Before you invest in our securities, you should be aware of various risks, including those described below and those set forth in the accompanying prospectus or otherwise incorporated by reference herein or the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us that relates to this offering. You should carefully consider these risk factors, together with all of the other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before you decide whether to make an investment in our securities. The risks set out below are not the only risks we face. If any of the following events occur, our business, financial condition and results of operations could be materially and adversely affected. In such case, our net asset value and the trading price of our securities could decline, and you could lose all or part of your investment.

Your economic and voting interest in us, as well as your proportionate interest in our net asset value, could be diluted as a result of this rights offering.

Stockholders who do not fully exercise their rights should expect that they will, at the completion of the offer, own a smaller proportional interest in us, including with respect to voting rights, than would otherwise be the case if they fully exercised their rights. We cannot state precisely the amount of any such dilution in share ownership because we do not know at this time what proportion of the shares of common stock will be purchased as a result of the offer.

In addition, if the subscription price is less than our net asset value per share, then our stockholders would experience an immediate dilution of the aggregate net asset value of their shares of common stock as a result of the offer. The amount of any decrease in net asset value is not predictable because it is not known at this time what the subscription price and net asset value per share will be on the expiration date of the rights offering or what proportion of the shares of common stock will be purchased as a result of the offer. Such dilution could be substantial.

This offering could also cause dilution in the net investment income per share of our common stock, which may affect the amount we are able to distribute subsequent to completion of the offering. In addition, our reported earnings per share will be retroactively adjusted to reflect the dilutive effects of this offering. See “Dilution.”

We have the ability to terminate this rights offering at any time prior to delivery of the shares of our common stock offered hereby, and neither we nor the subscription agent will have any obligation to you except to return your subscription payments, without interest.

We have the ability to terminate the rights offering at any time prior to the delivery of the shares of our common stock offered hereby. If the rights offering is terminated, all rights will expire without value and the subscription agent will return as soon as practicable all exercise payments, without interest. No amounts paid to acquire rights on the Nasdaq Global Select Market or otherwise will be returned.

There can be no assurance that a market for the rights will develop.

There can be no assurance that a market for the rights will develop or, if such a market develops, what the price of the rights will be. Changes in market conditions could result in the shares of common stock purchasable upon exercise of the rights being less attractive to investors at the expiration date. This could reduce or eliminate the value of the rights. Stockholders who receive or acquire rights could find that there is no market to sell rights that they do not wish to exercise.

Sales of substantial amounts of our common stock in the public market could have an adverse effect on the market price of our common stock.

Upon completion of this offering, we will have 66,534,894 shares of common stock outstanding if the offering is fully subscribed. Following this offering, sales of substantial amounts of our common stock, or the availability of such shares for sale, could adversely affect the prevailing market prices for our common stock. If this occurs and continues, it could impair our ability to raise additional capital through the sale of equity securities should we desire to do so.

You could be committed to buying shares of our common stock above the estimated subscription price per share.

The actual purchase price of the shares could exceed the estimated subscription price per share set forth on the cover of this prospectus supplement. See “The Offering — Subscription Price.” Rights holders who exercise their rights will have no right to rescind their subscriptions after receipt of their completed subscription certificates together with payment for shares or a notice of guaranteed delivery by the subscription agent, even if the purchase price per share exceeds the estimated subscription price per share set forth on the cover of this prospectus supplement.

S-11

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents that we incorporate by reference herein and therein, contain forward-looking statements that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about the Company, our current and prospective portfolio investments, our industry, our beliefs, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements. The forward-looking statements contained in this prospectus supplement and the accompanying prospectus involve risks and uncertainties, including statements as to:

• our future operating results, including our ability to achieve our investment objectives;

• our business prospects and the prospects of our portfolio companies;

• the impact of investments that we expect to make;

• our contractual arrangements and relationships with third parties;

• the dependence of our future success on the general economy and its impact on the industries in which we invest;

• the ability of our portfolio companies and CLO investments to achieve their operating or investment objectives;

• the valuation of our investments in portfolio companies, particularly those having no liquid trading market;

• market conditions and our ability to access alternative debt markets and additional debt and equity capital;

• our expected financings and investments;

• the adequacy of our cash resources and working capital;

• the timing of cash flows, if any, from the operations of our portfolio companies and CLO investments; and

• the ability of Oxford Square Management to locate suitable investments for us and to monitor and administer our investments.

These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including without limitation:

• an economic downturn could impair our portfolio companies’ and CLO investments’ ability to continue to operate, which could lead to the loss of some or all of our investments in such portfolio companies and CLO investments;

• a contraction of available credit and/or an inability to access the equity markets could impair our lending and investment activities;

• interest rate volatility could adversely affect our results, particularly because we use leverage as part of our investment strategy;

• the elevated levels of inflation and its impact on our investment activities and the industries in which we invest;

• currency fluctuations could adversely affect the results of our investments in foreign companies, particularly to the extent that we receive payments denominated in foreign currency rather than U.S. dollars;

S-12

• the impact of information technology system failures, data security breaches, data privacy compliance, network disruptions and cybersecurity attacks on us and our portfolio companies;

• the risks relating to the offering described under “Risk Factors” above; and

• the risks, uncertainties and other factors we identify in “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K, as well as in any of our subsequent SEC filings.

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. Important assumptions include our ability to originate new loans and investments, certain margins and levels of profitability and the availability of additional capital. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this prospectus supplement or the accompanying prospectus should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K, as well as in any of our subsequent SEC filings. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this prospectus. However, we will update this prospectus, and the documents that we incorporate by reference herein, to reflect any material changes to the information contained herein. The forward-looking statements contained in this prospectus supplement and accompanying prospectus, including the documents that we incorporate by reference herein and therein, are excluded from the safe harbor protection provided by Section 27A of the Securities Act.

S-13

USE OF PROCEEDS

We estimate that net proceeds we will receive from this offering will be approximately $45.7 million assuming all of the rights are exercised at the estimated subscription price of $2.87 and after deducting estimated offering expenses of approximately $236,000 payable by us and payments to the dealer manager of (i) 4.00% of the estimated subscription price per share for each share issued pursuant to exercise of the primary subscription and/or the over-subscription privilege other than to our affiliates and affiliates of Oxford Square Management, (ii) 0.00% of the estimated subscription price per share for each share issued pursuant to exercise of the primary subscription to our affiliates and affiliates of Oxford Square Management and (iii) 2.00% of the estimated subscription price per share for each share issued pursuant to exercise of the over-subscription privilege to our affiliates and affiliates of Oxford Square Management assuming, solely for purposes of this calculation, that none of our affiliates or affiliates of Oxford Square Management subscribe for shares.

We intend to use the net proceeds from the sale of shares of our common stock primarily (i) to repay outstanding indebtedness, (ii) to fund investments in debt securities and CLO investments in accordance with our investment objective and (iii) for general corporate purposes.

The indebtedness we may repay with the net proceeds of this offering includes the 6.50% Notes due 2024, the 6.25% Notes due 2026 and the 5.50% Notes due 2028.

We anticipate that we will use substantially all of the net proceeds of this offering for the above purposes within three months after the completion of this offering, depending on the availability of attractive opportunities and market conditions. However, we can offer no assurance that we will be able to achieve this goal.

Pending these uses, we will invest such net proceeds primarily in cash, cash equivalents, and U.S. government securities and other high-quality debt investments that mature in one year or less, which are consistent with maintaining our election as a RIC. These temporary investments are expected to provide a lower net return than we hope to achieve from our target investments. The management fee payable by us to our investment adviser will not be reduced while our assets are invested in such temporary investments.

A $0.10 increase or decrease in the estimated purchase price of $2.87 per share would increase or decrease the net proceeds from this offering by approximately $1.7 million, before deducting the estimated offering expenses payable by us and payments to the dealer manager.

S-14

CAPITALIZATION

The following table sets forth:

• our actual capitalization as of March 31, 2023; and

• on an as adjusted basis to give effect to the sale of 16,633,723 shares of our common stock in this offering, assuming all rights are exercised at an estimated subscription price of $2.87 per share and our receipt of the estimated net proceeds from that sale, assuming that none of our affiliates or affiliates of Oxford Square Management subscribe for shares.

|

As of March 31, 2023 |

||||||||

|

Actual |

As Adjusted for this Offering |

|||||||

|

Assets: |

|

|

|

|

||||

|

Non-affiliate/non-control investments (cost: $500,195,807 and $500,195,807, respectively) |

$ |

314,599,117 |

|

$ |

314,599,117 |

|

||

|

Affiliated investment (cost: $16,836,822 and $16,836,822, respectively) |

|

5,070,307 |

|

|

5,070,307 |

|

||

|

Cash and cash equivalents |

|

10,763,167 |

|

|

10,763,167 |

|

||

|

Interest and distributions receivable |

|

4,047,953 |

|

|

4,047,953 |

|

||

|

Other assets |

|

736,375 |

|

|

736,375 |

|

||

|

Total assets |

$ |

335,216,919 |

|

$ |

335,216,919 |

|

||

|

Liabilities: |

|

|

|

|

||||

|

Notes payable – 6.50% Unsecured Notes, net of deferred issuance costs |

$ |

64,044,632 |

|

$ |

18,135,557 |

|

||

|

Notes payable – 6.25% Unsecured Notes, net of deferred issuance costs |

|

44,071,474 |

|

|

44,071,474 |

|

||

|

Notes payable – 5.50% Unsecured Notes, net of deferred issuance costs |

|

78,441,304 |

|

|

78,441,304 |

|

||

|

Other liabilities(1) |

|

8,820,361 |

|

|

9,056,361 |

|

||

|

Total liabilities |

|

195,377,771 |

|

|

149,704,696 |

|

||

|

Net Assets: |

|

|

|

|

||||

|

Common stock, par value $0.01 per share; 100,000,000 shares authorized, 49,885,954 and 66,519,677 shares issued and outstanding, respectively |

|

498,859 |

|

|

665,197 |

|

||

|

Capital in excess of par value |

|

434,871,321 |

|

|

480,378,058 |

|

||

|

Total distributable earnings/(accumulated losses) |

|

(295,531,032 |

) |

|

(295,531,032 |

) |

||

|

Total net assets |

$ |

139,839,148 |

|

|

185,512,223 |

|

||

|

Total liabilities and net assets |

$ |

335,216,919 |

|

$ |

335,216,919 |

|

||

____________

(1) Other liabilities “as adjusted for this offering” reflect estimated accrued deferred offering costs of $236,000.

A $0.10 increase or decrease in the estimated purchase price of $2.87 per share would increase or decrease the cash and total assets by approximately $1.7 million, before deducting the estimated offering expenses payable by us and payments to the dealer manager.

S-15

DILUTION

The NAV dilution to investors in this offering will be represented by the difference between the subscription price and the pro forma NAV per share of our common stock after this offering. NAV per share is determined by dividing our NAV, which is our total tangible assets less total liabilities, by the number of outstanding shares of common stock.

As of March 31, 2023, our net assets were $139.8 million, or approximately $2.80 per share. After giving effect to the sale of 16,633,723 shares of our common stock in this offering, assuming all rights are exercised at an estimated subscription price per share of $2.87, and our receipt of the estimated net proceeds from that sale (which includes the deduction of estimated offering costs of $236,000), our pro forma NAV as of March 31, 2023 would have been approximately $185.5 million, or approximately $2.79 per share, representing an immediate dilution of approximately $0.01 per share to our existing stockholders. This offering will also cause dilution in the net investment income per share of our common stock, which may affect the amount we are able to distribute per share subsequent to completion of the offering.

The following table illustrates the dilutive effects of this offering on a per share basis, assuming all rights are exercised at an estimated subscription price per share of $2.87:

|

As of March 31, 2023 |

||||||

|

Actual |

As Adjusted |

|||||

|

NAV per common share |

$ |

2.80 |

$ |

2.79 |

||

|

Three Months Ended |

||||||||

|

Actual |

As Adjusted |

|||||||

|

Net increase in net assets resulting from net investment income per common |

$ |

0.13 |

(1) |

$ |

0.10 |

(2) |

||

|

Net increase in net assets resulting from operations per common share |

$ |

0.13 |

(1) |

$ |

0.09 |

(2) |

||

|

Distributions per common share |

$ |

0.105 |

|

$ |

0.079 |

(3) |

||

____________

(1) Basic and diluted, weighted average number of shares outstanding is 49,858,366.

(2) Assumes that on January 1, 2023, the beginning of the indicated period, (1) all rights were exercised at an estimated subscription price per share of $2.87, (2) 16,633,723 shares of our common stock were issued upon exercise of such rights and (3) no affiliates of ours or Oxford Square Management subscribed for shares.

(3) Assumes actual cash distributions divided by adjusted shares, including shares issued upon exercise of rights.

S-16

SALES OF COMMON STOCK BELOW NET ASSET VALUE

If the subscription price per share pursuant to this rights offering is less than our NAV per share, shares of our common stock will be sold below NAV. Our board of directors, including our independent directors, has determined that the sale of shares of our common stock below NAV pursuant to the exercise of the rights issued in this offering is in our best interests and in the best interests of our stockholders (including those stockholders who do not exercise their rights in the offering).

In making a determination that the sale of common stock below NAV per share pursuant to the exercise of the rights issued in this rights offering is in our and our stockholders’ best interests, our board of directors considered a variety of factors including:

• the effect that a sale of common stock below NAV per share would have on our stockholders, including the potential dilution to the NAV per share of our common stock our stockholders would experience as a result of the issuance, including dilution for those stockholders who do not exercise the rights issued to them in the offering;

• the amount per share by which the subscription price per share and the net proceeds per share are less than our most recently determined NAV per share;

• the relationship of recent market prices of our common stock to NAV per share and the potential impact of the issuance on the market price per share of our common stock;

• the potential dilution in the net investment income per share of our common stock, which may affect the amount we are able to distribute subsequent to completion of the offering;

• the potential market impact of being able to raise capital during the current financial market difficulties;

• the anticipated rate of return on and quality, type and availability of investments; and

• the leverage available to us.

Our board of directors also considered the fact that Oxford Square Management will benefit from this offering because Oxford Square Management will earn additional investment management fees on the proceeds of the sale of shares of common stock upon exercise of rights in the same manner as it would from the offering of any other of our securities or from the offering of common stock at premium to NAV per share.

The sale by us of our common stock at a discount to NAV per share upon the exercise of the rights issued in this offering poses potential risks for our existing stockholders whether or not they participate in this rights offering. Any sale of common stock at a price below NAV per share results in an immediate dilution to our existing common stockholders who do not fully exercise the rights issued to them in this rights offering to purchase their pro rata portion of the shares of common stock issued. See “Risk Factors — Your economic and voting interest in us, as well as your proportionate interest in our NAV, could be diluted as a result of this offering.”

The following two headings and accompanying tables explain and provide hypothetical examples on the impact of the rights offering if the subscription price is less than NAV per share on three different types of investors:

• existing stockholders who do not participate in the rights offering; and

• existing stockholders who subscribe for a relatively small amount of shares in the rights offering or a relatively large amount of shares in the rights offering.

Impact on Existing Stockholders Who Do Not Participate in the Rights Offering

If shares of our common stock are sold below NAV per share pursuant to the exercise of the rights issued in this offering, our existing stockholders who do not exercise the rights issued to them or who do not buy additional shares in the secondary market at the same or lower price as we obtain for subscriptions in the rights offering (after expenses and commissions) face the greatest potential risks. These stockholders will experience an immediate dilution in the NAV of the shares of common stock they hold and their NAV per share. These stockholders will also experience a disproportionately greater decrease in their participation in our earnings and assets and their voting power than the increase we will experience in our assets, potential earning power and voting interests due to such rights offering.

S-17

These stockholders could also experience a decline in the market price of their shares, which often reflects to some degree announced or potential increases and decreases in NAV per share. This decrease could be more pronounced as the size of the issuance pursuant to the rights offering and level of discounts increase. Further, if existing stockholders do not exercise their right to purchase any shares in order to maintain their percentage interest, regardless of whether such issuance is above or below the then current NAV, their voting power will be diluted.

The following chart illustrates the level of NAV dilution that would be experienced by a non-participating stockholder in three different hypothetical issuances of different sizes and levels of discount from NAV per share. It is not possible to predict the level of market price decline that could occur.

The examples assume that the issuer has approximately 49.9 million shares outstanding, $335.2 million in total assets and $195.4 million in total liabilities. The current NAV and NAV per share are thus $139.8 million and $2.80. The chart illustrates the dilutive effect on Stockholder A of (a) an issuance of approximately 2.5 million shares of common stock (5% of the outstanding shares) purchased at a subscription price of $2.66 per share before expenses and dealer manager fees (a 5% discount from NAV), (b) an issuance of approximately 5.0 million shares of common stock (10% of the outstanding shares) purchased at a subscription price of $2.52 per share before expenses and dealer manager fees (a 10% discount from NAV), (c) an issuance of approximately 10.0 million shares of common stock (20% of the outstanding shares) purchased at a subscription price of $2.24 per share before expenses and dealer manager fees (a 20% discount from NAV) and (d) an issuance of approximately 12.5 million shares of common stock (25% of the outstanding shares) purchased at a subscription price of $2.10 per share before expenses and dealer (a 25% discount from NAV). The example assumes a dealer manager fee of 4.00% is paid on all shares.

|

Example 1 |

Example 2 |

Example 3 |

Example 4 |

|||||||||||||||||||||||||||||

|

5% Issuance at |

10% Issuance at |

20% Issuance at |

25% Issuance at |

|||||||||||||||||||||||||||||

|

Prior to Sale Below NAV |

Following Sale |

% |

Following Sale |

% |

Following Sale |

% |

Following Sale |

% Change |

||||||||||||||||||||||||

|

Issuance Price |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Subscription Price per Share |

|

|

$ |

2.66 |

|

— |

|

$ |

2.52 |

|

— |

|

$ |

2.24 |

|

— |

|

$ |

2.10 |

|

— |

|

||||||||||

|

Net Proceeds per Share to Issuer |

|

|

$ |

2.55 |

|

— |

|

$ |

2.42 |

|

— |

|

$ |

2.15 |

|

— |

|

$ |

2.02 |

|

— |

|

||||||||||

|

Decrease to NAV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Total Shares Outstanding |

|

49,885,954 |

|

|

52,380,252 |

|

5.00 |

% |

|

54,874,549 |

|

10.00 |

% |

|

59,863,145 |

|

20.00 |

% |

|

62,357,443 |

|

25.00 |

% |

|||||||||

|

NAV per Share |

$ |

2.80 |

|

$ |

2.79 |

|

(0.47 |

)% |

$ |

2.77 |

|

(1.18 |

)% |

$ |

2.69 |

|

(4.04 |

)% |

$ |

2.65 |

|

(5.46 |

)% |

|||||||||

|

Dilution to Nonparticipating Stockholder A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Shares Held by Stockholder A |

|

498,860 |

|

|

498,860 |

|

0.00 |

% |

|

498,860 |

|

0.00 |

% |

|

498,860 |

|

0.00 |

% |

|

498,860 |

|

0.00 |

% |

|||||||||

|

Percentage Held by Stockholder A |

|

1.00 |

% |

|

0.95 |

% |

(5.00 |

)% |

|

0.91 |

% |

(9.00 |

)% |

|

0.83 |

% |

(17.00 |

)% |

|

0.80 |

% |

(20.00 |

)% |

|||||||||

|

Total NAV Held by Stockholder A |

$ |

1,398,391 |

|

$ |

1,388,896 |

|

(0.68 |

)% |

$ |

1,382,395 |

|

(1.14 |

)% |

$ |

1,338,708 |

|

(4.27 |

)% |

$ |

1,320,252 |

|

(5.59 |

)% |

|||||||||

|

Total Investment by Stockholder A (Assumed to Be $2.80 per |

$ |

1,398,391 |

|

$ |

1,398,391 |

|

— |

|

$ |

1,398,391 |

|

— |

|

$ |

1,398,391 |

|

— |

|

$ |

1,398,391 |

|

— |

|

|||||||||

|

Total Dilution to Stockholder A (Total NAV Less Total Investment) |

|

|

$ |

(9,495 |

) |

|

$ |

(15,996 |

) |

|

$ |

(59,683 |

) |

|

$ |

(78,139 |

) |

|

||||||||||||||

|

Investment per Share Held by Stockholder A (Assumed to be $2.80 per Share on Shares Held Prior to Sale) |

$ |

2.80 |

|

$ |

2.80 |

|

0.00 |

% |

$ |

2.80 |

|

0.00 |

% |

$ |

2.80 |

|

0.00 |

% |

$ |

2.80 |

|

0.00 |