UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14-a6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under §240.14a-12 |

TICC Capital

Corp.

(Name of Registrant as Specified In Its Charter)

NexPoint

Advisors, L.P.

Dr. Bob Froehlich

John Honis

Timothy K. Hui

Ethan Powell

William M. Swenson

Bryan A. Ward

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of the transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

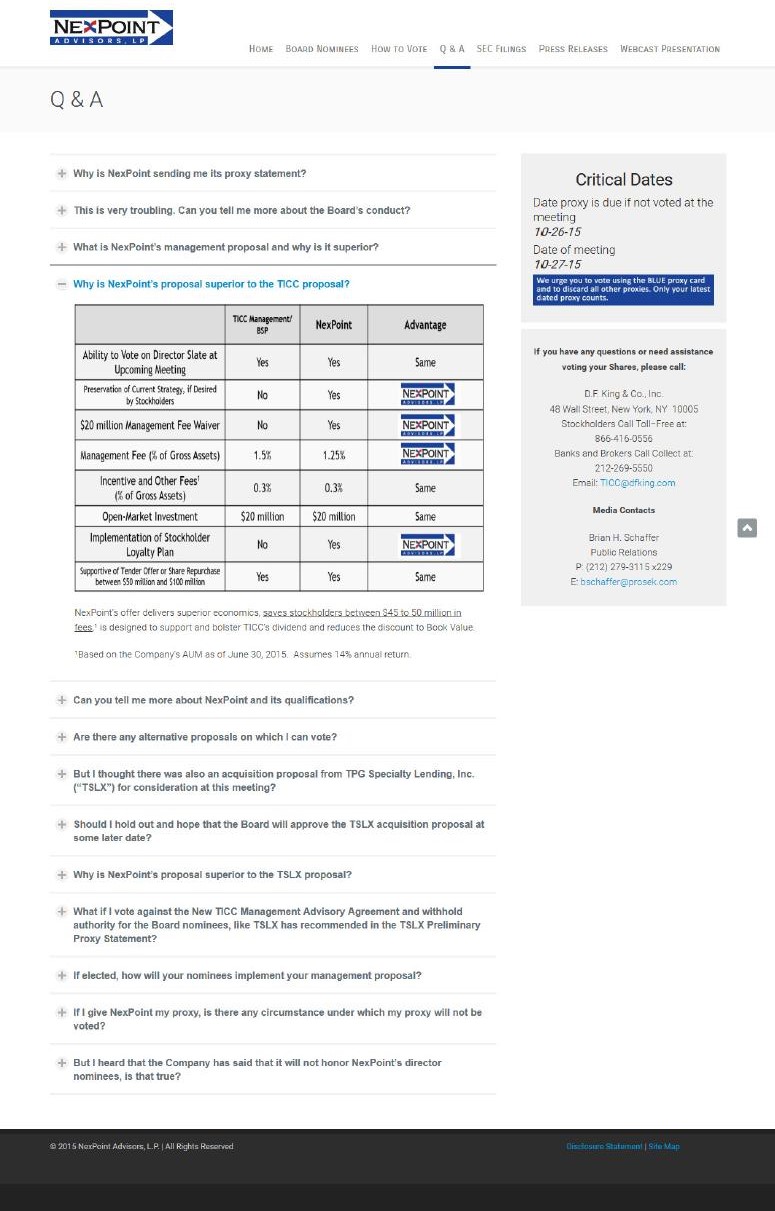

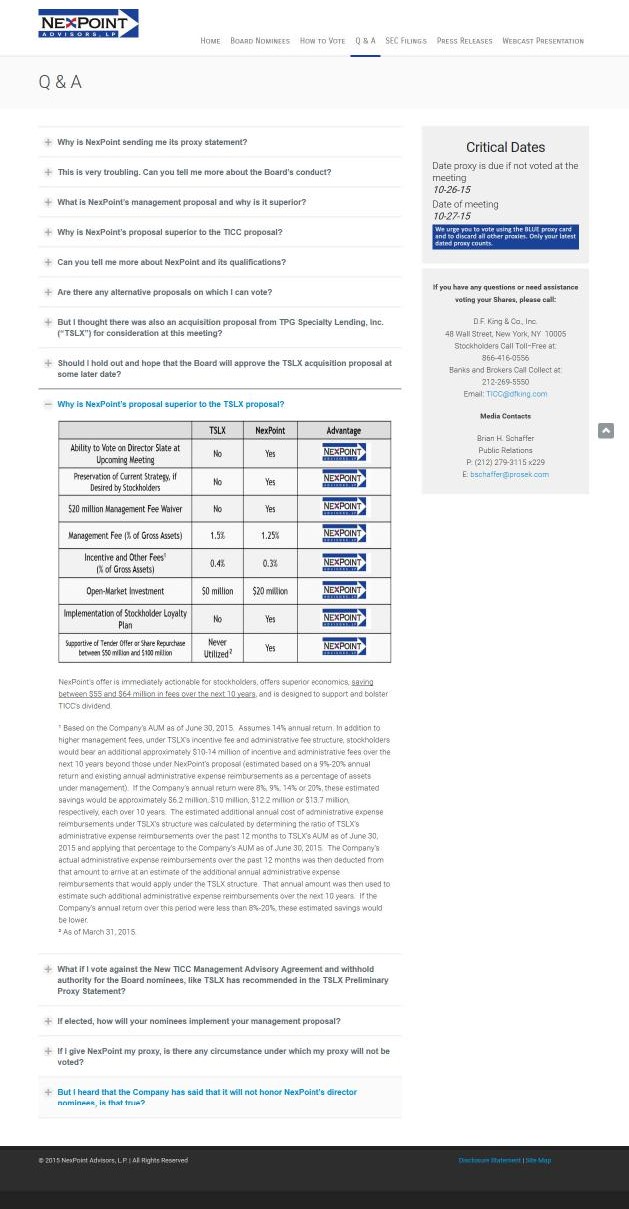

NexPoint Advisors, L.P. (“NexPoint”) has filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) of a proxy statement and accompanying BLUE proxy card to be used to solicit votes for the special meeting of stockholders of the Company scheduled to be held on October 27, 2015 (the “Special Meeting”): (i) AGAINST TICC Capital Corp.’s (the “Company”) proposal to approve a new investment advisory agreement between the Company and TICC Management, LLC, (ii) FOR a competing slate of six director nominees nominated by NexPoint and (iii) AGAINST the Company’s proposal to adjourn the Special Meeting in the event that a quorum is present and the Company’s proposals did not receive sufficient votes for approval.

This Schedule 14A filing consists of the following screenshots, which reflect content not previously filed with the SEC available at http://www.timetochangeticc.com/, a website established by NexPoint that contains information regarding the above solicitation.