Table of Contents

As filed with the Securities and Exchange Commission on June 17, 2011

Registration Statement No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CARMAX AUTO FUNDING LLC

(Depositor for the Trusts described herein)

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 6189 | 01-0794037 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary SIC Code Number) |

(I.R.S. Employer Identification No.) |

12800 Tuckahoe Creek Parkway, Suite 400

Richmond, Virginia 23238

(804) 935-4512

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Keith D. Browning

President

CarMax Auto Funding LLC

12800 Tuckahoe Creek Parkway, Suite 400

Richmond, Virginia 23238

(804) 935-4512

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Peter E. Kane, Esq. McGuireWoods LLP 901 East Cary Street Richmond, Virginia 23219 (804) 775-1000 |

Dale W. Lum, Esq. Sidley Austin LLP 555 California Street Suite 2000 San Francisco, California 94104 (415) 772-1200 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement as determined by market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark weather the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per |

Proposed Maximum Aggregate Offering |

Amount of Registration Fee(2) | ||||

| Asset Backed Notes |

$1,000,000 | 100% | $1,000,000 | $116.10 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | Calculated pursuant to Rule 457(a) of the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this Prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated [ ], 20[ ]

PROSPECTUS SUPPLEMENT

(To Prospectus dated [ ], 20[ ])

$[ ]

CarMax Auto Owner Trust 20[ ]-[ ]

Issuing Entity

[The issuing entity expects to issue fixed rate notes only, however, reserves the right to issue floating rate notes.]

| Initial Principal Amount |

Interest Rate(1) | Final Scheduled Payment Date | ||||||||||||

| Class A-1 Asset Backed Notes |

$ | % | ||||||||||||

| Class A-2 Asset Backed Notes |

$ | % | ||||||||||||

| Class A-3 Asset Backed Notes |

$ | % | ||||||||||||

| Class A-4 Asset Backed Notes |

$ | % | ||||||||||||

| Class B Asset Backed Notes |

$ | % | ||||||||||||

| Class C Asset Backed Notes |

$ | % | ||||||||||||

| [Class D Asset Backed Notes] |

$ | % | ||||||||||||

| [(1)] | [The interest rate for each class of notes will be a fixed rate, a floating rate or combination of a fixed rate and a floating rate if that class has both a fixed rate tranche and a floating rate tranche. If the interest rate is a floating rate, the rate will be based on LIBOR. If the issuing entity issues any floating rate notes, it will enter into a corresponding interest rate swap transaction with respect to each class or tranche of floating rate notes with the swap counterparty.] |

| CarMax Business Services, LLC Sponsor and Servicer

CarMax Auto Funding LLC Depositor |

|

You should carefully read the risk factors beginning on page S-16 of this prospectus supplement and on page 6 of the prospectus.

The notes are asset backed securities. The notes will be obligations of the issuing entity only and will not be obligations of or interests in CarMax, Inc., CarMax Business Services, LLC, CarMax Auto Funding LLC or any of their affiliates. Neither the notes nor the receivables are insured or guaranteed by any government agency.

This prospectus supplement may be used to offer and sell the offered notes only if accompanied by the prospectus.

The following classes of notes are offered pursuant to this prospectus supplement.

| Price | Underwriting Discounts | Net Proceeds to the Depositor | ||||||||||||||||

|

Class A-1 Asset Backed Notes |

$ |

( %) |

$ |

( %) |

$ |

( %) | ||||||||||||

|

Class A-2 Asset Backed Notes |

$ |

( %) |

$ |

( %) |

$ |

( %) | ||||||||||||

|

Class A-3 Asset Backed Notes |

$ |

( %) |

$ |

( %) |

$ |

( %) | ||||||||||||

|

Class A-4 Asset Backed Notes |

$ |

( %) |

$ |

( %) |

$ |

( %) | ||||||||||||

| Class B Asset Backed Notes |

$ |

( %) |

$ |

( %) |

$ |

( %) | ||||||||||||

| Class C Asset Backed Notes |

$ |

( %) |

$ |

( %) |

$ |

( %) | ||||||||||||

| [Class D Asset Backed Notes] |

$ |

( %) |

$ |

( %) |

$ |

( %) | ||||||||||||

|

Total |

$ | $ | $ | |||||||||||||||

| (1) | The net proceeds to the depositor exclude expenses, estimated at $[ ]. |

The notes are payable solely from the assets of the issuing entity, which consist primarily of a pool of motor vehicle retail installment sale contracts.

The trust will pay interest and principal on the notes monthly on the 15th day of each month or, if the 15th day is not a business day, on the next business day, beginning [ ], 20[ ]. The price of the notes will also include accrued interest, if any, from the date of initial issuance.

The trust generally will pay principal sequentially to each class of notes in order of seniority (starting with the class A-1 notes) until each class is paid in full.

The credit enhancement for the notes will be subordination, overcollateralization, a reserve account and excess collections on the receivables.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this prospectus supplement or the prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

Delivery of the notes, in book-entry form only, will be made through The Depository Trust Company against payment in immediately available funds, on or about [ ], 20[ ].

Joint Bookrunners

| [ ] |

[ ] | |||

| Co-Managers

| ||||

| [ ] |

[ ] |

[ ] | ||

The date of this Prospectus Supplement is , 20[ ].

Table of Contents

| Page | ||||

| S-3 | ||||

| S-3 | ||||

| S-4 | ||||

| S-5 | ||||

| S-16 | ||||

| S-23 | ||||

| S-23 | ||||

| S-23 | ||||

| S-23 | ||||

| S-24 | ||||

| S-25 | ||||

| S-26 | ||||

| S-26 | ||||

| S-26 | ||||

| S-27 | ||||

| S-28 | ||||

| S-28 | ||||

| S-29 | ||||

| S-29 | ||||

| S-31 | ||||

| S-31 | ||||

| S-32 | ||||

| S-32 | ||||

| S-33 | ||||

| S-33 | ||||

| S-38 | ||||

| S-38 | ||||

| S-44 | ||||

| Computing Your Portion of the Outstanding Principal Amount of the Notes |

S-44 | |||

| S-44 | ||||

| S-44 | ||||

| S-44 | ||||

| S-46 | ||||

| S-47 | ||||

| S-49 | ||||

| S-49 | ||||

| Page | ||||

| S-49 | ||||

| S-49 | ||||

| S-49 | ||||

| S-52 | ||||

| S-55 | ||||

| S-55 | ||||

| S-57 | ||||

| S-57 | ||||

| S-57 | ||||

| S-57 | ||||

| S-57 | ||||

| S-57 | ||||

| S-58 | ||||

| S-58 | ||||

| S-59 | ||||

| S-59 | ||||

| S-59 | ||||

| S-59 | ||||

| S-59 | ||||

| S-60 | ||||

| S-60 | ||||

| S-60 | ||||

| S-60 | ||||

| S-61 | ||||

| S-62 | ||||

| S-62 | ||||

| S-62 | ||||

| S-64 | ||||

| Affiliations and Certain Relationships and Related Transactions |

S-67 | |||

| S-67 | ||||

| S-67 | ||||

| S-67 | ||||

| S-68 | ||||

| A-I-1 | ||||

S-2

Table of Contents

READING THIS PROSPECTUS SUPPLEMENT AND THE PROSPECTUS

This prospectus supplement and the prospectus provide information about the issuing entity, CarMax Auto Owner Trust 20[ ]-[ ], and the terms and conditions that apply to the Notes to be issued by the issuing entity. We provide information in two documents that offer varying levels of detail:

Prospectus—provides general information, some of which may not apply to the Notes.

Prospectus Supplement—provides specific information about the terms of the Notes.

We suggest you read this prospectus supplement and the prospectus in their entirety. The prospectus supplement pages begin with “S”. If the information in this prospectus supplement varies from the information in the accompanying prospectus, you should rely on the information in this prospectus supplement.

We include cross-references to sections in these documents where you can find further related discussions. Refer to the Table of Contents in this prospectus supplement and in the prospectus to locate the referenced sections.

You should rely only on information on the Notes provided in this prospectus supplement and the prospectus. We have not authorized anyone to provide you with different information.

Any projections, expectations and estimates contained in this prospectus supplement are not purely historical in nature but are forward-looking statements based upon information and certain assumptions CarMax Business Services and the depositor consider reasonable, are subject to uncertainties as to circumstances and events that have not as yet taken place and are subject to material variation. Neither CarMax Business Services nor the depositor has any obligation to update or otherwise revise any forward-looking statements including changes in economic conditions, portfolio or asset pool performance or other circumstances or developments that may arise after the date of this prospectus supplement.

S-3

Table of Contents

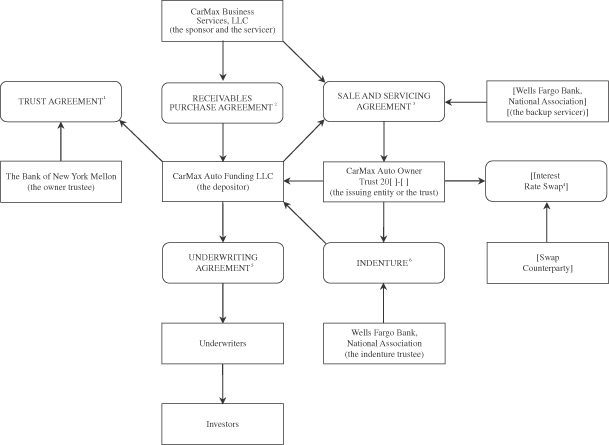

The following diagram identifies the transaction parties and the principal transaction documents. A form of each of these principal documents has been filed as an exhibit to the registration statement that includes the prospectus.

| 1 | The trust agreement will create the trust as a Delaware statutory trust, establish the terms of the certificates, provide for the issuance of the certificates to the depositor, direct how payments are to be made on the certificates, establish the rights of the certificateholders and establish the rights and duties of the owner trustee. |

| 2 | The receivables purchase agreement will transfer the receivables from the sponsor to the depositor, contain representations and warranties of the sponsor concerning the receivables and require the sponsor to repurchase receivables as to which certain representations and warranties are breached. |

| 3 | The sale and servicing agreement will transfer the receivables from the depositor to the trust, contain representations and warranties of the depositor concerning the receivables, require the depositor to repurchase receivables as to which certain representations and warranties are breached, appoint the servicer and [the backup servicer], establish the rights and duties of the servicer and [the backup servicer], require the servicer to purchase receivables as to which certain servicing covenants are breached and provide for compensation of the servicer and [the backup servicer]. |

| 4 | The interest rate swap will provide for the making of fixed rate interest payments by the trust and floating rate interest payments by the swap counterparty. |

| 5 | The underwriting agreement will provide for the sale of the offered notes by the depositor to the underwriters and the offer of the offered notes by the underwriters to investors. |

| 6 | The indenture will provide for the pledge of the receivables by the trust to the indenture trustee, establish the terms of the notes, provide for the issuance of the notes to the depositor, direct how payments are to be made on the notes, establish the rights of the noteholders and establish the rights and duties of the indenture trustee. |

S-4

Table of Contents

SUMMARY OF THE NOTES AND THE TRANSACTION STRUCTURE

This summary describes the main terms of the notes and this securitization transaction. This summary does not contain all of the information that may be important to you. To fully understand the terms of the notes and this securitization transaction, you will need to read both this prospectus supplement and the attached prospectus in their entirety.

Transaction Overview

CarMax Business Services, LLC will sell to CarMax Auto Funding LLC a pool of receivables consisting of motor vehicle retail installment sale contracts originated by certain affiliates of CarMax Business Services. CarMax Funding will sell the receivables to the trust in exchange for the notes and the certificates. CarMax Funding will use the net proceeds from the sale of the offered notes to pay CarMax Business Services for the receivables. The trust will rely upon collections on or in respect of the receivables and the funds on deposit in certain accounts to make payments on the notes. The trust will be solely liable for the payment of the notes. The notes will be obligations of the trust secured by the assets of the trust. The notes will not represent interests in or obligations of CarMax, Inc., CarMax Business Services, CarMax Funding or any other person or entity other than the trust. Neither the notes nor the receivables are insured or guaranteed by any government agency.

Transaction Parties

Sponsor and Servicer

CarMax Business Services, LLC is the sponsor of this securitization transaction and will service the receivables on behalf of the trust. CarMax Business Services’s principal executive offices are located at 12800 Tuckahoe Creek Parkway, Richmond, Virginia 23238, and its telephone number is (804) 747-0422.

Depositor and Seller

CarMax Auto Funding LLC will be the depositor for this securitization transaction. CarMax Funding’s principal executive offices are located at 12800 Tuckahoe Creek Parkway, Suite 400, Richmond, Virginia 23238, and its telephone number is (804) 935-4512.

Issuing Entity or Trust

CarMax Auto Owner Trust 20[ ]-[ ] will be the issuing entity for this securitization transaction. The trust will be governed by an amended and restated trust agreement, dated as of [ ], 20[ ], among CarMax Funding, BNY Mellon Trust of Delaware, as Delaware trustee, and The Bank of New York Mellon, as owner trustee.

Administrator

CarMax Business Services will act as administrator of the trust.

Owner Trustee

The Bank of New York Mellon will act as owner trustee of the trust.

Delaware Trustee

BNY Mellon Trust of Delaware will act as Delaware trustee of the trust.

Indenture Trustee [and Backup Servicer]

Wells Fargo Bank, National Association will act as indenture trustee with respect to the notes [and will act as backup servicer pursuant to the sale and servicing agreement.]

[Swap Counterparty]

[The issuing entity expects to issue fixed rate classes of notes only, however, the issuing entity retains the right, in its sole discretion, to issue floating rate classes or tranches of notes in addition to the fixed rate classes or tranches of notes. If any floating rate classes or tranches of notes are issued, will be the swap counterparty.]

S-5

Table of Contents

Terms of the Notes

The following classes of notes are being offered by this prospectus supplement:

| Note Class |

Aggregate Principal Amount |

Interest Rate Per Annum |

||||||

| A-1 |

$ | % | ||||||

| A-2 |

$ | % | ||||||

| A-3 |

$ | % | ||||||

| A-4 |

$ | % | ||||||

| B |

$ | % | ||||||

| C |

$ | % | ||||||

| [D] |

$ | % | ||||||

[The interest rate for each class of notes will be a fixed rate, a floating rate or a combination of a fixed rate and a floating rate if that class has both a fixed rate tranche and a floating rate tranche. For example, the class A-2 notes may be divided into a fixed rate tranche and a floating rate tranche, in which case the class A-2a notes will be fixed rate notes and a class A-2b notes will be a floating rate notes. If the interest rate is a floating rate, the rate will be based on LIBOR. We refer in this prospectus supplement to notes that bear interest at a fixed rate as “fixed rate notes” and to notes that bear interest at a floating rate as “floating rate notes.”]

[For each class or tranche of floating rate notes, the trust will enter into a corresponding interest rate swap transaction with the swap counterparty.]

The notes will represent obligations of the trust secured by the assets of the trust. Each class of notes with a lower alphabetical designation will be subordinated to each other class of notes with a higher alphabetical designation (i.e., A is higher than B, B is higher than C [and C is higher than D]). The notes will bear interest at the rates set forth above and calculated in the manner described below under “Interest Accrual”.

Terms of the Certificates

The trust will issue the CarMax Auto Owner Trust 20[ ]-[ ] certificates to CarMax Funding. The certificates are not being offered by this prospectus supplement. The certificates will not bear interest and all payments in respect of the certificates will be subordinated to payments on the notes. The certificates generally will evidence the residual interest in the trust and the right to receive any excess amounts not needed on any distribution date to pay the servicing fee and certain expenses of the servicer, make required payments [to the swap counterparty and] on the notes or make deposits into the reserve account.

Investment in the Notes

There are material risks associated with an investment in the notes.

For a discussion of the risks that should be considered in deciding whether to purchase any of the notes, see “Risk Factors” in this prospectus supplement and in the prospectus.

Statistical Calculation Date

The statistical calculation date is the close of business on [ ], 20[ ]. This is the date used in preparing the statistical information presented in this prospectus supplement. As of this date, the aggregate outstanding principal balance of the receivables was $[ ]. The receivables transferred to the trust on the closing date will have an aggregate principal balance of not less than $[ ] as of the cutoff date.

Cutoff Date

The cutoff date is the close of business on or about [ ], 20[ ].

Closing Date

The closing date will be on or about [ ], 20[ ].

Distribution Dates

The 15th day of each month (or, if the 15th day is not a business day, the next succeeding business day). The first distribution date will be [ ], 20[ ].

Record Dates

On each distribution date, the trust will make payments to the holders of the notes as of the related record date. The record dates will be the business day

S-6

Table of Contents

preceding each distribution date or, if the notes have been issued in fully registered, certificated form, the last business day of the preceding month.

Minimum Denominations

The notes will be issued in minimum denominations of $[5,000] and integral multiples of $[1,000] in excess of $[5,000], [except that notes in respect of which the issue proceeds are to be received by the trust in the United Kingdom and which have a maturity of less than one year from the closing date will only be issued if:

| • | the denomination of each such note is not less than £100,000 or an equivalent amount in United States dollars; and |

| • | such notes are issued to a limited class of professional investors.] |

For a more detailed description of the offer and sale of the notes, see “Underwriting” in this prospectus supplement.

Interest Rates

The trust will pay interest on each class of notes at the rate specified above under “Terms of the Notes”.

Interest Accrual

Class A-1 Notes [and Floating Rate Notes]

“Actual/360”, accrued from and including the prior distribution date (or from and including the closing date, in the case of the first distribution date) to but excluding the current distribution date.

[Fixed Rate] Notes Other Than Class A-1 Notes

“30/360”, accrued from and including the 15th day of the prior month (or from and including the closing date, in the case of the first distribution date) to but excluding the 15th day of the current month (assuming each month has 30 days).

This means that, if there are no outstanding shortfalls in the payment of interest, the interest due on each distribution date will be the product of:

| • | the outstanding principal amount of a class of notes; |

| • | the interest rate of that class of notes; and |

| (i) | in the case of the class A-1 notes [and floating rate notes], the actual number of days in the interest period divided by 360; or |

| (ii) | in the case of the other classes of notes, 30 (or, in the case of the first distribution date, assuming a closing date of [ ], 20[ ], [ ]) divided by 360. |

Interest Payments

On each distribution date, the trust will not pay interest to a class of notes until all interest due on that distribution date to any class of notes with a higher alphabetical designation has been paid in full. In addition, if the notes have not been accelerated following the occurrence of an event of default under the indenture, the trust will not pay interest to a class of notes until certain principal payments have been made to each class of notes with a higher alphabetical designation. If the notes have been accelerated following the occurrence of certain events of default under the indenture, the trust will not pay interest to a class of notes until each class of notes with a higher alphabetical designation has been paid in full.

On each distribution date, the trust will pay interest to the class A notes without regard to numerical designation. If the amount available on any distribution date to pay interest on the class A notes is less than the interest due on the class A notes on that distribution date, the trust will pay the available amount to the class A notes pro rata (based on the aggregate amount of interest due on each class of class A notes).

For a more detailed description of the payment of interest, see “Description of the Notes—Payments of Interest” and “Application of Available Funds”.

Principal Payments

On each distribution date, unless the notes have been accelerated following the occurrence of an event of default under the indenture, from the amounts allocated to the holders of the notes to pay principal described in clauses (5), (7), (9), (11) and (13) under

S-7

Table of Contents

“—Priority of Distributions (Pre-Acceleration)”, the trust will pay principal of the notes in the following order of priority:

| (1) | to the class A-1 notes until they have been paid in full; |

| (2) | to the class A-2 notes until they have been paid in full; |

| (3) | to the class A-3 notes until they have been paid in full; |

| (4) | to the class A-4 notes until they have been paid in full; |

| (5) | to the class B notes until they have been paid in full; |

| (6) | to the class C notes until they have been paid in full; and |

| [(7)] | [to the class D notes until they have been paid in full.] |

[If a class is split into a fixed rate tranche and a floating rate tranche, that class will be treated as a single class for the purpose of principal payments.]

If the notes have been accelerated following the occurrence of an event of default under the indenture, the trust will pay principal of the notes as described in “Application of Available Funds—Priority of Distributions (Post-Acceleration)”.

If not paid earlier, all principal and interest with respect to a class of notes will be payable in full on the final scheduled distribution date for that class. The final scheduled distribution dates for the notes are as follows:

| Note Class |

Final Scheduled | |

| A-1 |

||

| A-2 |

||

| A-3 |

||

| A-4 |

||

| B |

||

| C |

||

| [D] |

For a more detailed description of the payment of principal, see “Description of the Notes—Payments of Principal”, “Application of Available Funds” and “The Indenture—Rights Upon Event of Default”.

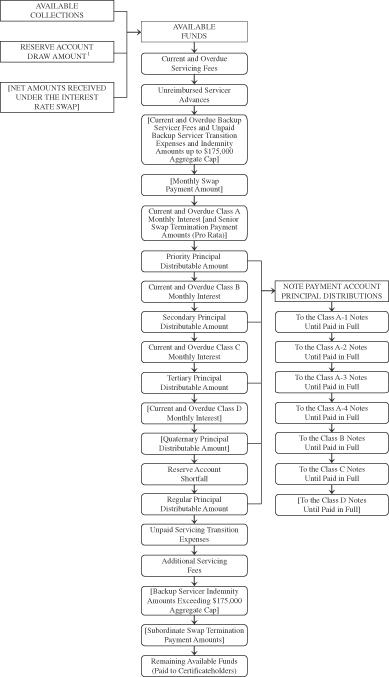

Priority of Distributions (Pre-Acceleration)

On each distribution date, unless the notes have been accelerated following the occurrence of an event of default under the indenture, from amounts received on or with respect to the receivables during the related collection period, [the net amount, if any, received by the trust under the interest rate swap for that distribution date] and amounts withdrawn from the reserve account, the trust will pay the following amounts in the following order of priority:

| (1) | the servicing fee for the related collection period plus any overdue servicing fees for prior collection periods plus any nonrecoverable servicer advances not previously reimbursed will be paid to the servicer, the backup servicer or any other successor servicer, as applicable; |

| (2) | the backup servicer fee for the related collection period plus any overdue backup servicer fees for prior collection periods plus any unpaid indemnity amounts due to the backup servicer plus, if the backup servicer has replaced CarMax Business Services as servicer, any unpaid transition expenses due in respect of the transfer of servicing to the backup servicer will be paid to the backup servicer, provided that the aggregate amount of such indemnity amounts and transition expenses paid pursuant to this clause (2) shall not exceed $175,000; |

| [(3)] | [the monthly swap payment amount will be paid to the swap counterparty;] |

| (4) | [pro rata,] interest on the class A notes will be paid to the holders of notes of that class [and any senior swap termination payment amounts owed by the trust will be paid to the swap counterparty]; |

| (5) | principal of the notes in an amount equal to the amount by which the aggregate principal amount of the class A notes exceeds the aggregate outstanding principal balance of the receivables as of the last day of the related collection period will be paid to the holders of notes of that class; |

| (6) | interest on the class B notes will be paid to the holders of notes of that class; |

| (7) | principal of the notes in an amount equal to the amount by which the sum of the aggregate |

S-8

Table of Contents

| principal amount of the class A notes and the class B notes exceeds the aggregate outstanding principal balance of the receivables as of the last day of the related collection period less any amounts allocated to pay principal of the notes under clause (5) above will be paid to the holders of notes of those classes, as applicable; |

| (8) | interest on the class C notes will be paid to the holders of notes of that class; |

| (9) | principal of the notes in an amount equal to the amount by which the sum of the aggregate principal amount of the class A notes, the class B notes and the class C notes exceeds the aggregate outstanding principal balance of the receivables as of the last day of the related collection period less any amounts allocated to pay principal of the notes under clauses (5) and (7) above will be paid to the holders of notes of those classes, as applicable; |

| [(10)] | [interest on the class D notes will be paid to the holders of notes of that class;] |

| [(11)] | [principal of the notes in an amount equal to the amount by which the sum of the aggregate principal amount of the class A notes, the class B notes, the class C notes and the class D notes exceeds the aggregate outstanding principal balance of the receivables as of the last day of the related collection period less any amounts allocated to pay principal of the notes under clauses (5), (7) and (9) above will be paid to the noteholders;] |

| (12) | the amount, if any, necessary to fund the reserve account up to the required amount will be paid to the reserve account; |

| (13) | principal of the notes in an amount equal to the lesser of the aggregate principal amount of the notes and the amount by which the sum of the aggregate principal amount of the notes and the overcollateralization target amount for that distribution date, described under “—Credit Enhancement—Overcollateralization”, exceeds the aggregate outstanding principal balance of the receivables as of the last day of the related collection period less any amounts allocated to pay principal of the notes under clauses (5), (7), (9) and (11) above will be paid to the noteholders; |

| (14) | if the backup servicer or any other successor servicer has replaced CarMax Business Services as servicer, any unpaid transition expenses due in respect of the transfer of servicing to the backup servicer that are in excess of the related cap described under clause (2) above plus any unpaid transition expenses due in respect of the transfer of servicing to any other successor servicer plus any additional servicing fees for the related collection period will be paid to the backup servicer or other successor servicer, as applicable; |

| (15) | any unpaid indemnity amounts due to the backup servicer that are in excess of the related cap described under clause (2) above will be paid to the backup servicer; |

| [(16)] | [any subordinate swap termination payment amounts will be paid to the swap counterparty; and] |

| (17) | unless the notes have been accelerated following the occurrence of an event of default under the indenture, any remaining amounts will be paid to the holders of the certificates. |

For purposes of these distributions, the principal amount of a class of notes as of any distribution date will be calculated as of the preceding distribution date after giving effect to all payments made on such preceding distribution date, or, in the case of the first distribution date, as of the closing date.

For a more detailed description of the priority of distributions and the allocation of funds on each distribution date prior to acceleration of the notes, see “Application of Available Funds—Priority of Distributions (Pre-Acceleration)”.

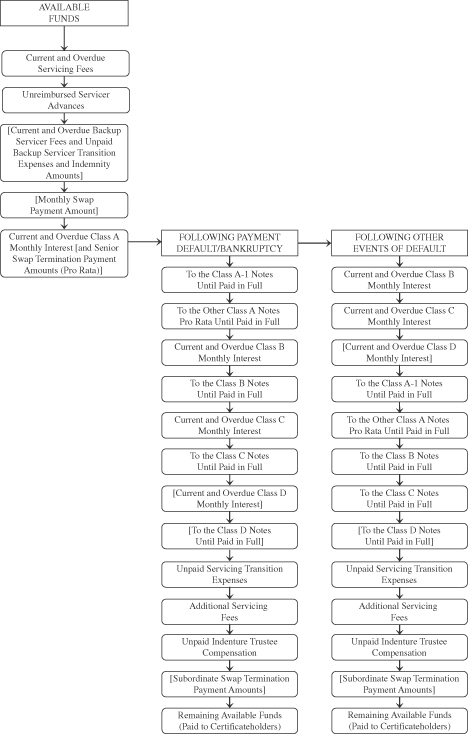

Events of Default, Acceleration and Priority of Distributions (Post-Acceleration)

Each of the following will constitute an event of default under the indenture:

| • | a default in the payment of interest on any note of the controlling class for five or more business days; |

| • | a default in the payment of principal of any note on the related final scheduled distribution date; |

S-9

Table of Contents

| • | a default in the observance or performance of any other material covenant or agreement of the trust made in the indenture, not cured for a period of 60 days after written notice; |

| • | any representation or warranty made by the trust having been incorrect in any material respect as of the time made, not cured for a period of 30 days after written notice; and |

| • | certain events of bankruptcy, insolvency, receivership or liquidation of the trust or its property. |

Following the occurrence of an event of default, the indenture trustee or the holders of notes evidencing not less than 51% of the controlling class may accelerate the notes.

If the notes have been accelerated following the occurrence of an event of default under the indenture, the priority of distributions will change as described in “Application of Available Funds—Priority of Distributions (Post-Acceleration)”.

For a more detailed description of events of default and the rights of noteholders, see “Description of the Indenture—Events of Default” and “—Rights Upon Event of Default” in the prospectus and “The Indenture—Rights Upon Event of Default” in this prospectus supplement. For a more detailed description of the priority of distributions and the allocation of funds on each distribution date following acceleration of the notes, see “Application of Available Funds—Priority of Distributions (Post-Acceleration)” in this prospectus supplement.

Credit Enhancement

The credit enhancement for the notes generally will include the following:

Subordination of the Class B Notes, the Class C Notes [and the Class D Notes]

The class B notes, the class C notes [and the class D notes] will be subordinated with respect to each class of notes with a higher alphabetical designation. On each distribution date:

| • | no interest will be paid on any such class of notes until all interest due on each class of notes with a higher alphabetical designation has been paid in full through the related interest period, including, to the extent lawful, interest on overdue interest; |

| • | as described herein, no interest will be paid on any such class of notes until certain payments of principal have been made on each class of notes with a higher alphabetical designation; and |

| • | no principal will be paid on any such class of notes until all principal due on each class of notes with a higher alphabetical designation has been paid in full. |

The subordination of the class B notes, the class C notes and [the class D notes] is intended to decrease the risk of default by the trust with respect to payments due to the more senior classes of notes.

Overcollateralization

Overcollateralization represents the amount by which the aggregate outstanding principal balance of the receivables exceeds the aggregate principal amount of the notes. Overcollateralization will be available to absorb losses on the receivables that are not otherwise covered by excess collections on or in respect of the receivables, if any. It is expected that the initial amount of overcollateralization will be less than $100. The application of funds as described in clause (13) of “—Priority of Distributions (Pre-Acceleration)” is designed to increase over time the amount of overcollateralization as of any distribution date to a target amount. The amount of target overcollateralization will be determined based on, among other things, interest rates as of the date of this prospectus supplement but will be the greater of (a) not less than [ ]% of the aggregate outstanding principal balance of the receivables as of the last day of the related collection period and (b) [ ]% of the aggregate outstanding principal balance of the receivables as of the cutoff date. However, if:

| • | the overcollateralization reduction test is met on the [ ] 20[ ] distribution date, the percentage in clause (a) will be reduced to [ ]% and the percentage in clause (b) will be reduced to [ ]% on that distribution date and will remain at these percentages for each following distribution date; or |

| • | the overcollateralization reduction test is met on the [ ] 20[ ] distribution date, the percentage in clause (a) will be reduced to |

S-10

Table of Contents

| [ ]% and the percentage in clause (b) will be reduced to [ ]% on that distribution date (regardless of whether the overcollateralization reduction test was met on the [ ] 20[ ] distribution date) and will remain at these percentages for each following distribution date. |

Overcollateralization will be effected by paying an amount of principal on the notes on the first several distribution dates after the closing date that is greater than the principal of the receivables paid by obligors during that time.

Excess Collections

Excess collections are generally the excess of interest collections on the receivables over the various fees and expenses of the trust, including the servicing fee, the backup servicer fee, interest payments on the notes [and any amounts due to the swap counterparty under the interest rate swap]. Any excess collections will be applied on each distribution date to make principal payments on the most senior class of notes to the extent necessary to reach the targeted amount of overcollateralization.

For a more detailed description of the use of excess collections as credit enhancement for the notes, see “Description of the Notes—Credit Enhancement—Excess Collections”.

Reserve Account

On the closing date, CarMax Business Services will establish, in the name of the indenture trustee, a reserve account into which certain excess collections on or in respect of the receivables will be deposited. The reserve account will be initially funded with a deposit of $[ ] made by CarMax Funding on the closing date. On each distribution date, the indenture trustee will deposit in the reserve account, from amounts collected on or in respect of the receivables during the related collection period and not used on that distribution date to make required payments to the servicer or the noteholders, the amount, if any, by which:

| • | the amount required to be on deposit in the reserve account on that distribution date exceeds |

| • | the amount on deposit in the reserve account on that distribution date. |

Amounts on deposit in the reserve account will be available to pay shortfalls in the monthly servicing fee, the monthly backup servicer fee, [monthly swap payment amounts] interest, [senior swap termination payment amounts] and certain principal payments required to be paid on the notes and may be used to reduce the principal amount of a class of notes to zero on or after its final scheduled distribution date. On each distribution date, the indenture trustee will withdraw funds from the reserve account, up to the amount on deposit in the reserve account, to the extent needed to make the following payments:

| • | to the servicer, the servicing fee for the related collection period plus any overdue servicing fees for one or more prior collection periods plus reimbursement of any nonrecoverable advances; |

| • | to the backup servicer, the backup servicer fee for the related collection period plus any overdue backup servicer fees for one or more prior collection periods plus, subject to an aggregate cap of $175,000, any unpaid indemnity amounts due to the backup servicer and any unpaid transition expenses due in respect of the transfer of servicing to the backup servicer; |

| • | [to the swap counterparty, the monthly swap payment amount and any senior swap termination payment amount; and] |

| • | to the noteholders, the monthly interest, the priority principal distributable amount, if any, the secondary principal distributable amount, if any, the tertiary principal distributable amount, if any, and the quaternary principal distributable amount, if any, required to be paid on the notes on that distribution date plus any overdue monthly interest payable to any class of notes for the previous distribution date plus, to the extent lawful, interest on the overdue monthly interest at the interest rate applicable to that class. |

The amount required to be on deposit in the reserve account on any distribution date will equal the lesser of:

| • | $[ ]; and |

| • | the aggregate principal amount of the notes; |

provided, however, that the required amount will be zero if the aggregate outstanding principal balance of the receivables as of the last day of the related collection period is zero. If the amount on deposit in

S-11

Table of Contents

the reserve account on any distribution date exceeds the amount required to be on deposit in the reserve account on that distribution date, after giving effect to all required deposits to and withdrawals from the reserve account on that distribution date, the excess, first, will be applied to fund any deficiency in the amounts described in clauses (13), (14), (15) or (16) under “—Priority of Distributions (Pre-Acceleration)” on that distribution date and, second, will be paid to the certificateholders.

For a more detailed description of the deposits to and withdrawals from the reserve account, see “Description of the Notes—Credit Enhancement—Reserve Account”.

Optional Prepayment

The servicer has the option to purchase the receivables on any distribution date following the last day of a collection period as of which the aggregate outstanding principal balance of the receivables is 10% or less of the aggregate outstanding principal balance of the receivables as of the cutoff date. The purchase price will equal the aggregate outstanding principal balance of the receivables plus accrued and unpaid interest thereon; provided, however, that the purchase price must equal or exceed the aggregate principal amount of the notes, accrued and unpaid interest thereon, all amounts due to the servicer in respect of its servicing compensation and reimbursement of nonrecoverable advances, [all amounts due to the backup servicer] [and all amounts due to the swap counterparty under the interest rate swap]. The trust will apply the payment of such purchase price to the payment of the notes in full.

It is expected that at the time this purchase option becomes available to the servicer only the class A-4 notes, the class B notes, the class C notes and [the class D notes] will be outstanding.

Property of the Trust

The property of the trust will include the following:

| • | a pool of simple interest retail installment sale contracts originated by certain affiliates of CarMax Business Services in the ordinary course of business in connection with the sale of new and used motor vehicles; |

| • | amounts received on or in respect of the receivables after the cutoff date, including amounts advanced by the servicer; |

| • | security interests in the vehicles financed under the receivables; |

| • | any proceeds from claims on or refunds of premiums with respect to insurance policies relating to the financed vehicles or the related obligors; |

| • | the receivable files; |

| • | funds on deposit in the collection account, the note payment account and the reserve account; |

| • | all rights under the receivables purchase agreement, including the right to cause CarMax Business Services to repurchase from CarMax Funding receivables affected materially and adversely by breaches of the representations and warranties of CarMax Business Services made in the receivables purchase agreement; |

| • | all rights under the sale and servicing agreement, including the right to cause CarMax Funding or the servicer, as applicable, to purchase receivables affected materially and adversely by breaches of the representations and warranties of CarMax Funding or the servicer made in the sale and servicing agreement or by breaches of certain servicing covenants of the servicer made in the sale and servicing agreement; |

| • | [net amounts, if any, received by the trust and all rights under the interest rate swap; and] |

| • | any and all proceeds relating to the above. |

Receivables

Summary characteristics of the receivables as of the statistical calculation date:

| Pool Balance |

$[ | ] | ||

| Number of Receivables |

[ | ] | ||

| New motor vehicles at origination(1) |

[ | ]% | ||

| Used motor vehicles at origination(1) |

[ | ]% | ||

| Average principal balance |

$[ | ] | ||

| Weighted average contract rate |

[ | ]% | ||

| Weighted average remaining term |

[ ] months | |||

| Weighted average original term |

[ ] months | |||

| Weighted average FICO® score(2) |

[ | ] |

| (1) | As a percentage of the pool balance as of the statistical calculation date. |

S-12

Table of Contents

| (2) | Reflects only receivables with obligors that have a FICO score at the time of application. The FICO score with respect to any receivable with co-obligors is calculated as the average of each obligor’s FICO score at the time of application. FICO® is a federally registered servicemark of Fair Isaac Corporation. |

[Exceptions to the Underwriting Criteria]

[Insert information on the nature of any exceptions made to the underwriting criteria, if any, and provide data regarding the number of such receivables that represent an exception to the underwriting criteria in the receivables pool.]

Servicing and Servicer Compensation

The servicer’s responsibilities will include, among other things, collection of payments, realization on the receivables and the financed vehicles, selling or otherwise disposing of delinquent or defaulted receivables and monitoring the performance of the receivables. In return for its services, the trust will be required to pay the servicer, for so long as CarMax Business Services or the backup servicer is the servicer, a servicing fee on each distribution date for the related collection period equal to the product of 1/12 of 1.00% and the aggregate outstanding principal balance of the receivables as of the first day of that collection period (or as of the cutoff date in the case of the first distribution date). The servicing fee will be paid from and only to the extent of amounts received on or with respect to the receivables and amounts withdrawn from the reserve account. The servicing fee will be paid prior to all other monthly payment items. If any entity other than CarMax Business Services [or the backup servicer] becomes the servicer, the servicing fee may be adjusted with the consent of the holders of notes evidencing not less than 51% of the controlling class.

Repurchases of Receivables

CarMax Business Services and CarMax Funding will make various representations and warranties about the origination, characteristics and transfer of the receivables. The trust, as assignee of CarMax Funding, will have the right under the receivables purchase agreement to cause CarMax Business Services to repurchase from CarMax Funding receivables affected materially and adversely by breaches of the representations and warranties of CarMax Business Services made in the receivables purchase agreement. The trust will have the right under the sale and servicing agreement to cause CarMax Funding or the servicer, as applicable, to purchase from the trust receivables affected materially and adversely by breaches of the representations and warranties of CarMax Funding or the servicer made in the sale and servicing agreement or by breaches of certain servicing covenants of the servicer made in the sale and servicing agreement.

For a more detailed description of the representations and warranties made about the receivables and the repurchase obligation if these representations and warranties are breached, see “Description of the Receivables Purchase Agreement—Sale and Assignment of Receivables—Representations and Warranties” and “—Repurchase of Receivables” and “Description of the Sale and Servicing Agreement— Sale and Assignment of Receivables—Representations and Warranties” and “—Repurchase of Receivables” in the prospectus. For a more detailed description of the servicer’s purchase obligation for breaches of certain servicing covenants, see “Description of the Sale and Servicing Agreement—Servicing Procedures” in the prospectus and “The Sale and Servicing Agreement—Servicing the Receivables” in this prospectus supplement.

[Interest Rate Swap]

[On the closing date, the trust will enter into an interest rate swap transaction with respect to each class or tranche of floating rate notes pursuant to an interest rate swap agreement with , as the swap counterparty, to hedge the trust’s floating rate interest obligations with respect to each class or tranche of floating rate notes.]

[In general, under each interest rate swap transaction, on each distribution date, the swap counterparty will be obligated to make a monthly payment to the trust in an amount equal to the product of:

| • | a notional amount equal to the outstanding principal amount of the corresponding class or tranche of floating rate notes as of the preceding distribution date or, in the case of the first distribution date, the closing date; and |

| • | a floating interest rate based on LIBOR for the related interest period; |

S-13

Table of Contents

and the trust will be obligated to make a monthly payment to the swap counterparty in an amount equal to the product of:

| • | a notional amount equal to the outstanding principal amount of the corresponding class or tranche of floating rate notes as of the preceding distribution date or, in the case of the first distribution date, the closing date; and |

| • | a fixed monthly interest rate on the basis of a 360-day year of twelve 30-day months.] |

[The fixed interest rate to be used in calculating the trust’s monthly payments to the swap counterparty under the interest rate swap transaction corresponding to the class notes will be equal to % per annum.]

[On each distribution date, the amount that the trust is obligated to pay to the swap counterparty will be netted against the amount that the swap counterparty is obligated to pay to the trust. Only the net amount payable will be due from the trust or the swap counterparty, as applicable. Monthly swap payment amounts payable by the trust will rank higher in priority than interest payments due on the notes.]

[In the event that the swap counterparty’s long-term or short-term ratings cease to be at the levels required by the rating agencies hired by the sponsor to rate the notes, the swap counterparty will be obligated to either assign its rights and obligations under the interest rate swap to another party with the required ratings or post collateral. If the swap counterparty has not taken one of these specified actions within the specified time, the trust may terminate the interest rate swap.]

[For a more detailed description of the interest rate swap, see “The Interest Rate Swap” in this prospectus supplement.]

Controlling Class

Holders of the controlling class will control certain decisions regarding the trust, including whether to declare or waive events of default and events of servicing termination, accelerate the notes, cause a sale of the receivables or direct the indenture trustee to exercise other remedies following an event of default. Holders of notes that are not part of the controlling class will not have these rights.

So long as any class A notes are outstanding, the class A notes will be the controlling class. As a result, holders of the class A notes generally will vote together as a single class under the indenture. Upon payment in full of the class A notes, the class B notes will be the controlling class, and upon payment in full of the class B notes, the class C notes will be the controlling class. Upon payment in full of the class C notes, the class D notes will be the controlling class.

Ratings

The depositor expects that the notes will receive credit ratings from [two] nationally recognized statistical rating organizations hired by the sponsor to rate the notes.

A rating is not a recommendation to purchase, hold or sell the related notes, inasmuch as a rating does not comment as to market price or suitability for a particular investor. The ratings of the notes address the likelihood of the payment of principal and interest on the notes according to their terms. A rating agency rating the notes may lower or withdraw its rating in the future, in its discretion, as to any class of notes. A rating agency rating the notes may place any class of notes on review or watch for downgrade in the future, in its discretion.

Each rating agency rating the notes will monitor its ratings using its normal surveillance procedures. No transaction party will be responsible for monitoring any changes to the ratings of the notes.

For a more detailed description of the ratings of the notes, see “Risk Factors—The ratings of the notes may be withdrawn or lowered, or the notes may receive an unsolicited rating, which may adversely affect your notes” and “Ratings of the Notes” in this prospectus supplement.

Tax Status

Opinions of Counsel

In the opinion of McGuireWoods LLP, for United States federal income tax purposes, the offered notes will be characterized as debt and the trust will not be characterized as an association (or a publicly traded partnership) taxable as a corporation.

S-14

Table of Contents

Investor Representations

If you purchase offered notes, you agree by your purchase that you will treat the offered notes as indebtedness for tax purposes.

For a more detailed description of the tax consequences of acquiring, holding and disposing of notes, see “Material Federal Income Tax Consequences” in this prospectus supplement and in the prospectus.

ERISA Considerations

The offered notes are generally eligible for purchase by or with plan assets of employee benefit and other benefit plans and individual retirement accounts, subject to the considerations discussed under “ERISA Considerations” in this prospectus supplement and the prospectus. Each employee benefit or other benefit plan, and each person investing on behalf of or with plan assets of such a plan, will be deemed to make certain representations.

For a more detailed description of the ERISA considerations applicable to a purchase of the notes, see “ERISA Considerations” in this prospectus supplement and in the prospectus.

[Eligibility for Purchase by Money Market Funds]

[On the closing date, the class A-1 notes will be eligible securities for purchase by money market funds under paragraph (a)(12) of Rule 2a-7 under the Investment Company Act of 1940, as amended. Rule 2a-7 includes additional criteria for investments by money market funds, some of which have recently been amended, including additional requirements relating to portfolio maturity, liquidity and risk diversification. A money market fund purchasing class A-1 notes should consult its legal advisors before making a purchase.]

S-15

Table of Contents

You should consider the following risk factors (and the factors under “Risk Factors” in the prospectus) in deciding whether to purchase any of the notes. The following risk factors and those in the prospectus describe the principal risks of an investment in the notes.

| Some notes have greater risk because they are subordinate to other classes of notes |

The notes with a lower alphabetical designation are subordinated with respect to interest and principal payments to the notes with a higher alphabetical designation ([the class D notes] are subordinated to the class A notes, the class B notes and the class C notes, the class C notes are subordinated to the class A notes and the class B notes and the class B notes are subordinated to the class A notes). In addition, the class A notes with a higher numerical designation are generally subordinated with respect to principal payments to the class A notes with a lower numerical designation (the class A-4 notes are subordinated to the class A-1, A-2 and A-3 notes, the class A-3 notes are subordinated to the class A-1 and A-2 notes and the class A-2 notes are subordinated to the class A-1 notes). If the notes have been accelerated following the occurrence of an event of default under the indenture, the priority of interest and principal distributions will change. The subordination arrangements could result in delays or reductions in interest or principal payments on classes of notes with lower alphabetical designations or, in the case of the class A notes, higher numerical designations. |

| See “Description of the Notes—Payments of Interest” and “—Payments of Principal” and “Application of Available Funds—Priority of Distributions (Pre-Acceleration)” and “—Priority of Distributions (Post-Acceleration)” in this prospectus supplement for a further discussion of interest and principal payments. |

| The targeted amount of overcollateralization may not be reached or maintained |

The amount of overcollateralization is expected to increase over time to the targeted amount of overcollateralization as excess collections are applied to make principal payments on the notes in an amount greater than the decrease in the receivables balance. There can be no assurance, however, that the targeted amount of overcollateralization will be reached or maintained or that the receivables will generate sufficient collections to pay the notes in full. |

| See “Description of the Notes—Credit Enhancement—Overcollateralization” in this prospectus supplement for a further discussion of overcollateralization. |

S-16

Table of Contents

| The amount on deposit in the reserve account may not be sufficient to assure payment of your notes |

The amount on deposit in the reserve account will be used to fund the payment of the monthly servicing fee, [the monthly backup servicer fee], [the monthly swap payment amount], monthly interest, [senior swap termination payment amounts] and certain distributions of principal to noteholders on each distribution date if payments received on or in respect of the receivables, including amounts recovered in connection with the repossession and sale of financed vehicles that secure defaulted receivables, [and net amounts, if any, received by the trust under the interest rate swap] are not sufficient to make that payment. There can be no assurance, however, that the amount on deposit in the reserve account will be sufficient on any distribution date to assure payment of your notes. If the receivables experience higher losses than were projected in determining the amount required to be on deposit in the reserve account, the amount on deposit in the reserve account may be less than projected. If receivable payments, including any amounts allocable to overcollateralization, [net amounts, if any, received by the trust under the interest rate swap] and the amount on deposit in the reserve account are not sufficient on any distribution date to pay in full the monthly interest and certain distributions of principal due on that distribution date, you may experience payment delays with respect to your notes. If the amount of that insufficiency is not offset by excess collections on or in respect of the receivables on subsequent distribution dates, you may experience losses with respect to your notes. |

| See “Description of the Notes—Credit Enhancement—Reserve Account” in this prospectus supplement for a further discussion of the reserve account. |

| You may suffer losses if the receivables are sold following an indenture event of default |

If the notes have been accelerated following the occurrence of an event of default under the indenture and the indenture trustee determines that the future collections on the receivables would be insufficient to make payments on the notes, the indenture trustee, acting at the direction of the holders of 66 2/3% of the aggregate principal amount of the controlling class (which will be the class of outstanding notes with the highest alphabetical designation), may sell the receivables and prepay the notes. If the proceeds from the sale of the receivables are insufficient to pay the full principal amount of your notes, you may experience losses with respect to your notes. If principal is repaid to you earlier than expected, you may not be able to reinvest the prepaid amount at a rate of return that is equal to or greater than the rate of return on your notes. |

| See “Description of the Indenture—Events of Default” in the prospectus and “The Indenture—Rights Upon Event of Default” and “Application of Available Funds—Priority of Distributions (Post-Acceleration)” in this prospectus supplement for a further discussion of events of default and the rights of the noteholders following an event of default. |

S-17

Table of Contents

| You may suffer losses because you have limited control over actions of the trust and conflicts between classes of notes may occur |

If an event of default under the indenture has occurred, the indenture trustee may, and at the direction of a specified percentage of the controlling class (which will be the class of outstanding notes with the highest alphabetical designation) will, take one or more of the actions specified in the indenture relating to the property of the trust. In addition, the holders of a majority of the controlling class, or the indenture trustee acting on behalf of the holders of the controlling class, under certain circumstances, has the right to waive events of servicing termination or to terminate the servicer. The interests of the controlling class may differ from the interests of the other classes of notes, and the holders of the controlling class will not be required to consider the effect of its actions on the holders of the other classes of notes. |

| The holders of the class B notes, and upon payment in full of such notes, the holders of the class C notes, and upon payment in full of such notes, [the holders of the class D notes,] will have only limited rights to direct remedies under the indenture and will not have the ability to waive events of servicing termination or to terminate the servicer until each class of notes with a higher alphabetical designation has been paid in full. |

| See “Description of the Sale and Servicing Agreement—Events of Servicing Termination”, “—Rights Upon Event of Servicing Termination” and “—Waiver of Past Events of Servicing Termination” in the prospectus for a further discussion of the rights of the noteholders with respect to events of servicing termination. |

| Geographic concentration may result in more risk to you |

The servicer’s records indicate that receivables related to obligors with mailing addresses in the following states constituted more than 10% of the aggregate outstanding principal balance of the receivables as of the close of business on [ ], 20[ ]: |

| Percentage of Pool Balance |

||||

| [State] |

[ ]% | |||

| [State] |

[ ]% | |||

| [State] |

[ ]% | |||

| If one or more of these states experience adverse economic changes, such as an increase in the unemployment rate, an increase in interest rates or an increase in the rate of inflation, obligors in those states may be unable to make timely payments on their receivables and you may experience payment delays or losses on your notes. We cannot predict, for any state or region, whether adverse economic changes or other adverse events will occur or to what extent those events would affect the receivables or repayment of your notes. |

S-18

Table of Contents

| [To Be Inserted: For any one state or other geographic region where 10% or more of the Receivables are or will be located, description of any economic or other factors specific to such state or region that may materially impact the Receivables or related cash flows.] |

| [To Be Inserted: For any other material concentration of Receivables, description of any economic or other factors specific to that concentration that may materially impact the Receivables or related cash flows.] |

| Economic developments may adversely affect the performance and market value of your notes |

The United States has experienced a period of economic slowdown that may adversely affect the performance and market value of your notes. This period has been accompanied by elevated unemployment, decreases in home values, increased mortgage and consumer loan delinquencies and defaults and a lack of availability of consumer credit, which may lead to increased default rates on the receivables. Delinquencies and losses with respect to motor vehicle receivables generally increased during this period and may increase again in the future. In addition, this period has been accompanied by decreased consumer demand for motor vehicles and an increase in the inventory of used motor vehicles, which may depress the price at which repossessed motor vehicles may be sold or delay the timing of those sales. If the default rate on the receivables increases and the price at which the related vehicles may be sold declines, you may experience losses with respect to your notes. |

| While certain economic factors have improved recently, other factors have not yet improved. If the economic slowdown worsens or continues for a prolonged period of time, delinquencies and losses with respect to motor vehicle receivables could increase again. |

| For more information regarding delinquency and loss experience of CarMax Business Services pertaining to certain motor vehicle receivables, see “CarMax—Delinquency, Credit Loss and Recovery Information” and “—Static Pool Information About Previous Securitizations” in this prospectus supplement. |

| Lack of liquidity in the secondary market may adversely affect your notes |

The secondary market for asset-backed securities may experience reduced liquidity. Any period of illiquidity may continue and even worsen and may adversely affect the market value of your notes. |

| See “Risk Factors—You may have difficulty selling your notes or obtaining your desired sale price” in the prospectus. |

S-19

Table of Contents

| Actions taken by domestic-based automotive manufacturers may adversely affect your notes |

Adverse conditions affecting one or more domestic-based automotive manufacturers may impact your notes. The period of economic slowdown has adversely affected the financial condition and business prospects of these manufacturers. Certain actions that these manufacturers may take or have taken, such as General Motors’ elimination of its Saturn and Pontiac brands, may adversely affect consumer demand for and values of used motor vehicles produced by these manufacturers, which may depress the price at which repossessed motor vehicles may be sold or delay the timing of those sales. If the prices at which the related vehicles may be sold decline, you may experience losses with respect to your notes. |

| The ratings of the notes may be withdrawn or lowered, or the notes may receive an unsolicited rating, which may adversely affect your notes |

A security rating is not a recommendation to purchase, hold or sell securities inasmuch as a rating does not comment as to market price or suitability for a particular investor. The ratings assigned to the notes address the likelihood of the payment of principal and interest on the notes according to their terms but are solely the view of the assigning rating agency and are subject to any limitations that the assigning rating agency may impose. Similar ratings on different types of securities do not necessarily mean the same thing. To the extent the notes are rated by any rating agency, that rating agency may change its rating of the notes if that rating agency believes that circumstances have changed, the performance of the receivables has deteriorated, there were errors in analysis or otherwise. Any subsequent change in a rating will likely affect the price that a subsequent purchaser would be willing to pay for the notes and your ability to resell your notes. |

| The depositor expects that the notes will receive ratings from [two] nationally recognized statistical rating organizations hired by the sponsor to rate the notes. Ratings initially assigned to the notes will be paid for by the sponsor. The sponsor is not aware that any other NRSRO, other than the NRSROs hired by the sponsor to rate the notes, has assigned ratings to the notes. Securities and Exchange Commission rules state that the payment of fees by the sponsor, the issuing entity or an underwriter to rating agencies to issue or maintain a credit rating on asset-backed securities is a conflict of interest for rating agencies. In the view of the Securities and Exchange Commission, this conflict is particularly acute because arrangers of asset-backed securities transactions provide repeat business to the rating agencies. |

| Under Securities and Exchange Commission rules aimed at enhancing transparency, objectivity and competition in the credit rating process, information provided by the sponsor or the underwriters to a hired NRSRO for the purpose of assigning or monitoring the ratings on the notes is required to be made available to each non-hired NRSRO in |

S-20

Table of Contents

| order to make it possible for non-hired NRSROs to assign unsolicited ratings to the notes. An unsolicited rating could be assigned at any time, including prior to the closing date. None of the depositor, the sponsor, the underwriters or any of their affiliates will have any obligation to inform you of any unsolicited ratings assigned to the notes, and these parties may be aware of unsolicited ratings assigned to the notes. Consequently, prospective investors should monitor whether an unsolicited rating of the notes has been assigned by a non-hired NRSRO and should consult with their financial and legal advisors regarding the impact of the assignment of an unsolicited rating to a class of notes. NRSROs, including the hired rating agencies, may have different methodologies, criteria, models and requirements. If any non-hired NRSRO assigns an unsolicited rating to the notes, there can be no assurance that the unsolicited rating will not be lower than the ratings provided by the hired rating agencies, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. In addition, if the sponsor fails to make available to the non-hired NRSROs any information provided to any hired rating agency for the purpose of assigning or monitoring the ratings on the notes, a hired rating agency could withdraw its ratings on the notes, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. |

| Furthermore, Congress or the Securities and Exchange Commission may determine that any NRSRO that assigns ratings to the notes no longer qualifies as a nationally recognized statistical rating organization for purposes of the federal securities laws and that determination may also have an adverse effect on the market price of the notes. |

| Prospective investors in the notes are urged to make their own evaluation of the creditworthiness of the receivables and the credit enhancement on the notes and not to rely solely on the ratings on the notes. |

| Federal financial regulatory reform could have an adverse impact on CarMax Business Services, the depositor or the trust |

The Dodd-Frank Wall Street Reform and Consumer Protection Act is extensive legislation that impacts financial institutions and other non-bank financial companies, such as CarMax Business Services. In addition, the Dodd-Frank Act will impact the offering, marketing and regulation of consumer financial products and services and will increase regulation of the securitization and derivatives markets. Many of the new requirements will be the subject of implementing regulations some of which have yet to be released. Until implementing regulations are finalized, there can be no assurance that the new requirements will not have an adverse impact on the servicing of the receivables, on CarMax Business Services’s securitization programs or on the regulation and supervision of CarMax Business Services, the depositor or the trust. |

S-21

Table of Contents

| See “Risk Factors—Federal financial regulatory reform could have an adverse impact on CarMax Business Services, the depositor or the trust” and “Material Legal Issues Relating to the Receivables—The Dodd-Frank Act” in the prospectus for a discussion of the alternative liquidation framework established by the Dodd-Frank Act for certain non-bank financial companies. |

| [Failure by the swap counterparty to make payments to the trust and the seniority of payments due to the swap counterparty could reduce or delay payments on the notes] |

[On the closing date, the trust will enter into an interest rate swap transaction with respect to each class or tranche of floating rate notes pursuant to an interest rate swap agreement because the receivables will bear interest at a fixed rate while the floating rate notes will bear interest at floating rates based on LIBOR.] |

| [During any period in which the amount based on a floating LIBOR-based rate payable by the swap counterparty is substantially greater than the amount based on the applicable fixed rate payable by the trust, the trust will be more dependent on receiving payments from the swap counterparty in order to make payments on the notes. In addition, if the interest rate swap is terminated, the swap counterparty may be obligated to make a termination payment to the trust, which could be substantial. If the swap counterparty fails to pay any amount due to the trust, you may experience delays and/or reductions in the interest and principal payments on your notes. If the swap counterparty fails to make a termination payment owing to the trust, the trust may not be able to enter into a replacement interest rate swap and, to the extent that the interest rate on any class or tranche of floating rate notes exceeds the applicable fixed rate that the trust would have been required to pay the swap counterparty under the interest rate swap, the amount available to pay principal of and interest on the notes will be reduced.] |

| [During any period in which the amount based on the floating rate payable by the swap counterparty is less than the amount based on the fixed rate payable by the trust, the trust will be obligated to make payments to the swap counterparty. In addition, if the interest rate swap is terminated, the trust may be obligated to make a termination payment to the swap counterparty, which could be substantial. The swap counterparty will have a claim on the assets of the trust for the monthly swap payment amounts and swap termination payments, if any, due to the swap counterparty under the interest rate swap. The swap counterparty’s claim other than with respect to subordinated swap termination payments may be higher than or equal in priority to payments on the notes. If there is a shortage of funds available on any distribution date, you may experience delays and/or reductions in interest and principal payments on your notes] |

| [See “The Interest Rate Swap” in this prospectus supplement for a further discussion of the interest rate swap.] |

S-22

Table of Contents

Capitalized terms used in this prospectus supplement are defined in the Glossary of Terms beginning on page S-68 and the Glossary of Terms beginning on page 64 of the prospectus.

The following information identifies certain transaction parties for this securitization transaction. For a detailed description of each transaction party and a description of the rights and responsibilities of each transaction party, see “The Sponsor”, “The Depositor and Seller”, “The Issuing Entity”, “The Servicer” and “The Trustees” in the prospectus.

CarMax Business Services, LLC is the sponsor of this securitization transaction and is primarily responsible for structuring the transaction. CarMax Business Services was formed on April 23, 2004 as a Delaware limited liability company and is a wholly-owned indirect subsidiary of CarMax, Inc.